Vilsack Calls Climate Initiative a Commodity Program, Not Carbon Bank or Carbon Trading

Both Senate and House expected to approve stopgap spending measure through Dec. 3

In Today’s Digital Newspaper

Market Focus:

• U.S. jobless claims rise slightly

• Another sign of U.S. inflation: Dollar Tree is raising prices

• Fed chairman: Run of higher inflation might last longer than anticipated

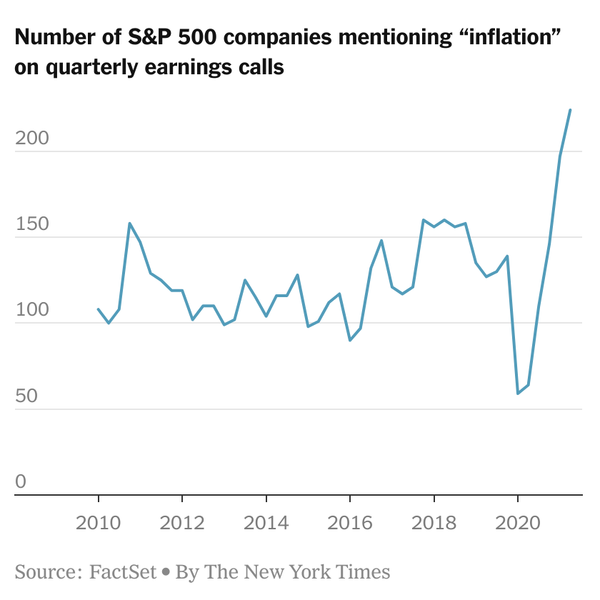

• Mentions of “inflation” on earnings calls at highest in more than a decade

• Cargill Inc.: Still a bullish picture for most ag commodities

• Port of Savannah, Ga. trying to clear a backlog

• Warning of risks of a supply chain meltdown

• Ag demand update

• Light buying as market readies for USDA reports that have historically sparked volatility

• Quarterly Grain Stocks and Small Grains Summary out today

• Late retreat for India’s monsoon

• Concerns about beef demand destruction on the rise

• Momentum favors bulls in lean hog market

Policy Focus:

• Where are CBO estimates of proposed social and climate change package?

• Zero-cost messaging strategy doesn’t add up

• Updates on lingering congressional spending/debt issues

China Update:

• Another small rice sale to China with sizable soybean, cotton sales latest week

• China Evergrande Group managed to appease some onshore investors

• Manufacturing activity in China dipped into negative territory in September

• China Caixin PMI rose to 50 — the line separating contraction from expansion

• Chinese feedmakers closing their doors due to power crunch

• China to hold 2022 TRQs steady with this year

• Two French slaughterhouses get green light to ship beef to China

Energy & Climate Change:

• RFS rumor mill has gone quiet, a very unusual situation

• USDA seeks comments on climate-smart commodities plan

• Vilsack insists climate plan is not a carbon market, but a commodity program

• Boozman wants hearing on climate plan

Livestock, Food & Beverage Industry Update:

• USDA to tap $3 billion in CCC authority for ASF, nutrition programs

Coronavirus Update:

• More people are getting Covid-19 boosters by attesting hey qualify for a third shot

• India preparing to produce its own mRNA-based Covid-19 vaccine

Politics & Elections:

• President Biden’s approval rating is now 45%

Congress:

• Republicans won the Congressional Baseball Game for the first time in five years

Other Items of Note:

• North Korea leader Kim Jong Un offered to restore a hotline with South Korea

MARKET FOCUS

Equities today: Global stock markets were mixed to firmer in overnight trading. The U.S. stock indexes are pointed to higher openings. Asian equities finished mixed tracking a mixed showing on Wall Street Wednesday. The Nikkei fell 91.63 points, 0.31%, at 29,452.66. The Hang Seng Index was down 87.86 points, 0.36%, at 24,575.64. The Shanghai Composite was up 31.87 points, 0.90%, at 3,568.17. European equities are mixed in early action with the Stoxx 600 and FTSE up 0.2%, but other regional markets are down 0.05% to 0.5%.

