U.S. Inflation Jumped 7.5% in Past Year, New 40-Year High

Conab slashes Brazil bean crop est. | China cancels some big prior U.S. corn sales

|

In Today’s Digital Newspaper |

Market Focus:

• U.S. inflation accelerated to a 7.5% annual rate in January, a new four-decade high

• Average U.S. household spending additional $250 a month because of inflation

• Fed’s Bostic foresees three or four rate hikes this year

• USDA announces big China corn cancellations from prior U.S. sales

• USDA daily export sales:

— 299,700 metric tons soybeans received during reporting period for unknown destinations.

Of the total, 233,700 metric tons is for delivery during 2021-2022 marketing year and

66,000 metric tons during the 2022-2023 marketing year.

• U.S./Canada officials raising concerns about impact of trucker-led protests on supply chains

• Next supply chain mess is coming for disposable cups

• Japanese car makers: stress on production from pandemic is continuing

• A.P. Moller-Maersk expects supply-chain bottlenecks to last until June, then gradually ease

• Pelosi: Dems to reach consensus on restricting stock trading by members of Congress

• EU cuts economic growth forecast, raises inflation outlook

• Ag demand update

• Soybeans surge above $16

• Brazil slashes soybean crop estimate

• Strategie Grains cuts EU wheat export forecast

• France lower winter wheat plantings estimate

• Cash cattle price forecast inches higher

• Big jump in cash hog price forecast

Policy Focus:

• Key WHIP+ topic

Personnel:

• Fed nominee Raskin reiterates stance on fossil fuels

• Senate panels confirm nominees to lead OMB

• Virginia Senate snubs Trump EPA chief

China Update:

• China buys U.S. soybeans and sorghum but cancels sizable corn buys

• China still has outstanding sales of 8,390,528 tonnes of U.S. corn on the books

• U.S. will hold China to account for failing to meet Phase 1 purchase commitments

• China new bank loans record-strong in January

• China halts Lithuanian beef in apparent political row

Trade Policy:

• Major change in trade policy beginning to take shape, fueled by nationalism and politics

Energy & Climate Change:

• Is there a brake (and break) coming for gas prices?

• Biden administration to unveil initial effort on EV charging stations

• RFS opponents want lower RFS corn-based ethanol mandate

Livestock, Food & Beverage Industry Update:

• Trade restrictions start with U.S. HPAI case in Indiana commercial turkey flock

• Canada confirms HPAI in Nova Scotia commercial flock

Coronavirus Update:

• States and businesses dropping mask rules

• Block on Biden administration’s vaccine mandate for federal workers will stay in place

• Japan extends some Covid measures

• U.K. Prime Minister to lift all remaining coronavirus restrictions in England later this month

Other Items of Note:

• Plan approved for U.S. troops to help Americans evacuate Ukraine if Russia invades

• Russia blocks portions of Black and Azov Seas

|

MARKET FOCUS |

Equities today: U.S. Dow opened over 200 points lower. Asian equities finished higher as traders looked ahead to US inflation data and monitored the Russia/Ukraine situation. The Nikkei advanced 116.21 points, 0.42%, at 27,696.08. The Hang Seng Index rose 94.36 points, 0.38%, at 24,924.35. European equities are mostly higher in early trade action that has seen some markets trade in negative territory at times. The Stoxx 600 was up 0.1% with regional markets mostly up 0.2% to 0.5% with the French CAC-40 weaker.

U.S. equities yesterday: The Dow gained 305.28 points, 0.86%, at 35,768.06. The Nasdaq was up 295.92 points, 2.08%, at 14,490.37. The S&P 500 rose 65.64 points, 1.45%, at 4,587.18.

On tap today:

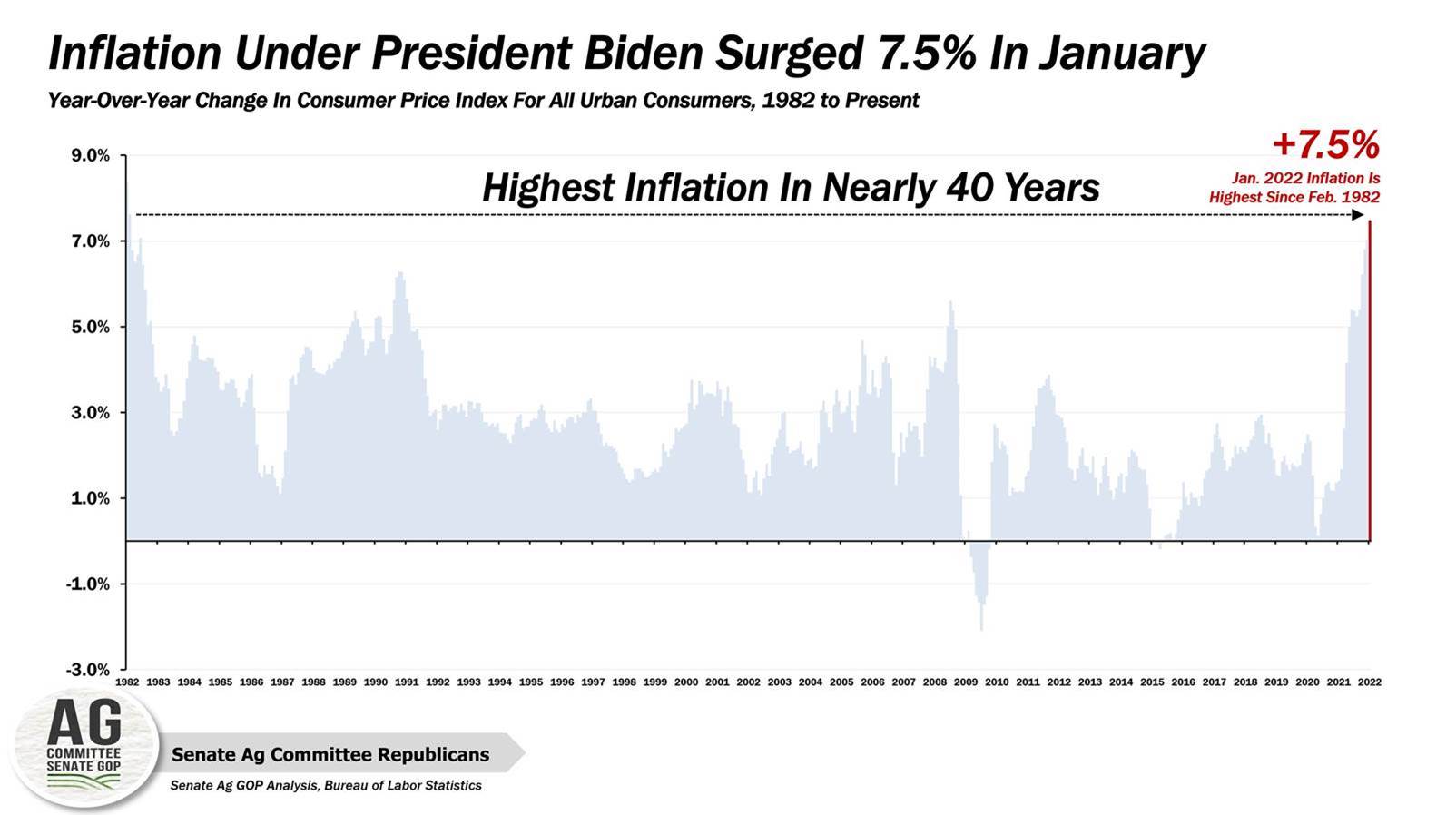

• U.S. Consumer Price Index for January is expected to increase 0.4% from one month earlier and 7.2% from one year earlier. Excluding food and energy, the CPI is forecast to rise 0.4% and 5.9%. (8:30 a.m. ET) UPDATE: U.S. inflation accelerated to a 7.5% annual rate in January, rising to a new four-decade high, the Labor Department said. The January number includes a once-a-year revision that affects seasonally adjusted data for the past five years. The Labor Department also updated the list of goods included in the calculation, known as a spending basket, to reflect consumer habits in 2019 and 2020.

