U.S. Consumer Prices Soared 7% in Past Year, Most Since 1982

USTR: USDA Sec. Vilsack misspoke on USTR Tai going to China

|

In Today’s Digital Newspaper |

Market Focus:

• Inflation hits four-decade high, consumer prices soar 7%

• Fed Chair Powell calls high inflation a ‘severe threat’ to a full economic recovery

• Fed is ready to raise rates: Powell

• Former N.Y. Fed Chief: Federal Reserve needs to get a lot more hawkish

• World Bank: global economic growth will slow to 4.1% in 2022, down from 5.5% last year

• World Economic Forum’s risk report shows pessimism about global prospects

• Buttigieg visits California ports which still show big backlog

• U.S. trucking will remain plagued with equipment and driver shortages this year

• 2021 in extreme weather

• USDA daily export sales:

— 132,000 MT soybeans to China during MY 2022-2023

— 100,000 MT of corn to unknown destinations during MY 2021-2022

• Ag demand update

• Quiet trade overnight ahead of USDA’s reports

• Barrage of January crop reports out later this morning

• Cash cattle trade starts at lower prices

• February hogs’ premium to cash almost gone

Policy Focus:

• Hoyer signals White House wants emergency spending bill to combat Covid-19

• Farm Bureau votes for boost in reference prices

Afghanistan:

• Roughly 18,000 Afghan refugees remain on U.S. bases months after withdrawal

China Update:

• USTR office corrects Vilsack by saying no travel plans by USTR Tai to China

• China lowers corn consumption forecast

• FAS official predicts China Phase 1 shortfall at $5 billion-$6 billion for ag products

• China’s latest Covid lockdowns are again affecting global supply chains

• China’s producer, consumer inflation rises at slower rates in December

• China had record bank loans in 2021

Trade Policy:

• U.S. Chamber criticizes U.S. for ‘standing still’ on trade deals

Energy & Climate Change:

• House Ag panel to look at EV impacts to ag, rural areas

• Air France adds charge for sustainable aviation fuel

• ADM proposes carbon dioxide pipeline, third in Iowa

• Carbon offset market’s volatility

Coronavirus Update:

• Québec will impose additional tax on unvaccinated residents

• CDC weighing recommending Americans wear high-quality N95 or KN95 face masks

• About 3,000 employees with United Airlines have tested positive for Covid-19

Politics & Elections:

• McConnell will run for another term as leader

• Democrat Sheila Cherfilus-McCormick wins special election in Florida's 20th District

• Biden challenged senators Tuesday to ‘stand against voter suppression’

• Rep. Budd wants Biden tp explain how many convicted felons got virus stimulus checks

Congress:

• Sen. Manchin: scrapping filibuster won’t make Senate ‘better’ in new Biden blow

• House, Senate panels to review WRDA

Other Items of Note:

• Russia-NATO talks

• EPA approves Enlist Duo herbicides through 2029 with conditions

|

MARKET FOCUS |

Equities today: Global stock markets were mostly higher overnight. U.S. Dow opened up just over 100 points higher; other indexes opened higher. Asian equities registered gains following the US rise after testimony by Fed Chair Jerome Powell. The Nikkei gained 543.18 points, 1.92%, at 28,765.66. The Hang Seng Index rose 663.11 points, 2.79%, at 24,402.17. European equities were registering modest gains in early trading, with the Stoxx 600 up 0.4% and regional markets up 0.05% to 0.6%.

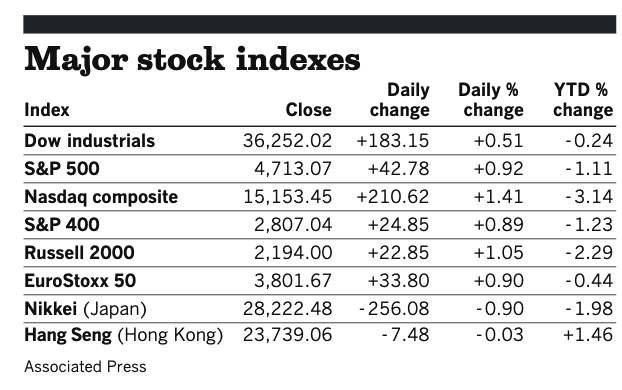

U.S. equities yesterday: The Dow rose 183/15 points, 0.51%, at 36,252.02. The Nasdaq gained 210.62 points, 1.41%, at 15,153.45. The S&P 500 was up 47.78 points, 0.92%, at 4,713.07.

On tap today:

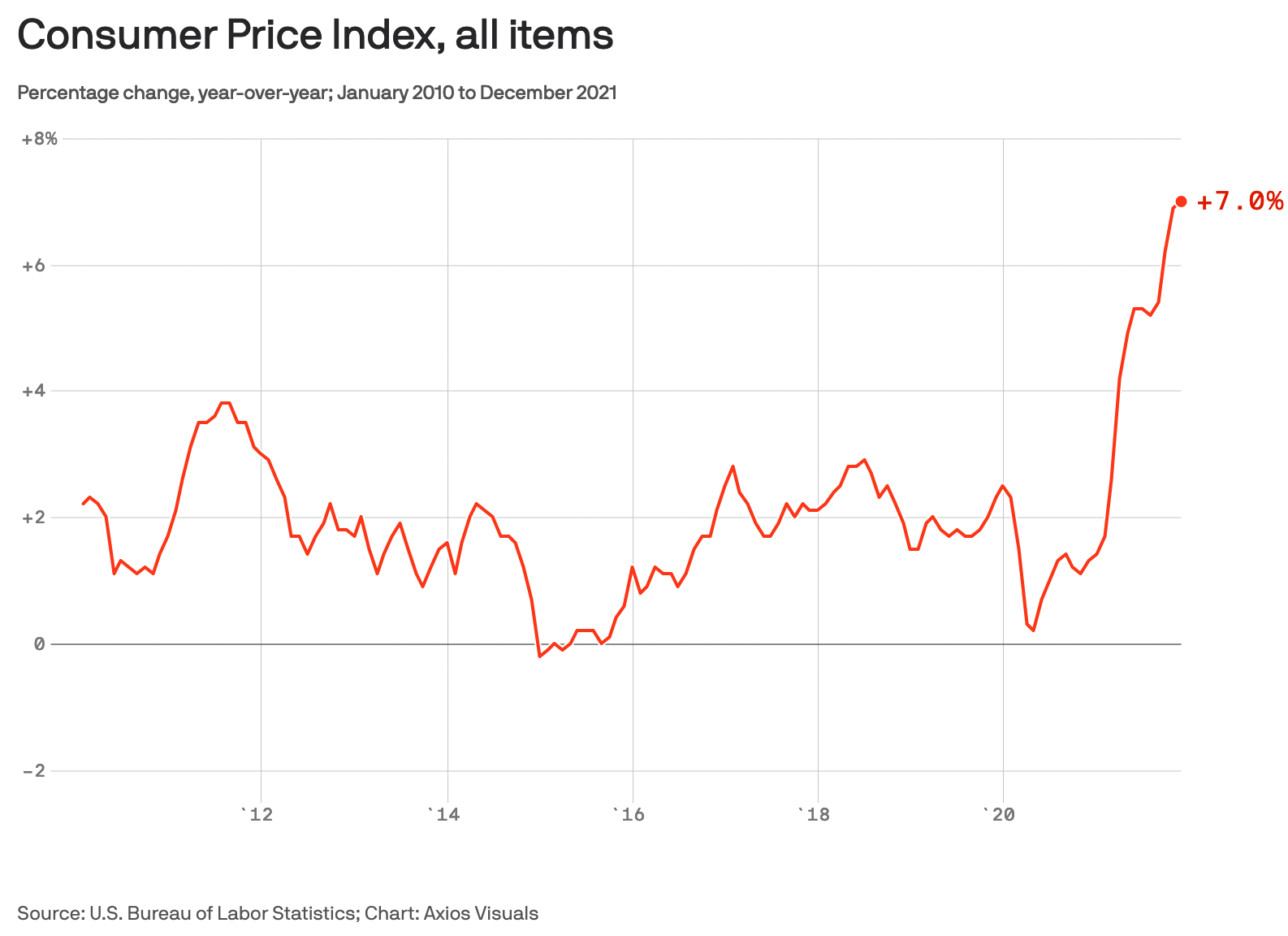

• U.S. consumer-price index for December is expected to rise 0.4% from one month earlier and 7% from one year earlier. Excluding food and energy, the CPI is forecast to increase 0.5% and 5.4%. (8:30 a.m. ET) UPDATE: The CPI came in near expectations with inflation at nearly a 40-year high. Inflation at the consumer level as measured by the Consumer Price Index (CPI) rose 0.5% in December from November, posting an annual increase of 7.0%, just behind expectations for a rise of 7.1%. The core inflation rate rose 0.6% in December from November, with a 5.5% increase on an annualized basis. Both were just above expectations for a monthly change of 0.5% and an annualized rate of 5.4%. But the data did not spook financial markets as stock index futures moved higher following the data. “Increases in the indexes for shelter and for used cars and trucks were the largest contributors to the seasonally adjusted all items increase,” the BLS said in a release. The latest surge marked the highest annual increase since June 1982. Inflation has exceeded 6% for three consecutive months.

• Energy forum: American Petroleum Institute and Energy Citizens will host the 13th annual 2022 “State of Energy” forum, 10 a.m. ET.

• U.S. federal budget deficit is expected to narrow to $15 billion in December from $144 billion one year earlier. (2 p.m. ET)

• Federal Reserve speakers: Cleveland’s Loretta Mester on the economy and monetary policy at a WSJ CFO Network event at 11:10 a.m., and Minneapolis’s Neel Kashkari at a St. Paul Area Chamber virtual town hall at 1 p.m. ET.

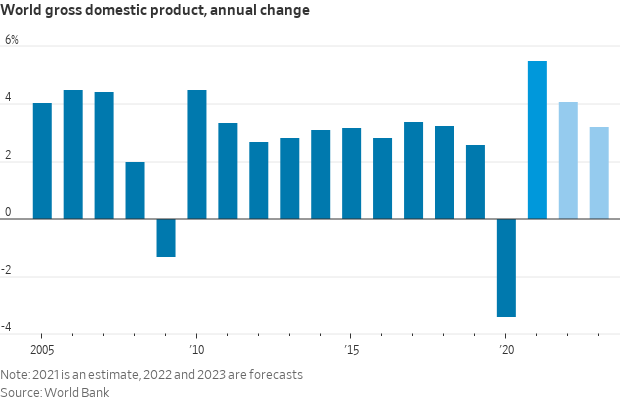

World Bank warns pandemic will slow economic growth in 2022. Global growth is expected to slow to 4.1% this year, from 5.5% in 2021, according to the World Bank. It is expected to drop further, to 3.2% in 2023. Output is expected to be weaker, and inflation is likely to be hotter than previously thought. “The Covid-19 crisis wiped out years of progress in poverty reduction,” David Malpass, the World Bank president, wrote in an introduction to the report. “As government’s fiscal space has narrowed, many households in developing countries have suffered severe employment and earning losses — with women, the unskilled and informal workers hit the hardest.”

Meanwhile, the World Economic Forum’s annual risk report showed a significant increase in pessimism about global prospects, with executives and leaders worried about the longer-term fallout from the pandemic.

Fed Chairman Powell tries to convince lawmakers central bank can walk a decision tightrope. Chair Jerome Powell sought to reassure lawmakers and investors on Tuesday that the central bank can pull off the tricky task of bringing down four-decade high inflation without damaging the U.S. economy.

Powell sought to explain to lawmakers how the central bank got caught off guard by the current bout of historic inflation. During his confirmation hearing, Powell blamed the Fed’s inflation call on two central issues: lingering supply chain problems and a slow return of workers to the jobs market. “We and other forecasters, we believed based on our analysis and discussions with people in industry that the supply side issues would be alleviated more quickly than now appears to be the case,” Powell said. “Substantially more quickly.” He added that officials expected a “much more significant return to the workforce than has turned out to be the case… While that is not what is causing current inflation,” Powell said, “labor supply can be an issue going forward for inflation, probably more than the supply side issues.” Powell said supply side challenges have been “more persistent and more substantial” than expected.

Looking ahead, Powell said his expectation is there will be “some relief” on the supply front this year and global supply chains “will loosen up.” If that doesn’t happen and inflation proves to be “even more persistent and higher,” Powell said that would increase the risk of it “becoming entrenched in the psychology” of businesses and households. “That would indicate that we would respond,” he added.

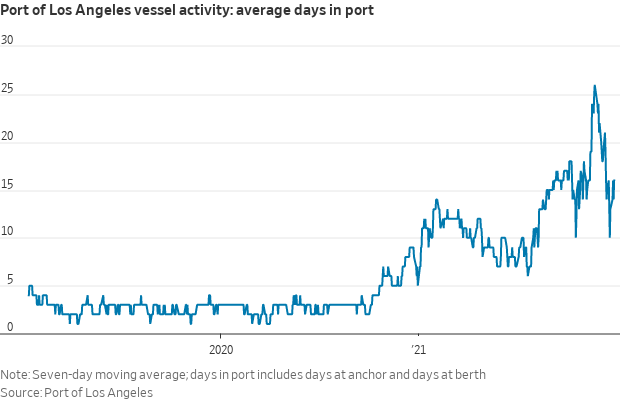

He defended his since-abandoned call that inflation would be “transitory,” pointing out that the Fed had little experience dealing with a pandemic shock followed by a rapid reopening. “The supply side constraints have been very persistent and very durable. We’re not seeing a lot of progress,” Powell said, pointing to very elevated levels of ships at anchor outside the busiest U.S. ports. Yet the Fed chief expressed confidence that eventually the central bank will achieve price stability, especially as interest rates rise.

Bottom line: Powell didn't reveal any new surprises. He emphasized the Fed's ability and willingness to act to counter high inflation ("If we see inflation persisting at high levels longer than expected, if we have to raise interest rates more over time, then we will") while arguing that the strength of the U.S. economy justified the same tightening ("It is really time for us to move away from those emergency pandemic settings to a more normal level").

Former N.Y. Fed Chief: The Federal Reserve needs to get a lot more hawkish. "As the economic recovery pushes unemployment unsustainably low — something that may already have happened — wage growth will spill into consumer price inflation. The Fed will have to respond by taking interest rates above neutral well before the end of 2024. How high might rates go? If inflation is running above the Fed’s 2% target, they must adjust both to compensate for higher inflation and to achieve tight monetary policy. So, if inflation subsides to 2.5% to 3% as supply chain issues dissipate, then a federal funds rate peak in the 3%-to-4% range seems reasonable," former New York Fed President Bill Dudley writes at Bloomberg Opinion (link).

Buttigieg visits California ports which still show big backlog. Transportation Secretary Pete Buttigieg visited the ports of Los Angeles and Long Beach yesterday, where he met with local officials and lawmakers about the supply chain and talked up the spending the state will be able to apply for from the recently enacted infrastructure law. “When there is an issue affecting ports here, you will feel it as far away as my Indiana hometown,” Buttigieg said, while touting port progress but warning that “as long as the pandemic persists, as long as we are making up for decades of past disinvestment, we are going to see impacts on shipping times and shipping costs.”

The Covid-19 Omicron variant is hampering efforts to clear a backlog of about 100 container ships at the U.S.’ busiest port complex as infections rise among Southern California dockworkers. About 800 dockworkers — roughly 1 in 10 of the daily workforce at the ports of Los Angeles and Long Beach — were unavailable for Covid-related reasons as of Monday, according to the Pacific Maritime Association. Absentees included workers who tested positive for the virus, were quarantining or awaiting test results, or who felt unwell.

A fresh surge of cargo from Chinese manufacturers is expected to flood U.S. ports before Chinese businesses close up to celebrate the Year of the Tiger starting Feb 1. The wave of cargo ships carrying goods to U.S. consumers is expected to reach California in the next two or three weeks, port officials said.

The supply-chain crisis is not over, Gene Seroka, executive director of the Port of Los Angeles, said while touring the Long Beach port with Buttigieg. “No one is taking a victory lap,” he said in an interview with the Los Angeles Times. “No one is high-fiving each other.”

A key hurdle: Officials have been unable to get the Los Angeles port to operate around-the-clock, as planned and announced in October under a Biden administration strategy to address the supply-chain crisis ahead of the holiday period. Seroka said the effort has been hampered because most elements of the supply chain — including warehouse operators and truck drivers — don’t operate 24 hours a day, making it difficult to accept cargo at the ports in the middle of the night when workers aren’t available to receive the products. Making matters worse, he said, is a shortage of truck drivers and warehouse workers since the start of the Covid-19 pandemic. “It’s the private sector that needs to drive this,” he said.

Officials at the ports started Nov. 15 to impose a fee on containers that sit around for more than six days if intended for rail transport or nine days if intended for trucks. The ocean carrier companies that brought in those idling containers face fines of $100 on the first day past deadline, $200 on the next and so on. Since Nov. 1, the number of idled cargo containers clogging the Port of Long Beach has been reduced by more than 40%, said Mario Cordero, executive director of the port. No fines have yet to be collected because the threat is working, he said. Seroka said the mere threat of fines has already reduced the number of cargo containers at the Port of Los Angeles by 60% since Oct. 24.

Lawmakers push BBB. Democratic California lawmakers at the port press conference used the event to push for the Senate to pass Democrats’ stalled social spending and tax bill through reconciliation (Build Back Better). Rep. Alan Lowenthal (D-Calif.), who serves on the House Transportation and Infrastructure Committee, said that the Senate “must pass” the legislation, which he says will “expand capacity and critically aid in our transition to zero emission operations” by giving additional money to ports.

— U.S. trucking will remain plagued with equipment and driver shortages this year, and while freight growth is slowing from last year’s pace, it “is leveling off at a very high level, and in some sectors it can continue to grow,” said Bob Costello, chief economist for the American Trucking Associations. The industry is short about 80,000 drivers even as pay has jumped, and truckmakers can’t keep up with demand, he said in an interview with Bloomberg. “Supply remains challenged this year in the trucking industry, even if we do add some more drivers.” Meanwhile, spot freight rates — which rose 29% last year, according to KeyBanc Capital Markets — will likely remain elevated.

Market perspectives:

• Outside markets: The U.S. dollar index was nearly unchanged ahead of U.S. inflation data (see related item above) with several foreign rival currencies weaker against the greenback. The yield on the 10-year U.S. Treasury note was basically steady awaiting U.S. economic data, trading around 1.74% with a weaker tone in global government bond yields. Gold and silver futures were little changed ahead of U.S. CPI data, with gold around $1,818 per troy ounce and silver around $22.80 per troy ounce.

• Crude oil futures have maintained modest gains ahead of U.S. gov’t inventory data due later this morning with U.S. crude around $81.50 per barrel and Brent around $83.90 per barrel. Crude was higher in Asian action, with U.S. crude up 29 cents at $81.51 per barrel and Brent up 19 cents at $83.91 per barrel.

• USDA daily export sales:

— 132,000 MT soybeans to China during MY 2022-2023

— 100,000 MT of corn to unknown destinations during MY 2021-2022

• Ag demand: Japan is seeking 80,000 MT of feed wheat and 100,000 MT of feed barley. Iran tendered to buy a nominal 60,000 MT of milling wheat from unspecified origins.

• 2021 in extreme weather. The U.S. suffered 20-billion-dollar extreme weather events that killed 688 people last year, according to a report released by NOAA’s National Centers for Environmental Information. Those events, which include California’s Dixie Fire, Hurricane Ida, and the winter storm in Texas, drove damages to $145 billion, or the third-highest cost on record. Hurricane Ida topped the list as the costliest event at $75 billion, and the Texas storm was the costliest winter storm on record.

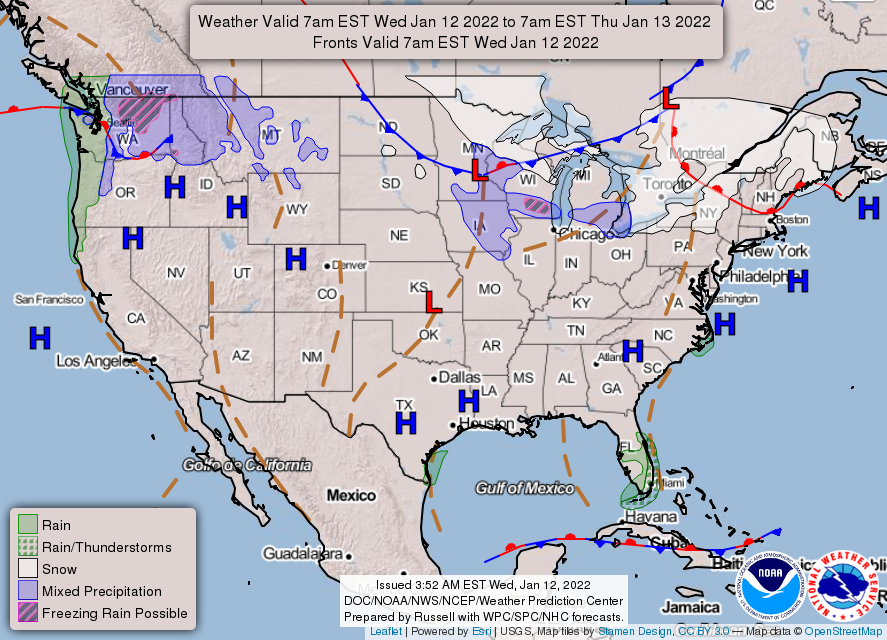

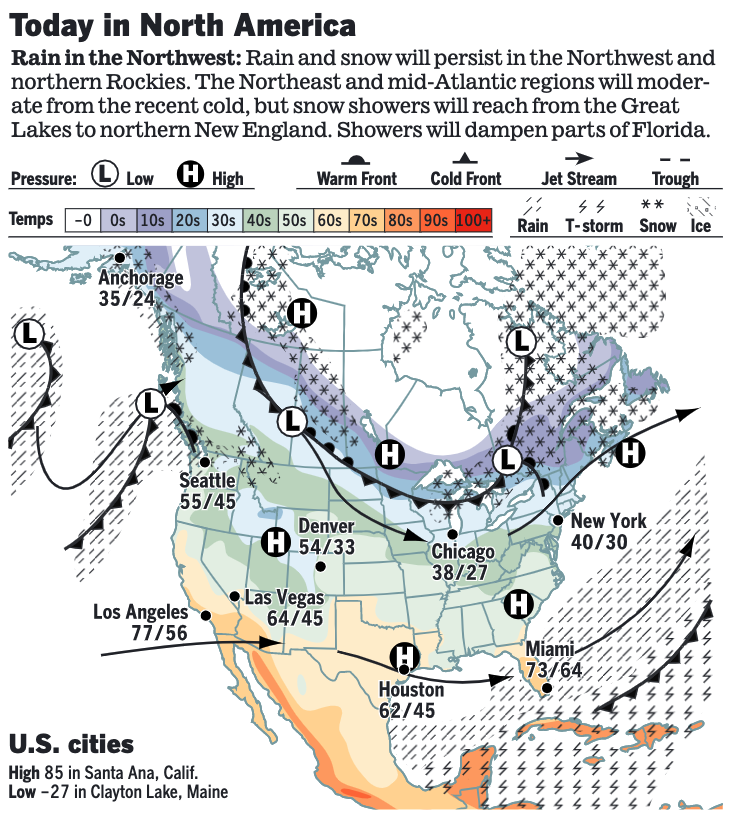

• NWS weather: Moderate to heavy rain continues across parts of western Washington today... ...Canadian storm system to bring accumulating snowfall to the Northern Plains Thursday night into Friday.

Items in Pro Farmer's First Thing Today include:

• Quiet trade overnight ahead of USDA’s reports

• Barrage of January crop reports out later this morning

• Cash cattle trade starts at lower prices

• February hogs’ premium to cash almost gone

|

POLICY FOCUS |

— Hoyer signals White House wants emergency spending bill to combat Covid-19. House Majority Leader Steny Hoyer (D-Md.) on Tuesday said “The administration is talking about a supplemental appropriation, which I think would be an emergency legislation… I expect there to be additional sums, substantial additional sums will be requested, to deal with and confront and try to contend with the coronavirus.” Hoyer added he thinks the funds should be directed toward making Covid tests free for all Americans and expanding vaccine access for poorer countries. This supplemental would likely be tied to or come around the same time as the fiscal year 2022 gov’t funding bill, which runs out Feb. 18. It could come as part of a bigger spending deal, in which Pentagon funding is also boosted on one side and there’s additional emergency Covid funding on the other.

— Farm Bureau votes for boost in reference prices. The full voting membership adopted a report of the Resolutions Committee calling for a reference price increase for all Title I commodities, increased commodity loan rates and inflation-adjusted farm program payment limits. Farm Bureau President Zippy Duvall said that the final decisions on these policies would be made by the Farm Bureau board.

The delegates debated whether to support the proposal by some senators to require a set percentage of cash sales. Duvall said the Farm Bureau board would decide its position on the Grassley-Fischer bill after comparing it to the Farm Bureau positions. The delegates adopted a resolution that said Farm Bureau supports the rights of producers and packers to enter into formula pricing, grid pricing and other marketing arrangements and contract relationships with a goal of “increasing the share of negotiated sales in fed cattle markets with a central focus on providing price transparency.”

MCOOL amendment nixed. The South Dakota Farm Bureau proposed an amendment to favor mandatory country of origin (MCOOL) labeling for beef, but it was rejected along with a secondary amendment that would have said mandatory country of origin labeling should comply with World Trade Organization rules.

|

AFGHANISTAN |

— Roughly 18,000 Afghan refugees remain on U.S. bases months after withdrawal. Five U.S. military bases are housing the roughly 18,000 Afghan refugees that have yet to be resettled within the United States, a Department of Homeland Security spokesperson told the Washington Examiner Tuesday. The refugees who are still on bases are being housed at Joint Base McGuire-Dix-Lakehurst, Fort McCoy, Fort Pickett, Camp Atterbury, and Holloman Air Force Base. While there are approximately 18,000 refugees still on bases, roughly 57,000 have already resettled into various communities across the country.

|

CHINA UPDATE |

— USTR office corrects Vilsack by saying no travel plans by USTR Tai to China. The U.S. Trade Rep’s office emailed: “Ambassador Katherine Tai is not going to China and the Phase 1 did not expire.” The Phase 1 deal, which covers a range of commitments, does not expire. The minimum purchase commitments, which are just one aspect of the agreement, only covered two years, 2020 and 2021.

— China lowers corn consumption forecast. China’s ag ministry lowered its forecast for 2021-22 corn consumption amid slowing demand from both the feed sector and industrial users. The country’s 2021-22 corn consumption is now forecast at 287.7 MMT, down 3 MMT from last month, but that would still be up 5.5 MMT from 2020-21. It continues to call for corn imports of 20 MMT in the current marketing year, down 9.56 MMT from 2020-21. China’s ag ministry made no changes to the soybean balance sheet this month. It forecasts soybean imports will reached 102 MMT in 2021-22, up 2.22 MMT from the previous marketing year.

— FAS official predicts China Phase 1 shortfall at $5 billion-$6 billion for agricultural products. U.S. agricultural exports to China currently stand at around $30 billion based on data through the first 11 months of 2021, and Foreign Agricultural Service (FAS) Administrator Dan Whitely predicted that shipments to China of agricultural goods in December should be $5 billion to $6 billion, bringing the 2021 total to $36 billion. In remarks at the American Farm Bureau Federation (AFBF) meeting, Whitely said that would mark a new record for U.S. agricultural exports to China, but one that could be even higher if China were to remove barriers to trade.

Whitley said he expects China will end up being around $5 billion to $6 billion shy of their Phase 1 purchase commitments. That is a narrower figure than one suggested by USDA Secretary Tom Vilsack earlier this week in his AFBF remarks when he said it appeared China was about $16 billion “light” on their purchases relative to the Phase 1 commitments.

Whitely also said USDA and the Office of the U.S. Trade Representative (USTR) were looking at the tariff exclusion process as the initial round of exclusions “left off a lot” of agricultural products, including inputs.

Another factor ahead could be additional Section 301 trade actions to address unfair activities by China. He acknowledged there is a fear in agriculture that the sector could be targeted further if the U.S. were to levy more trade actions against China.

Whitely played up the Biden administration’s goals of an economic framework with countries in the Indo-Pacific region, but he also made clear that rejoining what was the Trans-Pacific Partnership (TPP) trade deal was not in the cards, in part because the trade deal has “taken on a different shape” since the U.S. exited early in the Trump administration. Even if the U.S. sought reentry, shifting dynamics of the deal might mean the U.S, would have to “accept some things you wouldn't want to accept,” he cautioned.

— China’s latest Covid lockdowns are again affecting global supply chains. Samsung, Volkswagen, Nike, and Adidas are among the companies already facing production issues after Chinese authorities imposed severe restrictions on three cities. HSBC economists caution that if the highly infectious Omicron variant spreads across Asia, especially China, then disruption to manufacturing will be inevitable. “Temporary, one would hope, but hugely disruptive all the same” in the next few months, they wrote in a research note this week.

— China’s producer, consumer inflation rises at slower rates in December. China’s producer price index (PPI) climbed 10.3% from a year earlier in December, slower than the 12.9% jump in November and less than economists expected. Factory-gate prices rose more slowly than expected in December after government measures to contain high raw material prices. China's consumer price index (CPI) grew 1.5% versus year-ago in December, down from a 2.3% rise in November and below expectations. Food prices fell 1.2%, the second drop in three months, after a 1.6% gain in November as pork prices plunged 36.7% from year-earlier levels.

— China had record bank loans in 2021. Chinese banks extended 1.13 trillion yuan ($178 billion) in new loans in December, down from 1.27 trillion yuan in November. Despite new loans falling more than expected last month, lending in 2021 set a record at 19.95 trillion yuan (313 billion) for the year, up 1.6% from 2020, as the central bank ramped up policy support to cushion the slowing economy. China’s central bank cut reserve requirement ratios (RRR) twice in 2021 and lowered the rates on its relending facility by 25 basis points to support the rural sector and small firms. Most analysts expect further cuts to RRR this year, with some also penciling in modest cuts in policy rates if economic activity continues to slow.

|

TRADE POLICY |

— U.S. Chamber criticizes U.S. for ‘standing still’ on trade deals. U.S. Chamber of Commerce CEO Suzanne Clark said Tuesday (Jan. 11) that the U.S. has not entered into an agreement with a new partner in a decade and that is hurting businesses. Speaking at the State of American Business 2022, Clark said the Biden administration has done little to change that and “has yet to embrace even relatively uncontroversial initiatives such as a trade agreement with the U.K., our closest ally.”

She added, “But Europe is charging ahead. The EU has 46 trade agreements with 78 countries. The U.S. has just 14 trade agreements with 20 countries — and the trend for our tariffs has been up, not down.”

China aggressive in trade policy arena. A China-led trade pact, the Regional Comprehensive Economic Partnership, which covers all of East Asia, came into force on Jan. 1 and means better access to the world’s fastest growing markets from Korea and Japan to Indonesia and Vietnam.

Clark also had strong words for the Biden administration’s aggressive stance against mergers and acquisitions, along with other overreach when it comes to regulation. “If bureaucrats and elected officials don’t stop getting in the way, we will stop them. We will challenge overreach and defend the rule of law at every turn, in every agency, with every tool at our disposal ... in Washington, in statehouses, and in the courts,” she said.

|

ENERGY & CLIMATE CHANGE |

— House Ag panel to look at EV impacts to ag, rural areas. The House Agriculture Committee is holding a hearing today on the implications of electric vehicle spending for rural areas and the agriculture sector. David Strickland, vice president of global regulatory affairs at General Motors, and Trevor Walter, vice president of petroleum supply management at Sheetz, are among the witnesses before the panel. “Fuel retailers already have the real estate that customers visit when they refuel,” Walter, testifying on behalf of National Association of Convenience Stores, said in written testimony. “Until consumers see alternatives like electricity at the outlets where they currently refuel, they will not adopt those alternatives in large numbers.”

— Air France adds charge for sustainable aviation fuel. The Franco-Dutch company said it will add to tickets a surcharge of up to 12 euros, or $13.50, in order to help pay for the use of pricey sustainable aviation fuel (SAF). “In the absence of industrial production, the cost of using sustainable aviation fuels is four to eight times higher than that of fossil fuels,” Air France-KLM said in a statement yesterday.

Background. Airlines see sustainable aviation fuel, made from things like cooking oil and waste products, as the most immediately workable emissions-reduction strategy for the industry because it has demonstrated up to an 80% reduction in carbon dioxide emissions as compared to conventional jet fuel. “We're not going to be able to fly big airplanes long distances on batteries, or even hydrogen, anytime in the foreseeable future,” United Airlines CEO Scott Kirby said in December. United, through its Eco-Skies Alliance, is working with other corporate partners to collectively buy 7.1 million gallons of SAF this year. British Airways also signed an agreement with Phillips 66 to purchase SAF refined in the U.K. For Air France-KLM, SAF will constitute between 0.5% to 1% of total fuel used this year. It aims to make SAF 5% of total fuel in 2030 and 63% by 2050.

— ADM proposes carbon dioxide pipeline, third in Iowa. ADM said on Jan. 11 it would reduce its carbon footprint by building a 350-mile pipeline to transport carbon dioxide for injection in central Illinois from its ethanol plants in eastern Iowa. It was the third carbon dioxide pipeline proposed for Iowa, the No. 1 corn and ethanol producing state. The ADM pipeline would be owned and operated by Wolf Carbon Solutions, a carbon capture and pipeline company based in Calgary. Pipelines would need approval from the Iowa Utilities Board to proceed, said the Cedar Rapids Gazette (link).

— Carbon offset market’s volatility. BloombergNEF estimates that carbon offset prices could reach as high as $120 or as low as $47 per ton in 2050 depending on how restrictive an offset product the market allows. The fates of offsets that avoid emissions that would otherwise occur, versus those that remove carbon from the atmosphere and store or sequester it, will be the determining factors. “Should all types of offsets continue to be permitted, including those which avoid emissions that would otherwise occur, the market will be oversupplied with largely worthless credits, thereby driving down prices and attracting criticism around quality,” researchers with BloombergNEF said in a blog post. “Conversely, if the market is restricted to just offsets that remove, store or sequester carbon, there will be insufficient supply to keep up with demand, causing significant near-term price hikes and damaging liquidity,” the post added.

Companies that want to go green but need more time or new technology to reduce their own emissions can buy carbon offsets, which prevent or reduce emissions somewhere else. The price to offset a ton of emissions varies depending on the project, according to research from BloombergNEF. The most expensive are backed by carbon-capture-and-storage technology and nature-based projects such as tree-planting, which commanded about $14 a ton and nearly $6 a ton, respectively, in 2020. By 2030, carbon offsets could hit $215 per ton, BloombergNEF found. But longer term, they might fall to as low as $47.

Prices will depend largely on whether offset quality improves as standards are developed. Without stricter criteria, the market could be oversupplied with largely worthless credits that drive down prices and attract criticism, setting the whole system up for failure, BloombergNEF analysts warned. “While such low prices are a desirable outcome for corporations looking to use offsets as a ‘get out of jail free’ card, they offer developers, banks and brokers little financial incentive to support the market,” the report said.

Climate advocates want offsets to be supported by projects that actually remove emissions from the atmosphere as opposed to simply avoiding emissions. Reforestation, for example, would be acceptable. Preserving an existing forest, less so. In the current market, some 80% of existing offsets are built on avoiding emissions through clean energy projects or forest protections, BloombergNEF found.

If done correctly, the carbon offset market could be valued at more than $550 billion by 2050, said Kyle Harrison, head of sustainability research at BloombergNEF. “Suppliers, buyers of offsets, traders and investors will need to balance what is idealistic and what is realistic,” he said. “Otherwise, they risk the offset market burning out just as it’s getting started.”

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 313,676,517 with 5,506,497 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 62,313,787 with 842,322 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 521,156,804 doses administered, 297,954,605 have been fully vaccinated, or 63.35% of the U.S. population.

— Québec will impose an additional tax on unvaccinated residents. Although relatively small in number — around 13% of the eligible population in the Canadian province — they make up nearly half the cases in hospitals. Quebec Premier Francois Legault said Tuesday the tax is necessary because the unvaccinated are taking up roughly half of the acute-care beds in provincial hospitals and have become a drain on the healthcare system,

— The CDC is weighing new guidelines recommending Americans wear high-quality N95 or KN95 face masks; some Biden administration officials are pushing to make them more available to the public.

— About 3,000 employees with United Airlines have tested positive for Covid-19, but no vaccinated staffer has died from the disease over the past eight weeks, the company’s top executive said. United, the first major airline to implement a Covid-19 vaccine requirement, was reporting about one Covid-19 death per week among staffers prior to the mandate’s implementation, said Scott Kirby, chief executive of United. He said the company’s vaccine mandate has likely saved the lives of eight to 10 employees.

|

POLITICS & ELECTIONS |

— McConnell will run for another term as leader. Senate Minority Leader Mitch McConnell (R-Ky.) on Tuesday said he will run for another term as the chamber’s top GOP leader at the end of the year. “I’m going to be running again for leader later this year,” he told reporters when asked how long he plans to hold onto his job. McConnell has come under criticism from former President Trump over the past year after blaming Trump for inciting the Jan. 6 attack on the U.S. Capitol.

— Democrat Sheila Cherfilus-McCormick won the special election in Florida's 20th Congressional District on Tuesday to succeed the late Democrat Rep. Alcee Hastings, who died last year after a battle with cancer.

— Biden calls on senators to pass voting rights bill and backs filibuster changes. President Biden challenged senators Tuesday to “stand against voter suppression” by changing Senate rules to pass voting rights legislation that Republicans are blocking. Biden’s speech was blunt and explicit, referring to new efforts to limit voting access as “Jim Crow 2.0.”

Biden then asked a pointed question: “I ask every elected official in America: How do you want to be remembered?” Biden said. “Do you want to be on the side of Dr. King or George Wallace? Do you want to be on the side of John Lewis or Bull Connor? Do you want to be on the side of Abraham Lincoln or Jefferson Davis?” he asked, drawing a sharp line between men who fought for civil rights and others who fought to deny them, comparisons that at moments drew gasps from the crowd.

— Ted Budd demands Biden explain how many convicted felons got $1,400 virus stimulus checks. Rep. Ted Budd (R-N.C.) is demanding the White House explain how many convicted felons, including the terrorist responsible for the Boston Marathon bombing, received coronavirus stimulus checks from the Biden administration. Budd sent a letter to Treasury Secretary Janet Yellen on Tuesday urging the administration to make the information public “Hardworking taxpayers have the right to expect that their dollars are spent wisely and carefully,” said Budd, who is running for the U.S. Senate this year. “That’s why it is unconscionable that terrorists and murderers received taxpayer-funded checks from President Biden’s American Rescue Plan.”

|

CONGRESS |

— Sen. Manchin says scrapping filibuster won’t make Senate ‘better’ in new Biden blow. Centrist Sen. Joe Manchin (D-W.Va.) insisted again Tuesday that he does not support getting rid of the Senate’s legislative filibuster, undercutting President Biden call for changes to chamber rules to ease the passage of two sweeping election reform bills.

— House, Senate panels to review WRDA. The House Transportation and Infrastructure Committee wants to know how the Army Corps of Engineers is implementing funding for water projects included in the bipartisan infrastructure law, as well as changes to the harbor maintenance trust fund enacted in 2020, Chairman Peter DeFazio (D-Ore.) said in prepared remarks in advance of this morning’s subcommittee hearing kicking off work on the 2022 Water Resources Development Act (WRDA). The infrastructure law which President Joe Biden signed into law on Nov. 15, provided more than $17 billion to the Corps, with $11 billion targeted specifically for project construction. Congress directed the Corps to submit a specific spending plan to the appropriations committees within 60 days of the law’s enactment, a date that is fast approaching.

On tap today. After appearing before the House panel, Michael Connor, assistant Army secretary for civil works, and Lt. Gen. Scott Spellmon, the Corps’ chief of engineers and commanding general, will testify before the Senate Environment and Public Works Committee this afternoon.

|

OTHER ITEMS OF NOTE |

— Russia-NATO talks. NATO members meet with Russian representatives in Brussels today for the first NATO-Russia Council since 2019. U.S. Deputy Secretary of State Wendy Sherman, following her bilateral discussions on Monday, represents the United States. Ahead of the talks, Kremlin spokesman Dmitry Peskov said his side saw no “no significant reason for optimism” and would not be satisfied “with the endless dragging out of this process.”

— EPA approves Enlist Duo herbicides through 2029 with conditions. EPA Tuesday (Jan. 11) issued seven-year registrations for Corteva Agriscience’s Enlist Duo herbicides but included new restrictions to protect pollinators and endangered species. The registrations allow spraying of Enlist One (2,4-D-choline) and Enlist Duo (2,4-D-choline and glyphosate) on cotton, corn and soybeans tolerant to the chemical in 34 states. Prior approvals for the two herbicides were set to expire this month. EPA said the registration includes “robust control measures to protect non-target plants and animals” and will “ensure growers have access to effective pesticide tools for the 2022 growing season.” The agency also noted that it evaluated the potential effects on endangered species and has initiated Endangered Species Act (ESA) consultation with the U.S. Fish and Wildlife Service. EPA’s ESA evaluation found that use of the two herbicides is likely to adversely affect listed species but will not lead to jeopardy of listed species or adverse modification of designated critical habitat.