House Ag Panel Invites Top Five Meat Processor CEOs to April 27 Hearing

Some lawmakers push special counsel at USDA re: meat industry competition | Biden to Iowa

|

In Today’s Digital Newspaper |

Ukraine and Russia poured reinforcements into eastern Ukraine to prepare for what are likely to be the war’s biggest battles as refugees fled from the looming Russian assault. Ukrainian President Volodymyr Zelenskyy said his country is "ready" for an offensive, but urged civilians to evacuate the region. In Russia, President Vladimir Putin appointed a new general to direct the war in Ukraine after his troops failed to take the city of Kyiv.

Europe is banning imports of Russian coal but has stopped short of banning oil and gas. An outright ban on Russian fossil fuel imports would be difficult because of the sheer volume of foreign energy Europe relies on.

S&P placed Russia’s government in “selective default” because it repaid debt in rubles instead of dollars.

The House Ag Committee has requested the CEOs from the top five meat packers to appear before the panel on April 27, Pro Farmer has learned. Meanwhile, some lawmakers are pushing for a general counsel at USDA to investigate meat industry competition. On April 26, the Senate Ag Committee will have a hearing on livestock pricing bills.

President Joe Biden will be in Iowa early this week with biofuel proponents hoping he has something to say about year-round E15. Biden is going to Menlo, Iowa, which has an ethanol plant. USDA Secretary will not attend because he recently announced he was infected with Covid-19. Others say the trip may be to talk about the new infrastructure measure and economic agenda to lower costs for workers and families and will tout rural Iowa investments.

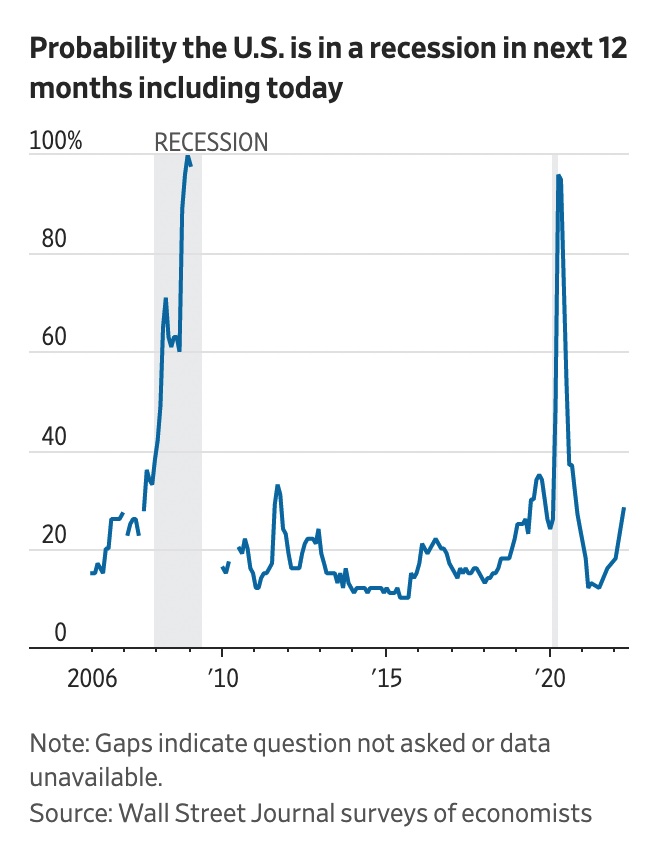

Economists surveyed by WSJ this month on average put the probability of the economy being in recession sometime in the next 12 months at 28%—up from 18% in January and just 13% a year ago—as the relentlessly strong U.S. economy whips up inflation, likely bringing a heavy-handed response from the Federal Reserve. Economists differ on the biggest source of inflationary risk, from commodity, food and gasoline prices to Russia’s war with Ukraine to wage growth or a tight labor market.

Soaring gasoline prices are squeezing transportation businesses and setting off debates about who will pay, the WSJ reports. Details below.

Covid-19 restrictions are weighing heavily for Democratic voters who say their party officials left mandates in place too long, with devastating consequences for their children, while Republicans have generally pushed to minimize school closures and keep the economy open. The defection of once-loyal voters—along with disapproval from independents—is among the challenges Democrats face in their bid to retain control of Congress and win state-level races in November’s midterm elections.

French President Emmanuel Macron and far-right leader Marine Le Pen led the first round of France’s presidential election, according to projections, setting the stage for a closely contested runoff amid public frustration over high inflation and immigration

Elon Musk decided not to join Twitter’s board of directors, a reversal announced late Sunday by Twitter CEO Parag Agrawal.

|

MARKET FOCUS |

Equities today: Global stocks markets were mixed overnight. The U.S. stock indexes are pointed toward lower openings. Asian equities ended with losses with focus on Chinese inflation data. The Nikkei was down 164.28 points, 0.61%, at 26,821.52. The Hang Seng Index fell 663.71 points, 3.03%, at 21,208.30. European equities are mixed in early action, with some losses shifting between losses and gains. The Stoxx 600 was down 0.4% with regional markets up 0.8% to down 0.4%. The week ahead will mark the beginning of the Q1 earnings season, with big banks such as JPMorgan Chase, Goldman Sachs, Citigroup, Morgan Stanley and Wells Fargo reporting first quarter earnings.

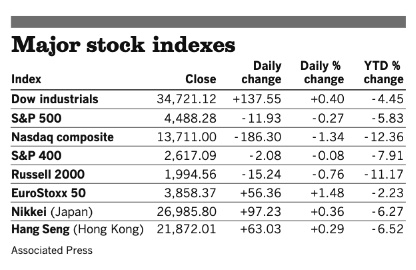

U.S. equities Friday: The Dow rose 137.55 points, 0.40%, at 34,721.55. The Nasdaq fell 186.30 points, 1.34%, at 13,711.80. The S&P 500 declined 11.93 points, 0.27%, at 4,488.28.

