April Market Selloff Continues as Parts of Beijing Now Facing Lockdown as Equities Crater

Barometer of congestion at the ports of Los Angeles and Long Beach worsened in March

|

In Today’s Digital Newspaper |

The U.S. is offering additional military support to Ukraine. The U.S. embassy will also reopen, secretary of state Antony Blinken and defense secretary Lloyd Austin told Ukrainian president Volodymyr Zelensky in Kyiv. Austin said Russia’s military capabilities should be degraded. “Russia is failing, Ukraine is succeeding,” Blinken said, asserting that Ukraine will persist as a sovereign country despite Russia’s attempts to overrun it.

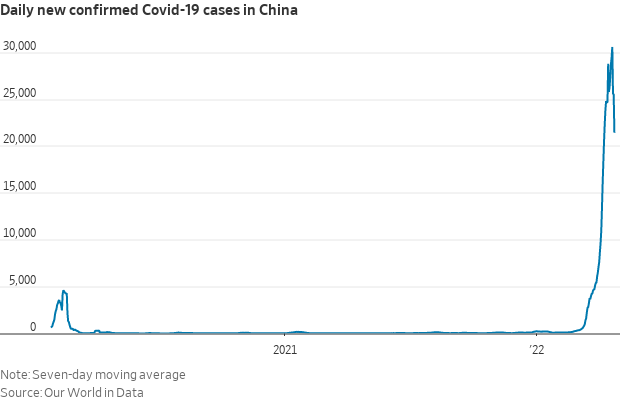

Parts of Beijing are facing lockdown. With mass testing under way, there are fears that restrictions could become as severe as Shanghai’s, where residents have been confined to their homes and have faced food shortages because of China’s covid-zero policy. Residents rushed to stock up on supplies after the government announced mass testing, while President Xi Jinping is also trying to quell escalating anti-government criticism in Shanghai, which is in its third week of lockdown.

The April market selloff is continuing with China stocks falling to their lowest level in two years. Overnight, the Shanghai Composite plunged over 5% for its biggest one-day drop since February 2020, while WTI crude oil slipped more than 4% to below $100 on demand concerns. Rising coronavirus cases are increasing fears of a wider lockdown in Beijing. Meanwhile, the Japanese yen has dropped to a 20-year low against the U.S. dollar, a rout that might cut into demand for Treasurys.

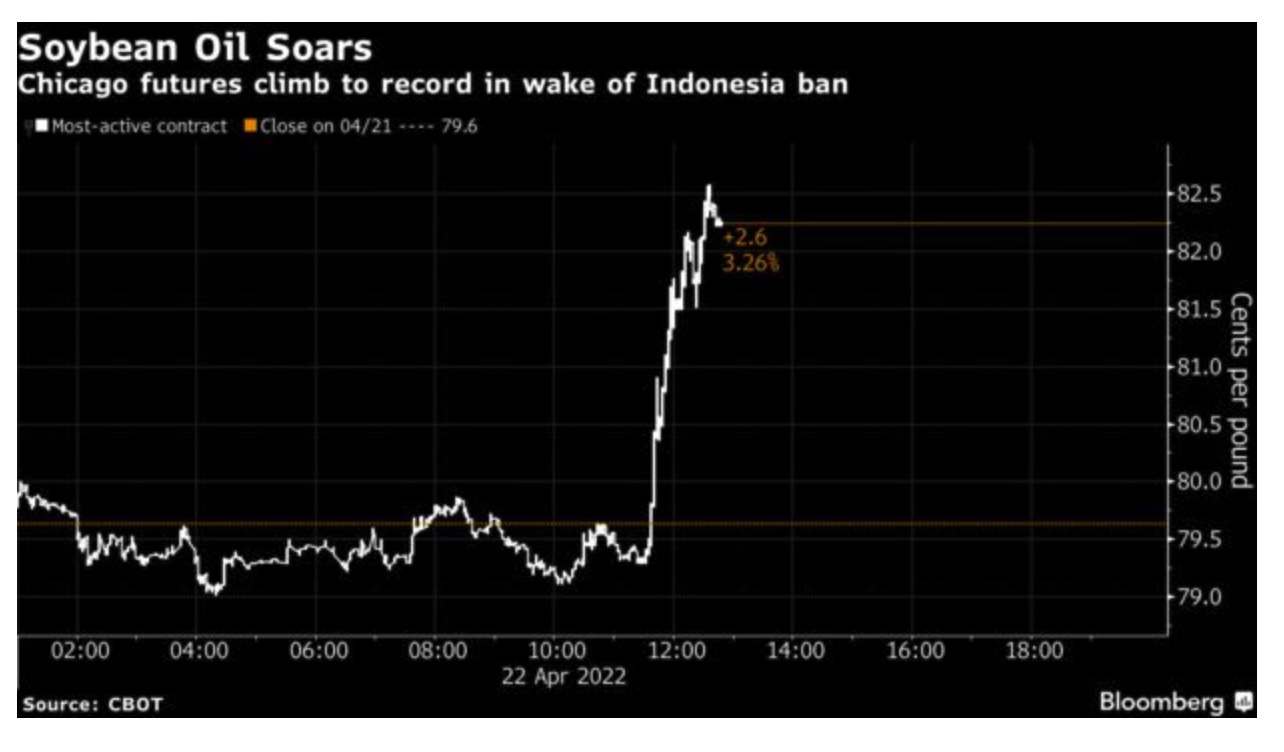

Indonesia excluded crude palm oil in its export restriction program. The soybean oil contract has reacted negatively and is pulling the soybean market lower.

