U.S. Public Transit Mask Mandate Overturned by Federal Judge; Most Airlines Lift Mandate

Natural gas unnaturally high and rising | World Bank: ‘Exceptional uncertainty’ | IMF forecasts

|

In Today’s Digital Newspaper |

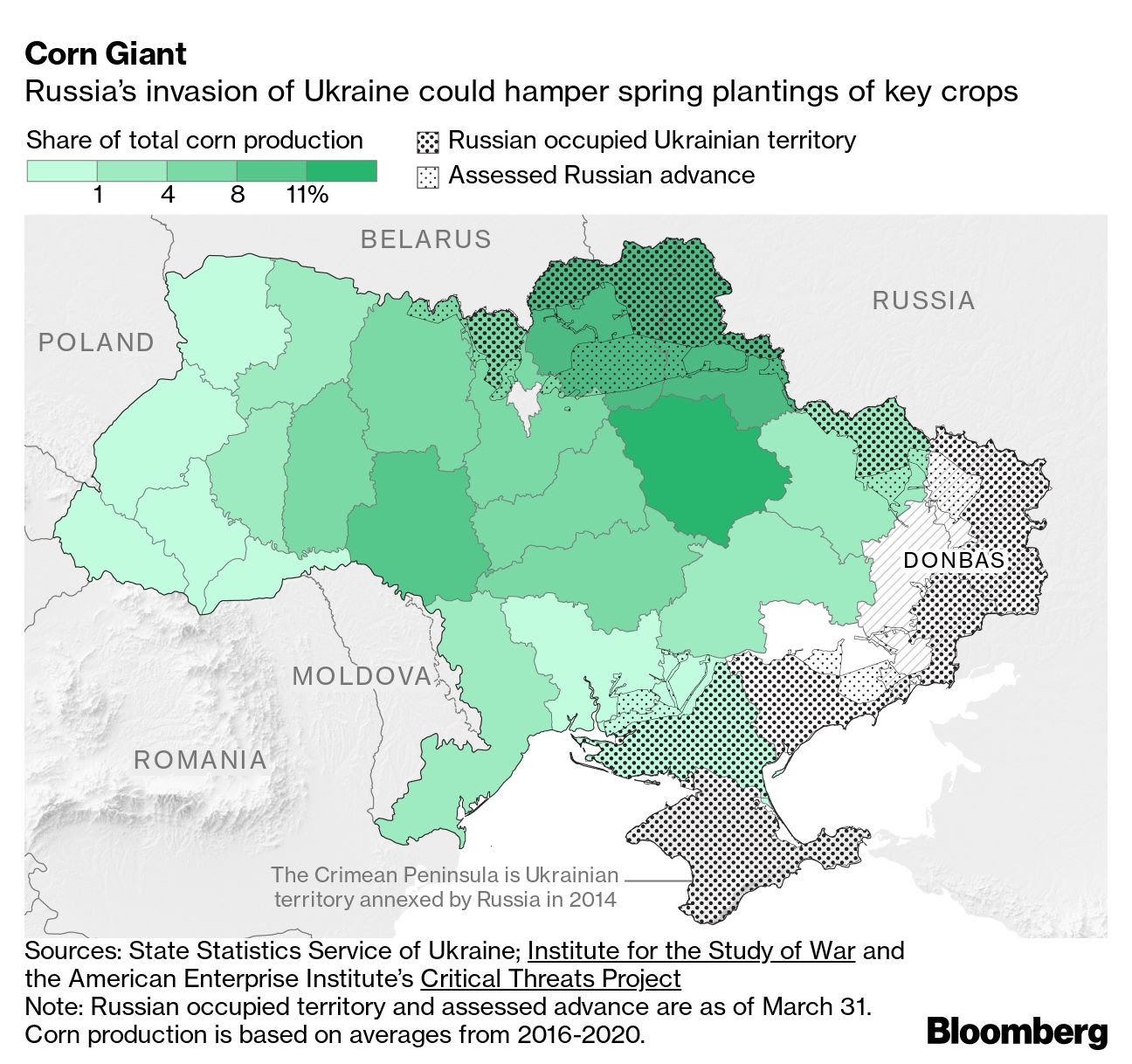

In eastern Ukraine, Russian forces have completed the regrouping of troops to launch an offensive to establish full control over the Donetsk and Luhansk regions, a Ukrainian defense ministry spokesperson said. Separately, U.S. Customs and Border Protection officials said they encountered about 5,000 Ukrainians in March, including 3,274 along the U.S. southern border, according to newly released agency data. President Joe Biden will hold a call later today with allies including Group of Seven states, the European Union leadership and NATO amid efforts to coordinate supplies of heavy weapons to Ukraine.

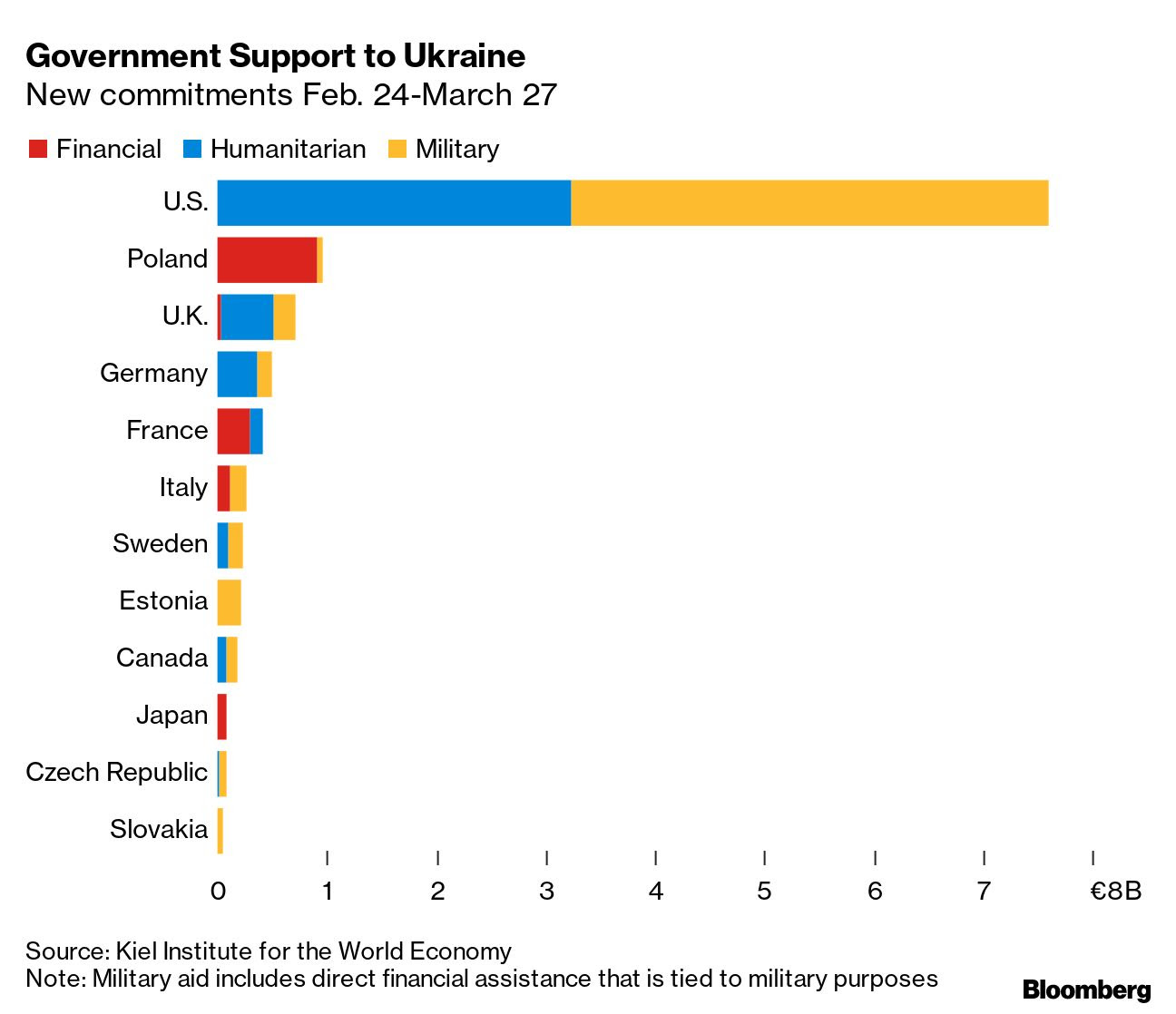

The U.S. has provided the equivalent of $8.2 billion to Ukraine since the outbreak of war, making it the country’s biggest supporter, according to the Kiel Institute for the World Economy’s Ukraine Support Tracker.

