Supreme Court Nominee Panel, Floor Votes Likely This Week

Reports include WASDE, Brazil and China ests., FAO food prices, FOMC minutes

Washington Focus

Release of FOMC minutes Wednesday, Brazil crop estimates from Conab on Thursday, USDA WASDE, China crop and U.N. food price updates on Friday, and additional action on a nomination to the Supreme Court highlight the week ahead.

The House and Senate are both in session.

Senate Judiciary Committee (link) on Monday will consider the nomination of Judge Ketanji Brown Jackson to the Supreme Court. Jackson's confirmation hearings concluded on March 24 after rounds of questioning and some heated exchanges with GOP senators — the panel vote will likely show all 11 Democrats voting in favor and all 11 Republicans voting no. Democrats can then vote to discharge her from Judiciary and put her nomination to the full Senate, likely by Thursday. Last week, Republican Sen. Susan Collins of Maine said she will vote to confirm Jackson to the high court — the first GOP senator to do so.

Next step: Jackson will likely get a full Senate vote this week ahead of an upcoming two-week congressional recess.

Senators are looking to close a deal this coming week to reappropriate roughly $10 billion to pay for Covid-19 treatments and vaccines, with lawmakers saying they need to act quickly ahead of a possible resurgence of the pandemic, the Wall Street Journal reports (link). “Negotiators are looking at pandemic-related funds that Congress has previously passed that remain unspent, after Republicans resisted new outlays and many Democrats rejected a previous deal involving $15.6 billion in repurposed funding. In the current round of talks, instead of looking at money originally allocated to states and localities, lawmakers are looking at other Covid relief dollars.” The $10 billion price tag is less than half of President Biden’s initial request.

Timing: Senate Majority Leader Chuck Schumer (D-N.Y.) said he wanted to pass the bill this week, before lawmakers leave for Easter recess (a common timeline this week).

Perspective: Since the outset of the pandemic, the Trump and Biden administrations have injected $5 trillion into the American economy, including the $1.9 trillion American Rescue Plan.

House Energy and Commerce Subcommittee on Oversight and Investigations will hold a hearing on "Big Oil" and gasoline prices on Wednesday. The subcommittee will hear from the leaders of BP PLC's American unit, Chevron Corp., Devon Energy Corp., Exxon Mobil Corp., Pioneer Natural Resources Co. and Shell USA about what they are doing to address rising gasoline prices.

Regarding the next farm bill, whenever it is, the House Ag Committee has two hearings on tap this week: (1) use of renewable energy in rural areas (Tuesday) and (2) international trade and food assistance (Wednesday).

As for carbon mitigation, on Monday the Intergovernmental Panel on Climate Change (link) will release a report on mitigation measures, including the potential of the ag sector to lower carbon emissions, including costs and benefits of carbon capture and sequestration, including ethanol pipelines.

On the farm policy front, USDA’s Farm Service Agency on Monday will commence enrolling landowners in the Grassland Conservation Reserve Program. Farmers can graze, hay, and produce seed on that land held in Grassland CRP under contracts for 10 or 15 years — deadline for applying for the program is May 13 (but we all know most USDA deadlines are extended and in the case of dairy, several times).

On the economic front, the focus is on Wednesday's release of the Federal Reserve's minutes from its monetary policy meeting last month, during which it raised interest rates for the first time since 2018. Fed Chairman Jerome Powell said at the news conference after the March 15-16 meeting that Fed officials "made excellent progress" on coming up with a framework to shrink the Fed's balance sheet and that the plan could be finalized as early as the Fed's next policy meeting in May. The minutes could provide some clues as to the direction of that plan.

California will hold a special primary election Tuesday for the state's 22nd Congressional District. Former GOP Rep. Devin Nunes set off this special primary contest with his resignation from Congress in January to join former President Donald Trump's new social media venture.

On the bright side, Thursday is Opening Day for Major League Baseball.

