Will Push by Some Ag Groups to Plant Some CRP Acres Alter RFS Mandates?

U.S. and EU close to deal aimed at slashing Europe’s dependence on Russian energy

|

In Today’s Digital Newspaper |

NATO estimated on Wednesday that 7,000 to 15,000 Russian soldiers have been killed in four weeks of war, and Secretary of State Antony Blinken said the U.S. has determined that Russian troops have committed war crimes in Ukraine. Meanwhile, Ukraine struck a Russian-occupied port in its southeast that has become a major logistics hub for Russian forces.

President Joe Biden is in Brussels today as he joins EU, G7, and NATO leaders in assessing the international response to Russia’s invasion of Ukraine as the conflict enters its fifth week. Volodymyr Zelenskyy, Ukraine's president, will appear by video link. Western powers are expected to announce further sanctions today. Biden is scheduled to finish the day with a press conference at NATO headquarters at 3 p.m. ET.

The U.S. and European Union are close to a deal aimed at slashing Europe’s dependence on Russian energy, while Russia demanded payment for its natural gas in rubles (for unfriendly countries), sending gas and oil prices higher.

A U.S. official says the United States will welcome up to 100,000 refugees from Ukraine as 3.5 million people flee Russia’s invasion.

The Senate will likely vote today on legislative trade stripping most favored trade status from Russian and Belarus and codifying the U.S. ban on Russian oil and energy imports. President Biden has already done so by executive order, but Congress wants to make it into law.

The U.S. gov’t released two key U.S. economic reports before the opening bell: jobless claims and durable goods. Filings for first-time unemployment benefits for the week ended March 19 dropped 28,000 to 187,000, fewer than expected and the lowest level since early September 1969. February durable goods orders fell 2.2%, more than double the estimated decline.

USDA daily export sale: 318,200 metric tons of soybeans to unknown destinations during the 2021-2022 marketing year.

Corteva: Farmers are starting to bring on extra acres... Due to rising commodity prices, farmers will plant more acres to crops, according to Corteva Inc. Chief Technology Officer Sam Eathington.

The U.S. and Japan announced an agreement that lowers the chances of Japan imposing higher tariffs on U.S. beef. Japan’s parliament must approve the new safeguard measures, so it’s uncertain when they would be implemented.

The Biden administration will exempt some Chinese imports from tariffs imposed during Donald Trump’s presidency. Trump had initially approved the exemptions for certain goods but allowed them to expire in 2020. (Impact is on about two-thirds of Chinese products that were previously granted waivers.)

On the farm policy front, some groups are urging USDA to allow cropping of Conservation Reserve Program (CRP) acreage classified as prime farmland or is less environmentally sensitive. Farm Bureau says it supports marginal and HEL returning as the main focus of CRP. Biofuel proponents fret that if requested CRP action is taken, this could up the odds of EPA altering RFS mandates via the food-vs-fuel debate.

The largest U.S. airlines are urging the Biden administration to drop the federal mask mandate on jetliners, along with the pre-departure testing requirement for international travelers. Earlier this month, the CDC for the third time extended its mass transit mask mandate by 30 days, until mid-April, and masking guidelines for airlines remain in place. The federal mandate applies across airports and trains, as well as buses and car share services.

Supreme Court nominee Ketanji Brown Jackson, a Harvard and Harvard Law alumna, said she plans to recuse herself from a Harvard affirmative-action case if she is confirmed. Meanwhile, today’s Wall Street Journal recalls a prior controversial ruling from the SCOTUS nominee regarding country-of-origin labeling.

|

MARKET FOCUS |

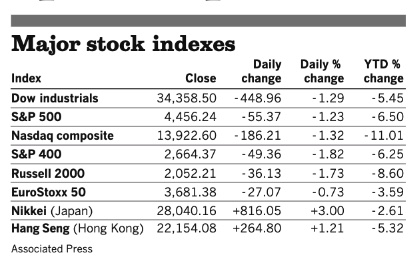

Equities today: Global stocks markets were mixed overnight. The U.S. Dow opened around 110 points higher. Asian equities were mixed. The Nikkei gained 70.23 points, 0.25%, at 28,110.39. The Hang Seng Index shed 208.13 points, 0.94%, at 21,945.95. European equities are narrowly mixed, with the Stoxx 600 nearly flat and most regional markets seeing losses of 0.2% to gains of 0.6%.

U.S. equities yesterday: The Dow fell 448.96 points, 1.29%, to 34,358.50. The blue-chip index is 6.6% off the record close it hit on Jan. 4 and down 5.4% for the year. The S&P 500 ticked down 55.37 points, 1.23%, to close at 4,456.24. The Nasdaq slid 186.21 points, 1.3%, to 13,922.60.

Foreign investors have unloaded $9.5 billion of mainland Chinese stocks so far this month, reflecting a reassessment of geopolitical risk following the financial isolation of Russia.

Agriculture markets yesterday:

- Corn: May corn futures rose 4 3/4 cents to $7.57 3/4. December corn gained 2 1/4 cents to $6.72 1/4 and posted a contract high for the third day in a row, touching $6.80 1/2.

- Soy complex: May soybeans rose 22 1/4 cents to $17.18 3/4, the highest settlement for a nearby contract since September 2012. May soyoil jumped 143 points to 75.97 cents per pound, while May soymeal climbed $8.30 to $485.10.

- Wheat: May SRW wheat fell 12 1/2 cents to $11.05 3/4. May HRW fell 5 cents to $11.11 1/2. May spring wheat fell 6 1/2 cents to $10.89 1/4.

- Cotton: May cotton futures fell 1 point to 130.03 cents per pound, after rising earlier to 132.96 cents, a contract high and the highest intraday price for a nearby contract since mid-2011.

- Cattle: June live cattle rose 27.5 cents to $135.975. May feeder cattle rose 37.5 cents to $165.80.

- Hogs: April lean hogs rose $2.30 to $102.55, while June jumped $2.90 to $122.975 after posting a contract high at $124.45.

