U.S. Shipping Costs Surge as China Looks to U.S. for More Corn; Other Factors Cited

Major media now focusing on potential for still higher food prices, surging fertilizer costs

|

In Today’s Digital Newspaper |

Ukraine rejected Russia’s ultimatum that Mariupol surrender after weeks of Russian bombardments and ongoing street-by-street guerrilla warfare. On Sunday, Ukrainian President Volodymyr Zelensky renewed his position that he is willing to negotiate with Russian President Vladimir Putin. Without negotiations, it will not be possible to end the war, Zelensky said during an interview on CNN’s Fareed Zakaria GPS. External pressure to end the conflict is expected to increase this week, as President Joe Biden joins his EU and NATO counterparts for meetings on Thursday. Turkish Foreign Minister Mevlut Cavusoglu, who has been mediating between his Russian and Ukrainian counterparts, told local media on Sunday he was “hopeful” that a cease-fire could soon take hold. Naftali Bennett, the prime minister of Israel, said his attempt to mediate between Russia and Ukraine had made some progress but that “fundamental” issues remain.

The White House announced late Sunday night that Biden was adding a trip to Poland to the itinerary. Biden will travel to Warsaw on Friday. On Saturday, Biden will meet with Polish President Andrzej Duda to discuss “the humanitarian and human rights crisis that Russia’s unjustified and unprovoked war on Ukraine has created.” Biden will also host a call this morning with French President Emmanuel Macron, German Chancellor Olaf Scholz, Italian Prime Minister Mario Draghi and British Prime Minister Boris Johnson.

White House to meet with Exxon, other firms on Russia sanctions. The Biden administration will brief banks, energy companies and other firms today on the impact of Russia’s invasion of Ukraine and ensuing sanctions. Treasury Secretary Janet Yellen, National Security Advisor Jake Sullivan and other top officials will host an off-record discussion with companies across several industries, an official said. They include firms in the energy, refining, financial services and manufacturing sectors, the official said.