Ukraine/Russia Update: Reports of civilian massacres in Bucha led to swift international condemnation and claims of war crimes from world leaders, as well as pledges to escalate the West’s economic measures against Russia. Volodymyr Zelenskyy, Ukraine’s president, called Russia’s war a “genocide” on CBS’s Face the Nation on Sunday. Antony Blinken, the U.S. Secretary of State, called the scenes from Bucha “a punch to the gut” on CNN, though he declined to call them war crimes. He said the U.S. will collect evidence in Ukraine and make a judgment. In an address early on Saturday morning Zelenskyy said that, although Russian forces in the north of the country were withdrawing at a “slow but noticeable” rate, the military situation in the east “remains extremely difficult.” Zelenskyy also condemned the Russian tactic of installing pro-Kremlin leaders in occupied Ukrainian cities. He warned the public that there would be consequences for collaborating with them. European officials have openly began calling for new sanctions to be imposed as soon as Wednesday. Both Germany and France’s foreign ministers have already vowed to push for strengthened sanctions, citing the atrocities in Bucha, according to the Financial Times. Some U.S. officials talked about “secondary sanctions” ahead.

Events on Tap This Week

Topics focus on Russia’s invasion of Ukraine, the FY 2023 budget, a new farm bill and gasoline prices.

Monday, April 4

• Supreme Court nominee vote. Senate Judiciary Committee markup to vote on Ketanji Brown Jackson to be an associate justice of the Supreme Court of the U.S. and other judicial nominations.

• Russian invasion of Ukraine: Impact on Japan. Henry L. Stimson Center virtual discussion on “The Impact of the Ukraine Crisis on Japanese Foreign Policy.”

• Russian invasion of Ukraine: U.S. diplomacy. Washington Post Live virtual discussion with U.S. Ambassador to Poland Mark Brzezinski on Ukraine, growing refugee needs, and “the U.S. influence on the situation in Ukraine and diplomacy during crisis.”

• Government competition. Justice Department and the Federal Trade Commission (FTC) virtual Enforcers Summit with remarks from Assistant Attorney General for Antitrust Jonathan Kanter; and FTC Chair Lina Khan deliver and a discussion on “Whole of Government Competition Policy: Lessons for Interagency Collaboration.”

• FDA Commissioner remarks. Academy Health April Health Datapalooza and National Health Policy Conference with keynote remarks from FDA Commissioner Robert Califf.

• Broadband spending. American Enterprise Institute for Public Policy Research virtual discussion on “How should states put federal broadband funds to use?”

• Russia and China issues. Heritage Foundation discussion on “Confronting Today's Reality of Totalitarian States, Deterrents, and Dependency,” focusing on Russia and China.

• Green electric grid. Resources for the Future virtual discussion on “Greening the Grid Through Demand-Side Automation.”

• Supreme Court views. The Ronald Reagan Presidential Foundation and Institute discussion with Supreme Court Justice Amy Coney Barrett.

Tuesday, April 5

• Federal Reserve. Fed Governor Lael Brainard delivers remarks on “Variation in the Inflation Experience of U.S. Households” at a Minneapolis Fed conference; Minneapolis Fed President Neel Kashkari and New York Fed President John Williams also scheduled to speak.

• Farm bill energy programs. House Ag Committee hearing on “A 2022 Review of the Farm Bill: Energy — Renewable Energy Opportunities in Rural America.”

• Russian invasion of Ukraine: European reliance on Russian gas. German Marshall Fund of the U.S. virtual discussion on “Getting off Russian Gas: Implications for Germany and Europe.”

• Russian invasion of Ukraine: Ukraine views & cryptocurrencies. Washington Post Live virtual discussion with Ukraine Deputy Minister of Digital Transformation Alex Bornyakov on “his country's efforts to pressure tech companies to come to Ukraine's aid and wage what is being called the world's first 'crypto war.'“

• Russian invasion of Ukraine: European impacts. Hudson Institute virtual discussion on “A New Era for Europe?” focusing on “Europe's emerging foreign and defense policy in the aftermath of Putin's invasion of Ukraine.”

• Russian invasion of Ukraine: Humanitarian issues. Foreign Policy virtual discussion on “Ukraine's Humanitarian Crisis.”

• Russian invasion of Ukraine: Dissent within Russia. Atlantic Council virtual discussion with Mikhail Khodorkovsky, founder of the Open Russia movement, on “escalating repressions on dissent in Russia, the war, and the future of Russia.”

• Russian invasion of Ukraine: Indo Pacific impacts. U.S. Institute of Peace virtual discussion on “What Russia's Invasion of Ukraine Means for the Indo-Pacific.”

• Technology issues. LeadershIP forum on “Cutting-edge policy issues at the intersection of Innovation, Intellectual Property, and Competition.”

• U.S./German relations. Johns Hopkins University Paul H. Nitze School of Advanced International Studies discussion on “Germany and the U.S.: What's Next for the Transatlantic Alliance?”

