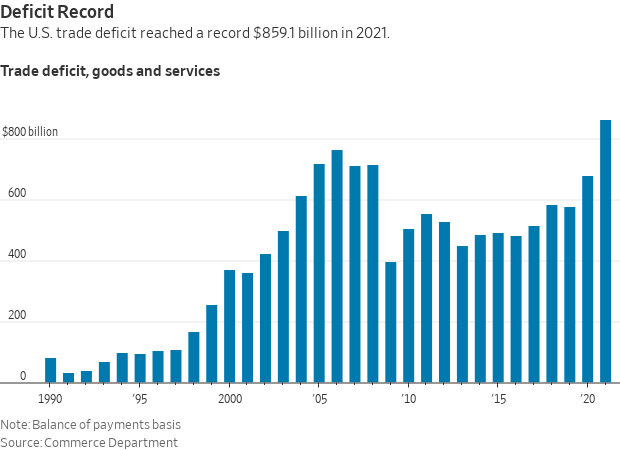

U.S. Trade Deficit Increased 27% Last Year to All-Time High of $859.1 Billion

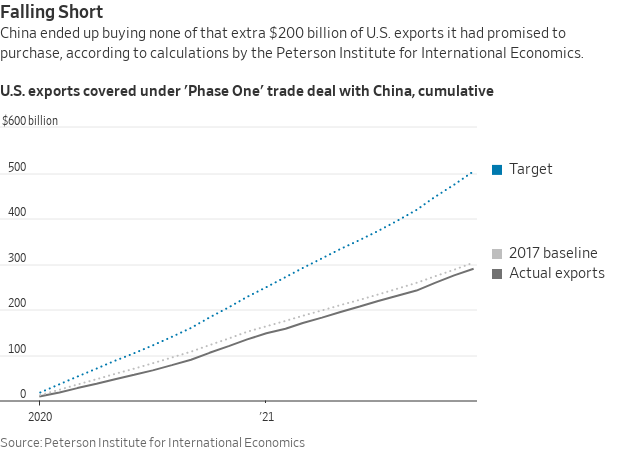

U.S. trade deficit with China grew 14.5% for 2021 as China short on Phase 1 commitments

|

In Today’s Digital Newspaper |

A short Policy Updates today as I am set to speak to the Missouri Pork Producers at breakfast session.

- Russia/Ukraine update: French President Emmanuel Macron said while he had no breakthrough to announce after meeting with Russian President Vladimir Putin, he said he thought the discussion should help prevent the situation from escalating. Macron traveled from Russia to Kyiv Tuesday to meet with Ukrainian President Volodymyr Zelensky and said both leaders were committed to the Minsk accords, the 2014 peace agreement, as a path to resolving the ongoing disputes. “This shared determination is the only way allowing us to create peace, the only way to create a viable political solution,” Macros said in a press conference with Zelensky. However, the Ukraine leader was still skeptical of his Russian counterpart. “I do not really trust words,” Zelensky said. “I believe that every politician can be transparent by taking concrete steps.” Macron indicated that Putin signaled he did not want the situation to escalate.

- North Korea boasted it is one of the few countries capable of “shaking up the world” by firing a missile that could reach the U.S. mainland. The hostile statement comes amid rising international tension over a recent series of North Korean ballistic missile tests. The U.S. State Department issued a statement urging North Korea to return to peaceful dialog, calls that Pyongyang has persistently ignored.

- U.S. trade deficit increased 27% last year to an all-time high of $859.1 billion, underscoring the strength of the American economy, as well as its continued dependence on imports from China and other nations. The 2021 trade deficit in goods and services well exceeded the previous record of $763.53 billion in 2006, the Commerce Department said Tuesday. Annual trade-balance records, which aren’t inflation-adjusted, date to 1960. The sharp increase in the trade deficit comes as the U.S. economy continues to rebound from the pandemic-induced slump of 2020. American consumers have spent heavily on imported goods such as computers, game machines and furniture. Robust demand for capital goods from businesses, as well as higher prices of energy and food items, have added to U.S. import bills.

