CPI: 8.3% YOY, Higher than Expected; Core Inflation Also Higher than Expected

Biden, Vilsack to Illinois farm today to discuss food prices, efforts to boost production

|

In Today’s Digital Newspaper |

The House of Representatives Tuesday evening passed a nearly $40 billion bill to deliver aid to Ukraine. The measure will next need to be passed by the Senate before it can go to President Joe Biden to be signed into law. We have details in Policy section.

Ukrainian leadership warned of a global food crisis if Russia does not lift a naval blockade that has decreased grain shipments leaving the nation’s ports. Citing the key role that Odesa, in the southwest near Moldova, plays in the global agricultural trade, Zelenskyy said in a video address that shortages of grain exports were bound to get worse if attacks continued and Western powers did not put an end to the Russian blockade of Ukrainian ports.

Russian troops in Ukraine are shipping grains and produce critical to the Ukrainian economy to Crimea, Ukrainian officials alleged, adding to a list of grievances against Russian occupying forces in some of the country’s most agriculturally rich regions.

Inflation is the key topic today with the CPI numbers out (higher than expected) and President Joe Biden and USDA Sec. Tom Vilsack are going to a farm in Illinois to talk about food prices and inflation. Meanwhile, the White House announced several ag-related programs designed to boost plantings and impact fertilizer production and utilization. Link for details. Meanwhile, Vilsack offered some other ag sector ideas during a Senate hearing Tuesday.

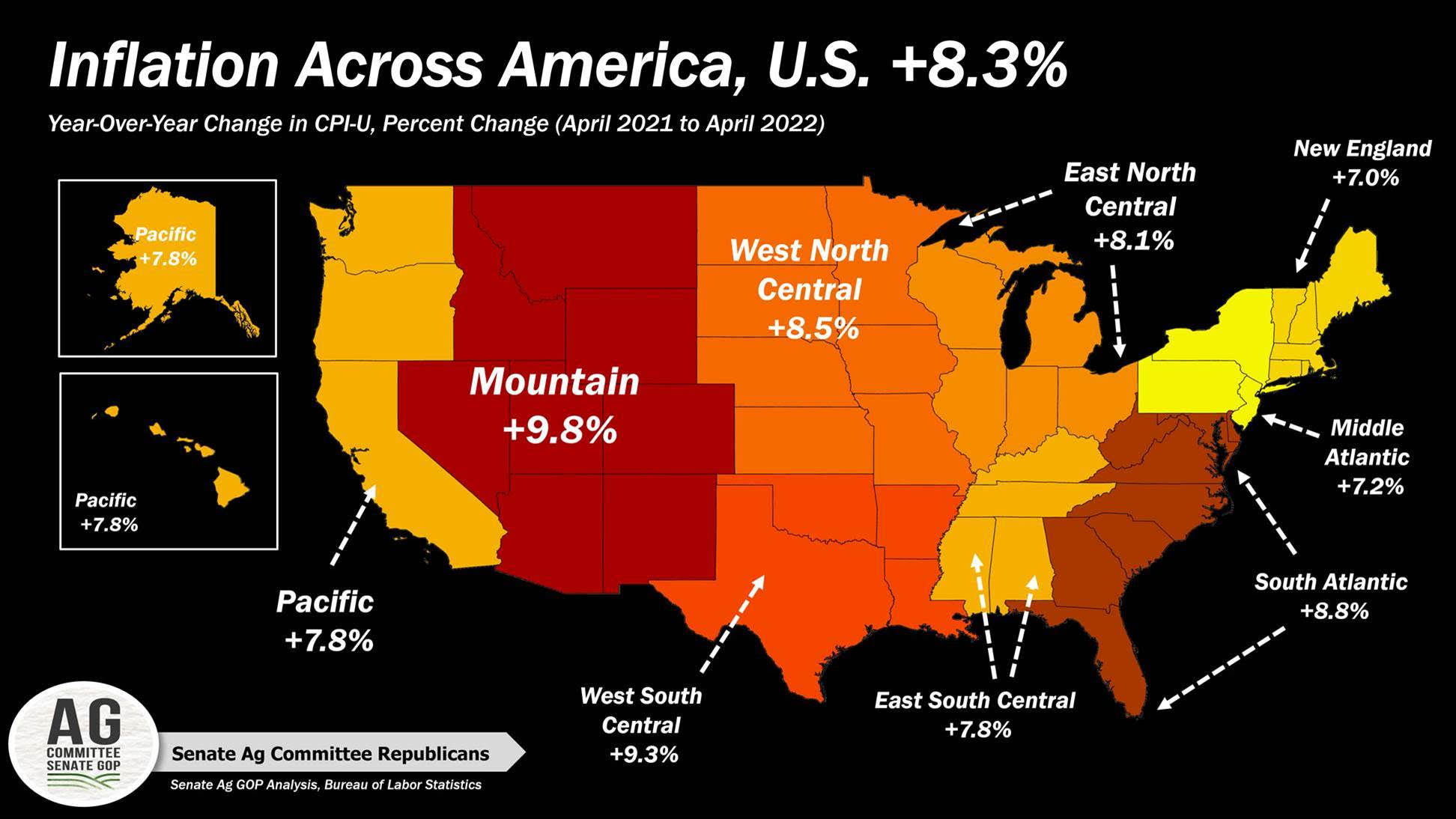

Inflation at 8.3% in April from a year ago, remaining near 40-year highs. So much for a turn in inflation as predicted by many economists. Removing volatile food and energy prices, so-called core CPI still rose 6.2%, against expectations for a 6% gain. The levels did mark a slight easing in the annual rates compared with March, but still remain elevated. Monthly changes were also above expectations in both the headline number and in the core rate.

Vilsack again promised WHIP+ details “soon” regarding eligible commodities for 2020 and 2021 disasters. A new structure coming this month, some payments in June.

Treasury yields have been shooting higher, and where they land this week will be key to setting interest rates on federal student loans.

The head of the WHO called on China to rethink its strategy of trying to wipe out Covid-19 cases in the country, in a rare challenge of a member state’s domestic Covid policies.

