Unknown: Why 8.4 Million Unemployed with 10 Million Job Openings?

Ida impacts | GOP Ag members want a say | Upbeat China trade stats | SALT push

In Today’s Digital Newspaper

Market Focus:

• Why is it so hard to find workers?

• Millions lose unemployment benefits

• Charts on USDA’s latest farm income forecasts, with some adjusted for inflation

• Ida-impacted transportation/shipments/price/gasoline impact update

• Brazil has second case of Mad Cow disease; China & Hong Kong stop Brazil beef imports

• Aluminum prices rose to their highest level in 10 years Monday

• Kansas City Southern taking new look at $27 billion offer from Canadian Pacific

• CFTC Commitments of Traders report

Policy Focus:

• Impact of a corporate tax rate increase

• House Ag GOP urge Chairman Scott against ‘another partisan reconciliation process’

Afghanistan:

• Biden administration officials head abroad after Afghan pullout

• Several planes chartered to evacuate several hundred people seeking to escape

• Taliban fighters violently suppressed women’s protest on Saturday in Kabul

• Taliban said they captured Panjshir Valley

China Update:

• China’s export growth unexpectedly surged in August

• China continues to buy U.S. soybeans

• Chinese officials acknowledging country's statistics riddled with fraud

Energy & Climate Change:

• Senate Finance Committee Democrats floating idea of a carbon price

• Maritime group backs carbon levy for cargo ships

Coronavirus Update:

• Trump unlikely to get Covid-19 Vaccine booster shot

• Tyson Foods strikes deal with unions on Covid-19 vaccines, sick pay

• FDA will meet Sept. 17 to discuss Covid-19 booster shots

• New Zealand announced it would ease restrictions outside Auckland

Politics & Elections:

• Biden's standing nosedives in wake of rocky Afghanistan exit, Covid surge

• 427 days until 2022 midterm elections

• End of the Angela Merkel era near

• Japan PM front runner surfaces

• Belarus opposition leader sentenced to prison

Congress:

• Democrats meeting this week to begin drafting social safety net

• Biden plan to raise revenue by boosting funds for IRS tax enforcement hits snag

• Rep. Suozzi: ‘No SALT, no deal’

Other Items of Note:

• Gensler to join panel aimed at curbing consolidation

MARKET FOCUS

Equities today: Global stock markets were mixed in quiet overnight trading. The U.S. stock indexes are pointed to narrowly mixed openings.

