White House to Hold Listening Sessions to Combat Hunger and Improve Nutrition

China competition bill heads to conference after Senate votes

|

In Today’s Digital Newspaper |

Ukraine said its forces were engaged in “difficult bloody battles” against Russian troops inside the Azovstal steelworks in Mariupol. Volodymyr Zelenskyy, Ukraine’s president, said civilians hiding in bunkers under the steelworks will need to be dug out by hand. The United Nations and the Red Cross are helping organize convoys out of the city but some 200 people remain trapped. Meanwhile, American officials told the New York Times that America has helped Ukraine “target and kill” Russian generals by providing intelligence. Twelve Russian generals have been killed so far during the war, although it’s not known how many were killed as a result of U.S. assistance.

As Russia’s offensives in Ukraine’s east appear to have stalled, its missile strikes in recent days have targeted rail hubs and electrical power facilities — in particular in Ukraine’s west, where arms are flowing into the country from the U.S. and its allies. Meanwhile, Russians are beginning to confront the toll of the war as soldiers come home in coffins.

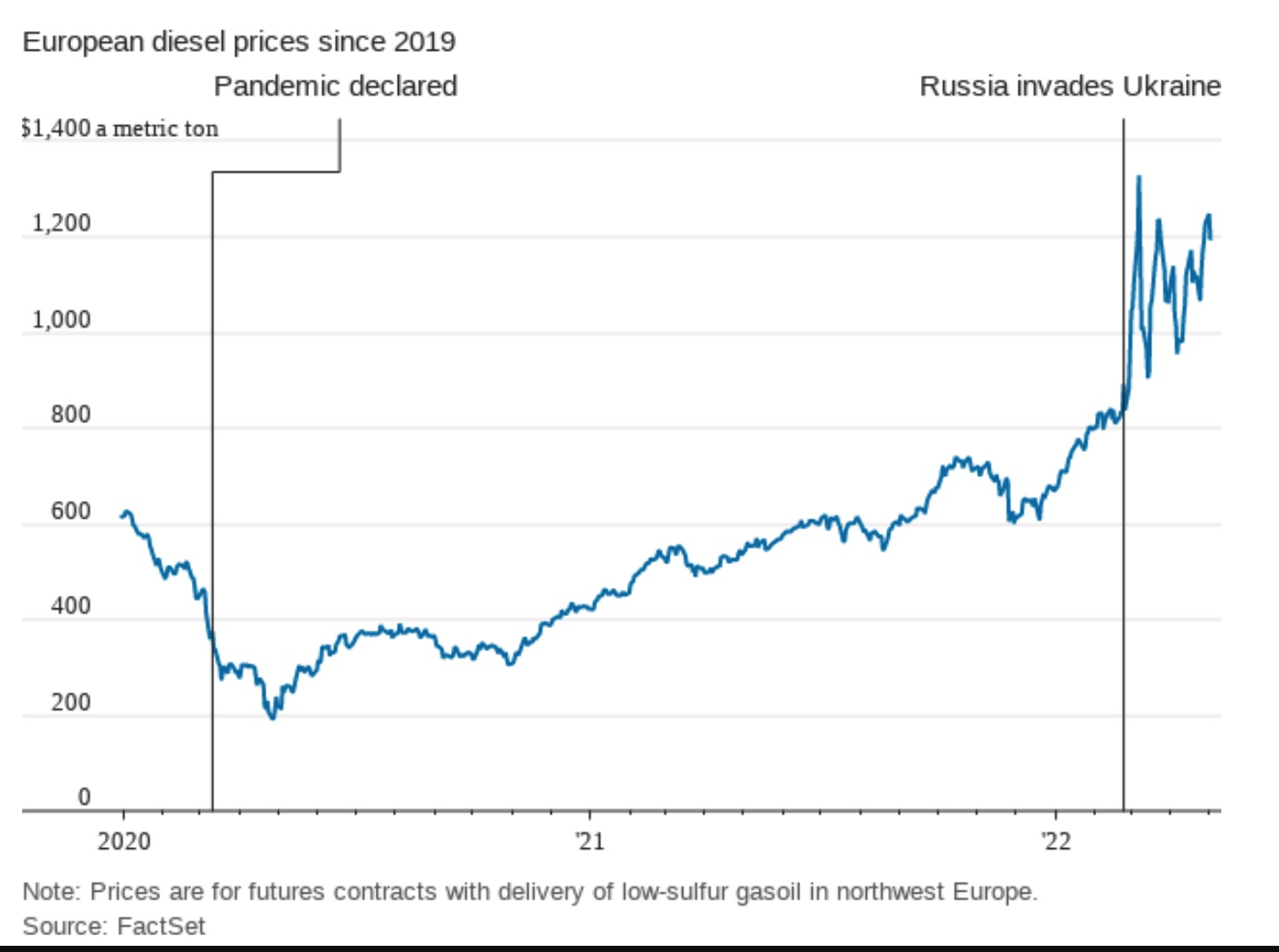

Oil prices are drifting ahead of today’s meeting of OPEC+ nations, with the cartel not expected to do much to curb a run-up in prices. WTI crude is around $108/barrel and is up about 2.5% in a week. Brent is around $110.50/barrel. Prices have risen as the EU announced a ban on Russian oil. A small production increase will be the likely result of today's meeting, according to analysts. The group must balance the EU's ban with a drop in demand from China due to Covid lockdowns. OPEC+ is also facing spare capacity issues, Bloomberg reported. OPEC March production came in about 85% short of growth targets.

