Key Inflation Gauge Rose 5.8% in December, Fastest Since 1982

Mixed outlook on Russia intentions re: Ukraine

|

In Today’s Digital Newspaper |

Market Focus:

• USDA export sales:

— 264,000 MT of soybeans to China in MY 2022-23

— 141,514 MT of soybeans to Mexico in MY 2021-22

— 251,500 MT soybeans in the reporting period to unknown destinations in MY 2021-22

• Key inflation gauge rose 5.8% in December, fastest since 1982

• Consumer spending fell last month amid rising prices and Omicron wave

• Employers spent 4% more on wages and benefits last year

• World’s largest spirits maker is running low on some of its products

• Chip delays to continue

• Germany's economy contracted in the fourth quarter

• France’s economy grew by 7% in 2021, fastest expansion since 1969

• Japan's Toyota vehicle sales rose by 10.1% last year

• Gold and silver prices being hit this week

• Farmers holding back grain and soybean sales in a bet that prices will rise further

• India is set to boost its sunflower oil imports from Argentina and Russia

• Canadian truck drivers want to shut down central Ottawa over gov’t vaccine mandate

• ‘Bomb cyclone” expected to batter Northeast this weekend4

• Ag demand update

• Old-crop soybeans score new highs

• Limited premium in February live cattle

• Outside markets overshadow fundamentals for hogs

Policy Focus:

• Vilsack addressed key ag issues in interview yesterday with AgriTalk

Personnel:

• Supreme Court update

• Vilsack hopes to soon announce a nominee for the department’s top trade post

• First Black woman to serve as chief economist at Labor Dept. left her position

China Update:

• Imbalances in Chinese economy have worsened: IMF

• China tries to calm foreign banks’ economic concerns

• China’s land sales growth slowed sharply in 2021

• Australian coal held at Chinese ports mostly cleared

Trade Policy:

• U.S., Canada hopeful for resolution on some PEI potato shipments

Energy & Climate Change:

• EPA finalizes delays in RFS compliance for 2019-2022

• U.S. federal judge annulled an oil and gas lease sold in the Gulf of Mexico

• Ethanol threat

Livestock, Food & Beverage Industry Update:

• United Nations to offer insight into prospects for world food-commodity prices

• USDA finds little concern about pesticide residues

Coronavirus Update:

• New spinoff of Omicron variant called BA.2 being talked about

Other Items of Note:

• Russia/Ukraine update

• Cotton AWP moves over $1.12 per pound

|

MARKET FOCUS |

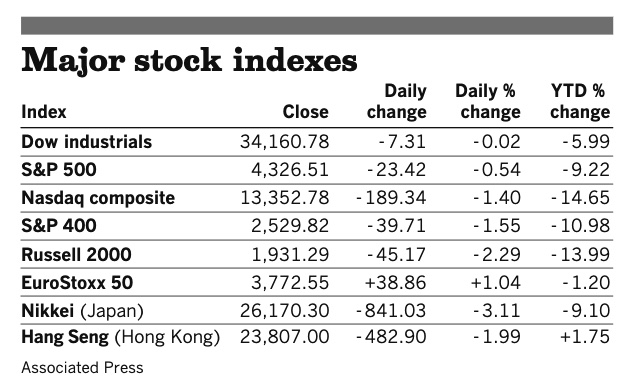

Equities today: Global stock markets were mixed to lower overnight. The Dow opened slightly lower but then declined around 250 points; the Nasdaq inched slightly higher. Asian equities finish mixed after volatile week. Hong Kong’s Hang Seng Index fell 256.92 points, 1.08%, at 23,550.08. Japan’s Nikkei rose 547.04 points, 2.09%, at 26,717.34. European equity markets are under pressure in early action. European equity markets are moving lower. The Stoxx 600 was off 2.1% while regional markets were seeing losses of 1.7% to 2.5%.