Rockefeller Foundation President Rajiv Shah called for debt relief and emergency aid to poorer nations to avert a “massive, immediate food crisis” that’s emerging following Russia’s invasion of Ukraine. USDA today updates its food price forecasts.

Logistics news will be in focus this week. Transportation Secretary Pete Buttigieg is among the Biden administration officials that will comment on efforts to solve recent rail service delays amid railroads’ struggle to hire workers. Buttigieg, along with USDA Deputy Secretary Dr. Jewel Bronaugh, and Federal Maritime Commission chief Carl W. Bentzel, are scheduled to appear at Tuesday’s Surface Transportation Board hearing. The two-day hearing will also include railroad executives and other industry stakeholders. Meanwhile, a barometer of congestion at the ports of Los Angeles and Long Beach worsened in March, ending three straight months of improvement, new figures show.

USDA approves faster line speeds at pork plant... USDA’s Food Safety and Inspection Service (FSIS) on Friday announced it approved the Clemens Food Group pork packing plant in Coldwater, Michigan, to run faster line speeds under a one-year trial program. The agency now has let four plants operate with faster harvesting line speeds, which could increase packing capacity and alleviate supply issues in the face of strong pork demand, according to NPPC.

The U.S. is nearing one million deaths attributed to Covid-19.

Emmanuel Macron retained the French presidency. But his far-right rival Marine Le Pen secured more than 40% of the vote.

European Union officials passed sweeping new legislation over the weekend that would require the world's biggest tech companies to regulate their platforms or potentially risk facing billions in fines.

Twitter is growing more receptive to Elon Musk’s $43 billion takeover offer. Musk met with Twitter executives on Sunday, according to reports.

