Frustrated Producers Hope Vilsack Unveils Details of WHIP+ This Week

Inflation | STB | WOTUS | High-speed internet | Baby formula shortage | Covid warning

|

In Today’s Digital Newspaper |

Russian President Vladimir Putin accused the West of leaving him no choice but to invade Ukraine as Russia is celebrating Victory Day, an annual commemoration of the country's defeat of Nazi Germany at the end of World War II. The Financial Times has a very revealing discussion about Putin and his war on Ukraine with U.S. CIA Director William Burns (some excerpts below). The U.S. announced new sanctions on Sunday, cutting off Kremlin-controlled media outlets from American advertisers and prohibiting the country from using U.S.-provided management and accounting consulting services

Ukraine is in talks with Poland and Lithuania to export its summer grain harvest through the countries’ ports. Meanwhile, Ukraine spring planting is ‘active’ despite war.

Roll Call: Stabenow pushes school food waivers in Ukraine talks.

President Joe Biden will deliver remarks on inflation tomorrow as Americans continue to struggle with rising. "He'll detail his plan to fight inflation and lower costs for working families and contrast his approach with Congressional Republicans,” a White House official said. Meanwhile, Bank of America economists expect U.S. inflation to slow over the next two years, “but the progress will be very uneven.”

Millions of low-income Americans will be able to get high-speed internet service for no more than $30 a month under an agreement the Biden administration has reached with major internet providers.

Saudi Arabia cut oil prices for buyers in Asia as coronavirus lockdowns in China weigh on demand.

Hedge funds have cut bullish bets on some commodities to the smallest since December as the biggest increase in U.S. interest rates in 22 years prompted recession fears.

China update with details in China section:

— Chinese Premier Li Keqiang warned in a statement on Saturday of a “complicated and grave” employment situation as the government tries to contain Covid.

— New-home sales in 23 major Chinese cities plunged 33% by area during a five-day national holiday compared with a year earlier.

— China’s exports and imports struggled in April as worsening Covid outbreaks cut demand.

— China’s soybean imports rose in April.

— China’s meat imports plunge in April

— China to step up economic support.

A national baby formula shortage has worsened, with about 40% of popular brands sold out.

West Coast dockworkers and cargo-handling companies are due this week to begin contract negotiations that carry high stakes for the American economy.

Eligible WHIP+ participants via 2020 and 2021 crops are anxiously (still) awaiting details and hope USDA Sec. Tom Vilsack presents them ahead of or during an appearance Tuesday on USDA’s budget requests.

The first of ten WOTUS roundtables take places today in Midwest. Details in Policy section.

Dem senators want $1 billion to boost conservation operations. In the recent FY 2022 omnibus spending bill, the Senate passed $904 million for NRCS Conservation Operations. NRCS staff help implement several farm bill conservation programs.

USDA Deputy Secretary Bronaugh tells Politico she supports White House plan to boost wheat and soybean acres.

Surface Transportation Board (STB) implemented new rules for some of the largest railroads after customers said train backlogs have hampered their operations. Details below.

NPPC asks SEC for more time to review climate reporting proposal while Farm Bureau issues a report about the proposal’s impact on the ag sector.

The Biden administration is issuing a new warning that the U.S. could potentially see 100 million Covid-19 infections this fall and winter. The White House is stressing the need for more funding from Congress to combat the virus. With an anticipated rise in coronavirus cases driven by an offshoot of the Omicron subvariant BA.2, health experts say now is not the time to loosen precaution measures, especially as many people are attending graduations and other large gatherings this month.

Baby, baby, baby, oh… The list of the most popular baby names in 2021.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. stock indexes are pointed toward solidly lower openings. On Wednesday the Walt Disney Company announces second-quarter figures, with traders focusing on whether its Disney+ streaming service has managed to extend the strong growth it reported in its first quarter or suffered a Netflix-style plunge in subscriptions. In Asia, Japan’s Nikkei 225 dropped 2.5%, while Australia’s S&P/ASX 200 fell 1.2%. China’s CSI 300 index, tracking the largest companies listed in Shanghai or Shenzhen, declined 0.8%. Hong Kong markets were closed for a public holiday.

