Shanghai Shutdown Will Disrupt Commercial Activity Well Beyond the City

Will Supreme Court finally accept petition to review Prop 12 ruling?

|

In Today’s Digital Newspaper |

Shanghai lockdown. Shanghai, the city of 25 million people, begins a strict pandemic lockdown. Local authorities today imposed restrictions on the eastern half of China’s financial center until April 1 to conduct mass coronavirus testing; its western half will then be locked down until April 5. Financial firms called employees into the office ahead of the start of restrictions, urging them to sleep at their workplaces. Tesla had to stop production at its plant there.

The White House is still trying to clear up President Joe Biden’s flub during a speech in Poland when he ad-libbed ad-lib that Vladimir Putin “cannot remain in power.” White House officials scrambled to emphasize that regime change is not part of their policy. Administration officials and Democratic lawmakers said Sunday the off-the-cuff remark was an emotional response to Biden’s interactions with refugees.

Ukrainian forces aim to roll back Russian gains as Moscow shifts its focus to controlling a swath of the country’s south and east. The idea of Russia pulling back to the eastern part of Ukraine leaves the idea of a better chance of crops to the West getting planted: mainly corn and sunflower.

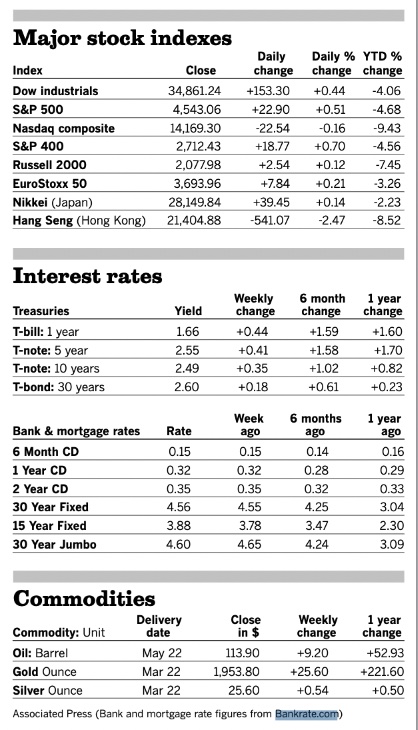

Part of the U.S. yield curve inverted for the first time in 16 years. Yields on five-year Treasury bonds rose to 2.63%, above those for 30-year notes. It’s a sign that investors believe the Fed may raise interest rates so high that it leads to a recession.

UBS estimates that around two million barrels a day, or about a fourth of the Russian output, has been disrupted. The International Energy Agency forecast that the level could reach three million by next month, warning of a potential spark in the worst energy-supply crisis in decades.

President Biden will propose a 20% minimum tax on the income and rising asset values of households worth more than $100 million. The White House today will unveil its FY 2023 budget, which will be a sop to both moderates in the Democratic Party and to its (very liberal) progressives.

We should know about 10 a.m. ET whether the Supreme Court accepted a petition to review a prior ruling on California’s Prop 12, which has the U.S. hog sector more than anxious.

A summit in Israel this week has former enemies in the Middle East looking to work together on containing Iran, as the U.S. rethinks its security role in the region.

Finally, a note about two “hitters”: Slugger Albert Pujols is going back to where he launched his Hall of Fame-caliber career in 2001 — the St. Louis Cardinals. Meanwhile, for those (most of you) who did not watch the Oscars/Academy Awards last evening, there was another hitter: Actor Will Smith slapped comedian Chris Rock on stage. Rock was presenting the award for documentary feature, but before announcing the nominees or the winner, the comedian joked about Smith’s wife, Jada Pinkett Smith, who was seated next to her husband at the Dolby Theatre in Hollywood. “Jada, I love ya. ‘G.I. Jane 2,’ can’t wait to see it,” Rock said, seeming to refer to the actor’s short hair. Pinkett Smith, who suffers from alopecia, wasn’t laughing. And neither was her spouse. “King Richard” star Will Smith stormed the stage, slapped the comedian, then made his way back to his seat as ABC bleeped the audio feed. But it wasn’t hard to read Smith’s lips. The next time Smith was on stage it was to accept lead actor award for his role as Richard Williams, the protective and demanding father of tennis stars Serena and Venus. He was visibly shaken, tears streaming down his face as he apologized to fellow nominees and the motion picture academy ... but not to Rock. “Art imitates life,” said Smith. “I look like the crazy father, just like they said about Richard Williams.”

|

MARKET FOCUS |

Equities today: Global stocks markets were mixed overnight. The U.S. stock indexes are pointed toward narrowly mixed openings. Asian equities finished mostly higher to open the week. The Hang Seng Index rose 280.09 points, 1.31%, at 21,684.97. The Nikkei was the exception, falling 205.95 points, 0.73%, at 27.943.89. European equities are advancing in early trade, with the Stoxx 600 up 1.1% and regional markets up 1.8% to 2.1%; the FTSE 199 was only managing a rise of around 0.7%.

