USDA Is Issuing Remaining 10% of 2019 and 2020 WHIP+ Payments

When will Biden sign BIF into law?

In Today’s Digital Newspaper

Market Focus:

• Quarles’ exit brings Biden total of four Fed slots to fill

• Fed: U.S. public health among biggest near-term risks to financial system

• Impacts growing re: lingering strike at Deere & Co

• Macy's will raise minimum wage to $15 an hour by May

• Germany’s export-oriented economy lagging

• U.S. gov’t energy report due out today may determine SPR tap

• Michigan pipeline in focus

• Crypto gains may be fueling the labor shortage

• November USDA WASDE/crop reports out at noon ET

• Ag demand update

• Mild price gains overnight

• USDA crop reports released today

• Consultant leaves South American crop estimates unchanged

• Winter wheat CCI ratings slip

• Feedlots cleaned up a lot of cattle

• Cash hog index firms again

Policy Focus:

• Good news: USDA issuing remaining 10% of 2019 and 2020 WHIP+ payments

• When will Biden sign BIF into law?

• Ag groups laud HOS rule exemption, young trucker pilot program included in BIF

China Update:

• China's real estate slowdown

• Biggest selloff China’s international junk-bond market has ever seen

• U.S. to start projects to counter China’s global infrastructure plan

Energy & Climate Change:

• Obama spoke at COP26 summit and criticized his successor, Trump

• South Korea flying military oil tanker to Australia this week to airlift urea solution

Livestock, Food & Beverage Industry Update:

• Americans cutting back on steak as rising grocery prices squeeze spending

• Supply crunch hits Thanksgiving dinner

Coronavirus Update:

• Together, U.S., India and Brazil account for 40% of reported Covid cases

• China’s zero-Covid aim has zero chance now virus has adapted: Sars expert

• Survey: Majority of federal employees disagree with Biden’s vaccine mandate

Politics & Elections:

• Trump: Will ‘probably’ make 2024 announcement after midterms

Congress:

• Republicans introduce bill to freeze H-2A wages

Other Items of Note:

• Justice Department charged Ukraine man with conducting cyberattacks

• Robinhood Markets said it experienced a security breach

• Neil Harl dies

MARKET FOCUS

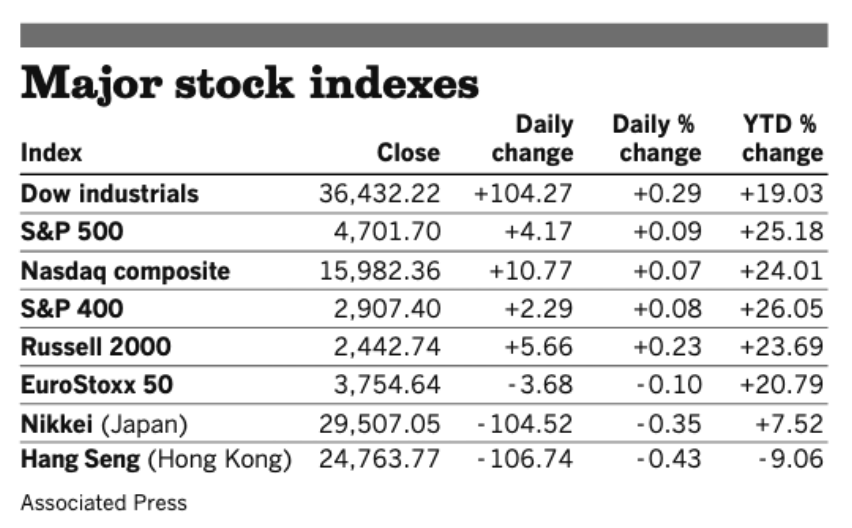

Equities today: Global stock markets were mixed in overnight trading. The U.S. stock indexes are pointed to mixed openings, with Dow futures slightly lower. Traders are focused on earnings and the economy with the October reads of CPI and PPI due out this week. Both the CPI and PPI are expected to accelerate on a month-to-month basis. Meanwhile, General Electric plans to split into three public companies focused on aviation, healthcare and energy by 2024. Shares in the industrial conglomerate rose 9% premarket. Asian equity markets were mixed. Japan’s Nikkei was down 221.59 points, 0.75%, at 29,285.46. The Hang Seng Index gained 46.36 points, 0.20%, at 24,813.13. European equities are mostly higher. The Stoxx 600 was up 0.3% while most other markets posted gains of 0.2% to 0.6%. Italian markets, however, were slightly lower.

U.S. equities yesterday: The Dow advanced 104.27, 0.3%, to 36,432.22, while the Nasdaq ticked up 10.77, less than 0.1%, to 15,982.36. Both indexes hit fresh records. The S&P 500 rose 4.17 points, less than 0.1%, to 4,701.70 — the eighth consecutive trading session in which the broad market index closed at a record, a feat it hasn’t accomplished since 1997.