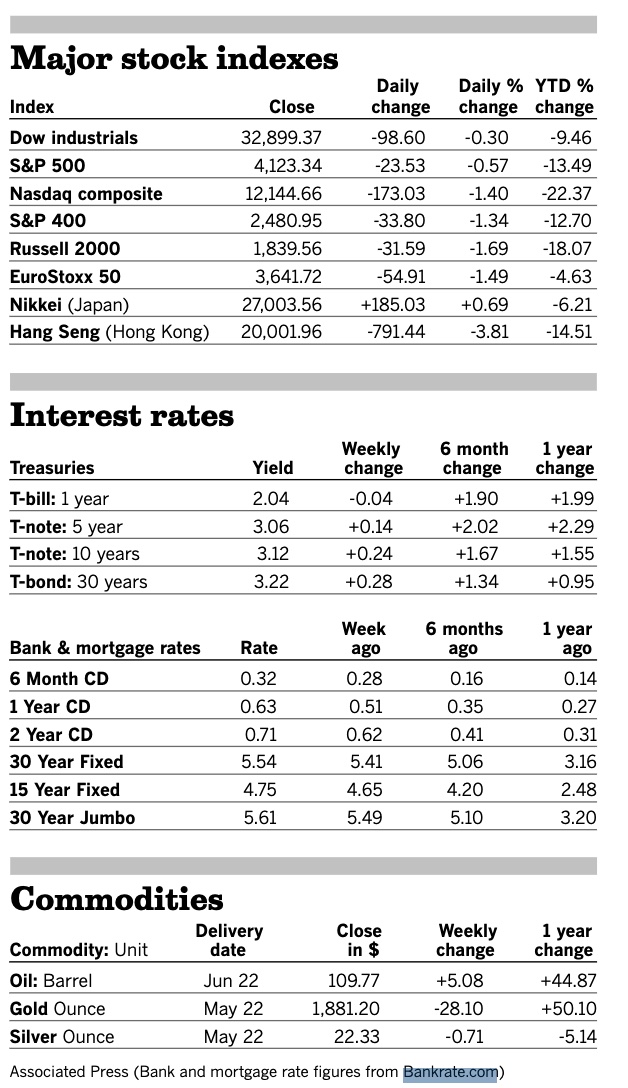

U.S. equities Friday. All three indices finished lower despite poking into positive territory briefly during the session The Dow ended down 98.60 points, 0.30%, at 32,899.37. The Nasdaq declined 173.03 points, 1.40%, at 12,144.66. The S&P 500 lost 22.53 points, 0.57%, at 4,123.34.

For the week: The S&P 500 was down 0.2%, for a fifth consecutive week of losses. The last time that happened was June 2011. The Dow lost only 0.2% for the week but it was still the sixth straight declining week for the index, while Nasdaq slumped 1.5%, closing nearly 25% below its record high from last November.

Agriculture markets Friday:

- Corn: July corn futures fell 12 3/4 cents to $7.84 3/4, a weekly drop of 28 3/4 cents to halt four straight weeks of gains. December corn fell 17 3/4 cents to $7.20 3/4, near a four-week closing low.

- Soy complex: July soybeans fell 25 cents to $16.22, down 62 3/4 cents for the week. November soybeans fell 21 cents to $14.70 3/4, a four-week closing low. July soymeal fell $6.30 to $413.60. July soyoil fell 95 points to 80.90 cents.

- Wheat: July SRW wheat rose 2 cents to $11.08 1/2, up 52 3/4 cents on the week. July HRW wheat futures fell 6 1/2 cents to $11.70 1/2, up 64 3/4 cents for the week. July spring wheat fell 1 cent to $12.08 3/4.

- Cotton: July cotton futures tumbled 515 points to 143.61 cents per pound, down 202 points for the week.

- Cattle: June live cattle fell $1.025 to $132.75, up 10 cents for the week. August feeder cattle rose 32.5 cents to $174.70. Choice cutout values fell 48 cents to $254.70, an eight-week low.

- Hogs: June lean hog futures fell $2.975 to $104.10, down $2.275 for the week. Pork cutout values fell 8 cents to $106.19.

Ag markets today: Wheat futures extended last week’s gains overnight amid crop concerns, while the corn and soybean markets were pressured by improved weather. As of 7:30 a.m. ET, wheat futures were trading 12 to 21 cents higher, corn was 8 to 10 cents lower and soybeans were 10 to 13 cents lower. Front-month U.S. crude oil futures were more than $2.50 lower and the U.S. dollar index was around 150 points higher this morning.

Technical and other viewpoints from Jim Wyckoff: “A feature in the marketplace early this week is rising bond yields,” says Wyckoff. “The yield on the 10-year U.S. Treasury note is at a nearly four-year high and is presently fetching 3.180%. Traders and investors fear that global price inflation has gotten out of control. Historically, problematic price inflation is bearish for paper assets like stocks and bonds, and bullish for hard assets like raw commodities and real estate.”

On tap today:

• Federal Reserve Bank of Atlanta President Raphael Bostic gives opening remarks at a financial markets conference. (8:45 a.m. ET)

• U.S. wholesale inventories for March are expected to increase 2.3% from the prior month. (10 a.m. ET)

• USDA Grain Export Inspections report, 11 a.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

"We expect U.S. inflation to slow over the next two years, but the progress will be very uneven," wrote Bank of America analysts in a recent note. "There is tentative evidence of an easing of supply chain challenges, and we expect 'two steps forward, one step back' process in the next year." But this won't be a decade-long struggle, they predict. Prices should begin to ease by 2023.

