Grain Markets Rattled by Threat of War Between Russia and Ukraine, Driving Wheat Higher

Trucking, logistics companies noting impact of vaccine requirements on truckers

|

In Today’s Digital Newspaper |

Market Focus:

• USDA daily export sales:

— 132,000 MT soybeans to China during 2022-2023 marketing year

— 110,000 MT corn to Mexico during 2021-2022 marketing year

• Fed officials suggest they’ll move quickly to cool the economy

• Reserve Bank of Australia will end bond-buying program

• Trucking, logistics companies noting impact of vaccine requirements on truckers

• White House trying to accelerate ag exports through ports

• Mounting conflict in breadbasket of Europe is driving volatility in wheat markets

• Ag demand update

• Wheat rebounds overnight

• Record soy crush, increase in corn-for-ethanol use expected

• India proposes to cut taxes on a host of imports

• Cattle futures should be supported by inventory data

• Slaughter levels back to normal

Policy Focus:

• Virtually unchanged CFAP 1, CFAP 2 payouts

China Update:

• USTR Tai signals little progress in talks with China on Phase 1 commitments

Trade Policy:

• WTO chief warns supply chain woes may last into 2023

Energy & Climate Change:

• Interior sets $1.15 billion in funding to address abandoned oil, gas wells

• Canada’s CGX Energy makes offshore oil and gas find near Guyana coast

Livestock, Food & Beverage Industry Update:

• OMB finishes review of USDA final rule on Child Nutrition Program

• USDA plans to gather consumer input on ‘Product of USA’ label

Coronavirus Update:

• Moderna's Covid-19 vaccine receives full approval FDA

Other Items of Note:

• Russia/U.S./Ukraine update

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. Dow opened up a few points higher. Asian equities were mostly higher in limited trading with several markets closed for the Lunar New Year holiday, including Hong Kong, mainland China, South Korea, Taiwan and Singapore. The Nikkei ended up 76.50 points, 0.28%, at 27,078.48. Australia’s S&P/ASX was up 34.4 points, 0.49%, at 7,006.0. European equities are showing solid advances in early trading to open February. The Stoxx 600 was up 1.2% with regional markets up 1% to 1.2%.

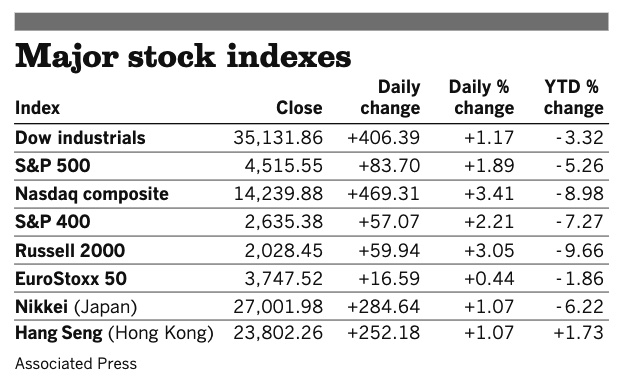

U.S. equities yesterday: While equities suffered a difficult start to 2022, all three major indices closed the final session of the month with gains. The Dow was up 406.39 points, 1.17%, at 35,131.86. The Nasdaq rose 469.31 points, 3.41%, at 14,239.88. The S&P 500 advanced 83.70 points, 1.89%, at 4,515.55.

For the month, all three indexes suffered their worst January since the 2008 financial crisis. The Dow was down 3.3% for January, while the S&P 500 was down 5.3% and the Nasdaq dropped 8.98%.

On tap today:

• IHS Markit's U.S. manufacturing index for January is expected to tick down to 54.8 from a preliminary reading of 55.0. (9:45 a.m. ET)

• Institute for Supply Management's manufacturing index is expected to fall to 57.4 in January from 58.7 one month earlier. (10 a.m. ET)

• U.S. construction spending for December is expected to increase 0.7% from the prior month. (10 a.m. ET)

• U.S. job openings and labor turnover survey is expected to show 10.5 million openings in December, down from 10.6 million one month earlier. (10 a.m. ET)

Fed officials suggest they’ll move quickly to cool the economy. Four of the central bank’s regional governors implied yesterday that the Fed will move decisively, not gradually, to withdraw emergency financial support, given the strength of the economy.

