U.S. Inflation Accelerated in May, Up 8.6%, Another 40-Year High

Vilsack to tap $1 billion in CCC funds for school meals | Advice to improve farm safety net

|

In Today’s Digital Newspaper |

Consumer prices rose 8.6% in the 12 months ending in May, unexpectedly returning to record levels — and climbing at the quickest pace in four decades — amid an unprecedented surge in gas prices.

Ukraine is losing between 100 and 200 soldiers per day in its fight with Russian forces in the east of the country, Ukrainian presidential advisor Mykhaylo Podolyak told the BBC on Thursday as he urged Western nations to commit more heavy artillery and rocket-launching systems to counter the Russian assault. Podolyak added that his side would only consider peace talks if Russia ceded territory it had gained since the invasion.

Actual export shipments of some U.S. ag export sales are lagging due to shortages of workers, trucks and other equipment, and containers, according to industry sources.

June S&D, Crop Production Reports out at noon ET. Pro Farmer says USDA is expected to fine tune its old- and new-crop balance sheets, with just minor changes expected to U.S. and global ending stocks. USDA will also update its U.S. winter wheat production estimates, though it typically makes minor adjustments in June. A potential wild card is the U.S. corn yield projection. In May, USDA cut its corn yield projection by 4 bu. per acre from trendline due to planting delays. As of June 5, the planting pace had surpassed the five-year average. That could prompt USDA to raise its yield some, though there’s no precedent of that happening in June, and we doubt there will be an upward revision. The July Supply & Demand and Crop Production Reports will be released at noon ET.

The European Union’s wheat harvest this year is expected to be weaker than forecast, dimming hopes that it might help fill a widening global grain gap.

USDA Sec. Tom Vilsack is expected to again tap the CCC, this time $1 billion for the school lunch program.

Summit of the Americas: The Biden administration plans to sign a migration agreement with Latin American nations that would mark a shift in the approach countries take to refugees and migrants amid unprecedented movement across the region.

House lawmakers investigating the Jan. 6 riot painted a portrait of Donald Trump pursuing an effort to undo the 2020 election, inciting supporters and rebuffing pleas to call off the mob storming the Capitol. Ivanka Trump said she accepted there was no evidence of election fraud and that her father lost.

More than half of Shanghai’s 25 million residents will undergo Covid-19 testing this weekend, raising the prospect of extended home confinement for any who test positive, one week after emerging from a monthslong lockdown.

The PGA Tour suspended 17 players, including Phil Mickelson and Dustin Johnson, who are participating in the first event of the new rival, Saudi-backed LIV Golf circuit.

|

MARKET FOCUS |

Equities today: U.S. equities were slammed lower following a report that showed U.S. inflation accelerating. Asian equities ended mostly lower. Japan’s Nikkei fell 422.24 points, 1.49%, at 27,824.29. Hong Kong’s Hang Seng shed 62.87 points, 0.29%, at 21,806.18. In Europe, the Stoxx 600 was down 1.5% in midday trading,

U.S. equities yesterday: The Dow fell 638.11 points, 1.94%, at 32,272.79. The Nasdaq declined 332.05 points, 2.75%, at 11,754.23. The S&P 500 lost 97.95 points, 2.38%, at 4,017.82.

Agriculture markets yesterday:

- Corn: July corn rose 8 1/2 cents to $7.73, the contract’s highest close since May 27. December futures faded from earlier gains to end 1 cent lower at $7.16 3/4.

- Soy complex: July soybeans surged 29 cents to $17.69, the highest close for a nearby contract since September 2012. November soybeans rose 14 1/4 cents to $15.82 1/4, a lifetime-high close for the contract.

- Wheat: July SRW wheat fell 3 1/2 cents to $10.71 1/4. July HRW wheat fell 1 1/4 cents to $11.53 3/4. July spring wheat fell 10 1/2 cents to $12.24.

- Cotton: July cotton rose 589 points to 146.51 cents per pound and December jumped 239 points to 124.93 cents.

- Cattle: August live cattle fell 32.5 cents to $137.20. August feeders gained 37.5 cents to $176.025.

- Hogs: July lean hogs fell $2.95 to $105.00, a three-week low. The CME lean hog index fell 32 cents to $107.48 and is expected to drop another 17 cents today.

