Ongoing Crop Insurance Case in Minnesota Could Have Implications for Others

If Russia invades Ukraine: U.S., other sanctions could tip countries into recession

|

In Today’s Digital Newspaper |

Market Focus:

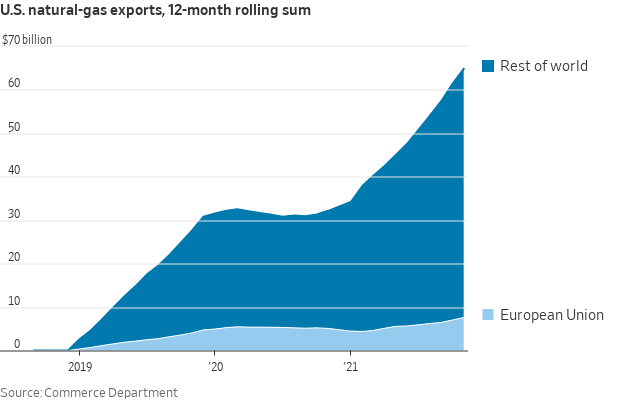

• Biden to lean on Qatari leader to counter power of Russian gas exports in Europe

• U.S. LNG exports to Europe

• Europe will suffer if Russia cuts off the gas, but it has some options

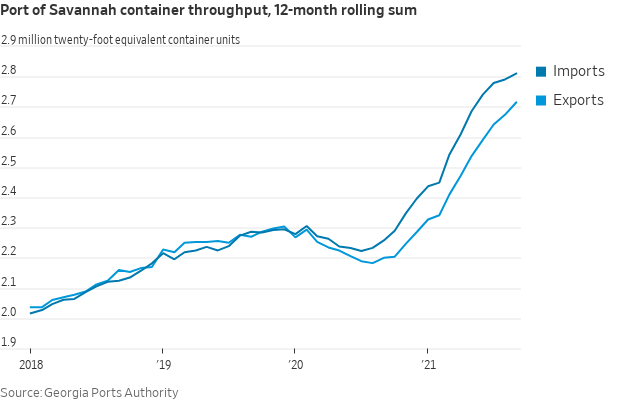

• Pathways around shipping bottlenecks in U.S. appear to be closing

• Higher U.S. interest rates, stable EU rates equal stronger U.S. dollar

• Analyst: Oil prices at $100 are a ‘distinct possibility this year’

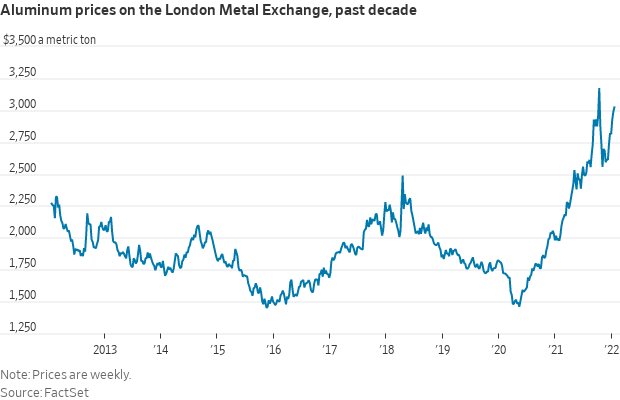

• Aluminum sector impacted by rising power prices over the past year

• Ag markets: Soybeans continue to surge

• Florida orange juice could skyrocket in price

Policy Focus:

• Crop insurance question but complex developments•

China Update:

• FCC bans Chinese company that is official telecom provider for Beijing Olympics

• China’s economy continued to slow at the start of the year

Energy & Climate Change:

• Transition to net-zero economy will be metal-intensive

Livestock, Food & Beverage Industry Update:

• Inflation coming to a longtime refuge of price-conscious consumers: restaurant value menus

Coronavirus Update:

• Canadian Premier vows to end proof of vaccine policy as truckers protest in Ottawa

Other Items of Note:

