Not Much Impact from E15 Announcement

Pork producers give reasons why they are not expanding operations

|

In Today’s Digital Newspaper |

President Joe Biden said for the first time that Russian forces had committed “genocide” in Ukraine. After repeatedly accusing Vladimir Putin’s troops of “war crimes,” Biden said he had seen more evidence of “the horrible things that the Russians have done,” adding that lawyers would ultimately make the official determination. Putin on Tuesday said the invasion of Ukraine will achieve what he called its “noble” aims and vowed to continue it until Moscow’s goals are completed.

The U.S. is said to be preparing a military assistance package of roughly $750 million for Ukraine. The U.S. has provided more than $2.4 billion in military assistance to Ukraine since Joe Biden took office, with $1.7 billion of that coming after Russia’s invasion.

Attending a pork management conference in Nashville, Tennessee, we asked attendees about the near-term hog market. Several said hog expansion is not happening due to (1) hard-to-find labor, (2) hard-to-get construction because of retrofitting some operations to deal with California’s Prop 12, (3) an inability to get a handle on some diseases and (4) the cost of feed. But it wasn’t all negative news. Several see a hog market rally in the summer amid more confirmation that other countries like Brazil and Spain are contracting even more than the United States and importing countries step up purchases. Several cited Japan as an example of recent big buys. Regarding the Supreme Court review of Proposition 12, most wanted it thrown out on constitutional grounds, but there is a difference about the impact of any such conclusion. More than a few U.S. hog operations have retrofitted to meet Prop 12 guidelines and still think there could be a marketing advantage in some states like California.

Constraints remain for President Biden’s action to allow E15 fuel sales in summer. The emergency action to allow E15 fuel to be sold during the June 1-September 15 period is touted as saving consumers up to 10 cents per gallon at the fuel station. But that’s part of the issue — only 2,300 of the 150,000 fuel stations currently are equipped to sell E15 fuels, with most of those in the Midwest. The need for fuel stations to have separate dispensers and fuel tanks to hold E15 has limited expansion of the fuel even though it is priced typically $0.05 to $0.10 per gallon cheaper than conventional gasoline. If the fuel were available nationwide, then the potential impact would be greater given that the Energy Information Administration (EIA) predicts that consumers will use 9.2 million barrels per day of gasoline during the summer driving season. But fuel prices are also expected to average $3.84 per gallon, the highest since 2014 on an inflation-adjusted level. EIA predicts consumers will shell out $455 more for gasoline this year than they did in 2021. More in Energy section below.

Bewildering: I do not understand why some are drawing the conclusion that the E15 move by President Biden this time is the same as former President Trump's. That was a permanent regulatory change. The Biden order is an emergency action that has to be reviewed every 20 days. Yes, they can continue it every 20 days very easily, but it is not a permanent regulatory change.

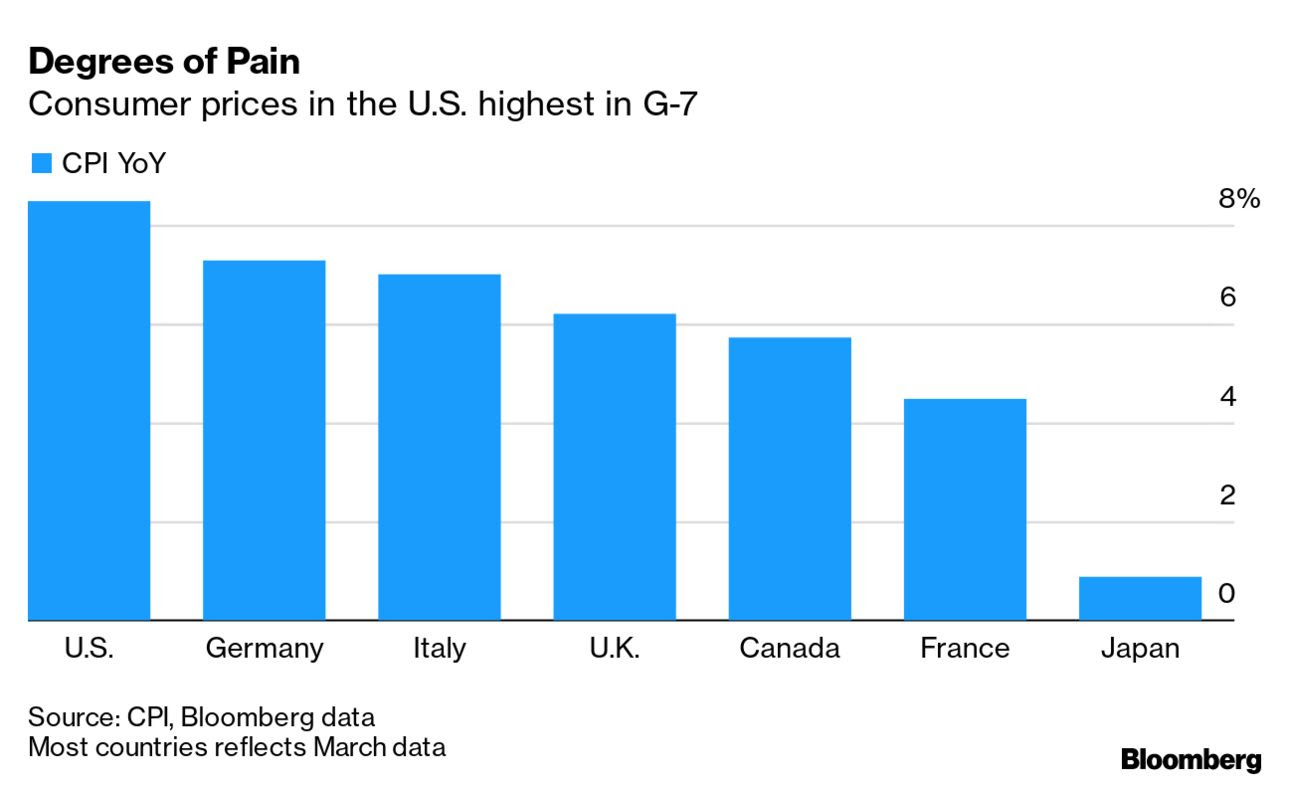

President Biden sidestepped months of U.S. inflation pressures that preceded the war in Ukraine, triggered by wage pressures in a strong economy and supply chain problems resulting from consumer demand amid the pandemic. U.S. inflation accelerated to 8.5% in March, rising at its fastest annual pace since December 1981 as an unrelenting increase in prices led to a sixth straight month of inflation above 6%. Federal Reserve governor Lael Brainard said Tuesday at WSJ’s Jobs Summit that the central bank will raise rates expeditiously to reduce soaring inflation and expressed confidence in its ability to moderate price pressures without triggering an economic downturn. We have lots on inflation in the. U.S. and other countries in today’s dispatch.