Ag markets today: Grain and soy markets faced price pressure overnight and are trading near session lows this morning. As of 7:30 a.m. ET, corn was trading 2 to 6 cents lower, soybeans were 12 to 15 cents lower, winter wheat was mostly 13 to 17 cents lower and spring wheat is 6 to 9 cents lower. Front-month U.S. crude oil futures were near unchanged after earlier pushing above $116 and the U.S. dollar index was around 125 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. jobless claims, due at 8:30 a.m. ET, are expected to fall to 210,000 in the week ended March 19 from 214,000 one week earlier. UPDATE: Filings for first-time unemployment benefits for the week ended March 19 dropped 28,000 to 187,000, fewer than expected and the lowest level since early September 1969.

• U.S. durable goods orders for February, due at 8:30 a.m., are expected to fall 1.0% from the prior month. UPDATE: February durable goods orders fell 2.2%, more than double the estimated decline.

• U.S. current account deficit, due at 8:30 a.m. ET, is expected to widen to $220 billion in the fourth quarter from $214.77 billion the prior quarter.

• USDA Weekly Export Sales report, 8:30 a.m. ET. UPDATE: Soybean export sales plummet. Net sales of 979,500 MT for 2021/2022 were down 47% from the previous week and 29% from the prior four-week average. Increases primarily for Mexico (265,300 MT, including decreases of 400 MT), Colombia (153,900 MT, including 49,000 MT switched from unknown destinations and decreases of 4,000 MT), South Korea (127,200 MT), unknown destinations (92,600 MT), and Israel (69,700 MT, including 65,000 MT switched from unknown destinations), were offset by reductions reported for Costa Rica (1,800 MT) and Nicaragua (1,300 MT). Total net sales of 6,100 MT for 2022/2023 were for Mexico.

• IHS Markit's preliminary U.S. manufacturing index for March, due at 9:45 a.m. ET, is expected to tick down to 57.0 from 57.3 at the end of February. The services index is forecast to be unchanged at 56.5.

• Kansas City Fed's manufacturing survey, due at 11 a.m. ET, is expected to fall to 26.5 in March from 29 one month earlier.

• Federal Reserve speakers: Gov. Christopher Waller on the U.S. housing market at 9:10 a.m. ET, Chicago's Charles Evans to the Detroit Regional Chamber at 9:50 a.m., and Atlanta's Raphael Bostic at Spelman College at 11 a.m. ET

Federal Reserve Bank of Cleveland President Loretta Mester said Wednesday that the U.S. central bank will need to front-load its rate-rise campaign with aggressive moves, but she doesn’t think this path will send the economy into recession.

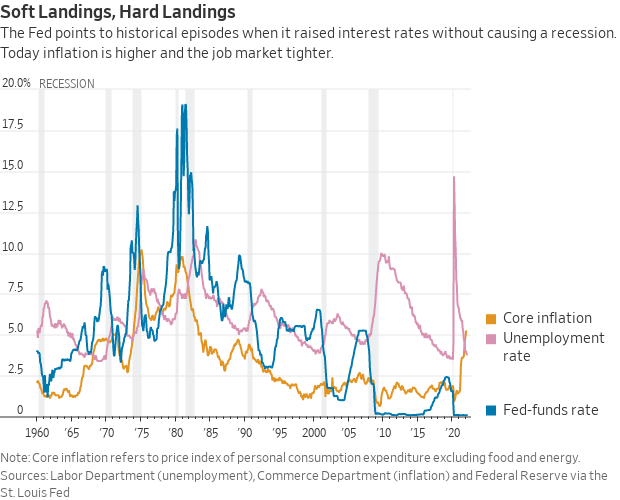

Fed risks a hard landing. Federal Reserve Chairman Jerome Powell explained this week what he and his colleagues hoped to accomplish with the interest-rate increases they initiated last week. “The economy achieves a soft landing, with inflation coming down and unemployment holding steady,” he told a conference of economists. In 1965, 1984 and 1994, the Fed raised interest rates enough to cool an overheating economy without precipitating recession, he noted, adding it may have done the same in 2019 but for the Covid-19 pandemic. WSJ writer Greg Ip writes (link), “Unfortunately, history isn’t on his side. Inflation is much further from the Fed’s objective, and the labor market, by many measures, is tighter than in previous soft landings. Yet the Fed starts with real interest rates—nominal rates adjusted for inflation — much lower, in fact deeply negative. In other words, not only is the economy already traveling above the speed limit, the Fed has the gas pedal pressed to the floor. The odds are that getting inflation back to the Fed’s 2% target will require much higher interest rates and greater risk of recession than the Fed or markets now anticipate.”

Inflation watch: Finger pointing about higher prices is not limited to the United States. Argentina’s food sector is rejecting gov’t accusations on price rises. Argentina’s food business group COPAL rejected accusations made by Interior Commerce Secretary Roberto Feletti that blamed the sector for inflation and price increases. The secretary’s remarks didn’t promote dialogue and instead put culpability on the food and beverage sector, despite the gov’t having recognized inflation as having many causes, the food group said. Breaches mentioned by secretary aren’t responsibility of supplier companies, according to COPAL, which urged the gov’t to avoid looking for culprits within an industry and to join forces to move forward with concrete measures.

Meanwhile, Argentina’s gov’t will create a new basket of 60 goods with regulated prices in April, Interior Commerce Secretary Roberto Feletti announced Wednesday. Feletti said the new basket will be rolled out along with the next edition of the government’s broader price control program known as Precios Cuidados. Feletti said the government will return wheat ton prices to levels recorded in January.

Inflation watch: The average Wall Street bonus jumped to a record high of $257,500 in 2021, boosted by low interest rates and a flourishing market for initial public offerings, according to estimates from the New York state Comptroller. The bonus pool rose 21%, to $45 billion last year. The average security industry salary of $438,470, including bonuses, was almost five times the $92,315 average salary in the rest of the private sector, the Financial Times reported. The security industry makes up 5% of private sector jobs in New York City.

Blame game: Sen. Elizabeth Warren (D-Mass.) blamed rising U.S. inflation in part on the largest ocean shipping companies, calling “the anti-competitive nature” of the industry the root cause of soaring prices to transport goods around the global economy.

Market perspectives:

• Outside markets: The U.S. dollar index is higher amid slight weakness in the euro against the greenback. The yield on the 10-year U.S. Treasury note has risen to trade around 2.38% with a mixed-to-positive tone in global government bond yields. Gold and silver futures are higher with gold above $1,947 per troy ounce and silver around $25.34 per troy ounce.