Ag markets today: Corn, soybean and winter wheat futures faced mild price pressure overnight as traders awaited USDA’s reports later this morning. As of 7:30 a.m. ET, corn futures were trading 4 to 5 cents lower, soybeans were 5 to 8 cents lower, winter wheat futures were 4 to 7 cents lower and spring wheat futures were mostly 1 to 3 cents higher. Front-month crude oil futures were around $1 higher and the U.S. dollar index is more than 300 points higher.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. consumer-price index for May is expected to increase 0.7% from one month earlier and 8.3% from one year earlier. Excluding food and energy, the CPI is forecast to increase 0.5% and 5.9%. (8:30 a.m. ET)

• University of Michigan's consumer sentiment index is expected to tick up to 58.5 in the opening weeks of June from 58.4 in May. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• U.S. Treasury Department releases federal budget figures for May at 2 p.m. ET.

• Commitments of Traders report, 3:30 p.m. ET.

• President Biden delivers remarks on inflation and supply chain issues at the Port of Los Angeles at 10:45 a.m. Pacific time. He’ll meet with delegations at the Summit of the Americas throughout the day before participating in two Democratic National Committee receptions at 5 p.m. and 7 p.m.

U.S. inflation accelerated, with consumer prices up 8.6% in the year through May.

- Overall prices rose 1% from April — surpassing the 0.7% economists were expecting and much higher than the previous month’s increase of 0.3%, according to data released by the Labor Department on Friday. Prices rose by 0.6 percent% after stripping out food and fuel prices, which can be volatile.

- The unexpected jump marks the largest 12-month increase since the period ending December 1981, according to the release, and comes after prices in April fell on a monthly basis for the first time since August.

- The overall increase was the result of broad upticks across shelter, food and gas prices, which jumped 4% after falling 6.1% in April, the government said.

- Energy prices surged 34.6% over the past year, the largest increase since September 2005. The cost of electricity rose 12%. Food prices soared 10.1%, the first double-digit increase since March 1981. The shelter index, which measures rents and other housing costs, posted a 5.5% increase, the biggest 12-month gain since 1991. Excluding food and energy prices, core CPI increased 6.0%.

Bottom line: The high pace of inflation means the Federal Reserve is all but certain to continue to aggressively raise interest rates when it meets next week.

Biden welcomed Western Hemisphere leaders to the Los Angeles Summit of the Americas, assuring them that the region remains a priority for the U.S. The president said his administration is eager to work with Latin American governments to boost food security, fight and adapt to climate change and improve health systems. He promoted a migration pact due to be announced Friday without revealing new details.

Biden to visit busiest U.S. port as he seeks to head off supply chain woes. Biden will visit the port of Los Angeles today with the White House closely watching talks on a new union contract for 22,000 West Coast dockworkers. A collapse of the negotiations risks a work stoppage during the port’s busiest time of year, one that would snarl U.S. supply chains still suffering pandemic disruptions. The International Longshore and Warehouse Union and the Pacific Maritime Association, which represents more than 70 terminal operators and ocean carriers, are negotiating in San Francisco over a contract for workers at 29 ports in California, Oregon and Washington. The current pact expires July 1. Some progress has been made to reduce massive backlogs at the twin ports of Los Angeles and Long Beach that contributed to inflation across the U.S. Together, the two ports handle the most container traffic in the country. However, industry sources signal backlogs are expected to increase with China reopening parts of its countries and ports. Biden, who’s pledged to be the most pro-union president in U.S. history, has directed Cabinet members and supply-chain experts to smooth negotiations between the ports and dockworkers in hopes of avoiding a repeat of the months-long disruptions that followed a 2014 labor dispute. Highlighting the stakes, Biden will discuss the latest data on US inflation while at the port and argue that cutting shipping costs will curb price increases, a White House official said.

Treasury Secretary Janet Yellen rejected the idea that corporate greed is causing the U.S. inflation surge, differing with fellow Democrats who have accused big businesses of price gouging. Meanwhile, Yellen said that cryptocurrency assets are a “very risky” choice to include in the retirement plans of average savers, and that it would be reasonable for Congress to address the danger.

Rule of 10. There is a theory that the U.S. economy generally runs into trouble when interest rates (the cost of money) together with energy prices reaches double digits. To calculate the indicator, the average rate on the 30-year fixed-rate mortgage (5.23% as of Thursday) is added to the prices at the pump (now averaging $5). The rule was coined by Strategas chief economist Don Rissmiller in 2011, when the U.S. was still recovering from the global financial crisis.

"The economy is definitely on thin ice here, but I don't think we're there yet," said Mark Zandi, chief economist at Moody's Analytics. "If we get to $5.50 or $6 [gasoline], that would be consistent with $150 for a barrel of oil. I think then, we're done. We're in for a recession. It would be too much to bear. I think we could digest $120 [oil] if we don't stay there too long."

