China Places 17.5 Mil. Residents of Shenzhen into Lockdown; Impact on Economy, Logistics

Argentina suspends export registrations for meal and soyoil

|

In Today’s Digital Newspaper |

The world is not done with Covid-19, with China locking down some huge areas, including Shenzhen’s population for at least a week amid a surge of infections. China also implemented fresh restrictions in Shanghai, the country’s most populous city whose ports are also among the busiest in the world. Meanwhile, people will need a fourth dose of Covid-19 vaccine to help fend off another wave of the pandemic, Pfizer CEO Albert Bourla said.

The Russian invasion of Ukraine as expected got uglier and bloodier, with several other developments catching the world’s attention, as detailed below, including Russian missiles striking a Ukrainian base near the Polish border. We also have more information on the impact of the war on Ukraine’s plantings and ag production and also some updates on Russia’s ag sector.

USDA Secretary Tom Vilsack on Friday provided more details on the Biden administration’s look for more information on potential competition issues in several sectors, including seed, fertilizer and food.

Global prices of soybean meal climbed to the highest in more than seven years as Argentina suspended export registrations for meal and soyoil on talk of a pending increase in taxes. But palm oil futures plunged almost 10% in Kuala Lumpur as Brent crude oil resumed its decline and China sold some of its state stockpiles of cooking oils and soybeans.

The average U.S. gas price up 22% in two weeks to record $4.43, and the energy surge will have an impact on rising electricity rates as Americans will see when they get their bills. Also, the WSJ reports car buyers looking to offset surging gasoline prices with a more fuel-efficient vehicle aren’t likely to find much.

There would be significant price impacts if Michigan Gov. Gretchen Whitmer succeeds in shutting down Enbridge’s Line 5 pipeline.

In the meat sector, the pork checkoff rate is dropping a nickel, to 35 cents per $100 value beginning Jan. 1, 2023. And USDA confirms HPAI in non-commercial flocks in Kansas, Illinois; commercial flock in Iowa.

Congressional update: President Biden on Friday signed the fiscal year 2022 budget measure, but House Democrats are having a hard time getting a consensus within the party regarding additional Covid aid, which may not occur this week.

On the election front, Democrats on Friday will debate changes to the primary calendar with a potential big impact for Iowa.

The U.S. won’t negotiate sanction exemptions with Russia to save the 2015 Iran nuclear deal.

|

MARKET FOCUS |

Equities today: Overnight the MSCI Asia Pacific Index dropped 1.4%, with Chinese shares listed in Hong Kong suffering their biggest plunge since November 2008. Japan’s Topix index closed 0.7% higher. In Europe the Stoxx 600 Index rose 1.7% in early trading. U.S. stock indexes are pointed toward higher openings.

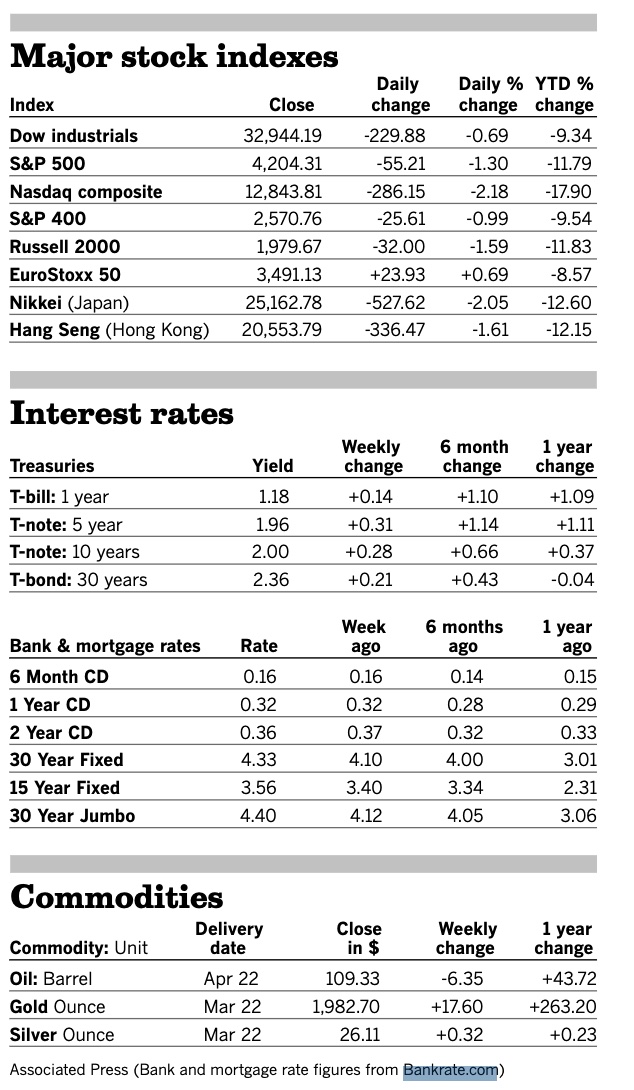

U.S. equities yesterday: The Dow closed down 229.88 points, 0.69%, AT 32,944.19. The Nasdaq fell 286.15 points, 2.18%, at 12,843.81. The S&P 500 was down 55.21 points, 1.30%, at 4,204.31.

For the week, the Dow notched its fifth consecutive week of losses, down 2%, while the S&P sank 2.9% and the Nasdaq slid 3.5%.

Crude oil posted its first weekly loss since Russia's invasion, after hitting 14-year highs early in the week.

Agriculture markets from Friday:

- Corn: May corn futures rose 6 3/4 cents to $7.62 1/2, up 8 1/4 cents for the week. December corn rose 3 1/2 cents to $6.55 1/4, up 25 3/4 cents for the week and a lifetime-high close for the contract

- Soy complex: May soybeans fell 10 1/4 cents to $16.76, up 15 1/2 cents for the week. May soymeal fell $6.60 to $477.10 per ton, up $16.70 for the week, while May soyoil rose 135 points to 76.03 cents per pound.

- Wheat: May SRW futures rose 19 1/2 cents to $11.06 1/2, down $1.025 for the week. May HRW futures rose 23 1/2 cents to $10.89 1/4, down $1.25 1/4 for the week. May spring wheat rose 15 1/2 cents to $10.70 1/4, down 76 3/4 cents for the week. Wheat futures capped a historically volatile week that saw May SRW contact trade in a wide of range of $3.20 1/4 and nearby SRW post a record high.

- Cotton: May cotton futures jumped 417 points to 121.03 cents per pound, up 461 points for the week and the highest closing price since March 1.

- Cattle: April live cattle rose $1.40 to $137.30, a gain of $1.525 for the week. April feeder futures surged $1.725 to $157.975, up 72.5 cents for the week.

- Hogs: April lean hog futures rose $2.625 to $102.725, up $2.275 for the week. Hog futures showed a bullish resurgence late this week amid signs of another updraft in the cash market. The CME lean hog index rose 65 cents at $99.91, a six-month high, and the preliminary figure for today is up another 85 cents.