Internet providers commit to low-income broadband program under infrastructure law. AT&T, Comcast, Verizon and other companies agreed to help offer high-speed internet to millions of unconnected households, the White House said. President Biden and Vice President Kamala Harris today will join with telecom executives, members of Congress and others to highlight the $30-a-month subsidy now available to low-income households to access high-speed internet. The program has run up against an early hurdle because the people who need it most are the hardest to reach because they aren’t online. The plan is part of a $65 billion program to build up the country’s broadband network through the roughly $1 trillion infrastructure law approved by Congress in 2021.

About 11.5 million households have signed up for the monthly subsidy, according to the Federal Communications Commission, which oversees the subsidies. The aid is available to households whose income is 200% or less than federal poverty guidelines or for those that qualify for a government assistance program such as Medicaid, Supplemental Nutrition Assistance Program (SNAP/food stamps) or a Federal Pell Grant.

Stores nationwide have been struggling to stock enough baby formula. Manufacturers say they're producing at full capacity and making as much formula as they can, but it's still not enough to meet current demand. The out-of-stock rate for formula stands at 40%, statistics show. In six states — Iowa, South Dakota, North Dakota, Missouri, Texas and Tennessee — more than half of baby formula was completely sold out during the week starting April 24. Pharmacy chains CVS and Walgreens confirmed that their stores are limiting customers nationwide to three toddler and infant formulas per transaction. Other major retailers like Target and Walmart are also imposing similar constraints on baby formula purchases.

West Coast dockworkers and cargo-handling companies are due this week to begin contract negotiations that carry high stakes for the American economy. The labor talks cover about 22,400 workers at 29 ports, including the big Southern California facilities that make up the country’s busiest gateway for imported goods. The WSJ reports (link) similar negotiations have been long and contentious in previous years, leading to extensive disruptions and delays in the flow of goods. The WSJ says the risks “have seldom been as high as they are this year, two years into a supply-chain crunch that was brought on by the Covid-19 pandemic and that has strained factory production, hobbled retail sales and helped push inflation to a 40-year high.”

IRS paying 4% interest on delayed tax returns. The IRS has millions of delayed tax returns and is paying billions in interest to those waiting. Generally, the Internal Revenue Service (IRS) has 45 days to process a tax return and pay a refund. After that, interest starts accruing in amounts tied to federal short-term interest rates. The tax agency now pays 4% for individuals and 1.5% for large corporate refunds. Those payments have real costs for the public. In fiscal year 2021, the IRS paid $3.3 billion in interest to tax filers, more than triple what it paid in 2015, according to a Government Accountability Office report. For the fiscal year that started in October, refund interest payments through March are down 11% but still well above 2019 levels. “It’s not a small amount of money,” says Jessica Lucas-Judy, director of tax issues at GAO.

Market perspectives:

• Outside markets: The U.S. dollar index is higher in early trading. U.S. government bonds sold off again, pushing the yield on the benchmark 10-year Treasury note to 3.183% on Monday from 3.124% on Friday. That put it on course to settle at another fresh multiyear high. The Cboe Volatility Index — also known as the VIX — rose to 33.56, its highest closing level since March 8. Gold futures fell 1.3% to $1,858.40 an ounce.

• The dollar starts the week at marginal new highs, driven by three key themes, according to ING Economics: i) Fed tightening ii) the war in Ukraine, and iii) the China slowdown. “All three themes are showing no signs of reversing, although we should see slightly softer U.S. inflation this week. For the near term, however, expect the dollar to continue higher and EM FX to stay pressured,” concludes ING Economics.

• Brent-crude futures prices fell 2.5% to $109.57 a barrel. West Texas Intermediate crude fell 2.4% to $107.15 a barrel.

• Saudi Arabia cut oil prices for buyers in Asia as coronavirus lockdowns in China weigh on demand. Saudi Aramco, the state-controlled company, dropped its key Arab Light crude grade for next month’s shipments to Asia to $4.40 a barrel above the benchmark it uses, from $9.35 in May. Aramco also lowered all grades for the northwest Europe region and almost all for the Mediterranean. Prices for U.S. customers were kept unchanged from May.

• Surface Transportation Board (STB) implemented new rules for some of the largest railroads after customers said train backlogs have hampered their operations, the agency said. The STB, which regulates freight railroad operations, says certain carriers will need to permit service-recovery plans and regular progress reports on rail service, operations and employment. The move follows complaints voiced at an STB hearing last month about rail-service congestion involving the major railways. Customers in the ag sector say delayed trains are impeding crop shipments, causing grain storage facilities to fill up, backing up fertilizer shipments and temporarily shutting down production at ethanol producing plants. Link for details via the STB.

The National Grain and Feed Association (NGFA) praised the STB action. “NGFA members continue to experience rail service issues in many areas of the country impacting feed availability for livestock, exports and processing facilities for food and fuel,” NGFA President and CEO Mike Seyfert said in response to STB’s announcement. “The additional transparency should help the board with its oversight and help shippers and receivers more efficiently plan operations and more accurately gauge when contingency plans are needed.”