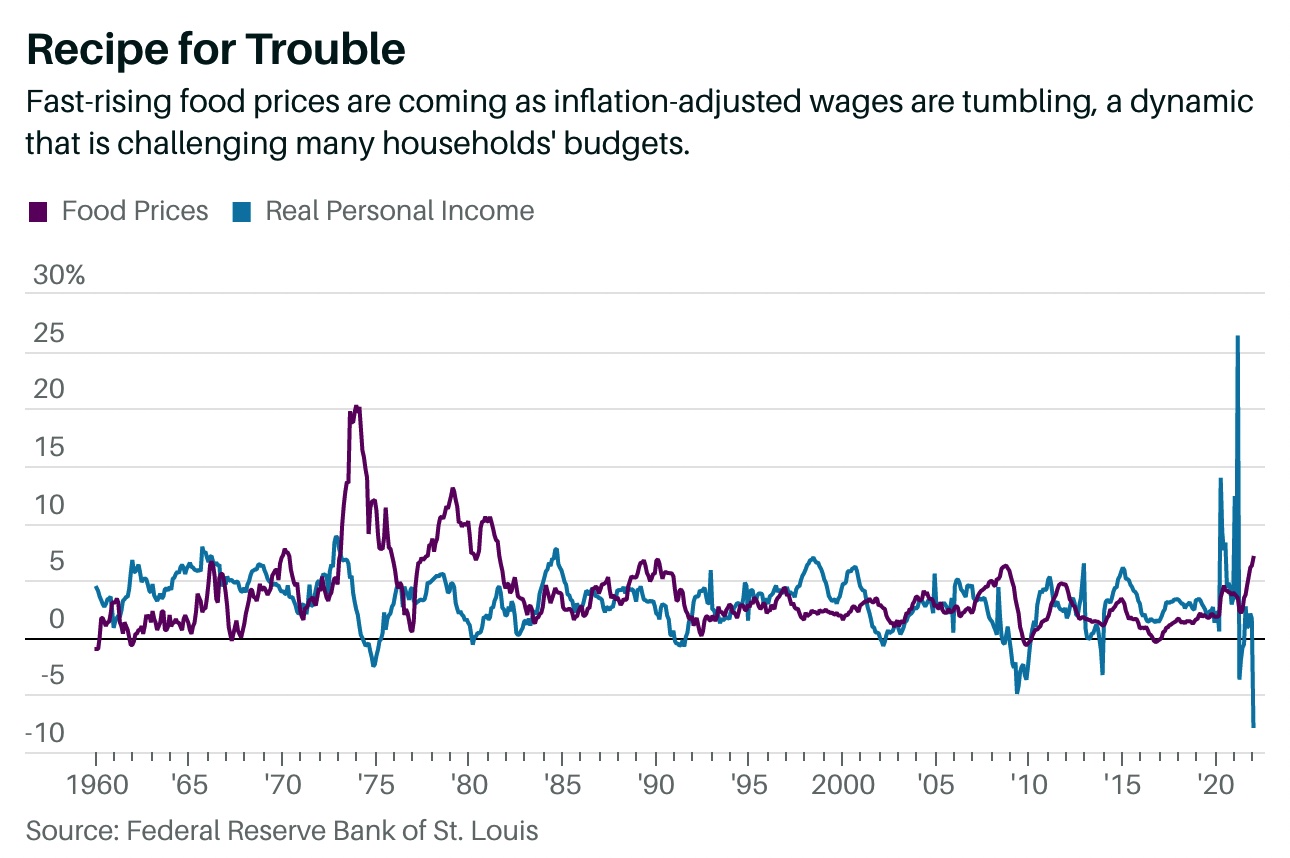

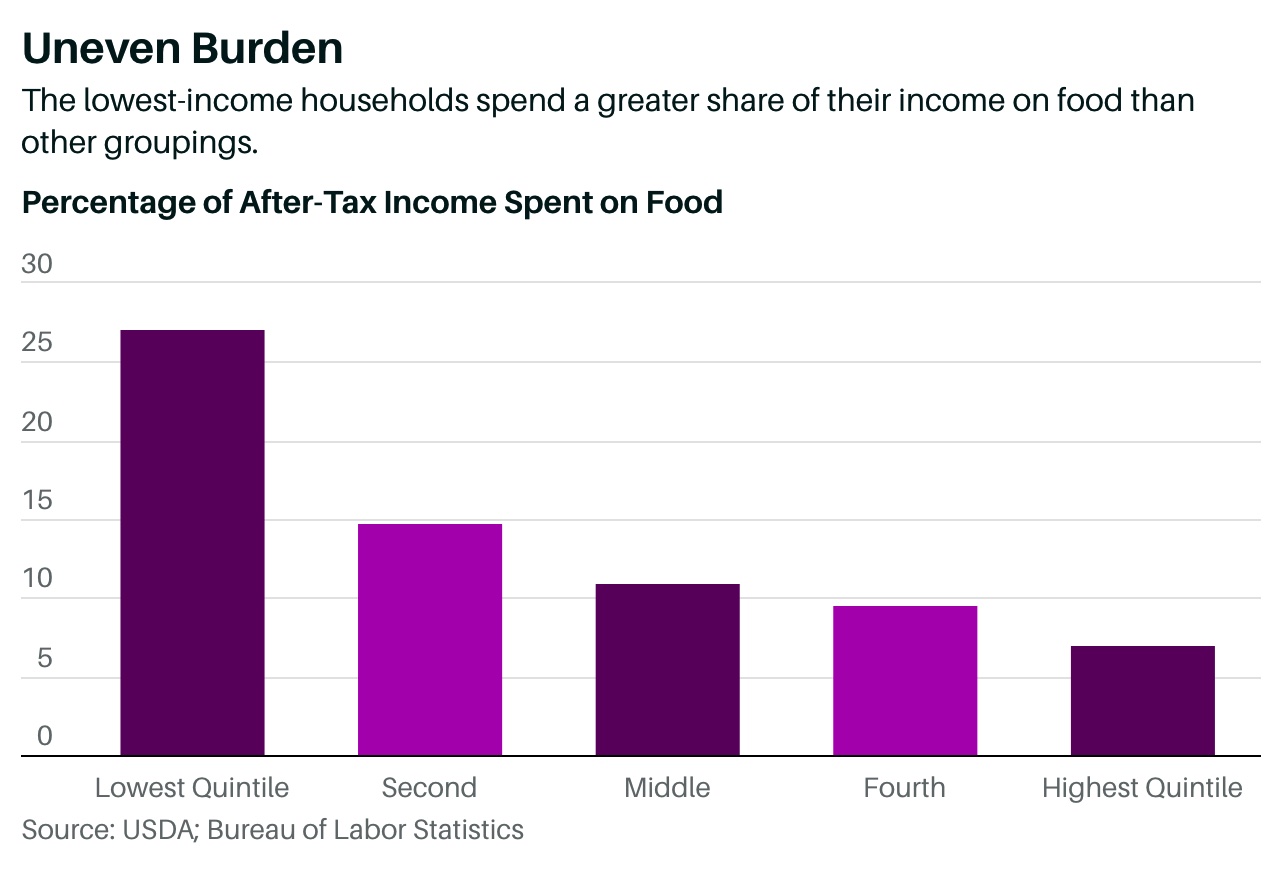

Major media is now focusing on the potential for still higher food prices, surging fertilizer if available and the potential for food scarcity in some countries. Earlier this month, the United Nations said that the war’s impact on the global food market alone could cause an additional 7.6 million to 13.1 million people to go hungry. The World Food Program’s costs have already increased by $71 million a month, enough to cut daily rations for 3.8 million people. “We’ll be taking food from the hungry to give to the starving,” David M. Beasley, the executive director of the World Food Program, said. A growing number of countries are halting exports of ag products and fertilizer. Bottom line: The war has blocked grain exports and curtailed spring planting. Countries world-wide are now relying on a 2022 harvest that may never arrive.

In other ag-related news, reports have increased regarding logistical constraints especially in China following its recent uptick in Covid-19 cases, while the Canadian Pacific Railway work stoppage began Sunday as talks restart with help of a federal mediator while others are urging the Canadian government to introduce back-to-work legislation that would force striking workers to return to their jobs. But this would require a vote of Canada’s parliament, which is set to convene today after a break. Meanwhile, costs to ship grains and soybeans on the Mississippi River have soared to an almost eight-year high.

China plane crash. A China Eastern Boeing 737 en route from Kunming to Guangzhou has crashed with more than 130 people on board near the city of Wuzhou in the southern Guangxi province, causing a fire in the mountains, according to CCTV. Rescue teams have been sent to the scene. The crash could be the worst in China since the 1990s, and raised investor concerns about the effect on Boeing, whose shares fell in premarket trading.

Investors are piling back into U.S. stocks, betting that the domestic equity market can withstand new economic headwinds better than other parts of the world. Despite big daily swings, the S&P 500 is up 5.6% since Russia invaded Ukraine. Many investors appear to be using recent pullbacks amid the volatility to continue to buy the dip.

The price of Brent crude, the global benchmark, increased 4% today to $112 per barrel following an attack on Saudi production facilities and a push for EU countries to join a Russian oil embargo. Meanwhile, QatarEnergy said on Sunday that German economy minister Robert Habeck confirmed during a meeting with Qatari officials that Berlin was fast-tracking the development of two LNG receiving terminals.

The Senate hearings for Supreme Court nominee Judge Ketanji Brown Jackson are scheduled to begin today.