Trucking, logistics companies noting impact of vaccine requirements on truckers. U.S. and Canadian rules that went into effect requiring foreign nationals entering the countries to be vaccinated for Covid-19 is already causing impacts even as the U.S. requirements went into effect Jan. 22, the Canadian requirements on Jan. 15. Ann Reinke, president and CEO of Transportation Intermediaries Association, said there already has been an “impact’ to the rules. The group represents the third-party logistics industry, an industry which arranges transportation between shippers and drivers. Truckers previously had been exempt from vaccine requirements which had only applied to non-essential travel. Reinke said the solitary nature of trucking makes them a minimal threat relative to Covid. “Is this going to help the health and safety of the American population, or just make the supply chain worse?” she commented to CQ Roll Call.

Significant disruptions possible. Bob Costello, chief economist with the American Trucking Association, said the situation has the “potential to cause significant disruptions across the supply chain,” noting fleets are unable to move as many loads as they were before the vaccinate mandate.

Dept. of Homeland Security maintained there has not been an impact and that wait times are “normal.” This comes as Canada has seen protests by truckers snarl downtown Ottawa with truck traffic. The Canadian Trucking Alliance estimates that 12,000 Canadian truckers will be unable to cross the border due to the vaccine rules.

White House trying to accelerate ag exports through ports. One step by the Biden administration is a project in Oakland, said White House port envoy John Porcari on Monday. The gov’t will pay part of the cost for a 25-acre “pop up” site near the port that will be dedicated to loading farm exports into scarce containers. The site could go into operation as soon as early March, said USDA Secretary Tom Vilsack. USDA will pay 60% of start-up costs and a $125 subsidy per container to offset “additional movement logistics.” USDA estimated that it will spend $5 million as a partner in the project, which was announced by the Port of Oakland on Jan 3.

Pop-up sites like Oakland’s were announced previously in Georgia, and Vilsack said more of them could be added to ports on the West Coast. “We’ll continue to build fluidity at the ports so that exports are not disadvantaged,” said Porcari. “We’ll emphasize rail use as part of the way that we can do that.

Vilsack said the Oakland site was “an important first step.” And he said, “we are starting to see some of the shippers coming back to Port of Oakland” following a December letter by Transportation Secretary Pete Buttigieg and Vilsack that urged leading freight lines to mitigate disruptions to agricultural shippers by restoring reciprocal treatment of imports and exports and to reverse decisions to suspend service to the Port of Oakland, a major export terminal for ag products.

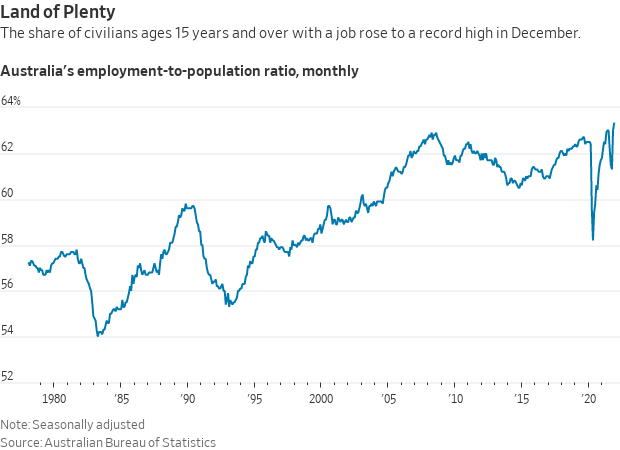

Reserve Bank of Australia will end a bond-buying program that has anchored its response to the Covid-19 pandemic due to accelerated inflation and a tight job market. The decision was paired with new economic forecasts showing the unemployment rate later this year is likely to fall to its lowest level since the 1970s. Elevated inflation is driving many central banks to end emergency policies put in place during the pandemic. The Bank of England raised interest rates in December — and could do so again this week — while the Bank of Canada recently signaled rate increases are on the horizon. Last week, Federal Reserve Chairman Jerome Powell said the central bank was ready to raise interest rates at its March meeting.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker ahead of U.S. trading with the euro and British pound both firmer against the greenback. The yield on the 10-year U.S. Treasury note has eased to trade around 1.75% with a generally weaker tone in global government bond yields. Gold and silver futures are advancing ahead of U.S. economic data, with gold trading above $1,808 per troy ounce and silver above $22.95 per troy ounce.

• Crude oil futures are lower ahead of U.S. market action, with U.S. crude around $87.65 per barrel and Brent around $88.85 per barrel. Futures had traded higher in Asian action, with U.S. crude around $88.35 per barrel and Brent around $89.50 per barrel.