Additional corn sales to China and a small rice sale reported by USDA in weekly data. USDA export sales figures for the week ended April 28 showed additional sales of U.S. corn, soybeans, upland cotton, pork and beef to China, with another small sale of rice in the update. Net sales for 2021-22 were 465,914 tonnes of corn, 200,765 tonnes of soybeans, 99,690 running bales of upland cotton, 18 tonnes of rice, but net reductions of 6,293 tonnes of sorghum. Activity for 2022-23 included 612,000 tonnes of corn and 268,000 tonnes of soybeans. Net sales for 2021 of 1,608 tonnes of beef and 703 tonnes of pork were also reported.

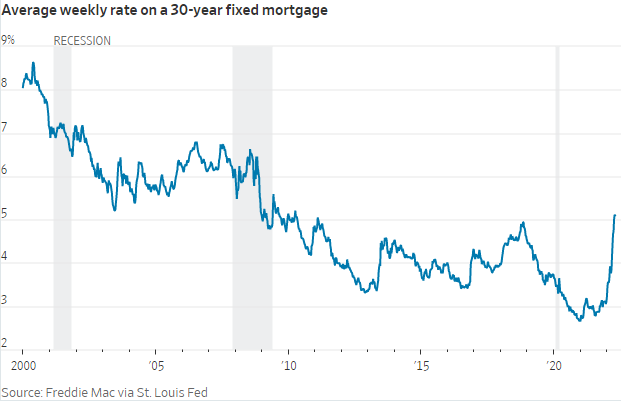

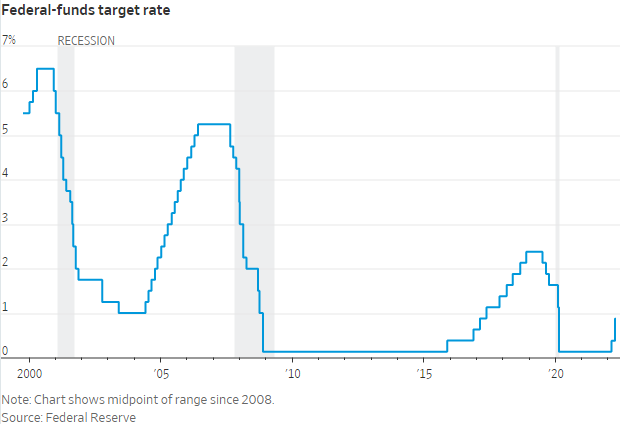

The Federal Reserve raised interest rates by a half-percentage, the first time in 22 years that the central bank has hiked rates this much. That means higher interest costs for mortgages, home equity lines of credit, credit cards, student debt and car loans. A 30-year fixed-rate mortgage hit an average of 5.10% as of the end of April — after hovering below 3% just one year earlier. The higher mortgage rates appear to be cooling a red-hot housing market, with sales of existing homes dropped nearly 3% from February to March. Business loans will also get pricier, for businesses large and small. The interest rate hike was unanimous, with all 12 members of the policy-setting Federal Open Market Committee agreeing on it. The Fed’s announcement contained “no major bombshells” — and could even provide comfort to investors who feared the bank could move to hike rates at a more rapid clip. We have more analysis of the Fed moves below.

