Fed Rate Hike Coming Wednesday but Key is What Chairman Signals Ahead

USTR Tai, Treasury Secretary Yellen among speakers this week in Washington

Washington Focus

The House is out, and the Senate is working this week.

House Speaker Nancy Pelosi (D-Calif.) led a secret congressional delegation to meet with Ukraine President Volodymyr Zelenskyy in the war-torn country’s capital city of Kyiv. Zelensky shared the footage showing him joined by an armed escort coming to meet Pelosi at the steps of a building in Kyiv as Ukrainian forces continue to resist bombardment from invading Russian forces. Pelosi, the highest-ranking U.S. gov’t official to visit Ukraine, was joined at the meeting by Rep. Adam Schiff and other congressional members, the video showed.

Pelosi said the U.S. should “not be bullied by bullies” when asked about sending additional aid to Ukraine without provoking a response from Russia. “Let me speak for myself. … Do not be bullied by bullies. If they’re making threats, you cannot back down. That’s my view of it,” Pelosi told reporters during a press conference in Poland. Pelosi added that the purpose of the trip was to “send a clear message to the world: America stands with Ukraine.”

Kaine says Ukraine aid, Covid-19 funding do not have to be combined. Sen. Tim Kaine (D-Va.) on Sunday said he does not think Covid-19 funding and aid for Ukraine need to be combined in a single piece of legislation, as Congress considers both priorities for the Biden administration.

President Biden on Thursday asked Congress to authorize $33 billion in aid to support Ukraine, with some funds going towards security assistance, weapons, military aid, humanitarian assistance and food security funding. The ask also comes as the White House is pushing for additional Covid-19 response funding. An administration official told reporters on Thursday that the administration thinks it “certainly makes sense” that the pandemic funding and Ukraine aid “move together” in legislation. On Friday, Speaker Nancy Pelosi (D-Calif.) endorsed that strategy.

U.S. Agency for International Development (USAID) Administrator Samantha Power on Sunday said Russia’s invasion of Ukraine has become something of a World War “in terms of effects,” with the conflict now in its ninth week. Power, during an interview with anchor George Stephanopoulos on ABC’s This Week, said the impacts of the Russia/Ukraine conflict are spreading beyond Kyiv and even Europe, with food prices spiking in several countries.

She said USAID has asked for a “substantial increase in humanitarian assistance” as a result, emphasizing the need for financial support from Congress. Stephanopoulos then likened her descriptions of the conflict’s effects to that of a world war. “Certainly in terms of effects, not confined to the horrors that the Ukrainian people are suffering,” Power added.

The administrator said the conflict, not sanctions, are driving food prices up, despite what Russia may try to argue. “And Russia tries to take advantage of this and say, oh, it’s the sanctions that are causing these high food prices. Not at all. It is Russian’s invasion of Ukraine for no reason and its unwillingness now to come to the negotiating table and get out of Ukraine and get back to Russia,” she said.

The two-day Federal Reserve meeting will conclude with a rate announcement on Wednesday, May 4. The market has fully priced in a 50 basis points hike for May and several other hikes before the end of year. But some analysts are already speculating that the first quarter GDP contraction of 1.4% may cause the Fed to be more cautious following this week’s half-point hike. Chairman Jerome Powell will give a press conference so each word utters will be listened to carefully, even though he and the Fed have made strategic policy mistakes over the past year. Powell will likely be asked about the possibility of a 75-point hike ahead but that seems less likely following the anemic GDP report last week. The Fed hasn’t done a 75-basis-point increase since 1994, toward the end of a path from 3% to 6%.

The Fed will also reveal more about plans to start shrinking the central bank’s $9 trillion asset portfolio. The moves are part of a double-barreled effort to slow the economy and ease inflation, running at a four-decade high.

On the farm policy front, we could get news this week on WHIP+ details for eligible 2020 and 2021 crops (USDA may rename the program).