Market perspectives:

• Outside markets: The 10-year Treasury yield on Friday remained above 3% ahead of May's consumer price data. West Texas Intermediate crude, the American benchmark, rose Friday, trading at more than $122 per barrel. Brent crude is around $124.05 per barrel. Gold was under $1,836 per troy ounce and silver under $21.37 per troy ounce.

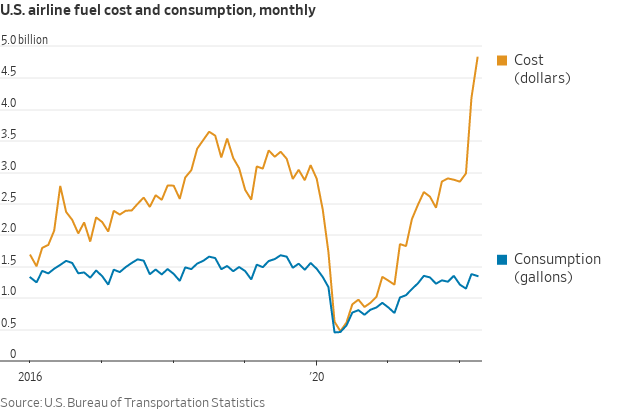

• Prices of gasoline, diesel and jet fuel continue to face upward pressure for many reasons that are unlikely to go away soon. Oil and fuel production hasn’t increased quickly enough to meet growing global demand. U.S. fuel-making capacity has actually declined due to refinery closures, while U.S. exports have remained strong. The results are being widely felt — from the food, automobile and trucking industries, to airlines, retail stores and service stations, and even in the oil-and-gas business itself.

• National average price at the pump reached $5 a gallon on Thursday, according to price-tracking site GasBuddy. The average price of regular gas is about 26 cents higher than last week and nearly $2-a-gallon higher compared with this time last year, according to AAA. Gasoline prices could reach a national average of $6.20 a gallon by August, JPMorgan Chase estimated.

Drivers are buying fewer gallons on each visit to gas stations, but making more frequent trips to fuel up. Shoppers are visiting Costco Wholesale Corp. more often for its discounted gasoline.

High gasoline prices cut consumption because drivers shift their routines. A 10% rise in gasoline prices leads to a 2% to 3% decline in gasoline consumption in the short term, Lucas Davis, an economist at the University of California, Berkeley, told the Wall Street Journal.

Energy prices have added to the cost of transportation, ingredients, and packaging. Mondelez International, maker of Oreos and other snacks, said its overall input costs will be up about 10% to 13% this year.

|

Items in Pro Farmer's First Thing Today include:

• Weaker tone ahead of USDA reports

• China’s new bank loans surged in May (details in China section)

• Indonesia eases palm oil export rules

• French wheat crop ratings continue to slide

• China continues soybean auctions

• Bullish attitudes in cattle

• Hog attitudes turn more bearish

|

RUSSIA/UKRAINE |

— Summary: Ukrainian leaders warn that the fate of the industrial heartlands in their country’s east depends on the amount of Western-supplied heavy weaponry that can be placed on the front lines in Donbas, as Russia presses on with its attempts to expand its control to Severodonetsk and other strategic cities.

- A Russia-backed court sentenced three men to death for fighting alongside Ukrainian forces.

— Market impacts:

- Global companies have racked up more than $59 billion in losses from their Russian operations, with more financial pain to come as sanctions hit the economy and divestitures and shutdowns continue.

|

POLICY UPDATE |

— Vilsack to use $1 billion from CCC to help fund school meal program. The funding will be announced soon and will continue the increased funding the Biden administration has provided the program. Apparently, the aggressive use of the Commodity Credit Corporation (CCC) for funding nontraditional programs still leaves enough funding for traditional program functions before Congress replenishes its funds. The funds will be provided as the universal free school meals program Congress authorized during the Covid-19 pandemic approaches its expiration date. USDA did something similar last December, as districts struggled to find consistent sources of food amid ongoing supply chain disruptions from the pandemic.

— A growing number of eligible crop ERP recipients say they have received their payments expected to total around $6 billion under Phase 1 of the program.

— Ag economists: Higher input costs will linger even after commodity prices ease. Ag economists told the House Agriculture Subcommittee on General Farm Commodities and Risk Management Thursday that high input costs will likely persist even after commodity prices decline, adding that current farm bill commodity programs are not well equipped to deal with any such situation.