|

MARKET FOCUS |

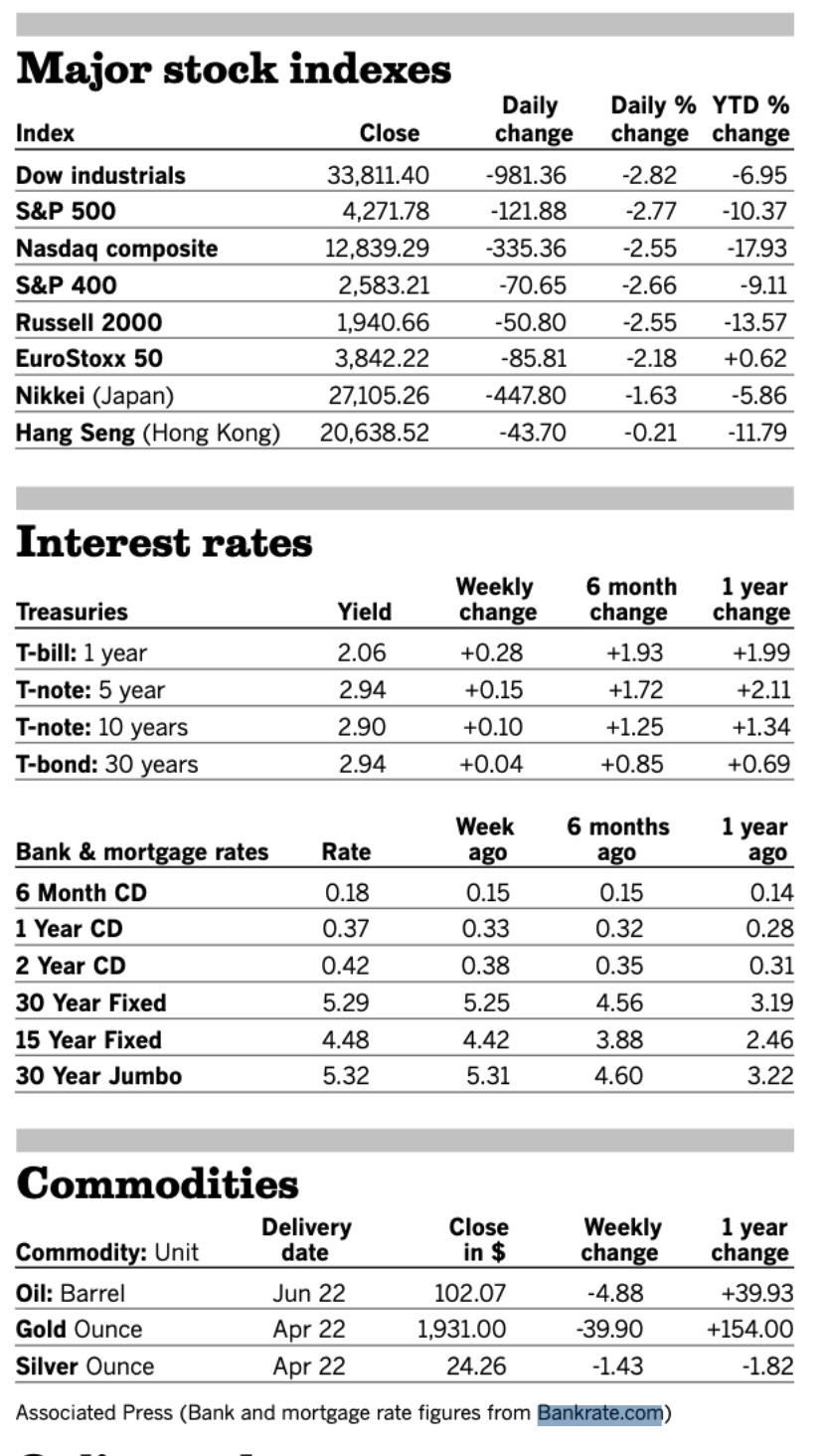

Equities today: Global stock markets were mostly lower overnight, led by the biggest drop in Chinese shares in two years. U.S. stock indexes are pointed toward lower openings. Asian equities opened the week with losses on concerns over U.S. Fed policy actions ahead and on global growth concerns. The Nikkei dropped 514.48 points, 1.90%, at 6,590.78 while the Hang Seng Index dropped 769.18 points, 3.73%, at 19,869.34. European equities were registering sizable losses in early trading, with the Stoxx 600 down more than 2% with regional market down 0.6% to 2.3%. Roughly one-third of the S&P 500 and almost half of Dow companies report earnings this week.

U.S. equities Friday: U.S. equity markets dropped Friday as traders continued to focus hawkish comments by Fed Chair Pro Tempore Jerome Powell on coming monetary policy decisions and on some disappointing earnings results. The Dow had its biggest single day percentage fall since Oct. 28, 2020, while the Nasdaq and S&P 500 had their biggest declines since March 7. The Dow ended Friday fell 981.36 points, 2.82%, at 33,811.40. The Nasdaq dropped 334.36 points, 2.55%, at 12,839.29. The S&P 500 was down 121.88 points, 2.77%, at 4,271.78.

Big declines for the week. The Dow finished down 1.9% in its ninth losing week of the last 11, while the S&P 500 fell 2.8% and the Nasdaq sank 3.8%.

Agriculture markets Friday:

- Corn: July corn futures fell 6 1/4 cents to $7.89, up 5 1/4 cents for the week. December corn fell 14 1/4 cents to $7.24 1/2, the contract’s third decline in the past four sessions.

- Soy complex: July soybeans fell 31 1/2 cents to $16.88, still up 22 3/4 cents for the week. July soymeal fell $11.80 to $452.10. May soyoil ended at 83.26 cents, a record close for a nearby contract.

- Wheat: July SRW wheat fell 1 1/4 cents to $10.75 1/4, down 29 1/4 cents for the week. July HRW wheat rose 6 cents to $11.49 1/2, still down 7 3/4 cents for the week. July spring wheat fell 8 1/4 cents to $11.62 3/4.

- Cotton: May cotton futures rose 87 points to 139.46 cents per pound, while new-crop December fell 102 points to 119.16 cents.

- Cattle: June live cattle fell $1.475 to $138.425, up $2.00 for the week. May feeder futures fell 97.5 cents to $163.875, a weekly gain of $2.10.

- Hogs: June lean hog futures rose $1.60 to $118.775, up 30 cents for the week. The CME lean hog index rose 32 cents today to $101.25, the highest since April 4, and is expected to gain another 10 cents Monday.

Ag markets today: Soybeans continued their Friday losses overnight. Wheat futures were trading higher. Corn was mixed. As of 7:30 a.m. CT, corn futures were trading fractionally higher to 2 cents lower, soybeans were 13 to 18 cents lower and wheat futures were 9 to 13 cents higher. Crude oil futures were trading $4.00 lower this morning. The U.S. dollar index was up about 400 points after setting a two-year high.

Technical viewpoints from Jim Wyckoff:

On tap today:

• USDA Food Price Outlook, 9 a.m. ET.

• USDA Grain Export Inspections report, 10:30 a.m. ET.

• Dallas Fed's manufacturing survey is expected to rise to 10 in April from 8.7 one month earlier. (10:30 a.m. ET.)

• USDA Crop Progress report, 4 p.m. ET.

• South Korea's first-quarter gross domestic product is expected to increase 2.8% from the same quarter one year earlier. (7 p.m. ET)

Israel will add the Chinese renminbi to its foreign exchange holdings for the first time as part of a “philosophy” change at the Bank of Israel, Deputy Governor Andrew Abir told Bloomberg (link). The decision also adds the Japanese yen, Australian dollar, and Canadian dollar to the bank’s currency portfolio, reduces its holdings in U.S. dollars and euros, and increases its British pound reserves. Israel held roughly $206 billion in foreign exchange reserves at the end of March.