U.S. equities yesterday: The Dow finished down 7.31 points, 0.02%, at 34,160.78, after struggling to stay in positive territory late in the session. The Nasdaq lost 189.34 points, 1.40%, at 13,352.78, having been lower since mid-session. The S&P 500 was down 23.42 points, 0.54%, at 4,326.51.

On tap today:

• U.S. consumer spending for December is expected to fall 0.7% from the prior month. (8:30 a.m. ET) UPDATE: Consumer spending, a key engine of economic growth, fell last month amid rising prices and the Omicron wave. Consumer outlays declined by 0.6% in December from the prior month, the Commerce Department said Friday. Meanwhile, the agency’s gauge of overall inflation rose 0.4% from a month earlier and 5.8% from a year earlier. The drop in consumer spending in December marked the first month-over-month decline since last winter, and signal that rising inflation, supply-chain volatility and the Omicron variant of Covid-19 all tempered consumer outlays in a key month of the holiday season.

• U.S. personal consumption expenditures price index excluding food and energy for December is expected to increase 0.5% from one month earlier and 4.8% from one year earlier. (8:30 a.m. ET) UPDATE: Consumer prices rose 5.8 in December compared to one year earlier, according to the Commerce Department’s Personal Consumption Expenditures index – the Federal Reserve’s preferred measure of inflation. The rate increased compared to November, when the PCE hit 5.7%. The core PCE, which does not include volatile food and energy prices, was up 4.9% year-over-year. The core figure rose from 4.7% in November. The spike in inflation marked the highest rate of increase since 1982. Inflation has remained high for months compared to the Federal Reserve’s target level of 2%.

• U.S. employment cost index for the fourth quarter is expected to rise 1.2% from the prior quarter. (8:30 a.m. ET) UPDATE: Employers spent 4% more on wages and benefits last year as workers received larger pay raises in a tight labor market and period of higher inflation, marking an increase not seen since 2001. The U.S. employment-cost index — a quarterly measure of wages and benefits paid by employers — showed that costs continued to rise at the highest rate in two decades of available records, with a seasonally adjusted increase of 1% in the fourth quarter of 2021 over the prior three months. The fourth quarter gain, compared with a year ago, rose 4% on a non-seasonally adjusted basis, the Labor Department said today.

• University of Michigan's consumer sentiment index for January is expected to tick down to 68.5 from a preliminary reading of 68.8. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

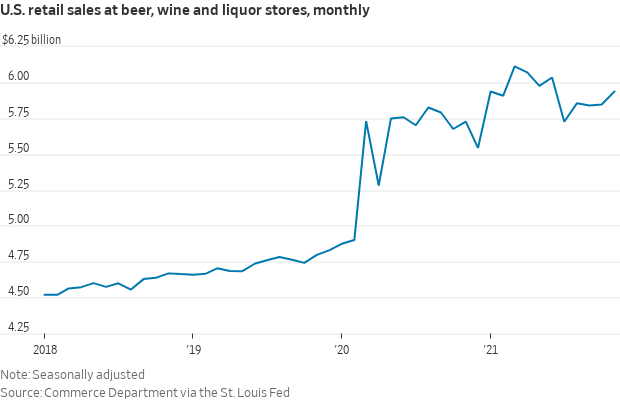

World’s largest spirits maker is running low on some of its products. Diageo PLC said soaring pandemic demand is depleting stocks of Crown Royal whisky, Lagavulin Scotch and Don Julio tequila. Diageo said it also hasn’t had enough bottles to package up Bulleit bourbon, is separately grappling with higher costs for aluminum and cereals that go into the booze-making process, and shipping and energy bills have climbed. To make up, Diageo is raising prices in some markets.

Chip delays to continue. The Biden administration concluded that a global semiconductor shortage will persist until at least the second half of this year, promising long-term strain on a range of U.S. businesses including automakers and the consumer electronics industry.