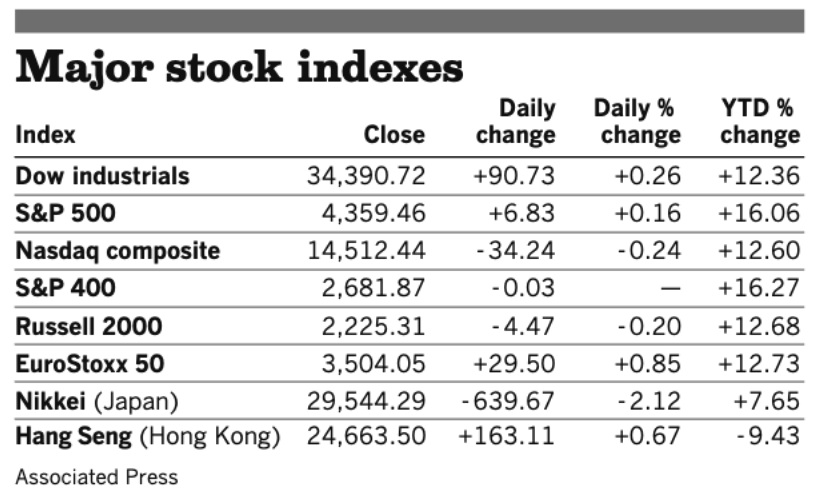

U.S. equities yesterday: The Dow closed up 90.73 points, 0.26%, at 34,390.72. The Nasdaq declined 34.24 points, 0.24%, 14,512.44. The S&P 500 rose 6.83 points, 0.16%, at 4,359.46.

On tap today (see detailed list of events and reports below):

• U.S. jobless claims are expected to fall to 335,000 in the week ended Sept. 25 from 351,000 a week earlier. (8:30 a.m. ET) Update: Initial jobless claims climbed again last week, rising to 362,000 as hiring appeared to remain sluggish while the U.S. continues to fight against the Delta variant. The total was the highest since the 377,000 for the week ended Aug. 7 and indicates that hiring may be slowing at a time when concerns are growing about the pace of the economic recovery and the impact the pandemic may have heading into autumn. Markets reacted little to the news.

• U.S. gross domestic product is expected to grow at a 6.6% annual pace in the second quarter, unrevised from an earlier reading. (8:30 a.m. ET) Update: The U.S. economy expanded at a 6.7% annual pace from April through June, the Commerce Department said, slightly upgrading its estimate of last quarter's growth in the face of a resurgence of Covid-19 in the form of the Delta variant.

• USDA Weekly Export Sales report, 8:30 a.m. ET

• Chicago purchasing managers index is expected to fall to 65 in September from 66.8 a month earlier. (9:45 a.m. ET)

• Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen appear before a House panel to discuss the pandemic response at 10 a.m. ET.

• Fed speakers: New York’s John Williams at a webinar on the Fed's response to the pandemic at 10 a.m. ET and again at 12:45 p.m. ET, Atlanta’s Raphael Bostic on economic mobility at 11 a.m. ET, Philadelphia’s Patrick Harker in a panel discussion at 11:30 a.m. ET, Chicago’s Charles Evans on the economy and monetary policy at 12:30 p.m. ET, St. Louis’s James Bullard at a book launch at 1:05 p.m. ET, and San Francisco’s Mary Daly to a women's leadership conference at 2:30 p.m. ET.

• Bank of Japan releases its September tankan survey of business sentiment at 7:50 p.m. ET.

Another sign of U.S. inflation: Dollar Tree. The retailer, which sells nearly everything for a dollar in its namesake chain, plans to add more products at slightly higher prices, the latest example of inflation pressure reaching consumers. Dollar Tree said it would start selling products at $1.25 and $1.50 or other prices slightly above $1 in some of its stores, as supply-chain glitches, a tight labor market and rising prices for materials push costs higher. Link for more via the WSJ.

Run of higher inflation might last longer than central bank officials had anticipated, Fed Chairman Jerome Powell said Wednesday. The Fed, which attributes the inflation primarily to supply-chain bottlenecks, now sees it continuing into next year before fading. The central bank faces a situation it hasn’t encountered for a very long time, Powell said: tension between its two objectives of low, stable inflation and high employment.

Mentions of “inflation” on earnings calls are at their highest in more than a decade. FactSet said the term came up more than 220 times in second-quarter earnings calls at S&P 500 companies. The previous record was one quarter earlier, showing that the surge in prices isn’t a passing preoccupation.

Market perspectives:

• Outside markets: The U.S. dollar index was slightly higher ahead of U.S. economic reports, with the euro slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note is firmer, trading just above 1.52%, with affirmer tone to global government bond yields. Gold and silver futures seeing modest gains ahead of U.S. economic updates, with gold around $1,726 per troy ounce and silver around $21.50 per troy ounce.

• Crude remains lower ahead of U.S. action, with U.S. crude trading around $74.25 per barrel and Brent around $77.55 per barrel. Futures were weaker in Asian trading, with U.S. crude down 11 cents at $74.72 per barrel and Brent down 29 cents at $77.80 per barrel.

• Cargill Inc. says there’s still a bullish picture for most ag commodities, despite weaker demand from China that’s seen corn purchases collapse. Wheat supplies remain tight and the outlook for palm and other vegetable oils is positive in part due to strong biofuels demand, according to Alex Sanfeliu, who runs Cargill’s World Trading Group. But short-term demand weakness in China is putting pressure on soybeans as crushing plants in parts of the nation halt or slow activity amid an energy crunch, he said. “China is less of a bull engine compared to last year, and potentially will be a bearish one here in the short term,” Sanfeliu said in an interview cited by Bloomberg. “We still have that situation where any supply disruption or significant change in demand can bring big moves. We are in a mixed environment, but still a healthy one.” Link for more.