• Border agents slam President Biden's migrant flights

• Russia/Ukraine update

• North Korea fired its most powerful ballistic missile in years

|

MARKET FOCUS |

Equities today: Global stock markets were mostly up overnight. U.S. stock indexes are pointed toward narrowly mixed openings. Earnings roll out this week from dozens of companies, including Amazon and Alphabet — roughly one in five S&P 500 companies are scheduled to report this week. Asian equity markets were mostly higher in trading to start the week. Markets in mainland China, South Korea and Taiwan were closed for a holiday. The Nikkei was up 284.64 points, 1.07%, at 27,001.98. The Hang Seng Index rose 252.18 points, 1.07%, at 23,802.26. European equities are mixed in early action with most markets off their initial opening marks. The Stoxx 600 was up 0.4% with regional markets down 0.4% to up 0.6%.

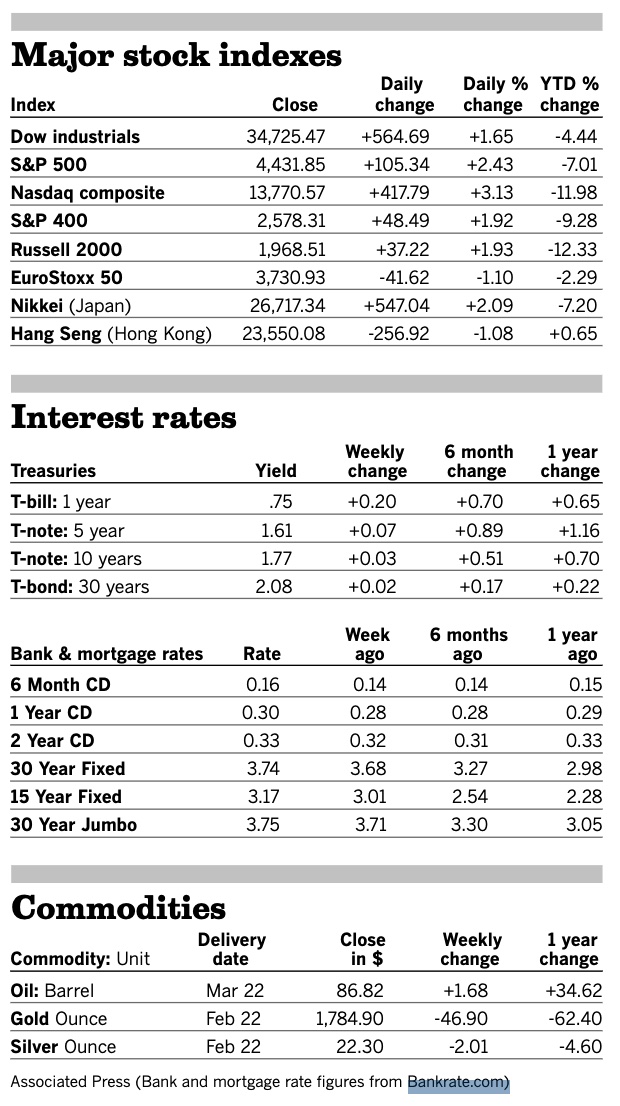

U.S. equities Friday: The Dow rose 564.69 points, 1.65%, at 34,725.47. The Nasdaq gained 417.79 points, 3.13%, at 13,770.57. The S&P 500 moved up 105.34 points, 2.43%, at 4,431.85. Financial conditions are going to be tightening, and Wall Street is ramping up expectations of how many times the Federal Reserve will raise rates this year -— five looks like the new consensus.

For the week, the Dow gained 0.8% while the Nasdaq was essentially flat for the week and is still considered in correction territory. The S&P 500 added 1.3% for the week.

On tap today:

• Chicago purchasing managers index is expected to fall to 62.3 in January from 63.1 one month earlier. (9:45 a.m. ET)

• Dallas Fed's manufacturing survey is out at 10:30 a.m. ET.

• USDA Grain Export Inspections report, 11:00 a.m. ET.

• USDA reports: Agricultural Prices, Cattle, Sheep and Goats and Capacity of Refrigerated Warehouses.