Barometer of congestion at the ports of Los Angeles and Long Beach worsened in March, ending three straight months of improvement, new figures show. The share of shipping containers dwelling at the ports for more than five days rose last month to 38.7% from 34.3% in February, according to data from the Pacific Merchant Shipping Association. The figures also showed the dwell time for rail-bound containers rose to 7.7 days from 5.2 days in February.

Market perspectives:

• Outside markets: The U.S. dollar index is higher ahead of U.S. market action, with the euro, yen and British pound all weaker against the greenback. The yield on the 10-year U.S. Treasury note was lower, trading around 2.83%, while there was a mixed tone in global government bond yields. Gold and silver futures are seeing sizable losses ahead of U.S. market action, with gold around $1,910 per troy ounce and silver around $23.60 per troy ounce.

• Crude oil futures are under pressure ahead of U.S. trading, with U.S. crude around $98 per barrel and Brent around $102.25 per barrel. Futures were lower in Asian action, with U.S. crude around $99.10 per barrel and Brent around $103.70 per barrel.

• Continued focus on Indonesia’s ban on palm oil exports. Indonesia, starting from April 28, is going to ban exports of palm oil, widely used in cooking and packaged foods, in a move that may well push up global food prices even further. The ban will continue until there’s no more shortage in the country, which accounts for more than half of the world’s palm-oil supply. Indonesia’s president, Joko Widodo, said he wanted to ensure that the cooking oil remains “abundant and affordable” at home, where prices have rocketed. Indonesian officials clarify palm oil export ban, telling palm oil companies an export ban it announced last week would cover shipments of refined, bleached, deodorized palm olein but not crude palm oil, Reuters reported. The news is cited as a negative in today's soybean oil trading. Meanwhile, the Indonesian Palm Oil Association respects the government’s decision to ban exports of cooking oil and associated raw materials and will follow the policy while monitoring its impact on the industry, spokesman Tofan Mahdi said in a statement late Friday. If the policy negatively impacts the sustainability of the industry, the association will ask the government to re-evaluate.

Meanwhile, No. 2 producer Malaysia opted to keep a tax on palm oil exports in place. Global vegetable oil supplies already were tight as a result of Russia’s assault on Ukraine, the world’s largest source of sunflower oil.

• Argentina won’t increase taxes on agriculture: Ag minister. Argentina’s Agriculture Minister Julian Dominguez sought to reassure the public that export taxes won’t be increased in the agricultural sector, as a protest Saturday by the nation’s grain delivery trucks got underway. “We have a permanent working relationship with the entities of the sector,” Dominguez told Clarin newspaper from Israel, where he’s on a scientific and technological official mission. “We’re working with the agenda of the issues.” About 4,300 trucks lined up to enter Argentina’s grain ports on Saturday, fewer than the daily average of more than 6,000, agency AgroEntregas said on Twitter.

• Some 5.5 million acres of agricultural land is irrigated by the Colorado River. As the water source declines, farmers in Arizona are losing most of the water they receive from the Colorado this year, and many are leaving large amounts of land unplanted. If shrinking water flows in the river don’t reverse, cities in Arizona and other states could be affected next. Link for details via the WSJ.

• Ag demand: Algeria tendered to buy a nominal 50,000 MT of optional origin durum wheat.