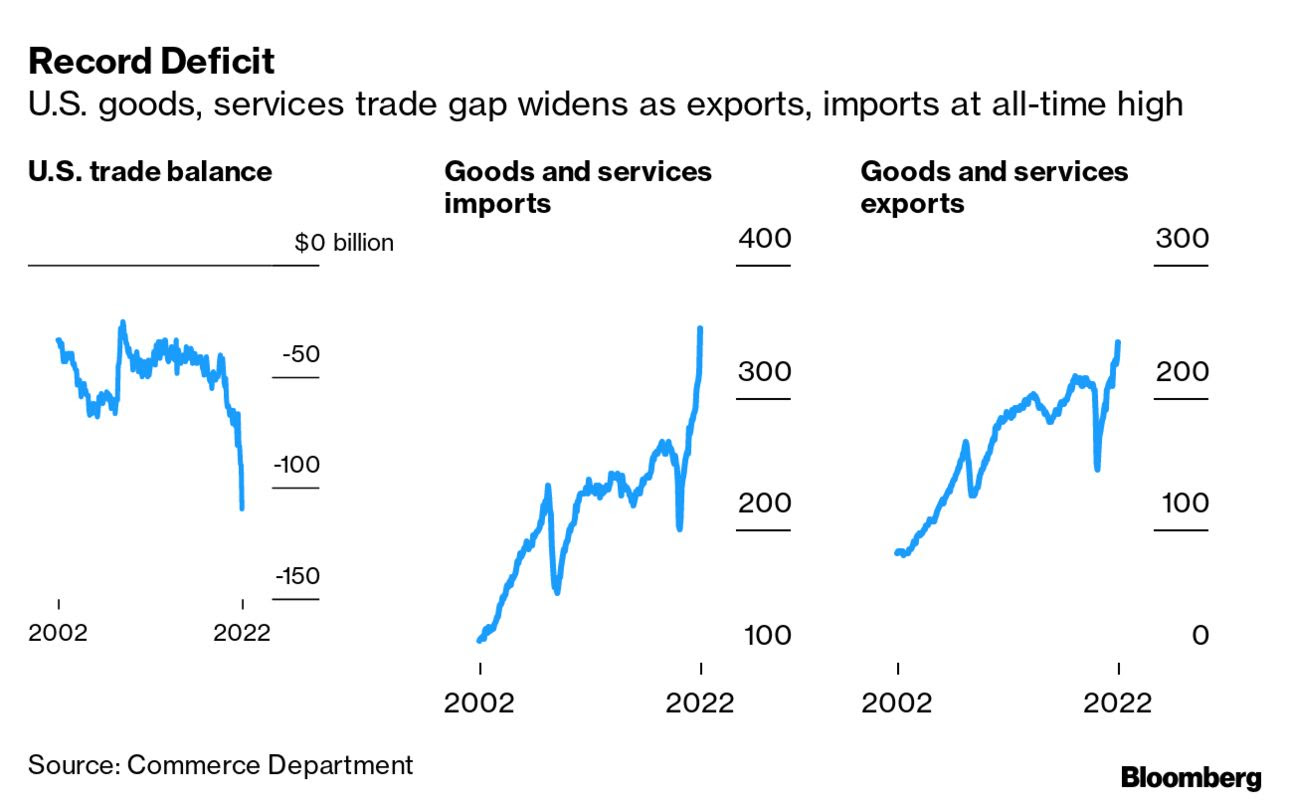

Record U.S. agricultural imports outpace rise in exports to produce monthly deficit. We have more details below.

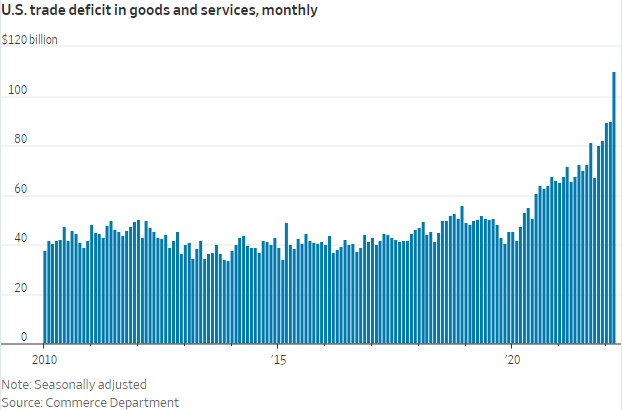

The U.S. trade deficit widened to a record in March, reflecting a surge in imports as companies relied on foreign producers to meet solid domestic demand. The gap in goods and services trade grew 22.3% to $109.8 billion, Commerce Department data showed Wednesday. Some analysts note that an improvement in the trade shortfall any time soon will be difficult as U.S. demand exceeds economic activity in many other nations.

Treasury Secretary Janet Yellen said the U.S. economy remains strong but that both persistently high inflation and spillovers from the war in Ukraine present economic risks. “The dangers at the global level are high,” she said. “I do worry about commodity prices, I am worried about spillovers from Russia and Ukraine that can have adverse impacts not just on the U.S. that is strongly positioned, but on Europe, on emerging markets.”

Of note: Corporations have more debt than they did during the financial crisis in 2008. That might cause trouble now that both interest rates and costs are rising.

Biden's plans to potentially cancel student loan debt invite legal scrutiny, according to former Education Department General Counsel Charlie Rose who wrote that Biden would be on shaky legal ground taking on mass forgiveness on his own. More than 40 million borrowers hold a collective $1.6 trillion in federal student loan debt, and none have been required to make payments since March 2020.

China’s Covid cases continue to significantly impact the country. Some of the most important economic centers, factories and businesses have had to close, sometimes for weeks. Migrant workers and recent college graduates have been hit especially hard.

Closed means open when it comes to the U.S. southern border. We have stats below from Secretary of Homeland Security Alejandro Mayorkas.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight, with European shares mostly up and Asian shares mostly down. U.S. Dow opened around 250 points lower. Asian markets registered losses with Japan still closed for a holiday. Hong Kong’s Hang Seng fell 76.12 points, 0.36% at 20,793.40. China’s Shanghai Composite rose 20.70 points, 0.68%, at 3,067.76 after being closed for a holiday. European equities are advancing in early trading, with the Stoxx 600 up 1.2% and regional markets rising 1.1% to 2.0%.

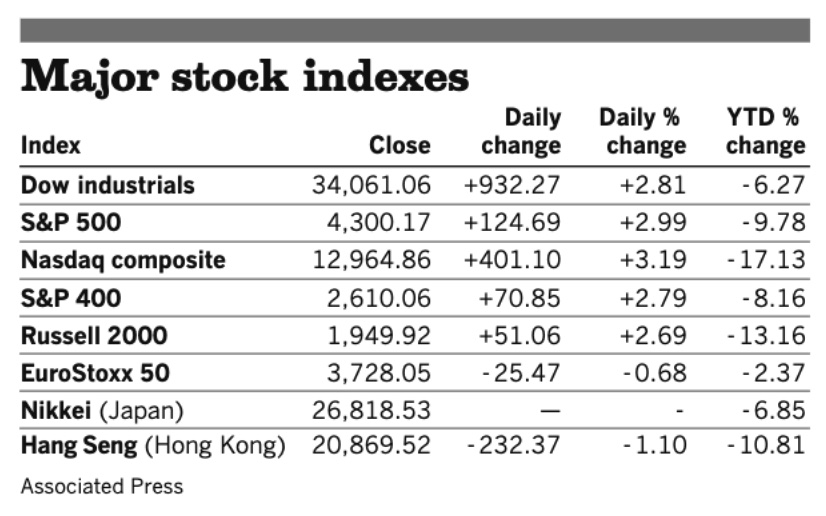

U.S. equities yesterday: The Dow pushed higher after Fed Chairman Jerome Powell spoke with reports following the Fed meeting conclusion where they raised the target range for the Fed funds rate by 50 basis points, the biggest rise since 2000. The Dow gained 932.27 points, 2.81%, at 34,061.06. The Nasdaq rose 401.10 points, 3.19%, at 12,964.86. The S&P 500 gained 124.69 points, 2.99%, at 4,300.17.