Session organized by U.S. Treasury’s Yellen on global food situation is set for today. Treasury Secretary Janet Yellen has organized a high-level panel of officials to address food security issues in the wake of the Russian invasion of Ukraine.

USDA daily export sale: 123,650 MT of soybeans for delivery to unknown destinations during MY 2021-2022.

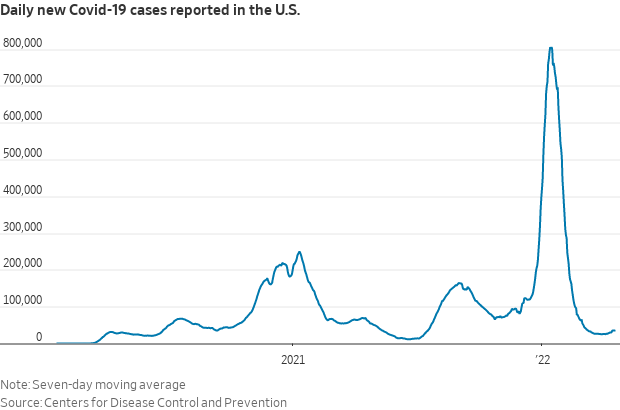

The U.S. will not enforce a travel mask mandate after a legal defeat. Most major U.S. airlines are no longer requiring travelers or employees to wear face coverings on domestic and some international flights. The airlines said they also will not require the use of masks at boarding gates or elsewhere in airports. Separately, the CDC removed all countries from its highest risk level as it updated its system for advising on Covid-19 risks abroad.

The World Bank lowered its forecast for global economic growth this year, citing the war in Ukraine, inflation and the lingering effects of the pandemic. The IMF released its updated world GDP forecasts today and we have details below. Meanwhile, China announced measures to boost economic growth, after data showed a significant drop in consumer spending amid pandemic lockdowns.

