U.S. Jobless Claims Plunge to Just 199,000, Lowest Level Since 1969

USDA forecasts record FY 2022 ag trade despite trimming exports | New record for ethanol exports

In Today’s Digital Newspaper

Market Focus:

• U.S. jobless claims fall to just 199,000, lowest level since 1969

• Dramatic drop in U.S. trade deficit in goods during October

• USDA daily export sales for marketing year 2021-22:

— 330,000 MT soybeans to unknown destinations

— 100,000 MT of corn to Mexico

• Not a dollar anymore: Most Dollar Tree products to get pricier

• General Mills raising prices on hundreds of items next year

• Deere & Co. quarterly earnings of $4.12 per share beats consensus estimate

• Cropland values surge by 15% in Midwest and Plains

• USDA still forecasting record FY 2022 ag trade despite trimming export outlook

• USDA forecasts new record for FY 2022 ethanol exports

• Slew of important economic reports today

• Higher yields in 20-year Treasury bond

• Traders closely watching the Turkish lira this week

• Front-month lumber futures have risen 44%

• Ag demand update

• Firmer price tone overnight

• Granholm pins blame on U.S. oil producers for elevated gas prices

• Market will closely gauge PCE data this morning

• USDA expects record ethanol exports in FY 2022

• U.S. boosts Mexico's sugar export limit

• DOJ files lawsuit to stop sugar merger

• Cash cattle trade higher again

• Hogs pause, waiting on cash fundamentals to bottom

Policy Focus:

• Oil prices rose slightly following news several countries would release oil stocks

• U.S. boosts Mexico's sugar export limit by 150,000 short tonnes

• Policy issue decisions ahead

Biden Administration Personnel:

• Biden to nominate Shalanda Young as OMB director

China Update:

• Biden invites 110 countries, including Taiwan but not China, to summit on democracy

• China blocking public access to shipping location data, citing national security concerns

Energy & Climate Change:

• Will EPA finally release RFS details as many stakeholders/lawmakers on holiday?

Livestock, Food & Beverage Industry Update:

• Two big grocery chains in U.S. limiting number of Thanksgiving staples customers can buy

• USDA still projects 2022 food price increases abating from 2021 marks

Coronavirus Update:

• Gov’t report on mandated vaccines coming

• Deaths in Europe from Covid-19 will reach 2.2 million by March based on current trends

• U.S. asks appeals court to reinstate Biden’s coronavirus vaccine mandate

Politics & Elections:

• Canada's Trudeau vows flood aid, climate action after third election win

• Olaf Scholz set to become German chancellor

• Will Dr. Oz run as GOP candidate in Pa. Senate race?

Congress:

• Ernst wants hearing to probe supply chain woes, asks Vilsack to testify

Other Items of Note:

• Sugar industry merger challenged by the Justice Department

Happy Thanksgiving! Many thanks to readers as we go into the holiday season. Policy Updates won't be published with markets and gov’t offices closed tomorrow, but we’ll be back Friday for any major developments.

MARKET FOCUS

Equities today: Global stock markets were mixed in overnight trading. The U.S. stock indexes pointed to lower openings. Asian equity markets were mixed as Japan fell after trading resumed following a Tuesday holiday. The Nikkei dropped 471.45 points, 1.58%, at 29,302.66. The Hang Seng Index moved up 33.92 points, 0.14%, at 24,685.50. European equities are mixed in early action even as inflation worries persist. The Stoxx 600 was down 0.1% with other markets up 0.1% to down 0.6%.

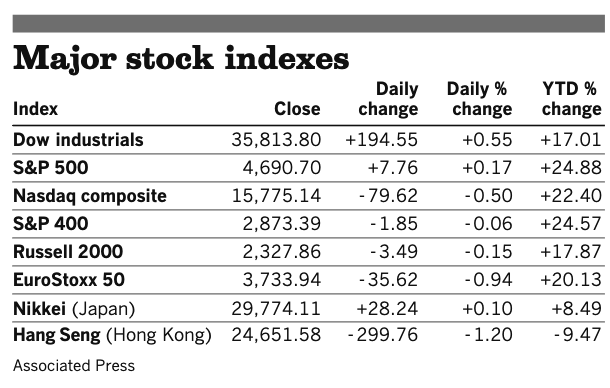

U.S. equities yesterday: The Dow gained 194.55 points, 0.55%, at 35,813.80, ending near its session high. The Nasdaq, however, finished down 79.62 points, 0.50%, at 15,775.14, off from its lows. The S&P 500 managed a gain of 7.76 points, 0.17%, at 4,690.70.

On tap today (see detailed list of events and reports below, and note updates for selected reports):

• U.S. jobless claims, due at 8:30 a.m. ET, are expected to fall to 260,000 in the week ended Nov. 20 from 268,000 one week earlier. UPDATE: The ranks of those submitting jobless claims tumbled to their lowest level in more than 52 years last week, the Labor Department reported Wednesday. New filings totaled 199,000, a number not seen since Nov. 15, 1969, when claims totaled 197,000. The report easily beat estimates of 260,000.

• International trade in goods: UPDATE: Dramatic drop in U.S. trade deficit in goods during October, as the trade red ink fell to $82.9 billion, well below expectations it would be around $94.5 billion, Exports rose at a faster pace in October than imports did, paring the deficit in goods. The broader trade data including services will be released next week.

• U.S. gross domestic product, due at 8:30 a.m. ET, is expected to grow at a 2.2% annual pace in the third quarter, up from an earlier estimate of 2.0%.

• U.S. durable goods orders for October, due at 8:30 a.m. ET, are expected to increase 0.3% from the prior month. UPDATE: Durable Goods Orders declined in October by 0.5% versus expectations they would expand 0.3%. It marked a second month in a row for declining orders for goods expected to last three years or more. The woes in the auto industry are a factor in the result as minus transportation, orders were up 0.5%. In a measure of broader economic activity, core capital goods orders increased 0.6%. Both the results for orders minus transportation and core capital goods were in line with expectations.

• Wholesale inventories: UPDATE: Wholesale Inventories rose 2.2% in October, well above expectations they would rise 0.8%, with the September result revised up to an increase of 1.4% from an initial 1.1% rise. This indicates businesses were seeking to restock ahead of the holiday season and replaced depleted supplies they have likely leaned on with supply chain pressures.