Agriculture markets yesterday:

- Corn: July corn futures rose 1 1/4 cent to $7.94 1/4, after dropping to a one-week low earlier, while December futures rose 1 cent to $7.36 1/4.

- Soy complex: July soybeans rose 10 cents to $16.40 1/2, after hitting a three-week low earlier. July soymeal fell $5.70 to $418.20, a three-month closing low. July soyoil rose 215 points to 82.43 cents.

- Wheat: July SRW wheat surged 31 cents to $10.76 1/2. July HRW wheat rose 30 1/2 cents to $11.23 1/4. July spring wheat climbed 21 3/4 cents to $11.77 1/4.

- Cotton: July cotton soared 468 points to 154.76 cents per pound after posting a contract high for the fifth straight session.

- Cattle: June live cattle fell 50 cents to $134.825, while August feeder cattle fell 7.5 cents to $176.20. Choice cutout values rose 15 cents early today to $259.70, after dropping $3.00 Tuesday.

- Hogs: June lean hog futures rose $2.90 to $105.10, the contract’s first gain in four sessions.

Ag markets today: Wheat futures led price gains overnight amid active followthrough buying to yesterday’s strong gains. Corn and soybeans followed wheat higher. As of 7:30 a.m. ET, winter wheat futures were 20 to 23 cents higher, spring wheat was 14 to 16 cents higher, corn was 1 to 3 cents higher and soybeans were 7 to 11 cents higher. Front-month U.S. crude oil futures were around 50 cents higher and the U.S. dollar index was about 650 points higher.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Bank of England releases a policy statement at 7 a.m. ET. UPDATE: BOE follows Fed with another rate hike. A day after the U.S. Federal Reserve raised interest rated by 50 basis points, the Bank of England (BOE) increased its benchmark rate by 25 basis points to 1% —the highest in 13 years in a bid to combat soaring inflation. BOE expects inflation to peak at slightly over 10% in the fourth quarter of this year. The rate-setting arm of BOE noted, “Global inflationary pressures have intensified sharply following Russia’s invasion of Ukraine. This has led to a material deterioration in the outlook for world and U.K. GDP growth.”

• U.S. jobless claims are expected to increase to 182,000 in the week ended April 30 from 180,000 one week earlier. (8:30 a.m. ET)

• U.S. labor productivity in the first quarter is expected to fall at a 5.2% pace from the prior quarter. (8:30 a.m. ET) UPDATE: Worker productivity fell to start 2022 at its fastest pace in nearly 75 years while labor costs soared as the U.S. struggled with surging Covid cases, the Bureau of Labor Statistics reported today. Nonfarm productivity, a measure of output against hours worked, declined 7.5% from January through March, the biggest decline since the third quarter of 1947. At the same time, unit labor costs soared 11.6%, bringing the increase over the past four quarters to 7.2%, the biggest gain since the third quarter of 1982.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Record U.S. agricultural imports outpace rise in exports to produce monthly deficit. U.S. agricultural exports rose to $17.69 billion in March, up 8.7% from February for the second highest total on record. But U.S. agricultural imports surged to $17.81 billion, a new record and up 23% from February to produce a monthly trade deficit for the sector of $118 million. In February, exports outpaced imports by $1.16 billion. The agricultural import total easily beat the prior record sent in November 2020 of $15.41 billion. This takes U.S. agricultural exports through the first half of Fiscal Year (FY) 2022 to $101.8 billion compared with $92.32 at this point in FY 2021 while imports are now at $92.82 billion versus $76.85 billion in FY 2021. The trade surplus at this point in FY 2021 was $15.47 billion.

But U.S. agricultural imports continued to hold above $14 billion each month for the remainder of FY 2021 while exports failed to clear that mark after May and the sector registered four straight monthly trade deficits to finish out FY 2021 and was under $1 billion over the March-May period. To meet USDA’s FY 2022 agricultural export forecast of $183.5 billion, shipments have to hit $13.62 billion each month — they failed to do so over the June-September period in FY 2021. Agricultural imports, meanwhile, have to be at $13.28 billion to reach USDA’s forecast of $172.5 billion. Agricultural imports have not been that low since February 2021 when they were at $11.86 billion. So far in FY 2022, agricultural exports have averaged $16.97 billion against imports averaging $15.47 billion. If imports follow the pattern seen in FY 2021, despite the surge in imports in FY 2021 that produced four monthly deficits, U.S. agriculture finished with a trade surplus of $8.83 billion. This suggests that USDA’s forecast for agricultural imports will likely have to be raised closer to $180 billion while the export outlook may be hit but will not if the same pattern of exports failing to clear $13 billion the final four months of FY 2022 unfolds this year.

Inflation, supply imbalances and strong demand for imported goods widened the U.S. trade deficit to a record in March, with clothing, computers, and vehicles driving the surge. The trade gap in goods and services widened by 22.3% in March from the prior month to a seasonally adjusted $109.8 billion, the Commerce Department said. Before the Covid-19 pandemic, the trade deficit had hovered for years between $40 billion and $50 billion a month. One factor behind the surge: In March, the gridlock at U.S. ports eased, alleviating supply-chain congestion that has disrupted trade during the pandemic and freeing up more goods for store shelves. Some analysts note that an improvement in the trade shortfall any time soon will be difficult as U.S. demand exceeds economic activity in many other nations.