• Indo-Pacific issues. Center for Strategic and International Studies and the U.S./ASEAN Business Council virtual U.S.-Indo-Pacific Conference, including Deputy U.S. Trade Representative Sarah Bianchi; and U.S. Ambassador to Singapore Ashok Mirpuri participate discussing “Indo-Pacific Economic Recovery: Digital.”

• Drinking water infrastructure. Senate Environment and Public Works Fisheries, Wildlife and Water Subcommittee hearing on implementation of the Drinking Water and Wastewater Infrastructure Act.

• FY 2023 budget: HHS. Senate Finance Committee hearing on “The President's FY 2023 Health and Human Services Budget” with HHS Secretary Xavier Becerra.

• FY 2023 budget: GAO. House Appropriations Legislative Branch Subcommittee hearing on “FY 2023 Budget Request for the Government Accountability Office.”

• FY 2023 budget: CBO. House Appropriations Legislative Branch Subcommittee hearing on “FY 2023 Budget Request for the Congressional Budget Office.”

• FEMA strategy. House Transportation and Infrastructure Economic Development, Public Buildings and Emergency Management Subcommittee hearing on “FEMA (Federal Emergency Management Agency) Priorities for 2022 and the 2022-2026 Strategic Plan.”

• Russia/East Europe legislation. House Foreign Affairs Committee markup of legislation to prohibit participation of the Russian Federation in the G7 and other legislation.

• Postal service electric fleet. House Oversight and Reform Committee hearing on “It's Electric: Developing the Postal Service Fleet of the Future.”

• Petroleum markets. Senate Commerce, Science and Transportation Committee hearing on “Ensuring Transparency in Petroleum Markets.”

• Insider trading. Senate Banking, Housing and Urban Affairs Committee hearing on “Keeping Markets Fair: Considering Insider Trading Legislation.”

• Corporate profits. Senate Budget Committee hearing on “Corporate Profits are Soaring as Prices Rise: Are Corporate Greed and Profiteering Fueling Inflation?”

• FTC views on competition enforcement. Computer and Communications Industry Association (discussion on “Competition Enforcement & Start-up Acquisitions: What is the Right Balance?” Federal Trade Commission Commissioner Noah Phillips delivers keynote remarks.

• Climate agenda. American Security Project virtual discussion on “the climate agenda on Capitol Hill and how to provide Americans, and the rest of the world, access to cheaper, reliable, and cleaner energy.”

• Energy crisis. House Transportation and Infrastructure Committee Republicans roundtable discussion on “The Energy Crisis.”

• Blockchain. Washington Post Live virtual discussion on “The Evolution of Money: Blockchain Security.”

Wednesday, April 6

• Federal Reserve. Philadelphia Fed President Patrick Harker scheduled to speak.

• Farm Bill trade and international assistance programs. House Ag Livestock and Foreign Agriculture Subcommittee hearing on “A 2022 Review of the Farm Bill: International Trade and Food Assistance Programs.”

• FY 2023 budget: EPA. Senate Environment and Public Works Committee hearing on the president's proposed budget request for FY 2023 for the Environmental Protection Agency with EPA Administrator Michael Regan.

• FY 2023 budget: U.S. Army Corps of Engineers. Senate Appropriations Energy and Water Development Subcommittee hearing on the FY 2023 budget for the Army Corps of Engineers, and the Bureau of Reclamation.

• FY 2023 budget: Veterans Affairs. House Appropriations Military Construction, Veterans Affairs, and Related Agencies Subcommittee hearing on “FY 2023 Department of Veterans Affairs Budget.”

• FY 2023 budget: HHS. House Budget Committee hearing on “Department of Health and Human Services FY 2023 Budget,” with HHS Secretary Xavier Becerra.

• Russian invasion of Ukraine: Sino-Russia relations. Johns Hopkins University Paul H. Nitze School of Advanced International Studies virtual discussion on “Sino-Russian Relations Amid War in Ukraine: What's Next?”

• Russian invasion of Ukraine: Ukraine in NATO. Washington Post Live virtual discussion on why “Ukraine should have been in the European Union and NATO a long time ago.”

• Iran nuclear deal. House Foreign Affairs Committee Republicans news conference on Iran and “why this potential agreement is so dangerous for the United States and our partners.”

