Vilsack: 'Stay Tuned’ As U.S. Dairy Groups Demand Retaliatory Tariffs in Canada Dispute

WHIP+/ERP payment calculation | Bernanke: Fed made waited too long on rate hikes

|

In Today’s Digital Newspaper |

Ukrainian fighters in Mariupol laid down their arms. More than 260 fighters, now prisoners of war — 53 seriously wounded — were moved out to Russian-controlled areas ahead of a planned prisoner exchange.

The U.N. is pursuing a high-stakes deal with Russia, Turkey and other nations to open up Ukrainian food exports to world markets and stave off a potential global food shortage.

Turkey laid out demands for Sweden and Finland as it potentially holds the decisive vote on their NATO admission.

U.S. retail sales grew 0.9% in April. The data suggest that Americans are still spending on merchandise at a rapid clip even as prices rise at the fastest pace in decades

Fed Chairman Jerome Powell is set to take questions today on the U.S. economic outlook and its implications for the labor market, inflation and central-bank policies..

Former Federal Reserve Chair Ben Bernanke said in an interview on CNBC that it was a "mistake" for the central bank to wait so long to raise interest rates. Bernanke noted that the pandemic made it more difficult for the Fed to assess "scrambled" economic indicators, but the central bank should have begun raising rates as soon as the Biden administration injected $1.9 trillion in stimulus payments into the economy last year. More on Bernanke’s new book below.

USDA Sec. Tom Vilsack is upset about a lot of things… Canada’s dairy policy, India’s wheat export ban, etc. He’s also worried about Ukraine old- and new-crop grains. More on this via several items in today’s dispatch.

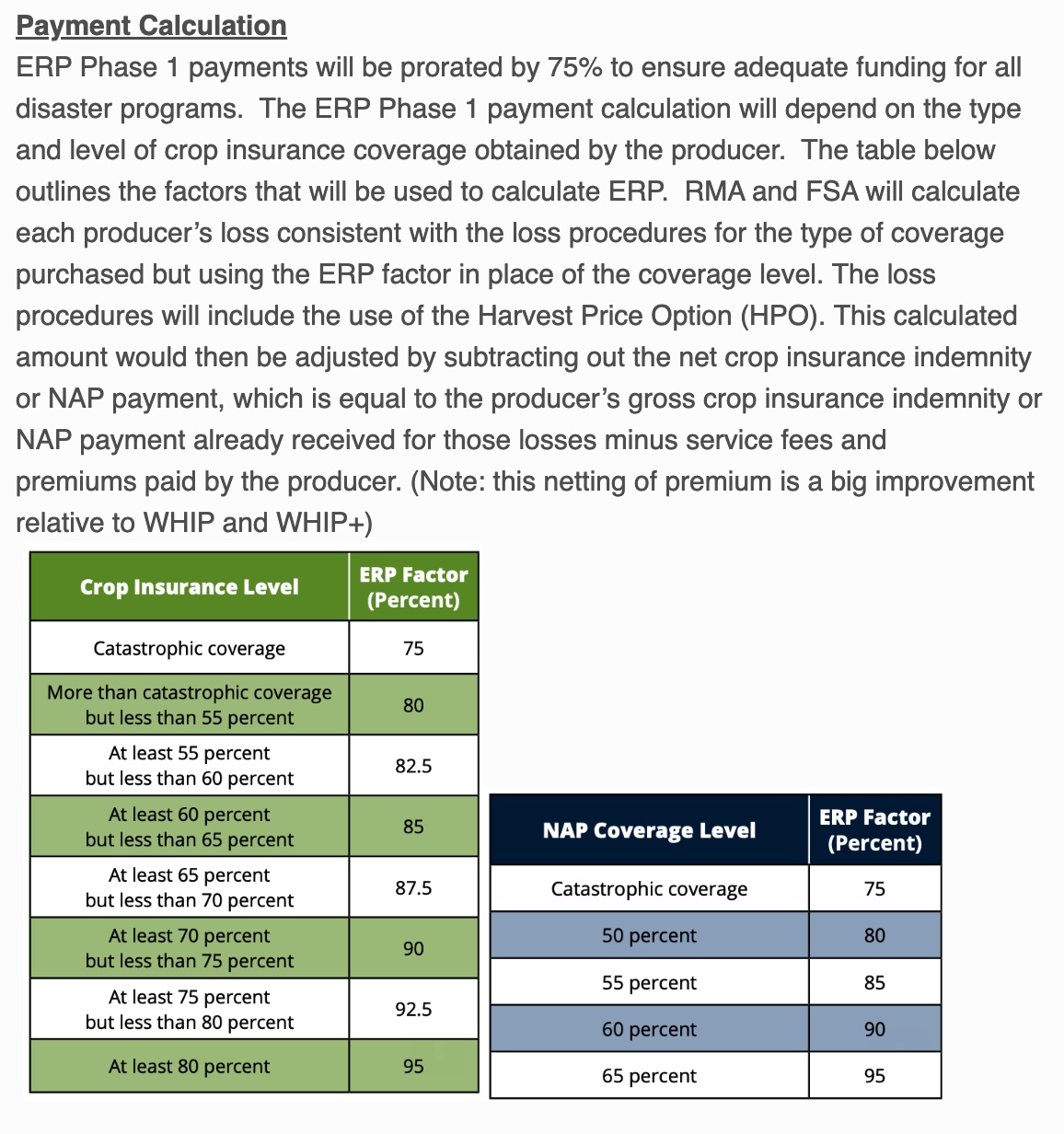

WHIP+/ERP payment calculation is provided below in a graphic courtesy of Combest-Sell & Associates.

Abbott reaches deal with FDA to reopen baby formula plant linked to shortage. The agreement with the FDA, subject to court approval, could see more formula hit stores in as early as eight weeks, Abbott said.

