Russia Agrees to Talks with Ukraine, Impacting Several Markets, Including Ag Futures

Vilsack comments on food prices, fertilizer and China | Vilsack/USTR Tai on tap today

|

In Today’s Digital Newspaper |

The big geopolitical news today is word that Russia has agreed to talks with Ukraine, a development significantly impacting a host of markets, including ag commodities. On the domestic front, President Biden reportedly selected Ketanji Brown Jackson as the first Black woman selected for the nation’s top court.

|

MARKET FOCUS |

Equities today: Global stock markets were Asian equities finished mostly higher, buoyed in part by the major recovery in U.S. markets Thursday. The Nikkei was up 505.68 points, 1.95%, at 26,476.50. The Hang Seng Index bucked the trend, falling 134.38 points, 0.59%, at 22,767.18. European markets are also in positive territory, posting advances in early action. The Stoxx 600 was up 2.1% with gains of 1.5% to 2.5% in regional markets.

U.S. equities yesterday: The Dow slashed an 859-point loss, turning positive in a stunning market reversal after Russia invaded Ukraine. The other major indices eventually rose as well, with an impressive rise by the Nasdaq. The Dow ended up 92.07 points, 0.28%, at 33,223.83. The Nasdaq rose 436.10 points, 3.34%, at 13,473.59. The S&P 500 gained 63.20 points, 1.50%, at 4,288.70. (The Nasdaq’s comeback was remarkable, turning a 3.5% loss, and a brief fall into bear market territory, into a 3.3% gain. The last time the index was down more than 3% at its low but closed more than 3% higher was in November 2008, according to Dow Jones Market Data.)

On tap today:

• U.S. personal income for January is expected to fall 0.3% and consumer spending is forecast to rise 1.6% from the prior month. (8:30 a.m. ET)

• U.S. personal consumption expenditures price index excluding food and energy for January is expected to rise 0.5% from one month earlier and 5.1% from one year earlier. (8:30 a.m. ET) UPDATE: The key measure of inflation showed prices accelerating at the fastest level in nearly 39 years, the Commerce Department reported today. The core personal consumption expenditures price index, the Federal Reserve’s primary inflation gauge, rose 5.2% from a year ago, slightly more than the 5.1% estimate. It was the highest level since April 1983. Including food and energy prices, headline PCE was up 6.1%, the strongest gain since February 1982. On a monthly basis, core PCE rose 0.5%, in line with estimates, while the headline gain was up 0.6%. The same report showed that consumer spending accelerated faster than expected, rising 2.1% on the month against the 1.6% estimate. The spending increase reversed a 0.8% decline in December. Personal income was flat for the month, which was better than the expectation for a drop of 0.3%. The war in Ukraine promises to push prices even higher, putting pressure on the Fed to raise interest rates.

• U.S. durable goods orders for January are expected to rise 0.8% from the prior month. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• University of Michigan consumer sentiment index for February is expected to hold at 61.7, unchanged from a preliminary reading. (10 a.m. ET)

• U.S. pending-home sales for January are expected to rise 1% from the prior month. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Container ship operators are set to negotiate record-high freight contract rates. Yearlong freight contracts, which contribute up to three-quarters of annual revenue for ship operators, will largely be settled at the TPM conference in Long Beach, Calif., next week. The average price to move a 40-foot box from China to the U.S. West Coast is likely to be between $7,000 and $8,000, a record high for annual freight pacts and higher than last year’s average of around $5,500, the Wall Street Journal reports (link), citing a half-dozen executives of carriers and importers involved in the talks.

Sharply high ocean freight rates are unlikely to fall for several years. Panelists at the USDA Outlook Forum on Thursday (Feb. 24) agreed ocean shipping rates are likely to stay elevated for the near future. For bulk rates, the most important variable is oil prices and with elevated oil prices likely for the next few years, the ocean shipping rates are likely to stay high for the next two-to-four years, predicted William Wilson, North Dakota State University professor and CHS chair in Risk Management and Trading. Wilson, who spoke on a panel of experts discussing the effects of shipping disruptions on the ag supply chain, said rates will remain high until there’s more capacity in the system and/or energy prices start to moderate. This comes as the steamship industry has made “twice more in nine months than it’s made in the last 10 years combined” for “an unprecedented level of profitability,” said Walter Lanza, international commodity trader at Scoular. Lanza said the challenges the supply chain face include unclogging ports, tackling the chassis shortage, expanding the footprint of warehouses, and addressing the labor problem.

Federal Reserve governor Christopher Waller said he could support raising the central bank’s benchmark interest rate next month by a half-percentage point if economic data in the next few weeks show evidence of accelerating price pressure, adding his voice to the debate over the size of the likely increase. “We constantly say we have the tools to fight inflation, and now we must demonstrate the will to use them,” Waller said. Fed officials have in recent days signaled near-unanimous support to raise interest rates at their March 15-16 meeting despite the uncertainty created by Russia’s invasion of Ukraine. But most officials have said they would prefer to raise rates by the traditional quarter-percentage-point increment.

Mortgage rates hovered near 4% for a second week, up sharply from the start of the year, maintaining stress on potential buyers facing high prices and low inventory.

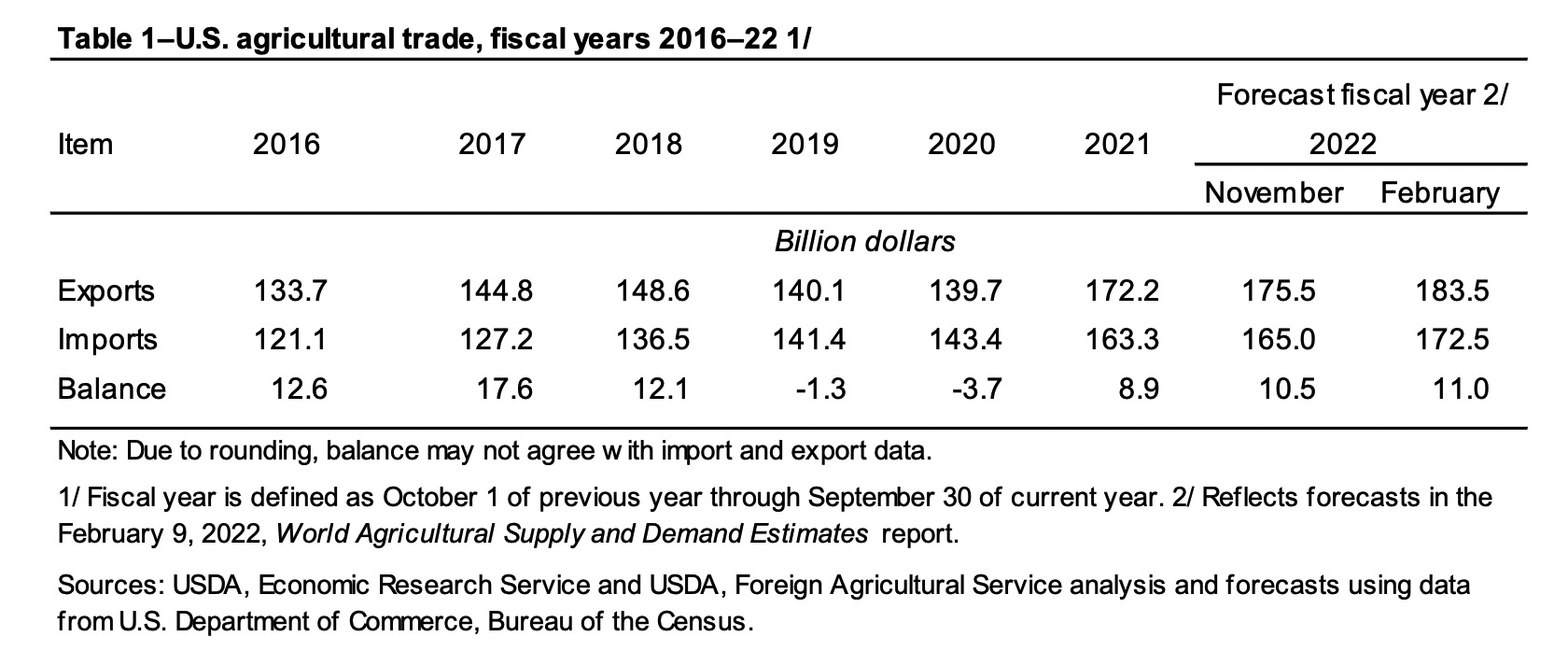

USDA raises FY 2022 ag export, import forecasts to new records. U.S. agricultural exports for fiscal year (FY) 2022 are now forecast at a record $183.5 billion while imports are also seen at a record mark of $172.5 billion which would result in a trade surplus of $11 billion, according to USDA’s Outlook for U.S. Agricultural Trade.

The increase in agricultural exports marks a rise of $8 billion from what would have been a record forecast in November of $175.5 billion.

Similarly, the import forecast is up $7.5 billion from the November forecast of $165 billion which also would have been a new record.

In FY 2021, U.S. agricultural exports totaled $172.2 billion against imports of $163.3 billion—both records—which left a trade surplus of $8.9 billion.

Increased oilseed exports one key. USDA now expects that oilseed/product exports will be even stronger than they forecast in November, with soybean exports put at $31.3 billion, up $2.9 billion from the prior outlook. “Adverse weather in South America is reducing global soybean supplies and supporting prices, more than enough to offset lower import demand from major buyers such as China,” USDA noted.

Grain and feed exports are also seen up versus the November outlook, with USDA now seeing them at $42.9 billion, up $1.4 billion from the prior outlook. Much of the rise is chalked up to wheat and feed and fodder exports.

Other crops are contributing to the record outlook, with horticultural products at $38.5 billion, up $800 million from the prior outlook, “partly driven by a record tree nut export projection.”

Livestock, poultry, and dairy exports are forecast at a record $39.2 billion, USDA said, up $500 million from their previous forecast, with “gains in beef and dairy more than offsetting declines in pork.”

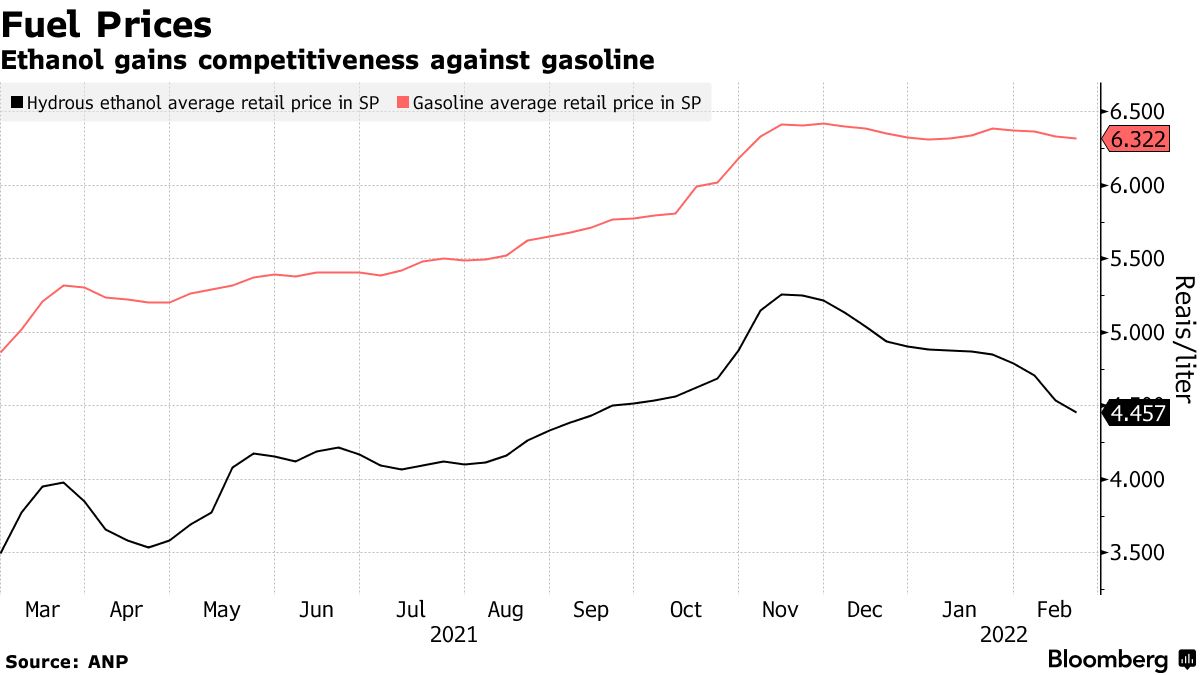

USDA still sees ethanol exports at $2.9 billion which would still be a record amount. “Compared with the previous year, elevated U.S. corn and crude oil prices support higher ethanol unit values, driving export value higher,” USDA detailed. “Export volume is expected to rise modestly surpassing the previous year’s low but remain well shy of the 2018 peak largely due to sharply lower sales to Brazil and absence of trade with China. Higher fuel prices constrain demand in the Philippines and Colombia, both price-sensitive markets.”

Who are the main customers of U.S. exports? The export forecast for China is unchanged at $36.0 billion and is up from the FY 2021 result of $33.6 billion. China is forecast to remain the largest U.S. agricultural market. “While China pork demand has softened on recovering pig herds, the losses are more than made up on extremely strong beef and poultry demand that surged in 2021, which is expected to continue through 2022,” USDA Chief Economist Seth Meyer said.

Forecast exports to Japan are up $1.2 billion to $14.8 billion, largely due to higher corn and beef exports.

The export forecast for Canada is up $2.0 billion at $26.0 billion, “largely driven by strong first-quarter performance of corn and ethanol. “

But Mexico has now muscled its way into the number two position for U.S. agricultural exports. USDA now forecasts them at $27 billion, up $3.5 billion from their prior outlook and up from $23.88 billion for FY 2021. The higher outlook for Mexico, USDA noted, is on “surging exports of corn, soybeans, dairy, and pork products to date.”

Some challenges have surfaced. Despite forecasting records for U.S. agricultural exports, Meyer indicated that there are clearly “headwinds” that confront the sector. “Containerized shipping, which makes up more 35% of the value of U.S. agricultural exports, continues to face disruptions in 2022,” he observed. “An unprecedented rise in imports of non-agricultural goods from Asia through the pandemic period led to a surge in shipping rates and backlogged West Coast ports. U.S. containerized agricultural exports, which are forced to compete with much higher Asia-to-U.S. shipping rates, faced reduced carrier service for key export routes resulting in higher levels of empty containers being sent back to Asia.”

Meyer noted the situation has hit U.S. agricultural exports to Southeast Asia and East Asia, except for China, and “markets have been particularly impacted, with containerized shipment volumes down more than 20% over the 2nd half of 2021. We know this will be an ongoing issue for 2022.”

Perspective: The shift higher in forecast U.S. agricultural imports is not surprising with FY 2022 starting with one fresh monthly record in November and both October and December showing strong readings. The rise in forecast exports is potentially surprising, but there has been an uptick in shipments of various products and sales on the books for various commodities that point to strong results in the months ahead in terms of actual exports.

To meet these updated forecasts, U.S. agricultural exports need to be $14.54 billion per month for January-September. But during FY 2021, U.S. agricultural exports only topped those levels three months over the January-September period in 2021.

As for imports, they would have to average $14.18 billion per month to meet the updated USDA forecast. And in January-September 2021, imports topped that level five months.

And now we have another factor thrown in the mix in the form of the Russian invasion of Ukraine. If that starts to affect commodity flows around the world, it could steer business toward the U.S. for products like wheat and vegoils. USDA’s Meyer acknowledged this in his comments. “Although we may expect global and regional grain markets to reorient to alternative suppliers and markets which may limit direct effects on U.S. agricultural exports, short-term broader macro effects would reverberate through the global economy depending on the severity and duration of the conflict,” he cautioned. “Additionally, interlinkages through fertilizer and energy markets could have knock-on effects for agricultural producers across the world.” Translation: These forecasts are likely to change in the months ahead with the next update due May 26.

Market perspectives:

• Outside markets: The U.S. dollar index has shifted lower amid a rise in several foreign currencies against the greenback. The yield on the 10-year US Treasury note has firmed to trade above 2% with a higher tone in global government bond yields. Gold and silver futures are seeing selling pressure in electronic trading, with gold under $1,898 per troy ounce and silver under $24.18 per troy ounce.

• Volatility continues in crude oil futures as contracts have again turned higher after hitting $100 per barrel again in overnight action only to drop back into negative territory. U.S. crude has moved above $93.35 and Brent above $95.65 per barrel as U.S. trading nears.

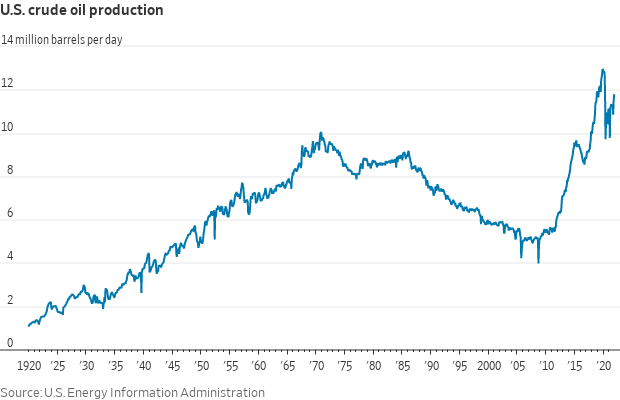

• U.S. oil companies and their investors are reluctant to drill too much, too quickly after an oil-market crash starting in 2014 that caused prices to fall below the level needed for many U.S. wells to turn a profit. Oil output in the U.S. is failing to keep up with demand as a result.

• Ethanol sales are soaring in Brazil as drivers turn to biofuel, a trend that may be strengthened by Russia’s invasion of Ukraine as the conflict is likely to drive gasoline prices higher. Link to more via Bloomberg.

• USDA daily export sales

— 334,000 MT soybeans received in the reporting period for delivery to China in MY 2022-23;

— 285,000 MT of soybeans to unknown destinations — 159,000 MT during 2021-22 and 126,000 during 2022-23.

• Ag demand: Taiwan passed on a tender to buy up to 65,000 MT of corn due to offered prices being too high.

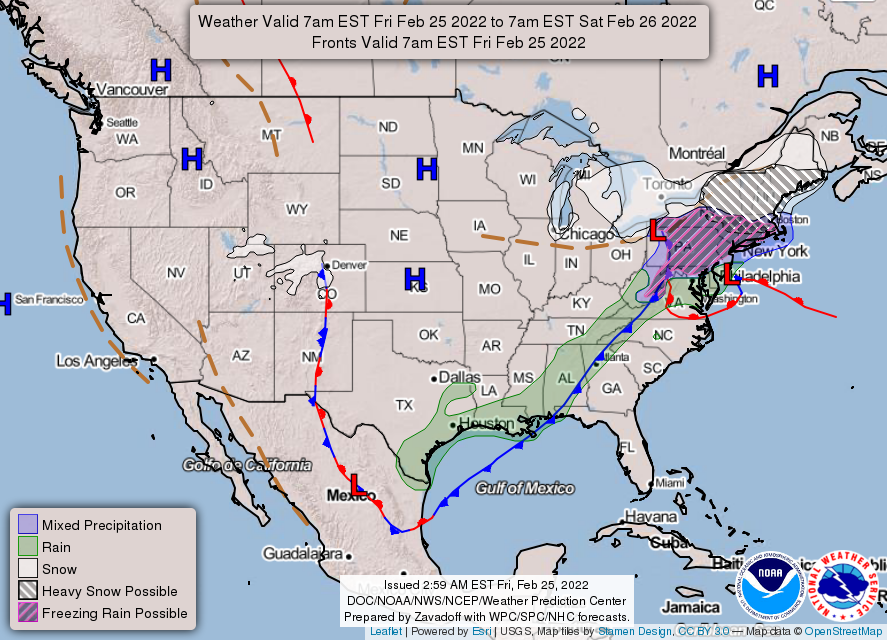

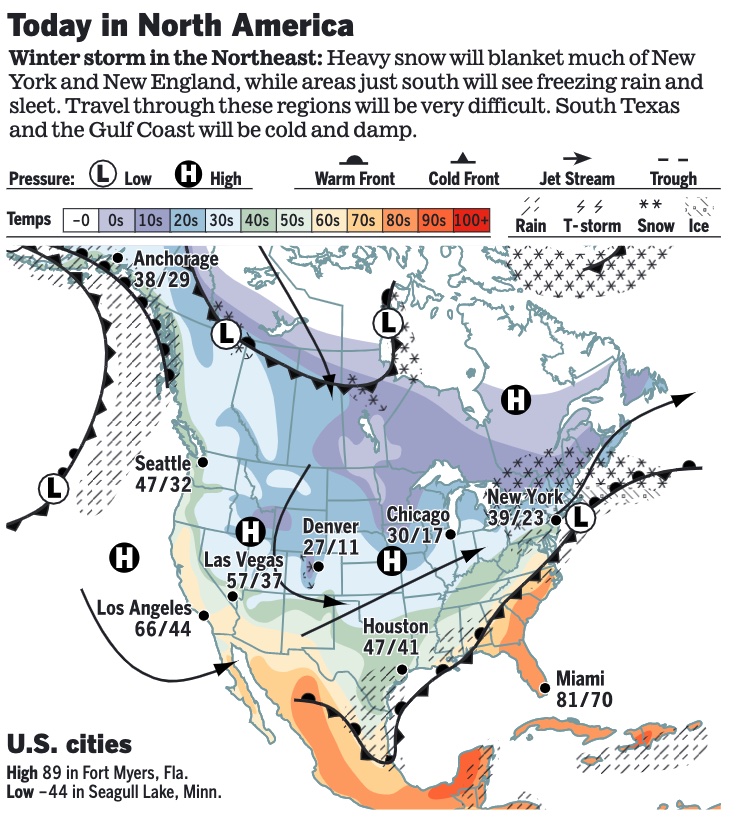

• NWS weather: A Major Winter Storm impacting areas from the Great Lakes into the Northeast except northern Maine today... ...Heavy rain threat over the interior eastern U.S. early today will give way to fine and cold conditions over the weekend... ...Increasing chance of precipitation moving into Texas and Deep South this weekend as well as over the Pacific Northwest.

Items in Pro Farmer's First Thing Today include:

• Grain, soy markets sharply lower overnight

• China to step up policy support for economy... see China section below for details

• Cattle on Feed Report out this afternoon

• Cash cattle prices weaken

• Key day for hog futures

|

RUSSIA/UKRAINE |

— Russia says it agrees to talks with Ukraine. The Kremlin today agreed to talks with Kyiv, saying Moscow was willing to send a delegation to the Belarusian capital, Minsk, Dow Jones reported. "In response to [Ukrainian President Volodymyr] Zelensky's offer, Vladimir Putin is ready to send to Minsk a Russian delegation," Kremlin spokesman Dmitry Peskov told reporters, according to Russian news agencies, saying that representatives would include officials from the defense and foreign ministries as well as the president's office. In a video statement earlier Friday, Ukrainian President Zelensky called on Russian President Putin to meet for talks. "I would like to address the president of the Russian Federation once again. Fighting is going on all over Ukraine. Let's sit down at the negotiating table to stop the death of people," he said in Russian in a video published on his Telegram channel.

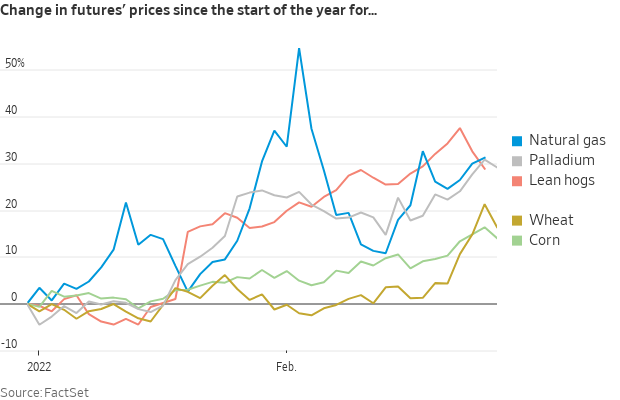

Ag market impact: Corn has mostly erased all of Wed./Thurs. gains while wheat may trade limit down, analysts signal. This could dramatically dampen concerns, but those could quickly rise again if the talks do not result in a halt of military action by Russia.

— President Joe Biden on Thursday announced “severe sanctions” and export controls against Russia, boosted U.S. troops in Europe, and outlined a contingency plan for releasing strategic oil reserves in a speech at the White House. "Putin is the aggressor. Putin chose this war. And now he and his country will bear the consequences," Biden said, adding that the invasion would turn Vladimir Putin into an international “pariah.” Meanwhile, lawmakers are mulling military and humanitarian aid for Ukraine, as Russian troops closed in on the Ukrainian capital of Kyiv and the city came under renewed bombing

- Biden announced that the U.S. will sanction Sberbank — Russia’s largest lender — and four other financial institutions that represent an estimated $1 trillion in assets, as well as a broad swath of Russian elites and their family members. The sanctions include VTB and Biden placed restrictions on 13 Russian entities, including Russia's state-owned oil and gas firm Gazprom, that bar them from raising new debt denominated in dollars with a maturity beyond 14 days. Seven Russian elites and their family members who hold some of the highest positions of power in the country will also be sanctioned. (Much of that wealth is stored abroad.) The Wall Street Journal, in an editorial, said the place to begin is the Navalny 35, a list of Russian elites compiled by dissident Alexei Navalny’s organization. These names include influential media, business, political and security figures “who play key roles in aiding and abetting Putin,” according to the Navalny group. First on the Navalny list is Roman Abramovich, “a well-known figure with significant assets in the West. He is best known as the owner of Chelsea Football Club in the English Premier League, and his deep ties to the U.K. are a reminder of London’s role as a sanctuary for Russian assets. Abramovich hasn’t been sanctioned, and he has denied that he has done anything to warrant them.”

"The sanctions we imposed exceed anything that’s ever been done,” Biden said. “The sanctions we imposed have generated two-thirds of the world joining us. They are profound sanctions.” - Biden said there is "a complete rupture right now in U.S. and Russia relations" and that sanctioning Russian President Vladimir Putin himself remains on the table. The Financial Times reported today that the EU is preparing to freeze the assets of Putin and his foreign minister Sergei Lavrov under a new sanctions package, citing four people familiar with the matter.

- The U.S. will also implement export controls designed to cut Russia off from semiconductors and other advanced technology crucial to the military, biotechnology, and aerospace sectors. Rules allow the U.S. to restrict exports to Russia from anywhere in the world using American technology, including software. The U.S. also plans to impose restrictions on Russia’s largest state-owned enterprises, blocking them from fund-raising from U.S. and European investors, Biden said.

- Of note, the U.S. and its allies will not bar Russia from the Swift international banking network because Europe (especially Germany and Italy) does not want to undertake that action, Biden said. But the sanctions imposed on major Russian banks should have a similar effect and limit Russia’s ability to do business in dollars, Euros, and pounds, he said. “The sanctions that we proposed on all their banks have an equal consequence, maybe more consequence than Swift, number one,” Biden said. “It is always an option, but right now that’s not the position the rest of Europe wishes to take.” (Some observers wonder why Biden did not announce sanctions on Russia’s central bank.)

Background: The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, is a global financial messaging network that connects more than 11,000 banks. Ukrainian officials, including the country’s president, had been vocal in urging Biden to block Russia from SWIFT, an action analysts say would have devastating consequences for Russia’s economy. The White House avoided that step because it could lead to a rise in global energy prices, according to an administration official who spoke on condition of anonymity to discuss sensitive internal deliberations. Putin has accumulated $640 billion in hard currency reserves, which buys him a certain amount of insulation. Severing the world’s 12th-largest economy from the financial system could harm Western business and benefit China, the Wall Street Journal reported (link). Russia and China have been working on their own alternative to Swift. China’s Cross-Border Inter-Bank Payments System would enable the two countries, which share a 2,600-mile border, to bypass SWIFT.

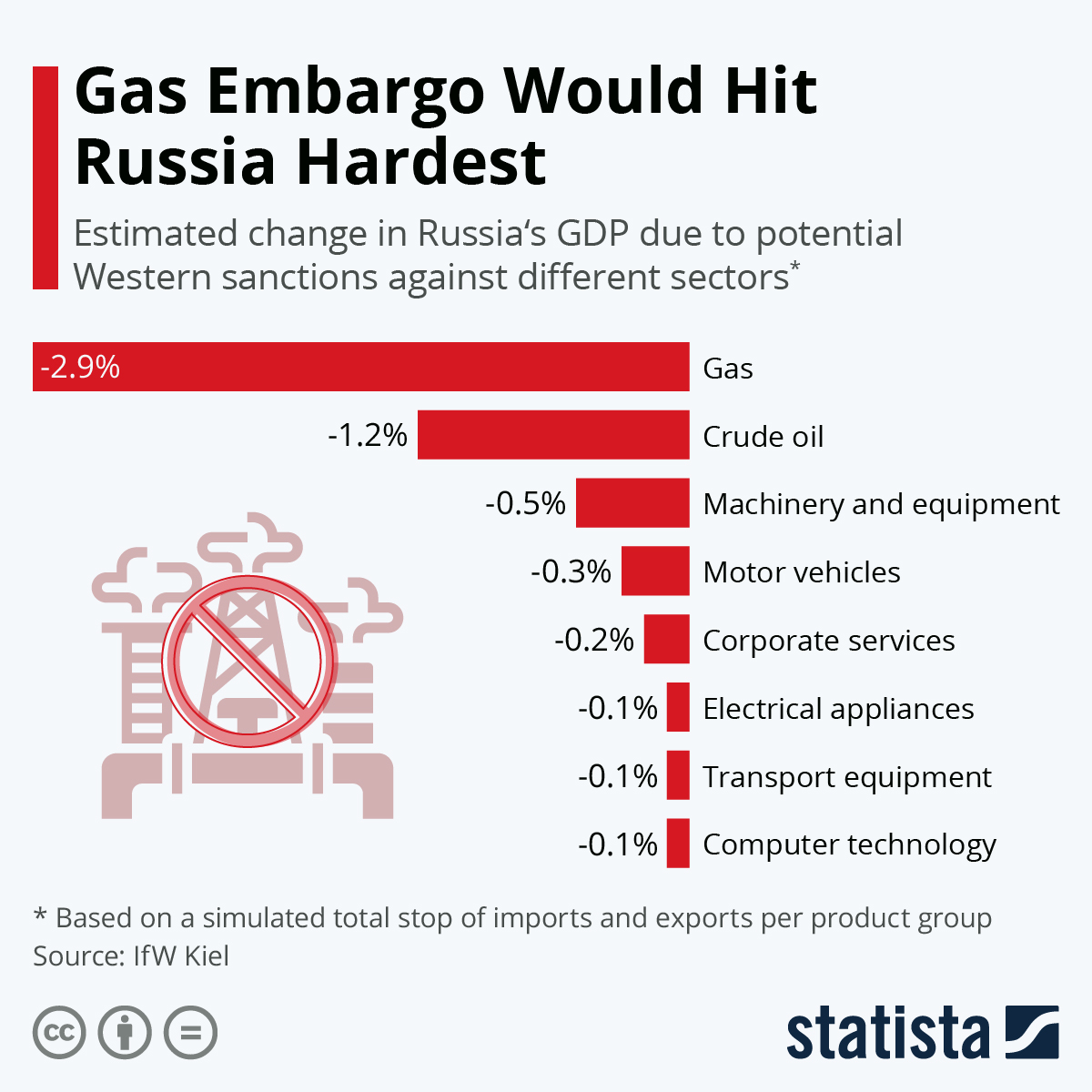

Germany comments: Suspending Russia from the SWIFT global interbank payments system, the international banking communication infrastructure that enables cross-border money flows, would be technically difficult to arrange and would have a massive impact on transactions for Germany and German businesses in Russia, a German government spokesperson said. Germany was one of the leading voices against blocking Russia from SWIFT, which is a key geopolitical tool and would inflict heavy economic pain on country. Germany's opposition focuses on the ability of its utilities to pay Russia's Gazprom for imports of natural gas, a situation they fear could cause Russia to turn off those supplies, key since more than 40% of German gas supplies come from Russia.

Disagreements on whether to oust a country from SWIFT have surfaced before. The most recent case occurred in 2018, when the Trump administration sought to cut off the access of Iran (Europe eventually went along with the ban due to fears of being in violation of sanctions against the country). In terms of a SWIFT ban on Russia, its effectiveness is debated among economists. Some say it's an overhyped tool that could backfire or result in stronger ties with China, while others say it has the potential to shrink Russia's GDP by as much as 5%.

Link to more info on SWIFT via the New York Times.

- EU leaders are discussing a sanctions plan that would restrict Russia’s access to Europe’s financial sector, as well as key technologies, according to people familiar with the matter. Meanwhile, Prime Minister Boris Johnson unveiled a tough package of penalties including an asset freeze against all major Russian banks and a plan to ban Russian companies from raising finance on U.K. markets.

- The U.S. is sending about 7,000 additional service members to Germany. The armored brigade combat team, with associated capabilities, is aimed at reassuring allies in NATO and deterring Russian aggression and will depart for the assignment in coming days, according to a top defense official.

- Russia’s multi-year push to remove the dollar’s hold over its economy and financial markets has so far helped ease the impact of sanctions. The nation slashed its dollar reserves to just 16% of the central bank’s stockpile in 2021, down from more than 40% just four years prior.

- Warner: Russian cyberattacks on NATO targets could constitute Article 5 violation. In an interview on MSNBC’s Morning Joe, Sen. Mark Warner (D-Va.), the chairman of the Senate Intelligence Committee, said, “The two gravest immediate concerns I have is if Russia launches its full cyberattacks, further against Ukraine. Those cyberattacks, once you unleash them, know geographic boundaries. We have reports that system of the cyberattacks launched again Ukraine have had results already in Latvia and Lithuania. If the Russian decide to shut down all the power in Ukraine and that suddenly shuts down the power in eastern Poland, where our troops are, you are getting pretty close to what can be an Article 5 violation. ... We can then see Putin actually launch cyberattacks directly against the west, and against the United States. We are in uncharted territory, and I think we all ought to buckle up.”

"About six years ago, five years ago, there was an attack...Russia launched against Ukraine that ended up hitting American, European, and even Russian assets, cost billions of dollars. That was one piece of malware. If Russia launches 100 pieces, 1000 pieces of malware out in an attack against NATO, or even against Ukraine that might bleed into NATO nations, we are in totally unpredictable territory,” Warner told CBS This Morning. In an appearance on CNN, Warner was asked if he believes Russia’s “goal [is] to topple the Ukrainian government.” Warner said, “I think it goes beyond toppling the Ukrainian government. I think Putin has an insatiable appetite. He wants to reconstitute the former Soviet Union in many ways. ... I wish — and we had urged — the Ukrainians to mobilize their forces much earlier. President Zelensky actually only mobilized all of the reserves in the last 48 hours, that has been unfortunately too late.” - China declines to characterize Russian offensive as an “invasion.” Reuters reports that the gov’t of China “rejected calling Russia’s moves on Ukraine an ‘invasion’ and urged all sides to exercise restraint, even as it advised its citizens there to stay home or at least take the precaution of displaying a Chinese flag if they needed to drive anywhere. ... “China is closely monitoring the latest situation. We call on all sides to exercise restraint to prevent the situation from getting out of control,” said Hua Chunying, spokesperson at China’s foreign ministry.” Reuters adds that “at a packed daily media briefing in Beijing, Hua bridled at journalists’ characterization of Russia’s actions. “This is perhaps a difference between China and you Westerners. We won’t go rushing to a conclusion,” she said. Hua is quoted as saying, “Regarding the definition of an invasion, I think we should go back to how to view the current situation in Ukraine. The Ukrainian issue has other very complicated historical background that has continued today. It may not be what everyone wants to see.” CNBC reports on its website that Hua “was asked by reporters several times whether she would call Russia’s attacks an invasion, but she repeatedly avoided giving a yes or no answer.” According to CNBC, “In response to one reporter, Hua appeared to express frustration at the question and said, ‘The U.S. has been fueling the flame, fanning up the flame, how do they want to put out the fire?’”

Perspective: China, which rebuffed U.S. efforts to help avert the invasion, has refrained from publicly criticizing Putin, including after a call between Xi Jinping and Putin today. Experts worry that Beijing is ready to help soften the blow of sanctions, and has grown emboldened by the lack of a united Western response to Putin’s move, the New York Times reports. Taiwan said it has already had to warn off more Chinese fighter jets entering its airspace. As with Russia's 2014 invasion of Crimea, it remains possible that China will refuse to recognize any territorial gains Russia makes from this invasion. Meanwhile, other Western allies, like India and Israel, have also refrained from harsh criticism of Russia, suggesting that the U.S.-led alliance is far from united.

— Russian airstrikes continued to hit Ukraine sights overnight. Russian forces captured the Chernobyl power plant north of Kyiv, site of the 1986 nuclear disaster — the White House said it had credible reports that Russian soldiers were holding staff at the nuclear site as hostages. Explosions were reported in Kyiv, Kharkiv and elsewhere. At least 40 Ukrainian troops were killed in the fighting, the Ukrainian ambassador to the U.S. said, along with “dozens” of civilians. She pleaded for help. Russia has failed to take any of its main objectives in the first wave of the attack, said U.K. Defense Secretary Ben Wallace. “It is behind its hoped-for timetable,” he said, adding that Russia had lost 450 personnel during the offensive.

— Market impacts:

- Global impacts: Increases in commodity prices could raise inflation in Europe and the U.S. by as much as 1.5 percentage points in the next few months, Capital Economics, a research firm, said. Parts of the Middle East and Africa receive most of their wheat from Russia and Ukraine, and restrictions could prompt concerns about social unrest.

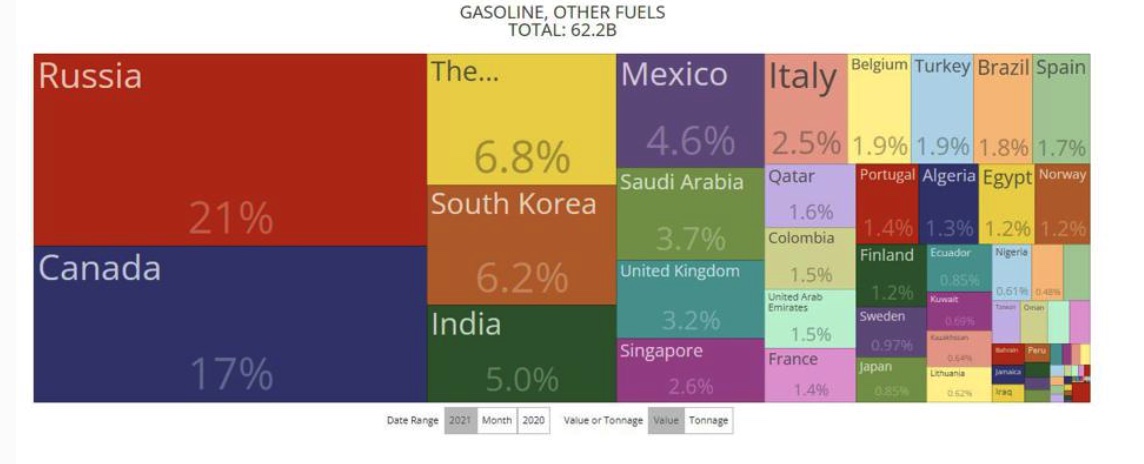

- U.S. stocks staged a furious comeback Thursday as investors piled into growth and technology stocks in the wake of Russia’s invasion of Ukraine. The Russian ruble weakened to a record low, declining 4.5% against the dollar, while the MOEX benchmark for Russian stocks tumbled by about a third. The Russian central bank said it would intervene in the foreign-exchange market and banned short selling. Various explanations for the surprising comeback for U.S. equities were presented, from oversold markets to a belief that sanctions against Russia would not impact its oil sales, including those to the United States (although the EU did announce a ban on exports needed to upgrade the country’s oil refineries early today). The U.S. imported more gasoline and other refined petroleum products from Russia than any other country in 2021. In 2021, Russia accounted for 21% of all U.S. gasoline imports, with Canada second at 17%. By value, Russian imports increased 71.05%, which is slightly less than overall imports, which increased 80.53%. The Russian total was $12.78 billion. The U.S. exported $84.94 billion of gasoline and other refined petroleum products in 2021, or about six times as much as those Russian imports.

- Natural-gas futures in Europe surged 50%. Benchmark prices for aluminum and nickel, two metals of which Russia is a major producer, rose to their highest levels in about a decade.

- Russian oil exports. Russia exports about 5 million barrels a day of crude, roughly 12% of global trade, and about 2.5 million barrels a day of petroleum products, some 10% of global trade, according to investment bank Cowen Inc. About 60% of Russia’s oil exports go to Europe and 30% to China. J.P. Morgan estimates that if 2.3 million barrels a day come off the global market, that would push oil prices up to $150 a barrel and push global consumer-price inflation up 7% at midyear, compared with the 5% projection in J.P. Morgan’s baseline forecast. Increased supplies from Iran might offset some of that risk.

Russia also exports about 23 billion cubic feet of gas a day, about 25% of global trade, and 85% of that gas goes to Europe, according to Cowen. Some of that goes through a pipeline network that runs through Ukraine. The network transports about 4 billion cubic feet a day at full capacity to Europe, but is currently flowing at about 50% of capacity, according to Cowen. Natural-gas futures contracts on the CBOE are up more than 60% from a year earlier.

- Wheat and corn futures advanced to multiyear highs, since both Russia and Ukraine are major grain producers. However, as previously noted, corn and wheat futures are down hard today on word Putin wants to talk with Ukraine.

- WSJ report: U.S. agriculture companies operating in Ukraine are closing offices and shuttering facilities there in response to Russia’s attack. WSJ details:

— Archer Daniels Midland Co. said Thursday that it had stopped operating its facilities in Ukraine, where, a company spokeswoman said, the crop trader and processor employs more than 630 people. ADM’s Ukraine facilities include an oilseed crushing plant in Chornomorsk, a grain terminal in the port of Odessa, six grain silos and a trading office in Kyiv.

— Bunge Ltd. closed company offices as well as temporarily suspended operations at processing facilities in two cities in Ukraine, the company said Thursday. Bunge employs more than a thousand workers in Ukraine who operate two processing facilities as well as grain elevators and a grain export terminal in various parts of the country.

— CHS Inc., a farm cooperative and major grain shipper and retailer of seeds and chemicals, said it has been drawing down its export activity in Ukraine for the past few weeks. It employs 46 people in the region but doesn't own port operations in the country.

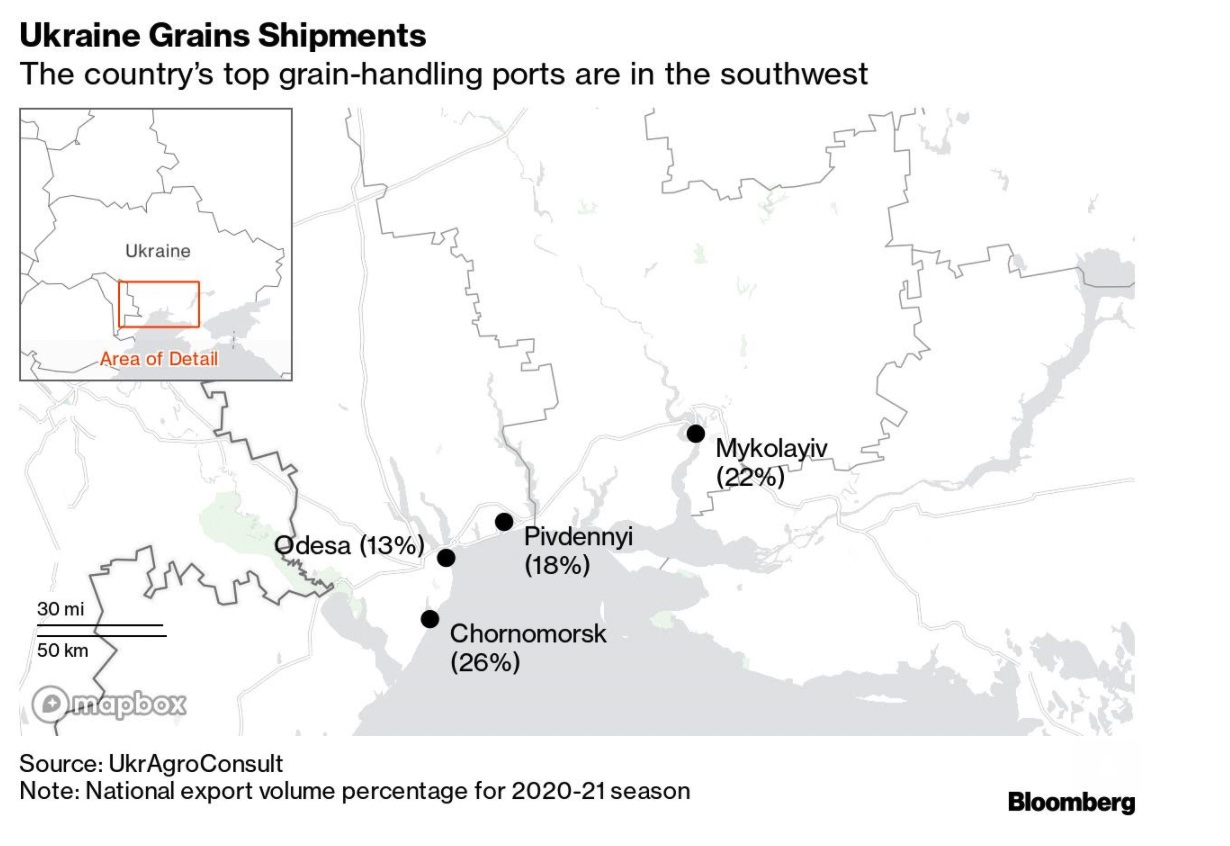

Perspective: Ports are dotted along the Sea of Azov — which is connected to the Black Sea by a strait that runs between Russia and Crimea, which Russia annexed in 2014 — and on the Black Sea coast further west. The southwestern ports of Odesa, Pivdennyi, Mykolayiv and Chornomorsk handle almost 80% of Ukraine’s grain exports, according to researcher UkrAgroConsult.

- Biggest immediate impact on supply chains has been in the shipping sector, particularly bulk and tanker operations. Germany’s Hamburger Hafen und Logistik, which runs a large container terminal at Odessa, said Ukrainian authorities closed the port. Commercial shipping in and out of Ukraine has largely stopped, the Wall Street Journal reports, with Kyiv warning ships to stay clear of the Sea of Azov. The sea connects to the Black Sea and is a key transit corridor for oil produced in Russia headed to European markets. One vessel, a Turkish-owned ultramax bulk ship, was hit by a bomb shortly after departing Odessa, highlighting concerns that the conflict could disrupt vital shipping routes that carry much of the world's wheat and other agricultural products. TradeWinds magazine reported (link) that the Yasa Jupiter was under charter to commodities trade Cargill.

- Gold, which like U.S. Treasury bonds typically rallies in times of stress, rose in price. The front month gold futures contract rose $15.90 per troy ounce, or 0.8%, to $1,925.10.

|

POLICY FOCUS |

— USDA’s Vilsack touches on Russia, food prices and China in Outlook Forum remarks, presser. USDA Secretary Tom Vilsack wanted to use his address to the department’s Outlook Forum to tout the administration’s agriculture agenda. While his prepared remarks did just that, his session with reporters was not surprisingly marked by questions over the Russian invasion of Ukraine.

Vilsack said it was “too early to tell” what the impacts will be from the Russian invasion, pointing to comments from USDA Chief Economist Seth Meyer that noted the importance Russia and Ukraine play in global grain trade. But sanctions against Russia could have an impact, Vilsack acknowledged, including how Russia responds and what “disruptions, if any, occur” and what steps the U.S. might take to “provide help and assistance.”

He also downplayed the potential for the situation to affect food prices for U.S. consumers, saying it was “still a little too early” to speculate on impacts in Europe. But he did not see a situation where “American consumers on the food side are necessarily going see the kind of impact and effect that the European consumers will see.”

As for China, Vilsack predicted an increase in agricultural exports to China compared with 2021. “There's a demand that continues to grow in that country,” he said, but added the U.S. will not relent on its push for more transparency from China on its vast ag marketplace. “We're going to make sure that we continue to look for ways in which we can encourage greater transparency, a set of rules that we all can live by so that we have competence and faith in the market.” As for the Phase 1 agreement, Vilsack told reporters the first step is assessing compliance with the existing deal. The administration’s view is that “before you can get to a next phase, you've got to make sure that the first phase is completed satisfactorily,” which he said is not yet the case.

|

PERSONNEL |

— Ketanji Brown Jackson is the first Black woman selected for the nation’s top court. President Biden decided on his nominee for the Supreme Court to replace the retiring Justice Stephen Breyer. Biden selected D.C. Circuit Court of Appeals Judge Ketanji Brown Jackson as his nominee, making history by picking a Black woman for the nation’s highest court, two sources familiar with the situation told Politico. Jackson, 51, has long been considered the leading contender for the post, particularly after Biden elevated her last year from the trial court bench to the appeals court seen as second in power only to the Supreme Court.

|

CHINA UPDATE |

— China to step up policy support for economy. China will step up policy support to stabilize the economy, Xinhua news reported, quoting the Politburo, a top decision-making body of the Communist Party. Beijing will implement a strategy to expand domestic demand and promote steady growth in foreign trade and foreign investment. China aims to fend off systemic risks and safeguard financial stability, seeking to combine fighting corruption in the financial sector with preventing risks.

— China’s sow herd declines, still up from year-ago. China’s sow herd fell 0.9% during January to 42.9 million head, though that was still up 2% from last year, according to the country’s ag ministry. The country’s hog slaughter totaled 28.5 million head during January, down 1.7% from December, but up 45.9% from last year.

— Soybean sales key in weekly business with China. Sales of old- and new-crop soybeans to China marked much of the activity in the week ended Feb.17, according to USDA. Weekly activity for 2021-22 included net sales of 11,242 tonnes of corn, 125,453 tonnes of sorghum, 291,379 tonnes of soybeans, and 91,957 running bales of upland cotton. For 2022-23, sales of 601,000 tonnes of soybeans were reported. Weekly activity for 2022 included net sales of 1,870 tonnes of beef and 334 tonnes of pork.

|

TRADE POLICY |

— Attention on USTR Tai. USDA Secretary Tom Vilsack will host U.S. Trade Representative Katherine Tai at the USDA Outlook Forum today, where attention will mostly be on the situation with China and the trade prospects there, especially linked to the Phase 1 agreement. Keys will be whether she discusses potential action the U.S. could take as China has not lived up to terms of the deal, but she will most likely indicate the U.S. is engaging with China to press them to live up to their commitments.

|

ENERGY & CLIMATE CHANGE |

— Biofuels outlook ‘bright’ from renewable jet fuel demand: Vilsack. USDA Secretary Tom Vilsack said the U.S. biofuels industry has a “bright, positive future,” especially in the burgeoning market for sustainable jet fuel. “We’re going to continue to look for ways to promote this industry, but we’re also excited about the grand challenge to focus on the aviation industry that currently wants, needs biofuel,” Vilsack said Thursday while addressing USDA’s Ag Outlook Forum. USDA chief economist Seth Meyer, also speaking at the conference, noted that EPA’s proposed biofuel blending mandate for 2022 could finally lead the corn-based ethanol industry to achieve 15 billion gallons of blending into the national gasoline supply.

— Climate envoy John Kerry comments on Russian war and climate change. Former U.S. Secretary of State John Kerry warned in an interview this week about “massive emissions consequences” from a Russian war against Ukraine, which he also said would be a distraction from work on climate change. Nevertheless, he added, “I hope President Putin will help us to stay on track with respect to what we need to do for the climate.”

— Carbon Costs and a court ruling. A federal judge temporarily blocked the Biden administration from increasing a metric that assigns a dollar value to the harm caused by greenhouse-gas emissions, a ruling that could delay lease sales and permits for drilling on federal lands.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Bird flu confirmations in additional commercial and backyard flocks. USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed the presence of H5N1 highly pathogenic avian influenza (HPAI) in two commercial turkey flocks in Greene County, Indiana, and in backyard flocks in Kalamazoo County, Michigan (mixed species, non-poultry) and Knox County, Maine (pet chickens, non-poultry), the second confirmed backyard find in Maine. There are now seven confirmed commercial operations with HPAI in Indiana, Delaware, and Kentucky, and five backyard flocks in Virginia, Maine, New York, and Michigan. More countries have added restrictions on poultry/products from Delaware.

— USDA’s Meyer does not cite concentration as factor for higher food prices. The Biden administration, including USDA Secretary Tom Vilsack, has been citing concentration in the U.S. meat industry in particular as a factor that has helped push meat prices higher for consumers. USDA Chief Economist Seth Meyer opened the USDA Outlook Forum by setting the economic stage for U.S. agriculture. In terms of food price inflation, Meyer noted food prices were up around 7%, with several factors contributing to the increase. “The drivers of these rising prices are extremely complex, including strong domestic and foreign demand, labor challenges, short-term supply chain constraints as well as geopolitical uncertainties that are driving up the prices of energy and raw materials, directly impacting the production costs of many goods,” Meyer explained. “Additionally, weather-related agricultural production shortfalls in many parts of the world put upward pressure on commodity and food prices.”

Meyer noted that in early 2021, “food price inflation was most heavily concentrated in meat products, but this has since broadened across the food sector with bakery, cereals, horticulture, dairy, packaged and processed food items experiencing very significantly levels of inflation in the last quarter.”

Missing from Meyer’s assessment of the causes is concentration in the U.S. meat sector that the Biden administration has been pushing as a cause. Economists at USDA’s Economic Research Service (ERS) will update their food price forecasts today and in their monthly updates in late 2021, they did mention the potential for concentration to have been a factor but have since removed that from their commentary. Question some are asking: Where is Vilsack getting this evidence of concentration affecting food prices when his top economist doesn't mention it at all.

— USDA provides funding for expanded meat and poultry processing. USDA announced on Feb. 24 that it is making available up to $215 million in grants to expand meat and poultry processing capacity. Link for details.

— Hog producer deadline extended. Hog producers will have an additional seven weeks, until April 15, to apply for coronavirus aid if they sold pigs for low prices on the cash market during the worst of the pandemic in 2020. Link for details.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 431,651,204 with 5,929,766 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 78,799,264 with 944,831 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 551,855,907 doses administered, 215,253,201 have been fully vaccinated, or 65.57% of the U.S. population.

— U.S. vaccinations plummet to slowest pace. The pace of Covid-19 shots in the U.S. has plummeted to the lowest level since the start of the vaccination campaign, the latest sign that the nation may be nearing maximum uptake. The seven-day average of shots administered fell to 337,874 on Feb. 18, the lowest since December 2020, when vaccine distribution had just begun. At the peak of the U.S. campaign, in April 2021, about 3.5 million shots a day were being given.

— Moderna sees fourth Covid-19 vaccine dose this fall. Moderna’s chief medical officer, Dr. Paul Burton, told investors the company “firmly” believes a fourth Covid-19 vaccine dose will be needed by the fall of 2022 to protect against waning vaccine effectiveness. He said the boosters would need to protect specifically against the Omicron and Delta coronavirus variants. Moderna’s president, Dr. Stephen Hoge, said the company is testing different boosters for the fall, including combining its original vaccine with an Omicron-specific formula.

— Biden administration is expected to announce significant changes to its federal mask-wearing guidelines today, revised recommendations that mean most people will no longer have to wear masks in indoor public settings, the Associated Press reported, citing sources familiar with the matter.

|

POLITICS & ELECTIONS |

— North Carolina Supreme Court says congressional maps are final. North Carolina’s highest court has thrown out challenges to a short-term congressional redistricting plan, finalizing lines that will be used for just one election cycle. The state Supreme Court dismissed challenges to the map. It creates seven districts that would have voted for Biden and seven that would have voted for Donald Trump in the 2020 presidential election.

— Inhofe out? Sen. Jim Inhofe of Oklahoma, the top Republican on the Senate Armed Services Committee, is expected to retire after almost three decades in the Senate. In a special election to finish the remaining years of his term, a Republican would be easily favored.

|

OTHER ITEMS OF NOTE |

— Vilsack warns companies against trying to profit from Russian invasion of Ukraine. USDA Secretary Tom Vilsack again warned fertilizer companies and other farm suppliers against taking “unfair advantage” of the Ukraine conflict and said his department would be watching for unjustified price increases. USDA will make sure companies “don’t use this situation as an excuse for doing something that isn’t necessarily justified by supply and demand,” Vilsack told reporters Thursday. “That’s my biggest and deepest concern, and we’re obviously going to continue to keep an eye on that.” Higher fertilizer prices have already been seen across U.S. agriculture, and Vilsack said the situation was part of broader challenges created by supply chain disruptions. Strong demand, high oil and gas prices and export controls imposed by other countries are all factors in the situation, he said. “That sends messages to us that we need to do more over time,” he observed, again asserting that a key is helping producers “understand or appreciate that there are alternatives,” including more efficient use of fertilizer, planting crops that require less fertilizer and leveraging conservation programs “that can be embraced and incorporated, that could potentially reduce those input costs.” He also said USDA backs an announcement from a coalition of state attorneys general on the launch of a new study focused on the fertilizer markets. The effort will “take a look at the current costs and determine whether or not that they are in fact justified and to make sure that there's an understanding of the history of fertilizer increases, and how it may track and compare to higher commodity prices.”

Vilsack said that while it’s “too early” to assess the impact of the conflict on global agricultural markets, he doesn’t expect the crisis to add to food inflation for U.S. consumers. “It’s too early to talk about Ukraine as it relates to Europe, but I think from a U.S. perspective I don’t foresee a circumstance where American consumers on the food side are necessarily going to see the kind of impact and effect the European consumers are going to see,” he said.

— CISA publishes new list of cybersecurity tools. The Cybersecurity and Infrastructure Security Agency (CISA) recently published a list of free cybersecurity services and tools to help organizations reduce cybersecurity risk and strengthen resiliency. Link for details.

— Cotton AWP eases a second week but remains elevated. The Adjusted World Price (AWP) for cotton moved down to 113.74 cents per pound, effective today (Feb. 25), marking a second consecutive weekly decline since it peaked at 117.60 cents per pound the week of February 11. Meanwhile, USDA said that Special Import Quota #19 would be established March 3 for 46,837 bales of upland cotton, applying to supplies purchased not later than May 31 and entered into the U.S. not later than Aug. 29.