Wheat Futures Soar as India Mostly Curbs Exports

China’s economic activity plummets as Covid lockdowns hit growth

|

In Today’s Digital Newspaper |

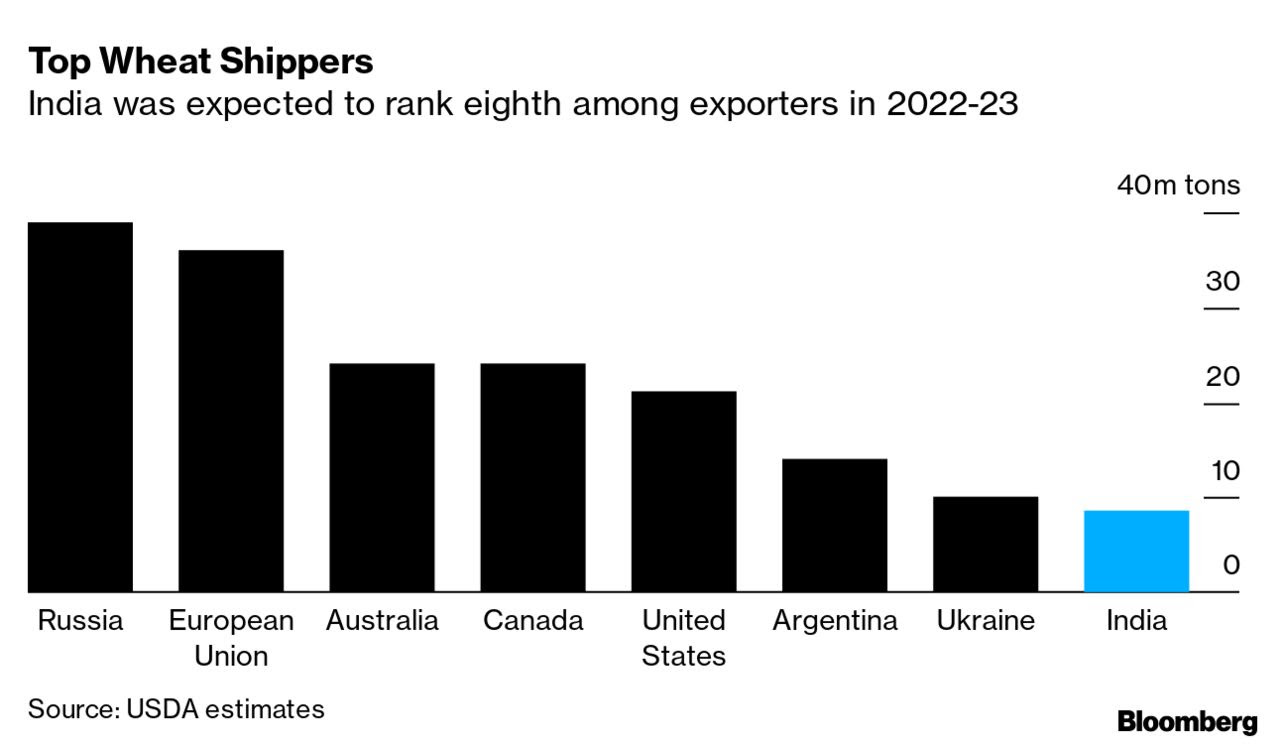

India’s government said that it was implementing a ban on overseas sales “in order to manage the overall food security of the country and to support the needs of the neighboring and other vulnerable countries." However, it said that it would still allow exports for which letters of credit had already been issued and it would consider sales to countries looking to meet their food security needs. Link for details. Wheat prices rose by the maximum amount allowed, stoking pressure on food costs as tight global supplies roiled international markets. Futures traded in Chicago to $12.47 a bushel, their highest level in two months. Wheat prices have risen more than 60% this year, driven up by disruption from Russia’s invasion of Ukraine.

German Foreign Minister Annalena Baerbock accused Russia of deliberately provoking a global food crisis to try to weaken the international alliance against its war in Ukraine. Russia is destroying transport routes and storage facilities for Ukrainian grain, which is pushing up prices and threatening to unleash “brutal hunger” around the world, especially in Africa, Baerbock said at a news conference after talks with Group of Seven counterparts in northern Germany. Ukraine is one of the world’s biggest growers of wheat and the U.S. expects production to fall by one-third this year compared to last season. Baerbock added that about 25 million tons of grain are stuck at Ukrainian ports, particularly in Odesa, due to the Russian blockade and only a small amount can be transported out by train. “We must not be naive about this,” Baerbock said. “It’s not collateral damage, it’s a perfectly deliberate instrument in a hybrid war that is currently being waged.”

Finland's government announced it will apply to join NATO, ditching decades of wartime neutrality and ignoring Russian threats of possible retaliation as the Nordic country attempts to strengthen its security following the onset of the war in Ukraine. The addition of Finland would roughly double NATO’s land border with Russia. NATO leaders said Sunday they were confident objections expressed by Turkey against the Swedish and Finnish bids could be overcome, allowing both countries to swiftly join the alliance. Sweden, another longtime holdout, is also expected to apply for membership soon.