U.S. equities Friday: The Dow rose 153.3 points, 0.4%, to 34,861.24. The S&P 500 added 22.9 points, 0.5%, to 4,543.06, while the Nasdaq dropped 22.54 points, 0.2%, to 14,169.3.

For the week, the Dow was up 0.3%, the S&P was ahead 1.8%, extending its gains over the past two weeks to 8.1%, the strongest run since late 2020. The Nasdaq rose 2%, extending its two-week rise to more than 10%.

Five-year Treasury yields rose above those on 30-year bonds to invert for the first time since 2006 and the spread between 3-month bills and 10-year notes was the widest in five years.

Agriculture markets Friday:

- Corn: May corn rose 5 3/4 cents to $7.54, up 12 1/4 cents for the week, while December corn firmed 1 1/2 cents to $6.69, up 23 1/2 for the week.

- Soy complex: May soybeans rose 9 1/2 cents to $17.10 1/4, up 42 1/4 cents for the week, while November soybeans gained 3 3/4 cents to $14.96 3/4. May soybean meal rose $2 to $487.90 per ton. May soybean oil rose 46 points to 74.75 cents per pound.

- Wheat: May SRW wheat rose 16 1/2 cents to $11.02 1/4, up 38 1/2 cents for the week and the first weekly gain in three. May HRW wheat rose 15 3/4 cents to $11.10 3/4, up 40 1/4 cents for the week. May spring wheat rose 21 1/2 cents to $11.04 1/4, the contract’s highest closing price since March 15.

- Cotton: May cotton futures surged the daily trading limit if 500 points to 135.90 cents per pound, up 904 points for the week the highest settlement for a nearby contract since mid-2011.

- Cattle: June live cattle rose 42.5 cents to $137.375, up 30 cents for the week. May feeder futures fell $1.175 to $165.325, down $2.125 for the week.

- Hogs: June lean hogs soared $3.775 to $125.85, up $8.075 for the week. Continued wholesale pork strength, signaling firm retail demand, boosted hog futures to contract highs.

Ag markets today: Wheat futures led overnight price declines, with corn and soybeans following to the downside. Despite the heavy pressure, wheat and corn futures remained within their recent sideways trading ranges, while soybeans stayed within their choppy to higher range. As of 7:30 a.m. ET, winter wheat futures were trading mostly 34 to 39 cents lower, spring wheat was 22 to 26 cents lower, corn was 6 to 10 cents lower and soybeans were 11 to 15 cents lower. Front-month U.S. crude oil futures were more than $5 lower and the U.S. dollar index was around 300 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. advance economic indicators for February are out at 8:30 a.m. ET.

• Dallas Fed's manufacturing survey is expected to tick down to 13 in March from 14 one month earlier. (10:30 a.m. ET)

• USDA Grain Export Inspections report, 11 a.m. ET.

• President Biden will announce his fiscal year 2023 budget, with OMB Director Shalanda Young also speaking, 2:45 p.m. ET.

Inflation watch: Fertilizer price index at record as Ukraine war tightens supply. With the Russia-Ukraine war in its fifth week, urea and phosphate keep climbing in New Orleans (NOLA), Brazil, Europe and the Middle East. Tampa ammonia closed at a record $1,625 a metric ton (mt) for April, up 43% from March. Potash prices jumped in NOLA and Brazil to almost two times last month's Chinese annual contract, according to Bloomberg Intelligence. The service notes that Brazilian potash prices topped $1,100 per mt in mid-March, up 32% in two weeks. Options for Brazilian buyers outside Russia are few. Belarus and Russia together produce 37% of the world's supply. Canada is the next best option, but China and India locked in a now-cheap 11-month contract at $590 per mt.