• U.S. advance economic indicators report for October is out at 8:30 a.m. ET

• University of Michigan's consumer sentiment index for November, due at 10 a.m. ET, is expected to hold at 66.8, unchanged from a preliminary reading.

• U.S. new-home sales, due at 10 a.m. ET, are expected to hold at an annual pace of 800,000 in October, unchanged from the prior month.

• U.S. consumer spending for October, due at 10 a.m. ET, is expected to increase 1% from the prior month, and personal income is forecast to rise 0.2%.

• U.S. personal consumption expenditures price index excluding food and energy for October, due at 10 a.m. ET, is expected to rise 0.4% from one month earlier and 4.1% from one year earlier.

• Baker Hughes rig count is out at 1 p.m. ET

• Federal Reserve releases minutes from its Nov. 2-3 meeting at 2 p.m. ET

Key economic reports released today. The debate over inflation could have more fodder today as at 10 a.m. ET, the Bureau of Economic Analysis will issue its report on consumer spending in October — a report that includes the Federal Reserve's favorite measure of inflation, the personal consumption expenditure deflator, or PCE deflator. At 2 p.m. ET, clues to what Federal Reserve policy makers may currently be thinking about inflation will be sought when the minutes from the Nov. 2-3 Federal Open Market Committee (FOMC) are released, giving further insight into the U.S. central bank’s decision to start slowing asset purchases.

Farm equipment maker Deere & Co. reported quarterly earnings of $4.12 per share, beating the consensus estimate of $3.90, although revenue came in slightly below analyst forecasts. Deere said solid demand for its products helped cushion the impact of a month-long workers strike. Deere rallied 3.7% in the premarket. Deere & Co.'s non-union workers are getting more money, too. Following the end of a five-week-long strike by the United Auto Workers on Nov. 17 that resulted in pay bumps and enhanced retirement benefits for the union employees, the company announced Tuesday that its salaried staff will receive 8% raises. "The future success of our company depends on our ability to retain and recruit the best talent in an increasingly competitive global marketplace," spokesperson Jennifer Hartmann said in a statement. "To do that, we’re committed to putting every one of our employees in a better economic position." Link to details via the Des Moines Register.

Cropland values surge by 15% in Midwest and Plains. Relatively high commodity prices and low interest rates fueled a 15% surge farmland values in the Midwest and Plains in the third quarter, according to surveys of ag bankers by four regional Federal Reserve banks. "Alongside prospects for further strength in commodity markets, the outlook for farm finances and agricultural land values through the end of 2021 remained strong," said a summary of the surveys. “The value of unirrigated cropland increased by an average of about 15% across all participating districts,” said the report (link), written by Kansas City Fed economists. It was the highest gain since 2013. The largest increases were in Iowa, up 28%; Minnesota, up 26%; and South Dakota, up 23%, versus values in the third quarter 2020.

USDA still forecasting record FY 2022 agricultural trade despite trimming export outlook. U.S. agricultural exports are now forecast at $175.5 billion in fiscal year (FY) 2022, down from an August outlook for $177.5 billion, but it would still mark a record, according to USDA’s Outlook for U.S. Agricultural Trade.

Imports are also seen at a new record, forecast to hit $165.0 billion, up from their August outlook for $159.5 billion.

The prior records were set in FY 2021 — $172.2 billion for exports and $163.3 billion for imports. Imports have been setting record marks nearly every year over the past decade.

The FY 2022 forecasts would result in a trade surplus of $10.5 billion, down sharply from the prior forecast of $18.0 billion, but above the FY 2021 balance of a positive $8.9 billion, ending what had been two years of rare trade deficits in FY 2020 and 2019.

The slower U.S. agricultural export outlook is due in part to declining soybean volume and value, with China a factor on that front. USDA noted “softening China demand and expectations of a large Brazilian harvest in early 2022 continue to provide strong headwinds for [soybean] export volumes and unit values next year.” Even as U.S. wheat is expected to potentially see an uptick in business with Russia limiting exports, USDA noted, “U.S. wheat prices are elevated due to a drought-impacted crop resulting in tight stocks for hard red winter, spring, durum, and white wheat, which are forecast at their lowest levels since 2007/08.”

As for China, the soybean situation was a factor in USDA downgrading U.S. agricultural exports to China in FY 2022 by $3.0 billion to a mark of $36.0 billion, but that would still be a record level of shipments to China.

U.S. ethanol exports are expected to set a record at $2.9 billion in FY 2022, up $500 million from USDA’s prior expectation. (See next item for details.)

FY 2022 livestock, poultry, and dairy exports are forecast up $1.9 billion to $38.7 billion on gains across all major commodities except pork.

The improving U.S. economy is clearly a factor in the rising agricultural import forecast as rising imports of all kinds are typically seen with an expanding economy as consumers demand more goods that are not necessarily produced in the U.S.

As for exports, the results will be key to watch ahead. Typically, U.S. agricultural exports register some of their strongest marks as each FY begins. If that does not unfold as FY 2022 starts, that could make meeting the new record levels for shipments difficult.

USDA forecasts new record for FY 2022 ethanol exports. Fiscal Year (FY) 2022 U.S. ethanol exports are forecast at a record $2.9 billion, according to USDA’s Outlook for U.S. Agricultural Trade, up $500 million from the August forecast on higher unit values. Ethanol is now considered as an agricultural product under the WTO definition that USDA has adopted over the course of 2021.

“Elevated U.S. corn prices and an upward revision in oil prices since August lead to higher ethanol unit values, driving export value to slightly exceed the FY 2012 record,” USDA noted.

USDA left unchanged or lowered most export volumes compared to their August outlook and pointed out that total volume remains well below the FY 2018 peak. “Since August, upward revisions in ethanol-blended gasoline prices have weakened expectations for fuel pool recoveries, thus lowering ethanol demand,” USDA noted. “There remains the risk that some countries may lower blending rates to slow inflation.”