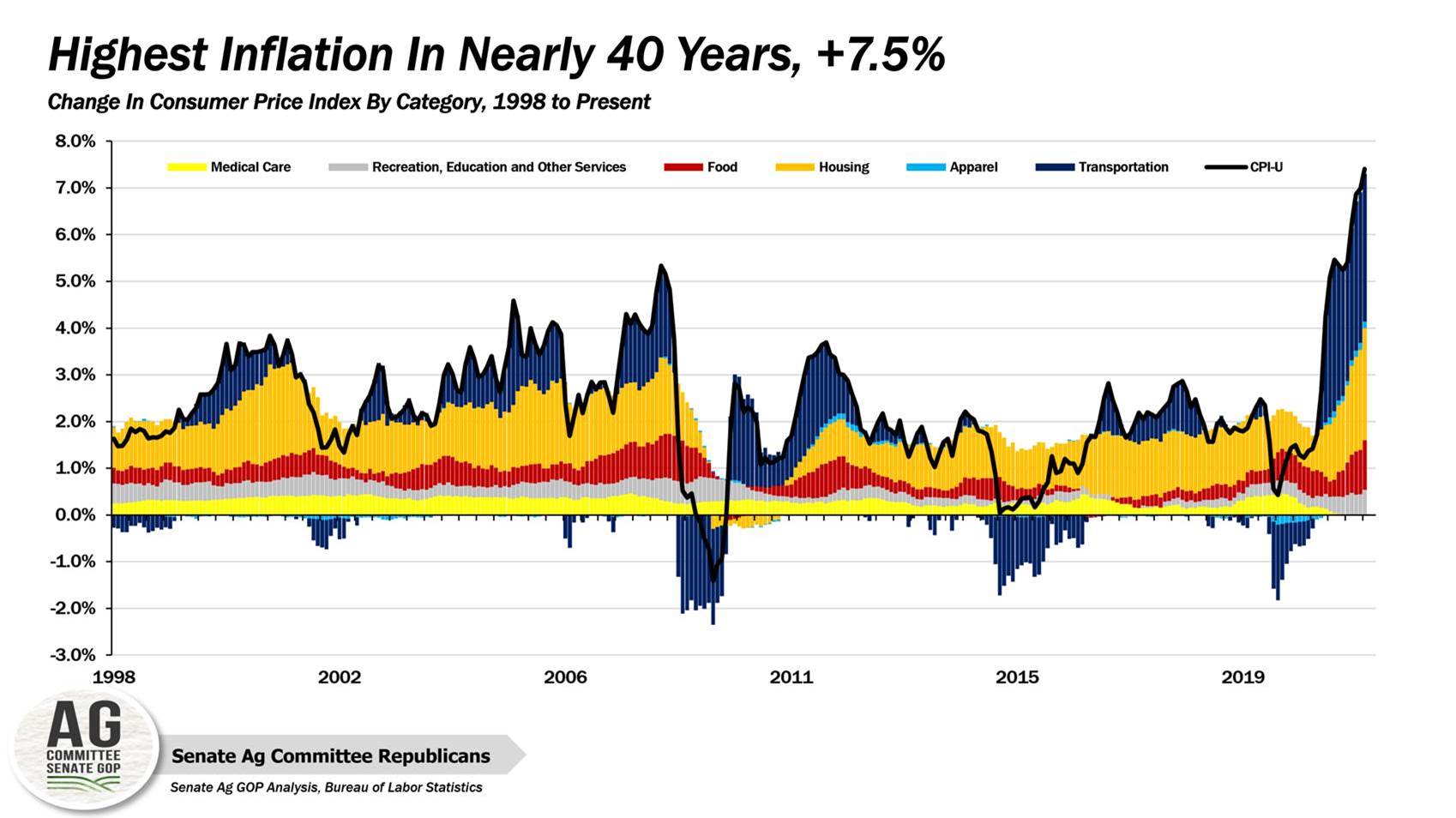

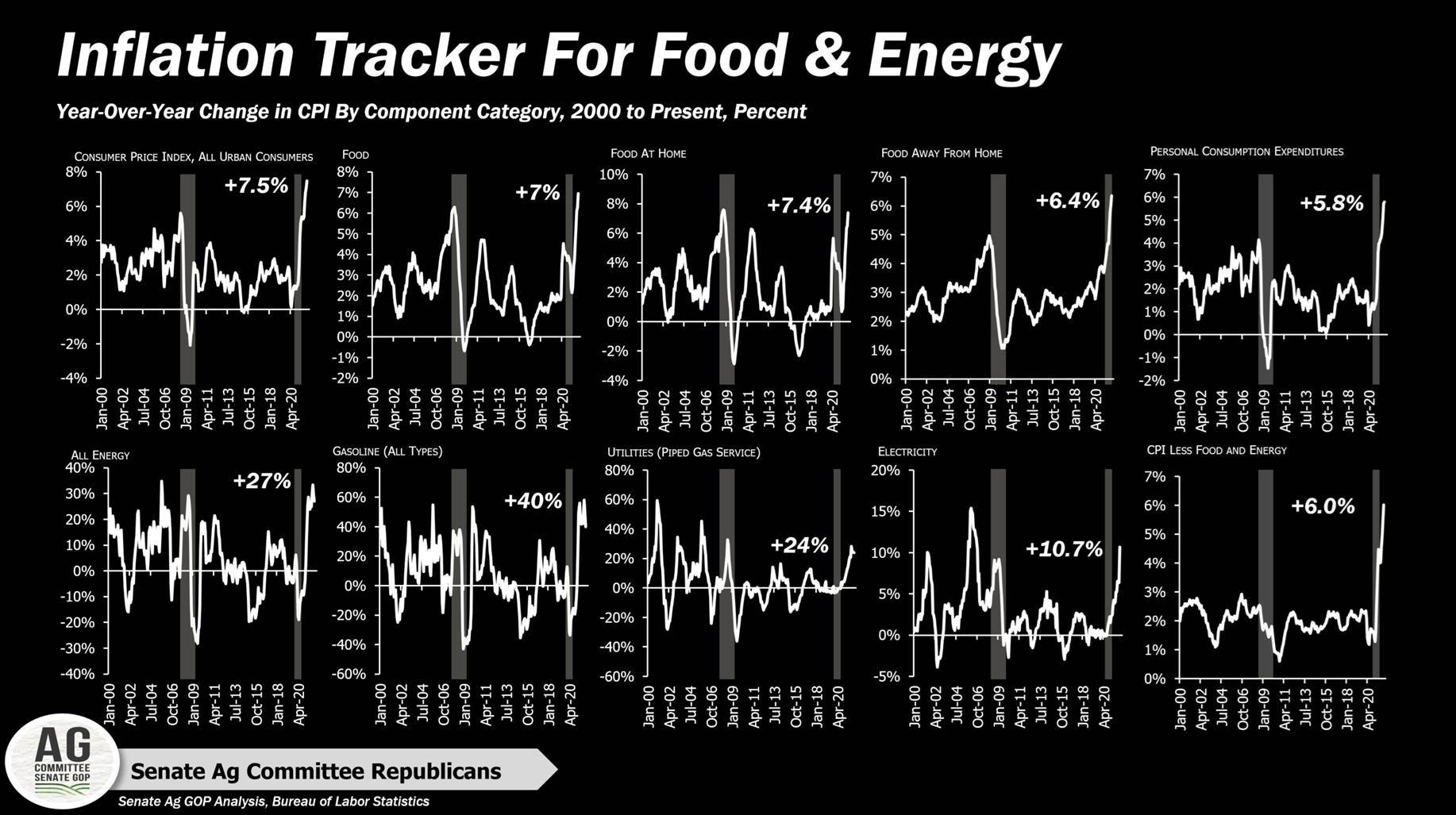

Details: The CPI was up 0.6% in January and there was an increase of 7.5% in prices compared with year ago, both numbers above expectations and the annual inflation rate reached its highest point in 40 years. The core CPI reading also beat expectations, up 0.6% from the prior month and up 6% from year-ago. Monthly inflation expectations were at 0.5% for both the headline and core levels, while the annual rates were expected to be at 7.3% overall and 5.9% for the core rate which strips out volatile food and energy prices. Costs for autos, furniture and appliances were behind much of the rise in consumer prices. Food prices rose 0.9% in January from December and notched a 7% increase compared with January 2021.