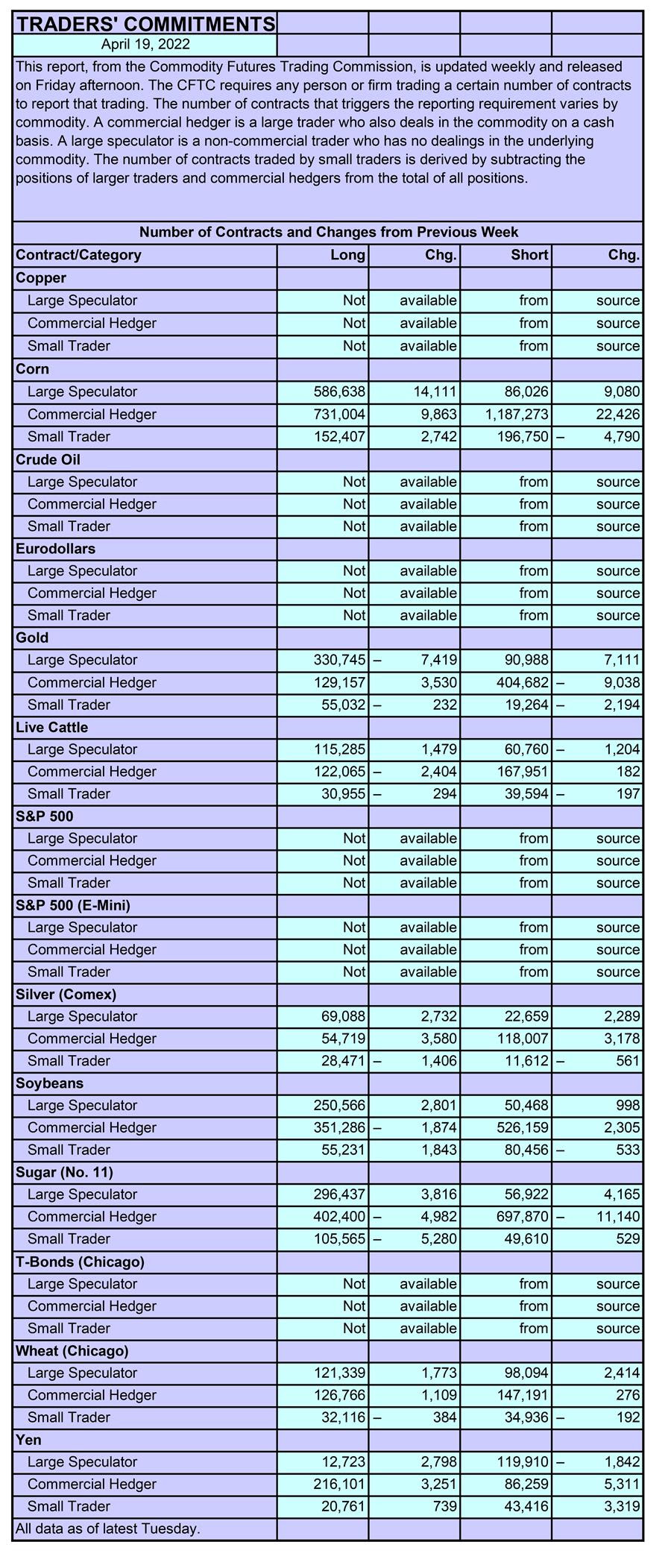

• CFTC Commitments of Traders report (Source: Barron’s):