Compared to FY 2021, exports to Brazil “remain poised to see the largest value and volume gains due to shortfalls and persistently high prices in Brazil,” USDA noted, but they cautioned that high U.S. prices, a stronger dollar and the ethanol import duty faced by U.S. supplies in Brazil will moderate the increase.

A disappointing situation with China was observed by USDA. “There have been no U.S. fuel ethanol sales to China since June 2021,” USDA said. “Should this continue through FY 2022, the absence of sales to China could negate export volume increases to all other markets.”

Inflation watch: Dollar Tree hikes prices 25%. Everything will cost $1.25. The chain said Tuesday it will raise prices from $1 to $1.25 on the majority of its products by the first quarter of 2022. The change is a sign of the pressures low-cost retailers face holding down prices during a period of rising inflation. Dollar Tree said in a quarterly earnings release that its decision to raise prices to $1.25 permanently was "not a reaction to short-term or transitory market conditions.” Selling stuff strictly for $1 hampered Dollar Tree, the company said, and forced it to stop selling some "customer favorites." Raising prices will give Dollar Tree more flexibility to reintroduce those items, expand its selection and bring new products and sizes to its stores. Dollar Tree has sold products at $1 for 35 years and was the last of the major dollar store chains to actually be a dollar store. Dollar Tree led the S&P 500 to its modest gain on Tuesday, surging 9.2% after the chain announced that it would be adding a $1.25 price point for its goods.

Inflation watch: General Mills is raising prices on hundreds of items next year. General Mills notified retail customers that it's raising prices in mid-January on hundreds of items across dozens of brands. They include Annie's, Progresso, Yoplait, Fruit Roll-Ups, Betty Crocker, Pillsbury, Cheerios, Cinnamon Toast Crunch, Lucky Charm's, Wheaties, Reese's Puffs, Trix and more, according to letters General Mills sent to at least one major regional wholesale supplier last week. For some items, prices will go up by around 20% beginning next year.

Market perspectives:

• Outside markets: The U.S. dollar index is firmer in action ahead of a barrage of economic updates, with the euro and British pound both weaker versus the U.S. currency. The yield on the 10-year U.S. Treasury note was higher ahead of data releases, trading above 1.66%. Gold and silver futures were slightly higher ahead of numerous economic reports, with gold around $1,785 per troy ounce and silver around $23.44 per troy ounce.

• Higher yields in 20-year Treasury bond. The 20-year Treasury bond, intended to help the gov’t get the lowest possible long-term borrowing costs, is offering higher yields than the 30-year bond.

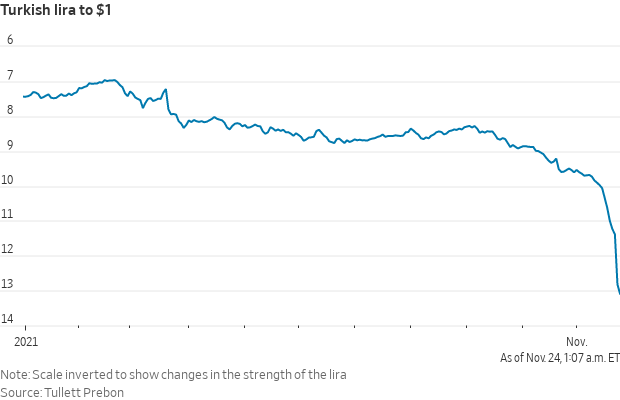

• Traders are closely watching the Turkish lira this week, which has dropped sharply to a record low against the U.S. dollar. Turkey’s president forced its central bank to lower its main interest rate recently despite rising inflation concerns. That sent the lira into a downward spiral. The lira did rebound a bit Wednesday. The lira slid as much as 18% Tuesday, before easing slightly, threatening to further shake the economy by undermining confidence, making it harder for businesses to pay off foreign-currency debt and increasing the cost of imported goods, especially oil. That would push the inflation rate, currently at around 20%, even higher, further hurting households, analysts say.

• Crude oil prices are mixed ahead of U.S. trading, with U.S. crude firmer around $78.60 per barrel and Brent weaker around $81.15 per barrel. Prices were also mixed in Asian action, with U.S. crude up five cents at $78.55 per barrel and Brent down 21 cents at $81.12 per barrel.