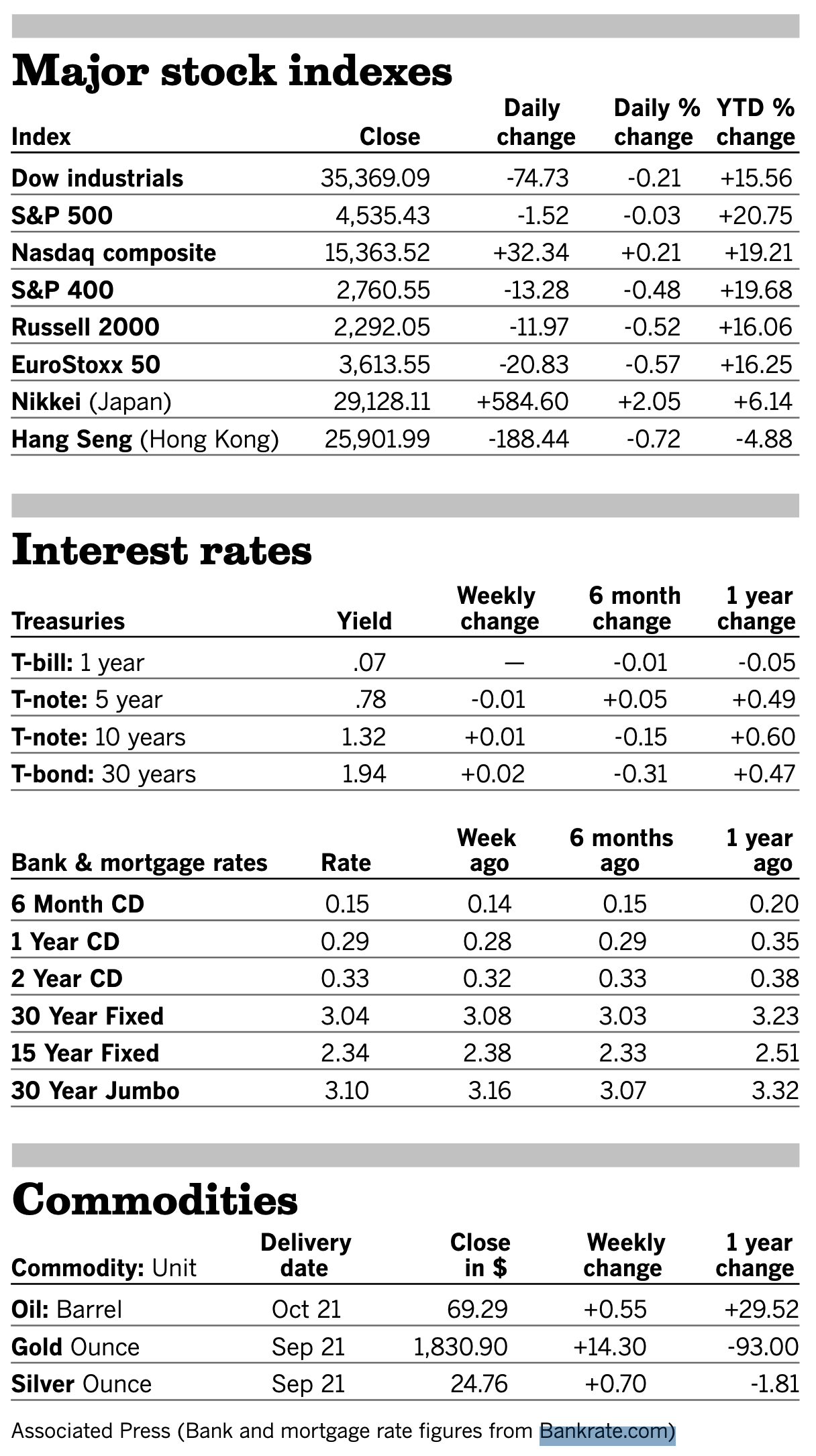

U.S. equities Friday: The Dow lost 74.73 points, 0.2%, to 35,369.09 and edged down 0.2% for the week, while the Nasdaq Composite closed at a fresh record, rising 32.34 points, 0.2%, to 15,363.52 and adding 1.6% for the week. The S&P 500 dropped 1.52 points, less than 0.1%, to 4,535.43. For the week, the index rose 0.6%.

On tap today:

• Conference Board's employment trends index for August is due at 10 a.m. ET. The index has risen for the past five consecutive months through July.

• USDA Grain Export Inspections, 11 a.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