On tap today:

• European Central Bank President Christine Lagarde gives a welcome address at an ECB banking supervision forum at 8 a.m. ET.

• U.S. producer price index for October is expected to increase 0.6% from the prior month. (8:30 a.m. ET)

• Federal Reserve speakers: St. Louis’s James Bullard at a UBS European Conference at 7:50 a.m. ET, Chairman Jerome Powell prerecorded opening remarks at a Fed, ECB, Bank of Canada and Bank of England conference on diversity at 9 a.m. ET, San Francisco’s Mary Daly to the National Association for Business Economics at 11:35 a.m. ET, and Minneapolis’s Neel Kashkari at the University of Wisconsin-Eau Claire at 1:30 p.m. ET.

• USDA WASDE and Crop Production reports, noon ET.

• Commerce Secretary Gina Raimondo will join today’s White House press briefing at 1 p.m. ET.

• Bank of Canada Gov. Tiff Macklem gives closing remarks at a Fed, ECB, Bank of Canada and Bank of England conference on diversity at 5:45 p.m. ET.

• China's producer price index for October is expected to increase 12.5% from one year earlier, and its consumer-price index is forecast to rise 1.4% from one year earlier. (8:30 p.m. ET)

Fed’s Quarles will resign at end of year. Federal Reserve governor Randal Quarles said he would resign his position around the end of this year. Quarles’s resignation will open up another seat for President Biden to fill on the central bank’s seven-member board of governors. He has served since 2017. His position as vice-chair for supervision ended in October, roughly four years after former President Donald Trump appointed him to the post. His governor role, however, would have allowed him to stay on at the central bank until 2032. The Biden administration is currently debating whether to reappoint chair Jay Powell for another four years before his current term expires in early February. The president must also decide on a replacement for vice-chair Richard Clarida, whose term as governor ends in January. Biden also inherited another vacancy to fill on the Fed’s board of governors from his predecessor, Trump. Governor Lael Brainard is often cited as a potential replacement for either Powell or Quarles, given her more stringent stance on regulatory matters. Biden said last week he would decide “fairly quickly,” and met with Powell and Brainard separately on Thursday. Perspective: Some progressives had argued that, among many other reasons, Powell shouldn't get a second term as chair because it would keep Dems in the minority on the Fed board. This is no longer the case the with the knowledge that Quarles will be gone in 2022.

Federal Reserve says U.S. public health is among the biggest near-term risks to the financial system. The central bank's semiannual Financial Stability Report (link) also noted that asset prices are susceptible to large declines should investor sentiment shift. “Asset prices may be vulnerable to significant declines should risk appetite fall, progress on containing the virus disappoint, or the recovery stall,” the report noted.

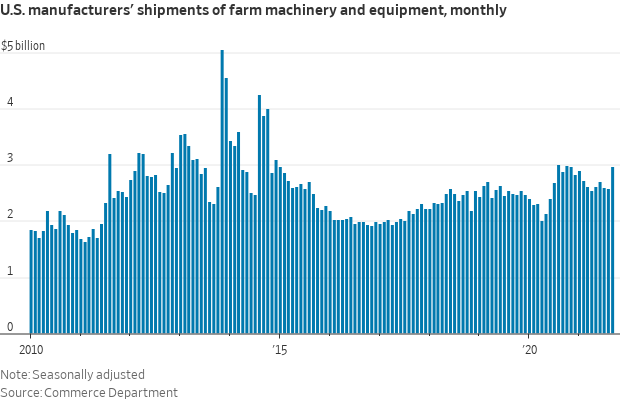

A lingering strike at Deere & Co. has dealers bracing for delayed deliveries of new equipment, and farmers fearing higher prices ahead. Supplies of new tractors and combines across the Farm Belt have been stretched for months as manufacturers struggle with shortages of raw materials, components and semiconductor chips. Now, farmers and dealers worry that shipments from Deere, the largest seller of farm equipment in North America, will be further undermined after more than 10,000 union workers walked off their jobs Oct. 14, the Wall Street Journal reports (link). The article cites farmer Dale Reimers, who grows corn, soybeans and other crops across 25,000 acres in eastern North Dakota, said he ordered three new Deere tractors and two crop sprayers before the strike. Delivery for some equipment already has been delayed for months, and it is unclear when the rest of his order will even be built, he said, adding that he worries the strike could further complicate things. Deere says it will operate its U.S. plants with supervisors and other nonunion employees, and the company is considering sourcing parts from its overseas plants. That’s likely to stretch out plant production schedules, and farmers say that would cut into their own production next year.

Inflation watch: Macy's will raise the minimum wage of its more than 100,000 U.S. employees to $15 an hour by May, as retailers fight to hire and retain workers in an increasingly competitive labor market. Once that happens, the company's average base pay will be above $17/hour across its workforce of 100,000 employees, and average total pay will be $20/hour.