Environmental and animal rights groups are pressuring the Biden administration to weigh in on a California Prop 12 case the Supreme Court has decided to hear. Today, the Sierra Club, Humane Society, and Center for Biological Diversity are running an ad in the Washington Post.

The Senate voted to confirm Lisa Cook to the Federal Reserve, with a tie-breaking vote from Vice President Kamala Harris, making Cook the first Black woman to sit on the central bank’s board.

West Virginia and Nebraska held primary elections yesterday, and former President Donald Trump suffered his first big loss of 2022 in Nebraska after his chosen candidate for governor in the Republican primary lost to the state party's choice. Trump fared better in West Virginia.

|

MARKET FOCUS |

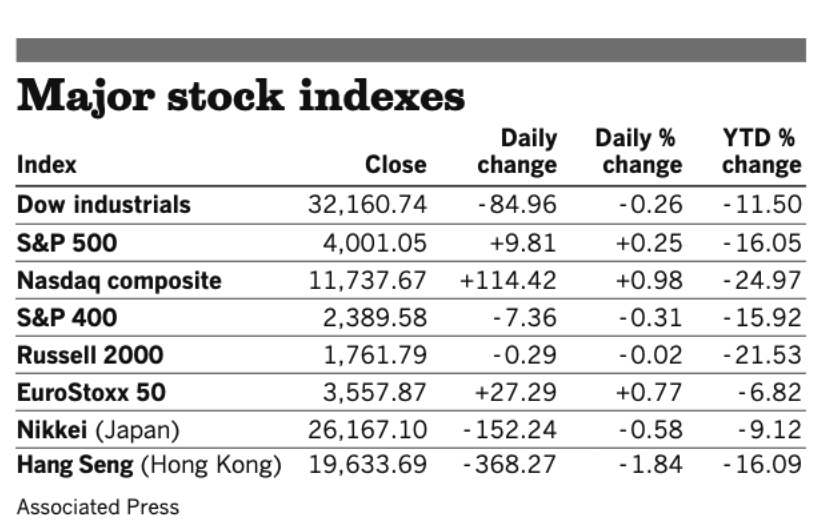

Equities today: Global stock markets were mostly higher overnight. U.S. stock indexes are pointed toward lower openings after a hotter-than-expected inflation report. The Stoxx Europe 600 gained 1.2%, led by shares of auto and real-estate companies. In Asia, Hong Kong’s Hang Seng gained 1% and the Shanghai Composite Index added 0.8%.

U.S. equities yesterday: The Dow ended down 84.96 points, 0.26%, at 32,160.74. The Nasdaq gained 114.42 points, 0.98%, at 11,737.67. The S&P 500 moved up 9.81 points, 0.25%, at 4,001.05.

Agriculture markets yesterday:

- Corn: July corn futures rose 3 1/4 cents to $7.75 1/4. December corn rose 8 1/4 cents to $7.19.

- Soy complex: July soybeans rose 7 cents to $15.92 1/4, while November rose 8 cents to $14.54 3/4. July soymeal fell $1.30 to $401.50 per ton. July soyoil rose 130 points to 81.04 cents per pound.

- Wheat: July SRW wheat ended unchanged at $10.92 3/4. July HRW wheat rose 10 3/4 cents to $11.75. July spring wheat rose 6 3/4 cents to $12.13 1/2.

- Cotton: July cotton futures rose 1 point 142.94 cents per pound.

- Cattle: June live cattle June live cattle fell $1.15 to $132.40, the contract’s lowest closing price since Nov. 1. August feeder futures fell $2.375 to $172.85. Choice cutout values fell cents early Tuesday to $257.33.

- Hogs: June lean hogs rose 27.5 cents to $101.575, the contract’s first gain in three sessions. July hogs fell $1.225 to $102.975, near a four-month closing low The CME lean hog index rose 18 cents to $101.09, the first gain in nine days.

Ag markets today: Corn, soybean and wheat futures built on Tuesday’s gains overnight amid supportive outside markets. As of 7:30 a.m. ET, corn futures were trading 5 to 7 cents higher, soybeans were 8 to 10 cents higher and wheat futures were mostly 13 to 18 cents higher. Front-month U.S. crude oil futures were nearly $4 higher, and the U.S. dollar index was around 350 points lower.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. consumer price index for April is expected to increase 0.2% from one month earlier and 8.1% from one year earlier. Excluding food and energy, the CPI is forecast to rise 0.4% and 6.0%. (8:30 a.m. ET) UPDATE: April CPI came in higher than expected. See item below for details.

• Federal Reserve Bank of Atlanta President Raphael Bostic speaks on the economy and monetary policy at 12 p.m. ET.

• U.S. federal budget is expected to swing to a $300 billion surplus in April from a $226 billion deficit one year earlier. (2 p.m. ET)

• President Joe Biden will visit a farm in Kankakee, Illinois to talk about food supply and prices and to announce programs to boost production and fertilizer production and utilization, 1:45 p.m. ET… Biden will deliver remarks at 2:15 p.m. ET. Outgoing White House Press Secretary Jen Psaki said USDA Sec. Tom Vilsack would join Biden.

Inflation at 8.3% in April from a year ago, remaining near 40-year highs. So much for a turn in inflation as predicted by many economists. The consumer price index, a broad-based measure of prices for goods and services, increased 8.3% from a year ago, higher than the estimate for an 8.1% gain. Removing volatile food and energy prices, so-called core CPI still rose 6.2%, against expectations for a 6% gain.

The levels did mark a slight easing in the annual rates compared with March, but still remain elevated. Monthly changes were also above expectations in both the headline number and in the core rate.