The nationwide average wholesale price of a dozen large eggs was $2.78, up by 11 cents for the second weekly increase in a row.

New York's court-appointed special master unveiled a congressional map proposal that would wipe out Democratic gains in the Empire State and make apportionment far more competitive than a prior enacted map.

Supreme Court sides with Sen. Ted Cruz, striking down campaign-finance regulation. Conservative 6-3 majority finds that limit on repaying campaign loans weeks after Election Day infringes on free speech.

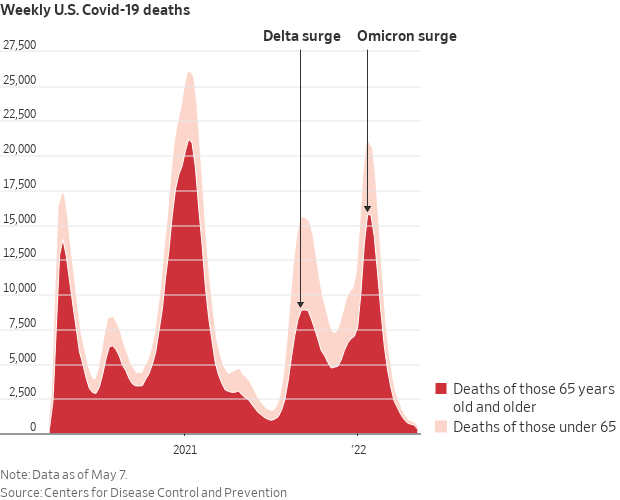

U.S. deaths attributed to Covid-19 surpass one million.

North Korea, suffering a Covid outbreak, reported its biggest daily surge in what it calls fever cases, but didn’t respond to a South Korean offer of vaccines.

The Biden administration is easing restrictions on travel and remittances to Cuba and boosting immigration from the nation, following the Trump-era rollback of President Obama’s push to normalize relations. But some lawmakers from both parties do not agree.

Elon Musk said his Twitter deal can’t move forward until the company shows proof that less than 5% of accounts are fake. Twitter's chief on Monday defended the messaging platform's battle against "bots" that aspiring buyer Elon Musk says vex the platform, only to have the billionaire respond with a poo emoji.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. stock indexes are pointed toward solidly higher openings.

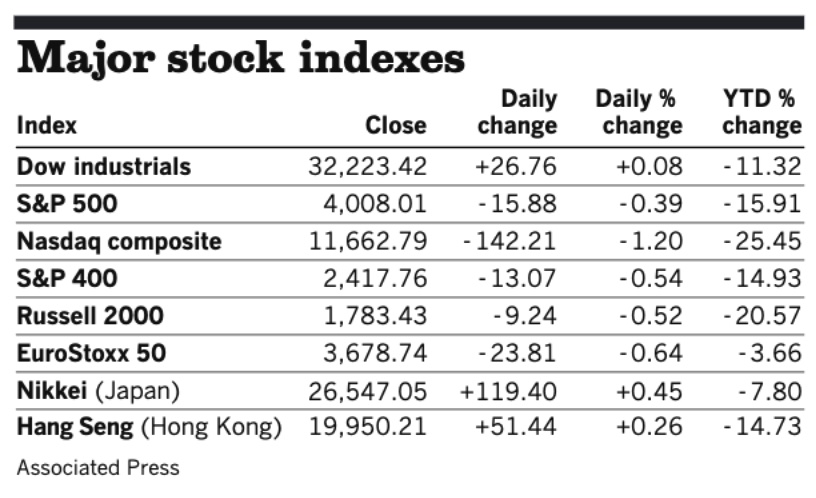

U.S. equities yesterday: The Dow edged up 26.76 points, 0.08%, at 32,332.42. The Nasdaq declined 142.21 points, 1.20%, at 11,662.79. The S&P 500 lost 15.88 points, 0.39%, at 4,008.01.

Agriculture markets yesterday:

- Corn: July corn futures rose 28 1/4 cents to $8.09 1/2 and December rose 16 3/4 cents to $7.65 1/2.

- Soy complex: July soybeans rose 10 cents to $16.56 1/2, the contract’s highest closing price since April 29. November soybeans gained 13 3/4 cents to $15.12. July soymeal rose $4.30 to $413.60 and July soyoil fell 80 points to 82.99.

- Wheat: July SRW wheat futures rose the 70-cent daily trading limit to $12.47 1/2, a two-month closing high, after India banned most wheat exports to manage domestic food security and prices. July HRW wheat closed limit-up at $13.52, the highest for a nearby contract since February 2008. July spring wheat rallied 60 cents to $13.85 and posted a contract high for a fourth consecutive day.

- Cotton: July cotton rose 545 points to 150.65 cents per pound, the contract’s highest closing price since May 4.

- Cattle: June live cattle gained $1.10 to $133.175, while August feeders fell 60 cents to $167.425.

- Hogs: June lean hog futures rallied $3.075 to $103.825 and July hogs gained $3.60 to $104.80.

Ag markets today: Wheat futures gapped higher overnight but reversed lower and are under heavy pressure this morning. Corn and soybeans also traded lower. As of 7:30 a.m. ET, SRW wheat futures were trading 22 to 27 cents lower, HRW wheat was 30 to 34 cents lower, HRS wheat was 16 to 19 cents lower, corn was 5 to 7 cents lower and soybeans were around 3 cents lower. Front-month crude oil futures were 90 cents higher, and the U.S. dollar index was more than 700 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. retail sales for April are expected to increase 1.0% from the prior month. (8:30 a.m. ET) UPDATE: The value of overall retail purchases increased 0.9%, after an upwardly revised 1.4% gain in March, Commerce Department figures showed this morning. Excluding vehicles and gas stations, sales rose 1% last month. The figures aren’t adjusted for inflation.