Ag markets today: Pro Farmer reports price pressure to start the week. Corn, soybeans and wheat are weaker this morning and trading near session lows. As of 6:30 a.m. CT, corn is trading 3 to 12 cents lower, soybeans are 3 to 8 cents lower, winter wheat futures are 22 to 25 cents lower and spring wheat is 19 to 21 cents lower. Soyoil futures are under heavy pressure, but soymeal is firmer. Front-month U.S. crude oil futures are around $6 lower, while the U.S. dollar index is down about 175 points this morning.

On tap today:

• USDA Grain Export Inspections report, 11 a.m. ET.

• China's industrial output for February is expected to increase 3.5% from one year earlier, retail sales are forecast to increase 4.2% from one year earlier, and fixed-asset investment for January and February is forecast to rise 5% from the same period one year earlier. (10 p.m. ET)

Yellen rejects notion sanctions could undermine dollar dominance. Treasury Secretary Janet Yellen said the U.S. dollar is in no danger of losing its status as the world’s dominant reserve currency because of sanctions imposed against Russia over its invasion of Ukraine. “I don’t think the dollar has any serious competition, and is not likely to for a long time,” Yellen told reporters in response to questions following a speech in Denver on Friday. Some commentators, including Credit Suisse Group AG interest-rate strategist Zoltan Pozsar, have warned sanctions that blocked Russia’ s access to its foreign currency reserves could drive other countries away from the dollar.

Global growth to shrink. Dana Peterson, the Conference Board’s chief economist, told Barron’s global growth will shrink by 0.4 to 0.9 percentage points this year, with inflation increasing by 0.7 to 2.7 percentage points with the absence of resources from Russia and Ukraine such as energy, food, metals, and rare earths.

Market perspectives:

• Outside markets: Nymex crude oil prices lower and trading around $104.00 a barrel. Crude prices have backed way off from last week’s 14-year highs. Analyst Jim Wyckoff says that suggests oil prices may have put in at least near-term tops. The U.S. dollar index is lower today. The benchmark U.S. 10-year Treasury note is presently yielding 2.08%. U.S. Treasury yields are on the rise. For perspective, the U.K. 10-year gild yield is presently 1.566% and the German 10-year bund is yielding 0.314%.

• The dollar index was up 0.6% last week and it has been rising during Russia’s attack on Ukraine. The index is the value of the dollar against a basket of currencies and is heavily weighted toward the euro. Marc Chandler, chief market strategist at Bannockburn Global Forex, also points out that the dollar funding market is seeing some pressure, but it is not strained. “The dollar is at five-year highs today against the yen. That’s not what you would expect in a risk-off environment,” he said. “That’s a testament to the dollar’s strength.”

• Average U.S. gas price up 22% in two weeks to record $4.43. The average U.S. price of regular-grade gasoline shot up a whopping 79 cents over the past two weeks to a record-setting $4.43 per gallon as Russia’s invasion of Ukraine is contributing to already-high prices at the pump, the Associated Press reported (link). The average price of gasoline “is $1.54 higher than it was a year ago. Each 10% increase in gas and oil prices means consumers will have to spend an additional $23 billion a year to keep up with earlier spending patterns, analysts at J.P. Morgan found. But the pandemic boosted Americans’ bank accounts, leaving them with an additional $2.5 trillion in savings to help cushion that blow.

The Hill reports that a “proposal to suspend the federal gas tax is gaining political momentum among Senate Democrats who are worried that high gas prices will hurt them in the midterm election.” Sens. Mark Kelly (D-Ariz.) and Maggie Hassan (D-N.H.), the sponsors of a Senate measure, both face “competitive re-election races.” Their bill “would suspend the 18.4-cent-per-gallon federal gas tax until January.” According to The Hill, “The idea has never gained much traction among Senate Democrats because the tax is the main source of funding for the Highway Trust Fund,” but “anxious Democratic senators say the rising price of gas, accelerated by the Russian invasion of Ukraine, has become a domestic ‘crisis.’” Link.

• Global prices of soybean meal climbed to the highest in more than seven years as Argentina suspended export registrations for meal and soyoil on talk of a pending increase in taxes, another sign of countries moving to protect their domestic market. Argentina suspended agriculture traders from registering soybean meal and oil for export, according to a memo (link) signed by Javier Preciado Patino, the secretary for agriculture markets. The government typically puts a block on the export register, known as DJVE, before increasing taxes on shipments to stop farmers from preempting the hike with a flood of selling. Speculation has been circling trading desks that Argentina will increase taxes on soy meal and oil to 33% from 31% currently. Argentine farmers start collecting soybeans at the end of the month, with the bulk of the harvest done in April and May.

• Palm oil imports by India slump to 12-month low in February: SEA. Palm oil purchases by the world’s biggest buyer decreased to 454,794 tons in February, from 553,084 tons a month earlier, according to the Solvent Extractors’ Association of India (SEA). That is the lowest since February 2021, when the nation imported 394,495 tons, and is in line with estimates.

• Palm oil futures plunged almost 10% in Kuala Lumpur as Brent crude oil resumed its decline and China sold some of its state stockpiles of cooking oils and soybeans. National stockpiler Sinograin auctioned on Friday nearly 60,000 tons of soybean oil from its state reserves, alongside 10,000 tons of rapeseed oil, and will sell another 295,000 tons of imported soybeans today. Meanwhile, last week Indonesia tightened control over shipments in a further sign of increasing food protectionism globally. The country now requires companies to set aside 30% of their export volume for the local market, up from 20%, tightening already squeezed world supplies. Talk that Indonesia has approved a substantial number of export permits under its Domestic Market Obligation rules is also pressuring prices

• Russian wheat export tax drops again. Russia’s wheat export tax for March 16-22 will be $86.30 per metric ton, based on an indicative price of $323.30 per metric ton. The wheat export tax has dropped nine straight weeks and is down from the peak rate of $98.20 per MT in mid-January but is still 207% higher than the initial rate of $28.10 per MT at the beginning of June when Russia started using the sliding scale.

• Some big banks worked over the weekend to resolve a crisis in the nickel market that leaves them on the hook for billions of dollars owed by Tsingshan. Trades by the Chinese metals giant on the London Metal Exchange contributed to an uncontrollable rise in prices and halted trading in the metal. The meltdown has bled into the financial system and jolted a planned mining acquisition.

• Ag demand: Iraq tendered to buy 50,000 MT of optional origin wheat.