A new report from the IMF revealed that the dollar's share of international reserves has been in decline over the past two decades as central banks have looked to diversify their holdings. For example, China has pushed for greater adoption of the yuan, and recently held talks with Saudi Arabia for a yuan-based oil deal. Link to report. Link to another report.

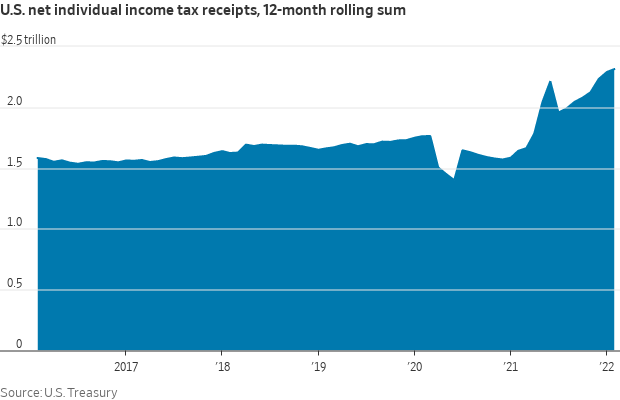

Wall Street banks increasingly expect the Federal Reserve to raise interest rates more aggressively than policy makers are projecting, with Citigroup economists now seeing four straight half-point moves amid persistent inflation. Citigroup now expects 2.75 percentage points of increases this year and more in 2023, taking the benchmark rate to a range of 3.5% to 3.75%, analysts led by Andrew Hollenhorst said in a research note Friday. That’s well beyond the 2.8% level that central bankers expect to reach, based on the median of projections released last week.

Goldman Sachs Group said it now expects the Federal Reserve to raise interest rates by a half-percentage point at both its May and June meetings to contend with surging inflation, leading the Wall Street bank to revise up its forecasts for U.S. Treasury yields across the curve.

Meantime, Bank of America said its team expects a quarter-point hike in May followed by two half-point moves, then quarter-point increases through May 2023 to reach a range of 3% to 3.25%.

Market perspectives:

• Outside markets: The U.S. dollar index is higher ahead of U.S. market action, with a generally higher tone in global currencies except the British pound. The yield on the 10-year U.S. Treasury note has climbed to trade above 2.50% ahead of U.S. market action with a higher tone in global government bond yields. Gold and silver are seeing sharp losses in electronic trade, with gold under $1,930 per troy ounce and silver under $25.25 per troy ounce.

• Crude oil futures are under pressure ahead of U.S. trading, with U.S. crude around $190.30 per barrel and Brent around $113.10 per barrel. Futures were lower in Asian action, with U.S. crude around $110.50 per barrel and Brent around $117.50 per barrel.

• Real effects of some buyers’ halt on Russian crude are creating a second wave of impact on oil markets, disrupting Russian exports and threatening further price increases. Oil is typically shipped around three weeks after a deal is struck, meaning that the drop in deal making in the early days of the war led to real disruptions in supply starting in the past week. The turmoil is being strongly felt in Europe, where prices for diesel, which powers cars, trucks and tractors, have soared, the WSJ notes (link).

• Rising oil prices have brought Alaska its biggest budget surplus in nearly 20 years. Now the state is debating whether to spend the money on education and infrastructure or save it for the next downturn. Taxes and royalties from oil and gas production in Alaska generate about half the state’s general fund.

• New round of SPR oil release discussed. The U.S. is considering another release of oil from its emergency reserves, according to reports. The specific amount is being discussed among top aides to Biden, but it would likely be more oil than the 30-million-barrel release announced earlier this month. The U.S. and other major economies last week discussed oil supply and the potential for another round of releases, Biden’s top national security aide said, raising the prospect of new government intervention to ease supply strains.

• Wheat futures tumbled the most in more than a week on signs that global supply may not be as constrained as some had feared in the immediate aftermath of the Russian invasion of Ukraine over a month ago.

• Ag demand: Turkey provisionally purchased 300,000 MT of optional origin corn.

• Los Angeles Mayor Eric Garcetti said he expects labor talks to be resolved without significant disruption to the biggest U.S. ports — and an already stressed supply chain — as West Coast dockworkers’ contracts expire this summer.

• West Coast port progress. At 39, the number of container ships backed up waiting for berths at the ports of Los Angeles and Long Beach on March 24 is below 40 vessels for the first time since Sept. 4, 2021, according to the Marine Exchange of Southern California.