Ukrainian President Volodymyr Zelenskyy met with a congressional delegation led by Senate Minority Leader Mitch McConnell (R-Ky.) in Kyiv on Saturday and called for Russia to officially be recognized as a "terrorist state."

Treasury Secretary Janet Yellen is heading to Brussels today ahead of the G7 finance ministers’ meeting in Bonn, Germany, on Thursday and Friday. President Joe Biden will visit the Republic of Korea and Japan from May 20-24 for meetings with his counterparts there.

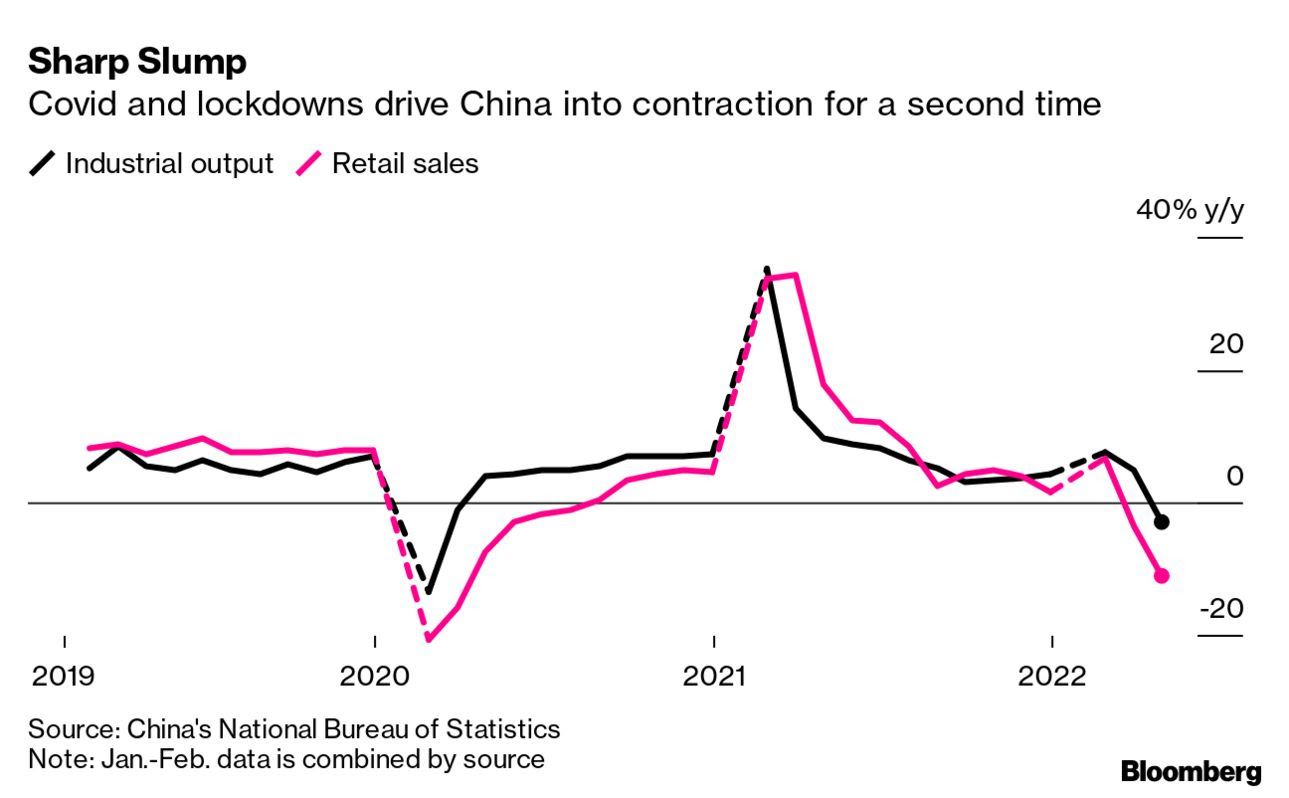

China’s economic activity plummets as Covid lockdowns hit growth. Consumer and industrial output fell sharply illustrating toll of Xi Jinping’s coronavirus strategy. Officials are taking measured steps to help the economy: China effectively cut the interest rate for new mortgages over the weekend to bolster an ailing housing market, but the one-year policy loan rate was left unchanged Monday.

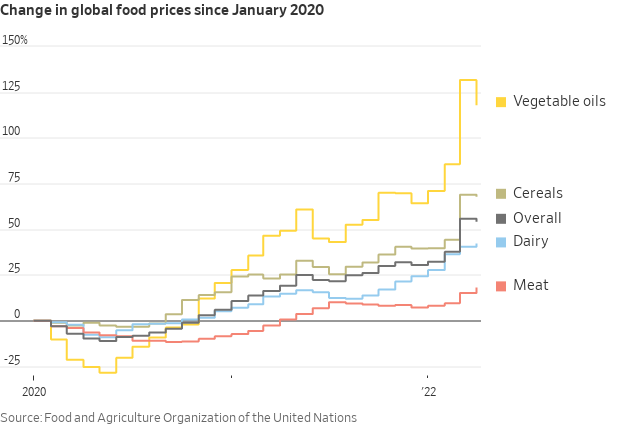

Soaring food prices are triggering shortages and protests across the developing world as disruption from the Ukraine war adds to existing strains on global supplies of grains, meat and other foodstuffs.