The three major stock market indexes posted losses for the week, with the S&P 500 snapping a three-week winning streak that had lifted it to its best performance since 2020, as investors reacted to the Federal Reserve's more aggressive tone in fighting inflation. For the week, the Nasdaq sank 3.6% and the S&P slipped 1.3%, the worst declines for both indexes in a month, while the Dow Jones edged lower by 0.3%.

Commodities had their best quarter in 30 years, rising 29%, as measured by the S&P GSCI benchmark. The gains stemmed from supply-and-demand dislocations created by the Covid pandemic, with supply chains further disrupted by the war in Ukraine and Western sanctions on Russia.

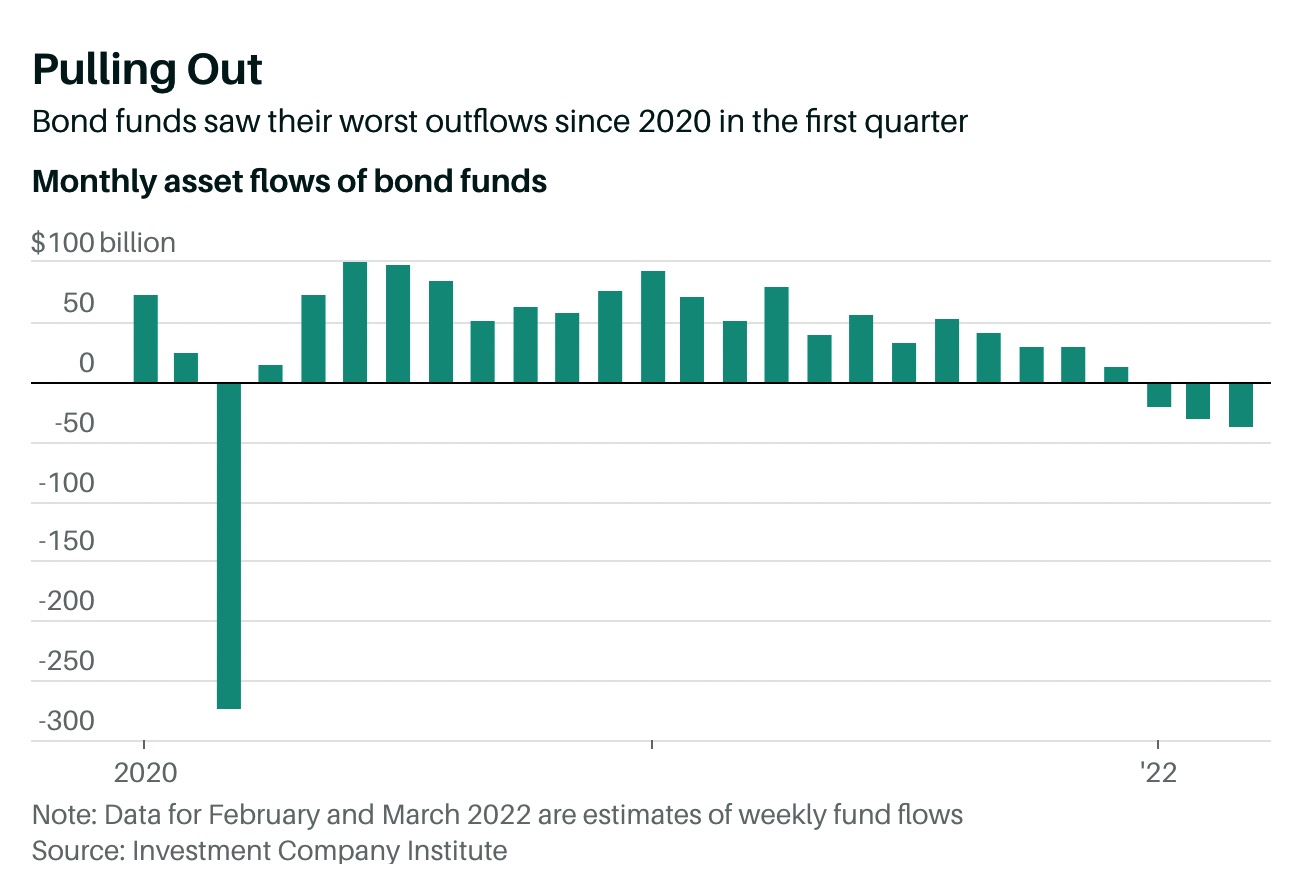

Bonds have logged losses this year. Investors pulled $87 billion from bond mutual funds and ETFs in the first three months of 2022, according to the Investment Company Institute, marking the biggest outflows since the first quarter of 2020.

Mortgage rates are now approaching 5% and could continue to climb along with longer-term Treasury bonds. The 10-year Treasury yield spiked to about 2.7% the past week, the highest level since March 2019.

Agriculture markets Friday:

- Corn: May corn futures rose 11 cents to $7.68 3/4, up 33 3/4 cents for the week and a lifetime-high close for the contract. December corn rose 7 cents to $7.16 after scoring a contract high for the third day during the week.

- Soy complex: May soybeans soared 43 1/2 cents to $16.89, up $1.06 1/4 for the week and the contract’s highest close since March 25. November soybeans gained 29 1/4 cents to $14.95 1/2, a two-week high. May soymeal rallied $8 to $468.20 per ton and May soyoil rose 210 points to 75.12 cents per pound.

- Wheat: May SRW wheat rose 31 1/2 cents to $10.51 1/2, up 65 cents for the week. May HRW wheat rose 36 cents to $11.06 3/4, up 93 3/4 cents for the week. May spring wheat advanced 27 3/4 cents to $11.27 1/4, up 62 cents for the week.

