Congress Out, as Inflation Reports and Russia/Ukraine War Remain Key Focus

New U.S. gun regulations coming | Vilsack tested Covid-positive

Washington Focus

Both the House and Senate are on their two-week Easter recess, with several lawmakers going on international trips.

The focus continues on Russia’s war with Ukraine and the escalating sanctions being put on them by the U.S. and its western allies. Russia lost a colonel, yet another death of a high-ranking military official roughly six weeks into the country's invasion of Ukraine. Russia named a new battlefield leader in Ukraine, Gen. Aleksandr V. Dvornikov. He has been accused of ordering strikes on residential neighborhoods in Syria.

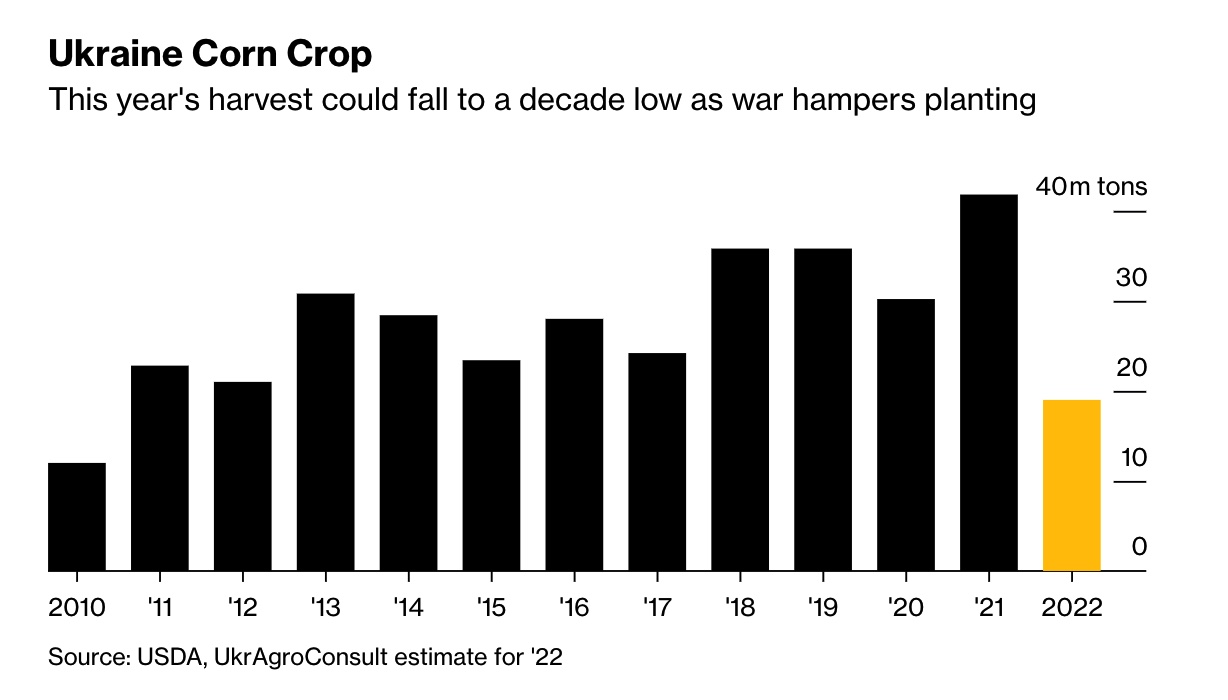

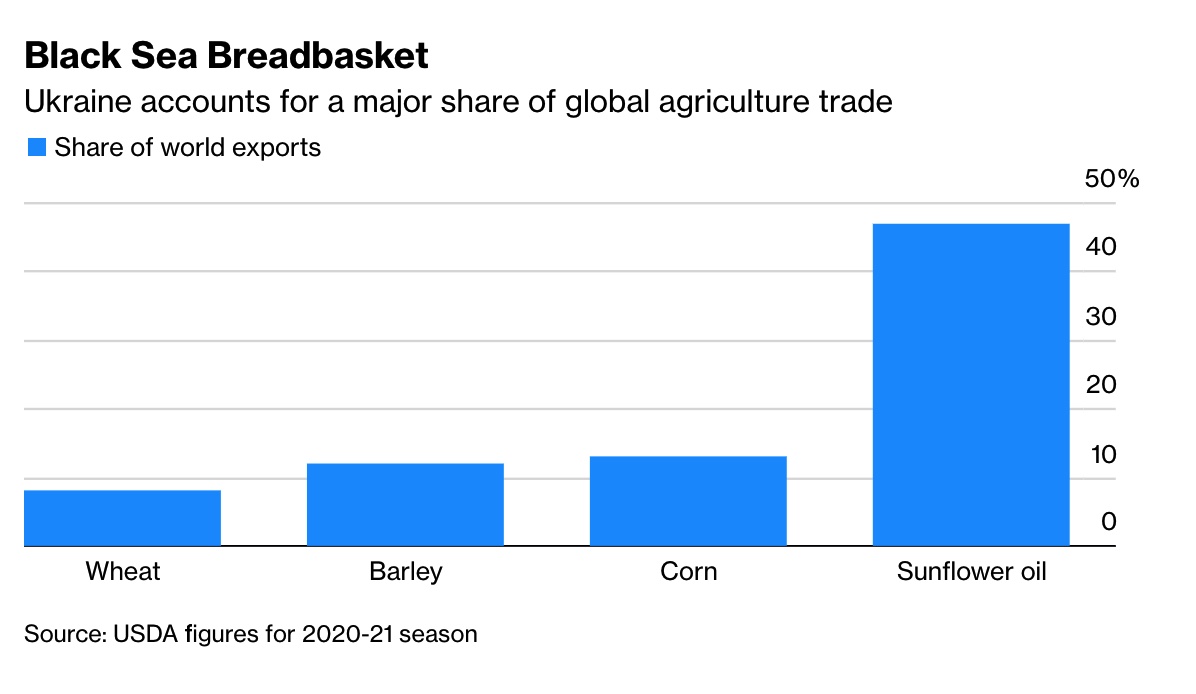

Russia’s new strategy: Uncontested control of eastern Ukraine, from the Donbas region, south to Odesa on Ukraine’s Black Sea coast and connecting with Crimea. That would make Ukraine a land-locked country with massive implications for its future grain and oilseed exports. Russian forces stepped up shelling in eastern Ukraine, while residents sought to flee the region. Slovakia gave its S-300 air-defense system to Ukraine, following entreaties by Ukraine President Volodymyr Zelenskyy for more Western military equipment. In response the Biden administration said it would deploy a Patriot missile-defense system to Slovakia, to be operated by American soldiers. Earlier the Czech Republic sent Soviet-made tanks to Ukraine and Britain promised an additional £100 million ($130.3 million) worth of “high-grade military equipment.” Meanwhile, nine evacuation corridors have been agreed upon in southern and eastern Ukraine, Ukraine’s deputy prime minister said Sunday, two days after a Russian missile strike on a train station killed at least 50 people.

Austrian Chancellor Karl Nehammer plans to meet Russian President Vladimir Putin on Monday, two days after visiting Kyiv. The impact of the war will shrink Ukraine’s economy by 45% this year, while Russia’s will contract by 11%, the World Bank projects.

