Biden, Ukrainian President Speak as U.S. Again Warns Invasion Could Soon Happen

Canada to Reopen Bridge to U.S. After Clearing Away Protestors | Senate to clear CR

Washington Focus

House is out; Senate is in. The House is not due back until the week of Feb. 28. The Senate left town last Thursday. They'll be back on Monday, with the House-passed postal reform bill first up on the agenda.

Russia/Ukraine/U.S. update. In an hour-long phone call Saturday with Russian leader Vladimir Putin, President Joe Biden warned that the U.S. and its allies would impose “swift and severe” costs on Russia if it invades Ukraine. During the talks, no material progress was made. Earlier, Putin spoke to France’s president, Emmanuel Macron, dismissing talk of an imminent invasion as “provocative speculation.” French officials said there was no indication from Putin’s words that an invasion was imminent, a word several Biden administration officials have used frequently. But Macron told Putin that “sincere negotiations” were incompatible with the military escalation. Germany, Britain, Canada, Denmark, the Netherlands, Norway, Estonia, and Latvia are among the countries that have joined the U.S. in urging their citizens to leave Ukraine.

How does the Biden administration define “imminent?” U.S. national security adviser Jake Sullivan on Sunday renewed the Biden administration’s warnings of a possibly imminent Russian invasion. Sullivan said officials were working to divert gas cargos to Europe if Russia “turns down the taps.” And he said that officials were working to draw up lists of people close to Putin whom the U.S. would penalize in the event of an invasion.

Russia declined to deescalate the tension with Ukraine saying the U.S. and NATO failed to address fundamental security concerns from Moscow: that NATO stops its eastward expansion and that strike weapons not be deployed near Russian borders, according to a statement obtained by Russian State Media TASS. “It was emphasized that these issues would be central in our assessment of the documents received from the U.S. and NATO, which would be brought to the notice of our colleagues,” Russian Foreign Minister Sergey Lavrov reportedly told U.S. Secretary of State Antony Blinken during a call on Saturday. After the call with Biden, a Kremlin aide said Russia would soon announce what actions it would take in response to the U.S. and NATO proposals.”

Russia is having naval drills in the Black Sea that would close off swaths of water along Ukraine’s southern coast, inhibiting traffic to key ports for exports. Ukraine’s foreign ministry complained about the economic consequences of the closures, calling them part of Russia’s “hybrid warfare.”

“Russia’s economic warfare against Ukraine continues,” the U.S. Embassy in Kyiv said on Twitter.

Of note: The Nord Stream 2 pipeline is a recently completed gas line that runs beneath the Baltic Sea from Russia to Germany, bypassing Ukraine and saving Russia hundreds of millions of dollars in Ukrainian transit fees. New German Chancellor Olaf Scholz publicly has said Germany will stand with the U.S. and the international community and sanction Russia … but he’s been careful not to specifically mention the pipeline. Scholz will visit Kyiv on Monday and Moscow on Tuesday to, in his words, “prevent a war in Europe” and “send a clear message to Russia that any military aggression would have consequences that would be very high for Russia and its prospects, and that we are united with our allies.” Scholz told reporters on Sunday that there was a “serious threat to peace in Europe.” He said a Russian invasion would “lead to tough sanctions that we have carefully prepared and which we can immediately put into force, together with our allies in NATO and Europe.”

The Russian “assault” against Ukraine “has already begun,” the Wall Street Journal reported (link), and has taken the form of a “hybrid war” that includes “cyberattacks, economic pressure and, most recently, false bomb threats.”

Sen. Lindsey Graham (R-S.C.) on whether he’s “convinced that Putin’s going to go in,” on ABC’s This Week: “No, I’m not, but I’m convinced that we could do more in Congress and should. We’ve been working in a bipartisan fashion for about three weeks now to come up with pre-invasion, post-invasion sanctions, and the White House keeps pushing back. So, the best thing that could happen is for us to pass this sanctions package … that would destroy the ruble and cripple the Russian economy so Putin could see it in writing. That might help him decide not to invade.”