• Indo-Pacific issues. Center for Strategic and International Studies and the U.S./ASEAN Business Council virtual U.S.-Indo-Pacific Conference with remarks from Commerce Secretary Gina Raimondo.

• Covid boosters. Health and Human Services Department; Food and Drug Administration teleconference of the Vaccines and Related Biological Products Advisory Committee to discuss considerations for use of Covid-19 vaccine booster doses and the process for Covid-19 vaccine strain selection to address current and emerging variants.

• Hong Kong and carbon neutrality. Woodrow Wilson Center's China Environment Forum virtual discussion on “Hong Kong's Pathway to Carbon Neutrality.”

• International financial system. House Financial Services Committee hearing on “The State of the International Financial System.”

• Indo-Pacific leadership. House Foreign Affairs Committee hearing on “Restoring American Leadership in the Indo-Pacific,” with Deputy Secretary of State Wendy Sherman.

• Gasoline prices. House Energy and Commerce Committee hearing on rising gas prices with heads of several energy companies.

• Postal Service nominations. Senate Homeland Security and Governmental Affairs Committee markup to vote on the nominations of Derek and Daniel Tangherlini to be a governors of the U.S. Postal Service.

• Market concentration and wages. House Select Committee on Economic Disparity and Fairness in Growth hearing on “(Im)Balance of Power: How Market Concentration Affects Worker Compensation and Consumer Prices.”

• TVA nominations. Senate Environment and Public Works Clean Air, Climate and Nuclear Safety Subcommittee hearing on several nominations at the Tennessee Valley Authority.

• Transportation in rural areas. Senate Banking Housing, Transportation, and Community Development Subcommittee hearing on “Advancing Public Transportation in Small Cities and Rural Places under the Bipartisan Infrastructure Law.”

• GOP future. Ronald Reagan Presidential Foundation and Institute discussion on “the future of the Republican Party.”

Thursday, April 7

• Federal Reserve. St. Louis Fed President James Bullard, Chicago Fed President Charles Evans and New York Fed President John Williams scheduled to speak.

• Russian invasion of Ukraine: Global food security. Washington International Trade Association virtual discussion on “The War in Ukraine and Global Food Security.”

• Russia invasion of Ukraine: Sanctions on oligarchs. New America virtual discussion on “Targeting Putin's Wallets: Exploring the Impact of Sanctions on Russian Oligarchs.”

• Energy transition. Resources for the Future virtual discussion on “The Global Energy Outlook 2022: Turning Points and Turmoil in the Energy Transition.”

• FY 2023 budget: IRS. Senate Finance Committee hearing on “The IRS, the President's FY 2023 Budget, and the 2022 Filing Season,” with IRS Commissioner Charles Rettig.

• Critical minerals and mining. Senate Energy and Natural Resources hearing on “The Scope and Scale of Critical Mineral Demand And Recycling.”

• Climate and energy costs. House Select Climate Crisis Committee hearing on “Cost-Saving Climate Solutions: Investing in Energy Efficiency to Promote Energy Security and Cut Energy Bills.”

• Midterm elections. Axios “News Shapers” discussion on politics of the day and a forecast for the midterm elections.

• Member day. House Appropriations Interior, Environment, and Related Agencies Subcommittee hearing on “Member Day.”

• China’s 20th Party Congress. Heritage Foundation virtual discussion on “The Chinese Communist Party's 20th Party Congress: What to Expect and the Implications for Washington.”

• U.S. energy transition. Financial Times Energy Source Live summit on “What's next for America's Energy Transformation?”

• SEC climate rule. Bipartisan Policy Center webinar on “Corporations and Climate: Potential Impacts of the SEC's Proposed New Rule.”

• U.S./China issues. Atlantic Council virtual discussion on “Managing strategic competition to avoid a U.S./China war.”

Friday, April 8

• China forced labor. Homeland Security Department public hearing on the Use of Forced Labor in China and measures to prevent the importation of goods produced, mined, or manufactured, wholly or in part in China.

• Small businesses and the pandemic. PunchBowl News virtual discussion with Sen. Gary Peters (D-Mich.) on “the challenges facing small business owners coming out of the pandemic.”

• Consumer Financial Protection Bureau. Consumer Financial Protection Bureau teleconference of the Academic Research Council to discuss broad policy matters related to the Bureau's Unified Regulatory Agenda and general scope of authority.