• U.S. jobless claims are expected to fall to 230,000 in the week ended Feb. 5 from 238,000 one week earlier. (8:30 a.m. ET)

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• U.S. Treasury releases federal budget data for January at 2 p.m. ET.

• Bank of England Gov. Andrew Bailey speaks at 4:05 p.m. ET.

• Richmond Fed President Thomas Barkin speaks to the Stanford Institute for Economic Policy Research at 7 p.m. ET.

Fed’s Bostic foresees three or four rate hikes this year. CNBC reports on its website that Atlanta Federal Reserve President Raphael Bostic “said Wednesday he anticipates hiking interest rates three or four times this year, but he stressed that the central bank isn’t locked into a specific plan.” According to CNBC, in an appearance on Squawk Box, Bostic “signaled a view that is less aggressive than the markets on rates.” Bostic is quoted as saying, “In terms of hikes for the interest rates, right now I have three forecast for this year. I’m leaning a little towards four, but we’re going to have to see how the economy responds as we take our first steps through the first part of this year.” CNBC reports that “market pricing current is anticipating at least five and possibly six hikes of 0.25 percentage points each.”

“A hotter-than-expected U.S. inflation print would push the Federal Reserve closer to considering its single-largest rate hike in more than two decades,” Bloomberg notes, adding: “The January consumer price index, due today, is one of the most important data releases before the central bank’s March meeting, which Chair Jerome Powell has signaled will kick off a series of interest-rate hikes. A reading above the projected 7.2% annual advance in prices – which would be the largest since 1982 — may pressure the Fed to consider its first half-percentage-point increase since 2000, instead of a typical quarter-point move.”

U.S./Canada border officials are raising concerns about the impact of trucker-led protests on supply chains. Traffic was moving only at reduced levels across the partially-blocked Ambassador Bridge on Wednesday, the Wall Street Journal reports (link), and much of the commercial business was being re-routed more than 60 miles north to the Blue Water Bridge at Port Huron, Mich. The critical Ambassador Bridge crossing is the latest target of trucker-led protests against Canada’s vaccine mandates. The White House says it’s watching the situation closely, with an eye on the impact on automotive supply chains that depend on the border. U.S. trade data estimates Canada imported $44 billion worth of auto-related goods in 2021 from the U.S.

Average U.S. household is spending an additional $250 a month because of inflation that is rising at its fastest rate in nearly 40 years, a new analysis from Moody’s Analytics showed. The squeeze stems from higher prices across a range of products and services, including cars, gasoline, furniture and groceries. The analysis compares what the average household spent under 7% inflation, the rate in December, versus the amount it would have spent when inflation was 2.1%, the average in 2018 and 2019.

Separate research from Wells Fargo shows that inflation is also squeezing some groups more than others. The CPI reflects the change in prices for the average basket of spending. But people’s spending baskets vary based on who they are, which influences to some degree their daily needs, where they live, how they get around and what they do for fun.

Meanwhile, car insurers are rapidly raising rates to try to get ahead of inflation, which has boosted the prices of car repairs, replacements and rentals. Many insurers are boosting premiums by 6% to 8% while some are asking for double-digit increases.

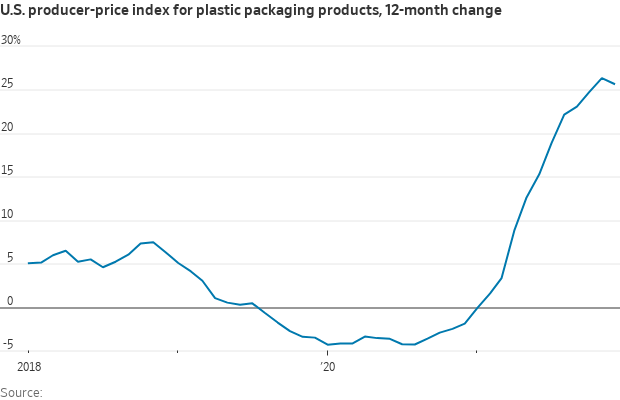

Next supply chain mess is coming for disposable cups as imports from China and elsewhere are stuck in ports along the mucked-up supply chain. American paper mills are short workers. And the U.S. hasn’t caught up from the extreme cold snap in Texas last year that suspended production of resins used to make plastic cups and the coating on paper cups.

Japanese car makers said the stress on production from the pandemic was continuing, and a shortage of components was likely to stretch through this year, striking a more pessimistic tone than their peers in Detroit. Honda on Wednesday reported a 32% decline in net profit for the October-December quarter, which it said was largely due to falling vehicle sales. Also Wednesday, Toyota again ratcheted down production forecasts, citing semiconductor shortages and the effects of the Omicron wave of Covid-19.

Danish container-ship company A.P. Moller-Maersk said it expects supply-chain bottlenecks to last until June and then start to gradually ease. Chief Executive Soren Skou said demand for manufactured goods should wane as people return to work and spend more on services like travel and entertainment. Maersk moves 17% of the world’s shipping containers on its vessels.