Nuggets from President Joe Biden’s Tuesday comments on inflation, other topics:

• Biden on inflation: “I know you’ve got to be frustrated,” President Biden said during remarks Tuesday. “Frustrated by high prices, by gridlock in Congress, by the time it takes to get anything done.” Biden said his administration is taking steps to curb inflation, and lamented Congress’ lack of progress in enacting his agenda. “You justifiably are right; we control all three branches of government. We don't really,” Biden said. “I have been pushing the things I have been proposing here and you heard me speak to since I got in office. I need to get 60 votes to pass them.” Biden said tackling inflation is his top economic challenge as gas prices surged to a new high despite White House efforts to stabilize them. Biden has called on U.S. oil and gas producers to ramp up production, announced the release of 180 million barrels of oil from the U.S. emergency stockpile — the largest one-time release since its creation in 1974 — and sought to characterize the high prices as an extension of Russian President Vladimir Putin’s war in Ukraine, referring to the soaring costs on multiple occasions as “Putin’s price hike.” The administration also announced last month that it will resume lease sales for oil and gas on federal land, although it made clear it only did so because of a court order.

• Biden on Republicans: He admitted that he has been surprised by the state of the Republican Party: “I never expected the ultra-MAGA Republicans who seemed to control the Republican Party now. … I never anticipated that happening.” He added: “The MAGA Republicans are counting on you to be so frustrated by the pace of progress they have done everything they can to slow down that you will hand power to them so they can enact their extreme agenda.”

• Biden mentioned the Federal Reserve, which plays a big role in attempting to combat inflation by raising interest rates. He called on the Senate to confirm several of his nominees to the central bank as soon as possible. “While I will never interfere with the Fed’s judgements or tell them what to do,” Biden said, “I believe inflation is our top economic challenge right now and I think they do too. The Fed should do its job, and will do its job, with that in mind.”

• Biden said he is “looking at” the best way to reduce the tariffs on China imposed by former president Donald Trump but said no decision had been made on the matter. Biden administration officials have been locked in negotiations with the Chinese for months over easing the tariffs but so far have not announced a breakthrough on the issue.

$105 billion in aid coming to states, cities. The Treasury Department is set to begin infusing states and local governments with about $105 billion of aid, the second installment of pandemic relief payments, according to a Treasury official. The package was designed so most recipients received their money in two tranches, with the first installment starting to come in last May.

Toyota warned that this year’s operating profit could drop by 20%, to $1 billion. The world’s largest car maker has struggled with raw materials doubling in price as well as soaring energy and logistics costs. Still, it expects to sell 10.7 million vehicles this financial year, 400,000 more than in 2021, helped by a depreciating yen.

Estimates of three million daily fliers would top the last summer travel record of 2.8 million in one day, American Association of Airport Executives CEO Todd Hauptli said on Tuesday. David Pekoske, administrator of the Transportation Security Administration, said the agency has “taken every step to ensure we’re ready” for potential record summer travel.

Market perspectives:

• Outside markets: The dollar snapped a four-day rally ahead of the U.S. inflation reading. The yield of the 10-year Treasury bond retreated 5 bps, having fallen below 3%. Oil, gold and Bitcoin also rose.

• Brent crude, the global benchmark, rose 3.5% to $106.02 a barrel. European natural-gas prices jumped after Ukraine said it would reduce flows of Russian gas through its transit pipelines to Europe. Futures for gas in the Netherlands, Europe’s benchmark, rose 5.4% to 98.80 euros ($104.21) a megawatt-hour.

• Highest average price is in California, at $5.84 per gallon, and the lowest is in Georgia, at $3.90 per gallon.

• Ag trade: Japan tendered to buy 70,000 MT of feed wheat and 40,000 MT of feed barley.