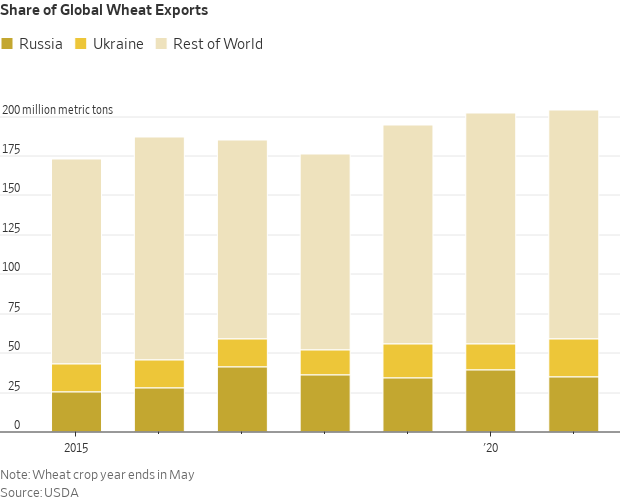

• Mounting conflict in the breadbasket of Europe is driving volatility in wheat markets, the Wall Street Journal reports (link). Russia and Ukraine account for 29% of global wheat exports, and wheat futures are rising on the threat of war and the potential for Western sanctions on Russian exports, the WSJ notes. Ports in both nations are key gateways for grain exports to buyers in North Africa and the Middle East, and damage to port infrastructure or disruption to shipments could snarl supplies for countries that depend on imports to keep their populations fed. Ukraine’s key wheat-growing regions also lie close to Russian-held territory. The risks are pushing wheat futures traded in Chicago up to nearly $8 a bushel. Other major wheat growers like the U.S., France or Australia could use any disruption to expand their share of the export market.

• USDA daily export sales:

— 132,000 MT soybeans to China during 2022-2023 marketing year

— 110,000 MT corn to Mexico during 2021-2022 marketing year

• Ag demand: Japan is seeking 53,957 MT of Canadian and Australian wheat in its weekly tender. Tunisia tendered to buy 100,000 MT of wheat, 75,000 MT of durum and 75,000 MT of feed barley — all optional origin.