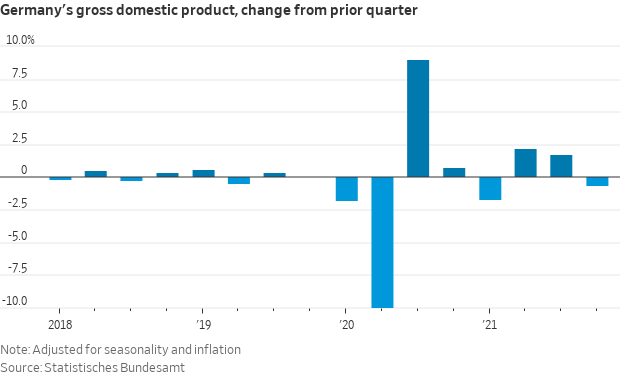

Germany's economy contracted in the fourth quarter due to a rise in coronavirus cases and a re-imposition of pandemic restrictions, the German Federal Statistical Office said today. Gross domestic product fell by an adjusted 0.7% from the previous quarter. The data for Europe's biggest economy follow the first estimates of fourth-quarter GDP in France and Spain, which posted on-quarter expansions of 0.7% and 2.0%, respectively.

France’s economy grew by 7% in 2021, the fastest expansion since 1969. Growth was driven by increased consumer spending and business investment. The French statistics agency said GDP has now “significantly” exceeded its pre-crisis levels. In Spain, the economy grew by 5% in 2021, the quickest expansion in 21 years but still below the government’s target of 6.5%.

Japan's Toyota said its vehicle sales rose by 10.1% last year, making it the world's biggest carmaker for a second straight year and putting it further ahead of its nearest rival, Germany's Volkswagen.

Market perspectives:

• Outside markets: The U.S. dollar index is firmer ahead of U.S. economic updates, with the euro slightly weaker versus the U.S. currency. The yield on the 10-year U.S. Treasury note was higher ahead of inflation data, trading just above 1.83% while there was a mostly firmer tone in global government bond yields. Gold and silver futures were lower ahead of U.S. economic updates, with gold under $1,786 per troy ounce and silver under $22.45 per troy ounce.

• Gold and silver prices are being hit this week. Gold is down almost $70 an ounce from the early week two-month high. Silver prices are down over $2.00 an ounce from a two-month high hit last week.

• Crude oil futures are higher ahead of U.S. trading, with U.S. crude around $87.70 per barrel and Brent around $89.20 per barrel. Futures were higher overnight in Asian action, with U.S. crude up 61 cents at $87.22 per barrel and Brent up 40 cents at $88.57 per barrel.

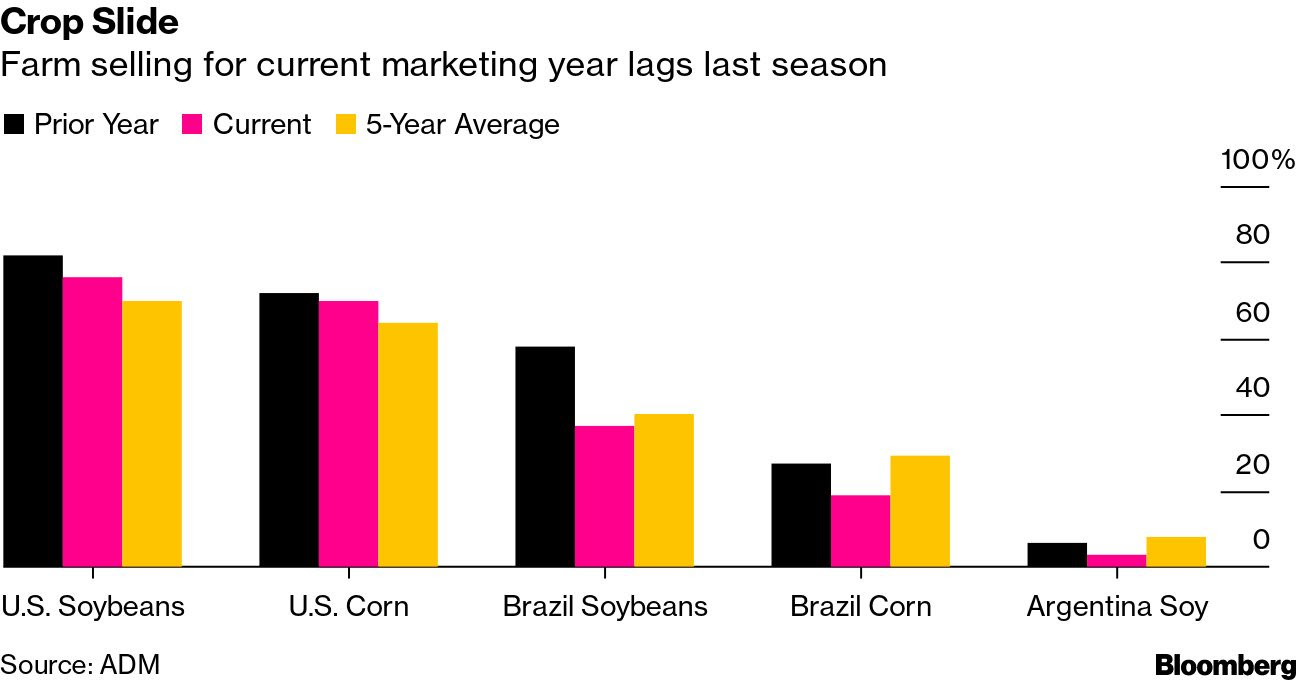

• Farmers are holding back grain and soybean sales in a bet that prices will continue rising as dry weather in Brazil and Argentina stokes fears of tight global supplies. Crop sales by farmers for the current season were below a year ago in the U.S., Brazil and Argentina, which together account for more than three-quarters of global corn and soy exports, according to Archer-Daniels-Midland Company.

• India is set to boost its sunflower oil imports from Argentina and Russia due to worries that shipments from Ukraine, the biggest supplier, could be disrupted amid growing tension.

• USDA export sales:

— 264,000 MT of soybeans to China in MY 2022-23

— 141,514 MT of soybeans to Mexico in MY 2021-22

— 251,500 MT soybeans in the reporting period to unknown destinations in MY 2021-22

• Ag demand: Japan purchased 22,410 MT of Australian milling wheat. The Philippines purchased around 50,000 MT of Australian feed wheat.

• Canadian truck drivers determined to shut down central Ottawa over a federal government vaccine mandate rolled across the country toward the capital, boosted by praise from Tesla Chief Executive Elon Musk. Link to more via Reuters.