• U.S. industrial production for April is expected to increase 0.5% from the prior month. (9:15 a.m. ET)

• U.S. business inventories for March are expected to rise 1.9% from the prior month. (10 a.m. ET)

• National Association of Home Builders housing market index is expected to fall to 75 in May from 77 one month earlier. (10 a.m. ET)

• European Central Bank President Christine Lagarde speaks to the Soroptimist International at 1 p.m. ET.

• Federal Reserve Chairman Jerome Powell speaks at the WSJ Future of Everything Festival at 2 p.m. ET.

• More Fed speakers: St. Louis's James Bullard on the economy and monetary policy at 8 a.m. ET, Philadelphia's Patrick Harker on health care and the economy at 9:15 a.m. ET, Cleveland's Loretta Mester on inflation and monetary policy at 2:30 p.m. ET, and Chicago's Charles Evans on the economy and monetary policy at 6:45 p.m. ET.

• Japan's gross domestic product for the first quarter is out at 7:50 p.m. ET.

Ben Bernanke says the U.S. economy, for the first time since the 1970s, could be heading toward a period of stagflation. Bernanke, the former Federal Reserve chair who headed the central bank during the 2008 financial crisis, warns that the nation is headed for a situation, much like the 1970s, where Americans were losing their jobs but still facing higher prices at the grocery store and at the pump. “Even under the benign scenario, we should have a slowing economy,” Bernanke told the NYT’s DealBook, in an exclusive interview with Andrew ahead of Bernanke’s new book. The book, 21st Century Monetary Policy: The Federal Reserve from the Great Inflation to Covid-19,” is publishing today. “So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high.”

Bernanke is still hopeful a recession can be avoided. He said the Fed’s credibility with the public is going to be crucial to its ability to fight inflation, and it is something he is deeply worried about given how polarized the nation appears to be. In addition, he remains concerned that supply chain problems continue for all types of goods — even his own. “Given supply-chain disruptions, this book took six months to go from final manuscript to appearing in the store,” he said.

Even so, Bernanke says backing away from a 2% inflation target would be a mistake. He says current Fed chair Jay Powell should make it clear that the Fed’s inflation target remains unchanged. And do whatever it takes to bring inflation back to that level. “In everyday life, we judge the credibility of promises more by the reputations of the promise-makers than by the exact words they use,” Bernanke writes in the book. “The same principle applies to central bank promises.”

Layoffs are rising. A number of industries, particularly those that are affected by higher rates, seem vulnerable to job cuts, reports the New York Times (link). Layoffs rose by 6% in April versus the same month in 2021, according to the outplacement firm Challenger, Gray and Christmas. And April was the first month this year to have a year-over-year increase in layoffs.

Treasury Secretary Janet Yellen said Russia’s invasion of Ukraine has created a global crisis by exacerbating food security issues for the whole world. “The war is having an impact beyond Ukraine and it’s something that we’re very concerned about,” she said in Warsaw on Monday.

Yellen fails to win Poland pledge to remove hold on tax deal. Yellen is leaving Warsaw without a public pledge from Polish government officials to drop their opposition to a key part of a global corporate tax deal that Yellen identifies as a top priority. Warsaw’s resistance is holding up a measure that would implement a 15% minimum corporate tax rate across the European Union — part of an agreement backed in principle by almost 140 countries, including Poland, last October.

Inflation kerfuffle between White House and Bezos. The White House on Monday pushed back against Amazon.com founder Jeff Bezos after he criticized the Biden administration in two tweets over the weekend (link) for tying the corporate tax structure to rising inflation. Andrew Bates, a spokesman for the White House, said in a statement that “it doesn’t require a huge leap to figure out why” Bezos would oppose President Biden’s economic proposals that would raise taxes on the wealthy.

Index of ag prices at record high.

There are no imminent signs of a slowdown in demand by American consumers judging by the number of shipping containers coming through the Port of Los Angeles, according to Executive Director Gene Seroka. Imported cargo can be a leading indicator on the health of the economy, and there’s “nothing just yet” hinting that the U.S. is heading for a recession, Seroka said on Bloomberg Television. He also indicated that ocean freight flowing through the country’s busiest ports from China appear consistent despite lockdowns in the Asian nation. (Click here to watch the full interview.) “There’s really not a look here that says consumer buying is going to slow down any time soon,” he said. “All indications from the retailers are strong in the continued shipment volume as we look forward.”

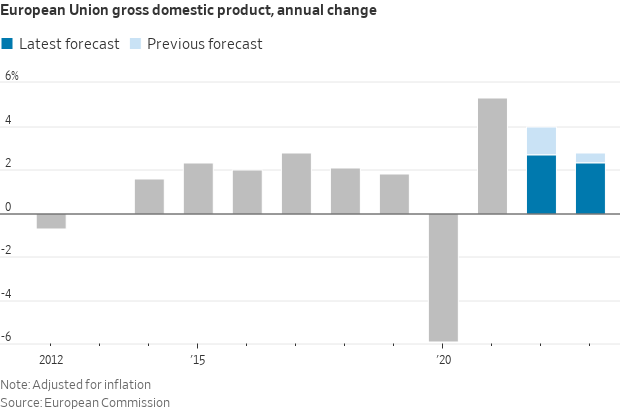

The European Union’s economy would likely contract during the remainder of this year if supplies of natural gas from Russia were to be halted soon, with the deepest recessions felt by countries that rely on that source for much of their energy generation, the bloc said Monday. The European Commission said that if energy supplies from Russia continue and energy prices don’t rise much further, the bloc’s economy should grow by 2.7% in 2022 and 2.3% in 2023. It had previously forecast growth of 4% and 2.8%, respectively.

Market perspectives:

• Outside markets: The dollar fell. 10-year Treasuries yield rose 3 basis points as it hovered below 3%. West Texas Intermediate crude rose 0.7% to $114.96 a barrel. Gold futures rose 0.7% to $1,827.20 an ounce.