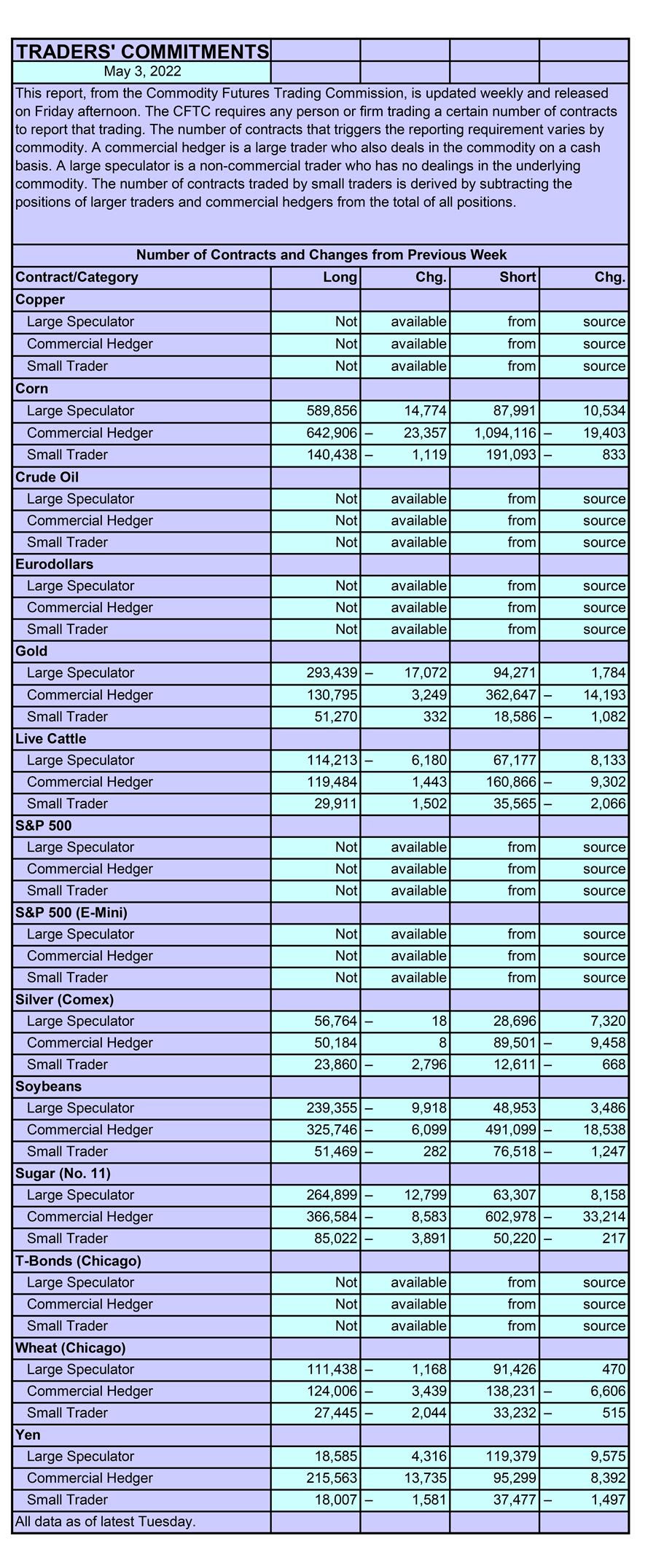

• CFTC Commitments of Traders report (Source: Barron’s, Bloomberg):

Hedge funds have cut bullish bets on some commodities to the smallest since December as the biggest increase in U.S. interest rates in 22 years prompted recession fears. But bullish wagers on crude oil, diesel and gasoline expanded amid ongoing supply tightness and disruptions stemming from the war in Ukraine.