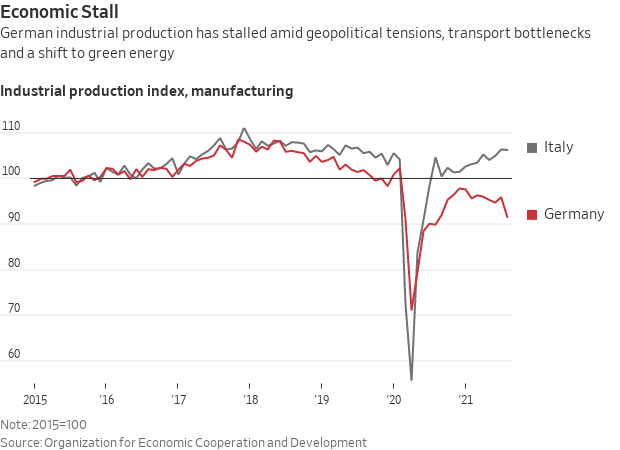

Germany’s export-oriented economy is lagging. German manufacturers are struggling to produce cars and factory equipment because of parts and labor shortages. They face surging energy prices that are making sky-high electricity bills even higher. And they must invest hundreds of billions of dollars over coming years to meet new clean-energy standards. Chinese businesses, Germany’s biggest customers, are turning into competitors.

Market perspectives:

• Outside markets: The U.S. dollar index is lower amid strength in the British pound. The yield on the 10-year US Treasury note fell, trading near 1.46%, with a mixed-to-negative tone noted in other global government bond yields. Gold futures are up while silver futures are lower, with gold trading around $1,830 per troy ounce and silver around $24.51per troy ounce.

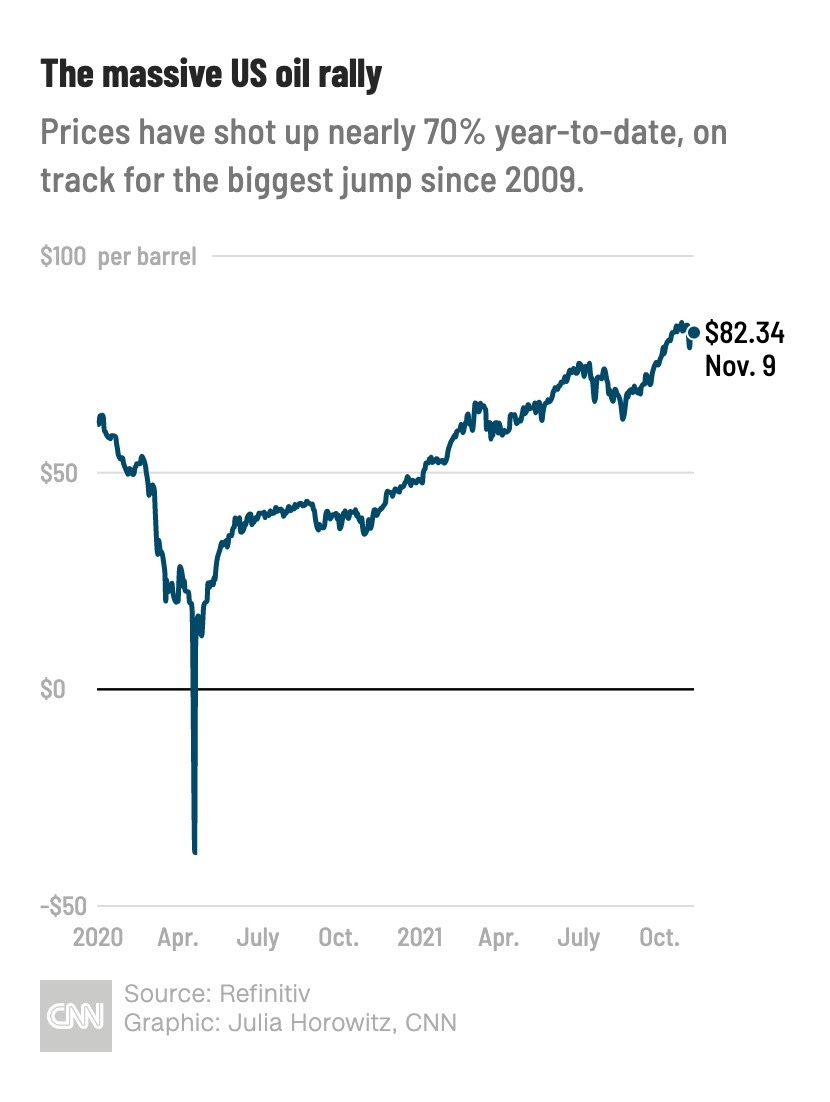

• Crude prices are up ahead of U.S. trading with U.S. crude trading around $82.30 per barrel and Brent around $83.75 per barrel. Futures posted gains in Asian action, with U.S. crude up $0.39 at $82.32 per barrel while Brent was up $0.31 at $83.74 per barrel.

• U.S. gov’t energy report due out today may determine whether the Biden Administration decides to release crude from the Strategic Petroleum Reserve. Administration officials will likely be looking for significant revisions to price forecasts and the balance of supply and demand from last month’s Short Term Energy Outlook before deciding. “It’s very useful to see where their projections are going for oil prices into the future and where their projections for comparable gas prices at the retail pump are going as well,” Deputy Energy Secretary David Turk said in an interview at the COP26 climate summit in Glasgow, Scotland. “What you’ll see is a dropping-off of that” as more production catches up with post-pandemic demand despite “some near-term challenges,” Turk said. Ahead of the release, crude is adding to yesterday’s gain, trading above $82 a barrel. Saudi Aramco warned that spare capacity in the oil market will shrink significantly next year as people fly more.

• Michigan pipeline in focus. The White House said it’s waiting on a study by the U.S. Army Corps of Engineers before deciding whether to wade into a debate over the future of a controversial oil pipeline that carries Canadian oil across the Great Lakes into Michigan. The idea that the Biden administration is considering shutting Enbridge’s Line 5 is “inaccurate,” White House spokeswoman Karine Jean-Pierre told reporters yesterday, in response to news reports.

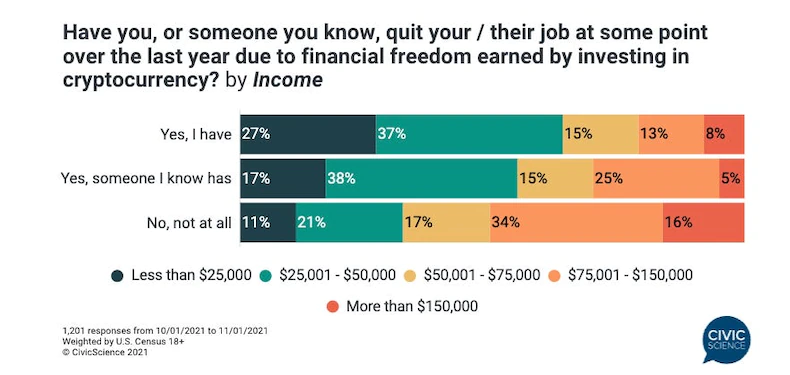

• Crypto gains may be fueling the labor shortage. A new study from CivicScience found that people are leaving low-paying work to take their chances on risky digital assets. The survey comes as the total market cap for digital assets hits $3 trillion for the first time. Link for details. Meanwhile, Citi's CEO says all big banks will soon consider crypto trading. Vikram Pandit sees the shift happening in the next one to three years. In overnight news, Bitcoin prices rose to another record high near $68,000. The sector’s overall market cap rose by about 3.6% in the past 24 hours, pushing it above $3 trillion for the first time Monday morning, according to pricing data from CoinGecko.

• November USDA WASDE/crop reports out at noon ET. Traders anticipate USDA will continue to raise its corn and soybean crop estimates. The average pre-report estimate from a Reuters survey puts the corn crop at 15.050 billion bu. and the soybean crop at 4.484 billion bushels. The bigger crop estimate is expected to increase the 2021-22 bean ending stocks projection, which is estimated to rise 42 million bu. from last month to 362 million bushels. But traders see corn carryover declining by 20 million bu. to 1.480 billion bushels. The report is expected to show little if any change to U.S. wheat ending stocks, with the average pre-report estimate at 581 million bushels.

• Ag demand: The Philippines purchased 50,000 MT of Australian feed wheat. Japan is seeking 157,987 MT of wheat from the U.S., Canada and Australia. South Korea tendered to buy 115,000 MT of optional origin non-GMO soybeans. Tunisia tendered to purchase 100,000 MT of soft milling wheat and 75,000 MT of feed barley – both optional origin.