- Cotton: May cotton futures fell 79 points to 132.41 cents per pound, down 214 points for the week. New-crop December rose 79 points to 115.48 cents.

- Cattle: April live cattle fell 17.5 cents to $137.825, down 82.5 cents on the week. June live cattle fell 27.5 cents to $133.825, down $2.025 for the week. May feeder futures sagged 10 cents to $159.375, down $6.75 for the week.

- Hogs: June lean hog futures rose 42 1/2 cents to $114.575, down $5.875 for the week. April hogs fell 2.5 cents to $99.025.

Ag markets today: Wheat and corn futures were supported by solid followthrough buying from last week’s gains in overnight trade, while soybeans weakened. As of 7:30 a.m. ET, winter wheat futures were mostly 10 to 13 cents higher, spring wheat is mostly 8 to 12 cents higher, corn was 4 to 6 cents higher and soybeans were 2 to 6 cents lower. Front-month U.S. crude oil futures were down more than $4 and the U.S. dollar index was just above unchanged.

Technical viewpoints from Jim Wyckoff: “The U.S. data point of the week comes Tuesday with the consumer price index report for March, which is expected to come in hot at up 8.4%, year-on-year.”

On tap today:

• Fed Speakers: Atlanta Fed president Raphael Bostic and governors Michelle Bowman and Christopher Waller speak at a Fed Listens event at 9:30 a.m. ET; Chicago Fed president Charles Evans speaks at a Detroit Economic Club event at 11:30 a.m. ET and New York Fed president John Williams moderates a panel at noon ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• USDA Crop Production Historical Track Records report, 3 p.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

Fed’s Mester sees U.S. inflation rate at more than 2% into 2023. Federal Reserve Bank of Cleveland President Loretta Mester said she’s confident that the U.S. will avoid a recession as the Fed tightens policy, though the inflation rate will probably remain at more than 2% into next year. “I think that it will take some time to get inflation down,” Mester said on CBS’s Face the Nation, citing rising energy and commodity prices. “So, I think inflation will remain above 2% this year and even next year, but the trajectory will be that it’ll be moving down.” China’s attempts to stamp out Covid-19 are also contributing, Mester said. “Certainly, the lockdown in China is going to exacerbate the problems that we have in supply chains,” she said. “So that is putting upward pressure on prices.”

Mester said that while there’s an increased risk of recession, she’s “optimistic that we’ll be able to remove monetary-policy accommodation and maintain good labor-market conditions and the expansion… It’ll be challenging, but we can do it,” she said. With wages failing to keep up with prices for many U.S. families, the Fed will use its policy tools to ensure that inflation doesn’t become “embedded in the economy,” Mester said.

WSJ survey: Recession risk is rising, economists say. Economists see a growing risk of recession as the strong U.S. economy whips up inflation, likely bringing a heavy-handed response from the Federal Reserve. Economists surveyed by the Wall Street Journal this month (link) on average put the probability of the economy being in recession sometime in the next 12 months at 28%, up from 18% in January and just 13% a year ago. Forecasters raise probability of economic contraction in next 12 months to 28% as the Fed tightens to beat back inflation.

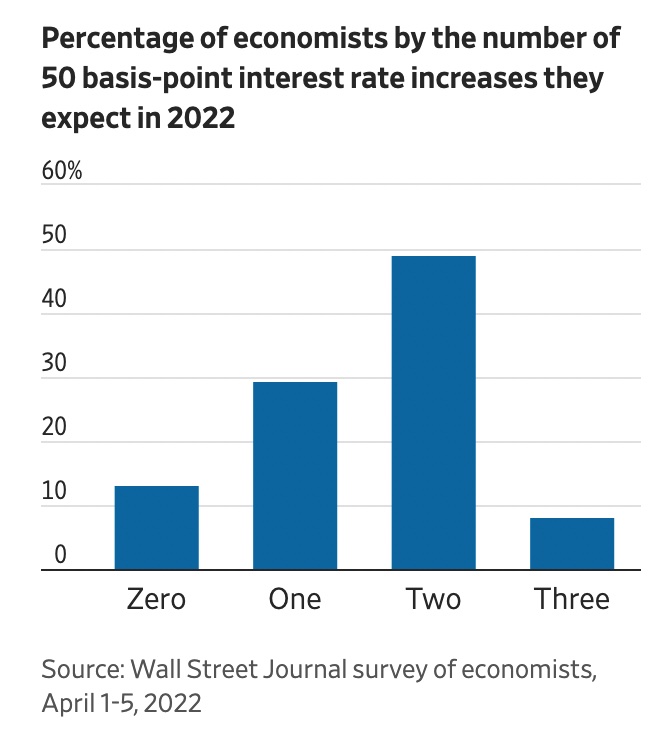

Some 84% of economists surveyed said they expect the Fed to raise rates by a half-point in early May. More than 57% see two or more such increases through the end of 2022.

27% of respondents pointed to wage growth or a tight labor market as the biggest inflationary threat.