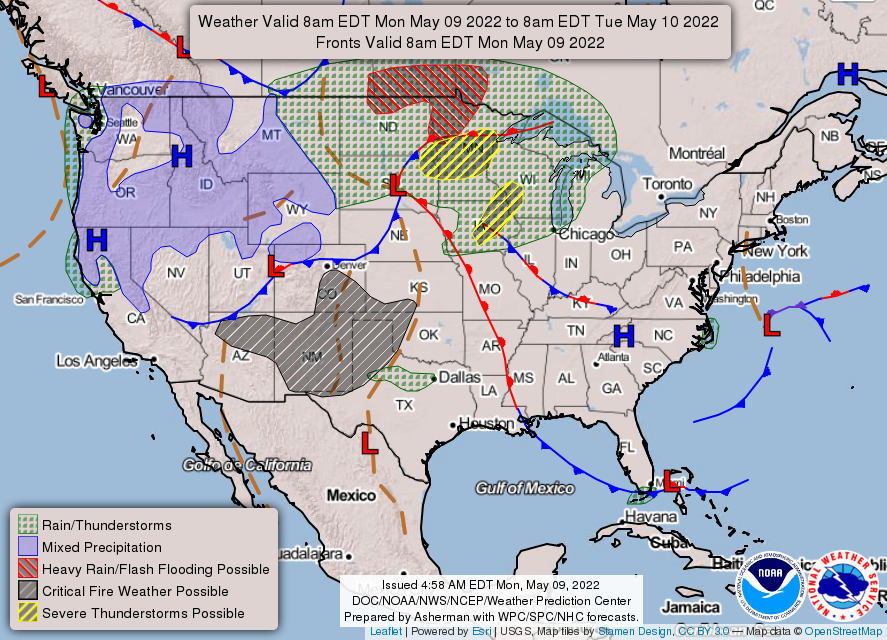

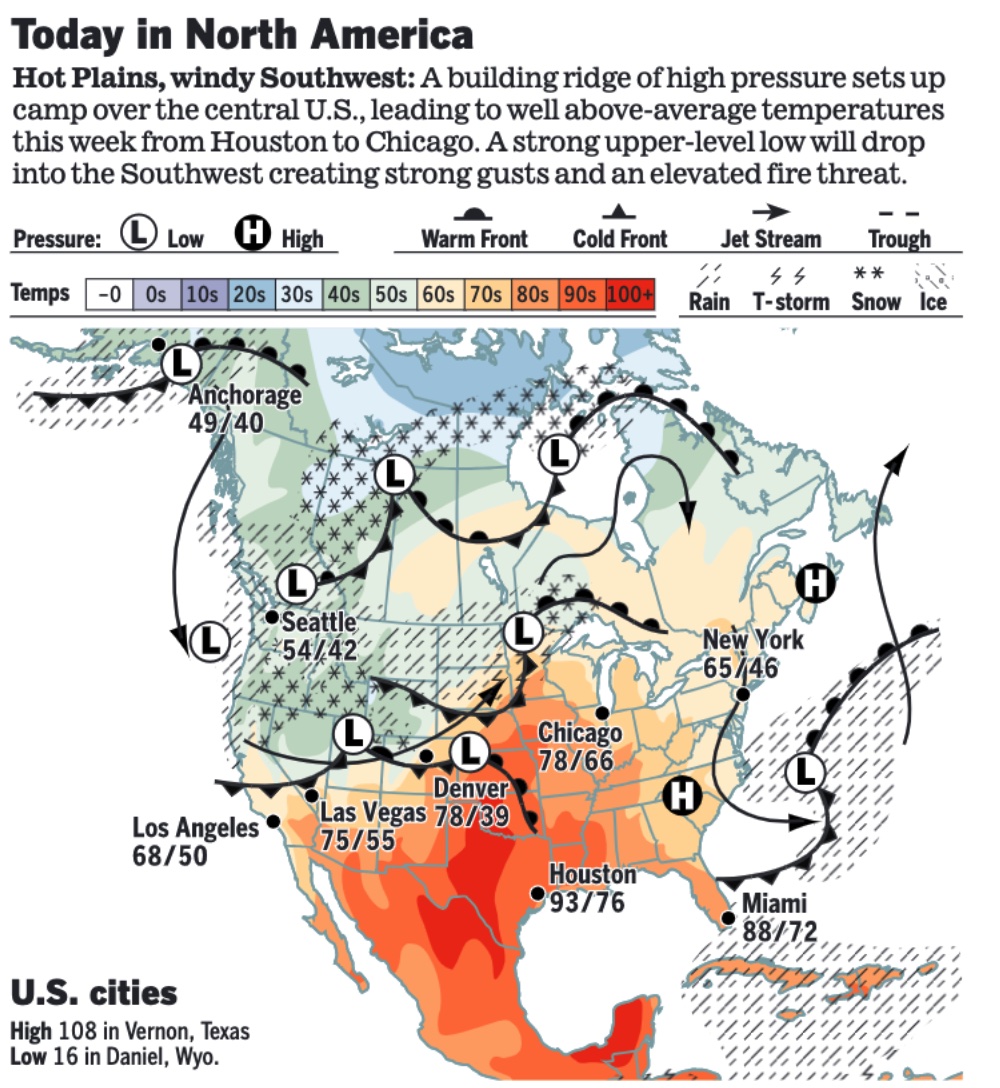

• NWS weather: Anomalous heat expected to spread from the central/southern Plains toward the Midwest as critical to extreme fire danger persists from the Southwest to the southern High Plains... ...Cold and mountain snows from the West Coast to the northern Rockies and Pacific Northwest as a quick round of heavy rain, thunderstorms and winds sweeps across the northern Plains today... ...Severe storms possible in West Texas on Tuesday; Continued chilly and windy conditions along the East Coast with prolonged high surf for coastal communities.