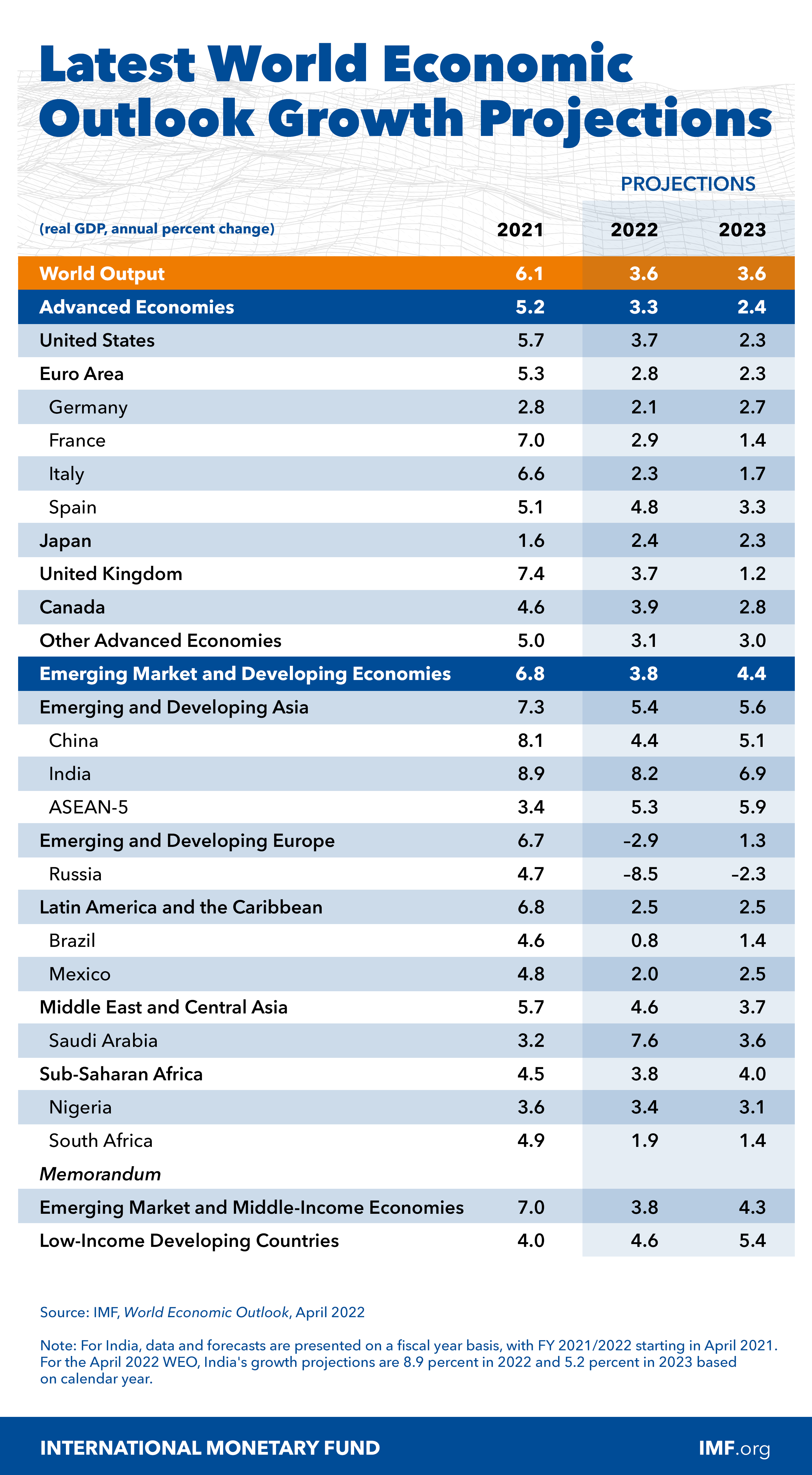

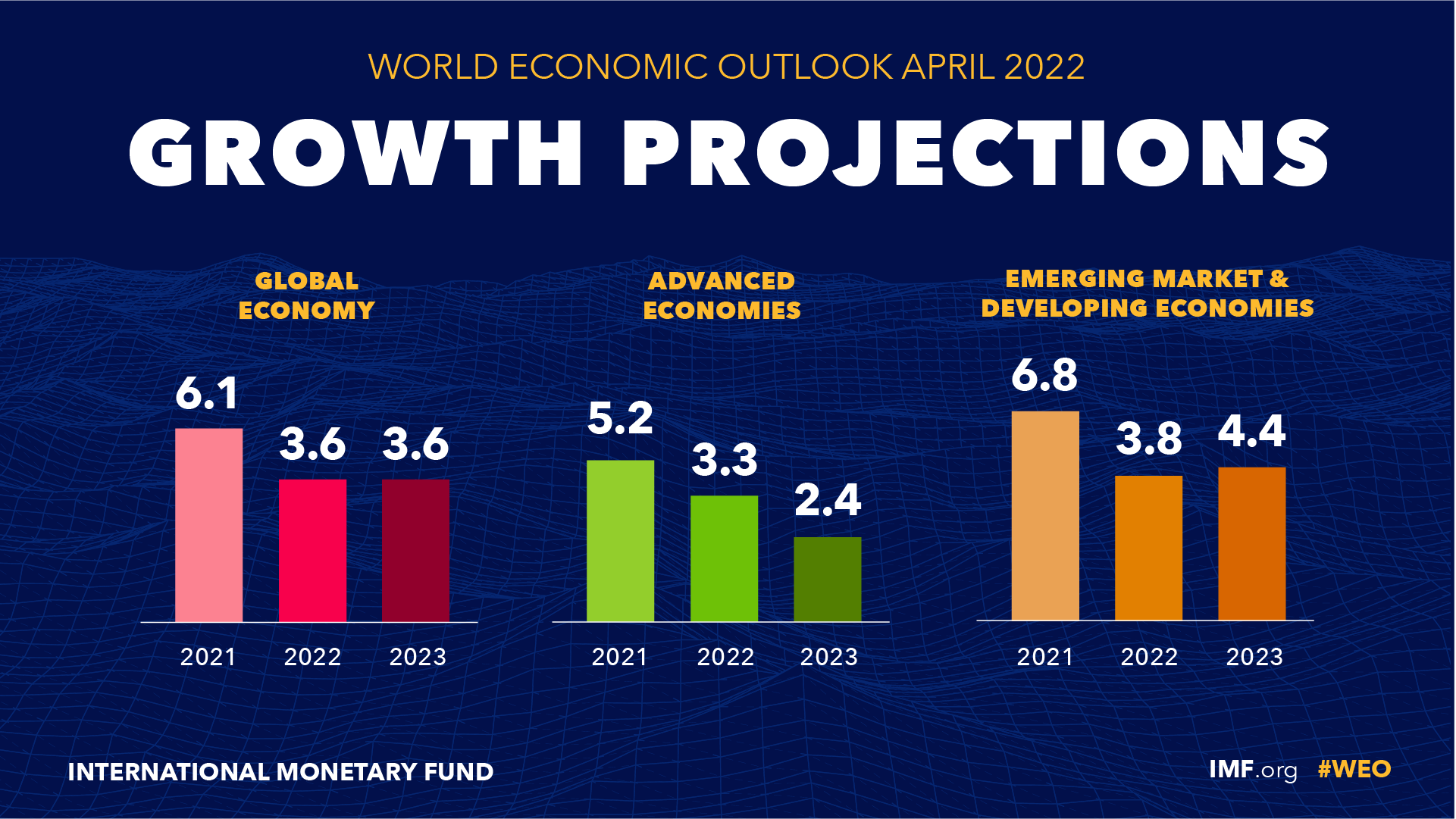

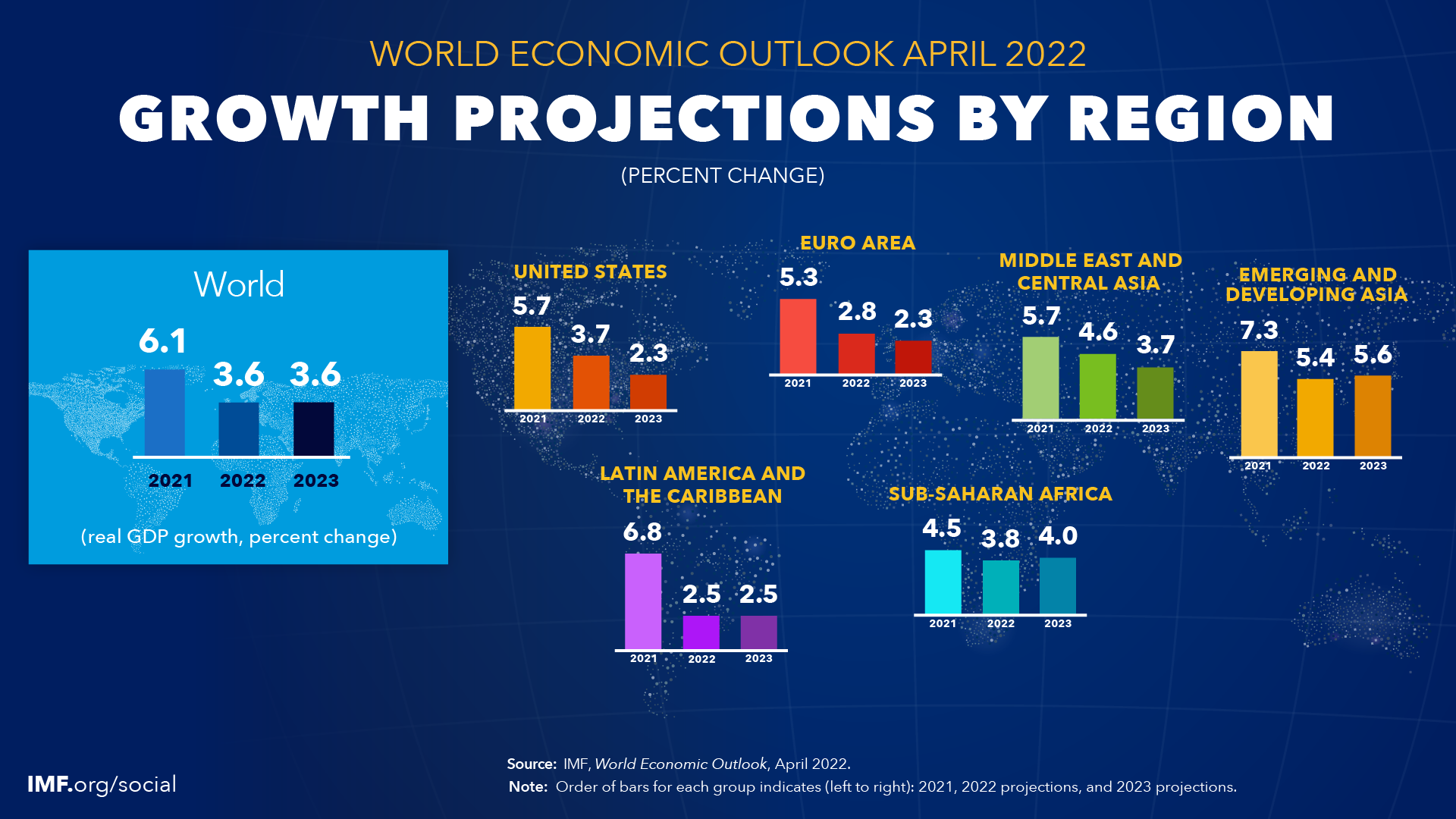

The International Monetary Fund (IMF) cited the war in Ukraine as a key factor which will lower economic growth around the globe and further boost inflation. The war is a “a costly humanitarian crisis that demands a peaceful resolution.” The IMF said that the economic impact will “contribute to a significant slowdown in global growth in 2022.” Not surprisingly, the IMF expects a “severe double-digit drop in GDP for Ukraine and a large contraction in Russia” as likely with “worldwide spillovers through commodity markets, trade, and financial channels.” Beyond reducing economic growth, the IMF said the situation will also “add to inflation” and that elevated inflation “will complicate the trade-offs central banks face between containing price pressures and safeguarding growth.” Interest rates are expected to rise as central banks tighten policy, which the IMF said will be “exerting pressure on emerging market and developing economies. Moreover, many countries have limited fiscal policy space to cushion the impact of the war on their economies.” The IMF said global growth is projected to slow from an estimated 6.1% in 2021 to 3.6% in 2022 and 2023. This is 0.8 percentage points and 0.2 percentage points lower than their January projections for 2022 and 2023. Beyond 2023, global growth is forecast to decline to about 3.3% over the medium term. But the forecast is based on some important assumptions — the war will stay contained to Ukraine and that sanctions will exempt the energy sector.

75-basis-point rate hike? St. Louis Fed President James Bullard said he wouldn't "rule out" a 75 basis-point increase, "but it isn't my base case.” The market has priced in a 50-basis-point hike for the May 3-4 meeting, kicking off a ramped-up tightening cycle.