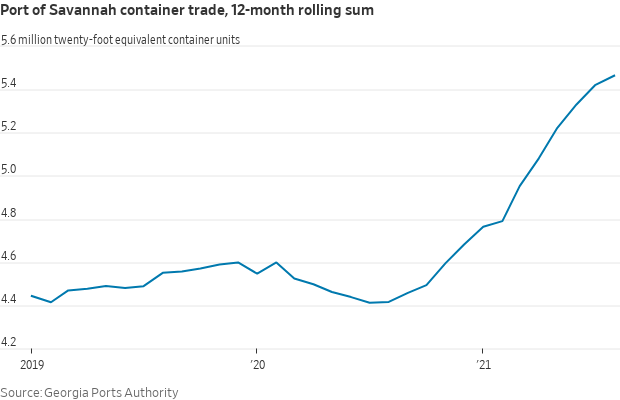

• Port of Savannah, Ga., the fourth-largest U.S. gateway for seaborne imports, is trying to clear a backlog of more than 20 container ships that has grown in the waters outside the port, in the latest logjam to hit the country’s swamped supply chains. The backup is part of the congestion that has delayed cargo around the world this year, raised shipping costs and created periodic shortages of some goods. Savannah is a crucial port for goods heading into the U.S. Southeast and it has been inundated with inbound volumes from retailers rushing to restock.

• Warning of risks of a supply chain meltdown. In an open letter to the United Nations General Assembly, business leaders from the International Chamber of Shipping, IATA and other transport groups (that account for more than $20 trillion of annual global trade) sounded the alarm on the risks of a supply chain meltdown. "We are witnessing unprecedented disruptions and global delays and shortages on essential goods including electronics, food, fuel and medical supplies. Consumer demand is rising, and the delays look set to worsen ahead of Christmas and continue into 2022. Our calls have been consistent and clear: freedom of movement for transport workers, for governments to use protocols that have been endorsed by international bodies for each sector and to prioritize transport workers for vaccinations... before global transport systems collapse."

• Ag demand: Jordan made no purchase in its tender to buy 120,000 MT of wheat. Tunisia’s state grains agency issued an international tender to buy around 125,000 MT of soft wheat and 100,000 MT of barley.