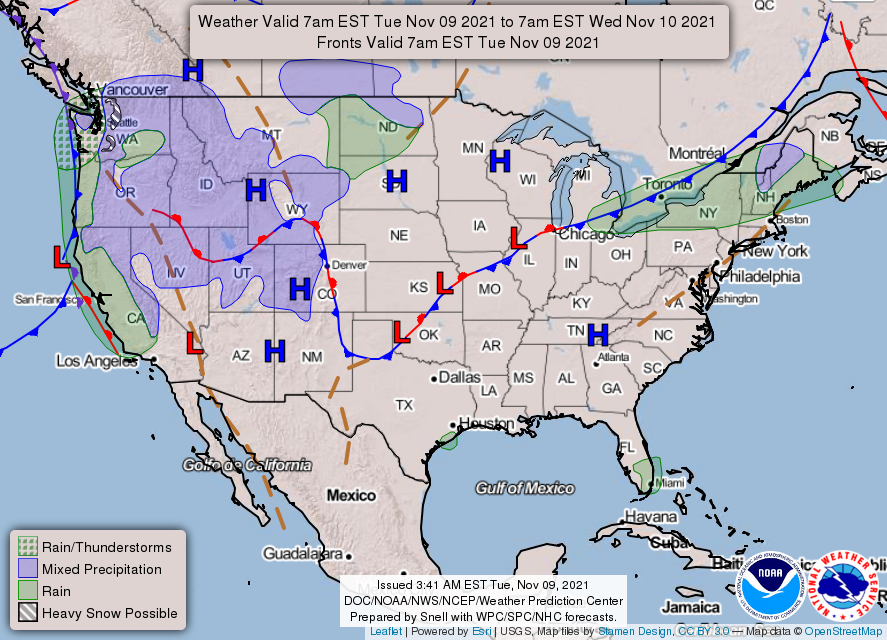

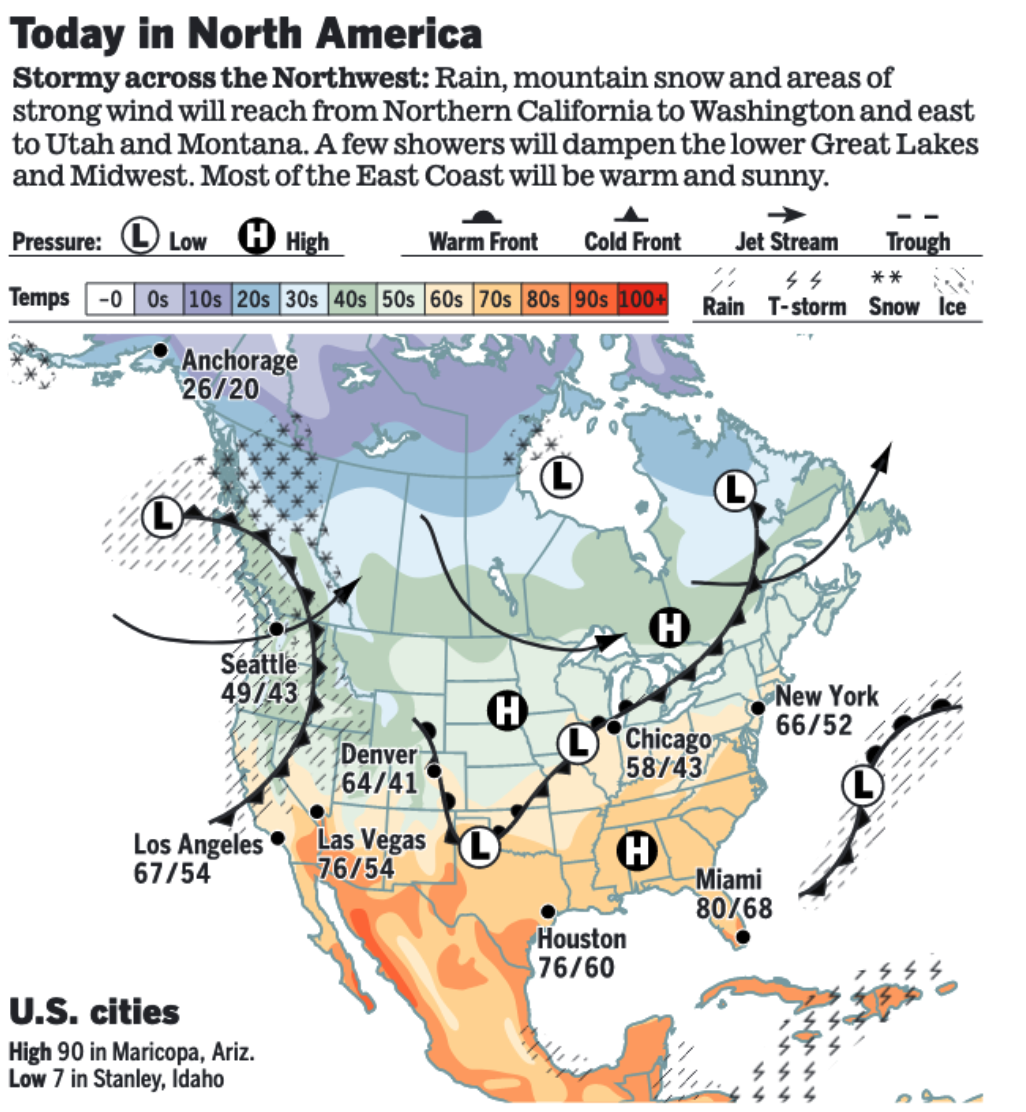

• NWS weather: Rain and higher elevation snow over parts of the Pacific Northwest, Northern/Central California, and Northern Rockies/Great Basin... ...Temperatures will warm up over parts of the eastern third of the country.

Items in Pro Farmer's First Thing Today include:

• Mild price gains overnight

• USDA crop reports released today

• Consultant leaves South American crop estimates unchanged

• Winter wheat CCI ratings slip

• Feedlots cleaned up a lot of cattle

• Cash hog index firms again

POLICY FOCUS

— Good news: USDA is issuing the remaining 10% of 2019 and 2020 WHIP+ payments. Because of budget constraints, 2019 and 2020 WHIP+ payments were initially subject to a 50% factor. In June 2021, FSA authorized a second payment equal to 40% of the calculated payment. At that time, it was also announced that a third round of payments may be issued if sufficient funds become available. But now, sufficient funds are available to issue final 2019 and 2020 WHIP+ payments. USDA’s Farm Service Agency FSA has authorized a final payment equal to the remaining 10% of 2019 and 2020 calculated payments.

— When will Biden sign BIF into law? Those observers who see a conspiracy around everything think President Biden is holding off signing the cleared bipartisan infrastructure bill (BIF) until Congress also approves the much larger Build Back Better (BBB) package. But White House sources say the president is simply waiting until lawmakers return to Washington on Nov. 15 so there can be a full-fled signing ceremony at the White House sometime the week of Nov. 15. During Monday’s White House daily press briefing, deputy press secretary Karine Jean-Pierre was asked why Biden has not yet signed the bill after the White House and president “talked about the urgency” of passing it. “So he talked about this on Saturday — he and he basically said he wants to make sure that the congressional members who work very, very hard on this when they come back, then we’ll — we’ll figure out a time to sign it,” Jean-Pierre told reporters. “But you’re right, is it — it’s urgent, but we also want to make sure that the people who spent the last couple of weeks, last couple of months just all in delivering on this — on this promise are here for the signing as well,” she added. When pressed on a specific date, Jean-Pierre said she does not have a date set but “it will be very soon.”

— Ag groups laud HOS rule exemption, young trucker pilot program included in BIF. While welcoming passage of the bipartisan infrastructure package (BIF) by Congress last week, several farm and commodity groups are highlighting provisions expanding a “short haul” exemption for ag haulers. National Cattlemen’s Beef Association (NCBA) Executive Director of Government Affairs Allison Rivera said the change, which extends a 150-air-mile exemption for livestock haulers to include the destination of hauls, provides “much needed flexibility under current hours-of-service regulations.” Previously, the exemption only applied to the origination side of hauls. Meanwhile, National Grain and Feed Association (NGFA) also highlighted BIF’s inclusion of new pilot apprenticeship program to allow the hiring of 18- to 20-year-olds as interstate truckers, saying it will help “address the nationwide truck driver shortage.”

CHINA UPDATE

— China's real estate slowdown. China’s aggressive campaign to root out speculative real-estate activity could slow the country’s growth rate for years to come, economists say, even if a major housing correction with sharply falling home prices is averted. China is attempting a controlled slowdown of the country’s property market — whose decadeslong boom has led to runaway price increases and a glut of empty apartments — to reduce financial risks and put the economy on sounder footing. While economists generally agree that purging the market of irrational behavior is necessary, they say the campaign will at least partly deprive China of one of its biggest sources of growth.

— Biggest selloff that China’s international junk-bond market has ever seen has wiped out around a third of bondholders’ wealth in just six months. The steep and rapid decline shows how regulatory curbs on borrowing, extremely dislocated credit markets, and slowing home sales have combined to pressure more Chinese property developers, which account for most of China’s high-yield issuance.

— U.S. to start projects to counter China’s global infrastructure plan. The U.S. plans to invest in five to 10 large infrastructure projects around the world in January as part of a broader Group of Seven (G7) program to counter China's Belt and Road Initiative, a senior U.S. official said on Monday. Officials are meeting gov’t and private-sector leaders as they hunt for projects to be funded under the Build Back Better World (B3W) initiative launched by the G7 in June. Plans could be finalized during a G7 meeting in December, the official said. Washington will offer developing countries "the full range" of U.S. financial tools, including equity stakes, loan guarantees, political insurance, grants and technical expertise to focus on climate, health, digital technology and gender equality, the official told reporters. Link to White House fact sheet on B3W. The program will look to counter Chinese influence by offering funding for projects with higher labor standards, a focus on climate issues and helping disadvantaged minorities like female entrepreneurs. It takes its name from Biden’s campaign slogan and was launched at the G7 summit earlier this year.

ENERGY & CLIMATE CHANGE

— Former President Barack Obama spoke at the COP26 summit and criticized his successor, Trump, for pulling the U.S. out of the Paris Agreement and setting off "four years of active hostility towards climate science." He also took aim at the Chinese and Russian Presidents for skipping the COP26 entirely.