Items in Pro Farmer's First Thing Today include:

• Wheat firmer, corn and soybeans weaker to start the week

• Improved weather for many major U.S. crop areas

• China’s soybean imports rise in April (details in China section)

• China’s export growth slows in April amid Covid lockdowns

• Ukraine spring planting ‘active’ despite war (details in Russia/Ukraine section)

• Cattle bulls must defend support

• Hog traders maintain pessimistic attitudes

|

RUSSIA/UKRAINE |

— Summary: Volodymyr Zelenskyy, Ukraine’s president, said that any peace deal with Russia would require Russian forces to pull back to their pre-invasion positions. He said he was elected to be “president of Ukraine, not as president of a mini-Ukraine of some kind.” Earlier, leaders warned residents of the threat of increased missile strikes ahead of today when Russians celebrate their role in defeating Nazi Germany (see item below). President Biden convened a call Sunday with G7 leaders to take review the allies’ response to Russian President Vladimir Putin’s war against Ukraine. The leaders were joined by Ukraine President Volodymyr Zelenskyy for discussions. G7 leaders pledged to ban the import of Russian oil.

- Russia’s President Vladimir Putin attempted to justify his invasion of Ukraine on “Victory Day” — one of the most important events on the country’s national calendar. The West was “preparing for the invasion of our land, including Crimea,” Putin said without providing evidence, according to a Reuters translation. He added that NATO was creating threats at Russia’s borders.

- Biden: U.S. will send more aid to Ukraine. President Biden on Friday announced another security assistance package for Ukraine totaling $150 million he said would include artillery munitions, radars and other equipment.

- The U.S. announced new sanctions on Sunday, cutting off Kremlin-controlled media outlets from American advertisers and prohibiting the country from using U.S.-provided management and accounting consulting services, according to a senior administration official and a White House fact sheet (link). Meanwhile, the U.S. announced it would sanction executives of Gazprombank for the first time (but it is not freezing assets or prohibiting transactions with the bank). The EU has so far not disconnected the lender, a subsidiary of Gazprom, from the SWIFT international payments system.

- Vladimir Putin “doesn’t believe he can afford to lose,” says William Burns, CIA director. In a very informative discussion with the Financial Times (link), the U.S. intelligence chief discussed Russian president and war in Ukraine.

Key excerpt: “He was convinced that having invested a lot to modernize his military, that the Russian military could achieve a quick, decisive victory at minimal cost. He seemed convinced that our closest European allies were distracted by political transitions in Germany and by elections coming up in France and were risk averse. And he also seemed convinced that he had created a sanctions-proofed economy. He had put away a war chest of hard currency reserves. As we’ve seen, as we saw in the first few weeks of this war, he was wrong on each of those counts. Those assumptions were profoundly flawed.”

Burns said Putin is “in a frame of mind in which he doesn’t believe he can afford to lose… I don’t think this means Putin is deterred at this point because he staked so much on the choice that he made to launch this invasion that I think he’s convinced right now that doubling down still will enable him to make progress.

— Market impacts:

- Ukraine is in talks with Poland and Lithuania to export its summer grain harvest through the countries’ ports. The Wall Street Journal reports (link) that to move Ukraine’s wheat out to global markets, Poland would make space available at its seaports in Gdansk, Gdynia and Szczecin, and put those ports at the disposal of Ukraine. Lithuania has made the same offer. The two countries are also looking to create port space for sunflower oil, of which Ukraine is the world’s biggest producer. The bigger issue, beyond storing and shipping the grain, is to transport it out of Ukraine, which has seen extensive damage to its rail network.

- Ukraine spring planting ‘active’ despite war. Ukraine has sown about 7 million hectares of spring crops so far this year, 25% to 30% less than in the corresponding period in 2021, according to the country’s ag minister. He says, “The sowing campaign is going on actively despite the difficulties associated primarily with logistics.” He noted the sowing this year was not of the same quality as last year and the planted area for corn was smaller. The ag minister says the country exported nearly 1.1 MMT of grain in April. He highlighted the importance of exports of Ukrainian grain via Romania while Russia is blockading Ukrainian ports but said those exports could be complicated in two months by exports of the new wheat crop in Romania and Bulgaria.

- The European Union will drop a proposed ban on EU vessels from transporting Russian oil to third countries, while retaining a plan to prohibit insuring those shipments, according to documents seen by Bloomberg and people familiar with the matter. Greece, which is among the world’s largest shipowners, was among the member states that pushed for the provision to be removed from the EU’s sixth package of sanctions over Russia’s invasion of Ukraine, citing a lack of agreement among Group of Seven nations.

|

POLICY UPDATE |

— Producers frustrated over lack of WHIP+ details for eligible 2020 and 2021 commodities. USDA Secretary Tom Vilsack appears Tuesday before a Senate Ag Appropriations Subcommittee on USDA’s fiscal year 2023 budget. Vilsack usually has some updated policy news whenever he appears before a congressional panel. And that is what producers want relative to WHIP+ (expected to be renamed). Vilsack has frequently said details would come in May so some news is expected, hopefully including when payments will be issued.