Fed was not as aggressive as some thought. On Wednesday the FOMC hiked interest rates by 50 basis points, to a range of 0.75%-1%, the biggest hike in 22 years. The increase was expected and came with a tame outlook compared to what the market was fearing. Fed Chief Jerome Powell indicated an aggressive 75 basis point increase was off the table for now and that a series of 50 basis point hikes should be expected. That would lift the rate to a range last seen in 2019, before the pandemic prompted the central bank to open its monetary spigots and would represent a policy-tightening pace as aggressive as any since the 1980s. Said Powell: “Inflation is much too high, and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down.”

Overall, the tone was much more balanced than at the January and March FOMC meetings. The risk for the market now is that inflation will continue to rise despite the onset of interest rate hikes and force the FOMC to up its game once again. If history is any indication, the Fed will have to spark a recession to get inflation under control. Following the FOMC statement and Fed presser, equities soared, indicating that equity traders feared a more aggressive Federal Reserve that did not occur. On Wednesday, the Dow jumped 2.8% and the Nasdaq composite climbed 3.2%.

The Fed also outlined its plan to begin trimming its nearly $9 trillion balance sheet beginning in June, reducing its holdings of Treasury debt and mortgage-backed securities and that gameplan was not as aggressive as some analysts predicted.

Sen. Mitt Romney (R-Utah): “Unfortunately, the Fed kept their foot on the gas too long. Covid obviously disrupted our supply chain. And the president did almost everything wrong, throwing a lot of fuel on the inflation fire. To get the inflation under control was going to require someone to put the brakes on, and the Fed has the brakes. It’s a painful process, but that’s what’s gonna have to happen.”

India’s raised its own rates for the first time since 2018. The Reserve Bank of India (RBI) characterized it as a defense against inflation driven by imported food and fuel. Adding 40 basis points to its historically low 4%, the RBI caught investors off-guard: stock markets drooped. Other countries joined the rate-raising exercise after the Fed’s announcement, including Brazil and most of the Gulf states.

Bank of England boosts rates, warns of recession. The Bank of England (BOE) concluded its policy meeting by increasing interest rates by 25 basis points, taking it to 1%, the highest since 2009. But in announcing the action, the BOE also warned the U.K. economy could fall into recession later this year as high energy prices push inflation over 10% and negatively impact U.K. households. Three of the nine Monetary Policy Committee (MPC) members voted for a more-aggressive 50-basis-point increase.

Treasury Secretary Janet Yellen said the U.S. economy remains strong but that both persistently high inflation and spillovers from the war in Ukraine present economic risks. “The outlook is very uncertain. The dangers at the global level are high,” she said. “I do worry about commodity prices, I am worried about spillovers from Russia and Ukraine that can have adverse impacts not just on the U.S. that is strongly positioned, but on Europe, on emerging markets.” Yellen spoke virtually at the Wall Street Journal’s CEO Council Summit in London as the Biden administration grapples with the Russian invasion of Ukraine and the highest inflation in decades.

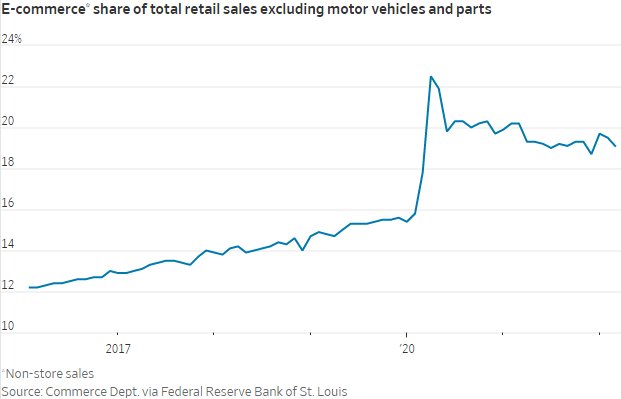

WSJ Chief Economics Commentator Greg Ip writes that the economy has arrived at a new postpandemic normal — and it isn’t as lucrative as investors had hoped. The pandemic catalyzed a once-in-a-generation change in consumer, worker and company behavior: a shift to remote life and work accompanied by the digitization of business models, from e-commerce to telehealth. Companies that drove this shift saw their sales, profits and especially stock prices skyrocket. That shift is now largely complete. While the pandemic is still with us, Americans are learning to live with it. Wall Street, as is its wont, was too optimistic about how long and how far this transformation would go. Link to article.

Market perspectives:

• Outside markets: The U.S. dollar index is higher with the euro and British pound weaker versus the greenback. The yield on the 10-year U.S. Treasury note has eased to trade around 2.94%. Gold and silver futures are posting solid gains, with gold around $1,900 per troy ounce and silver around $23.05 per troy ounce.

• Crude oil futures are higher ahead of U.S. trading, with U.S. crude around $109.45 per barrel and Brent around $111.95 per barrel. Futures were firmer in Asian action, with U.S. crude around $108.20 per barrel and Brent around $110.65 per barrel.

• OPEC and allied oil-producing countries, including Russia, are weighing conflicting forces today as they decide how much crude should flow to volatile global markets. Europe's proposal to phase out Russian oil and other Western sanctions are choking back supply, while Covid-19 shutdowns in China are cutting demand, the AP notes. Analysts expect the 23-country alliance known as OPEC+ to stick with a set schedule of modest increases in production, amounting to 432,000 additional barrels of oil per day in June. The gradual increases are aimed at making up deep production cuts made during the depths of the pandemic recession in 2020.

• Shipping progress. A backup at South Caroline’s Port of Charleston that had reached 27 container ships is down to five vessels.