Bottom line: On Sunday, Biden spoke with Ukraine’s president, Volodymyr Zelensky, who has continued to urge calm. Some airlines suspended flights in Ukrainian airspace; foreign embassies in Kyiv, the capital of Ukraine, withdrew nonessential staff; nations urged their citizens to leave the country; and the Russian military buildup in the region showed no signs of slowing. The New York Times noted that the Biden administration “still does not have an ambassador to Ukraine, a 13-month delay that diplomats say is impossible to explain.” Russia/Ukraine news is likely to be in focus for stock, bond, energy and commodity markets in the coming days.

Senate nomination vote will occur Tuesday on a new commissioner for the Food and Drug Administration. President Biden’s nominee, cardiologist Robert Califf, has run into opposition even from some Democrats because of his ties to pharmaceutical companies. Senate Majority Leader Chuck Schumer (D-N.Y.) has filed cloture on Califf, setting up a vote to advance the nomination as soon as Tuesday.

The Senate will join the House in approving another stopgap spending bill for fiscal year 2022, which began Oct. 1, ahead of the Feb. 18 latest deadline.” The new continuing resolution (CR) will go through March 11, which means the fiscal year will be nearly half over before tardy appropriators reach agreement on spending.

The CR will also provide another extension for USDA’s mandatory livestock price reporting system. Authority for the system was scheduled to expire last September but has been temporarily extended by stopgap spending measures.

Canadian police officers on Sunday cleared a roadway of protesters and made some arrests, working to reopen the Ambassador Bridge between Detroit, Michigan, and Windsor, Ontario. Demonstrators protesting Canada’s coronavirus vaccine mandates and restrictions have blocked access across the bridge since last Monday. A Canadian judge granted the Windsor police permission to remove the protesters starting Friday evening. The bridge had not yet reopened as of midday Sunday, but authorities were working on reaching that goal, multiple reports said. The Ottawa mayor’s office said it reached an agreement with protest organizers to move the trucks that have clogged traffic and other places in the capital’s downtown area for the third weekend.

The White House said Canadian officials intend to reopen the key North American trade corridor after earlier clearing away remaining protestors. In a statement (link) on Sunday, Homeland Security Advisor Liz Sherwood-Randall said, “Canadian authorities intend to reopen” the bridge Sunday after “necessary safety checks.” The statement, released by the White House, added “We stand ready to support our Canadian partners wherever useful in order to ensure the restoration of the normal free flow of commerce.”

Around 2.3 million trucks crossed the Ambassador Bridge in 2021, making it the busiest crossing point for freight across the Ontario border, according to data from the Bridge and Tunnel Operators Association. Nearly 30% of the annual trade between Michigan and Canada comes across the Ambassador Bridge.

Hearings and other events of note this week include:

Monday

- National Association of Conservation Districts annual meeting through Wednesday, in Orlando, Florida.

- National Association of State Departments of Agriculture winter policy conference, Arlington, Virginia.

- Renewable energy. Wall Street Journal holds a virtual discussion on "Sustainability and Energy Transition: The Outlook for Corporate Renewable Energy Use."

- China issues. The Woodrow Wilson Center's (WWC) Asia Program holds its virtual second annual Wilson China Conference, including sessions on "The State of U.S./China Relations and the Study of China,” and "The U.S./China Trade War, Multinationals, and China's Economy."

Tuesday

- House Natural Resources Committee hearing on environmental justice legislation.

- Energy and Commerce Committee hearing on "restoring Brownfield sites to economic engines.”

- Grid resilience and climate. House Select Climate Crisis Committee hearing on "Keeping the Lights On: Strategies for Grid Resilience and Reliability."

