Putin: Open for Conversation on Ukraine

Farmers, crop insurance agents have different opinions regarding SCO

|

In Today’s Digital Newspaper |

Market Focus:

• Canada opens blockaded bridge

• S.F. Federal Reserve president: measured lifting of interest rates

• K.C. Fed president: Sell bonds to address high inflation

• Inflation policy debate between Stiglitz and Summers

• Prices for used cars have risen by 40.5% over past year

• Most of Asia thus far is escaping a big rise in inflation

• Finally, some good news: logjams are beginning to ease

• Nearly 24 million taxpayers still haven't had last year’s returns processed by IRS

• Oil prices soaring toward $100 per barrel, threatening to drive inflation higher

• Saudi Arabia transfers shares in Saudi Aramco to country’s sovereign wealth fund

• National Cotton Council projects 2022 U.S. cotton acreage at 12.0 million acres, up 7.3%

• U.S. soybean prices have surged in recent months

• Baltic Dry Index measuring dry-bulk shipping rates has bounced back

• Organic cotton movement in India booming, but much of growth is fake: NYT

• Ag demand update

• Soybeans under heavy pressure to open the week

• Status quo for South American weather

• NCC projects cotton acreage to rise 7.3%

• China sells virtually all wheat put up for auction

• Money flow likely more important than fundamentals for cattle market

• Early week price action key for hog futures

Policy Focus:

• Farmers and crop insurance agents give different and accurate opinions about SCO

Personnel:

• Wilkes sworn in as USDA undersecretary

China Update:

• Covid-19's threat to the global economy increasingly runs through China

• Wave of Covid-19 infections has “overwhelmed” Hong Kong

• Chinese official calls for increased soybean production

Energy & Climate Change:

• DOE to invest nearly $3 billion in advanced battery supply chains

Livestock, Food & Beverage Industry Update:

• USDA steps up wild bird surveillance for avian influenza

• Trade restrictions continue U.S. HPAI case in Indiana commercial turkey flock

Coronavirus Update:

• FDA delays meeting on kid vaccines as Pfizer promises more data

• CDC: Boosters lost much of their potency after about four months

• Sen. Bill Cassidy (R-La.) on school mask mandates

• Biden pressed to use State of the Union speech to endorse return to sense of normalcy

Politics & Elections:

• Economist releases data-driven investigation of U.S. congressional redistricting

• Biden should take note of this

• Pelosi on whether she’ll run for speaker again if Democrats hold the House

• Maryland GOP Gov. Larry Hogan on a possible 2024 presidential run

• Jury resumes deliberations in Sarah Palin’s defamation lawsuit against New York Times

Other Items of Note:

• Russia/Ukraine update

• Blinken signals U.S. committing to competition with China

• Koalas now an endangered species

|

MARKET FOCUS |

Equities today: Global stock markets were mostly lower overnight. U.S. stock indexes are pointed toward lower openings. Asian equities ended broadly lower as energy prices rose amid Russia/Ukraine tensions. The Nikkei was down 616.48 points, 2.23%, at 27,079.59. The Hang Seng Index fell 350.09 points, 1.41%, at 24,556.57. European equities are seeing sharp losses in early action with a focus on Russia/Ukraine situation. The Stoxx 600 was down 2.7% with losses in regional markets from 2% to 3.5%.

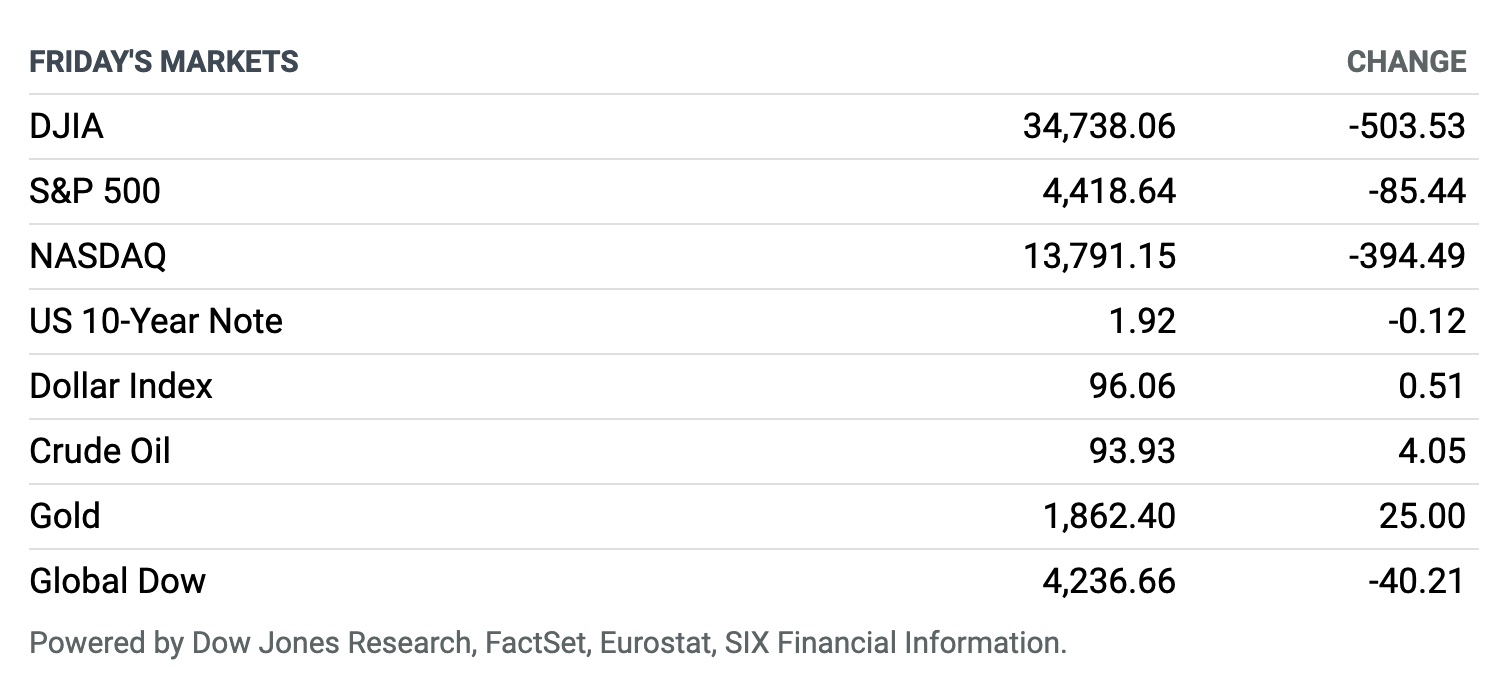

U.S. equities Friday: Stocks fell sharply on Friday as rising fears of a Russian invasion of Ukraine added to a spike in near-term inflation expectations and weakened consumer sentiment. U.S. National Security Advisor Jake Sullivan warned at a Friday afternoon White House briefing that a Russian invasion could take place during the Olympics, sending Treasury yields tumbling, oil prices surging and the S&P 500 falling back below its 200-day moving average. The benchmark 10-year yield, which broke above 2% on Thursday for the first time since 2019, fell back to about 1.93% on Friday. The week’s volatility in the bond market started after hotter than expected inflation data, which spooked investors and prompted St. Louis Fed President James Bullard to call for accelerating rate hikes.

Details: On Friday, the S&P 500 tumbled 85.44 points, 1.9%, to settle at 4,418.64. Its combined two-day loss over Thursday and Friday amounted to 3.7%, the index’s largest two-day percentage decline since October 2020. The Nasdaq slid 394.49 points, 2.8%, to finish at 13,791.15. The Dow lost 503.53 points, 1.4%, to end at 34,738.06.

All three major indexes ended the week with losses. The S&P 500 and Nasdaq lost 1.8% and 2.2%, respectively, for the week. The Dow ended with a weekly loss of 1%.

On tap today:

• USDA Grain Export Inspections report, 11 a.m. ET

• European Central Bank President Christine Lagarde speaks before the European Parliament about the 20th anniversary of euro banknotes and coins at 11:15 a.m. ET.

• Japan's gross domestic product for the first quarter is expected to grow 1.4% from the prior quarter. (6:50 p.m. ET)

Police cleared protesters from the Ambassador Bridge in Windsor, Ontario, an important crossing on the U.S./Canada border. Demonstrators have occupied several Canadian cities, agitating against Canada’s Covid-19 testing and quarantine policies. The protests have choked trade between the countries and disrupted the supply chains of carmakers in Detroit. Police moved in to clear protesters bridge border crossing linking Detroit and Windsor, Ontario.

Canadian police on Sunday arrested protesters in a renewed effort to clear access to the Ambassador Bridge. The demonstrators, whose numbers had dwindled by Sunday morning, had mostly blocked traffic since last Monday in a bid to push governments in Canada to drop Covid-19 rules.

Meanwhile, a group of about 100 frustrated Ottawa residents staged a counterprotest on Sunday, upset with authorities for not doing more to shut down the Freedom Convoy, which for the third weekend in a row has brought Canada's capital city to its knees. In the Canadian capital of Ottawa, protests raged on: Hundreds of truckers were entering their third week of occupation of the area around Parliament Hill.

Perspective: $4.07 is the average price per mile for truckload van shipments on the spot market from Canada to the U.S. on Feb. 5, an increase of 44%, or $1.24, since Jan. 3, according to Truckstop.com.

San Francisco Federal Reserve president echoed concerns across policy makers that central banks need to be measured as they are starting to lift interest rates. Mary Daly told CBS on Sunday that “abrupt and aggressive action can actually have a destabilizing effect” on growth and prices. This followed a warning from European Central Bank governing council member Olli Rehn that a strong reaction to inflation “would probably cause economic growth to stop.” Bottom line: Slower growth and higher inflation are the hallmarks of a post-Covid world.

Kansas City Fed President Esther George said the central bank should consider selling bonds from its $9 trillion asset portfolio to address high inflation and guard against harmful effects that can result from raising short-term rates above long-term rates.

Inflation policy debate. Inflation is rising at the fastest pace in 40 years, and it’s not clear when price pressures will abate. Even so, Nobel-winning economist Joseph Stiglitz says the Federal Reserve shouldn't overreact. "A large across-the-board increase in interest rates is a cure worse than the disease. We should not attack a supply-side problem by lowering demand and increasing unemployment. That might dampen inflation if it is taken far enough, but it will also ruin people’s lives. What we need instead are targeted structural and fiscal policies aimed at unblocking supply bottlenecks and helping people confront today’s realities," he writes for the Roosevelt Institute (link).

But… Former U.S. Treasury Secretary and current Harvard professor Lawrence Summers has a different inflation perspective. Summers has called inflation the most serious short-run threat facing the U.S. economy and pushed the Fed to raise interest rates faster and higher than forecast. In a series of tweets (link) responding to Stiglitz, he says "inflation denialism of the Stiglitz variety is a prescription for stagflation followed by recession."

Prices for used cars have risen by 40.5% over the past year, according to the latest Labor Department data. The Dodge Grand Caravan, Nissan Versa and Toyota Prius have seen biggest increases in average prices paid for three-year-old models. Link to list of the top ten.

Most of Asia thus far is escaping a big rise in inflation. Inflation has surged to multi-decade highs in much of the world. But across most of Asia’s large economies, such as China and India, the pressure is far less extreme, the Economist notes. “The much more modest pace of price increases can be put down to three big “F” factors: food, freight and fun.” The global price of wheat is up by around 20% year on year but rice — the staple in many Asian economies — is down by around the same amount. Shipping-container prices have exploded for exports leaving Asia, but the return trips cost barely more than a tenth of that in some cases. The more gradual easing of Covid-induced restrictions means the cost of leisure activities has not picked up as much either. But the Economist warns: “There are still threats from a fourth “F”: foreign-exchange rates. If America’s Federal Reserve raises interest rates rapidly, a stronger dollar will increase import prices for many Asian economies. That will put central banks in the region in a tough spot.”

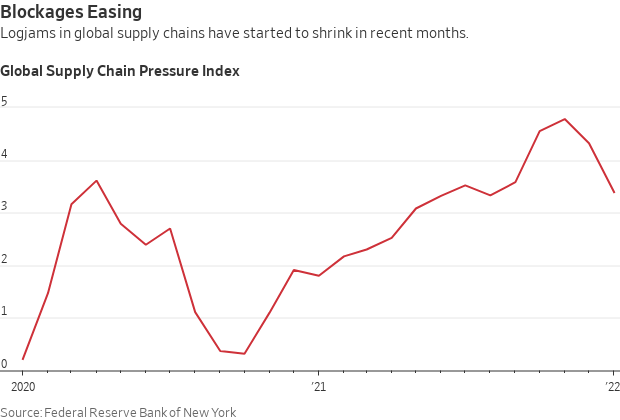

Finally, some good news: logjams are beginning to ease…

Nearly 24 million taxpayers still haven't had last year’s returns processed by the IRS — more than the agency previously reported. The inventory of unprocessed returns and related correspondence was provided by the IRS’s taxpayer advocate service to the tax-writing committees in Congress. The backlog is likely to further slow service in the 2022 filing season. Meanwhile, only one in nine taxpayer calls for assistance were answered last tax season, taxpayer advocate Erin Collins reported. Collins told a House Ways and Means Committee oversight panel that the IRS filled fewer than 200 of 5,000 open positions this tax season. Some new hires fail to show up.

Market perspectives:

• Outside markets: The U.S. dollar index is higher as there is a generally weaker trend in foreign currencies against the greenback. The yield on the 10-year U.S. Treasury note has moved lower to trade under 1.93% with a lower tone in global government bond yields. Gold and silver futures are seeing gains ahead of U.S. trading, with gold around $1,858 per troy ounce (a three-month high on safe-haven demand) and silver around $23.69 per troy ounce.

• Crude oil futures have reversed course and are showing losses ahead of U.S. trading, with U.S. crude around $92.85 per barrel and Brent around $94 per barrel. Crude had been higher in Asian action, trading around $94.60 per barrel with Brent around $95.80 per barrel.

• Oil prices are soaring toward $100 per barrel, threatening to drive inflation higher and hamper global economic growth. In Europe, natural-gas and electricity prices rose by more than 10%. Demand for oil has outpaced production growth as economies slowly rebound from the worst of the pandemic, leaving the market with a small buffer to mitigate an oil-supply shock, the Wall Street Journal reports (link). Russia is the world’s third-largest oil producer, and if a conflict in Ukraine leads to a substantial decrease in the flow of Russian barrels to market, it would be perilous for the tight balance between supply and demand. Those dynamics have led traders in recent days to price in a sizable geopolitical risk premium, according to analysts. Crude oil prices, which haven’t topped $100 a barrel since 2014, jumped to an eight-year high on Ukraine concerns Friday.

• Saudi Arabia has transferred shares in Saudi Aramco worth about $80 billion to the country’s sovereign wealth fund. That 4% stake in the state-owned oil company is part of a plan for the fund, currently holding $480 billion, to be worth more than double that by 2025, and to lessen the kingdom’s dependence on oil money. With oil over $90 a barrel, Aramco is worth just under $2 trillion.

• National Cotton Council projects 2022 U.S. cotton acreage to be 12.0 million acres, 7.3% higher than 2021. Based on the state-level 10-year average abandonment rates and five-year average yields, 2022 harvested area is estimated to be 9.8 million acres with an overall abandonment rate of 18.9 percent. U.S. production is estimated to be 17.3 million bales with an average yield of 850 pounds per acre, which includes 16.8 million upland bales and 438,000 extra-long staple bales. In November, the European Union voted to no longer accept Indian organic exports certified by the main companies responsible for organic cotton. Link for details.

• U.S. soybean prices have surged in recent months amid shrinking forecasts for South American crops. That’s not all bad news: U.S. farmers are poised to take advantage by planting more, the Wall Street Journal reports (link).

• Baltic Dry Index measuring dry-bulk shipping rates has bounced back in February after falling to a 12-month low.

• Organic cotton movement in India appears to be booming, but much of this growth is fake, say those who source, process and grow the cotton. Link for details via the New York Times.

• Ag demand: Taiwan tendered to buy 54,920 MT of U.S. milling wheat.

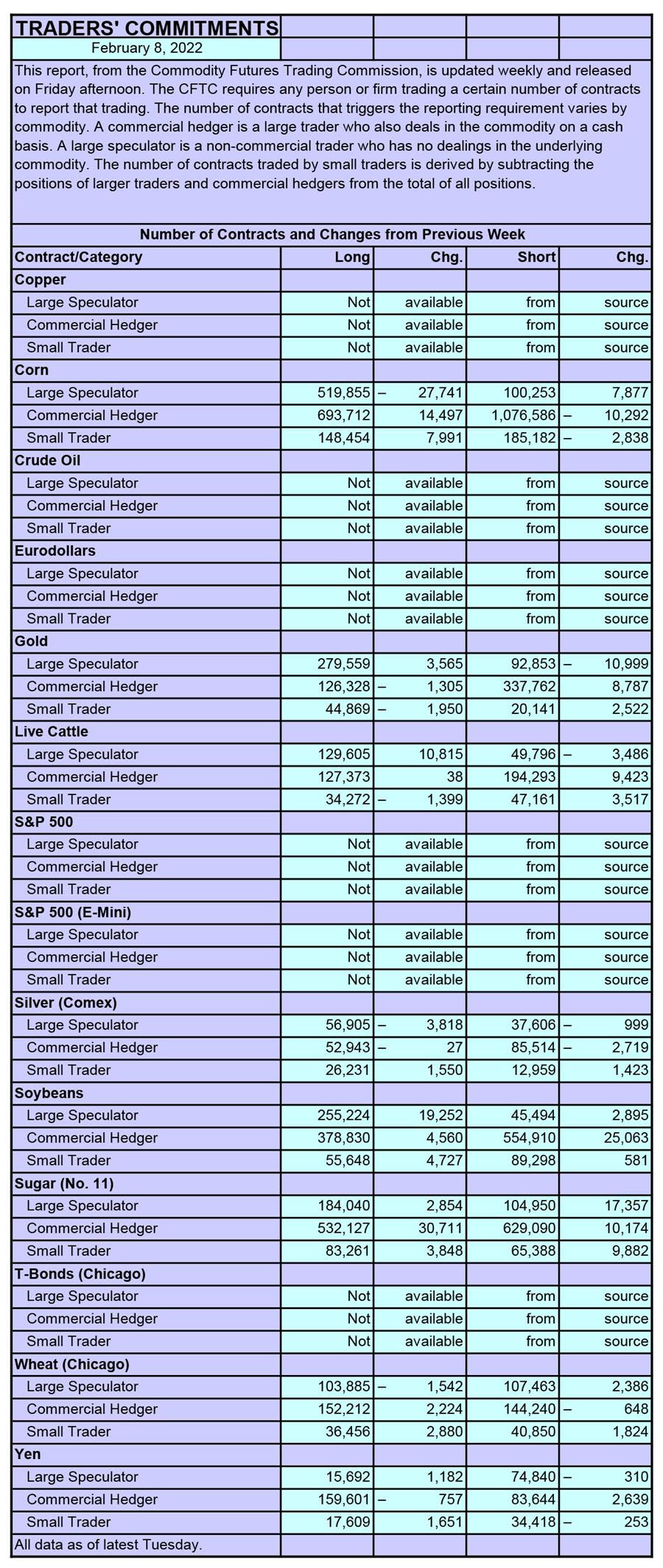

• CFTC Commitments of Traders report (Source: Barron’s, Bloomberg):

- Hedge fund managers cut net bullish cotton bets

- Net bullish live cattle bets boosted to 8-week high

- Hedge funds boost net bullish natural gas bets to 11-week high

- Hedge funds boost net bullish hog bets to 5-month high

- Hedge funds cut net bullish corn bets to 3-week low

- Hedge funds flip to net bullish on feeder cattle

- Net bullish soybeans bets boosted to 9-month high

- Hedge fund managers cut net bullish soy oil bets

- Net bullish soy meal bets boosted to 13-month high

- Net bearish Chicago wheat bets boosted to 19-month high

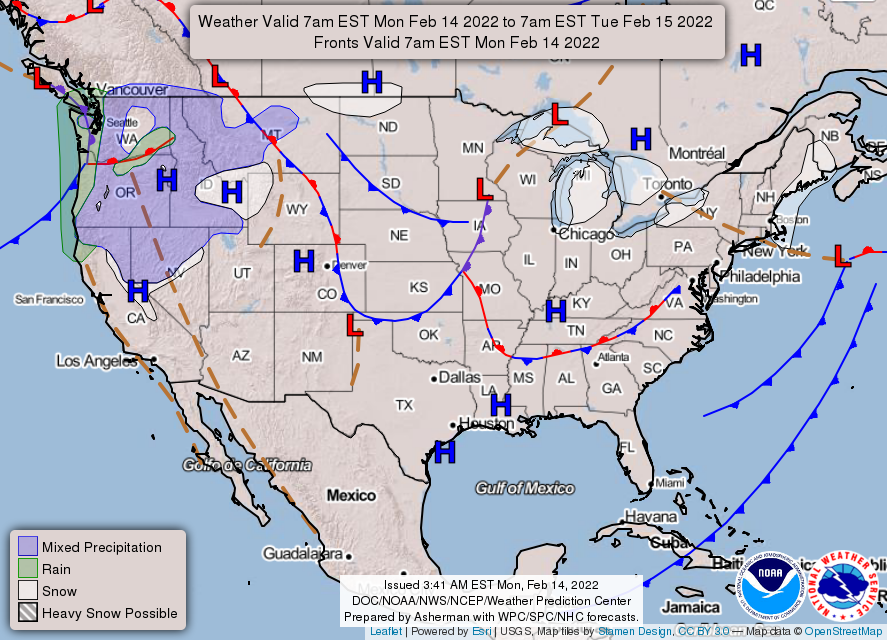

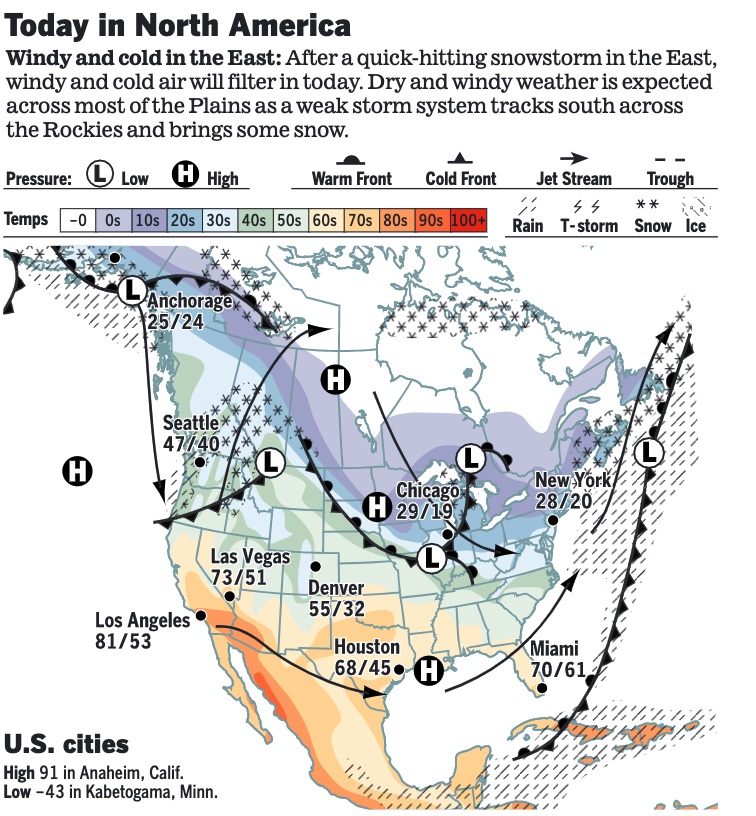

• NWS weather: Unsettled weather to enter the Pacific Northwest today, before a burst of light-to-moderate snow spreads across the Intermountain West and Rockies through midweek... ...Critical fire weather conditions forecast throughout the southern High Plains and parts of the Southwest.

Items in Pro Farmer's First Thing Today include:

• Soybeans under heavy pressure to open the week

• Status quo for South American weather

• NCC projects cotton acreage to rise 7.3%

• China sells virtually all wheat put up for auction

• Money flow likely more important than fundamentals for cattle market

• Early week price action key for hog futures

|

POLICY FOCUS |

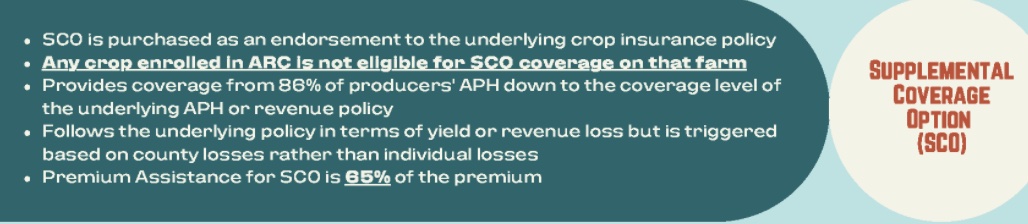

— Farmers and crop insurance agents give different and accurate opinions about choice of SCO. Farmers and crop insurance agents agree on this: Because of where most farm program commodities prices are, it is very unlikely that either ARC or PLC will make payments for 2022 for corn, beans, sorghum, wheat, or cotton base acreage. Recall that producers get to make a choice for ARC and PLC. This choice is by crop by farm number. But if ARC is chosen for a crop, a producer may not buy SCO for that crop. ECO may be purchased. If PLC is chosen, a producer may purchase SCO and ECO.

Quick recap of SCO (Source: Combest-Sell)

In recent trips to farm country in several states, farmers and agents have distinctly different opinions about SCO. With SCO/ECO/STAX, a farmer may purchase effective price protection at a much higher level than that provided by ARC, and also get better yield protection. For corn in 2022, assuming normal yields, prices would have to fall below $3.18/bu. (86% of $3.70 RP) to trigger help. Combest-Sell, a noted ag consultant/farmer advocate firm, says: “We won’t quote any numbers here as price elections are still in discovery, but we can say with certainty that any of the SCO/ECO provide options to lock in price protection well above $3.18 — even close to or above $5.00/bu. on corn — and the same could be said for cotton including STAX too. There is a price for these policies, but in most cases, it can be made very reasonable.”

That depends on other factors, say some farmers, notably at what level a producer is at relative to crop insurance. Some farmers are in a position where they can buy higher individual coverage, which is a great option to consider. But not all farmers are in that spot. “Go further west in ND or SD and farmers have 65 percent or maybe 75 percent coverage. Adding area wide to get to 90 makes sense,” says one observer. “If they can affordably buy up to 85% that may be the best option. But if they have tougher growing conditions and can only afford say 75%, buying SCO makes sense.”

If a farmer is picking ARC to guard against a major yield loss, SCO covers the same band, but a farmer gets it at the RMA price guarantee. (Remember, if one selects ARC, choosing SCO is not an option.) For corn that’s $6 vs $3.70 as the guarantee price. If a farmer sees a major yield loss, there would be a much larger payment and much more quickly with SCO.

Best advice is for producers to talk to their crop insurance agent to understand the different options to start with. On SCO producers gets covered up to 86% of county and the big thing is you get to use the RMA crop insurance price opposed to 5-year average with ARC. Says one observer, “If the price is right on SCO you get a lot of extra coverage with the high price at a pretty low premium. My brother in Ohio could buy 75% revenue with SCO for about $20 an acre on corn.”

But a key downfall with SCO is a yield loss needs to be seen on a county basis. That is an important item to remember and why some farmers are not so interested in SCO.

Links to help farmers make a choice:

Link: AFPC at Texas A&M decision tool

Link: FarmDoc Daily article for corn and beans

Link: For cotton, Plains Cotton Growers conducted a webinar.

|

PERSONNEL |

— Wilkes sworn in as USDA undersecretary. USDA Secretary Tom Vilsack announced Friday that Homer Wilkes has been sworn in as USDA undersecretary for natural resources and environment. President Biden’s nomination of Wilkes was confirmed Tuesday by the Senate. The U.S. Forest Service is under Wilkes's jurisdiction.

|

CHINA UPDATE |

— Covid-19's threat to the global economy increasingly runs through China. The U.S. and Europe are learning to live with the virus, but Beijing’s “zero-Covid strategy” — which requires strict lockdowns when local outbreaks occur — could hit supply chains. China is the world’s leading supplier of the parts other manufacturers use to make the products households buy, which are known by economists as intermediate goods. Should it have to lock down significant parts of its economy, the impact would likely be felt in lower growth and higher inflation in Western economies.

— Carrie Lam, Hong Kong’s chief executive, said a wave of Covid-19 infections has “overwhelmed” the territory. Over 1,500 new cases are expected to be logged on Monday. Despite stringent social-distancing measures, the government says it is not yet considering a mainland-style full lockdown — though it is still clinging to a zero-covid policy. Confounding matters, few elderly people have bothered to get vaccinated.

— Chinese official calls for increased soybean production. Chinese Vice Premier Hu Chunhua called for China to expand soybean production at a meeting on spring farm output held in Shandong province, Xinhua news reported. Hu also emphasized stabilizing planted grains acreage and strengthening farmland protection, reiterating policies previously laid out by central leadership. Hu did not give details on how to expand soybean acreage, though the country’s ag ministry last month promoted intercropping of soybeans with corn as one way to boost output. China’s leadership wants to increase soybean production to around 23 MMT by the end of 2025, up 40% from current levels. China’s Inner Mongolia region, the country’s second-largest soybean growing area, will expand soybean planting by 287,000 hectares this year, state media reported.

|

ENERGY & CLIMATE CHANGE |

— DOE to invest nearly $3 billion in advanced battery supply chains. The Department of Energy (DOE) issued two notices of intent Friday (Feb. 11) to invest $2.93 billion to support U.S.-based production of advanced batteries used in electric vehicles (EVs) and energy storage. The funding is part of $7 billion provided under the bipartisan infrastructure framework package (BIF) to strengthen the U.S. battery supply chain. It will support battery materials refining and production plants, battery cell and pack manufacturing facilities and recycling facilities. DOE said the funding will be made available in the coming months and aligns with the National Blueprint for Lithium Batteries, guidance released last year by the Federal Consortium for Advanced Batteries and led by DOE alongside the Departments of Defense, Commerce and State. The blueprint is focused on ensuring a domestic battery supply and promoting the development of “a robust and secure” domestic battery industrial base by 2030.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— USDA steps up wild bird surveillance for avian influenza. The confirmation of several cases of highly pathogenic avian influenza (HPAI) in wild birds is resulting in stepped-up surveillance efforts for avian influenza in the Mississippi and Central Flyways, which is an expansion in the effort already underway in the Atlantic and Pacific Flyways, which is in place to conduct surveillance of birds that may interact with wild birds from Europe and Asia. The National Wildlife Disease Program is focused on collecting 16,500 samples in 25 states. Adding surveillance in the Mississippi and Central Flyways will involve collecting an additional 14,500 wild bird samples for a total of more than 31,000 wild bird samples in 49 states. The expanded effort includes sample collection in targeted watersheds in the Central and Mississippi Flyways; opportunistic sampling of wild bird species obtained through agency removal programs, such as at airports or for crop damage management, airport removal and other agency captures; coordination with State Department of Wildlife/Natural Resources during bird banding operations; and continued vigilance and investigation of wild bird morbidity and mortality events. HPAI has been confirmed in wild birds in North Carolina, South Carolina, Virginia, Maryland, Delaware, Florida, and New Hampshire. And USDA on Feb. 8 confirmed a case in a commercial turkey flock in Indiana.

— Trade restrictions continue U.S. HPAI case in Indiana commercial turkey flock. More countries have put trade restrictions on U.S. poultry after the confirmation of the H5N1 strain of highly pathogenic avian influenza (HPAI) on a commercial turkey farm in Dubois County, Indiana. The following trade actions have been taken by US trading partners, according to USDA’s Food Safety and Inspection Service (FSIS), with halts on imports of poultry/products:

— From Indiana from birds slaughtered on/after Feb. 8: China, Korea, Tunisia, Belarus, Cuba, Kazakhstan, Ukraine, Dominica, Uruguay.

— From Indiana from birds slaughtered on/after Jan. 18: Benin, Namibia, South Africa, and Japan (date listed as Jan. 17).

— From Indiana loaded on/after Feb. 9: Taiwan.

— From DuBois County or an area within Indiana processed on or after Feb. 8: Singapore, Barbados, India, Jamaica (DuBois and two other counties), Jordan, Qatar, United Arab Emirates, Western Samoa (50 kilometer radius), El Salvador, Guatemala, Honduras, Nicaragua, Peru, Chile, Hong Kong.

— From all of US as of Feb. 8: U.K.

FSIS still does not list Mexico as a country that has put any restrictions on imports of U.S. poultry even though reports indicated that Mexico has taken such an action relative to products from Indiana.

While the restrictions continue to increase, most of them are centered on DuBois County, Indiana or an area within that country. Key for trade impacts will be how long the restrictions remain in place.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 412,048,856 with 5,817,235 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 77,740,175 with 919,697 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 547,109,724 doses administered, 213,869,678 have been fully vaccinated, or 65.15% of the U.S. population.

— FDA delays meeting on kid vaccines as Pfizer promises more data. The Food and Drug Administration is delaying its planned Tuesday meeting of outside advisers to consider recommending Covid-19 vaccines for children under 5 years old after new data from Pfizer and BioNTech convinced regulators to wait for more information about the effectiveness of a third dose. Peter Marks, director of the agency’s Center for Biologics Evaluation and Research, declined to explain what new information prompted the decision.

— CDC released data showing that boosters lost much of their potency after about four months, raising the possibility of a fourth dose, especially for immunocompromised people.

— Sen. Bill Cassidy (R-La.) on school mask mandates, on Fox News Sunday: “We have to follow the science. If the science says that mask is only a marginal benefit, but that the cost of the child is more than marginal cost, then we have to follow the science. And I’ll just say that because clearly what has happened over the last year, children have suffered. From being locked out of school and some say from wearing the mask. Let’s follow the science. I’m a doc, that’s what I believe, that’s what we should do.”

— President Biden is being pressed by some Democrats to use his planned State of the Union speech to endorse a return to a sense of normalcy as Covid-19 cases fall.

|

POLITICS & ELECTIONS |

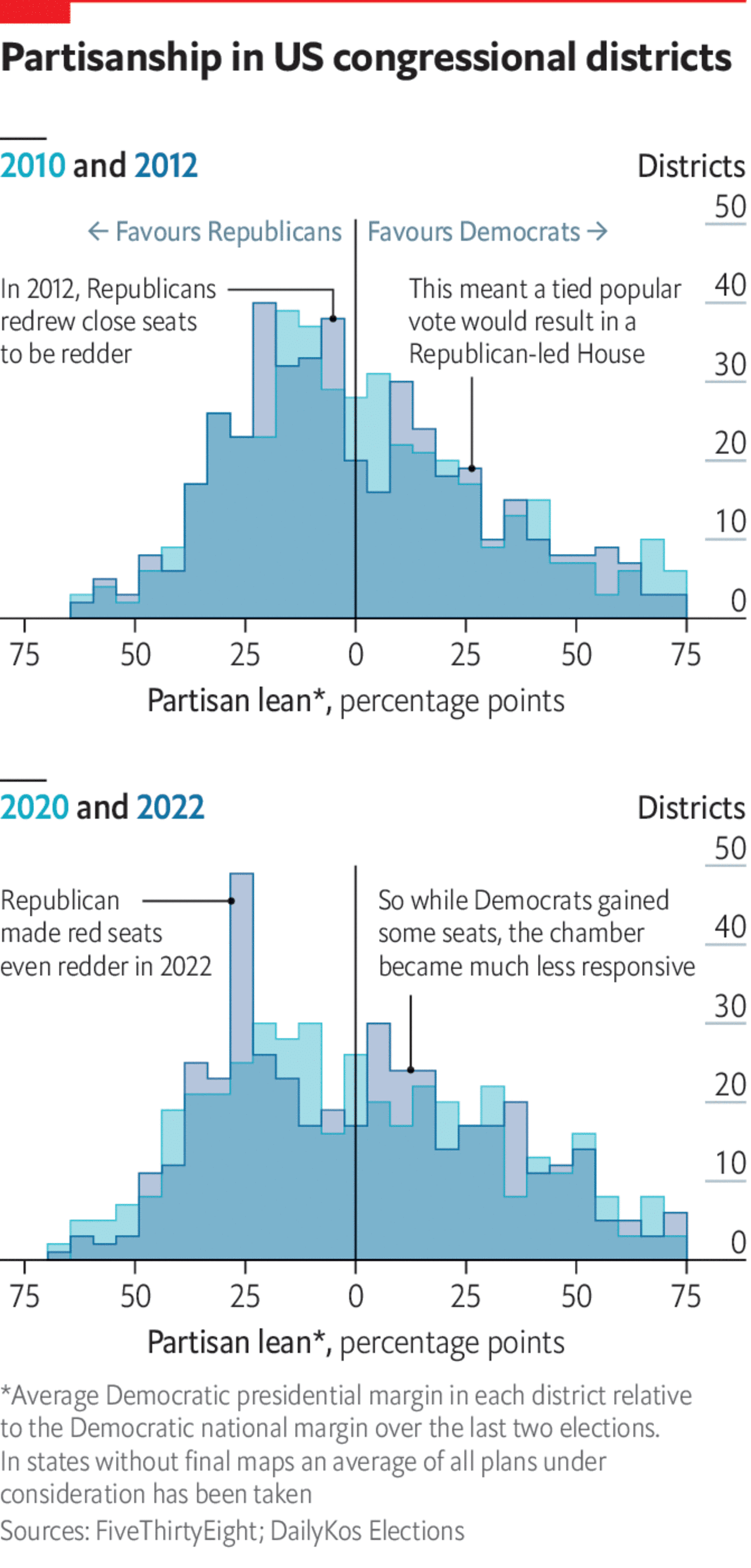

— The Economist recently published a data-driven investigation of U.S. congressional redistricting for the 2020s. Its findings show an increase in rigging on both sides of the aisle; Democrats have managed to flip close seats in blue states such as Illinois, New Mexico and New York while Republicans have padded their margins, making red districts in Texas and Georgia even redder. As a result, says the Economist, “this decade’s map will be much fairer — though still slightly biased towards the Republicans.” Bottom line: “The number of seats that both Republicans and Democrats have a good chance of winning will shrink from 44 to about 40, according to analysis of the new maps.”

— Biden should take note of this: Not a single president in the past seven decades has “substantially improved” his approval numbers between the beginning of a midterm year and the midterm election, he wrote, citing Gallup polling. Link for more via Nathan L. Gonzales.

— Speaker Nancy Pelosi (D-Calif.) on whether she’ll run for speaker again if Democrats hold the House, on This Week: “That’s not a question. My purpose right now is just to win that election, is to win that election. Nothing less is at stake than our democracy.”

— Maryland GOP Gov. Larry Hogan on a possible 2024 presidential run, on State of the Union: “I will make a decision about 2024 after I finish this job.” Jake Tapper: “So, you are considering it?” Hogan: “We’re certainly going to take a look at it after January of ’23.”

— Jury resumes deliberations in Sarah Palin’s defamation lawsuit against the New York Times. In closing arguments, lawyers for Palin sought to portray the NYT as a newspaper that used its power to disfavor conservatives, while the Times said the former Alaska governor was attempting to seize on a mistake it made to undermine important legal protections for a free press.

|

OTHER ITEMS OF NOTE |

— Russia/Ukraine update. Will the word “imminent” join team “transitory”? U.S. National Security Advisor Jake Sullivan told CNN on Sunday there’s “a distinct possibility that there will be major military action very soon.” A weekend call between the Russian and U.S. presidents proved inconclusive. But for weeks, various Biden administration officials have said a Russian invasion of Ukraine is “imminent.” Russian officials have said they do not intend to invade Ukraine. Meanwhile, Russian attack helicopters were spotted yesterday buzzing within miles of the country’s borders. Link for Sunday’s update on the topic.

Possible compromise? In a recent Foreign Affairs essay (link), Samuel Charap recommended non-aligned status for post-Soviet states like Ukraine and Georgia, to satisfy Russia’s concerns about Western influence in its neighborhood. At Foreign Policy (link), Anatol Lieven — who has warned about Russia/Ukraine conflict since last fall — proposes a suite of measures: a non-aggression pact between NATO and the Russia-led CSTO alliance; trade normalization between the EU and the trade bloc Russia leads; and a new European security council of sorts, composed of the U.S., France, Germany, the U.K., and Russia.

Unlikely to happen: During a phone call with President Biden, Volodymyr Zelensky, Ukraine’s president, asked the American president to come to Kyiv to “contribute to de-escalation” and to send “a powerful signal.”

This just in: A statement by Putin that he is open for a conversation set the wheat market back.

Ukraine demanded a meeting with President Vladimir Putin's government to explain why Russia has amassed more than 100,000 troops along the countries’ shared border. Following talks between Putin and the presidents of the U.S. and France, Olaf Scholz will be next to try to talk Russia’s leader down. Germany’s chancellor visits Ukraine today and Russia on Tuesday.

— On his Asia-Pacific trip, U.S. Secretary of State Antony Blinken signaled that the U.S. was committing to competition with China. He also pledged to open a new embassy in the Pacific islands and vowed to unite with South Korea and Japan against North Korea.

— Koalas are now an endangered species. The Australian government blames habitat loss, brush fires and drought fueled by climate change for pushing the cuddly marsupials to the edge of extinction. Roughly 58,000 koalas remain in the country; an estimated 30% have died since 2018, according to one conservation group.