Sources expect the same announcement on crops as livestock: two phases. Phase 1 is where RMA and FSA have the data for the producer due to CI or NAP claims filed. They run the data they have, apply pay limits, and send out from KC without need to apply. Phase 2 is where they do not have that producer data. That’s the announcement most expect this month. When checks go out is after May but don’t know when at this time.

Former House Speaker Newt Gingrich (R-Ga.) predicts Republicans could pick up 25 to 70 seats in the House in the Nov. 8 midterm elections, as well as four in the Senate, returning control of both chambers of Congress to the GOP. Gingrich made the to Maria Bartiromo on her Fox News show Sunday Morning Futures. In the House, that would top the 63-seat gain by Republicans in 2010, the height of the Tea Party movement and the highest gain for both parties since 1948.

Gingrich also predicted Rep. Kevin McCarthy (R-Calif.), who is facing a leaked tape controversy, will go on to be House speaker. "I think he will do an amazingly good job," he said.

Donald Trump’s influence faces a big test in Republican primaries. The first verdict on Trump’s ability to serve as a party kingmaker will come this Tuesday in Ohio, where he has endorsed venture capitalist and author J.D. Vance for a Senate seat in one of the GOP’s most contentious primaries.

Events on Tap This Week

U.S. Trade Rep Katherine Tai and Treasury Secretary Janet Yellen are two speakers of note this week at various events in DC.

Monday, May 2

• NATO and Europe. Atlantic Council virtual conference on "Priorities for the NATO Summit and security in Europe,” including a focus on the Russian invasion of Ukraine.

• Bankers meeting. Independent Community Bankers of America 2022 Capital Summit; Consumer Financial Protection Bureau Director Rohit Chopra delivers remarks; runs through Wednesday.

• Maritime meeting preparation. State Department public meeting in preparation for the International Maritime Organization (IMO) FAL 46 Meeting.

• Stablecoins. American Enterprise Institute for Public Policy Research discussion on "Private Stablecoins: Fad or Lasting Innovation?"

• Price gouging. American Bar Association virtual discussion on "Price Gouging, Global Markets, and Uncertainty."

• Supreme Court ethics. American Constitution Society for Law and Policy virtual discussion on "Supreme But Not Immune: Creating a Binding Code of Ethics for Supreme Court Justices."

• Cybersecurity. Government Executive Media Group's Federal Computer Week virtual discussion on "How serious is the Cybersecurity Threat Posed by the Current Geopolitical Climate?"

• U.S. trade policy. Council on Foreign Relations virtual discussion on "A U.S. Trade Rethink?" as part of the Renewing America series.

• Urban-rural divide. Georgetown University Institute of Politics and Public Service discussion on "Ceasefire: Bridging the Urban-Rural Divide."

• Trade issues. U.S. Trade Representative Katherine Tai delivers remarks at the Milken Institute's Global Conference in Beverly Hills, California.

Tuesday, May 3

• FY 2023 budget: Defense. Senate Appropriations Defense Subcommittee hearing on FY 2023 Defense Department budget.

• FY 2023 budget: Transportation. Senate Commerce, Science and Transportation hearing on the President's proposed budget request for FY 2023 for the Transportation Department, with Transportation Secretary Pete Buttigieg testifying.

• FY 2023 budget: IRS. Senate Appropriations Financial Services and General Government Subcommittee hearing on the FY 2023 Internal Revenue Service budget.

• Russian invasion of Ukraine: Nuclear weapons. The Arms Control Association (ACA); the Lawyers Committee on Nuclear Policy, and the Princeton University Program on Science and Global Security hold a virtual discussion on "The Threat of Use of Nuclear Weapons and Russia's War on Ukraine: Meeting the Legal and Political Challenge."

• CEO Council Summit. Wall Street Journal CEO Council Summit, with remarks from U.K. Defense Staff Chief Adm. Tony Radakin on "Russia, Ukraine and the New World Order." Runs through Wednesday.

• Bankers meeting. Independent Community Bankers of America 2022 Capital Summit with breakfast remarks from Sen. Mike Rounds (R-S.D.); runs through Wednesday.

• Carbon management. Information Technology and Innovation Foundation (ITIF) virtual discussion on "Active Carbon Management: Critical Tools in the Climate Toolbox."