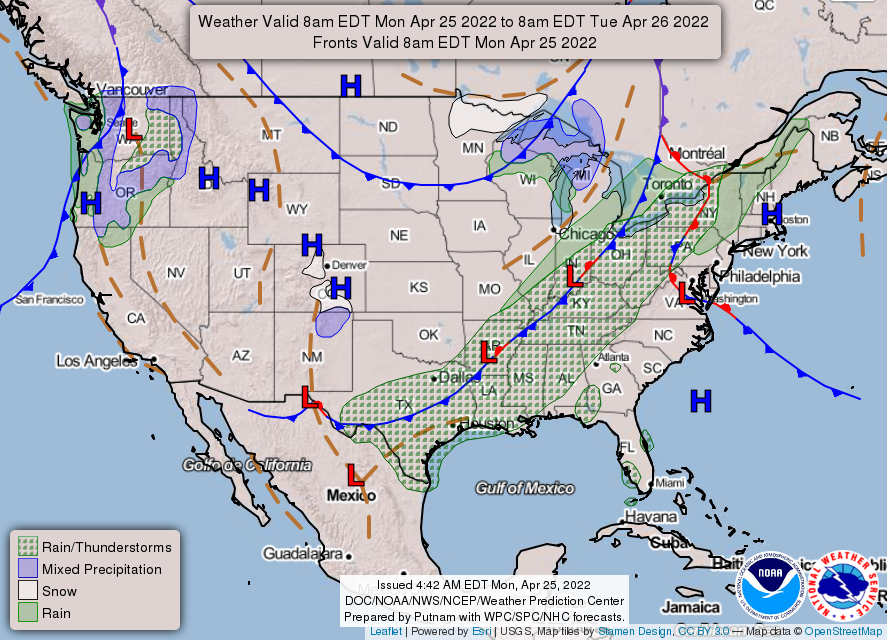

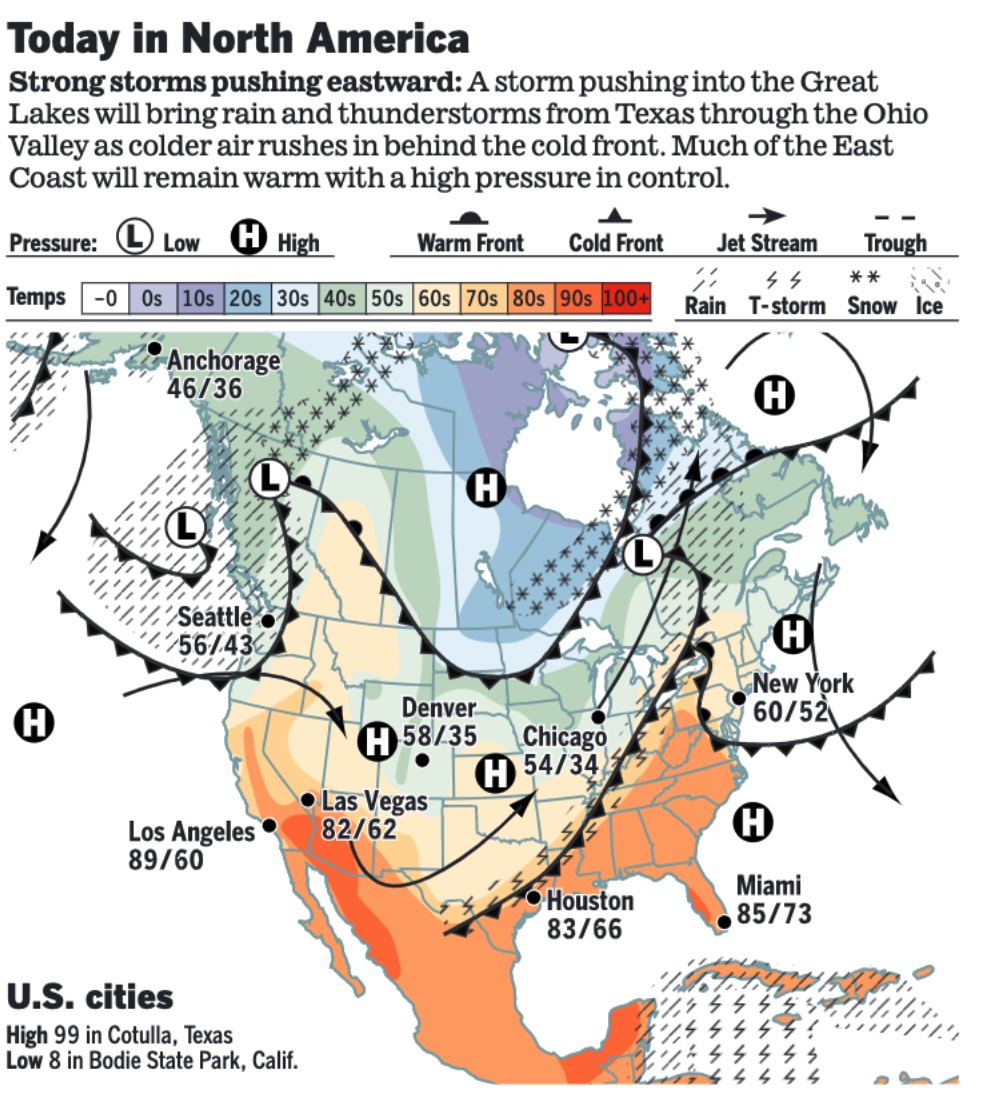

• NWS weather: Isolated flash floods possible across parts of the Lower Mississippi Valley and southern/eastern Texas today... ...A Marginal Risk of severe weather extends along a cold front from the Lower Great Lakes to South Texas through tonight before shifting towards the southern Mid-Atlantic on Tuesday... ...Well below average temperatures forecast across the northern Plains, Upper Midwest and Great Lakes through midweek.

Items in Pro Farmer's First Thing Today include:

• Soybeans weaker, wheat firmer

• Record soyoil prices ‘mixed blessing’ in Argentina

• China halts wheat reserves auctions

• Mexico detects bird flu near the Texas border

• Bearish USDA report data for cattle market

• Pork stocks climbed contra-seasonally in March

|

RUSSIA/UKRAINE |

— Summary: Ukrainian President Volodymyr Zelenskyy says he met top U.S. officials in Kyiv Sunday (U.S. Secretary of State Antony Blinken and Defense Secretary Lloyd Austin) as heavy fighting continues in the east and south of the country. Ukrainian officials acknowledged that Russian forces seized 42 small towns in their initial drive this week to seize eastern Ukraine, the N.Y. Times reports (link). Rustam Minnekayev, a senior Russian military official, publicly outlined wider ambitions than the Kremlin had admitted. He said Russia aims to take full control of not just eastern Ukraine but also the south. The general said that would open the way to Moldova, which shares a border with Ukraine. Ukraine leader Volodymyr Zelenskyy said in his nightly video address: "This only confirms what I have said many times: the Russian invasion of Ukraine was intended only as a beginning, then they want to capture other countries ... Who is next?" Meanwhile, the United Nations secretary-general, António Guterres, announced that he will meet Russia’s president, Vladimir Putin, in Moscow this Tuesday.

- Blinken confirmed that the U.S. would reopen its embassy in Ukraine, with diplomats first operating in the western city of Lviv. The United States would also provide $713 million in foreign military financing to Ukraine and more than a dozen other nations to purchase new weapons, replenishing arms that were provided to Ukrainian forces. The U.S. wants Russia weakened so "it can’t do the kinds of things that it has done in invading Ukraine," Defense Secretary Lloyd Austin said after a visit to Kyiv.

- Russia’s scorched earth policy evident in Mariupol. Nearly half of Mariupol has suffered grave damage and satellite images show that 90% of ruined buildings were residential.

- Putin abandons hopes of Ukraine deal and shifts to land-grab strategy. Russian leader Vladimir Putin has lost interest in diplomatic efforts to end his war with Ukraine and instead appears set on seizing as much Ukrainian territory as possible, according to the Financial Times (link/paywall), citing three people briefed on conversations with the Russian president.

— Market impacts:

- Actions by the U.S. and its allies to restrict Russia’s access to high-tech imports and parts has seen those shipments fall by more than 50%, frustrating the nation’s manufacturing and servicing efforts, Commerce Secretary Gina Raimondo said.