Texas A&M Univ. is expected today to post its updated report on fertilizer prices.

Another country, New Zealand, is taking on Canada’s dairy trade policy, the first under the CP-TPP trade pact. Meanwhile, some observers privately say the Biden administration is not doing enough to alter Canada’s dairy policy following a USMCA complaint.

Fetterman suffers stroke. Days ahead of his expected victory in the Democratic primary for Senate, Pennsylvania Lt. Gov. John Fetterman suffered a stroke on Friday that hospitalized him. Fetterman said in a statement on Sunday that he’s on his way toward a “full recovery” after doctors successfully removed the blood clot that caused the stroke.

Sen. Chris Van Hollen (D-Md.) was admitted to George Washington Hospital over the weekend “after experiencing lightheadedness and acute neck pain.” Testing revealed he’d suffered a minor stroke. He said he was informed there were no long-term effects as a result and will remain under observation for a few days before returning to the Senate.

|

MARKET FOCUS |

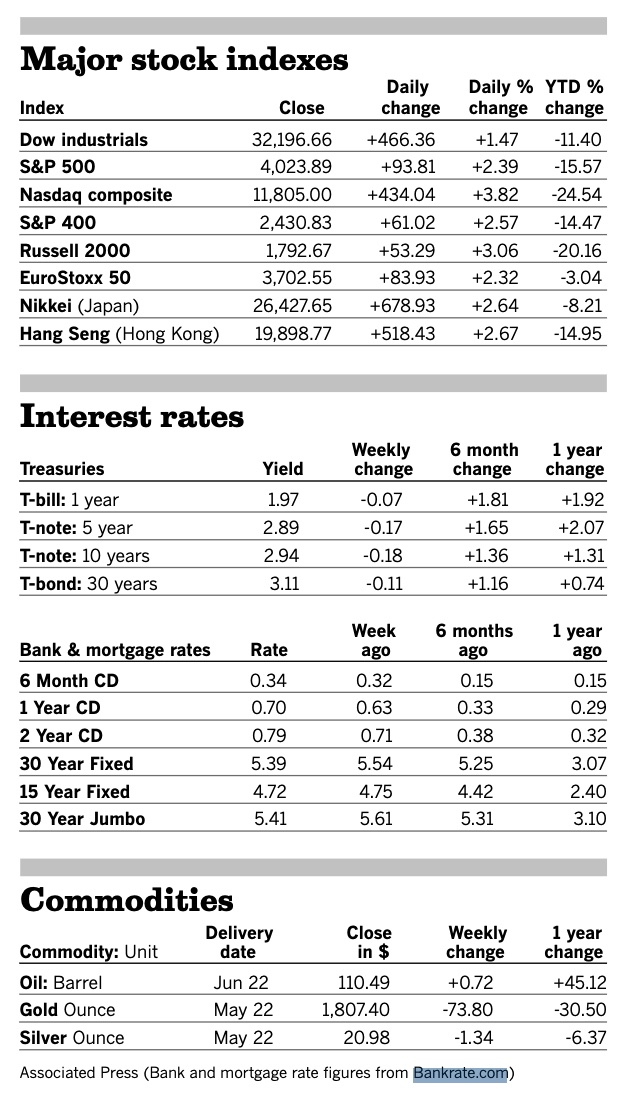

Equities today: Global stock markets were mixed but mostly lower overnight. U.S. stock indexes are pointed toward weaker openings. European indexes were mixed. In Asia, the Nikkei 225 index in Tokyo rose 0.5%, while South Korea’s Kospi Composite edged down 0.3%.

U.S. equities Friday: The Dow was up 466.36 points, 1.47%, at 32,196.66. The Nasdaq gained 434.04 points, 3.82%, at 11,805.00. The S&P 500 rose 93.81 points, 2.39%, at 4.023.89.

Equities were all lower for the week. The Dow was down 2.1% for a seventh weekly loss, The Nasdaq fell 2.8% and the S&P 500 declined 2.4%.

Agriculture markets Friday:

- Corn: July corn futures fell 10 1/4 cents to $7.81 1/4, down 3 1/2 cents for the week. December corn fell 4 1/4 cents to $7.48 3/4, still up 28 cents for the week.

- Soy complex: July soybeans surged 32 3/4 cents to $16.46 1/2, a gain of 24 1/2 cents for the week. July soymeal rallied $13.30 to $409.30, the contract’s first gain in six sessions. July soyoil rose 127 points to 83.79 cents, a two-week high.

- Wheat: July SRW wheat rose 1 1/4 cents to $11.77 1/2, a two-month high and a gain of 69 cents for the week. July HRW wheat rose 12 cents to $12.82, a lifetime-high close and a gain of $1.11 1/2 for the week. July spring wheat rose 9 cents to $13.25 after posting a contract high for the third straight day.

- Cotton: July cotton fell 33 points to 145.20 cents per pound, up 159 points for the week.