• Broadband workers. Senate Health, Education, Labor and Pensions Employment and Workplace Safety Subcommittee hearing on supporting the broadband workforce.

• Judiciary ethics. Senate Judiciary Federal Courts, Oversight, Agency Action and Federal Rights Subcommittee hearing on "An Ethical Judiciary: Transparency and Accountability for 21st Century Courts."

• U.S. diplomacy. Senate Foreign Relations Committee hearing on "State Department Authorization: Strengthening U.S. Diplomacy for the 21st Century."

• DOE nominee. Senate Energy and Natural Resources Committee to markup several pieces of legislation and vote on the nomination of Maria Duaime Robinson to be assistant Energy secretary for Electricity.

• PFAS panel. Environmental Protection Agency virtual meeting of the Science Advisory Board Per- and Polyfluoroalkyl Substances (PFAS) Review Panel.

• Workers and heat. Occupational Safety and Health Administration virtual Stakeholder Meeting on OSHA Initiatives To Protect Workers From Heat-Related Hazards.

• Crypto. Axios virtual discussion on "Understanding the Crypto Hype."

• Community banking. Federal Deposit Insurance Corporation virtual meeting of the Advisory Committee on Community Banking to discuss current issues affecting community banking.

• Maritime security. Coast Guard teleconference of the National Maritime Security Advisory Committee including a discussion on how to support further development of the Maritime Cyber Risk Assessment Model; and Recommendations on Cybersecurity Information Sharing; runs through Wednesday.

• EPA research. Bipartisan Policy Center virtual forum on "Graduate workshop: Data-driven environmental economics research from the EPA (Environmental Protection Agency)."

Wednesday, May 4

• FY 2023 budget: HHS. Senate Appropriations Labor, Health and Human Services, Education and Related Agencies Subcommittee hearing on the FY 2023 Health and Human Services budget.

• FY 2023 budget: Energy. Senate Appropriations Energy and Water Development Subcommittee hearing on the FY 2023 Energy Department budget.

• FY 2023 budget: Homeland Security. Senate Appropriations Homeland Security Subcommittee hearing on the FY 2023 Homeland Security budget.

• FY 2023 budget: Forest Service. Senate Appropriations Interior, Environment, and Related Agencies Subcommittee hearing on the FY 2023 Forest Service budget.

• FY 2023 budget: Veterans Affairs. Senate Appropriations Military Construction, Veterans Affairs, and Related Agencies Subcommittee hearing on the FY 2023 Veterans Affairs budget.

• Russian invasion of Ukraine: War crimes. The Commission on Security and Cooperation in Europe (CSCE) holds a hearing on "Russian War Crimes in Ukraine."

• CEO Council Summit. Final day of the Wall Street Journal CEO Council Summit, including remarks from Treasury Secretary Janet Yellen on the U.S. economy.

• Lithium batteries. Pipeline and Hazardous Materials Safety Administration virtual meeting of the Lithium Battery Air Safety Advisory Committee.

• Covid and supply chains. Business Council for International Understanding virtual discussion on the Covid-19 response towards supply chain and logistical challenges and the role of the U.S. gov’t and the private sector in fighting and preparing for future pandemics.

• WRDA, TVA nominee. Senate Environment and Public Works Committee markup of the "Water Resources Development Act of 2022"; to vote on the nomination Benny Wagner to be inspector general of the Tennessee Valley Authority; and to consider six GSA resolutions.

• Climate change. Society for International Development, Washington, D.C. Chapter virtual discussion on "Putting The Pieces Together: How Development Practitioners Facilitate Investment Addressing Climate Change."

• China activities. Atlantic Council virtual discussion on "China's Discourse Power Operations in the Global South."

• Forests and climate change. Resources for the Future virtual discussion on "Working Forests: A Path to Climate Solutions."

• Social media. Senate Judiciary Privacy, Technology, and the Law Subcommittee hearing on "Platform Transparency: Understanding the Impact of Social Media."

