U.S. Skeptical About Russia Withdrawing Troops in Ukraine

World Bank president: In times of food shortages, reduce subsidies for ethanol

|

In Today’s Digital Newspaper |

Equities are heading lower this morning. Skepticism is growing over Russia's signal that it will withdraw its troops from around Kyiv, which is weighing on risk appetite. Meanwhile, the U.S. is planning new sanctions on Russian military suppliers.

Ukraine will need quick help from other countries to get the fertilizer and seeds needed to restore its farming output and crucial exports to the rest of the world once Russia’s invasion is over, according to the head of the World Bank.

World Bank President David Malpass also said that at a time of food shortages in the developing world, governments in advanced economies also should reduce subsidies that keep prices artificially high — such as those for ethanol in the U.S. and the Common Agricultural Policy in the European Union. Countries should instead focus on targeting support to the poor, he said.

The bond market is flashing a recession signal in the U.S. Meanwhile, former New York Fed President Bill Dudley: The Federal Reserve has made a recession all but inevitable.

Germany issued an early warning about its gas supplies, prompting a contingency plan that could include rationing energy in case Russia cuts it off.

The inventory of U.S. homes for sale at the end of January slid to the lowest level on record since the National Association of Realtors began tracking total existing-home inventory in 1999.

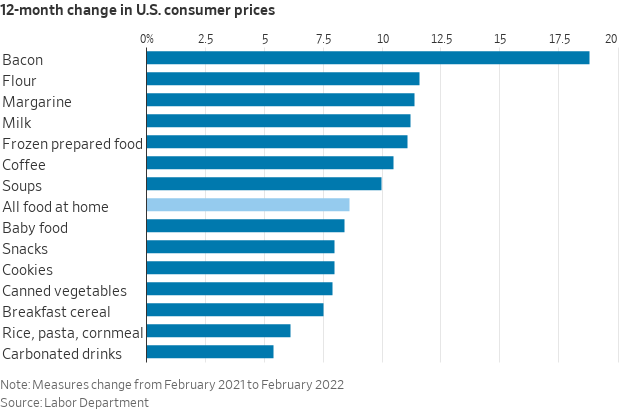

Americans are really worried about inflation. According to a new Gallup poll, more people consider rising prices the country’s worst problem than at any point since the 1980s. That’s a potential problem for Democrats and the White House as midterm elections loom. As for U.S. consumers, as inflation spreads and stretched supply chains leave gaps on shelves, shoppers are becoming increasingly fickle, with availability and price determining what goes into their shopping carts.

Fears of a fertilizer shortage are slowing soybean expansion in Brazil.

U.S. Trade Representative (USTR) Katherine Tai today will start two days of congressional testimony on the Biden administration’s trade policy. She will tell lawmakers that China is still not living up to terms of the Phase 1 agreement reached during the Trump administration despite sessions she has held since October 2021 with Chinese Vice Premier Liu He. She is also expected to signal the administration now has to more directly take on China relative to their economic actions and failure to meet their commitments.

President Biden’s budget signals no new Gulf oil and gas leases through FY 2023.

In the meat sector, some House lawmakers will again offer mandatory COOL legislation. And a chicken price-fixing prosecution ends in second mistrial; third trial planned. Also: Carl Icahn is taking his pregnant pig campaign to Kroger.

FDA approved a second Covid booster for Americans 50 and older. The additional shot of the Pfizer-BioNTech or Moderna vaccine, at least four months after a first booster, could help address waning immunity, the agency said.

On the political front, Senate Minority Whip John Thune (R-S.D.) is guaranteed to win re-election this year after the South Dakota filing deadline came and went Tuesday without anyone else entering the race. No Democrat will challenge him either.

Lastly, a trip down memory lane: On this day 155 years ago, the U.S. agreed to buy Alaska from Russia for $7.2 million — or about $140 million in today’s money. Seems Russia made some bad decisions then, too.

|

MARKET FOCUS |

Equities today: Global stocks markets were mixed but mostly higher overnight. The U.S. stock indexes are pointed toward weaker openings. Asian equities finished mostly higher on optimism over Russia/Ukraine talks. The Nikkei was the exception, falling 225.17 points, 0.80%, at 28,027.25. The Hang Seng Index rose 304.40 points, 1.39%, at 22,232.03. European equities are lower as optimism over Russia/Ukraine talks has faded. The Stoxx 600 was down 0.6% with losses of 0.3% to 1.4% in regional markets.