- USDA civil rights complaints. House Agriculture Nutrition, Oversight, and Department Operations Subcommittee hearing on "Review of the Office of the Inspector General Report on “USDA Oversight of Civil Rights Complaints."

- Trade and promoting jobs. Senate Commerce, Science and Transportation Tourism, Trade, and Export Promotion Subcommittee hearing on enhancing U.S. trade and promoting American exports to create jobs.

- Infrastructure and small businesses. House Small Business Underserved, Agricultural, and Rural Business Development Subcommittee hearing on "The Infrastructure Investment and Jobs Act's Benefits for Small Businesses."

- Russia and China issues. The Woodrow Wilson Center Kennan Institute for Advanced Russian Studies virtual discussion on "Russia and China on the Brink."

Wednesday

- RFS. Senate Environment and Public Works Committee will vote on two EPA nominees, and then hold a hearing on the Renewable Fuels Standard (RFS).

- Climate, trade and geopolitics. Bipartisan Policy Center virtual discussion on "Linking Climate, Trade, and Geopolitics."

- World Bank conference on climate. The World Bank and World Resources Institute 2022 virtual conference on "Climate-Centered Mobility for a Sustainable Recovery," including remarks from Riccardo Puliti, vice president for infrastructure at the World Bank; Ani Dasgupta, president and CEO of the World Resources Institute, and Transportation Secretary Pete Buttigieg.

- FDA's Frank Yiannas, the deputy commissioner for food policy and response, USDA Sec. Tom Vilsack and the leaders of the Senate Agriculture Committee speak at the National Association of State Departments of Agriculture's annual winter policy conference.

- House Energy and Commerce subcommittee hearing, ”Connecting America: Oversight of NTIA.”

- China conference. Woodrow Wilson Center's Asia Program virtual second annual Wilson China Conference, with sessions on "China and Its Relations with Developing Countries and the Global South,” and on "China's Influence Overseas: Democracy, Norms, and Overseas Chinese Communities."

- Abolishing the debt limit. House Budget Committee hearing on "Why Congress Needs to Abolish the Debt Limit."

- Midterm elections impact. CQ Roll Call and FiscalNote webinar on "2022 Legislative Forecast: Congressional Agenda & the Midterm Elections."

- Germany and the situation in Ukraine. American Bar Association virtual discussion on "Germany's Perspective of the Ukraine Crisis."

- Covid and U.S./China. The United States Institute of Peace virtual discussion on "How is Covid-19 Impacting U.S./China Competition."

- Food security. The Hill virtual Food Security Summit.

- USDA releases USDA Agricultural Projections to 2031.

Thursday

- Senate Budget Committee hearing titled “Warrior Met and Wall Street Greed: What Corporate Raiders are Doing to Workers and Consumers.”

- U.S. economy. Senate Banking, Housing and Urban Affairs Committee hearing on "The State of the American Economy: A Year of Unprecedented Economic Growth and Future Plans, with Cecilia Rouse, chair of the Council of Economic Advisers and other members of the council.

- House Natural Resources Committee hearing on climate adaptation science at the U.S. Geological Survey.

- Telehealth and rural America. Federal Communications Commission online open meeting to discuss "promoting telehealth in rural America, Aureon refund data order, updating technical rules for radio broadcasters, and enforcement bureau actions."

