Typical Russian Brutality Surfaces in War with Ukraine

Analysts size up ag markets in a very uncertain world ahead

|

In Today’s Digital Newspaper |

Russia’s brutality in invasions and wars was evident over the weekend as pictures put out by the New York Times (link) and others illustrated. Some markets continued their surge (oil, grains) while others shot lower (equities). In discussions with top traders and analysts over the weekend, how long the war occurs will determine the topside of ag and oil markets. Analysts consulted were so high on their potential prices that at this juncture we choose not to report them.

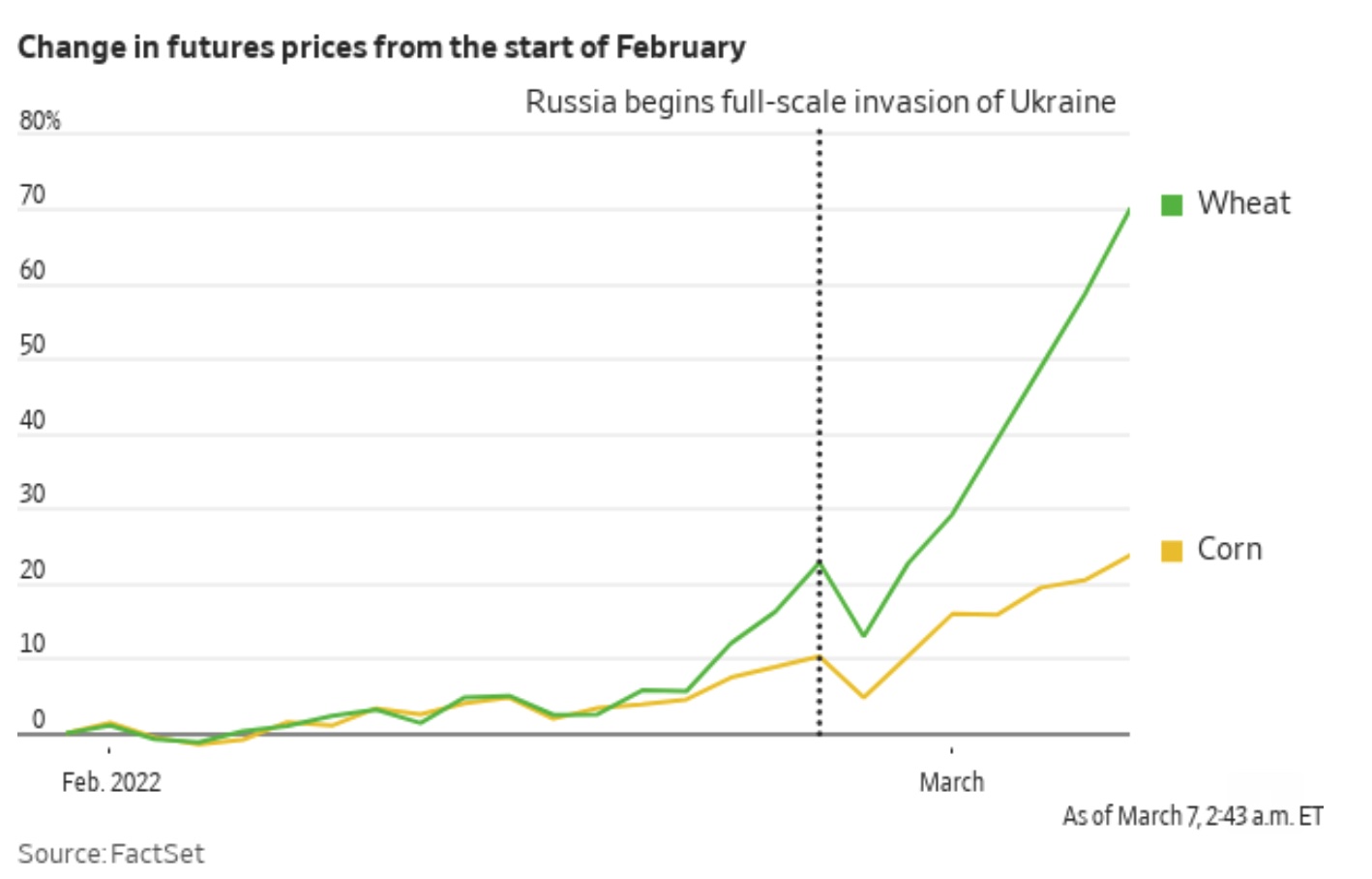

Unknowns include whether Ukraine can get their crops (wheat, corn, sunseed, barley in particular) planted and if so, how much. Some analysts are taking production levels down by 50%... for now. That means more potential exports for the United States. Consider Ukraine’s planting window is about the same as the United States, so there is still time. From a timing issue, the wheat in Ukraine should be top-dressed now; barley plantings would start in around 30 days, corn in 30-45 days.

Several analysts pointed to the potential chaos in the Mideast and northern Africa should food become scarce (logistics, prices), resulting in potential revolts by its peoples.

Regarding infrastructure and shipping logistics, one analyst said the key issue is the infrastructure and export facilities, getting the mines out of the ports, who is going to own the grain and get paid, and expected long delays in shipping, etc.