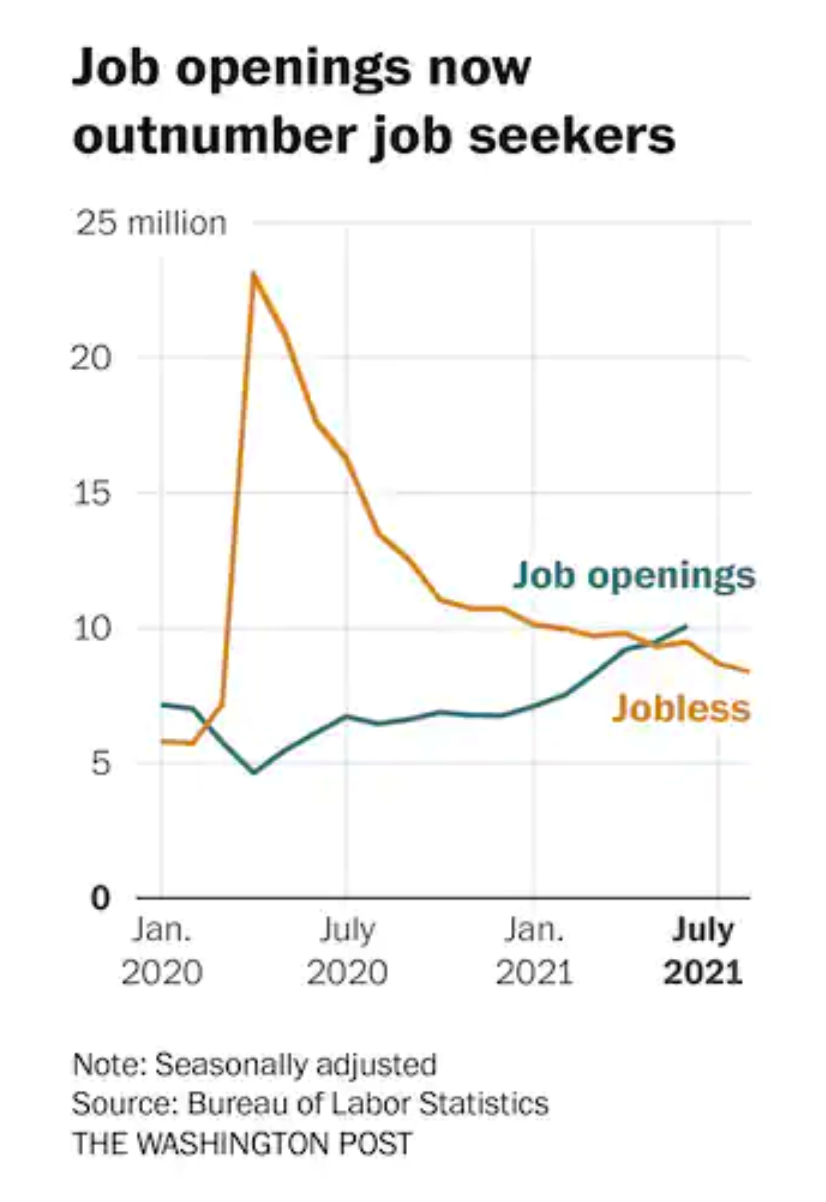

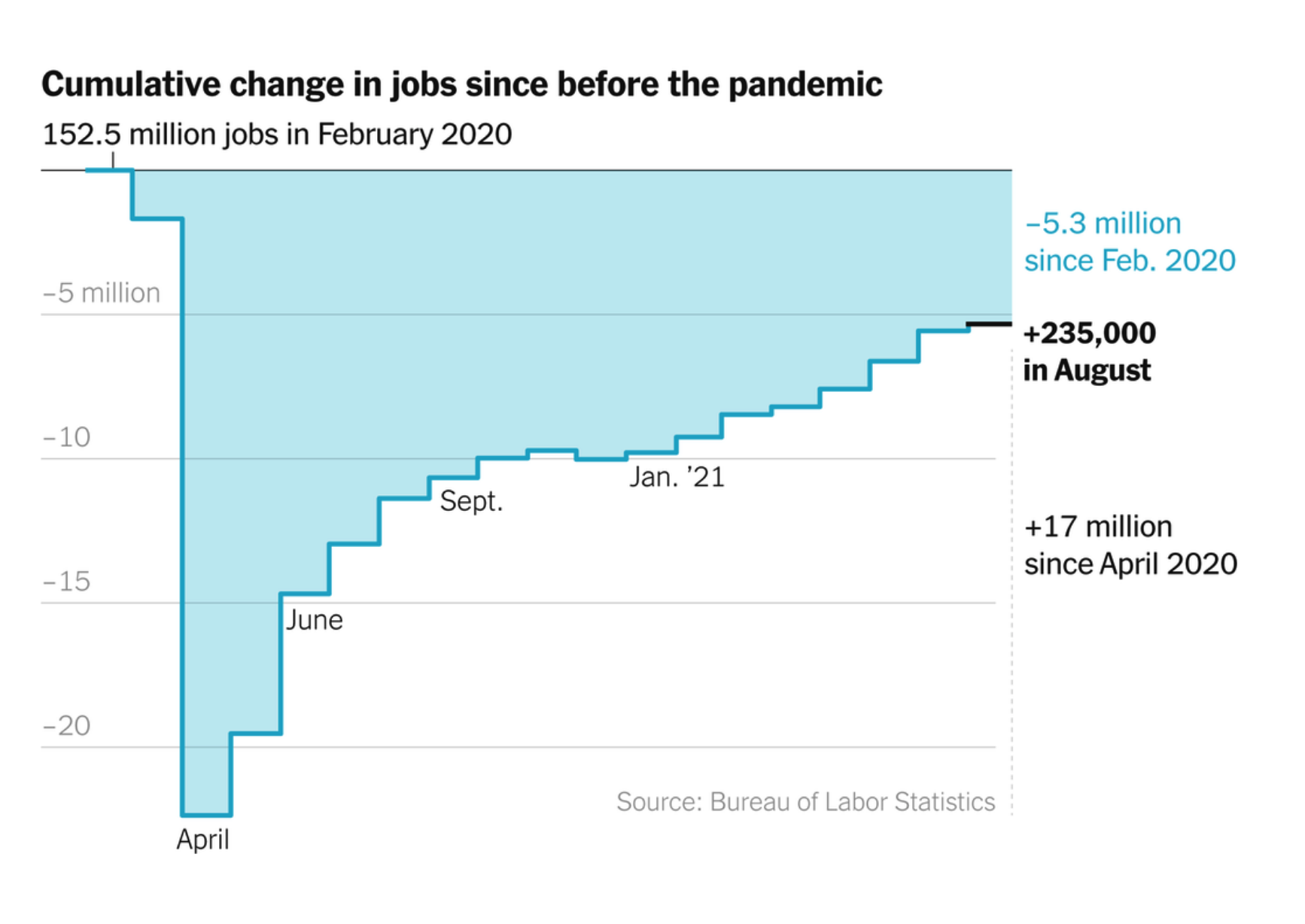

Why are there 8.4 million unemployed when there are 10 million job openings? In August, the Labor Department reported only 235,000 net new jobs, well below the consensus forecast by economists of 733,000. There are still 5 million fewer jobs compared to before the pandemic. But resignations are the highest on record — up 13% over pre-pandemic levels. There are 4.9 million more people who aren’t working or looking for work than there were before the pandemic. Meanwhile, the National Federal of Independent Business says 50% of firms couldn’t fill their job openings in August. Consider:

• An Oregon McDonald’s is now attempting to hire 14-year-olds and 15-year-olds to work due to “staffing issues,” according to the manager and operator.

• Schools are open but don’t have enough school bus drivers.

• Have you noticed some Walmart shelves are bare? It’s because of a lack of people to stock the shelves, and to logistical glitches in getting products.

Why is it so hard to find workers? The decline in real wages in the last year is one of the reasons, analysts note, as wages after inflation have fallen for seven straight months, which is a disincentive to take a job. That is despite employers paying more as average hourly earnings rose 17 cents in August, or a 6.9% annual rate. The wage gains are even higher for low-skilled jobs that employers are finding especially hard to fill. Some see a jobs improvement ahead, noting the $300 federal unemployment bonus ended Monday (more than 7 million people will be cut off from the assistance), but other cash or in-kind benefits that require no work will continue — such as the child tax credit and expanded food stamps. Also, there has been a surge in retirements with 3.6 million people retiring during the pandemic, or more than 2 million more than expected.

There could be another reason, according to the Wall Street Journal: The software that sorts through applicants deletes millions of people from consideration. Link for details. And link to a Washington Post article on the topic.

Bottom line: The U.S. economy lost a staggering 22.4 million jobs in March and April 2020, when the pandemic hit the U.S. Hiring has bounced back: Employers have brought back 17 million jobs since April 2020. But Mark Zandi, chief economist at Moody’s Analytics, expects that employers are likely to be scrambling for workers for a long time. For one thing, many Americans are taking their time returning to work — some because they’re still worried about Covid-19 health risks and child-care problems, others because of generous federal unemployment benefits, set to expire nationwide Monday. In addition, large numbers of baby boom workers are retiring. “The labor market is going to be very, very tight for the foreseeable future,” Zandi says. Lydia Boussour, lead U.S. economist at Oxford Economics, calculated last month that 40% of the missing jobs are vulnerable to automation, especially those in food preparation, retail sales and manufacturing.

