Will Manchin Fold Like a Weak Chair or Postpone/Defeat Biden’s BBB Package?

La Niña strengthens, will persist longer than previously thought

In Today’s Digital Newspaper

Market Focus:

• USDA daily export sale: 256,930 MT soybeans during reporting period

to unknown destinations during 2021-2022 marketing year

• Shifting chairs at the Federal Reserve

• Rising U.S. inflation leading more analysts to predict higher interest rates sooner

• Where inflation is highest in the U.S.

• Surge in energy prices saps pandemic recovery in Europe

• Deere and UAW resume negotiations as strike drags on

• Disasters cost farming sectors of developing countries over $108 billion, 2008-2018

• OPEC oil market report highlights

• Coal shortage that led to an energy crisis in China is rippling beyond its borders

• U.S. coal exports are 29% higher this year

• Container shipping rates drop, but still highly elevated

• Russian wheat export tax rises again

• Cotton futures surged back to highest level in more than a decade

• Blizzards could affect China's corn marketing

• Federal weather forecasters: likelihood of a La Niña winter in U.S. is increasing

• Grain, soybean futures trading near their overnight lows

• Inclement weather, harvest delays push China corn prices higher

• Inflation pulling forward expectations for Fed rate hike

• Russian wheat export tax rises again

• Ukraine winter wheat sowing 94% complete

• Packers buying a lot of cattle again this week

• Traders expecting cash hog decline to continue

Policy Focus:

• Update on infrastructure measures

Afghanistan:

• U.S. joined rivals China and Russia to call on Taliban to cut ties with terrorist groups

• People seeking to get out of Afghanistan forced to leave safe houses

Biden Administration Personnel:

• White House doubles down on support for Saule Omarova amid controversies

• Biden poised to nominate Califf as FDA chief

• Senate to vote next week for Bonnie as USDA undersecretary post `

China Update:

• Xi Jinping now has a mandate to potentially rule for life

• Xi expected to invite Biden to join him in Beijing in February for 2022 Winter Olympics

• U.S. firms and Chinese affiliates are investing in China’s semiconductor industry: WSJ

Energy & Climate Change:

• Biofuel groups tout report showing above average unionization in biofuel supply chains

Livestock, Food & Beverage Industry Update:

• Farm Bureau hopes parts of new cattle market bill will be rolled into LMR reauthorization

• Judge keeps Tyson Covid suit in federal court

Coronavirus Update:

• Moderna defends safety of its Covid-19 shot from questions about associated heart risks

• Coronavirus deaths in Europe rose 10% in first week of November

Politics & Elections:

• Murkowski announces re-election bid opposed by Trump

• Republican Jack Ciattarelli plans to concede New Jersey governor’s race

Other Items of Note:

• U.S. warning EU allies that Russia may be planning to invade Ukraine

• Belarus president threatens to block transit of gas and goods to Europe

• Portugal makes it illegal for bosses to call, text or email outside regular working hours

MARKET FOCUS

Equities today: Global stock markets were mixed in overnight trading. The U.S. stock indexes are pointed to firmer openings. Johnson & Johnson plans to split into two publicly traded companies in 18 to 24 months, separating its high-margin but risky prescription-drugs and medical-devices business from the slower-growing one that sells the likes of Band-Aids and Tylenol. Meanwhile, Japan’s Toshiba plans to split in three — an infrastructure business, an electronic-devices maker and a holding company. Asian equity markets posted gains, rebounding from losses earlier in the week following a higher-than-expected US inflation read. Japan’s Nikkei was up 332.11 points, 1.13%, at 29,609.97. The Hang Seng Index gained 79.98 points, 0.32%, at 25,327.97. European equities are mixed. The Stoxx 600 was up 0.1% while other markets posted gains of 0.5% to losses of 0.4%.

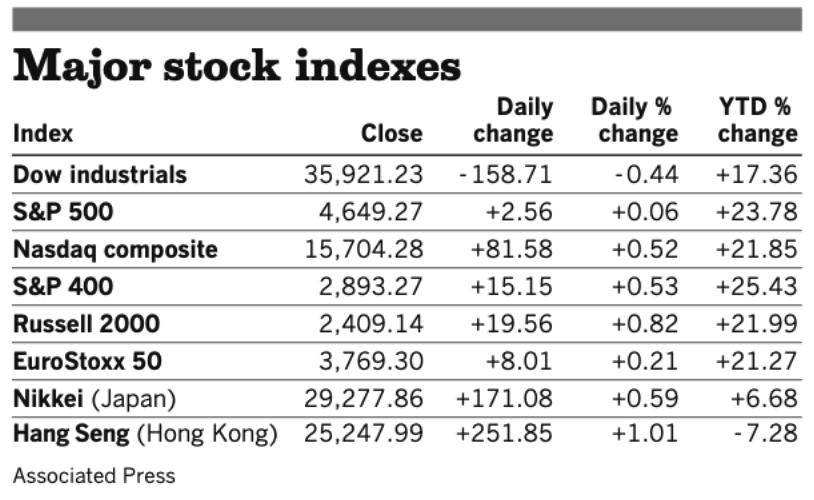

U.S. equities yesterday: The Dow lost 158.71 points, 0.4%, to end at 35,921.23. The S&P 500 added 2.56 points, 0.1%, to end at 4,649.27. The Nasdaq gained 81.58 points, 0.5%, to finish at 15,704.28.

On tap today:

• USDA Weekly Export Sales report, 8:30 a.m. ET.

• University of Michigan's preliminary consumer sentiment survey for November is expected to rise to 72.5 from a final reading of 71.7 in October. (10 a.m. ET)

• U.S. job openings and labor turnover survey is expected to show openings fell to 10.2 million in September from 10.4 million one month earlier. (10 a.m. ET)

• New York Fed President John Williams speaks at his bank on heterogeneity in macroeconomics at 12:10 p.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

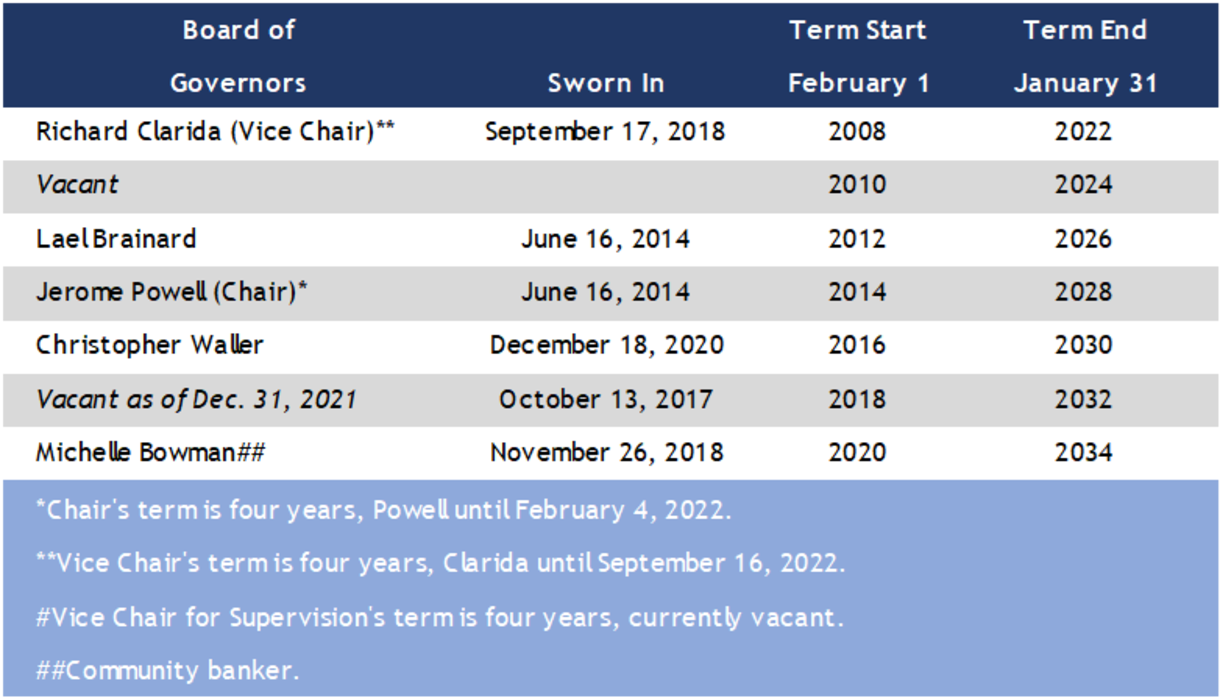

Shifting chairs at the Federal Reserve with the resignation of Fed Governor Randal Quarles. For terms as governors, there is one vacancy right now on the board for the term ending Jan. 31, 2024. At the end of December 2021, there will be another opening for the term ending Jan. 31, 2032, when Quarles departs the board. Many fully anticipate a third vacancy when Vice Chair Richard Clarida’s term ends on Jan. 31, 2022.

Fed Chairman Jerome Powell’s term ends Feb. 4, 2022. His term as governor runs through Jan. 31, 2028, but he is unlikely he would stay on if not renominated as chair. That decision will be made soon… no later than early next year. Fed Governor Lael Brainard met with President Joe Biden at the White House last week. She’s generally thought to be more dovish than Powell and thus, more likely to let the economy run hotter for longer. There’s speculation that if Governor Lael Brainard is not offered the position of chair, she might leave he Fed. She is also in the running for vice chair or vice chair of supervision.

President Biden could place as few as three, or as many as five Fed governors in the near term. The only remaining governors appointed during the Trump administration would be Christopher Waller and Michelle Bowman, with terms ending on Jan. 31, 2030, and Jan. 31, 2034, respectively.”

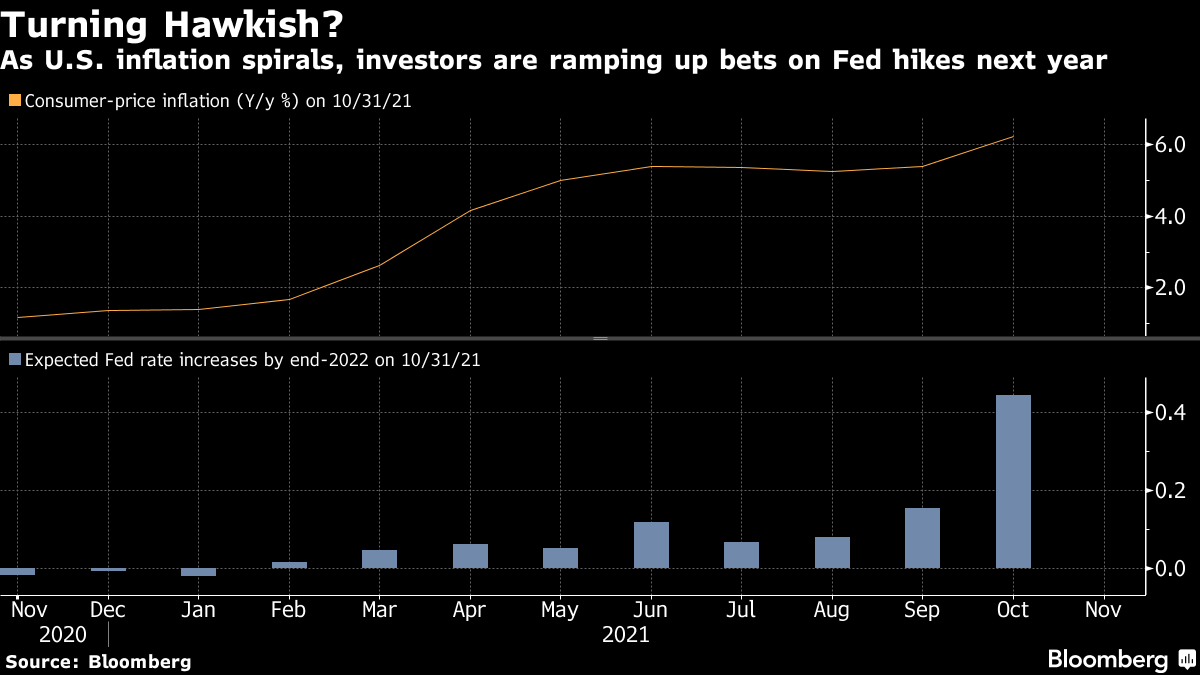

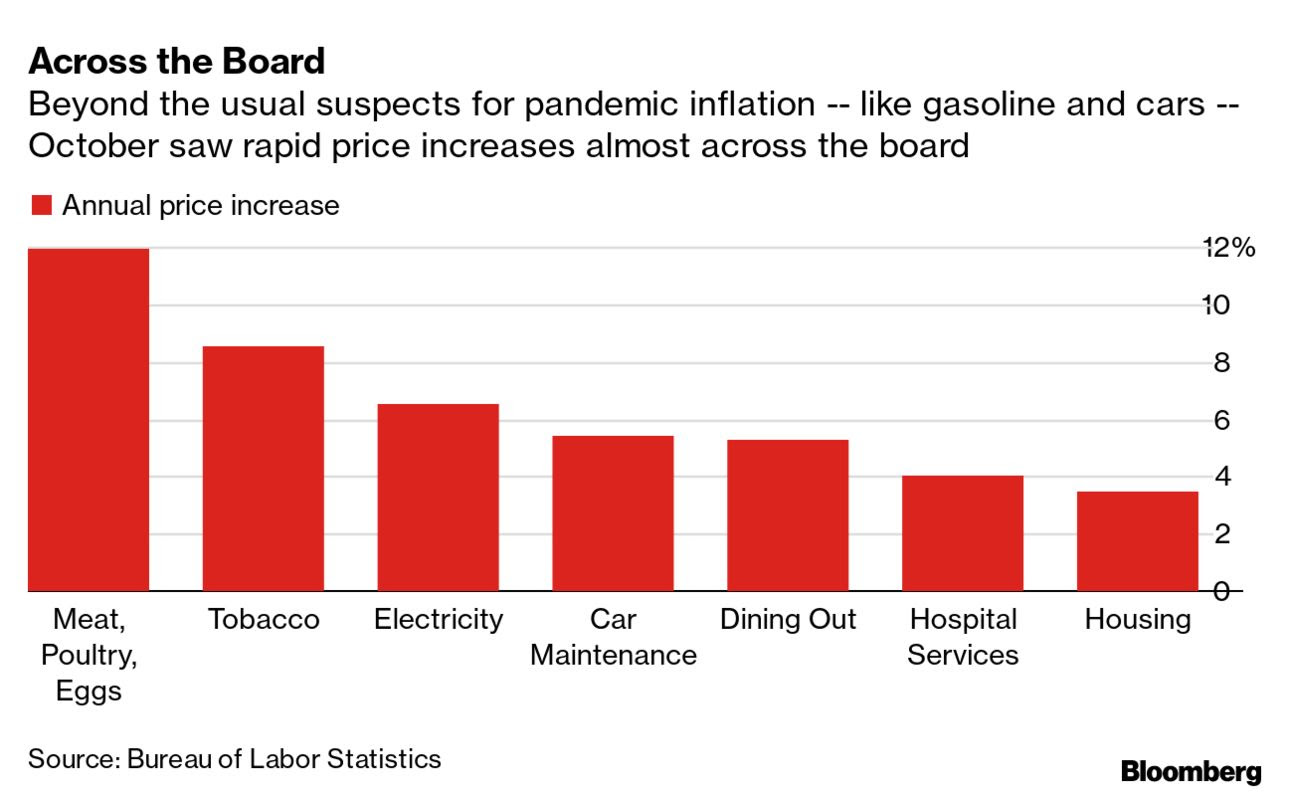

Rising U.S. inflation is leading more analysts to predict higher interest rates sooner than previously expected. U.S. inflation hit a 6.2% annual rate in October, the hottest since 1990 and prompting 30-year rates to spike by as much as 14 basis points.

Market pricing now implies great confidence that the Fed will begin increasing interest rates by next summer. Fed Funds futures are pricing in just a 27% likelihood that the central bank's target range will remain at its current 0.00% to 0.25% after its June 2022 meeting. That's down from 72% just a month ago. By the end of 2022, market pricing implies the greatest odds of a 0.75% to 1.00% target range, or three quarter-point increases' worth. That would be a recipe for significantly higher bond yields than we're seeing today.

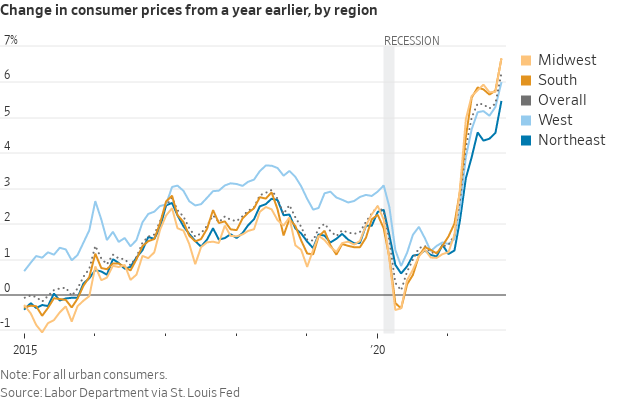

Where inflation is highest in the U.S.: Consumer prices have risen the most in the Midwest and South as inflation hits a 30-year high. Data from the St. Louis Fed shows the year-over-year change in consumer prices is above-average in those two regions, while the West and Northeast are seeing below-average price changes.

Surge in energy prices saps pandemic recovery in Europe. The European Commission said sporadic pandemic-related lockdowns in some parts of Europe, together with emerging labor shortages, were adding to the disruptions, while inflation has hit a 10-year high.

Deere and UAW resume negotiations as strike drags on. Deere & Co. and United Auto Workers (UAW) representatives reportedly met Thursday (Nov.11) in the Quad Cities area of Iowa and Illinois for new talks aimed at ending a strike that first began October 14, Bloomberg reported. Details discussions are not clear as information on the meeting was not made public. Last week, UAW members at several Deere plants voted down a second contract offer from the company. The rejected contract would have given more than 10,000 striking Deere employees an immediate 10% increase in pay, plus an $8,500 bonus for each worker and additional 5% pay raises in 2023 and 2025. Late last week, Deere Chief Administrative Officer Marc Howze said the company was not prepared to raise its contract offer.

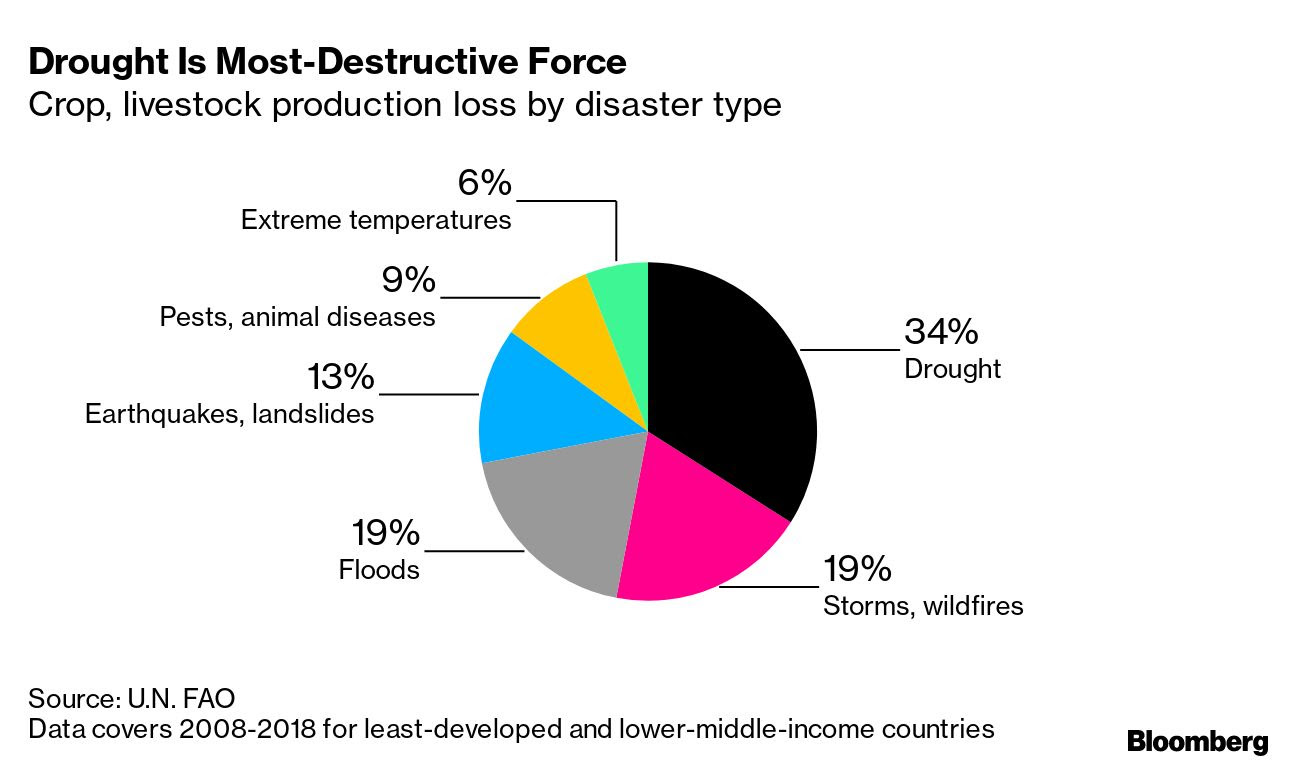

Impact of disasters cost the farming sectors of developing country economies over $108 billion between 2008 and 2018, according to data from the FAO. Over that period, Asia was hit the hardest, followed by Africa, Latin America and the Caribbean.

Market perspectives:

• Outside markets: The U.S. dollar index is slightly lower amid strength in the British pound. The yield on the 10-year U.S. Treasury note rose, trading over 1.52%, with a mixed tone noted in other global government bond yields. Gold and silver futures are down, with gold trading around $1,855 per troy ounce and silver around $25.10 per troy ounce.

• Crude oil prices are lower ahead of U.S. trading with U.S. crude trading around $80.00 per barrel and Brent around $81.40 per barrel. Futures posted losses in Asian action, with U.S. crude down $1.61 at $79.98 per barrel while Brent was off $1.47 at $81.40 per barrel.

• OPEC oil market report highlights: In Thursday’s updated monthly oil market assessment, OPEC lowered expectations for global demand through the end of the year, projecting growth at a rate of 5.7 million barrels per day through the end of the year, 160,000 barrels per day fewer than before. The cartel said lower-than-anticipated demand from China and India during the third quarter were mainly responsible for the revision. It also identified Canada, Russia, China, Norway, Brazil, and Guyana as the main drivers of global oil supply growth in 2021.

• Coal shortage that led to an energy crisis in China is rippling beyond its borders, threatening to disrupt supply chains and farming in some countries, the WSJ reports (link). India and South Korea are experiencing shortages of urea, which is extracted from coal, since China placed new restrictions on exports. It is widely used in India as a fertilizer and in South Korea to produce urea solution, which is used to reduce diesel emissions in vehicles and factories. Prices of urea solution have soared as much as 10 times on secondhand markets. Logistics-industry experts say the shortage hasn’t had a significant impact on supply chains but that it could if the situation doesn’t improve by next month.

• U.S. coal exports are 29% higher this year, the Energy Information Administration (EIA) said in its monthly outlook Tuesday. "Higher U.S. exports reflect rising global demand for coal amid high natural gas prices," EIA said. Coal consumption in the U.S. power sector is slated to be 18% higher this year than 2020, also reflecting higher gas prices. However, EIA notes coal-fired power has not increased as much in response to gas prices as in the past, due to lower supplies.

• $13,924 is the average price, per 40-foot container, for Asia to U.S. West Coast transport over the past week, a 26% decline from the previous week but 261% higher than the same week a year ago, according to the Freightos Baltic Index. Meanwhile, Trans-Pacific container lines are starting to remove premium fees and other charges as they lower freight rates. And, Union Pacific says congestion in its international intermodal network out of Southern California is easing.

• USDA daily export sale: 256,930 MT soybeans during reporting period to unknown destinations during 2021-2022 marketing year

• Russian wheat export tax rises again. Russia’s ag ministry says the sliding export tax on wheat shipments will rise to $77.10 per metric ton for the week of Nov. 17-23. That’s up $7.20 (10.3%) from the current rate. The wheat export tax has surged $49.00 (174%) since the initial level of $28.10 per metric ton at the beginning of June when Russia’s government launched its formula-based duty.

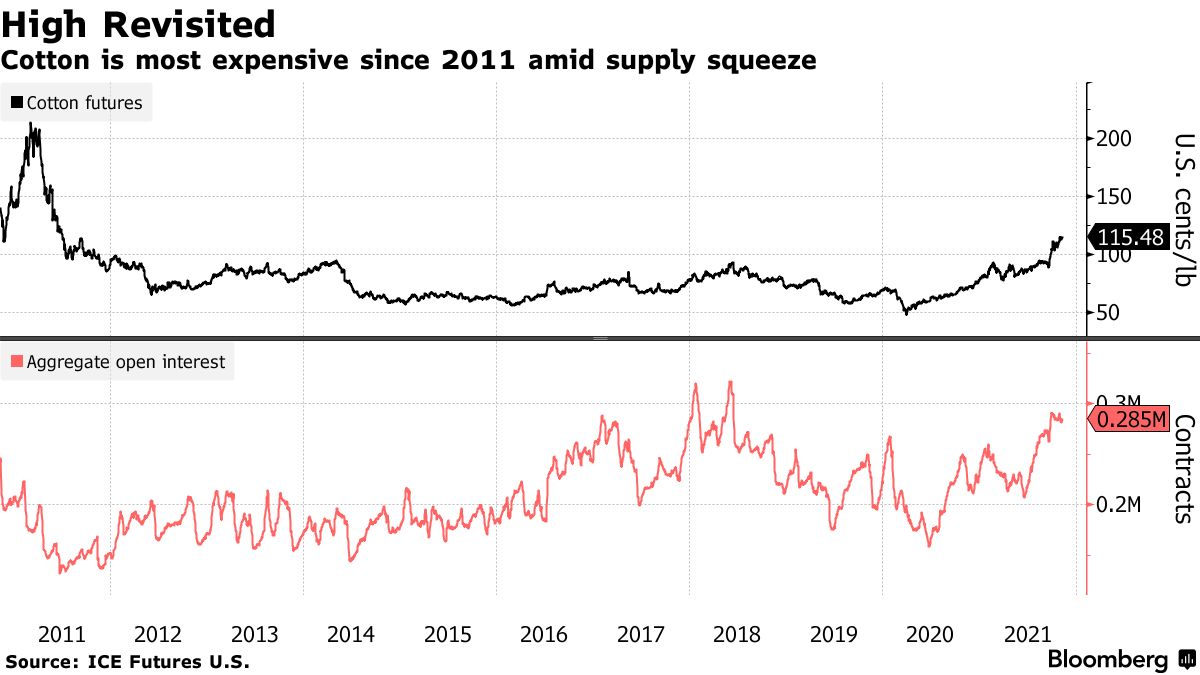

• Cotton futures surged back to the highest level in more than a decade, leaving traders with short positions struggling to secure supplies. The fiber has jumped almost 50% in 2021 on expectations for a second straight world deficit, pulled by soaring demand, especially for apparel. Bloomberg reports that supplies are so tight, there’s a short squeeze in play when it comes to the nearby December futures contract, which ought to fuel even more upside for prices. Some commercial traders are holding a large sold positions that must be closed by buying futures, said O.A. Cleveland, a consultant and agricultural economics professor emeritus at Mississippi State University.

• Blizzards could affect China's corn marketing. Record snowfall across northern China this week is the latest in a string of unusual weather events in 2021. A report in China Grain Net raises concerns that the heavy snow could impact this year's corn marketing. Dalian corn futures have rallied nearly 9% over the past month to their highest since June and cash corn prices in Shandong province have risen a like amount since the start of the month. Wheat prices have also climbed amid strong demand from the feed sector amid the slowed corn sales. Cash wheat prices in Shandong are up 10% over the past two months.

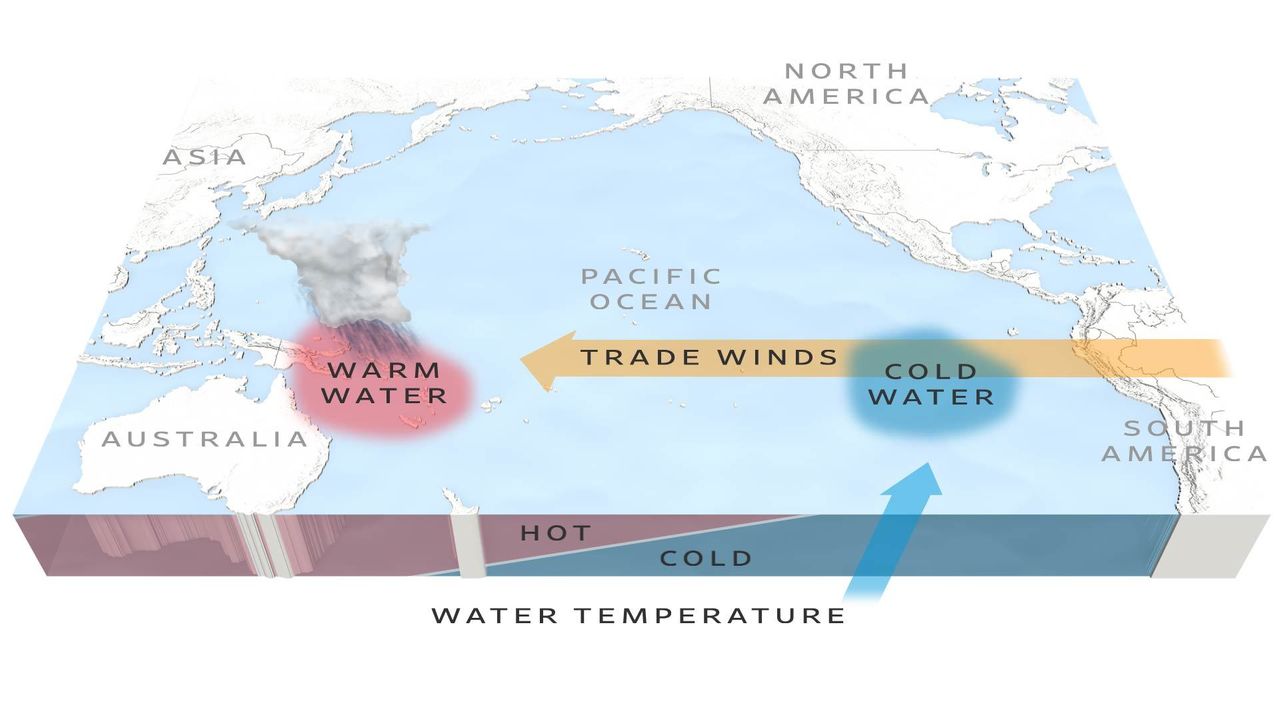

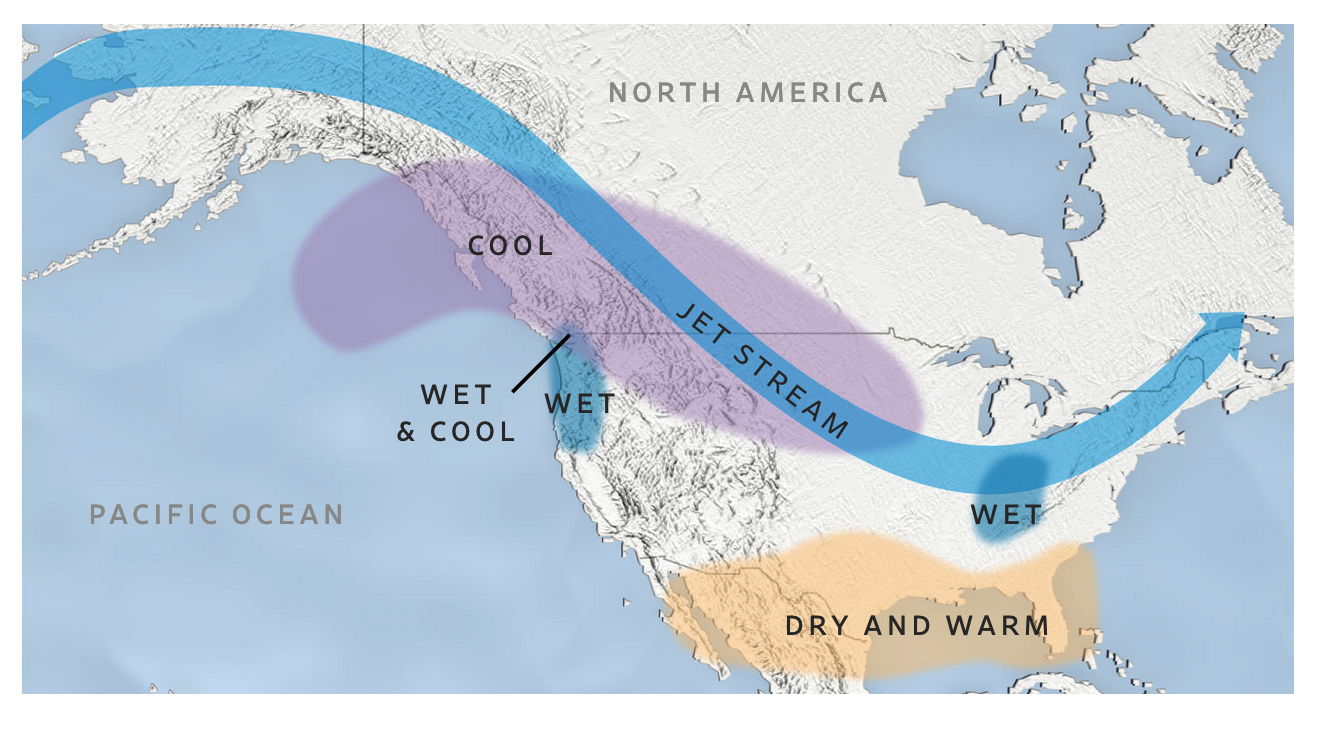

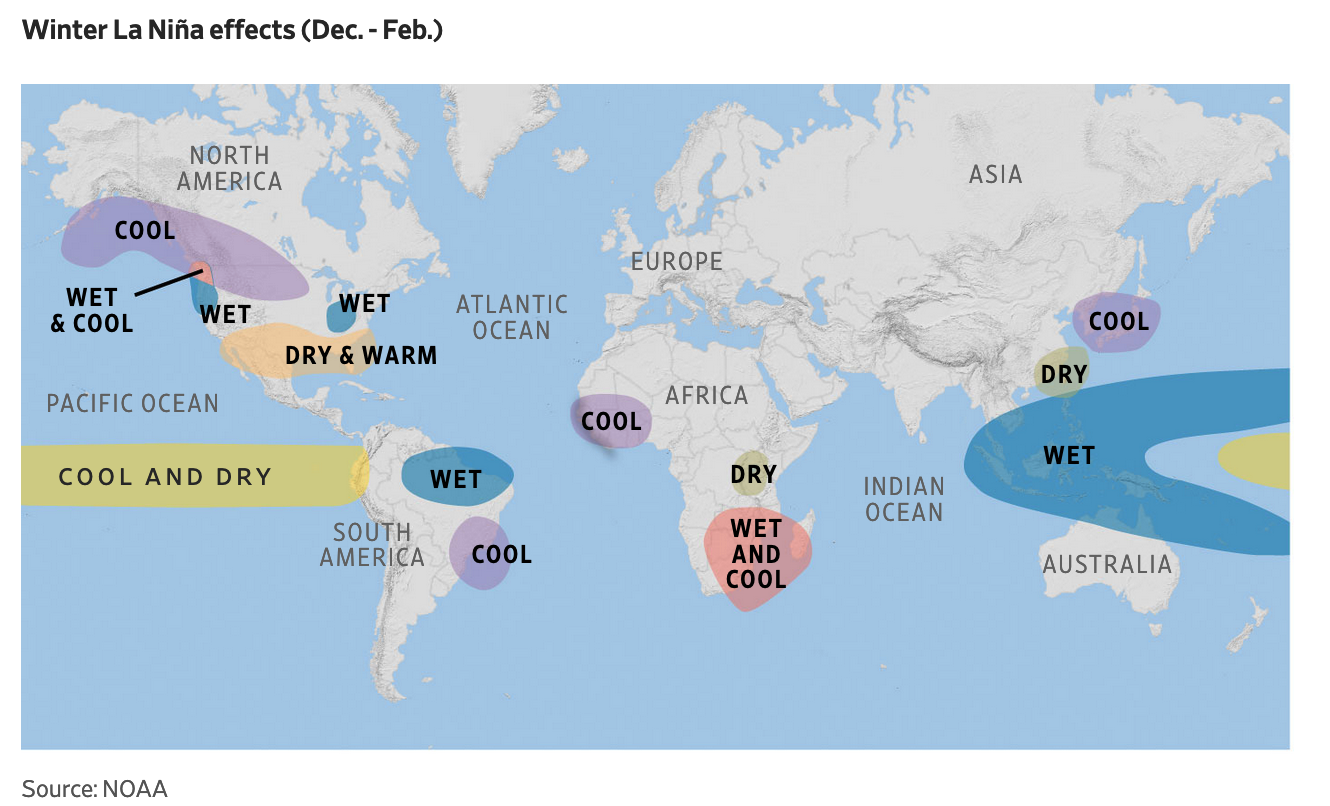

• Federal weather forecasters say the likelihood of a La Niña winter in the U.S. is increasing, potentially prolonging the West’s drought and keeping northern areas colder than usual. The latest fluctuations in climate conditions across the Pacific Ocean are increasing the likelihood of a La Niña winter in the U.S., the National Oceanic and Atmospheric Administration (NOAA) said Thursday. NOAA predicts that water and air temperatures over the Pacific Ocean — closely watched metrics ahead of winter in the U.S. — have created La Niña conditions with a 90% chance of continuing through the winter and a 50% chance during the spring. The winter outlook is up from NOAA’s October forecast, when it predicted an 87% chance of La Niña conditions for December through February.

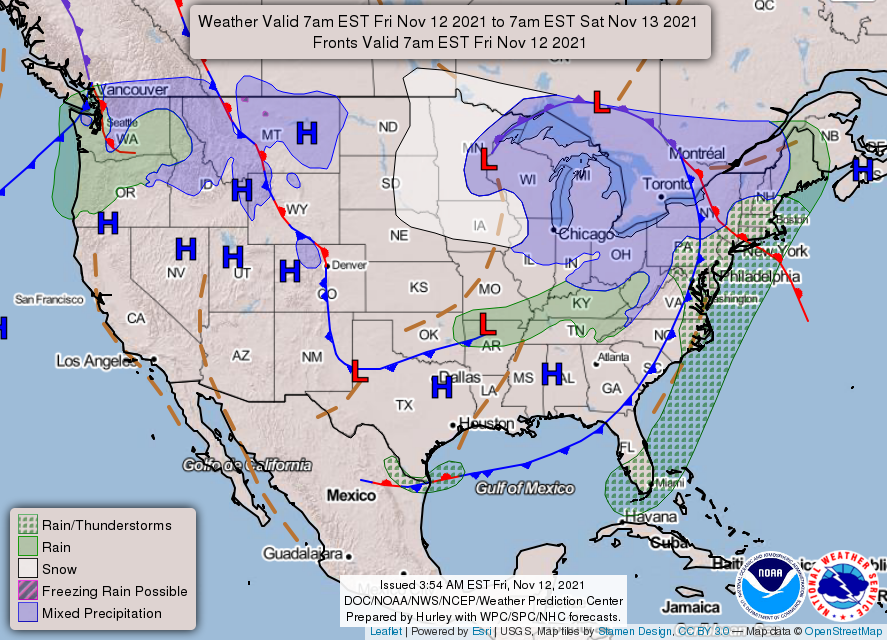

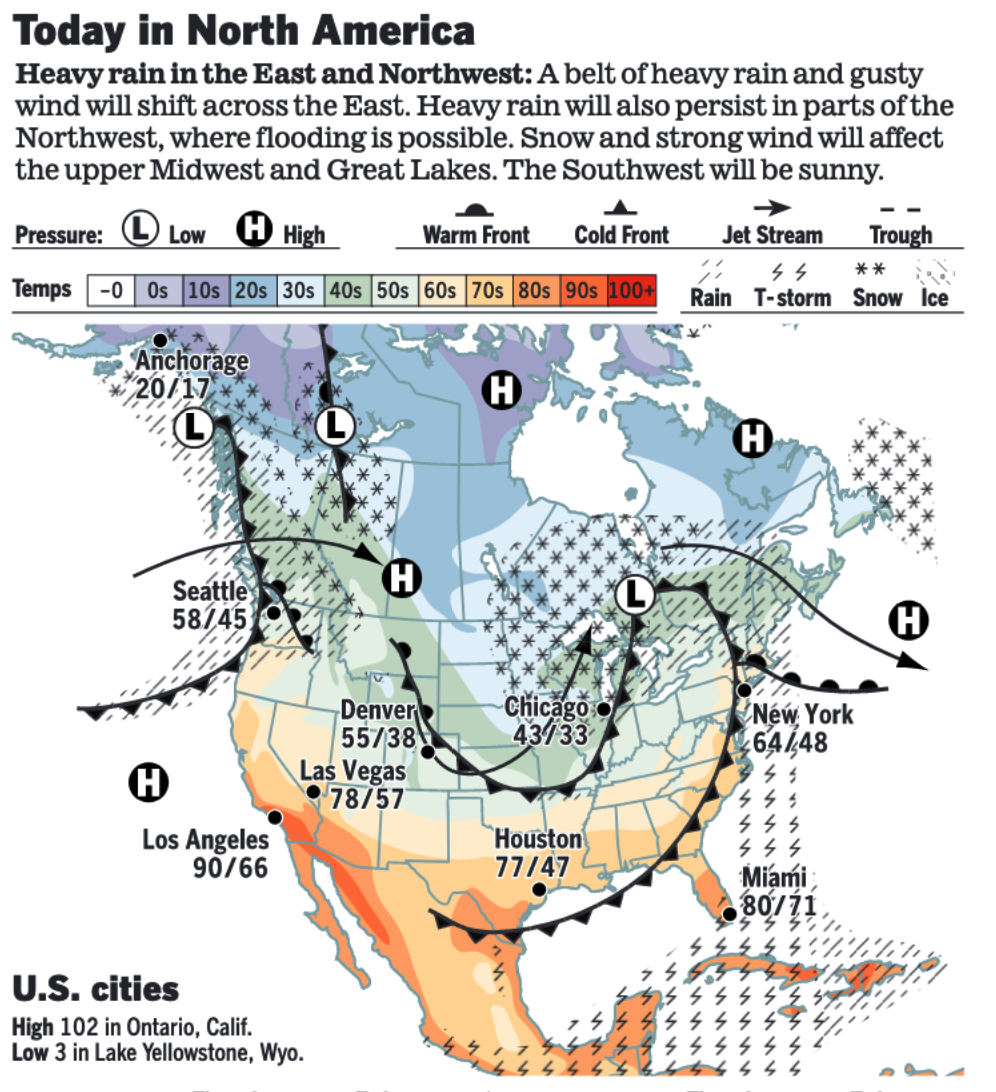

• NWS weather: Snow and high winds over the northern Plains/upper Midwest gradually subside today as locally heavy rain and strong thunderstorms move across the Northeast and Mid-Atlantic... ...Flash flooding potential to continue over the Pacific Northwest into early Saturday as onslaught of heavy rainfall continues... ...An Alberta clipper will deliver another around of snow/rain and gusty winds across the northern Plains Saturday into early Sunday.

Items in Pro Farmer's First Thing Today include:

• Grain, soybean futures trading near their overnight lows

• Inclement weather, harvest delays push China corn prices higher

• Inflation pulling forward expectations for Fed rate hike

• Russian wheat export tax rises again

• Ukraine winter wheat sowing 94% complete

• Packers buying a lot of cattle again this week

• Traders expecting cash hog decline to continue

POLICY FOCUS

— Update on infrastructure measures:

- President Biden on Monday will sign the bipartisan infrastructure framework (BIF) into law at a White House ceremony. Senate Minority Leader Mitch McConnell (R-Ky.), who voted for the measure, said he would not attend the signing ceremony.

- Fate of Build Back Better is murky with inflation rising and centrist Sen. Joe Manchin (D-W.Va.) previously pushing a delay on economic, debt and inflation concerns.

- Sen. Manchin opposes a provision of Biden’s $1.75 trillion social and climate spending and tax plan that would offer $4,500 more in tax credits for the purchase of an electric vehicle made in the U.S. by union labor. Manchin, in an interview with Automotive News, called the extra credit “wrong” and “not who we are as a country.”

AFGHANISTAN

— U.S. joined rivals China and Russia to call on the Taliban to cut ties with terrorist groups and stop them from operating in Afghanistan after a recent spate of attacks that have been linked mostly to the Islamic State. The concerted push from these world powers and Pakistan, known as the “extended troika,” to ensure the Taliban fulfilled their commitments followed a meeting in Islamabad yesterday and signals the growing concern of a spillover of terror activities in the region. The group also met with senior Taliban representatives on the sidelines of the meeting.

— Hundreds of people seeking to get out of Afghanistan have been forced to leave safe houses after the group trying to help them couldn’t negotiate their passage and ran out of money.

BIDEN ADMINISTRATION PERSONNEL

— White House doubles down on support for Saule Omarova amid controversies surrounding nominee. The White House says it still stands behind Saule Omarova as its nominee to run the Office of the Comptroller of the Currency, despite attacks against her from Republicans and concerns from key Democrats such as Sen. Jon Tester (D-Mont.) "Saule Omarova is eminently qualified and was nominated for this role because of her lifetime of work on financial regulation, including in the private sector, in government and as a leading academic in the field. The White House continues to strongly support her historic nomination," the White House said in a statement to FOX Business this week. If she is confirmed, Omarova will head a branch of the Treasury

Saule Omarova, a Cornell University law professor, has raised eyebrows for comments she has made, which include saying the banking industry is the "quintessential a------ industry," as well as calling for an end to banking "as we know it" by "the complete migration of demand deposit accounts to the Federal Reserve." Omarova made headlines again this week when footage re-emerged in which she seemed to support energy industries going "bankrupt" for the sake of tackling climate change. Link for details.

— Biden poised to nominate Califf as FDA chief. President Biden today is expected to nominate former Commissioner Robert Califf to lead the Food and Drug Administration, in a move that would bring the Obama-era official back for a second tour atop the agency, according to several media reports this morning. The White House has chosen a new chief for the Food and Drug Administration, a key player in the battle against the coronavirus, after nearly 10 months of having an interim leader. Califf, a cardiologist and former Duke University researcher who now works for Verily, the life sciences research group, and Google Health, was FDA head during the Obama administration. He is known for his clinical-trial expertise and ties to the pharmaceutical industry.

— Senate to vote next week for Bonnie as USDA undersecretary for farm production and conservation. When the Senate returns on Monday, it is scheduled to vote on Graham Steele to be Treasury assistant secretary and it could then turn to Robert Bonnie, an agriculture undersecretary during the Obama era. Bonnie joined USDA as its first climate adviser on the same day that President Biden took office. Meanwhile, the Senate Ag Committee scheduled a hearing on Nov. 17 on the nomination of Chavonda Jacobs-Young to be undersecretary for research. The White House has not yet announced nominees for three undersecretary posts: public nutrition, food safety, and agricultural trade.

CHINA UPDATE

— Xi Jinping delivered the first doctrine on Communist Party history by a Chinese leader in 40 years, a mandate to potentially rule for life. Only Mao Zedong and Deng Xiaoping had previously enacted so-called historical resolutions, and both went on to dominate party politics until they died. The Central Committee's communique of approval called for China to "unite around the party with Xi at the core" to reach goals through 2049. It trumpeted Hong Kong’s move from “chaos to governance” and reiterated Xi's position on Taiwan.

— Chinese President Xi Jinping is expected to invite President Biden to join him in Beijing in February for the 2022 Winter Olympics, according to a CNBC report on Thursday. The two leaders are set to meet virtually next Monday evening in a bid to smooth over tensions surrounding Taiwan, trade, and human rights. It’s not clear how sincere Xi’s gesture could be, seeing as Western powers have for months mulled a diplomatic boycott of the Games.

— U.S. firms and their Chinese affiliates are investing in China’s semiconductor industry, aiding Beijing’s bid for dominance, a WSJ investigation found (link). Firms including Intel participated in 58 such investment deals between 2017 and 2020, more than twice the number of the prior four years, according to an analysis by Rhodium Group at the Journal’s request. Beyond that, the China-based affiliates of Silicon Valley venture firms have made at least 67 investments in Chinese chip-sector companies since the start of 2020. The sums invested in many deals aren’t disclosed, but the financing rounds overall raised billions of dollars.

ENERGY & CLIMATE CHANGE

— Biofuel groups tout report showing above average unionization in biofuel supply chains. A new report commissioned by biofuel proponents found the sector’s supply chains have above-average unionization, which they said underscores the sector’s contribution to the Biden administration’s priority of building up good-paying, middle class jobs. The report, titled Union Jobs in Ethanol & Biodiesel Industries: An American Success Story, was conducted by two former officials with the Bureau of Labor Statistics (BLS) and General Services Administration (GSA), and KPMG International. It was commissioned by the Advanced Biofuels Business Council, Growth Energy, the National Biodiesel Board (NBB), and the Renewable Fuels Association (RFA).

Details: The study found that of the roughly 315,000 employees directly employed in ethanol production, around 9,000 are union members. For the roughly 17,000 employed directly in biodiesel production, around 800 are union members. But, when those not involved in direct production are included, the industry’s contribution to unionization is more favorable. Overall, employment in the ethanol and biodiesel industries includes 30,000 union members—working “directly for and in supplier industries” to the sector, the report found. “Perhaps most striking is that union gains are found in farm country and among agricultural workers, both areas where union membership has historically lagged,” it said.

The biofuel industry’s positive impact on unionization also runs counter to national trends, the report pointed out, noting that the share of unionized U.S. workers has steadily declined from a peak of 30% in 1954 to just 10.8% in 2020. Further, it noted that across the private sector just 6.3% of workers were union members. “This decline in ‘union density’ has paralleled two other important economic trends that are damaging to American workers: a decline in the percentage of middle-wage, middle-skills jobs in America, and decades-long stagnation in real wages,” the report said.

“Higher union density rates in the ethanol and biodiesel industries contrasts favorably with conventional agriculture, where most agricultural workers do not have rights to organize and bargain collectively protected by federal or state law,” the report said. “Also, self-employment is significantly more common in agriculture, which makes union organizing less likely. As a result, conventional agriculture is an industry with a union density rate well below the national average.”

Key takeaway from the data, the report said, is that “continued support for the ethanol and biodiesel industries will have a positive causal effect on union jobs and is a pathway to an increase in union membership.” It added that the result of continued support for biofuels “is likely to be an increase in middle-wage and middle-skill union jobs in traditionally agricultural economies.”

Predictably, the groups sponsoring the study hailed the conclusions. “This important report illustrates how America’s biofuel industry is growing union jobs and helping to rebuild the middle class,” RFA, the Advanced Biofuels Business Council, Growth Energy, and NBB said in a joint statement. “It also underscores the truth behind President Biden’s declaration that ‘doubling down on these liquid fuels of the future will not only make value-added agriculture a key part of the solution to climate change — reducing emissions in planes, ships, and other forms of transportation — but will also create quality jobs across rural America.’ As global climate conversations continue, we urge policymakers to embrace America’s biofuel industry as a vital tool to rebuild the economy around homegrown and clean energy solutions.”

Perspective: The report appears aimed at burnishing the biofuel sector’s labor bona fides at a time when boosting unionization and expanding middle-class jobs is a major priority for the incumbent Biden administration. As the sector lobbies the administration to ensure biofuels have a place in its climate plans — and for continued support of the sector through robust biofuel blending mandates — the report serves to associate growth in the biofuels sector with the administration’s broader jobs agenda.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Farm Bureau hopes parts of new cattle market bill will be rolled into LMR reauthorization. The American Farm Bureau Federation (AFBF) hopes parts of the new Cattle Price Discovery and Transparency will be rolled into Livestock Mandatory Reporting (LMR) reauthorization. The measure was introduced this week by Sens. Chuck Grassley (R-Iowa), Jon Tester (D-Mont.), Deb Fischer (R-Neb.) and Ron Wyden (D-Ore.). It would establish regional mandatory minimums for cash negotiated cattle trades, require USDA to establish a publicly available library of marketing contracts between packers and producers, prohibit department from using confidentiality as a reason for not reporting all LMR information, and require additional reporting around carcass weights and cattle for slaughter.

Farm Bureau comments: “We support the bill, and we hope that parts of this bill are incorporated into Livestock Mandatory Reporting reauthorization. However, it is of utmost importance for Farm Bureau that Livestock Mandatory Reporting does not lapse,” AFBF Congressional Relations Director Scott Bennett said Thursday (Nov.11) on the group’s Newsline podcast. “Senator Fischer and Senator Grassley will be working closely with the Senate and House Agriculture Committee to get portions, if not all of this bill, into Livestock Mandatory Reporting reauthorization.” If LMR is reauthorized without the changes, Bennet said the group hopes to see potions of the bill included in the next LMR reauthorization.

— Judge keeps Tyson Covid suit in federal court. A Pennsylvania judge has kept a Covid-19 wrongful death suit filed against Tyson Foods in federal court, concluding the company’s Pennsylvania subsidiary is immune from the claims under the state’s worker’s compensation act. The complaint was filed in December 2020 in state court by the widow of Brian Barker, a supervisor at Tyson’s Original Philly Cheesesteak Co. plant in Philadelphia. Barker died in in April 2020 and his widow alleges the company failed to take proper mitigation measures to protect him and other workers from Covid-19. The case was remanded to the U.S. District Court for the Eastern District of Pennsylvania at Tyson’s request, a decision upheld last week by U.S. District Judge Paul S. Diamond. The judge did not consider Tyson’s claims that it was acting under a federal officer — an issue that has dominated dozens of similar lawsuits — but instead found claims belong in federal court because of the shield provided for state claims under the Pennsylvania Workers’ Compensation Act. “In light of my decision, I will not address Tyson’s arguments regarding federal question and federal defense jurisdiction,” he concluded in the Nov. 4 order.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 252,080,729 with 5,082,569 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 48,852,796 with 759,677 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 432,808,435 doses administered, 192,382,921 have been fully vaccinated, or 59.22% of the U.S. population.

— Moderna held a brief conference call Thursday to defend the safety of its Covid-19 shot from a barrage of questions about associated heart risks in young people. It said that its vaccine’s benefits continue to outweigh the extremely rare risk of myocarditis, while acknowledging that a link seems to exist for young male recipients. The company’s market value had recently taken a blow as several European countries pivoted to other vaccines due to the safety concerns, with shares down 35% this month through yesterday’s close. Last month, the EU authorized the use of an extra dose of Moderna’s shot for those with a severely weakened immune system.

— Coronavirus deaths in Europe rose 10% in the first week of November and made up over half of the Covid deaths reported globally during that time, the WHO said. Europe also accounted for about two-thirds of the world’s 3.1 million new reported coronavirus infections in that week. The highest death tolls were in Russia, Ukraine and Romania. The highest new case numbers were in Russia, Britain and Turkey, according to the WHO figures.

POLITICS & ELECTIONS

— Murkowski announces re-election bid opposed by Trump. Sen. Lisa Murkowski, who voted to convict Donald Trump in his second impeachment trial and has repeatedly bumped heads with the former president, announced today that she will run for re-election. Trump endorsed a leading opponent of Murkowski in June. Kelly Tshibaka was commissioner of Alaska's Department of Administration before resigning to run for the Senate. In July, the Alaska Republican State Central Committee endorsed Tshibaka after Murkowski's impeachment vote.

— Republican Jack Ciattarelli plans to concede the New Jersey governor’s race to incumbent Phil Murphy (D) today, more than a week after the Nov. 2 election. The former state lawmaker will hold a press conference at 1 p.m. local time announcing the concession, according to a person with knowledge of the matter. Ciattarelli trailed by about 1 percentage point, or 29,000 votes, when the Associated Press called the race for Murphy on Nov. 3. Since then, a flood of mail-in and early ballots have been counted. As of Nov. 11, Murphy was ahead by more than 73,000 votes, according to the AP.

OTHER ITEMS OF NOTE

— U.S. is warning EU allies that Russia may be planning to invade Ukraine as tensions flare over migrants and energy supplies. Washington is closely monitoring a buildup of Russian forces near the Ukrainian border, and Biden administration officials have briefed EU counterparts on their concerns. Russia said the military deployments are on its territory and denies any aggressive intentions. Back in 2014, Russian special forces were deployed to occupy Crimea during the Ukrainian Maidan revolution, though they ended up taking over government buildings and the republic was annexed by Russia following a disputed referendum.

— Belarus president Alexander Lukashenko has threatened to block the transit of gas and goods to Europe if the EU imposes further sanctions on his regime over the migrant crisis on the Belarusian-Polish border. Lukashenko was responding to an announcement by Ursula von der Leyen, European Commission president, on Wednesday that the bloc would widen sanctions, accusing Minsk of a “cynical geopolitical powerplay” in funneling migrants to the EU’s borders to destabilize it. Lukashenko warned on Thursday that he would respond to any “unacceptable” sanctions. “We are heating Europe, and they are threatening to close the border,” he said, according to Belarus state news agency Belta. “What if we cut off gas to them… We should not stop at anything to defend our sovereignty and independence.” Gazprom had just started filling up storage tanks in Europe as Vladimir Putin seeks to leverage his country as an oil and gas superpower and pressure European regulators into approving Nord Stream 2.

— Portugal just made it illegal for bosses to call, text or email employees outside of their regular working hours. Chatter is that a slew of journalists inquired about jobs in Portugal.