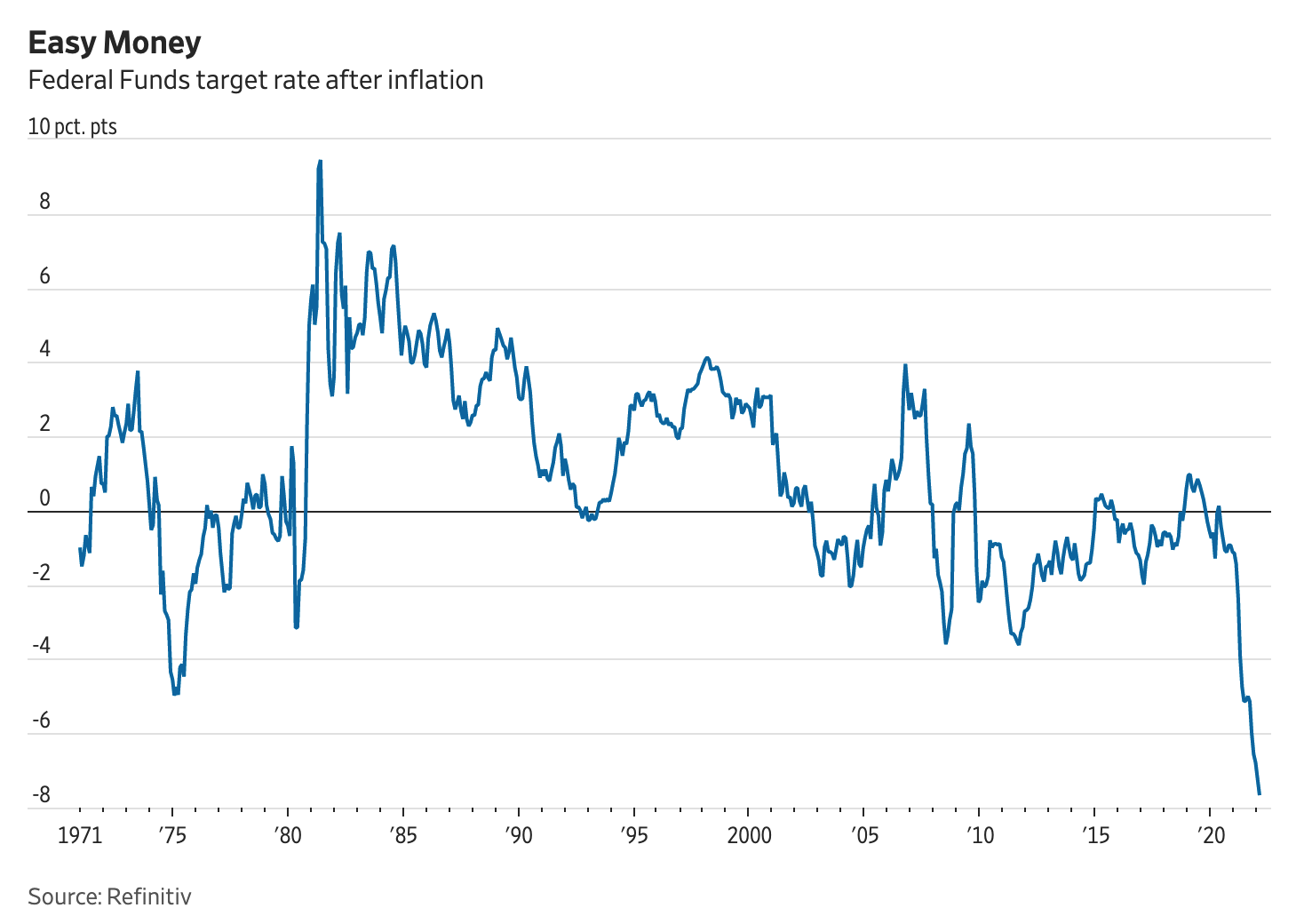

Inflation and Fed interest rate and QT perspective: During the 1980s, interest rates were on average more than 4 percentage points higher than inflation. The Fed Funds target rate now is an extraordinary 7 percentage points below inflation. Also: The last time the Fed conducted quantitative tightening (QT), it waited two years after interest-rate liftoff to shrink its balance sheet. Its newly suggested plan would amount to double policy tightening — something some investors might be missing, say some analysts. Traders are pricing in 80% odds of a half-point rise in May and a 50% chance of another in June, according to CME data. Fed Chairman Jerome Powell earlier this year said, “I think we have a much better sense, frankly, of how rate increases affect financial conditions and, hence, economic conditions. [The] balance sheet is still a relatively new thing for the markets and for us, so we’re less certain about that.” The Fed signaled that it would let its balance sheet run down by $60 billion in Treasuries and $35 billion in mortgage-backed securities a month, ramping up to that pace over three months. It will let these maturing securities roll off, instead of reinvesting the proceeds.

Inflation numbers coming this Tuesday and Wednesday. The Consumer Price Index for March will be released Tuesday morning. Economists are forecasting that the CPI numbers will show prices rose at an 8.3% clip over the past 12 months, according to Reuters. That would be up from February's year-over-year increase of 7.9%, which was a 40-year high.

Inflation is even more problematic at the wholesale level. The government's Producer Price Index, out Wednesday, measures prices for raw goods sold to businesses. It surged 10% in the 12 months ending in February. The PPI is expected to jump 10.5% year over year on a nonseasonally adjusted basis, while the core PPI, which excludes volatile food and energy prices, is seen rising 8.4%. This compares with increases of 10% and 8.4%, respectively, in February.

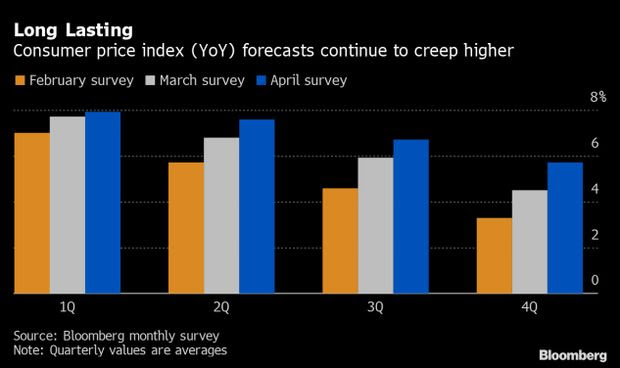

Bloomberg survey: economists boost inflation expectations in worrying sign for Fed. Economists have boosted their U.S. inflation forecasts — again — and downgraded expectations for economic growth through most of 2023, underscoring growing risks to the outlook as the Federal Reserve tries to curb the fastest price growth in decades. The consumer price index will now average 5.7% in the final three months of the year, up from the 4.5% estimated a month ago, according to the median forecast of 72 economists in a Bloomberg survey. The chance of a recession over the next year also increased to 27.5% from 20% in March. The March CPI report will be released Tuesday.