• U.S./China relations. Women's Action for New Directions (WAND) virtual discussion on "The U.S./China Relationship: Where Cooler Heads Must Prevail."

• Protecting the U.S. Senate Homeland Security and Governmental Affairs Committee hearing on "Resources and Authorities Needed to Protect and Secure the Homeland,” with Homeland Security Secretary Alejandro Mayorkas.

• Australian elections. Center for Strategic and International Studies virtual discussion on "Australia's Election: Foreign Policy and National Security Implications."

• State of Europe. Woodrow Wilson Center's (WWC) Global Europe Program virtual conference on "The State of the Union: A Europe Fit for the Next Generation?" Italian Undersecretary of State for European Affairs Vincenzo Amendola delivers remarks.

Thursday, May 5

• FY 2023 budget: Energy. Senate Energy and Natural Resources Committee hearing on "The President's FY2023 Budget Request for the Department of Energy." Energy Secretary Jennifer Granholm testifies.

• Russian invasion of Ukraine: Swiss actions. The Commission on Security and Cooperation in Europe virtual briefing on "Russia's Swiss Enablers."

• Russia invasion of Ukraine: Impacts. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "Ukraine's Impact on Asia and Korea."

• Russian invasion of Ukraine: Swedish views. Washington Post Live virtual discussion with Swedish Ambassador to the United States Karin Olofsdotter on "the growing public support in her country to join NATO" and rising tensions between her country and Russia over the invasion of Ukraine.

• Russian invasion of Ukraine: Western influence. SETA Foundation at Washington DC virtual discussion on "Can the Western Policy Help Ukraine Achieve Victory?"

• Securing the U.S. border. Senate Homeland Security and Governmental Affairs Committee hearing on "Securing and Ensuring Order on the Southwest Border."

• Oil legislation. Senate Judiciary Committee markup of S 977, the "No Oil Producing and Exporting Cartels (NOPEC) Act of 2021.”

• Indo-Pacific issues. Woodrow Wilson Center'sAsia Program and the Foreign Policy Research Institute's Asia Program virtual symposium on "Economic Security and Geopolitics in the Indo-Pacific,” including a focus on supply chains.

• U.S. foreign policy. Brookings Institution virtual discussion on the “U.S. Grand Strategy Under President Biden and Beyond," focusing on U.S. foreign policy.

• Tech regulation. Protocol Media virtual discussion on "Tech Regulation Beyond Big Tech."

• Student loans. Senate Banking, Housing and Urban Affairs Committee hearing on "Examining Student Loan Servicers and Their Impact on Workers."

• Former Attorney General William Barr views. American Enterprise Institute for Public Policy Research discussion with former Attorney General William Barr to discuss his service under Presidents George H. W. Bush and Donald Trump and his new book One Damn Thing After Another: Memoirs of an Attorney General.

Friday, May 6

• Federal reserve. Fed Governor Christopher Waller speaks on monetary policy; New York Fed President John Williams, Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly scheduled to speak.

• Trade issues. George Washington University Elliott School of International Affairs 11th annual Washington Area International Trade Symposium Conference.

• FERC meeting. Federal Energy Regulatory Commission virtual meeting of the Joint Federal-State Task Force on Electric Transmission to examine barriers to the efficient, expeditious, and reliable interconnection of new resources through the FERC-jurisdictional interconnection processes, including the allowance of participant funding for interconnection-related network upgrades in regional transmission organizations and independent system operators. The agency also holds a virtual meeting of the Joint Federal-State Task Force on Electric Transmission to discuss various electric transmission issues.

• Decommissioning nuclear plants. Senate Environment and Public Works Committee field hearing on "Issues Facing Communities with Decommissioning Nuclear Plants."

• PFAS review panel. Environmental Protection Agency virtual meeting of the Science Advisory Board Per- and Polyfluoroalkyl Substances (PFAS) Review Panel.