• Federal Reserve Chairman Jerome Powell said the central bank supported innovation in digital financial products but warned that it is “easy to see the risks” of certain new technologies, including cryptocurrencies, that would demand a regulatory overhaul. Powell said Wednesday that some of these innovations would require changes to existing laws and regulations to ensure proper oversight of the broader financial sector. He spoke during a panel discussion with other central bank governors hosted by the Bank of International Settlements.

• Crude oil futures are lower in choppy trade ahead of U.S. trading. U.S. crude is trading around $114.35 per barrel and Brent around $117.65 per barrel. Futures fluctuated between losses and gains in Asian action, with U.S. crude trading around $115.00 per barrel and Brent near $118.20 per barrel.

• Oil may surpass $200 a barrel, top traders predict. Sanctions on Russia and a lack of alternatives could lead to the loss of millions of barrels a day in crude that won’t be replaced anytime soon, industry executives said at a Financial Times conference. “Wakey, wakey,” Pierre Andurand, a prominent oil trader said. “We are not going back to normal business in a few months.”

• Indonesia’s biodiesel exports seen surging. Indonesia, the world’s largest palm oil producer, is seen exporting 1 million kiloliters of biodiesel this year as demand increases due to rising crude oil prices, Vice Chairman of Indonesia Biofuel Producer Association, Paulus Tjakrawan, said in an interview with Bloomberg in Yogyakarta. Exports were only about 91,500 kiloliters in 2021. The association sees this year’s robust demand coming from China and European countries. Indonesia produced 8.98 million KL of biodiesel in 2021 and consumed 8.44 million KL. B30 biodiesel mandate will use about 17% of 2022 palm oil production.

Meanwhile, Indonesia will push for a greater proportion of palm oil in biofuels even as the edible oil’s price trades near the highest in decades. The government won’t stop at B30 mandate, which requires that fossil fuels be blended with 30% palm oil, said Airlangga Hartarto, coordinating minister for economic affairs. Officials are studying the rules and infrastructure to increase the requirement beyond that, Energy and Mineral Resources Minister Arifin Tasrif added. The B30 mandate has an economic value of more than $4 billion and helps reduce greenhouse gas emission by the equivalent of up to 25 million tons of carbon dioxide, Tasrif said. Indonesia put on hold its plan to increase palm content in biodiesel to 40% last year, before restarting preparations to do road tests on vehicles using that mix this year.

• Fuel price protests in Spain. Vehicles and burning tires blocked highways as truckers teamed up in slow-moving convoys to snarl traffic in several cities, disrupting a broad supply chain network. French dairy giant Danone and brewer Heineken have warned they may have to halt operations and distribution in Spain. One of Spain’s largest supermarket operators, Carrefour, put signs up in some stores to notify customers about shortages.

• North American rail traffic decreased 3.5% in the week ending March 19 as a two-day lockout on Canadian Pacific and other supply chain constraints weighed on railroad volume, according to Bloomberg Intelligence.

• Corteva: Farmers are starting to bring on extra acres due to rising commodity prices, says Corteva Inc. Chief Technology Officer Sam Eathington. This is probably a multiyear trend around high commodity prices, Eathington said in a Wednesday interview cited by Bloomberg. “When you start seeing the corn, soybean, cotton, wheat commodity numbers, you’re going to bring acres into production if you can,” he said. Crop chemical supplies are tight because of supply-chain disruptions, and some farmers are having difficulty with availability of products. Corteva hasn’t seen any dramatic change in farmer seed choice, he added.

• Ag trade: Jordan made no purchase in its tender to buy 120,000 MT of optional origin wheat.

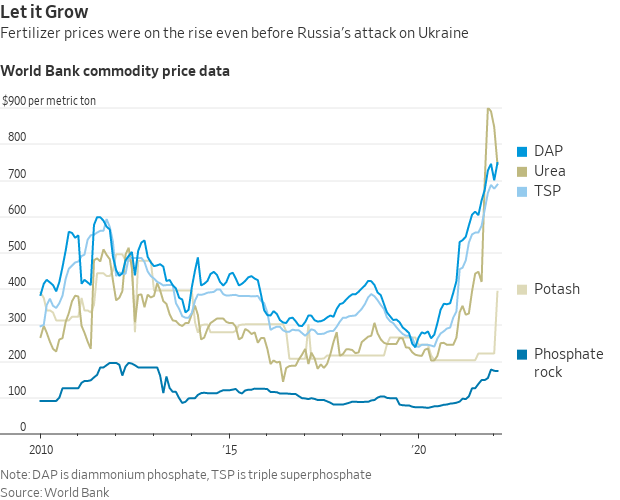

• Fertilizer prices continue to surge as exports from Russia — the world’s largest producer — fall sharply. Farmers’ struggles began before the war. Higher energy costs last year pushed up fertilizer prices, as did new curbs and export-licensing requirements by China, Turkey, Egypt and Russia

• Mining companies are sitting on vast reserves of commodities that the world needs, but they don’t have additional production that can be brought on quickly, the Wall Street Journal reports (link). The International Energy Agency estimates that it takes more than 16 years on average from the discovery of a potential mine site through to first production. That won’t help countries looking for alternatives to Russia’s thermal coal, potash and other foundation commodities used in industrial and agricultural production. It will also leave bulk carriers continuing to scramble to redirect vessels in a volatile market. Potash, used by farmers to fertilize crops, illustrates the difficulty facing miners in ramping up supply to capitalize on the windfall from high prices. Russia and its ally, Belarus, account for nearly 40% of global supply of potash, which was already in demand as a rising global population consumes more food. According to the WSJ article:

“BHP Group Ltd.’s Jansen deposit in the Canada prairies contains more than enough potash to offset any loss of supply from Belarus and Russia. The problem: Jansen won’t start producing the fertilizer for about five years and output will only increase in phases.

“To access reserves that BHP predicts could last up to 100 years, workers have dug a pair of almost 3300-feet-deep shafts in a region where winter temperatures can drop to minus 22 degrees Fahrenheit. BHP has been working on the project, which it believes will become the largest potash mine globally, since 2006 and doesn’t expect first output until 2027.

“BHP couldn’t significantly accelerate production even if it wanted to, Chief Executive Mike Henry said last month, because the construction schedule is in large part limited by the extreme weather. “Flexibility on timing is not that great,” he said.