U.S. equities yesterday: The Dow closed up 338.30 points, 0.97%, at 35,924.19. The Nasdaq gained 264.73 points, 1.84%, at 14,619.64. The S&P 500 rose 56.08 points, 1.23%, at 4,631.60.

Agriculture markets yesterday:

- Corn: Corn futures followed wheat futures sharply lower Tuesday, with the nearby May contract tumbling 22 1/4 cents to $7.26 1/4 and new-crop December falling 11 3/4 cents to $6.52 3/4.

- Soy complex: May soybeans closed down 21 1/4 cents at $16.43 and in the lower end of today’s range. Prices also hit a four-week low today. May soybean meal closed down $12.90 at $466.00, nearer the daily low and hitting a three-week low. May bean oil closed down 79 points at 71.66 cents, nearer the session low and scoring a four-week low.

- Wheat: Winter wheat futures finished mostly 40-plus cents lower. May SRW wheat fell 42 3/4 cents to $10.14 1/4, while May HRW plunged 46 cents to $10.24 1/2. Spring wheat ended mostly 35 to 36 cents lower, with the May contract down 36 1/2 to $10.43.

- Cotton: May cotton futures plunged 226 points to 136.81 cents. December cotton dropped 26 points to 111.04 cents.

- Cattle: The nearby April live cattle contract rallied 60 cents to $140.90, while most-active June surged $1.70 to $138.475. May feeder futures leapt $4.325 to $169.40.

- Hogs: June lean hogs closed down $1.425 at $124.625 and nearer the session high. April lean hogs fell $1.525 at $106.05.

Ag markets today: Corn and soy complex futures posted modest corrective gains overnight. Wheat futures were weaker for most of the overnight session but have turned mixed early this morning. As of 7:30 a.m. ET, corn futures were trading 4 to 7 cents higher, soybeans were 4 to 8 cents higher, winter wheat futures were mostly 1 to 2 cents lower and spring wheat was mostly around a penny higher. Front-month U.S. crude oil futures were around $2.75 higher and the U.S. dollar index was more than 450 points lower.

Technical viewpoints from Jim Wyckoff, who says: “Serious chart damage Tuesday suggests market tops in place for corn, soybeans.”

On tap today:

• ADP's employment report is expected to show that the U.S. private sector added 450,000 jobs in March. (8:15 a.m. ET)

• U.S. gross domestic product is expected to advance at a 7% annual pace in the fourth quarter, unrevised from the previous estimate. (8:30 a.m. ET)

• Federal Reserve speakers: Richmond's Thomas Barkin on investing in rural America at 9:15 a.m. ET, and Kansas City's Esther George on the economy and monetary policy at 1 p.m. ET.

• USDA Hogs & Pigs report, 3 p.m. ET.

• China's official purchasing managers indexes for the manufacturing and service sectors in March are out at 9:30 p.m. ET.

The bond market is flashing a recession signal in the U.S. The two-year yield briefly exceeded the 10-year on Tuesday for the first time since 2019, reinforcing the view that Federal Reserve rate increases may cause a recession.

Former New York Fed President Bill Dudley: The Federal Reserve has made a recession all but inevitable. "The Fed needs to adjust how it puts its monetary policy framework into practice. It shouldn’t be completely reactive, waiting passively until inflation exceeds target and the labor market is extremely tight. Such extreme 'patience' forces it to slam on the brakes, increasing the likelihood of an early recession. Also, officials need to be more forthright about the road ahead: Getting inflation down will be costly, in terms of jobs and economic growth," former New York Fed President Bill Dudley writes at Bloomberg Opinion (link).

A global debt default might be looming. And developing nations are set to bear the brunt of the impact. On Tuesday, a World Bank economist said Russia's war on Ukraine could spark the worst debt crisis for developing nations in a generation. "The Ukraine war immediately darkened the outlook for many developing countries that are major commodity importers or highly dependent on tourism or remittances," wrote Marcello Estevao, the World Bank's global director for macroeconomics, trade, and investment. The poorest nations have increasingly taken greater amounts of variable-rate debt, which increases their vulnerability to rate hikes.