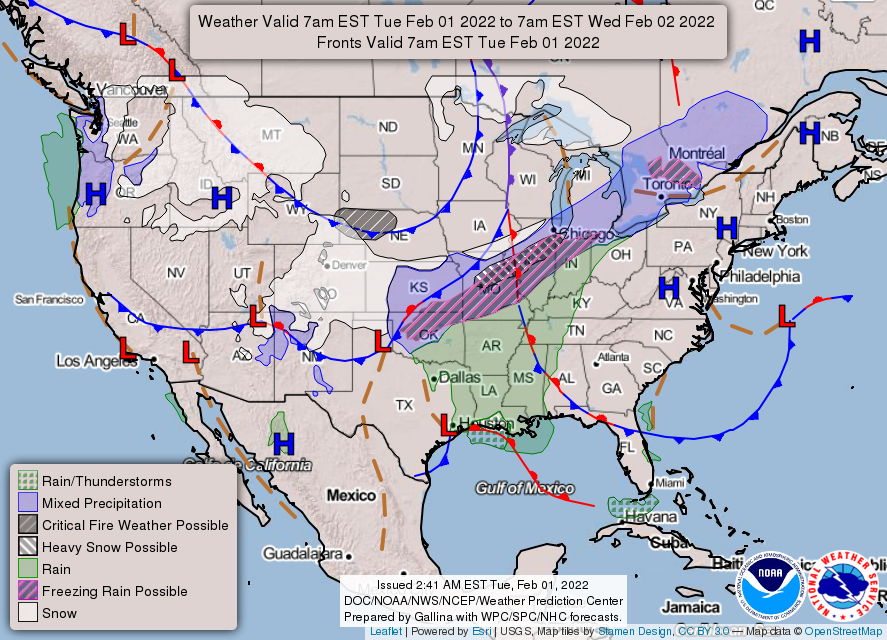

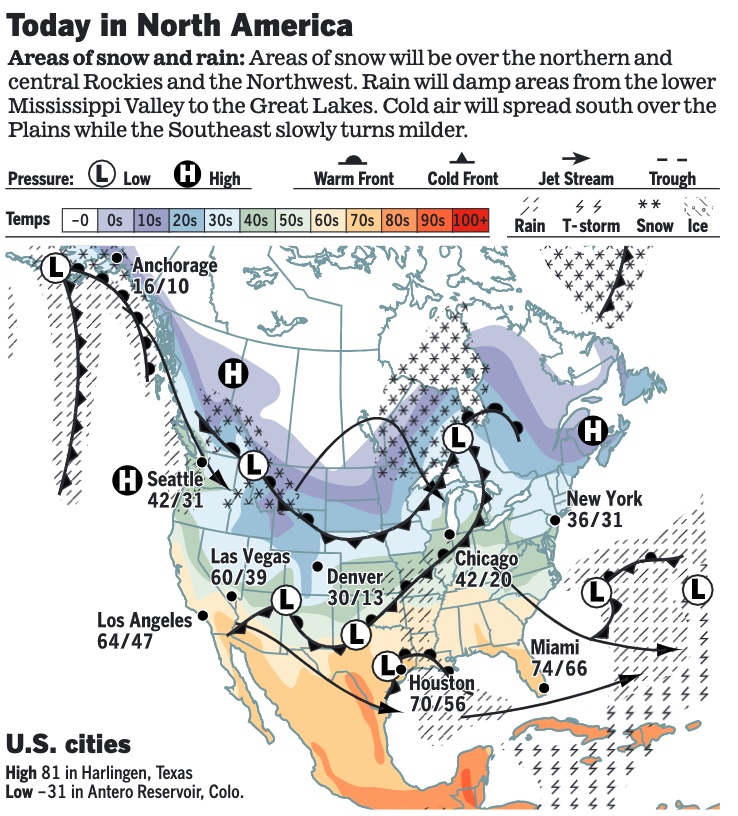

• NWS weather: A major winter storm is expected to impact much of the central U.S. beginning Tuesday night and continuing through Thursday morning... ...Frigid arctic air sweeps south across Great Plains beginning Wednesday.

Items in Pro Farmer's First Thing Today include:

• Wheat rebounds overnight

• Record soy crush, increase in corn-for-ethanol use expected

• India proposes to cut taxes on a host of imports

• Cattle futures should be supported by inventory data

• Slaughter levels back to normal

|

POLICY FOCUS |

— Virtually unchanged CFAP 1, CFAP 2 payouts. Payments under the Coronavirus Food Assistance Program 1 (CFAP 1) and CFAP 2 programs were virtually unchanged as of Jan. 30, with total CFAP 2 payments at at $19.07 billion, with original CFAP 2 payouts at $14.24 billion and the top-up payments at $4.83 billion ($4.82 billion prior). CFAP 1 payments were unchanged at $11.76 billion, including $10.57 billion in original CFAP 1 payments and $1.19 billion in top-up payments.

|

CHINA UPDATE |

— USTR Tai signals little progress in talks with China on Phase 1 commitments. Talks with China on meeting the terms of the Phase 1 agreement signed between the U.S. and China under the Trump administration have not yet yielded any results, according to U.S. Trade Representative (USTR) Katherine Tai. “We are in a very difficult stage of this trade relationship,” Tai said at a virtual meeting of the National Asian Pacific American Bar Association. She said the conversations thus far are “not easy” but her team at the USTR will “engage robustly” relative to the Phase 1 agreement.

The relationship with China is “one of the defining issues” for the Biden administration.

Tai said she has started the “step-one” discussions with China on the Phase 1 deal, but those have not yet yielded any results, adding that her discussions with Chinese Vice Premier Liu He are “quite difficult.” However, she pledged the U.S. was “unflinchingly honest” in raising concerns with China on the Phase 1 agreement purchase commitments in particular.

Comments: The talks apparently will take longer than many have expected. Tai’s comments focused on the purchase commitments, but U.S. agriculture interests are even more focused on getting China to fulfill their commitments on areas like biotechnology approvals and other trade matters that have tempered trade with China. And this pushes further back any possibility of a Phase 2 set of negotiations.

|

TRADE POLICY |

— WTO chief warns supply chain woes may last into 2023. Supply chain issues which have snarled global trade flows may last longer than originally thought, according to WTO Director General Ngozi Okonjo-Iweala, who remarked in France Monday they could last into 2023, according to a report in the Financial Times (FT). “We thought the supply chain disruptions would be temporary,” Okonjo-Iweala told a meeting organized by the Jeune Afrique Media Group. “We still think that, but they are taking longer to resolve than we expected — maybe by the end of this year or maybe into next year.” As with inflation that was viewed by the U.S. Fed as being “transitory,” Okonjo-Iweala used that same term to describe supply chain pressures in an October 2021 interview with the FT.