Supreme Court Justice Clarence Thomas was admitted to a hospital late Friday "after experiencing flu-like symptoms," the court's public information office said, adding that he does not have Covid-19.

|

MARKET FOCUS |

Equities today: Global stocks markets were mixed overnight. The U.S. stock indexes are pointed toward weaker openings. Asian equities were mixed as markets continued to focus on the Russia/Ukraine situation. The Hang Seng Index was don 191.06 points, 0.89%, at 21,221.34. The Shanghai Composite was up 2.61 points, 0.08%, at 3,253.69. The Nikkei was closed for a holiday. European equities are mixed, with several markets shifting between losses and gains in early action. The Stoxx 600 was up 0.2% while other markets were down 0.1% to up 0.7%.

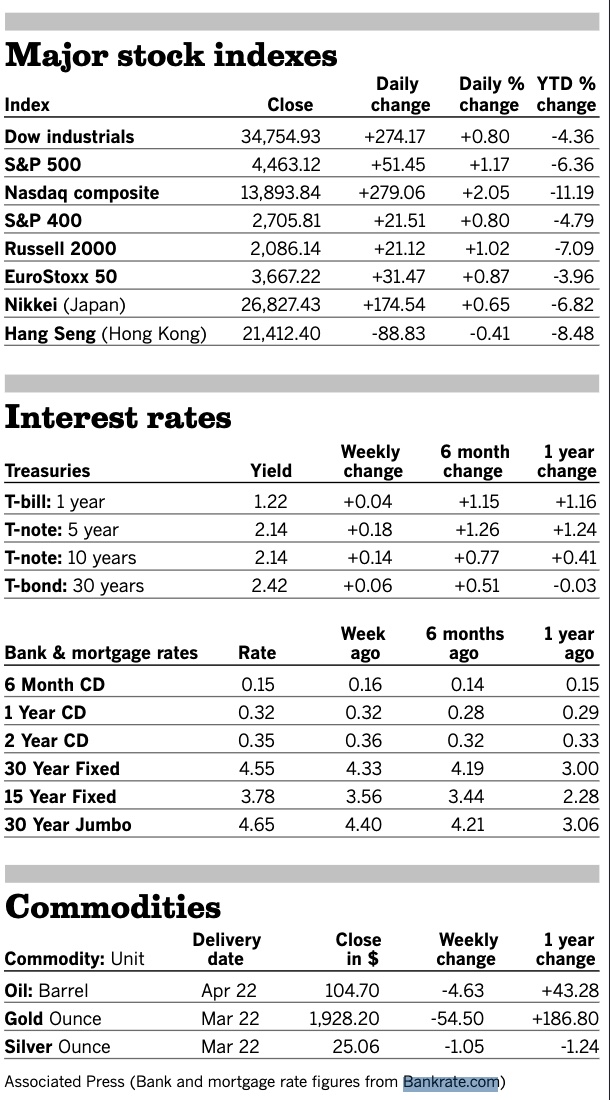

U.S. equities Friday: The Dow gained 174.17 points, 0.80%, at 34,754.93. The Nasdaq rose 279.06 points, 2.05%, at 13,893.84. The S&P 500 was up 51.45 points, 1.17%, at 4,463.12. Friday was the biggest triple witching day in memory, with some $3.5 trillion in options set to expire with more near-the-money options maturing than at any time since 2019, according Louis Navellier, founder of Navellier & Associates.

Stocks closed out their best week since November 2020, For the week, the Dow Jones index jumped 5.5% (snapping a five-week losing streak), the S&P 500 spiked 6.1% (though year to date it's still down 6.4%) and the Nasdaq Composite surged 8.2% (its largest weekly point gain on record).

Agriculture markets Friday:

- Corn: May corn futures fell 12 3/4 cents to $7.41 3/4, a drop of 20 3/4 cents for the week. December futures rose 1/2 cent to $6.45 1/2, down 9 3/4 cents for the week.

- Soy complex: May soybeans fell 1/2 cent to $16.68, down 8 cents for the week. May soybean meal rose $2.90 to $477.00 per ton, down 10 cents for the week. May soybean oil fell 234 points to 72.29 cents per pound, down 374 points for the week and the contract’s lowest closing price since Feb. 25.

- Wheat: May SRW wheat fell 34 1/4 cents to $10.63 3/4, losing 43 1/4 cents for the week. May HRW futures lost 21 3/4 cents to $10.70 1/2, down 18 3/4 cents for the week. May spring wheat fell 18 3/4 cents to $10.60 1/4, down 10 cents for the week.

- Cotton: May cotton futures closed 500 points higher at 126.85 cents per pound, a lifetime-high close for the contract and a weekly gain of 582 points.

- Cattle: June live cattle rose $1.15 to $137.075, the contract’s highest closing price since Feb. 28 and a gain of $4.125 for the week. April feeder cattle rose $1.225 to $162.325. Live cattle closed near a three-week high on renewed cash strength.

- Hogs: April lean hogs fell 95 cents to $99.40, the contract’s lowest closing price since Feb. 2 and a decline of $2.10 for the week.

Ag markets today: Bulls controlled overnight trade in the grain and soy complex amid global supply concerns as Russia’s invasion of Ukraine is showing no signs of letting up or ending anytime soon. As of 7:30 a.m. ET, corn is trading 13 to 14 cents higher, soybeans are 15 to 24 cents higher, winter wheat is mostly 26 to 30 cents higher and spring wheat is 12 to 16 cents higher. Front-month U.S. crude oil futures are around $4.50 higher and the U.S. dollar index is up around 175 points this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• Federal Reserve: Atlanta's Raphael Bostic at the 38th Annual NABE Economic Policy Conference at 8 a.m. ET, and Chairman Jerome Powell at the same conference at 12 p.m. ET.

• USDA Grain Export Inspections report, 11 a.m. ET.