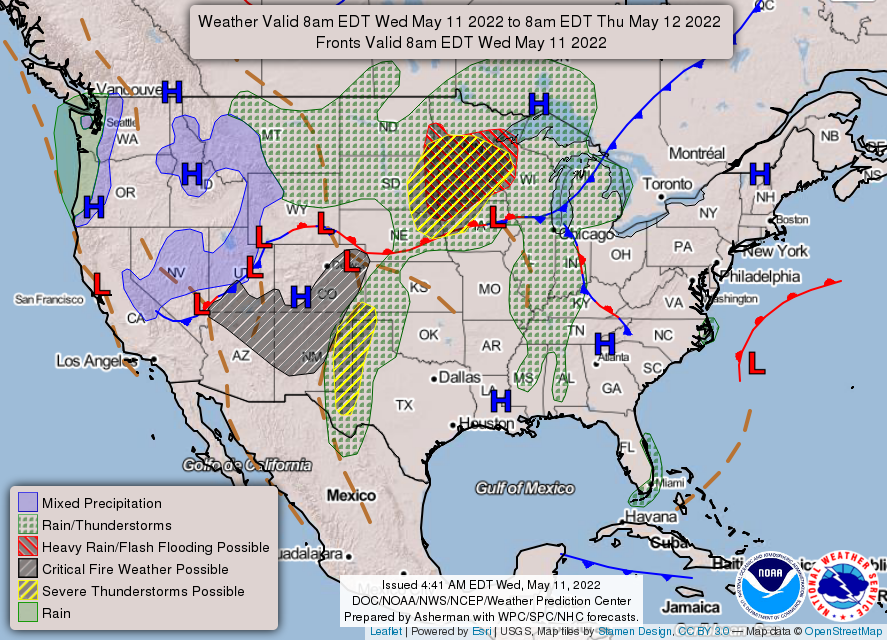

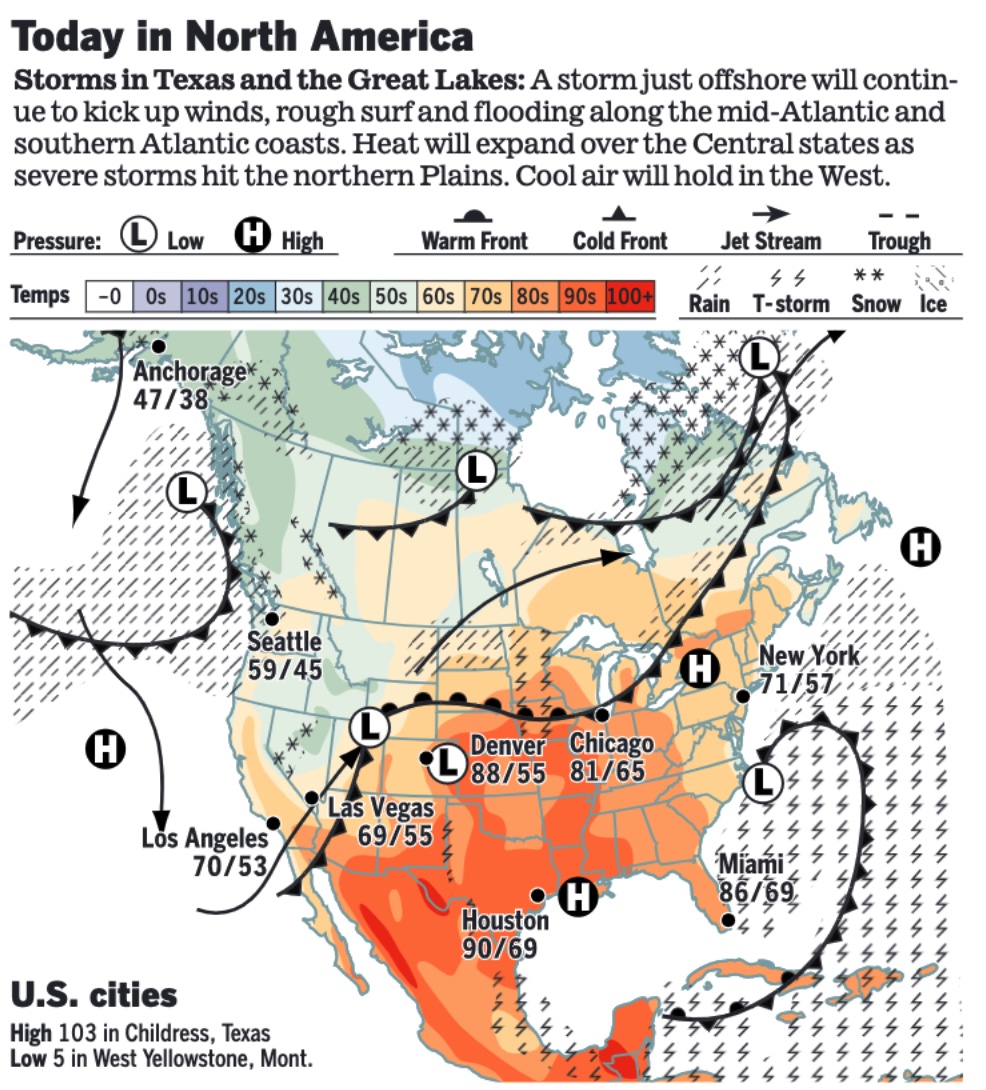

• NWS weather: Summer-like heat continues to expand northeastward through the Midwest and into the interior Northeast as a rapidly developing low pressure system brings a quick episode of rain, wind, and severe thunderstorms across the northern Plains by Thursday night... ...Additional rounds of thunderstorms expected to impact the southern High Plains and the upper Midwest today and Thursday... ...Cool temperatures and scattered low elevation rain/high elevation snow persist over the western U.S., with heavier precipitation forecast for the Pacific Northwest Thursday but critical fire danger persists from the Southwest to the High Plains.

Items in Pro Farmer's First Thing Today include:

• Followthrough buying overnight

• France cuts wheat export forecast

• Cash cattle trade at steady prices

• Pork cutout weakens, too

|

RUSSIA/UKRAINE |

— Summary: The operator of Ukraine’s gas network announced that it would stop the flow of Russian natural gas to Europe through a key pipeline for the first time. Fuel has been piped through the country for the duration of the war so far. The operator’s boss said that Russian troops have been rerouting gas to separatist areas in the east but did not provide evidence for the claim. Meanwhile Ukrainian officials said that their armed forces have taken back territory north of Kharkiv from the Russians.

- Russian forces now control an estimated 80% to 90% of the Donbas, according to Ukrainian officials, compared with more than a third when the war began. Severodonetsk, the last city in the Luhansk region still under Ukraine’s control, is nearly encircled by Russian forces, the Wall Street Journal reports (link).

- Putin’s move a temporary shift? Russian President Vladimir Putin’s decision to focus his military’s efforts in eastern Ukraine is probably a “temporary shift to regain the initiative,” and he likely “still intends to achieve goals beyond the Donbas” region,” Avril Haines, the director of national intelligence, told a hearing of the Senate Armed Services Committee on “worldwide threats.”

“We assess President Putin is preparing for a prolonged conflict in Ukraine during which he still intends to achieve goals beyond the Donbas,” Haines told the panel. “Putin most likely also judges that Russia has a greater ability and willingness to endure challenges than his adversaries,” she said. “And he is probably counting on U.S. and EU resolve to weaken as food shortages, inflation and energy prices get worse.” Haines said Ukraine and Russia both believe they can make battlefield gains, making a near-term diplomatic solution unlikely. - JPMorgan Chase and Goldman Sachs are being pressed to hand over extensive information on clients trading Russian debt. Sen. Elizabeth Warren (D-Mass.) and Rep. Katie Porter (D-Calif.) wants to know whether Wall Street is profiting on the invasion of Ukraine.

- Ukrainian leadership warned of a global food crisis if Russia does not lift a naval blockade that has decreased grain shipments leaving the nation’s ports. Citing the key role that Odesa, in the southwest near Moldova, plays in the global agricultural trade, Zelenskyy said in a video address that shortages of grain exports were bound to get worse if attacks continued and Western powers did not put an end to the Russian blockade of Ukrainian ports. Nations around the world depend heavily on grain from the fertile Black Sea region, which some call the “breadbasket of Europe… Without our agricultural exports, dozens of countries in different parts of the world are already on the brink of food shortages. And over time, the situation can become downright terrible.”

Ukraine is “sitting on 8 billion euros’ worth [about $8.4 billion] of wheat” that cannot be exported amid the war and Russia’s blockade of Black Sea ports, the president of the European Investment Bank, Werner Hoyer, said Tuesday. “They are sowing like crazy right now, and they will expect probably a good harvest, maybe 70% of last year’s harvest, in a couple of months,” Hoyer said. “And then what to do with it?”

