U.S. Economy Added Just 210,000 Jobs in November, Well Short of Expectations

Congress clears stopgap spending bill through Feb. 18, but no waiver of pay-as-you-go rules

In Today’s Digital Newspaper

Market Focus:

• Huge miss on payrolls as Nonfarm payrolls increased by just 210,000

• U.S. unemployment rate fell sharply to 4.2%

• Slower pace of hiring in November came ahead of Omicron Covid variant

• Employment level still 3.9 million under mark seen in February 2020

• Labor force participation rate moved up to 61.8, 1.5 percentage points under Feb. 2020

• New Gallup survey on inflation is bad news for Democrats in power

• Yellen joins Fed Chair Powell in jumping off ‘transitory’ inflation mantra

• Federal Reserve official: time central bank to prepare to raise interest rates

• Wages are increasing in the U.S., not so much elsewhere

• Americans hoarding cash because of fatigue and uncertainty

• Brazil officially slid into a recession on Thursday

• OPEC+ agrees to go ahead with oil output rise, with a caveat

• USDA announces 98th Agricultural Outlook Forum

• Ag demand update

• USDA daily export sale: 122,000 MT soybeans to unknown destinations, 2021-22 MY

• Canada’s wheat crop estimate slightly larger than trade guess

• It’s December… where’s the snow in Denver?

• Soybeans continued to push higher overnight

• Canadian crop production data out later this morning

• Workers at Canadian beef plant to vote on Cargill offer ahead of strike date

• Beef prices firm and movement was strong again

• Cash hog index up for a second day in a row

Policy Focus:

• House, Senate clear stopgap spending bill with Feb. 18 deadline

• What was not included in CR measure important for ag sector

• Manchin is casting renewed skepticism re: BBB

• Sinema predicts no BBB until after Christmas

• Schumer and McConnell float idea attaching debt-limit increase to NDAA package

Biden Administration Personnel:

• Senate confirms Larry Turner as Labor Department watchdog

China Update:

• Two Chinese developers sunk deeper into financial distress

• Didi quits U.S. stock market just months after its huge IPO

• China releases draft rules on herbicides for GM crops

Energy & Climate Change:

• Reports indicate RFS levels (again) coming soon

• Virtual hearing today on EPA’s plans to extend RFS compliance deadlines

• Vilsack lays out potential timeline for initial climate-smart agriculture pilots using CCC funds

• Vilsack says effort aimed at shaping next farm bill

• Vilsack comments on sensitive topic of carbon emissions & livestock production

• DOE invests in technologies aimed at cutting fossil fuel sector methane emissions

Livestock, Food & Beverage Industry Update:

• Kellogg’s workers strike deal to end two-month walkout

Coronavirus Update:

• Too early to tell whether Omicron variant is milder or more severe than other strains

• Germany announces nationwide lockdown for unvaccinated

• Japan and Israel barring almost all foreign visitors

• FDA prepares for speedy review of Omicron vaccines

• Biden laid out a new 9-point pandemic strategy

• Scientists studying Omicron in S. Africa seeing rise in Covid-19 reinfections

Politics & Elections:

• Democratic pollster says party has ‘a national branding problem’

Other Items of Note:

• U.S. antitrust officials sued to block chipmaker Nvidia’s takeover of U.K.-based Arm

• Lawsuit marks beginning of aggressive FTC antitrust campaign under leader Khan

• White House competition focus on U.S. ag/food sector

• ITA publishes notifications on UAN investigation results

• FDA proposes water rule for produce growers

MARKET FOCUS

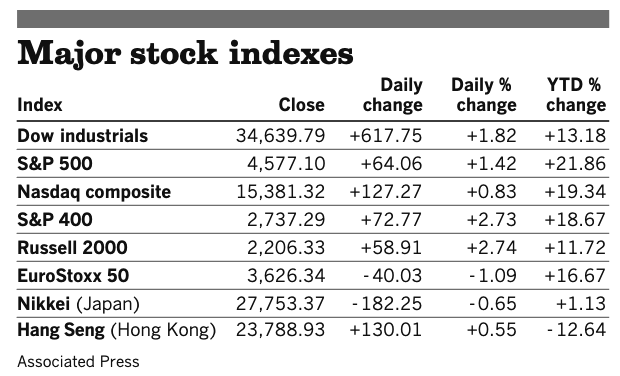

Equities today: Global stock markets were mixed to firmer in overnight trading. The U.S. Dow opened 100 points higher. Nasdaq is up around 40 points. Asian equities finished mixed to mostly higher after the rise in US markets Thursday. The Nikkei rose 276.20 points, 1.00%, at 28,029.57. The Hang Seng Index declined 22.24 points, 0.09%, at 23,766.69. European equities are currently higher after having dipped into negative territory early in their trading session. The Stoxx 600 was recently up 0.3% with regional markets up 0.1% to 0.4%.

U.S. equities yesterday: All three major indices didn't repeat the pattern of a stronger start and weaker finish that they did Wednesday. The Dow ended up 617.75 points, 1.82%, at 34,639.79. The Nasdaq rose 127.27 points, 0.83%, at 15,381.32. The S&P 500 gained 64.06 points, 1.42%, at 4,577.10.

Warren Buffett’s right-hand man offered a warning to investors. Berkshire Hathaway’s Charlie Munger told a conference that markets are wildly overvalued in places and that the current environment is “even crazier” than the dotcom boom of the late 1990s that subsequently led to a bust. Munger, 97, also said that he wished cryptocurrencies didn’t exist, while at the Sohn conference in Sydney, the Australian Financial Review reported.

On tap today:

• Employment report: The Labor Department is expected to show nonfarm payrolls likely rose by 573,000 in November, after having risen by 531,000 in October. The unemployment rate likely slipped to 4.5% for the same month, compared with 4.6% in October. 8:30 a.m. ET. UPDATE: The U.S. economy created far fewer jobs than expected in November, before a new Covid threat created a scare that growth could slow into the winter, the Labor Department reported. Nonfarm payrolls increased by just 210,000 for the month, though the unemployment rate fell sharply to 4.2%.

Analysis of Jobs report: The slower pace of hiring in November came ahead of the Omicron Covid variant appearing and that has the potential to restrict activity ahead, especially if more restrictions are deployed. Goods producing jobs rose a solid 60,000, but there was a major slowdown in the service sector with just 175,000 private service sector jobs added. Leisure and hospitality is simply not rebounding as some thought (+23,000) while gov’t employment fell for the fourth month in a row. Retail also saw a 20,000 fall. Even as job gains so far in 2021 have averaged 555,000 per month and has increased 18.5 million since April 2020, it still leaves the employment level 3.9 million under the mark seen in February 2020. Other notes from the report include that the labor force participation rate moved up to 61.8%, but still is 1.5 percentage points under the February 2020 mark. Professional and business services, transportation, warehousing, construction and manufacturing were the sources of most of the job gains in November. The hourly wage ticked up by eight cents to $31.03 per hour, up 4.8% over the past 12 months. Revisions increased the October job gains to 546,000 (531,000 prior) and September to 379,000 (312,000 prior) for a combined increase of 82,000.

Comments: The slowing could be turned in December if temporary holiday hiring unfolds as retail hiring declined 20,000 and remains 176,000 under the February 2020 mark. The rise in wages continues, but the pace of inflation is more than offsetting increased wages. Bottom line is that the U.S. economy continues to move forward, but there is still an underlying current of uncertainty that appears to be tempering activity.

• St. Louis Fed President James Bullard speaks on the economy and monetary policy at 9:15 a.m. ET.

• IHS Markit's U.S. services index for November is expected to tick up to 57.1 from a preliminary reading of 57.0. (9:45 a.m. ET)

• Institute for Supply Management's services index is expected to fall to 65 in November from 66.7 one month earlier. (10 a.m. ET)

• U.S. factory orders for October are forecast to rise 0.4% from the prior month. (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Inflation watch: A new Gallup survey on inflation is bad news for Democrats in power. 71% of Americans making under $40,000 said they are experiencing hardships due to recent price increases. The rate of Americans who say inflation is hurting them declines with increased wealth: the number is 47% for the $40,000 to $99,999 bracket and just 21% for those making $100,000 or more per year. Voters in the lowest income brackets are a Democratic-leaning constituency; it’s striking to see how many say they’ve been negatively affected by inflation. Link to survey.

Yellen joins Fed Chair Powell in jumping off ‘transitory’ inflation mantra. Treasury Secretary Janet Yellen on Thursday said she believed it was time to retire the term “transitory” to characterize inflation as temporary and suggested that the Omicron variant of the coronavirus could prolong the problem of rising prices. Speaking at an event sponsored by Reuters, Yellen said that over the summer it appeared that the pandemic was subsiding and that the economy would soon normalize. The spread of new variants, she said, has changed that calculus. “Now the new variant, the Omicron variant, the pandemic could be with us for quite some time and hopefully not completely stifling economic activity but affecting our behavior in ways that contribute to inflation,” Yellen said. “I am ready to retire the word transitory,” Yellen said. “I can agree that that hasn’t been an apt description of what we are dealing with.” She said that Powell’s suggestion this week that the Fed would consider speeding up its plan to withdraw financial support from the economy “makes sense… What we don’t want to have develop is a wage-price spiral, in which inflation becomes its own self-reinforcing kind of phenomenon that would become chronic in the U.S. economy, something endemic,” Yellen said.

A top Federal Reserve official said it was time for the central bank to prepare to raise interest rates because inflation was likely to stay above the Fed’s 2% target for longer than anticipated. Fed governor Randal Quarles, in his final public appearance before he leaves the central bank at the end of the month, said it was reasonable for much of the year to think inflation was being driven primarily by idiosyncratic price increases related to the reopening of the economy. But he said it now appears fiscal stimulus over the past two years had boosted demand to levels that might exceed the pre-pandemic trend. “This is not a question of demand at pre-Covid levels and supply taking a while to reach back up to that pre-Covid capacity. But rather we have sustained higher demand,” Quarles said.

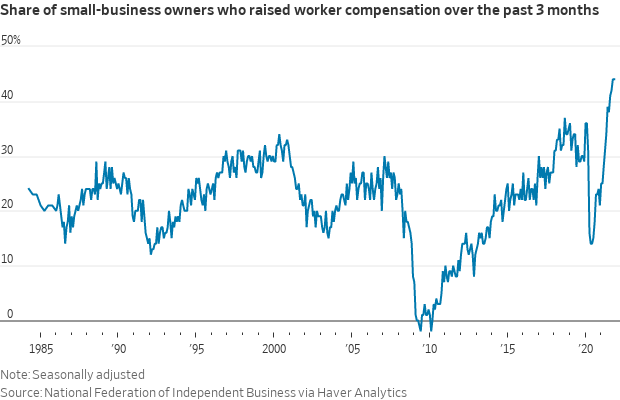

Wages are increasing in the U.S., but not so much elsewhere. U.S. workers are getting their largest pay bumps in three decades. But for employees in some large Asia-Pacific economies such as Australia and Japan, it is the opposite experience. Many are struggling to negotiate a wage increase — if they can get one — that covers higher consumer prices. The situation has implications for how quickly central banks tighten monetary policy in response to price pressures, the Wall Street Journal reports (link). Meanwhile, wage pressure in the U.S. likely continued into November. The share of small-business owners raising compensation held at a record high, according to the National Federation of Independent Business.

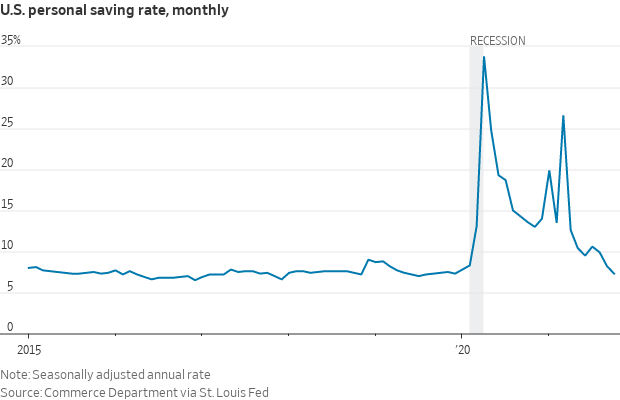

Americans are hoarding cash because of fatigue and uncertainty, with little chance the trend will reverse soon. Over the past two years, households have stashed away close to $1.6 trillion in “excess savings,” or resources they otherwise wouldn’t have been able to save before the Covid-19 crisis, according to the Federal Reserve Bank of New York. The funds are well beyond the three to six months of emergency savings generally recommended by financial advisers. While the saving rate has dropped back to 2019 levels after four consecutive quarters of record highs, financial advisers, money managers and economists say Americans are too nervous about potential worst-case scenarios to dip into their funds.

Brazil officially slid into a recession on Thursday, as the country grapples with high levels of inflation and interest rate hikes. The Brazilian economy — the largest in Latin America — has been especially strained by severe drought, the worst to hit the country in almost a century.

USDA announces 98th Agricultural Outlook Forum. USDA announced the program of its 98th Agricultural Outlook Forum, a virtual event that will be held on Feb. 24-25, 2022. Link.

Market perspectives:

• Outside markets: The U.S. dollar index was little changed ahead of the US Employment report. The yield on the 10-year Treasury note was lower, trading around 1.43%, with a lower trend in global government bond yields. Gold and silver futures were registering solid gains ahead of the jobs update, with gold around $1,775 per troy ounce and silver around $22.40 per troy ounce.

• Crude oil prices have advanced ahead of the U.S. trading start, with U.S. crude around $68.15 per barrel and Brent around $71.70 per barrel. Futures were higher in Asian action, with U.S. crude up 98 cents at $67.48 per barrel and Brent up 89 cents at $70.56 per barrel.

• OPEC+ agrees to go ahead with oil output rise, with a caveat. The oil cartel and its allies agreed to stick to their existing policy of monthly oil output increases despite fears that a U.S. release from crude reserves and the new Omicron coronavirus variant would lead to a fresh oil price rout. The countries said they would raise their collective production by another 400,000 barrels a day in January. However, they said they were willing to adjust it if the Omicron variant poses a bigger threat to demand. The group said it had considered a range of options, from freezing the quota altogether to a smaller supply rise. Many market watchers expected the group to pause in opening taps any wider due to the uncertain economic impact of efforts to contain Covid-19.

• Ag demand: Japan purchased another 25,510 MT of Australian wheat from its weekly tender.

• USDA daily export sale: 122,000 MT soybeans to unknown destinations, 2021-22 MY

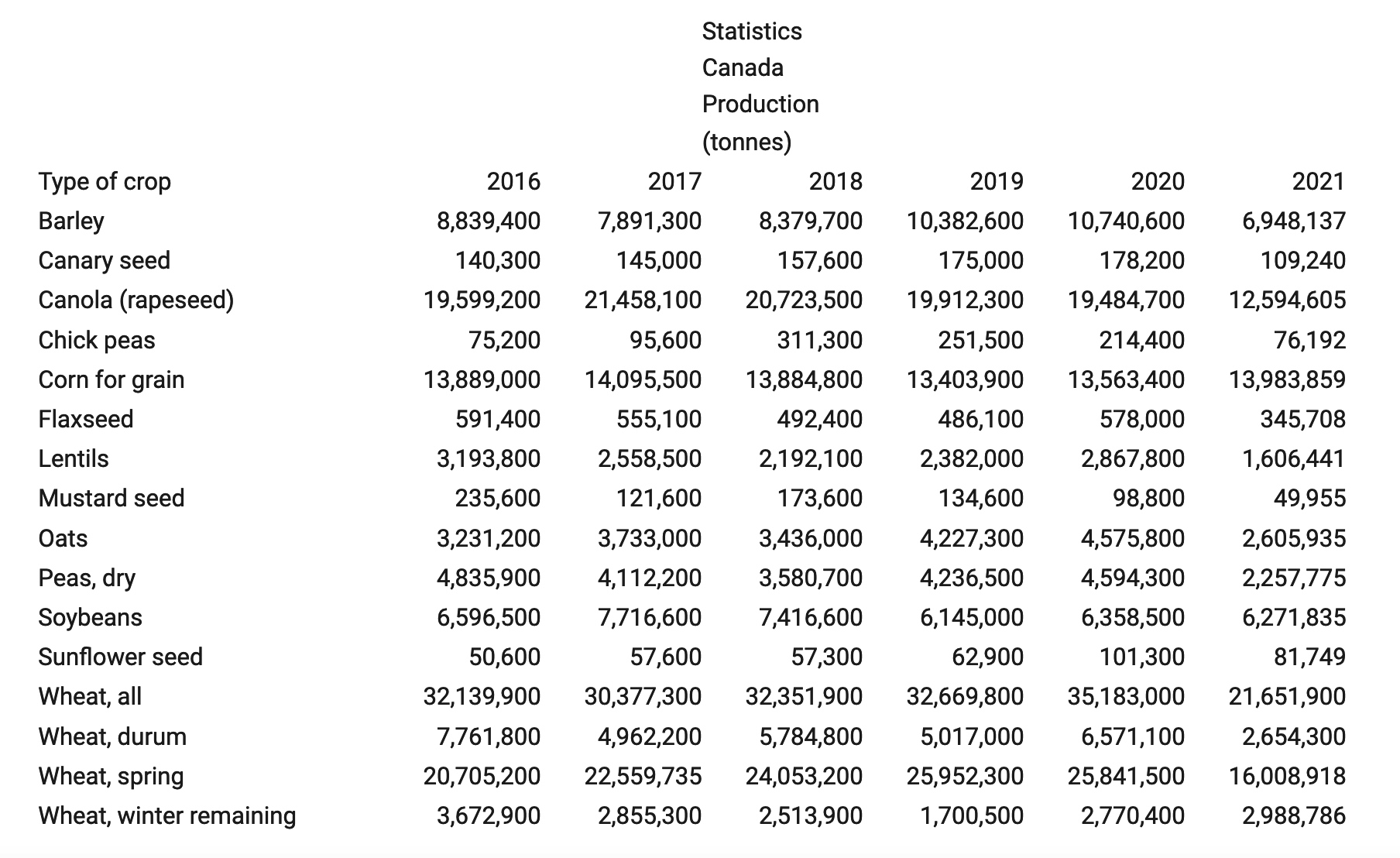

• Canada’s wheat crop estimate at 21.652 MT was slightly larger than the trade guess. The wheat market will be looking at the Saudi tender to see how it is priced. The U.S. has a chance for some of the new crop shipments, says industry analyst Richard Crow. The tender will be sold optional origin,” so it will be time to see where it comes from, May, June, July shipment.”

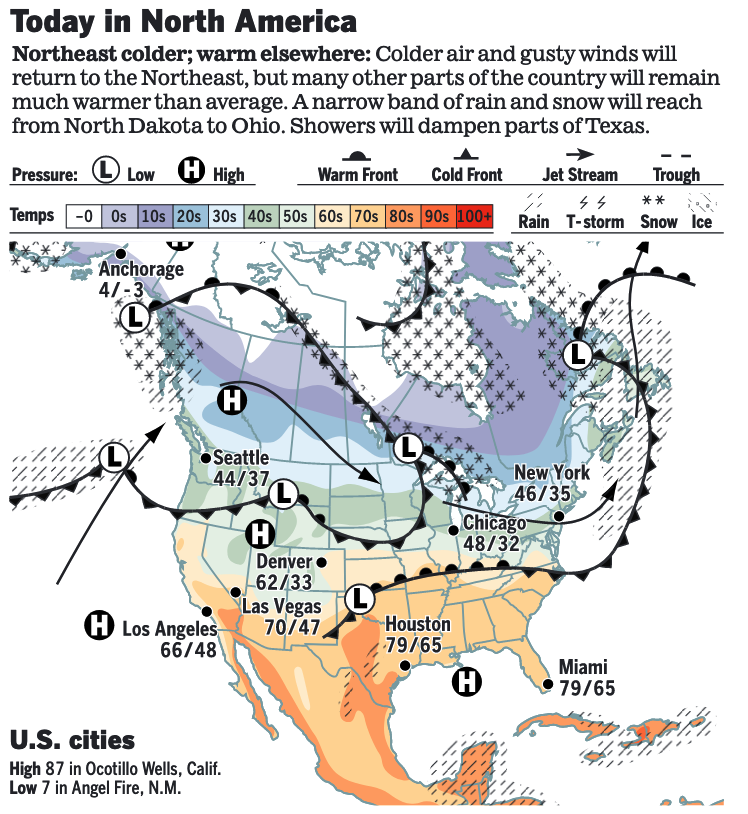

• It’s December… where’s the snow in Denver? Denver has never entered December without measurable snow since it started keeping records back when Chester A. Arthur was president. But there are blizzard warnings for Hawaii… could be up to a foot of snow and 100-mph wind gusts.

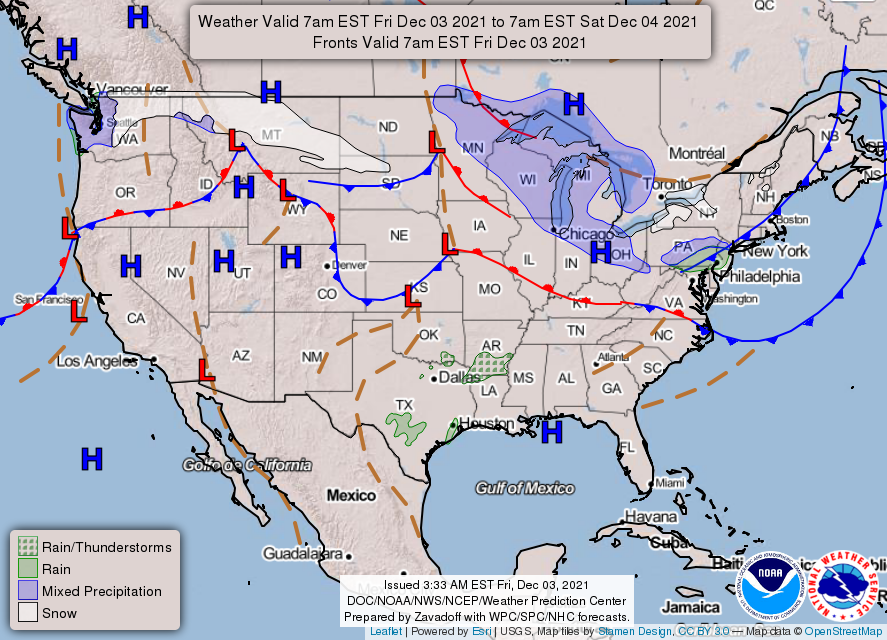

• NWS weather: Record breaking warmth continues from the Southeast to the Southern Plains today, with widespread above average temperatures lingering throughout much of the Nation this weekend... ...Heavy snow to impact portions of the Northern Plains and Upper Midwest beginning Saturday morning.

Items in Pro Farmer's First Thing Today include:

• Soybeans continued to push higher overnight

• Canadian crop production data out later this morning

• Workers at Canadian beef plant to vote on Cargill offer ahead of strike date

• Beef prices firm and movement was strong again

• Cash hog index up for a second day in a row

POLICY FOCUS

— No gov’t shutdown as both House and Senate clear stopgap spending measure through Feb. 18. Those predicting a shutdown in government were wrong again, as both chambers of Congress on Thursday relatively quickly approved a continuing resolution (CR) for fiscal year (FY) 2022, funding agencies and departments at FY 2021 levels. The House passed the CR by a vote of 221-212; Rep. Adam Kinzinger (R-Ill.) was the lone Republican to back the government funding bill in the House. The Senate cleared the measure 69-28, meaning 19 Republicans joined with all Democrats to avoid a shutdown. President Joe Biden will sign it into law before a deadline of midnight Friday. The Senate first voted 48-50 to reject an amendment from a group of Republican conservatives to bar funding to implement a new private sector vaccine mandate as well as requirements for federal employees, federal contractors, health care workers and the military. The stopgap bill will carry $7 billion in emergency funds for continued assistance to Afghan evacuees who fled that war-torn country after the Taliban takeover, including $4 billion in aid for those being sheltered at overseas U.S. military operations. Another $1.6 billion in new funding is designated to help care for unaccompanied children who crossed the border and are in U.S. custody.

Of note, the temporary funding measure would not waive statutory pay-as-you-go rules that could lead to deep spending cuts starting in January — including cutting farm subsidies and wiping out dozens of smaller programs. Republicans and Democrats couldn't agree on that in part because there's a chance Congress will have to deal with the pay-as-you-go issue again once the budget reconciliation bill (HR 5376) passes. Others say lawmakers expect to include the waiver in another bill before the end of the year. It can't be included in a reconciliation bill due to Senate budget rules, but another vehicle that's still available is the fiscal 2022 defense authorization measure (HR 4350, S 2792).

— Manchin is casting renewed skepticism re: BBB; Sinema predicts no BBB until after Christmas. Centrist Sen. Joe Manchin (D-W.Va.) is skeptical that the Build Back Better (BBB) bill can pass the Senate this year, potentially delivering a blow to the Senate Majority leader's push to get the bill approved by Christmas. Manchin still has several concerns, namely that budget gimmicks hide the true cost of the bill, and he's pushing to ensure it costs no more than $1.75 trillion. But he also is seeking to pare down the bill, which passed the House last month, in several other areas, including paid family leave, a methane fee on emissions from energy producers and a Medicare expansion to cover hearing costs.

Meanwhile, Sen. Kyrsten Sinema (D-Ariz.) has been telling colleagues she doesn’t believe the BBB will pass until after Christmas. Sinema avoided a question on BBB timing during a CNN interview on Thursday. The senator also wouldn’t commit to voting for the package.

— Schumer and McConnell float idea attaching debt-limit increase to compromise NDAA package. House and Senate leaders have been discussing trying to combine the annual defense policy bill (National Defense Authorization Act/NDAA) and the debt limit. Senate Majority Leader Chuck Schumer (D-N.Y.) and Minority Leader Mitch McConnell (R-Ky.) are considering it. That would allow the Senate to take up the issue before the Dec. 15 deadline mentioned by Treasury Secretary Janet Yellen. But House GOP leadership and some in the White House are not yet supportive of the possible linkage. Also, some Republicans who would otherwise support the NDAA would vote against the Pentagon policy bill if the debt-limit provision was included. “Let me assure everyone the government will not default, as it never has,” McConnell said Tuesday, without revealing how one would be avoided.

BIDEN ADMINISTRATION PERSONNEL

— Senate confirms Larry Turner as Labor Department watchdog. The Senate confirmed Larry Turner to head the Labor Department’s independent oversight office, a role he’s held on an acting basis since June 2020. Turner, confirmed by voice vote Thursday night, now has the Senate’s sanction as head of DOL’s Office of Inspector General, which audits the overall operations of the sprawling department, including its response to the Covid-19 pandemic. He became the department’s acting inspector general when Scott Dahl retired. Turner is a career official and has worked at DOL since 2014.

CHINA UPDATE

— Two Chinese developers sunk deeper into financial distress, with Kaisa Group failing to pull off a bond swap that would have bought it more time to repay creditors, and lenders calling in loans from China Aoyuan Group after credit downgrades. Kaisa, a Chinese property developer, warned there was “no guarantee” it would pay a $400 million bond due next week, adding to the woes of China’s debt-ridden property market. For years property giants have accrued debt to finance activities, a splurge that came to an end last year after regulators tightened borrowing criteria. Meanwhile, Didi quit the U.S. stock market just months after its huge IPO. The Chinese ride-hailing company, which went public in New York at a $69 billion valuation in June, said it would delist its U.S. shares and prepare for an offering in Hong Kong. The shift comes as Chinese officials rein in the country’s tech giants, with growing hostility toward companies that list shares abroad.

— China releases draft rules on herbicides for GM crops. China published draft rules outlining registration requirements for herbicides used on genetically modified crops, in another sign that Beijing is gearing up to allow greater use of GM technology in agriculture. The rules include guidelines on efficacy trials for herbicides used on herbicide-tolerant corn and soybeans, according to the statement on the Ministry of Agriculture and Rural Affairs' website. China currently does not permit planting of any GM varieties of major feed or food crops, though most of its cotton is genetically modified. Last month it drafted new rules that lay out requirements for integrating a GM trait into conventional seed varieties, which was seen by the industry as a major step towards greenlighting commercial production of GM corn. The rules on herbicides are open for comment until Dec. 31.

ENERGY & CLIMATE CHANGE

— Reports indicate RFS levels (again) coming soon. Multiple reports Thursday again raised the prospect of EPA releasing its proposed levels for the Renewable Fuel Standard (RFS) soon, with some suggesting it could come today. Reports quoted sources who said they were advised by lawmakers being briefed on the situation, but Bloomberg noted the timing was still potentially in flux as previous situations where the RFS levels were to be released “soon” did not materialize.

The Office of Management and Budget (OMB) review of proposed levels EPA forwarded August 26 has not yet been concluded. However, once that review is concluded, a quick announcement by EPA is certainly expected — OMB completed its review of the EPA plan to reinstate the pre-2015 definition of Waters of the U.S. (WOTUS) Nov. 17 with the agency announcing the effort November 18. EPA is behind on meeting deadlines for the RFS levels as they are to be finalized by Nov. 30 the year prior to taking effect. The Trump administration did not propose or finalize their 2021 RFS blending levels, with former EPA Administrator Andrew Wheeler recently saying that was due to the complications from the pandemic and court decisions.

The Biden administration has missed the deadline for finalizing the 2022 biofuel levels.

As for the eventual levels, Reuters reported in August that EPA was planning to propose reduced RFS levels for 2021 and 2022 and was going to retroactively reduce the 2020 levels. Their report said EPA would set 2021 RFS levels at 18.6 billion gallons of biofuel and reduce 2020 to 17.1 billion gallons, the latter reflecting the downturn in gasoline demand due to the pandemic.

As for 2022, the report indicated the agency would propose a mark of 20.8 billion gallons.

Comments: If the proposed marks eventually released by EPA are close to those levels, it raises questions about why it has taken the agency so long to act. EPA Administrator Michael Regan said in November that some will be “disappointed” in what the agency proposes, something which many interpreted as a signal to biofuel backers relative to reduced mandates. But those backers have been pressing the administration to hold to the campaign promises from President Joe Biden that they would support the biofuel industry. Some speculate that the administration may be trying to time the RFS announcement with announcement of other aid for the biofuel sector, including the promised $700 million in pandemic aid USDA has said since June was coming for the industry. And the administration could also tout the biofuel support included in the Build Back Better (BBB) package as another salve for the industry. But there are other decisions awaited that are important on the biofuel front, including decisions on small refinery exemptions (SREs) for 2019 and 2020, and the proposed plan from EPA on how it intends to set biofuel levels for 2023 and beyond without the levels mandated by the 2007 energy law. That plan has not yet been sent forward to OMB for their review. So even once the 2021 and 2022 RFS levels are announced, they will still need to be finalized and other decisions for the sector will still be pending.

Of note: Some are speculating that if the Biden administration wants to restore the 15-billion-gallon mandate for conventional, there is room to do so in the 20.8-billion-gallon mandate for 2022 by reducing the total advanced category which as leaked was at 6.7 billion. These market watchers suggest you could take 900 million out of that account and add it to the leaked 14.1 billion conventional whereby restoring the 14.1 to 15 billion.

— Virtual hearing today on EPA’s plans to extend RFS compliance deadlines. While the proposed levels for 2021 and 2022 under the Renewable Fuel Standard (RFS) are awaited, EPA today will hold a virtual hearing on its proposal to extend RFS compliance deadlines. The agency in November proposed to extend the RFS compliance reporting deadline and the associated attest engagement reporting deadline for the 2019 compliance year for small refineries only and to extend deadlines for all parties relative to the 2020 and 2021 compliance years. Plus, the agency has proposed tying future compliance and attest engagement reporting deadlines to when those levels are finalized for a given compliance year. Comments on EPA’s plan are due by Jan. 3.

— Vilsack lays out potential timeline for initial climate-smart agriculture pilots using CCC funds, says effort aimed at shaping next farm bill. USDA is currently reviewing some 378 comments filed by producers and others relative to its Climate-Smart Agriculture and Forestry (CSAF) initiative, with USDA Secretary Tom Vilsack telling those at a Foreign Policy (FP) Virtual Food+ Summit the agency plans to launch its efforts “in a very significant way in the first quarter of 2022” with the first grants coming potentially as soon as the second quarter of 2022.

In a release announcing the CSAF initiative, Vilsack indicated the effort “could” rely on the Commodity Credit Corporation (CCC) authority. Vilsack stated there were 45 practices that USDA knows are “climate smart,” which include cover crops. USDA is already incorporating climate into existing programs like working on climate-smart incentives for the crop insurance program relative to cover crops. But USDA is not planning on solely using CCC authority for this initiative, as Vilsack also pointed to the billions of dollars in funding for conservation efforts that is contained in the Build Back Better (BBB) package that has passed the House and is being worked on in the Senate. Vilsack said the efforts would also include focusing on reducing crop inputs like fertilizers as another way to cut greenhouse gas (GHG) emissions, boost water quality and improve farmers’ bottom lines. Part of that would rely on deploying more use of precision agriculture which allows farmers to tailor their use of crop inputs in particular.

— Vilsack comments on sensitive topic of carbon emissions and livestock production, offering emphasizing that a reduction in meat and dairy consumption are not part of the plan. “There’s going to be an increased need for protein,” he noted. “That’s protein of all kinds and sources.” But another point Vilsack emphasized is that the CSAF effort is being eyed at providing information via the pilot programs to lawmakers as they write the next farm bill. But it is not clear how much action related to climate issues will be incorporated into that legislation.

The current farm bill will expire during 2023 and already there are expectations the measure could be extended considering expectations that Republicans could be in the majority in the House and possibly the Senate after the 2022 elections. Those in the majority control the agenda for major legislation and a shift to Republican control is a factor behind expectations the 2018 Farm Bill could be extended.

Comments: Additional information on USDA’s plans will be key in assessing the potential impact the CSAF effort will have on production agriculture, including how broad the pilot efforts are, what crops or practices they cover and perhaps most important, the level of compensation farmers would receive for their participation.

— DOE invests in technologies aimed at cutting fossil fuel sector methane emissions. The Department of Energy (DOE) is investing $35 million across 12 projects focused on developing technologies to reduce methane emissions in the oil, gas, and coal industries. The investments are part of DOE’s Advanced Research Projects Agency–Energy (ARPA-E) Reducing Emissions of Methane Every Day of the Year (REMEDY) program, aimed at universities and private companies developing methane reducing technologies. The selected projects look to reduce methane emissions from engines, flares and mine shafts. Colorado State University, MAHLE Powertrain, the University of Michigan, and the Massachusetts Institute of Technology are among the funding recipients. Funding for REMEDY will be released in two stages spanning a total of three years, DOE said.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Kellogg’s workers strike deal to end two-month walkout. Kellogg’s has reached a tentative agreement with its 1,400 cereal plant workers that will deliver 3% raises and end a nearly two-month-long strike.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 264,304,501 with 5,237,087 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 48,832,268 with 785,912 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 464,445,580 doses administered, 197,838,728 have been fully vaccinated, or 60.27% of the U.S. population.

— It is still too early to tell whether Covid-19 caused by the new Omicron variant is milder or more severe than that from other strains of the coronavirus, doctors tracking a rapidly growing outbreak in South Africa said.

— Germany announced a nationwide lockdown for the unvaccinated yesterday as its leaders backed plans for mandatory vaccinations in the coming months.

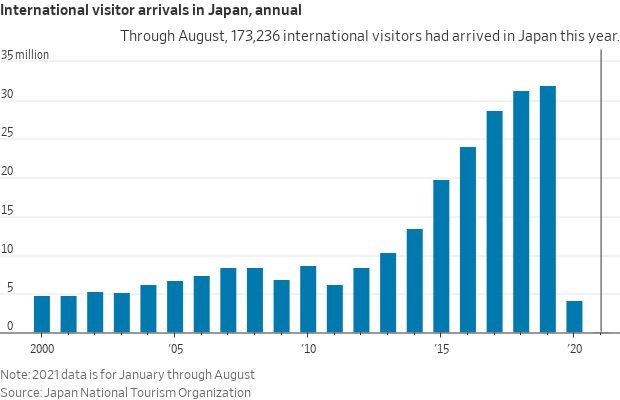

— Japan and Israel are now barring almost all foreign visitors. Countries across Europe and Asia have instituted new rules for international travelers — including additional testing and quarantine requirements. The new rules make trips harder to plan and more expensive if additional testing is required. Quarantine rules can make business travel, in particular, impractical.

— FDA prepares for speedy review of Omicron vaccines. The FDA is laying the groundwork for the rapid review of Omicron-targeted vaccines and drugs, meeting with makers and setting guidelines for the studies and data needed. Under the rules it is putting in place, development and testing a new vaccine would take about three months, a person familiar with the matter said, and an expedited FDA review process would yield a decision in one to two weeks.