• Georgia on my mind. A yearslong effort to deepen the harbor at Georgia’s Port of Savannah was completed.

• Alaska Air will convert two of its 737-800 passenger jets to freighters after cargo revenue jumped 25% last year.

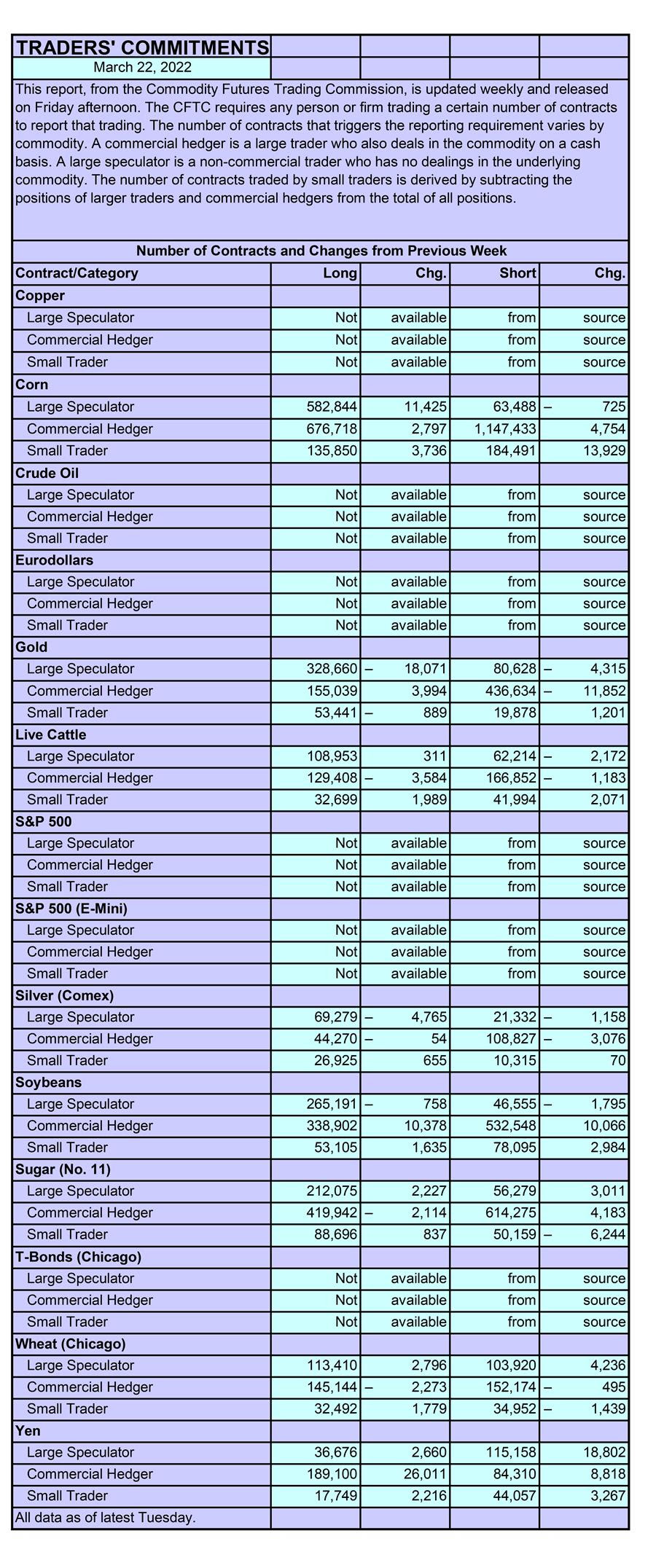

• CFTC Commitments of Traders report (Source: Barron’s):