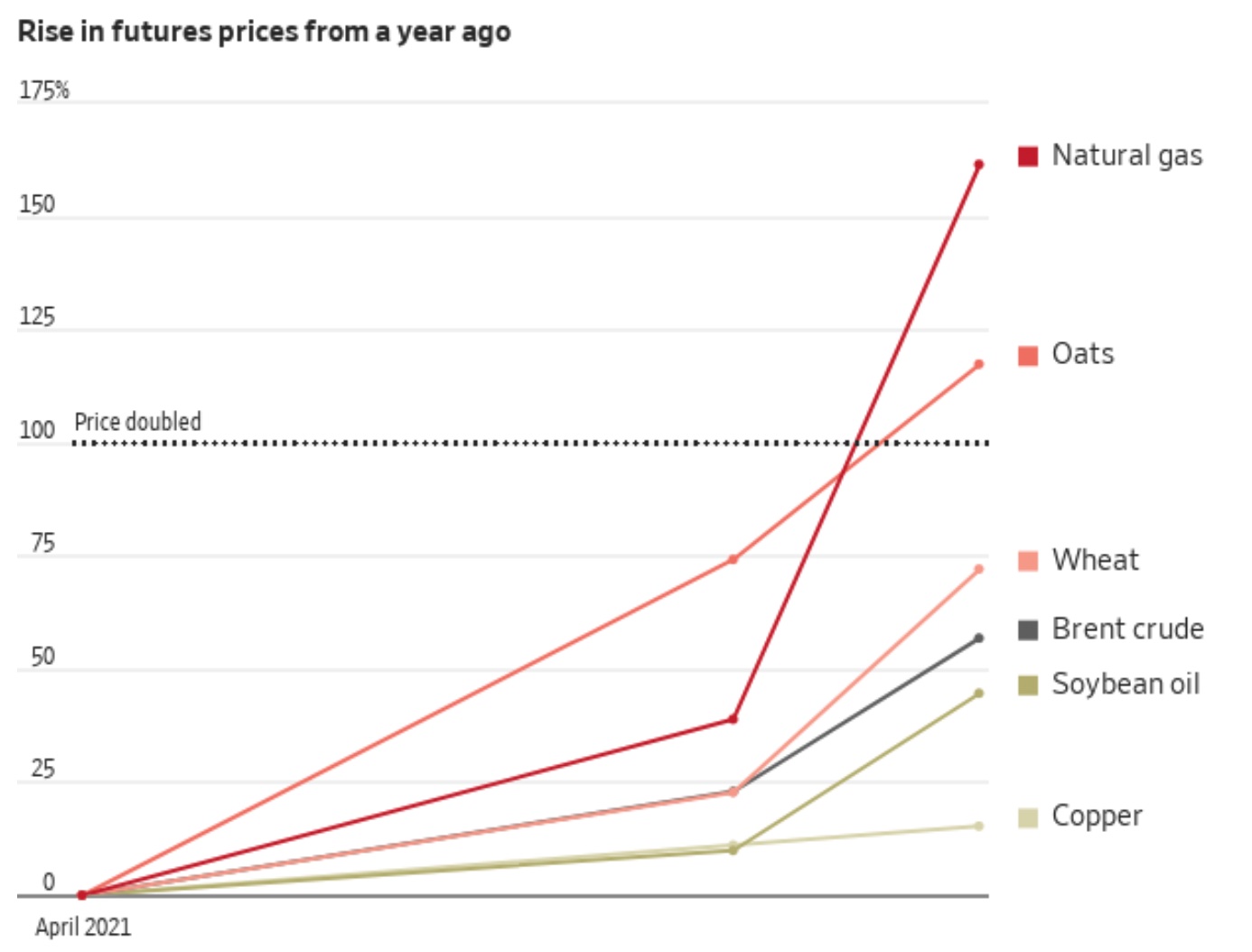

U.S. natural-gas prices have jumped 79% in 2022. Oil has fallen about $23 a barrel from a recent high, but the benchmark U.S. price is still up 34% this year. Appalachian coal, soybean oil, oats, canola, rapeseed oil, natural gas in the Netherlands, wheat in Paris and Chicago, gasoline, diesel, propane, palm oil, copper and tin have all notched new highs in 2022. Soybeans, lean hogs, frozen pork bellies and zinc aren’t far off their records.

The Financial Times is reporting that analysts have concluded that cutting off Russian energy from Germany Five of Germany’s top economic research groups would send Europe’s largest economy into recession with an estimated 2.2% decline in GDP in 2023 with the loss of more than 400,000 jobs. The forecasts were submitted to the German government by the German Institute for Economic Research, the Ifo Institute, the Kiel Institute for the World Economy, the Halle Institute for Economic Research and RWI, the report said.