All of those consulted see a tight U.S. corn, soybean and world wheat situation continuing into the 2023-24 season.

Potential U.S. gov’t policy responses brought different comments. Some wondered whether the White House would announce price controls, an action most said would create more problems. Others openly wondered if the Biden administration sees the Renewable Fuel Standard as a pseudo “grain reserve” that would allow more corn onto the market. Still others mentioned recent market chatter that the Biden administration could look to the Conservation Reserve Program for possible more production of wheat and corn. Others openly fretted that Russia could implement cyberattacks and ag, food and water bioterrorism.

Most of the analysts mentioned the importance of USDA’s March 9 supply and demand (WASDE) report. Ever since the beginning of the World Board in the 1970s, it has made clear it is non-political and independent. It does not predict policy nor provide policy advice to personnel making those decisions.

|

MARKET FOCUS |

Equities today: Global stock markets were lower overnight, and the U.S. stock indexes are pointed toward solidly lower openings.

U.S. equities Friday: The Dow dropped 179.86 points, 0.5%, to 33,614.80, falling 1.3% for the week. The S&P 500 fell 34.62 points, 0.8%, to 4,328.87. The Nasdaq shed 224.50 points, 1.7%, to 13,313.44. The S&P 500 and Nasdaq lost 1.3% and 2.8%, respectively, last week.

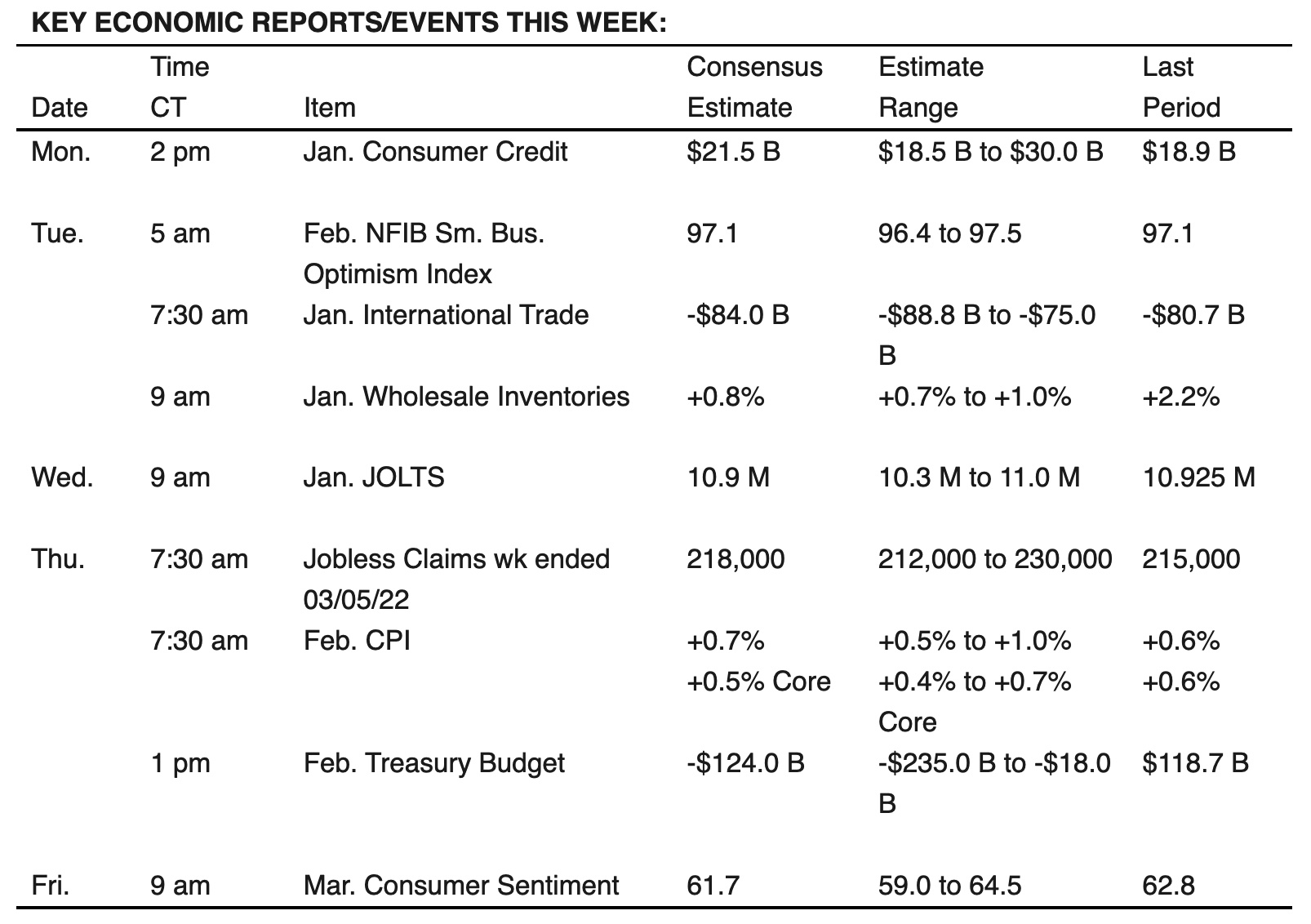

On tap today:

• USDA Grain Inspections report, 11 a.m. ET.