The ag market focus has been on the growing food price escalation in the U.S. and around the world, and some of its major reasons: supply-chain and logistics’ snafus (extended in part as China copes with surging Covid-19 cases), soaring gasoline, diesel fuel and fertilizer prices, the war in Ukraine and collectively the impacts on crop plantings around the world but especially in Ukraine.

The war in Ukraine has triggered an alarming global surge in gov’t controls on the export of food. It’s critical for policymakers to halt the trend, which is making a global food crisis more likely, according to David Malpass president of the World Bank Group. Writing in Barron’s (link), Malpass says, “In the space of a few weeks, the number of countries slapping on food-export restrictions jumped by 25%, bringing the total number of countries to 35. By the end of March, 53 new policy interventions affecting food trade had been imposed — of which 31 restricted exports, and nine involved curbs on wheat exports, according to the latest data. History shows that such restrictions are counterproductive in the most tragic ways. A decade ago, most notably, they exacerbated the global food crisis, driving up wheat prices by a whopping 30%.”

Wheat in focus. Malpass details that export and import controls currently encompass about 21% of world trade in wheat — well below the 74% share at the peak of the 2008-2011 crisis. “But conditions are ripe for a retaliatory cycle in which the scale of restrictions could grow rapidly.” (Source of charts below: Bloomberg)

USDA Sec. Tom Vilsack tested Covid-positive, joining other recent Biden administration officials infected with the virus. Vilsack, 71, said he tested positive for Covid-19 and experienced mild symptoms on Friday, his office said in a statement. “I tested positive for Covid. I’m both vaccinated and boosted and thankfully my symptoms are mild. If you have yet to get vaccinated and boosted, please don’t wait,” Vilsack Tweeted.

