Russia’s Invasion of Ukraine Enters Second Week, Energy Prices Retreat on Rumors of Iran Deal

China reportedly buying U.S. corn after continued buys of soybeans

|

In Today’s Digital Newspaper |

Russian citizens face canceled flights, long lines at banks and a run on medications as sanctions take hold. More credit rating agencies cut Russia’s bonds to “junk”; MSCI pulled “uninvestable” Russian stocks from its emerging market indexes; and the London Stock Exchange suspended trading in more than two dozen companies with Russian ties. Meanwhile, Russian oligarchs are trying to fun faster than their yachts due to U.S. and ally sanctions.

The Russian invasion of Ukraine is clearly in its typical ugly Russian stage, with the focus on key cities and ports. Russia deepened its military offensive in southern Ukraine, penetrating the city of Kherson, as Ukrainian forces held back Russia’s advance on Kyiv and the two sides prepared to resume cease-fire talks.

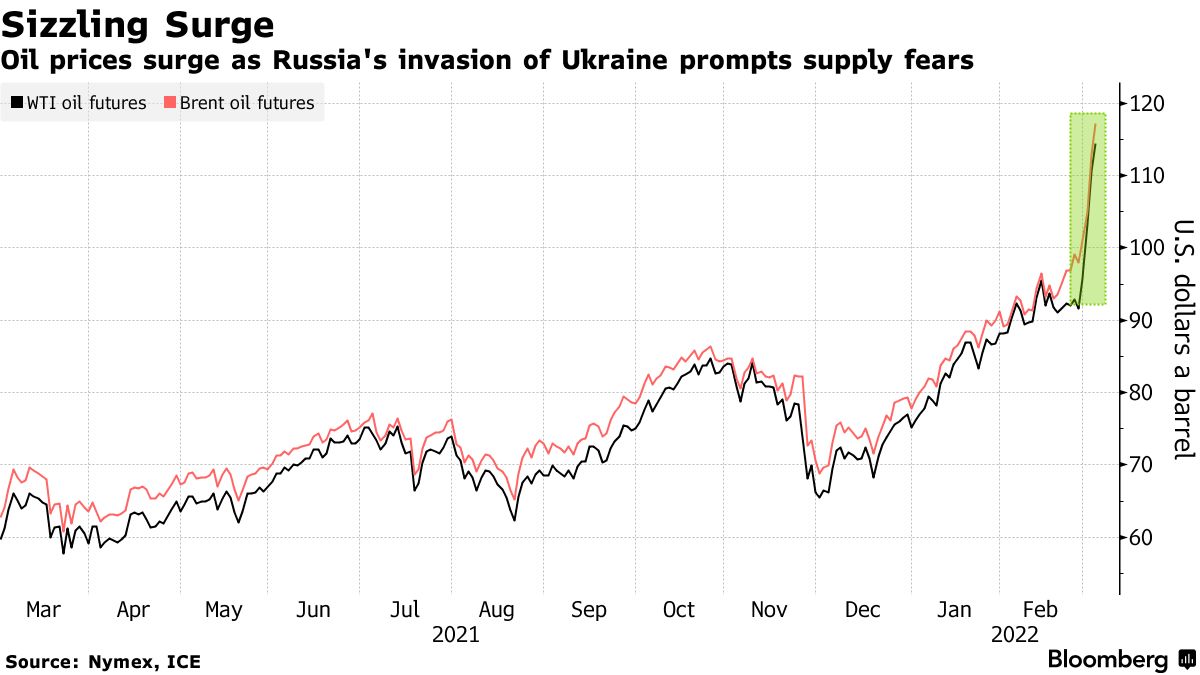

Crude oil futures turned negative on rumors of a deal with Iran that could allow Iran to export more oil. Previously, markets reached over $116 a barrel, upping the odds of a worldwide recession later on if that lofty level grows and is sustained.

Wheat futures continues their bull run, reaching above $11.

“The markets are behaving rationally. It’s Putin who is irrational,” says Eugene Fama, the Nobel-winning economist known as the father of the efficient market theory, on making sense of the market’s swings since Russia’s invasion of Ukraine.

A Univ. of Illinois tweeting economist thinks the only solution to more U.S. plantings is to tap the Conservation Reserve Program. Others are doubtful. Meanwhile, European agriculture ministers raised the idea of letting farmers put fallow land into protein crops.

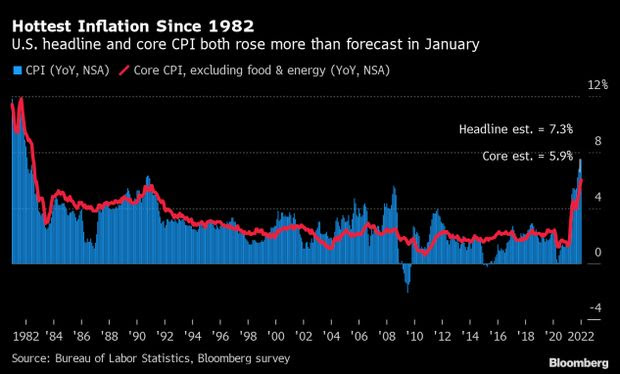

Day two of Fed chair Jerome Powell’s testimony before Congress. The Fed chair on Wednesday suggested that if inflation doesn’t start to ease, the central bank may have to get tough. “I am inclined to propose and support a 25 basis-point rate hike” later this month, Powell told the House Financial Services Committee.

You think inflation is bad in the U.S., look at the eurozone. We have figures below.

China continues buying U.S. soybeans and there are signals they and others are looking at U.S. corn. Traders note the freight market and basis trade would imply significant corn business has or is taking place. This morning, USDA announced 132,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021-2022 marketing year and 66,000 metric tons is for delivery during the 2022-2023 marketing year. Also announced: 337,000 metric tons of corn for delivery to unknown destinations during the 2021-2022 marketing year.

Bird flu was found in Iowa, the top egg-producing state.

On the political front, a Washington Post columnist counters President Joe Biden’s assertion that the “state of the union is stronger today than we were a year ago.”

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight, and the U.S. Dow opened up around 200 points higher. Asian equities finished with mixed, with support coming from testimony from U.S. Fed chair Jerome Powell in Washington. The Nikkei gained 184.24 points, 0.70%, at 26,577.27. The Hang Seng Index advanced 123.42 points, 0.55%, at 22,467.34. Markets in mainland China and India were lower. European equities have fallen lower after most markets opened in positive territory. The Stoxx 600 was off 0.5% with most regional markets seeing losses of 0.6 % to 2.1%. However, French markets were slightly higher.