Demand-side pressure that pushed up freight rates and caused delays are expected to ease this year with more supply coming on line, the WTO official said. “Demand for goods should come down, especially with the inflationary pressures and the winding down of support from pandemic-related fiscal measures,” she said.

“Shipping companies are making unprecedented profits and some are investing in capacity.” However, she said that “structural problems” could also persist, and specifically mentioned that problems at U.S. West Coast ports could be due to structural and bureaucratic changes.

The WTO will convene a meeting of business executives, ministers and trade experts to examine the persistent supply chain blockages.

|

ENERGY & CLIMATE CHANGE |

— Interior sets $1.15 billion in funding to address abandoned oil, gas wells. The Department of Interior (DOI) announced $1.15 billion in funding from the Bipartisan Infrastructure Law will be deployed in 26 states for cleaning up abandoned oil and gas wells. Phase One of the effort includes up to $25 million in initial grant funding, one quarter of the total formula grant money to the 26 states that expressed an interest in the effort. DOI will release detailed guidance on the initial grants in coming weeks, including on building out their plugging programs, remediating high-priority wells, and collecting additional data regarding the number of orphaned wells in their states. DOI will also release additional information on states to access the formula grant funding along with further instructions on applying for $1.5 billion in state performance grants.

— Canada’s CGX Energy makes offshore oil and gas find near Guyana coast. Canada's CGX Energy and its parent company Frontera Energy confirmed Monday (Jan. 31) they discovered a new oil and gas reservoir off the coast of Guyana, Reuters reported. CGX’s Kawa-1 well found around 177 feet of hydrocarbon-bearing reservoirs, but the companies offered no estimate yet of the deposit’s total size. "We are very pleased to have successfully drilled the Kawa-1 well with our partner CGX,” said Frontera CEO Orlando Cabrales. Last month, CGX said it may need to seek additional financing to continue drilling, with costs of Kawa-1 rising to around $115 to $125 million. Final well costs estimates and more information on the find will be disclosed later, CGX said.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— OMB finishes review of USDA final rule on Child Nutrition Program temporary standards for milk, whole grains and sodium. The Office of Management and Budget (OMB) has completed its review of USDA’s final rule for temporary standards on milk, whole grains and sodium in Child Nutrition Programs (CNP). The standards will cover the National School Lunch Program and School Breakfast Program as well as the Child and Adult Care Food Program (CACFP) and the Special Milk Program (SMP) for operators returning to operations after the Covid-19 pandemic. The final rule will implement a meal pattern standard for School Years (SY) 2022-2023 and 2023-2024. U.S. dairy interests have followed the development of the rule closely, with representatives of several organizations meeting with OMB on the matter in December.

— USDA plans to gather consumer input on ‘Product of USA’ label. USDA has released a notice covering the process they will use to gather input from consumers on the voluntary “Product of USA” label for pork and beef, seeking comments on the process to be used. USDA said this will be used to develop proposed changes to the effort, but this initial step still leaves some very important issues to be tackled. Link for details.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 378,716,963 with 5,675,536 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 74,943,050 with 886,691 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 539,337,296 doses administered, 211,818,885 have been fully vaccinated, or 64.53% of the U.S. population.

— Moderna's Covid-19 vaccine has received full approval from the U.S. Food and Drug Administration (FDA) for use in people ages 18 and older. The vaccine, named Spikevax, is the second coronavirus vaccine to receive full approval from the FDA behind Pfizer’s Comirnaty vaccine. There's no difference between the newly approved vaccine and the vaccine previously available through emergency use authorization.

|

OTHER ITEMS OF NOTE |

— Russia/U.S./Ukraine. U.S. Secretary of State Antony Blinken will speak by phone with Russian Foreign Minister Sergei Lavrov following U.S. proposals on de-escalating the situation. Russia still denies it plans an invasion, while western allies are finalizing a package of sanctions that could be imposed in case diplomatic efforts fail. The U.S. and U.K. plan to target Russian oligarchs and businesses connected to the Kremlin as part of a broad sanctions effort if Russia invades Ukraine.