U.S. supply chains are facing major new disruptions at the border with Mexico. Two major international bridges connecting the countries have been effectively shut down after a state security initiative brought traffic to a halt and protesting Mexican truckers blocked the Pharr-Reynosa International Bridge. The shutdown is the most dramatic fallout so far from Texas Gov. Greg Abbott’s plan to inspect all trucks for drugs or immigrants. In Laredo, the nation’s largest inland port, passage at the border bridge stretched to 10 hours. Pharr is a key transit point for fresh produce coming into the U.S. Delays there have exceeded 36 hours, with many truckers stuck on the 3-mile-long bridge without access to bathrooms, food or water. One trucking company says some loads of fruits and vegetables were lost after sitting in sweltering heat when trucks ran out of the diesel needed to cool them. Link to more via the WSJ.

The White House is signaling the government may extend the transportation mask mandate, which has been scheduled to expire on Monday, despite the requirement’s unpopularity with the travel industry and among many fed-up travelers. Meanwhile, large universities are returning to mask requirements for students, faculty, administrators and staff as infections and exposures climb again

U.K. Prime Minister Boris Johnson said he’s paid a fine for breaching his own government’s Covid lockdown rules, just hours after disclosing the police were penalizing him.

|

MARKET FOCUS |

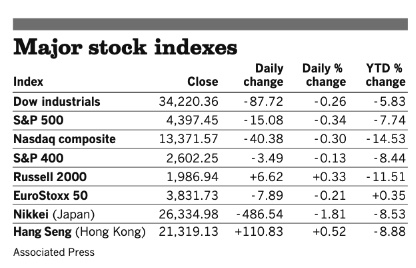

Equities today: Global stocks markets were mixed to firmer overnight. The U.S. stock indexes are pointed toward firmer openings. Asian equities were mixed as traders assessed US inflation readings and expectations out of China on COVID lockdowns eventually being reduced. The Nikkei gained 508.51 points, 1.93%, at 26,843.49. The Hang Seng Index ended up 55.24 points, 0.26%, at 21,374.37. European equities are mixed in choppy early trading activity. The Stoxx 600 was recently down 0.2%, while regional markets were up 0.1% to down 0.8% with several shifting between losses and gains.

U.S. equities yesterday: The Dow closed down 87.72 points, 0.26%, at 34,220.36. The Nasdaq declined 40.38 points, 0.30%, at 13,371.57. The S&P 500 was down 15.08 points, 0.34%, at 4,397.45.

Benchmark Treasury yields have climbed to test their four-decade downtrend using a logarithmic scale, a more appropriate measure given the timespan involved. They hit 2.83% to test the trendline Tuesday, based on calculations by Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo, before pulling back to close lower. “A push toward 3% — the whisper target for many investors now — would seal the deal,’ he writes.

Agriculture markets yesterday:

- Corn: May corn futures rose 11 3/4 cents to $7.76 1/4, a lifetime-high settlement for the contract. December corn rose 13 cents to $7.31 and posted a contract high for the third day in a row.

- Soy complex: May soybeans rose 15 cents to $16.70 1/4 while November soybeans gained 21 1/4 cents to $15.07, near a three-week high. May soymeal rose $1.80 to $460.90 and May soyoil rose 113 points to 75.43 cents per pound.

- Wheat: July SRW wheat rose 23 1/2 cents to $11.12 1/2, the contract’s highest closing price since $11.27 1/2 on March 15. July HRW wheat rose 21 1/4 cents to $11.66 3/4, the highest close since March 8. July spring wheat rose 15 1/2 cents to $11.56, also the highest settlement since March 8.

- Cotton: May cotton futures jumped 322 points to 138.51 cents per pound, while new-crop December posted a third consecutive contract high before closing up 241 points at 120.03 cents.

- Cattle: April live cattle climbed $1.425 to $139.95, while June futures gained $1.50 to $136.30, the highest closing price since March 31. May feeder futures advanced $1.025 to $160.925.

- Hogs: June lean hogs rose $3.45 to $118.475, the contract’s highest close since April 1. April hogs gained $1.20 to $99.625.

Ag markets today: Grain and soybean futures posted two-sided trade overnight, with wheat and corn narrowly mixed and soybeans under pressure this morning. As of 7:30 a.m. ET, corn futures were 2 cents lower to 2 cents higher with old-crop weaker and new-crop firmer, soybeans were 5 to 11 cents lower and wheat futures a penny lower to 2 cents higher. Front-month U.S. crude oil futures were around $2 higher and back above $100, while the U.S. dollar index was just above unchanged.

On tap today:

• Producer Price Index for March is expected to rise 1.1%. (8:30 a.m. ET)

• Treasury Secretary Janet Yellen delivers an address on the global economy following Russia's invasion of Ukraine. (10 a.m. ET)

A rally in commodities prices more intense than anything seen in the modern trading era is shaking the markets meant to ease the flow of raw materials around the world. The Wall Street Journal reports (link) that the wild swings in futures markets are complicating business for the people and companies who produce and use natural gas, zinc and other commodities. The volatility is driving speculators and others from the markets, triggering even choppier trading and higher prices. A broad range of commodities have exceeded or approached record highs this year. Demand from consumers emerging from the pandemic is propelling the surge, leaving mills, mines, drillers and farmers struggling to catch up on supply. Russia’s invasion of Ukraine is adding to market disruption, especially in energy and grain sectors. Prices for pig iron used in steel production are surging because of shortages following Russia’s invasion of Ukraine.

Sen. Joe Manchin blamed the White House and Fed for failing to head off inflation. Manchin (D-W.Va.), whose opposition derailed Biden’s economic agenda, said, “The Federal Reserve and the administration failed to act fast enough, and [Tuesday’s inflation] data is a snapshot in time of the consequences being felt across the country.” Manchin said, “instead of acting boldly, our elected leaders and the Federal Reserve continue to respond with half-measures and rhetorical failures.”

“Runaway inflation is crushing American families and our economy,” House Republican Leader Kevin McCarthy (R-Calif.) said in a tweet. “Under President Biden, prices are accelerating faster than any time in more than 40 years, sucking up paychecks and draining savings.”