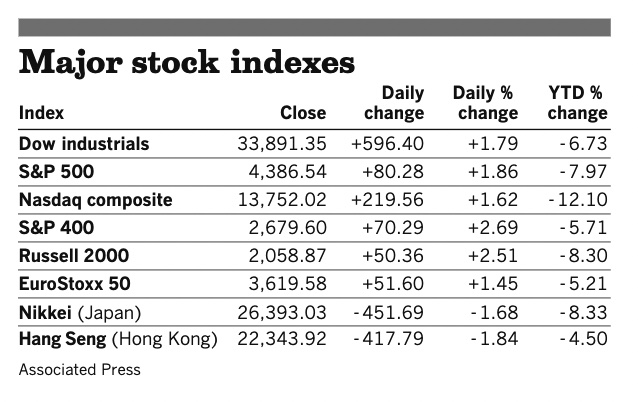

U.S. equities yesterday: The Dow gained 596.40 points, 1.8%, to 33,891.35 and the Nasdaq added 219.56 points, 1.6%, to 13,752.02. The S&P 500 rose 80.28 points, 1.9%, to 4,386.54.

On tap today:

• U.S. jobless claims are expected to fall to 225,000 in the week ended Feb. 26 from 232,000 one week earlier. (8:30 a.m. ET)

• U.S. labor productivity for the fourth quarter is expected to increase at a 6.7% annual pace from the prior quarter. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• IHS Markit's U.S. services index for February is expected to tick up to 56.8 from a preliminary reading of 56.7. (9:45 a.m. ET)

• Institute for Supply Management's services index is expected to tick up to 61.0 in February from 59.9 one month earlier. (10 a.m. ET)

• U.S. factory orders for January are expected to increase 0.7% from the prior month. (10 a.m. ET)

• Fed Chairman Jerome Powell appears before the Senate Banking Committee to discuss monetary policy and the state of the economy at 10 a.m. ET.

• More from the Fed: Richmond’s Thomas Barkin on the economy at a CFO Society of Baltimore event at 12 p.m. ET, and New York’s John Williams speaks to the Council for Economic Education at 6 p.m. ET.

• President Biden will convene a meeting at 2 p.m. ET with Vice President Kamala Harris and members of his Cabinet.

The Bank of Canada yesterday raised rates, as expected, in the first major central bank policy decision since Russia’s invasion of Ukraine began. Federal Reserve Chair Jerome Powell backed a quarter-point rate hike this month during his first day of testimony to Congress. European Central Bank Chief Economist Philip Lane said the bank will take into account the economic consequences of the war when making its decision next week.

Day two of Powell’s testimony. In over three hours of testimony yesterday, Fed Chair Jerome Powell was peppered with questions about prices from lawmakers with constituents worried by the rising cost of living. The Fed chair suggested that if inflation doesn’t start to ease, the central bank may have to get tough. “I am inclined to propose and support a 25 basis-point rate hike” later this month, Powell told the House Financial Services Committee. “To the extent that inflation comes in higher or is more persistently high than that, then we would be prepared to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings.” Powell will appear before the Senate Banking Committee at 10 a.m. ET today. His comments will be watched closely to see if they veer from the positions he outlined in the testimony on the House side. That will be key for any potential shifts in market response to his remarks.

For the remainder of the year, Powell said the U.S. central bank would move “carefully,” a statement most believe signals that future rate increases would also be 0.25%. Powell indicated again that the Fed would be “nimble” as it makes monetary policy decisions ahead, a word he has used for several months to describe coming Fed actions.

As for trimming the Fed’s massive balance sheet, he said officials at the March 15-16 meeting would “make progress on agreeing on a plan to shrink the balance sheet” but no final decision has been made. He also emphasized that the Fed wants to take actions on the balance sheet “in a predictable manner” which would first focus on letting maturing securities run off of the portfolio before making outright sales. primarily letting maturing securities run off of its portfolio, rather than outright sales, he said.

As for the Russian invasion of Ukraine, Powell told lawmakers “We will proceed carefully as we learn more about the implications of the Ukraine war on the economy.” A lot could also take place on the geopolitical stage, with Powell acknowledging that the Russian invasion could lead to the reshaping of Western economies due to the effects of financial sanctions.

One in three small businesses now say inflation is the biggest challenge facing the U.S. small business community, up from about one in four last quarter, according to a survey released today. To cope with rising costs, about two thirds of respondents reported raising prices over the past year, data from the MetLife & U.S. Chamber of Commerce Small Business Index survey showed. Four in 10 owners cited decreasing staff while some 39% reported taking out a loan in response to growing price pressures.

Inflation key focus in Fed’s Beige Book report; high agriculture input prices noted. Inflation was one of the key focal points in the Fed’s Beige Book report released Wednesday (link), with the word used 17 times in the text. However, price increases, elevated prices and similar terms were used considerably more in the anecdotal reports from the 12 Fed districts. There were some districts indicating that there could be some easing in inflationary pressures ahead, but that was not yet the majority view based on the comments related in the report. And even when inflation linked to goods eases, many indicated they saw wage inflation continuing.

The report also said that businesses primarily linked the rise in prices on supply chain issues and labor issues, two common threads that have been underlying the inflationary trends that have seen prices rise to 40-year highs. There were mixed views from businesses on whether they had been able to pass along price increases to consumers. The St. Louis Fed’s recap in the report noted that one business indicated the inability to pass along price increases to consumers was in part due to “a shortage of in-store staff to physically change price tags.”

Higher input prices were also noted ranging from inputs for manufacturing and other businesses to agriculture. Some of the recaps raised concerns about rising fertilizer and other input prices as a concern point for the agriculture sectors in some districts.

In all, the report provides Fed officials with a wealth of anecdotal evidence that inflation remains a major factor across the U.S. economy. While Fed leader Jerome Powell indicated he backed only a 0.25% rate hike in March, he couched his answer by citing inflation as one of those factors that could alter the Fed’s thinking.

Eurozone producer prices surge. In a stunning report, the eurozone producer price index jumped 30.6% versus year-ago in January after rising 26.3% in December. The huge increase was mainly a result of an 11.6% monthly and 85.6% annual increase in oil and gas prices. Eurozone factory gate and consumer inflation are both record-high, increasing odds the European Central Bank will need to raise interest rates.

U.S. employers need to offer more than better pay to lure more workers off the sidelines. New research from the Atlanta Fed finds that millennials and Generation X are both less responsive to higher wages than baby boomers at the same stage of life, possibly a reflection of changing values related to workplace qualities, family and leisure time. "Rather than coax workers up the supply curve with higher wages, employers might be better served by focusing more on nonwage incentives, such as letting workers decide where and when to work, offering hiring and 'boomerang' bonuses (incentives to return to a previous employer), or providing creative benefits, to shift the labor supply curve outward to clear the market," Julie Hotchkiss writes at the Atlanta Fed's Policy Hub (link).

Market perspectives:

• Outside markets: The U.S. dollar index has again moved higher ahead of U.S. market action with a generally lower tone in foreign currencies versus the greenback. The yield on the 10-year U.S. Treasury note has eased to trade around 1.85% despite a higher tone in global government bond yields. Gold and silver futures are seeing buying interest overnight, with gold above $1,935 per troy ounce and silver above $24.54 per troy ounce.

• Four Democratic senators pressed Treasury Secretary Janet Yellen for information on how regulators are monitoring cryptocurrencies to ensure Russia is not using decentralized digital markets to skirt sanctions.

• Crude oil futures turned negative on rumors of a deal with Iran that could allow Iran to export more oil. Previously, futures were elevated ahead of U.S. trading, with U.S. crude trading just under $114 per barrel and Brent just under $116 per barrel. Futures were higher in Asian action with more-subdued moves than those seen in U.S. trading Wednesday. Crude traded around $113 per barrel and Brent around $116.50 per barrel in Asian trading. Crude is now up over 50% YTD, a massive increase, given that we are only two months into the year.

• China has been a steady buyer of U.S. soybean beans. Contacts note the freight market and basis trade would imply significant corn business has or is taking place. World wheat trade has people looking to load more out of Baltic states. USDA this morning announced export sales of soybeans and corn — see next item.

• USDA daily export sales:

— 132,000 metric tons of soybeans for delivery to China. Of the total, 66,000 metric tons is for delivery during the 2021-2022 marketing year and 66,000 metric tons is for delivery during the 2022-2023 marketing year;

— 337,000 metric tons of corn for delivery to unknown destinations during the 2021-2022 marketing year.

• Ag demand: Taiwan purchased 130,000 MT of U.S. and/or Argentine corn. South Korea purchased 207,000 MT of optional origin corn but rejected offers for 65,000 MT of feed wheat. Jordan tendered to buy 120,000 MT of milling wheat after passing on a similar tender on Wednesday.

• California’s drought… again. After a dry start to 2022, the statewide snowpack is just 63% of normal for this time of year, and water officials “are sounding the alarm for a third year of severe drought” in California. Link to more via the L.A. Times.

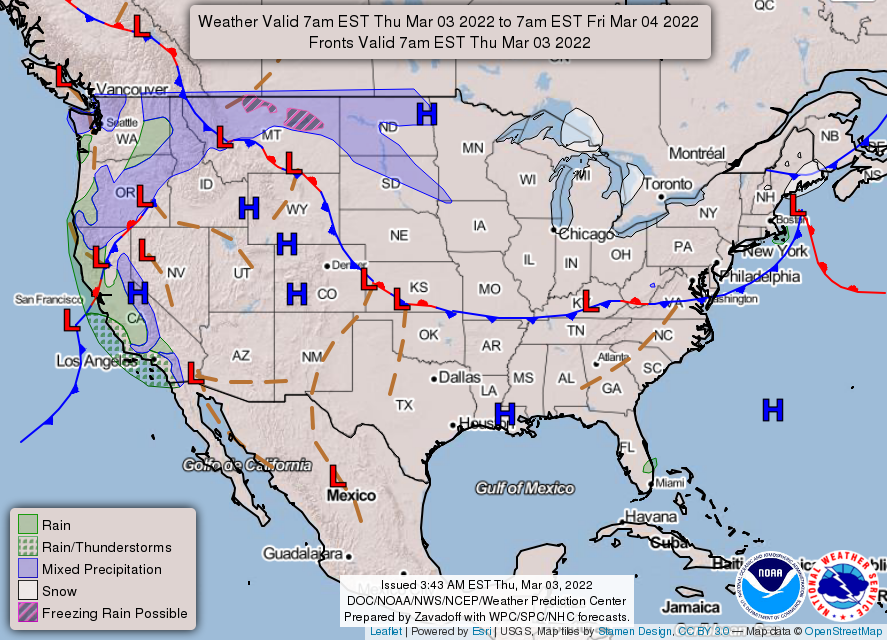

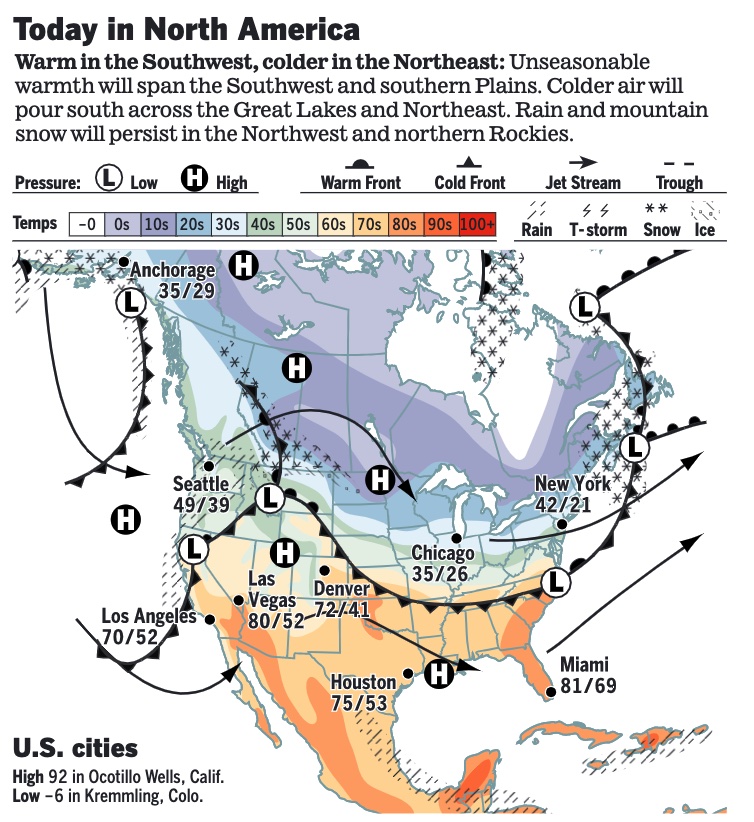

• NWS weather: A dynamic system will produce snow and freezing rain over parts of the Northern/Central Plains and Upper Midwest this weekend... ...Above normal temperatures continue from the Great Basin to the Southeast, with fire weather conditions worsening in the High Plains... ...Cooler temperatures, lower elevation rain, and mountain snow move into California, the Southwest, and Great Basin tonight.

Items in Pro Farmer's First Thing Today include:

• Wheat continues to surge

• India to import less palm oil, China slightly more

• Light cash cattle sales at lower prices

• April hogs still hold big premium to cash index

|

RUSSIA/UKRAINE |

— Summary: Russian and Ukrainian negotiators meet in Belarus today for peace talks as the war enters its second week. Ukrainian officials said 2,000 civilians have died in the Russian invasion, as Moscow bombarded residential areas. Russian authorities denied targeting non-combatants. The capture of the port of Kherson, a city of some 300,000 people, marked the expanding reach of Russian forces across the south. It is the home to a port on both the Black Sea and Dnieper river. Kherson’s mayor said the city would now be in the hands of a Russian military administration. The front line in Kharkiv, Ukraine’s second-largest city some 30 miles from the border, has held. Russian troops are trying to make their way to the capital, Kyiv, seeking to oust Ukraine’s elected government. Russia’s forces in the south are attempting to shut off Ukraine’s access to the Black Sea. Mariupol in the east is still surrounded, while an amphibious assault on Odessa could come as soon as today, according to U.S. officials. More than 1 million people have fled Ukraine following Russia’s invasion, in the swiftest refugee exodus this century, the United Nations said.

- A Western intelligence report said that China asked Russia to delay attacking Ukraine until after the Olympics, suggesting that Beijing knew something about Moscow’s plans. A spokesman for China’s foreign ministry denied the report.

- Four to six weeks. U.S. officials think it could take an invading Russian military about that long to achieve a "tactical seizure" of its outgunned democratic neighbor Ukraine. That includes one week to surround the capital city of Kyiv, and another 30 days of violence and threats before it falls to the increasingly isolated bully from Moscow, according to CBS News. U.S. lawmakers were given those estimates at a briefing earlier in Washington. More broadly, Western officials are expecting something more like a 10-year battle for the entire country, with most Ukrainians spending nearly all of that time in insurgency mode. "Given the durability of the Ukrainian resistance and its long history of pushing Russia back, the U.S. and Western powers do not believe that this will be a short war," CBS reported. Indeed, "Lawmakers at the Capitol were told Monday it is likely to last 10, 15 or 20 years — and that ultimately, Russia will lose."

- Russia is taking incredible battlefield losses, possibly around 1,500-2,000 troop deaths so far, according to conservative estimates Western officials offered the New York Times on Tuesday. "For a comparison, nearly 2,500 American troops were killed in Afghanistan over 20 years of war." Russia — traditionally secretive about combat casualties — for the first time provided an accounting of its battlefield deaths, with the Ministry of Defense acknowledging that 498 soldiers had been killed and 1,597 wounded since the start of its assault. Ukraine has claimed that more than 10 times as many Russian soldiers have died.

- Russia was using a crowdsourcing app to scout airstrike locations inside Ukraine. That firm, Premise, caught wind of the allegation and shut down operations inside Ukraine over the weekend.

- No-fly zone for Ukraine? Very few people who know anything about prior NFZs are advocating for it. The latest public figure to quash talk on the matter was Sen. Chris Murphy (D-Conn.) who tweeted, "There's been a lot of loose talk from smart people about 'close air support' and 'no fly zones' for Ukraine… Let's just be clear what that is — the U.S. and Russia at war," he said. "It's a bad idea and Congress would never authorize it."

- U.N. scoreboard. Only four countries — Belarus, North Korea, Eritrea and Syria — joined Russia Wednesday voting against a non-binding U.N. resolution that condemned the invasion of Ukraine. Another 35 abstained, including India and China. 141 countries voted in favor of the resolution. Meanwhile, India continues to avoid condemning Vladimir Putin’s invasion of Ukraine as it needs Russian weapons in its standoff with China, and officials in New Delhi are confident the U.S. won’t apply much pressure, reports note.

- The U.S. and its allies are applying more economic pressure on key allies of Vladimir Putin: Russian oligarchs. But as governments around the world attempt to seize or freeze these billionaires’ extensive and far-flung assets, they are finding that a comprehensive crackdown isn’t easy. France said it has seized a yacht belonging to Igor Sechin, the head of the Russian state oil giant Rosneft, while Germany has reportedly taken a yacht owned by Alisher Usmanov. (Maritime tracking now shows at least five oligarch-owned yachts around the Maldives, which doesn’t have an extradition treaty with the U.S.) Japan said today that it would freeze assets tied to oligarchs, matching Western actions. Britain said it was exploring how to seize properties from oligarchs and would publish a list of people and groups tied to Putin, including those not under formal sanctions, with the aim of discouraging anyone from doing business with them. Link to details via Bloomberg.

- U.S. Justice Department announced a new team, known as Task Force KleptoCapture, which Attorney General Merrick Garland says will pursue the assets of “those whose criminal acts enable the Russian government to continue this unjust war.” Link to more info via the New York Times.

- U.S. Secretary of State Antony Blinken begins a weeklong tour of Europe today, starting in Belgium, as the U.S. seeks to maintain a united front among allies following Russia’s invasion of Ukraine. Blinken will also visit Poland, Moldova, Latvia, and Lithuania on his travels.

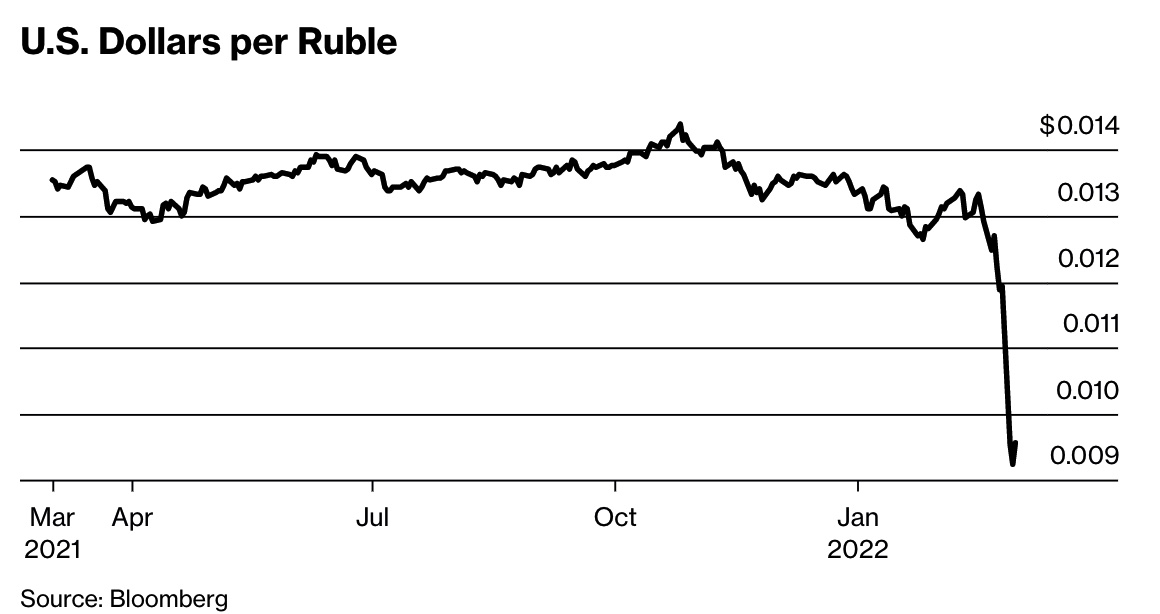

- For average Russians, Western sanctions are starting to bite. Long lines have formed at some banks as the ruble continues to plummet and Russians rush to withdraw hard currency. Some have shelved plans to buy a new home after mortgage interest rates more than doubled to 20%. Travel plans have been canceled. Meanwhile, some people have started to stock up on products such as foreign medications out of fear they might become scarce or completely run out. Around 55% of Russian medications are imported. Link to details via the WSJ.

- Russia’s space agency is refusing to launch a batch of internet satellites for a London-based startup as a form of retaliation against U.K. sanctions.

— Market impacts:

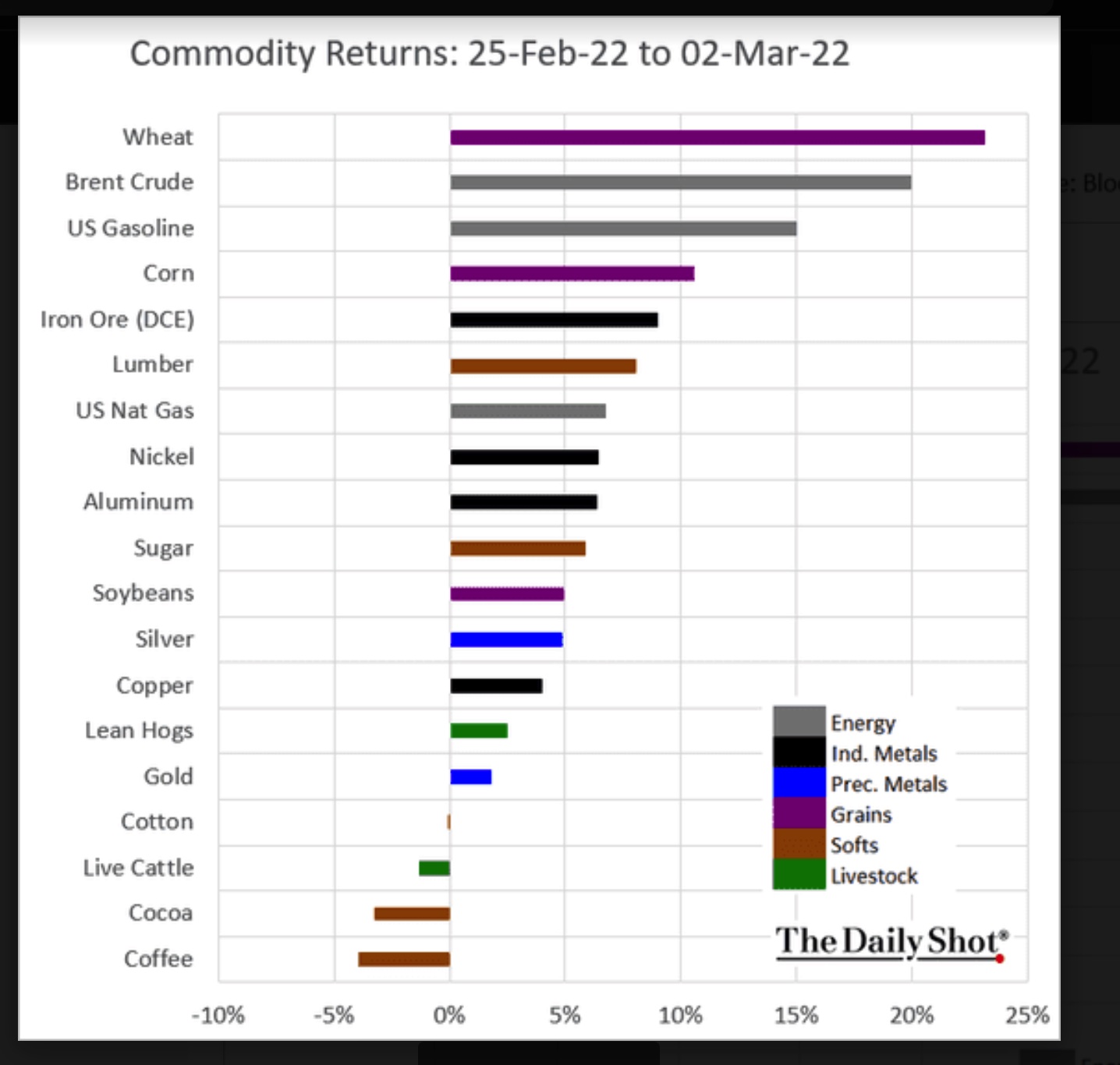

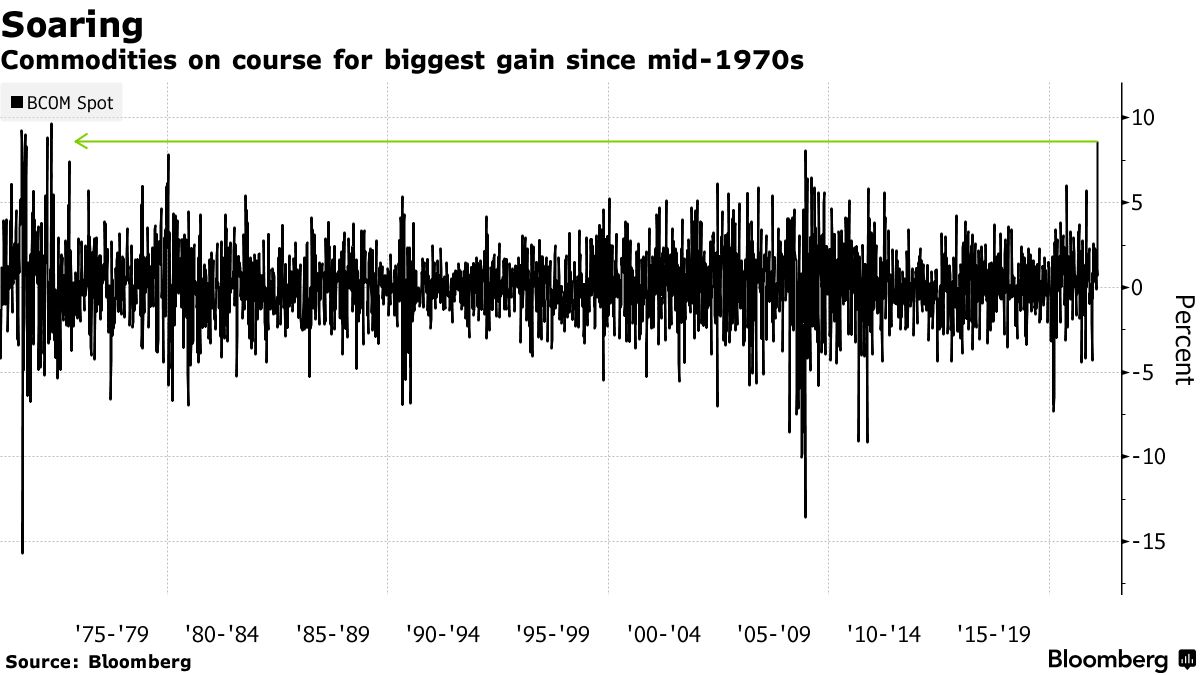

- Commodities have posted the biggest weekly gain since the mid-1970s, with massive increases in prices of grains, energy, and industrial metals. Aluminum, nickel, zinc and wheat all continue to rise, putting the Bloomberg Commodity Spot Index on course for its biggest weekly gain since 1960.

- Ag market update (from Pro Farmer): May contracts for all three wheat markets topped $11 overnight, though HRS futures have since retreated below that level. As of 7:30 a.m. ET, May SRW wheat is 68 cents higher, May HRW wheat is 43 cents higher, May HRS wheat is 19 cents higher, corn is 2 to 6 cents higher and soybeans are mostly 7 to 11 cents higher. Front-month U.S. crude oil futures are around $2.50 higher after earlier rising nearly $6.00. The U.S. dollar index is around 150 points higher this morning.

- Crude prices surged over $116 a barrel for the first time since 2008, as refiners balked at buying Russian oil, reducing the global energy supply. Since Russia’s invasion of Ukraine, investors are worried that a prolonged elevation in oil prices could precede a combination of slowing growth and higher inflation, known as stagflation. Bloomberg reports that with traders continuing to avoid Russian supply over sanctions uncertainty, OPEC+ not hiking their scheduled quota increase yesterday and Iran talks still not resolved, traders are paying the biggest premium in more than two years to bet on higher prices. (Crude prices retreated some this morning after reports of a U.S. deal with Iran.)

- An estimated two million barrels per day of Russian oil exports — and possibly more soon — are not finding any buyers despite Western sanctions not directly targeting Russia's oil and gas exports.

- It may not be as easy to increase U.S. oil production as many think. Reasons: Like many industries during the pandemic, oil producers are struggling with a shortage of workers. They're also having trouble sourcing some of the equipment they would need to ramp up production, including pipes and specialized sand used in fracking to extract shale oil. Another reason: Investors seem to be reluctant to invest in fossil fuel stocks as major U.S. oil stocks have lagged the broader market for most of the last two years. Even if someone starts drilling oil wells today, the increased supply might be 6 months, 12 months, even years away. U.S. oil production is just under 12 million barrels a day, 8% lower than in 2019.

- The value of Russia’s ruble hits record low.

- Russia’s credit rating was slashed to junk status by ratings agencies, while MSCI is eliminating Russian equities from its emerging-markets indexes (MSCI estimates about $16 trillion are linked to its indices). "Russian assets have become toxic, for a lack of better expression," explained Marek Drimal, a strategist at Societe Generale. "Onshore markets are barricaded and basically uninvestable, while offshore markets have been hammered. The speed of events as they are happening is just mind-boggling."

- "Never seen weaponization of money on this scale before…you only get to play the card once," Dylan Grice, a hedge fund manager based in the U.K., tweeted (link). "It’s a turning point in monetary history: the end of USD hegemony."

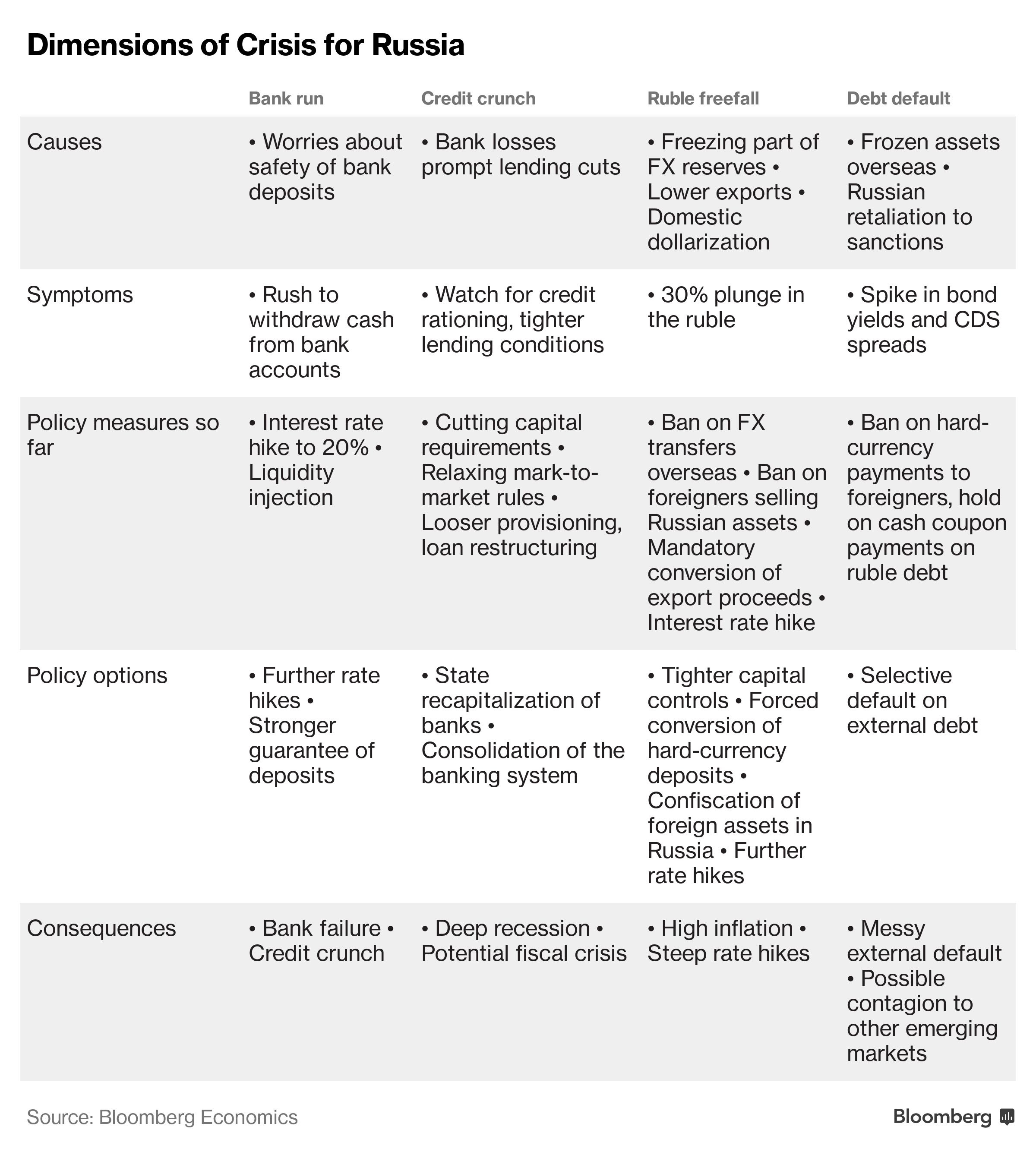

- Finance as a weapon of war leaves Russia facing what Bloomberg Economics calls “four intersecting” crises, which they predict will unite to tip Russia into a deep recession and cool growth elsewhere.

Crisis 1: A bank run provoked by concern over the safety of deposits

Crisis 2: A credit crunch as lenders retrench amid losses

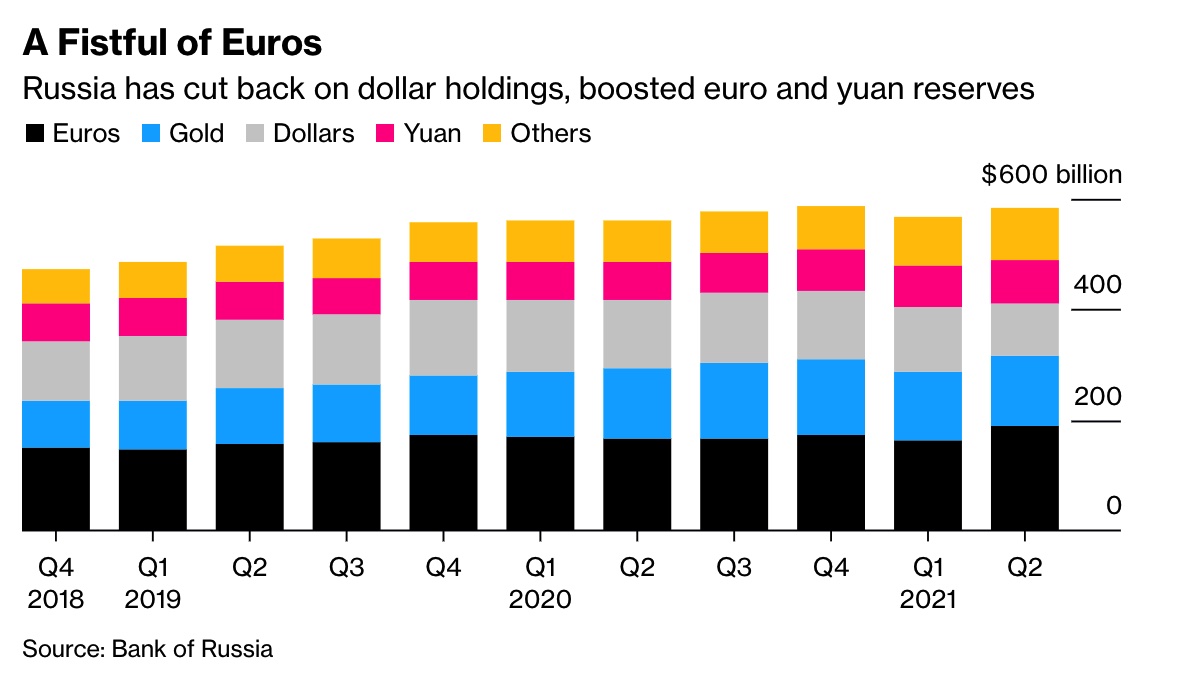

Crisis 3: A freefalling ruble amid the freezing of reserves, diminished trade and a rush to safety

Crisis 4: A debt default as assets held abroad are frozen and Russia retaliates

Just how much pain there will be is hard to say, but this Bloomberg chart shows the implications of each shock:

- How China will handle Russia's yuan assets. China's not expected to freeze them — but faces a dilemma in how to aid its strategic partner, Russia, without running afoul of Western sanctions, Bloomberg writes (link).

|

POLICY FOCUS |

— Univ. of Illinois economist thinks CRP should be tapped for more plantings. The Biden administration may have to open the Conservation Reserve Program (CRP) to cropping this year because of grain shortages that could result from the Russian invasion of Ukraine. “I am convinced it is going to be the biggest supply shock to global grain markets in my lifetime,” University of Illinois economist Scott Irwin says in tweets (link). He believes the world “desperately needs additional acres for grain production in 2022. … The only policy lever that I can think of in the hands of the US gov't is to open up the Conservation Reserve Program for cropping on a one-year emergency basis.” U.S. gov’t and congressional sources give the suggestion low odds of being acted on, especially at this juncture. Said one observer, “Let market prices determine plantings rather than thinking the government can fix everything.”

European agriculture ministers raised the idea of letting farmers put fallow land into protein crops during a meeting on Wednesday, reported Reuters (link). The French agricultural cooperative InVivo said that waiving EU land set-aside rules could increase cropped acreage by 10 to 15 percent and boost wheat production this year. Russia and Ukraine grow 14 percent of the wheat in the world and account for 28 percent of the global wheat trade.

Bottom line: If USDA is going to try and get the CRP to the maximum acreage allowed under the farm bill, it would seem releasing the acres for a year would not be in the cards.

|

PERSONNEL |

— Four nominees to be commissioners of the CFTC cleared the Senate Ag committee. The nominees include Christy Goldsmith Romero, a special inspector general for the Office of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP); Kristin Johnson, a law professor at Emory University; Summer Mersinger, the chief of staff to current CFTC Commissioner Dawn Stump; and Caroline Pham, a managing director at Citi Bank. CFTC, which regulates U.S. derivatives markets, has three vacant seats -- soon to increase to four with Stump stepping down in April.

|

CHINA UPDATE |

— New-crop soybeans, old-crop sorghum key sales to China in most recent week. USDA export sales figures for the week ended Feb. 24 for 2021-22 included net sales of 4,544 tonnes of corn, 144,994 tonnes of sorghum, net reductions of 14,996 tonnes of soybeans, and net sales of 75,769 running bales of upland cotton. For 2022-23, net sales of 1,260,000 tonnes of soybeans were reported along with net reductions of 700 running bales of upland cotton.

Net sales of 4,260 tonnes of beef and 16,569 tonnes of pork were also reported.

Keep in mind: These sales numbers are BEFORE Russia invaded Ukraine… not just China but all countries in the Weekly Export Sales report out this morning.

— China moves to secure commodity supplies rocked by Ukraine war: Bloomberg (link). Government agencies, including the country’s top economic planning body — the National Development & Reform Commission — have been ordered to push state-owned buyers to scour markets for materials including oil and gas, iron ore, barley and corn to fill any potential gaps brought on by the conflict, according to people familiar with the matter cited by Bloomberg. The officials made no mention of prices, the people said, indicating the cost of imports isn’t a focus right now.

— China is increasing its commitments to purchasing wheat and energy from Russia, indicating a willingness to aid the Russian economy and a disdain for Western-led sanctions. Sinosure, the state insurance company for foreign trade, has received inquiries about how firms will be affected.

— Supply chains in China. The isolation of Russia from the international order will cause increased supply chain problems for an already strained China. Foreign Policy reports that shipping delays and port problems due to the pandemic had shifted a surprising amount of trade to land routes through Russia, a heavy part of the Belt and Road Initiative. With those routes now off the table, that trade will return to the ports and add to an overburdened system.

— China prepares to live with Covid-19. China, the last major country to stick with a zero-tolerance approach to Covid-19, is now actively exploring ways to loosen controls. In preparation for a potential opening, Chinese officials are looking into the use of travel bubbles modeled on measures taken during the Winter Olympics, collecting data on new antiviral drugs and scouting sites abroad for future production of homegrown Chinese mRNA vaccines, according to people familiar with the matter. Covid-19 controls likely won’t be eased before next spring, but experimental opening measures could arrive in select cities as early as this summer. Link for more via the WSJ.

|

TRADE POLICY |

— U.S. potato groups concerned over Mexican actions on imports. While the U.S. and Mexico reached agreement on allowing imports of U.S. potatoes to Mexico in a long-running dispute, U.S. potato growers are concerned that recent signals out of Mexico indicate that the country may not be making good on its commitments by reportedly ordering more inspections of processing and shipping facilities in the U.S. before full access to the Mexican market can be granted.

|

ENERGY & CLIMATE CHANGE |

— DOE issues notice of sale for release of 30 million barrels of crude from SPR. The Department of Energy (DOE) has issued a notice of sale for the release of 30 million barrels of crude oil from Strategic Petroleum Reserve (SPR) as part of a coordinated effort with other countries for the release of 60 million barrels worldwide from strategic reserves. The sale will be conducted with crude oil from the following four SPR sites:

o Up to 2 million barrels from Big Hill

o Up to 10 million barrels from West Hackberry

o Up to 8 million barrels from Bryan Mound

o Up to 10 million barrels from Bayou Choctaw

Bids are due by 10 am CT March 8 and awards for contracts to successful offerors will come no later than March 17. Deliveries are to take place between April 1 and May 31 and requests for early deliveries will be accommodated to the maximum extent possible.

— Advocates of helping farmers and ranchers fight the effects of climate change want Congress to invest $2.3 billion over five years in a “soil carbon moonshot,” spying the next round of farm bill negotiations as a potential vehicle for the plan. As Congress readies a new farm bill, lawmakers including Rep. Scott Peters (D-Calif.), and the climate-focused group Carbon180, are pushing for a coordinated, interagency program housed at USDA to advance soil carbon research, education, and technical assistance efforts. Carbon180 unveiled recommendations (link) for policymakers and the administration to boost the agricultural sector’s role in addressing climate change.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Two additional backyard flock HPAI finds confirmed by USDA. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed two more finds of H5N1 highly pathogenic avian influenza (HPAI) in two non-commercial backyard flocks (non-poultry) in New London County, Connecticut and Pottawattamie County, Iowa. This brings total HPAI finds in the U.S. to 17, with eight of those in commercial flocks and the remainder in backyard flocks.

So far there have not yet been any trade-related actions taken by U.S. trading partners linked to these two latest cases. International Organization for Animal Health (OIE) trade guidelines call on member countries to not impose bans on the international trade of poultry commodities in response to such notifications in non-poultry, but several countries have put blocks on imports of U.S. poultry in place in areas where HPAI finds have been confirmed in backyard non-commercial flocks.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 440,526,456 with 5,974,544 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 79,142,885 with 954,519 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 553,778,476 doses administered, 215,775,839 have been fully vaccinated, or 65.73% of the U.S. population.

— Biden administration introduced a national pandemic strategy that shifts from a crisis response to managing the virus. The 96-page blueprint (link) for a plan President Biden previewed the State of the Union address aims to protect against Covid-19 without snuffing it out for good. A major new part of the plan includes a new "Test to Treat" initiative that Americans would be able to get tested for Covid-19 at a pharmacy and receive free antiviral pills "on the spot" if they test positive. The approach focuses on expanding access to treatment, preparing for new variants, preventing business and school shutdowns and continuing global vaccine donations. The new plan will require additional funding from Congress.

— Australia fully reopens its borders. After 697 days, the last of the country’s pandemic entry restrictions were lifted for fully vaccinated travelers. Separately, Google told employees at several of its U.S. locations to begin returning to the office in April.

|

POLITICS & ELECTIONS |

— President Biden declared Tuesday that the state of the union is strong. Is it? Marc Thiessen, a Washington Post columnist, was asked about the topic in an appearance on Fox’s Kudlow, who asked “Do you think there's any way in which the president or anybody could credibly say we are stronger today than we were a year ago?” Thiessen responded:

“There isn't, and one of the lessons I learned as a presidential speechwriter is that when the president says something that is directly contradicted by the lived reality of Americans, Americans tune him out. There's no way you can do that. If you think about what the lived reality of Americans is over the first year of the Biden administration, it is the worst inflation in 40 years, worst supply chain crisis and worst labor shortage we've had in living memory, worst crime wave in American cities since the 1990s. The worst border crisis in American history. Worst foreign policy debacle that we've experienced in living memory with the withdrawal from Afghanistan, and now the worst act of unprovoked aggression in Europe since World War Two. And on top of that, the lingering effects of the worst global health crisis in a century. That's a pretty bad situation. And most people don't think that Biden has made those things better… they make they think they've made all those things worse. All the polls show that he's underwater on every single issue from Covid to foreign policy to the economy. So, when you say something like that, most Americans look at you and just shrug their heads and say, ‘This is why I don't want this kind of run again.’”

— Former President Donald Trump and a right-wing lawyer were part of a "criminal conspiracy" to overturn the 2020 presidential election, the House select committee investigating the January 6 Capitol riot alleged in a court filing yesterday. The 61-page filing is part of an attempt to gain access to emails from lawyer John Eastman, who the committee says helped Trump orchestrate the plot. House members have also signaled they may make a criminal referral to the Justice Department about Trump, depending on their findings.

— Election Day 2022 is 250 days away. Election Day 2024 is 978 days away.

— South Korea’s election. The race to become South Korea’s next president is in its final week with Democratic Party candidate Lee Jae-myung and conservative Yoon Suk-yeol in a tight race according to the latest polls. A survey released on Wednesday, the last day polling is allowed to be published before the March 9 vote, found 46.3% of respondents favored Yoon while 43.1% preferred Lee.

|

CONGRESS |

— Massive $1.5 trillion FY 2022 omnibus bill scheduled to come to the House floor early next week. Tentative add-ons include a Ukraine package of around $10 billion, while Covid relief funding may be $30 billion to $35 billion, but there is push back by some against additional Covid relief funding due to billions of dollars in existing funding still not spent and comments from President Biden during his State of the Union address that unspent billions from the American Rescue Plan would be move to ObamaCare funding. Republicans asked the Biden administration for a more thorough accounting as to how the White House might spend $30 billion in new aid. And they further pressed the administration to deliver more detail on how much actually remains in existing programs.

— Sen. Joe Manchin (D-W.Va.) discussed a much scaled down version of the Build Back Better (BBB) measure that he says he could vote for under the special budget reconciliation process. Manchin said he could support a reconciliation package that reforms the tax code and lowers the cost of prescription drugs if the money raised is split between spending on new climate change proposals and deficit reduction and fighting inflation. He noted he has not many any formal counterproposal to the White House but is sketching the outlines of a proposal that he could support along with the rest of the Senate Democratic Caucus. He suggested spending on several initiatives to fight climate change would likely unify his Democratic colleagues. “Half of that money should be dedicated to fighting inflation and reducing the deficit,” he said. “The other half you can pick for a 10-year program, whatever you think is the highest priority and right now it seems to be the environment — and that’s a pretty costly one — would take care of it.”

|

OTHER ITEMS OF NOTE |

— The Biden administration is committed to expanding the Trump-era “Remain in Mexico” border program even as it opposes the policy, officials told a House panel yesterday. The Department of Homeland Security enrolled roughly 13 border-crossers per day in the program in January, while encountering some 5,000 migrants per day overall that month. Those placed in the program, formally known as the Migrant Protection Protocols, must wait in Mexico while U.S. officials review their cases for entry.

— In a legal win for the National Rifle Association, a judge has blocked the New York attorney general's attempt to dissolve the organization -- but has allowed her suit against it to move forward. The judge denied the attorney general's claim to dissolve the NRA, stating in part that the attorney general’s office had failed to prove that the alleged mismanagement of the organization's funds has created public harm. He also said dissolving the NRA could impact the free speech rights of its members. In a statement yesterday, NRA President Charles Cotton called the decision a "resounding win" for the organization and its 5 million members.