Summers on recession. Former Treasury Secretary Lawrence Summers predicted that the consensus among economists will increasingly fall in line with the U.S. tipping into a recession next year. Summers also highlighted that the U.S. has never experienced inflation above 4% and unemployment below 4% without that being followed by an economic slump within two years. Last month, consumer prices are estimated to have surged more than 8%, while the jobless rate was 3.6%.

Rising food costs push Arab world’s anxiety. Global foods costs are up more than 50% from mid 2020 to a record and households worldwide are trying to cope with the strains on their budgets. The Middle East and North Africa region’s net food and energy importers are especially vulnerable to shocks to commodity markets and supply chains resulting from Russia’s war on Ukraine, according to the International Monetary Fund. That’s in countries where the rising cost of living helped trigger the Arab Spring uprisings a little over a decade ago. Governments in Egypt, Morocco and Tunisia are struggling to maintain subsidies for food and fuel that have helped keep a lid on discontent. The World Food Program has warned that people’s resilience is at “breaking point,” while the United Arab Emirates moved to help ally Egypt, the world’s largest buyer of wheat, to shore up its food security and ward off potential instability. Egypt is also seeking IMF help. Egypt has banned exports of key foodstuffs including flour, lentils and wheat.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer ahead of US trading, with a mixed tone in global currencies versus the greenback. The U.S. 10-year Treasury note yield has moved up to trade around 2.75% amid a higher tone in global government bond yields. Gold and silver futures are seeing solid buying interest, with gold atop $1,960 per troy ounce and silver above $25.30 per troy ounce.

• Crude oil futures are under pressure ahead of U.S. market action with U.S. crude around $94 per barrel and Brent around $98.75 per barrel.

• The number of oil and gas rigs operating in the U.S. significantly increased this past week, data from oil and gas services Baker Hughes showed on Friday. The number of oil rigs grew by 13, including 9 added in the Permian Basin, to 546. The number of natural gas rigs rose by three to 141. The increase in the rig count suggests that energy producers are responding to sharply higher prices and a decrease in supply related to a ban on Russian energy imports.

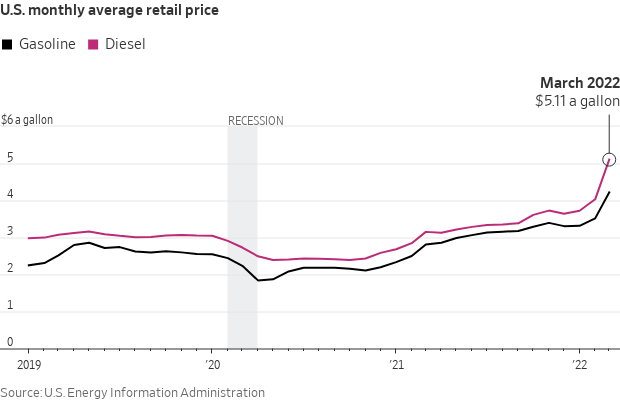

• Soaring gas prices are squeezing transportation businesses and setting off debates about who will cover the higher costs, the WSJ reports (link). Firms such as FedEx Corp., Uber Technologies Inc. and Lyft Inc. have imposed new or higher fuel surcharges but drivers and local contractors say that’s not enough. The war in Ukraine and the sanctions on Russia have raised gas prices around the world. The national average price for a gallon of regular gasoline in the U.S. rose 20% in March from February.