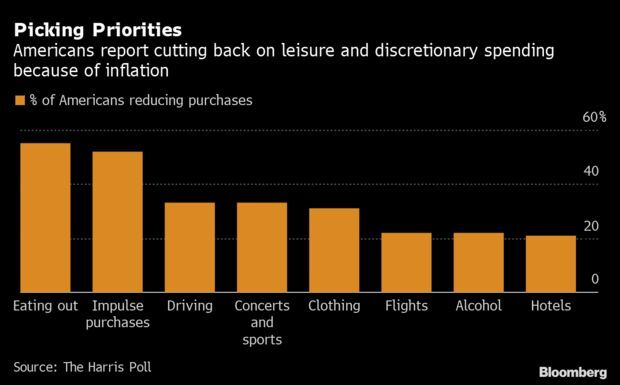

Inflation is fueling changes in spending habits. About 84% of Americans plan to cut back on spending as a result of higher prices, according to a nationally representative survey conducted by the Harris Poll for Bloomberg News. The biggest cuts involve eating out, impulse purchases, driving and experiences like concerts and sports. More than 70% of respondents said they’re feeling the effects of inflation the most in gas prices and groceries.

Upshot: Whatever gains people are making in wages are being lost by the rise in costs that they’re enduring.

St. Louis Fed’s Bullard to FT: ‘Fantasy’ to think modest rate hikes will quell inflation. St. Louis Fed President James Bullard continues to be a consistent voice for a more-aggressive stance by the Fed on monetary policy as it seeks to quell inflation. “There’s a bit of a fantasy, I think, in current policy in central banks,” Bullard told the Financial Times. “Neutral is not putting downward pressure on inflation. It’s just ceasing to put upward pressure on inflation.” The hawkish Bullard said the Fed needs to “put downward pressure on the component of inflation that we think is persistent Getting to neutral isn’t going to be enough it doesn’t look like, because while some of the inflation may moderate naturally . . . there will be a component of it which won’t.” Bullard dissented at the March 15-16 Federal Open Market Committee (FOMC) meeting as he wanted a 50-basis-point hike in interest rates rather than the 25-basis-point increase taken.

The inflation data released Tuesday in the Consumer Price Index (CPI) update showed prices rose for consumers at an annualized rate of 8.5%. “This [inflation] report just underscores the urgency that the Fed is behind the curve and needs to get moving,” he said. Bullard said his judgment is the Fed needs to get rates to 3% by the third quarter relative to the target range for the Fed funds rate which is currently at 0.25% to 0.5%. He acknowledged that is an “aspirational” level but issued this stark warning: “If markets and households get the idea that the Fed’s not going to do the right thing and not going to keep inflation under control, then you have to gain credibility by actually doing things that show them you are serious.” While he said the Fed is “holding on to our credibility,” he warned if that slips it will become “much more difficult” to beat inflation. Bullard has long been a hawk and currently is a voter on the FOMC and his comments suggest he will be a dissenter if the Fed does not take more-aggressive action. Key will be how many of his Fed colleagues will be persuaded to join him. Minutes from the March meeting indicated there was broader support for a 50-basis-point increase, but the Russian invasion of Ukraine held the more-aggressive action at bay.

Prices in the U.S. are surging the fastest among the Group of Seven advanced economies, propelled by higher costs of energy, food and a raft of other goods and services.

Inflation watch: Senior Citizens League estimates the Social Security cost-of-living adjustment, or COLA, for 2023 could be 8.9%. On top of the 5.9% last for 2022. The 2023 number, if realized, would be the biggest COLA since 1981.

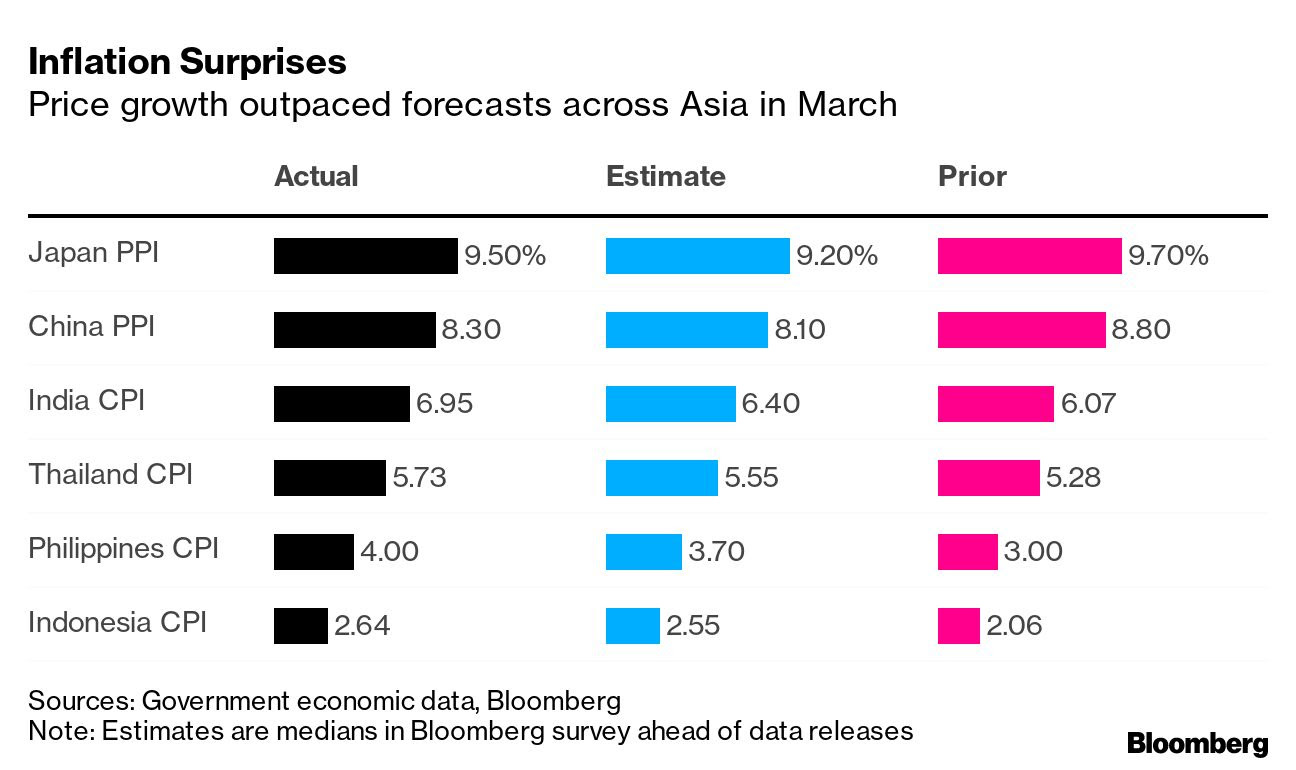

Oil jumped back above $100 a barrel as concerns mounted inflationary pressures will stay elevated and hamper economic growth in the U.S. and around the world. For example, India also reported a 6.95% rise in consumer prices.