• Federal Reserve releases consumer credit data for January at 3 p.m. ET.

Update on economic reports since The Week Ahead was released:

- Tuesday: The U.S. trade deficit hit a record last year, signaling both strong domestic demand and dependence on overseas suppliers. That will likely continue in 2022. For January, analysts predict another record monthly trade gap as American consumers kept spending, businesses worked to replenish inventories and inflation pushed prices higher.

- Wednesday: China’s inflation probably eased further in February. The producer price index is forecast to increase 8.8% from a year earlier, slowing from January’s 9.1% gain. Annual consumer price inflation is likely to stay flat as weak food prices offset rising costs for other commodities. But some say world food prices may surprise some with their great than expected rise.

- Thursday: The European Central Bank will likely lower its forecast for economic growth and raise its outlook for inflation after Russia’s invasion of Ukraine sent commodity prices soaring, further hampered supply chains and raised the risk of broader economic and geopolitical fallout. But the ECB like the U.S. Fed is in a dilemma of having to balance competing risks: surging consumer prices but either stagnant or tempered economic activity.

Yelling about Yellen. One should want to know what Treasury Secretary Janet Yellen is saying because she hasn’t been very accurate for… well a while. Like since she became a Biden Cabinet member. Yellen on Friday again touted the benefits of the Biden administration’s social-investment proposals as a means of overcoming what’s projected to be a return to subdued economic growth after the current rapid pandemic recovery. “Forecasters uniformly agree that growth over the next several decades will be sluggish, limited by slow productivity growth and an aging population that restricts growth in labor supply,” Yellen said in remarks to the Stanford Institute for Economic Policy Research. Yellen reiterated her characterization of President Joe Biden’s economic agenda as “modern supply-side economics” — expanding the productive capacity of the nation through social-support programs that encourage greater labor-force participation. Biden’s economic team is still plugging for measures including childcare support, an expanded earned income-tax credit and greater education spending, all of which were flagged by Yellen in her remarks. “All told, these investments represent one of the most ambitious expansions in training and education in our nation’s history —an investment program that would revitalize the preparedness of our nation’s workforce,” she said.

But note this: During a question-and-answer session following her remarks, Yellen said that the U.S. debt-to-GDP ratio can be kept on a “sustainable path” by ensuring that investments in the Biden agenda are paid for with tax revenues. Wonder what centrist Democratic Sens. Joe Manchin (W.Va.) and Kyrsten Sinema (Ariz.) think about that.

Fed up with the Fed? Yellen isn’t, because she used to lead the Fed before the current Fed head Jerome Powell. Yellen on Friday also expressed confidence that the Federal Reserve will successfully pull-down inflation without causing a recession. (That’s like calling inflation transitory and sitting on that prediction well into 2021 before having to admit she and the Fed was wrong.) “They’re going to bring inflation down but in a way that achieves a soft landing,” she said. “This is something that is not unheard of,” she said, echoing comments earlier this week by her successor as Fed chief, Jerome Powell, that history shows examples of the central bank securing price stability without triggering a recession.

Market perspectives:

• Outside markets: The escalating conflict between Russia and Ukraine has sent investors dashing to safer assets, propelling the dollar to its highest level since the coronavirus-induced volatility of two years ago.