- US. trade deficit with China grew 14.5% for the full year and, according to an analysis by Chad Bown, a senior fellow at Peterson Institute for International Economics, Beijing fell far short of the purchase targets set under the “Phase 1” agreement signed with the Trump administration in January 2020. The wider gap and missed targets increase pressure on the Biden administration to respond to Beijing on trade policy. Administration officials have said they would hold China accountable but haven’t disclosed specific steps.

- U.S. agricultural exports, imports fell in December. U.S. agricultural exports totaled $16.15 billion in December, down more than more than 10% from the record November result of $18.48 billion. But U.S. agricultural imports also declined in December to $14.65 billion, down 5% from the monthly record of $15.41 billion in November. That left a trade surplus of $1.89 billion for December. The export total was still above the year-ago level of $16.15 billion while imports were well above the December 2021 mark of $12.51 billion. Unlike FY 2021, The December 2021 export mark also was a new record at that point and was the highest monthly total for FY 2021. One-quarter through Fiscal Year (FY) 2022, that puts US agricultural exports at $52.62 billion against imports of $44.87 billion for a cumulative surplus of $7.76 billion. The three-month totals for US agricultural exports and imports would be the highest on record for the opening quarter of a fiscal year. At this point in FY 2021, exports totaled $47.70 billion against imports of $37.60 billion for a surplus of $10.1 billion.

USDA currently forecasts U.S. agricultural exports will total $175.5 billion for FY 2022 with imports of $165.0 billion — both would be new record marks — for a surplus of $10.5 billion. After the first quarter of trade data, FY 2022 exports would have to average $13.65 billion per month and imports $13.35 billion per month to meet those forecasts. U.S. agricultural exports were below $13.65 billion the final four months of FY 2021, but U.S. agricultural imports were at $14 billion or more the final six months of FY 2021, with monthly trade deficits registered the final four months of FY 2021. This suggests that USDA will likely raise their forecast for agricultural imports when they update the outlook Feb. 24. As for agricultural exports, it is not clear USDA will have to adjust that outlook by a significant amount. But it could result in a much smaller trade balance in FY 2022 than is currently expected and potentially below the result for FY 2021 of $8.89 billion when exports totaled a record $172.12 billion, and imports were at a record $163.29 billion. - Chipotle raises menu prices to cover higher wage, food costs. Chipotle reported earnings this week that exceeded expectations for its fourth quarter that ended Dec. 31, with part of the improved results coming from higher prices at its restaurants. The company raised prices 4% in December and said menu items are now around 10% higher than they were last year. CEO Brian Niccol told the Wall Street Journal in an interview that another increase is likely as the chain seeks to offset higher wage and food costs. “I just don’t see the inflation, unfortunately, going away anytime soon,” he said. He took a jab at those who initially characterized higher prices as being short-lived, noting, “It sure doesn’t look transitory to me.” During its fourth quarter the firm said costs for beef, freight and avocados were up and wages also were higher during the period.