- Cattle: June live cattle rose 42.5 cents to $132.075, still down 67.5 cents from the end of last week. August feeder cattle gained $1.50 to $168.025 but lost $6.675 for the week.

- Hogs: June lean hog futures rose $3.275 to $100.75, up from a four-month low the previous day. June hogs still tumbled $3.35 for the week, the third consecutive weekly drop.

Ag markets today: Wheat gapped higher, with HRW and HRS futures moving to new contract highs after India’s ban on wheat exports over the weekend. Corn and soybeans also posted strong gains. As of 7:30 a.m. ET, wheat futures were trading 44 to 52 cents higher, corn was 13 to 16 cents higher and soybeans were 15 to 16 cents higher. Front-month crude oil futures were around $1 lower and the U.S. dollar index was about 175 points lower this morning.

On tap today:

• New York Fed's Empire State survey, due at 8:30 a.m. ET, is expected to fall to 16.5 in May from 24.6 one month earlier.

• New York Fed President John Williams participates in a moderated discussion at 8:55 a.m. ET.

• Bank of England Gov. Andrew Bailey appears before Parliament's Treasury Committee at 10:15 a.m.

• USDA Grain Export inspections report, 11:00 a.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

• President Joe Biden hosts Greece’s Prime Minister Kyriakos Mitsotakis today at the White House. Ukraine is expected to top the agenda, which will also include discussion on climate change and energy security.

China’s economic activity plummets as Covid lockdowns hit growth. Retail sales, the country’s main gauge of consumer activity, slumped 11.1% year on year, compared with forecasts of a 6.6% fall by economists. Retail sales also dropped in March, down 3.5% year on year. Dozens of cities and hundreds of millions of people across China have been placed under full or partial lockdowns as part of a policy that is expected to have deep ramifications for global supply chains.

Industrial production dropped 2.9% but was expected to rise slightly despite the recent restrictions.

According to Nomura, a Japanese bank, 41 cities accounting for nearly 30% of China’s GDP were in full or partial lockdown on May 10. On Monday Shanghai’s deputy mayor announced plans to gradually lift covid-19-related restrictions from June 1.

Recession watch. Goldman Sachs Group Inc. Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a U.S. recession, saying it’s a “very, very high risk.” Goldman Sachs just downgraded their 2022 U.S. growth forecast (to 2.4% from 2.6%) and 2023 (to 1.6% from 2.2%).

EU cuts growth forecast, raises inflation outlook. Russia’s invasion of Ukraine and the resulting surge in energy and commodity prices will slash eurozone economic growth this year and next, while boosting inflation to record levels. The European Commission cut its economic growth forecast for the 19 countries sharing the euro to 2.7% this year from 4.0% predicted only in February. Growth is expected to slow to 2.3% next year, down from 2.7% previously forecast. Inflation will be 6.1% this year, the Commission forecast and fall only to 2.7% next year. Before the war, the Commission expected inflation to rise 3.5% in this year and 1.7% in 2023.

Federal Reserve Bank of Cleveland President Loretta Mester said the U.S. central bank needs to press forward with aggressive rate rises, and that by early fall it may be able to take stock of whether it can slow down or will need to speed up the process of removing support from the economy. “Given economic conditions, ongoing increases in the fed-funds rate are called for, and unless there are some big surprises, I expect it to be appropriate to raise the policy rate another 50 basis points at each of our next two meetings,” Mester said in a Friday speech.

Fedspeak picks up again in the week ahead, highlighted by Federal Reserve Chairman Jerome Powell giving a talk at a Wall Street Journal conference on May 17 at 2 p.m. ET. Powell will take the stage, with the market anticipating a half-point interest rate hike at the June and July meetings of the Fed's policymaking committee.

Securities and Exchange Commission Chair Gary Gensler will appear at the FINRA 2022 Annual Conference at 10 a.m. ET Monday, while Rostin Behnam, head of the Commodity Futures Trading Commission, is set to discuss his agency's agenda and crypto regulation on Wednesday at 9 a.m. ET Gensler will speak again Tuesday at the North American Securities Administrators Association 2022 Spring Meeting and Public Policy Symposium. And Behnam is slated to appear at two other Wednesday events: Politico's 2022 Sustainability Summit at 1:10 p.m. ET, and the 20th Annual Symposium on Building the Financial System of the 21st Century at 6 p.m. ET.

An estimated $163 billion from pandemic unemployment benefits was stolen or misspent. The money may never be recovered.

As part of efforts to combat inflation, the Biden administration released a “Housing Supply Action Plan” meant to help create thousands of affordable housing units in the next three years and urged local governments to dedicate more of their American Rescue Plan funds to build affordable housing.

Inflation watch: the tooth fairy. The Tooth Fairy’s average cash payout has reached $5.36 per tooth, according to Delta Dental’s 2022 Original Tooth Fairy Poll. It is the highest price paid per tooth in the 24-year history of the poll… quadruple the value of $1.30 in 1998. So, where’s the inflation? If it matched the CPI, a tooth left under the pillow would be worth only $2.24 today.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker in early trading. In bond markets, the yield on the benchmark 10-Year U.S. Treasury note edged up to 2.939% from 2.932% on Friday. Brent crude, the international oil benchmark, fell 0.7% to $110.79 a barrel. West Texas Intermediate crude fell 0.9% to $109.49 a barrel. Gold prices ticked down 0.5%. Spot gold fluctuated around $1,800, a level it’s been unable to break free from since mid-2020.