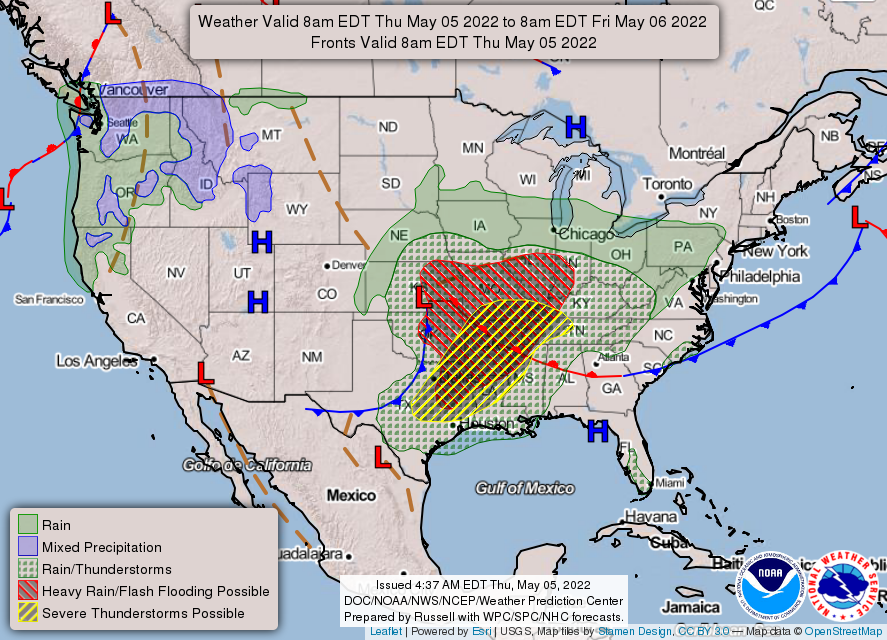

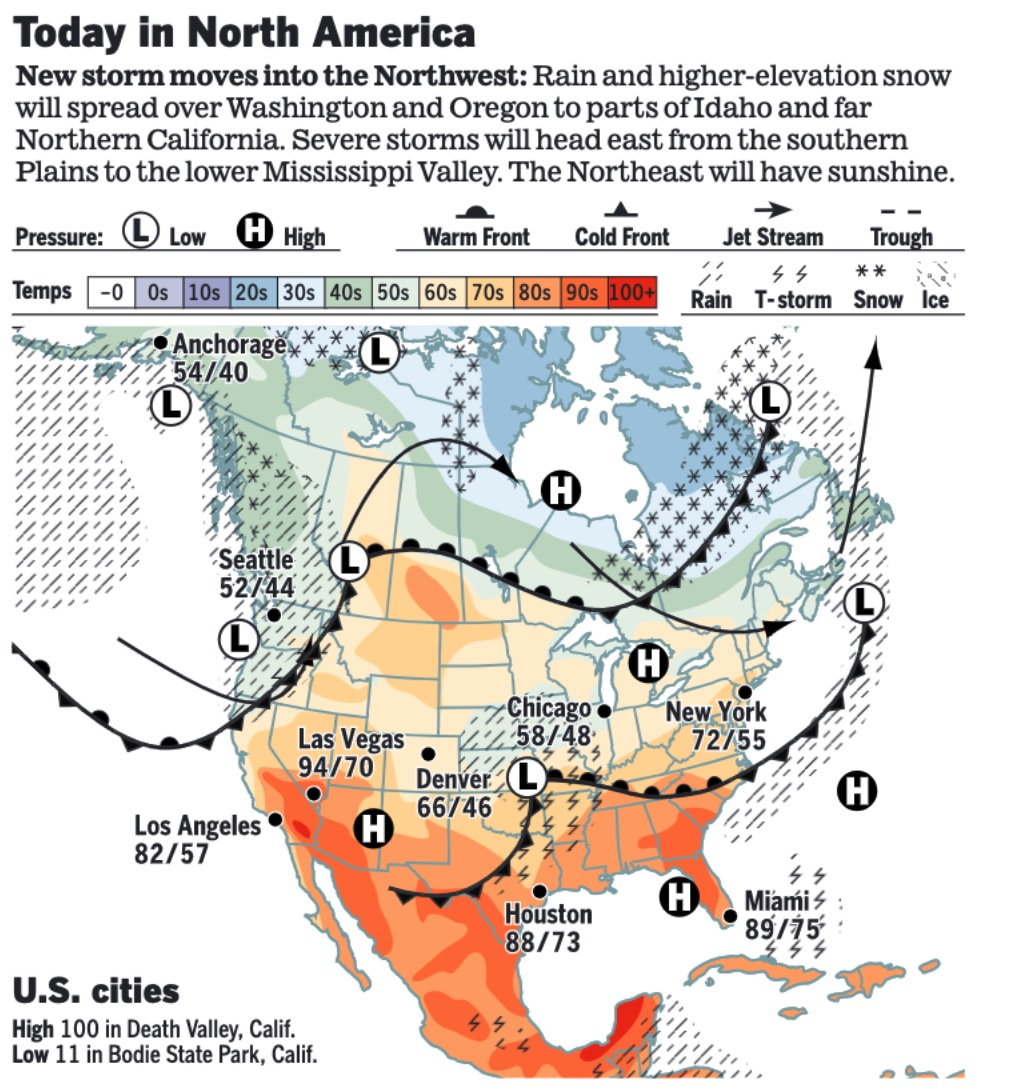

• NWS weather: On Thursday, heavy rain and severe thunderstorms will develop over portions of the Southern Plains, Middle/Lower Mississippi Valley, and Ohio/Tennessee Valleys... ...On Friday, heavy rain and severe thunderstorms will develop over portions of the Central/Southern Appalachians, Central Gulf Coast/Southeast, and Eastern Ohio Valley/Mid-Atlantic.