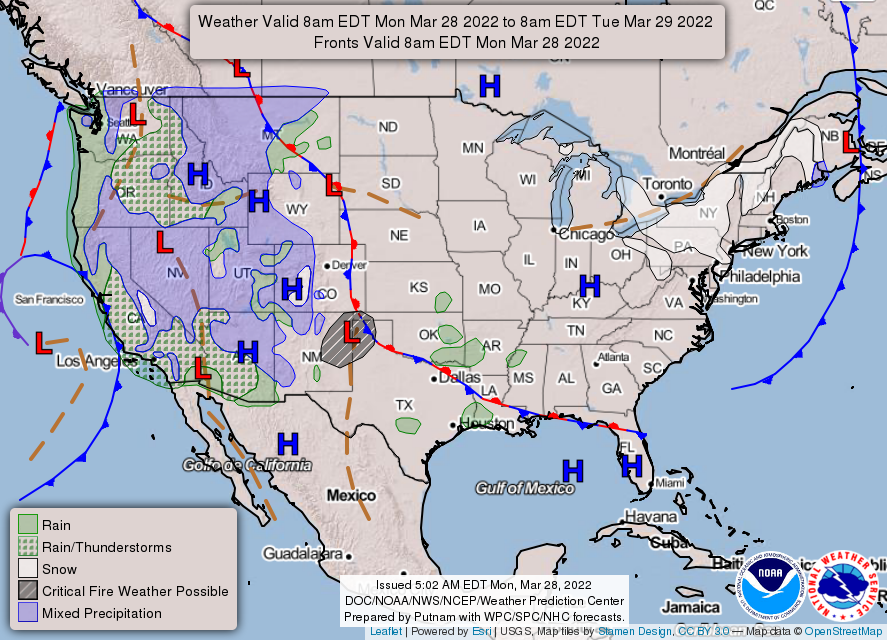

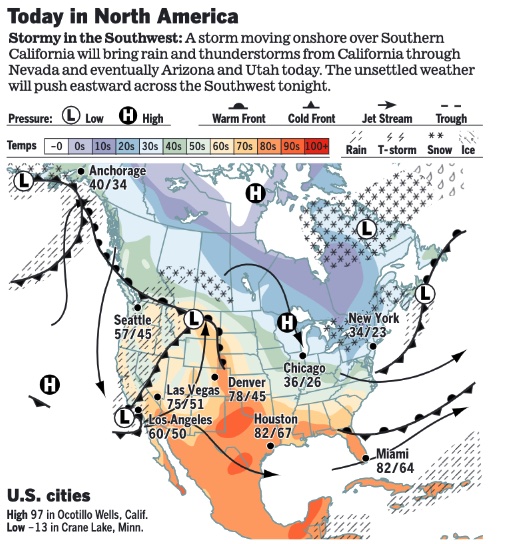

• NWS weather: Much below-average temperatures are expected from the Great Lakes into the Northeast, with records possible... ...Lake effect snow to remain active off the Lower Great Lakes, beginning to diminish overnight Monday... ...There is a Critical Risk of fire weather over parts of the Southern High Plains... ...Rain and snow return to the West.

Items in Pro Farmer's First Thing Today include:

• Heavy price pressure to open the week

• Demand remains strong for China wheat auctions

• Mildly negative Cattle on Feed Report

• Cash hog index the highest since the end of August

|

RUSSIA/UKRAINE |

— Summary: Ukrainian President Volodymyr Zelenskyy said Kyiv could declare its “neutrality” and effectively renounce its ambitions to join NATO in a potential peace deal with Moscow but stressed that Ukraine’s sovereignty and territorial integrity are “beyond doubt." Ukrainian and Russian negotiating teams plan to meet in Turkey this week. Russian missile strikes continued to pummel Ukraine over the weekend, including more around the city of Mariupol, which Russia wants to capture because of its strategic port. Ukraine’s military intelligence head says Russia’s assault on the capital city of Kyiv has failed, and instead of capturing the government, Russian President Vladimir Putin could now be aiming to cleave Ukraine in two — like North and South Korea. Meanwhile, President Joe Biden denied he’s seeking the removal of Vladimir Putin after European allies raised concern and critics said he was further inflaming tension with Russia. French President Macron and U.K. officials distanced themselves from Biden’s comment at a rally in Warsaw that Russia’s president “cannot remain in power.”

- In an interview with the Economist, Zelenskyy said Putin is “throwing Russian soldiers like logs into a train’s furnace.” He offered a mixed assessment of the West’s response to Russia’s invasion, praising Britain and warning that Germany is “making a mistake” with its pragmatism. He reiterated his request for planes, armored vehicles and tanks from the West, and said he wants to negotiate with \Putin, with the goal of saving “as many lives as possible.” Link for details.

- Ukraine announced that it would not be operating any humanitarian corridors out of besieged cities, including Mariupol, on Monday because of the risk to civilians of “provocations” by Russia. Zelenskyy said that more than 2,000 children in Mariupol had been abducted by Russia.