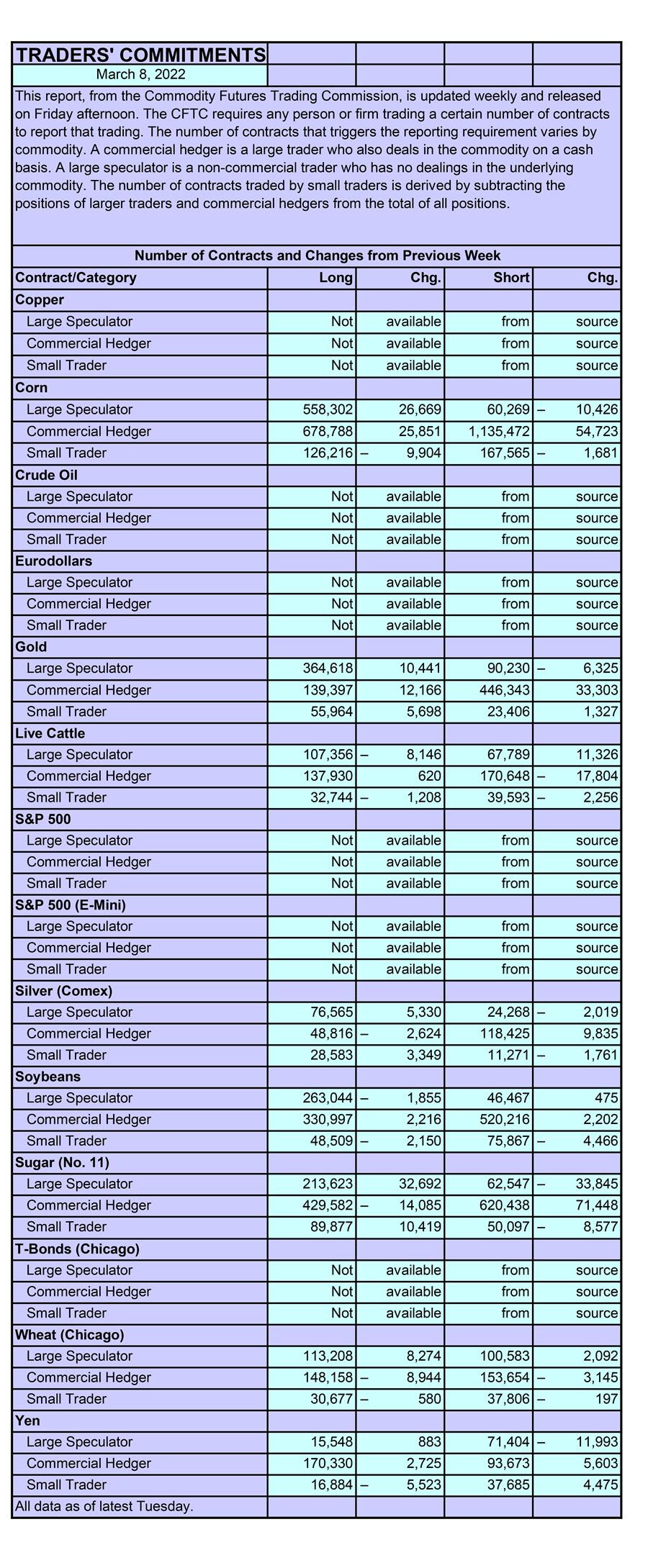

• Commitments of Traders report (Source: Barron’s):

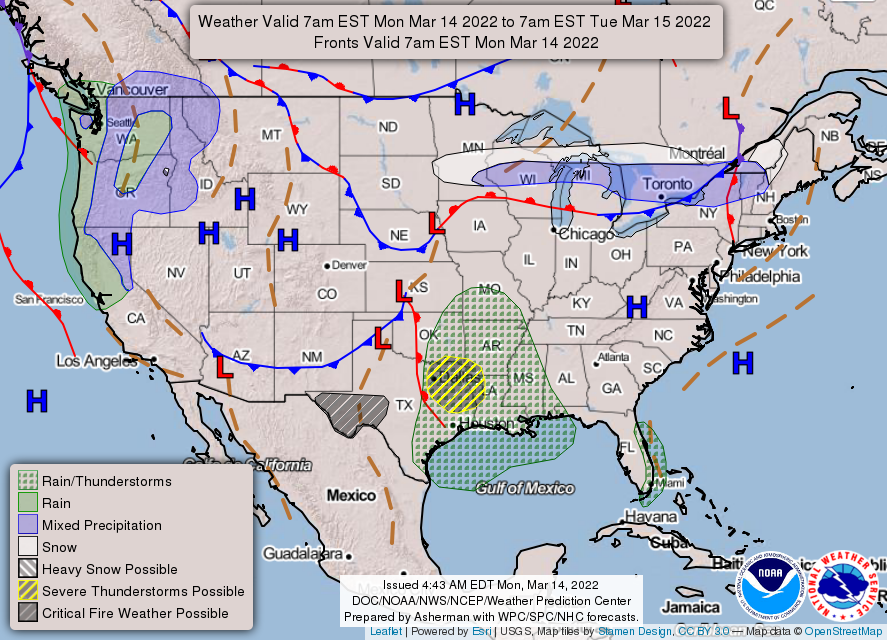

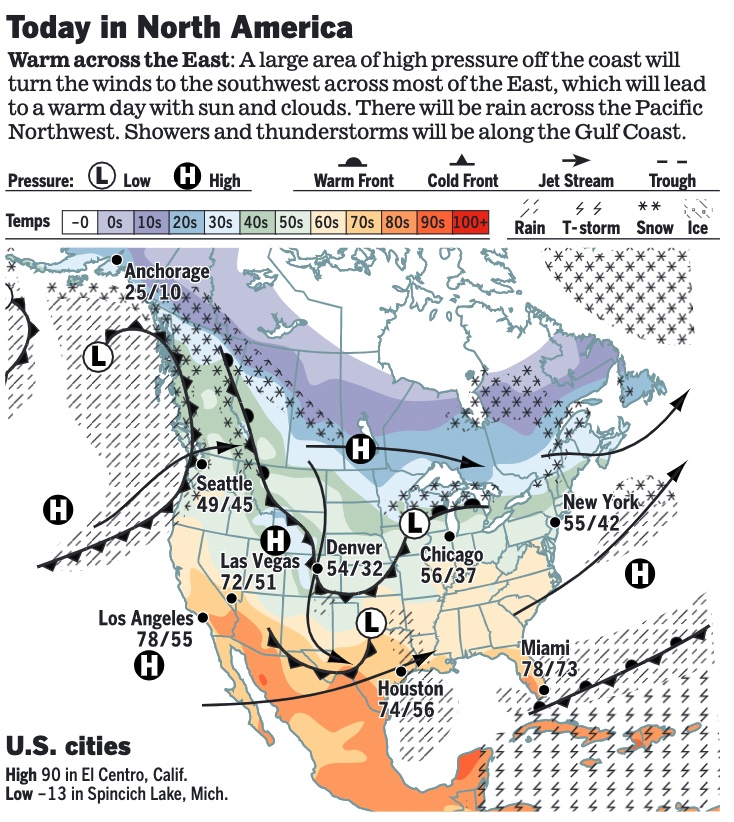

• NWS weather: Severe weather possible over Northeast Texas and the ArkLaTex on Monday and across northern Florida on Tuesday... ...Critical fire weather conditions across portions of the Southern High Plains on Monday... ...Additional heavy precipitation possible across the Northwest Monday into Tuesday.