New U.S. home construction rose unexpectedly in March to the highest level since 2006, boosted by multifamily projects as builders seek to replenish housing inventory.

The Supreme Court declined to review a New York-led constitutional challenge to the $10,000 cap on state and local tax deductions imposed by Congress in the 2017 tax law. The high court issued an order Monday denying the request from New York, New Jersey, Maryland, and Connecticut to review a decision of the U.S. Court of Appeals for the Second Circuit.

A cargo of crude from the U.S. Strategic Petroleum Reserve departed a Texas port bound for Europe, a signal of increasing oil-market disarray as refiners shun Russian supplies and prices surge.

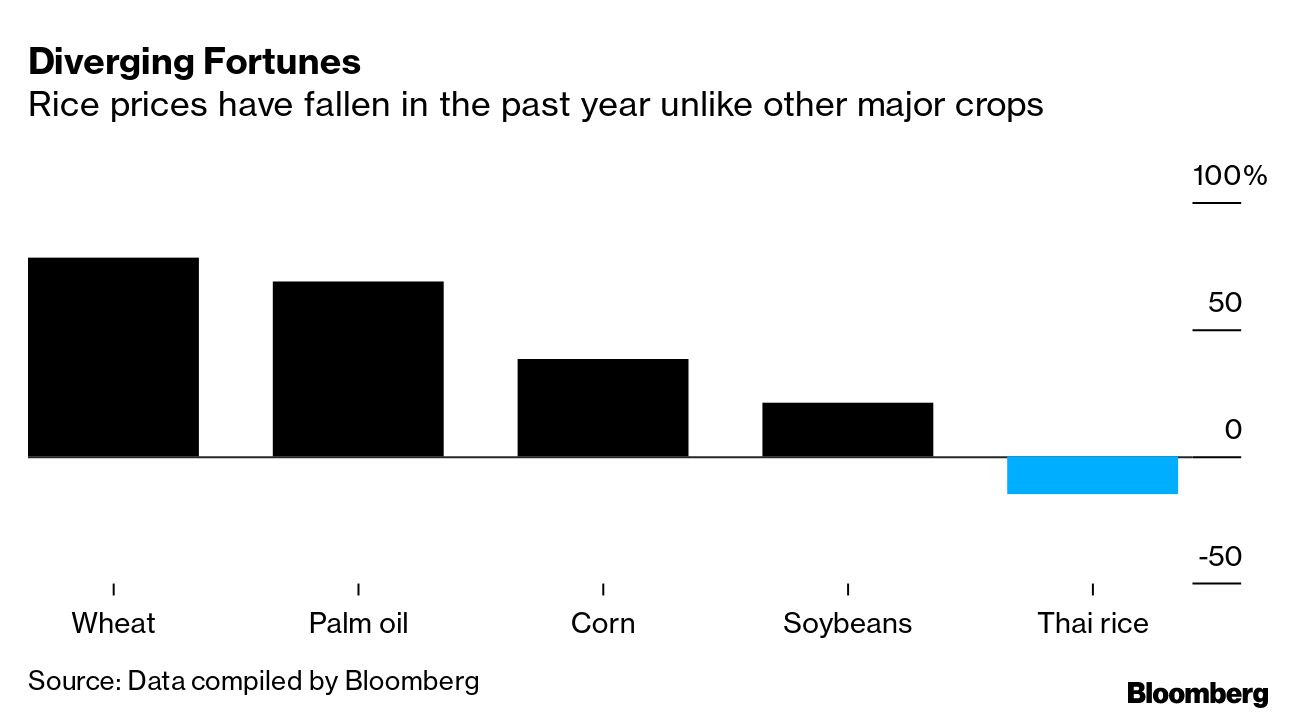

Soaring fertilizer costs have rice farmers in Asia scaling back their use, threatening harvests of a staple that feeds half the world and risking a full-blown food crisis if prices aren’t curbed.

USTR Katherine Tai will meet with members of the Agricultural Policy Advisory Committee for Trade (APAC) and Agricultural Technical Advisory Committees (ATACs) today. USDA Secretary Tom Vilsack will also take part in the session that is closed to the press. Meanwhile, Tai met with Singapore’s Minister for Finance Lawrence Wong Monday, with the virtual meeting focusing on the U.S./Singapore Free Trade Agreement (FTA) and on the U.S. effort to establish an Indo-Pacific Economic Framework (IPEF) deal in the region.

Egg farm losses from bird flu top 20 million hens. Wholesale prices for eggs were at least $1 higher per dozen than a year ago, with HPAI as a factor.

U.S. lawmakers joined agriculture/farm groups in filing brief at Supreme Court supporting WOTUS challenge.

President Biden told former President Obama that he is planning to run for re-election in 2024, two sources told The Hill.

|

MARKET FOCUS |

Equities today: Global stocks markets were mixed to weaker overnight. The U.S. Dow opened up about 65 points higher. The Nasdaq opened lower. Signs are emerging that Q1 earnings season will be more disappointing than expected, especially with regards to forward estimates and guidance, Morgan Stanley says. "Earnings revisions breadth for the S&P 500 has resumed its downtrend over the past two weeks and is once again approaching negative territory (which would mean more downward than upward out-year EPS revisions)," strategists wrote. Asian equities finished mixed. The Nikkei rose 185.38 points, 0.69%, at 26,985.09. Hong Kong’s Hang Seng fell 490.32 points, 2.28%, at 21,027.76 after being closed Monday for a holiday. European equities are lower as they resumed trading after the Easter Monday holiday. The Stoxx 600 was off 1.1% and regional markets seeing losses of 0.3% to 1.6%.

U.S. stocks see biggest outflows of the year. U.S. equity funds had outflows of $15.5 billion in the week through April 13, BofA strategists wrote, citing EPFR Global data.

The benchmark 10-year Treasury yield topped 2.9%, a level not seen since late 2018.

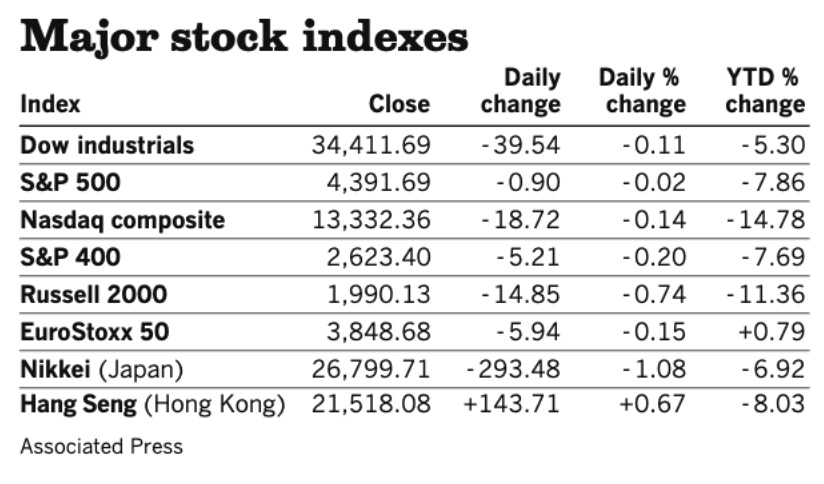

U.S. equities yesterday: U.S. equity markets finished with losses after a volatile session that saw values climb late in the session. The Dow finished down 39.54 points, 0.11%, at 34,411.69. The Nasdaq was down 18.72 points, 0.14%, at 13,332.36. The S&P 500 was down just 0.90 point, 0.02%, at 4,391.69.

Agriculture markets yesterday:

- Corn: May corn futures rallied 23 cents to $8.13 1/4, the highest nearby closing price since August 2012. December gained 14 1/2 cents to $7.49 3/4, a lifetime-high close.