• Federal Reserve speakers: San Francisco's Mary Daly at Reuters Breakingviews Predictions 2022 at 11:30 a.m. ET, and Kansas City's Esther George to the Economic Club of Indiana at 12:40 p.m. ET.

• U.S. President Joe Biden hosts the emir of Qatar, Sheikh Tamim bin Hamad Al Thani at the White House today with a packed agenda. Biden is expected to lean on the Qatari leader for support in countering the power of Russian gas exports in Europe by sending some of its own stocks to the continent. It’s not clear what capacity Qatar has to divert gas to Europe; it already accounts for roughly five percent of Europe’s gas, but the majority of its exports go to Asia.

The pathways around shipping bottlenecks in the U.S. appear to be closing, according to the Wall Street Journal (link). The port congestion that has locked up goods moving through Southern California is spreading to other gateways, and that is adding headaches and raising costs for American importers. Container ships are backed up off South Carolina’s Port of Charleston and the Port of Oakland, and ships entering the Port of New York and New Jersey are waiting longer for berth space. The new delays are in part the result of rising volumes as shippers seek alternatives to the ports of Los Angeles and Long Beach. Increased worker absences related to Covid-19 have also complicated cargo handling and trucking operations. Sea-intelligence reports global schedule reliability for container lines deteriorated again in December, and now carriers and their customers are hoping a lull during the upcoming Lunar New Year provides some relief.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly lower with a generally firmer tone in most foreign rival currencies versus the greenback. The yield on the 10-year U.S. Treasury note is firmer, trading just under 1.79%, with a mixed tone in global government bond yields. Gold and silver futures are moving higher ahead of U.S. trading with gold around $1,790 per troy ounce and silver around $22.50 per troy ounce.

• It’s no wonder the U.S. dollar has been rising. Traders think the latest Federal Reserve information via the FOMC and presser from Chairman Powell signal multiple rate hikes this year, with the consensus at five 25 basis point hikes. Compare that to the European Central Bank (ECB) which will set rates on Feb. 3. The ECB has signaled that no hike is likely this year. But some economists expect the central bank to rise its deposit rate in December.

• Crude oil futures are little changed ahead of US trading, with US crude around $86.85 per barrel and Brent around $88.60 per barrel. Crude was higher in Asian action with US crude above $87.80 and Brent above $89 per barrel.

• Oil prices at $100 are a “distinct possibility this year, driven by both strong demand and minimal gains on the supply side,” says Bill Fitzpatrick, managing director and portfolio manager at Logan Capital. While OPEC would love to see oil hover at $80 to $100, prices above the top end of that range will probably see demand destruction, with consumers forced to reduce consumption, and that is the last thing OPEC wants, he says. Link to more via Barron’s.

• U.S. LNG to Europe. U.S. LNG exporters, which are already running near capacity, have told officials that they are sending as many shipments as they can to Europe without violating other customers' long-term supply agreements. In fact, Europe is taking 70% of America's LNG cargoes, according to S&P Global Platts. There are also some near-term bottlenecks that have to be ironed out, including a limited number of U.S. export terminals that can turn gas into a liquid so it can be shipped over long distances. However, U.S. officials tried to persuade Europe for years to buy American natural gas as a bulwark against Russia, with the Trump administration dubbing it “molecules of freedom.” But most countries stuck with the cheaper Russian supplies, and options to send more gas now are limited.

Europe will suffer if Russia cuts off the gas, but it has some options. The continent could use more liquefied natural gas from countries such as China and its energy system has become more resilient in recent years, leaving once isolated countries better connected. The bigger price will be paid by Russia. Turning the taps off completely could cost Gazprom, its state-controlled gas giant, between $203 million and $228 milliion a day in lost revenues, according to one calculation. Russia’s central-bank reserves would cushion such a blow. But the wider commercial fallout would surely hurt Gazprom’s ability to do business.

• The aluminum sector has been impacted by rising power prices over the past year. The prospect of a Russian invasion of Ukraine has made matters worse. Russia is one of the world’s biggest aluminum producers and a key source of natural gas for Europe — traders worry a conflict could disrupt supplies of both. Energy can account for up to half of the cost of making aluminum.

• Ag markets: Soybeans continue to surge as futures posted another round of contract highs overnight, with the front-month contract reaching the highest level since June 2021 on the continuation chart. Corn and wheat followed soybeans higher. Soybeans were up 10 to 13 cents, corn is 2 to 6 cents higher, winter wheat is mostly 1 to 3 cents higher and spring wheat is 6 to 12 cents higher.

• Next big squeeze: Florida orange juice could skyrocket in price. A citrus disease, freezing temperatures and more supply chain problems mean growers can’t meet heightened demand for the state’s “liquid gold.” The state’s crop is down more than 75 percent from its peak, according to Florida Citrus Mutual. Florida has lost 50% of its growers because of consolidation, land development and growers just quitting the business. Link for details via the Washington Post.

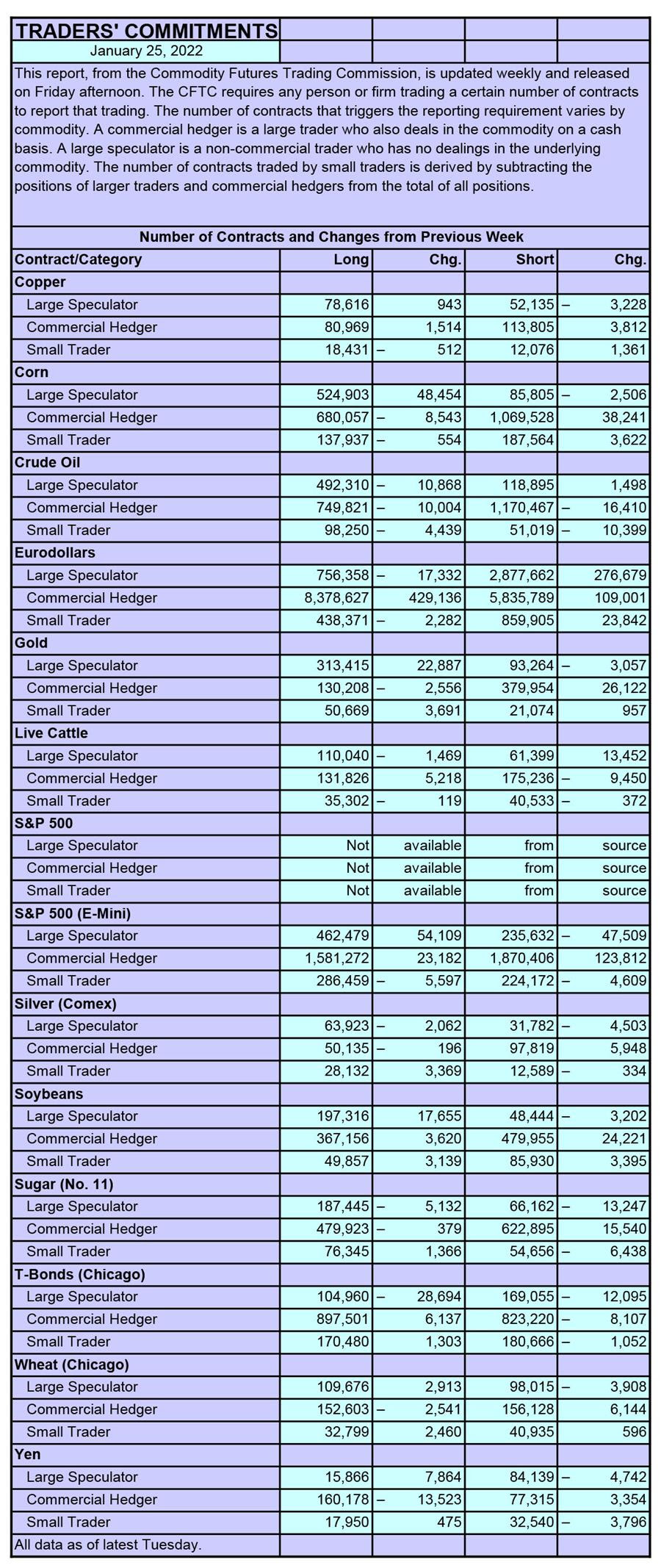

• CFTC Commitments of Traders report (Source: Barron’s):