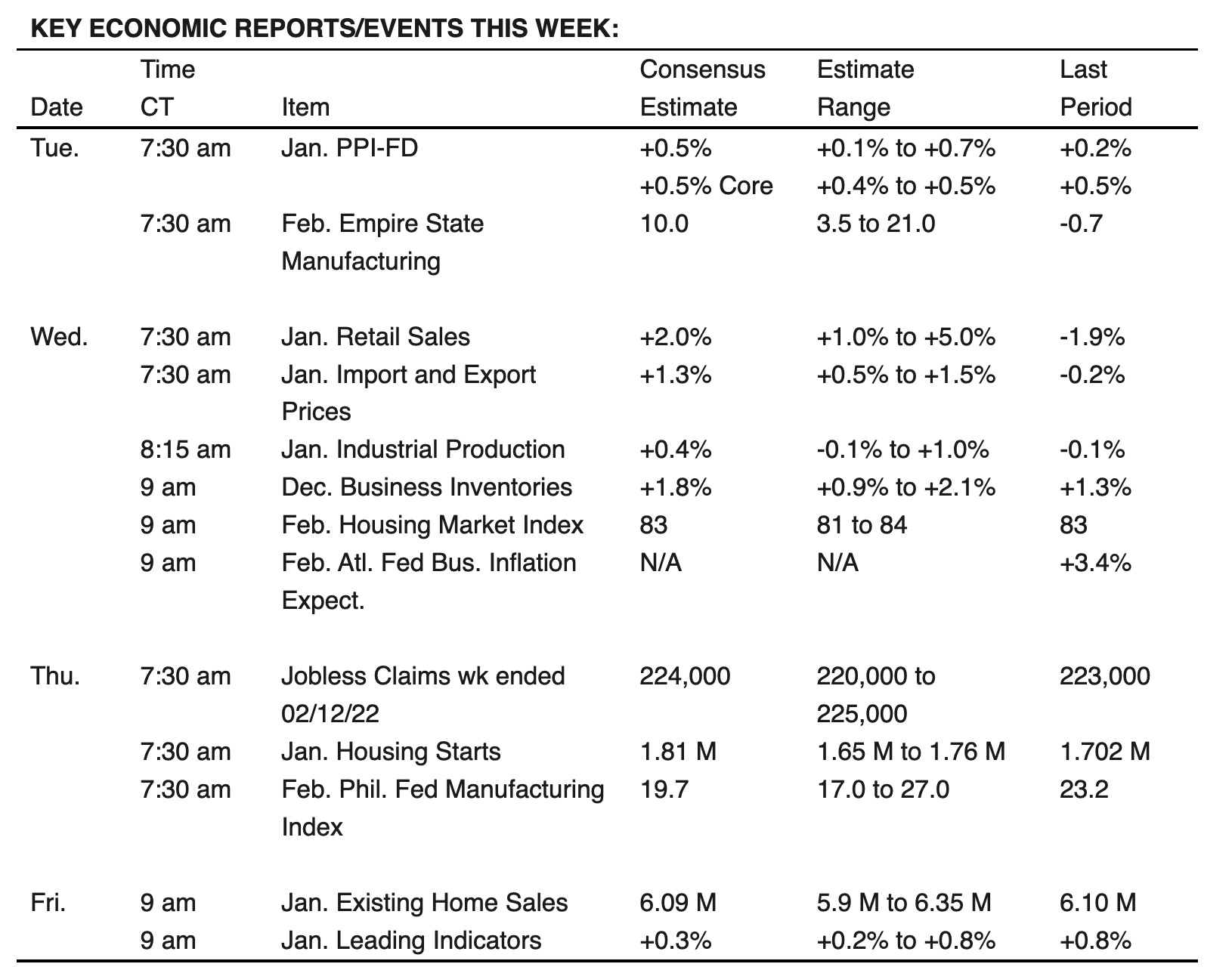

Economic Reports for the Week

The economic calendar features updates on producer prices, retail sales, housing starts and existing home sales. Fedspeak will be front and center again with Chicago Federal Reserve Bank President Charles Evans, New York Federal Reserve Bank President John Williams, St. Louis Federal Reserve Bank President James Bullard and Cleveland Federal Reserve Bank President Loretta Mester all giving speeches. FOMC minutes are also due out on Feb. 16.

Tuesday, Feb. 15

- Bureau of Labor Statistics reports the producer price index for January. Consensus estimate is for a 9.3% year-over-year jump, after a 9.7% spike in December. The core PPI, which excludes volatile food and energy prices, is expected to rise 8%, compared with a 8.3% gain previously.