The inventory of homes for sale at the end of January slid to the lowest level on record since the National Association of Realtors began tracking total existing-home inventory in 1999. Some buyers rushed to make purchases in January, as mortgage rates started to increase, because they expected rates to continue to rise, according to real-estate agents.

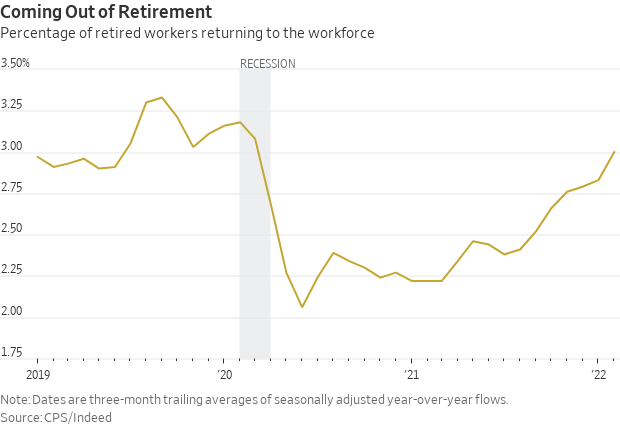

Tom Brady syndrome: Millions of U.S. workers retired during the pandemic. Now many are returning to work. In February, the share of retired workers re-entering the workforce climbed to around 3% of total retirees, its highest level since early March 2020, according to an Indeed analysis of federal labor data. Many are people under the official retirement age who, spurred by rising asset values or Covid-19 worries, left the workforce ahead of schedule, labor economists say. Some now are returning to work to shore up their finances. Labor shortages, a recent stock-market rout, plus the widespread availability of remote-work options, could lure more early retirees back to the job market in the coming months. Link to more details via the WSJ.

Inflation watch: U.S. shoppers are buying what they can find — and afford. Well-known brand names and flashy ad campaigns are no longer enough to command U.S. consumers’ loyalty in grocery stores, retail executives said. As inflation spreads and stretched supply chains leave gaps on shelves, shoppers are becoming increasingly fickle, with availability and price determining what goes into their shopping carts. Big food companies like Kraft Heinz and Kellogg risk losing market share to competitors and store brands that are more readily able to fill in empty spots in store aisles.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker in action ahead of U.S. economic updates as the euro and British pound are firmer. The yield on the 10-year U.S. Treasury note has risen to trade around 2.41% amid a mixed tone in global government bond yields. Gold and silver futures are seeing gains ahead of U.S. trading, with gold atop $1,922 per troy ounce and silver above $25 per troy ounce.

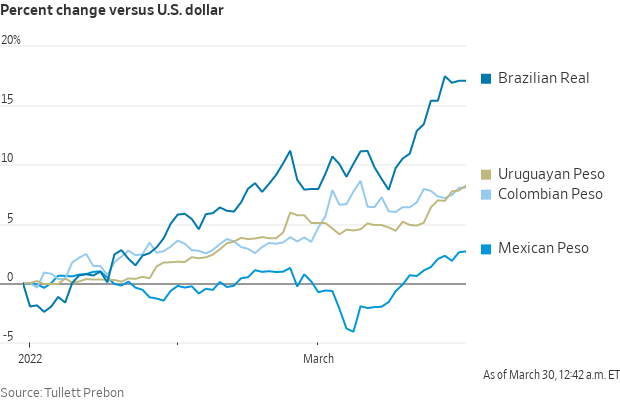

• One place the U.S. dollar hasn’t posted big gains this year: Latin America. Currencies from Brazil to Uruguay have defied the dollar’s broad strengthening. The Brazilian real has risen more than 17% against the dollar, making it the world’s top performer through nearly three months of 2022. The Chilean and Uruguayan pesos are up about 9.5% and 7.4%, respectively, while Mexico’s has gained around 2.4%. For perspective, the U.S. dollar is higher this year against about three quarters of the major currencies tracked by The Wall Street Journal. One source of strength for emerging markets in 2022: the run-up in commodity prices. That has benefited economies that rely heavily on raw-material export.