- Soy complex: July soybeans rose 28 cents to $16.93 1/4, the contract’s highest closing price since March 23. July soymeal rose $4.60 to $460.30 per ton and July soyoil rose 120 points to 78.09 cents per pound.

- Wheat: July SRW wheat rose 24 1/4 cents to $11.28 3/4 and July HRW wheat rose 31 3/4 cents to $11.89, with both hitting six-week highs. July spring wheat rose 31 1/4 cents to $11.78.

- Cotton: July cotton gained 254 points to 143.25 cents per pound, a lifetime-high close for the contract.

- Cattle: June live cattle fell 62.5 cents to $135.80, while May feeder cattle fell $2.625 to $159.15. Feeder cattle came under pressure from strong gains in the corn market.

- Hogs: June lean hogs jumped $3.925 to $122.40, the contract’s highest closing price since $124.225 on March 30. The CME lean hog index is expected to rise 35 cents Tuesday, the fourth straight daily gain, to $100.32.

Ag markets today: Overnight price action in the grain and soy markets was quiet and choppy. As of 7:30 a.m. ET, corn futures were trading steady to a penny lower, soybeans were 2 cents lower to 2 cents higher, winter wheat futures were mostly 1 to 4 cents lower and spring wheat futures were steady to fractionally lower. Front-month U.S. crude oil futures were around $1.50 lower and the U.S. dollar index was around 110 points higher.

Technical and other viewpoints from Jim Wyckoff: “Flying under the radar screen of the marketplace has been the severe depreciation of the Japanese yen on the foreign exchange market the past few months.”

On tap today:

• U.S. housing starts are expected to fall to an annual pace of 1.73 million in March from 1.769 million one month earlier. (8:30 a.m. ET) UPDATE: New U.S. home construction rose unexpectedly in March to the highest level since 2006, boosted by multifamily projects as builders seek to replenish housing inventory. Residential starts climbed 0.3% last month to a 1.79 million annualized rate from an upwardly revised February figure, according to government data released this morning. Applications to build, a proxy for future construction, climbed to an annualized 1.87 million units.

• International Monetary Fund releases its World Economic Outlook report at 9 a.m. ET. See details below.

• Chicago Fed President Charles Evans speaks to the Economic Club of New York at 12:05 p.m. ET.

• USDA and the Census Bureau hold spring Data User's Meeting, 2 p.m. ET, in Chicago. Link to details.

• President Joe Biden is set to deliver remarks at 2:45 p.m. ET on the modernization of ports. Ahead of his speech, he’ll visit New Hampshire’s Portsmouth Harbor, which is set to receive funding from the bipartisan infrastructure law.

Federal Reserve Bank of St. Louis President James Bullard said the central bank needs to move quickly to raise interest rates to around 3.5% this year with multiple half-point hikes and that it shouldn’t rule out rate increases of 75 basis points. Fed Chair Jerome Powell has said that a 50 basis-point increase is possible at the Fed’s May 3-4 meeting.

World Bank: ‘Exceptional uncertainty.’ World Bank Chief Economist Carmen Reinhart said the global economy is passing through a period of “exceptional uncertainty” and added that she wouldn’t rule out further downgrades to the growth outlook. The Washington-based institution lowered its estimate for global growth in 2022 to 3.2% from 4.1% in January as Russia’s invasion of Ukraine — a major grain producer —shows no sign of ending, and China’s lockdowns to combat Covid are stressing supply chains. The World Bank is also looking to discuss a new crisis-response package of about $170 billion. The IMF released its updated country GDP forecasts today — see next item.

IMF: War sets back the global recovery. The war in Ukraine has triggered a costly humanitarian crisis that demands a peaceful resolution, the IMF said. “At the same time, economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and add to inflation. Fuel and food prices have increased rapidly, hitting vulnerable populations in low-income countries hardest. Global growth is projected to slow from an estimated 6.1% in 2021 to 3.6% in 2022 and 2023. This is 0.8 and 0.2 percentage points lower for 2022 and 2023 than projected in January.”

Beyond 2023, global growth is forecast to decline to about 3.3% over the medium term. War-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7% in advanced economies and 8.7% in emerging market and developing economies — 1.8 and 2.8 percentage points higher than projected last January. “Multilateral efforts to respond to the humanitarian crisis, prevent further economic fragmentation, maintain global liquidity, manage debt distress, tackle climate change, and end the pandemic are essential,” the IMF concluded.

Session organized by U.S. Treasury’s Yellen on global food situation set for today. Treasury Secretary Janet Yellen has organized a high-level panel of officials to address food security issues in the wake of the Russian invasion of Ukraine. Yellen first suggested the session last week, and the U.S. Treasury Monday announced that Yellen would meet with the heads of the International Monetary Fund, World Bank, International Fund for Agricultural Development along with ministers from the G7 and G20 countries and technical exports from the global financial institutions. Reuters quoted senior Treasury officials as saying that Yellen’s focus for the session is to make sure that international financial institutions are sharing their knowledge on rising food insecurity and that there was no specific target in mind relative to aid to countries affected by the situation. Yellen is expected to urge that countries do not impose export restrictions and take action to boost local food production in areas like Africa and other areas dependent on food imports. An action plan is expected to be released after the event to help structure the global response, Reuters said.

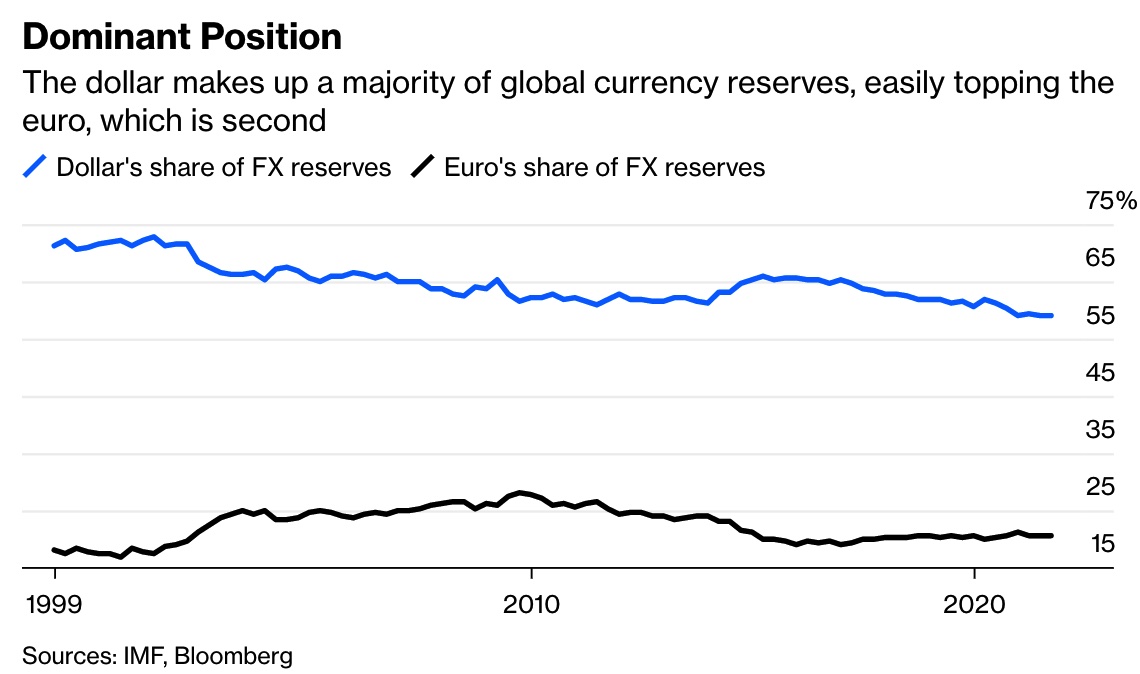

Will the dollar be dethroned as the world’s major currency? The dollar has been the world’s reserve currency since the U.S. and its allies agreed at the 1944 Bretton Woods conference to peg it to a rate of $35 per ounce of gold. But Russia’s invasion of Ukraine and the resulting U.S. decision to restrict Moscow from its own U.S. dollar holdings has prompted talk that the greenback’s days as the world’s reserve currency may be numbered. But most dollar watchers and analysts say the U.S. dollar will prevail for the foreseeable future. While China and Russia are conducting more trade in yuan (China’s currency), the dollar continues as the preferred currency for nearly half of cross-border transactions, even though the U.S. accounts for just 10% of global trade — only about 3% of global transactions are conducted in yuan, according to SWIFT, the messaging service that facilitates the vast majority of money transfers globally. Meanwhile, around 55% of foreign exchange reserves held by central banks are denominated in dollars versus only 15% denominated in euros and just 2.5% in yuan. As the world’s primary reserve currency, the U.S. enjoys the privilege that goes along with that, such as interest rates that are lower than they might otherwise be and the government being able to fund budget deficits in perpetuity.