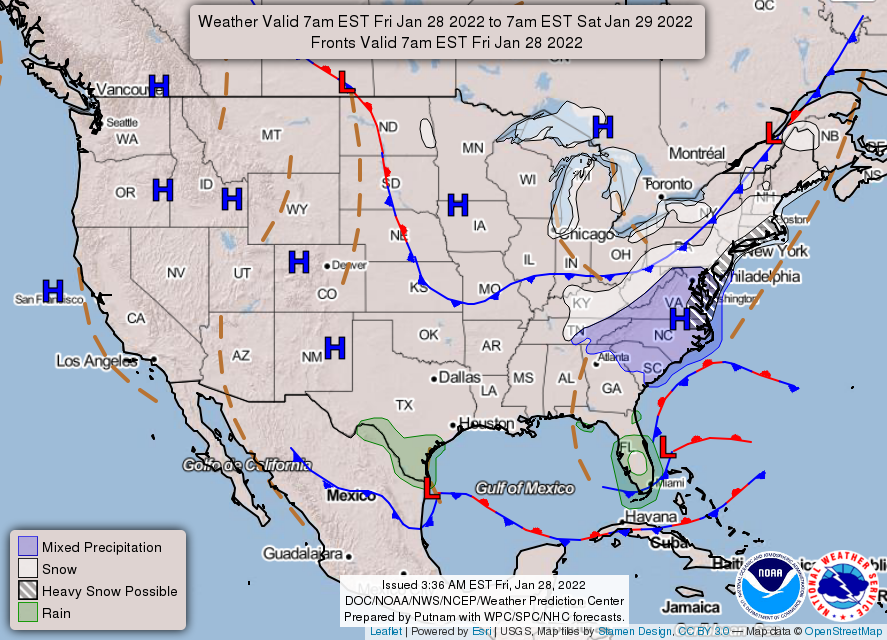

• A “bomb cyclone” is expected to batter the Northeast this weekend with heavy snow, wind and coastal flooding. More than 55 million Americans are currently under winter storm watches and travel advisories. Some forecasts remain uncertain, but most are showing that Eastern Massachusetts, including Boston, and Rhode Island could be hit hard with 12 to 24 inches of snow combined with wind gusts up topping 60 mph. The storm is expected to form off the coast of the Carolinas today, and once it reaches the East Coast, it may dump as many as 14 inches of snow in portions of Connecticut and New York, where wind gusts may reach as high as 55 mph. Portions of northeastern North Carolina and southeastern Virginia could also see up to 3 inches of snow and high winds.

• NWS weather: Powerful winter storm to produce significant impacts across parts of New England and coastal Mid-Atlantic/Northeast on Saturday... ...Well below average temperatures will expand across eastern third of the country this weekend before moderating next week; Great Plains warm up this weekend.

Wx

Items in Pro Farmer's First Thing Today include:

• Old-crop soybeans score new highs

• Limited premium in February live cattle

• Outside markets overshadow fundamentals for hogs

|

POLICY FOCUS |

— Vilsack addressed key ag issues in an interview yesterday with AgriTalk. Keys:

• Covid and disaster aid payments coming. USDA is close to figuring out how the money will be divvied up. Vilsack wouldn’t commit to a specific timeline, but said aid for hog producers they are coming soon, as “issues” are close to being resolved.

• CRP enrollment. He thinks USDA has already taken steps to attract acres... “realigned bid rates based on what’s happening in the real world.” USDA will hold a general signup for the Conservation Reserve Program (CRP) Jan. 31 to March 11 and a Grassland CRP signup April 4 to May 13.

• Corn-based ethanol mandate. Vilsack said the proposed 15-billion-gallon mandate for 2022 is solid because the current EPA won’t grant small refinery exemptions.

|

PERSONNEL |

— Supreme Court update. Justice Stephen Breyer made his retirement official on Thursday, submitting a formal letter to President Biden and appearing alongside him at a White House event. “I’ve made no decision except one,” Biden said of his nominee to succeed Breyer. “The person I will nominate will be someone with extraordinary qualifications, character, experience and integrity, and that person will be the first Black woman ever nominated to United States Supreme Court.” Biden said he would announce his nominee by the end of February. Democrats are hoping to move quickly from there. The confirmation could be as short as the four weeks it took Republicans to confirm Amy Coney Barrett in 2020. Breyer will remain on the bench until June, but Democrats hope to have his successor in place well before then.

— Vilsack hopes to soon announce a nominee for the department’s top trade post —Undersecretary of Agriculture for Trade and Foreign Agricultural Affairs. USDA Secretary Tom Vilsack made the comments during an interview Jan.27 on the Agri-Talk radio program. When asked about the timeline for an Undersecretary for Trade and Foreign Agricultural Affairs nominee — the position previously held by now-National Association of State Departments of Agriculture (NASDA) CEO Ted McKinney during the Trump administration — Vilsack said, “we have a person which we have asked to take on that responsibility. He's going through the… vetting process.” Vilsack originally made similar statements last week following a hearing before the House Agriculture Committee on the state of rural America.

The next person to take the position would be only the second one in that role, which was made a standalone role in 2017 as mandated by the 2014 Farm Bill. Before that, responsibilities for trade issues were assigned to what was the Undersecretary of Farm and Foreign Agricultural Services. But with the advent of the trade role, that position was renamed the Undersecretary for Farm Production and Conservation the Natural Resources Conservation Service (NRCS) moved under that post.

Vilsack said the delay in rolling out a pick boils down to the extensive vetting process, a refrain he has lamented before. “There's a lot of questions concerning his business dealings, and we're just going through the process of trying to make sure ethically… he's not going to have any issues or any problems,” he remarked, adding, “it takes a long time, unfortunately, and so that's where we are.”

Vilsack stressed that “we have a great team at the [Foreign Agricultural Service], and they're doing a fantastic job,” and that key work on trade issues is “getting done.” He added that “aggressive” efforts by FAS to boost ag exports continue, and said he expects 2022 ag exports to exceed the record seen during 2021.

— First Black woman to serve as chief economist at the Labor Department left her position yesterday after less than a year serving in the role. Janelle Jones announced her departure on Twitter, saying that working for Biden’s White House “has been an incredible experience. And it ended today.” She didn’t specify the reason for the unexpected departure and said she would spend all of February reading sci-fi and fantasy.

|

CHINA UPDATE |

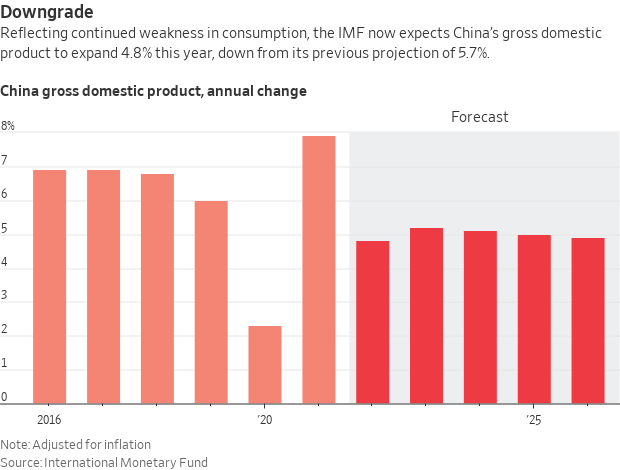

— Imbalances in the Chinese economy have worsened and delayed China’s transition to consumption-led growth, the International Monetary Fund (IMF) said in an annual review today, slashing its outlook for the country this year. The IMF forecast China’s GDP growth at 4.8% in 2022, down from its previous forecast of 5.7% growth. The IMF assessment reflects growing concern among some economists and officials that greater state intervention in the economy could be hindering China’s long-held goal of “high-quality” growth — one driven by consumption rather than investment.

— China tries to calm foreign banks’ economic concerns. The China Securities and Regulatory Commission (CSRC) met this week with executives at top western banks and asset managers to reassure them about the country’s economic prospects after regulatory crackdowns in 2021, Reuters reports, citing three sources familiar with the situation. Senior executives from firms including BlackRock, Credit Suisse, Fidelity International, Goldman Sachs, JPMorgan, Morgan Stanley and UBS attended the meeting. The CSRC official reassured the meeting participants China will achieve “respectable growth” in 2022. He also said China’s leadership understood the regulatory changes Beijing introduced in 2021 would affect economic growth but was determined to tolerate the pains. However, 2022 will be different year as it will have a series of significant events, including the key once-in-five-years Communist Party congress later this year, according to one source.

— China’s land sales growth slowed sharply in 2021. Chinese government revenue from land sales climbed a modest 3.5% last year, a sharp slowdown as the country’s property developers grappled with a liquidity crunch caused by regulatory efforts to rein in the sector’s ballooning debt. The land sales growth slowed from 15.9% in 2020 and 11.4% in 2019. Sentiment in the Chinese property market, which accounts for a quarter of GDP by some metrics, has been increasingly shaken by the liquidity crisis that has engulfed some of the country’s biggest and most indebted developers.

— Most of the Australian coal used by steelmakers that was being held at Chinese ports in the wake of Beijing’s import ban has now been cleared, according to local research firm Fengkuang Coal Logistics, although there’s no sign that the halt on new shipments will be lifted.

|

TRADE POLICY |

— U.S, Canada hopeful for resolution on some PEI potato shipments. Meetings between USDA Secretary Tom Vilsack and Canadian Agriculture Minister Marie-Claude Bibeau resulted in Vilsack agreeing to the Animal and Plant Health Inspection Service (APHIS) undertaking a risk analysis of fresh potatoes from Prince Edward Island (PEI) to Puerto Rico within two weeks, and one for PEI potatoes to mainland U.S. in the weeks after that. “It gave us a lot of hope,” Bibeau told Reuters. The actions could reopen trade in table potatoes from PEI to the U.S. that Canada halted after potato wart was discovered. Canada took the step to avoid the U.S. halting the imports. Bibeau said it would take longer to address concerns over potatoes for processing and planting.

|

ENERGY & CLIMATE CHANGE |

— EPA finalizes delays in RFS compliance for 2019-2022. EPA has finalized its plan to delay the compliance deadlines under the Renewable Fuel Standard (RFS) for 2019-2022.

EPA is extending the deadline for the 2019 compliance year only for small refineries to the next quarterly reporting deadline after the effective date of the 2021 RFS levels which the agency said typically is 60 days after publication of the rule in the Federal Register.

As for 2020, 2021 and 2022 compliance deadlines, EPA said for 2020 it will be the next quarterly reporting deadline after the 2019 compliance deadline for small refineries; for 2021 it will be the next quarterly reporting deadline after the 2020 compliance deadline; and the 2022 compliance deadline will be the next quarterly reporting deadline after either the effective date of the 2023 RFS standards or the 2021 compliance deadline, whichever is later.

For 2019–2022, EPA is extending the associated attest engagement reporting deadlines to the next June 1 annual attest engagement reporting deadline after the applicable 2019–2022 compliance deadline.

These mark slight shifts in the proposal initially released by EPA in November. The action also changes the compliance and attest engagement reporting deadlines for 2023 and beyond. Link to read more on EPA’s final determinations. EPA will soon publish a notice of the final rule in the Federal Register.

— Some Senate Republicans express concern over EPA RFS plans. A group of Republican senators wrote to EPA Administrator Michael Regan to express concerns over the levels proposed for 2022 by the agency for the Renewable Fuel Standard (RFS) and the proposed rejection of all 65 pending small refinery exemptions (SREs). The lawmakers said the EPA proposal “runs counter to congressional intent” relative to the SREs and said the 2022 Renewable Volume Obligations (RVOs) proposed do “not reflect market realities and is likely to further raise costs for refiners — especially small and independent refiners — and therefore American consumers and the economy.”

The lawmakers noted that the Clean Air Act allows for SREs to help small refiners in cases where complying with the mandates would cause them “disproportionate economic hardship.” The lawmakers argued the proposed 2022 RVO levels are “likely baking in elevated blending mandates for years to come.”

Those signing the letter included Sens. Shelley Moore Capito (R-W.Va.), John Barrasso (R-Wyo.), and James Inhofe (R-Okla.), all repeated critics of the RFS program. EPA is taking public comments on the proposed RFS levels through Feb. 4 and on the proposal to deny all pending SREs through Feb. 7.

— U.S. federal judge annulled an oil and gas lease sold in the Gulf of Mexico, arguing that it failed to account for its impact on the environment. The judgement casts uncertainty over the future of the Biden administration’s offshore drilling programs. The leases were auctioned for a total of $190 million in November but were challenged by a coalition of environmentalists.

— Ethanol threat. Ethanol producers are increasingly under threat not only from electric-vehicle substitution, but also from the growing number of markets — such as California — that favor lower-carbon fuel options, spurring a need to further decarbonize ethanol, Bloomberg Intelligence said.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— United Nations will next week offer more insight into the prospects for world food-commodity prices when it updates its monthly gauge of costs. The index is near a record set in 2011 that contributed to a global food crisis. Food inflation in the OECD hit 5.5% in November, the highest reading since 2009, data published by the Paris-based organization show.

— USDA finds little concern about pesticide residues. More than 99% of food sampled by USDA in 2020 had pesticide residues below federal tolerances and 30% had no detectable residues, according to a new report released by USDA’s Agricultural Marketing Service (AMS). The Pesticide Data Program’s annual survey includes data from some 9,600 samples of 18 commodities of fresh and processed fruits and vegetables. This year’s survey included: apple juice, bananas, blueberries (fresh and frozen), broccoli, cantaloupe, carrots, cauliflower, collard greens, eggplant, green beans, kiwi fruit, orange juice, radishes, summer squash, sweet bell peppers, tangerines, tomato paste and winter squash. The findings show that “when pesticide residues are found on foods, they are nearly always at levels below the tolerance, or maximum amount of a pesticide allowed to remain in or on a food,” the report stated.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 366,589,668 with 5,638,962 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 73,428,433 with 878,467 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 536,370,947 doses administered, 211,162,083 have been fully vaccinated, or 64.33% of the U.S. population.

— New spinoff of Omicron variant called BA.2 is being talked about, but experts say there's no reason to panic as there's no indication it causes more severe symptoms or spreads more easily than the original strain of Omicron. Some are warning though that BA.2 is a “stealth variant” because it doesn’t cause a certain signature on lab tests and can look lik

|

OTHER ITEMS OF NOTE |

— U.S. and Ukrainian officials disagree regarding the “risk levels” of a potential Russian invasion of Ukraine, a senior Ukrainian official told CNN yesterday. A 20-minute phone call between President Biden and Ukrainian President Volodymyr Zelensky yesterday "did not go well," the official said. Biden warned his Ukrainian counterpart that a Russian invasion may be imminent, saying that it is now virtually certain in the coming months. Zelensky, however, said the threat from Russia remains "dangerous but ambiguous," emphasizing it is not certain that an invasion will take place. The Biden administration yesterday also called for the first U.N. Security Council meeting on the situation along the Russia/Ukraine border to discuss Moscow's recent aggressions. NATO, the defense alliance set up to promote peace and stability, is also rapidly trying to reinforce its presence in the region to help ease tensions.

Russian Foreign Minister Sergei Lavrov said the American proposal to defuse tensions with Ukraine contained “rational elements,” even though some key points were ignored. “It’s at least something,” Lavrov said of offers to discuss restricting missile deployments and military maneuvers near Russia’s borders. The U.S. and its allies rejected Russian demands that NATO close its door to Ukraine’s potential future membership and roll back forces from former Soviet states.

Bottom line: The Kremlin continues to deny that is has any intentions of doing invading, despite massing thousands of troops, tanks and equipment near its neighbor’s eastern border. Meanwhile, talks between both sides continue even as Russia criticizes proposals from the U.S. and NATO. For markets, the uncertainty remains a key driver of the rally in oil prices this week which saw global benchmark Brent hit the highest level since 2014.

— Cotton AWP moves over $1.12 per pound. The Adjusted World Price (AWP) for cotton moved up to 112.43 cents per pound, effective today (Jan. 28), the highest of the year and the fourth straight week it has been $1 per pound or more. This is the highest AWP since it was at 112.84 cents per pound the week of July 1, 2011. Meanwhile, USDA announced Special Import Quota #15 will be established Feb. 3 for 43,094 bales of Upland Cotton, applying to supplies purchased not later than May 3 and entered into the U.S. not later than Aug. 1.