• U.S./UK trade talks. U.S. Trade Representative Katherine Tai and UK International Trade Secretary Anne-Marie Trevelyan will meet in Baltimore Monday and Tuesday for talks labeled as the “Dialogues on the Future of Atlantic Trade.” But the talks are not a resumption of the free trade agreement talks that were launched under the Trump administration.

• President Joe Biden will host a call with the leaders of France, Germany, Italy and the U.K. to coordinate responses to the war in Ukraine.

Inflation watch. Around 80% of food and beverage companies have passed on higher costs to customers: survey. According to Mazars' research, 83% of respondents expected sales to increase in 2022, while 54% identified higher shipping costs as their primary concern.

Barron’s cover: Food inflation isn’t going away. That’s a Problem. Surging prices for groceries, energy, and other household essentials may not be as fleeting as economists or Fed policy makers expect. That brings a host of risks, from runaway inflation to social unrest. Here’s why investors need to pay attention. Link for details (paywall).

Logistical snafus impact a very important person: me. I early on saw the glitches in getting products delivered in a timely fashion when I remodeled my house and had to wait four to six months for some appliances. That’s a definition of patience, especially for someone like me. But the delivery kerfuffle has again hit me. This time it occurred when I ordered a pair of Zeba Shoes — if you haven’t seen the commercials for them, you can easily take them off and better yet put them back on without bending over or sitting down or bending the heels… plus, no-tie shoestrings. If you scoff, wait until you get older. Anyway, when I ordered them, Zeba said I would receive them within six to seven business days. It’s been longer than that, so I made an inquiry. Here is an edited response I received from Zeba Shoes: “Thanks for getting in touch with Zeba Shoes. I have linked the tracking number for your order for your viewing. As seen on the tracking, FedEx is having an operational delay and your shipment has been delayed because of that. We have contacted FedEx about this, and they have informed us that there have been Covid-19 related shutdowns at the shipping hubs/distribution centers we use. Once FedEx has resolved the issue, the item should be on its way and will be with you shortly. I apologize for the delay and inconvenience.” Those shutdowns took place in China.

Deere & Co. signals more open access for customers to service their own equipment. Deere & Company has announced it is expanding access to self-repair resources and will make a customer service adviser available to customers and independent repair shops to buy such resources through the johndeerestore.com in the U.S. The customer service adviser will also be available via John Deere dealers. The company said in 2023, they will offer the ability for the remote download of software updates to embedded controllers. The issue of “right to repair” has risen in focus with the Biden administration taking a keen focus on the situation via the Federal Trade Commission (FTC). The FTC prior to the Biden administration announcement had already concluded that it was going to pursue “right to repair.”

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher ahead of U.S. trading, with most foreign currencies weaker versus the greenback. The yield on the 10-year U.S. Treasury note has risen to trade around 2.19% amid a firmer tone in global government bond yields. Gold and silver futures are mixed, with gold slightly weaker around $1,926 per troy ounce and silver firmer around $25.20 per troy ounce.

• Crude oil futures are higher ahead of U.S. market action, with U.S. crude around $109.50 per barrel and Brent around $112.90 per barrel. Crude futures were up in Asian action, with U.S. crude topping $106 per barrel and Brent around $111 per barrel.

• European natural gas prices fell to the lowest since early March as Russian shipments through Ukraine held stable and forecasts showed warmer-than-usual weather on the horizon. In the U.K., Prime Minister Boris Johnson is due to meet leaders from the nuclear and wind industries to discuss ramping up alternative energy sources.

• Canadian Pacific Railway work stoppage begins as talks restart with help of federal mediator. Global shipments of key manufactured goods and commodities such as fertilizers halted after contract negotiations between the company and its conductors and engineers collapsed. Canadian Pacific and the Teamsters Canada Rail Conference, which represents more than 3,000 conductors, engineers and yard workers at the railway, disagreed over what triggered the breakdown in talks. Negotiations began in September. Canadian Pacific said if the two sides were unable to agree on a new contract it would favor shifting the discussions to a binding arbitration process. Some are urging the Canadian government to introduce back-to-work legislation that would force striking workers to return to their jobs. But this would require a vote of Canada’s parliament, which is set to convene today after a break. Canadian Pacific is the sixth-largest freight railway in North America. It is the primary shipper of fertilizers such as Canadian potash, which is mined in the province of Saskatchewan.

A letter signed by the premiers of Alberta, Saskatchewan and Manitoba says a work stoppage would affect the oil and gas, grain, livestock, forestry and potash sectors. “A disruption of this magnitude, stacked on an already stressed system, would be severe,” says the letter, which was posted on Twitter by Saskatchewan Premier Scott Moe (link). The letter asks Trudeau to “take immediate and effective measures to ensure that service on Canadian Pacific’s critical rail network resumes as quickly as possible.” It also asks for a meeting to discuss longer-term measures on how to avoid rail work stoppages, such as by declaring railways as an essential service.

Upshot: Potash giant Nutrien has been planning on increasing production of its fertilizer. But a lengthy shutdown could push the company to reduce output because its warehouses are already full of the fertilizer.

• U.S. grain shipping costs soar. War in Ukraine and drought in Brazil have global crop importers turning to the U.S. Result: costs to ship grains and soybeans on the Mississippi River have soared to an almost eight-year high. Rates for dry bulk barges on the Mississippi at St. Louis jumped to $34.75 per short ton, the highest since 2014, according to USDA.