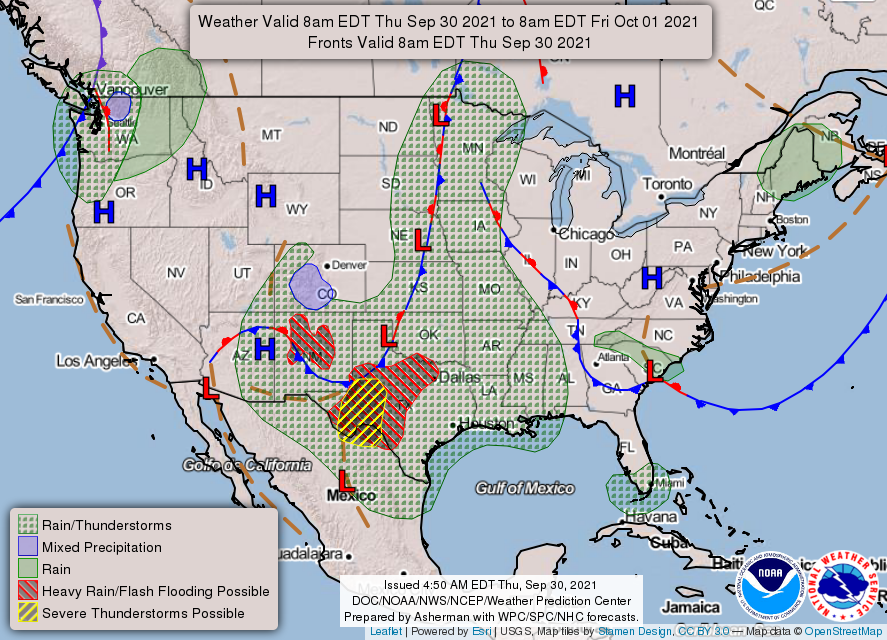

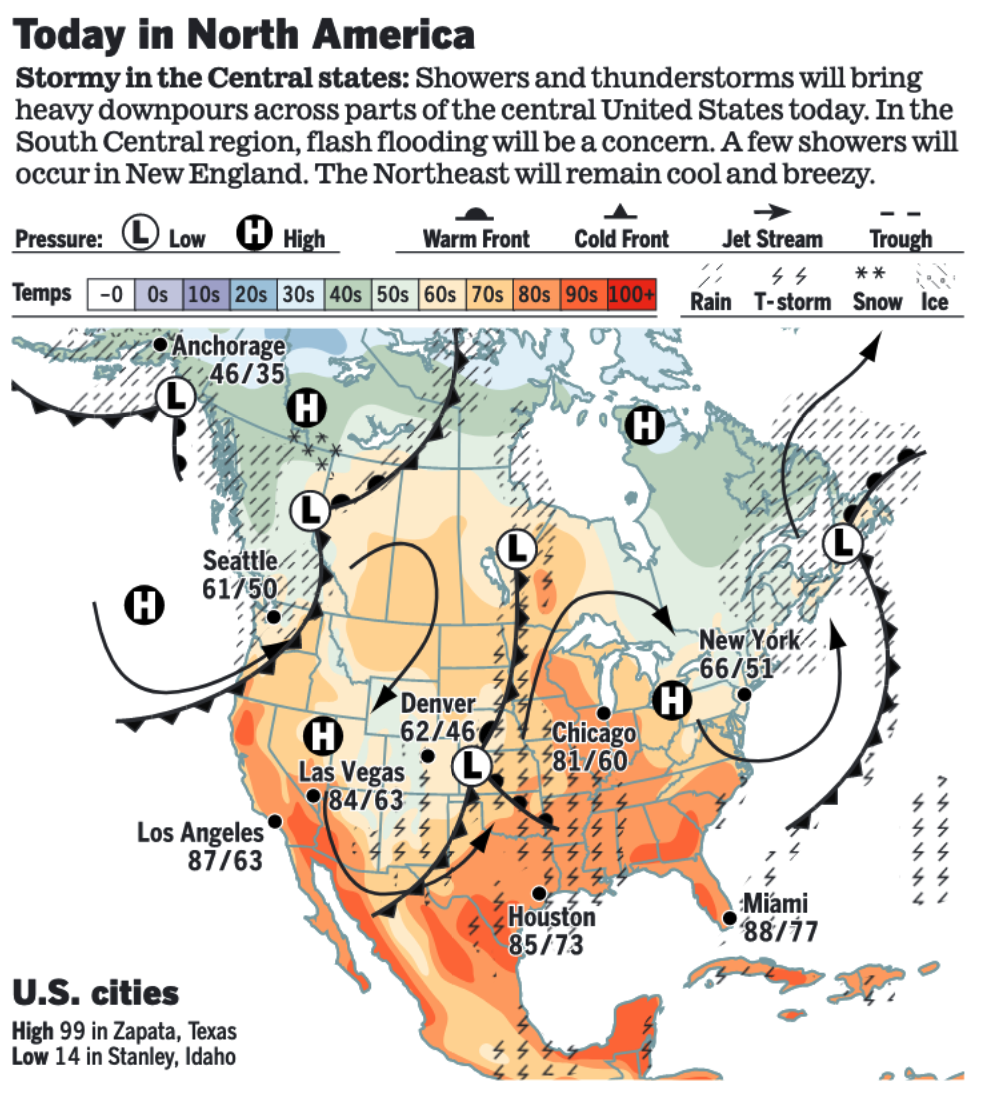

• NWS weather: Heavy rain and scattered flash flooding possible across the Southern Plains over the next few days... ...Severe weather with large hail and locally damaging wind gusts are possible across parts of West Texas today... ...Well above average temperatures continue across the Midwest and Upper Great Lakes as cooler air surges into the central/southern Rockies.

Items in Pro Farmer's First Thing Today include:

• Light buying as market readies for USDA reports that have historically sparked volatility

• Quarterly Grain Stocks and Small Grains Summary out today

• Late retreat for India’s monsoon

• Concerns about beef demand destruction on the rise

• Momentum favors bulls in lean hog market

POLICY FOCUS

— Where are CBO estimates of proposed social and climate change package? Various think tanks and private industry have issued estimates regarding the costs and impacts of the $3.5 trillion Democrat-push plan. But the Congressional Budget Office (CBO) has not. Why? This is particularly important now, observers note, because President Biden and liberal Democrats are putting a zero-dollar price tag on their $3.5 trillion social and climate spending spree in hopes of getting votes from centrist Democrats. Congressional sources say CBO cannot provide estimates without legislative language, and that could be weeks to months away.

— A zero-cost messaging strategy doesn’t add up. Bill Hoagland, a former Republican Senate budget and appropriations expert, believed the "$0" messaging strategy was deployed to help Democrats as Congress grapples with infrastructure reform, a possible federal government shutdown, and debt ceiling crisis. But the Bipartisan Policy Center senior vice president said the legislative package being considered by Congress was likely not deficit-neutral. The House Ways and Means Committee projects it can raise $2.3 trillion in revenue over the next decade to fund $1.3 trillion in "Child Tax Credit extensions, infrastructure, and some of the social safety net programs," according to Hoagland. But that leaves $1 trillion "for Medicaid, for agriculture, for energy, for immigration, for justice," he told the Washington Examiner. Still, he noted, the bills have not yet been given final cost estimates.

The Committee for a Responsible Federal Budget, a group that advocates for lower deficits, estimated the reconciliation bill would not bring in the $600 billion of added revenues from faster economic growth that Democrats want.

— Updates on lingering congressional issues:

- Averting a gov’t shutdown: Both the Senate(first) and then the House are expected to clear a stopgap spending measure through Dec. 3 today, averting a partial gov’t shutdown.

- The CR will include an extension of authority for USDA’s livestock price reporting system.

- The CR contains $28.6 billion in disaster relief (including $10 billion for ag disasters in 2020 and 2021) and provides $6.3 billion to address needs created by the end of the more than 20 years of war in Afghanistan.

- One of the five Sente amendments offered includes one from Sen. Patrick Leahy (D-Vt.), chair of the Appropriations Committee, removing debt-limit language from the continuing resolution. This could be voice voted.

- The Senate should complete the vote by midafternoon.

- In the House, Rules Committee Chair Jim McGovern (D-Mass.) offered a unanimous consent agreement Wednesday night stipulating the funding package doesn’t have to be considered by Rules but can go straight to the floor. That signals the House could move quickly to the measure.

- Bottom line: There should be wide bipartisan support for the measure in both chambers.

- Suspending the debt ceiling before the U.S. gov’t defaults, something Treasury Sec. Janet Yellen says could take place Oct. 18: The House passed “a clean” debt limit hike yesterday on a virtual party-line vote, but that’s going nowhere in the Senate due to Senate Minority Leader Mitch McConnell’s (R-Ky.) opposition. (GOP Rep. Adam Kinzinger (Ill.) was the lone Republican vote in support. Two House Democrats — Reps. Jared Golden (Maine) and Kurt Schrader (Ore.) — opposed the measure.)

- Passing a pair of bills that, together, hold the heart of Biden’s domestic agenda:

- BIF: One of the bills already passed the Senate with bipartisan support and awaits a vote in the House that Speaker Nancy Pelosi (D-Calif.) has already shifted to today and may alter again — Pelosi has said she won’t bring a measure to the floor that doesn’t have the votes to pass, and it’s not clear she can overcome opposition from progressives. The measure is a $1 trillion bipartisan infrastructure (BIF) plan ($550 billion in new funding) to upgrade the nation’s roads, bridges, ports and other infrastructure. Asked Wednesday night if she intends to pull the vote, Pelosi reiterated that “the plan is to bring the bill to the floor.” Is she worried she doesn’t have the votes? “One hour at a time,” she said. Pelosi will hold her weekly press conference at 10:45 a.m. ET.

Of note: If Pelosi pulls the infrastructure package from the floor or it is voted down, both chambers will need to take up a standalone measure to reauthorize federal transportation programs before they expire before Friday at 12:01 a.m. ET and would trigger several thousand furloughs.

- Reconciliation: “We take it one step at a time,” Pelosi said, adding that House Democrats are seeking an agreement with Senate Democrats on the $3.5 trillion spending package, which has not yet materialized. Pelosi said she’s waiting on the Senate and Biden. “We have to come to a place where we have agreement in legislative language,” Pelosi said. “Not just in principle. Legislative language that the president supports. It has to meet his standard because that's what we are supporting. Then, I think we will come together.”

Bottom line: A clear signal that the timeline for the social and climate change package is later, to much later, is when Sen. Joe Manchin (D-W.Va.) released a statement (link) listing several problems with the Democrats’ reconciliation package, including its overall cost and impact on inflation. This helped motivate opposition to the BIF by progressive Democrats. The BIF and reconciliation measures are linked despite Pelosi this week formally severing the linkage that both would be voted on together.

CHINA UPDATE

— Another small rice sale to China with sizable soybean, cotton sales latest week. USDA reported strong sales of U.S. soybeans to China and another small sale of U.S. rice to China in the week ended Sept. 23. Net sales of 2,096 tonnes wheat, 4,245 tonnes of corn, 2,510 tonnes of sorghum, 776,482 tonnes of soybeans, 10 tonnes of rice (all reported as shipped) and 418,588 running bales of upland cotton were reported. The small sales of rice were the first since 20 tonnes of rice were sold to China in the prior marketing year, a result of the Phase 1 agreement with China.

Meat sales: For 2021, USDA said there were net sales of 2,762 tonnes of beef and 13,960 tonnes of pork.

— China Evergrande Group managed to appease some onshore investors by making a partial repayment on money owed to investors who bought its high-yielding investment products, after failing to redeem them amid a liquidity crunch. The debt-stricken developer is said to have made the first instalment to mostly retail investors since suspending repayments this month, according to some who spoke to the South China Morning Post on condition of anonymity. They confirmed receiving 10% of what they were due on Thursday. Link for details.

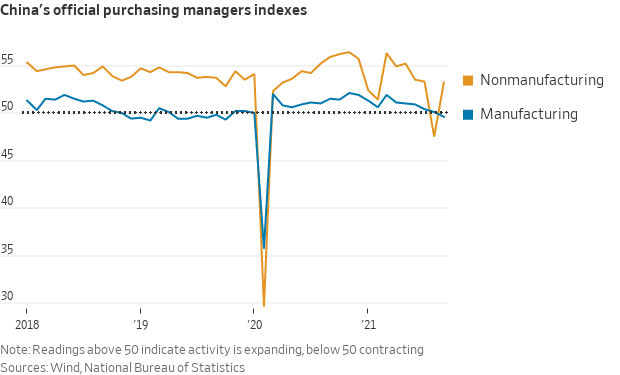

— Manufacturing activity in China dipped into negative territory in September, for the first time since the pandemic began. Its purchasing managers’ index fell to 49.6; analysts had not expected it to cross the 50-point threshold that separates expansion from contraction. Power shortages and sporadic outbreaks of Covid-19 are risking China’s growth outlook. So is Evergrande’s debt crisis.

Meanwhile, the China Caixin PMI rose to 50 — the line separating contraction from expansion — in September from a mark of 49.2 in August. The reading right at 50 suggests a stall in the manufacturing activity level.

— Chinese feedmakers closing their doors due to power crunch. At least half the soybean crushing plants in northern and northeastern China have been shut since last week and will stay closed until at least after the National Day holiday on Oct. 1 due to the country’s power outages, a plant manager and a feed purchase manager told Reuters. This is resulting in a spike in feed costs as supplies tighten, compounding troubles for Chinese livestock producers and hog farmers, in particular, who are already struggling with losses and weak margins. “Right now, pig farmers are being squeezed on each end. The price for hogs is incredibly low and demand is weak, at the same time the price for soybean meal and feed is rising,” said Darin Friedrichs, senior Asia commodity analyst at StoneX. He also added this could impact drying of the corn crop. The power shortages stem from new measures curbing emissions.

— China to hold 2022 TRQs steady with this year. China set its low tariff rate quotas (TRQ) for wheat, corn, cotton and rice imports in 2022 at the same level as in 2021. They stand at: 9.636 MMT for wheat, 7.2 MMT for corn, 894,000 MT for cotton and 5.32 MMT for rice, the state planner said. In recent years, Chinese purchases of some of these products have blown past these levels. Chinese customs data shows the country’s 2021 corn imports through August stand at 21.40 MMT, with wheat imports at 6.96 MMT. The Phase 1 trade agreement requires China to fulfill its TRQ obligations, something that had not occurred previously.

— Two French slaughterhouses get green light to ship beef to China. China’s certification watchdog has given approval to two French slaughterhouses to export beef to the country. In June, China lifted a two decade-long embargo on French beef and three weeks ago the two sides reached an agreement on hygiene and inspection requirements. While Chinese demand for pork and pork imports has recently wanted, its demand for beef has been growing steadily.

ENERGY & CLIMATE CHANGE

— RFS wait continues. The proposed Renewable Fuel Standard (RFS) levels are still showing as being under review at the Office of Management and Budget (OMB) and the rumor mill in Washington is unusually quiet on the potential for EPA to announce the proposed marks. However, contacts say they cannot rule in or out an announcement by the agency yet this week.

— USDA seeks comments on climate-smart commodities plan; Vilsack insists is not a carbon market. USDA is looking for public comments on what they are saying is the “possible development” of a Climate-Smart Agriculture and Forestry (CSAF) Partnership Program, an effort that links back to the executive order from President Joe Biden on Tackling the Climate Crisis at Home and Abroad. The notice seeking public input is in today’s Federal Register (link), with only a 30-day comment period.

Vilsack tries to define the plan. In unveiling the effort in Colorado, Vilsack made clear that it was not a carbon market. “I want to be clear,” Vilsack stated. “This initiative is not a carbon bank, nor a carbon market. It’s not even a conservation program.” Vilsack stressed the effort is “first and foremost a commodity program, one that seeks to empower farmers, ranchers, producers and foresters to produce climate-smart commodities, meeting domestic and global consumer demand.”

But Federal Register notice does mention carbon sequestration, so Vilsack’s insistence may not be as convincing. “The term ‘climate-smart commodity’ is used to refer to an agricultural commodity that is produced using farming practices that reduce greenhouse gas (GHG) emissions or sequester carbon.” The effort also seeks to “test development” of a partnership program that “could encourage adoption of CSAF practices and promote markets for climate-smart commodities.”

CCC ‘could’ be used. One of the key around the issues of carbon sequestration and a carbon bank is whether USDA’s Commodity Credit Corporation (CCC) authority could be used to fund such an effort. In the request for comments, USDA said the CSAF Partnership Program “could be developed” under the CCC authority. Vilsack also addressed the issue in his Colorado remarks. “As a commodity program, and one that helps promote markets and exports, the CCC resources can be used to fund this effort,” Vilsack stated. “And if they are used, they will be at a significant level that will allow us to accomplish the purpose of this initiative without compromising CCC’s other important role — to support farm bill programs and meet other emergency needs as they arise.” That will be a key focus for those analyzing the potential USDA efforts as there had been pushback from Republicans on the Hill in particular on whether USDA had the authority to use CCC authority for a carbon bank.

Not a carbon market, but… USDA’s public comment document makes several mentions of markets and commodities, no doubt seeking to downplay any focus on carbon markets, carbon banks or carbon credits. “New markets for climate-smart commodities provide an opportunity and a challenge for U.S. farmers, ranchers, and forest landowners,” USDA said. “Domestic and international consumers are demonstrating a preference for agricultural commodities produced using CSAF practices, creating new market opportunities for producers. Markets for climate-smart commodities include sustainable supply chain initiatives and internal corporate commitments where companies are pledging to reduce emissions within their own supply chains and production facilities.”

USDA also said that those opportunities could include “markets for low-carbon biofuels and renewable energy.” But the document still brings carbon markets or carbon credits into the mix, although it avoids using those terms. “Agricultural producers and landowners also have opportunities to market GHG reductions generated as a part of climate-smart commodity production,” USDA said.

‘Benefits’ a code word for carbon credits? USDA noted there are “barriers” that have kept markets for climate-smart commodities from “reaching scale,” including the lack of a standard definition of climate-smart commodities. But others include a “lack of clear standards for measurement of climate benefits of CSAF practices,” and the “potential for double-counting benefits.” USDA also noted things like “high transaction costs,” the “limited ability for small producer participation,” the lack of “efficient supply chain traceability,” and the “high risk of market entry” as being barriers.

USDA wants comments on promoting CSAF “including systems for quantification, options, and criteria for proposal evaluation, use of information collected, potential protocols, and options for review and verification.” Plus, they want to know how the U.S. gov’t “might encourage CSAF practices by leveraging private-sector demand and providing new income streams for farmers, ranchers, and forest landowners.”

USDA does mention carbon markets in the specific questions they want addressed, including a key one: “How would existing private sector and state compliance markets for carbon offsets be impacted from this potential federal program?” If the potential USDA effort is not a carbon market, then it would seem impacts to already existing efforts would be minimal.

USDA said that projects should promote “the production of climate-smart commodities and support adoption of CSAF practices,” listing examples of “Activities that develop standardized supply chain accounting for carbon-friendly products; activities that provide supply chain traceability; innovative financing for low-carbon fuel from agricultural feedstocks; or green labeling efforts, among others.” Other possibilities USDA noted include using grants, loans and loan guarantees to producers for equipment they would use for CSAF practices, and those actions include testing, standardizing, quantifying and verifying protocols for CSAF practices.

But a carbon market could obviously be part of the mix. USDA said examples could include: “Activities that generate voluntary carbon offsets through CSAF practices. Within carbon offset markets, the GHG benefit is separated from the commodity and sold as a carbon offset credit. Should the USDA consider hybrid approaches where the GHG benefit could be assigned to a climate-smart commodity, or separated and sold as a voluntary carbon offset?”

Noting that costs could be “high” if USDA were to contract with individual producers or landowners, the agency said it could “make more sense to work with groups of producers and landowners” such as producer associations, state/tribal/local governments, farmer cooperatives, carbon offset project developers, conservation districts, institutions of higher education, which could include cooperative extension.

USDA wants input on what criteria would be used to evaluate proposed projects for funding, noting “potential criteria may include estimated GHG or carbon sequestration benefits; estimated costs; potential for addressing identified barriers for producers; ability to benefit underserved producers and early adopters; environmental justice benefits; and demonstrated capability to ensure success.”

While Vilsack stressed that it is not a carbon bank or carbon market, the document asks: “Should USDA establish a consistent payment per ton of GHG generated through these partnership projects as part of the project payment structure, or evaluate a range of incentive options?”

USDA also wants input on the kind of data and metrics that should be collected for such an effort and the kind of systems that should be used to “track participation, implementation and potential benefits generated.” Further, USDA asks how should the “ownership of potential GHG benefits that may be generated be managed?”

Trying to include a wide range of landowners and producers, USDA asks how to include early adopters and those in underserved areas and that the benefits are “provided to producers.”

Comments: Vilsack, a lawyer by training, is clearly trying to set the case that this plan is a “commodity program” and thus could qualify for CCC funding. “As a commodity program, and one that helps promote markets and exports, the CCC resources can be used to fund this effort,” Vilsack said. “And if they are used, they will be at a significant level that will allow us to accomplish the purpose of this initiative without compromising CCC’s other important role: to support farm bill programs and meet other emergency needs as they arise.” Vilsack’s mention of making this a pilot program is also of note.

Sen. John Boozman (R-Ark.), ranking member on the Senate Ag Committee, said: “There are concerns with this latest approach that merit bipartisan, bicameral hearings in tandem with USDA’s producer outreach efforts, including whether it is appropriate to use Commodity Credit Corporation funds to implement and carry out this program. It is my hope that Secretary Vilsack will come before the committee to explain outreach efforts the department is engaging in and share input that he is receiving from the agriculture community, as well as answer any process questions members may have. It is our responsibility as a committee to conduct oversight on USDA’s efforts, and the questions that surround this initiative are a prime example of why that authority exists. I want to make sure that ‘producer-driven’ is more than a talking point. It needs to be the standard. This new program must be informed by producers and foresters who actively work the land to produce the food, fuel and fiber our nation depends upon. Their voices must be heard during this process and congressional oversight is needed to ensure they largely inform the creation of this program.”

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— USDA to tap $3 billion in CCC authority for ASF, nutrition programs. USDA Wednesday announced that it will use $3 billion in authority under the Commodity Credit Corporation (CCC), including up to $500 million, to prevent African Swine Fever (ASF), $500 million to support drought recovery, $500 million to “provide relief from agricultural market disruption and up to $1.5 billion to provide assistance under the Food and Nutrition Service and Agricultural Marketing Service (AMS) to support procurement of agricultural commodities for schools.

The ASF funds will be used to expand and coordinate “monitoring, surveillance, prevention, quarantine, and eradication activities” through the Animal and Plant Health Inspection Service.

The efforts for agricultural market disruptions are aimed at addressing increased transportation challenges, availability and cost of certain materials, and “other near-term obstacles to the distribution of certain commodities.” There was little initial detail provided by USDA on the specifics involved in the efforts.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 233,286,306 with 4,774,571 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 43,349,448 with 695,116 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 391,992,662 doses administered, 184,335,263 have been fully vaccinated, or 56.2% of the U.S. population.

— More people are getting Covid-19 boosters by attesting that they qualify for a third shot under guidance that federal officials released last week.

— India is preparing to produce its own mRNA-based Covid-19 vaccine by the end of the year, in a scientific breakthrough that would help expand the range of global production hubs for the shots.

POLITICS & ELECTIONS

— President Biden’s approval rating is now 45%, according to an average of polls by FiveThirtyEight. This is down from an average of 53% in late July. For context, by September in his first year, Biden’s approval rating now is worse than any president since World War II with one exception: Donald Trump’s 39% approval rating at this point in his term was worse. The last four presidents were all more unpopular than popular at this point. Other than Trump, most modern presidents — including Ronald Reagan, Bill Clinton, George W. Bush, and Barack Obama — all won re-election despite a dip in their approval ratings around this time.

CONGRESS

— Republicans won the Congressional Baseball Game for the first time in five years Wednesday night, defeating the Democrats 13-12.

OTHER ITEMS OF NOTE

— North Korea leader Kim Jong Un offered to restore a hotline with South Korea — a possible sign of rapprochement — after a week in which his North Korean regime test-fired more missiles into the sea near its neighbors. The communications channel was severed in August, following joint South Korean/American military drills.

EVENTS AND REPORTS

Thursday, Sept. 30

· Federal Reserve. New York Fed President John Williams, Atlanta Fed President Raphael Bostic, Chicago Fed President Charles Evans, St. Louis Fed President James Bullard and Philadelphia Fed President Patrick Harker are to speak.

· Afghanistan. Senate Armed Services Committee hearing on "Afghanistan."

· Housing in rural America. Bipartisan Policy Center virtual discussion on "Meeting Rural America's Housing Needs."

· Fed, Treasury pandemic response oversight. House Financial Services Committee hearing on "Oversight of the Treasury Department's and Federal Reserve's Pandemic Response."

· Covid response. House Transportation and Infrastructure Committee hearing on "Assessing the Federal Government's Covid-19 Relief and Response Efforts and its Impact, Part II."

· Small business issues. House Small Business Committee hearing on “Empowering Employee Owned Businesses and Cooperatives Through Access to Capital.”

· Hydrogen issues. U.S. Chamber of Commerce virtual discussion on "Blueprint for the Hydrogen Economy," as part of the EnergyInnovates series.

· Cryptocurrencies. Brookings Institution virtual discussion on "Regulating Cryptocurrencies and Future Technologies."

· Homeland Security. House Homeland Security Oversight, Management and Accountability Subcommittee hearing on "20 Years After 9/11: Transforming DHS to Meet the Homeland Security Mission."

· COP26 conference. Washington Post Live virtual discussion on "Protecting Our Planet: What's at Stake," previewing the COP26 conference this November in Scotland.

· Energy systems and disasters. United States Energy Association virtual discussion on "Energy Communications in the Control Room," focusing on communications systems during disasters.

· Economic reports. Jobless Claims | GDP | Chicago PMI

· Energy reports. EIA Natural Gas Report

· USDA reports. FAS. Export Sales NASS: Grain Stocks | Small Grains Summary | Agricultural Prices ERS: Dairy: Per Capita Consumption; Milk: Supply and Utilization of All Dairy Products | Per Capita Consumption of Selected Cheese Varieties