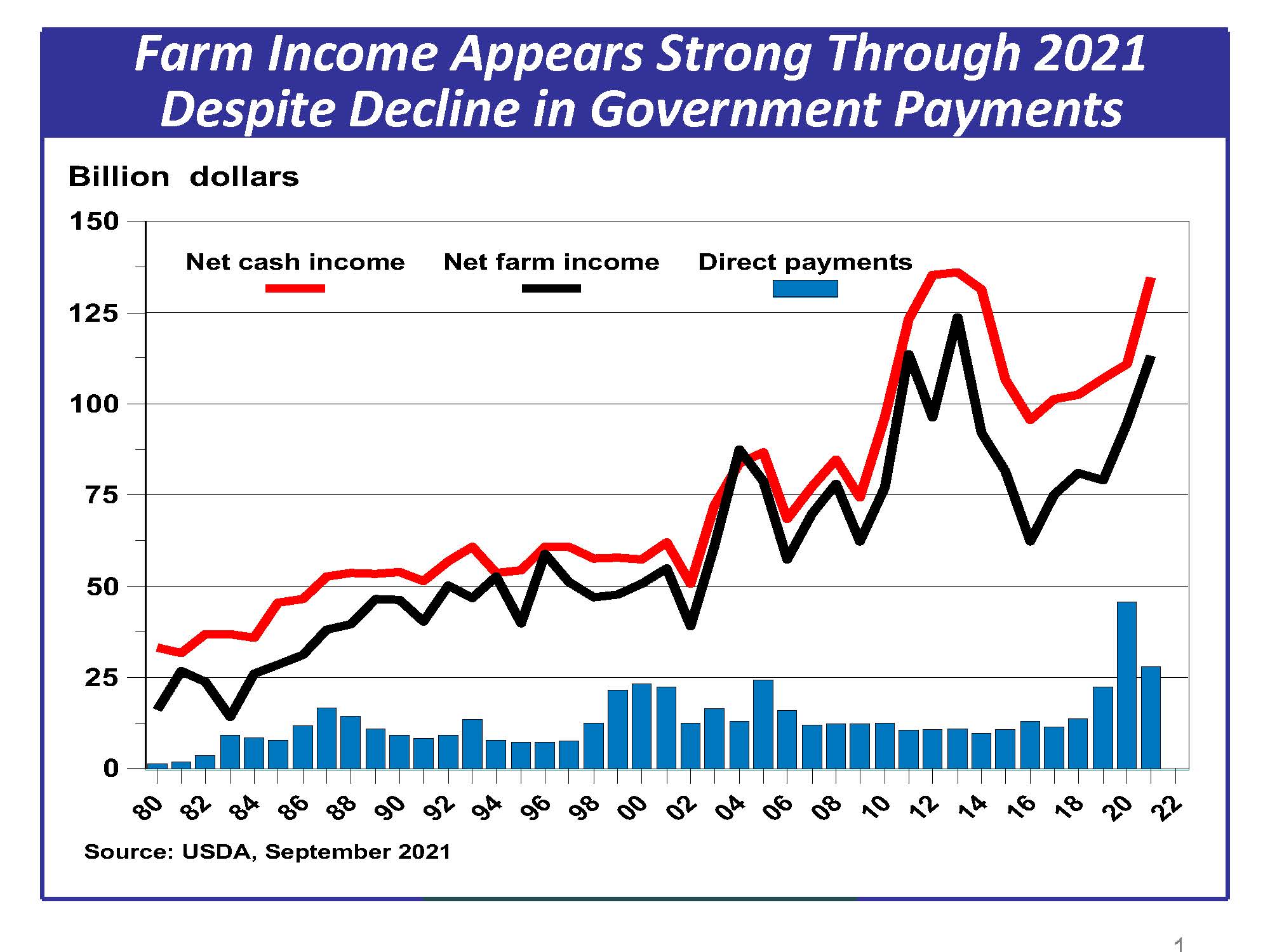

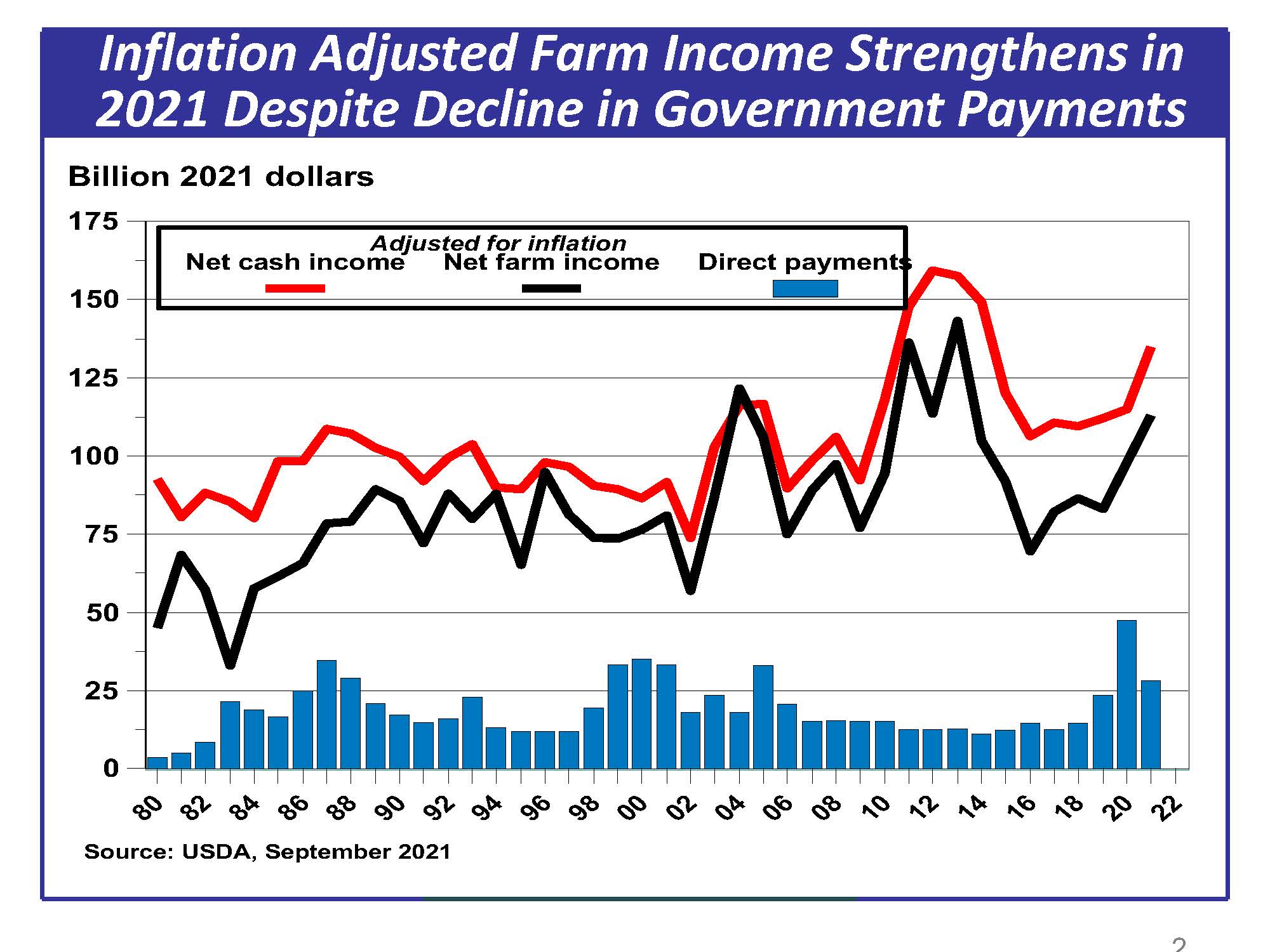

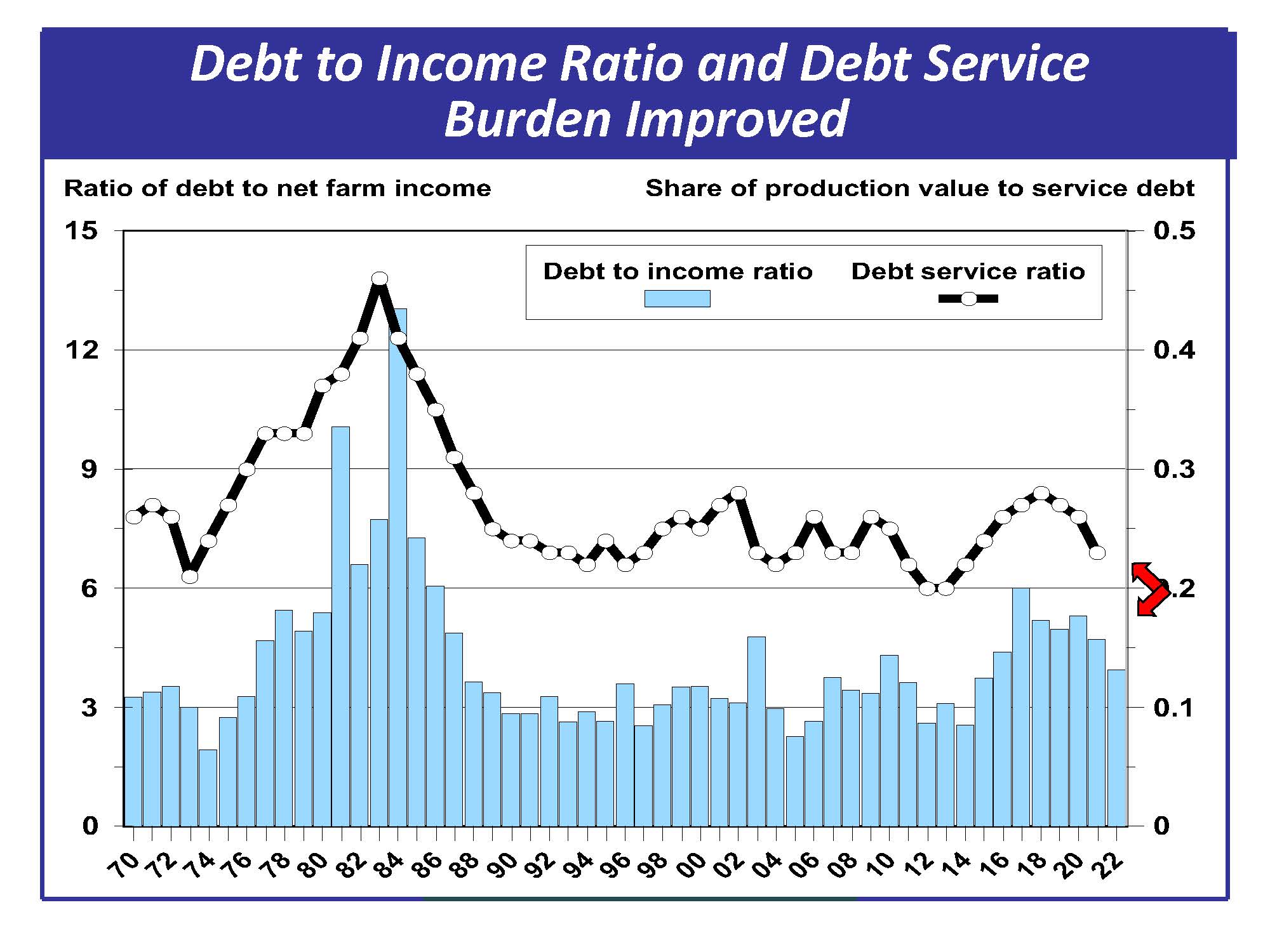

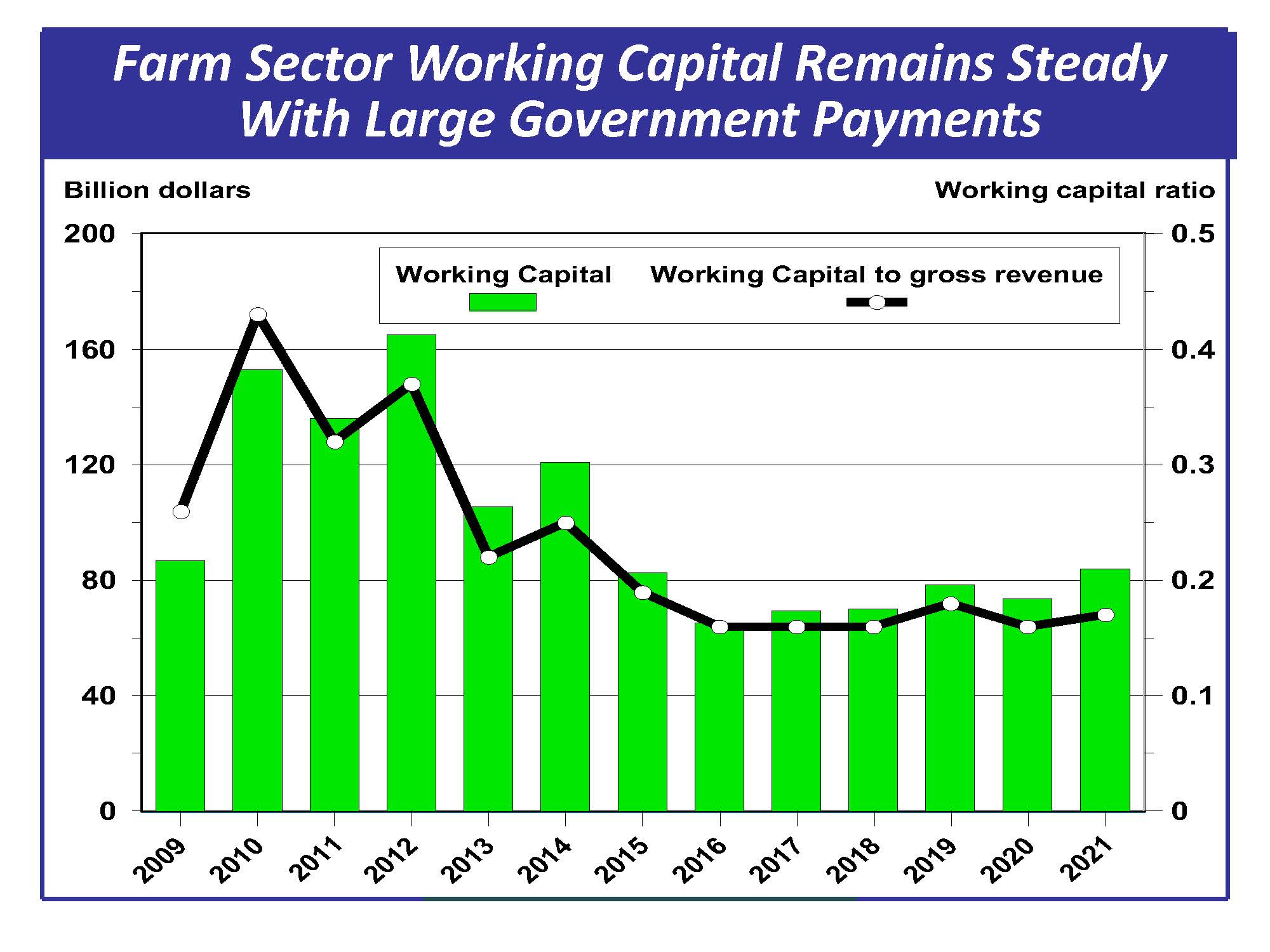

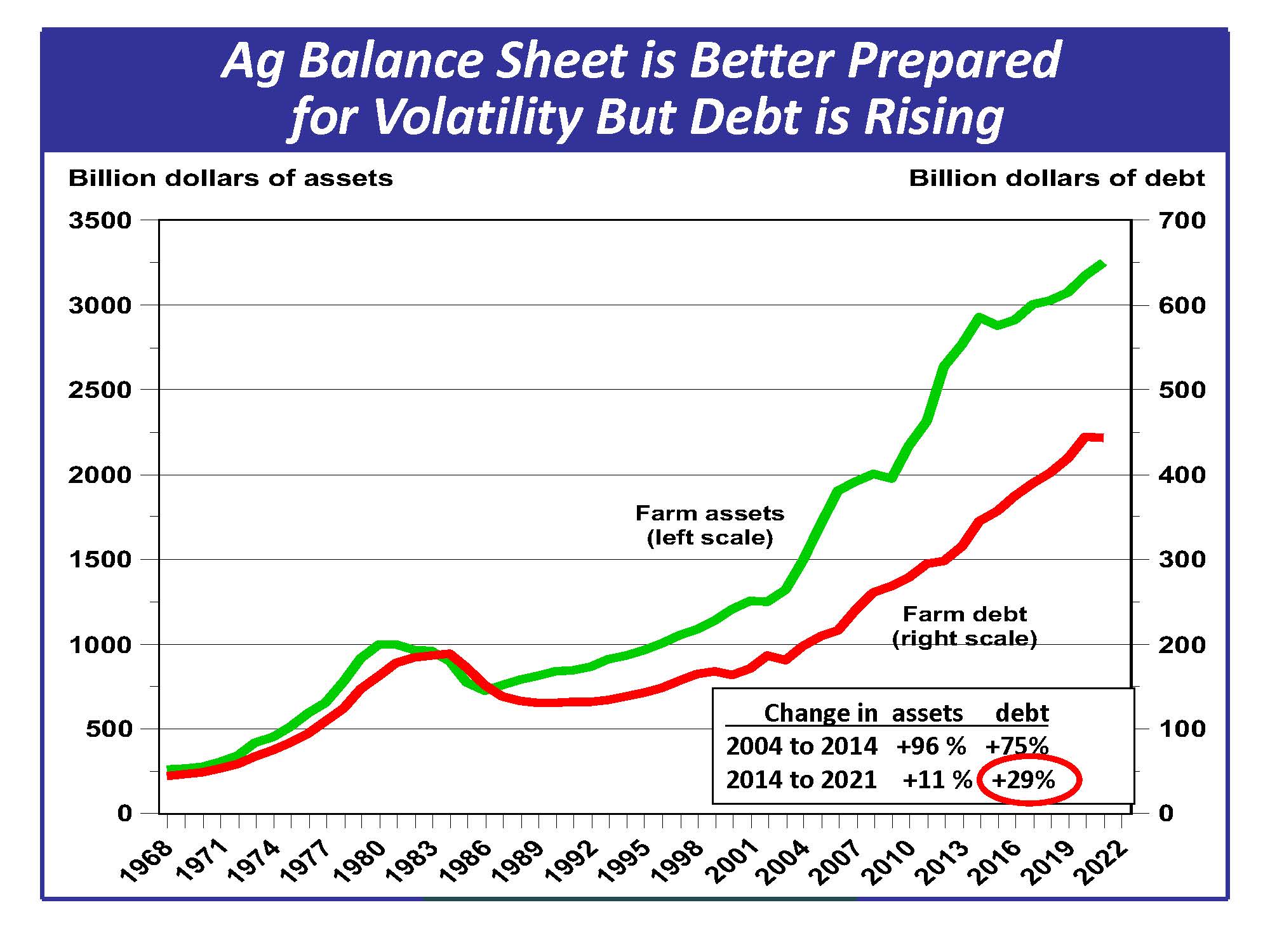

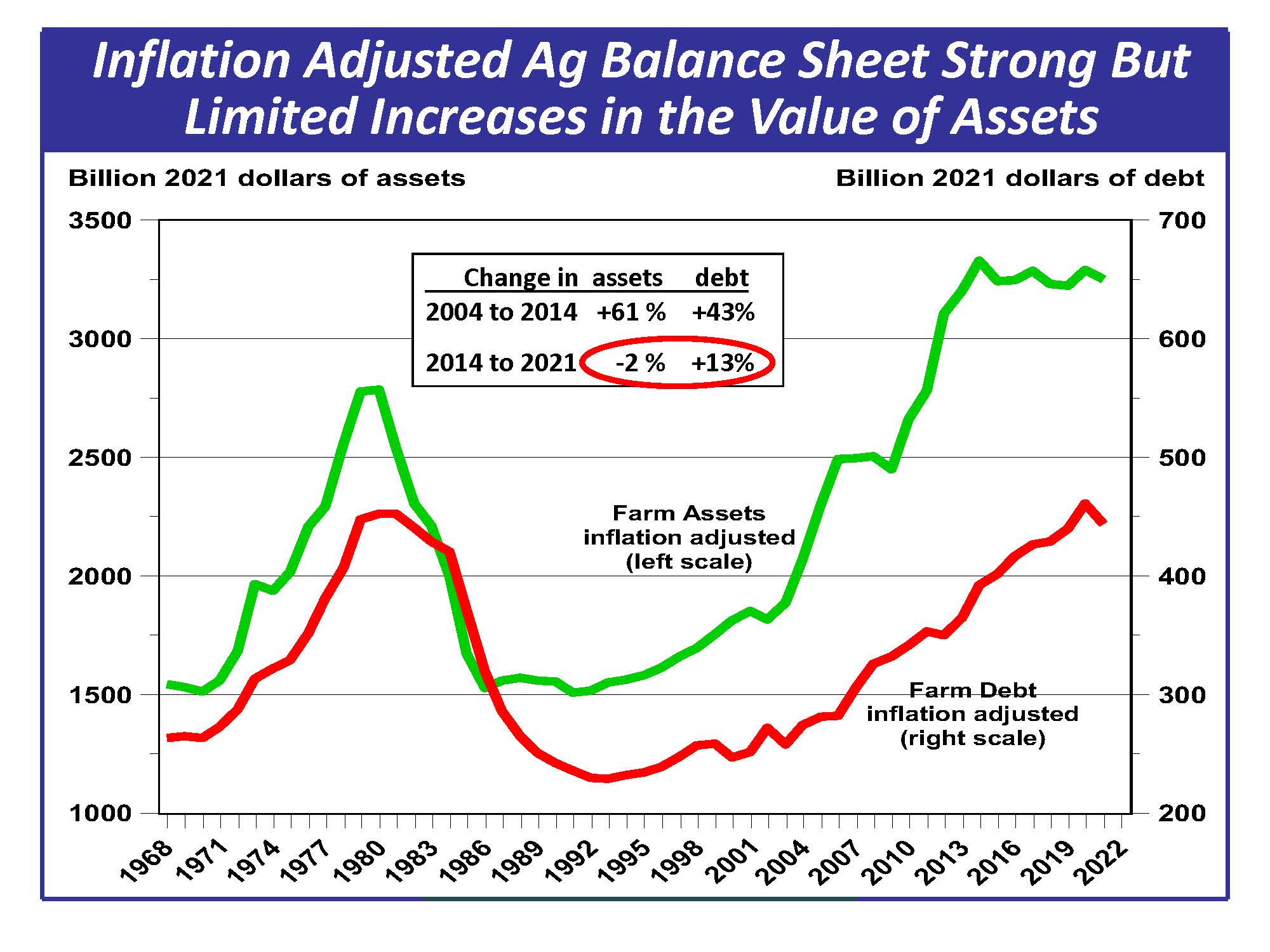

Charts on USDA’s latest farm income forecasts, with some adjusted for inflation. (Source: Terry Barr of Economic Insights LLC):

Market perspectives:

• Outside markets: The U.S. dollar index is higher. Nymex crude oil futures prices are lower and trading around $68.50 a barrel. The yield on the benchmark U.S. 10-year Treasury note is presently fetching 1.365%.

• Ida-impacted transportation/shipments/price/gasoline impact update:

- Shuttered ports, halted rail operations…The Port of New Orleans is a critical link in the U.S. agricultural supply chain. About 65% of the ports' exports are agricultural products, and coffee is one of the major goods imported at the gateway, according to Everstream Analytics (link). Ida knocked out at least 10% of U.S. grain export capacity.