- New info on the Russian economy is closing. In recent days, Russian authorities stopped publishing data on government debt, trade statistics and oil production. The growing data blackout is part of an effort by the Russian authorities to protect the economy and is making it harder for the West to know if sanctions are working.

- The European Union’s top diplomat said there was insufficient support from member states for a complete embargo on Russian oil and gas imports. Speaking to Die Welt, a German newspaper, Josep Borrell said, “we in the EU do not have a unified position”. The issue will be discussed at the next EU summit, due to take place at the end of May.

- The spot market price of pig iron in the U.S. is about 70% higher since the start of the year. Pig iron shipments from Russia and Ukraine have stopped since the invasion of Ukraine, forcing U.S. steelmakers to seek other sources, often at higher prices.

- The World Bank estimates the cost of physical damage to Ukraine’s infrastructure and buildings from Russia’s attacks at $60 billion.

- Risk aversion? “If you take the risk, your ship will earn more than $200,000 a day for going into the Black Sea compared with $30,000 elsewhere” — A Singapore oil trader.

|

POLICY UPDATE |

— Buttigieg, USDA official to discuss freight delays. Transportation Secretary Pete Buttigieg is among the Biden administration officials that will comment on efforts to solve recent rail service delays amid railroads’ struggle to hire workers. Buttigieg, along with USDA Deputy Secretary Dr. Jewel H. Bronaugh, and Federal Maritime Commission chief Carl W. Bentzel, are scheduled to appear at Tuesday’s Surface Transportation Board hearing. The two-day hearing will also include executives from BNSF Railway Company, CSX Transportation, Norfolk Southern Railway Company, and Union Pacific Railroad Company, according to a hearing notice. The companies are scheduled to share their “ongoing and planned efforts to improve service,” as well as estimates on how long it will take to return to normal service, according to an earlier notice. Representatives from labor organizations will also speak during the event. Unions previously complained that the delays are due to freight railroad operators, including Union Pacific, cutting employees.

To bring immediate relief for shippers facing poor rail service, the STB proposed a rule change asserting that the agency can take emergency action on its own to address delays. “The recent acute service issues have made clear the need for the board to provide the opportunity for shippers to receive swift action to ensure that the nation’s freight rail traffic continues to move,” the board said in a statement last Friday. The proposal is open for public comments until May 23 and reply comments are due June 6.

The board vote comes as Class 1 railroads are reporting improved quarterly earnings despite declining shipping volumes. Union Pacific Chairman Lance Fritz said after the railroad reported a 22% profit gain that service problems are “having a real impact on our customers and their ability to serve their markets.

Meanwhile, unions and freight rail companies continue national bargaining negotiations, which have been underway since Jan. 1. The National Carriers’ Conference Committee (NCCC) last Friday proposed to make monthly payments of up to $600 to rail employees starting in May until the end of the year, or when a deal is reached, whichever is earlier. “The NCCC believes advance payments could address the impact of this unprecedented pandemic on employees while the parties resolve the important issues that remain open in negotiations,” the group said in a statement last Friday.

|

CHINA UPDATE |

— Shanghai reported its highest number of daily Covid-19 deaths in the current outbreak, as the city’s strict lockdown measures entered their fourth week. The city recorded 39 fatalities for Saturday, up sharply from 12 the previous day. Meanwhile, more Covid clusters were found in Beijing at the weekend, with the city’s Communist Party chief describing the situation as “urgent and serious.”

— Manufacturers in China are discovering that reopening their factories isn’t so simple. German manufacturers such as auto-parts supplier Robert Bosch and chemicals producer BASF say they are facing potential disruptions as logistics snags in the Yangtze River Delta region have dried up the flow of components. China is ramping up efforts to get businesses back on track, and cities are trying to ease logistics disruptions. Still, Tesla display supplier AU Optronics forecasts the supply-chain impact to last for another three months even if lockdowns end soon.

— Chinese stocks suffered their worst selloff in more than two years and the yuan hit its lowest level since late 2020, as investors worried about new Covid-19 lockdowns. The offshore price for the yuan has fallen 2.4% over the past week to 6.53 per dollar, Bloomberg data showed. Rising U.S. bond yields and worries over China's economic growth have led investors to shed the county's securities. A spokesperson at China's foreign exchange bureau said the yuan's recent fluctuations are due to global market volatility, adding that the currency remains basically stable. "With strengthened resilience in the foreign exchange market, China has the foundation and conditions to adapt to the [U.S.] Fed's policy adjustment," the spokesperson said Friday.

— Demand for oil in China is on pace to slide 20% this month. Gasoline and jet fuel are seeing declines as the country orders massive lockdowns under its zero-tolerance approach toward the spread of the coronavirus.