The government of Mexico, where Vilsack met officials on Monday and Tuesday, has been informed out of “an abundance of caution,” though he tested negative upon his departure and return, according to his office. Other positive cases the past week include Attorney General Merrick Garland and Commerce Secretary Gina Raimondo. House Speaker Nancy Pelosi (D-Calif.) tested positive on Thursday, a day after joining President Joe Biden and other lawmakers for a bill signing at the White House.

Inflation continues as a hot topic. Mainland China, France, Germany, India, Japan, the U.K. and the U.S. will all be updating markets on cost of living rises with either consumer price index or producer price index reports, or both — some U.S. details in Economic Reports section below.

New U.S. gun regulations coming. President Joe Biden is expected to announce new firearm regulations as soon as Monday meant to contain the use of privately made weapons, people familiar with the matter told CNN. Biden has come under pressure to take more steps to address gun violence.

Events on Tap This Week

Monday, April 11

• Federal Reserve: Fed Governor Michelle Bowman delivers opening remarks at a Fed Listens session in Nashville, Tennessee. Atlanta Fed President Raphael Bostic, New York Fed President John Williams, and Chicago Fed President Charles Evans scheduled to speak.

• Russian invasion of Ukraine: Food security implications. German Marshall Fund of the United States virtual discussion on “The War in Ukraine and Implications for Global Food Security.”

• Russian invasion of Ukraine: Impact on Turkey. Carnegie Endowment for International Peace virtual discussion on “Caught in the Middle: Turkey's Position Amidst Russia's War on Ukraine.”

• Taiwan issues. Atlantic Council virtual discussion on “Democracy under siege: What does the Ukraine crisis mean for Taiwan?”

• Foreign affairs. George Washington University discussion with Assistant Secretary of State for African Affairs Molly Phee.

• Rural health issues. Health Resources and Services teleconference of the National Advisory Committee on Rural Health and Human Services; through Wednesday.

• Clinton Foundation. Clinton Foundation virtual 2022 Clinton Global Initiative University meeting, with Former President Bill Clinton; former Secretary of State Hillary Clinton; and first lady Jill Biden to deliver remarks; runs through Wednesday.

• Brazilian elections. Atlantic Council virtual discussion on “Brazil's Choice in 2022.”

Tuesday, April 12

• Federal Reserve. Fed Governor Lael Brainard to discuss the economy at the Wall Street Journal Jobs Summit. Richmond Fed President Thomas Barkin scheduled to speak.

• Agriculture carbon markets. Farm Foundation virtual discussion “Solving the Barriers to Agricultural Carbon Markets.”

• Climate, agriculture and food security. American Enterprise Institute for Public Policy Research forum on “Climate change, agriculture, food security, and policy.”

• Russian invasion of Ukraine: Impacts on Eurasia. Center for Strategic and International Studies virtual discussion on “The War in Ukraine: Geopolitical Implications for Eurasia.”

• Russian invasion of Ukraine: Nuclear weapons. Foreign Policy virtual discussion on “Would Putin Use Nuclear Weapons?”

• Global economic prospects. Peterson Institute for International Economics virtual discussion on “Global Economic Prospects: Spring 2022.”

• China/EU relations. Carnegie Endowment for International Peace virtual discussion on “China/U.S. Relations Amid the Ukraine Crisis.”

• China/Latin America. Inter-American Dialogue virtual discussion on “China/Latin America Economic Update.”

• Biden Middle East policy. Middle East Institute virtual discussion on “U.S./Middle East policy under the Biden administration,” as part of the Defense Leadership series.

• Rural health issues. Health Resources and Services Administration teleconference of the National Advisory Committee on Rural Health and Human Services, including a discussion on Access to Emergency Medical Services in Rural America; runs through Wednesday.

• Jobs market. The Hill virtual “Future of Jobs” summit on “the evolving, long-term inclusive American workforce of tomorrow.”

• SEC climate disclosure rule. Ceres webinar on the “SEC (Securities and Exchange Commission) Climate Disclosure Rule.”

Wednesday, April 13

• Russian invasion of Ukraine: Ukraine economy. Peterson Institute for International Economics virtual discussion on “Ukraine's wartime economy and resilient financial system.”

• Russian invasion of Ukraine: Tech exports to Russia. The German Marshall Fund of the United States Digital Innovation and Democracy Initiative virtual discussion on “Export Controls on Cutting-Edge Technology to Russia.”

• Russian invasion of Ukraine: Global food and other supply chains. Woodrow Wilson Center's Environmental Change and Security Program virtual discussion on “System Shock: Russia's War and Global Food, Energy, and Mineral Supply Chains.”

• Russian invasion of Ukraine: Financial issues. Center for Global Development virtual discussion on “The War in Ukraine, Global Liquidity, and Latin America: A Conversation with Central Bank Governors.”

• USAID meeting. Agency For International Development virtual meeting of the Partnership for Peace Fund Advisory Board.

• Nuclear power in China. Woodrow Wilson Center's China Environment Forum virtual discussion on “Dark Horse Contender for Decarbonization: Nuclear Power in China.”

• Automation issues. Bloomberg Live virtual forum on “Intelligent Automation: Creating the Workforce of The Future.”

• Global economy. Atlantic Council discussion on “the future of the global economy and U.S. economic leadership.”

• Afghanistan. United States Institute of Peace virtual discussion on “The State of Afghanistan's Economy and Private Sector: What can be done to alleviate the ongoing crisis?”

• Rural health issues. Final day of the Health Resources and Services Administration teleconference of the National Advisory Committee on Rural Health and Human Services

• Climate change. Environmental and Energy Study Institute virtual discussion on “Living with Climate Change: The Polar Vortex — Anticipating Threats and Building Preparedness.”

• Clinton Foundation. Final day of Clinton Foundation virtual 2022 Clinton Global Initiative University meeting.

• Covid response. Federal Emergency Management Agency meeting under the Pandemic Response Voluntary Agreement Under Section 708 of the Defense Production Act to establish a national strategy for the coordination of national multimodal healthcare supply chains to respond to Covid-19, to implement the Voluntary Agreement for the manufacture and distribution of critical healthcare resources necessary to respond to a pandemic.

• Democratic Party presidential nomination process. Democratic National Committee's Rules and Bylaw Committee meeting “to continue the process of considering the 2024 presidential nominating rules.” Runs through Thursday.

Thursday, April 14

• Federal Reserve. Cleveland Fed President Loretta Mester and Philadelphia Fed President Patrick Harker scheduled to speak.

• Russian invasion of Ukraine: Trade issues. Washington International Trade Association virtual discussion on “Russian Energy Sanctions: A Trade Pivot to a Cleaner Future.”

• Farm Credit Administration economic condition. Farm Credit Administration meeting, including a discussion of the Quarterly Report on Economic Conditions and Farm Credit System Condition.

• China issues. U.S./China Economic and Security Review Commission virtual hearing on U.S./China Relations, including a discussion on U.S. policies to address China's nonmarket economy practices and WTO abilities to address Chinese market distortions.

• National security issues. Economic Club of Washington, DC discussion with White House National Security Affairs Jake Sullivan.

• Democratic president nomination rules. Final day of the Democratic National Committee's Rules and Bylaw Committee meeting “to continue the process of considering the 2024 presidential nominating rules.”

• Cryptocurrencies. Federalist Society for Law and Public Policy Studies virtual discussion on “stablecoins,” focusing on cryptocurrency.

• U.S./China relations. George Washington University's Sigur Center for Asian Studies discussion on “U.S./China Relations: Perilous Past, Uncertain Present.”

Friday, April 15

• Markets. Most U.S. financial and commodity futures markets are closed in observance of Good Friday. U.S. federal gov’t offices are open.

• Global corporate tax reform. Brookings Institution and the Urban Institute's Tax Policy Center virtual discussion on “Global Corporate Tax Reform: Why It's Important and What It Will Do (and Not Do).”

Economic Reports for the Week

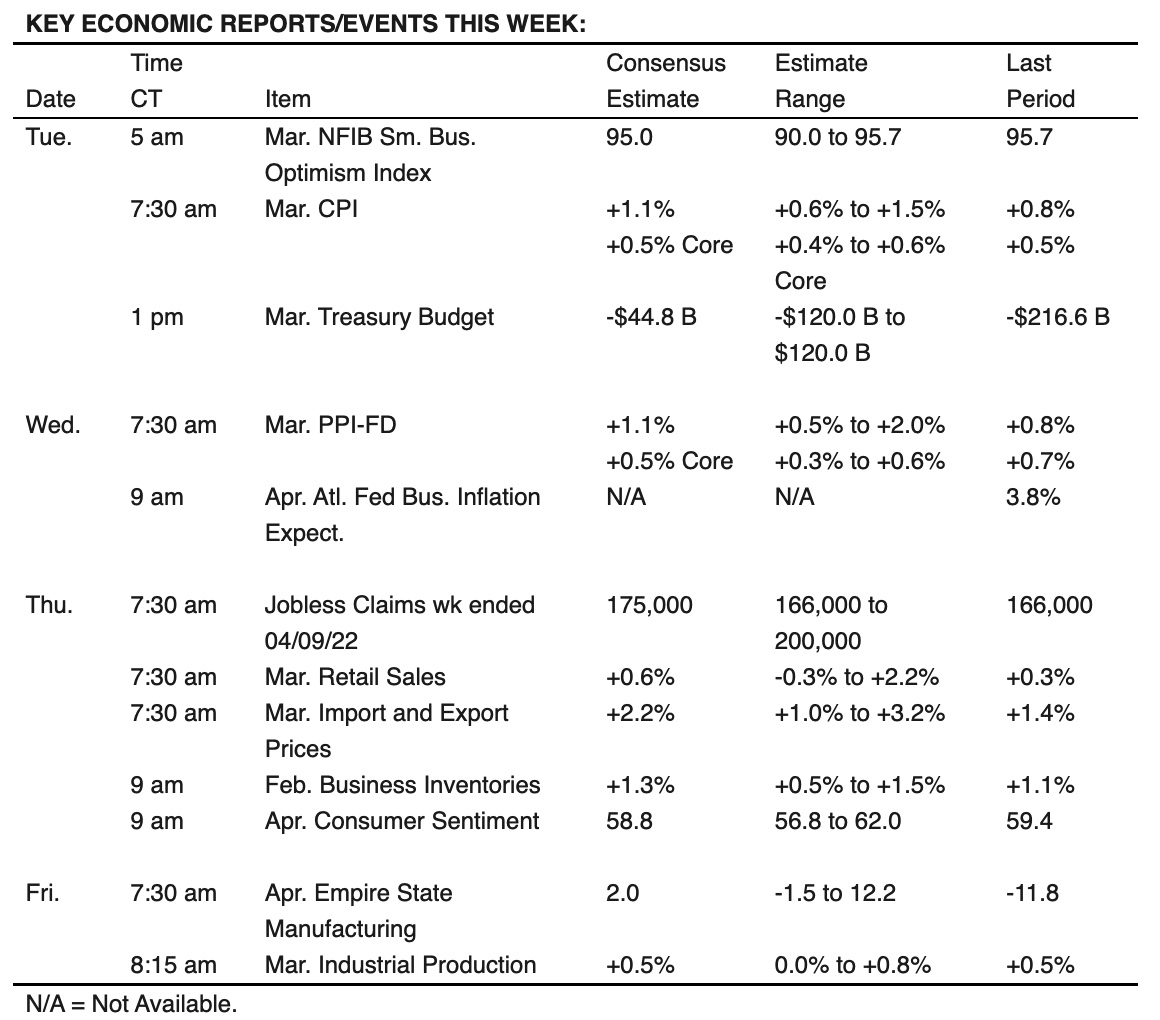

The economic calendar is headlined by the highly anticipated Consumer Price Index (CPI) report on Tuesday. The CPI is expected to show inflation rising 1.1% in March on a month-to-month comparison and 8.3% to 8.4% from a year ago. That's an acceleration from the pace seen in February. Updates on producer prices, retail sales and consumer sentiment are also due in next week. Meanwhile, Federal Reserve speakers will also make comments as investors continue to eye the pace of rate hikes and Fed actions to reduce its balance sheet. With inflation such a big topic around the world, the daily reports below include other countries reporting ahead.

Monday, April 11

- Federal Reserve Bank of Chicago President Charles Evans discusses his outlook for the economy, employment, inflation, and interest rates at the Detroit Economic Club. Atlanta Fed President Raphael Bostic will host a FedListens session focused on Nashville, with Fed Governors Michelle Bowman and Christopher Waller also scheduled to speak.

- China March consumer price index (CPI) and producer price index (PPI) data

- Japan, March PPI figures plus the Bank of Japan holds its quarterly branch managers’ meeting with opening remarks delivered by Governor Haruhiko Kuroda

- U.K. March GDP estimate plus trade figures and construction output data

Tuesday, April 12

- Bureau of Labor Statistics (BLS) reports the Consumer Price Index for March. Consensus estimate is for an 8.4% year-over-year spike for the CPI, after a 7.9% increase in February.