• Saudi Aramco posted record quarterly profit on surging oil prices. The Saudi oil giant said its net income rose 80% in the first quarter of this year, as state-owned oil giants reap profits from an energy-price boom caused by Russia’s invasion of Ukraine.

• India reversal on wheat export ban called a “shape shifter” for global markets. Tobin Gorey, director of agricultural strategy at Commonwealth Bank of Australia, said the wheat export ban would be a “shape shifter” for global markets. “The trade will likely need to replace at least some Indian wheat in the pipeline,” Gorey said. “We suspect that will create an initial flurry of trading but the market will take some time to assess the details.” A report Sunday has the Indian government selling 500,000 tons to Egypt. If correct, 2 million tons of exports are known. India’s exports of 3 million tons may be possible, analysts note. USDA had India in for 8 million tons of wheat exports, while some others were up to 12 million tons.

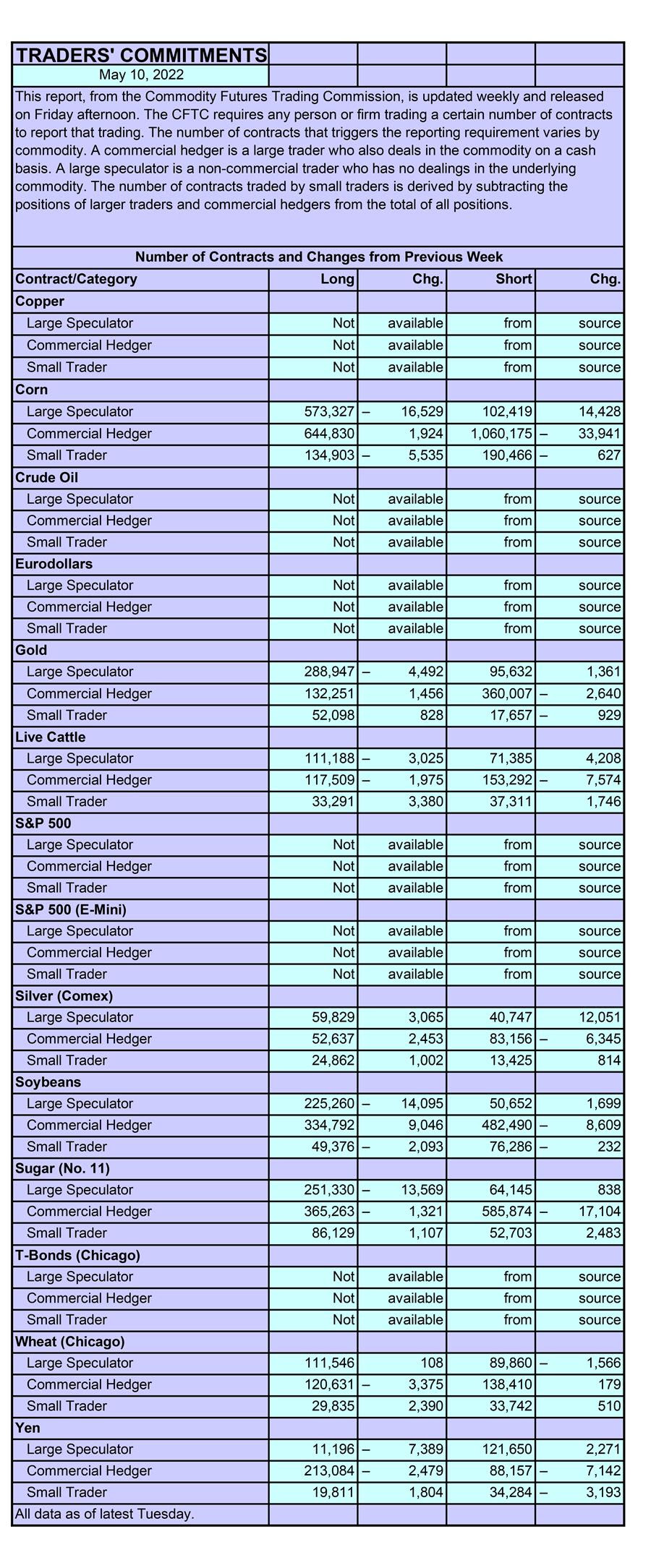

• CFTC data shows that money managers trimmed their net long positions in soybeans and corn last week ahead of USDA’s monthly WASDE report. Managed money net longs in CBOT soybean dropped by 22,592 lots over the week to a three-month low of 130,661 lots, as the market was expecting the USDA to estimate a large supply surplus for 2022/23 due to a recovery in production in South America. Similarly for corn, money managers reduced their net long positions by 14,956 lots over the week to leave them with net longs of 338,562 lots as of 10 May 2022. Net bullish Chicago wheat bets were boosted to a 4-week high.