— South Korea is flying a military oil tanker to Australia this week to airlift 27,000 liters of urea solution, used in diesel vehicles and factories to cut emissions, amid a dire shortage threatening to stall commercial transport and industries. Approximately two million diesel vehicles, mostly cargo trucks, are required by government to use the additive.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

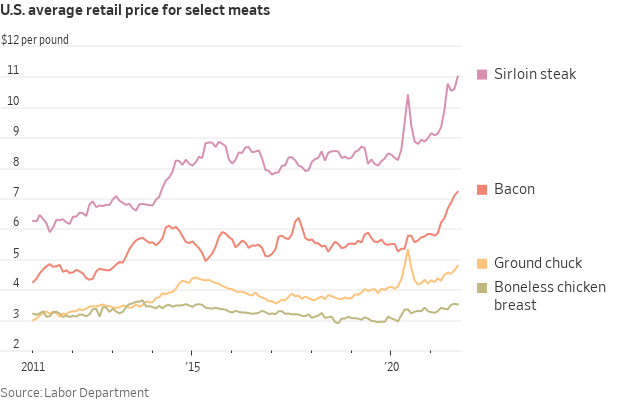

— Americans are cutting back on steak as rising grocery prices squeeze spending. Supermarkets say shoppers are buying more store-brand meat products and trading down from beef to less-expensive alternatives such as chicken or pork, after prices for products such as rib-eye climbed about 40% from a year ago, according to research firm IRI. Food makers ranging from Mondelez International to Kraft Heinz have been raising prices in recent months to offset escalating costs in labor, raw materials and transportation.

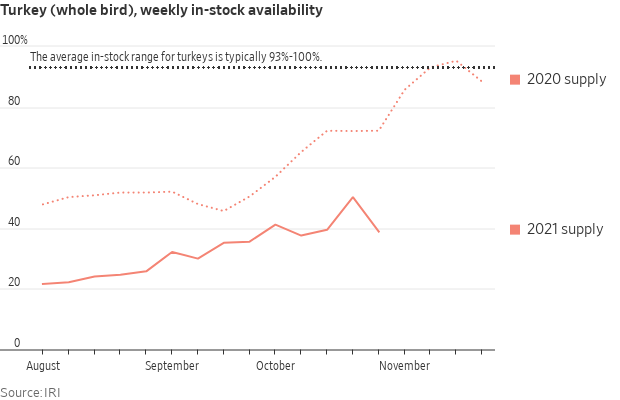

— Supply crunch hits Thanksgiving dinner. Supplies of food and household items are 11% lower than normal as of Oct. 31, according to data from market-research firm IRI. That figure isn’t far from the bare shelves of March 2020, when supplies were down 13%. Turkeys are especially low in stock amid labor and supply challenges. Many other holiday essentials — including cranberry sauce and pies — are already in short supply. Link to what’s in and out of stock right now, according to IRI data. For grocery shoppers this holiday season, it means that someone with a 20-item list would be out of luck on two of them. According to the Farm Bureau, the average cost of preparing Thanksgiving dinner in 2020 was about $47, and it’s expected to cost up to 5% more this year.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 250,486,697 with 5,058,876 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 46,613,210 with 755,643 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 430,487,397 doses administered, 194,001,108 have been fully vaccinated, or 59.10% of the U.S. population.

Together, the U.S., India and Brazil account for 40% of reported cases. Globally, about 4 billion people have gotten at least one dose of a Covid-19 vaccine, and about 3.1 billion people are fully vaccinated.

— China’s zero-Covid aim has zero chance now virus has adapted, Sars expert says. “No chance” of eliminating cases because virus “will stay with us,” Guan Yi says, adding China must find out people’s antibody level, not obsess about testing. China should focus on building a shield of protection using vaccines, and should test its population’s immunity level after vaccination to determine which jabs to administer, Guan Yi told Phoenix TV in an interview aired on Monday. Guan is director of the State Key Laboratory of Emerging Infectious Diseases at Shantou University in southern China, which runs the lab in partnership with the University of Hong Kong. Mainland China has begun giving booster shots after inoculating almost 80 per cent of its 1.4 billion people, and has started vaccinating its children.