— President Biden laid out a new 9-point pandemic strategy on Thursday as the U.S. confronts the new Omicron variant and the potential of a winter surge. The U.S. stopped short of imposing a mandatory seven-day quarantine on arrivals. Nor did it upgrade its standard for an acceptable Covid screen from an antigen to a P.C.R. test, which can take significantly longer to produce results. Some of the details:

- Shortened the time frame for travelers to the U.S. to take a Covid-19 test to within a day before departure, regardless of vaccination status. The new testing rules are expected to take effect next week.

- Free at-home coronavirus tests.

- Campaign for boosters for all adults and hundreds of vaccination sites aimed at families.

— Scientists studying Omicron in South Africa are seeing a rise in Covid-19 reinfections. The findings suggest previous infection provides less protection against the new variant than against earlier versions. An estimated 70% of South Africans have already had Covid-19, while only around a quarter of the country is vaccinated. Existing shots have fended off the worst of the disease caused by variants with some similar characteristics to Omicron, scientists say.

POLITICS & ELECTIONS

— Democratic pollster says party has “a national branding problem.” The New York Times reports (link) Terry McAuliffe’s (D) defeat in the Virginia governor’s race “alarmed” Democratic pollster Brian Stryker “and most every Democratic political professional.” McAuliffe’s loss “prompted a centrist group, Third Way, to have Stryker convene focus groups to examine why Governor-elect Glenn Youngkin won in a state that President Biden had carried by 10 points last year.” Stryker “drafted and posted a bluntly worded memo with his analysis from the focus groups, and that memo has circulated widely in his party.” Stryker told the NYT that Democrats have “a national branding problem that is probably deeper than a lot of people suspect. Our party thinks maybe some things we’re saying aren’t cutting through, but I think it’s much deeper than that. ... People think we’re more focused on social issues than the economy – and the economy is the No. 1 issue right now.”

OTHER ITEMS OF NOTE

— U.S. antitrust officials sued to block chipmaker Nvidia’s proposed $40 billion takeover of U.K.-based Arm, saying the deal would hobble innovation in semiconductors and undermine Nvidia’s rivals. The regulators said the acquisition from Japanese owner SoftBank would deliver Nvidia vast sway over the market by giving it control over chip designs used by the world’s biggest technology companies, including makers of smartphones. Meanwhile. Sportsman’s Warehouse and Great Outdoors, which owns Bass Pro Shops and Cabela’s, called off their retail merger after they said the commission hinted that it may not approve it.

The Nvidia-Arm suit is the first major merger challenge that has been filed by the FTC under Lina Khan, a prominent critic of corporate consolidation who was appointed chair by President Biden. The White House has asked regulatory agencies to investigate past mergers in several industries to see if deals have restricted choice or increased prices. This week, the F.T.C. sought information from Amazon, Procter & Gamble, Walmart and other large companies to investigate whether supply chain issues and higher prices are “harming competition in the U.S. economy.”

Bottom line: The lawsuit marks the beginning of what is likely to be an aggressive FTC antitrust campaign under Khan.

— White House competition focus on U.S. ag/food sector. Top officials from the White House’s National Economic Council provided a glance into the administration’s ongoing efforts to crack down on big firms dominating the agriculture sector. Biden’s top economic advisor, Brian Deese, and two members of his NEC team made clear on Thursday that the White House is gearing up to be much more vocal in its efforts to connect inflation and the rising prices of food and consumer goods to corporate consolidation. Meanwhile, Bharat Ramamurti, Deese’s deputy, responded to a question at an American Economic Liberties Project about small farmers being squeezed by both higher input costs and lower earnings from selling into a market dominated by a few firms. Ramamurti said rising prices for consumers aren’t a “simple story” of companies passing along price increases right now, but rather, “it’s them deciding that this moment allows them to charge the next person, whether it’s the consumer or the grocery store or whatever, more money because it means more profits for them… That’s a market structure problem in part,” Ramamurti said, adding that the White House plans to “promote more competition both by going at concentrations of power and by helping create the emergence of new competitors.”

Upshot: Deese said the White House team is focused on going after anticompetitive behavior in industries like agriculture, referencing Justice Department and USDA investigations into meat processing plants that recorded huge profits during the pandemic, as well as price fixing in the poultry sector. Most look for potential Dept. of Justice action.

— ITA publishes notifications on UAN investigation results. The International Trade Administration (ITA) has published in the Federal Register notices that countervailable subsidies on urea ammonium nitrate solutions (UAN) are being provided to producers and exporters from the Russian Federation (link) and the Republic of Trinidad and Tobago (link). The ITA also said that it was aligning the final determination in this countervailing duty (CVD) case with the final determination in a companion antidumping (AD) investigation of UAN from the two trading partners. The final CVD determinations will be issued on the same date as the AD determinations which currently is no later than April 11, 2022, unless it is postponed.

— FDA proposes water rule for produce growers. Fruit and vegetable growers would be required to conduct annual assessments of their water supplies to identify and mitigate threats of contamination for their crops under a rule proposed by the FDA on Thursday. The assessments would replace a requirement that growers conduct tests of water quality. The proposed rule, to be published in the Federal Register on Monday, calls for produce farms to make an annual assessment of water sources to identify contamination hazards and decide if corrective steps are needed. The produce and water safety rules are part of the FDA’s implementation of the 2011 Food Safety Modernization Act.