- Ukraine’s foreign ministry said that Russian troops were being withdrawn from their positions around Kyiv, having suffered “significant losses”. Russia now seems to be concentrating its efforts even more solidly on two cities: Mariupol in the south and Chernihiv in the north.

— Market impacts:

- On Friday, Russian stocks fell 3.7% a day after the Moscow stock exchange partially reopened after a month-long closure, reversing some of Wednesday’s 4.4% jump. Gazprom slid 12% and Russia’s largest lender Sberbank declined 3.5%.

- No stagflation in Europe? Christine Lagarde, president of the European Central Bank, said she doesn’t expect the war in Ukraine to contribute to stagflation in the euro zone.

- Russia's war has caused $63 billion worth of damages to Ukraine's infrastructure, according to the Kyiv School of Economics.

|

POLICY UPDATE |

— Biden to propose new minimum tax on wealthiest Americans. President Biden will propose a new minimum tax on households worth more than $100 million as part of his annual budget, the White House said, in a bid to ensure the very wealthiest Americans pay at least 20% in tax on their income and rising asset values each year. The proposal would affect fewer than 20,000 households, and it would apply only to those who don’t pay at least 20% in tax on a combination of income as typically defined and their unrealized gains on unsold assets such as stocks and closely held businesses. The plan would generate roughly $360 billion in revenue over 10 years, according to a White House fact sheet released in advance of today’s full budget proposal. That is about twice as much money as raising the top individual income-tax rate to 39.6% from 37%, and it would affect a much smaller group of people.

|

PERSONNEL |

— Rural power trade group taps new legal chief. The National Rural Electric Cooperative Association has recruited its first new legal chief in nearly a decade: D. Scott Barash, who was most recently the top lawyer for Washington, D.C.’s public school system. The association is currently grappling with a range of regulatory and legislative issues related to climate change, infrastructure, and rising energy prices.

— FAA Chief: Billy Nolen, the FAA’s associate administrator for aviation safety, will lead the agency on an acting basis after administrator Steve Dickson steps down at the end of March.

|

CHINA UPDATE |

— Shanghai will lock down half of the city in turns to conduct a mass testing blitz for Covid-19, as authorities race to staunch a spiraling outbreak. Residents will be barred from leaving their homes, public transport will be suspended, and private cars will not be allowed on the roads unless necessary. An analysis of figures shows China’s latest outbreak was preceded by an influx of imported cases from Hong Kong. All over Shanghai, the government’s announcement sparked frenzied scrambles to food markets and grumbling about the disruption to urban life in a city that until recently appeared relatively unaffected by Covid. Any suspension of commercial activity in Shanghai will likely have global ripple effects as the city is one of China’s primary centers for finance, manufacturing and goods trade.

One impact: Tesla: The electric-car maker is suspending production at its plant in Shanghai for four days.

|

ENERGY & CLIMATE CHANGE |

— Russia’s invasion of Ukraine is further driving up the price of renewable-energy projects. A third of U.S. utility-scale solar capacity scheduled for completion in the fourth quarter of 2021 was delayed by at least a quarter and 13% of the projects planned to complete this year have been delayed for a year or canceled, according to a new report.

— NHTSA to unveil fuel economy rules for cars and light trucks. The National Highway Traffic Safety Administration (NHTSA) is set to finalize new fuel economy standards for cars this week. The U.S. Transportation Department, which oversees NHTSA, said when it first proposed the new standards last year that they would increase fuel-efficiency 8% annually for model years 2024-2026, and increase the estimated fleet-wide average by 12 miles per gallon by model year 2026. The agency faces a March 31 deadline to finalize new rules for the 2024 model year.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA continues to confirm new HPAI finds. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed several cases of highly pathogenic avian influenza (HPAI) in both backyard and commercial flocks, including the first finds in Minnesota.

Two flocks in Minnesota were confirmed with HPAI — one in a commercial turkey flock in Meeker County and the other in a backyard mixed species flock (non-poultry) in Mower County. There was no information provided on the flock size.

Iowa officials said that APHIS confirmed a third case of HPAI in Buena Vista County in a commercial turkey flock.