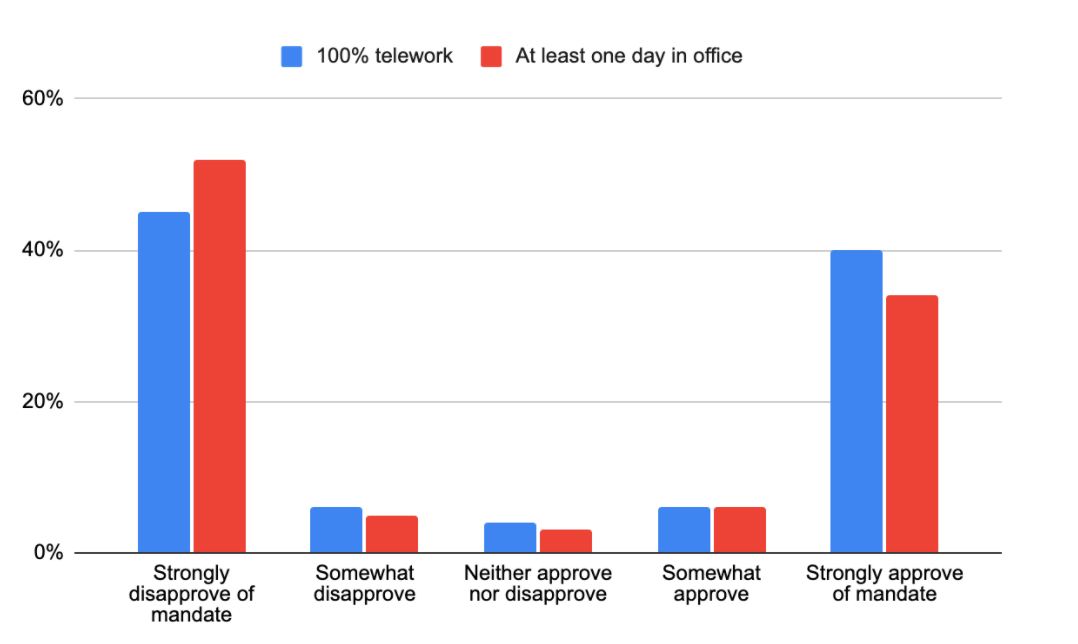

— Survey: Majority of federal employees disagree with Biden’s vaccine mandate. The majority of federal employees recently surveyed (53%) strongly or somewhat disagreed with the Biden administration’s Covid-19 vaccine mandate for federal employees, while 44% strongly or somewhat agreed with it. The Government Business Council, the research arm of Government Executive, sent a survey between Oct. 27 and Nov. 2 to Government Executive and Defense One readers, which drew 3,186 respondents. The survey had a 95% confidence level and margin of error of +/- 3%; the vast majority of respondents currently work for a federal agency but the results did include some retirees and congressional and private sector workers. President Biden announced the mandate on Sept. 9 and the deadline is Nov. 22.

One respondent who said they work for USDA’s Farm Service Agency said they love their job and customers they serve, “but lately I do not feel the agency has my back or appreciates the work our agency does. After being on the front lines, figuring out telework, changing the way our agency goals are achieved I feel the employees deserve a little more than a 'do it or get out policy.'”

POLITICS & ELECTIONS

— Trump: Will ‘probably’ make 2024 announcement after midterms. Former President Donald Trump said he will “probably” wait until after next year’s midterm elections to announce whether he will run for president in 2024. “I think a lot of people will be very happy, frankly, with the decision,” Trump told Fox News in an interview published Monday (link). When asked about the pack of other Republicans who have been the subject of speculation about a 2024 White House run, Trump noted that many of the GOP hopefuls have already said they will defer to his decision on whether to run for president. Trump is quoted as saying, “Almost all of them said if I run, they’ll never run.”

CONGRESS

— Republicans introduce bill to freeze H-2A wages. Rep. Greg Steube (R-Fla.) introduced a measure that would temporarily freeze changes in the Adverse Effect Wage Rate (AEWR) paid to H-2A foreign guestworkers. The Keep Food Local & Affordable Act would stay changes in the AEWR until Dec. 1, 2022, for states with an unemployment rate of not more than 5% and in which the Food Price Index increased by more than 3% between December 2020-September 2021.

Steube said the measure is aimed at combatting a rise in food prices tied to labor shortages and inflation. “The temporary stay placed on the H-2A AEWR will help address the rising input costs crippling our farmers and consumers,” he said.

American Farm Bureau Federation (AFBF) President Zippy Duvall welcomed the bill, calling it “a targeted response to immediate concerns regarding inflation and rising food costs.” Attempts by the Trump administration to freeze changes in AEWRs administratively were tossed out in the courts, and Steube’s measure looks to sidestep those legal roadblocks.

A Senate companion bill (S. 3134) was introduced Nov. 2 by Sens. Thom Tillis (R-N.C.), John Boozman (R-Ark.), John Cornyn (R-Texas) and Lindsey Graham (R-S.C.).

OTHER ITEMS OF NOTE

— Justice Department charged a Ukraine man with conducting cyberattacks and recovered more than $6 million in ransom.

— Robinhood Markets said it experienced a security breach in which an intruder obtained the email addresses of about 5 million people — but no bank account or Social Security numbers were exposed.

— Neil Harl dies. Agricultural economist Neil Harl, who focused a lot on resolving the farm debt crisis of the late 1980s, died at age 88; he was a faculty member of Iowa State University for half a century.