House Speaker Nancy Pelosi expects Democrats to soon reach consensus on restricting stock trading by members of Congress, amid debate over the scope of legislation, including whether to extend a ban to lawmakers’ spouses. Pelosi on the topic: “I'm a big believer in our committees and we tasked the House Administration Committee to review the options that members are putting forth. And they have different views on the subject. But I said that certain criteria that I wanted to see — whatever design they have for that, that's one but the other is we have to tighten the fines on those who violate the STOCK Act. It's not sufficient to deter behavior. And then third is … it has to be government wide. We make a disclosure every year, of our financial disclosure .... And, and then in addition to that on a regular basis, when there's a stock transaction, to record that. The court system, the third branch of government, the judiciary has no reporting. The Supreme Court has no disclosure, it has no reporting of stock transactions, and it makes important decisions every day. I do believe the integrity of people in public service. … It is a confidence issue and if that's what the members want to do, then that's when we will do.”

Republicans have also shown interest in new rules. House Minority Leader Kevin McCarthy (R-Calif.) is considering backing new limits on lawmaker stock ownership, according to an aide, and Senate Minority Leader Mitch McConnell (R., Ky.), who said he holds his investments in a mutual fund and advises colleagues to do the same, said he would need to examine the issue.

The Federal Reserve refused to release documents on officials’ stock trading. Reuters reports that the Federal Reserve, “responding to a Freedom of Information Act request by Reuters, said there are about 60 pages of correspondence between its ethics officials and policymakers regarding financial transactions conducted during the pandemic year 2020. But it ‘denied in full’ to release the documents.” Reuters reports that “the disclosure of trading by two regional reserve bank presidents during the pandemic led them to resign last fall, and prompted Fed chair Jerome Powell to overhaul Fed ethics rules and request the central bank’s inspector general to investigate.” Reuters says it “requested release under the information act of any 2020 communication ‘regarding the propriety of individual financial transactions’ exchanged between the Fed’s general counsel or ethics staff and members of the Board of Governors, then Dallas Fed president Robert Kaplan, or then Boston Fed president Eric Rosengren.”

Facts and figures: Lawmakers and their immediate families bought $267.4 million of assets and sold $363.5 million last year, according to Capitol Trades, with both figures down from the prior year. The value of trading in stock options roughly doubled in 2021, to $25.9 million from $12.8 million a year earlier.

EU cuts economic growth forecast, raises inflation outlook. Eurozone economic growth will be slower than earlier expected this year because of a new wave of Covid infections, high energy prices and continued supply-side disruptions, while inflation will be much stronger, the European Commission said. It now forecasts 2022 EU GDP at 4.0%, down from its previous forecast of 4.3% growth. The commission now expects inflation will be 3.5% this year, up sharply from its 2.2% forecast in November.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher even as several foreign currencies were firmer against the greenback. The yield on the 10-year U.S. Treasury note was firmer, trading around 1.93%, with a mixed tone to global government bond yields. Gold futures were lower and silver higher ahead of U.S. inflation data. Gold was trading under $1,833 per troy ounce and silver above $23.35 per troy ounce.

• Crude oil futures are higher ahead of U.S. trading, with U.S. crude around $90.40 per barrel and Brent around $92.05 per barrel. Futures had moved lower in Asian action, with U.S. crude trading under $89.60 per barrel and Brent under $91.45 per barrel.

• Conab pegs the Brazil soybean crop at only 125.5 million tons, a cut of 15 million, a 10.7% slashing, due to drought in “the entire southern region and part of Mato Grosso do Sul.” A crop that size, analysts say, forces larger bean acres in the U.S., plus cutting demand as prices ration usage. USDA as expected on Wednesday took a more conservative approach, reducing its forecast by 5 million tons, to 134 million. Conab’s unprecedented cut likely surprised many private analysts as well. The government forecasting agency slashed its 2021-22 soybean export forecast by 9.1 MMT to 80.2 MMT. Conab cut its Brazilian corn crop estimate by 559,000 MT from last month to 112.3 MMT. It now forecasts 2021-22 Brazilian corn exports at 35 MMT, down 1.7 MMT from last month. Says one analyst: “This year's Brazil beans is last year's Brazil safrinha corn… if weather turns (still a big if), this year's safrinha corn will be last year's Brazil beans and keep getting bigger.”

• USDA daily export sales:

— 299,700 metric tons soybeans received during reporting period for unknown destinations. Of the total, 233,700 metric tons is for delivery during 2021-2022 marketing year and 66,000 metric tons during the 2022-2023 marketing year.

• Ag demand: Taiwan purchased one cargo (about 65,000 MT) of Argentine corn. Japan purchased 115,913 MT of wheat in its weekly tender, including 54,684 MT from the U.S., 32,526 MT from Canada and 28,703 MT from Australia.