- Ukraine accuses Russia of stealing its grain. Russian troops in Ukraine are shipping grains and produce critical to the Ukrainian economy to Crimea, Ukrainian officials alleged, adding to a list of grievances against Russian occupying forces in some of the country’s most agriculturally rich regions. The WSJ said (link) Russian authorities didn’t immediately respond to a request for comment. Russia is making slow but significant advances in Donbas, with Severodonetsk representing perhaps the most vulnerable point of the entire front line. Nearly encircled, with no power, water, cellphone coverage or access to news, remaining residents in the city are sheltering in basements.

— Market impacts:

- European Council President Charles Michel visited Odessa and said "silos full of grain, wheat, and corn ready for export" are sitting idle in Odessa. "This badly needed food is stranded because of the Russian war and blockade of Black Sea ports," which he said is "Causing dramatic consequences for vulnerable countries. We need a global response.”

- Ukraine’s natural gas grid operator said that it would stop transporting Russian gas through an entry point in occupied territory, raising fears of a cutoff for Europe.

- As Russia faces another round of payments on its sovereign debt, Biden administration officials are weighing whether forcing Moscow into default for its invasion of Ukraine would really be the best outcome. Treasury Secretary Janet Yellen said Tuesday that the matter is being “actively examined” before a crucial deadline in two weeks, and a decision will be made shortly.

|

POLICY UPDATE |

— Remember the $500 million ag-related package linked with Ukraine aid package? No more as Dems tossed it out. Reason: Very little support for it for a simple reason: it didn’t make much sense. Recall this was the package of much higher loan rates for some commodities and other schemes to woo more 2023 plantings for wheat and soybeans.

But some global food aid did make it. President Biden’s proposed $20 million in funding for the Bill Emerson Humanitarian Trust for global food aid did make it into the final bill (details on other food aid and funding below). Senate Minority Whip John Thune (R-S.D.) said Republicans had questions about whether global food aid should be included in this package.

USDA Secretary Tom Vilsack during the Tuesday Senate hearing said he will be traveling to Germany and then to Poland to “get a firsthand look” at the situation relative to Ukraine. “We have a twin challenge here… an immediate global food security challenge… and the impact it's going to have on potentially unstable conditions in the Middle East, in North Africa, because of food shortages,” he said.

Now what? USDA is looking at “administrative changes” they can make without congressional approval. More on that in an item below.

— White House to announce new measures on food prices, war in Ukraine. The measures to be announced when President Biden visits a farm today in Illinois include doubling the amount of funding for domestic fertilizer production to $500 million and increasing technical assistance for adoption of precision agriculture methods — USDA programs that use technology and other tools to reduce the use of fertilizer. The administration said, “Precision agriculture is a farm management system that allows farmers to use technology to target application of inputs to soil and plant needs, resulting in less fertilizer usage without reducing yields, saving farmers money over time and extending the usefulness of critical products in short supply worldwide.” Link for details.

Also, USDA will start insuring double cropping in 681 more counties, bringing total eligible counties to 1,935. The administration explained, “Double cropping allows farmers to plant a second crop on the same land in the same year, helping boost production without relying on farmers to substitute crops or cultivate new land. But it is not free from risk and some farmers who practice double cropping cannot obtain crop insurance… The Biden-Harris administration is seeking to expand insurance for double cropping to as many as 681 additional counties, bringing the total number of counties where this practice qualifies for crop insurance to as many as 1,935, so more American farmers have the financial security they need to start or expand double cropping.”

"As the world’s second largest exporter of wheat and soybeans, these actions will help grow new markets for American-grown food, supporting jobs in rural communities across America,” according to the administration.

— Vilsack floats others ag sector ideas at Tuesday hearing. Some of them:

- Linking double cropping to climate smart agriculture effort. Vilsack likes the idea of linking to the Climate Smart Agriculture and Forestry (CSAF) pilot program USDA is operating. It got 450 applications from 350 organizations, Vilsack detailed, adding the programs submitted were probably “three to four times the $1 billion we put on the table.”

- On double cropping, Vilsack acknowledged USDA should focus on crops besides wheat and soybeans, such as sorghum or sunflowers. “There is no reason we couldn’t include those... and [we] should.”

- Asked about a potentially difficult situation for farmers in 2023, including on inputs, Vilsack said USDA was looking at whether or not USDA storage programs could be used. “Because there may well be the capacity to purchase and store which farmers could potentially utilize to get them through a potentially tough 2023 crop year.”

Comments: One economist emailed: “Best thing to increase food production is to stay away and let the farmers plant.” After watching the business of agriculture policy for 50 years there is a clear conclusion: If bureaucrats implement too many efforts to boost production, it will not be long before the same people want a return of acreage reduction programs. Washington always wants to "fix" everything... the "fix" usually makes it worse… one gov’t program to offset another. Why?... largely because situations constantly change, and gov't action is SLOW and backward looking. Another lesson learned many times: Programs that stifle innovation, and limit free trade for agricultural commodities and inputs for vital production.

Another viewpoint via another email: “We will see how drought, wet conditions, and other weather events affect production. But assuming things work out weather wise, there are things that can be done around the edges to cause production where it may not otherwise occur. But the big issue is if prices somehow soften but costs stay where they are or rise further. That is where policy can make a critical difference.”

— What’s in 30-page House Ukraine aid package that chamber passed Tuesday evening 368 to 57 (link to more details). Fifty-seven House Republicans voted against the bill, as the GOP lawmakers said they didn’t have enough time to review the legislation, dubbed the Additional Ukraine Supplemental Appropriations Act. There were no House Democrats voting against the package, including the Squad. The Ukraine legislation will now move to the Senate, which has promised to take it up and pass it quickly.

- Totals $39.8 billion in emergency spending bill that funds new weapons and provides economic and humanitarian assistance.

- Includes $19.7 billion for the Defense Department, more than $3 billion above the level requested by the Biden administration. This includes the $6 billion in direct security assistance to Ukraine that President Biden sought last month and $8.7 billion to replenish weapons stocks given from the Pentagon to Ukraine. The package would provide $4 billion in foreign military financing for Ukraine and other countries affected by the invasion to help them purchase weapons.