Economic Reports for the Week

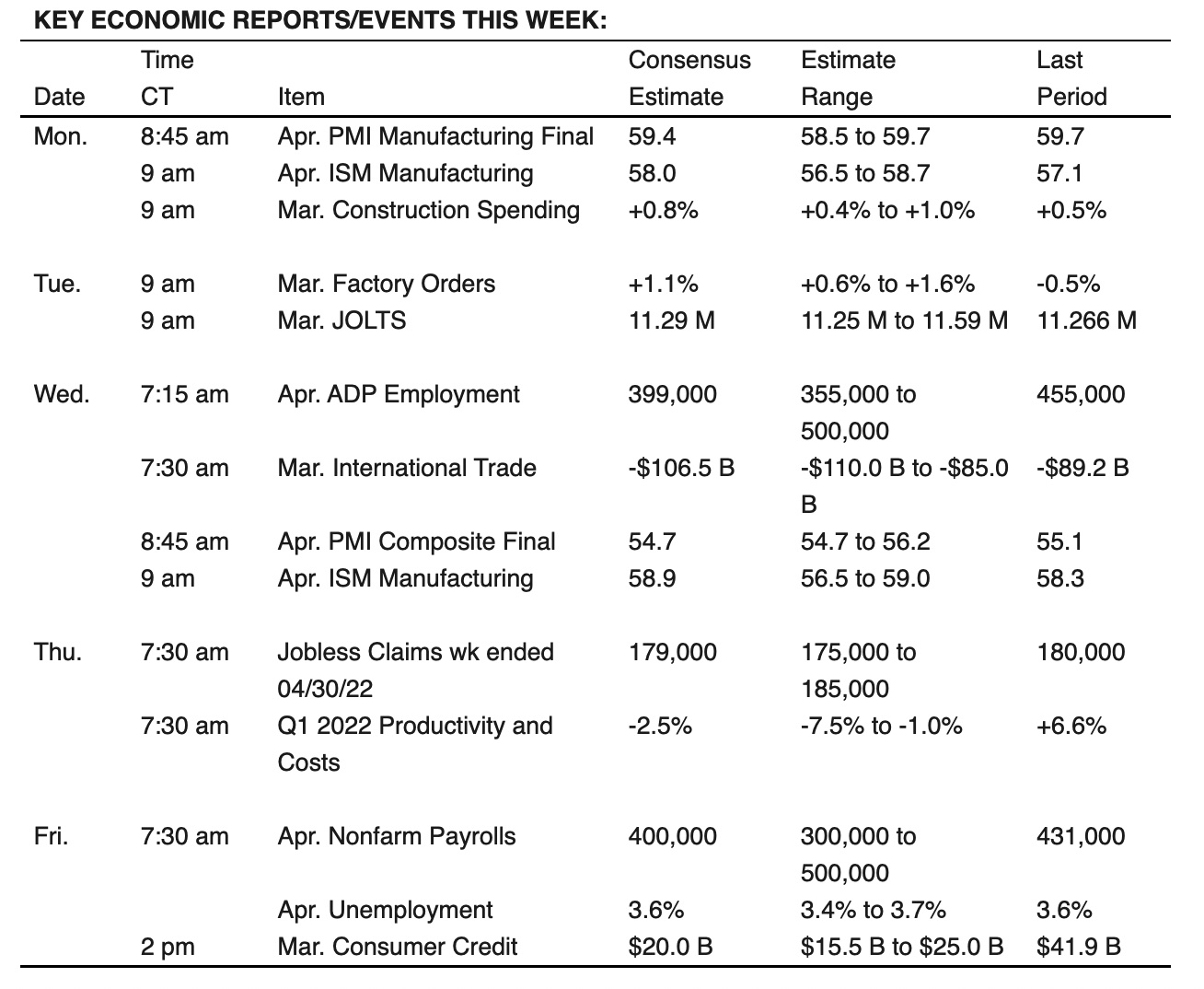

The two-day meeting of the policy-making committee of the Federal Reserve (FOMC) will be the focus. The economic calendar also includes updates on construction spending, durable goods orders, trade balance, and U.S. jobs report. Analysts forecast a payrolls gain of 390,000 for April and an unchanged unemployment rate of 3.60%. A slight downtick in hourly earnings growth to 5.4% is anticipated.