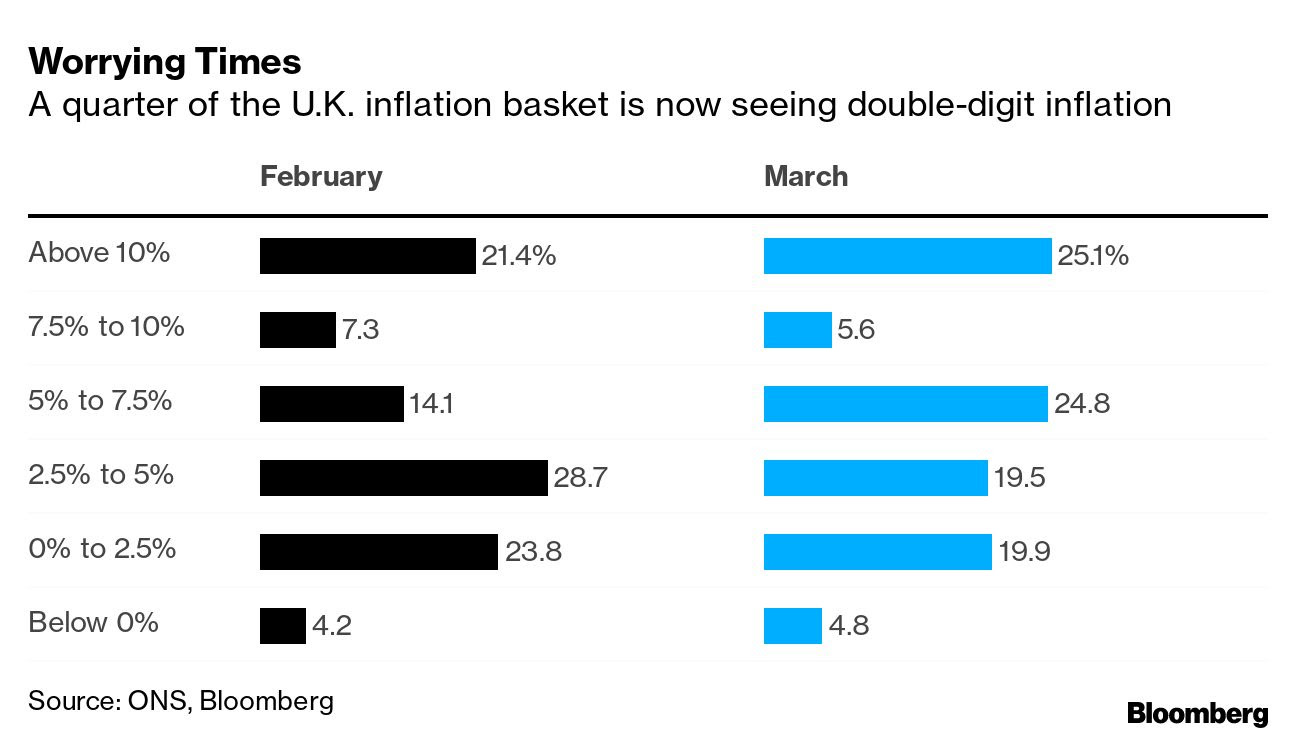

British consumer price inflation leapt to a 30-year high of 7.0% in March, its highest since March 1992 and up from 6.2% in February, official figures show. The leap reflects the intensifying cost-of-living squeeze faced by British households.

Inflation rates in Asia are also accelerating, with more in the region likely to follow.

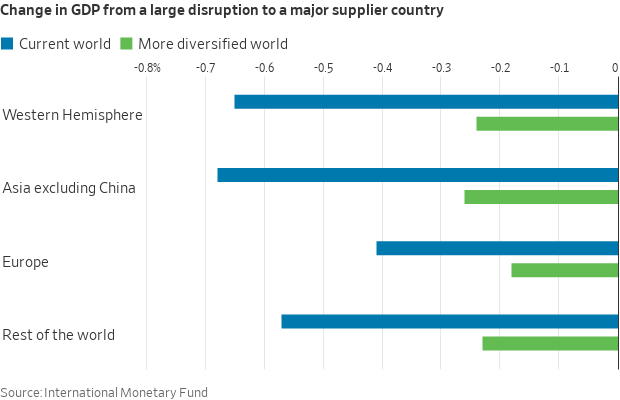

Reshoring won’t work: IMF. Efforts by the U.S. and other countries to solve supply-chain problems by boosting domestic production likely won’t be effective, according to a report by the International Monetary Fund. The report said diversifying sourcing is likely to be a better solution. The Biden administration wants to encourage more domestic production and reshoring of industries.

Market perspectives:

• Outside markets: The U.S. dollar index is higher even as most foreign currencies are higher versus the greenback. The yield on the 10-year U.S. Treasury note has eased to trade around 2.73% with a mixed tone in global government bond yields. Gold and silver futures are firmer ahead of U.S. trading, with gold trading around $1,980 per troy ounce and silver around $25.85 per troy ounce.

• Crude oil futures continue to move higher ahead of US government crude inventory data due later this morning. US crude was trading around $102 per barrel and Brent around $106.20 per barrel. Crude prices rose overnight in Asian action, with US crude trading around $101 per barrel and Brent around $105 per barrel.