• Crude oil futures have rebounded higher with U.S. crude around $107 per barrel and Brent around $110.50 per barrel. Future firmed overnight in Asian action with U.S. crude around $105 per barrel and Brent around $108.25 per barrel.

• The Organization of the Petroleum Exporting Countries will meet on Thursday to decide on output levels from May. The group chose not to increase output in April despite oil prices pushing above $110 a barrel at the time.

• Germany set up a crisis team to prepare for gas shortages, on fears that deliveries from Russia might be disrupted. Russia has demanded that exports be paid for in rubles, which G7 countries unanimously rejected. Germany’s emergency plans allow for rationing. European gas prices, which have been elevated since Russia’s invasion began, rose further today.

• Malaysia’s agriculture sector is set to expand 1.5% this year on higher palm oil production, according to the central bank today. Palm oil output will be supported by gradual easing of labor shortage. Heavier rainfall in the early part of this year is also expected to improve soil moisture and increase oil palm yields in the latter part of year. Agriculture sector shrank 0.2% last year due to weaker oil palm output as the acute labor crunch and floods affected harvesting.

• Fears of a fertilizer shortage are slowing soybean expansion in Brazil. Planted areas of the oilseed are expected to rise just 0.5% in the upcoming 2022-23 season, the slowest growth since 2006, according to a forecast from Itau BBA. Rising production costs and concerns about fertilizer shortages in particular are the source of Brazilian farmers’ hesitation this season, according to Itau BBA analyst Guilherme Bellotti. Russia is Brazil’s main supplier of fertilizers, and the war in Ukraine is leading to fears that crop nutrient shipments will be disrupted. Brazil imports 85% of its fertilizers. Margins for Brazilian farmers could fall a third to 40% amid soaring costs this year, Bellotti said to journalists Tuesday. “It’s still a good margin,” he said. The Brazilian harvest could still increase 15% over last year’s to 141 million tons according to preliminary estimates, as fertilizer residues in the soil from past seasons soften the impact of lower applications now, Bellotti said.

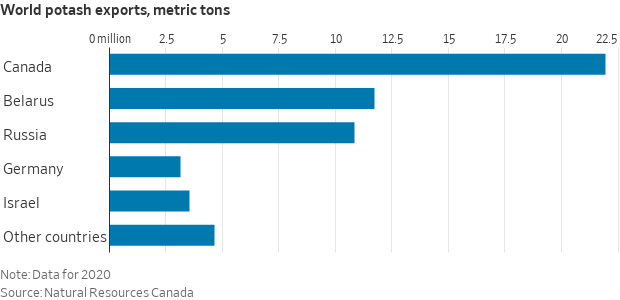

• As trade with Russia halts, countries are turning to Canada. Canada, which shares similar climate and geographical features, produces many of the same commodities as Russia, the WSJ notes (link). Both countries are among the world’s largest producers of crude oil, uranium, nickel and potash, a fertilizer ingredient. Along with Ukraine, they are among the world’s largest wheat exporters. Buyers are turning to Canada to replace the energy, food and minerals that are being blocked because of the war and international sanctions on Russia.

• H&P Report out this afternoon. USDA’s Hogs & Pigs Report is expected to show the U.S. hog herd contracted 1.2% from year-ago as of March 1. Based on the average pre-report estimate, the March 1 hog herd is expected to total just over 73 million head, including a market hog inventory of 66.8 million head (down 1.3%) and breeding herd of 6.2 million head (up 0.1%).

• Ag trade: Taiwan purchased 40,000 MT of U.S. milling wheat. Bangladesh tendered to buy a nominal 50,000 MT of optional origin milling wheat.

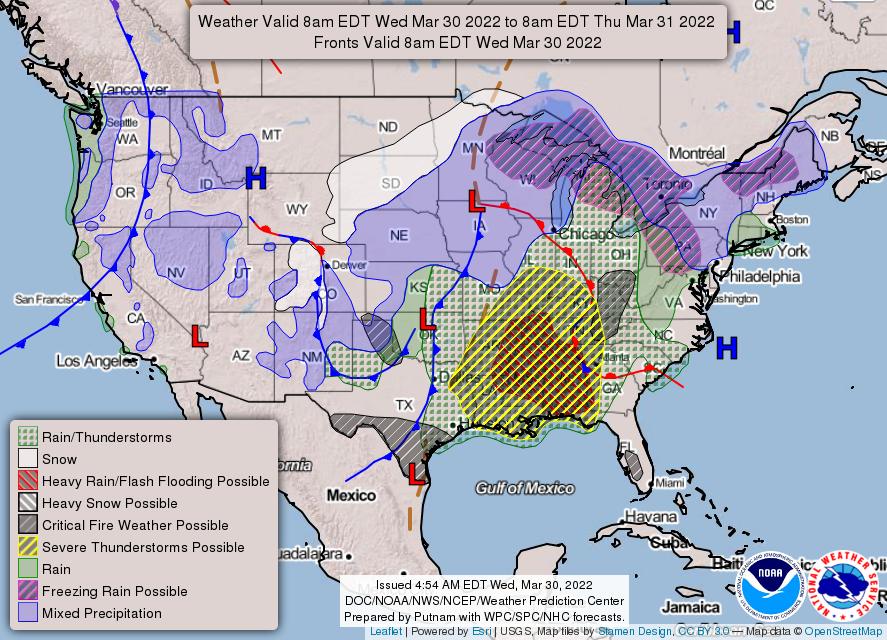

• NWS weather: Severe thunderstorms are expected through tonight from the lower Missouri Valley to central Texas. Damaging gusts, severe hail, and a few brief tornadoes are possible. A severe weather outbreak is expected tomorrow across the Lower Mississippi Valley into the Southeast. All severe hazards are possible, including widespread damaging winds, and several tornadoes, some of which could be strong.

|

RUSSIA/UKRAINE |

— Summary: Russia’s pledge to scale back in Ukraine was met with skepticism, with a U.S. spokesman branding the move “a repositioning, not a real withdrawal.” Russian attacks on Ukraine are continuing after Moscow said it would reduce its military activity in some parts of the country. Russia said Tuesday that it would cut back its military activity near Kyiv and the northern city of Chernihiv. U.K. Deputy Prime Minister Dominic Raab also expressed skepticism over Russia’s claims that it intends to scale back its military operations in some parts of Ukraine. “We judge the Russian military machine by its actions, not just its words,” he told Sky News on Wednesday, saying the U.K. was not putting a lot of faith in Russia’s stated intentions. “Japan shares the belief that it is important to achieve a concrete cease-fire as soon as possible, and we will continue to monitor the situation with great interest, and at the same time, we will provide the various types of support to Ukraine that we have already announced in a prompt and steady manner,” Japan’s Chief Cabinet Secretary Hirokazu Matsuno said.

- Ukrainian officials say there was no reduction in hostilities overnight, and no area in the country was without sirens as the siege persists. New images and video from cities like Irpin and Mariupol show the extent of the destruction, with entire blocks obliterated. The mayor of Chernihiv said Russia was continuing to attack the city in northern Ukraine. Russia had earlier claimed to be pulling back its assault, which the mayor called “a lie.”

- The U.S. Treasury department is preparing sanctions against Russia’s military supply chain, according to an official. The aim, the department said, is to hit “Russia’s ability to build and maintain the tools of war that rely on these inputs.”

- Several European countries said they would expel 43 Russian diplomats whom they accused of espionage. Belgium told 21 Russians to leave while the Netherlands kicked out 17. Ireland and the Czech Republic together expelled five. Russia promised to retaliate. Earlier other European countries, including Bulgaria, Poland and the Baltic states, ordered dozens of Russians to leave.

— Market impacts:

- Ukraine will need quick help from other countries to get the fertilizer and seeds needed to restore its farming output and crucial exports to the rest of the world once Russia’s invasion is over, according to the head of the World Bank. Ukraine would be helped by fertilizer from western Europe to replace imports of that key agricultural input from Belarus that have been cut off, David Malpass, president of the Washington-based development lender, said in a Bloomberg Television interview with Tuesday.

In a remark that will get the attention of U.S. biofuel proponents, Malpass said that at a time of food shortages in the developing world, governments in advanced economies also should reduce subsidies that keep prices artificially high — such as those for ethanol in the U.S. and the Common Agricultural Policy in the European Union. Countries should instead focus on targeting support to the poor, he said. The World Bank provides about $17 billion annually in food support and has disbursed more than $500 million overall in assistance for Ukraine in recent weeks, Malpass said.

- Russian grain exporters may seek ruble payments: Kommersant. The Russian Union of Grain Exporters asked the central bank to consider making it possible for foreign buyers of grain to pay in rubles under export contracts, Kommersant reports. The initiative was discussed, among other topics, at a meeting with the central bank last week. The union asked central bank to provide ruble liquidity to foreign banks serving grain buyers, the largest of which are Turkey, Egypt, Iran, and Saudi Arabia. While most contracts are now agreed in foreign currency, international sanctions that followed Russia’s invasion of Ukraine complicated payments in foreign exchange because some banks sometimes refuse to transfer money.

Russian grain exporters asked the central bank to help them resolve issues receiving foreign currency payments, Interfax reports, citing the letter sent to the regulator from the union. Exporters said many foreign banks won’t send money to Russian lenders, even if they are not subject to sanctions. They also face losses when servicing FX loans due to a regulation requiring them to exchange 80% of FX earnings.

|

PERSONNEL |

— Key House GOP lawmaker joins calls on Biden administration to fill ag trade posts. House Ways and Means Trade Subcommittee Ranking Member Rep. Adrian Smith (R-Neb.) is the latest lawmaker urging the Biden administration to quickly fill two key ag trade posts, saying that supply chain challenges and impacts from the Russian invasion of Ukraine have elevated the need to have U.S. ag advocates in those key positions.

The two positions at issue — chief agriculture negotiator in the Office of the U.S. Trade Representative (USTR) and USDA Undersecretary for Trade and Foreign Agricultural Affairs — remain vacant more than a year into the Biden administration. Elaine Trevino, who Biden first nominated for the USTR post in September 2021, withdrew her name from consideration earlier this month saying that it seemed clear there was no “timely path forward to gain Senate confirmation,” amid reports of possible vetting issues. She will instead join the administration in another capacity related to supply chain issues affecting the US ag sector.

As for the USDA position, USDA Secretary Tom Vilsack indicated in late January that the administration had a nominee in mind but that the vetting process was still ongoing. Since those statements, however, there has been little news about the status of that process. Reports have indicated the individual being vetted for the position has withdrawn from consideration due to requirements that they would have had to divest of some expenses.

— FTC nomination update. Senate Majority Leader Chuck Schumer (D-N.Y.) opened a path to break a deadlock and force a confirmation vote on the nomination of Alvaro Bedoya to the Federal Trade Commission (FTC). The vote, scheduled for today by Schumer, would bring Bedoya’s nomination out of the Senate Commerce, Science, and Transportation Committee, where it has been blocked by committee Republicans for months. Bedoya’s confirmation as an FTC commissioner would cement the agency’s Democratic majority.

|

CHINA UPDATE |

— USTR Tai to tell lawmakers China not heeding push to fulfill Phase 1 commitments. U.S. Trade Representative (USTR) Katherine Tai today will start two days of congressional testimony on the Biden administration’s trade policy before the House Ways and Means Committee. She will tell lawmakers that China is still not living up to terms of the Phase 1 agreement reached during the Trump administration despite sessions she has held since October 2021 with Chinese Vice Premier Liu He.

She is also expected to signal the administration now has to more directly take on China relative to their economic actions and failure to meet their commitments. However, it is not clear whether Tai will spell out what kind of actions the Biden administration plans to take on that front.

Tai will face intense questioning from Republicans and potentially even some Democrats on the administration’s stance of not negotiating new trade agreements but focusing instead on framework deals that do not involve addressing market access issues in the Indo Pacific region and other areas.

Tai will appear Thursday (March 31) before the Senate Finance Committee. The sessions are expected to provide more insight into the administration’s trade plans which so far have been on enforcement of existing deals and pursuing framework arrangements as opposed to new trade agreements.

— China to step up financial support for soybeans, other oilseeds. China’s central bank said it would step up monetary policy support for rural areas this year, including providing more financial support to ensure food security and the supply of soybeans and oilseeds. It also encouraged firms to use the yuan currency for bilateral payments abroad.

|

ENERGY & CLIMATE CHANGE |

— Biden budget signals no new Gulf oil and gas leases through FY 2023. The Biden administration’s fiscal year (FY) 2023 budget signals there will be another delay in selling offshore drilling rights in the Gulf of Mexico until at least October 2023. The budget listed FY 2023 revenues from offshore oil auction bids and annual rental payments are expected to be just $25 million in FY 2023, down from nearly $400 million in FY 2022. Bloomberg reported that Department of Interior (DOI) spokeswoman Melissa Schwartz said the estimates on future leasing are “placeholders only, in recognition of the dynamics of pending litigation and appeals” and DOI’s development of a five-year plan for offshore leases. An email statement to Bloomberg also pointed out, as DOI has done relative to questions on its oil and gas leasing efforts, that there are still more than 11 million acres of offshore federal waters under lease and 8.29 million acres of those are not being used for production. DOI held a lease auction in November 2021 after being ordered by courts to do so, but a federal judge later invalidated the auction, saying regulators did not fully account for climate impacts of the leases. The current five-year plan for lease sales expires June 30 and a new one is not expected to be in place by then.

Upshot: This will continue to raise questions about the administration’s actions on the energy front as it seeks to combat lofty gasoline prices and other rising energy costs.

— Farm-state senators urge Biden to prioritize green fertilizer. Democratic Senator Amy Klobuchar (D-Minn.) and four colleagues asked President Joe Biden to prioritize domestic green ammonia production and other uses as they develop Regional Clean Hydrogen Hubs. “A clean, stable, domestic source of ammonia-based nitrogen fertilizers is extremely important for America’s agriculture industry,” the senators said in a letter. “A Regional Clean Hydrogen Hub focused on the manufacture of green ammonia for fertilizer would allow America’s farmers to drastically reduce their carbon footprint while also providing price and supply stability to this critical farm input.” Sens. Chuck Grassley (R-Iowa), Democratic Tina Smith (D-Minn.), Deb Fischer (R-Neb.) and Tammy Baldwin (D-Wis.) also signed the letter. The letter comes as fertilizer prices skyrocket to records after Russia, a major exporter of every kind of crop nutrient, invaded Ukraine.

— Oil execs to testify before House Energy and Commerce subcommittee but not Natural Resources. Executives from several oil companies indicated Tuesday they will not testify before the House Natural Resources Committee at a hearing April 5, but a larger group of oil executives will testify before the House Energy and Commerce Oversight and Investigations Subcommittee April 6. The session, entitled “Gouged at the Gas Station: Big Oil and America’s Pain at the Pump,” will feature executives from Devon Energy, Exxon Mobil, BP, Chevron, and Pioneer Natural Resources. CEOs of EOG Resources, Devon and Occidental Petroleum declined to testify at the House Natural Resources Committee session to “examine the fossil fuel industry’s failure to help stabilize American gasoline prices.” That session has now been canceled.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA confirms two more HPAI cases in commercial Iowa operations. USDA’s Animal and Plant Health Inspection Service (APHIS) March 28 confirmed two additional cases of highly pathogenic avian influenza (HPAI) in commercial operations in Iowa. Cases were found in 1,460,030 commercial layer chickens in Guthrie County, Iowa, and 28,000 commercial turkeys in Hamilton County, Iowa. That puts total cases at 79 in the U.S.

— House lawmakers to offer mandatory COOL legislation. Reps. Ro Khanna (D-Calif.) and Lance Gooden (R-Texas) will introduce legislation in the House to reinstate mandatory Country of Origin labeling (MCOOL) for beef products. The legislation calls on USDA to implement MCOOL so that is “in compliance with all applicable rules of the World Trade Organization.” However, the three-page bill does not indicate how that is to be done.

Background. The U.S. removed MCOOL for pork and beef after the program was found to be in violation of U.S. commitments under the WTO. Canada and Mexico have reserved the right to impose more than $1 billion in sanctions against the US if MCOOL was put back in place. A version of the measure was introduced last fall in the Senate. It is still not clear there is enough support for the resumption of MCOOL for beef and Canada has already signaled they would not hesitate to deploy retaliation if such an effort emerged in the U.S.