• Gas prices reach another record high at $4.48 per gallon. Gas prices hit another record high Monday for the fourth week in a row, with the national average reaching $4.48 per gallon, according to AAA. The national average gallon of gas price was 40 cents more than a month ago, and $1.43 more than a year ago. Only three states (Georgia, Kansas and Oklahoma) have gas prices below $4 per gallon, while California and Hawaii own the highest prices at $5.98 and $5.31 per gallon, respectively.

• Corn planting nearly half done. USDA reports 49% of the U.S. corn crop was planted as of Sunday, an advance of 27 percentage points during the week and in line with pre-report expectations. But planting remains well behind the five-year average of 67% for mid-May. In the top 12 production states, planting stood at 55% in Illinois (70% on average), 40% in Indiana (54%), 57% in Iowa (80%), 60% in Kansas (64%), 31% in Michigan (41%), 35% in Minnesota (72%), 65% in Missouri (79%), 62% in Nebraska (77%), 4% in North Dakota (41%), 31% in Ohio (41%), 31% in South Dakota (54%) and 34% in Wisconsin (52%).

Corn emergence increased nine points over the past week to 14%, still 18 points behind average.

• Study looks at impacts of higher crop and input prices on farms. An updated report from the Agricultural and Food Policy Center at Texas A&M University analyzed impacts of farms due to higher crop and input prices. The report, titled Economic Impact of Higher Crop and Input Prices on AFPC’s Representative Crop Farms” concludes: “As the nation struggles to recover from the Covid-19 pandemic, several supply chain disruptions continue to wreak havoc on agricultural input markets, both in terms of availability and prices. The purpose of this report was to analyze the impact that increased input prices are having on AFPC’s 64 representative crop farms. To carry out that work, we reached out to our 489 representative farm panel members to obtain estimates of the amount they spent on inputs last year and the amount they expect to spend this year. Following are the key highlights of the analysis (link to full report):

- A major point of reference for this report – net cash farm income in 2021 – included a significant amount of ad hoc assistance. Absent another infusion of assistance in 2022, we estimate that significant increases in input prices will result in a huge decline in net cash farm income in 2022 (compared to 2021).

- Despite the significant reduction from 2021, high commodity prices will likely still result in positive net cash farm income for most of AFPC’s representative farms. The noticeable outlier is rice — two-thirds of the rice farms are facing losses in 2022.

- Finally, much of our analysis hinges on producers being able to lock in high commodity prices at average yields. With drought ravaging half of the country (and many other areas facing excess moisture), this assumption may be overly optimistic. This is perhaps the most important point to note because producers are beginning to plant a crop that will require them to put an enormous – indeed historic – amount of capital at risk.

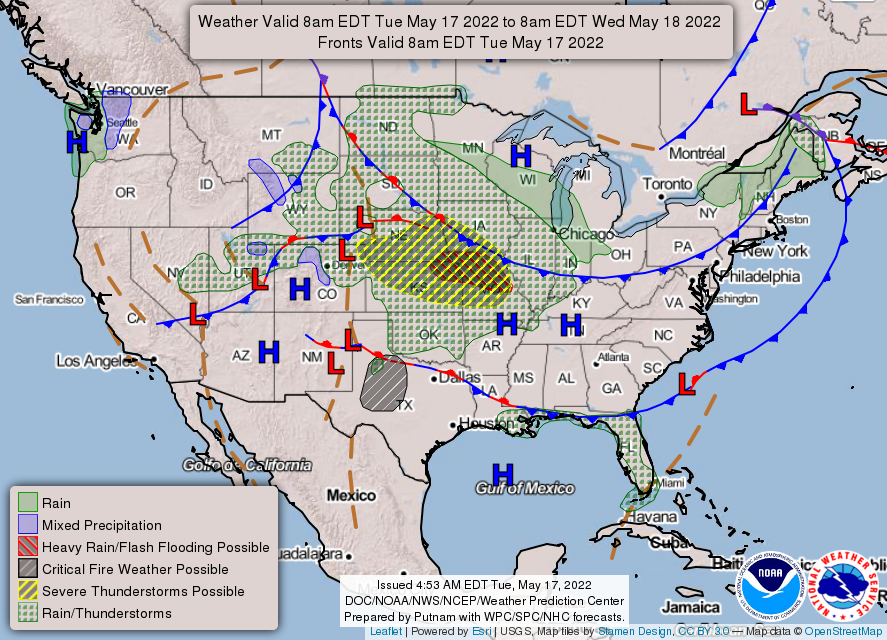

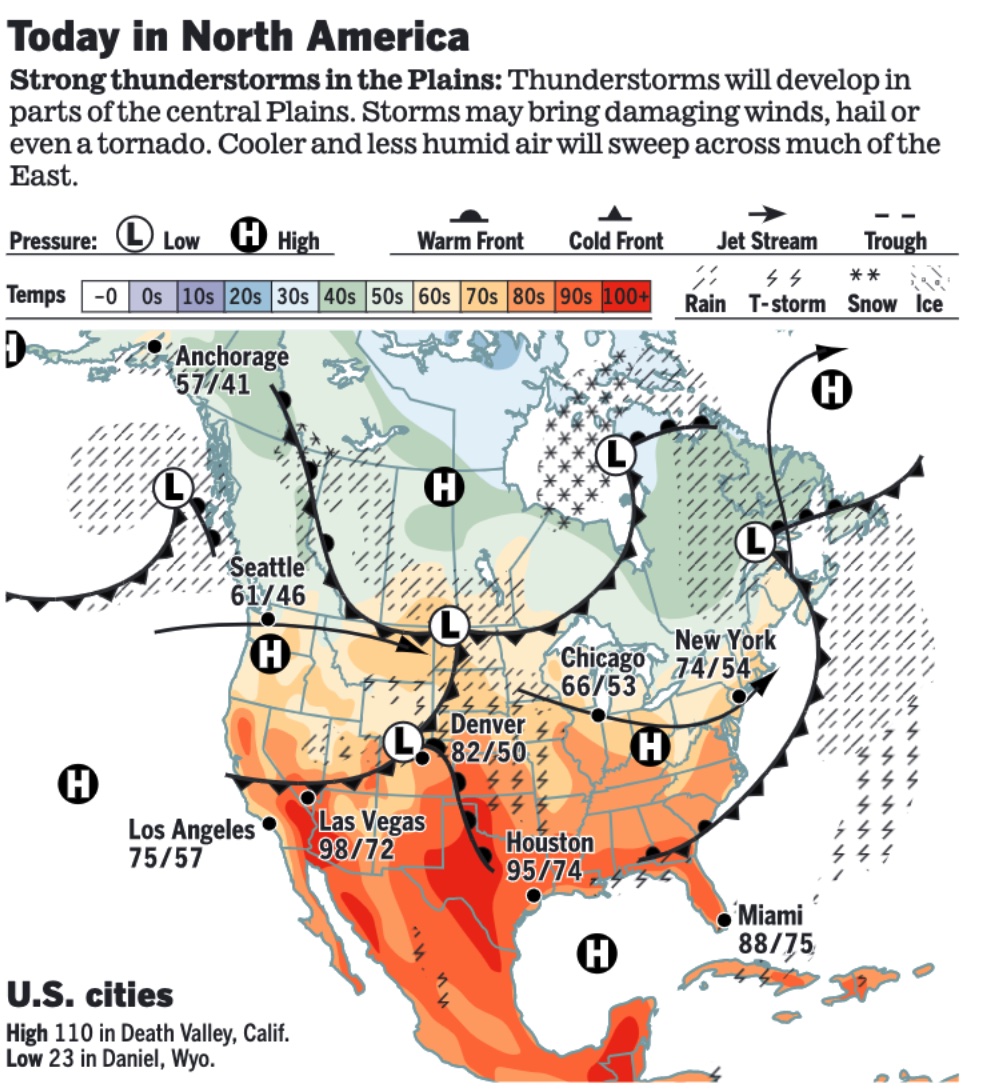

• NWS weather: Severe thunderstorms and flash flooding likely over portions of the Middle/Upper Mississippi Valley and Central Plains today and Wednesday... ...Record breaking heat to persist across the Southern Plains and Lower Mississippi Valley through midweek... ...Critical Fire risk for parts of west-central Texas today.

Items in Pro Farmer's First Thing Today include:

• Wheat leads overnight price pullback

• India eases wheat export restrictions a little

• Ukraine limits corn deliveries to Port of Reni, signs deal with Poland (details below)

• HRW, SRW crops head in opposite directions

• Tunisia to restart phosphate exports

• China pledges more support for manufacturers, small firms (details in China section)

• Big beef gains, limited movement

• Summer hogs back at premiums to cash index

|

RUSSIA/UKRAINE |

— Summary: The battle for Mariupol concluded after nearly three months of Russian bombardment. More than 260 Ukrainians evacuated from Mariupol’s Azovstal steelworks will be subject to an “exchange procedure” said Hanna Maliar, the country’s deputy defense minister.

- Sweden's Foreign Minister Ann Linde today signed an application declaring the country wants to join NATO. The move marks a formal step by Sweden toward joining the U.S.-led military alliance — ending decades of military neutrality. Russian President Vladimir President Putin said the entry of both Sweden and Finland into NATO will not create a threat to Russia, but military expansion into the territory will "certainly cause our response." The 30 current NATO members must agree unanimously on any new entries, Turkey’s opposition is significant.

- Efforts are underway to get some cargo ships moving again through the Black Sea. United Nations Secretary-General António Guterres is pursuing a high-stakes deal with Russia, Turkey and other nations to open up Ukrainian food exports to world markets, the Wall Street Journal reports (link). The effort is aimed at staving off a potential global food shortage and would have Moscow permit some Ukrainian grain shipments to get past its shipping blockade in exchange for moves to ease Russian and Belarusian exports of potash fertilizer. As one of the largest grain exporters, Ukraine exported 41.5 million metric tons of corn and wheat in the 2020-21 season, and more than 95% was shipped through the Black Sea. Russia and Belarus are key suppliers of potash, a plant nutrient that can ensure good harvests in other regions of the world. Belarusian potash is currently banned from world markets under Western sanctions.

- Ukraine limits corn deliveries to Port of Reni, signs deal for more grain movement through Poland. Ukrainian national railway company Ukrzaliznytsia will restrict corn transportation to the Danube port of Reni from May 18 for an indefinite period, APK-Inform agriculture consultancy said. It gave no reason for the decision, but it previously said that similar restrictions were imposed due to congestion of rail cars near the crossing points. Meanwhile, Poland will simplify inspections controls and add inspectors to boost the volume of Ukrainian grain exports through its country. “The measures envisaged... will significantly simplify the border crossing of our grain goods and increase export volumes,” Ukraine’s agriculture minister said.

- Treasury Secretary Janet Yellen said in a speech that massive investment on the scale of the Marshall Plan will be needed to rebuild Ukraine, referring to the post-World War II effort to aid Europe's recovery. Speaking at the Brussels Economic Forum, Yellen said "the bilateral and multilateral support announced so far will not be sufficient to address Ukraine's needs, even in the short term." Link for more via Bloomberg.

— Market impacts:

- Groups publish reports on high commodity prices. USDA’s s Foreign Agricultural Service has published a report (link) on the impact of the Ukraine war and other issues on global commodity prices. Meanwhile, the Agricultural Market Information System (AMIS), an organization run by the United Nations Food and Agriculture Organization and nine other international organizations, published (link) a summary of major market developments and the policy and other market drivers behind them.

|

POLICY UPDATE |

— WHIP+… now ERP. As we noted on Monday, USDA released Emergency Relief Program (ERP) details, formerly known as WHIP+. Link to our summary.