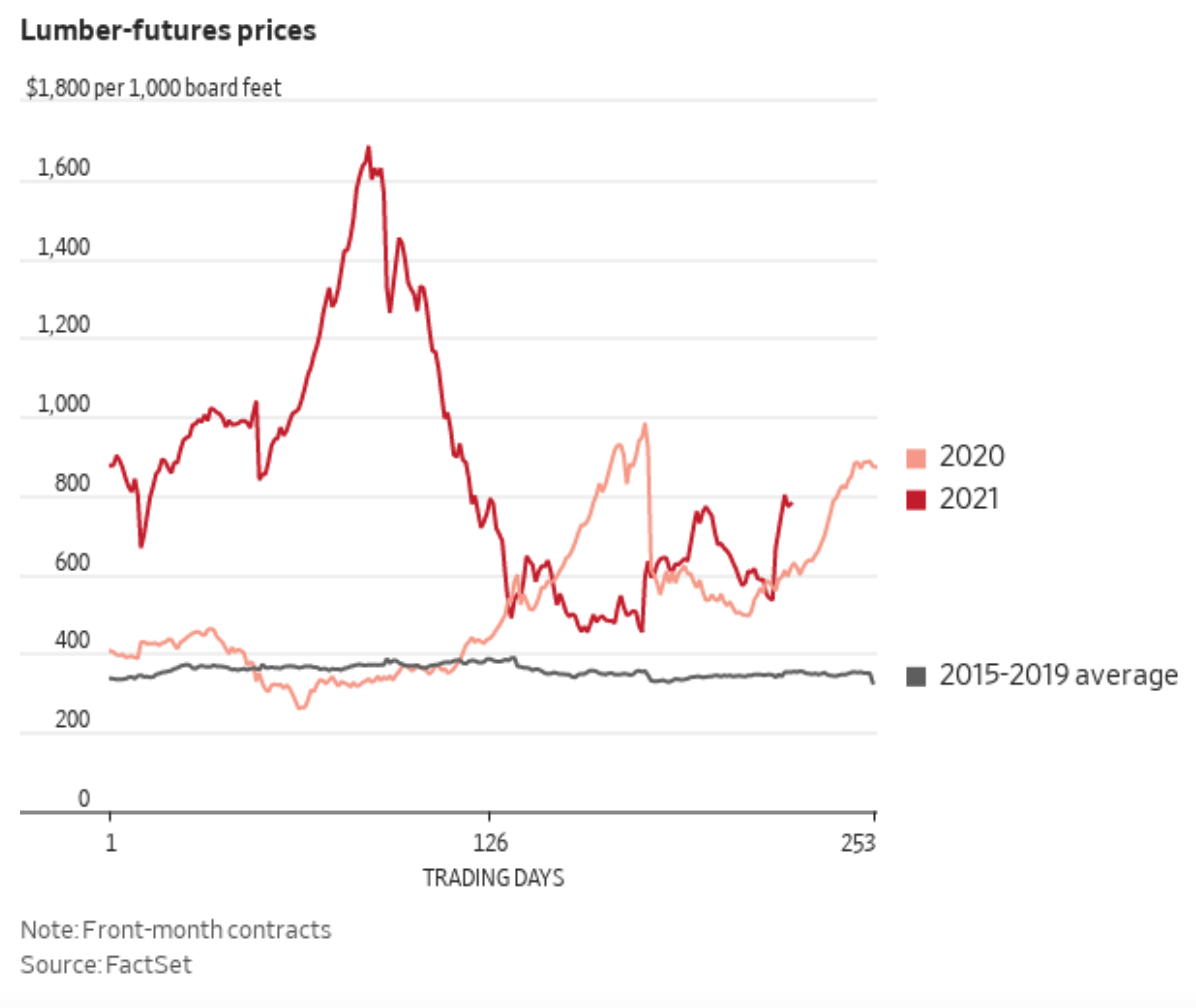

• Front-month lumber futures have risen 44% after deluges washed out roads and bridges, caused landslides and cut off rail lines in British Columbia, where more rainfall is in the forecast. Meanwhile, U.S. gasoline barges are heading to Vancouver, British Columbia, to mitigate fuel shortages in the wake of widespread flooding.

• USDA daily export sales for marketing year 2021-22:

— 330,000 MT soybeans to unknown destinations

— 100,000 MT of corn for delivery to Mexico

• Ag demand: In three separate tenders, South Korea purchased between 256,000 and 271,000 MT of corn — 68,000 MT was expected to be sourced from South America or South Africa, with the remainder unspecified origin. South Korea passed on a tender to buy 65,000 MT of feed wheat because prices were too high. The Philippines purchased around 100,000 MT of feed wheat — likely Australian origin.

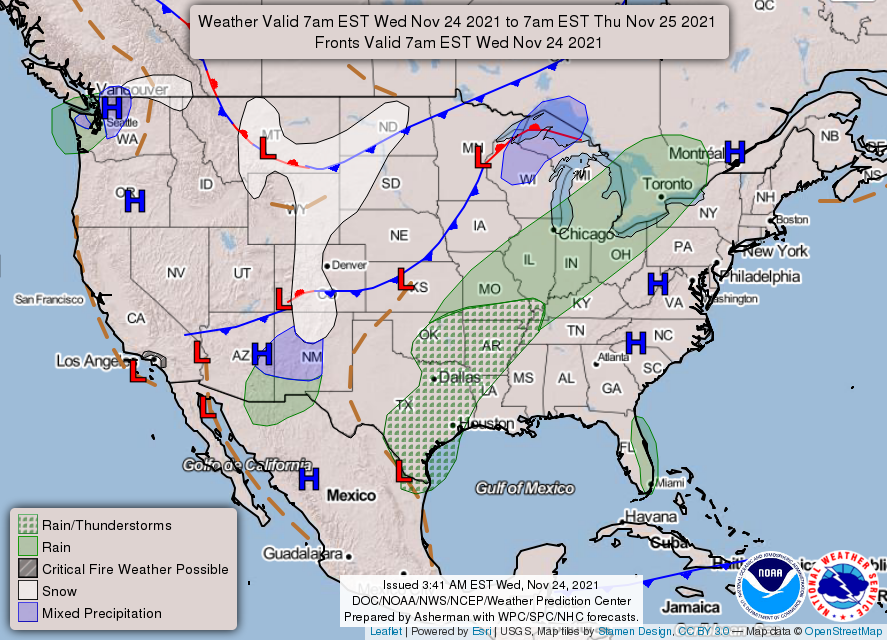

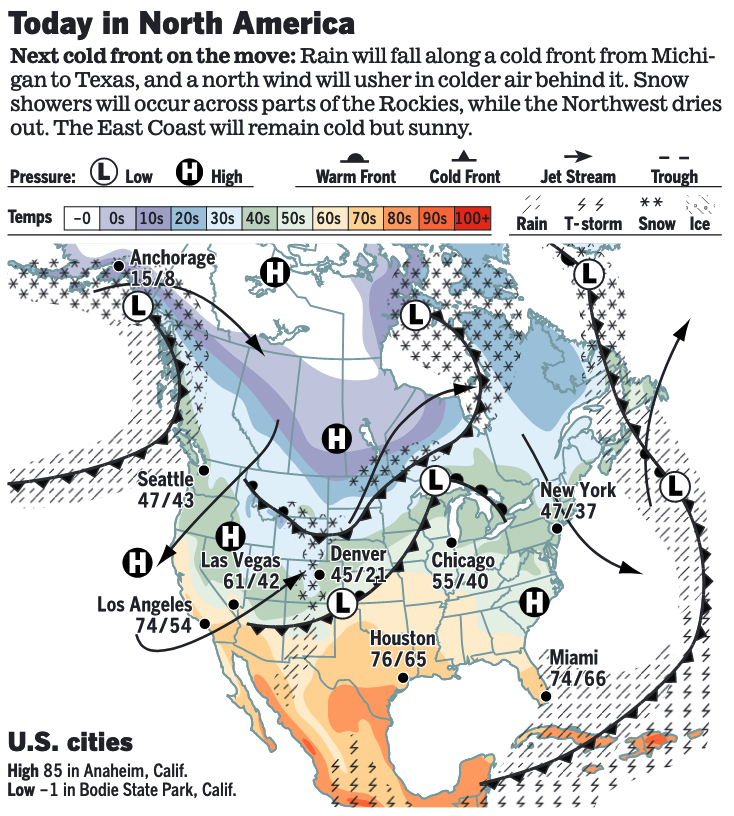

• NWS weather: Unsettled weather to track over the Middle Mississippi Valley Wednesday night, then into the Great Lakes and Mid-South on Thanksgiving; thunderstorms and Excessive Rainfall possible in the South Central U.S... ...Atmospheric River to deliver coastal and valley rain, high elevation snow to the Pacific Northwest on Thanksgiving... ...Critical Risk of fire weather in Southern California today; brief warm up in the East, cold Canadian air-mass returns by Black Friday.