“But without new supply sources like Jansen, Western farmers that rely on potash face higher costs that could spur food-price inflation.”

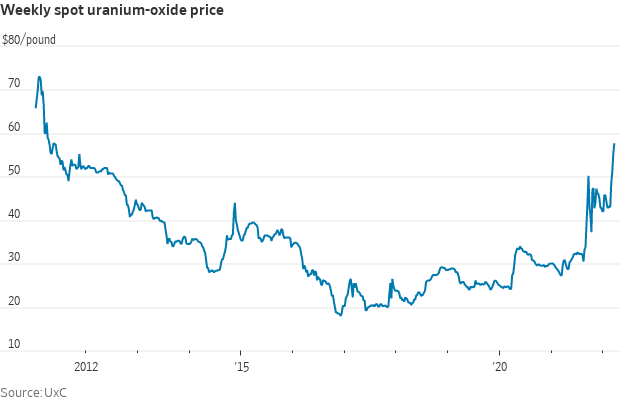

• Russia is fueling uranium’s rally. Prices of uranium oxide have soared to $57.50 per pound, levels last seen more than a decade ago before the Fukushima disaster turned global sentiment against nuclear energy. They are up more than a third since the invasion of Ukraine. The immediate catalyst is fear that uranium supply out of Russia might be disrupted.

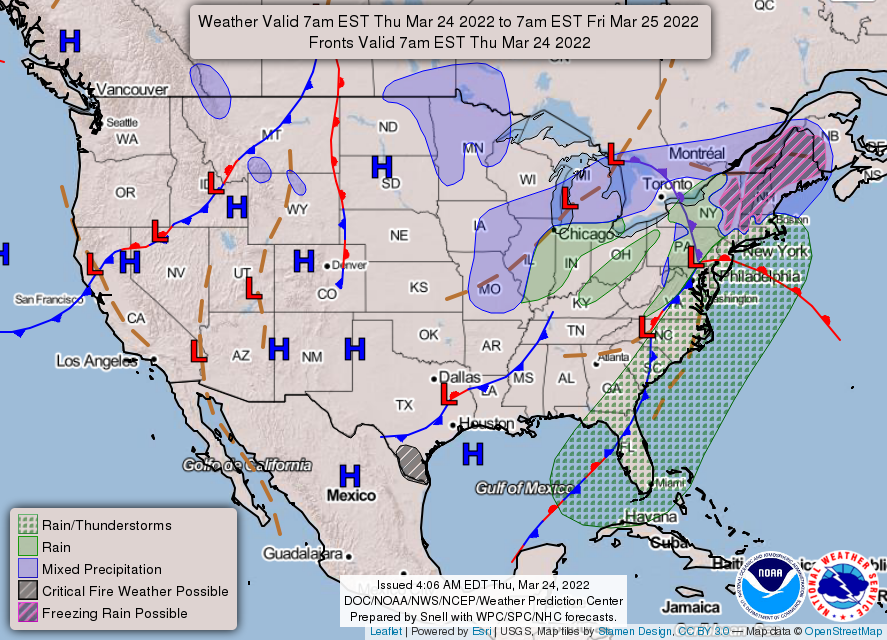

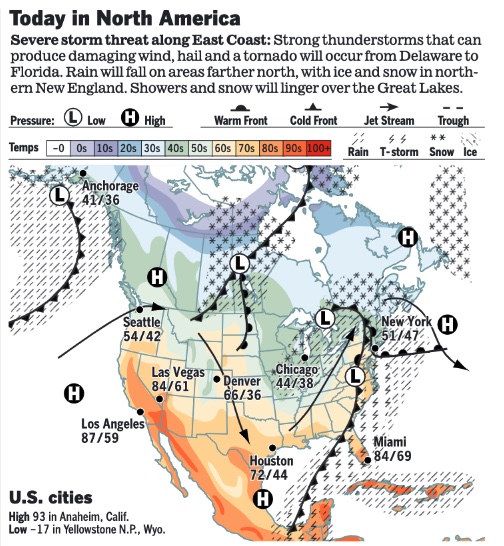

• NWS weather: Showers and thunderstorms exiting the East Coast on Thursday, with some light ice and snow accumulations possible across parts of New England... Critical fire weather threats for parts of south Texas on Thursday, and the north-central Plains on Friday... Record warmth likely across parts of the West into this weekend.

Items in Pro Farmer's First Thing Today include:

• Grain, soy markets retreat overnight

• Negative Cold Storage data

• Surprises in the cash cattle market

• Pork cutout, cash hog index both decline

|

RUSSIA/UKRAINE |

— Summary: NATO estimated Russia has lost as much as one-fifth of its combat forces sent to Ukraine in about a month of fighting as President Biden and alliance leaders gathered in Brussels for a summit to discuss providing further support to Kyiv. Between 7,000 and 15,000 Russian soldiers have been killed in Ukraine and up to 40,000 Russian troops in total have been killed, wounded, taken prisoner or are missing, said NATO. Russia may also have lost 10% of its equipment, impairing Moscow’s ability to maintain its pace of operations. Biden will huddle with other NATO heads of state. This afternoon, Biden will meet with other G7 leaders. And in the evening, Biden will take part in a European Council Summit.

- A plan to diversify Europe’s gas supply to reduce its reliance on Russian sources and begin replacing it with U.S. liquefied natural gas (LNG) is expected to be made official today. Speaking on Air Force One on Wednesday, U.S. National Security Adviser Jake Sullivan said that the U.S. was looking for ways “to increase LNG supplies — surge LNG supplies to Europe — not just over the course of years, but over the course of months as well.” However, Germany’s leader said that a boycott of Russian energy would “mean plunging our country and all of Europe into recession.” German Vice Chancellor and Economics Minister Robert Habeck is working on a plan to diversify the German energy supply — including new LNG import terminals — but said last week that even if those efforts are successful the nation could remain reliant on energy imported from Russia for months, or even years.

- NATO allies are expected to formally announce the deployment of additional troops to Eastern and Central Europe to shore up NATO’s eastern flank. Speaking on Wednesday, NATO Secretary-General Jens Stoltenberg said he expected leaders would agree to “strengthen NATO’s posture in all domains, with major increases to our forces in the eastern part of the alliance: on land, in the air and at sea.” The plan includes four new NATO battlegroups, with one each for Bulgaria, Hungary, Romania, and Slovakia. U.S. Ambassador to NATO Julianne Smith said on Wednesday the stationing of troops there could become permanent, a position that is sure to irk the Kremlin.