Monday, May 2

- Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for April. Consensus estimate is for a 57.7 reading, roughly even with the March data.

- PMI Manufacturing

- Construction Spending

Tuesday, May 3

- Bureau of Labor Statistics releases the Job Openings and Labor Turnover Survey (JOLTS). Economists forecast 11.4 million job openings on the last business day for March, 134,000 more than in February.

- Factory Orders

Wednesday, May 4

- MBA Mortgage Applications

- ADP releases its National Employment Report for April. Economists forecast that the economy added 350,000 private-sector jobs, after a 455,000 rise in March. The total workforce has passed prepandemic levels.

- Federal Open Market Committee announces its monetary-policy decision. The FOMC is widely expected to raise the federal-funds rate by half a percentage point to 0.75%-1%. The current Wall Street consensus calls for the federal-funds rate to be at 3%-3.25% by the end of this year, as a hawkish Fed tries to catch up in its fight against the highest inflation readings in four decades.

- Fed chair press conference

- ISM releases its Services Purchasing Managers’ Index for April. Expectations are for a 58.5 reading, slightly ahead of March’s 58.3 figure, and well above the 50 level, which indicates growth in the services sector.

- International Trade: After a slight narrowing in February, the U.S. trade deficit in goods and services likely widened to a record in March as American businesses and consumers slaked their demand for capital goods, cars, computers, food and other products by purchasing them from overseas.

- PMI Composite Final

Thursday, May 5

- Jobless Claims

- Productivity and Costs

- Fed Balance Sheet

- Money Supply

Friday, May 6

- BLS releases the jobs report for April. Economists forecast a gain of 375,000 jobs in nonfarm payrolls, compared with an increase of 431,000 in March. The unemployment rate is expected to remain unchanged at 3.6%, near historical lows. The labor market remains tight, as job openings continues to outpace job seekers.

- Consumer Credit

Key USDA & international Ag & Energy Reports and Events

The International Cotton Advisory Committee will release its global outlook report Monday, while the United Nations’ monthly FAO food price index will be published Friday, the same day Statistics Canada issues stockpile data for crops such as wheat and canola.

Monday, May 2

Ag reports and events:

- Export Inspections

- Crop Progress

- Cotton market outlook by International Cotton Advisory Committee

- Commodity Costs and Returns

- Amber Waves, May issue

- Milk Cost of Production Estimates

- Cotton System Consumption and Stocks

- Fats & Oils: Oilseed Crushings, Production, Consumption and Stocks

- Flour Milling

- Flour Milling, Annual

- Grain Crushings and Co-Products Production

- Holiday: China, Malaysia, Indonesia, Hong Kong, Singapore, Thailand, Vietnam, Pakistan, Bangladesh, U.K.

Tuesday, May 3

Ag reports and events:

- Purdue Agriculture Sentiment

- EU weekly grain, oilseed import and export data

- Holiday: China, India, Malaysia, Indonesia, Singapore, Japan, Vietnam, Pakistan, Bangladesh

Energy reports and events:

- API weekly U.S. oil inventory report

Wednesday, May 4

Ag reports and events:

- Broiler Hatchery

- Milk cows and production by State and region, Annual

- Dairy Products

- Noncitrus Fruits and Nuts, Annual

- Holiday: China, Japan, Malaysia, Indonesia, Thailand, Bangladesh, Pakistan

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

Thursday, May 5

Ag reports and events:

- Weekly Export Sales

- Livestock and Meat International Trade Data

- U.S. Agricultural Trade Data Update

- Holiday: Japan, Indonesia, South Korea, Pakistan

Energy reports and events:

- EIA natural gas storage change

- Russian weekly refinery outage data from ministry

- Insights Global weekly oil product inventories in Europe’s ARA region

- OPEC+ meeting, virtually

Friday, May 6

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- FAO World Food Price Index

- Statistics Canada releases stockpiles data for barley, canola and wheat

- FranceAgriMer weekly update on crop conditions

- Holiday: Indonesia

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts