Ukraine and Russia Meet for Peace Talks | Russia to ‘Drastically Reduce’ Military Assault

Perspective on Biden’s FY 2023 budget wish list | SCOTUS takes on Prop 12

|

In Today’s Digital Newspaper |

Russian and Ukrainian officials hold cease-fire talks, oil prices fall, and President Biden calls for an increase in defense spending. In late-breaking news, Russia said it will "drastically reduce" military assault on Kyiv and Chernihiv. Russian Deputy Defense Minister Alexander Fomin confirmed "to radically, at times, reduce military activity," according to state media RIA.

Russia and Ukraine are holding cease-fire talks in Turkey while Ukrainian forces pressed to retake territory and Russian forces fired missiles at several Ukrainian cities. Meanwhile, the Group of Seven nations rejected Russia’s demand that they pay for Russian natural-gas imports in rubles. Russia wants its annexation of Crimea to be recognized and independence for the Donbas region, but Volodymyr Zelenskyy, Ukraine’s president, has said that the country won’t compromise on its territorial integrity. Russia is no longer demanding Ukraine be “de-Nazified” and is reportedly prepared to let it join the EU, however.

Ukraine farmers started sowing on 15-20% of planned area: UAC.

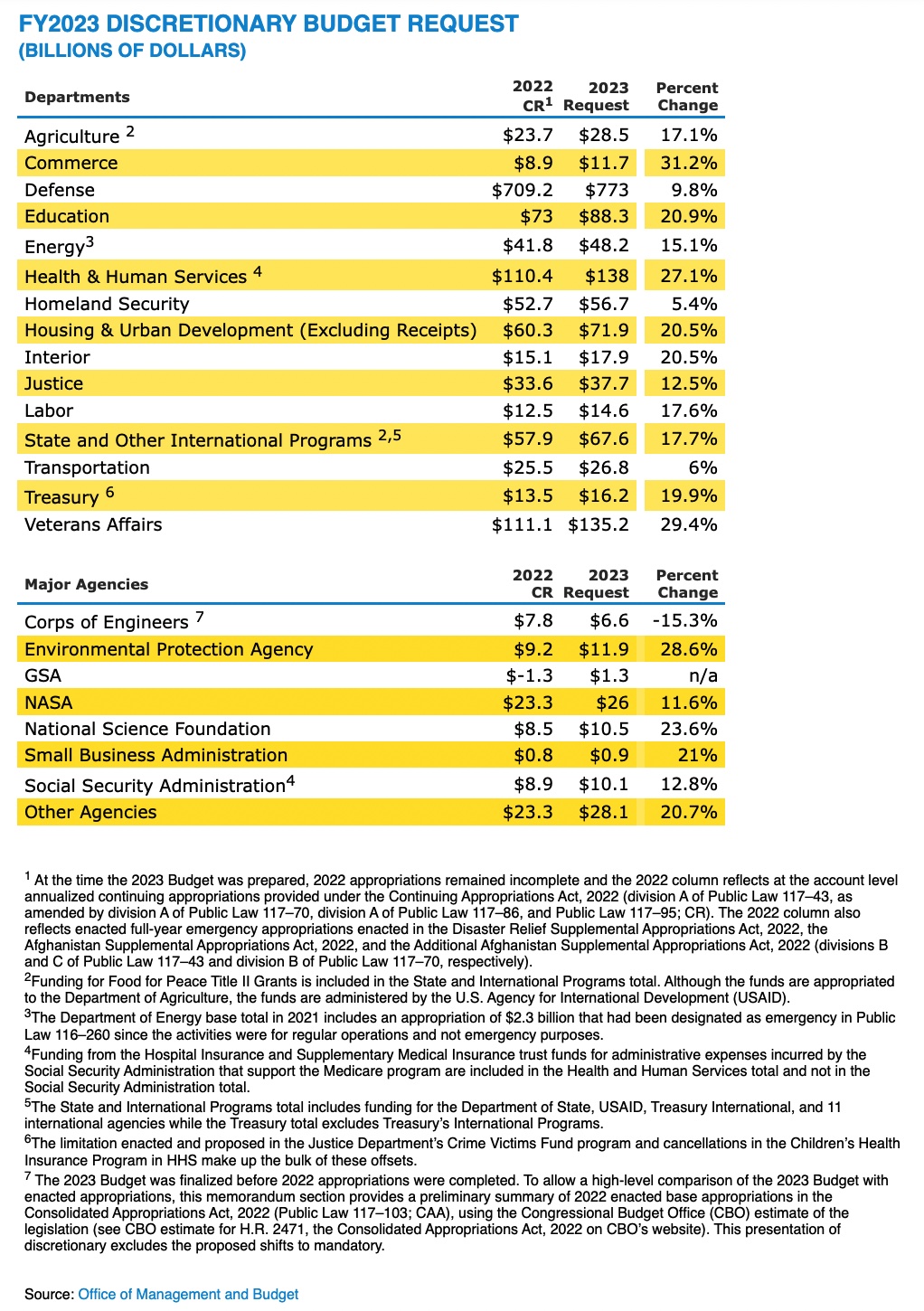

President Biden proposed a $5.8 trillion annual budget yesterday, a request that reflects growing security and economic concerns at home and abroad. There are billions set aside to invest in police departments and the military, paid for in part by higher taxes on corporations and the wealthy that centrist Sen. Joe Manchin (D-W.Va.) has already cast doubt on. For Congress, the budget is a largely symbolic document. The White House budget wish list is an important accounting of the administration’s priorities, most notably that Biden appears to be focusing on smaller policy specifics instead of on the sweeping changes in his Build Back Better bill. Reason: polls showing Democrats are in trouble heading into Nov. 8 midterm elections.

Below we detail the White House spending requests for USDA, with lots of spending boosts on the wish list.

Oil prices slide 7% Monday on expectations that Shanghai’s Covid-19 lockdown will weigh on demand. But still high gas prices have House Speaker Nancy Pelosi (D-Calif.) asking Dems what they could do to soften the pump price blow ahead of Nov. 8 elections.

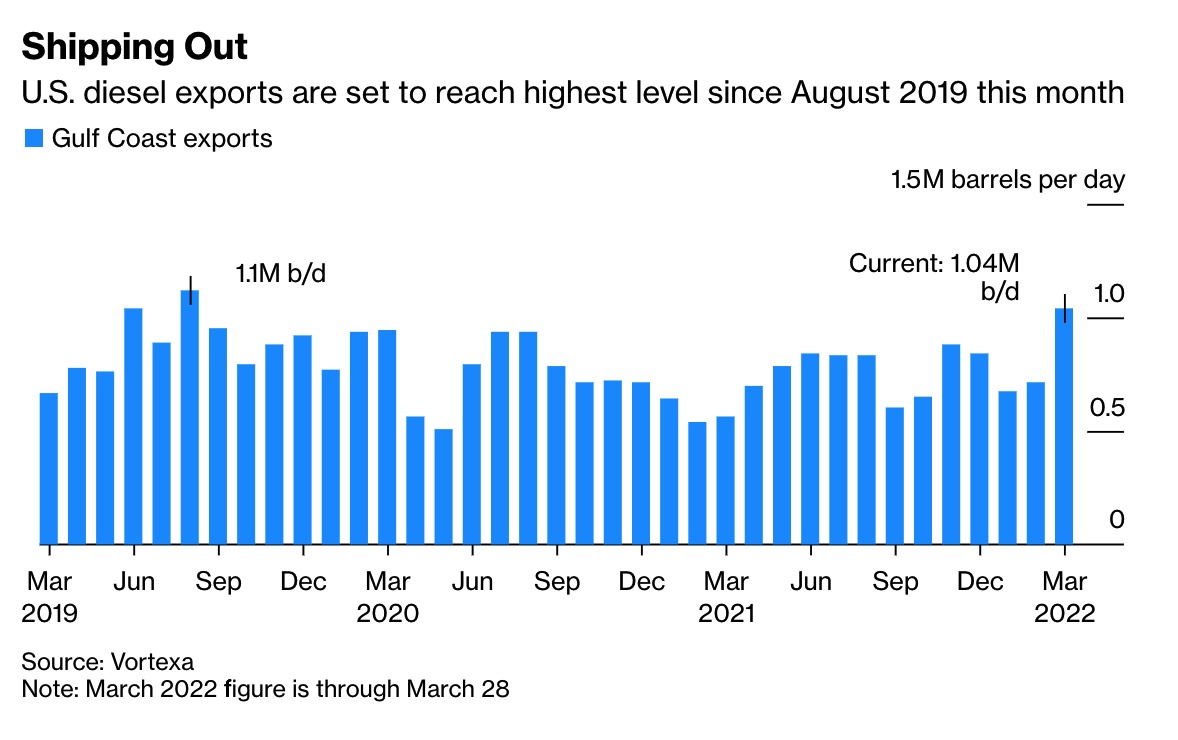

The U.S. is exporting more diesel than it has in years as buyers in Europe and Latin America vie to secure supplies that have tightened since Russia’s invasion of Ukraine.

Business travel is picking up. Corporate travel transactions are up significantly over the past nine weeks, as pandemic restrictions drop across the world and people become more comfortable with face-to-face get-togethers.

White House chief economist said U.S. farmers will respond to “price signals” and increase their production to avert any domestic food shortage stemming from Russia’s invasion of Ukraine. But others ask: where does Cecilia Rouse, the chair of President Joe Biden’s Council of Economic Advisers, think all these extra plantings will come?

The U.S. Supreme Court decided to take up the case regarding California’s Proposition 12 that sets requirements for the amount of space required for animals to be raised.

Sens. Chuck Grassley (R-Iowa), Deb Fischer (R-Neb.), Jon Tester (D-Mont.) and Ron Wyden (D-Ore.) released an updated version of the Cattle Price Discovery and Transparency Act. Under the revised version, there would still be a requirement for minimum purchase levels by packers, a key concern point among many in the cattle industry. The measure still faces an uphill battle in Congress.

|

MARKET FOCUS |

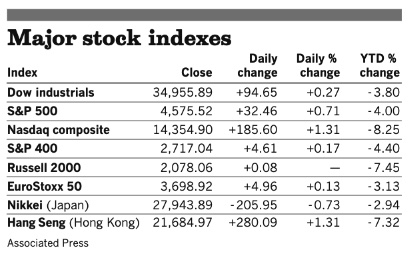

Equities today: Global stocks markets were mostly higher overnight. The U.S. Dow opened around 320 points higher and is currently up just over 400 points. Asian equities were mostly higher as traders assessed China’s lockdown of Shanghai and lower oil prices. The Nikkei rose 308.53 points, 1.10%, at 28,252.42. The Hang Seng Index rose 242.66 points, 1.12%, at 21,927.63. The Shanghai Composite, however, was down 10.56 points, 0.33%, at 3,203.94. European equities are seeing solid advances in early trading with the Stoxx 600 up 1.5% and regional markets mostly up 2% to nearly 3%

U.S. equities yesterday: The Dow gained 94.65 points, 0.27%, at 34,955.89. The Nasdaq was up 185.60 points, 1.31%, at 14,354.90. The S&P 500 rose 32.46 points, 0.71%, at 4,575.52.

Agriculture markets yesterday:

- Corn: May corn futures closed down 5 1/2 cents at $7.48 1/2 and nearer the session high. December corn lost 4 1/2 cents at $6.64 1/2.

- Soy complex: Fures finished sharply lower and low-range for the day. May soybeans fell 46 cents to $16.64 1/4 and November beans dropped 28 cents to $14.68 3/4. May meal futures ended $9.00 lower at $478.90. May soyoil plunged 230 points to 72.45 cents.

- Wheat: Futures posted sharp losses and finished near session lows. May SRW wheat plunged 45 1/4 cents to $10.57. May HRW wheat fell 40 1/4 cents to $10.70 1/2. May HRS wheat dropped 24 3/4 cents to $10.79 1/2.

- Cotton: May cotton futures closed up 317 points at 139.07 cents and nearer the session high. May futures hit at another contract and an 11-year high. December cotton futures closed down 44 points at 111.30 cents.

- Cattle: June live cattle closed down 60 cents at $136.775 and nearer the session high. April cattle closed down 17 1/2 cents at $140.30. May feeder cattle closed down 25 cents at $165.075 and nearer the session low.

- Hogs: April through June hogs posted gains today, while far-deferred contracts ended lower. April hogs firmed 10 cents to $107.575. June hogs firmed 20 cents to $126.05.

Ag markets today: Wheat and corn continued to be pressured in overnight trade. Soybeans traded higher. As of 7:30 a.m. ET, wheat futures were trading mostly 13 to 15 cents lower, corn was 1 to 4 cents lower, and soybeans were 1 to 3 cents higher. Front-month U.S. crude oil futures were more than $1.50 higher, and the U.S. dollar index was around 300 points lower this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• S&P CoreLogic Case-Shiller 20-city home-price index for January is expected to increase 18.6% from one year earlier. (9 a.m. ET)

• U.S. job openings are expected to edge down to 11.1 million in February from 11.3 million the prior month. (10 a.m. ET)

• Conference Board's consumer confidence index is expected to fall to 107.5 in March from 110.5 the prior month. (10 a.m. ET)

• Federal Reserve speakers: New York's John Williams at a New York Fed event on banking at 9 a.m. ET, and Philadelphia's Patrick Harker on the economic outlook at 10:45 a.m. ET.

U.S. farmers will respond to “price signals” and increase their production to avert any domestic food shortage stemming from Russia’s invasion of Ukraine, the White House’s chief economist said Monday. “We don’t expect a shortage here, because we are net exporters,” Cecilia Rouse, the chair of President Joe Biden’s Council of Economic Advisers, said during a budget briefing. “But we are acutely aware of the fact that there are regions in the world that depend heavily on exports of wheat in particular and other grains from Ukraine and Russia.” She predicted American farmers would adjust and increase their planting to take advantage of higher prices. “With the price of food rising, they will be responding by doing —making additional plantings and trying to take advantage of the increased price signal,” she said. “So, the market will work as the market will work.”

Question: So where does Rouse think all these extra plantings will come?

U.S. is the most likely country likely to fall into stagflation, with prices set to continue rising into the second half of this year, according to the latest Bloomberg Markets Live survey. Investment professionals are more pessimistic on the outlook than retail clients, with a majority saying the U.S. is late in the economic cycle. Professional investors favor commodities as the top hedge in such environment, while the retail crowd prefers value stocks.

Business travel is picking up. Corporate travel transactions are up significantly over the past nine weeks, as pandemic restrictions drop across the world and people become more comfortable with face-to-face get-togethers. Conference centers, airlines and hotels are also seeing a bump in bookings related to business travelers. Small and midsize companies are driving much of the acceleration, with some emphasizing their need to get back on the road to meet with existing and prospective clients.

Market perspectives:

• Outside markets: The U.S. dollar index was weaker ahead of U.S. economic data, with the euro and Swiss franc firmer against the greenback. The yield on the 10-year U.S. Treasury note has firmed to trade around 2.5% with a mixed tone in global government bond yields. Gold and silver futures are showing sizable losses, with gold under $1.907 per troy ounce and silver under $24.60 per troy ounce.

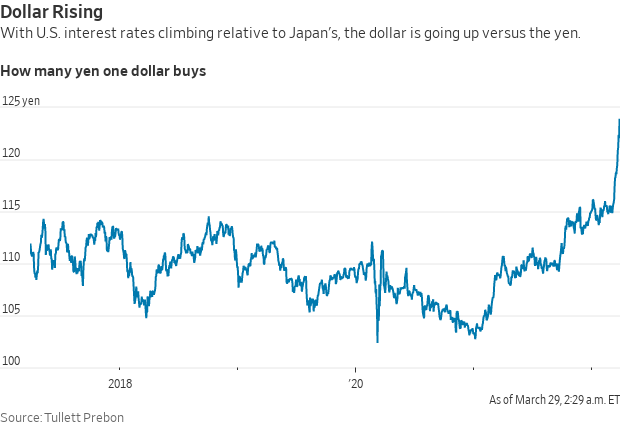

• U.S. dollar rose to a more than six-year high against the yen Monday, fueled by Japan’s preference for a weaker currency and — in a shift — tacit acceptance from U.S. officials focused on inflation. For the first time since August 2015, a dollar on Monday briefly bought more than 125 yen on foreign-exchange markets, vs around 110 yen a half-year ago. The strong dollar means Americans and others whose currencies are linked to the dollar get more bang for their buck when they buy goods made in Japan, a potential boon with U.S. inflation running at nearly 8%. It also means Japanese manufacturers have lower costs in dollar terms and gain an edge over U.S. competitors.

• Crude oil futures have started to pare losses ahead of U.S. market action as U.S. crude is trading around $102.30 per barrel and Brent around $106 per barrel, off their lows seen earlier. Crude prices were weaker in Asian action with U.S. crude around $105.20 per barrel.

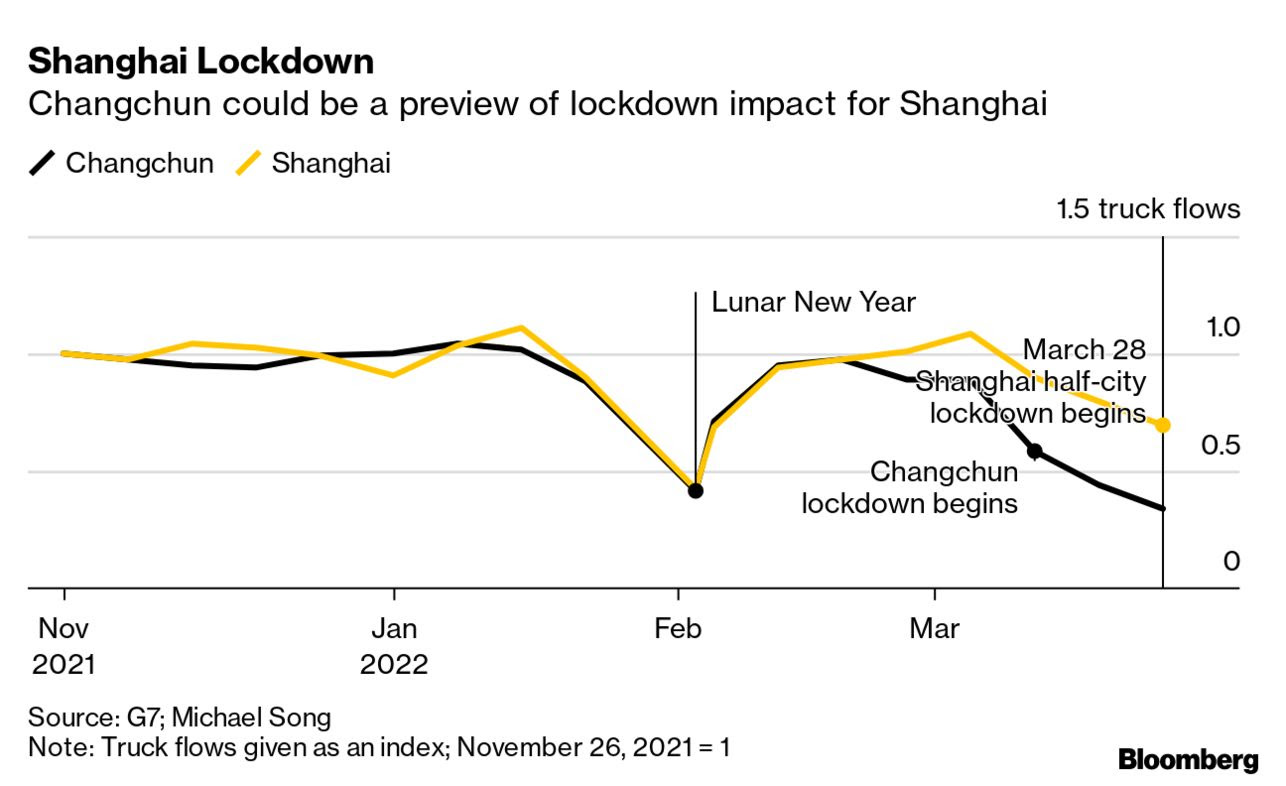

• Shanghai lockdown whacks oil price runup. As expected, new Covid-19 restrictions in China dragged oil prices further below recent highs on Monday, with the prospect of reduced fuel demand easing some pressure on global crude markets. U.S. oil prices slid 7% to $105.96 a barrel, continuing their fall from a recent closing high of $123.70 reached earlier this month. Oil prices remain sharply higher since Russia invaded Ukraine in February, as Western sanctions and boycotts against Russia have effectively cut world-wide supply. China’s aggressive approach to containing Covid-19 is likely to dent the country’s demand for oil, analysts at Commerzbank wrote in a Monday note to clients, after rising cases sent half of Shanghai into a lockdown.

• U.S. diesel exports surge. The U.S. is exporting more diesel than it has in years as buyers in Europe and Latin America vie to secure supplies that have tightened since Russia’s invasion of Ukraine. Bloomberg reports that Waterborne diesel exports out of the U.S. Gulf Coast have climbed to 1.04 million barrels per day so far this month, on track to hit the highest level since August 2019, according to estimates from oil-analytics firm Vortexa. Volumes to Europe have seen the biggest jump in the period to 84,700 barrels per day, on course for an eight-month high. The overseas pull on diesel is straining U.S. stockpiles, which fell to their lowest level in eight years seasonally. Europe, which relied on Russia for about a fifth of its diesel imports in 2019, has been scrambling to find alternatives as concerns mount over the prospect of supplies running out. Meanwhile, buyers in Latin America, the preferred export destination for U.S. refiners in recent years, have had to pay more to remain competitive in international markets.

• Wheat prices held their biggest daily drop in more than a week as India, the second-largest grower, could export a record amount of the grain in the coming year to help fill the gap left by choked Black Sea supply. India could ship 12 million tons of wheat to the world market in the 2022-23 year, the most on record, according to the median of five estimates in a Bloomberg survey of traders, millers and analysts. That compares with shipments of 8.5 million tons in 2021-22, USDA data show. India is in final talks to start wheat shipments to Egypt, the world’s top buyer, while discussions are in progress with countries such as China, Turkey, Bosnia, Sudan, Nigeria and Iran, the commerce ministry said this month. Wheat exports from India were already up more than fourfold to about 6 million tons in the 10 months through January from a year earlier, government data show.

• Australia is ‘pretty well’ sold out for the first half of the year as buyers in the Middle East and Southeast Asia seek to replace Black Sea supplies cut off by the war in Ukraine, according to CBH Group, the country’s biggest shipper. Most of the available capacity will be in the second half, Jason Craig, chief marketing and trading officer, said by phone to Bloomberg. Australia is looking to ship a record amount of wheat this year after a huge harvest. The country is set to export 27.5 million tons of wheat in 2021-22, behind Russia with 32 million tons and the European Union with 37.5 million tons, according to USDA, although Russian shipments could be impacted as the war persists and sanctions take hold.

• India makes Russian sunflower oil purchases at record high prices. India has purchased 45,000 MT of sunflower oil at record prices to be delivered in April, five industry officials told Reuters. Crude sunflower oil at a record price of $2,150 per MT, compared with $1,630 before Russia invaded Ukraine. India buyers halted Russian purchases for a month after the invasion but are now buying as banks offer letters of credit. More than 300,000 MT of Ukraine sunflower oil is stuck. India has also been trying to purchase sunflower oil from Argentina. However, the country will still likely need to import other vegetable oils to cover demand.

• Ag demand: Turkey reduced its purchases of optional origin corn to 100,000 MT from the initial volume of 300,000 MT. Algeria tendered to buy a nominal 50,000 MT of optional origin milling wheat.

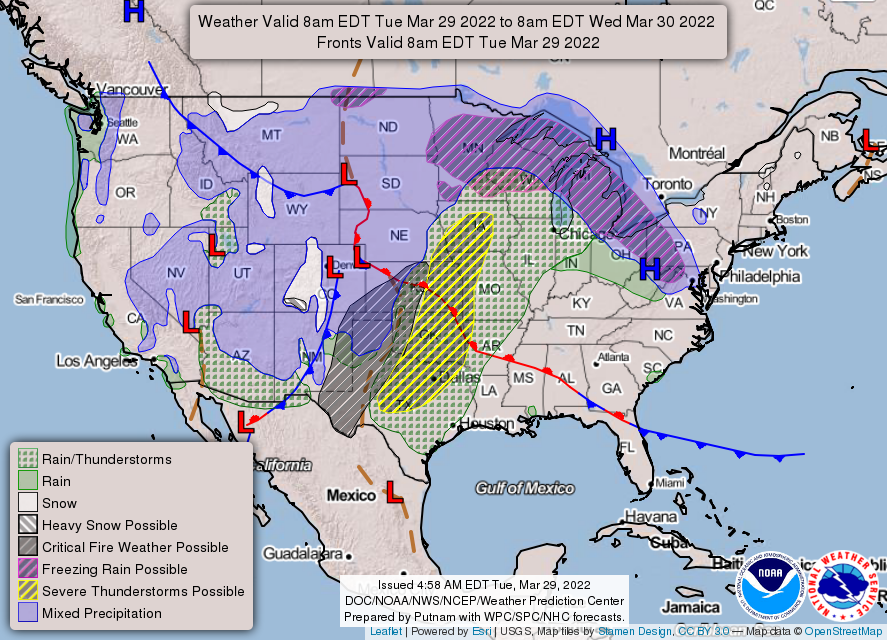

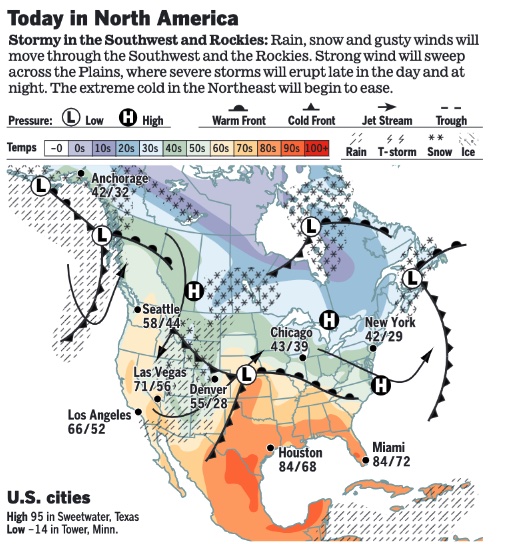

• NWS weather: Severe thunderstorms and excessive rainfall threat on Tuesday into Thursday morning... ...Much below-average temperatures are expected from the Great Lakes into the Northeast/Mid-Atlantic, with records low temperatures possible on Tuesday... ...There is an Extreme Risk of fire weather over parts of the Southern High Plains on Tuesday.

Items in Pro Farmer's First Thing Today include:

• Wheat and corn lower, soybeans higher

• HRW wheat crop ratings improve a little during March

• Consultant expects fewer U.S. corn acres, more soybean plantings

• India makes Russian sunflower oil purchases at record high prices (see details below)

• Fed pivots to higher rate hikes

• Wholesale beef prices firm, but movement slows

• Plenty of cash optimism built into April hogs

|

RUSSIA/UKRAINE |

— Summary: On-site talks between Russian and Ukrainian delegates are continuing in Istanbul today. Turkish President Recep Tayyip Erdogan said he expects "solid outcomes" from the talks and wants an immediate ceasefire. Ukrainian officials want to secure a resolution to the humanitarian crisis, and a cease-fire agreement. Meanwhile, the U.K. said Russian troops still pose a “significant threat” to Kyiv, noting Moscow is currently reorganizing and resetting its forces. Ukraine’s military recaptured the town of Irpin west of the capital from Russian troops, President Volodymyr Zelenskyy said. Meanwhile, President Joe Biden said his weekend remarks that Vladimir Putin cannot stay in power reflected his “moral outrage,” and didn’t mean the U.S. had adopted a policy of regime change. He added that it was “ridiculous” to interpret the remark as calling for regime change and that he would make “no apologies for it”. NATO allies are split on whether they should talk to Putin and what further weapons to send to Ukraine. More than 3.8 million people have fled Ukraine since the war began, according to the United Nations — and half of them are children.

Russian and Ukrainian delegations are meeting today for peace talks at the Dolmabahce Palace in Istanbul, Turkey.

- Deputy Treasury Secretary Wally Adeyemo said the U.S. and its allies will tighten the sanction screws on Russia over its invasion of Ukraine, singling out industries integral to Moscow’s war effort. “Our allies and partners are committed to taking additional significant steps to constrain the Russian economy, for as long as Russia’s invasion continues,” Adeyemo said in the text of a speech he’s scheduled to deliver this morning in London at Chatham House, an international policy institute.

- A major Ukrainian internet provider said it suffered a large cyberattack, and the authorities blamed Russian forces. The inner workings of a pro-Russia hacking group were exposed in a leak.

- Russians can still charge it. Western sanctions have disrupted nearly every part of Russia's financial system, but there is one big exception: Most Russian consumers never lost the ability to use their Mastercard- and Visa-branded cards domestically, even after the card giants exited the country earlier this month. A homegrown system overseen by Russia’s central bank runs the financial plumbing that underpins card transactions, even for cards bearing Visa and Mastercard logos. Link for details via the WSJ.

— Market impacts:

- Ukraine farmers start sowing on 15-20% of planned area: UAC. Ukrainian farmers have started sowing on at least 15-20% of the planned areas for spring crops, UkrAgroConsult (UAC) said. “Spring has finally come to Ukraine; the soil has already frozen off enough to start sowing.” Other areas are still facing frosts at night. Farmers often are not receiving diesel fuel purchases as military forces are getting priority for fuel supplies. Seeds are available, while fertilizer supplies are worse.

- The ruble continued its rebound against the dollar today, boosted by Russian central-bank efforts to prop up its value.

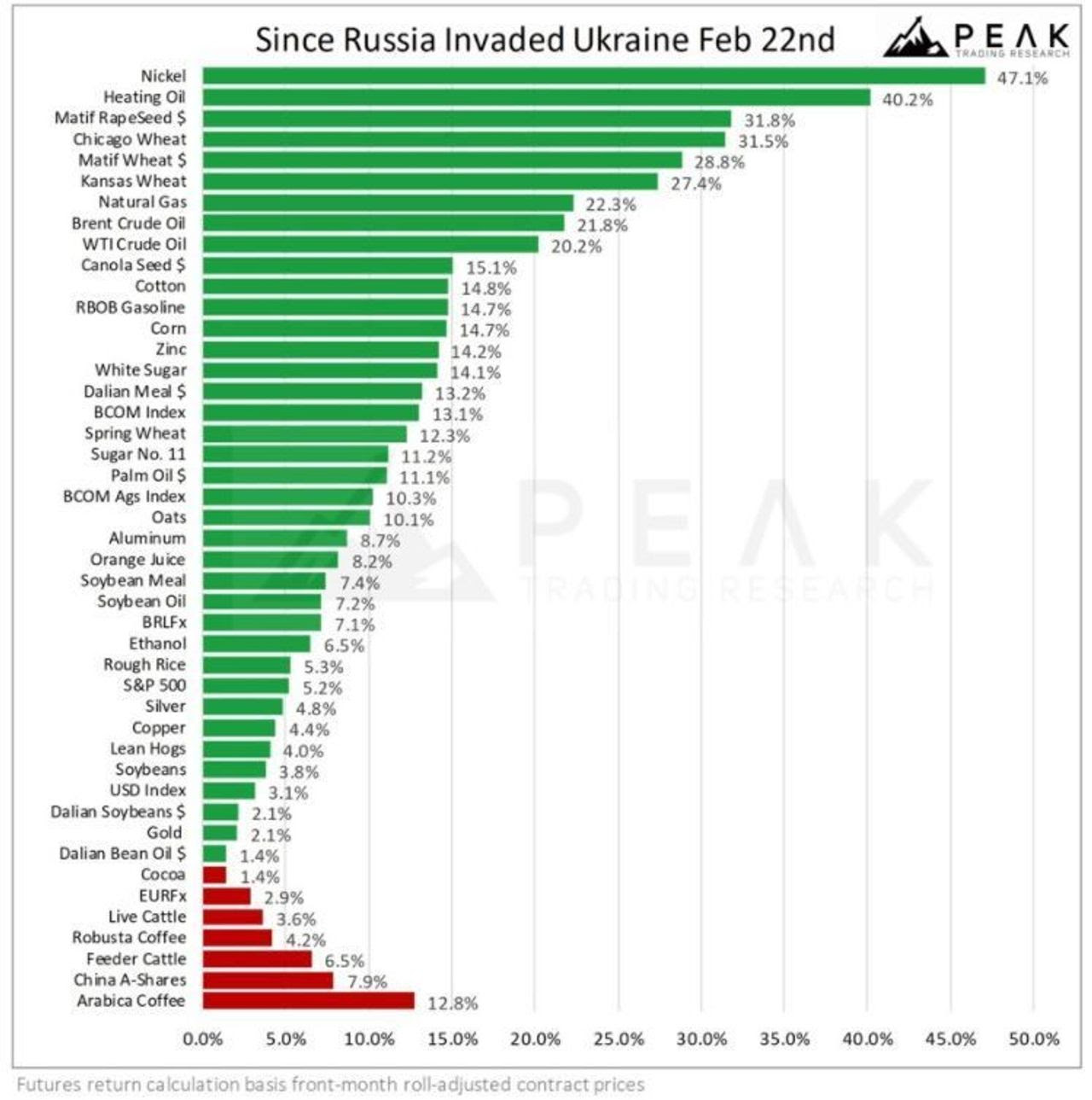

- Market impacts since Russia invaded Ukraine Feb. 24 (not Feb. 22 as the chart below notes):

|

BIDEN’S FY 2023 BUDGET PROPOSALS |

— How to deal with most of President Biden’s FY 2023 budget: don’t get too serious about it. And remember, it took Congress almost six months into this fiscal year (2022) before there was agreement to pass the last budget. The White House budget should largely be looked on as a political document as to where the party in power wants to put taxpayer money. And in an election year such as this, the reams of budget papers and proposals have even more of a political tinge to them as the White House tries to help save some of the Democrats looking at poll numbers slipping for their party.

Upshot: Biden’s budget proposal is mostly a wish list, as the 12 appropriations measures that fund the government are ultimately approved by Congress. Hence, the president’s budget mainly serves as a messaging tool for the administration.

— Biden’s FY 2023 budget: talk about out of date. Consider this passage from a budget document released Monday regarding USDA’s budget proposals: “The Budget provides $9.1 billion for commodity program payments to maintain an effective farm safety net. Commodity programs are critical components of the farm safety net, serving to provide risk management and financial tools to farmers and ranchers. Approximately 1.8 million farms are enrolled in the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs, which are helping cushion the financial strain felt by producers due to continued low prices for many commodities.” Continued low prices? You must wonder when that budget refrain was written — well before the Feb. 24 start of Russia’s war on Ukraine.

— Biden’s FY 2023 budget, some of the key priorities:

- The budget would bolster domestic spending by 7% from current levels, to roughly $1.6 trillion.

- Boost defense spending by 4% from fiscal 2022 to 2023. Biden called for the largest-ever level of military spending and increased funding for law enforcement in a $5.8 trillion budget, playing down his proposals for expanding social programs in favor of backing initiatives generally favored by centrist lawmakers. The budget proposes $773 billion for the Department of Defense, compared to $728.5 billion provided in discretionary spending in 2022. “To sustain and strengthen deterrence, the Budget prioritizes China as the Department’s pacing challenge,” the White House stated. The budget also includes nearly $1.8 billion for the State Department and USAID “to support a free and open, connected, secure, and resilient Indo-Pacific Region and the Indo-Pacific Strategy,” as well as $400 million for the “Countering the People’s Republic of China Malign Influence Fund.” Cybersecurity is also a major security concern reflected in the budget.

- Ukraine aid: Proposed economic, humanitarian, and security assistance to Kyiv, Ukraine. The budget allocates roughly $682 million in aid to Ukraine.

- Law enforcement funding: Allocates $3.2 billion in discretionary funds for state and local grants, as well as $30 billion in mandatory funds to “support law enforcement, crime prevention, and community violence intervention.” There will be more community police officers on the streets across the country under this plan, White House officials said. The plan also proposes to increase the capacity of federal law enforcement agencies such as the FBI and the U.S. Marshals Service to fight violent crime.

- Tax on ultra-rich. Biden is asking Congress to approve legislation that requires the richest U.S. families to pay a minimum of 20% on all of their income, including capital gains on unsold assets such as stocks. (In 2020, there were fifty Fortune 500 companies that made profits of over $50 billion, but they didn't pay anything in federal taxes.) Capital gains are only taxed when they’re realized — when the assets are sold — under current law. Only the wealthiest 0.01% of U.S. households (those worth more than $100 million) will be subject to the tax, according to the plan. Households earning more than $1 billion will account for more than half of the revenue, the White House stated in a fact sheet. However, centrist Sen. Joe Manchin (D-W.Va.) said the idea is a “tough one.” You can’t be taxed “on things you don’t have,” he said. “You might have it on paper. There are other ways for people to pay their fair share, and I think everyone should pay.” Manchin’s early opposition comes as Senate Finance Committee Chairman Ron Wyden (D-Ore.) said he wants to hold hearings to build support for Biden’s proposal. Manchin’s support would be needed to ram the new tax through the 50-50 Senate using a budget procedural maneuver to bypass a Republican Senate filibuster.

- Infrastructure: It calls for broad increases in funding for the Transportation Department to modernize roads, bridges, ports and public transit systems. The budget includes about $115 billion in funding that was part of the infrastructure bill passed by Congress last year.

- Climate: It seeks $45 billion to address climate change — an increase of nearly $17 billion from the year before — for the five major agencies tasked with addressing environmental risks. The president also proposed $11 billion to help other countries hit hard by global warming. The budget calls for a record $11.9 billion in funding — a 28.8% increase — for the Environmental Protection Agency that includes increases in spending for environmental justice efforts, staffing and air, water and chemicals programs.

- Health: The administration asks for a major increase for the FDA’s budget to prepare for another pandemic. The agency’s budget would rise by a third, to $8.4 billion.

- Space funding: The plan includes $26 billion for NASA — the largest request for science in the space agency's history — setting the stage for human exploration on Mars.

- Biden wants to give nearly every agency a big budget boost: The Commerce Department would see the highest percentage increase of the Cabinet departments at 31.2%, moving from $8.9 billion under the CR to $11.7 billion under Biden’s request. This would be closely followed by the Veterans Affairs Department, which would see a 29.4% boost from $111.1 billion in the CR to $135.2 billion under the request. USDA’s increase would be 17.1%.

- Other spending proposals include: a 21% increase in funding for education, new low-income housing vouchers, an 18% rise in spending on diplomatic programs, and a plan to modernize IRS rules, including for crypto tax reporting.

- Political spin: Key Republicans bashed the budget, saying the national security funds wouldn’t keep up with inflation. Republicans want a much higher defense figure than Biden’s proposal for a 4% increase. Progressive Democrats said a military spending boost isn’t justifiable after ending the nearly 20-year war in Afghanistan.

- Biden’s 10-year outlook would rack up $14.4 trillion in deficits — even after accounting for t$1 trillion in net deficit cuts from new policies like tax increases on the wealthy and corporations.

BidenDeficit - Bottom line: Russia’s invasion of Ukraine, Biden’s decline in opinion polls, and decades-high inflation have combined to pull many Democrats toward issues they see as better resonating with voters.

— USDA FY 2023 budget proposals focus on climate, conservation & research. The White House fiscal year (FY) 2023 budget proposals include a $3.8-billion discretionary spending increase for USDA, with climate, conservation and clean energy again major focal points.

- Plan requests $31.1 billion in discretionary spending for USDA, a 12% increase over the FY 2021 enacted level. On the mandatory spending side, which includes farm bill commodity and conservation programs, the budget estimates spending at $164.8 billion, $14.7 billion less than FY 2021 enacted levels. Across mandatory and discretionary spending, USDA’s FY 2023 request is $10.2 billion under FY 2021 levels at $195.9 billion. Outlays for mandatory programs in FY 2023 are estimated at $164.4 billion, or 80.9% of total outlays of $209.3 billion.

- Climate change and conservation: Includes $1.8 billion for climate-related initiatives, with $300 million in new funding aimed at helping rural utilities transition to carbon-free energy sources by 2035. Another $15 million was requested to support increased coordination between USDA, the Department of Energy (DOE), and the Department of Interior to “support the creation of the Rural Clean Energy Initiative” supporting work to reach President Joe Biden’s clean energy goals.

- For USDA’s Agriculture Buildings and Facilities account, the request seeks $134.8 million, $25 million of which is aimed at hiring and buying “hybrid, alternative, and/or electric” vehicles and providing associated charging infrastructure.

- For Natural Resources Conservation Service (NRCS), the budget plan seeks more than $1 billion in discretionary spending for conservation-related technical assistance in FY 2023, up from $832 million in FY 2021 and 2022. Including mandatory spending — such as for programs including the Environmental Quality Incentives Program (EQIP) and the Agricultural Conservation Easement Program (ACEP) — the plan eyes $2.74 billion, down slightly from $2.96 billion in FY 2022 and $2.93 billion in FY 2021. The request included $21 million to support key climate priorities at NRCS, “including establishing a soil health monitoring network that will include a network of soil sampling sites, integrating soil carbon monitoring into the conservation planning process, and efforts to increase the internal capacity of NRCS staff regarding key soil carbon and climate-smart activities.”

- For the Conservation Reserve Program (CRP) the request seeks $2.4 billion to help enroll up to 27 million acres of environmentally sensitive cropland and grassland — the statutory acreage cap in place for FY 2023 under the 2018 Farm Bill.

- For staffing at the NRCS, the request seeks funding for an estimated 11,746 employees at the service in FY 2023 — 655 more than provided for under FY 2022 spending levels (a 2,000-employee increase over what the agency had in FY21). For the Farm Service Agency (FSA), the budget request seeks funding for an estimated 3,157 employees, an increase of 79 from FY 2022 levels. Notably, across all agencies, the request seeks an additional $365 million spending bump to cover 4.6% pay increases for all USDA workers.

- Other conservation program highlights:

- $2 billion for EQIP, up $175 million from FY 2022.

- $1 billion for the Conservation Stewardship Program (CSP), up $200 million from FY 2022.

- $450 million for ACEP, the same as FY 2022.

- $300 million for the Regional Conservation Partnership Program (RCPP), the same as FY 2022.

- Ag research spending would also see a boost under the FY 2023 plan, which seeks $4 billion for ag and food research programs—above FY 2022’s $3.5 billion level—to “support research to advance the competitiveness of US agriculture, promote food security and increase climate change research.” At USDA’s Agricultural Research Service (ARS), the plan looks for discretionary spending of $1.9 billion, up from $1.6 billion in FY 2022. That includes increases of $127 million for “climate science and adaptation and resilience research,” $101 million for clean energy research and development, $5 million for USDA Climate Hubs, and $75 million for “additional high priority investments.”

- ARS’ budget also seeks a $48 million spending increase for research and operations at the National Bio and Agro-Defense Facility (NBAF), the department’s state-of-the-art facility for the study of emerging and zoonotic animal disease threats. Another $45 million is earmarked for NBAF capital improvement and renovation and construction at the Beltsville Agricultural Research Center (BARC) in Maryland.

- At the National Institute of Food and Agriculture (NIFA), the budget blueprint proposes discretionary spending of $1.8 billion, up from FY 2022’s $1.6 billion. For NIFA’s Agriculture and Food Research Initiative (AFRI), the request eyes a $129 million increase in discretionary spending over FY 2022, to $564 million. USDA says there will be “a broad emphasis on climate-smart agriculture, nutrition security, and the application of clean energy” at AFRI, and describes the additional funding as supporting the administration’s “whole-of-government” approach to addressing climate change.

- USDA’s Economic Research Service (ERS) discretionary spending is requested at $100 million for FY 2023, up from $85 million in FY 2022. USDA said $2 million of the increase will be used to support climate science activities. The request seeks $217 million in discretionary spending at USDA’s National Agricultural Statistics Service (NASS), up from $184 million in FY 2022.

- Market enforcement and department oversight: The Biden administration has placed an emphasis on the need to strengthen the enforcement of rules aimed at ensuring fairness in livestock markets and has highlighted market concentration — including across the ag sector — as a key issue. Part of that push are new USDA rulemakings focused on the Packers and Stockyards Act (P&SA), with the FY 2023 request seeking an additional $12 million in discretionary spending “to fund new statutory requirements, to strengthen oversight of livestock and poultry markets and minimalize IT security vulnerabilities,” related to P&SA activities.

- For USDA’s Office of the Inspector General (OIG), the request eyes discretionary spending at $112, up from $109 million in FY 2022 which also included $9 million set aside for one time audit and investigation outlays.

- Other highlights:

- Trade. Spending for USDA’s Foreign Agricultural Service (FAS) would see little change under the FY 2023 request, with most additional discretionary spending focused on salaries and expenses, and other line items largely the same as FY 2022 marks. Overall, FAS discretionary spending is requested at $2.217 billion, up from $2.198 estimated for FY 2022.

- Rural broadband. USDA’s ReConnect rural broadband grant and loan program would see a funding boost under USDA’s FY 2023 request. The request eyes $113 million in additional funding for ReConnect over FY 2022 enacted levels—to $600 billion.

- Rural business loans. The request looks for a large funding increase for the Rural Business-Cooperative Service’s (RBCS) Business and Industry (B&I) Guaranteed Loan Program, seeking $1.5 billion for B&I loan guarantees—nearly $600 million over FY 2021 and almost $1 billion over FY 2022 enacted levels.

- SNAP & WIC. The budget request proposes $111 billion in funding for the Supplemental Nutrition Assistance Program (SNAP), enough to cover 43.5 billion beneficiaries per month. Meanwhile, it seeks to hold funding for the Special Supplemental Nutrition Program for Women, Infants and Children (WIC) at $6 billion. Note: Food stamp enrollment will remain high well into 2023 due to the lingering effects of the pandemic and its disruption of the U.S. economy, USDA said. It estimated an average 43.5 million people would receive food stamps during fiscal 2023, a 3 percent increase from this year.

|

POLICY UPDATE |

— CFAP payouts stay mostly static. Payments under the Coronavirus Food Assistance Program 2 (CFAP 2) held steady in the week ended March 27 with total CFAP 2 payments at $19.17 billion which includes $14.34 billion in original CFAP 2 payments and $4.83 billion in top-up payments. CFAP 1 payments were slightly lower as original CFAP 1 payments are at $10.62 billion ($10.63 billion the prior week) while the top-up payments were steady at $1.19 billion. The downward trim to original CFAP 1 payments did not change the overall total which remained at $11.82 billion.

— USDA plans major farm bill push. The fiscal year (FY) 2023 budget proposal for USDA notes the agency will be working “this year” with Congress, partners, stakeholders and the public “to identify shared priorities for the 2023 Farm Bill.” The document also brings its concept of climate-smart commodities into the mix, noting they are looking forward to “working with the Congress to address climate change through climate-smart agriculture and forestry and investments in renewable energy that open new market opportunities and provide a competitive advantage for American producers of climate-smart commodities, including small and historically underserved producers and early adopters, and through voluntary incentives to reduce climate risk.” USDA also said they “anticipate sharing more detail on the administration’s Farm Bill priorities” without providing a timeline for such an effort. Historically, USDA efforts to put forward their priorities for a farm bill have been met with minimal enthusiasm on the Hill and at times outright rejection as lawmakers view crafting the omnibus legislation as their job and not that of the administration.

|

PERSONNEL |

— Senate confirms CFTC nominees. The Senate Monday confirmed the nominations of Christy Goldsmith Romero, Kristin Johnson, Summer Kristine Mersinger, and Caroline Pham to serve as Commissioners of the Commodity Futures Trading Commission (CFTC). This comes ahead of CFTC Chairman Rostin Behnam’s scheduled appearance to testify on the State of the CFTC before the House Agriculture Committee March 31.

— Senators today will resume consideration of the nomination Nani A. Coloretti to be to be deputy director of the Office of Management and Budget. At 5:30 p.m., if cloture is invoked, the Senate will vote on Coloretti’s confirmation.

— Lisa Cook update. Senate Majority Leader Chuck Schumer (D-N.Y.) set up a vote to break a deadlock in the Banking Committee and force the nomination of Lisa Cook to the Federal Reserve Board of Governors to the Senate floor. The vote, scheduled by Schumer (D-N.Y.) for this morning, would bring Cook’s nomination out of the Banking Committee, which had cleared Biden’s other nominees: Jerome Powell to a second term as Fed chair, Lael Brainard as vice chair and Philip Jefferson as a governor all advanced.

|

CHINA UPDATE |

— China’s grain supplies ample, prices to stay stable: Economic Daily. China’s supplies of grains and other farming products key to daily life are secure and their prices can stay stable, Economic Daily reports, citing agriculture ministry and its affiliated researchers. China’s grains are more than 95% locally produced, which has helped contain domestic price gains even as global prices rise faster this year. Cooking oil prices are expected to fall gradually as output is likely to rise this year, while pork price declines may ease as government steps up support to farmers. Supplies of eggs, dairy products and vegetables are all ample.

— Taiwan to extend tariff cut on wheat, soybean to end of June. Taiwan plans to extend the tariff cut on wheat, corn, soybean, butter, powdered milk for baking and imported beef to end-June to stabilize prices and ease inflationary pressure, according to a statement from the cabinet late Monday. The reduction of the commodity tax on gasoline and diesel oil will also be extended to end-of-June.

— Shanghai’s port remains open, but exporters are bracing for delays as the lockdowns hit warehouses, transport and staffing, a pattern experienced during similar targeted lockdowns such as the one in the southern city of Shenzhen. The WSJ reports (link) that though China is getting better at keeping ports open and factories humming when restrictions tighten in response to rising caseloads, economists and company executives say the repeated flare-ups and logistical headaches of navigating shifting public-health measures are nonetheless weighing on industry, keeping up inflationary pressure on a world economy already struggling with surging prices. Bottom line: “China is getting better at managing the shocks, but the shocks are getting bigger,” said Hui Shan, chief China economist at Goldman Sachs in Hong Kong.