- Ukrainian President Volodymyr Zelenskyy asked President Biden to wait on sanctioning Roman Abramovich, a prominent Russian oligarch, because he might prove important as a go-between with Russia in helping to negotiate peace.

- Toomey: Europe needs to stop buying Russian gas and oil. In an appearance on Fox News, Sen. Pat Toomey (R-Pa.) said, “We estimate that the world is buying, mostly Europe, is buying $5 to $7 billion per week of Russian gas and oil, which they produce at very low cost. So, this is a huge amount of revenue to fund Vladimir Putin’s war machine. This is crazy. I mean, the Ukrainian people deserve better than this. ... We could cut off the source of revenue for Putin. How long can he continue to conduct this war if we shut off his biggest source of revenue? That’s the step we need to take.” Toomey added, “I’m not suggesting this a really easy thing to do for the Europeans —but how important is it to stop Vladimir Putin from trying to develop this brutal empire that will threaten who knows how much more of Europe.”

- Putin aide Chubais resigns over Ukraine war, has left Russia. Reuters reports Anatoly Chubais, a “veteran aide of President Vladimir Putin has resigned over the Ukraine war and left Russia with no intention to return, two sources said on Wednesday, the first senior official to break with the Kremlin since Putin launched his invasion a month ago.” The Kremlin “confirmed” that Chubais “had resigned of his own accord.”

- War crimes designation. Secretary of State Antony Blinken cited reports of indiscriminate attacks on Ukrainian civilians in concluding that Russian forces had committed war crimes. The move will formalize investigations into alleged atrocities.

- Biden’s national security adviser outlined the types of Chinese support for Russia that would elicit a response from the U.S., including “backfilling” goods to Russia to avoid export controls.

- Biden council preps for Putin worst case. A White House "Tiger Team" of national security officials is sketching responses for the U.S. and allies if Putin "unleashes his stockpiles of chemical, biological or nuclear weapons," the New York Times reports (link). The Tiger Team is also examining responses if Mr. Putin reaches into NATO territory to attack convoys bringing weapons and aid to Ukraine, according to several officials involved in the process cited by the NYT.

- Russian countermeasures. On Wednesday, Russian President Vladimir Putin announced new rules that would force “unfriendly countries” to buy Russian gas in rubles, a ploy designed to prop up the currency’s value as sanctions bite. The Russian currency gained 7% against the dollar immediately after the announcement, paring its year-to-date loss to 23%, while Dutch gas futures, a European benchmark, reigniting a wild rally.

- Ukrainian Navy claimed that it destroyed a large Russian ship in the port of Berdyansk, a Russian-occupied city in the south of the country. Meanwhile British intelligence suggested that Russian troops near Kyiv may find themselves surrounded. Britain has agreed to send a further 6,000 “defensive missiles” to Ukrainian troops and £25 million ($33 million) to help fund the army and the police force.

— Market impacts:

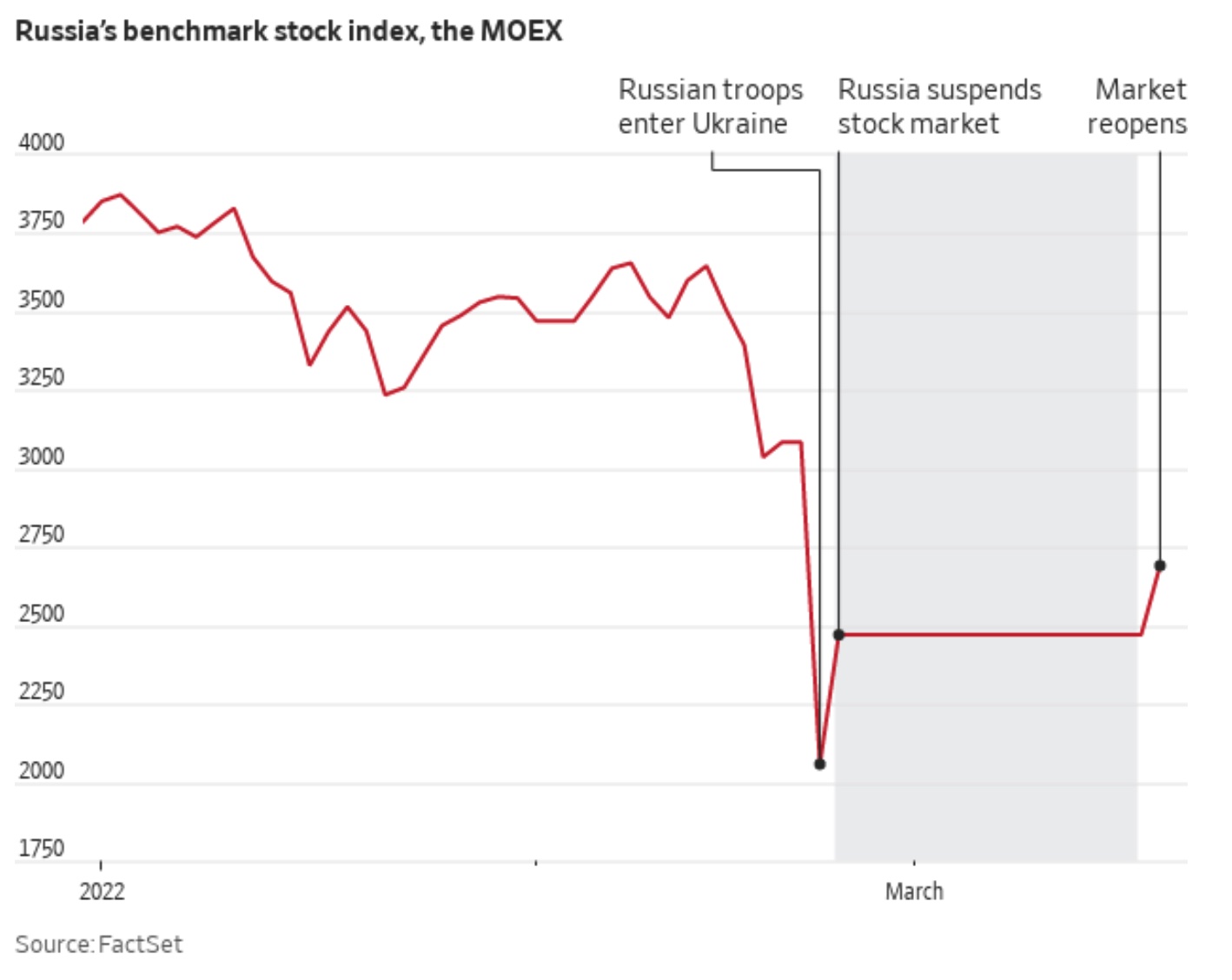

- Russian stock market reopens. Trading reopened in only 33 Russian stocks, for the first time in a month, and the market responded positively to crippling sanctions and having most of its banks thrown out of the Swift messaging system. There is, however, a ban on short selling and sales by foreign investors. The White House called the event a “Potemkin market opening” designed to obscure the impact of Western sanctions. Natural gas giant Gazprom, oil companies Lukoil and Rosneft and aluminum producer Rusal International saw double-digit percentage gains. One of the few decliners was Aeroflot, the Russian airline, which dropped 11%, which isn’t bad considering it was banned from flying in the airspace of the European Union, the U.K. and Canada. The last time Gazprom traded in London, on March 3, its ADR was trading for 58 cents, which given the ratio to the underlying, and exchange rate moves, was the equivalent of 28 rubles per share. Gazprom was trading around 268 rubles in Moscow on Thursday. Lukoil traded at the equivalent of 58 rubles in London, and 100 times that in Moscow. Bottom line: the market overall remains well below prewar values. Also: Foreign funds held more than 80% of shares trading on the Moscow Exchange in the first half of 2021, according to Reuters. The U.S. and Canada accounted for 54% of the total, with 22% from the United Kingdom and 21% from the rest of Europe.

- Egypt asked the IMF for support to soften the economic blow from the war in Ukraine. Earlier Egypt let its currency depreciate by about 15%, seen as a prelude to negotiations with the fund £25 million ($33 million) to help fund the army and the police force.

- Price of potassium iodide pills, a potential nuclear survival aid, have increased 50% on Amazon since war broke out in Ukraine.

- Latest companies pledging to suspend some operations in Russia include Renault, the biggest western automaker in Russia, and Nestlé, which had been called out specifically by Ukraine’s president. More than 400 companies have now withdrawn from Russia, removing products that reflect the power of Western culture and commerce. Renault said it is halting operations at its Moscow plant and is considering the future of a longstanding Russian venture called AvtoVaz.

- Flights are taking up to 40% longer as airlines avoid Russian airspace. For example, Russian national airline Aeroflot added three hours of flight time on a February 27 flight from Serbia to Moscow. The detours are adding up to 40% of flight time, according to aviation consultancy Ishka, and up to $12,000 per hour in additional costs, aviation consultant Robert Mann told ABC News. Meanwhile, British Airways is adding one hour of time between New Delhi and London by flying south of Russia.

- The number of ships leaving Russian ports for international destinations has declined 35% since the invasion of Ukraine. (Source: Lloyd’s List)

- Commodity giant Trafigura doubled the size of a credit facility to more than $2 billion to weather extreme price moves sparked by Russia’s attack on Ukraine.

|

POLICY UPDATE |

— Pressure grows on cropping some CRP acres. Some groups are urging USDA to allow cropping of Conservation Reserve Program acreage classified as prime farmland or is less environmentally sensitive. Farm Bureau says it supports marginal and HEL returning as the main focus of CRP. USDA’s Farm Service Agency said it had no immediate plan to relax CRP rules, while USDA Sec. Tom Vilsack, in a March 10 town hall, did not rule it out. "I think it's a little premature to make that call, because we really don't know precisely what's going to happen," said Vilsack.

In a letter (link) to USDA Secretary Tom Vilsack on Wednesday, seven agriculture lobbying organizations representing U.S. farmers, feed producers, grain exporters, millers, bakers and oilseed processors asked USDA to provide flexibility to farmers to plant crops on more than 4 million acres of "prime farmland" currently enrolled in the CRP without penalty. "It remains unclear whether Ukrainian farmers will be able to safely plant crops this spring," the letter said. "Time is of the essence. The planting window in the United States has already opened." If those acres are planted, at 2021's average corn yield, that could mean an additional 18.7 million tonnes of grain produced.

The letter, signed by the American Farm Bureau Federation, the National Grain and Feed Association and others, echoes a March 8 request by Sen. John Boozman (R-Ark.) of Arkansas, and calls from some agriculture economists.

Some of those pushing for the CRP change point to the European Union which as reported earlier this week will allow crops on conservation acreage this spring. EU Agriculture Commissioner Janusz Wojciechowski said last week that the EU is working on measures that would allow fallow land to be used to grow protein crops to avert a scarcity of feed, and measures to support the pork industry. The European Union will for the first time tap an agricultural crisis fund to cushion the impact of the ongoing war in Ukraine on food producers facing high energy prices and shortages of some key products. The European Commission will use the fund’s nearly 500 million euros ($551 million) to support European farmers as part of a package to tackle the fallout of the invasion on the agricultural sector and to ensure food security in the bloc. EU agriculture ministers on Monday discussed additional measures to support farmers suffering significant impacts of Russia’s invasion on inputs like natural gas, fertilizers and animal feed. The ministers also undertook to look at other requests including fertilizer autonomy. “We depend far too much on imports from Russia and Belarus in the fertilizer sector,” French Agriculture Minister Julien Denormandie said.