Ag commodity prices “are going to decline, but input prices are going to stay up for a while. …they always do ... and that's going to a cost-price squeeze,” said Texas A&M Ag Economist and Co-director of the Agricultural and Food Policy Center (AFPC) Dr. Joe Outlaw. “At the end of the day, it’s not what you bring in, it’s the margin you’re left with, and I have tremendous concerns about where we’re headed right now,” said Glenn Thompson of Pennsylvania, the senior Republican on the House Agriculture Committee. “It will only take some softening of prices before producers may be underwater.”

Economists suggested some moves they said could help make Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) better deal with lower prices, including providing farmers with the higher payment, if any, from either program, rather than making them elect coverage from one. Updating PLC reference prices was also suggested so they can more adequately reflect the impact of higher input prices.

Another suggestion: margin coverage like what currently is in place for dairy via the Dairy Margin Coverage (DMC) program. This would account for changes in both commodity prices and input costs. The dairy margin program issues payments when feed costs are too close to milk prices. There is a $100-a-year fee for the base level of coverage. Farmers can buy higher levels of protection. Thompson, in line to chair the committee if Republicans win a House majority in the Nov. 8 elections, asked how a margin protection plan for row crops would compare to the current crop subsidy programs, which are triggered by low market prices. “Well, clearly, the benefit is that it would take into consideration both the cost side and the revenue side,” said Dr. Joe Outlaw of the Agricultural and Food Policy Center at Texas A&M. The dairy margin program needed repeated revisions, so it would be best to test the idea with a pilot project, he said. “On the cost side, fertilizer and clearly fuel and labor — and there’s a whole lot of things that would matter for a certain set of crops that might not matter for another set of crops, so we’d have to be really careful to make sure we did it balanced. But it would be worth looking at, for sure.”

Rep. Al Lawson (D-Fla.) asked about suggestions to create a permanent disaster program. Outlaw and Joe Janzen of the University of Illinois said taxpayer-subsidized crop insurance generally was sufficient. “There’s going to be natural disasters,” said Outlaw, and it would be helpful for farmers to “understand what kind of help they might get.”

The rice grower situation was also addressed because they are already facing a cost squeeze because of relative flat prices as input costs surged. Outlaw urged lawmakers to consider targeted assistance to rice producers, noting that without some sort of aid soon, the U.S. could face the loss of producers and infrastructure across the rice sector.

“Most of my suggestions require additional resources that may be difficult to secure but are necessary,” said Outlaw in written testimony.

Link to written testimony.

|

CHINA UPDATE |

— U.S. relations with China are likely in the worst state since former President Richard Nixon’s historic trip in 1972 helped re-establish diplomatic ties between Washington and Beijing, according to Nicholas Burns, the current American ambassador to the Asian nation.

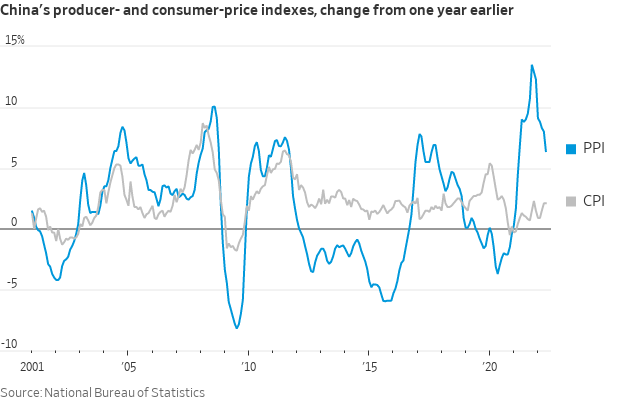

— China's inflation muted, auto sales rebound. Inflationary pressure stayed soft in China as Covid-19 lockdowns hammered domestic demand. Consumer inflation was up 2.1% from a year earlier in May, the National Bureau of Statistics reported Friday, matching April’s rate. With decades-high inflation continuing to torment the U.S. and many developed countries, that makes China an outlier among the world’s largest economies.