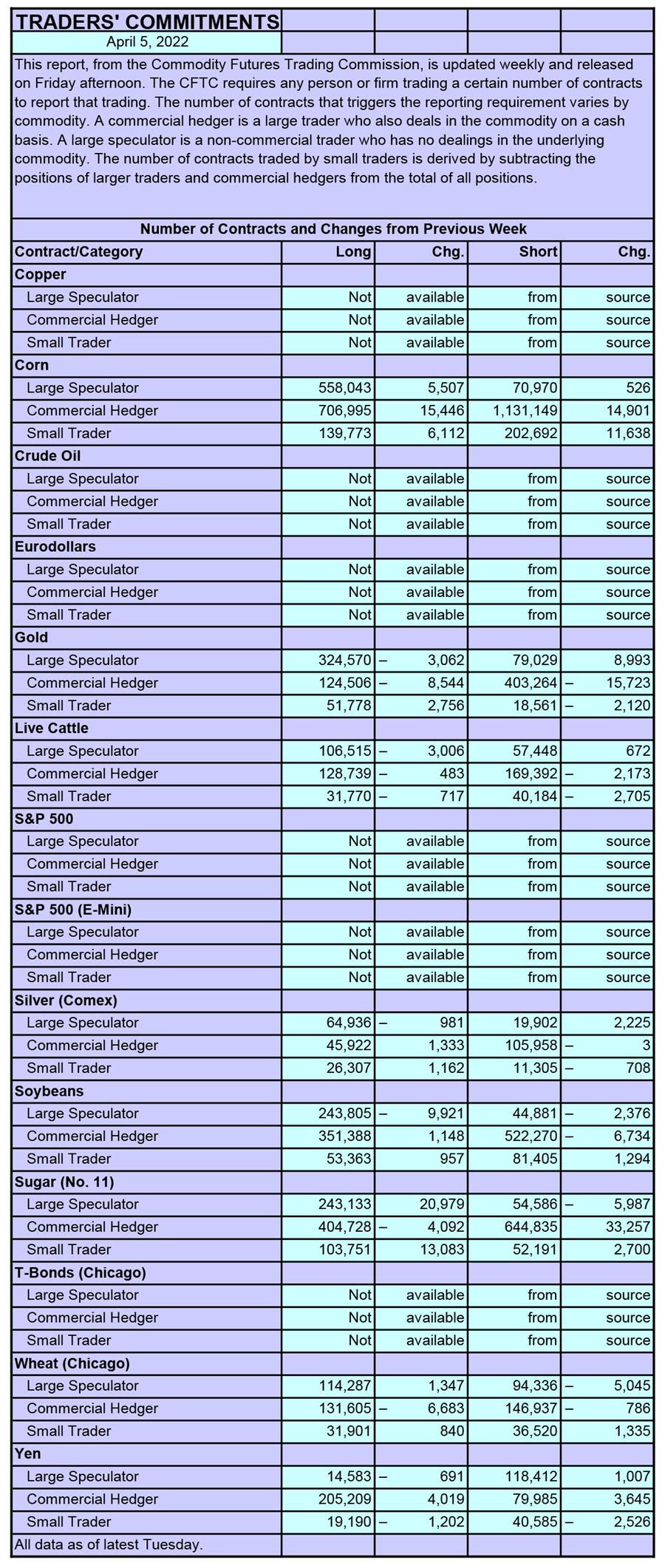

• CFTC Commitments of Traders report (Source: Barron’s):

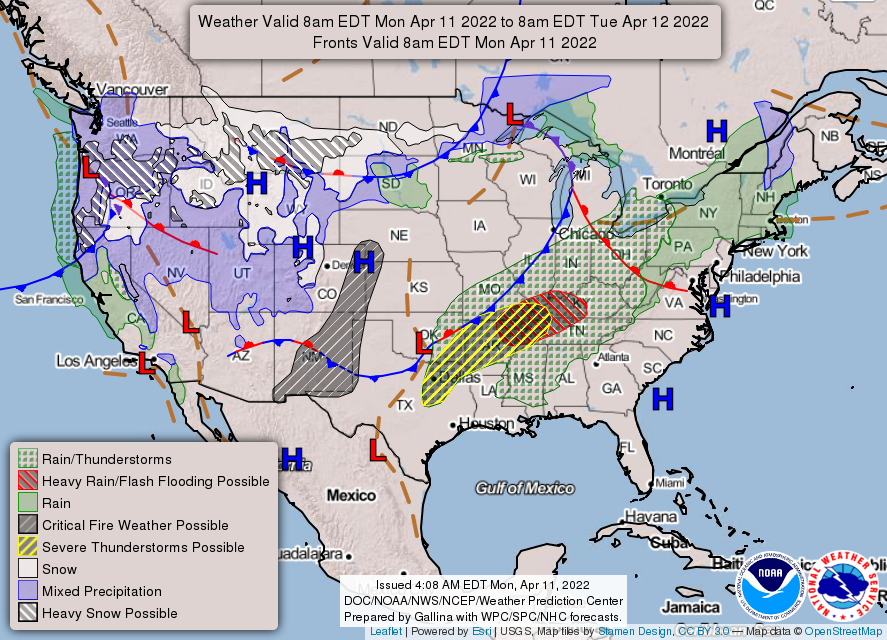

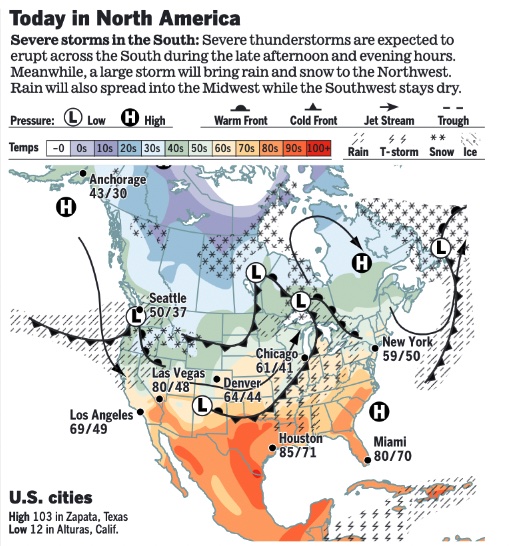

• NWS weather: There is a critical to extreme threat for fire weather over a large portion of the Southwest and the Central/Southern High Plains into next week... ...A major late-season winter storm will begin to impact the West by tonight with strong winds, heavy rain, and heavy mountain snow... ...Severe weather and Flash Flooding are expected to begin impacting areas of the Southern Plains and the lower-to-middle Mississippi Valley by this afternoon.

Items in Pro Farmer's First Thing Today include:

• Wheat and corn firmer, soybeans weaker to open the week

• Ukraine’s grain harvest, exports to fall sharply (details in Russia/Ukraine section)

• China’s new bank loans jump in March

• Kazakhstan wheat, flour export restrictions to start Friday

• Strong demand at Chinese wheat auction

• Another week of flat cash cattle prices?

• Cash hog index continues to decline

|

RUSSIA/UKRAINE |

— Summary: Ukraine and Russia poured reinforcements into eastern Ukraine to prepare for what are likely to be the war’s biggest battles as refugees fled from the looming Russian assault. Russia lost a colonel, yet another death of a high-ranking military official roughly six weeks into the country's invasion of Ukraine. Russia named a new battlefield leader in Ukraine, Gen. Aleksandr V. Dvornikov. He has been accused of ordering strikes on residential neighborhoods in Syria. Russia’s new strategy: Uncontested control of eastern Ukraine, from the Donbas region, south to Odesa on Ukraine’s Black Sea coast and connecting with Crimea. That would make Ukraine a land-locked country with massive implications for its future grain and oilseed exports. Russian forces stepped up shelling in eastern Ukraine, while residents sought to flee the region. Slovakia gave its S-300 air-defense system to Ukraine, following entreaties by Ukraine President Volodymyr Zelenskyy for more Western military equipment. In response the Biden administration said it would deploy a Patriot missile-defense system to Slovakia, to be operated by American soldiers. Earlier the Czech Republic sent Soviet-made tanks to Ukraine and Britain promised an additional £100m worth of “high-grade military equipment.” Meanwhile, nine evacuation corridors have been agreed upon in southern and eastern Ukraine, Ukraine’s deputy prime minister said Sunday, two days after a Russian missile strike on a train station killed at least 50 people.