- Includes $8.8 billion in direct economic support for Ukraine along with funds to repair the U.S. embassy in Kyiv, document war crimes and protect against nuclear fuel leaks.

- Includes $4.35 billion for global food and humanitarian aid to be administered by the U.S. Agency for International Development and another $700 million in global food funding at the State Department. The inclusion of the funds was made despite some concerns from Republicans that the global food crisis should not be addressed in the bill.

- $20 million to reimburse the Bill Emerson Humanitarian Trust, which is a critical backstop when international famine needs exceed available normal funding for U.S. assistance.

- $150 million for the Global Agriculture and Food Security Program to help countries, including Ukraine, weather impacts from rising food prices.

- Contains language to allow Ukrainian refugees to access U.S. gov’t benefits over the objections of some Republicans.

— Vilsack: USDA to announce WHIP+ details soon. USDA Secretary Tom Vilsack told the Senate Ag Appropriations Subcommittee USDA will announce in the “next couple of weeks” the structure and framework of applying for WHIP+ for 2020 and 2021 crops so payments can “potentially start in June.” He said, “We are in the process of finalizing the work that will allow us to pre-fill the application” so farmers need to fill in just a few details instead of the roughly 250 items on the form that would be required otherwise. WHIP+ payments for crops will come in two tranches, the same as previously announced aid for livestock producers.

Vilsack revealed $560 million has already been provided through the first tranche livestock aid. He said a smaller second round of payments is planned for livestock producers for those not covered under USDA’s Livestock Forage Disaster Program or other aid efforts. Sen. John Hoeven (R-N.D.) told Vilsack the payment rate for calves under 250 lbs. is too low and not reflective of costs under the Livestock Indemnity Program. Hoeven also said some coverage is needed for animals that get sick and die later — delayed losses. Vilsack told him, “We’re focusing on those two issues” — timeliness and “taking a look at payment rates.” Vilsack says it’s “challenging” because USDA needs to tie livestock aid with what is done for crops. His agency is also looking at ways to “potentially provide for more production information” for “better understanding of how to value livestock at various times depending on the disaster, depending on the weight.”

A topic that wasn’t addressed at the hearing but should have been: Farmers are confused when USDA sends them a check because they are unclear what it is for and how it was calculated. USDA should clearly identify what the payment is for and how it was calculated. Someone who farms crops and raises livestock can’t know for sure whether they received a payment for livestock losses or crop losses. And they can’t know if the calculation is right because it currently doesn’t indicate anywhere.

Other topics Vilsack addressed during Tuesday Senate hearing.

- Sugar imports. Sen. John Hoeven (R-N.D.) said he is concerned about a recent increase in the quota for imported sugar. Vilsack said USDA made the decision to allow more imports because the stocks-to-use ratio had fallen to 12%, which is below the 13.5% to 15.5% USDA seeks to maintain. Hoeven said that U.S. growers are worried the ratio will rise above 15.5%.

- School lunch waivers. Expiring child nutrition program waivers allowing expanded access and resources for school meals was a topic addressed when Vilsack was asked what USDA’s plan was to transition back to the pre-pandemic status quo as those waivers expire. “This is going to be chaotic,” he said of Congress’ failure to renew the waivers via GOP opposition. He said USDA has limited flexibility and cannot increase reimbursement rates or expand free meals, adding the focus will instead be on community eligibility, the limited waivers at the department’s disposal, and “any additional capacity we have with resources in terms of quantity of purchases.”

- Forever chemicals. Sen. Susan Collins (R-Maine) was clearly unhappy about USDA’s lack of response on aiding farmers faced with “forever chemicals” on their land. Collins said she’s disappointed the Biden administration hasn’t done more to help farmers who’ve lost their livelihoods due to land contaminated with the chemicals, known as PFAS. Her home state of Maine is now the only state that’s banned fertilizer from sewage sludge, which can contain chemicals that have been linked to increased risk of high cholesterol and some cancers. Some Maine farmers have been told they cannot sell their milk or meat from their cattle because of contamination from PFAS. PFAS concentrate over time and can linger in food and water, leading to the name “forever chemicals. Vilsack apologized for his department’s unresponsiveness to letters from Collins and other Maine delegates on the issue. He acknowledged that PFAS is “pervasive” far beyond Maine, adding that the USDA is happy to work with Congress and the Environmental Protection Agency to assist affected farmers. But asked after the hearing whether the country should follow Maine’s lead on banning the practice, he said the department needs to work closely with the EPA to better understand the risks of the chemicals. “I think it’s a bit premature until we get the information and data, until we have a standard, to know precisely how to respond to this,” he told reporters.

Vilsack said USDA realized reimbursing them for the contaminated milk wasn’t enough. “We need to make sure we continue to fund research because I think we’re going to continue to find some challenges with reference to things that we’ve done for years and years and years,” he said, in reference to sludge that may contain PFAS. “They’re now cropping up as being problems.” Collins said the dairy indemnity program only covers milk, but Vilsack said USDA had been providing aid based on livestock and that he is working with EPA on a national standard for PFAS and that he would be happy to work with the Senate Agriculture Appropriations Subcommittee or any other committee to establish the level of resources needed to deal with the farmers’ problems.

- USDA’s ability to respond to natural disasters affecting agriculture. Sen. Dianne Feinstein (D-Calif.) called agencies “chronically understaffed” to respond to raging wildfires, and Sen. Martin Heinrich (D-N.M.) brought up similar worries about the monsoon rainy season.

- Climate-smart ag pilots. Sen. Tammy Baldwin (D-Wis.) requested an update on USDA’s climate efforts, including the $1 billion Partnerships for Climate-Smart Commodities (PCSC) initiative. “We're really excited about the response,” Vilsack said, noting the department got 450 applications from 350 partner organizations spanning all 50 states. “Even at the minimum, we're talking $2.5 billion to $2.2 billion,” in funding requested, “I'm pretty sure we're probably 3x or 4x, to what we put on the table,” he detailed. “There's obviously tremendous interest there.”