Items in Pro Farmer's First Thing Today include:

• Price pressure to start the week

• Spain to approve emergency U.S., Argentine corn buys

• Algeria bans foodstuffs exports

• Technical action key for cattle, hog futures

|

RUSSIA/UKRAINE |

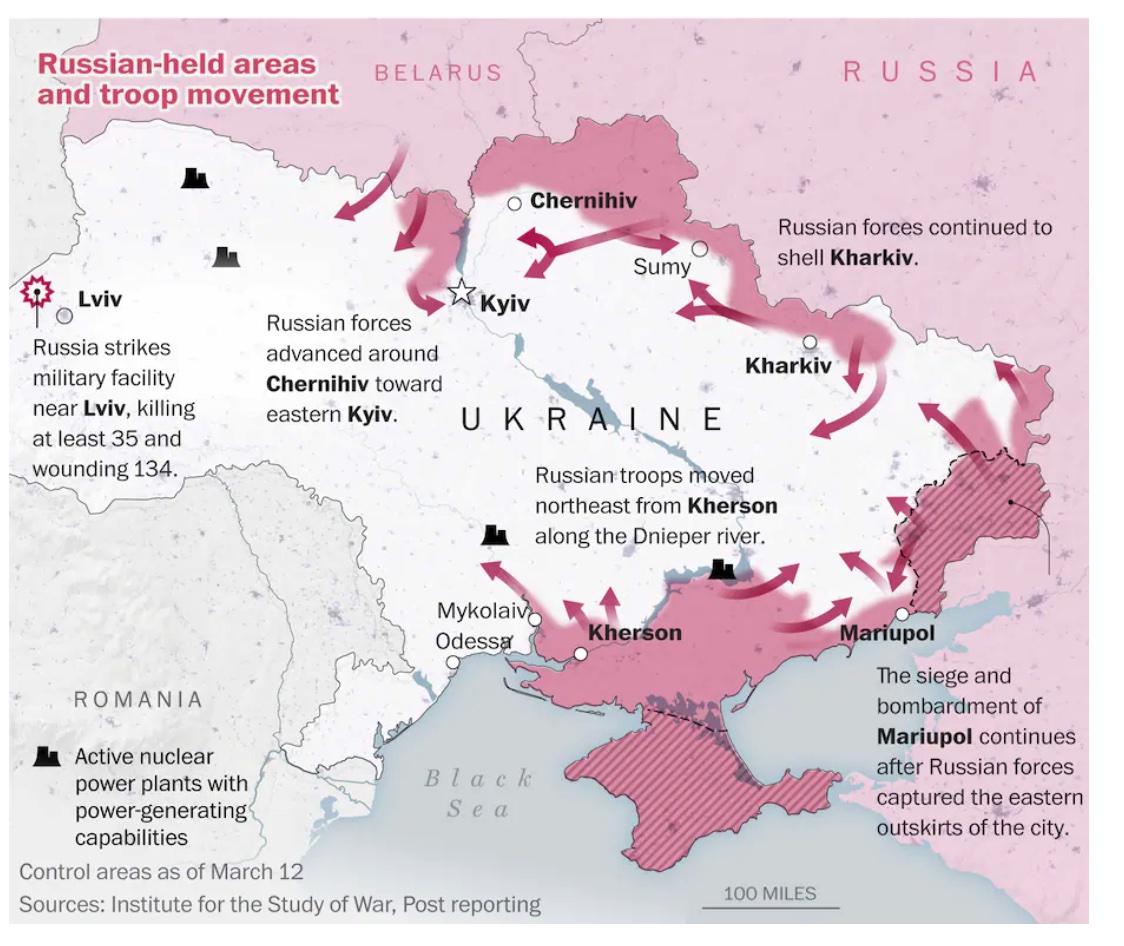

— Summary: Russia asked China for military equipment, U.S. officials said. Some 35 are dead in a Russian strike on a Ukrainian military site in western Ukraine, near Poland, Lviv governor said; the U.S. warned of a full NATO response if Poland is hit. Western officials said the attack at NATO’s doorstep was not merely a geographic expansion of the invasion but a shift in Russian tactics Ukrainian officials accused Russian forces of kidnapping a second mayor within the span of days. Russian President Vladimir Putin showed no willingness to accept a ceasefire in Ukraine during a phone call, a senior aide to French President Emmanuel Macron said. Ukrainian President Volodymyr Zelenskyy said he has appealed to several Western leaders for help to free the mayor of a southern Ukrainian city he says was kidnapped by Russians. The power supply has been restored at the defunct Chernobyl nuclear power plant in Ukraine, according to the nation’s minister of energy, days after Ukrainian officials said Russian forces disconnected the site from the grid. Meanwhile, Zelenskyy has called for Israel to serve as a mediator for negotiations with the Kremlin. Putin said that Russian and Ukrainian representatives had continued to negotiate via video link after recent talks the past week. Putin is demanding that Ukraine recognizes its 2014 annexation of the Crimean Peninsula and the independence of two separatist statelets in the Donbas region, commits to demilitarization and declares neutrality in its constitution. Ukraine has said it is open to making some concessions but has described Moscow’s stance as a demand for “capitulation.” Source of map: Washington Post

- Russia has turned to China for military equipment and aid. White House national security adviser Jake Sullivan told CNN that the administration was “communicating directly, privately to Beijing, that there will absolutely be consequences” for any Chinese efforts to assist Russia in evading sanctions.” Traditionally, China has bought military equipment from Russia rather than the other way around. China has advanced missile and drone capabilities that Russia could use in its Ukraine campaign.

- The U.S. and China will hold the first high-level, in-person talks since Russia’s full invasion of Ukraine, as the Biden administration continues to try to enlist Beijing to exert influence on its neighbor to end the crisis. The White House said National Security Adviser Jake Sullivan will meet in Rome today with China’s top diplomat, Communist Party Politburo member Yang Jiechi.

- Russia has warned that it will fire on western armaments shipments to Kyiv, raising the risk of a direct military confrontation between Moscow and NATO during the war in Ukraine. Deputy foreign minister Sergei Ryabkov said on Saturday that “pumping up [Ukraine] with weapons from a whole range of countries” was “not just a dangerous move — it’s something that turns these convoys into legitimate military targets”, according to the Interfax news agency. The U.S. has promised $6.5 bil. in defense spending, the U.K. has sent 3,615 NLAW anti-tank missiles and Javelin anti-tank weapons while Nordic states have sent more than 10,000 anti-tank weapons.

- Russian prosecutors have threatened to arrest corporate leaders in Russia who criticize the government or to seize assets of companies that withdraw from the country, the Wall Street Journal reported (link).