Other cases: USDA also reported cases that were confirmed March 22 in Charles Mix County, South Dakota (57,100 commercial turkeys); Hanson County, South Dakota (102,250 commercial turkeys); Beadle County, South Dakota (29,900 commercial turkeys); Butler County, Nebraska (570,000 commercial broiler chickens); Suffolk County, New York (4,000 commercial upland game birds); and discoveries confirmed March 23 in Beadle County, South Dakota (50,000 commercial turkeys); Kingsbury County, South Dakota (124,000 commercial layer chickens); and Edmunds County, South Dakota (31,730 commercial turkeys).

The new cases would put total confirmed HPAI cases at 62 (USDA data shows 59 as the cases in Minnesota and Buena Vista County, Iowa, have not been added to their confirmed list but are likely to be added today or early this week).

— Canada confirms HPAI in Ontario. The Canadian Food Inspection Agency (CFIA) has confirmed H5N1 highly pathogenic avian influenza (HPAI) in a poultry flock in southern Ontario. CFIA had previously confirmed HPAI finds in both Nova Scotia and Newfoundland and Larador in both backyard and commercial flocks.

— Will Supreme Court announce this morning that it will accept a petition to review a Prop 12 ruling? If so, the news should break around 10 a.m. ET. Some sources say the SCOTUS may be waiting for Californian to issue final rules. And, it’s unclear Justice Clarence Thomas’ recent illness disrupts any timeline. A California law passed by voters in 2018 and backed by the Humane Society is prompting anxiety among the U.S. hog sector. The law, called Proposition 12, requires breeding pigs to be able to lie down and turn around in spaces in which they are housed, essentially outlawing pork produced using small gestation stalls in most circumstances. Link to WSJ article on the topic.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 481,009,234 with 5,974,544 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,954,460 with 976,704 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 559,873,640 doses administered, 217,424,576 have been fully vaccinated, or 66.23% of the U.S. population.

— FDA is expected to greenlight additional Covid-19 booster shots for adults over the age of 50 as early as next week. Once that happens, the CDC will likely make a “permissive recommendation,” which means the additional shots won’t be officially recommended, but will be available to those who want them.

|

POLITICS & ELECTIONS |

— In blow to Democrats, judge throws out Maryland redistricting map. The Washington Post reports (link) a Maryland judge has thrown out the state’s congressional map, calling it an “extreme partisan gerrymander” in what is a victory for Republicans who said Democrats in the state General Assembly sought to silence their votes. According to the WaPo, “The ruling Friday by Anne Arundel County Senior Judge Lynne A. Battaglia marks the first time in Maryland history a judge has found a congressional map violated the state constitution.”

— Milwaukee, Nashville make final pitches to house 2024 GOP presidential convention. The Associated Press reports (link) that Milwaukee and Nashville, which are vying to host the 2024 Republican presidential convention, made their final pitches to the Republican National Committee in Washington last week and a final decision is expected soon. AP says, “It may rest on whether Republicans see more value in the honky-tonk-infused branding that Nashville offers as a way to connect with the white working-class voters likely to be at the center of the 2024 general election — or the chance to stake a claim to Wisconsin, a perennial presidential swing state that has its fair share of those voters in play.”

— NBC News had additional bad polling news for Biden, Dems. President Biden’s approval ratings hit 40% — the worst of his presidency. “‘What this poll says is that President Biden and Democrats are headed for a catastrophic election,” said Republican pollster Bill McInturff of Public Opinions Strategy, who conducted the survey with Democratic pollster Jeff Horwitt of Hart Research Associates.

|

CONGRESS |

— Klobuchar: Supreme Court nominee Ketanji Brown Jackson will be confirmed in two weeks. Sen. Amy Klobuchar (D-Minn.) said on ABC’s This Week that Jackson will get Republican support. Klobuchar said, “She has in every other nomination she’s had for various levels of the court. I would make very clear here, she’s not going to get confirmed in two years. She is not going to get confirmed in two months. She’s going to get confirmed in two weeks.”

|

OTHER ITEMS OF NOTE |

— Mideast Summit clouded by Iran, Ukraine. Secretary of State Antony Blinken sought to reassure Israeli and Arab partners convening for a rare summit in Israel on Sunday that the U.S. would continue to counter any Iranian threat even as he promoted nuclear diplomacy with Tehran. The summit includes foreign ministers from three Arab states that normalized ties with Israel even as peace-making with the Palestinians is stalled. Blinken's visit comes as some allies in the region question the Biden administration's commitment and brace for fallout from an Iranian nuclear deal and the Ukrainian crisis.