Perspective: The broader call for bringing some conservation land into production could boost pressure from some groups to have EPA reduce its biofuels blending mandates. Meanwhile, the Environmental Working Group said (link) the gov’t should increase funding for land retirement programs and charge higher crop insurance premiums on farmland in the Mississippi River basin that floods frequently and has cost $1.5 billion in indemnities since 2001.

|

PERSONNEL |

— CFTC nominees advance. Members of the Senate Agriculture Committee cleared four nominees for CFTC commissioner for a confirmation vote in the full Senate. Link

|

CHINA UPDATE |

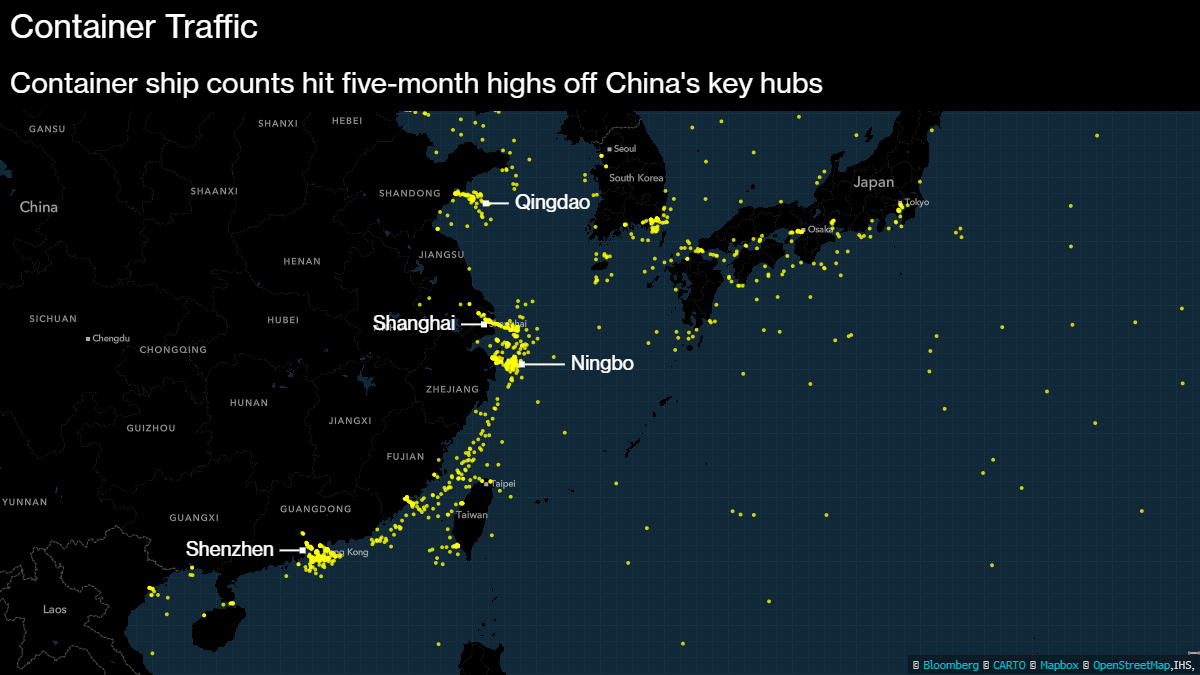

— Stuck in China. Congestion in the key Chinese ports of Shenzhen and Hong Kong due to Covid-19 lockdowns has risen to the highest level in five months, posing possible delays to goods heading to the U.S. this summer. Bloomberg details there were approximately 174 vessels anchored or loading off the South China hubs, the largest number since Oct. 21, when the region dealt with the aftermath of Typhoon Kompasu. A queue of ships is also growing at Shanghai. Source of chart: Bloomberg.

Container ship positions, as of March 23, mapped in yellow.

— Chip shot. The chief executives of some of the largest U.S. chip manufacturing companies urged Congress to pass legislation that includes $52 billion in incentives for their industry, calling it “essential” to maintaining competitiveness with China and other countries.

— China gets a warning with U.S./U.K. tariff deal: Raimondo. A key clause in the U.S./U.K. agreement to ease tariffs on British steel and aluminum sends a warning to China about its policy of subsidizing producers, Commerce Secretary Gina Raimondo said. The agreement announced Tuesday, which will allow steel up to a certain level to be imported into the U.S. duty-free, includes a provision that any British steel company owned by a Chinese entity must undergo an audit of financial records to assess influence from China’s government and share the results with the U.S.

— U.S. reinstates some expired product exclusions from tariffs on Chinese imports. The U.S. Trade Representative's office said on Wednesday it has reinstated 352 expired product exclusions from U.S. "Section 301" tariffs on Chinese imports. The reinstated product exclusions will be effective retroactively from Oct. 12, 2021, and extend through Dec. 31, 2022. They cover a wide range of the initially estimated $370 billion worth of Chinese imports that former president Donald Trump hit with punitive tariffs of 7.5% to 25%. China's commerce ministry said the U.S. decision was beneficial to normalizing the trade flow and hoped bilateral trade relations would get back on a normal track.

Bottom line: The move, which reinstates 352 of 549 eligible exemptions through the end of the year, was made amid pressure from business groups and lawmakers who said the levies were hurting American companies. Wednesday’s decision will have a relatively small impact on the tariffs overall. The tariffs imposed in 2018 and 2019 covered more than $350 billion a year worth of trade, and companies had filed more than 53,000 requests for tariff relief. Meanwhile, China welcomed Washington’s decision to reinstate tariff exemptions on more than 350 Chinese goods, while calling for all Trump-era duties to be lifted “as soon as possible.”

— Beijing closes in on security pact that will allow Chinese troops in Solomon Islands. Leaked draft raises prospect of People’s Liberation Army building naval base in South Pacific. Link for details via the Financial Times (paywall).

— China’s push to isolate Taiwan demands U.S. action: Report. Chinese officials are ramping up a campaign to force United Nations agencies, governments, companies and even schools to say Taiwan is a part of China. Link for details via the New York Times.

— China is quietly taking cheap Russian crude as India buys more. China’s oil refiners are discreetly purchasing cheap Russian crude as the nation’s supply continues to seep into the market. Link to details via Bloomberg.

|

TRADE POLICY |

— U.S. and Japan reach deal on beef tariffs. The U.S. and Japan announced an agreement that lowers the chances of Japan imposing higher tariffs on U.S. beef. The agreement includes a new mechanism that requires three separate conditions to be reached — instead of only one — for Japan to invoke a “safeguard trigger” and impose higher duties on U.S. beef for 30 days. For the safeguard tariffs to kick in, total beef imports from not only the United States but also the 11 members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CP-TPP) must exceed the threshold set in the CP-TPP agreement.

Japan’s parliament must approve the new safeguard measures, so it’s uncertain when they would be implemented.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 475,873,114 with 6,105,197 at deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,844,497 with 974,830 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 556,460,943 doses administered, 217,184,868 have been fully vaccinated, or 66.17% of the U.S. population.

