Biden Agrees to Meet Putin, Provided There's No Invasion

With some South American crops plunging, USDA to issue new-crop guesstimates Thursday

|

In Today’s Digital Newspaper |

A revised dispatch today because it’s a holiday. We will be back with the full package on Tuesday.

|

MARKET FOCUS |

Equities today: Markets are closed due to Presidents’ Day. Link to the origins of the holiday, via Ballotpedia.

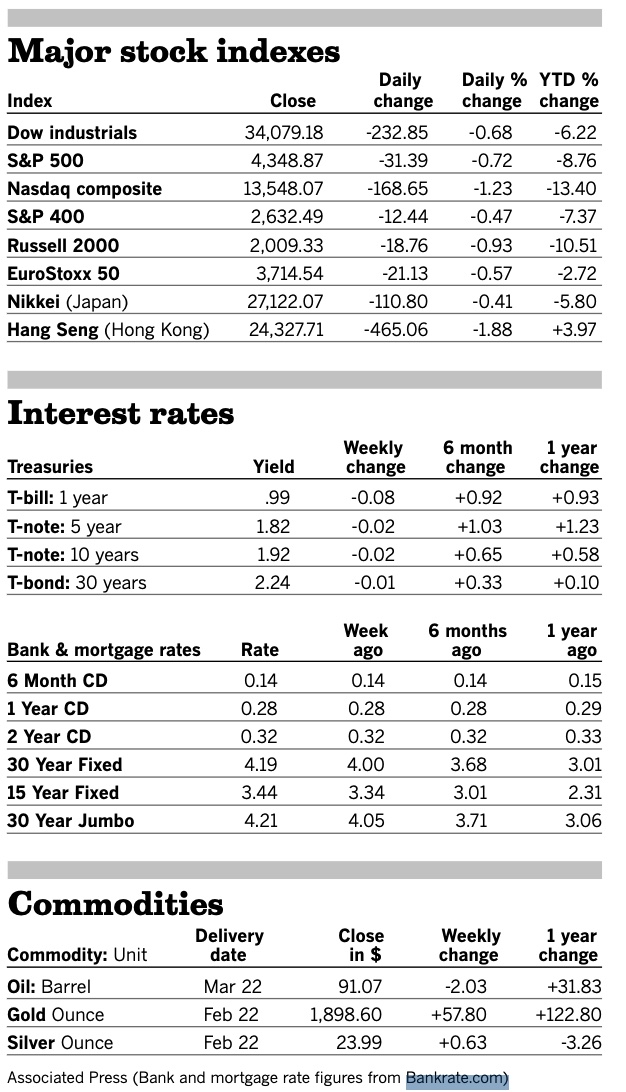

U.S. equities Friday: The Dow ended down 232.85 points, 0.68%, at 34,079.18. The Nasdaq fell 168.65 points, 1.23%, at 13,548.07. The S&P 500 declined 31.39 points, 0.72%, at 4,348.87.

For the week, the Dow was down 1.9%, the Nasdaq was 1.8% lower and the S&P 500 lost 1.6%. Energy, communications services and financials were the worst-performing sectors for the week. West Texas Intermediate futures rose above $95 per barrel in the past week for the first time in seven years. But by Friday, the priced retreated to about $91.

What’s ahead: four to seven rate hikes this year and the runoff of the Fed’s balance sheet. The 10-year Treasury yield was at 1.93% Friday. Yields move opposite price. Investors have been looking to the 10-year as a safe haven against possible weekend developments in Ukraine.

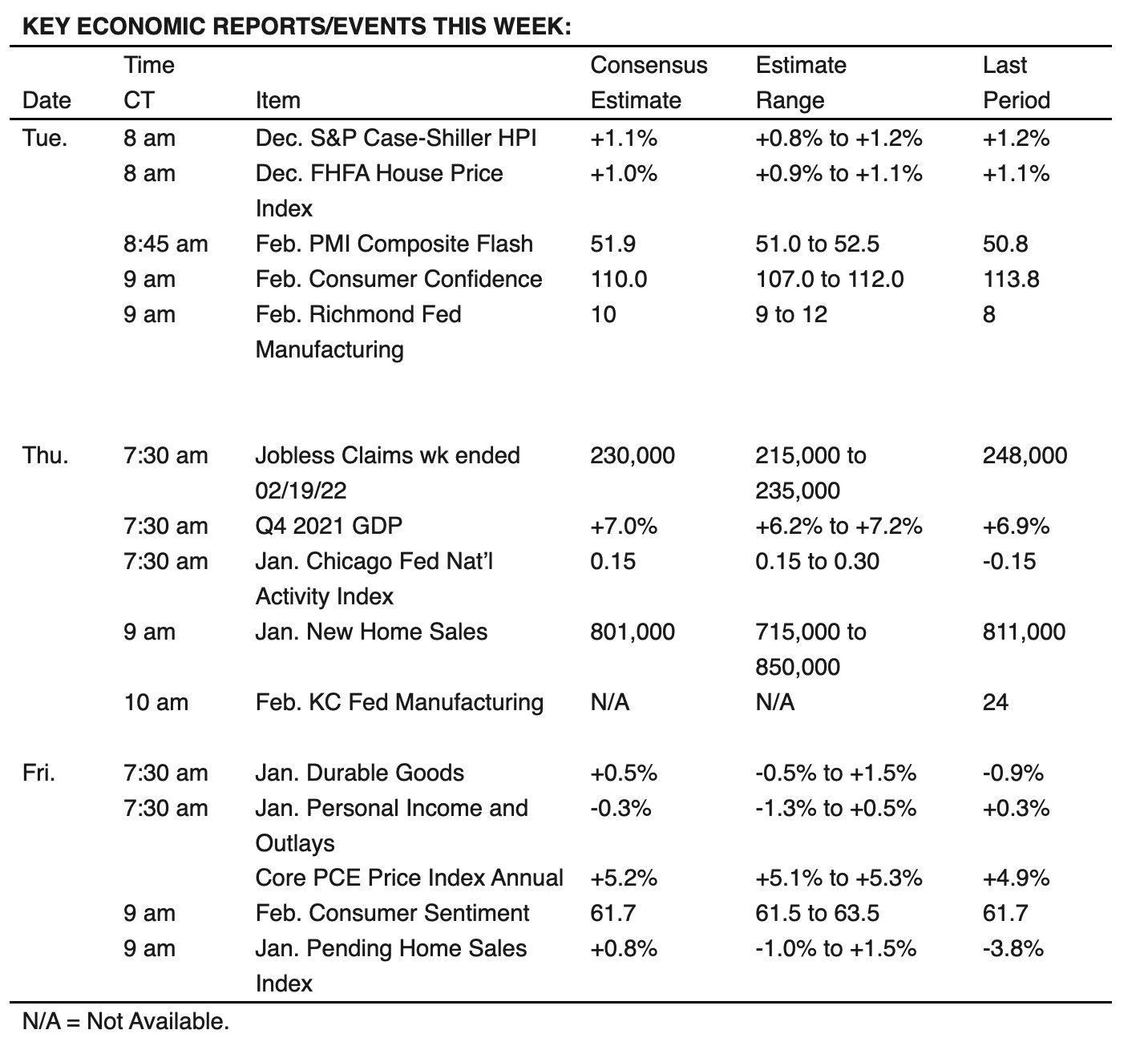

Events on tap this week include:

Tuesday, Feb. 22

· President Joe Biden hosts an event to announce "progress on restoring critical supply chains, powering clean energy manufacturing and creating good paying jobs."

· Federal Reserve. Atlanta Fed President Raphael Bostic scheduled to speak.

· Low carbon human meat industry. The Breakthrough Institute holds a virtual discussion on "How to Build a Low-Carbon and Humane Meat Industry."

· Fed policy shift. The National Association for Business Economics (NABE) Financial Roundtable holds an online event to discuss "The Federal Reserve's Policy Shift: Assessing the Impact."

· U.S./China relations. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "U.S./-China Relations."

· The Arctic and climate change. The Woodrow Wilson Center's (WWC) Polar Institute and the Asia-Pacific Center for Security Studies hold a virtual discussion on "The Arctic: The Geopolitics and Subsurface Impacts of Climate Change."

· Politics and Ukraine. The Carnegie Endowment for International Peace (CEIP) holds a virtual discussion on "Understanding Putin and Ukraine."

· Long Covid. U.S. News and World Report holds a virtual discussion on "The Looming Crisis of Long Covid."

· Pandemic spending. Rep. Jackie Walorski (R-Ind.) holds an online GOP roundtable to discuss "$80 Billion (and Counting) in Pandemic Unemployment Fraud Part II."

· Ukraine situation. The Atlantic Council holds a virtual discussion on "what is at stake in Ukraine and how the international community can stand with Ukraine on the frontlines of democracy."

· Worker safety. Labor Department holds a virtual meeting of the Occupational Safety and Health Administration National Advisory Committee on Occupational Safety and Health (NACOSH) to discuss agency updates from OSHA and the National Institute for Occupational Safety and Health (NIOSH), a discussion of OSHA's work on heat illness prevention, and a discussion on risk-based safety.

· U.S./Russia relations. The Woodrow Wilson Center's (WWC) Kennan Institute for Advanced Russian Studies holds a virtual discussion on "Managing Crisis and Competition in the Coming Decade between Russia and the United States."

· Economic reports. S&P CoreLogic Case-Shiller HPI | FHFA House Price Index | PMI Composite Flash | Richmond Fed Manufacturing | Consumer Confidence

· Energy reports/events. International Energy Week starts; runs through Thursday

· USDA reports. AMS. Export Inspections NASS: State Stories | Chickens and Eggs - Ann. | Chickens & Eggs | Cold Storage | Poultry Slaughter ERS: | Vegetables and Pulses Data | Fruit & Tree Nut Data

Wednesday, Feb. 23

· Green energy payments and farmers. The Farm Foundation holds a virtual forum on "Green Energy Pitfalls and Payouts on the Farm."

· Canadian protests. The Council on Foreign Relations (CFR) holds a virtual discussion on "Protests and Populism: Canadian Convoys and Their International Ramifications."

· Global methane tracker. The International Energy Agency (IEA) holds a press webinar on the launch of IEA's "Global Methane Tracker 2022."

· Transatlantic response to Russia. The Atlantic Council holds a virtual discussion on "Strengthening the transatlantic response to Russian aggression."

· China/Russia relations. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "What's Next for the China/Russia Relationship?"

· Defense supply chains. The Institute for Defense and Government Advancement (IDGA) holds a virtual discussion on "Securing the Defense Industrial Base: Mitigating Risk and Delivering Resiliency in Physical and Digital Supply Chains."

· Pandemic preparedness. The Bipartisan Policy Center (BPC) holds a virtual discussion on "Pandemic Preparedness: Now is the Time."

· Clean energy. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "Sustainable Development Goal #7: Affordable and Clean Energy."

· Ukraine crisis. The Jewish Democratic Council of America (JDCA) holds a virtual briefing on "The Crisis in Ukraine."

· Energy reports/events. API US inventory report | Genscape ARA weekly crude inventory |

· USDA reports. NASS: Milk Production | Broiler Hatchery

Thursday, Feb. 24

· Federal Reserve. Fed Governor Christopher Waller to deliver remarks on the Economic Outlook; Atlanta Fed President Raphael Bostic and Cleveland Fed President Loretta Mester are scheduled to speak.

· USDA Outlook Forum. First day of the two-day USDA Outlook Forum which will feature remarks from USDA Secretary Tom Vilsack, USDA Chief Economist Seth Meyer, Nathan Kauffman, vice president Federal Reserve Bank of Kansas City; and USDA will release its updated Outlook for U.S. Agricultural Trade.

· British perspective on Ukraine situation. Washington Post Live holds a virtual discussion on "World Stage: Crisis in Ukraine" with British Ambassador to the United States Karen Pierce.

· Lithium batteries. The Atlantic Council holds a virtual discussion on "Pure Lithium: Next-Generation Batteries for the Energy Transition," as part of the EnergySource Innovation Stream series.

· Trade in Asia. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "the Indo-Pacific Economic Framework, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and economics and trade in Asia."

· Ukraine situation. Washington Post Live holds a virtual discussion with Lithuanian Prime Minister Ingrida Simonyte, on "The Crisis in Ukraine."

· Russia/Ukraine situation. The German Marshall Fund of the United States (GMFUS) holds a virtual discussion, beginning at 9 a.m., on "The Russia/Ukraine Crisis and Turkey's Balancing Act."

· Covid impacts. The Peterson Institute for International Economics (PIIE) holds a virtual discussion on "Supporting and Restructuring Enterprises Affected by the Covid-19 Crisis."

· Hydrogen issues. The Center for Strategic and International Studies (CSIS) holds a virtual discussion on "Connecting Hydrogen Supply and Demand: Building Blocks for a Hydrogen Economy.”

· Cryptocurrencies. The Federalist Society for Law and Public Policy Studies holds a virtual book discussion on "Cryptocurrencies: Money, Trust and Regulation."

· Covid impact on consumers and food consumption. Morning Consult holds a virtual discussion on "The State of Food and Beverage: How Consumers are Reshaping Their Food and Beverage Choices in the Wake of the Covid-19 Pandemic."

· Climate change. The Potomac Officers Club holds a virtual forum on "How Climate Policy Can Drive Change."

· Covid and Defense Production Act. Homeland Security Department’s Federal Emergency Management Agency holds a virtual meeting to Implement Pandemic Response Voluntary Agreement Under Section 708 of the Defense Production Act to Establish a National Strategy for the Manufacture, Allocation, and Distribution of Personal Protective Equipment (PPE) to Respond to Covid-19 and the Plan of Action to Establish a National Strategy for the Manufacture, Allocation, and Distribution of Diagnostic Test Kits and other Testing Components to Respond to Covid-19.

· Energy and climate issues. The Environmental and Energy Study Institute (EESI) holds a virtual briefing on "Energy Efficiency Means Business: Federal Programs That Deliver Climate Mitigation and Adaptation Benefits Every Day."

· Environmental justice. Environmental Protection Agency holds a virtual meeting of the White House Environmental Justice Advisory Council focusing on the performance scorecard that is being developed to assess the progress of federal agencies' in addressing current and historic environmental injustice.

· China actions in Hong Kong. The Institute of World Politics (IWP) holds a virtual book discussion on "Today Hong Kong, Tomorrow the World: What China's Crackdown Reveals About Its Plans to End Freedom Everywhere."

· Economic reports. Jobless Claims | GDP |Chicago Fed National Activity Index | New Home Sales | KC Fed Manufacturing

· Energy reports. EIA Petroleum Status Report | Weekly Ethanol Production | EIA Natural Gas Report | Singapore onshore oil-product stockpile weekly data | Russia weekly refinery outage data

· USDA reports. USDA Agricultural Outlook Forum | USDA 2022 commodity outlooks ERS: Outlook for US Agricultural Trade NASS: CE: Corn, Soybeans, Sunflowers, Sorghum | Crop Values | Livestock Slaughter

Friday, Feb. 25

· USDA Outlook Forum. Final day of the USDA Outlook Forum with sessions on the individual commodity outlooks and various other agriculture and climate topics including USDA’s updated food price outlook.

· Worker health standards. Labor Department holds a virtual meeting of the National Advisory Committee on Occupational Safety and Health Heat Injury and Illness Prevention Work Group to evaluate OSHA's heat illness and prevention guidance materials, develop recommendations for guidance materials, evaluate stakeholder input, and develop recommendations on potential elements of a proposed heat injury and illness prevention standard.

· Credit and non-banks. The Peterson Institute for International Economics (PIIE) holds a virtual discussion on "Credit allocation in an era of non-banks and new technologies."

· Biden administration response to Covid. The Hill holds a virtual discussion on "America's Report Card," focusing on the Biden administration's response to the Covid-19 pandemic and impact on the economy.

· Election security. CQ Roll Call holds a virtual discussion on "Modernizing U.S. Election Infrastructure and Security: 2022 and Beyond."

· Economic reports. Durable Goods Orders | Personal Income & Outlays | Pending Home Sales Index | Consumer Confidence

· Energy reports. Baker-Hughes Rig Count | ICE weekly Commitments of Traders report for Brent, gasoil | CFTC Commitment of Traders

· USDA reports. USDA Agricultural Outlook Forum FAS: Export Sales ERS: Food Price Outlook | Agricultural Exchange Rate Data Set NASS: Poultry Slaughter - Ann. | Cattle on Feed | Peanut Stocks and Processing | Chickens & Eggs | Peanut Prices

Market perspectives:

• Ag focus this week is on USDA’s Annual Outlook confab on Thursday and Friday. USDA will provide a commodity outlook on Thursday and individual analysts on Friday will provide discussion of individual commodity outlooks (not based on surveys) of supply and demand forecasts for the 2022-23 marketing (link). A seasoned analyst said: “We know they are based off the February WASDE. Brazil’s government agency (CONAB) has cut the size of their soybean crop — and USDA usually adopts that in the end — in their February estimate. As a result, one really needs to take them with a grain of salt this year. The caveat would be if the run in the actual market prices after the CONAB report would drive more total corn plus bean area in 2022.”

Bottom line: While some observers think we are beginning to price ration some commodities, others are not in that camp. “Soybean crush margins are still good,” said one analyst. “Also, oil prices are high and likely going higher. Meanwhile, Brazil is going all out on exports now… what if they halt exports June or July before U.S. new crop?”

• In cryptocurrencies, Bitcoin retreated over the weekend and was trading near $38,000, adding to evidence of investor caution.

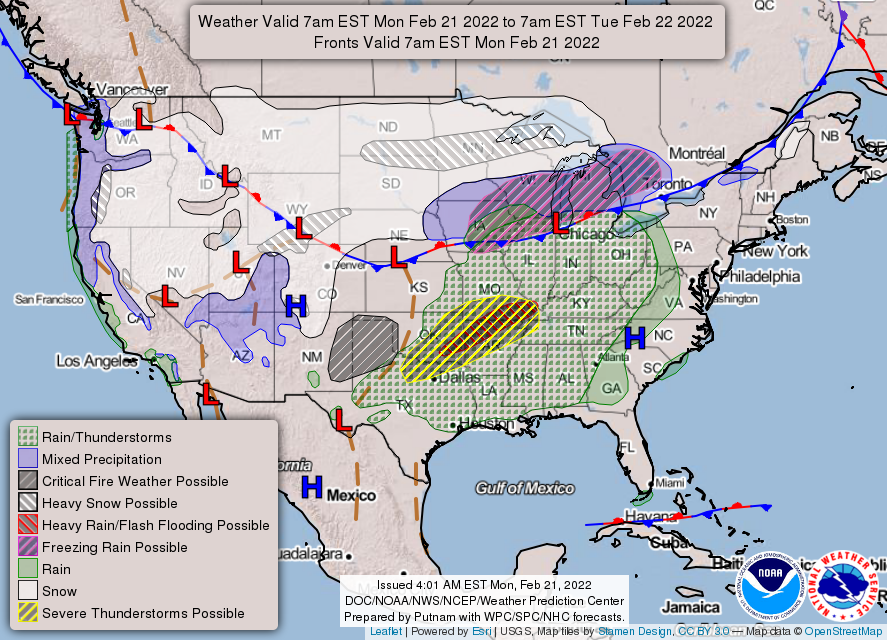

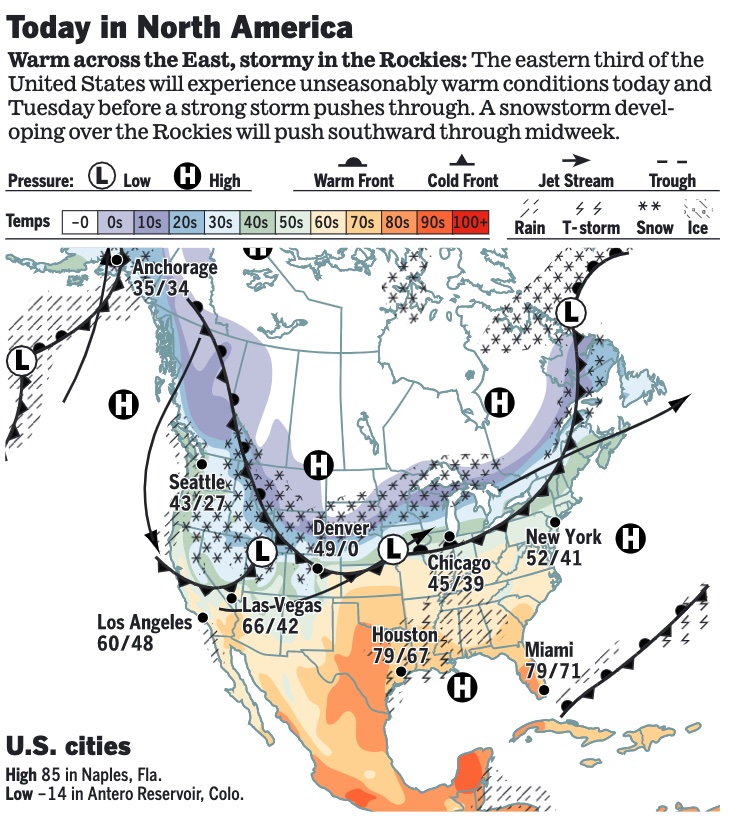

• NWS weather: ...Significant winter storm impacting areas of the Plains into the Great Lakes on Monday into Tuesday... ...Risk of Excessive rainfall, Critical fire weather and severe thunderstorms increasing from the Southern Plains to Tennessee/Ohio Valleys from Monday into Wednesday... ...Temperatures will be 20 to 30 degrees below average over the Northern Tier States; In contrast, temperatures will be 10 to 25 degrees above average over Lower/Middle Mississippi Valley into the Ohio Valley.

|

RUSSIA/UKRAINE |

— Biden late Sunday agreed to a summit with Putin assuming no invasion of Ukraine has taken place. The last-ditch attempt at diplomacy was brokered by French President Emmanuel Macron, with further details to be worked out by Secretary of State Antony Blinken and Russian Foreign Minister Sergey Lavrov’s slated meeting this week in Europe. German media is reporting that Chancellor Olaf Scholz will speak with Russian leader Vladimir Putin today. However, a spokesman for Russia’s president, Vladimir Putin, said there were no concrete plans for a summit with President Joe Biden to discuss Ukraine, contradicting earlier claims from America and France.

Putin will meet with his Security Council today and Kremlin spokesman Dmitri Peskov said, “It’s clear that tensions are rising. It’s too early to talk about concrete plans for organizing any summits,” Peskov said, the New York Times reported (link). One senior White House official said there were no plans for either the format or timing of a meeting between the two leaders. Another official called it all completely notional and said that all evidence suggests Russia still intends to invade Ukraine in the coming days. Both officials spoke on condition of anonymity to discuss internal deliberations.

White House Press Secretary Jen Psaki: “As the president has repeatedly made clear, we are committed to pursuing diplomacy until the moment an invasion begins. Secretary Blinken and Foreign Minister Lavrov are scheduled to meet later this week in Europe, provided Russia does not proceed with military action. President Biden accepted in principle a meeting with President Putin following that engagement, again, if an invasion hasn’t happened. We are also ready to impose swift and severe consequences should Russia instead choose war. And currently, Russia appears to be continuing preparations for a full-scale assault on Ukraine very soon.”

Biden met with the National Security Council on Sunday, including Vice President Kamala Harris and Blinken, both of whom attended the Munich Security Conference over the weekend. Defense Secretary Lloyd Austin and National Security Adviser Jake Sullivan were also in Europe. Harris joined the NSC call from Air Force Two en route back to Washington.

Bottom line: Some news outlets note Russia has not yet officially announced any summit. And its fate depends in part on the outcome of talks between the two countries later this week. But if Putin wants a face-saving off ramp, this could be it, depending on whether he gets enough to declare himself the “winner” of the matter. Upshot: Russian troops are getting closer and this is being seen as a diplomatic Hail Mary. Unless that works, Russia already has all the forces it needs to conduct an invasion of Ukraine on a massive scale. The latest U.S. intelligence suggests Russia could target not just Kyiv but also other major Ukrainian cities like Kharkiv, Kherson and Odessa, Bloomberg reported. “An invasion from multiple locations could essentially fence Ukraine in.” If you are confused regarding the end game on this, you are not alone. The Biden administration for WEEKS have said an invasion is “imminent” and recently said Putin has given the order to invade. But then there is the last-minute possible summit meeting pitched by France, with Russia yet to confirm it will be held. Finally, the U.S. gov’t told the United Nations it had “credible information” that the Kremlin is drawing up lists of Ukrainians “to be killed or sent to camps following a military occupation.”

|

CHINA UPDATE |

— Australia demanded a “full investigation” into an incident in which a Chinese warship shone a laser at an Australian military plane. Both were within Australia’s exclusive economic zone at the time. China has not yet offered any explanation. Tensions between the two countries have been heightened since Australia formed an Indo-Pacific alliance with America and Britain, a pact known as AUKUS.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Carl Icahn has launched a proxy fight for two board seats at McDonald’s, as the activist investor pushes the fast-food chain to require its suppliers to change their treatment of pigs. The company said in a statement (link) on Sunday that it would evaluate his nominees. The activist investor nominated Leslie Samuelrich and Maisie Ganzler to stand for election at the 2022 annual meeting. McDonald’s has a 12-member board. Samuelrich is head of Green Century Capital Management, an environmentally responsible investment firm. Ganzler is chief strategy officer of Bon Appétit Management Co. The topic was first reported by the Wall Street Journal (link).

Icahn is taking issue with the pork that McDonald’s buys to make its sausage patties and other food items. The 86-year-old activist investor says he wants the burger chain’s suppliers to change what he claims is mistreatment of pigs, specifically pregnant pigs, by housing them in small crates.

Background: In an interview on Bloomberg television last week (link), Icahn said the issue wasn’t financial for him, as he holds only 100 shares of McDonald’s. The issue is “emotional” because pregnant pigs are suffering, he says. (McDonald’s says he owns 200 shares.) “You got these companies making all this money and the animals are just suffering for no reason,” Icahn told Bloomberg.

|

CORONAVIRUS UPDATE |

— Boris Johnson, Britain’s prime minister, said his government would reveal its “living with covid” strategy today which would involve scrapping all covid-related restrictions.

|

POLITICS & ELECTIONS |

— Texas will hold its 2022 primary elections on March 1. Runoffs are set for May 24 if candidates in individual races don't surpass 50% of the vote. In the gubernatorial race, Republican Gov. Greg Abbott faces seven primary challengers to his re-election bid: businessman Don Huffines, ex-state GOP Chairman Allen West, conservative media personality Chad Prather, philanthropist Kandy Kaye Horn, attorney Paul Belew, businessman Danny Harrison, and a Rick Perry who is not the same Rick Perry that was previously the governor of Texas. The chances of any of Abbott’s challengers unseating him are slim: Abbott currently leads his likely Democratic challenger former Rep. Beto O’Rourke by 47% to 37%, and no incumbent governor of Texas has lost their party’s nomination since 1978, according to Ballotpedia.

|

CONGRESS |

— Congress is out of session. House Majority Leader Steny Hoyer (D-Md.) and House Minority Leader Kevin McCarthy (R-Calif.) are visiting Israel this week with separate congressional delegations.

|

OTHER ITEMS OF NOTE |

— Supreme Court will decide future of “Remain in Mexico” policy. On Friday (Feb. 18), the court agreed to hear an appeal from President Biden and decide whether he may end the Trump administration’s policy of requiring migrants seeking asylum to wait on the Mexican side of the border until their cases can be heard. The main issue before the court is whether Biden moved too hastily and without adequate rationale when ending the policy. Justices fast-tracked the administration’s appeal, setting the case for oral argument in late April — with a decision expected before the court’s summer recess. Link for details.

— Biden to pay Texas ranchers and farmers for property damage by illegal migrants. The Biden administration has agreed to reimburse farmers and ranchers across 33 Texas counties for damages sustained in the surge of illegal immigration and drug smuggling at the U.S./Mexico border. USDA announced an initiative that would provide financial assistance to landowners “currently impacted by damage to fields and farming infrastructure,” though the news release avoided mentioning what caused the widespread damages. Every county along the 1,250 miles that Texas spans the international border, as well as those as far as 100 miles away from the border, will be eligible to have 26 types of damages covered.

— Fence to be installed around Capitol building for potential Freedom Convoy protests, ahead of the March 1 State of the Union address by President Joe Biden. U.S. Capitol Police and the Secret Service have been "working together" to plan for extra security measures after receiving reports about a potential protest on March 1, according to a statement from the Capitol Police. As part of increased security measures, a fence will be installed. Truckers referring to themselves as the "Freedom Convoy" have been protesting for several weeks over a rule that truckers returning from the U.S. to Canada to show proof of vaccination. Since then, multiple border crossings have become impassable to traffic, with Ambassador Bridge only recently reopening after multiple arrests were made.