Deputy Treasury Secretary Wally Adeyemo on Monday countered the argument that the U.S.’ sanctions-based response to Russia’s invasion of Ukraine would encourage adversaries to build their own, separate international economic and financial system. “My takeaway is the opposite, that we have shown not only how indispensable this system is and how costly it is to be excluded from it, but also the futility of trying to avoid it,” Adeyemo says in the text of a speech he’s scheduled to deliver at an event sponsored by the Peterson Institute for International Economics.

Upshot: Before the dollar, the British pound was the world’s dominant currency, having held the crown throughout the 1800s until World War II. The timeline suggests the dollar has a long way to go before being toppled. Reason: there is no alternative.

Market perspectives:

• Outside markets: The U.S. dollar index is higher amid a broadly higher tone in global currencies. The yield on the 10-year U.S. Treasury note was firmer, trading around 2.88%, with global government bond yields also higher. Gold and silver futures are seeing mild pressure ahead of U.S. economic data, with gold around $1,983 per troy ounce and silver around $26.15 per troy ounce.

• The U.S. dollar on Monday hit a 20-year high against the Japanese yen when the yen approached ¥127 per dollar, with some signaling it could hit ¥130. (The higher the rate, the weaker the yen.) The euro has fallen below $1.08 in recent days from a one-year high above $1.20 last May, and parity with the dollar is possible. Britain’s pound sterling trades near $1.30, down from above $1.40 last year. A stronger greenback will let Americans pay fewer dollars for imported goods.

• Crude oil futures are lower ahead of U.S. trading, with U.S. crude around $106.50 per barrel and Brent around $111.60 per barrel. Crude prices were lower in Asian action, with U.S. crude around $107.50 per barrel and Brent around $112.20 per barrel.

• Natural gas unnaturally high and rising. Natural gas is trading up at its highest price point in well over a decade. NYMEX futures rose above $7.50. Prices have been steadily increasing all month, now standing more than 25% higher than when April began. Gas demand has remained high largely due to relatively cool temperatures, the American Gas Association’s latest market report, released on Friday, noted. Other factors include lower storage levels and high demand for U.S. LNG in Europe, where prices in the $30/mmBtu range continue to support lots of LNG shipments. Overall, natural gas is up by 113% since the end of last year.

• Cargo ships are skipping Asia’s largest refueling hub in Singapore as delays at ports in China and elsewhere prompt vessels to reschedule their stops. Meanwhile, the Evergreen container ship that had been stuck in Chesapeake Bay mud for more than a month was pulled free and towed to an anchorage spot nearby for damage inspection.

• Soaring fertilizer costs have rice farmers across Asia scaling back their use, a move that threatens harvests of a staple that feeds half of humanity and could lead to a full-blown food crisis if prices aren’t curbed, Bloomberg reports. From India to Vietnam and the Philippines, prices of crop nutrients crucial to boosting food production have doubled or tripled in the past year. Lower fertilizer use may mean a smaller crop.

• Report: Indonesia launching corruption probe on palm oil exports. Indonesia’s Attorney General Sanitiar Burhanuddin released a televised statement Tuesday announcing a corruption case relative to issuing palm oil export permits, naming four suspects in the matter, according to a report from Reuters. "We have conducted an investigation and have found strong indications of the criminal offence of corruption relating to the issuance of export permits for palm oil," Burhanuddin said, noting there was evidence that permits were issued for companies that had not met requirements of meeting locally supplies. Suspects in the case include a director general of international trade at the trade ministry and officials at three companies — Permata Hijau Group, PT Wilmar Nabati Indonesia and Musim Mas.

• Ag trade: Japan is seeking 27,320 MT of Australian wheat in its weekly tender.