Items in Pro Farmer's First Thing Today include:

• Firmer price tone overnight

• Granholm pins blame on U.S. oil producers for elevated gas prices

• Market will closely gauge PCE data this morning

• USDA expects record ethanol exports in FY 2022

• U.S. boosts Mexico's sugar export limit

• DOJ files lawsuit to stop sugar merger

• Cash cattle trade higher again

• Hogs pause, waiting on cash fundamentals to bottom

POLICY FOCUS

— Oil prices rose following news that several countries would release oil stocks, with both Brent crude and West Texas Intermediate gaining a few percent. WTI remains below $80 per barrel, while Brent surpassed it. In Asia trading on Wednesday, Brent was little changed at $82.34 a barrel, while West Texas Intermediate rose 0.2% to $78.71. Meanwhile, European natural gas futures edged up after the U.S. imposed its latest sanctions aimed at Russia’s Nord Stream 2 pipeline, a move the Kremlin says is “illegal.” Biden administration officials said prices could fall in coming weeks.

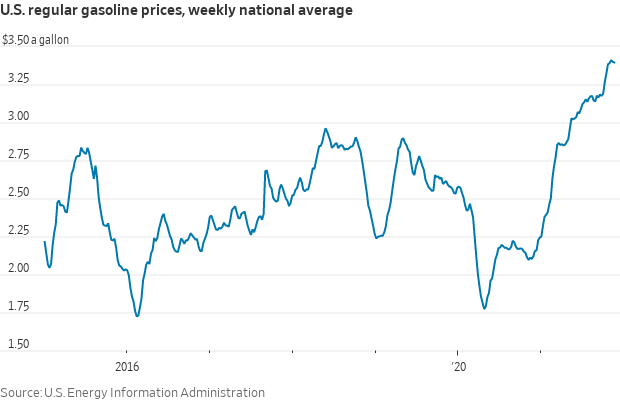

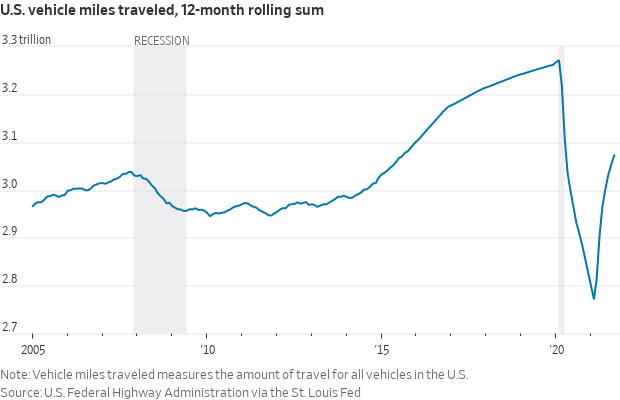

The coordinated U.S. effort with China, India, Japan, the U.K. and South Korea aims to bring down gasoline prices — which are up 61% from a year ago — that have become a big contributor to inflation, Biden administration officials said. Britain said it would authorize the release of up to 1.5 million barrels and India said it would release five million. Analysts estimated Japan and South Korea would each add four million to five million barrels. China did not announce details of its plans. Energy Aspects, a consultancy, said it expected more details from China to emerge in a few days, to create distance from the U.S. announcement. The Global Times, a nationalist tabloid in China, described Beijing’s participation as a sop to President Joe Biden, adding that the U.S. “needs to seriously mull over how to get along with China peacefully.” Analysts said it was the first time in recent history that Beijing had participated in such an effort.

The six countries combined are likely to put about 65 million to 70 million barrels from government stockpiles onto world markets, according to a tally by RBC Capital Markets. That figure is only a little more than half of the world’s daily consumption, which the Energy Department estimates will surpass 100 million barrels in the final three months of 2021.

Traders had been expecting a larger release of as much as 100 million barrels.

Part of the oil price reaction stemmed from the fact that a portion of the U.S. release will have to be returned to the strategic stockpile over the next two to three years. Others noted oil prices because they had fallen more than 10% in recent weeks as expectations grew that the White House would act.

Some observers also expect the Organization of the Petroleum Exporting Countries and Russia to respond in kind at their next meeting Dec. 2 by reducing supply. OPEC+ has been steadily raising supply by about 400,000 barrels per day each month.

Centrist Sen. Joe Manchin (D-W.Va.) called the SPR release “an important policy Band-Aid for rising gas prices” but one that “does not solve for the self-inflicted wound that shortsighted energy policy is having on our nation. With an energy transition underway across the country, it is critical that Washington does not jeopardize America's energy security in the near term and leave consumers vulnerable to rising prices,” Manchin said.

Will Biden move backfire? Robert McNally, president of Rapidan Energy Group, a market research firm and a former energy adviser in George W. Bush’s White House, said Tuesday’s announcement “may be politically smart, but I don’t think it is smart in terms of policy and will likely backfire… There are good odds that OPEC+ will offset this, and they have a bigger fire hose than we do,” he said. “Using strategic stocks to defend an oil price level set in a global market is pure folly.”

On Tuesday, Biden said his environmental agenda was not contributing to the recent price increases at the pump. “My effort to fight climate change is not raising the price of gas,” he said.