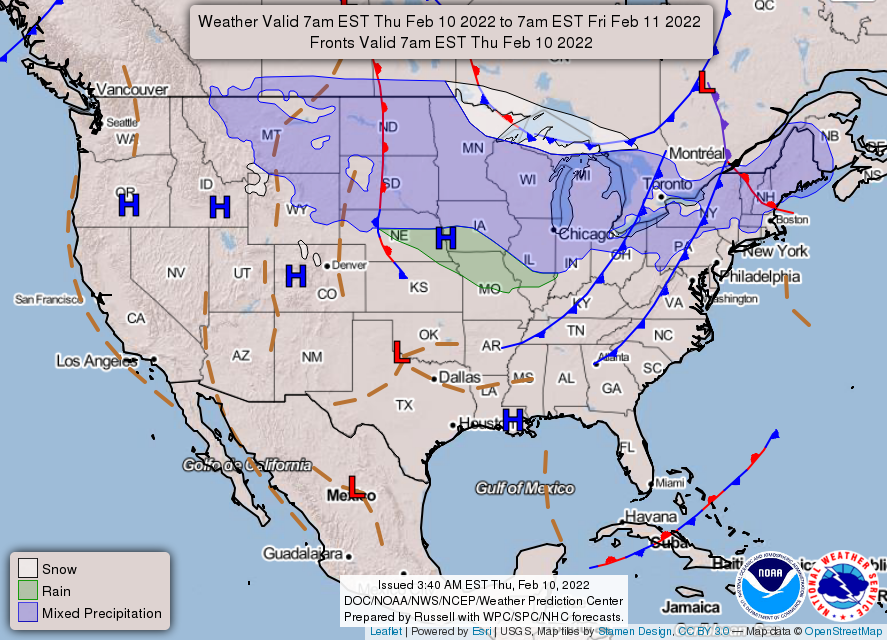

• NWS weather: Early taste of spring across most of the Lower 48; record warmth in California and the Pacific Northwest... ...Frontal system to produce rain and snow showers across the eastern Great Lakes and New England... ...Heavier snowfall to come with the second storm system on Thursday across the Upper Midwest/Great Lakes, next round of Arctic air arrives in the Midwest by the start of the weekend.

Items in Pro Farmer's First Thing Today include:

• Soybeans surge above $16

• Brazil slashes soybean crop estimate

• Strategie Grains cuts EU wheat export forecast

• France lower winter wheat plantings estimate

• Cash cattle price forecast inches higher

• Big jump in cash hog price forecast

|

POLICY FOCUS |

— Key WHIP+ topic: Sources say WHIP+ will use the higher of harvest price option or yield price election.

|

PERSONNEL |

— Fed nominee Raskin reiterates stance on fossil fuels in written answers to Senate panel. Sarah Bloom Raskin, nominated by President Joe Biden to be a Fed Governor and the top banking regulator on the Fed, has provided written responses to questions from members of the Senate Banking Committee. In her responses to questions regarding her prior comments on financing of oil and gas projects, Raskin largely reiterated what she told lawmakers during the hearing — it is not the Fed’s job to pick winners or losers or to allocate capital. And she said she saw “no path” for the Fed to diminish the role of the oil and gas industry. “The Federal Reserve does not engage in credit allocation and does not choose the borrowers to whom banks extend credit,” she wrote. However, she said that the Fed could take actions relative to climate risks facing institutions under its supervision. financial risks, and those “might include disorderly price adjustments in various asset classes; potential disruptions in proper functioning of financial markets; and rapid changes in policy, technology, and consumer preferences that markets have not anticipated.” She also emphasized that it is not the Fed’s role to create energy policy. She stated that high inflation remains a concern and that actions thus far by the Fed to address inflation have been “appropriate.”

The Senate Banking Committee is to vote February 15 on the nominations of Raskin, Philip Jefferson, And Lisa DeNell Cook to be Fed governors, and on Fed Chairman Jerome Powell to serve another four years as Fed chairman.

— Senate panels confirm nominees to lead OMB. Two Senate Committees Wednesday approved the nominations of Shalanda Young to be director of the Office of Management and Budget (OMB) and Nani Coloretti to be deputy director of OMB. You was confirmed by the Senate Budget Committee on a vote of 15-6 and by the Homeland Security Committee eight-to-three. Coloretti was approved by the same vote margins in both committees. That sends the nominations to the full Senate, but it is not clear when the full chamber will act. Given the margins, it would appear the vote in the full chamber will not be contentious for either nominee and that could allow them to move forward relatively soon.

— Virginia Senate snubs Trump EPA chief. Virginia Senate lawmakers voted to reject former EPA administrator Andrew Wheeler from serving in the Cabinet of GOP Gov. Glenn Youngkin –– a rare snub of a state-level gubernatorial appointee, and one that precludes the former Trump administration official from serving as Virginia’s secretary of natural resources. Voting along party lines, lawmakers in Virginia’s narrowly divided Senate voted 21-19 to strip Wheeler –– a former coal lobbyist who served as EPA administrator from 2019 to 2021 –– from a resolution confirming the rest of Youngkin’s Cabinet nominees.

Background: Youngkin tapped Wheeler last month for the job, and the decision immediately sparked backlash from some environmental groups, as well as former EPA employees, who penned two separate warning letters to the state Senate detailing their concerns about Wheeler. More than 150 former EPA employees who served in both Republican and Democratic administrations signed onto one letter, which charged that Wheeler “pursued an extremist approach” as EPA administrator, which had the effect of “methodically weakening EPA’s ability to protect public health and the environment …” Wheeler, the former employees added, “sidelined science at the agency, ignored both agency and outside experts, rolled back rules to cut greenhouse gases and protect the climate, and took steps to hamstring EPA and slow efforts to set the agency back on course after he left office.” The letter’s signatories included two deputy EPA administrators and two former EPA administrators from the mid-Atlantic region, according to the Associated Press.

|

CHINA UPDATE |

— China buys U.S. soybeans and sorghum but cancels sizable corn buys. U.S. export sales activity for the week ended Feb. 3 saw China continue its purchases of U.S. soybeans and sorghum, but the country also cancelled sizable corn purchases from the U.S. Sales activity for 2021-22 included net reductions of 375,229 tonne sof corn (net sales of 4,771 tonnes and cancellations of 380,000 tonnes), net sales of 248,729 tonnes of sorghum, 298,143 tonnes of soybeans, and 100,817 running bales of upland cotton. For 2022-23, sales of 316,000 tonnes of soybeans were announced. For 2022, net reductions of 271 tonnes of beef and net sales of 946 tonnes of pork were announced.