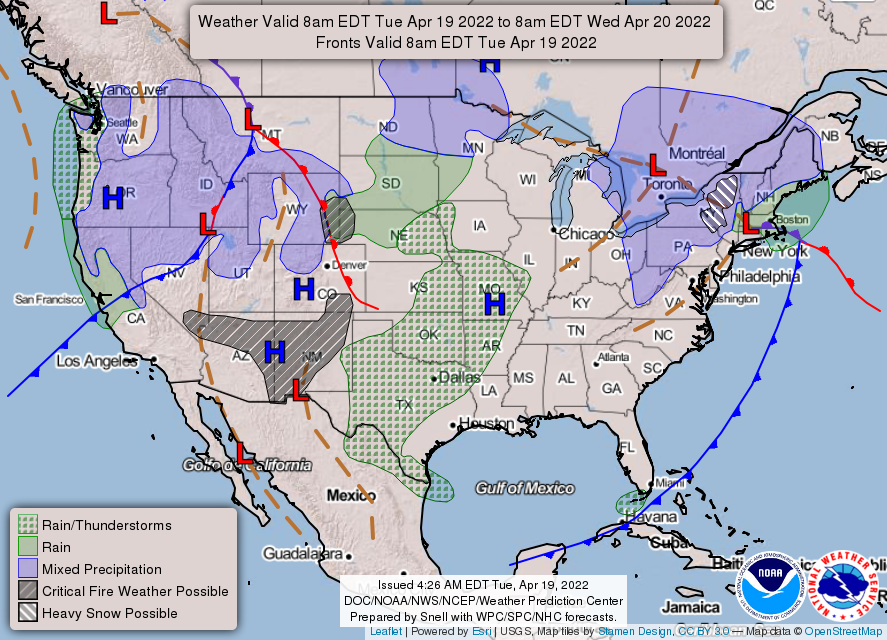

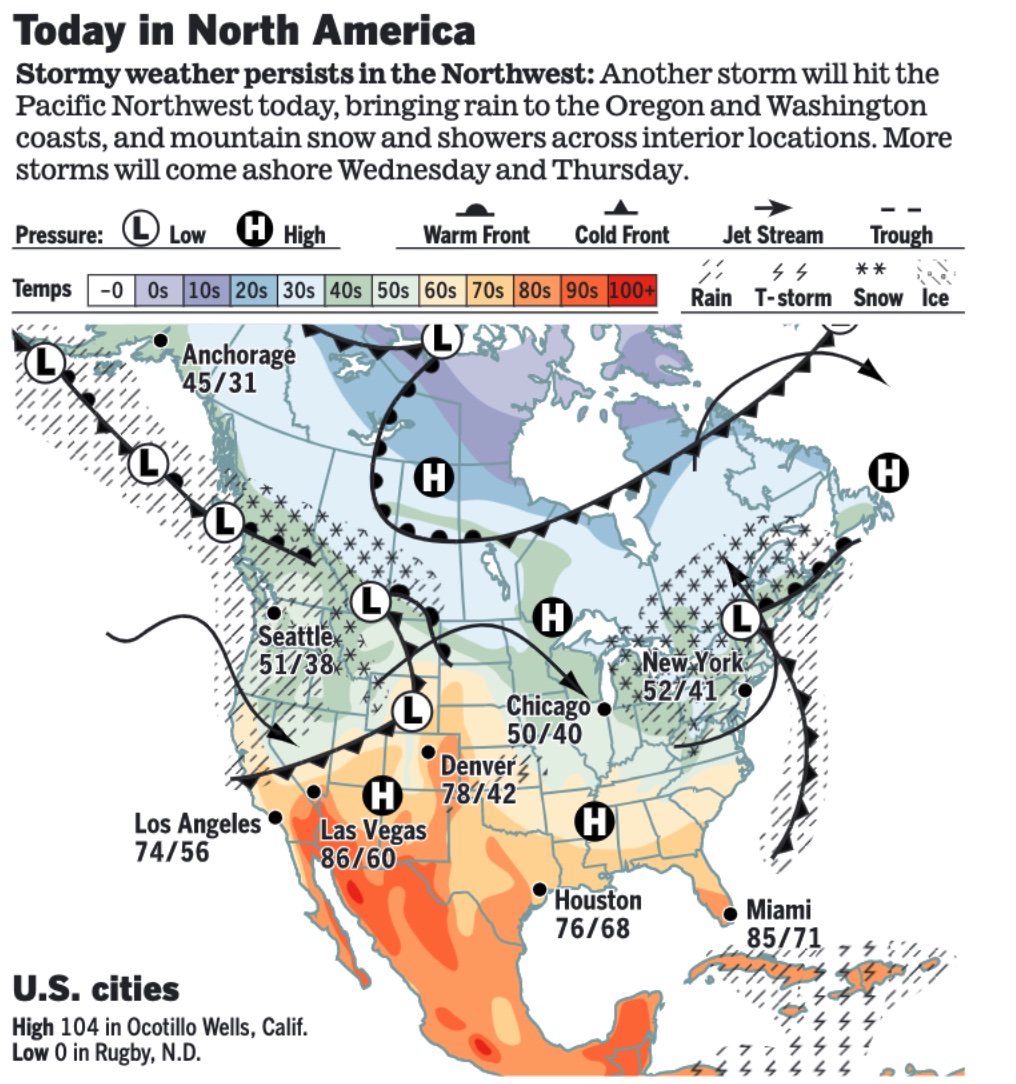

• NWS weather: Late season snow for the interior Northeast Tuesday morning; chilly temperatures for Mid-April to stick around in the East through mid-week... ...Mountain snow to blanket the highest elevations of the Northwest; Severe storms to form in parts of the Southern Plains today and Wednesday; unsettled & stormy weather arrives in the Pacific Northwest on Wednesday... ...There is a Critical Risk of fire weather over parts of the Southwest and Southern Plains; summer-like warmth in these same regions.

Items in Pro Farmer's First Thing Today include:

• Light, two-sided commodity trade overnight

• HRW CCI rating declines, SRW improves

• China to auction beef, mutton reserves

• Higher cash cattle hopes, but recent trend suggests otherwise

• Pork cutout unable to hold strong morning gains

|

RUSSIA/UKRAINE |

— Summary: U.S. troops will train Ukrainian counterparts to use the artillery pieces headed their way against Russian forces gathering in Ukraine’s Donbas region, defense officials said Monday. Russian forces launched a ground assault along a nearly 300-mile front in eastern Ukraine, according to Ukrainian officials, after hitting the country with one of the most intense missile barrages in weeks. At least seven people were killed in Lviv, a western city that had been a refuge for fleeing civilians, barely 50 miles from Poland. Meanwhile, Russia is tightening its hold over occupied areas of southern Ukraine, installing pro-Moscow leaders, hunting for dissenters and dismantling Ukrainian state institutions. A U.S.-led coalition will try to hamper the Russian military's ability to build back its war-fighting capabilities as it continues its campaign against Ukraine.

- How much will it cost to rebuild Ukraine? "Researchers from the Centre for Economic Policy Research (CEPR), a network of economists, have used data on property damage, figures on the country’s capital stock and historical analogies to estimate the overall cost of what will have to be done to rehabilitate the country after the war at €200 billion-€500 billion ($220 billion-$540 billion). The upper bound is over three times Ukraine’s pre-war GDP; the lower number is roughly four times the EU’s foreign-aid budget," the Economist writes (link).

— Market impacts:

- International sanctions are beginning to choke Russia’s economy. Moscow’s mayor warned that 200,000 people risked losing their jobs in the capital alone, while the head of the central bank warned that the effects of Russia’s isolation were just starting to be felt. Russia said it is taking legal steps to recover its frozen foreign currency. The U.S. sanctions on about $300 billion of Russian assets are “unprecedented,” according to the head of the country’s central bank. Meanwhile, Russian leader Vladimir Putin will meet executives and owners of big business tomorrow. No agenda has been announced.

- Ukraine and Russia together account for about a quarter of the world’s grain trade, and disruption to shipments from the Black Sea region is bringing turmoil to the global market. With the price of corn at a decade high and wheat soaring, the United Nations has warned an additional 13 million people could be left undernourished. Drought-affected countries across the Horn of Africa are likely to be the hardest hit, the World Food Program says. A third of Ukraine’s crops and agricultural land may not be harvested or cultivated in 2022, the United Nations’ Food and Agriculture Organization (FAO) said.

Meanwhile, Sri Lanka, which defaulted on its sovereign debt last week, said that the International Monetary Fund is considering its request for help paying for imports of fuel, food and medicines. The prime minister, Mahinda Rajapaksa, wants to change the country’s constitution to shift some powers from the president to parliament — he says that would both support the IMF application and help to quell street protests.

|

POLICY UPDATE |

— Most projects jumpstarted by the bipartisan infrastructure law must use American-made steel, iron and other materials, the Biden administration announced in a new guidance. It’s an effort to bolster domestic manufacturing, though it also includes an opportunity for waivers from the requirement if U.S. capacity can’t meet demand.

— Supreme Court won’t hear challenge to key SALT tax deduction. The Supreme Court on Monday declined to review a challenge to the $10,000 ceiling imposed on the state and local tax (SALT) deduction, one of the most controversial provisions of the 2017 tax bill ushered into law by President Trump and a GOP-led Congress. The court’s move, via a brief unsigned order without noted dissent, effectively ended a legal challenge brought by several high-tax, Democratic-led states. The Republican-led tax cuts capped at $10,000 the amount of state and local taxes that individuals could deduct from their federal income taxes, a move that effectively increased the tax burden on high-earners in states like New York and California.

— Lawmakers join agriculture/farm groups in filing brief at Supreme Court supporting WOTUS challenge. A group of 45 senators and 154 members of the House have filed an amicus brief with the U.S. Supreme Court which calls on the nation’s top court to reverse a lower court ruling on Waters of the US (WOTUS) under the Clean Water Act (CWA). The lawmakers, led by Senate Environment and Public Works Ranking Member Shelley Moore Capito (R-W.Va.) and House Transportation and Infrastructure Ranking Member Sam Graves (R-Mo.), detailed several arguments for the nation’s top court to narrow the determination of what county as navigable waters under the CWA. They indicated that the case marks the chance for the nation’s top court to “put the genie back in the bottle” on WOTUS and reverse the lower court ruling as failing to do so would mean “the definition of ‘waters of the United States’ will continue to whipsaw from one administration to the next.”

A separate filing by the American Farm Bureau Federation and 13 other groups notes that the organizations grow “virtually every agricultural commodity produced commercially in the United States, including much of the U.S. wheat, corn, rice, soybean, cotton, wool, sugar, milk, poultry, egg, pork, lamb, and beef supply,” adding that producers face “significant problems” from the shifting definitions of WOTUS.

The Supreme Court is expected to hear arguments in the case later this year.