Energy Secretary Jennifer Granholm on Tuesday sought to pin the blame for elevated prices on American oil producers, which she said were making “enormous profits” and failing to sufficiently increase output in the wake of the coronavirus pandemic, noting they have not returned production to pre-pandemic levels and have not invested in boosting output. “Oil production is lagging behind as the economy roars back to life after the shutdown,” Granholm said, adding that oil companies have “not rehired. They have not turned on the rigs. They have not taken advantage of the permits that they have on the land that they have.” Some note that the reluctance of the U.S. oil industry could be in part due to actions by the Biden administration which have sought to expand renewable energy and the cancellation of the Keystone XL pipeline as factors making them reluctant to deploy investments.

Biden last week called on the Federal Trade Commission (FTC), the competition watchdog, to crack down on price gouging in the sector. Other Biden administration options reportedly under review include a ban on crude oil exports, which were first liberalized during the Obama administration. Reducing the biofuel component in gas blends via the Renewable Fuel Standard (RFS) is another option, although some observers say any such move would backfire and this would not fit with the carbon emission reduction movement. (The thinking on reducing the RFS may be in part from ethanol prices being higher than gasoline or that if the blending requirements were lowered, refiners wouldn't have to "spend" so much on RINs and would not have the extra costs to pass along on gas prices.)

Republican members of the FTC Tuesday said they were asking the White House to share the evidence cited when President Joe Biden asked the regulatory agency to investigate the market, according to Reuters. In a letter, the commissioners said they wanted to examine the evidence “so that we might consider how to proceed” with the requested examination of the markets. Commissioners Noah Phillips and Christine Wilson said while they were concerned about current gasoline prices, the regulatory body has previously probed gasoline prices during prior administrations and found no evidence of collusion or illegal behavior, according to Reuters. "The FTC has a long history of studying the oil and gas industries," they wrote. "For example, our agency's work has highlighted the fact that prices at the pump may not correlate immediately with the price of crude."

Comments: Following the decision, some are referring to the U.S. emergency stockpile as the Strategic Political Reserve, with the president under pressure to tamp down inflation.

Even if crude prices do fall, relief for consumers might be short-lived as demand is expected to keep rising into next year as the global economy continues its recovery from the Covid-19 pandemic.

— U.S. boosts Mexico's sugar export limit by 150,000 short tonnes. The U.S. gov’t on Tuesday increased Mexico's sugar export limit by 150,000 short tonnes, following a request by USDA, according to an official document from the Department of Commerce. The document said USDA “has identified a need for additional sugar supplies in the U.S. market.” The additional volume has to be exported no later than March 31, 2022.

— Policy issue decisions ahead:

- Immigration reform: On Tuesday, Nov. 30, Democratic staff will meet with the Senate parliamentarian to discuss the path forward on immigration reform, according to two sources familiar with the matter. The meeting comes after the House last week passed the party’s social spending bill, which included a provision that allows millions of undocumented immigrants to apply for work permits and receive temporary protection from deportation. Some initial discussions on this topic have been held, including a meeting yesterday.

- Defense policy: When Congress returns in December: First topic will be the annual defense policy bill, which could take up the first week of December. There will also be a House-Senate conference that could take up more time.

- FY 2022 spending: Dec. 3 is when the current stopgap measure funding for the government expires. Most expect another continuing resolution (CR), but the length of this is still being debated. Some Democrats have mentioned Dec. 17 but that apparently lacks GOP support. All this concerns spending for fiscal year 2022, which began Oct. 1.

- Debt ceiling: Dec. 15 is the date that Treasury Secretary Janet Yellen says is the new deadline for dealing with the debt ceiling to avoid default on the nation’s debt. Private forecasts have a longer deadline — Wrightson ICAP, which tracks the debt limit, now says it believes the Treasury Department has until the middle of January before the nation hits the borrowing cap. Senate Majority Leader Chuck Schumer (D-N.Y.) and Minority Leader Mitch McConnell (R-Ky.) are talking so a potential compromise may be near. Republicans have said they want Democrats to tack the debt limit onto reconciliation and increase the debt limit on a party-line vote. But Democrats are still pushing for a bipartisan solution.

- BBB vote in Senate: The Senate will not take up the social spending/climate change bill dubbed Build Back Better (BBB) until the second week of December, at the earliest. Many see just before Christmas as the deadline for considering the $1.75 trillion measure.

BIDEN ADMINISTRATION PERSONNEL

— Biden to nominate Shalanda Young as OMB director. If confirmed by the Senate, Young would be the first Black woman to lead the Office of Management and Budget (OMB). Young currently serves as acting director of the agency. Young, a former staff director for the House Appropriations Committee, has strong support among House Democrats. Young was confirmed as deputy director earlier this year in a bipartisan 63-37 vote. The plans were first reported by the Washington Post.

CHINA UPDATE

— President Biden invited 110 countries, including Taiwan but not China, to a virtual summit on democracy in December. Taiwan’s inclusion is likely to anger the government in Beijing. Earlier this month it warned America against recognizing the island’s sovereignty. The summit is seen as Biden’s attempt to take a stand against authoritarian governments. Traditional American allies, Egypt and Saudi Arabia, were similarly snubbed. Instead of sending its leader Tsai Ing-wen, Taipei said that its digital minister Audrey Tang and de facto ambassador to the U.S. Hsiao Bi-khim would represent Tsai at the summit. China’s Ministry of Foreign Affairs spokesman Zhao Lijian called on Washington to “stop providing any podium for pro-Taiwan independence forces… Joining the pro-Taiwan independence forces to play with fire could only lead to burning oneself,” he said during the regular press conference in Beijing on Wednesday.

— China blocking public access to shipping location data, citing national security concerns. The number of Automatic Identification System (AIS) signals from ships in Chinese waters dropped dramatically. The AIS was initially developed to help avoid collisions between vessels and support rescue efforts in the event of a disaster. But it also become a valuable tool to enhance supply chain visibility and for governments to track activity in overseas ports. “The intelligence extracted from this data endangers China’s economic security and the harm cannot be ignored,” warned a Chinese state media report on Nov. 1 on AIS stations in the coastal province of Guangdong. Foreign intelligence agencies, companies and think-tanks use the system to keep tabs on China’s military vessels and analyze economic activity by surveying cargo traffic. The decline in AIS data is one of the first victims of China’s new data protection regime, which restricts transfers of sensitive information overseas. Companies wanting to send important data abroad need to undergo a security assessment with the country’s data watchdog.