- Ukraine into EU? Ursula von der Leyen, the president of the European Commission, promised a quick response to Ukraine’s bid to join the EU. During a visit to Kyiv on Friday, she told Zelenskyy that a decision on Ukraine’s membership would come in a “matter of weeks.”

- EU countries disagree over Russian energy ban. Ursula von der Leyen, European commission president, has pledged to work on oil sanctions, while Josep Borrell, the EU’s chief diplomat, said of a crude embargo: “Sooner or later . . . it will happen.” But Viktor Orban’s government in Hungary, which has strong ties with President Vladimir Putin’s regime, has said measures targeting Russia’s lucrative oil and gas exports were a “red line.” This is essentially a veto on a measure that requires unanimity among the 27 member states. Olaf Scholz, German chancellor, said last week that his country was working actively to wean itself from Russian oil this year. Reports note that Berlin could implement a Russian oil embargo, but probably only by the end of this year or the beginning of 2023. The EU relies on Russia for around 25% of its oil imports, with some member states’ (such as Germany’s) dependency far higher.

— Market impacts:

- Ukraine economy to fall 45% in 2022, Russia 11%: World Bank. President Vladimir Putin’s invasion of Ukraine will cause that country’s economy to contract by almost half — or 45.1% — this year, while Russia’s will shrink by 11.2%, according to the World Bank. Emerging market and developing economies in Europe and Central Asia are projected to decline by a combined 4.1% this year, twice the drop triggered by the onset of the Covid-19 pandemic in 2020, the World Bank said in its spring forecasts published on Sunday.

- Ukraine’s grain harvest, exports to fall sharply. Ukraine’s grain traders’ union UGA expects wheat production to plunge around 45% to 18.2 MMT and corn output to fall 38% to 23.1 MMT this year due to fallout from the war with Russia. UGA expects the country to export 10 MMT of wheat and 20 MMT of corn in 2022-23. UGA says the country is currently able to export 600,000 MT of grains and oilseeds per month, though that capacity could increase to 2 MMT. Before the war with Russia, Ukraine could export up to 6 MMT of grains and oilseeds per month.

- EU and Russia energy facts and figures. According to Ben McWilliams, analyst at Brussels-based think tank Bruegel, the EU was importing around 800 million euros a day, equivalent to $870 million, in energy from Russia in November, comprising 400 million euros of gas, 380 million euros of oil and 20 million euros of coal. In November, the EU purchased 2.7 million barrels a day in Russian crude oil and 1.1 million barrels a day in other oil products. Russia, the world’s third largest oil producer, provided about a quarter of the EU’s oil imports in the first half of 2021, according to the EU’s statistics agency. That accounted for roughly half Russia’s oil exports.

- Ukraine has already lost at least $1.5 billion in grain exports since the war began, the country’s deputy agriculture minister said recently. The New York Times reports (link) that in Ukraine, warehouses are filled with grain that cannot be exported. Russia has blocked access to the Black Sea, Ukraine’s main export route, cargo trains face logistical hurdles, and trucking is stymied because most truck drivers are men aged 18 to 60 who are not allowed to leave the country and cannot drive agricultural exports across the border. Ukraine has also banned some grain exports to ensure that it has enough food to feed its people. Last Tuesday, the Agriculture Ministry said that six large granaries had been destroyed by Russian shelling. Farmers say they face shortages of fuel and fertilizer, and that some of their workers have gone to the battlefield. Farmland covers 70% of the country and agricultural products were Ukraine’s top export, making up nearly 10% of its gross domestic product. Ukraine was one of the world’s main exporters of corn and wheat and the biggest exporter of sunflower oil. The country now has 13 million tons of соrn and 3.8 million tons of wheat that it cannot export using its usual routes, primarily by sea, the deputy agriculture minister, Taras Vysotsky, said last week.

Farmers also worry whether they will be able to sow crops this spring, putting next season’s crops at risk. On Thursday, Ukraine’s prime minister, Denis Shmygal, said that the government expected a 20% decrease in crops to be sown this spring. Russian forces have mined some farmland, blown up machines and destroyed fuel reserves, an effort, Ukrainian authorities say, to disrupt planting. A government survey last month found that farmers had 20% of the fuel needed for the spring sowing. The Ukrainian government has temporarily exempted agriculture workers from military duties, but some have chosen to fight.

|

POLICY UPDATE |

— White House to blunt medical debt costs for vets, home borrowers. Vice President Kamala Harris will announce new steps designed to reduce the cost of federal home loans for Americans saddled with medical debt and make it easier for veterans to have loans forgiven, as part of a White House push to help the millions facing unpaid health care bills. The efforts will include a push within the federal government to stop considering medical debt when determining eligibility for grants and loans — including in programs like USDA’s $20 billion rural housing program. Because the government won’t consider how much applicants owe in medical expenses, those in debt should receive more favorable terms on loans to buy or build new homes.

|

CHINA UPDATE |

‑— China's producer inflation surging. China's producer inflation for March was higher than expected. The producer price index surged 8.3% as compared with a year ago, official data showed Monday, above expectations for a 7.9% increase in a Reuters poll. Chinese consumer inflation also rose more than expected in March, with the consumer price index climbing 1.5% year-on-year. That was above expectations in a Reuters poll for a 1.2% increase.

— China farming and seed firms gain after President Xi Jinping stressed the importance of the seed industry for grain security. Seeds are the key to China’s food security, and the country must have independently controlled seed sources and self-reliant technology, Xi said during a trip to a Sanya seed lab in Hainan province, according to a Xinhua report. Denghai Seeds, Zhongnongfa Seed Industry and Gansu Dunhuang all rose by as much as their 10% daily limit; Hainan Shennong Tech up by 20% limit in Shenzhen; Winall Hi-Tech Seed +16%, Jinjian Cereals +8.5%, Yuan Longping High-tech Agriculture +8.8%.

— China’s new bank loans jump in March. Chinese banks extended 3.13 trillion yuan ($492 billion) in new yuan loans in March, up sharply from February and exceeding analyst expectations. That pushed bank lending in the first quarter to a record 8.34 trillion yuan, up 8.7% from 7.67 trillion yuan in the first quarter of 2021, which was the previous record.

— China is accelerating its nuclear buildup over rising fears of a conflict with the U.S., the Wall Street Journal reports (link). China has stepped up an expansion of its nuclear arsenal because of a change in its assessment of the threat posed by the U.S., people with knowledge of the Chinese leadership’s thinking told the WSJ, shedding new light on a buildup that is raising tension between the two countries. The Chinese nuclear effort long predates Russia’s invasion of Ukraine, but the U.S.’s wariness about getting directly involved in the war there has likely reinforced Beijing’s decision to put greater emphasis on developing nuclear weapons as a deterrent, some of these people say. Chinese leaders see a stronger nuclear arsenal to deter the U.S. from getting directly involved in a potential conflict over Taiwan. Work has accelerated this year on more than 100 suspected missile silos in China’s remote western region that could be used to house nuclear-tipped missiles capable of reaching the U.S., according to analysts that study satellite images of the area.

— China is defending its virus measures after the U.S. encouraged Americans to reconsider traveling to China. The State Department recommended avoiding virus hotspots, including Shanghai, due to what it calls an “arbitrary enforcement” of Covid restrictions, and allowed non-emergency employees and their family members to leave its Shanghai consulate. Cases continue to rise in the city, with nearly 25,000 new infections on Saturday, despite lockdowns.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— House Ag Committee has requested the CEOs from the top five meat packers to appear before the panel on April 27, Pro Farmer has learned. They will reportedly be sworn in before making comments and the panel will take “other measures” if the CEOs say they will not attend, contacts advise.

Meanwhile, some lawmakers are pushing for a general counsel at USDA to investigate meat industry competition. On April 26, the Senate Ag Committee will have a hearing on livestock pricing bills.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 498,154,313 with 6,176,420 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,399,474 with 985,482 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 565,598,011 doses administered, 218,377,792 have been fully vaccinated, or 66.53% of the U.S. population.

— GOP renews calls to end mask mandate. The top Republican lawmakers on committees that oversee transportation last Friday renewed their calls asking President Joe Biden in a letter to rescind or not extend the mask mandate, which expires April 18 despite signs of an uptick in Covid-19 cases. Travel groups have also been pushing for the mandate to end.

— Apple says corporate staff must return to the office starting today (April 11), working there three days a week by May 23.

— Saudi Arabia will allow one million Muslims to travel to Mecca this year for the hajj, as long as they are vaccinated and under 65, and test negative.

|

POLITICS & ELECTIONS |

— Pakistan's Prime Minister Imran Khan has been ousted as the country's leader following a vote of no-confidence over allegations of economic mismanagement, bringing an end to his tumultuous term in office.

— Emmanuel Macron to face Marine Le Pen in French election run-off; President and far-right rival qualify for second round of voting on April 24. Macron got around 27% of the vote compared with about 24% for Le Pen, according to interior ministry figures based on 96% of registered voters counted. Turnout was reportedly 4% lower than the 2017 election.

— Australia’s prime minister has called for an election to be held on May 21, with China, climate change and the pandemic likely to be big issues, the Associated Press reports. The opposition Labor Party, headed by Anthony Albanese, is currently favored to win — as they were in 2018 when Morrison defied the polls to score an upset victory. Morrison has framed the choice as one “between a government you know and a Labor opposition that you don’t.”

|

OTHER ITEMS OF NOTE |

— The Iran deal. Iranian lawmakers on Sunday announced conditions under which the 2015 nuclear should be revived, including a call for guarantees, approved by the U.S. Congress, that the U.S. would not leave the deal and that the U.S. government would not “use pretexts to trigger the snapback mechanism” on sanctions. The demands were made in a letter signed by 250 of 290 Iranian lawmakers and came as Foreign Minister Hossein Amir-Abdollahian called on President Joe Biden to lift some sanctions via executive order as a sign of goodwill.

— A massive migrant surge is likely to occur at the U.S./Mexico border next month. On May 23, the Biden administration is set to lift a Trump-era border policy that cited pandemic concerns to justify denying people entry to the U.S. President Joe Biden and the CDC have determined the restriction is no longer necessary —- but once it's repealed, up to 60,000 people could seek entry within hours, a federal law enforcement official said.

— Elon Musk decided not to join Twitter’s board of directors, a reversal that cast new uncertainty over the relationship between the social-media platform and its largest shareholder. If he is not on Twitter’s board, Musk is not bound by the “standstill” agreement in which he pledged to buy no more than 14.9% of Twitter’s stock. Recall that Musk initially disclosed his stake in a filing that suggested he was a passive investor in Twitter, but later refiled with the form that activist investors use.

— Cranes are known for being monogamous, but… sometimes crane couples will bring in a third bird. Link for details.