— CFAP payouts hold steady. Totals for payments issued under the Coronavirus Food Assistance Program (CFAP) efforts were reported as holding steady as of April 17. CFAP 2 payments were at $19.16 billion with original CFAP 2 payments at $14.33 billion and top-up payments at $4.83 billion. Total CFAP 1 payouts were at $11.81 billion, with original CFAP 1 payments at $10.62 billion and top-up payments at $1.19 billion.

|

PERSONNEL |

— Toombs to lead NIFA. Dr. Dionne Toombs, a leader in USDA science and nutrition work, was named acting director of the National Institute of Food and Agriculture, which distributes $1.8 billion a year in grants for agricultural research. Link for details.

|

CHINA UPDATE |

— Officials in Shanghai said some residents might have to live at their work places even after the city lifts a citywide lockdown. "Beijing now appears to prioritize controlling the pandemic above all…That means local governments will likely focus on limiting infections and put aside concerns about the economy for now,” said Tommy Wu of Oxford Economics.

|

TRADE POLICY |

— USTR Tai meets with Singapore, Taiwan trade leaders. U.S. Trade Representative Katherine Tai met with Singapore’s Minister for Finance Lawrence Wong Monday, with the virtual meeting focusing on the U.S./Singapore Free Trade Agreement (FTA) and on the U.S. effort to establish an Indo-Pacific Economic Framework (IPEF) deal in the region. A USTR readout of the virtual session with Taiwan Minister-Without-Portfolio John Deng focused on bilateral trade issues and working together on numerous issues including the WTO. However, there was no mention of the IEPF in the discussions with the Taiwanese official.

— Agricultural trade in focus for USTR Tai today. USTR Katherine Tai will meet with members of the Agricultural Policy Advisory Committee for Trade (APAC) and Agricultural Technical Advisory Committees (ATACs) today. USDA Secretary Tom Vilsack will also take part in the session that is closed to the press.

|

ENERGY & CLIMATE CHANGE |

— EV battery shortage is ‘looming’: Rivian CEO. Rivian CEO RJ Scaringe is warning of a “looming” shortage of EV battery supplies in the U.S. — a challenge he believes will pose one of the biggest hurdles for U.S. automakers, who have scrambled to boost production of the battery powered vehicles.

There’s a huge supply-demand imbalance. EV demand has surged — both with the addition of more affordable models, and the recent uptick in fuel prices. But unlike traditional vehicles, Scaringe noted, most of the supply chain for EVs has not yet been built. Manufacturers need supplies such as cobalt, lithium and nickel for battery production. Some car companies are even constructing their own battery plants in a bid to procure as much of the supply as possible, he said, according to the Wall Street Journal.

How bad is it? “Put very simply, all the world’s cell production combined represents well under 10% of what we will need in 10 years,” he said, “Meaning, 90% to 95% of the supply chain does not exist,” he said. Scaringe said he expects to see shortages “everywhere from the mining of raw materials, to processing them, to building the battery cells themselves.”

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA lists more details on Pennsylvania HPAI. USDA’s Animal and Plant Health Inspection Service (APHIS) lists the confirmed highly pathogenic avian influenza (HPAI) case in Lancaster County, Pennsylvania as involving 1,443,000 commercial layer chickens. The agency also said there was another commercial operation in Wisconsin confirmed with HPAI — 20,000 commercial turkeys in Polk County. Other confirmed HPAI cases listed by APHIS for April 15 and 16 were in backyard mixed species (non-poultry).

Bottom line: Egg farm losses from bird flu top 20 million hens. Wholesale prices for eggs were at least $1 higher per dozen than a year ago, with HPAI as a factor.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 505,089,025 with 6,200,298 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,686,455 with 988,912 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 569,642,898 doses administered, 218,937,361 have been fully vaccinated, or 66.70% of the U.S. population.

— Federal judge in Florida voided the national mask mandate covering airports, planes and other public travel. U.S. District Judge Kathryn Kimball Mizelle said the mandate was unlawful because it exceeded the statutory authority of the U.S. Centers for Disease Control and Prevention and because its implementation violated administrative law. The agency just last week extended its mandate through May 3. Judge Mizelle’s ruling came in a case brought by Health Freedom Defense Fund, an Idaho-based nonprofit legal group that advocates against mask and vaccine mandates, and two Florida residents. A Justice Department spokeswoman said the department was reviewing the ruling but declined to comment further. It is unclear how quickly the ruling will be implemented at airports or train stations, or if the Justice Dept. will seek an order halting the ruling and file and appeal.

The U.S. Transportation Security Administration said after the court ruling that it would stop requiring passengers on planes, trains and other public transportation to wear masks “at this time.”

Most major U.S. airlines are no longer requiring travelers or employees to wear face coverings on domestic and some international flights. The five largest U.S. carriers —American Airlines Group Inc., Alaska Air Group Inc., Delta Air Lines Inc., Southwest Airlines Co. and United Airlines Holdings Inc. — said they were dropping their mandates effective immediately. Use of masks will be optional for both passengers and staff, they said. The airlines said they also will not require the use of masks at boarding gates or elsewhere in airports.

|

POLITICS & ELECTIONS |

— Court clears Finkenauer candidacy. Iowa’s Supreme Court ruled unanimously that former Rep. Abby Finkenauer, the front-runner Democrat against Republican Sen. Chuck Grassley, submitted enough signatures to appear on the ballot for the Democratic nomination. Link for details via the Associated Press.

— Biden has told Obama he’s running again. President Biden told former President Obama that he is planning to run for re-election in 2024, two sources told The Hill. The admission to Obama is the latest indication that Biden is likely to run for a second term. Link for details. Meanwhile, Nelson Peltz hosted a $5,000-a-plate fundraiser for Sen. Joe Manchin (D-W.Va.) at the billionaire's sprawling Florida estate last month, where several top executives said they privately hoped the conservative Democrat would switch parties and run against President Joe Biden in the 2024 election, CNBC reports (link).

|

CONGRESS |

— Sen. Warren warns Dems about Nov. 8 elections. “To put it bluntly: if we fail to use the months remaining before the elections to deliver on more of our agenda, Democrats are headed toward big losses in the midterms,” Sen. Elizabeth Warren writes in a NYT op-ed that was posted Monday morning (link). Here’s her advice:

On reconciliation: Make “giant corporations pay their share to fund vital investments in combating climate change and lowering costs for families.” Of the long list of Dem reconciliation spending priorities, she mentions “clean energy, affordable child care, and universal pre-K.”

On corruption: “Members of Congress and their spouses shouldn’t be allowed to own or trade individual stocks.” She has her own bipartisan plan she wants passed.

On inflation: “Beefing up regulators’ authority to end price-gouging, breaking up monopolies, and passing a windfall profits tax is a good start.”

Executive actions Biden can and should take: Canceling student debt, “lowering prescription drug prices,” “ensuring that more workers are eligible for overtime pay.”

|

OTHER ITEMS OF NOTE |

— The two top Republican tax-writers in Congress still want answers from Treasury on how a news outlet got private tax information on some of the wealthiest Americans. Senate Finance Committee ranking member Mike Crapo (R-Idaho) and House Ways and Means Committee ranking member Kevin Brady (R-Texas) are pressing the Treasury Department again to identify how the information ended up with ProPublica, which has published a series of articles based on the tax data.

— Illegal crossings of the Mexican border into the U.S. are running at the fastest pace in at least two decades. The U.S. has made more than a million arrests at the U.S.-Mexico border since October, the fastest pace of illegal border crossings in at least the last two decades, according to new data released Monday by U.S. Customs and Border Protection. Border agents made 209,906 arrests along the border in March, making it the busiest month in two decades. Another 11,397 migrants were permitted to enter the country to seek humanitarian protection at land border crossings, according to the data. The numbers cover a period from the beginning of the fiscal year to the end of March.

— Vilsack to Mississippi. USDA Secretary Tom Vilsack and White House domestic policy adviser Susan Rice will join Rep. Bennie Thompson, chairman of the House Homeland Security Committee, in his Mississippi district for events tied to the administration's "rural infrastructure tour" on Wednesday