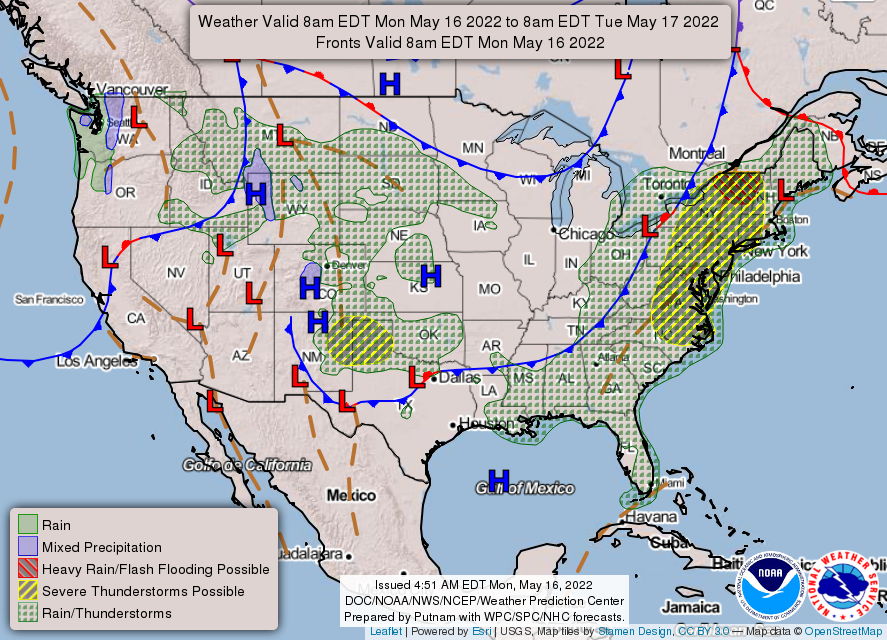

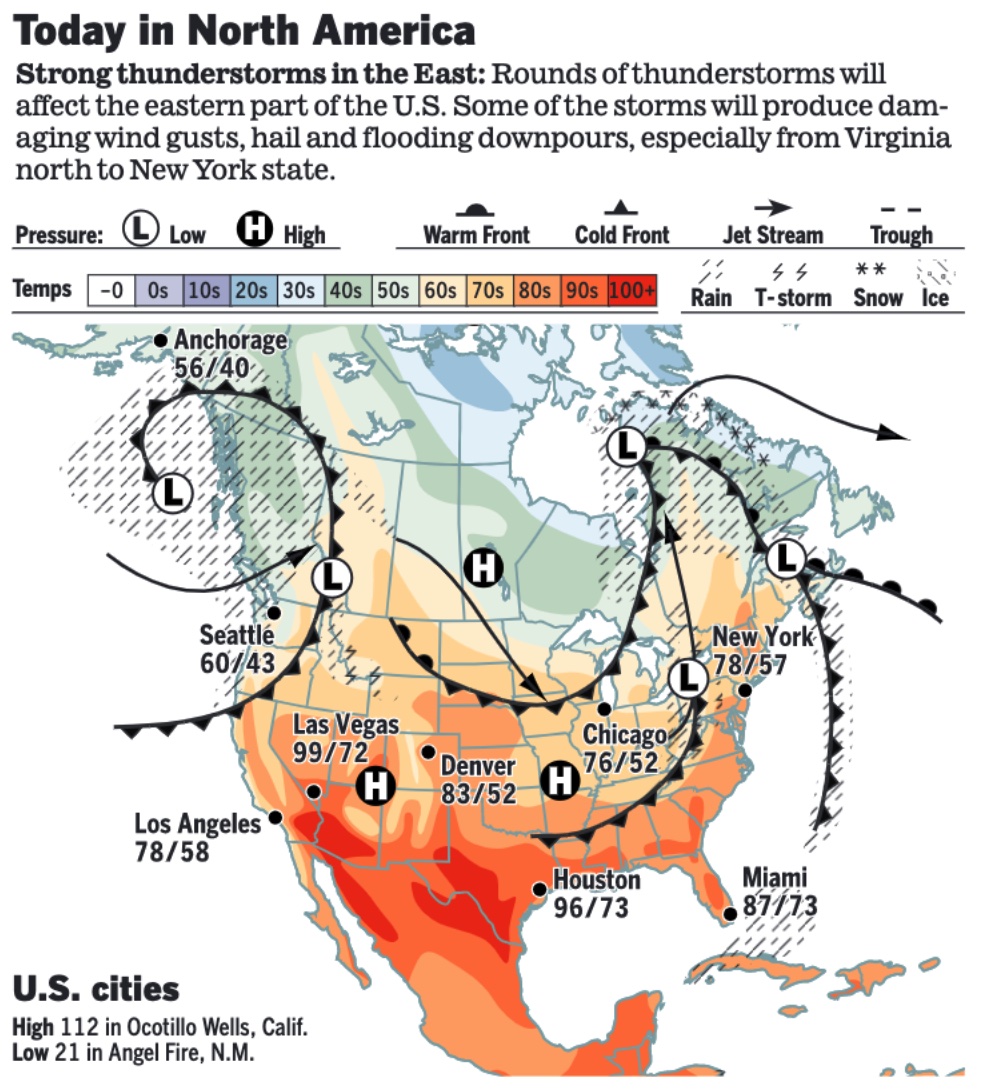

• NWS weather: Severe weather and flash flooding concerns shift to the East today... ...Record warm temperatures in the South this week... ...Fire weather risk for parts of the Southwest and Southern Plains