- Cost of international food aid transport. Vilsack said he is bothered that it will cost more to ship U.S. commodities recently purchased with funds from the Bill Emerson Humanitarian Trust than it cost to buy them. He said, “It's amazing” that transportation costs more than the value of the product … so I think there is an opportunity for us to look at ways in which that could potentially be addressed.” USDA and the U.S. Agency for International Development recently announced that they would use $282 million in the Bill Emerson Humanitarian Trust to procure U.S. food commodities to bolster existing emergency food operations in six countries facing severe food insecurity: Ethiopia, Kenya, Somalia, Sudan, South Sudan, and Yemen. They also announced USDA will provide $388 million in additional funding through the Commodity Credit Corporation (CCC) to cover ocean freight transportation, inland transport, internal transport, shipping and handling, and other associated costs.

A proposal has been made by Sens. Chris Coons (D-Del.) and Joni Ernst (R-Iowa) to temporarily waive the U.S. cargo preference law requiring that 50% of Title II food aid shipments (by tonnage) be carried on U.S.-flagged vessels staffed by crews in which at least 75% of the sailors are U.S. citizens. Under current law, the president, the Defense secretary or Congress can waive the 50% cargo preference requirement temporarily.

- Potato research and a trip to the past. Sen. Collins urged USDA to ask for more money for potato research. Vilsack said the Agricultural Research Service provides a list of research priorities and that there are many commodities in need of more research. Collins noted potatoes don’t get direct farm subsidies, but Vilsack said the government spends money buying potatoes for nutrition programs. Collins then recalled that Vilsack in his USDA terms under the Obama administration tried to get rid of a lab at the University of Maine and eliminate potatoes from the Special Supplemental Nutrition Assistance Program for Women, Infants and Children (WIC). Vilsack said the WIC proposal was not against potatoes but to try to get beneficiaries to consume foods they normally do not. He also said USDA is trying to increase potato exports to Mexico. Vilsack said he is not against potatoes, but Collins said, “it feels like it.”

- USDA staffing. Vilsack again stressed the need for additional funding to staff up key USDA agencies. Asked about filling job vacancies at the Economic Research Service (ERS) and National Institute of Food and Agriculture (NIFA) following their relocation from Washington, DC, to Kansas City, Vilsack reported progress. “We have a goal of about 750 people between the ERS facility and [for] the NIFA mission area [the goal is] about 650. We've seen about 450 folks who've been hired in those two mission areas,” he said, adding the department is seeing robust hiring and improving morale.

- Loan delinquency rates. Vilsack said USDA has struggling customers in many states, detailing “24,673 farm families that are either delinquent in their loans to USDA, are bankrupt or are pending foreclosure. This is a serious issue.” He said, “These are people who have borrowed from USDA or who have had a guaranteed loan from USDA, which means that they haven’t been able on their own to go to a commercial bank and be able to secure financing. So, these are folks who need help. They need assistance.”

|

PERSONNEL |

— Senate confirmed in a 75-22 vote Ann Phillips to lead the Maritime Administration as the Biden administration seeks to implement record funding to ports from the infrastructure law. Phillips will become the first woman confirmed to lead the roughly 800-person agency.

— Senate voted to confirm Lisa Cook to the Federal Reserve, making her the first Black woman to sit on the central bank’s board. Cook was approved Tuesday on a party-line vote. The 51-50 vote required a tie-breaking appearance by Vice President Kamala Harris.

— Eric Garcetti, Biden’s pick to be U.S. envoy to India, “likely” knew or should have known about harassment complaints against a former top aide, said a GOP review of the allegations, which have held up his nomination since it was approved by the Senate Foreign Relations Committee earlier this year. A report on the matter was commissioned by Sen. Chuck Grassley (R-Iowa).

— Glauber to be interim head of AMIS. Dr. Joe Glauber will serve as interim Secretary of the Agricultural Market Information System (AMIS) following the retirement of Abdolreza Abbassian in January. Glauber is currently a Senior Research Fellow at the International Food Policy Research Institute (IFPRI) in Washington. Prior to joining IFPRI in 2015, Glauber spent over 30 years at USDA, including as Chief Economist from 2008 to 2014.

Background. AMIS is an inter-agency platform to enhance food market transparency and policy response for food security. It was launched in 2011 by the G20 Ministers of Agriculture following the global food price hikes in 2007-08 and 2010. Bringing together the principal trading countries of agricultural commodities, AMIS assesses global food supplies (focusing on wheat, corn, rice and soybeans) and provides a platform to coordinate policy action in times of market uncertainty. AMIS is composed of G20 members plus Spain and seven additional major exporting and importing countries of agricultural commodities.

|

CHINA UPDATE |

— Officials in Shanghai claimed that half the city had achieved “zero-covid” status, while also imposing the tightest covid-19 restrictions thus far. The World Health Organization said that China’s approach to the virus was “unsustainable,” leading to mentions of the WHO and Tedros Ghebreyesus, its boss, being censored on Chinese social media.

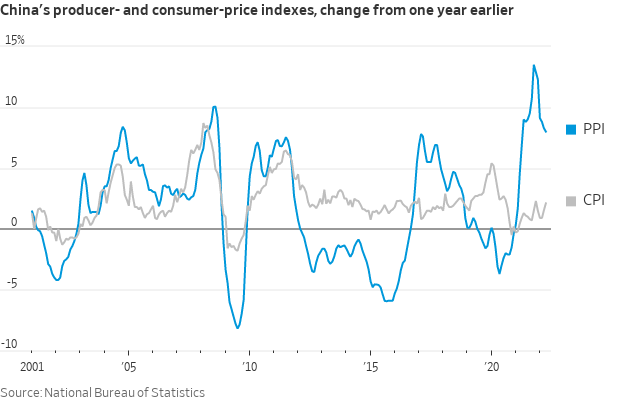

— China’s consumer inflation edged up in April and factory-gate price pressures remained elevated as Covid-19 lockdowns jammed up logistics networks and the Ukraine war pushed up global energy prices. China’s consumer price index in April was up 2.1% from a year earlier, official data showed today, the fastest pace in five months. The producer price index, a gauge of factory-gate inflation, was up 8% in April from a year earlier, down from March’s 8.3%. China still imports significant volumes of crude oil and coal, whose prices have been pushed higher by geopolitical turbulence in Europe.