— Chicken price-fixing prosecution ends in second mistrial; third trial planned. Jurors in Denver deadlocked for the second time in the trial of 10 chicken company executives accused of price fixing, handing a significant setback to efforts by the U.S. Justice Department to police competition in food markets. U.S. District Judge Philip Brimmer ended the case Tuesday after jurors said they were unable to reach a verdict against the defendants, who worked for companies including Tyson Foods Inc., Pilgrim’s Pride Corp. and Perdue Farms LLC. The jurors deliberated for four days. In December, an earlier trial also ended in a deadlock. Chicken producers have been sued by buyers claiming anti-competitive practices. The Denver case was the first trial for a federal investigation targeting the biggest companies in the $95 billion chicken market. After the mistrial, a member of the prosecution team said the government plans to try the 10 defendants for a third time, according to three lawyers who were in the court room. The judge ordered the head of the Justice Department’s Antitrust Division to travel to Denver next week to explain that decision, the lawyers said. A Department spokeswoman declined to comment on the mistrial.

— Carl Icahn takes his pregnant pig campaign to Kroger. Carl Icahn, the activist investor who has been prodding McDonald’s over the treatment of pregnant pigs in its supply chain, also raised the issue at Kroger, where he has nominated two people to the national grocery chain’s board. Icahn told Kroger he was concerned about animal welfare. Kroger said it isn’t directly involved in raising or processing animals but it is committed to helping protect the welfare of animals in its supply chain. Icahn objects to pig producers using small crates for pregnant pigs, something Kroger said it expects its suppliers to stop doing by 2025. Icahn owns about 100 Kroger shares and met with Kroger for the first time on March 25 before submitting the names, Kroger said. Kroger’s average hourly wage is $17, which is up 25% over the past four years, it said. Icahn nominated Alexis C. Fox, an animal-rights activist, and Margarita Paláu-Hernández, an investor. Kroger said it would review the matter, adding its shareholder meeting hasn’t been scheduled.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 485,275,045 with 6,133,718 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 80,019,167 with 978,692 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 560,181,791 doses administered, 217,498,967 have been fully vaccinated, or 66.26% of the U.S. population.

— The BA.2 subvariant of Omicron has taken over in the U.S. as the dominant strain of the coronavirus that causes Covid-19, and is now about 55% of cases, according to estimates by the Centers for Disease Control and Prevention. Its rapid spread is a concern to health officials, who are watching cases and hospitalizations spike abroad.

— The Food and Drug Administration authorized second booster doses of the Pfizer-BioNTech or Moderna Covid-19 vaccines for adults aged 50 and over, and others at higher risk who want them at least four months after the first booster dose. Some adults in the U.K., France, and Germany are already getting second booster doses. Pfizer cited studies from Israel that showed the fourth shots increased antibody levels and lowered infection rates. Both Pfizer and Moderna are running additional clinical trials of fourth doses.

— Florida is among 21 states asking a U.S. judge to block the federal mask mandate on airplanes, trains, buses, and ride-share vehicles, Reuters reported. The Biden administration extended the rule through at least April 18.

|

POLITICS & ELECTIONS |

— Senate Minority Whip John Thune (R-S.D.) is guaranteed to win re-election this year after the South Dakota filing deadline came and went Tuesday without anyone else entering the race. Former President Donald Trump attacked Thune, claiming Thune’s political career was over after the No. 2 Senate Republican criticized efforts to overturn the last presidential election. No Democrat will challenge him either.

|

CONGRESS |

— Senate Majority Leader Chuck Schumer (D-N.Y.) said he’s confident that Judge Ketanji Brown Jackson will be confirmed to the Supreme Court “by the end of this work period,” which is next week. The Senate Judiciary Committee is expected to vote on Jackson’s nomination next Monday, teeing it up for floor consideration later next week. The Senate is scheduled to depart for the Easter recess on April 8.

|

OTHER ITEMS OF NOTE |

— Percentage of working Americans testing positive for drugs hit a two-decade high last year, driven by an increase in positive marijuana tests, as businesses might have loosened screening policies amid nationwide labor shortages. Of the more than six million general workforce urine tests that Quest Diagnostics, one of the country’s largest drug-testing laboratories, screened for marijuana last year, 3.9% came back positive.

— On this day 155 years ago, the U.S. agreed to buy Alaska from Russia for $7.2 million — or about $140 million in today’s money.