Bottom line: China’s Covid lockdowns are likely costing the country at least $46 billion a month, or 3.1% of GDP, in lost economic output, and the impact could double if more cities tighten restrictions. That’s a minimum estimate from an economist at the Chinese University of Hong Kong based on the assumption that cities generating about 20% of China’s gross domestic product are currently imposing targeted lockdowns.

— Senate passes China competition bill to start talks with House. The Senate Monday passed its version of a long-stalled bill (HR 4521) to aid the domestic semiconductor industry and bolster U.S. competitiveness with China, a key step needed to kick off negotiations with the House on final legislation. The Senate voted 68-28 for the plan, which includes $52 billion in grants and incentives to bolster chip manufacturing as well as provisions aiming to jump-start innovation and bring key industries back to the U.S. amid a global supply chain crunch.

— U.S. Department of Commerce said that it will investigate whether Chinese solar producers are illegally circumventing solar tariffs by routing operations through four countries in Southeast Asia. The investigation could culminate in the imposition of significant tariffs on solar cells and modules from Chinese companies operating out of Cambodia, Thailand, Vietnam and Malaysia.

|

ENERGY & CLIMATE CHANGE |

— Oppose holiday on federal gas taxes, get a higher rating. The U.S. Chamber of Commerce told lawmakers that it would reward them with higher ratings from their lobbying group if they oppose a holiday on federal gas taxes, according to a letter from the Chamber reviewed by the Wall Street Journal (link), as the Chamber is concerned that suspending the gas tax could hurt infrastructure projects. In another lobbying effort, the American Road & Transportation Builders Association is sending around a new study to lawmakers that claims changes to gas taxes don't always result in savings for consumers.

— EPA chief talks oil output boost and carbon emissions. EPA Administrator Michael Regan said in an interview with the Financial Times (link) that the Biden administration's recent calls for increased oil output are still "compatible" with its goals to cut carbon emissions and transition to green energy, and that the two objectives aren't "mutually exclusive." Regan also said that the rise in oil prices shows that the United States is "held captive to fossil fuels" to a certain extent, but that increasing renewable resources will make the country less "vulnerable" in the future.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Scores of new HPAI cases confirmed by USDA. USDA’s Animal and Plant Health Inspection Service (APHIS) now shows 77 confirmed cases of highly pathogenic avian influenza (HPAI). APHIS added several new confirmed cases, including March 25 confirmed finds in Meeker County, Minnesota (240,000 commercial turkeys); Mower County, Minnesota (20 backyard mixed species – non-poultry); Franklin County, Iowa (250,239 commercial pullet chickens); Suffolk County, New York (408 backyard mixed species – non poultry); Mitchell County, Kansas (20 backyard mixed species – non-poultry); and Hutchinson County, South Dakota (46,700 commercial turkeys). Cases confirmed March 26 were in Stearns County, Minnesota (36,000 commercial turkeys); Washington County, Maine (18 backyard mixed species – non-poultry); Holt County, Nebraska (53 backyard mixed species – non-poultry); Gentry County, Missouri (113 backyard mixed species – non-poultry); and Bon Homme County, South Dakota (150 backyard mixed species – non-poultry). Confirmations on March 27 were made in South Dakota—Clark County (42,000 commercial turkeys); McPherson County (43,500 commercial turkeys); and Hutchinson County (39,000 commercial turkeys).

Confirmed HPAI cases have now been found in 45 commercial operations and 32 backyard flocks.

— Lawmakers unveil latest version of cattle market bill. Sens. Chuck Grassley (R-Iowa), Deb Fischer (R-Neb.), Jon Tester (D-Mont.) and Ron Wyden (D-Ore.) released an updated version of the Cattle Price Discovery and Transparency Act. Under the revised version, there would still be a requirement for minimum purchase levels by packers, a key concern point among many in the cattle industry.

Under the revamped version, USDA would establish five to seven regions in the continental U.S. and set “minimum levels of fed cattle purchases made through approved pricing mechanisms.” The legislation identifies those mechanisms as cattle purchases made through negotiated cash, negotiated grid, at a stockyard and through trading systems that multiple buyers and sellers regularly can make and accept bids.

There would be a maximum penalty for covered packers of $90,000 for mandatory minimum violations. The legislation defines covered packers as ones that have slaughtered 5% of the number of fed cattle nationally in the preceding five years.

The package would create a publicly available library of marketing contracts, mandating boxed beef reporting to ensure transparency, expediting the reporting of cattle carcass weights and requiring a packer to report the number of cattle scheduled to be delivered for slaughter each day for the next 14 days.

The lawmakers also worked with USDA to develop the current version, with Grassley noting it was the result of “months of working with staff at [USDA] to make technical changes that will allow them to best implement the bill.”

It is not clear that the changes in the package will win any additional supporters as the bill has been bogged down by concerns that the minimum purchase requirements could thwart innovative cattle pricing efforts by packers and in turn could harm producer. The fact it has taken months for this version of the legislation to be developed underscores the challenges of implementing such a measure.

— Supreme Court to take up case on California’s Proposition 12. The U.S. Supreme Court has finally decided to take up the case regarding California’s Proposition 12 that sets requirements for the amount of space required for animals to be raised. The National Pork Producers Council (NPPC) and American Farm Bureau Federation (AFBF) petitioned the Supreme Court to intervene in the case after the U.S. Court of Appeals for the Ninth Circuit dismissed the suit brought by NPPC that the California law was unconstitutional.

NPPC and AFBF contend that because Prop 12 applies to producers — regardless of whether they are located in California — the measure violates the Constitution’s Commerce Clause that prohibits states from regulating interstate commerce. The lower court ruling found that while the groups “plausibly alleged that Proposition 12 will have dramatic upstream effects and require pervasive changes to the pork production industry nationwide,” the groups failed to show the California law is a violation of the Commerce Clause under the court’s precedent in the matter.

The Sacramento County Superior Court also issued a ruling to delay enforcement of Proposition 12 for pork retailers in January for 180 days.

NPPC and AFBF welcomed the court’s decision to take up the case while the Humane Society of the U.S. called on the nation’s highest court to uphold Proposition 12.

What’s next: Briefs in the case are expected to be filed in the coming weeks and the Supreme Court could set oral arguments for the fall which could open the door for a decision in the case by the end of 2022.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 482,397,962 with 6,128,039 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,995,544 with 977,688 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 559,976,590 doses administered, 217,448,365 have been fully vaccinated, or 66.24% of the U.S. population.

— Biden administration has started administering Covid-19 vaccines to migrants claiming asylum at the U.S.-Mexico border.

|

CONGRESS |

— Congress will honor the late Rep. Don Young (R-Alaska), who is scheduled to lie in state at the U.S. Capitol.

|

OTHER ITEMS OF NOTE |

— Secretary of State Antony Blinken will hold talks in Morocco Tuesday with the de facto ruler of the United Arab Emirates. Blinken and Abu Dhabi Crown Prince Mohammed bin Zayed will “discuss regional security and international developments,” according to a U.S. statement.

— Antitrust bill: The Justice Department endorsed legislation forbidding large digital platforms such as Amazon and Google from favoring their own products and services over competitors.