StLouis

• Canada cuts 2022-23 wheat ending stocks by 450,000 tons. Ending stocks were cut as exports estimate was raised for both 2021-22 and 2022-23 marketing years, Agriculture and Agri-Food Canada said Friday. Details:

- 2022-23 ending stocks cut to 4.7 million tons vs 5.15 million in February report

- 2021-22 ending stocks cut to 3.8 million tons vs 4 million tons

- 2022-23 canola ending stocks cut to 600,000 tons from 650,000 tons

• Brazil has to cut wheat import tariff: Economy minister. Brazil’s gov’t will reduce more taxes and import tariffs to face the cost increase triggered by Russia’s invasion of Ukraine, Economy Minister Paulo Guedes said during an event. Brazil’s government plans on reducing IPI taxes by another 35%: Guedes said, adding that the gov’t may take additional measures to reduce fuel prices if necessary.

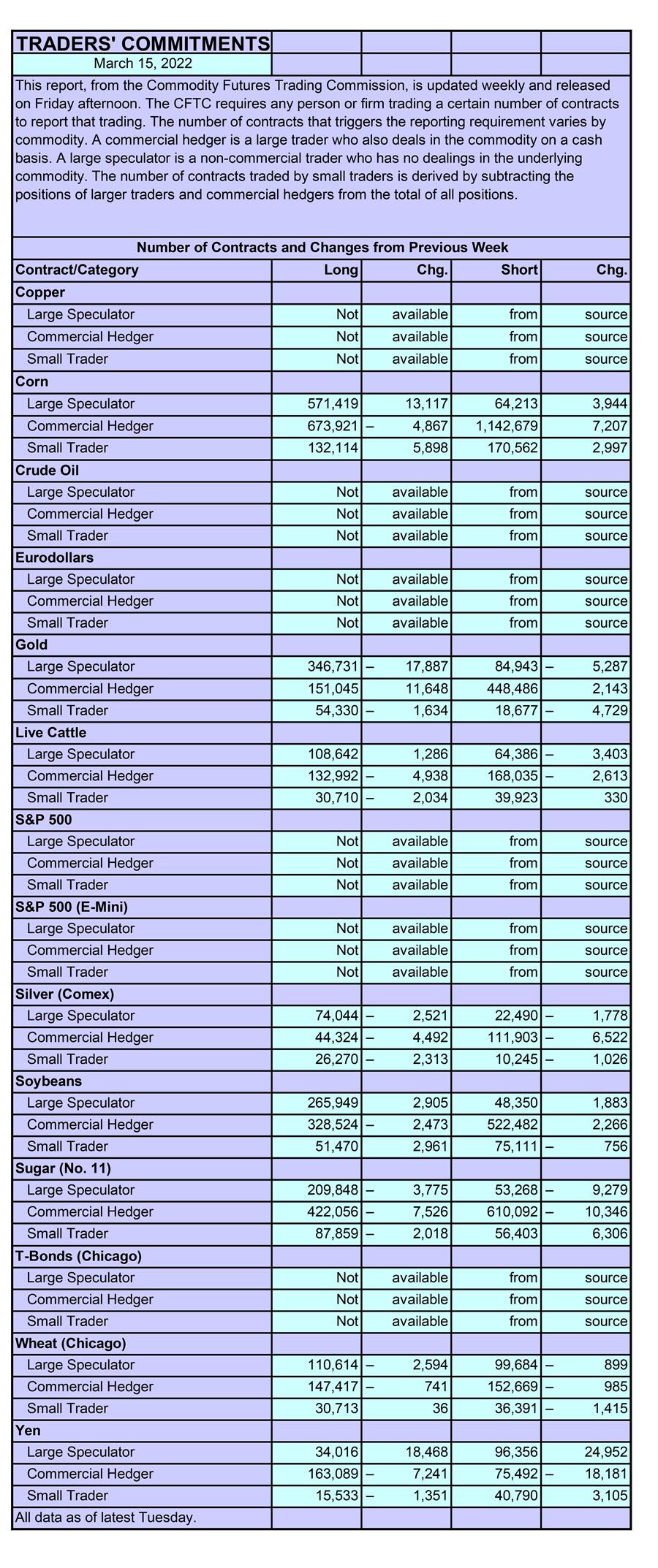

• CFTC Commitments of Traders report (Source: Barron’s):

• A food crisis is looming. this fertilizer stock stands to gain. Mosaic’s price target was just increased by Goldman to $83 from $50, which also raised its rating on the stock to Buy from Neutral, note’s a Barron’s article (link). Goldman analyst Adam Samuelson recently advised the bank’s clients that the invasion of Ukraine could be one of the most disruptive events in the food and agricultural supply chain in decades.

• 5.8 is the average number of days containers remained at the ports of Los Angeles and Long Beach waiting for handling in February, the lowest level since August 2021.

• Ag demand: South Korea purchased 60,000 MT of U.S. corn and 45,000 MT of U.S. milling wheat.