Combest-Sell & Associates put he following graphic on the payment calculation:

Payment limitation. If at least 75% of the person or legal entity’s average AGI is derived from farming, ranching, or forestry related activities the payment limitation will be $900,000 for each program year for specialty crops and $250,000 per program year for all other crops. If at least 75% of AGI is not derived from farming the payment limitation will be $125,000 per program year for specialty crops and $125,000 per program year for all other crops. To request the increased payment limitation a producer needs to file form FSA-510 and a certification from a licensed CPA or attorney.

ERP Phase 2 will be announced at a later date to cover losses that were not covered under Phase 1. This will include producers who saw a shallow loss but were not able to collect an indemnity from crop insurance or NAP. It will also include producers with area-based policies (SCO, STAX, ARPI, ECO, etc.) as indemnities for those policies have not yet been calculated.

— Vilsack: ‘Deep concern’ with India wheat export ban. USDA Secretary Tom Vilsack said on Monday he has “deep concern” about India’s wheat export ban at a time when there are already global supply worries. “What we need is transparency in the market, what we need is a market that is helping to get goods to those who are in need,” Vilsack said on a call with journalists. Vilsack said India was constraining the ability to access wheat, which he defined as a “wrong thing at this time.”

German agriculture minister Cem Ozdemir said the move also hurts Indian farmers as it would mean “a roller-coaster ride for prices.”

The U.S. hopes to convince India to “reconsider” its decision on its wheat export ban as such restrictions would “exacerbate food shortages.” Speaking at a press briefing in New York on Global Food security, U.S. Ambassador to the UN Linda Thomas-Greenfield said: “We have seen the report of India's decision. We're encouraging countries not to restrict exports because we think any restrictions on exports will exacerbate the food shortages.” The U.S., which is the president of the U.N. Security Council for this month, will host an event on food security this week. India will participate in the event. Thomas-Greenfield said the U.S. hopes that India would reconsider its decision after hearing the concerns being raised by other countries.

— Vilsack more worried about this year’s grain crop in Ukraine than exports of remainder of last year’s crop. During a call to reporters from Poland following a meeting of G7 ministers in Stuttgart, Germany, Vilsack detailed 80% of last year’s Ukrainian crop had already been shipped before Russia began blocking the Black Sea ports and said that while the remaining grain needs to be moved out of the country, a bigger problem will be if there is not adequate storage space or shipping opportunities for this year’s crop. Despite concerns about whether Ukrainian farmers can plant and harvest their crops, Vilsack said officials anticipate that the Ukrainian crop will be 50 to 60% of normal.

The European Union wants to get the grain out of Ukraine, Vilsack said, but noted the difficulty because Ukrainian railroad tracks are different from those of neighboring countries and grain must be unloaded and reloaded for it to move. “Whether they get it out is anybody’s guess, but there is going to be a heck of an effort to get it out,” he added. Ukraine has asked the G7 group of wealthier countries for equipment related to shipping, including weighing devices, and Vilsack said USDA will look into its own resources and ask universities and the private sector about the availability of equipment they may be replacing.

The European Commission last week announced a plan of action to help facilitate the movement of agricultural products. The plan will focus on physical infrastructure such as cars, vessels and loaders needed to move products outside of Ukraine, a major agricultural exporter. The Commission also is focused on helping Ukraine import what it needs to continue to produce. “Following Russia's invasion of Ukraine and its blockade of Ukrainian ports, Ukrainian grain and other agricultural goods can no longer reach their destinations,” the Commission said in a May 12 statement “The situation is threatening global food security and there is an urgent need to establish alternative logistics routes using all relevant transport modes.” The Commission has developed “an action plan to establish ‘Solidarity Lanes’ to ensure Ukraine can export grain, but also import the goods it needs, from humanitarian aid to animal feed and fertilizers. The plan calls on EU “market players to urgently make additional vehicles available” for rail transport and to “prioritize” Ukrainian agricultural exports, which are bottlenecked.

As noted Monday, Germany condemned Russia’s use of hunger as a weapon, and of Russia’s theft of grain. Vilsack revealed that in a four-way conversation with agriculture commissioners from Poland, Ukraine and the European Union, concerns were noted that Russia may use the stolen grain to “ingratiate itself" with food insecure countries.

Vilsack said he and other ag ministers are concerned about the availability of fertilizer, and said he hopes the $500 million Biden administration program to encourage the development of fertilizer companies makes the United States “more self-sufficient,” an assessment few agree will occur.

Regarding increasing production in countries to make up for the loss of Ukrainian crops on world markets, Vilsack said the European Union is adding flexibility to its Farm to Fork program, which has been expected to reduce production. Vilsack told other officials about U.S. plans to increase production through land that is not being renewed in the Conservation Reserve Program and double cropping.

Vilsack said he spoke with EU officials about minimum residue levels for fruits and vegetables to get them into the EU market and shipping disruptions due to the inconsistent application of health certificates. He also urged Germany to join the U.S.-led AIM for Climate group and the sustainability growth coalition. Vilsack said he discussed apples and pears and the Polish concern about African swine fever and the vaccine the United States is hoping to develop.

|

CHINA UPDATE |

— Today marked the third straight day that Shanghai did not record a virus infection outside of the city’s quarantine zones. Shanghai is a key economic hub in the country that has been hit with a strict Covid lockdown. On Monday the deputy mayor said she hoped China’s biggest city would return to normal by mid-June.

— China pledges more support for manufacturers, small firms. China’s state planner will strengthen support for manufacturers, the service sector and small firms, it said on Tuesday, as strict Covid-19 curbs reduce economic activity. The National Development Reform Commission says China’s economy “faces increasing downward pressure,” necessitating the need for more targeted support.

|

TRADE POLICY |

— Canadian publishes new dairy tariff rate quota (TRQ) policies in reaction to U.S. case via USMCA complaint. But USDA Secretary Tom Vilsack said the announcement was “disappointing” and “inadequate,” while U.S. dairy industry leaders called on the Biden administration to impose retaliatory tariffs on Canada.