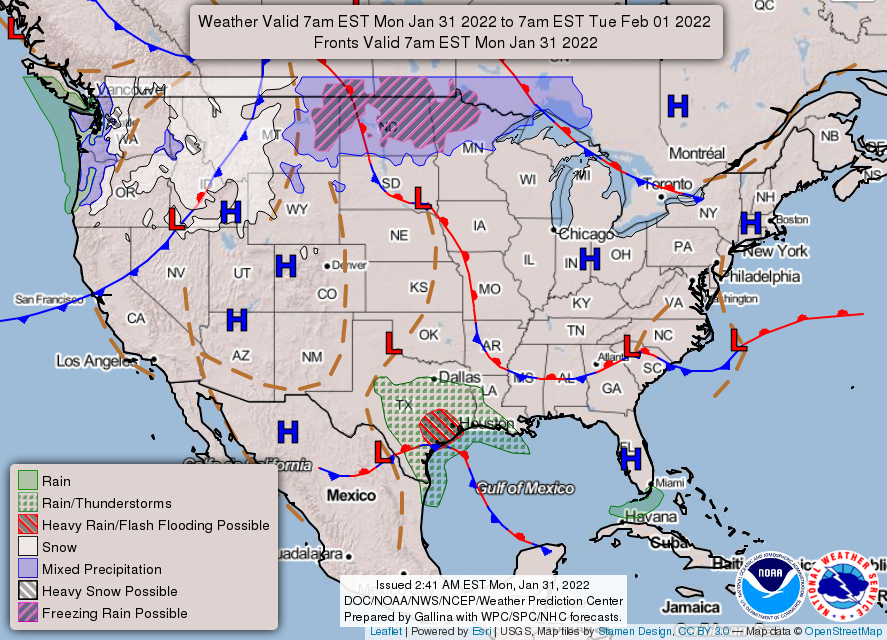

• NWS weather: Slight Risk of Excessive Rainfall leading to Flash Flooding for parts of the central Texas Gulf Coast today... ...Pacific Northwest system produces moderate to heavy snowfall for Cascades and Northern Rockies today before spreading light snow and high winds across the Northern Plains tonight; Critical Fire Weather Risk for parts of northwestern Nebraska this afternoon... ...A large and significant winter storm is expected to impact much of the central U.S. beginning the middle of this week.

|

POLICY FOCUS |

— Crop insurance question but complex developments. The issue: Farmers who grow crops that can be harvested for grain or cut for silage can insure their crop either way as long as the corn seed planted can be used for harvested corn or silage. If the farmer decides to harvest a way other than how he insured it, he just needs to get an adjustment.

But a frustrated farmer is using a fraud statute to argue that if a farmer insures a crop one way and also says that in his Farm Service Agency (FSA) filing but harvests it in another way, that is a false claim and fraudulent. A Minnesota federal judge is now reviewing the matter after a trial ended. This case is important because if the case goes the wrong way, farmers who both harvest their crop for grain and cut it for silage will face serious legal uncertainty.

USDA has not offered guidance as apparently USDA lawyers do not want to get involved in litigation. This has frustrated the judge. It looks like either USDA or Congress will have to step in if the case is wrongly decided. If not, corn, dairy, wheat, sorghum and many other farmers could find themselves in legal trouble.

The trial is now over, and a decision is near. Whatever the outcome, it is expected to go to the 8th circuit. Maybe the Supreme Court will have to decide yet another critical agriculture case?

Farmers and agents familiar with crop insurance say grain could be harvested or chopped as silage and be insured either way, as long as the seed can be used for either and they called for an adjustment if they wanted to harvest differently than they initially insured.

Bottom line: If clarity is not forthcoming from USDA, this case could mean farmers would have to do exactly as they say in their insurance and form 578 from now on or face fraud charges from the government or private third parties.

|

CHINA UPDATE |

— FCC bans Chinese company that is official telecom provider for Beijing Olympics. The Federal Communications Commission banned China Unicom Americas from the U.S. market, labeling the Chinese military-linked company as a national security threat even as it is set to be the telecommunications provider at the Winter Olympics.

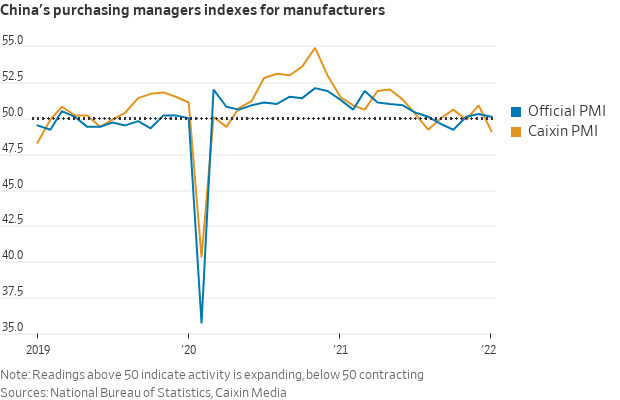

— China’s economy continued to slow at the start of the year, with manufacturing output slipping and Covid-19 outbreaks curbing consumer spending. The official purchasing managers’ surveys released Sunday showed a moderation in factory production and services in January. Two gauges of Chinese manufacturing activity — one official and one private — each retreated in January, while a third measure, of the country’s services sector, brought into relief the deep toll that the latest burst of coronavirus infections has inflicted on domestic demand. China’s official manufacturing purchasing managers index fell to 50.1 in January, the National Bureau of Statistics said, down from 50.3 in December and just above the 50 mark that separates activity expansion from contraction. The Caixin China manufacturing PMI, a private gauge that is more focused on small private businesses than the official manufacturing index — which is weighted more toward large state-owned enterprises — tumbled to 49.1 in January, its lowest level since February 2020, at the height of the initial Covid-19 outbreak in China.

Outlook: Things don't look any better in the foreseeable future. Factories will likely see an output lull in February as workers head home for the Lunar New Year holiday. Industrial activity has also been impacted by the government's decision to cut steel plant output capacity to reduce air pollution before the Winter Olympics in Beijing. The developments, along with a zero-Covid policy, saw Goldman Sachs last week cut its 2022 forecast for China's economic growth to 4.3%, down from 4.8% previously.

|

ENERGY & CLIMATE CHANGE |

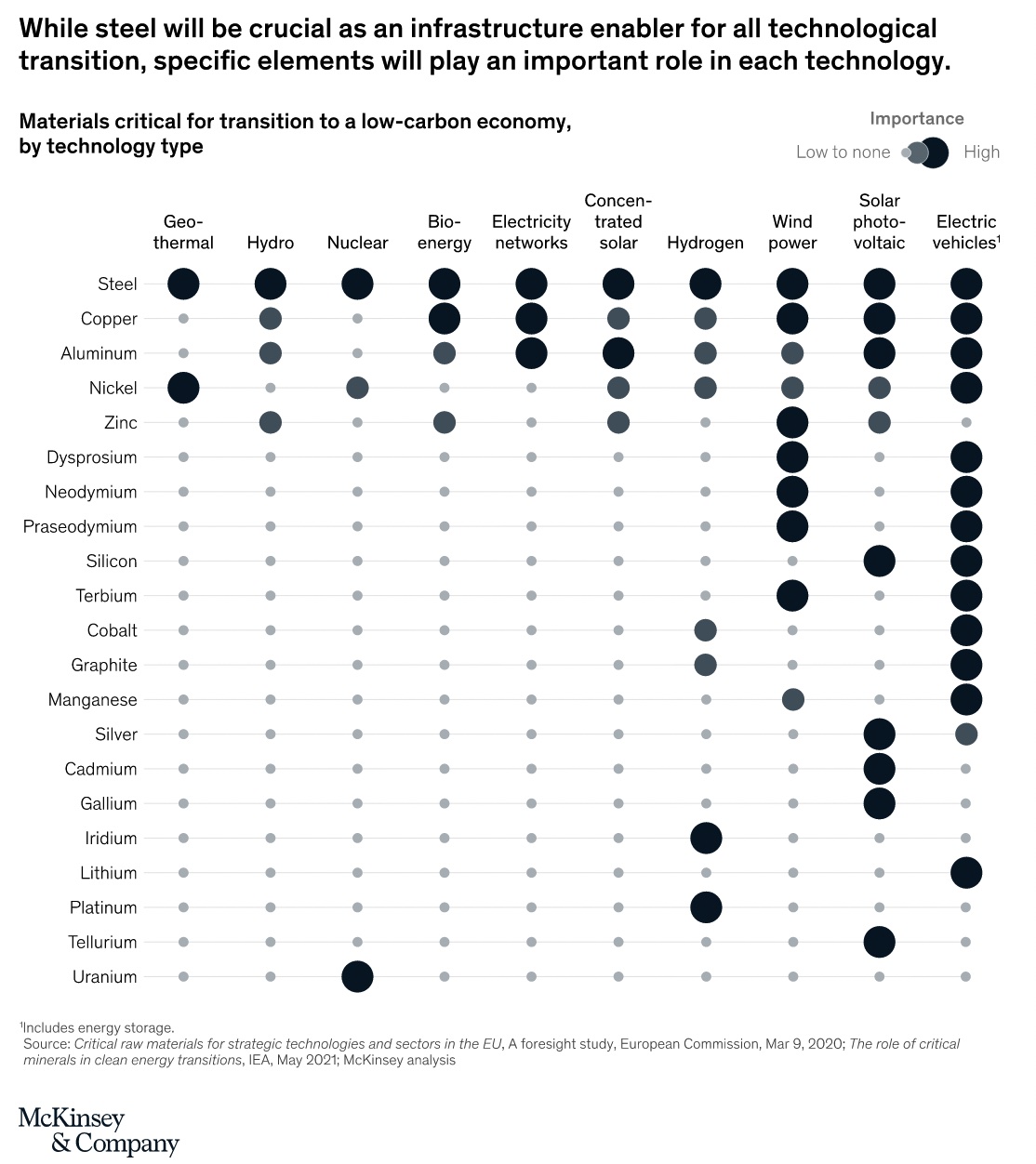

— Transition to a net-zero economy will be metal-intensive. New technologies will require base metals — for example, copper for electrification and nickel for battery EVs. Green technologies will also need hefty amounts of rarer metals, such as lithium and cobalt for batteries, tellurium for solar panels, and neodymium for the permanent magnets used both in wind power generation and EVs. The required pace of transition means that, for some of these commodities, we will soon need ten times or more than is available today, according to a McKinsey & Company report (link).

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

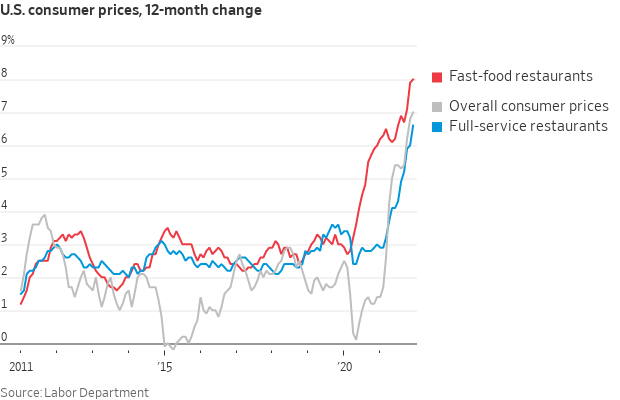

— Inflation is coming to a longtime refuge of price-conscious consumers: restaurant value menus. Burger King, Denny’s and Domino’s Pizza are among the chains that are reducing their menu of discounted items or shrinking portions to try to improve their profits, executives said. Some chain executives hope the trimming of discount menus and meal deals might bring less pushback from consumers than straight price increases. Prices for food away from home rose 6% in the year ended December, the biggest increase in nearly four decades, federal figures show. Many chains increased prices multiple times last year as they tried to compensate for rising costs for labor, food and materials, and have said that more increases could come in 2022 if the inflation persists, the Wall Street Journal reports (link).

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 375,078,356 with 5,665,252 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 74,333,528 with 884,265 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 538,829,920 doses administered, 211,695,131 have been fully vaccinated, or 64.49% of the U.S. population.

— ‘Makes no sense’: Canadian Premier vows to end proof of vaccine policy as truckers protest in Ottawa. A Canadian premier said Saturday the proof of vaccine requirement makes no sense, and he will end it in the “not-too-distant future” in his province. Saskatchewan Premier Scott Moe said in a statement (link) that being vaccinated doesn’t prevent one from getting the virus and the vaccine mandate “makes no sense… I want to be clear on how I feel about vaccines. I am fully vaccinated with my booster shot. This did not prevent me from recently contracting Covid-19, but I believe it did keep me from becoming sick,” he said in a statement. “That said, because vaccination is not reducing transmission, the current federal border policy for truckers makes no sense. An unvaccinated trucker does not pose any greater risk of transmission than a vaccinated trucker,” he continued. He will “continue to encourage everyone to get vaccinated” though, believing it will prevent people from becoming seriously ill.

Meanwhile, tens of thousands of protesters gathered outside Canada’s parliament buildings, clogging up main arteries in the capital, as they demanded the government rescind

|

OTHER ITEMS OF NOTE |

— 'Doing nothing': Border agents slam President Biden's migrant flights. Angry border patrol agents lashed out at Homeland Security Secretary Alejandro Mayorkas and Border Patrol Chief Raul Ortiz during what was meant to be a morale-boosting visit with the two officials in Laredo, Texas, according to a leaked video released Saturday. Link for details.

— Russia/Ukraine update. Senate Foreign Relations Chair Bob Menendez (D-N.J.) on Congress’ response to Russia, on CNN’s State of the Union: “There is an incredible bipartisan resolve for support of Ukraine and an incredibly strong bipartisan resolve to have severe consequences for Russia if it invades Ukraine, and, in some cases, for what it has already done. … What we are devising … these are sanctions beyond any that we have ever levied before … And I think that that sends a very clear message.”

Foreign Relations ranking member Jim Risch (R-Idaho), on timing for the sanctions: “I'm more than cautiously optimistic at this point that, when we get back to D.C. [Monday], that we’re going to be moving forward.”

The U.N. Security Council will meet today, and U.S. officials are vowing to press their Russian counterparts. (On Tuesday, Feb. 1, Russia assumes the rotating presidency of the U.N. Security Council for the month of February.) Meanwhile Britain drafted plans to widen the range of sanctions it could apply to Russia if it attacks Ukraine.

Senators will get a classified briefing from administration officials on Thursday morning and the House will have a meeting Thursday afternoon. Leading these briefings: Secretary of State Antony Blinken, Defense Secretary Lloyd Austin, DNI Avril Haines and Chair of the Joint Chiefs Gen. Mark Milley.

— Major U.S./allies’ sanctions on Russia could have huge impacts. According to the New York Times (link): Sanctions imposed on Russia “could cause severe inflation, a stock market crash and other forms of financial panic that would inflict pain on its people — from billionaires to government officials to middle-class families… [T]he strategy comes with political and economic risks. No nation has ever tried to enact broad sanctions against such large financial institutions and on an economy the size of Russia’s. And the ‘swift and severe’ response that U.S. officials have promised could roil major economies, particularly those in Europe, and even threaten the stability of the global financial system.”

— North Korea fired its most powerful ballistic missile in years over the weekend, an escalation of its weapons program and a possible sign of larger tests to come. A senior U.S. official says the launch — the latest in a string of provocations from North Korea — could be designed to extract concessions from the U.S. ahead of potential negotiations.