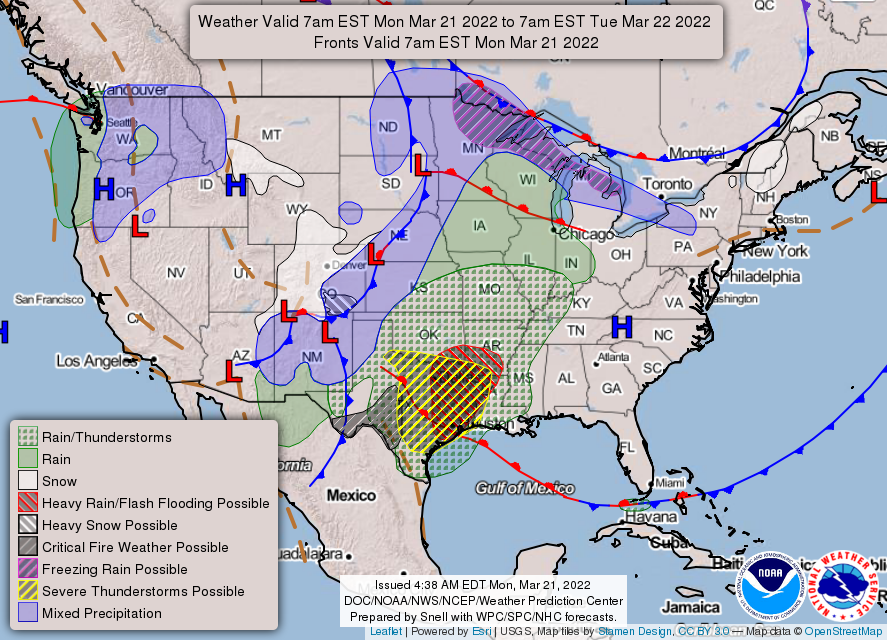

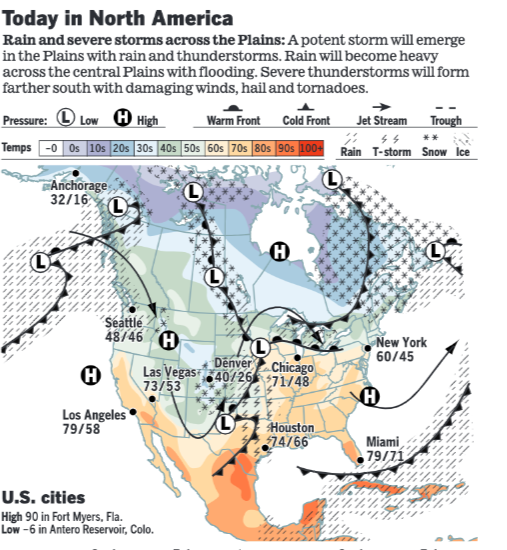

• NWS weather: Heavy to excessive rainfall and severe thunderstorms likely Monday-Tuesday across portions of the Deep South... ...Critical risk of fire weather continues Monday for parts of the southern Plains.

Items in Pro Farmer's First Thing Today include:

• Strong market starts to the week

• European leaders considering another round of sanctions on Russia

• Russian wheat exports actively flowing from Black Sea ports (see details below)

• Hopes for firmer cash cattle trade

• Bears hold the upper hand in hog futures

|

RUSSIA/UKRAINE |

— Summary: The Russian military reported it has used its latest hypersonic missile for the first time in combat, according to the Associated Press (link). Hypersonic weapons, which are part of the U.S./China competition, can carry a nuclear warhead, fly low and be hard to detect, Bloomberg explains (link). Fighting reached the center of Mariupol, according to the city’s mayor. He said more than 80% of residential buildings had been either damaged or destroyed and that “there’s no city center left.”

- President Biden warned President Xi Jinping of China on Friday of “implications and consequences” if Beijing decides to give material aid to Russia to support its war in Ukraine, the White House said. During a nearly two-hour video call, Biden laid out Xi the punishments the U.S. and its allies had imposed on Russia after it invaded Ukraine last month, said a senior U.S. official, who added China would pay a similarly heavy price if it backed President Vladimir Putin of Russia in the fight. Xi noted “the situation in Ukraine has developed to this point, which China does not want to see.” He reiterated standard talking points that China would provide humanitarian aid and that Russia and Ukraine should hold peace talks. Xi called for dialogue, criticized the West’s sweeping sanctions against Russia and warned America about the dangers of encouraging pro-independence forces in Taiwan.

- Halliburton Co. said it’s winding down operations in Russia and will halt future business in the nation amid sanctions imposed in response to President Vladimir Putin’s invasion of Ukraine. Halliburton followed some of the largest oil explorers in announcing plans to abandon Russia including BP Plc and Shell Plc. “The war in Ukraine deeply saddens us,” Halliburton Chief Executive Officer Jeff Miller said Friday in a statement. “We have employees in both Ukraine and Russia, and the conflict greatly impacts our people, their families, and loved ones throughout the region.” Halliburton generates about 2% of its sales from Russia, according to JPMorgan Chase & Co.

- GOP senators introduce bill to ban uranium imports. Sen. John Barrasso (R-Wyo.) and several other Republican senators introduced legislation that would ban imports of Russian uranium as an additional way to economically isolate Russia over its invasion of Ukraine. “The time is now to permanently remove all Russian energy from the American marketplace,” Barrasso, who is the top Republican on the Senate Energy and Natural Resources Committee, said in a statement. “We know Vladimir Putin uses this money to help fund his brutal and unprovoked war in Ukraine.” Sens. Kevin Cramer (R-N.D.), Cynthia Lummis (R-Wyo.) and Roger Marshall (R-Kan.) joined Barrasso in introducing the legislation.

— Market impacts:

- Food supply chains in Ukraine are “falling apart” because of insecurity caused by the war and the reluctance of drivers to enter the country, said an official from the World Food Program. Food and water supplies in cities encircled by Russian troops, such as Mariupol, are running out. The agency also warned of “collateral hunger” in other parts of the world.

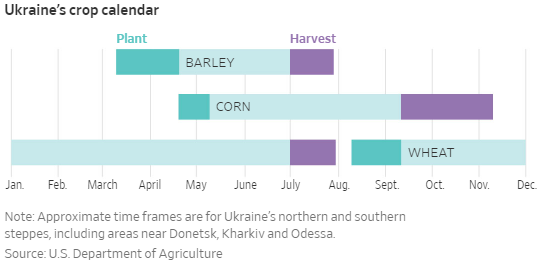

- A critical share of the world’s food and fertilizer is stuck in Russia and Ukraine, sending global prices soaring and foreshadowing a rise in world hunger, the New York Times reports (link). It says “China, facing its worst wheat crop in decades after severe flooding, is planning to buy much more of the world’s dwindling supply. And India, which ordinarily exports a small amount of wheat, has already seen foreign demand more than triple compared with last year.” “This year’s seedling situation can be said to be the worst in history,” said China’s agriculture minister, Tang Renjian. For Russia and Ukraine, over the past five years, they have together accounted for nearly 30% of the exports of the world’s wheat, 17% of corn, 32% of barley, and 75% of sunflower seed oil, an important cooking oil in some parts of the world. Ukraine’s agriculture minister has begged allies for 1,900 rail cars of fuel, saying that the country’s farms had run out after supplies were diverted to the military. Without that fuel, he said, Ukrainian farmers would be unable to plant or harvest. Meanwhile, the United Nations estimated that up to 30% of Ukrainian farmland could become a war zone. And with millions of Ukrainians fleeing the country or joining the front lines, far fewer can work the fields.