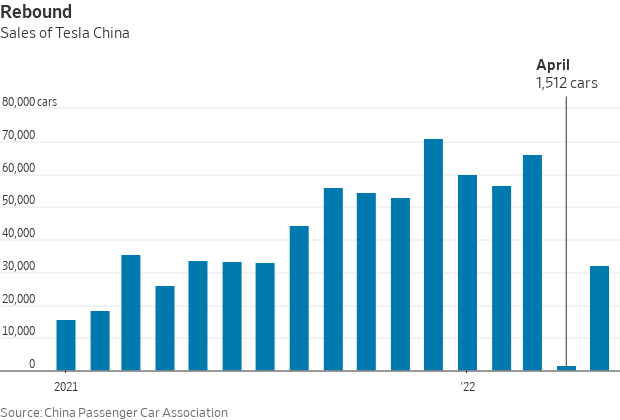

— China’s car sales began to rebound in May as production gradually resumed in lockdown-hit Shanghai and government cash incentives stimulated purchases in the world’s biggest auto market. Passenger-car sales in May rose 30% to 1.35 million from 1.04 million vehicles in April, the China Passenger Car Association said Thursday. The total was still down 17% from last May, indicating that the industry has a way to go to restore its fortunes.

— More than half of Shanghai’s 25 million residents will undergo Covid-19 testing this weekend, raising the prospect of extended periods of home confinement for any who test positive, a rude awakening that comes just one week after the city celebrated its emergence from a punishing monthslong lockdown.

— China’s new bank loans surged in May. New bank lending in China jumped far more than expected in May and broader credit growth also quickened, as policymakers try to pull the world’s second-largest economy out of a Covid-induced slump. Chinese banks extended 1.89 trillion yuan ($282.62 billion) in new yuan loans in May, nearly tripling April’s tally. However, 38% of the new monthly loans were in the form of short-term bill financing, which was down from 80% in April but still higher than 10% in the first quarter, suggesting real credit demand remains weak.

— Austin’s Shangri-La summit. U.S. Secretary of Defense Lloyd Austin holds his first in-person meeting with his Chinese counterpart Wei Fenghe today in Singapore on the margins of the Shangri-La Dialogue in Singapore. The U.S. side is hoping to improve crisis communications with Chinese officials as part of the meeting.

|

ENERGY & CLIMATE CHANGE |

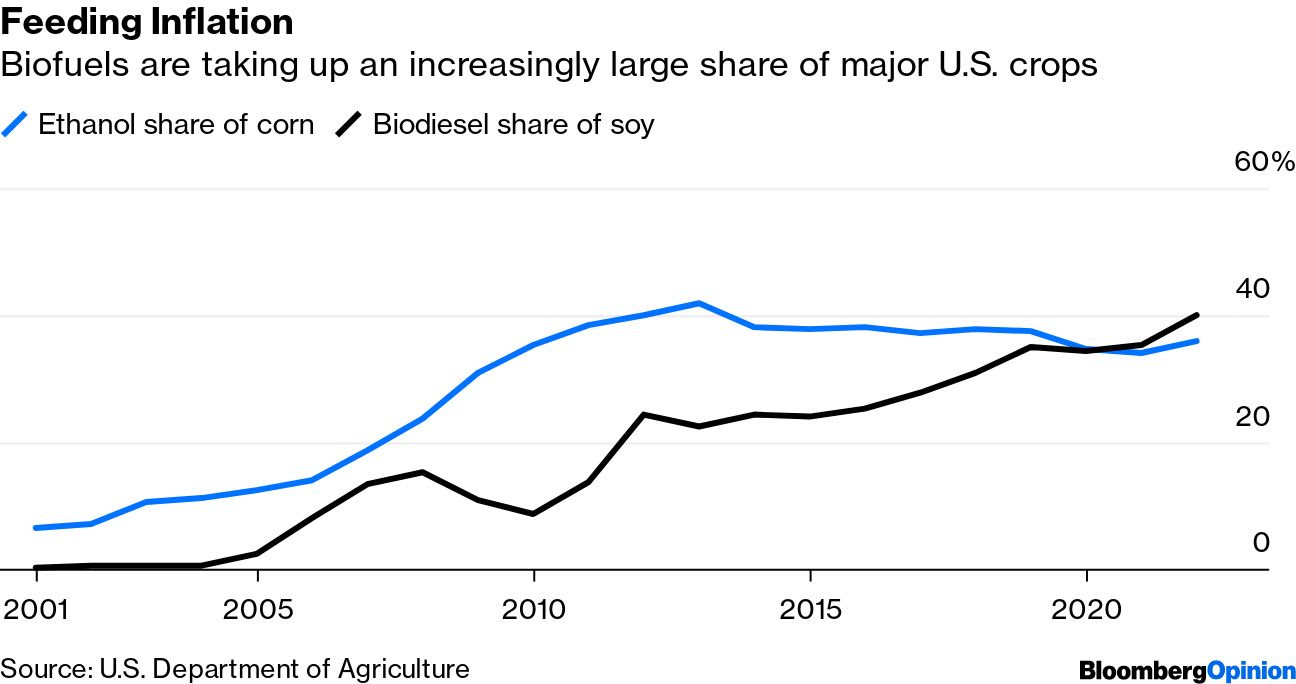

— Sugar, palm oil and soybean oil prices are surging and a single factor connects the disparate events: biofuels, Bloomberg notes.