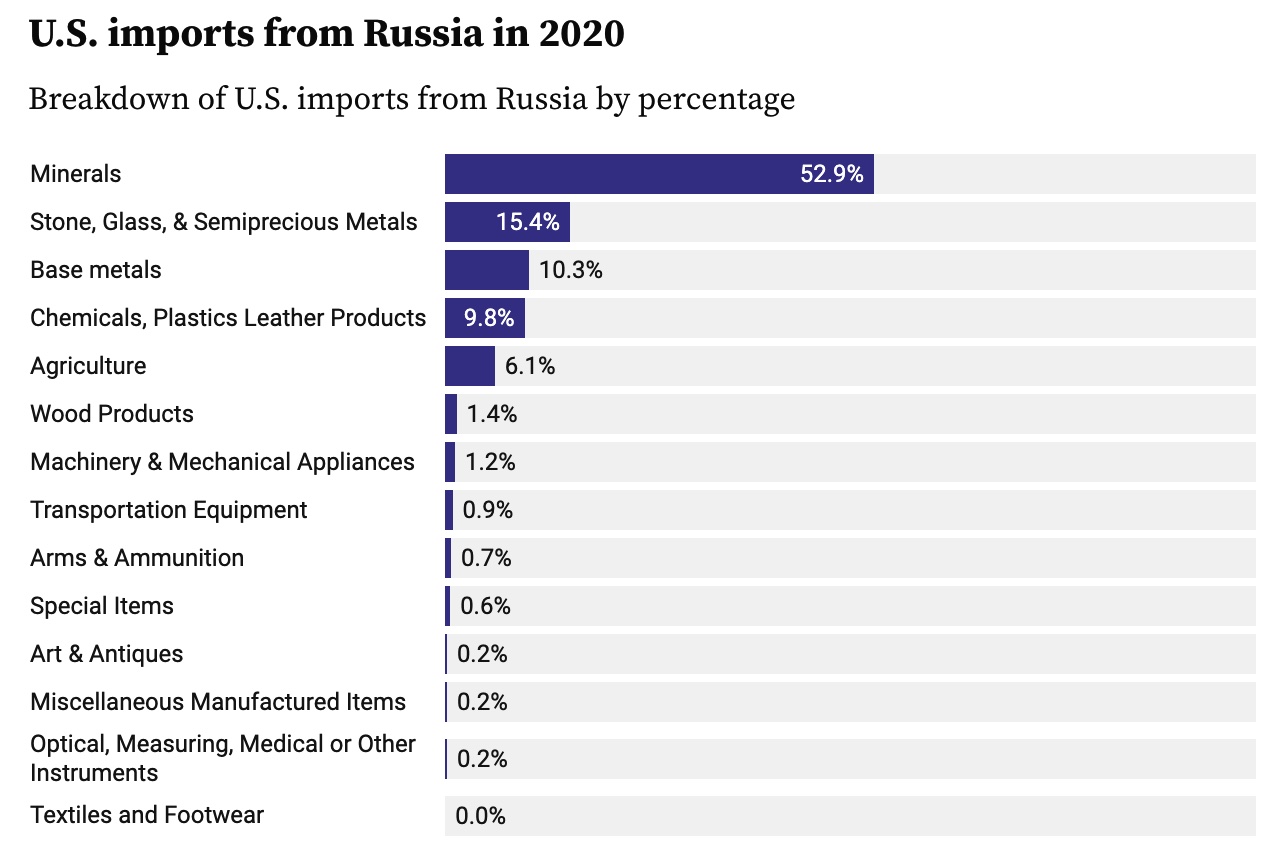

- Russia has yet to detail the full list of products subject to sanctions but said Thursday's order said restrictions on exports are "necessary to maintain stability on the Russian market." The ban affects all countries except the group of ex-Soviet countries that make up the Eurasian Economic Union. The U.S. imported $16.8 billion worth of goods from Russia in 2020 — a 24.3% decline from the prior year, according to a report from the U.S. Bureau of Industry and Security's Office of Technology Evaluation. Most goods imported from Russia are minerals, primarily made up of mineral fuels such as coal, petroleum and natural gas. These mineral fuels made up $13 billion worth of imports in 2019, according to a report from the Office of the United States Trade Representative (link).

- Syria supporting Russia. President Bashar al-Assad of Syria, who owes his government’s survival to Russian intervention in the Syrian civil war, declared support for Moscow’s invasion. Russia has tried to recruit Syrian fighters to join the Ukraine war, according to the Pentagon.

- The White House Friday released a fact sheet listing additional steps to sanction Russia. They included denying borrowing privileges at multilateral financial institutions, full blocking sanctions on additional elites, and new guidance by the Treasury Department to thwart sanctions evasion, including through virtual currency. Link to fact sheet.

— Market impacts:

- Ukraine President Volodymyr Zelenskyy is urging farmers to sow as many fields as possible to protect the food supply. The country should organize a full-fledged sowing campaign in all of its territory “to the extent that’s possible,” Zelenskyu said in a video released Friday. “All depends on people and the situation, because this is about life.” His nation is the world’s second-biggest shipper of grains and biggest exporter of sunflower oil.

One of Ukraine’s largest agricultural companies, UkrLandFarming, said several company managers had been killed in Sumy in northern Ukraine, and in Kyiv. UkrLandFarming has lost at least 120,000 hectares (297,000 acres) of land in the Kherson, Odesa and Mykolayiv regions to the Russian invasion, or about a third of its land portfolio. It’s been forced to shut three egg farms including Europe’s largest, the Chornobaivka factory near Kherson, where 3.1 million laying hens are dying, the company said.

IMC SA, another agricultural company, wants to keep its operations going, but it isn’t allowing workers into many fields because of worries about their safety, Chief Executive Officer Alex Lissitsa said Friday in an interview with Bloomberg. Lissitsa, a board member of the Ukrainian Agribusiness Club, said summer crops such as corn could be affected more severely, with only about half the normal area planted because of the fighting and severed logistics.

- Head of Ukraine’s leading food supplier fears disruption to vital spring planting season. John Rich, executive chair of Ukraine’s leading food supplier MHP, said the vital spring planting season is critical not only for domestic supplies in Ukraine but also the huge quantities of grains and vegetable oil that the country exports around the globe. “This conflict has had an enormous impact on Ukraine and Russia’s ability to supply the world,” Rich said. The success of the planting season would be decided by “military action in the next week or two”, he added. This would be jeopardized if Russia’s army moved into the west of the country. Rich warned of “spiraling inflation” in the cost of wheat, corn and other commodities — prices of which were rising before the hostilities because of drought and high demand as economies emerged from the pandemic. “It’s a pretty toxic mix,” he said. The U.N. Food and Agriculture Organization has warned that up to 30% of crop areas in Ukraine will either not be planted or be unharvested this year because of the conflict.

- Food and agriculture giant Cargill plans to continue operating its food and animal-feed facilities in Russia.

- “Russian ports are operating normally but no one is willing to pay extremely high insurance costs to book cargos from there,” said Will Osnato of agricultural data firm Gro Intelligence.

- Russia resuming Black Sea wheat exports. Russia is gradually resuming wheat exports from its Black Sea ports while navigation in the Azov Sea remains restricted, export sources reported. SovEcon said Russia’s Black Sea terminals loaded 400,000 MT of wheat last week, and that vessels were going in and out of the ports there. Prices for Russian wheat remain extremely volatile, consultancy IKAR said, noting that for wheat with 12.5% protein content from the Black Sea ports was priced at $415 per metric ton free on board (FOB) on March 11.

- Russia threatened to pay international bondholders in rubles rather than dollars just days before a key interest payment on its external debt comes due. Anton Siluanov, Russia’s finance minister, said on Sunday that it was “absolutely fair” the country would make all of its sovereign debt payments in rubles until western sanctions that he claimed have frozen $300 billion of the country’s reserves were lifted. Moscow is scheduled to make a combined $117 million in interest payments this Wednesday on two dollar-denominated bonds, according to JPMorgan. Neither bond’s contracts gives Russia the option of paying in rubles, according to the Wall Street bank. “We need to pay for critical imports. Food, medicine, a whole array of other vital goods,” Siluanov told a state television interviewer. “But the debts we need to pay to the countries that have been unfriendly to the Russian Federation and have limited our use of foreign currency reserves — we will pay off our debt to these countries in the ruble equivalent,” he said. Siluanov said that almost half of Russia’s $643 billion foreign reserves had been hit by the sanctions but did not disclose the denominations and jurisdictions where Russia holds other currencies. IMF managing director Kristalina Georgieva told CBS on Sunday that “in terms of servicing debt obligations, I can say that no longer we think of Russian default as improbable event.”

Background. The central bank publishes data on the structure of Russia’s foreign reserves with a lag of at least six months. As of June 2021, the euro made up 32.3% of Russia’s holdings, the renminbi 13.1%, the pound 6.5%, other currencies 10%, and gold 21.7%. China held 14.2% of Russia’s reserves, the largest share of any country, with Japan holding 12.3% and Germany 11.8%.

- Turkish ships carrying sunflower oil have been permitted to exit the Azov Sea, Turkey’s Transportation Minister Adil Karaismailoglu said, after transit in the waterway linked to the Black Sea was suspended following Russia’s attack on Ukraine.

|

POLICY FOCUS |

— USDA seeks comments on broad swath of agriculture, including fertilizer, seed and intellectual property and on food retail and distribution. USDA will soon release requests for information (link) from agricultural stakeholders and others covering the fertilizer industry (link to pre-publication document), intellectual property and seed industry (link) and on the food retail and distribution situation (link). The information requests cover a swath of information in the three areas and will be used to generate reports to the Chair of the White House Competition Council. There will be a 60-day comment period once the information requests are published. In information request relative to fertilizer, USDA seeks answers to 15 questions on the industry, concentration in the industry and other questions, seeking comments on “all aspects of the market structure for fertilizer as it affects agricultural producers.” USDA does request “evidence” from commenters on these issues.

On IP and seed issues, the USDA request seeks “views” from commenters on the 25 questions asked by the agency in this area, including on access to information for farmers and others. Relative to the food and retail distribution, the 20 questions center on impacts to “agricultural producers and small, midsized and otherwise independent (SME) processors — as well as potentially ultimately impacting consumers.” The series of questions on the food and retail distribution situation do include request for specific examples of actions. A common thread in the requests on fertilizer and seed is on climate impacts.

However, there is no specific focus on climate in the food and retail distribution request.

The requests for information are based on the Executive Order issued by President Joe Biden July 9, 2021, on “Promoting Competition in the American Economy.” That executive order (link) called for a report to the White House Competition Council “not later than 300 days” after the EO. That would mean USDA is to have completed the report by May 5, 2022. Since the documents have not been published in the Federal Register yet, the deadline will not be met as the comment period will still be open when the report is due.

|

PERSONNEL |

— Nominees announced. President Biden Friday announced his intent to nominate Brendan Owens for assistant secretary for energy, installations and environment at the Department of Defense; and Carmen Cantor for assistant secretary for insular and international affairs at the Department of Interior.

— Senate to vote on OMB head. The Senate late this afternoon will resume consideration of Shalanda Young’s nomination to be director of the Office of Management and Budget (OMB). A vote on the motion to invoke cloture, or limit debate, on her nomination is scheduled for 5:30 p.m. ET. Young, who is OMB’s deputy director, has been serving as acting director of the key White House office since a bipartisan majority of senators balked at Neera Tanden’s bid for the job. Young’s confirmation on a bipartisan basis is expected.