Economic Reports for the Week

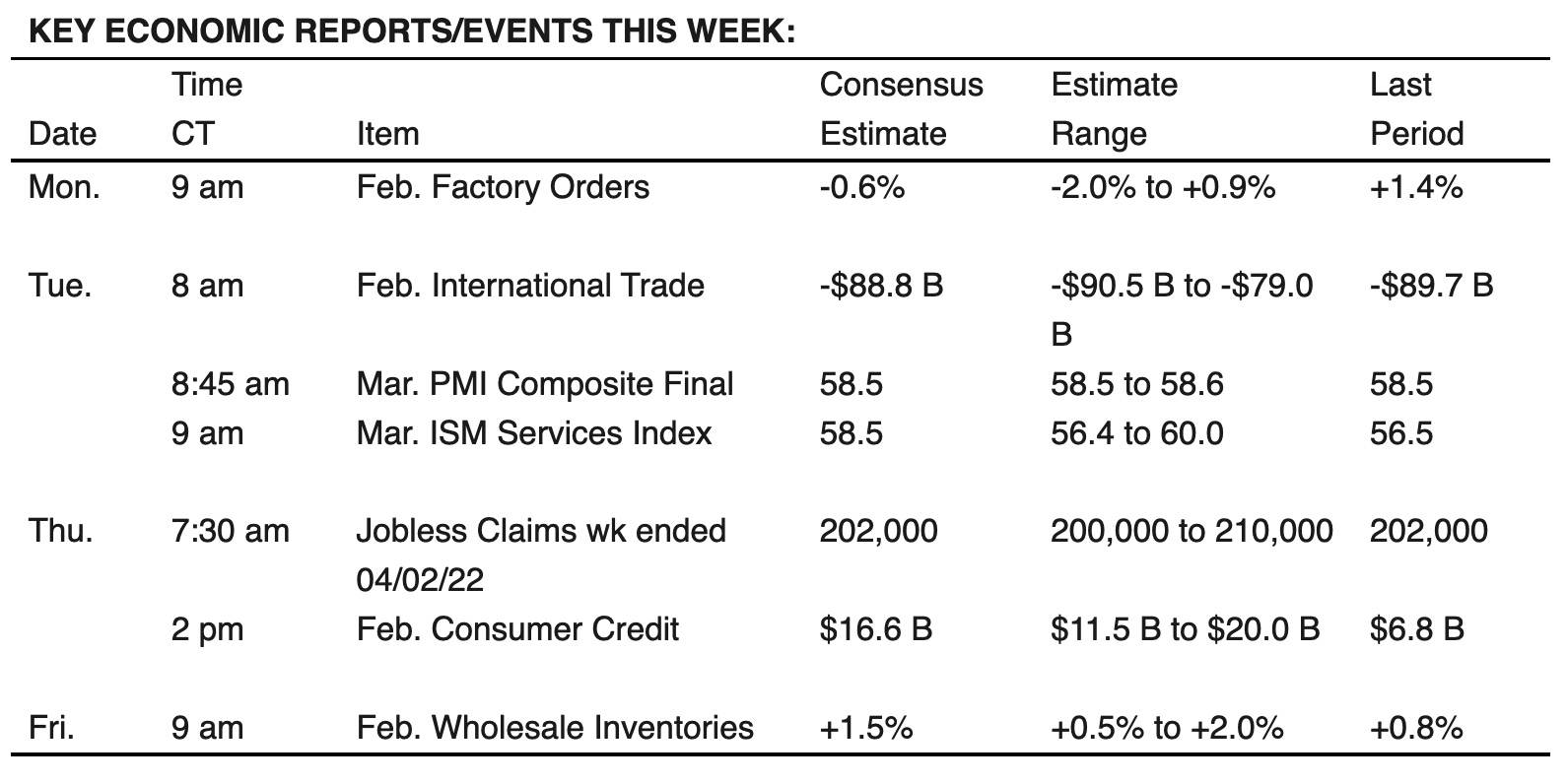

Wednesday’s release of the minutes of the last Federal Reserve minutes will be watched very closely for thinking on rate hikes and plans to shrink the Fed’s balance sheet. Meanwhile, remarks from Fed officials highlight a relatively light week for economic data. Economic reports of note include updates on factory orders, PMI prints, trade balance and jobless claims.

Monday, April 4

- Census Bureau reports on new factory orders for February. Consensus estimate is that new orders for manufactured durable and nondurable goods will increase 0.5% month over month to a seasonally adjusted $548 billion. In January, factory orders increased 1.4%; new orders for durable goods jumped 1.6%, to $278 billion; and nondurable goods gained 1.2%, to $267 billion.