- National Federation of Independent Business releases its Small Business Optimism Index for March. Consensus estimate is for a 94.9 reading. February’s 95.7 reading was the second consecutive month below the 48-year average of 98.

- Fed Governor Lael Brainard gives remarks at the Wall Street Journal Jobs Summit, which will focus on searching this job market as part of what it calls The Great Reshuffle. Also, Thomas Barkin, president and CEO of the Federal Reserve Bank of Richmond, speaks.

- Germany March CPI data plus ZEW economic sentiment survey

Wednesday, April 13

- MBA Mortgage Applications

- BLS releases the Producer Price Index for March. The PPI is expected to jump 10.5% year over year on a nonseasonally adjusted basis, while the core PPI, which excludes volatile food and energy prices, is seen rising 8.4%. This compares with increases of 10% and 8.4%, respectively, in February.

- Atlanta Fed Business Inflation Expectations

- Bank of Canada interest rate announcement. Expectations are that the Bank of Canada will extend its tightening cycle with a 50 basis points rise to 1%.

- U.K. March CPI and retail price index (RPI) data

Thursday, April 14

- Jobless Claims

- University of Michigan releases its Consumer Sentiment Survey for April. Expectations are for a 58.9 reading, compared with 59.4 in March.

- Census Bureau reports on Retail Sales spending for March. Expectations are for a seasonally adjusted 0.6% month-over-month increase in retail sales, compared with a 0.3% rise in February. Excluding autos, spending is seen rising 1.0%, compared with 0.2% in the previous period.

- BLS reports export and import price data for March. Expectations are for a 2.2% month-over-month rise in export prices, while import prices are seen increasing 0.6%. This compares with gains of 3.0% and 1.4%, respectively, in February.

- Business Inventories

- Fed Balance Sheet

- Money Supply

- Federal Reserve speakers: Loretta Mester and Patrick Harker

- Fed Balance Sheet

- European Central Bank interest rate decision. it is expected to hold rates.

Friday, April 15

- Empire State Manufacturing Index

- U.S. industrial production in February recorded its highest level since December 2018. Economists anticipate it rose again in March by 0.4%.

- Treasury International Capital

- France, Italy, Poland: March CPI figures

Saturday, April 16

- China GDP

Key USDA & international Ag & Energy Reports and Events

China’s first batch of March trade data for commodities, including soybean, edible oil, and meat imports, will be out Wednesday. OPEC and the International Energy Agency issue their monthly market reports on Tuesday and Wednesday, respectively. The EIA releases its Short-Term Energy Outlook on Tuesday. Major markets will close for the Good Friday holiday, ahead of Easter.

Monday, April 11

Ag reports and events:

- Export Inspections

- Crop Progress

- Feed Grains Database

- Season Average Price Forecasts

- Wheat Data

- Crop Production Historical Track Records

- Malaysian Palm Oil Board’s data for March output, exports and stockpiles

- Malaysia’s April 1-10 palm oil export data

- Brazil’s Unica may release sugar output and cane crush data (tentative)

Tuesday, April 12

Ag reports and events:

- Cotton and Wool Outlook

- Meat Price Spreads

- Oil Crops Outlook

- Dairy Monthly Tables

- Feed Outlook

- Rice Outlook

- Wheat Outlook

- France Agriculture Ministry report; 2022 crop plantings

- EU weekly grain, oilseed import and export data

Energy reports and events:

- API weekly U.S. oil inventory report

- OPEC Monthly Oil Market Report

- EIA Short-Term Energy Outlook, including Summer Fuels Outlook

Wednesday, April 13

Ag reports and events:

- Broiler Hatchery

- Turkey Hatchery

- Feed Grains: Yearbook Tables

- China’s first batch of March trade data, incl. soybean, edible oil, & meat imports

- FranceAgriMer report; monthly French grains outlook

- Holiday: Thailand

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- IEA monthly Oil Market Report

Thursday, April 14

Ag reports and events:

- Weekly Export Sales

- Potato Stocks

- Peanut Prices

- Livestock, Dairy, and Poultry Outlook

- Sugar and Sweeteners Outlook

- Thursday: Argentina, India, Thailand

Energy reports and events:

- EIA natural gas storage change

- Russian weekly refinery outage data from ministry

- Insights Global weekly oil product inventories in Europe’s ARA region

- Baker Hughes weekly U.S. oil/gas rig counts

Friday, April 15

Ag reports and events:

- CFTC Commitments of Traders report

- FranceAgriMer weekly update on crop conditions

- Holiday: Major markets closed due to Good Friday holiday