Canada comments and reacts. Canada’s international trade minister, Mary Ng, said Canada adjusted its dairy quotas to satisfy the USMCA ruling even if the U.S. did not like the result. The new dairy quota system eliminated TRQ pools reserved for processors — “the sole finding” against Canada, she said. “The new policies end the use of processor-specific TRQ pools,” Ng said. She added that Canada “has the full discretion to administer its TRQs under CUSMA [the Canadian acronym for the Canada-U.S.-Mexico Agreement] in a manner that supports Canada’s supply management system for dairy… We will always stand up for its dairy industry, farmers and workers and the communities they support, and at a time when global food security is under threat, it is even more important that we strengthen and maintain a strong and vibrant domestic dairy industry,” Ng added.

USTR Tai comments. U.S. Trade Representative Katherine Tai said in a statement the U.S. was “deeply disappointed” by Canada’s announcement and communicated her disappointment to Canadian officials before the notice published Monday. “We will evaluate all options, and work with stakeholders and members of Congress, as we determine our next steps in the coming days.”

Vilsack comments. During a call to reporters from Poland after meeting with G7 leaders about the Ukraine situation, Vilsack said he had had a “very frank and specific conversation” with Canadian Minister of Agriculture and Agri-Food Marie-Claude Bibeau to tell her “how inadequate” the response was, and that the United States was “greatly disappointed” that the new quotas do not include retailers. Vilsack added, “There is no distance” between USDA, the Office of the U.S. Trade Representative and the U.S. dairy industry in reaction to the Canadian response. But some industry sources privately said the U.S. needed to get more aggressive with Canada. Asked about U.S. dairy groups calling today for retaliatory tariffs against Canada, Vilsack said “the first step was to convey the level of dissatisfaction… I am hopeful that the nature of my conversation with the Canadian minister underscores the initial level of disappointment,” Vilsack said, adding that he believes Bibeau “is capable of reading between the lines about what’s next.”

Canadian officials ought to be “capable of reading between the lines about what’s next, and maybe what’s next doesn’t have to happen,” Vilsack said during the teleconference. “I can assure you we are not going to give up on this.”

U.S. dairy industry wants action against Canada. The National Milk Producers Federation (NMPF) and the U.S. Dairy Export Council (USDEC) called on the U.S. government to levy retaliatory tariffs on Canada. “Canada made a clear choice to thumb its nose at both the United States government and its international treaty obligations,” said NMPF President and CEO Jim Mulhern. “It has completely disregarded the USMCA agreement signed just a few short years ago… Ottawa’s decision today is clearly designed to test our resolve by doubling down on its longstanding dairy trade violations, ignoring both the spirit and the letter of its trade agreements. That decision demands retaliatory action by the U.S. government. Otherwise, our trade agreements will be seen as toothless before the ink is dry,” Mulhern said.

Bottom line: Remember when USMCA participants said its dispute resolution would take a lot less time than under WTO? That is now being called into question.

|

ENERGY & CLIMATE CHANGE |

— EU, U.S. to develop standards for electric car charging stations. The European Union and the US will develop common standards to facilitate the use of charging stations by electric vehicles as they push to boost green alternatives for mobility and reduce dependency on fossil fuels. Both sides said the proposal is critical to expand the availability of electric vehicles across Europe and the U.S. as the two sides met on Monday at the Trade and Technology Council to strengthen bilateral economic cooperation.

— OMB as usual is holding meetings on the RFS. This time it concerns mandatory biofuel levels for 2020, 2021 and 2022. One of the nearly 20 groups consulted was from a major RFS opponent, the American Bakers Association. There is a June 3 court-ordered deadline to announce the final RFS levels and EPA Administrator Michael Regan said the agency will meet that deadline. Frankly, arguments from both RFS proponents and opponents are well known after years of similar meetings.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Abbott says deal reached to restart baby formula plant. Baby formula manufacturer Abbott Nutrition said it has reached an agreement with the Food and Drug Administration on a path to restart operations at its Sturgis, Mich., plant within two weeks. Production at the facility was halted in February after four infants drinking formula manufactured at the facility had fallen ill with rare and serious bacterial infections. Two of the babies died. After production resumes, it will take six to eight weeks for the formula to reach store shelves, the company said. FDA also has outlined a process by which it "would not object" to importing formula products "intended for a foreign market.”

“We are hopeful this call to the global market will be answered and that international businesses will rise to the occasion to assist in bolstering the supply of products that serve as the sole source of nutrition for many infants,” said FDA Commissioner Robert Califf.

Meanwhile, Nestlé said it would fly extra baby formula into the U.S. from Switzerland and the Netherlands as the Gerber owner looks to accelerate deliveries to alleviate a severe shortage across the U.S. Switzerland-based Nestlé is the third-largest player in the U.S. baby formula market, with a share of 9.7% according to Euromonitor. Similac owner Abbott Laboratories is No. 1, followed by U.K.-based Reckitt Benckiser Group PLC, which makes the Enfamil brand.

— Egg prices rise again. The nationwide average wholesale price of a dozen large eggs was $2.78, up by 11 cents for the second weekly increase in a row, with nearly 37.9 million birds in domestic flocks dead due to outbreaks of highly pathogenic avian influenza. Link for details.

|

CORONAVIRUS UPDATE |

— One million Covid-19 deaths. More than two years after recording its first Covid-19 death, the U.S. has crossed a once-unthinkable threshold: one million deaths attributed to the disease, according to the Centers for Disease Control and Prevention. The WSJ looked at how the virus has swept through the U.S. since the pandemic began (link).