- Canada, Bank of Canada publishes its Business Outlook Survey

Tuesday, April 5

- Institute for Supply Management releases its Services Purchasing Managers’ Index for March. Economists forecast a 58 reading, 1.5 points more than the February figure.

- Services PMI

- Bureau of Economic Analysis reports light-vehicle sales. Auto makers are projected to have sold 13.9 million vehicles at a seasonally adjusted annual rate in March. This would be down 21% from March of 2021 but a significant improvement from the second half of last year as supply-chain issues ease.

- The U.S. trade deficit hit a fresh record in January as consumers and businesses snapped up vehicles, energy supplies and other goods produced overseas. Strong demand is expected to keep the trade gap running at a high level for much of the year, though economists forecast that it narrowed in February as exports rose faster than imports during the month.

- Reserve Bank of Australia announces its monetary-policy decision. The central bank is expected to keep its cash target rate unchanged at 0.1%, the same level it has been since November 2020.

- Federal Reserve speakers: Fed Governor Lael Brainard, Minneapolis Fed President Neel Kashkari and New York Fed President John Williams

Wednesday, April 6

- MBA Mortgage Applications

- Federal Open Market Committee (FOMC) releases minutes from its mid-March monetary-policy meeting. The FOMC raised the federal-funds rate a quarter point at the meeting to 0.25% to 0.5%, the first interest rate hike since December 2018.

- Federal Reserve speaker: Philadelphia Fed President Patrick Harker/

- Russia, consumer price index (CPI) figures

Thursday, April 7

- Jobless Claims

- Department of Labor reports initial jobless claims for the week ending on April 2. Jobless claims averaged 208,500 in March and recently hit a five-decade low as job openings continue to outpace job seekers.

- Federal Reserve reports on consumer credit data. Consensus estimate is for total consumer debt to increase at a seasonally adjusted annual rate of 2.7% to a record $4.46 trillion.

- Fed Balance Sheet

- Money Supply

- Federal Reserve speakers: St. Louis Fed President James Bullard, Atlanta Fed President Raphael Bostic, Chicago Fed President Charles Evans and New York Fed’s Williams.

Friday, April 8

- Wholesale trade

- India’s central bank sets interest rates. Governor Shaktikanta Das signaled there’s no hurry for it to follow the U.S. Fed and others in hiking borrowing rates.

Key USDA & international Ag & Energy Reports and Events

USDA’s World Agricultural Supply and Demand Estimates (WASDE) are coming Friday, with Brazil’s Conab updating its crop estimates on Thursday. China’s agriculture outlook committee releases its supply and demand report Friday, the same day as the United Nations’ monthly FAO food price index update.

Monday, April 4

Ag reports and events:

- Export Inspections

- Crop Progress

- Amber Waves

- Holiday: China

Energy reports and events:

- Saudi Aramco official selling prices for May crude loadings; typically issued to the market sometime during the first five days of the preceding month

Tuesday, April 5

Ag reports and events:

- Hatchery Production, annual

- EU weekly grain, oilseed import and export data

- Malaysia’s April 1-5 palm oil export data

- Purdue Agriculture Sentiment

- Holiday: China, Hong Kong

Energy reports and events:

- API weekly U.S. oil inventory report

Wednesday, April 6

Ag reports and events:

- Broiler Hatchery

- Livestock and Meat International Trade Data

- U.S. Agricultural Trade Data Update

- Holiday: Thailand

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

- U.S. House Energy and Commerce subcommittee hearing on gasoline prices, Including witnesses from BP America, Chevron, ExxonMobil, Shell USA

Thursday, April 7

Ag reports and events:

- Weekly Export Sales

- Brazil’s Conab releases data on area, yield and output of corn and soybeans

Energy reports and events:

- EIA natural gas storage change

- Russian weekly refinery outage data from ministry

- Insights Global weekly oil product inventories in Europe’s ARA region

Friday, April 8

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- WASDE

- Crop Production

- Cotton: World Markets and Trade

- Grain: World Markets and Trade

- Oilseeds: World Markets and Trade

- World Agricultural Production

- Livestock: World Markets and Trade

- FAO World Food Price Index

- China’s agriculture ministry (CASDE) monthly report on supply and demand for corn and soybeans

- FranceAgriMer weekly update on crop conditions

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts