Markets are Hyper-Sensitive to Fast-Moving Russia/Ukraine Events

Russia raises rates to 20% as ruble plunges | Shipping from Ukrainian ports all but ceased

|

In Today’s Digital Newspaper |

Russia’s invasion of Ukraine is again easily the key factor across a host of markets. Today’s dispatch has an update on the latest war events and how the U.S. and allies continue to react. Congress returns today with President Biden’s State of the Union address on Tuesday moving the Biden agenda to the foreign policy arena and but another test for the president with weak polling numbers.

|

MARKET FOCUS |

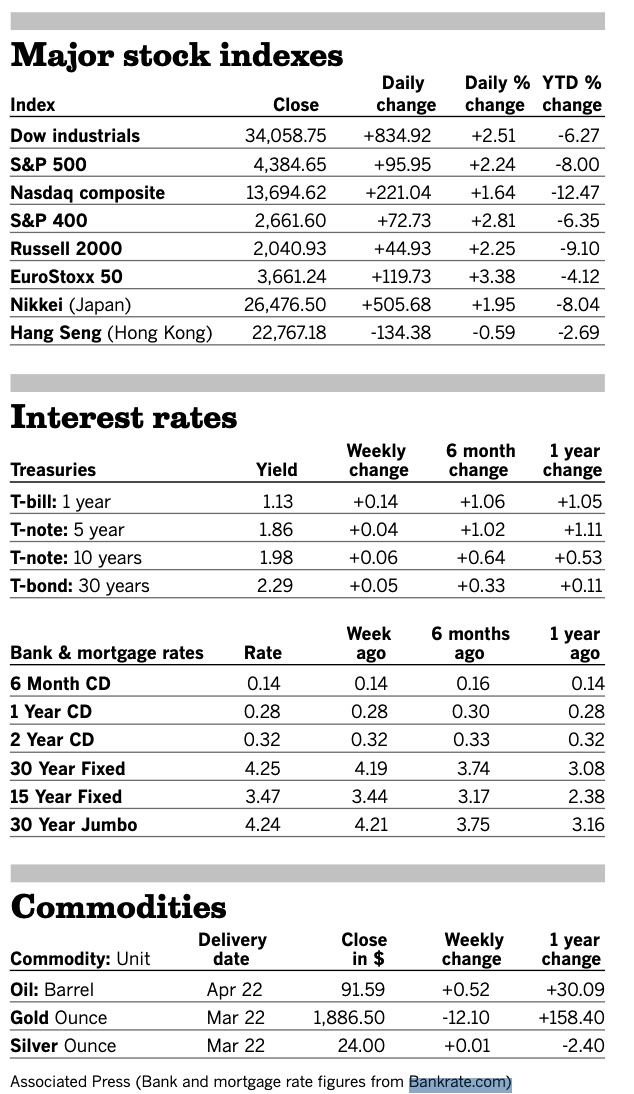

Equities today: Investors continue to monitor and assess the impact of the war in Ukraine on global markets, energy prices and commodities. One of the biggest wildcards of the week will be the decision on Wednesday by OPEC on production boosts. Asian equities were mixed as traders assessed the weekend developments in Russia/Ukraine and monitored energy prices in particular. The Nikkei was up 50.32 points, 0.19%, at 26,526.82. The Hang Seng Index declined 54.16 points, 0.24%, at 22,713.02. European equities are posting sharp declines in early trading to open the week. The Stoxx 600 was down 1.5% with regional markets down 1.2% to more than 3%.

U.S. equities Friday: The Dow gained 834.92 points, 2.51%, at 34,058.75. The Nasdaq rose 221.04 points, 1.64%, at 13,694.62. The S&P 500 moved up 95.95 points, 2.24%, at 4,384.65.

For the week: The S&P 500 closed the week with a 0.8% gain after falling as much as 5.5%, the Nasdaq Composite increased 1.1% after plunging as much as 7%, the Dow Jones nearly broke even after losing 5.3% midweek.

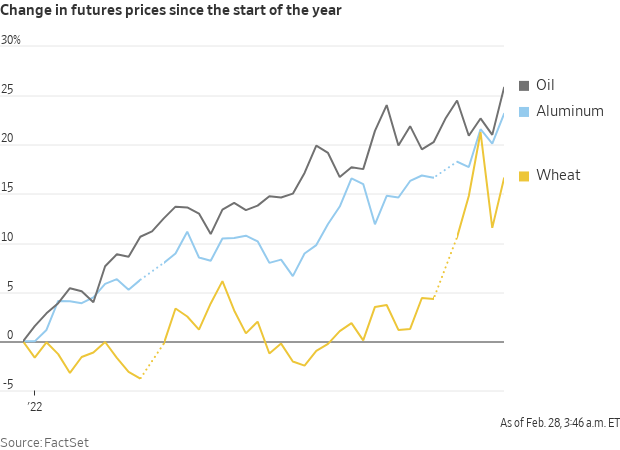

WTI crude oil surged to more than $100 a barrel for the first time since 2014, before dropping back to trade near the $90 level.

Warren Buffett's Berkshire Hathaway reported a nearly $40 billion profit in the fourth quarter, up more than 10% from the same period of 2020. Profits more than doubled for the full year, to just shy of $90 billion.

On tap today:

• U.S. advance economic indicators for January are out at 8:30 a.m. ET.

• Chicago purchasing managers index is expected to fall to 63.4 in February from 65.2 one month earlier. (9:45 a.m. ET)

• Dallas Fed's manufacturing survey is expected to rise to 5.5 in February from 2 one month earlier. (10:30 a.m. ET)

• European Central Bank President Christine Lagarde speaks at a Women in Economics and Finance event at 10:50 a.m. ET.

• USDA Grain Inspections report, 11 a.m. ET.

• Federal Reserve Bank of Atlanta President Raphael Bostic speaks with Harvard University students at 11:10 a.m. ET

• China's official purchasing managers indexes for February are out at 8:30 p.m. ET, and China's Caixin manufacturing index for February is out at 8:45 p.m. ET.

• Reserve Bank of Australia releases a policy statement at 10:30 p.m. ET.

USDA’s 2022 food price inflation forecasts rise, as expected. USDA now expects food price inflation in 2022 to be from 2.5% to 3.5% based on the all food Consumer Price Index (CPI), up from their prior outlook food prices would be up 2% to 3% compared with 2021.

The forecast for food away from home (restaurant) prices is for an increase of 4% to 5%, their second increase in as many months — in January, their initial outlook of 3% to 4% was increased to a rise of 3.5% to 4.5%.

Food at home (grocery store) prices are now forecast to be up 2% to 3% in 2022, up from their initial outlook that those prices would increase 1.5% to 2.5% from 2021 levels.

In 2021, grocery store prices increased 3.5% and restaurant prices were up 4.5%, with all food prices up 3.9% versus 2020 levels. The biggest increases in items tracked by USDA’s Economic Research Service (ERS) were the beef and veal category at 9.3% and the fresh vegetables category had the smallest rise of 1.1%.

Changes versus month- and year-ago levels. The overall food price CPI rose 1% from December to January and was up 7% from January 2021. The restaurant CPI increased 0.7% in January 2022 and was 6.4% higher than January 2021. Meanwhile, grocery prices were up 1.2% from December while those prices stood 7.4% higher than they were in January 2021.

The increases versus year-ago marks were substantial for some categories even though prices actually edged lower for some of the products compared to December. Prices for meats, poultry, and fish were up 12.2% from January 2021 while they edged up just 0.2% from December. Prices for meats were 13.6% higher than a year ago, while beef and veal prices gained 16% and pork prices were 14.1% higher. The CPI for meats did decline 0.3% from December, with a fall of 1.3% for beef and veal while pork prices moved up 0.1%.

Upward shifts in 2022 price forecasts for several commodities. While the forecast for meats overall held steady at a 3% to 4% rise, prices for fish and seafood are seen rising 3.5% to 4.5%, a rather sharp increase from a prior 2% to 3% forecast increase. Originally, USDA forecast those prices to move up 1.5% to 2.5%.

Dairy product prices are seen rising 2.5% to 3.5% in 2022 versus 2021, the second month in a row the price outlook has been increased. In January, USDA raised the forecast to a rise of 1.5% to 2.5% which was a sharp upward move from the initial outlook that prices would be down 0.5% to up 0.5%.

Other food category forecasts were also increased, ERS noted. “Following large price increases in January, forecast ranges for fats and oils, fresh fruits, processed fruits and vegetables, cereal and bakery products, nonalcoholic beverages, and other foods have been adjusted upward.”

Perspective: The increases USDA now forecasts compare with 20-year averages of 2.4% for all food, 2.9% for restaurant prices and 2% for grocery store prices. That puts forecast increases for all food and restaurant prices above the historical average and the low end of the grocery store forecast range right on the 20-year average. But more increases appear likely. USDA starts forecasting the food price CPI for the next year in July of the prior year. For 2021, USDA in July 2020 had an outlook for all food prices to rise 2% to 3%, with restaurant prices seen up 1.5% to 2.5% and prices at the grocery store to be up 1% to 2%. It took until June 2021 for their all-food price outlook to be increased, with it moved up to 2.5% to 3.5% that month. It was further increased to 3% to 4% in August where it remained through December. The final reading was an increase of 3.9%. Food away from home prices held at the initial forecast level until October 2020 when it was boosted to 2% to 3%, with another increase to 2.5% to 3.5% in April 2021. Increases were made in June (to 3% to 4%), August (3.5% to 4.5%) and in November (to 4% to 5%). The eventual final reading was an increase of 4.5%. The increase for grocery store prices was held at the initial 1% to 2% level until May 2021 when it was increased to 1.5% to 2.5%. Further increases were made in June (to 2% to 3%), July (2.5% to 3.5%) and August (to 2.5% to 3.5%) where they remained for the balance of 2021. The eventual final reading was an increase of 3.5%.

Bottom line: While USDA is already increasing its outlook for all food, restaurant and grocery store price increases, it could result in additional moves higher in coming months. And with those prices already at or above the 20-year averages, it looks like 2022 has the potential for consumers to have gone through three straight years of above-average food price inflation. But U.S. consumers still pay among the lowest share of their income on food around the globe — about 10%. That pales in comparison to some countries where upwards of 50% of income must go to put food on the table. And relative to grocery store prices, consumers saw those prices increase 0.9% in 2019, 0.4% in 2018, and actually decline by 0.2% in 2017 and fall by 1.3% in 2016.

Market perspectives:

• Outside markets: The dollar is rising against virtually every peer as fallout from the sanctions levied against Russia supercharges demand for the world’s reserve currency. Treasuries also rallied. Energy and commodity markets were thrown into disarray with Brent crude soaring over $105 a barrel and wheat and gold also rallying. The yield on the 10-year US Treasury note has moved down to trade around 1.91% with a generally lower trend in global government bond yields. Gold and silver futures are seeing additional safe-haven buying, pushing gold above $1,905 per troy ounce and silver to around $24.45 per troy ounce.

• Crude oil futures are posting strong gains ahead of U.S. market action, with U.S. crude around $95.70 per barrel and Brent around $98.45 per barrel. Futures were higher in Asian trading, with U.S. crude around $96 per barrel and Brent above $102 per barrel.

• Fed rate rise in focus as Jerome Powell testifies. The Federal Reserve chairman is scheduled to appear in Congress on Wednesday and Thursday amid surging inflation and expectations that the central bank will raise interest rates at its next meeting in mid-March. Lawmakers will likely ask for answers on how the Russian invasion might ripple through the U.S. economy.

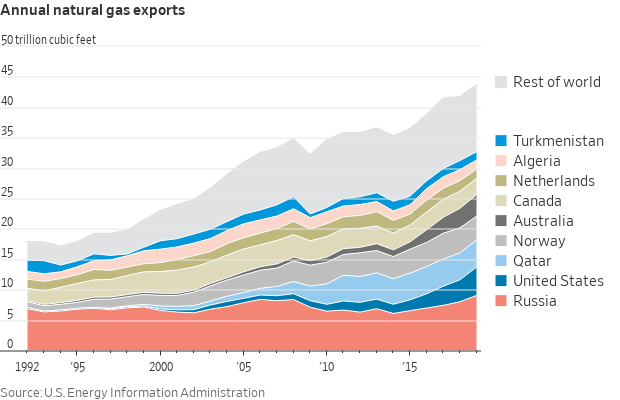

• Drivers are already feeling the effects of Russia’s invasion. The national average price of regular unleaded gasoline rose three cents, to $3.57 per gallon. Expect further increases in the coming days, most analysts predict, with many looking for the national average price to hit $4 per gallon sometime this spring. Diesel, now averaging $3.98 per gallon, is also likely to push higher, further boosting inflation ahead. Natural gas prices are elevated, too, but U.S. prices are considerably below those in Europe, which depends heavily on Russian gas imports. At $4.50 per million British thermal units, the benchmark U.S. gas futures contract is near its highest point in weeks. With winter nearing its end, and parts of the United States are starting to experience springlike weather, domestic demand will drop, and gas prices are likely to pull back some.

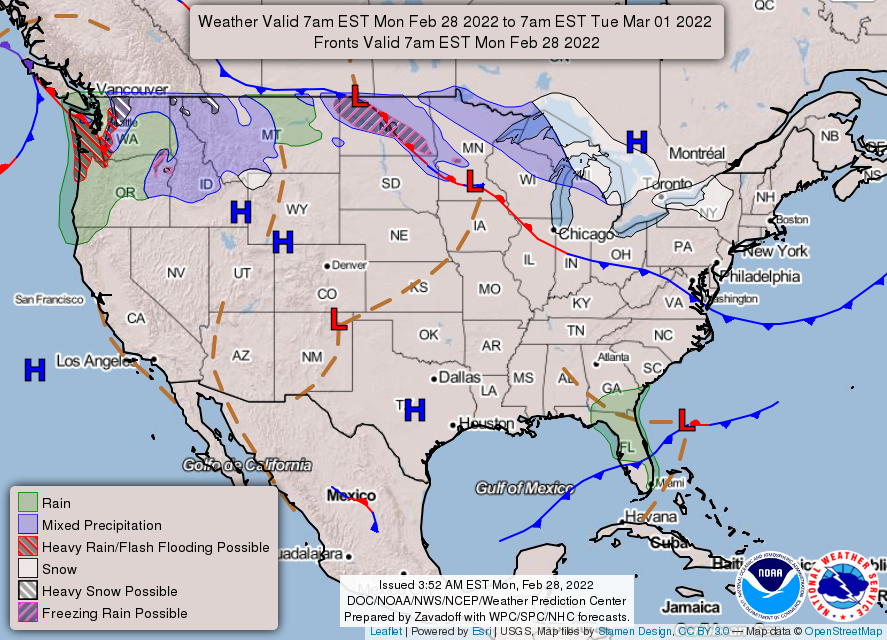

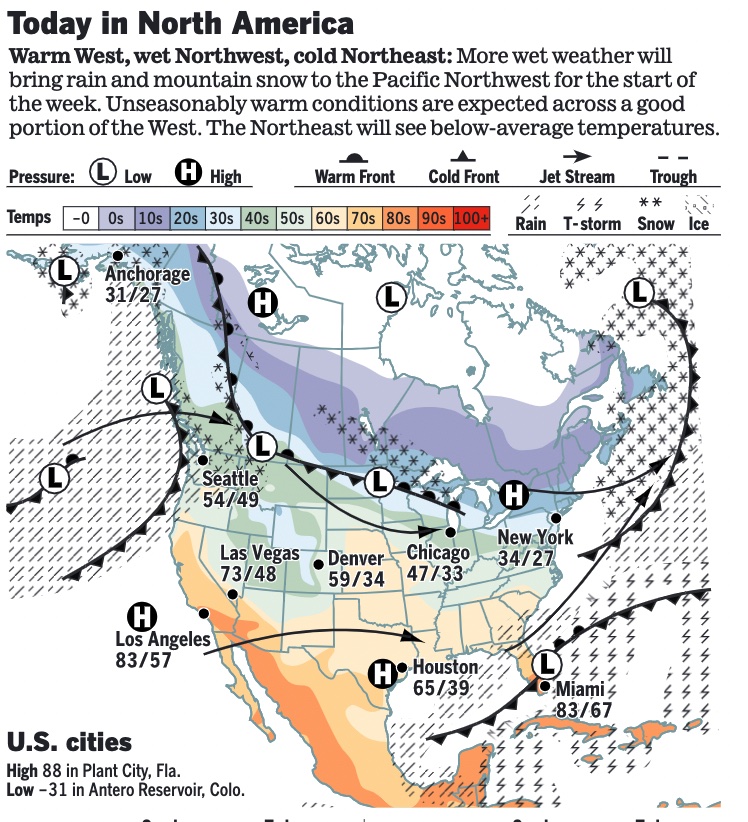

• NWS weather: Heavy rain and snow melt to contribute to increasing flooding concerns across portions of the Pacific Northwest... ...Above normal temperatures will expand eastward into the eastern U.S. but cold conditions with periods of light snow remain across the northern tier.

|

RUSSIA/UKRAINE |

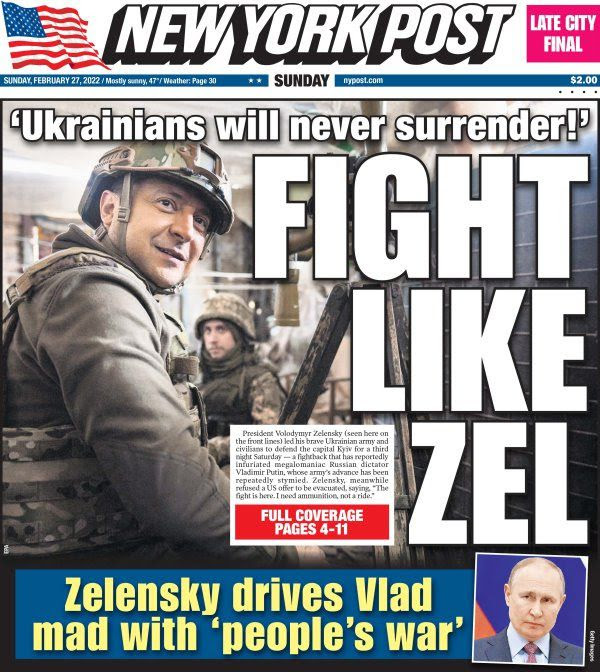

— Russia/Ukraine update: Activity accelerated over the weekend as Ukraine continued to exert strong resistance against Russian troops and military hardware. In the face of Ukrainian opposition, Russia has had to “commit a bit more logistics and sustainment capability, like fuel specifically, than what we believe they had originally planned to do this early in the operation,” a U.S. defense official said. The U.S., the EU and allies made it official Saturday night: “Selected Russian banks” are now banned from participating in SWIFT, the international payment system. Russians were on Sunday queueing at banks and ATMs to withdraw cash. President Vladimir Putin on Sunday ordered Russian nuclear deterrent forces put on high alert Sunday in response to what he called “aggressive statements” by leading NATO powers. Late-breaking news Sunday morning broke that Ukraine President Volodymyr Zelenskyy agreed to negotiate with the Russians but fighting continues across Ukraine — a Ukrainian delegation has arrived near the border with Belarus to hold talks with Russian officials. Ukraine’s delegation included Defense Minister Oleksiy Reznikov, Presidential Office Advisor Mykhailo Podolyak, and Deputy Foreign Minister Mykola Tochytsky, among others. “The main subject of the negotiations is an immediate cease-fire and the withdrawal of troops from Ukraine,” the statement said.

Street fighting broke out in the center of Kharkiv as Russian troops entered Ukraine’s second-largest city. Russia has now invaded Ukraine with a majority of the 150,000 troops it had amassed along the country’s borders, the U.S. assessed Saturday. The Ukrainian Army said it was targeting Russian supply lines while fighting to keep control of Kyiv and Kharkiv, although satellite images show a large unit of Russian forces closing in on the capital. New satellite imagery shows a miles-long convoy of Russian military vehicles bearing down on the Ukrainian capital despite the negotiations.

Concludes the Financial Times: “Prolonged wars are expensive, and the unexpected vigor of the Ukrainian resistance amplifies the effects of western financial sanctions. This, though, entails new risks. One is that a collapsing ruble and spiraling prices could spark a backlash among Russians who never sought this war — against not Putin, but the west… Another fear is that slow progress in Ukraine will prompt Putin to order his army to use its more terrifyingly destructive weapons, against civilians too.”

- Link to Saturday report. Link to Sunday update.

- Ukrainian delegation is meeting with Russia as Putin's forces try to take Kyiv. A Ukrainian delegation met with Russian officials near the Belarusian border, Ukrainian President Volodymyr Zelenskyy's office confirmed. The announcement comes after Zelenskyy rejected an offer to hold talks in Belarus, saying the country is not neutral territory because Moscow carried out part of its assault from there on Thursday.

Zelenskyy comments. While Zelenskyy willingly moved forward with the meeting, he remains unconvinced that discussions will change anything. "But let them try, so that no citizen of Ukraine doubts that I, as president, tried to stop the war when there was still a chance, however small," said Zelensky in a Telegram message, according to the Kyiv Independent.

- The U.S. did make a deal in 1994 with Ukraine, known as the Budapest Agreement. Ukraine had the third-largest nuclear weapons stockpile. This was because the newly founded Ukraine ended up with the Soviet Union’s nuclear weapons in their territory after the Soviet Union collapsed. This agreement meant that Ukraine would destroy the weapons and the U.S., United Kingdom (U.K.), and Russia would guarantee Ukraine staying secure. This, however, is not a treaty.

- EU bans Russian planes from its airspace. The European Union is banning Russian planes from its airspace and will fund arms purchases for Ukraine, in what the bloc's president called a "watershed moment." The EU also will extend to Belarus its sanctions on Russia and ban from the 27-country bloc Russian state-owned media outlets Russia Today and Sputnik, as well as their subsidiaries.

- BP to exit stake in Russian state oil company Rosneft. BP said it was exiting the 20% stake in the Russian state oil company Rosneft it has held since 2013 in a stark sign of the corporate backlash from Russia’s invasion of Ukraine.

- If Russian gas is disrupted, the EU would have enough gas in storage and alternative suppliers to get it through the winter in the next month without significant disruptions, said Henning Gloystein, director for energy, climate and resources at risk consulting firm Eurasia. But it would need to spend the spring and summer refilling its inventories ahead of next winter.

- Inflation implications. "I believe that Russia's invasion of Ukraine marks nothing less than a shift away from the largely U.S./Western-dominated world order that has prevailed since the fall of the Berlin Wall," Michael Strobaek, the global chief investment officer at Credit Suisse, said in a note to clients. "Russian President Vladimir Putin intends to reposition Russia as a powerful nation whose strength rests on its energy and commodity resources as well as its military," he said. "This is likely to have significant repercussions for the security arrangements in Europe and globally." Furthermore, Strobaek continued, other global powers like China are watching closely to see how the conflict evolves and how the West reacts. "We are now moving to a new multi-polar world," he said.

"If anything, this aggravates the inflation problem in the U.S.," Krishna Guha, vice chairman of Evercore ISI, told firm clients in a Thursday webinar on the implication of Russia's invasion. "It makes it harder to achieve the soft landing" the Fed is trying to execute.

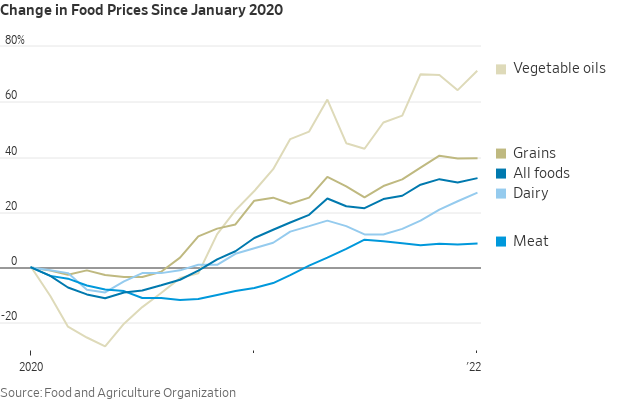

- Foreign Policy: Russia’s war on Ukraine could cause a global food crisis. With some of the most fertile land on Earth, Ukraine is known as Europe’s breadbasket. Its fast-growing agricultural exports — grains, vegetable oils, and a host of other products — are crucial to feeding populations from Africa to Asia. A substantial part of Ukraine’s most productive agricultural land is in its eastern regions, exactly those parts most vulnerable to Russian attacks. As the war unfolds, a Foreign Policy dispatch (link) says “one concern that has gone relatively unnoticed is the question of what happens to these regions — and to the countries around the world that depend on Ukraine for food.

- G7 leaders are also restricting the Russian Central Bank from (1) “deploying its international reserves,” (2) blocking the sale of “golden passports” to people with links to the Russian government, (3) creating a task force to begin “identifying and freezing assets” of any sanctioned companies, officials and oligarchs and (4) working on ways to boost the fight against disinformation campaigns.

The president of the EU Commission said: “We will paralyze the assets of Russia’s central bank. This will freeze its transactions. And it will make it impossible for the Central Bank to liquidate its assets.” - The U.K. would support Group of Seven nations setting limits on the amount of Russian oil and gas its members could import “over time,” Foreign Secretary Liz Truss told Sky News on Sunday. Russia’s “is funded by revenues from oil and gas,” so we want to cut its dependency on them, Truss said.

- The U.S. Agency for International Development (USAID) and State Department are sending $54 million in food, water, hygiene supplies, blankets and other emergency goods to Ukrainians. “The United States is the single largest donor of humanitarian assistance in Ukraine,” said USAID. “Since the conflict began in 2014, the United States has provided nearly $405 million to vulnerable communities across Ukraine, including nearly $169 million from USAID and nearly $236 million from the Department of State.”

- Former Australia official sizes up why Putin gambled the West was weak. Tony Abbott served as prime minister of Australia, 2013-15. In a commentary for the Wall Street Journal (link), Abbott writes:

“Reducing emissions is an important policy objective but should never be governments’ main task — especially when it entails risking significant economic damage and putting national security at risk. Europe has been busily closing down coal-fired power stations (and in Germany even emissions-free nuclear ones) only to become dependent on Russian gas that Putin can turn off and on like a tap. Here in Australia, we’re set on closing coal-fired power stations without any base-load substitute even while our thermal coal exports surge to record levels (including to China, an even more dangerous strategic competitor than Russia). It’s the private sector that’s doing this, an unforgivable folly reminiscent of Lenin’s reported quip that the ‘capitalists will sell us the rope by which we hang them.’”

— Market impacts:

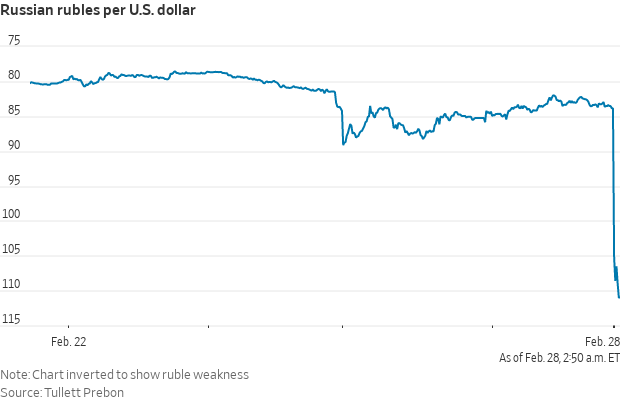

- Russia’s central bank raised interest rates to 20%, up from 9.5%. The Bank of Russia also delayed trading on domestic debt and currency markets, making it difficult to assess where the ruble would end up, and blocked the opening of the stock market until at least later in the afternoon Monday. As global sanctions kick in, the ruble is crashing, and crippling hyperinflation could be on its way. The ruble fell as far as 119.50 per dollar on Monday, down a whopping 30% from Friday’s close.

- Brent futures jumped more than 7% before pulling back slightly to trade near $103 a barrel. Goldman Sachs raised its one-month forecast for Brent to $115 a barrel, from $95, with significant upside risks on further escalation or longer disruption. China and other buyers have paused purchases of Russia’s flagship Urals grade, which is trading at a deep discount to Brent.

- Iraq stopped oil production from two southern fields with a combined capacity of almost half a million barrels a day. The shutdowns curtail the ability of OPEC’s second-largest member to pump crude just as Russia’s invasion of Ukraine and tight supplies globally send prices soaring. Iraq pumped 4.16 million barrels a day in January, less than its target of almost 4.3 million, Bloomberg reported earlier this month. That was because of bad weather at ports and the country should meet its quota for February, Oil Minister Ihsan Abdul Jabbar said in an interview on Feb. 21. Iraq has repeatedly said it is able to pump as much as 5 million barrels-a-day.

- BP moved to dump its shares in oil giant Rosneft, taking a financial hit of as much as $25 billion.

- OPEC+ meets on Wednesday to discuss its supply policy for April amid calls for increased production. “Removing some Russian banks from Swift could result in a disruption of oil supplies as buyers and sellers try to figure out how to navigate the new rules,” Andy Lipow, president of Lipow Oil Associates in Houston, said in a note. The IEA pledged last week to help ensure global energy security, while India said it would support initiatives to release emergency oil reserves to help calm prices.

OPEC+ revised down its forecast for the 2022 oil market surplus by about 200,000 barrels per day (bpd) to 1.1 million bpd, according to a base scenario in a technical committee report seen by Reuters on Sunday. The data - part of a report the Joint Technical Committee (JTC) prepares for OPEC+ ministers - also shows stocks in the developed world standing at 62 million barrels below the 2015 to 2019 average by the end of the year. - Societe Generale and Credit Suisse Group stopped financing commodities trading from Russia, according to reports. The two banks, key financiers to commodity trading houses, are no longer providing the money needed to move raw materials such as metals and oil from Russia.

- Ag market prices early today: Corn up 17 to 27 cents; beans up 24 to 44 cents; winter wheat up mostly 45 to 60 cents; spring wheat 28 to 30 higher.

- The conflict is bottling up Ukraine and Russia’s vast commodity exports, sending the price of oil, natural gas, wheat and sunflower oil rocketing. Shipping from Ukrainian ports, an important corridor for grain, metal and Russian oil shipments to the rest of the world, has all but ceased.

|

POLICY FOCUS |

— State of the Union address Tuesday. The White House wants this speech to set the tone for the rest of the year. The House chamber will be open to all members and senators for the speech. No guests will be allowed to attend the speech.

Biden is going to be on the road amplifying his speech as much as possible in the next few weeks. He will start by traveling to Superior, Wisconsin the day after the speech, with the First Lady. Topic: the bipartisan infrastructure framework (BIF) bill signed into law. As with most SOTU speeches, the president will focus on what the administration has accomplished so far and what they still want to do.

Biden may use the speech to in part pivot on Covid to a far less mandate approach. He is expected to announce a major move bring many government people back to work.

As noted in The Week Ahead, other topics likely to be addressed include:

• Update on Russian invasion of Ukraine and what the U.S. and allies are doing. And some of the economic impacts short term.

• Perspective on inflation, including food and energy prices.

• Supply-chain glitches: An update on prior efforts announced to temper some of the glitches in the transportation and shipping sectors.

• Comments on Supreme Court nominee Ketanji Brown Jackson, a historic pick that is expected to get approval.

• Climate change: As his number-one administration issue when he first became president, Biden will likely give an update on this topic.

• Other geopolitical issues beyond Russia, including China, Iran and North Korea.

• Topics he should address include: border and immigration issues, trade policy and regulations.

|

PERSONNEL |

— Biden to send most federal workers back to the office. In his State of the Union address on Tuesday, President Biden plans to announce accelerating the return of the federal workforce, Axios reported Sunday. USDA top officials are expected to report to the office today, mid-level staff to return by March 28, and all staff by May 27. USDA has a policy of “maximum telework,” which means that employees can work from home as much as eight of 10 days, but individual employee schedules have to be worked out with supervisors.

|

TRADE POLICY |

— Update on Biden administration trade policy: Push to seek more/different markets. It’s been hard to discern President Biden’s trade policy because for most of its first year in office, they reviewed the trade policy of the Trump administration. In recent weeks, some initial asseverations have surfaced, including a Friday session at USDA’s Ag Outlook Forum between USDA Sec. Tom Vilsack and U.S. Trade Representative (USTR) Katherine Tai.

- Biden administration is assessing ag trade impacts from Russia’s invasion of Ukraine, with Tai labeling the Phase 1 U.S./China trade talks/review “more difficult” over time. China’s compliance with Phase 1 purchase commitments and other ag and non-ag provisions of the deal “has been uneven,” Tai said, with the U.S. pressing China to address those shortfalls. “We have had very direct, honest, respectful conversations with the Chinese … since the beginning of October around how can we hold China accountable for these commitments,” she said, adding that those discussions “have gotten more difficult over time.”

China trade remains firmly on the mind of the ag sector. In a separate session Thursday (Feb. 24), USDA Foreign Agricultural Service (FAS) Administrator Dan Whitley said a major concern for him is that, “one day, China could just wake up and for whatever reason, and say, ‘Hey, you know, we've kind of had enough of this,’” and shun U.S. ag products, perhaps to send a “signal to the American agricultural sector or the U.S. government.”

- Tai described the Russia/Ukraine conflict as another potential “shock” to supply chains and trade, likening it to the Covid-19 pandemic and other recent events that have raised “bigger questions around a lack of resilience in this version of globalization that we have.” She noted Ukraine’s position as an agricultural powerhouse in global markets and said, while it is early, the sense in terms of economic impacts from the situation is that they “may very well be coming.” Several federal agencies will work to “assess where the impacts are going to be” in terms of ag trade and the broader economy, Tai said. “There is a lot of coordination that we need to do with [NATO] allies — but also within our own government and economy — to look at appropriate responses to the Russian actions,” she remarked, adding that it is “really critical” to “figure out how to respond appropriately.”

The Russia/Ukraine situation also underscores the nexus of trade and foreign policy and the need to “think through” how those policies work in concert, Tai said, along with their effect on domestic economic needs. The key, she added, is that all those policies “ensure that we can be the kind of trading partner that our allies need us to be — and how we take care of our own.”

- Tai is optimistic for progress on the U.S./U.K. trade relationship. Vilsack asked Tai what her hopes were for building a closer trade relationship with the U.K., especially with “challenging issues” seen on the ag side. Prior experience has revealed “certain brick walls” on ag trade issues — both with the U.K. and other trading partners, she noted. Tai said the “enhanced sense of insecurity around the global marketplace and our supply chains” could provide new opportunities for progress with the U.K., the question being how to “capture” those and existing openings with “outside the box” thinking. Overall, she said she is “quite pleased” with the “pretty intensive clip of engagement” she has enjoyed with the U.K. government and expressed optimism that talks can be expanded to other topics.

- Biden administration’s new Indo-Pacific initiative also surfaced, with Tai explaining that the effort aims to “deepen our economic relationships with the countries and economies in this region, and to coordinate our approaches” to trade and foreign policy challenges.

The U.S. withdrew from the Trans-Pacific Partnership (TPP) trade deal the third day of the Trump administration, but Tai has repeatedly signaled that a re-entry to the pact is not currently in the cards. In the session with Vilsack, she noted how engagement in the Indo Pacific is “more intensive and different than it was five or seven years ago.” She said changes that have happened over that time mean “we can't just revert back to the way we were thinking and the plans we were making” before — likely a reference to TPP and a sentiment she has expressed before.

China may want to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP, the trade pact following TPP), but Beijing won’t be able to meet the agreement’s standards, Vilsack told reporters. The Biden administration also is not ready to join the agreement, Vilsack said. Doing so will first require rebuilding public trust in trade agreements and tearing down existing trade barriers, Vilsack said, without providing additional details.

The White House recently released a report (link) outlining its economic strategy in the Indo-Pacific region, which aims to fill the hole in U.S./Asia strategy left by the U.S. 2017 departure from the TPP. - Resilience and sustainability have both emerged as key themes in recent conversations with Indo Pacific trading partners, Tai said. “I think that we are now really even more conscious than we were before about the need that our economies and our engagement with other economies needs to be supporting sustainability,” she remarked. Tai said another key is the issue of inclusion, to ensure that the most vulnerable and disadvantaged — both at home and abroad — are not left further behind as policymakers confront current challenges.

Competitiveness remains a focal point, including in the Indo Pacific effort, noted Tai. “I just want to underscore that, in terms of the framework that we're building out, we are working to set standards that promote fair and open competition,” she said. For ag, that means “commitments in our conversations to address some of the persistent challenges” on top trade hurdles faced by U.S. exporters relative to market access and regulatory and standards. India’s move to open its market to U.S. pork and pork products is one of the initial “couple of wins” to come out of that work, she added.

- The role of TIFAs. More broadly, Tai also discussed how work on trade and investment framework agreements (TIFAs) can serve as a foundation for collaboration and cooperation with trade partners. “I think we've got over 40 of them. Some of them are with individual economies and countries, some of them are with groupings,” she said. “A lot of the gains that we've made over the course of the last year in the Indo Pacific have come out of our agenda to intensify our TIFA engagement.”

- USMCA implementation: Implementation of the U.S.-Mexico-Canada Agreement (USMCA) remains a priority for USTR, and Tai commented on some of the latest efforts. She pointed to the U.S.’ win in a USMCA dispute panel challenge of Canada’s implementation of new dairy tariff rate quotas (TRQs) for the U.S., calling it “a really important victory for us to have in hand.” Seeing Canada abide by the decision will include partnering with USDA and the U.S. dairy sector, she detailed. However, Canada has yet to indicate how they are going to bring their system into compliance with USMCA.

Regarding Mexico, Tai emphasized the need for U.S. producers to have “clear regulatory signals” on biotech products. “Both you and I have raised our concerns with counterparts in Mexico City,” she recalled to Vilsack, and praised his relationship with his Mexican counterpart as paving the way for “more frank and more serious conversations” than might otherwise be possible. “This has been a very difficult issue area and I know our teams have been working very closely together — including with our industry stakeholders — to examine our options,” she related. - Vilsack on trade market development. During his keynote to the conference Thursday (Feb. 24), Vilsack touted his recent trade mission to the United Arab Emirates (UAE) and emphasized the region’s role as a gateway to the growing African market. Vilsack asked Tai what she viewed as key in building relationships with trade partners in Africa. The U.S. approach, she said, should “reinforce rather than undermine” efforts at economic integration underway across the continent, adding it must support African countries’ “own ambitions with respect to their development trajectory.”

Tai also pointed to the African Growth and Opportunity Act (AGOA) as another “foundational policy,” that should factor into engagement, namely how it “links up with programs and engagements” that go beyond that existing initiative. However, Tai did not mention the now-stalled trade talks between the U.S. and Kenya. - Climate change is a topic the Biden administration has indicated is an issue it wants addressed in policy work across the board. Because USTR is an economic agency, Tai said it is clear to her that “climate change is an economic force, that, unless we grapple with it, we're condemning ourselves to struggling” with resilience and related issues. “This is one of those issues that we really have to take head on,” she stressed.

The private sector also plays an important role relative to climate, noted Tai. “Increasingly, we see the private sector more forward leaning on some climate issues and climate initiatives and climate urgency than we see some governments,” she observed. “I think that reinforces the notion that … this is something that we cannot afford to ignore.”

Comments: It looks like the Biden administration is in no hurry to push a major new trade agreement via Congress. Before that can even be a possibility, the White House needs to ask Congress to reauthorize Trade Promotion Authority (TPA/fast track) by which Congress can vote on any new trade agreement proposals in an up or down vote without any amendments.

But one thing Vilsack and Tai are doing that makes sense: they are pushing a Biden administration goal to reduce U.S. reliance on exports to China, the biggest buyer of U.S. ag products. USDA earlier this month led a trade mission to Dubai, including Vilsack, marking the first such mission to any country since the onset of the Covid-19 pandemic. USDA officials say that countries like the UAE want to increase exposure to U.S. agricultural goods in response to supply-chain woes that set in during the Covid-19 pandemic. U.S. exports of grains to the UAE rose nearly 20% in 2021, surpassing $1 billion, according to the USDA. But that pales in comparison to the top importing countries as China, North American trading partners Canada and Mexico each import more than $20 billion in U.S. grains. “We need to diversify to decrease reliance on any one market,” Vilsack.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Rising food prices are emerging as a significant headwind to the economic recovery from the pandemic this year, particularly in developing countries where food accounts for an important share of household consumption, the Wall Street Journal reports (link). Russia’s invasion of Ukraine could make those headwinds even stronger. The price of basic staples such as wheat, corn and soybeans rose steeply last year, which would translate into higher grocery prices world-wide this year, economists said. Consumer food prices tend to lag behind commodity prices by several months. Even if food commodity inflation slows, as many forecasters expect, households will still face higher grocery bills in the months ahead.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 435,451,292 with 5,949,819 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 78,939,203 with 948,397 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 552,526,931 doses administered, 215,457,016 have been fully vaccinated, or 65.64% of the U.S. population.

— Two major studies point to a market in Wuhan, China, as the birthplace of the coronavirus pandemic. Scientists concluded that the coronavirus was very likely present in live mammals sold in the Huanan Seafood Wholesale Market, an object of early suspicion, in late 2019. They suggested that the virus twice spilled over into people working or shopping there and found no support for the so-called lab leak theory. The pair (link) of studies (link), released Saturday, have not yet been published in a scientific journal that would require peer review.

|

POLITICS & ELECTIONS |

— Ex-Attorney General William Barr urges GOP to look beyond Trump. Former Attorney General William Barr writes in a new book that former President Donald Trump has “shown he has neither the temperament nor persuasive powers to provide the kind of positive leadership that is needed,” and that it is time for Republicans to focus on rising new leaders in the party.

|

CONGRESS |

— House Minority Leader Kevin McCarthy has included Indiana Rep. Victoria Spartz in the party that will escort the president into the State of the Union. Spartz is Ukrainian-American.

|

OTHER ITEMS OF NOTE |

— North Korea launched a ballistic missile off the east coast of the Korean Peninsula yesterday -- an "undesirable" move for peace stabilization while the world is trying to resolve the Ukraine war, South Korea's National Security Council said in a statement. The launch is North Korea’s eighth test this year and comes nearly a month after Pyongyang fired what it claimed was its longest-range ballistic missile since 2017.