— Airlines ask Biden to drop mask mandate on flights. An airline trade group that supported a federal mask mandate for all air travelers has asked the Biden administration to end the mask requirement and eliminate other Covid-19 protocols for travelers. Airlines for America, which represents American, Delta, United, Southwest, Alaska, JetBlue and other carriers, released a letter Wednesday addressed to President Biden, saying “the persistent and steady decline of hospitalization and death rates are the most compelling indicator that our country is well protected against disease from Covid-19.” The letter adds: “Now is the time for the administration to sunset federal transportation travel restrictions, including the international predeparture testing requirement and federal mask mandates.” The U.S. Travel Assn., which represents the country’s travel industry, also issued a letter Wednesday, asking the Biden administration to end coronavirus testing for international travelers to the U.S. and mask mandates on flights.

— FDA’s outside vaccine experts will meet April 6 to consider separate requests by Moderna and Pfizer to authorize fourth doses of their Covid vaccines. Pfizer said fourth shots should be administered to adults 65 and older, while Moderna wants all adults to be boosted.

— N.Y. baseball teams breathing a sigh of relief. Mayor Eric Adams of New York is set to announce that professional athletes and performers in the city would no longer need to show proof of vaccination.

|

POLITICS & ELECTIONS |

— Supreme Court on Wednesday rejected a Republican challenge to Wisconsin’s congressional district map proposed by the state’s Democratic governor and approved by the state’s Supreme Court, allowing it to take effect for the 2022 midterm elections. In a separate unsigned order issued with an opinion, the high court agreed with the state’s GOP-controlled legislature by rejecting a map of state legislative districts the Wisconsin Supreme Court also had approved after Gov. Tony Evers and the legislature deadlocked.

— Donald Trump rescinded an endorsement for Alabama Senate candidate Mo Brooks, saying the congressman had moved on from pushing claims about a stolen 2020 presidential election.

|

CONGRESS |

— County-of-origin ruling becomes part of SCOTUS nominee debate. The Wall Street Journal has found a USDA case in commenting on Judge Ketanji Brown Jackson. In a commentary item, the WSJ notes (link) she “has been less expansive even than most Supreme Court nominees this week as she faces the Senate. She says she has a judicial ‘methodology’ but not a philosophy, and her record as a judge is thin. But one case that offers some insight is her 2013 ruling as a trial judge upholding a USDA country-of-origin rule for meat.”

More from the WSJ item: “Congress in 2008 required grocery stores to provide country-of-origin information on meat and directed USDA to write the regulation. The purpose was to promote U.S. livestock. USDA required meat to be labeled with the countries where the animal was born, raised and slaughtered. It also barred processors from “commingling” meat from different countries — a common industry practice of mixing animals from different producers together for slaughter and packaging — in the name of simplifying its labeling regime. The American Meat Institute (AMI v. USDA) contended that the rule violated the First Amendment and Administrative Procedure Act. Under the Supreme Court’s Zauderer precedent, the government may require companies to disclose “purely factual and uncontroversial information” in advertising to prevent consumer deception. But the USDA rule didn’t apply to advertising and wasn’t needed to prevent consumer deception.”

WSJ commentators said “Judge Jackson nonetheless accepted the policy purpose that the USDA put forth only after it was sued: that the rule would prevent consumer confusion and correct misleading speech. In doing so, she misapplied the Supreme Court’s precedent on commercial speech and administrative law, which doesn’t allow regulators to provide post-hoc explanations after being sued. She also ruled the USDA could ban commingling meat though Congress didn’t authorize it. The absence of the word ‘commingling’ from the text, she wrote, “renders doubtful Plaintiffs’ assertion that Congress clearly intended to address, and to protect, the practice.” In other words, if Congress doesn’t explicitly forbid regulators from doing something, they can do it.”

The WSJ editorial concludes: “Her AMI opinion suggests she’d give liberal rein to regulators.”

|

OTHER ITEMS OF NOTE |

— Albright dead at 84. U.S. officials continue to mourn the passing of Madeleine Albright, the first woman to serve as secretary of State, who died on Wednesday aged 84. The cause was cancer, her family confirmed in a statement. In a statement released on Wednesday evening, President Joe Biden described her as “a force” whose hands “turned the tide of history.” An immigrant from Czechoslovakia, she served in the post under Bill Clinton from 1997 to 2001. A day before Russia invaded Ukraine, Albright predicted in the New York Times that any such assault “would ensure Putin’s infamy by leaving his country diplomatically isolated, economically crippled and strategically vulnerable in the face of a stronger, more united Western alliance.” Albright presided over U.S. diplomacy in the aftermath of the Cold War, renegotiating the nation’s relationship with Russia and advocating the enlargement of the North Atlantic Treaty Organization by including former Soviet states.

— North Korea fired an intercontinental ballistic missile towards the sea off its east coast, according to South Korea. If true, this would violate a self-imposed moratorium on such tests in place since 2018. Japan, which provided similar flight data, said the missile had flown for about 71 minutes and based on an initial assessment was an “ICBM-class ballistic missile.” The Thursday test “greatly exceeded” that of the ICBM launch four years ago, Japanese Defense Minister Nobuo Kishi said.

— EPA sued for cadmium water standards. EPA has been served with litigation alleging it failed to fully assess the potential harm to endangered species from a key ingredient in phosphate fertilizers. Filed Tuesday (March 22) by the Center for Biological Diversity, the lawsuit targets freshwater chronic criteria set for cadmium in 2016. The complaint notes that some 50% of the cadmium found in surface waters comes from the production and use of phosphate fertilizers — the heavy metal is found in phosphate rock used to make fertilizer. The lawsuit alleges EPA’s decision weakened water-quality criteria without the required Endangered Species Act (ESA) review and contend the agency has approved adoption of the metric in at least 18 states. “When the EPA nearly triples the allowable water pollution from a heavy metal it knows harms endangered fish and sea turtles, it’s announcing that Big Oil and Big Ag are calling all the shots,” said Hannah Connor, a senior attorney at the Center. “The Biden administration needs to correct this terrible decision and make the EPA do its duty to stop the pollution of our rivers, lakes and oceans.” The lawsuit asks the U.S. District Court for the District of Arizona to vacate the criteria and compel EPA to conduct the ESA review.