- Global concerns that Russia’s invasion would curtail Ukraine’s 2022 harvest have come to fruition, the Wall Street Journal reports (link). With wheat already in the ground, and only a few weeks left to plant corn, farmers in Ukraine can’t get needed fertilizers and chemicals. They are low on fuel for tractors and other farm equipment. Workers are quitting to join the fight or to leave the country, leaving farms short-handed. Ukraine’s nutrient-rich soils yield 10% of global wheat exports, 14% of corn exports and about half of the world’s sunflower oil, according to USDA. In just three weeks, war disrupted Ukraine agriculture, triggering higher prices as well as the threat of global shortages. Much of the exports go to developing economies already struggling with food-cost inflation.

- Russian wheat exports actively flowing from Black Sea ports. Russia is exporting more wheat via its Black Sea ports as Azov Sea routes remain restricted, while domestic wheat prices rose last week because of the weakening ruble. “Exports are active. If the weather permits - it is currently unstable in the Black Sea due to strong wind - Russia will export more than 2 MMT of wheat in March,” said Dmitry Rylko, the head of the IKAR ag consultancy. SovEcon, another consultancy, said: “Traders report some issues with payments from abroad when banks refuse to send money even to non-sanctioned institutions, but the overall situation seems to improve. Russia continues to actively ship wheat, mainly from its Black Sea terminals.”

- Aluminum jumped (by around 4%) after Australia banned alumina shipments to Russia, adding to inflation fears.

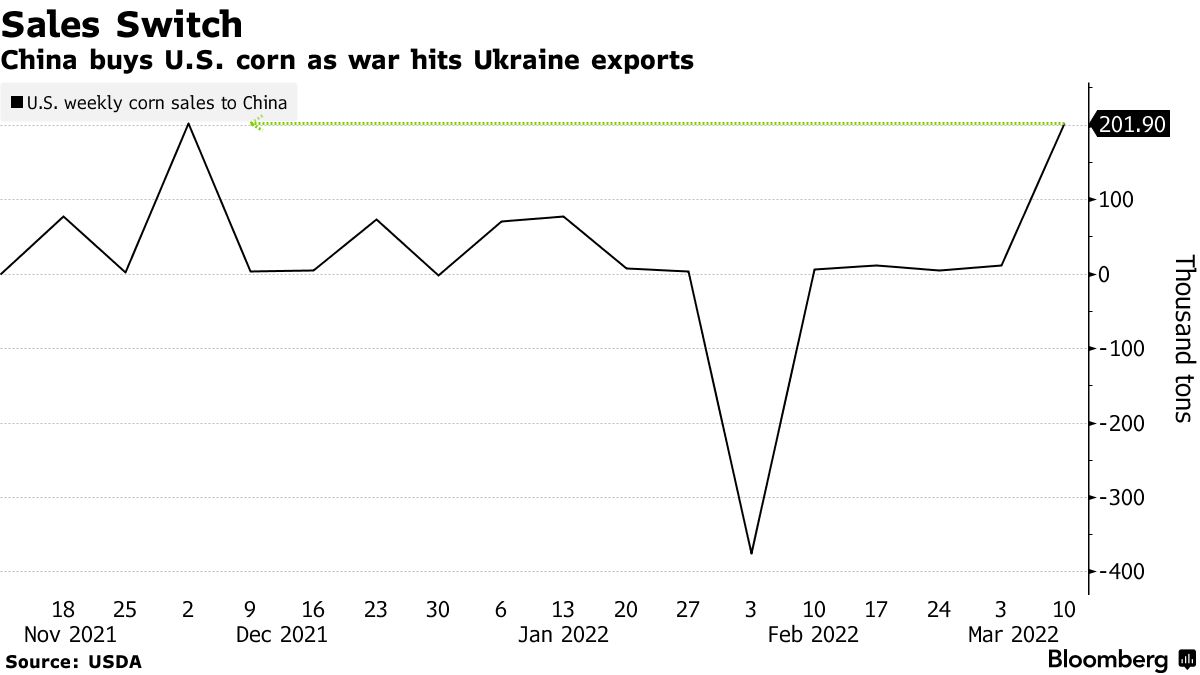

- China is expanding its purchases of corn from the U.S. to replace Ukraine shipments, Bloomberg reports (link).

|

CHINA UPDATE |

— Xi focus appears to be on Taiwan. In a Friday call with President Biden about Russia’s invasion, China’s leader, Xi Jinping, seemed more concerned about the fate of Taiwan than the war in Ukraine. Concludes the New York Times: “What happens in Taiwan will likely be influenced by what happens in Ukraine. If Russia succeeds in overtaking Ukraine, it increases the danger for Taiwan. If Russia ultimately retreats, or suffers lasting, damaging consequences, that could be good news for the island.”

— Chinese city of Jilin will begin a three-day lockdown of its 4.5 million residents this evening as authorities deal with a wave of new coronavirus infections driven by the omicron variant; 4,000 new infections were reported nationwide on Sunday as cities move to tighten movement restrictions to halt further spread. On Friday, China announced its first recorded Covid-19 deaths since January 2021 after two people died of the illness. Although China’s cases are high by the country’s standards they are only a fraction of the U.S. caseload, which averages roughly 30,000 new infections and more than 1,000 deaths each day.