ENERGY & CLIMATE CHANGE

— Will EPA finally release RFS details while lawmakers, industry stakeholders on holiday? It’s happened before. But no official word yet from EPA. But as of this morning, the proposed regulation was still shown as being on review at OMB.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Two big grocery chains in the southeastern U.S. are limiting the number of Thanksgiving staples customers can buy, the Wall Street Journal reports (link), in a reminder to consumers that supply-chain snarls are still roiling retailers as the holiday season unfolds. Publix Super Markets limited its customers to no more than two individual items from a menu of Thanksgiving ingredients. Winn-Dixie restricted shoppers to one turkey apiece while encouraging customers to “only purchase what they need.” That’s a contrast with a holiday typically marked by abundance, and it suggests there are still strains in food supply chains farms to processing plants. For supermarkets, the holiday is the first big test of the season of their ability to fill shelves and staff stores.

— USDA still projects 2022 food price increases abating from 2021 marks; overall food price inflation, grocery store price increases in 2022 seen back near 20-year average.

Inflationary pressures for food are set to post a second straight year of increases in overall food prices, restaurant and grocery prices that are above the 20-year average, according to the latest update from USDA’s Economic Research Service (ERS).

ERS expects overall food price inflation at 3.0% to 4.0% in 2021, with grocery store prices (food at home) up 2.5% to 3.5% and restaurant (food away from home) prices up 4.0% to 5.0%. Restaurant prices are on the only overall category to be revised higher this month, previously having been forecast to increase by 3.5% to 4.5%.

But the increases for 2021 are coming after similar boosts in 2020 — overall food prices rose 3.4%, restaurant prices rose 3.4% and grocery store prices rose 3.5%. All of those levels are above the 20-year averages of 2.4% for all food prices, 2.8% for restaurant prices and 2.0% for grocery store prices.

If the current forecast levels hold, 2021 overall food price inflation and grocery price increases are the highest since 2020 while restaurant prices will have risen the most since 1990 when they rose 4.7%.

|

|

OVERALL INCREASES FOR ALL FOOD, RESTAURANT AND GROCERY STORE PRICES |

||||

|

Category |

20-year average |

2020 |

2021 |

2022 |

|

|

All Food |

2.4% |

3.4% |

3.0% to 4.0% |

2.0%-3.0% |

|

|

Food Away From Home |

2.8% |

3.4% |

4.0% to 5.0% |

3.0% to 4.0% |

|

|

Food At Home |

2.0% |

3.5% |

2.5% to 3.5% |

1.5% to 2.5% |

|

USDA increased its forecast levels at the grocery store for several products, including meat, poultry and fish; meats; beef/veal; and pork. Plus, increases for fats and oils and fresh vegetables are also now seen rising even more than the month-ago outlooks. USDA noted that the level of food price inflation “varies depending on whether the food was purchased for consumption away from home or at home.” They detailed that restaurant prices were up 0.8% in October 2021 and 5.3% higher than October 2020. Grocery store prices rose 1.1% from September to October and the October 2021 levels are 5.4% higher than October 2020.

So far this year, grocery store prices are up 2.8% from the same period in 2020, with restaurant prices up 3.9% and overall food prices registering an increase of 3.3%. “All food categories tracked by ERS increased in price from September to October,” the agency said.

What has factored into the increases? “Prices have been driven up by strong domestic and international demand, labor shortages, supply chain disruptions, and high feed and other input costs,” ERS said.

The agency again mentioned concentration in the meat industry as a potential factor, but adjusted their statement to say, “Concentration and capacity constraints within the meat industry could also affect prices.” In their update issued in October, ERS said, “Consolidation in the meat industry also could have an effect on prices.”

Increases in meat prices in 2021 mark two years of sizable increases. The increased outlook for several food categories in 2021 versus the month-ago forecasts mean several categories will have seen back-to-back years that have increased more than the 20-year average. Meat, poultry and fish prices are expected to rise 5.0% to 6.0% after rising 6.3% in 2020. For meats, the forecast increase of 6.0% to 7.0% comes after an increase of 7.4% in 2020, while beef prices are seen rising 7.5% to 8.5% compared with the 9.6% increase for 2020. Pork prices are expected to increase 7.0% to 8.0% in 2021 after rising 6.3% in 2020.

|

GROCERY STORE MEAT PRICE INCREASES FOR 2020, 2021 & 20-YEAR AVERAGE |

|||

|

Item |

20-year average |

2020 |

2021 |

|

Meat, Poultry and Fish |

2.9% |

6.3% |

5.0 to 6.0% |

|

Meats |

3.2% |

7.4% |

6.0 to 7.0% |

|

Beef and veal |

4.4% |

9.6% |

7.5 to 8.5% |

|

Pork |

2.2% |

6.3% |

7.0 to 8.0% |

|

Other meats |

2.2% |

4.4% |

2.0 to 3.0% |

|

Poultry |

2.1% |

5.6% |

4.0 to 5.0% |

|

Fish and seafood |

2.5% |

3.3% |

4.0 to 5.0% |

Bottom line: Consumers are seeing more inflationary pressures for food than they have seen in a while, with the combination of increases for 2020 and 2021 taking a bigger portion of consumer spending than the 20-year average. While this is after increases in 2019 and 2018 that were below the 20-year average and actual decreases in grocery store prices in 2016 and 2017, it still marks a series of increases that are sapping increased wages for consumers. The 2022 outlooks are for food price inflation to moderate, but these are early forecasts and will likely change — perhaps considerably — before all is said and done for 2022. USDA’s initial outlooks for 2021 issued in July 2020 were for an overall rise in food prices of 2.0% to 3.0%, restaurant prices to rise 1.5% to 2.5% and grocery store prices to increase 1.0% to 2.0%. And several items within the grocery store were expected to decline from 2020 prices, including meats, poultry, and fish, meats, beef and veal; pork, other meats and poultry prices were seen holding steady.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 258,963,779 with 5,169,570 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 47,982,843 with 773,857 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 452,704,982 doses administered, 195,973,992 have been fully vaccinated, or 59.7% of the U.S. population.