WHIP+ livestock details have already been unveiled and will take place in two tranches, something also expected for eligible commodities.

— WOTUS roundtable today in Midwest. The Environmental Protection Agency (EPA) and U.S. Department of the Army (Army) will host a virtual Midwest-focused regional roundtable on "waters of the United States" (WOTUS) today from 9:30 a.m. to noon CT. The event was organized by the National Parks Conservation Association and is one of ten roundtables selected to highlight different perspectives and regional experience on WOTUS implementation. Link for details from EPA, including other roundtable locations and background information.

EPA has begun two rulemakings that would update which streams and wetlands are protected under the Clean Water Act after a court last year vacated the Trump administration’s rule restricting the waters eligible for protection. The Science Advisory Board will meet May 31 and June 2 to consider the adequacy of the “scientific and technical basis” for the first of the proposed rules, which roughly reinstates a 1986 definition of federally protected waters, according to a recent Federal Register notice. EPA is expected to attempt to expand the definition of WOTUS with a second rulemaking after the first is finalized. A public comment period for the rule closed in February. The board is accepting public comments on the basis of the rule though May 24.

The Supreme Court is reviewing the scope of the Clean Water Act’s jurisdiction over waters and wetlands. Environmental attorneys say they expect the court in Sackett v. EPA to narrowly define federally protected waters, possibly undermining both EPA rulemakings. Oral arguments in the case are expected this fall.

— Dem senators want $1 billion to boost conservation operations. On Friday, Sen. Chris Van Hollen (D-Md.) joined Sens. Michael Bennet (D-Colo.), Debbie Stabenow (D-Mich.), and Chris Coons (D-Del.) in requesting full funding for farm bill conservation programs in the fiscal year (FY) 2023 budget. In their letter to the U.S. Senate Ag Appropriations Subcommittee (link), the senators also ask for $1 billion to continue to increase USDA Natural Resource Conservation Service (NRCS) Conservation Operations to help ensure farmers, ranchers, and foresters can be part of the climate solution.

“Recognizing the importance of land-based solutions in combating climate change, it is necessary to continue federal investments in USDA conservation programs,” wrote the senators. “We need strong investments in USDA Natural Resource Conservation Service (NRCS) staff and resources to support farmers, ranchers and foresters to help mitigate and adapt to climate change.”

Facts and figures: In the recent FY 2022 omnibus spending bill, the Senate passed $904 million for NRCS Conservation Operations. NRCS staff help implement several farm bill conservation programs.

Other senators signing the letter. Besides Van Hollen, Bennet, Stabenow, and Coons, the letter is signed by Sens. Tim Kaine (D-Va.), Chris Murphy (D-Conn.), Bob Casey (D-Pa.), Ben Cardin (D-Md.), Amy Klobuchar (D-Minn.), Angus King (I-Maine), Dianne Feinstein (D-Calif.), Tom Carper (D-Del.), Cory Booker (D-N.J.), Tammy Duckworth (D-Ill.), John Hickenlooper (D-Colo.), Bernie Sanders (I-Vt.), Sherrod Brown (D-Ohio), Raphael Warnock (D-Ga.), Sheldon Whitehouse (D-R.I.), Richard Durbin (D-Ill.), Jeanne Shaheen (D-N.H.), Richard Blumenthal (D-Conn.), and Tina Smith (D-Minn.).

— USDA Deputy Secretary Bronaugh tells Politico she supports White House plan to boost wheat and soybean acres. Asked about some of the criticism of the subsidies (higher loan rates and subsidy to double crop wheat/soybeans), USDA Deputy Secretary Jewel Bronaugh told Politico USDA wants to “support our farmers and ranchers in being productive” amid “concern[s] about food availability… To be able to increase the availability of soybeans and wheat in our major commodities, both here in the United States and all over the world, is going to be critical not only from a nutrition security standpoint, but also from an ability to support our producers here in the United States,” Bronaugh said.

Asked why crops like soybeans would require subsidies into next year, Bronaugh said prices could dip in the next year — even though ag economists expect prices to remain high through 2023. “We always want them to be able to, through their prices, to be able to survive in terms of our major commodities,” Bronaugh told Politico. “But the reality of the history of so many years [is that] they have needed more support. And so, we as necessary will continue to support them, because that’s what they’re going to need to be sustainable.”

Comments: New-crop soybeans and wheat are currently considerably above the loan rate levels under the White House plan designed to attract more wheat and soybean plantings. Of note, Politico said a USDA spokesperson says the department was involved in designing the programs. USDA Secretary Tom Vilsack has yet to specifically comment on the acreage-boosting plans but will likely be asked to comment on this topic during a Senate hearing Tuesday.