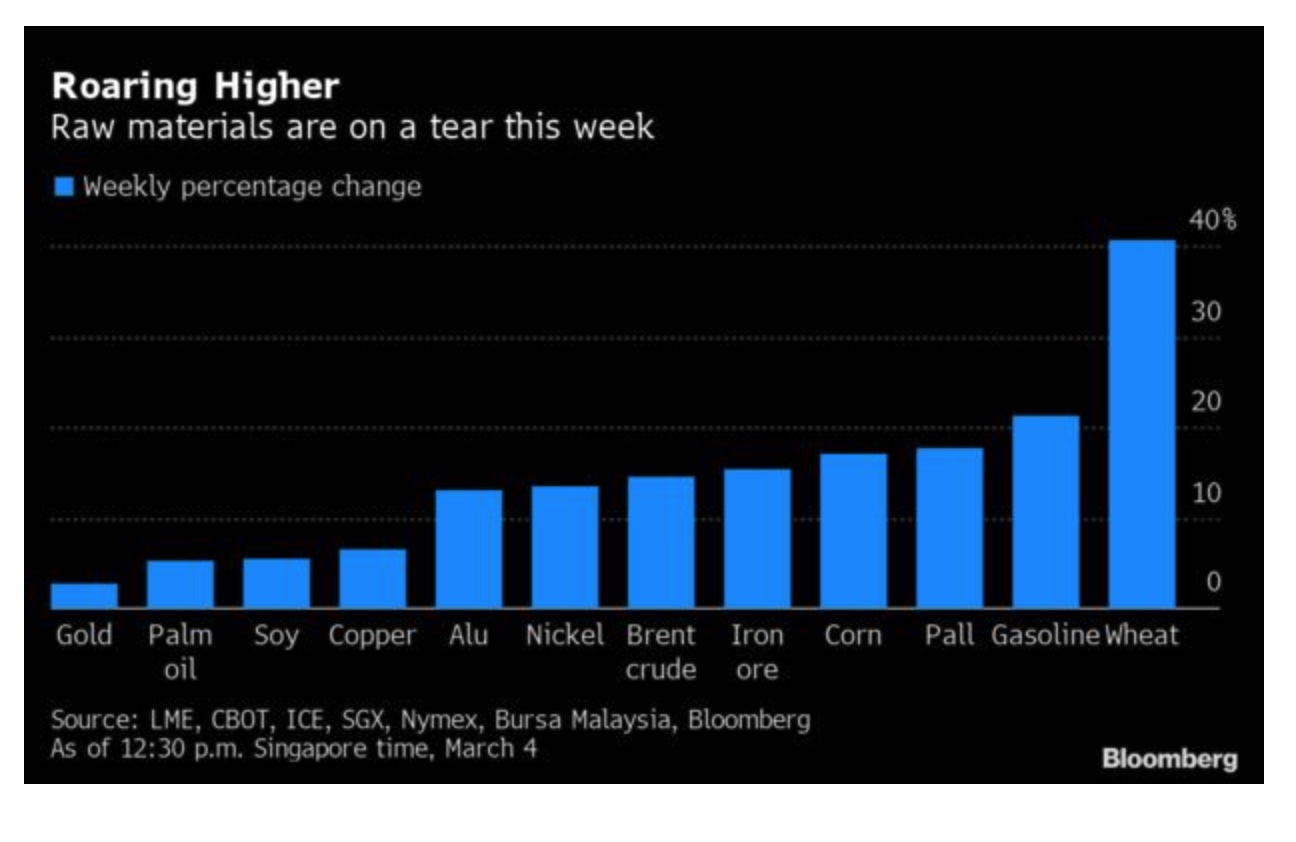

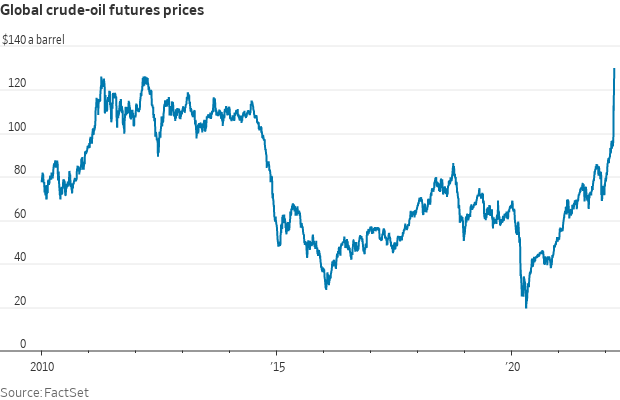

• The Russian invasion of Ukraine pushed oil prices up $24 a barrel last week. That represents a 60-cent swing at the pump. Beyond crude, commodities extended their rally and are roiling global markets on fears of supply crunches.

• The average price for a gallon of regular gas hit $4 on Sunday, the highest level since 2008. There are now 18 states, plus Washington, DC, where the price of gas is $4 or greater. The highest prices are being seen in California, where the statewide average stands at $5.29 a gallon.

• What straight up commodity prices look like.

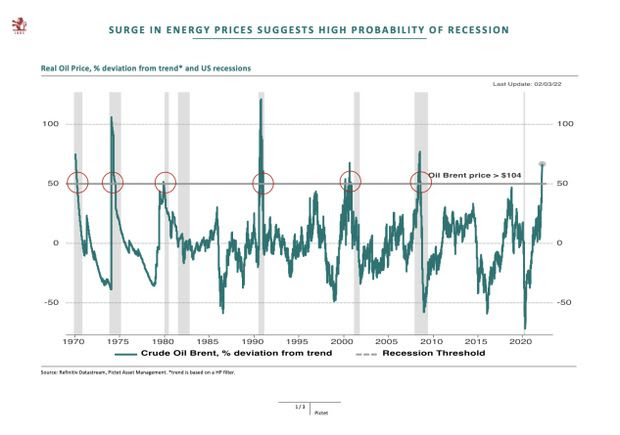

• History suggests recession probable. Historically, a surge in crude-oil prices of this magnitude have ended U.S. economic expansions and tipped the U.S. economy into recession, according to Pictet Asset Management. In the past 50 years, every time oil prices, adjusted for inflation, rose 50% above trend, a recession followed, data from Luca Paolini, chief strategist at Pictet, show. Brent, the international gauge for prices has rallied more than 50% this year to decade highs. West Texas Intermediate, the U.S. gauge, has climbed nearly 50% in 2022.

• Does USDA know how difficult it is in the countryside in terms of input costs and input availability? Crop protection is frequently triple the cost of last year and many distributors just don’t have product available. Some have noted some co-ops are having loads of herbicide completely canceled.

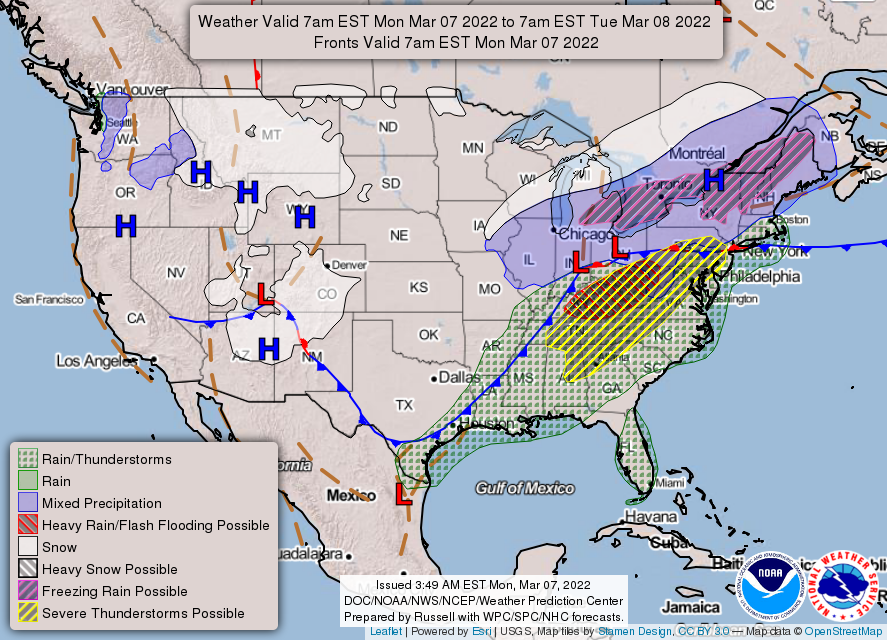

• NWS weather: Severe thunderstorms and instances of flash flooding possible for much of the eastern third of the country today... ...Record-breaking warmth expected to continue throughout East Coast today... ...Cold front entering the Northwest will generate heavy snowfall over the Northern Rockies through Tuesday.

|

RUSSIA/UKRAINE |

— Russia’s brutality escalates as civilians were being attacked in Irpin, outside Kyiv, as they tried to evacuate Sunday. Meanwhile in Russia, more than 4,600 people were detained during protests yesterday, according to an independent monitoring group. Negotiators say Ukraine and Russia are scheduled to hold a third round of talks today, following two previous rounds of talks that failed to yield any major resolutions.

- U.S. in talks with Poland over shipment of fighter jets to Ukraine. U.S. Secretary of State Antony Blinken indicated Sunday that the U.S. is in active discussions with Poland to backfill its fleet of planes if it supplies Ukraine with fighter jets.

- Russia: Countries allowing Ukraine to use their airfields ‘may be regarded’ as entering conflict. Russia’s Defense Ministry on Sunday warned that any country that offers the use of its airfields to Ukraine’s military for attacks on Russian assets could be considered as having entered the conflict. “The use of the airfield networks of these countries to base Ukrainian military aircraft and their subsequent use against the Russian armed forces may be regarded as the involvement of these states in an armed conflict,” Russian Defense Ministry spokesman Igor Konashenkov told the Interfax news agency on Sunday evening local time. Konashenkov said Russian officials are aware of “Ukrainian combat plans which earlier flew to Romania and other neighboring countries,” without elaborating.

- Ukrainian officials have “plans in place” in case President Volodymyr Zelenskyy is killed, U.S. Secretary of State Antony Blinken revealed Sunday. “The Ukrainians have plans in place that I’m not going to talk about or get into any details on to make sure that there is what we would call continuity of government one way or another. And let me leave it at that,” Blinken told CBS-TV’s Face the Nation.

- A tough new Russia sanctions bill being mulled in Congress. Legislation is being negotiated that goes beyond a ban on importing Russian oil and gas. In a letter released Sunday night (link), House Speaker Nancy Pelosi (D-Calif.) said the House bill would also “repeal normal trade relations with Russia and Belarus,” “take the first step to deny Russia access to the World Trade Organization,” and “empower the Executive branch to raise tariffs on Russian imports.” (See the trade policy section for more on repealing PNTR.)

- Anonymous, a diffuse group of hackers, claims to have hacked into Russian state television and broadcast footage of the war in Ukraine. The group launched a “cyber war” against the Russian government shortly after the invasion began. Russian media will only refer to the war as a “special military operation” and are still peddling the Kremlin’s line that Russia is liberating Ukraine.

— Market impacts:

- President Biden’s advisers are discussing a possible visit to Saudi Arabia this spring to help repair relations and convince the Kingdom to pump more oil, Axios reported. Biden will likely take trips to Japan, Spain, Germany and, potentially, Israel, Axios noted.

- Biden officials were in Venezuela this weekend to meet with the government of President Nicolás Maduro. Some Republicans and Democrats in Washington suggest Venezuela's oil could replace Russia's, according to the New York Times (link).

Observes one industry contact: “We’re trying to wrap up Iranian nuclear talks and accelerate fresh talks with Venezuela to source 200,000-300,000 barrels daily. Pick your international despot poison ladies and gentlemen but for goodness sake, do not source Canadian or Dakota sands crude.”

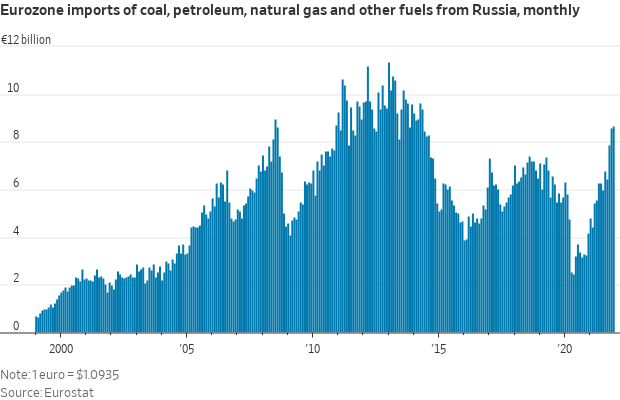

- Oil soared to as high as $139 a barrel in Asia trading after it emerged that the Biden administration was weighing a possible embargo of Russian crude. Banning the U.S. purchase of Russian oil, which may be announced this week, is not the same as whether to sanction all Russian energy exports. Oil and gas revenue makes up about half of the Kremlin’s budget and is critical to financing Vladimir Putin’s war on Ukraine. The glitch: sanctions on Russian energy could also harm the world economy and especially Europe, which imports about 25% of its oil and 40% of its natural gas from Russia. Russia accounted for only 8% of U.S. petroleum imports and 3% of oil consumption last year. Russian energy is exempt from the Swift sanctions against some Russian banks, and the U.S. has declined to impose so-called secondary sanctions against banks world-wide that finance the Russian energy trade. The U.S. has imposed those sanctions on Iran and North Korea, and they are effective, the Wall Street Journal noted in an editorial.

Administration officials were discussing with the U.S. oil and gas industry last week how a ban could affect American consumers and global energy supplies, as lawmakers in both parties in Washington race to advance bills barring Russian oil imports to punish the Kremlin for its invasion of Ukraine.

How high could prices go? Nobody knows and overnight trading in Asia shows the volatility. As with so many other market factors relative to the Russian invasion, including for ag markets, it would depend on how long sanctions are in effect and how long the war in Ukraine lasts. Meanwhile, last week 70% of Russian oil exports couldn’t find a buyer due to logistical challenges and sanctions risk. Russia’s exports of eight million or so barrels a day can’t be replaced overnight, but much of it could be by the end of this year, the WSJ calculates.

Crude oil prices rose 25% last week, to more than $118 a barrel, the highest level since 2013. Gas prices have gone up an average of 43.7 cents a gallon in the U.S., according to data from price tracker GasBuddy. On Sunday, the national average was $4.02 a gallon, according to GasBuddy.

- The U.S. and allied nations should continue taking deliveries of Russian oil and gas but withhold payments in an escrow account until Putin retreats, said Naftogaz Chief Executive Yuriy Vitrenko. Russia will need to continue to pump because simply shutting down wells would do permanent damage, he said. Putin views his country’s energy output as his biggest bit of leverage because, “He believes that the west depends on Russian oil and gas,” Vitrenko said in an interview with Bloomberg Friday.

- Elon Musk says more fossil fuel production is needed now, even if it’s bad for his electric car company, Tesla. Musk signaled that the adoption of electric models and a wider shift to renewable energy couldn’t be accelerated fast enough to shield consumers from higher prices in the short term.

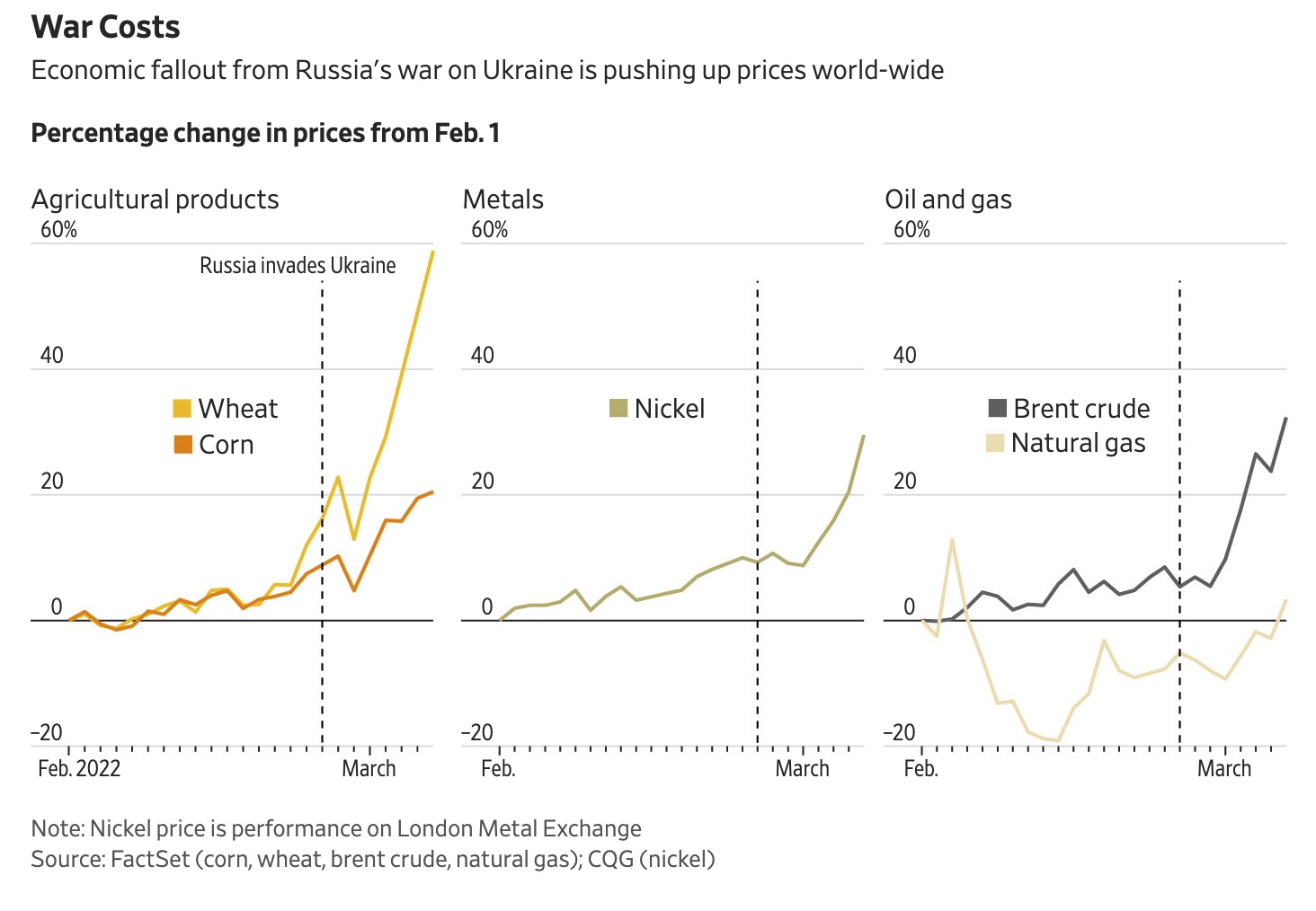

- Grain markets recently hit a 14-year high in anticipation of a diminished harvest in Ukraine, which would raise costs to feed the world’s cattle and poultry. Wheat futures rose more than 40% over the past week. Corn and soybean prices over the past month were up roughly 21% and 15%, respectively.

- Russia, one of the world’s largest suppliers of fertilizers such as potash and nitrogen, on Friday said it could suspend exports. Farmers and consumers will bear the cost of any prolonged shortage.

- Shipping costs and port closures. Many Western shipping companies are steering clear of Russian ports, an important Asia-to-Europe rail line is used less, much of the Black Sea remains out of bounds and many air cargo flights are either banned from or are avoiding Russian airspace, a key route for goods moving between Europe and Asia. Shipping and airfreight rates have moved higher.

- Global food prices hit all-time high. Global food prices as measured by the U.N. Food and Agriculture Organization (FAO) increased 3.9% in February to an all-time high and were 24.1% above year-ago. Only sugar prices declined. The bulk of impacts from the Russia/Ukraine crisis won’t be reflected until next month.

|

PERSONNEL |

— DOE nominations on tap Tuesday. The Senate Energy and Natural Resources Committee on Tuesday will consider a slate of nominations for the Department of Energy (DOE), including: Shalanda Bake to be director of the Office of Minority Economic Impact; Asmeret Asefaw Berhe, to be director of the Office of Science; Joseph F. DeCarolis to be administrator of the Energy Information Administration; and Maria Duaime Robinson to be an assistant secretary of the Office of Electricity.

|

CHINA UPDATE |

— China detailed a plan to expand its economy, labeling stability as its “top priority.” The National People’s Congress continues in Beijing through March 11. The annual government work report delivered on Saturday did not even mention Russia’s invasion of Ukraine, suggesting China could weather the situation.

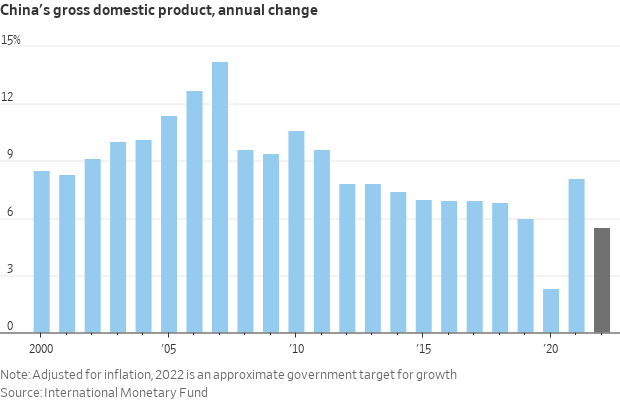

Details: Beijing is calling for heavy government spending and lending. Social welfare and education outlays are both set to increase about 10% this year. China’s military budget will grow by 7.1% to about $229 billion — suggesting Beijing is preparing for an increasingly dangerous world. Analysts surmise China is prioritizing economic growth, with an expansion goal of around 5.5%, over domestic consumer spending. That is lower than any annual target since China began setting such benchmarks in 1994.

— The Taiwan issue is fundamentally different from the Ukraine situation as it is a “purely domestic affair” rather than between two countries, China’s foreign minister said on Monday. Speaking during his annual briefing with foreign media in Beijing, Wang Yi said it was a “blatant double standard if some respect the sovereignty of Ukraine but repeatedly harm China’s sovereignty over Taiwan.” He said “certain parties” in the U.S. were pushing Taiwan towards danger and it would have unbearable consequences for the U.S.. Their purpose was to use Taiwan to contain China’s rise, he added. Wang also said tensions across the Taiwan Strait were the result of the ruling Democratic Progressive Party’s failure to recognize the “one-China principle.”

— U.S. to begin review of tariffs on $300 billion of China Imports. The review is on the duties first imposed by the Trump administration in July 2018. The review is of the first group of tariffs on more than $300 billion in Chinese imports needed to prevent their expiration, a process likely to bring new scrutiny of their effectiveness as inflation runs at a four-decade high. The evaluation, officially known as a “review of necessity,” so far has attracted little attention. It relates to Section 301 of the Trade Act of 1974.

Background: The law states that the tariffs expire four years after they were imposed, unless the U.S. Trade Representative’s office analyzes their effectiveness and consequences. The review needs to happen within 60 days of their potential end, which is July 6 for the first group of $34 billion in Chinese goods, with the majority set to expire in the following months.

Ending them while getting nothing in return could leave Biden open to charges of being soft on China –- an accusation already made by some Republicans in Congress like Sen. Marco Rubio (R-Fla.). The AFL-CIO, the biggest U.S. labor federation and a key Democratic interest group, also wants the tariffs to stay in place until China changes its policies.

|

TRADE POLICY |

— U.S. may withdraw preferential trade status for Russia, Belarus. Following Canada’s lead, the U.S. is considering withdrawing the preferential trade treatment of goods from Russia and Belarus for their involvement in the invasion of Ukraine. Canada recently revoked Most Favored Nation (MFN) status for both countries and put a 35% tariff on their imports. Canada is the first country to impose trade sanctions on Russia and Belarus, which let Russian President Vladimir Putin use it as a staging area for the invasion. Senate Finance Committee Chairman Ron Wyden (D-Ore.) and Ranking Member Mike Crapo (R-Id.) support repealing Russia’s permanent normal trade relations (PNTR) status, and in the House, Ways and Means Committee members Lloyd Doggett (D-Texas) and Earl Blumenauer (D-Ore.) will introduce legislation that strips Russia of PNTR and calls for revoking that country’s membership in the World Trade Organization.

The European Union also will consider ending Russia’s MFN status. Additionally, the United States and several other countries, including Canada, the EU and the United Kingdom, have restricted various products from being exported to Russia.

|

ENERGY & CLIMATE CHANGE |

— DOE approves more strategic oil loans to Exxon Mobil. Exxon Mobil will receive a batch of crude on loan from strategic reserves administered by the U.S. Department of Energy (EOE), according to reports. The company will get 2.7 million barrels of SPR oil under the terms of an exchange program announced in November. Exxon’s total volume of barrels on loan stands at just over 10 million. If so, this puts Exxon at the maximum limit allowed for any one company under the plan, which offered a total of 32 million barrels.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA confirms more HPAI cases. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed highly pathogenic avian influenza (HPAI) in a commercial chicken layer flock in Cecil County, Maryland, and in commercial broiler flock of chickens totaling 240,000 birds in Stoddard County, Missouri, and a commercial mixed species flock in Charles Mix County, South Dakota. The agency also confirmed another case in commercial turkey in Dubois County, Indiana, totaling 35,988 birds.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 446,399,672 with 6,000,316 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,271,466 with 958,621 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 555,112,353 doses administered, 216,147,515 have been fully vaccinated, or 65.85% of the U.S. population.

|

OTHER ITEMS OF NOTE |

— A group of truckers protesting Covid-19 mandates encircled the U.S. capital, on Sunday morning. The New York Times reports the convoy of vehicles — dozens of trucks, along with minivans, motorcycles, pickups and hatchbacks — “aimed to complete two loops on Interstate 495, a 64-mile highway known as the Capital Beltway, before returning to a staging area in Maryland, with plans to potentially ramp up the demonstration in the coming days. But by the second time around, the vehicles appeared to be so spread out that the congestion took on the feel of a weekday morning commute.” Their demands have been undercut by the reality that many U.S. states have already started rolling back restrictions as virus cases and deaths have ebbed. And the Centers for Disease Control and Prevention issued new guidance in late February suggesting that the vast majority of Americans could stop wearing masks.

— Denmark will hold a referendum in June on joining the EU’s defense policy, following Russia’s invasion of Ukraine. Danes voted to opt out almost 30 years ago.