• OPEC cuts forecasts for global growth, oil demand, citing Ukraine war. OPEC on Tuesday slashed its forecasts for global economic growth for the year to 3.9% from an earlier assessment of 4.2%, as economies are expected to suffer under the weight of high commodity prices. The oil producers’ cartel cut its forecasts for Russian production this year by 530,000 barrels a day to 10.8 million barrels a day. That is slightly higher than last year’s output which stood at 10.59 million. OPEC raised its U.S. production forecasts by 261,000 barrels a day to 17.75 million barrels. OPEC downgraded its growth forecast for the eurozone economy to 3.5% from 3.9%. Russia’s economy is expected to contract by 2% under the weight of Western sanctions. Last month, OPEC forecast Russia’s economy would grow by 2.7% this year. It cut its forecast for growth in demand for oil this year by 500,000 barrels a day to 3.7 million barrels a day. For the year, OPEC expects the globe to burn through 100.5 million barrels of oil a day, 410,000 barrels a day less than it was forecasting before the war broke out. OPEC said its forecasts assume the war won’t escalate further and that the conflict should ease in the second half of the year.

• Dockworkers at the U.S.’ West Coast ports and their employers will likely reach an agreement when their current contract expires this summer, International Longshore and Warehouse Union International President Willie Adams said.

• South Africa suspended shipping at its main port in Durban after the heaviest rains in more than six decades and resultant flooding damaged roads leading to the harbor.

• Ag trade: Algeria bought an estimated 80,000 to 100,000 MT of optional origin milling wheat, though that figure could change. Japan is seeking 70,000 MT of feed wheat and 40,000 MT of feed barley.

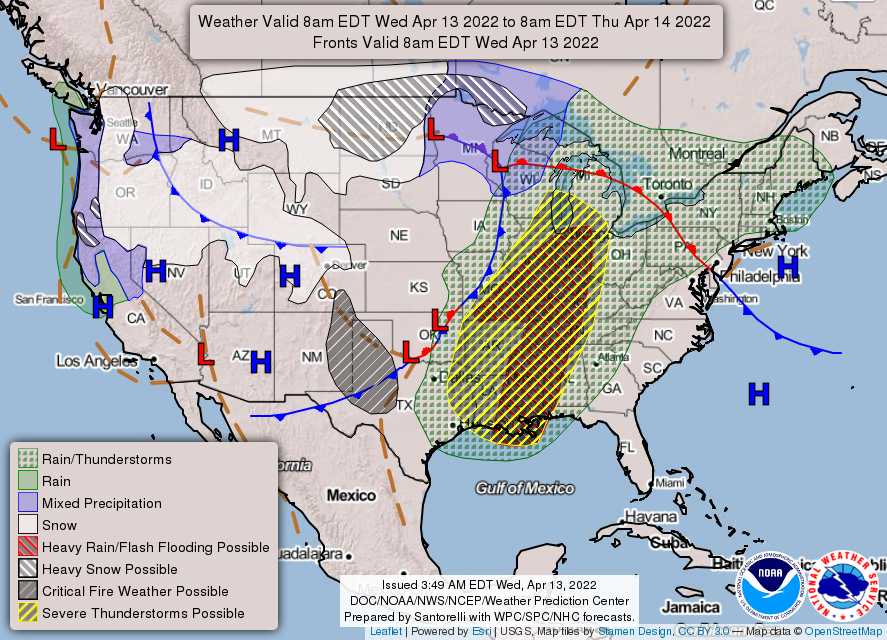

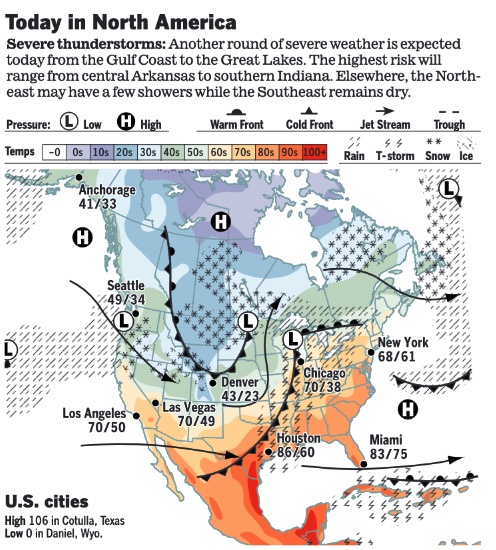

• NWS weather: Major winter storm to bring heavy snow and blizzard conditions to parts of the Northern Plains through Thursday... ...Significant severe weather and some flash flooding possible today from the Lower Mississippi Valley north into the Midwest... ...Dangerous fire weather conditions for the Southern/Central High Plains... ...Active period continues across Pacific Northwest as low elevation rain and mountain snow impact the region.

Items in Pro Farmer's First Thing Today include:

• Corn and wheat mixed, soybeans lower this morning

• Chinese are stockpiling amid Covid restriction concerns

• France cuts non-EU wheat exports

• Argentine grain trucker strike continues

• Cash cattle trade higher

• April hogs now above the cash index

|

RUSSIA/UKRAINE |

— Summary: Russian President Vladimir Putin said Ukraine peace talks are at a “dead end” and It’s unclear when the war will end. The U.S. is monitoring claims Russian forces may have deployed a poisonous substance in Mariupol. But verifying a chemical attack will be difficult. Ukraine’s Deputy Defense Minister Hanna Malyar said the incident was being investigated, but that a preliminary assumption was that phosphorous bombs — gruesome weapons not classed as chemical — may have been responsible. President Joe Biden has said for the first time that Russia's invasion of Ukraine amounts to genocide, a significant escalation of the president’s rhetoric. “Yes, I called it genocide because it has become clearer and clearer that Putin is just trying to wipe out the idea of being able to be Ukrainian and the evidence is mounting," Biden told reporters. Meanwhile, Biden's administration is also expected to announce as soon as today another $750 million in military assistance for Ukraine for its fight against Russian forces, two U.S. officials familiar with the matter told Reuters.