Items in Pro Farmer's First Thing Today include:

• Wheat surges overnight

• HRW crop tour this week

• Planting delays to continue in northern crop areas

• Record NOPA April soy crush expected

• Traders watching to see if cash cattle have topped

• Hogs: Bottom or just a corrective bounce?

|

RUSSIA/UKRAINE |

— Summary: NATO’s Secretary-General Jens Stoltenberg said Sunday that “Ukraine can win this war” following an informal meeting of the group. Ukrainian forces have advanced to near the Russian border in recent days after pushing Russian troops from the outskirts of Kharkiv, Ukraine’s second-largest city. Evidence is growing that Russia’s offensive in the Donbas region farther east is faltering after initial modest gains. Russia has lost a third of the ground forces it committed to the offensive in Ukraine, according to British intelligence officials.

- Treasury Secretary Janet Yellen aims to increase economic pressure on Russia to end “its brutal and illegal war” during a trip to Europe this week, the Treasury Department said in a statement Friday. Also, during the trip to Germany May 19-20, Yellen will participate in a meeting of Group of Seven finance ministers and central bank governors in talks that will also feature work to implement last year’s global corporate tax deal.

- Secretary of Defense Lloyd Austin urged Russia’s Defense Minister Sergei Shoigu for an immediate ceasefire in Ukraine in their first call since Feb. 18, the Pentagon said in a statement. Austin also emphasized the importance of maintaining lines of communication; he and Shoigu had not spoken since the Russian invasion of Ukraine.

- Biden told the leaders of Sweden and Finland that he supports their right to decide whether to join NATO and underscored his backing for the alliance’s open-door policy, according to the White House. Turkey said Friday it doesn’t favor Sweden and Finland joining NATO, potentially dashing the two countries’ hopes of a quick accession to the military alliance. An application to join NATO must be unanimously approved by its 30 members. Turkey has raised issues over the pending applications, though it has suggested it will not oppose admission if its own security concerns are addressed. Governments in Helsinki and Stockholm are set to deliver their formal applications at NATO’s headquarters in Brussels later in the week once their respective parliaments have signed off.

- Russia cut electricity supplies to Finland from Saturday, as tensions mount about the Nordic country’s plan to join NATO. RAO Nordic, the Russian company that exports the electricity, claimed not to have been paid for previous deliveries. Finland says Russia supplies only 10% of the power for its grid.

— Market impacts:

- Germany plans to stop importing Russian oil by the end of the year even if the European Union fails to agree on an EU-wide ban in its next set of sanctions, government officials said. EU foreign ministers are meeting in Brussels today to discuss the next round of sanctions and EU diplomats have floated a delay in the phased-in oil ban after Hungary objected.

- McDonald's said it would quit Russia and sell its business there, ending more than three decades in the country over the invasion of Ukraine.

|

POLICY UPDATE |

— Illinois farmer comments on USDA push to boost double cropping. “I agree this move is not going to lead to large increase in soybean acres, but this is a very farmer friendly move. In west central Illinois we have been doing more double cropping, but the beans were non insurable. All we got was lip service when RMA Washington head visited this area of the state couple years ago. Nothing happened. I will say again this was a farmer friendly move and did not cause any market disruption. I will take those from USDA any day.”

|

PERSONNEL |

— Karine Jean-Pierre begins her first full week as White House press secretary following the departure of Jen Psaki last Friday. Jean-Pierre is the first Black and out LGBTQ person to hold the position.

— Senate Banking Committee on Thursday will consider the nominations of Michael Barr for vice chair for supervision for the Fed and Jaime Lizárraga and Mark Toshiro Uyeda as SEC commissioners. Barr, the dean of the Gerald R. Ford School of Public Policy at the University of Michigan and a former Treasury Department official, is President Joe Biden's second pick for the Fed's top bank cop after Sarah Bloom Raskin's nomination was sunk by Republicans.

|

CHINA UPDATE |

— Department of State sent Congress a report on plans to pressure China over its “horrific abuses” of Uyghur minorities in the Xinjiang region. This would be done in meetings with other nations, multilateral institutions such as the G7, and the private sector. But the report doesn’t provide a list of new entities it says may be benefiting from forced labor.