Items in Pro Farmer's First Thing Today include:

• Wheat sharply extends Wednesday’s price strength

• PBOC pledges more support for slumping economy (details in China section)

• Cash cattle trade starts around steady prices

• Cash hog index declines again

|

RUSSIA/UKRAINE |

— Summary: Ukraine’s military says that it recaptured some areas in the south and repelled Russian attacks in the east. Meanwhile, a bloody battle rages at a steel mill in Mariupol where Ukrainian troops are holed up in tunnels and bunkers, fending off a Russian onslaught. Ten weeks into a devastating war, Ukrainian and Russian forces are fighting village by village, as Moscow struggles to gain momentum in the eastern industrial heartland of the Donbas. Russia switched its focus to that region after a stiffer than expected resistance bogged its troops down and thwarted its initial goal of overrunning the capital. In addition to heavy shelling of the Donbas, Russian forces also kept up their bombardment of railroad stations and other supply-line targets across the country.

- EU targets Russia’s global oil trade with shipping sanctions. The bloc is proposing to ban European vessels and companies from providing services — including insurance -— linked to the transportation of Russian oil and products globally as part of its new sanctions package. While member states are still wrangling over the terms, it’s a potentially powerful tool because Bloomberg notes that 95% of the world’s tanker liability cover is arranged through a London-based insurance organization called the International Group of P&I Clubs that has to heed European law.

— Market impacts:

- “If oil is available and at a discount, why shouldn’t I buy it? I need it for my people.” — Nirmala Sitharaman, India’s finance minister. India has found substantially discounted Russian oil to be an irresistible deal, no matter the diplomatic pressure. India’s purchases of Russian crude have soared since the conflict’s start, rising from nothing in December and January to about 300,000 barrels a day in March and 700,000 a day in April. The crude now accounts for nearly 17 percent of Indian imports, up from less than 1 percent before the invasion. Last year, India imported about 33,000 barrels a day on average from Russia. Indian refiners can also use the crude to make products like diesel and jet fuel and sell it at better-than-usual margins abroad.

- BP has sent 55 LNG cargoes into Europe over the past five months, while the company’s European refineries are garnering huge profits as the price of fuel they sell outstrips the cost of crude they buy. U.S. LNG supplier Cheniere Energy just raised its 2022 profit forecast by some 17% after record first-quarter exports, with about 75% going to Europe.

|

POLICY UPDATE |

— Negotiations are underway in Congress on provisions in the Ukraine aid package forwarded by President Joe Biden, including provisions that would provide a temporary boost in commodity loan rates for wheat, soybeans, rice and minor oilseeds, and would provide a $10-per-acre incentive for double cropping soybeans after winter wheat in 2023. The agriculture provisions fall under the Senate Agriculture Committee’s jurisdiction, and panel Chair Debbie Stabenow (D-Mich.) said discussions between the House and Senate Democrats and Republicans were ongoing relative to the scope and content of the overall package. “It’s really the White House, the four leaders and relevant other committees trying to just get an agreement,” she said, according to CQ Roll Call. The ag-related package is getting a thumbs down from GOP ag leaders in Congress.

|

CHINA UPDATE |

— U.S. regulators added more than 80 Chinese companies to a “non-compliance” list, meaning they could be expelled from Wall Street’s stock exchanges. The move is in retaliation for China’s refusing to share the businesses’ financial audits. The affected companies — including the e-commerce giants JD.com and Pinduoduo as well as Sinopec, a petrochemical colossus — have three years to comply.

— A longer wait for Biden’s China strategy. The unveiling of President Joe Biden’s detailed strategy toward China — delayed by internal deliberations, Covid-19 and the Ukraine conflict — will have to wait even longer. Despite anticipation over how the U.S. sees relations between the world’s two biggest economies developing, Secretary of State Antony Blinken is likely to offer little that’s new to help guide policy makers, analysts and markets in a speech he was meant to deliver, according to people familiar with his planned remarks who spoke on condition of anonymity in advance of the event. The address was scheduled for Thursday but was delayed after Blinken tested positive for Covid-19.

— Covid-19 lockdowns in Shanghai and elsewhere in China are denting sales, disrupting operations and adding strain to supply chains that could be felt well into the summer. Activity in China’s services sector fell in April to its weakest level since the onset of the pandemic, according to one indicator.

— PBOC pledges more support for slumping economy. China’s central bank pledged monetary policy support to ensure ample liquidity to help businesses badly hit by the latest Covid-19 outbreak. “(We shall) waste no time planning incremental policy tools to support steady economic growth, stabilize employment and prices... to provide a fair monetary and financial environment,” the People’s Bank of China (PBOC) said in a statement on Wednesday. It did not detail what measures it could take. Financial institutions should aim to meet the needs of the general economy, PBOC said, such as boosting financing for small firms with lower costs, helping import and export firms, as well as the service sector and aviation companies which have been badly hit by the pandemic. The bank also called for “stable and orderly” growth in financing the real estate sector, which has experienced a prolonged slowdown in recent months. In a separate statement, the PBOC said it had allocated an additional 100-billion-yuan ($15.13 billion) worth of loans dedicated to coal production and storage, part of Beijing’s efforts to boost energy security and stabilize supply chains.

|

TRADE POLICY |

— USTR formally publishes notice on review of China Section 301 tariffs. The Office of the U.S. Trade Representative (USTR) today published the notice in the Federal Register (link) that announces the statutory review of the Section 301 tariffs deployed against China on July 6, 2018, and Aug. 23, 2018. The notice sets in motion a 60-day periods for those benefiting from the trade actions to request they be continued. For the July 6, 2018, tariffs, the 60-day period is May 7-July 5 and for the Aug. 24, 2018, tariffs it will be June 24-Aug. 22. If there are one or more requests to continue the tariffs, USTR will then move to the next phase which will provide the opportunity for public comments from all interested parties. The second phase of the review will be announced in “one or more subsequent notices,” USTR said.