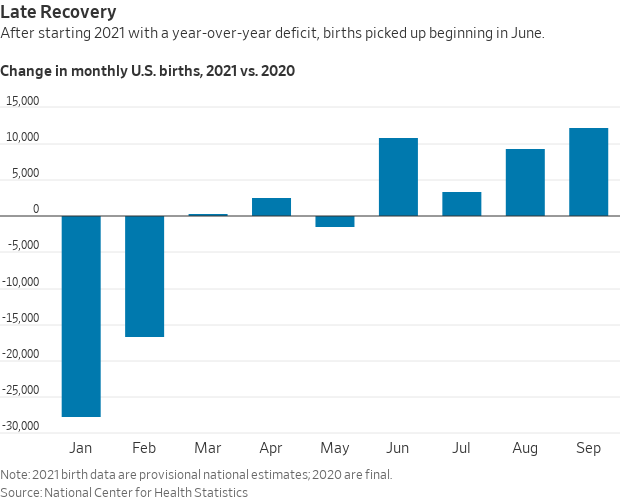

- New data on U.S. births suggest that the Covid-19 pandemic has led to a smaller-than-expected baby bust, the Wall Street Journal reports (link). The U.S. saw about 7,000 fewer births through the first nine months of 2021 compared with the same period the year prior, according to provisional data from the Centers for Disease Control and Prevention’s National Center for Health Statistics. The numbers reflect conceptions that occurred roughly from April through December 2020, a period that includes the first part of last winter’s Covid-19 case surge. Starting in June 2021, monthly births began to show consistent gains over their year-earlier levels, which reflect pre-pandemic conceptions, and that mostly offset declines in the first two months of 2021.

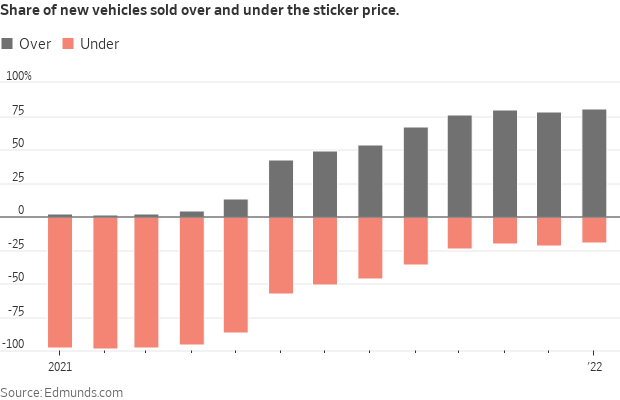

- Car sticker shock revenge. Ford Motor and General Motors are clamping down on dealerships that are trying to charge more than the sticker price, a tactic that has proliferated amid the car shortage. Ford Chief Executive Jim Farley said Thursday that dealers who engage in this practice will face consequences, including losing supplies of future models. In a letter to its dealers last month, GM also said it could take action against “a small minority of bad actors” who were selling or leasing vehicles at rates “far in excess” of sticker prices set by the auto company.

- USDA climate pilot effort challenged by House Agriculture panel’s top Republican. House Agriculture Committee Ranking Member GT Thompson (R-Pa.) pressed USDA Undersecretary for Farm Production and Conservation Robert Bonnie Tuesday on the effort announced Monday for a $1 billion pilot program for climate-smart commodities, again questioning whether USDA has the authority to operate the effort using authority under the Commodity Credit Corporation (CCC). The House Agriculture General Farm Commodities and Risk Management Subcommittee held a hearing with Bonnie on U.S. farm programs, part of the panel’s effort to start work on the next U.S. farm bill, with Bonnie saying he agreed with USDA Secretary Tom Vilsack that the agency is properly using the CCC authority as the effort seeks to find ways of measure the reduction in greenhouse gases to quantify the role agriculture plays in climate efforts. But Thompson continued to question the use of CCC, characterizing the USDA effort as a “conservation program dressed up as a marketing program.” The notice of funding availability for the effort was released by USDA’s Natural Resources Conservation Service (NRCS).

Bonnie also sought to assure lawmakers from both parties that early adopters of practices like no-till or minimum-till will not be penalized under the coming pilot efforts.

Thompson also warned Bonnie that there will be coming oversight on the USDA effort, an action linked to the expectation that Republicans are likely to gain control of the House which would put Republicans in charge of the agendas pursued by congressional committees.

Bottom line: It is clear from the initial hearings by House Agriculture subcommittees that climate issues are going to be a major focus and potential friction point on the panel as it works toward a new farm bill, and that discord continues to build expectations that there will be a one- or two-year extension of the current farm law while lawmakers sort out these and other issues.