For perspective, China still has outstanding sales of 8,390,528 tonnes of U.S. corn on the books.

— U.S. will hold China to account for failing to meet the purchase commitments pledged under Phase 1 trade deal inherited from the Trump administration, President Joe Biden’s commerce chief said. “We intend to hold them to account,” U.S. Secretary of Commerce Gina Raimondo said on Bloomberg Television’s European Close. U. S. Trade Representative Katherine Tai “is in the thick of those negotiations now,” she said, adding that Beijing “is not playing by the rules” as the government subsidizes companies, limiting American businesses’ ability to compete.

Comments: U.S. Chamber of Commerce official Myron Brilliant said that the administration could deploy a new trade investigation that could see additional tariffs levied against China for not living up to their Phase 1 commitments. Key will be exactly how the administration proceeds.

— China new bank loans record-strong in January. New bank lending in China more than tripled in January from the previous month, hitting a record high, as the People’s Bank of China (PBOC) eased monetary policy to boost economic activity. Chinese banks extended 3.98 trillion yuan ($626 billion) in new yuan loans in January, up from 1.13 trillion yuan in December. Broad M2 money supply in January grew 9.8% from a year earlier, PBOC data showed.

— China halts Lithuanian beef in apparent political row. China suspended beef imports from Lithuania without giving a reason, though there is a growing trade spat between the two countries centered on Chinese-claimed Taiwan. Lithuania allowed Taiwan to open a de facto embassy in its capital Vilnius last year, angering Beijing, which regards the self-governed island as its own territory. The suspension comes after Britain said on Monday it will join the U.S. and Australia in backing an EU trade case against China at the World Trade Organization over Beijing’s alleged trade curbs on Lithuania.

|

TRADE POLICY |

— There is a major change in trade policy beginning to take shape, fueled by nationalism and politics. Trade policy experts consulted say this includes the U.S. and they expect the Biden administration to gradually show its new trade policy vision in the months ahead. U.S. farmers want to know how their various farm groups will deal with any such development.

|

ENERGY & CLIMATE CHANGE |

— Senate Democrats propose suspending federal gas tax for the rest of the year. The AP reports that “some Democratic senators on Wednesday called for suspending the federal gas tax for the remainder of the year to help consumers struggling with rising fuel prices.” According to the AP, “The legislation from Sens. Mark Kelly of Arizona and Maggie Hassan of New Hampshire could prove popular during an election year in which the average price of gas nationally, according to AAA, exceeds about $3.45 a gallon and could go higher during peak driving season.” The AP adds that “four other Democratic senators quickly signed on as co-sponsors.”

The Gas Price Relief Act, introduced Wednesday, would suspend the $18.4 cents per gallon federal gas tax through 2023. It comes as the average price of gas in the U.S. is up roughly $1 from the previous year. Experts expect that price to rise even higher in the coming months as many Americans resume in-person activities, including returning to the office and classrooms full-time.

To offset the lost revenue from taxes, the bill would require the Treasury Department to transfer money from a general fund into the Highway Trust Fund to keep it solvent through 2023.

Hassan comments. “We need to continue to think creatively about how we can find new ways to bring down costs, and this bill would do exactly that, making a tangible difference for workers and families,” Hassan said in a statement Wednesday announcing the effort.

— Biden administration to unveil initial effort on EV charging stations. The initial efforts by the Biden administration on installing charging stations for electric vehicles (EVs) will be unveiled today and will focus initially on getting charging locations along interstate highways and fast-charging stations before expanding into rural areas and heavier-populated urban areas. The administration today is to announce the guidelines for states to apply for an initial $5 billion in funds for the effort that could be rolling out as soon as September. There would be $615 million granted to states in the first 12 months of the program, with the biggest amount going to Texas, California and Florida. The funding follows traditional federal highway grants to states.

Details: The guidelines will call on states to focus on the interstate highway system before building in other areas. The Department of Transportation will be the agency to approve the plans. The rules call for the stations to be installed every 50 miles and no more than one mile off the interstate. The stations will have to have at least 600 kilowatts of total capacity and have at least four charging ports delivering at least 150 kilowatts each simultaneously. States are expected to contract with the private sector to install and operate the stations, with the federal government covering 80% of the cost of the stations, according to a memo from the Federal Highway Administration. The Departments of Energy and Transportation will jointly implement the effort and said the rules for another $2.5 billion in funding will be set later this year.

— RFS opponents want lower RFS corn-based ethanol mandate. More public officials are asking the Biden administration to rethink its proposal for the Renewable Fuel Standard (RFS) and argue that its denial of exemptions which dispense small refiners from complying with fuel blending obligations threatens to close those refineries down. Sen. Jon Tester (D-Mont.) wrote EPA Administrator Michael Regan this week and is requesting that he create a “workable exemption” for small refiners, saying a proposed denial of all petitions “ignores the real hardships faced by small refineries in colder areas like Montana.” The five Republican governors of Utah, Alabama, Wyoming, Oklahoma, and Idaho have sent a separate letter to Biden asking him to direct EPA to reject the proposed denial of exemptions and, like Tester, say the RFS proposal threatens to raise gasoline prices further if refiners go out of business. They also say it “runs flagrantly counter to [the administration’s] stated policy of lowering gas prices.” Senate Republicans sent their own letter to Regan last month making the same case.