— Backlogs of cargo ships are building off some of China’s busiest ports after lockdowns aimed at curbing new Covid-19 outbreaks. More than 35 ships have gathered off Shenzhen and another 30 were waiting recently to the north at Qingdao, the Wall Street Journal reports (link), raising the prospect of a new round of bottlenecks that could push up freight rates and slow deliveries. The shipping slowdowns come even as restrictions in Shenzhen are easing and operations at the world’s fourth largest port remain open. The tighter bars on business shuttered many factories over the past week, however, and container loading at terminals has slowed because fewer trucks are arriving. Freight forwarders are adjusting operations, even switching off drivers to meet Covid restrictions while keeping goods moving. But the backups at sea suggest supply chains remain fragile and that new waves of disruption could reach across the Pacific in the coming weeks.

— Demand remains high for Chinese wheat reserves. China sold 522,804 MT of state-owned wheat reserves out of 524,804 MT put up for auction last week — 99.6% of the total. But the average price declined slightly from the two previous weeks to 2,958 yuan ($465) per metric ton.

— China releasing potash reserves ahead of spring planting. China’s state planner has asked major companies to release 1 MMT of state potash reserves. It is also organizing the timely release of imported potash fertilizer to the market to secure demand during spring planting. The National Development and Reform Commission will work with other departments and take measures to promote domestic fertilizer production, increase imports and release fertilizer reserves to ensure supplies.

|

TRADE POLICY |

— EU/U.S. trade deal urged. German Finance Minister Christian Lindner has called for the revival of discussions on an EU/U.S. trade deal after they ran aground during the presidency of Donald Trump. Speaking to German daily Handelsblatt, Lindner said the Ukraine crisis had highlighted “how important free trade is with partners in the world who share our values,” and said any deal must learn from the mistakes of the earlier Transatlantic Trade and Investment Partnership, which European critics argued would have lowered food, environmental, and consumer protection standards.

|

ENERGY & CLIMATE CHANGE |

— Why pipelines are needed. Despite the U.S. producing about 11.6 million barrels of crude per day — No. 1 in the world, followed by Saudi Arabia’s 10 million and Russia’s 10 million — almost all of the drilling occurs in the Midwest and Southwest, with Texas accounting for five million barrels daily and New Mexico producing one million. “Then you have lesser amounts coming from Oklahoma, Colorado and Wyoming,” according to Andy Lipow, president of Lipow Oil Associates, a consulting company in Houston. Alaska, which produced two million barrels a day in 1988, is now at 450,000. The challenge of moving oil thousands of miles across the country means that it’s sometimes cheaper and easier to buy it from other countries. Canada and Mexico provide most U.S. energy imports. Once crude oil is drilled from the ground, it goes to refineries to be processed into fuel for our cars and trucks. But most of these refineries are in the Gulf Coast, where 54% of our gasoline gets made. Lesser quantities come from California, Indiana, Ohio and Colorado.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Food price rises coming in U.S., other countries. Russia’s war in Ukraine has sparked a fresh wave of hoarding in parts of Europe with panic buying surfacing caused in part by shortages of various food and other products in world markets. This month, global wheat prices spiked at more than 80% higher than a year ago. Sunflower oil — 80% of it produced by Ukraine and Russia — is rapidly becoming unavailable, pushing up the cost of alternatives. Other products, such as some fish and the wood pulp used in packaging and labels, are becoming scarce as supplies from Russia and Ukraine dry up.

In the U.S., food inflation will likely continue longer than most government forecasters currently predict. USDA this Friday will issue an update for its Food Price report, which should show some upward revisions.

— Some 8,000 U.S. diners that have closed for good since the pandemic hit, according to Datassential, a food-industry market-research firm.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 470,852,725 with 6,078,361 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,734,867 with 971,162 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 558,544,815 doses administered, 217,060,180 have been fully vaccinated, or 66.12% of the U.S. population.

— A new study found that the Johnson & Johnson coronavirus vaccine remains durable and effective, even through the surge of cases caused by the Delta variant. The research, outlined in the medical journal JAMA Network Open, found that the J&J shot was 76% effective in preventing Covid-19 infections and 81% effective in preventing Covid-related hospitalizations. The study also showed that it provided lasting immunity at least six months after the shots.

|

POLITICS & ELECTIONS |

— Jan. 6 Committee: Give me rewrite. There is word the panel looking into the Jan. 6 Capitol riot is searching for ways to add drama to the committee's report. "The House January 6 committee has tried to recruit high-profile journalists to write its report about the attack on the Capitol, hoping to build a narrative thriller that compels audiences and is a departure from government reports of yore," reported the Washington Post (link).

|

CONGRESS |

— Don Young, the longest-serving member of America’s House of Representatives, died at the age of 88. Young, a Republican and Alaska’s sole congressman, was serving his 25th term. He strongly supported the state’s oil industry, beginning with the Trans-Alaska Pipeline early in his career. According to his congressional biography, he advocated for legislation to establish a 200-mile fishing limit to help Alaska’s fishing industry, and also “fought against federal control of lands and resources to which Alaskans are rightfully entitled.”

— U.S. Senate confirmation hearings begin for Ketanji Brown Jackson, Joe Biden’s nominee to replace Justin Stephen Breyer on the nine-person Supreme Court.

— Supreme Court Justice Clarence Thomas was hospitalized with an infection (not Covid-19) and is expected to be fine, although he will miss oral arguments today. Thomas, 73, has been at Sibley Memorial Hospital in Washington since Friday after experiencing “flu-like symptoms,” the court said in a statement. The court offered no explanation for why it waited to disclose the hospitalization. While not giving more details about the infection, it said Thomas is being treated with antibiotics and his symptoms are abating. Thomas, who has been on the court since 1991, could be released in the next couple of days, the court said.