- Russia claims more than a thousand Ukrainian marines have surrendered in the besieged port of Mariupol, Moscow's main target in the eastern Donbas region. Their claim has yet to be proven.

- The presidents of Poland, Lithuania, Latvia and Estonia are on their way to Kyiv to meet Ukraine's President Volodymyr Zelenskiy, an adviser to the Polish leader said.

— Market impacts:

- China's overall trade with Russia rose by more than 12% in March from a year earlier in dollar terms, even as Beijing criticized Western sanctions on Russia following its invasion of Ukraine. Overall trade with Russia increased 12.76% in March to $11.67 billion.

- Cutting off Russian energy from Germany Five of Germany’s top economic research groups would send Europe’s largest economy into recession with an estimated 2.2% decline in GDP in 2023 with the loss of more than 400,000 jobs, the Financial Times reports. The forecasts were submitted to the German government by the German Institute for Economic Research, the Ifo Institute, the Kiel Institute for the World Economy, the Halle Institute for Economic Research and RWI, the report said.

|

PERSONNEL |

— Fed nominee. President Biden is seriously considering Michael Barr, a Treasury Department veteran and an architect of the Dodd-Frank Act of 2010, as the Fed’s chief banking supervisor, Bloomberg reports.

|

CHINA UPDATE |

— People across China are stockpiling food, concerned their cities might follow Shanghai’s Covid-19 lockdown. The Wall Street Journal reports (link) they are buying kitchen staples, toilet paper, toothpaste and other household necessities, with some even consulting shopping lists on social media. Meanwhile, the U.S. State Department ordered the departure of all nonemergency U.S. Consulate staff and their families from Shanghai, as the city battles China’s worst Covid-19 outbreak in two years. The pandemic lockdowns are also impacting manufacturing. More factories in and around Shanghai, including two run by an Apple supplier, are halting production, adding to pressure on the global supply chain.

— China's top offshore oil and gas producer CNOOC Ltd. is preparing to exit its operations in Britain, Canada and the United States, because of concerns in Beijing the assets could become subject to Western sanctions, industry sources told Reuters.

— China’s winter wheat crop improves more than expected. China’s winter wheat crop improved more than expected after a poor start last fall. The percentage of first and second grade wheat was on par with normal levels, the country’s ag ministry said. But recent Covid outbreaks and stricter lockdowns are impacting farmers to varying degrees, with some facing reduced crop inputs and fuel, while others are stuck in cities where they take on winter jobs. That combination has resulted in spring planting delays in key growing regions, especially the major grain producing provinces in northeast China.

— China’s soybeans imports fall sharply versus year-ago in March. China imported 6.4 MMT of soybeans in March, down 18.3% from last year, as poor crush margins and delays in shipments from Brazil slowed arrivals. Through the first three months of the year, China’s soybean imports stood at 20.3 MMT, down 4.2% from the same period last year.

— China’s meat imports plunged in March. China imported 594,000 MT of meat in March, down 42% from last year’s record. Its meat imports during the first three months this year at 1.7 MMT fell 37% from the same period last year. The preliminary data doesn’t give specifics of meat imports by category, but the sharp drop was driven by a significant decline in pork arrivals as domestic pork production has surged as the country aggressively rebuilt its herd after the African swine fever outbreak.

— China’s March imports unexpectedly fall. China’s overall imports fell 0.1% from year-ago in March, marking the first decline since August 2020. That was a stark slowdown from the 15.5% gain in imports notched in the first two months of the year due to strict Covid restrictions at major ports. China’s exports rose 14.7% from year-ago, though that was down from a 16.3% rise in the first two months of the year. China posted a trade surplus of $47.4 billion in March, more than double the forecast of $22.4 billion, thanks to the unexpected decline in imports. China’s trade surplus with the U.S. rose by 50% from last year to $32.1 billion.

|

TRADE POLICY |

— Sens. Warren, Casey press Biden trade officials on workers. Sens. Elizabeth Warren (D-Mass.) and Bob Casey (D-Pa.) pressed senior Biden administration trade officials to prioritize the interests of workers over companies in talks on a potential new pact among Pacific nations. Warren and Casey said in separate letters to Commerce Secretary Gina Raimondo and U.S. Trade Representative Katherine Tai that too often, trade talks have been dominated by concerns of corporations, not workers, and they are urging the White House to avoid a repeat as they negotiate the Indo-Pacific Economic Framework (IPEF).

Letters to Raimondo and Tai. Warren and Casey said in separate letters to Commerce Secretary Gina Raimondo and U.S. Trade Representative Katherine Tai that too often trade negotiations have been dominated by concerns of corporations, not workers, and they are urging the Biden administration to avoid a repeat as they negotiate the Indo-Pacific Economic Framework. “The upcoming negotiation must move these policies forward, not return the U.S. to old, failed trade policies like the Trans-Pacific Partnership,” they wrote in the letters. “We worry that IPEF could repeat the mistakes of previous trade policy and conflict with the administration’s commitment to a worker-centered trade policy.”

The two senators asked for answers by April 25 on a series of questions, including how labor and environmental protections will be improved and whether digital standards will benefit consumers and not just “Big Tech.”

|

ENERGY & CLIMATE CHANGE |

— Is Biden administration E15 announcement much ado about little? Some analysts think so. They note the sparse number of gas pumps in place to even sell E15, and most of those are in the Midwest whereas the big city states in the East and West Coasts drive more and have far less E15 pumps. As noted on Tuesday, only about 2,300 of the nation’s more than 150,000 stations now sell E15, and though it is available in roughly 30 states, the fuel is most widely offered in the Midwest. Perspective: When the Trump administration finalized its plan for year-around E15 sales in 2019, they noted that there were 1,800 fuel stations in the U.A. that sold E15.

Not only is E15 hard to find, but it’s hard to get an assessment of what impact the White House ethanol gimme will have.