USDA Secretary Tom Vilsack recently told AgriTalk that the 15 billion gallon mandate for ethanol is a solid one due to few if any RFS waivers.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Trade restrictions start with U.S. HPAI case in Indiana commercial turkey flock. Confirmation of the H5N1 strain of highly pathogenic avian influenza (HPAI) on a commercial turkey farm in Dubois County, Indiana, has resulted in trade actions by importers of U.S. poultry. The flock of 29,000 turkeys was quarantined and is being depopulated. USDA is reporting the situation to the World Organization for Animal Health (OIE) as well as international trading partners. USDA said it is encouraging countries to follow OIE standards and minimize trade impacts. OIE trade guidelines call on countries to base trade restrictions on sound science and, whenever possible, limit restrictions to those animals and animal products within a defined region that pose a risk of spreading disease of concern,” USDA noted. It is not clear how long the restrictions will last. For example, when the last case of HPAI was found in a commercial turkey flock in South Carolina in February 2020, China removed its block on imports of poultry from the state August 5, 2020. The following trade actions have been taken by US trading partners, according to USDA’s Food Safety and Inspection Service (FSIS), with halts on imports of poultry/products:

- From Indiana from birds slaughtered on/after February 8: China, Korea, and Tunisia.

- From Indiana from birds slaughtered on/after January 18: Benin, Namibia, and South Africa.

- Loaded on/after February 9: Taiwan.

- From affected area within Indiana processed on or after February 8: Singapore.

The eight destinations that have so far taken trade actions account for just 8% of the 550 million pounds of U.S. turkey exports. The trading partner to watch is Mexico — they buy 67% of U.S. turkey exports and 23% of broilers.

— Canada confirms HPAI in Nova Scotia commercial flock. The Canadian Food Inspection Agency has confirmed the presence of H5N1 highly pathogenic avian influenza (HPAI) in a commercial flock in western Nova Scotia. The discovery also prompted varying trade actions to be deployed against poultry from Canada.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 403,909,435 with 5,779,881 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 77,267,876 with 912,257 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 544,772,697 doses administered, 213,246,140 have been fully vaccinated, or 64.96% of the U.S. population.

— States and businesses are dropping mask rules. More Democratic governors relaxed coronavirus restrictions in their states, while federal officials cautiously suggested that the U.S. was headed toward “more normality.” Officials in New York, Illinois, Massachusetts and Rhode Island said Wednesday that rules requiring masks or proof of vaccinations intended to curb the spread of the Covid-19 pandemic would end by March. Earlier in the week, California, Oregon, New Jersey, Connecticut and Delaware officials announced similar rollbacks. Meanwhile, CVS said it expected demand for coronavirus tests and vaccines to drop this year.

— A block on the Biden administration’s vaccine mandate for federal workers will stay in place after a U.S. appeals court upheld a lower court’s ruling Wednesday, Reuters reports. The 5th Circuit Court of Appeals, by a 2-to-1 vote, declined to lift the injunction preventing the president from requiring about 3.5 million government workers to get vaccinated — or face potentially being fired barring a religious or medical exemption. The White House can appeal the decision to the Supreme Court, but for now, the mandate’s chances of surviving if it reaches the justices is unclear.

— Japan extends some COVID measures. Japan extended measures in Tokyo and some other places to curb outbreaks of Covid until March 6 as the country tries to bring the spread of the Omicron variant under control. The restrictions, largely requests that restaurants and bars to close early, were to end Feb. 13. The decision came after requests from governors in areas where daily infection cases are overwhelming hospitals. While more than 80% of the Japanese population have received two COVID vaccine shots, only about 7% have gotten boosters.

— U.K. Prime Minister Boris Johnson said he plans to lift all remaining coronavirus restrictions in England later this month, including the requirement to isolate if infected.

|

OTHER ITEMS OF NOTE |

— White House approved a plan for U.S. troops to help Americans evacuate Ukraine if Russia invades, according to two US officials. Nearly 2,000 troops in the region are now setting up processing areas and temporary shelters inside Poland near Ukraine's border where Americans fleeing Ukraine could go for help while in transit. Meanwhile, Russia and Belarus began 10 days of joint military exercises today. The U.S. and NATO have expressed concerns about the buildup of Russian troops in Belarus, which is a close ally of Russia.

— Russia blocks portions of Black and Azov Seas. The Russian gov’t has reportedly warned shippers to avoid significant portions of the northern end of the Black Sea, as well as the adjacent Sea of Azov due to upcoming naval exercises. This could amount to a de facto blockade of Ukraine’s southern coastlines, which in turn might be part of preparations for new large-scale Russian military intervention into that country. Ukraine’s ministry of foreign affairs “strongly protests” the seaway blockades saying: “Unprecedented coverage of maneuvers makes navigation in both seas virtually impossible. In essence, this is a significant and unjustified complication of international shipping, especially trade, which can cause complex economic and social consequences, especially for the ports of Ukraine. Such aggressive actions of the Russian Federation, which fit into the concept of its hybrid war against Ukraine, are unacceptable. This is a manifestation of open disregard for the norms and principles of international law, including the U.N. Charter, U.N. General Assembly resolutions and the U.N. Convention on the Law of the Sea. Ukraine is closely working with the partners, primarily those of the Black Sea region, to ensure that such actions of the Russian side receive a proper assessment and response.”