— China witnessed $17.5 billion worth of portfolio outflows last month, an all-time high, according to the most recent data from the Institute of International Finance (IIF). The U.S.-based trade association called this capital flight by overseas investors "unprecedented," especially as there were no similar outflows from other emerging markets during this period. The outflows included $11.2 billion in bonds, while the rest were equities. "China's support for the Russian invasion of Ukraine was clearly the catalyst for capital to leave China," said George Magnus, an associate at the China Centre at Oxford University and former chief economist for UBS.

|

TRADE POLICY |

— $797 is the amount per household that Americans could save if the Biden administration cut tariffs, according to a study from the Peterson Institute for International Economics (link). Economists at the think tank say a trade liberalization package would deliver such savings along with a one-time reduction in the consumer price index of around 1.3 percentage points.

|

ENERGY & CLIMATE CHANGE |

— Renewed calls for green jet fuel credit. Dozens of companies and groups urged congressional leaders to enact a “sufficiently robust” blenders tax credit for green jet fuel in a letter (link) last Friday. Trade groups advocating for the credit said they are hopeful discussions will pick up again after the congressional recess, and that a credit would move forward as part of a slimmed-down, more climate-focused reconciliation package. Lawmakers proposed new legislation this month on funding for sustainable aviation fuel, while continuing negotiations on a tax credit to help the transition to greener fuel.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA allows more packing plants return to faster line speeds. USDA’s Food Safety and Inspection Service (FSIS) on Friday announced it approved the Clemens Food Group pork packing plant in Coldwater, Michigan, to run faster line speeds under a one-year trial program. The agency now has let four plants operate with faster harvesting line speeds, which could increase packing capacity and alleviate supply issues in the face of strong pork demand, according to NPPC.

Background. FSIS established the line speeds program last November, after a provision in USDA’s 2019 New Swine Inspection System (NSIS) was struck down by a U.S. District Court in March 2021. Nine pork packing plants that had adopted the NSIS — six of which were operating with faster line speeds — were allowed to apply for the program, under which they need to collect data on the effects of the faster speeds on workers and share it with USDA and the U.S. Occupational Safety and Health Administration. The information could be used to formulate a new regulation for allowing plants to run faster line speeds. According to Iowa State University economist Dermot Hayes, if six plants are in the program, the aggregate impact on U.S. pork harvest capacity will be a 3.6% expansion. After one year, that would translate into an increase in live hog prices of 6%.

— FDA report: little resistance in antibiotic resistance. The FDA released its latest report (link) on trends in antimicrobial resistance in certain bacteria collected from people, animals and retail meat. The 2019 National Antimicrobial Resistance Monitoring System (NARMS) report showed that 78% of human isolates of Salmonella, one of the two leading bacterial causes of foodborne illness in the U.S., were not resistant to antibiotics, a trend that has remained consistent for the past 15 years. Although changes to how pork samples are collected make it difficult to determine trends, the report showed no overall increase in resistance in swine-associated samples, according to NPPC, which has been supportive of NARMS as a source of science-based data on antimicrobial resistance.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 509,566,779 with 6,218,282 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,984,914 with 991,254 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 572,595,338 doses administered, 219,338,297 have been fully vaccinated, or 66.57% of the U.S. population.

— The U.S. is nearing one million deaths attributed to Covid-19. The Covid-19 mortality count—over 990,000 and still rising—is reflected in death certificates recorded by the CDC, which show how fatal cases have swept through the U.S. since the pandemic began, hitting states and populations unevenly.

|

POLITICS & ELECTIONS |

— A panel of five mid-level appellate judges ruled 3-2 that the Democrats in charge in Albany engaged in unconstitutional gerrymandering. If that ruling is upheld by New York’s highest court, those new congressional district boundaries with their pro-D tilt won’t be used in November. Bloomberg notes that is especially noteworthy because “in some states, courts are allowing maps of questionable constitutionality to be used in this cycle to avoid disrupting election processes while litigation continues.” Republicans need a net gain of five congressional seats this fall to retake the U.S. House majority.

|

CONGRESS |

— Congress returns with lingering unfinished business on spending. The lengthy agenda list includes President Joe Biden’s social and climate spending priorities, Biden’s request for billions of dollars in additional Covid-19 aid, sending more funding to Ukraine and a bill to boost the chip sector. Some of this may come via another attempt at using the budget reconciliation process to get some projects approved without any GOP votes.

|

OTHER ITEMS OF NOTE |

— European lawmakers agreed in Brussels on a law that will force Big Tech to police social platforms more strictly for hate speech and disinformation — with big fines if they don't. Online giants like Google and Meta (previously Facebook) will have to do more to police illegal content on their platforms. If they don’t, they risk fines of billions of dollars. Ursula von der Leyen, the president of the European Commission, called the Digital Services Act a “historic” piece of legislation. Online platforms with more than 45 million European users would also be expected to complete annual risk assessments and share more information about their algorithms.

— Elon Musk’s bid to take control of Twitter is getting a lot of serious attention. Last week, Musk laid out funding for the deal —with $25 billion of committed financing from investment banks. And the Wall Street Journal reported late Sunday that the two sides are discussing the finer details of the transaction that could go through as soon as this week. If Twitter’s management rejects Musk, they have got to offer an alternative. That could be a new plan to get the stock up or a rival bid. Twitter reports earnings on Thursday.