— New York City officials say people should wear masks inside again. ‘We don’t anticipate that this wave will last much longer, so hang in there,’ New York City Health Commissioner Ashwin Vasan says.

— The CDC yesterday updated its guidance for people traveling within the U.S. The agency now urges all domestic travelers to "consider getting tested as close to the time of departure as possible (no more than three days) before your trip.” The agency also moved up four destinations to the "high" Covid-19 risk category for travelers.

— White House chief medical adviser Dr. Anthony Fauci said he would not continue to serve in his role if former President Donald Trump was elected to a second term. "Well, no," Fauci said with a chuckle when asked during an interview Sunday on CNN if he would stay on in his post if Trump were to return to the White House.

— North Korea’s official case count reached 168 infections and one death — although 1.5 million people are showing symptoms of “fever,” the army has been mobilized to distribute medicines and 10,000 health workers are trying to trace potential infections.

|

POLITICS & ELECTIONS |

— New York’s redistricting process looks as if Republicans could even pick up seats in several newly competitive districts. Jonathan Cervas, the court-appointed special master, released a proposed map of new congressional districts for the Empire State, and it’s bad news for Democrats. According to Dave Wasserman of the Cook Political Report with Amy Walter: “This N.Y. map is pretty bad news for Democrats. With so many competitive seats, it’s not hard to envision a 16D-10R (or even 15D-11R) split on a great GOP night, which is a far cry from the 22D-4R rout Dems initially tried to gerrymander. …“Rep. Nicole Malliotakis (R) gets to keep a redder #NY11 (Trump +3), which makes her the clear favorite in a rematch vs. Max Rose (D). Rep. Tom Suozzi’s (D) open #NY03 now at serious risk for Dems (Biden +6), and Rep. John Katko’s (R) open #NY22 more holdable for Rs (Biden +7).” Wasserman also said it looked unlikely that Rep. Mondaire Jones (D-N.Y) would run in the same district as Maloney. Jones lives in White Plains, which Wasserman said could put Jones in the same district as fellow progressive Rep. Jamaal Bowman (D-N.Y.).

— Supreme Court struck down a federal limit on political candidates fundraising after an election to repay personal campaign loans. In a 6-3 decision authored by Chief Justice John Roberts, the high court’s conservatives sided with Sen. Ted Cruz (R-Texas) and ruled the $250,000 limit on loan repayments was unconstitutional and violated a candidate’s First Amendment rights. The Supreme Court ruling strikes down a provision in the 2002 McCain-Feingold Bipartisan Campaign Reform Act.

|

CONGRESS |

— Senate votes to advance Ukraine aid despite GOP opposition. The Senate voted on Monday to advance $40 billion more aid for Ukraine in its war against Russia, setting the stage for a vote on the bill this week after the military and humanitarian aid was delayed due to opposition from one Republican senator. The tally was 81 to 11 on the first of a potential three procedural votes paving the way for final Senate passage of the funding, requested by President Joe Biden's administration to keep aid flowing and boost the government in Kyiv nearly three months after the start of the Russian invasion.

|

OTHER ITEMS OF NOTE |

— President Biden reversed some Trump policies related to Cuba, making it easier for families to visit relatives in the country. The State Department announced it will reinstate the Cuban Family Reunification Parole Program and increase consular services as well as visa processing. The Biden administration is also lifting the family remittance cap of $1,000 per quarter, which limited monetary transfers from American residents. The announced changes to Cuba policy leave in place some restrictions and maintain sanctions on certain entities. The U.S. will still prohibit American tourism in Cuba and won't allow individuals to travel there for educational purposes, senior administration officials said.

Sen. Rick Scott (R-Fla.) said he would put a hold on all relevant Biden nominees requiring Senate confirmation until the decision is reversed. “Biden can frame this however he wants, but this is the truth: This is nothing but an idiotic attempt to return to Obama’s failed appeasement policies and clear sign of support for the evil regime,” Scott said.

Sen. Robert Menendez (D-N.J.), who heads the Senate Foreign Relations Committee, said the moves send the “wrong message” to Cuban President Miguel Díaz-Canel’s government. Menendez was particularly critical of the administration decision to reinstate travel by groups for educational and cultural exchanges as well as some travel for professional meetings and professional research on the island.

— Judge strikes down California law mandating women on boards. A state judge struck down a California law requiring companies in the state put female directors on their boards, the second legal setback in as many months for efforts to mandate board diversity.

— Supreme Court restricted immigrants from challenging in federal court adverse factual findings by immigration judges. The court split 5-4 in holding that federal district courts cannot review factual findings by immigration judges in certain deportation proceedings. Writing for the majority, Justice Barrett said when noncitizens in such cases appeal to federal court, Congress authorized district judges to review legal and constitutional findings by immigration judges, but not their determinations of fact. The case involved Pankajkumar Patel, a citizen of India who entered the U.S. unlawfully and then sought authorization to remain. While that case was pending, he applied for a Georgia driver’s license and checked a box stating he was a U.S. citizen. In later proceedings, an immigration judge found Patel had lied on the driver’s license form, making his deportation mandatory.

— Elon Musk says Twitter deal "cannot move forward" until bot claims are proved. Musk declared he won’t proceed with his $44 billion takeover of Twitter Inc. unless the social media giant can prove bots make up fewer than 5% of its users, casting yet more uncertainty over the deal. Meanwhile, Twitter's chief on Monday defended the messaging platform's battle against "bots" that aspiring buyer Elon Musk says vex the platform, only to have the billionaire respond with a poo emoji.

— USDA extends deadline to June 15 for public to comment on competition challenges in seed, fertilizer, other agricultural inputs, and retail markets. Link for details. USDA filed three notices in the Federal Register earlier this year with a comment period closing May 16. As noted, USDA extended the comment period on its request for information from the public on access to fertilizer markets (link), competition in intellectual property issues on seed and inputs (link), and promoting competition in the food and agricultural markets (link).