|

CHINA UPDATE |

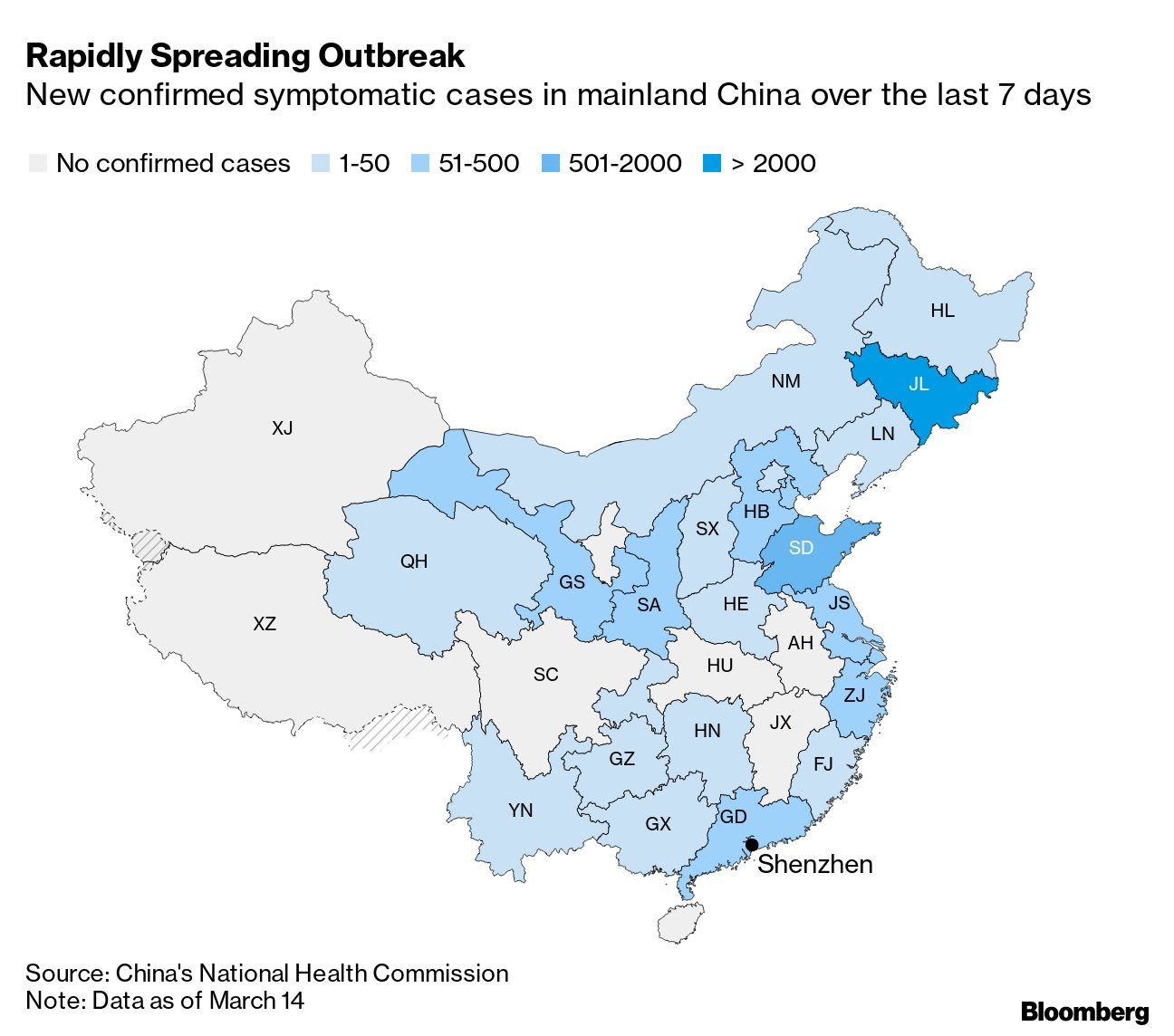

— Chinese authorities put Shenzhen’s population in lockdown yesterday for at least a week amid a surge of Covid-19 infections. China also implemented fresh restrictions in Shanghai, the country’s most populous city. This and similar restrictions across the world’s second-largest economy could affect half of the country’s population and gross domestic product, according to economists at Australia & New Zealand Banking Group. Apple supplier Foxconn suspended operations at its Shenzhen sites, according to multiple reports. The city’s ports are also among the busiest in the world. Hong Kong’s Hang Seng Index tumbled 5% Monday, as tech stocks were taking a hammering. JD.com slumped close to 15% and Alibaba fell 11%.

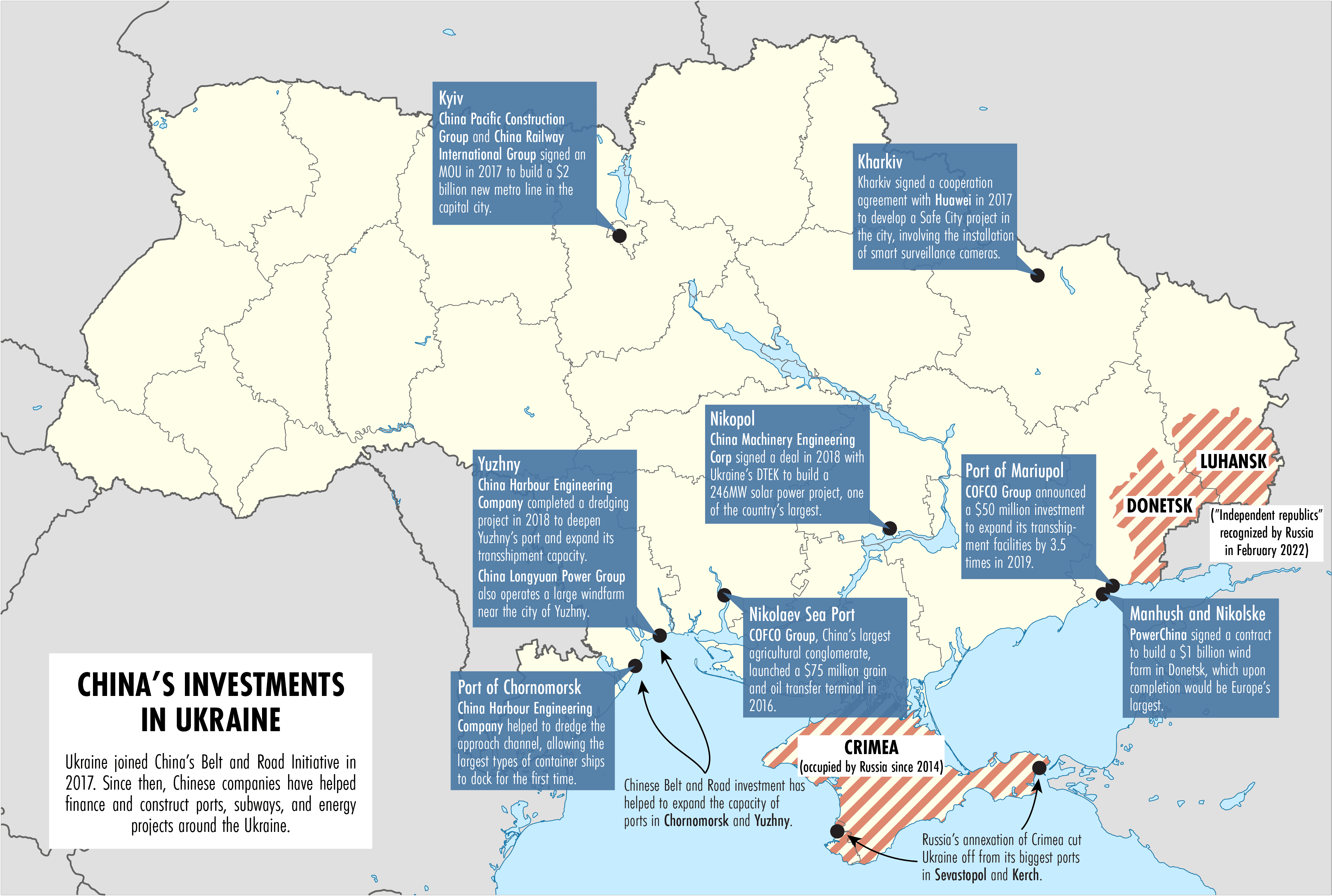

— China’s investment in Ukraine. Bilateral trade between China and Ukraine has grown three-fold in the last five years, driven by a significant increase in Ukrainian exports to China. In 2019, China overtook Russia to become Ukraine’s largest single trade partner (although Ukraine’s trade with the EU as a bloc remains much larger).

— Active demand at China wheat auction. China sold all 525,869 MT of wheat from its auction of state reserves last week. The average selling price was 2,991 yuan ($470) per MT, down from 3,054 yuan ($480) per MT the previous week. China has sold nearly 5 MMT of state-owned wheat reserves since starting the auctions in October.

— Growth in China’s industrial production likely continued to slow in the first two months of 2022. January-February industrial output, out Tuesday, is forecast to be up 3.5% from a year earlier, decelerating from a 4.3% pace in December. Economists expect other key measures of activity to improve slightly: Fixed-asset investment and retail sales are both estimated to have advanced at a faster annual rate than in December.

— China halted for a week beef shipments from a JBS plant at Mozarlandia in Brazil’s Goias state, after the cargoes tested positive for Covid-19, Valor Economico reports, citing the decision taken by the Chinese customs administration. Shipments from another plant owned by Frialto in Mato Grosso do Sul state were also suspended for a week, according to the newspaper. Suspension is just a routine measure and shipments from both companies are expected to be resumed after a week, Valor adds.

|

TRADE POLICY |

— House lawmakers this week will revoke Russia’s permanent normal trade relations (PNTR) status, a measure they were set to pass last week until President Joe Biden asked them to wait. House Speaker Nancy Pelosi (D-Calif.) said the bill is likely to be fast-tracked through a process requiring two-thirds of lawmakers voting in favor of it “because we have that much support.” The move comes after Biden said he would ban imports of Russian vodka, caviar and diamonds and called on U.S. lawmakers to join Western allies in revoking the country’s preferential trade status. Removing the designation has support from both Democratic and Republican lawmakers. Biden’s signature on the bill would clear the way for increased import tariffs, and Russia would join Cuba and North Korea as the only countries in the world without preferential trade status in the U.S.

|

ENERGY & CLIMATE CHANGE |

— Impact if Michigan Gov. Gretchen Whitmer succeeds in shutting down Enbridge’s Line 5 pipeline. Michigan’s governor is in state and federal court trying to compel the closure of Line 5, a crucial pipeline carrying fossil fuels between Canada and several U.S. states. If the Democratic governor prevails, consumers in Ohio, Michigan, Indiana and Pennsylvania will pay an additional $4.756 billion or more each year for gasoline and diesel fuel, according to a new report from the Consumer Energy Alliance, a business and consumer advocacy group.

Details: Line 5 moves more than half a million barrels of oil and natural gas liquids each day throughout Canada and the Great Lakes region. No ready alternative exists to transport this amount of energy. The industry report predicts a closure would mean that “refineries in Michigan, Ohio, Pennsylvania, Ontario, and Quebec would lose about 45% of their crude oil input.” One study estimates a closure would drive up the cost of gasoline and diesel from 9.47% to 11.66%.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Starbucks holds its annual meeting on March 16. The coffee giant is likely to outline its post-pandemic recovery expectations and update on the suspension of the business in Russia. The Starbucks board of directors is asking shareholders to vote against a proposal that would require the company to produce annual reports on harassment and discrimination in the workplace.

— Pork checkoff rate is dropping a nickel, to 35 cents per $100 value. Delegates at the Pork Forum approved the reduction with 94% of shares voting in favor. It goes into effect Jan. 1, 2023.

— USDA confirms HPAI in non-commercial flocks in Kansas, Illinois; commercial flock in Iowa. USDA has confirmed highly pathogenic avian influenza (HPAI) a commercial layer flock in Taylor County, Iowa, according to the Iowa Department of Agriculture and Land Stewardship (IDALS), though the confirmation has not yet been listed on the Animal and Plant Health Inspection Service (APHIS) website. The agency has also confirmed HPAI in a backyard mixed species flock in Franklin County, Kansas, and a non-commercial backyard flock (non-poultry) in Mclean County, Illinois. The samples were confirmed at the APHIS National Veterinary Services Laboratories (NVSL) in Ames, Iowa. The cases bring total confirmed HPAI cases in the U.S. to 30, with 18 being in commercial operations and the rest in backyard or non-commercial flocks.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 456,908,767 with 6,041,077 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,517,492 with 967,552 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 556,980,091 doses administered, 216,647,869 have been fully vaccinated, or 66.00% of the U.S. population.

— Barack Obama tests positive for Covid-19. "I've had a scratchy throat for a couple days, but am feeling fine otherwise," Obama said in a statement on Twitter, adding that he and his wife, Michelle, were "grateful to be vaccinated and boosted."

— People will need a fourth dose of Covid-19 vaccine to help fend off another wave of the pandemic, Pfizer CEO Albert Bourla said yesterday. Protection after three doses is "not that good against infections" and "doesn't last very long" when faced with a variant like Omicron, Bourla said. Some immunocompromised people who've had three doses of the Pfizer or Moderna Covid-19 vaccines can already get a fourth dose, according to the CDC. But it’s not clear if or when the FDA might authorize the fourth Covid-19 dose for healthy teens and adults.

|

POLITICS & ELECTIONS |

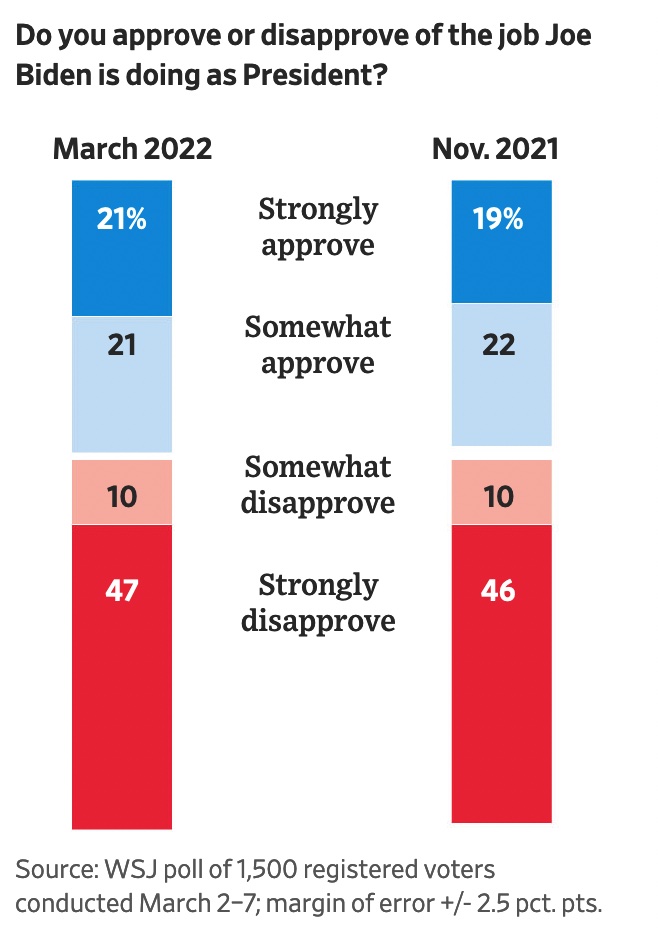

— A mixed Biden poll. A Wall Street Journal poll found that "57% of voters remained unhappy with Biden’s job performance, "despite favorable marks for the president’s response to the Russian invasion of Ukraine and a recent State of the Union speech." Link for details.

— Democrats to debate changes to primary calendar with potential big impact for Iowa. After complaints about disenfranchisement and logistical snafus, the party is reconsidering Iowa and New Hampshire’s coveted spots in the presidential nominating process. One idea to be discussed Friday would consolidate all four of the current early-voting states — Iowa, New Hampshire, South Carolina and Nevada — into a single first voting day before Super Tuesday.

|

OTHER ITEMS OF NOTE |

— Iran talks on pause. Negotiations aimed at restoring Iran’s nuclear deal with world powers went on what its European hosts described as “a pause” on Friday, after Russia demanded relief from sanctions targeting Moscow over its war on Ukraine. Diplomats did not say when the months-long talks in Vienna might resume. The Wall Street Journal cited a senior U.S. official saying Moscow had a week to withdraw its demand for written guarantees exempting Russia from any Ukraine-related sanctions that would constrain Moscow’s future trade with Iran.

— North Korea may be readying to launch an intercontinental ballistic missile as soon as this week, Yonhap News Agency reported. That comes as South Korea prepares to inaugurate a conservative president and the world focuses on the war in Ukraine.