— Roll Call: Stabenow pushes school food waivers in Ukraine talks. Senate Agriculture Committee Chairwoman Debbie Stabenow (D-Mich.) wants to extend pandemic waivers set to expire June 30 that allow schools to provide universal free meals to children, regardless of income, as part of a Covid-19 funding bill that could be combined with a separate Ukraine aid package, Roll Call reports (link).

|

CHINA UPDATE |

— Chinese Premier Li Keqiang warned in a statement on Saturday of a “complicated and grave” employment situation as the government tries to contain Covid. Li instructed all government departments and regions to prioritize measures aimed at helping businesses retain jobs and weather the current difficulties

— New-home sales in 23 major Chinese cities plunged 33% by area during a five-day national holiday compared with a year earlier. That’s despite the Chinese officials making sweeping vows to stimulate the economy and the top policy maker saying it would encourage “real housing demand,” in its clearest message condoning relaxation of property curbs.

— China’s exports and imports struggled in April as worsening Covid outbreaks cut demand, undermined production and disrupted logistics in the world’s second-largest economy.

Export growth in April in dollar terms slowed to 3.9% from a year earlier, compared to an increase in March of 14.7%, customs data showed Monday. That’s the weakest pace since June 2020 but faster than the median estimate of a 2.7% gain in a Bloomberg survey of economists.

Imports were unchanged in April after sliding 0.1% in the previous month. Economists expected a 3% decline.

ChinaTrade

— China’s soybean imports rise in April. China imported 8.1 MMT of soybeans last month, up 27.2% from March and 8.5% more than April 2021, as delayed shipments from Brazil arrived at Chinese ports. Through the first four months of 2022, China imported 28.4 MMT of soybeans, down 0.8% from the same period last year. China-based consultancy Mysteel expects China’s soybean imports this month to climb to about 9.4 MMT.

— China’s meat imports plunge in April. China imported 592,000 MT of meat in April, down nearly 36% from last year. China’s preliminary trade data doesn’t break down meat imports by category, but the sharp reduction was due to significantly lower pork arrivals. Through the first four months of this year, imports at nearly 2.3 MMT also fell 36% from the same period last year.

— China to step up economic support. China’s central bank said today it would step up support for the real economy, while closely watching domestic inflation and monitoring policy adjustments by developed economies. The People’s Bank of China (PBOC) will keep liquidity reasonably ample, prioritize stability and take steps to boost confidence, the bank said in its first-quarter monetary policy implementation report. Beijing will keep its economic operations within reasonable range, the central bank said, adding that it will not resort to flood-like stimulus and will not use property as short-term stimulus for economy.

|

ENERGY & CLIMATE CHANGE |

— NPPC asks SEC for more time to review climate reporting proposal. National Pork Producer Council (NPPC) officials met last week with senior leadership from the Securities and Exchange Commission (SEC) on the agency’s proposed regulations mandating that publicly traded companies report on their carbon emissions and other climate-related information, including not only their direct greenhouse gas emissions but the GHGs from partner companies, suppliers and distributors throughout the supply chain.

NPPC raised concerns, including the proposal’s potential to expose farmers and ranchers to the risk of litigation and lead to further concentration in and integration of the pork industry.

In late March, the SEC voted 3-1 to advance the rule but provided only a 39-day comment period on the more than 500-page proposal. The deadline for filing comments on the proposed rule is May 20. NPPC signed onto a letter from 120 agricultural groups sent to SEC Secretary Vanessa Countryman asking for an additional 180 days to review and comment on the regulation, which company with experience in environmental, social and governance reporting estimated would cost companies $6.7 billion over the next three years.

Link to Farm Bureau report, Overreach of SEC Proposed Climate Rule Could Hurt Agriculture.

|

CORONAVIRUS UPDATE |

— Biden administration is issuing a new warning that the U.S. could potentially see 100 million Covid-19 infections this fall and winter, as officials publicly stress the need for more funding from Congress to prepare the nation.

|

POLITICS & ELECTIONS |

— German Chancellor Olaf Scholz’s SPD party received a crushing defeat in the northern German state of Schleswig-Holstein. Sunday’s vote saw Scholz’s party getting only 16% of the votes — about 11 percentage points less than five years ago, according to the projections. The SPD was even overtaken by the Greens, who came second at 18.3%, gaining about 5 points, according to public broadcaster NDR.

|

OTHER ITEMS OF NOTE |

— Most popular baby boy and girls’ names in U.S. in 2021. The Social Security Administration on Friday released its list (link).

Liam has been parents’ top choice for baby boys for five years in a row and remained at the top of the list in 2021. It was followed by Noah, Oliver, Elijah and other popular picks.

Olivia was at the top of the list for popular girls' names, and it has “topped the list for three years,” according to a news release from the Social Security Administration. Olivia was followed by Emma, Charlotte, Amelia and other classic names.