— Car makers are asking European lawmakers to give them more time to make the shift to electric cars, as Europe moves closer to approving a legal ban on the sale of new cars with internal-combustion engines.

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 534,223,901 with 6,306,500 deaths.

- U.S. case count is at 85,329,812 with 1,010,805 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 579,387,321 doses administered, 221,601,089 have been fully vaccinated, or 67.26% of the U.S. population.

— Some school districts are bringing back mask requirements as summer-school sessions are set to begin amid rising Covid-19 levels. Link for more via the WSJ.

|

POLITICS & ELECTIONS |

— France parliamentary elections. French voters return to the polls on Sunday for the first time since April’s presidential contest to begin voting for a new parliament for Emmanuel Macron’s second term. Traditionally, such elections go the way of the president’s party, but a close contest is predicted heading into the Sunday first round vote, with a left-wing coalition led by Jean-Luc Melenchon hoping to cause an upset for Macron’s centrist bloc. Polls currently show Macron’s party winning the most seats but falling short of an absolute majority. The second round takes place on June 19.

— House lawmakers investigating the U.S. Capitol riot detailed then-President Donald Trump’s efforts to undo his election loss during a televised hearing that ended with the account of a police officer injured in the Jan. 6, 2021, melee. Thursday night’s televised hearing was the first of seven sessions that the committee says will reveal the key role Trump played in piling up lies to build a false narrative about the 2020 election. Ivanka Trump, the daughter of Trump and a former White House adviser, said she accepted that there was no evidence of fraud and that her father had lost the 2020 election. A clip of her testimony was played during the hearing. Jared Kushner, the son-in-law of Trump, told House investigators that he hadn’t taken seriously the White House counsel’s threats to resign over Trump’s attempts to overturn the 2020 election. He dismissed it as “whining.”

— Next week voters head to the polls for primaries in Maine, Nevada, North Dakota and South Carolina, and on Saturday, Alaska is holding its special primary to succeed late GOP House dean Don Young.

— Dave Wasserman, House editor of the Cook Political Report with Amy Walter, sized up the June 7 primaries which he says produced “strong GOP nominees.” His bottom line: “Given the strong political headwinds facing them, Democratic hopes for holding down their losses this fall rests partly on GOP primary voters nominating the more flawed GOP candidate in crowded primary contests. However, that didn’t pan out for Democrats on Tuesday. The more electable GOP candidate emerged victorious in states like California, New Jersey, Iowa, and New Mexico.”

— California Rep. David Valadao, a member of the House Appropriations subcommittee on agriculture, prevailed over Trump supporter Chris Mathys and will face state Assemblyman Rudy Salas, a Democrat, in the general election in U.S. House District 22.

|

CONGRESS |

— Congress will likely rely on a stopgap funding measure to keep the government running beyond Sept. 30, though they could at least manage to strike a deal in November or December, a key senator told reporters Thursday. Lawmakers are “looking at a CR right now,” Senate Appropriations Vice Chairman Richard Shelby (R-Ala.) said, referring to a continuing resolution, as an agreement on total spending for next year remains elusive.

|

OTHER ITEMS OF NOTE |

— North Korea/China relations. China has not ruled out sanctioning North Korea in the event of a new nuclear test, its U.N. Ambassador Zhang Jun said on Thursday, one day after he joined with his Russian counterpart to veto a Security Council resolution targeting North Korea for its recent ballistic missile tests. Zhang also said that talks between the United States and North Korea should remain on the table. “The United States is the number one superpower in the world. If the United States wants to engage in dialogue with anyone in the world, it’s not a difficult thing,” Zhang said. “It’s up to DPRK to make their decision, but definitely our willingness is there.”

— Cotton AWP lower. The Adjusted World Price (AWP) for cotton declined to 134.41 cents per pound, effective today (June 10), down from 135.36 cents per pound the prior week. Meanwhile, USDA said that Special Import Quota #8 will be established June 16 for 50,978 bales of Upland cotton, applying to supplies purchased not later than Sept. 13 and entered into the U.S. not later than Dec. 12.