— Gov’t report on mandated vaccines coming. The Office of Management and Budget will issue a chart today summarizing the percentage of staff at each agency who have complied with the mandate.

— Deaths in Europe from Covid-19 will reach 2.2 million by March based on current trends, the World Health Organization warned as the European Union attempts to agree on how to manage vaccine rollouts. German Chancellor Angela Merkel said earlier this week that the latest surge in infections is worse than anything the country has experienced so far and called for tighter restrictions.

— U.S. asks an appeals court to reinstate Biden’s coronavirus vaccine mandate. Government lawyers asked the U.S. Court of Appeals for the Sixth Circuit to immediately lift another court’s stay of its rule for large companies. The Big Three Detroit carmakers have also asked unionized factory workers to voluntarily submit their vaccination status, and several hundred Google employees signed a petition protesting the company’s vaccine mandate.

POLITICS & ELECTIONS

— Canada's Trudeau vows flood aid, climate action after third election win. Canadian Prime Minister Justin Trudeau, opening a new parliamentary session, vowed to help British Columbia rebuild after the devastating floods last week, and said it was time to ramp up the fight against climate change.

— Olaf Scholz set to become German chancellor. Germany’s Social Democrats, Greens and liberals have reached a deal on forming a new coalition government, paving the way for finance minister Olaf Scholz to succeed Angela Merkel as leader of Europe’s largest economy.

— Celebrity surgeon Mehmet Oz is poised to shake up the Pennsylvania Senate race, bolstered by a vast personal fortune to invest in a 2022 campaign and enviable poll numbers that suggest the Republican would be an immediate front-runner. Oz, 61, has not decided whether to pull the trigger on a bid for the seat being relinquished by retiring Republican Sen. Pat Toomey. But if the television personality runs, he is prepared to back the effort with millions of his own money and would begin a campaign for the GOP nomination with stratospheric ratings among key demographics, a source close to Oz revealed in an interview with the Washington Examiner. Link for details.

CONGRESS

— Ernst wants hearing to probe supply chain woes, asks Vilsack to testify. Sen. Joni Ernst (R-Iowa) late last week called for Senate Ag Chairwoman Debbie Stabenow (D-Mich.) to hold a hearing to examine the recent supply chain crisis and to probe the Biden administration’s plan to address supply chain failures as it relates to the agricultural industry. In a letter (link) to Stabenow, Ernst highlights the dramatic increase in the cost of fertilizer and other ag inputs and asks for USDA Sec. Tom Vilsack, a co-chair of the Supply Chain Disruption Task Force, to testify.

OTHER ITEMS OF NOTE

— U.S. Justice Dept. files lawsuit to stop sugar merger. The U.S. Justice Department (DOJ) said on Tuesday that it had filed an antitrust lawsuit aimed at blocking U.S. Sugar Corp from buying rival Imperial Sugar Co. from Louis Dreyfus Company. The deal was valued at about $315 million, according to the Justice Department lawsuit. The DOJ complaint, filed in the U.S. District Court for the District of Delaware, alleges that the transaction would leave an overwhelming majority of refined sugar sales across the Southeast in the hands of only two producers. "As a result, American businesses and consumers would pay more for refined sugar, a significant input for many foods and beverages," DOJ said.

The National Confectioners Association, which represents candy companies that use sugar, announced it supports the Justice Department’s move.

The Justice Department detailed its case in a release (link). “U.S. Sugar and Imperial Sugar are already multibillion-dollar corporations and are seeking to further consolidate an already cozy sugar industry. Their merger would eliminate aggressive competition in the supply of refined sugar that leads to lower prices, better quality, and more reliable service,” Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division said in the release. “This deal substantially lessens competition at a time when global supply chain challenges already threaten steady access to important commodities and goods. The department’s lawsuit seeks to preserve the important competition between U.S. Sugar and Imperial Sugar and protect the resiliency of American domestic sugar supply.”

U.S. Sugar said it plans to fight the lawsuit. “We disagree with the Justice Department’s decision and fully intend to litigate this matter," U.S. Sugar said. "The facts will ultimately show that U.S. Sugar’s acquisition of Imperial Sugar will result in increased production and distribution of refined sugar, provide a more secure sugar supply for American farmers, food producers and consumers, and protect American jobs. This transaction will improve supply chain logistics and will not result in higher prices or any harm to customers and consumers. We look forward to making our case in court.”

Comments: The suit, filed Tuesday in a Delaware federal court, is the fourth major deal challenge in recent months from the department, which has been following through on a Biden-era enforcement pledge to take a harder line against industry consolidation. “U.S. Sugar and Imperial Sugar are already multibillion-dollar corporations and are seeking to further consolidate an already cozy sugar industry,” said the DOJ’s new antitrust chief, Jonathan Kanter, who won Senate confirmation last week. Some observers note the case potentially could raise issues related to a sugar-industry regulatory program run by USDA. According to the lawsuit, U.S. Sugar and Imperial have argued the program gives USDA the ability to prevent the kinds of harms the Justice Department alleges. But DOJ disagreed, arguing USDA regulation wasn’t a substitute for antitrust enforcement and wouldn’t protect grocers, food and beverage manufacturers or consumers from diminished competition.

EVENTS AND REPORTS

Wednesday, Nov. 24

· COP26 outcomes for energy. International Energy Agency (IEA) virtual news conference on the current energy market situation, the outcomes of the COP26 Climate Change Conference in Glasgow and several new IEA special projects.

· Renewables and COP26. REN21 virtual discussion on "The Way Forward: Building renewables leadership to drive action post-COP26."

· Economic reports. Jobless Claims | GDP | Durable Goods Orders | International Trade in Goods | Wholesale Inventories | New Home Sales | Personal Income & Outlays | Consumer Sentiment | FOMC Minutes

· Energy reports. EIA Petroleum Status Report | Weekly Ethanol Production | EIA Natural Gas Report | Baker-Hughes Rig Count | Genscape ARA weekly crude inventory

· USDA reports. ERS: Agricultural Exchange Rate Data Set NASS: Livestock Slaughter | Cotton Ginnings | Broiler Hatchery | Farm Labor