— Car sales in China declined 36% in April from a year earlier, the worst fall in more than two years, as weekslong anti-Covid lockdowns in parts of the country shutter factories, disrupt supply chains and keep car buyers at home. Passenger-car sales in April tumbled to 1.04 million vehicles, the China Passenger Car Association said, while production fell by 41%, to 969,000 vehicles. Among those hardest hit were Tesla, Volkswagen and Nissan Motor. Last month, Tesla sold just 1,512 cars made at its Shanghai plant, down 94% from a year ago, according to data from the association. The impact rippled globally too as Tesla’s exports from China, where the company makes the Model 3 and Model Y, fell to zero. The company exported about a third of the cars it made in Shanghai outside of China last year.

CarStop

— China admonished the U.S. over both its words and actions toward Taiwan on Tuesday on the same day senior U.S. intelligence officials gave their public assessment of China’s policy toward the island nation. China accused the U.S. of supporting “Taiwan independence secessionist forces” by sending a U.S. Navy ship through the Taiwan Strait for the second time in two weeks. It also criticized the changing of language on the U.S. State Department website which had previously said the U.S. did not support Taiwan’s independence and acknowledged Beijing’s position that Taiwan is part of China. Chinese foreign ministry spokesman Zhao Lijian called the changes “a petty act of fictionalizing and hollowing out the one-China principle,” while U.S. State department spokesman Ned Price said the changes in the Taiwan fact sheet reflected “our rock-solid unofficial relationship with Taiwan.”

|

TRADE POLICY |

— Senators chastise USTR Tai for failure to consult Congress. A bipartisan group of the top senators on the committee that deals with trade blasted Biden’s chief negotiator U.S. Trade Representative Katherine Tai for failure to adequately consult with lawmakers regarding the administration’s positions. Tai’s recent consultations with Congress haven’t met the standard of transparency principles announced last year, senators including Ron Wyden (Ore.) and Mike Crapo (Idaho), the leading Democrat and Republican on the Senate Finance Committee, wrote in a letter on Tuesday.

|

ENERGY & CLIMATE CHANGE |

— Transportation Secretary Pete Buttigieg said it’s less expensive for cars to fill up on electricity than gasoline as Republican lawmakers questioned the White House’s plans to spend money on a national EV charging network. House Republicans raised their concerns to Biden’s top transportation official that drivers in rural areas wouldn’t benefit from increased spending on EVs.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Proposition 12 update. Environmental and animal rights groups are pressuring the Biden administration to weigh in on a California Prop 12 case the Supreme Court has decided to hear. Today, the Sierra Club, Humane Society, and Center for Biological Diversity are running an ad in the Washington Post calling for the Biden administration to publicly oppose a legal challenge from the pork industry and Farm Bureau to a ballot measure passed in California that prevents intensive confinement of chickens and pigs.

|

CORONAVIRUS UPDATE |

— Some Covid-19 patients have relapsed after taking Pfizer’s antiviral pill, puzzling health authorities, researchers and physicians trying to stay ahead of the virus. Within two weeks of appearing to get better, some Paxlovid users experienced cold-like symptoms such as sore throat and cough. Pfizer said its real-world data indicates the relapses occur in fewer than 1 in 3,000 patients. The rebound cases haven’t resulted in severe disease so far. Doctors and health authorities still encourage Paxlovid’s use among people at high risk of developing severe Covid-19.

|

POLITICS & ELECTIONS |

— Rising prices are a major problem for Democrats. Voters have repeatedly ranked inflation as the top problem facing the U.S., as well as President Biden’s top problem politically. The percentage of Americans who viewed inflation as the top economic problem facing the U.S. more than doubled between January and March, a Gallup poll found, rising from 8% in January to 17% in March. Inflation was ranked in that survey as the second-worst problem facing the country overall, falling slightly behind “the government, poor leadership.”

— Trump loses in Nebraska but wins in West Virginia. Charles Herbster, former President Donald Trump’s candidate for governor of Nebraska, lost his GOP primary race last night to Jim Pillen, who had the endorsement of the Republican establishment, including current Nebraska GOP Gov. Pete Ricketts. Pillen got 33.3% of the vote, Herbster had 30.4% and State Sen. Brett Lindstrom had 26.1%. Trump-endorsed Rep. Alex Mooney (R-W.Va.) easily beat Rep. David McKinley (R-W.Va.). Mooney got 54.2% of the vote and McKinley got 35.6%. Sen. Joe Manchin (D-W.Va.) was backing McKinley, while Trump supported Mooney.

— U.S. Chamber of Commerce endorsed Rep. Henry Cuellar (D-Texas) ahead of the May 24 Texas primary runoff election. Cuellar is facing a serious primary challenge from progressive Jessica Cisneros.

— Elon Musk said he’d reverse Twitter’s ban on Donald Trump. The Tesla chief executive called booting the former president a “morally bad decision” and said permanent bans undermine trust in the social-media platform. Musk agreed last month to buy Twitter in a $44 billion deal, but said that several steps, including a Twitter shareholder vote, still needed to be completed. He made his remarks virtually at the Financial Times Future of the Car summit.

|

CONGRESS |

— Grassley meets Paris Hilton. Paris Hilton was on Capitol Hill on Tuesday and posed for photos while waiting in line for coffee. She also met with Chuck Grassley (R-Iowa).

|

OTHER ITEMS OF NOTE |

— President Biden unveiled a plan to help speed construction of projects funded under the $550 billion infrastructure law passed last year. The administration will create sector-specific teams in hopes of speeding permitting and supply chain issues slowing construction. The White House said it will improve environmental reviews to avoid duplicity and prioritize tribal and disadvantaged communities.

— Biden administration urged the Supreme Court to reject Bayer’s bid to block potentially billions of dollars in claims that its top-selling Roundup weedkiller causes cancer. Bayer said federal approval of Roundup’s label meant that Hardeman’s lawsuit — and others like it — can’t go forward.