— Russia’s war with Ukraine is giving a group of European Union countries fresh incentives to speed up work on free-trade agreements. At least nine nations including Germany and Spain are planning to send a letter to the EU seeking to speed the delayed talks, according to a draft obtained by Bloomberg (link). The signatories want faster negotiations with New Zealand, Australia, India and Indonesia, while speeding the implementation of accords agreed with Chile, Mexico and the Mercosur bloc of countries, which include Argentina, Brazil, Uruguay and Paraguay. The letter also says that the process to negotiate, sign and implement trade deals is too long, and points out that the massive Regional Comprehensive Economic Partnership was signed in late 2020 and will enter into force this year for most members.

|

ENERGY & CLIMATE CHANGE |

— Energy giant Shell reported record profits for the first quarter of 2022, as oil and gas prices surged due to the war in Ukraine. The company made $9.1 billion, nearly triple what it made during the same period last year. But it said divestments from Russia due to the war will cost it almost $4 billion. The profits will add to opposition party calls in Britain for a windfall tax on the likes of Shell and BP.

— Volkswagen is accelerating investment in the U.S. electric-vehicle market, where it expects little impact on growth from the Ukraine war or China’s Covid lockdowns.

— Big bucks for climate change. John Doerr, a venture capitalist, and his wife, Ann Doerr, are making a $1.1 billion donation to Stanford for a new school focusing on sustainability and climate change.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Biden pledges to ‘combat hunger and improve nutrition for every American.’ In a White House video, President Biden said on Wednesday that the administration would “lay out our plan to combat hunger and improve nutrition for every American” at the hunger, nutrition, and health conference set for September. More than 10% of Americans were food insecure and hunger rates spiked during the early months of the pandemic. “As more Americans experienced hunger, we saw how diet-related diseases heighten the risk of severe Covid,” said Biden. “It’s time we make real change. I’m committed to taking bold steps that are going to end hunger and enable everyone — everyone — to have access to affordable, healthy food and safe places to be physically active.”

The White House will hold listening sessions ahead of the conference to gather ideas on how to meet its goal of ending hunger and increasing healthy eating and physical activity by 2030 to reduce the prevalence of such diet-related diseases as obesity, diabetes, heart disease, and cancer.

It will be the first presidential hunger conference since 1969, during the Nixon administration. The 1969 conference provided helped launch the Women, Infants, and Children program and expanding the food stamp and school lunch programs, and eventually led to development of the Dietary Guidelines for Americans.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 515,638,077 with 6,245,315 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 81,620,403 with 996,705 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 577,306,842 doses administered, 219,902,417 have been fully vaccinated, or 66.74% of the U.S. population.

|

POLITICS & ELECTIONS |

— A CNN poll released on Wednesday showed Biden’s economic approval numbers continue to tick downward, with 34% now approving and 66% disapproving, compared with 37% approval and 62% disapproval earlier this year.

— Broadly forgiving student debt by executive action would be legally risky, warns an analysis prepared last May by Charlie Rose, the Education Department’s top lawyer from 2009 to 2011. President Biden is seriously considering canceling some debt for certain borrowers, but according to Rose, failing to tie relief to their individual needs and use regulatory procedures would risk being overruled in court. Loan-servicing companies and investors that own securities backed by student loans might be able to sue the administration, the analysis suggests.

|

CONGRESS |

— China competition bill heads to conference after Senate votes. The Senate last night completed the last series of votes needed to go to conference with the House on multibillion-dollar manufacturing and innovation legislation (HR 4521) aimed at improving U.S. competition with China. A final bill would need to be agreed to by both chambers before it can be sent to President Joe Biden’s desk.

|

OTHER ITEMS OF NOTE |

— Open U.S. southern border. Secretary of Homeland Security Alejandro Mayorkas confirmed to Fox News' Bret Baier this weekend that over 1 million migrants have been caught and released into the U.S. since President Joe Biden took office. Many of these migrants do show up in immigration court to file asylum claims, but asylum cases take years to complete. The current average is 4 1/2 years. By the time their asylum claims are decided — they're usually rejected — the migrants in question are no longer a priority for deportation. That's because, under enforcement guidelines issued by Mayorkas, migrants whose only offense is illegally crossing the border more than a year and a half ago are not a priority for removal. Biden’s decision not to deport migrants in this category is a big reason why deportations fell to a record low, 59,011, in the president's first year in office. Throw in what Mayorkas admits is somewhere between 200,000 to 400,000 migrants who escape apprehension, and that means somewhere between 1.2 million and 1.4 million illegal immigrants have entered the U.S. since Biden took office, while fewer than 60,000 have been deported. Asked by Baier if it is "the objective of the Biden administration to sharply reduce the total number of illegal immigrants coming across the southern border,” Mayorkas said it was not. “It is the objective of the Biden administration to make sure that we have safe, legal, and orderly pathways for individuals to be able to access our legal system,” Mayorkas said.

— Groups can intervene in debt relief suit. A U.S. district court judge in Texas ruled that the National Black Farmers Association and the Association of American Indian Farmers can intervene in a lawsuit by Texas Agriculture Commissioner Sid Miller to block federal debt relief for socially disadvantaged farmers. Link for details.