— China’s central bank effectively cut the interest rate for new mortgages to prop up the ailing housing market and boost the slowing economy. The People’s Bank of China said first-home buyers will be able to borrow money at an interest rate as low as 4.4%, down from 4.6% previously. The change will “promote the stable and healthy development of the property market,” the PBOC said.

|

TRADE POLICY |

— New Zealand challenges Canada over dairy tariffs, kicking off a dispute resolution under the trans-Pacific Partnership pact — the first of its kind. Canada's dairy tariff rate quotas (TRQs) set out how much dairy product can cross its border tariff-free, but Trade Minister Damien O'Connor said New Zealand submitted a request for consultations under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a free trade agreement both countries — and 10 others — are signatories to. It is the first time such a dispute settlement has been sought by any country under the CPTPP. "Many of Canada's dairy TRQs remain unfilled, and this represents a tangible loss to New Zealand's dairy exporters… The value to New Zealand of this lost market access is estimated to be approximately $68 million over the first two years, with this expected to increase year on year as the size of these quotas increase under CPTPP." Canada has seven days to respond, after which the two countries can formally try to resolve the issue.

It follows a similar complaint over Canada's quotas by the U.S. and Mexico, who took their case to a dispute settlement panel under the U.S.-Mexico-Canada trade agreement USMCA. The panel found Canada's approach was inconsistent with its commitments, although Canada said the finding was "overwhelmingly in Canada's favor.” Some observers privately say the U.S. is not pressing Canada hard enough to resolve the dairy trade dispute.

|

ENERGY & CLIMATE CHANGE |

— Sen. Sheldon Whitehouse (D-R.I.) plans to introduce a carbon border adjustment measure "within the next 10 days or so" as the legislation seeks to impose a fee on imports of energy-intensive goods modeled after the federal government's social cost of carbon. The policy could win the backing of some Republicans as a way to hit polluting industries that have moved to China.

— Sen. Chris Van Hollen hospitalized after 'minor stroke'. Sen. Chris Van Hollen (D-Md.) announced on Sunday that he has been hospitalized after suffering a “minor stroke” over the weekend while giving a speech. The junior senator from Maryland said in a statement on Twitter that doctors at George Washington University Hospital in Washington, D.C., have informed him that “there are no long-term effects or damage as a result of this incident.” Van Hollen says he will remain hospitalized for "a few days" but plans to return to work in the senate later this week.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Soaring food prices are triggering shortages and protests across the developing world as disruption from the Ukraine war adds to existing strains on global supplies of grains, meat and other foodstuffs, the Wall Street Journal reports (link). India on Saturday invoked a rare ban on wheat exports to help tame domestic prices, a move likely to exacerbate global strains. The country is the world’s second-largest wheat grower, behind China. Late last month, Indonesia halted the export of certain types of palm oil to lower soaring prices of cooking oil at home. Rising prices helped stoke the violent unrest that led to the resignation of Sri Lanka’s prime minister earlier this week and have fanned more peaceful protests in the Middle East. In parts of Africa, millers have run out of wheat. Consumers are skimping on food items once considered everyday staples and substituting cheaper products.

|

CORONAVIRUS UPDATE |

— North Korea’s leader, Kim Jong Un, called the country’s first Covid-19 outbreak a “great disaster” during an emergency meeting on Saturday. The country of 25 million people announced its first cases since the start of the pandemic on Thursday, but state media later said that there had been half a million cases of unexplained fever since late April and a total of 27 deaths. A strict lockdown is in place.

|

POLITICS & ELECTIONS |

— Congressional districts for northern Florida drawn by the governor’s office remain in place, for now, while the state appeals a judge’s decision that found them to be unconstitutional. Judge Layne Smith of Florida’s Second Judicial Circuit could vacate the stay, and the case now before the First District Court of Appeals could be fast-tracked to the Florida Supreme Court.

— Voters will head to the polls Tuesday for primary elections in Idaho, Kentucky, North Carolina, Oregon and Pennsylvania in what will be another test of former President Donald Trump's endorsement power. Much of the focus will be on Pennsylvania, where GOP Senate candidate Kathy Barnette has emerged as a major threat to Trump-backed Mehmet Oz — the celebrity heart surgeon and former television personality.

— Pennsylvania Lt. Gov. John Fetterman, the leading Democrat in the state’s high-profile Senate contest, has suffered a stroke but is on his way to a “full recovery,” his campaign said Sunday. Fetterman, 52, said in a statement that he wasn’t feeling well Friday and went to the hospital at the urging of his wife. “I had a stroke that was caused by a clot from my heart being in an A-fib rhythm for too long,” Fetterman said in a statement. He said the doctors were able to remove the clot, “reversing the stroke,” and had gotten his heart under control. “The good news is I’m feeling much better, and the doctors tell me I didn’t suffer any cognitive damage,” he said in the statement.

|

CONGRESS |

— A House panel will hold an open congressional hearing Tuesday about UFOs for the first time in more than 50 years. The public hearing will focus on a Pentagon program that was established last year after the U.S. intelligence community released a preliminary assessment on 144 reports of "unidentified aerial phenomena" since 2004 — and could explain only one.

|

OTHER ITEMS OF NOTE |

— Elon Musk said that he was still committed to buying Twitter, despite saying the deal was on hold. Twitter didn’t comment on Musk’s tweets. Musk waived detailed due diligence to reach an agreement faster. The WSJ said it couldn’t be determined if the latest tweets were a negotiating tactic to abandon the transaction or reprice the deal.