This brings up the topic of biofuel infrastructure, long a weak spot in the biofuels arena. In fact, this topic was in large part the reason there was a new ethanol/biofuel group that surfaced years ago.

Meanwhile, Chet Thompson, president and CEO of AFPM, described the Biden EPA E15 decision as “an unlawful executive order” that is “not how to solve the problem” of high fuel prices. “Emergency fuel waivers are short term and reserved for very specific unforeseen events and regionally acute supply disruptions, such as those resulting from a hurricane,” Thompson said in a statement. “An additional three months of E15 sales won’t do anything to address high crude oil prices.”

But the White House said it’s pursuing an emergency waiver, not proposing a rulemaking to change the E15 regulation. An administration official said Monday the EPA action “will be rooted in the current fuel supply emergency” and said “EPA is planning to make this waiver so long as the current fuel supply emergency continues.” An EPA FAQ page on fuel waivers stresses that they “cannot be issued to address concerns regarding the price of fuel.” But White House officials characterized the decision as “yet another action that the president is taking to combat Putin's price hike.”

The FAQ says also the Clean Air Act allows for waivers “only to address a temporary emergency fuel supply shortage that exists throughout a state or region that was caused by an unusual situation such as an Act of God, and that could not have been avoided by prudent planning.”

Note: The E15 decision has to reviewed every 20 days.

— Gensler: Climate plan consistent with SEC authorities. Securities and Exchange Commission (SEC) Chair Gary Gensler zeroed in on his view that it is within the agency’s remit to require companies to disclose details about their greenhouse gas pollution. The SEC will consider all public comments, including from people who are against the agency’s plan, as the regulator weighs changes to a proposal announced last month that would change how corporations disclose climate-change risks, Gensler said in remarks at a conference on Tuesday.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Border blockade risks avocado, auto part shipments. Mexican truckers blockaded a key Texas border crossing for a second day to protest Gov. Greg Abbott’s stepped-up cargo inspections, raising the specter of delivery disruptions for everything from avocados to auto parts. The growing queue of 18-wheelers on the Mexican side of the Pharr-Reynosa International Bridge has choked crossings to a near-halt, according to local media reports. With temperatures forecast to reach 100 degrees Fahrenheit, produce is at risk of spoiling at a time of already rampant food inflation.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 500,937,232 with 6,185,548 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,478,065 with 986,408 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 566,532,062 doses administered, 218,521,227 have been fully vaccinated, or 66.57% of the U.S. population.

— Some universities across the U.S. are partially reinstating campus mask mandates following an uptick in Covid-19 cases. The latest schools to bring back indoor masking requirements are three universities in the Washington, DC, region — American, Georgetown and Johns Hopkins. This comes as Covid-19 case numbers have begun to edge up throughout the country, and nearly all of them are caused by the Omicron subvariant BA.2.

|

POLITICS & ELECTIONS |

— President Biden's public approval rating fell to 41% this week, a blow to his Democratic Party's hopes of retaining control of Congress in Nov. 8 elections, according to a Reuters/Ipsos opinion poll.

— New York Lt. Gov. Brian Benjamin (D) was arrested on Tuesday on federal charges of bribery, fraud and falsification of records while serving as a state senator amid an alleged campaign finance scheme. Hours later, New York Gov. Kathy Hochul (D), who is running for reelection this year, accepted his resignation, saying in a statement that “it is clear to both of us that he cannot continue to serve.”

— McConnell: ‘It’s actually possible’ for GOP to ‘screw this up.’ Senate Minority Leader Mitch McConnell (R-Ky.) crowed Tuesday that Republicans have a political environment “better than it was in 1994” amid “a perfect storm of problems for the Democrats.” But, according to The Hill, McConnell said Republican victories are no fait accompli if the party nominates bad general-election candidates. “How could you screw this up? It’s actually possible. And we’ve had some experience with that in the past,” McConnell said. Still, he said he’s feeling good about the GOP candidates thus far. A line some have used is that when it comes to elections, Republicans can foul up a two-car funeral procession.

— Iowa Supreme Court to hear appeal of ruling that Democratic Rep. Finkenauer cannot appear on Senate primary ballot. A Polk County Iowa judge ruled that Rep. Abby Finkenauer (D-Iowa) cannot appear on the June 7 Democratic primary to seek the party’s nomination to take on Sen. Chuck Grassley (R-Iowa) in November. Republicans argued in court that Finkenauer did not have the needed valid signatures on her nomination petition to appear on the ballot. The Iowa Supreme Court will hear arguments Wednesday afternoon and the Iowa Secretary of State’s office told the Des Moines Register the court decision needs to be determined by April 15 so that ballots can be finalized and sent to overseas military members. Finkenauer is considered the front-runner in the field of Democrats seeking to take on Grassley in November.

|

CONGRESS |

— House appropriators target June for fiscal year (FY) 2023 markups. The House Appropriations Committee is tentatively set to markup FY 2023 spending bills in June with potential for the House to act on the measures in July, according to sources cited by CQ Roll Call. The report said Appropriations subcommittees would mark up their measures June 13-22, and full committee markup would take place June 22-30, but the report noted that the schedule is tentative and will not be final until the full panel sends out a notice. The top four members of the House and Senate Appropriations panels are to meet shortly after lawmakers return from their Easter break to open their discussions about getting a bipartisan deal on overall discretionary spending for FY 2023.

|

OTHER ITEMS OF NOTE |

— British Prime Minister Boris Johnson and his finance minister have been fined by police for hosting parties on U.K. government premises during the Covid-19 lockdown. London's Metropolitan Police yesterday said they had issued more than 50 fines as part of their investigation into gatherings held on government premises in Downing Street and Whitehall while the rest of the country was living under strict pandemic restrictions. Revelations of the parties sparked national outrage. The penalty makes Johnson the first sitting U.K. Prime Minister to be found guilty of breaking the law. Late yesterday, Johnson apologized for breaching the lockdown rules, and said that he had paid the fines issued by the Metropolitan Police.