- Empire State Manufacturing Index

- Treasury International Capital

Wednesday, Feb. 16

- MBA Mortgage Applications

- FOMC Minutes: Minutes from the latest Fed meeting could offer insight into the debate over rates. With inflation at a 40-year high, the question facing Federal Reserve officials is no longer whether they will raise interest rates next month but by how much. Some analysts note that this rate-increase cycle could be more dangerous than others because stocks have entered it at elevated valuations.

- National Association of Home Builders releases its Housing Market Index for February. Economists forecast a 83 reading, about even with the January data. Home builders remain quite bullish on the near-term prospects of the housing market, despite rising mortgage rates and supply constraints.

- Census Bureau reports retail spending data for January. Expectations are for a 1.9% monthly increase, after a 1.9% decline in December. Excluding autos, retail sales are seen rising 1% compared to a 2.3% drop in December. Some economists speculated that the disappointing December spending data were a result of holiday shopping being pulled forward due to the well-publicized supply shortages.

- Import and export prices

- Industrial Production

- Business Inventories

- Atlanta Fed Business Inflation Expectations

Thursday, Feb. 17

- Jobless Claims

- Census Bureau releases new residential construction data for January. Consensus estimate is for a seasonally adjusted annual rate of 1.7 million housing starts, roughly even with December.

- Philadelphia Fed Manufacturing Index

- Fed Balance Sheet

- Money Supply

- Federal Reserve: James Bullard speaks; Loretta Mester speaks

Friday, Feb. 18

- Conference Board releases its Leading Economic Index for January. Economists forecast a 1% monthly increase, following a 0.8% gain in December.

- Existing Home Sales

- Federal Reserve: Charles Evans speaks; John Williams speaks

Key USDA & international Ag & Energy Reports and Events

USDA will publish its grain and soybean export inspections Monday, while the International Grains Council will release its monthly report Thursday.

Monday, Feb. 14

Ag reports and events:

- Export Inspections

- Feed Grains: Yearbook Tables

Energy reports and events:

- EIA monthly Drilling Productivity Report

Tuesday, Feb. 15

Ag reports and events:

- Livestock, Dairy, and Poultry Outlook

- Sugar and Sweeteners Outlook

- EU weekly grain, oilseed import and export data

- Malaysia’s Feb. 1-15 palm oil exports

- Malaysia crude palm oil export tax for March (tentative)

Energy reports and events:

- API weekly U.S. oil inventory report

Wednesday, Feb. 16

Ag reports and events:

- Broiler Hatchery

- USDA Agricultural Projections to 2031.

- Turkey Hatchery

- Vegetables, Annual

- FranceAgriMer report; monthly grains outlook

- Holiday: Thailand

Energy reports and events:

- EIA weekly U.S. oil inventory report

- U.S. weekly ethanol inventories

- Genscape weekly crude inventory report for Europe’s ARA region

Thursday, Feb. 17

Ag reports and events:

- Weekly Export Sales

- Tree Nuts: World Markets and Trade

- National Hemp Report

- Potato Stocks

- International Grains Council monthly report

Energy reports and events:

- EIA natural gas storage change

- Russian weekly refinery outage data from ministry

- Insights Global weekly oil product inventories in Europe’s ARA region

Friday, Feb. 18

Ag reports and events:

- CFTC Commitments of Traders report

- Peanut Prices

- Food Expenditure Series

- Farms and Land in Farms

- FranceAgriMer weekly crop condition report

- Deere, which recently saw its shares hit a record high, holds a conference call to discuss first-quarter fiscal 2022 results. A Barron’s article (link) says, “It isn’t often that farming captures Wall Street’s imagination, but Deere has done just that, earning a new nickname along the way: the ‘Tesla of farming.’”

Energy reports and events:

- Baker Hughes weekly U.S. oil/gas rig counts