- Export facilities at the Gulf are still without power. The rail lines are said to be running, and the container port facilities are open for operation it appears. The market is optimistic of some power this week. Grain destined for the Gulf faces a reduced basis until facilities reopen. The PNW is operational, Mobile is operational as is the Houston facilities.

- President Biden said Friday that his administration is pushing to boost gasoline deliveries to regions badly impacted by Hurricane Ida, where flooding, road closures, and downed power lines have led to gas shortages, leaving residents scrambling to find fuel for generators. Biden said at a Friday press briefing in LaPlace, Louisiana, that measures to boost fuel supplies include dipping into the nation’s Strategic Petroleum Reserve (SPR) to enable refiners in the region to access the crude they need to continue operations, while providing flexibility for truck drivers to ramp up gasoline deliveries. At his direction, the Department of Energy has authorized the strategic reserve to conduct an exchange of 1.5 million barrels of crude oil with ExxonMobil Baton Rouge to address supply disruptions.

- Biden also noted greater flexibility for how many hours truckers are legally allowed to drive and transport gasoline.

- As of Saturday morning, nearly three-quarters of stations were without fuel in Baton Rouge, and over two-thirds of stations stood empty in New Orleans, the most populous city in the state, according to Patrick De Haan, head of petroleum analysis at GasBuddy.com.

- Entergy, the utility company that provides electricity to much of Louisiana, has vowed to restore power to almost all New Orleans residents by Wednesday, which would be 10 days after many electricity went out.

- Initial impact on Gulf of Mexico oil supply has been greater than any other storm in history. Ida has been responsible for the loss of 16.8 million barrels of output in the ten days since the first production platforms were evacuated. That’s 32% more crude than was lost to Katrina, and 42% more than to Gustav/Ike in comparable periods. The prolonged disruption caused by the 2005 storms eventually led to the deferral of more than 160 million barrels of Gulf of Mexico production.

- Rep. Garret Graves (R-La.) is warning gasoline shortages from Hurricane Ida are bound to get worse and is calling on the Biden administration to provide more relief. Graves sent a letter to Energy Secretary Jennifer Granholm and EPA Administrator Michael Regan, warning fuel shortages are likely to persist in Louisiana due a bevy of problems. These include transmission lines falling across the Mississippi River and blocking maritime access to refineries, fuel-makers unable to produce because of power outages, gas stations lacking electricity to power pumps, and supply disruption from shut-in oil and gas output in the Gulf of Mexico. Among other requests, Graves asked to temporarily provide refiners relief from Renewable Fuel Standard blending requirements. Analysts note that RFS waivers as called for by Graves would be unhelpful, since the challenges in the gasoline market have nothing to do with ethanol-blending obligations, but they said a Jones Act waiver would be more useful, allowing Houston barges to cheaply ship gasoline to the Louisiana coast.

- Fallout from Hurricane Ida has roiled exports in and around New Orleans, the biggest U.S. agricultural trading hub. Futures for December corn delivery fell 5.4% in a week that included a drop to the lowest since mid-July. December corn futures weakened to their lowest level since July 12 and November soybeans fell to their lowest price since late June as Hurricane Ida caused export uncertainties at the Gulf and funds lightened long positions.

• Brazil has second case of Mad Cow disease. China and Hong Kong have stopped Brazil beef imports.

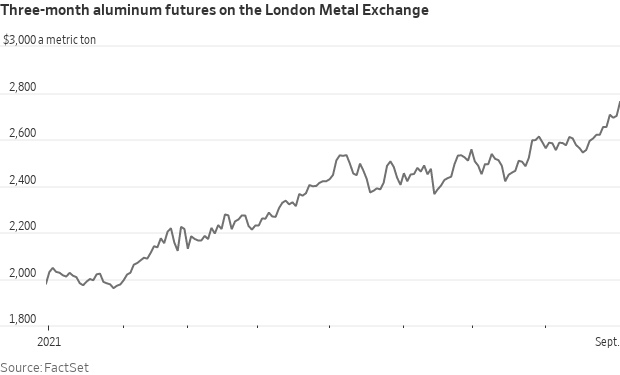

• Aluminum prices rose to their highest level in 10 years Monday after a military coup in mineral-rich Guinea threatened to snarl the lightweight metal’s supply chain. A faction of Guinea’s military on Sunday said they had suspended the country’s constitution and detained President Alpha Condé. The West African nation is a major global supplier of bauxite — crucial for the manufacturing of aluminum — and iron ore. Three-month aluminum forward contracts on the London Metal Exchange were trading at decade highs of more than $2,750 a metric ton today.

• Kansas City Southern is taking a new look at $27 billion offer from Canadian Pacific. A larger deal with Canadian National was thrown into doubt after intervention by a U.S. regulator. The Surface Transportation Board ruled that a “voting trust” proposed by Canadian National in its bid for Kansas City Southern could not be used. The board of the railroad, which is headquartered in Kansas City, Missouri and runs between that city and Mexico, said on Saturday that Canadian Pacific’s offer “could reasonably be expected to lead to” a “superior” offer than the one Canadian National made in May to buy the railroad for $30 billion. Kansas City Southern said it would open its books to Canadian Pacific, but that the move would not necessarily lead to a deal. If Canadian National acquires Kansas City Southern, the railroad would be the third largest on the continent. A tie-up with Canadian Pacific would still be the smallest of the six remaining big rail operators. Canadian Pacific chief executive Keith Creel said a deal between his railroad and Kansas City Southern was “the only truly end-to-end Class 1 merger that preserves and enhances competition. It is the perfect combination… for the rail industry and for commerce in North America.” Canadian Pacific previously offered to pay $275 per share in stock and cash for the railroad but has raised that to $300 per share. Kansas City Southern stockholders are scheduled to meet Sept. 24 to consider its next steps. Link to KC Southern statement.

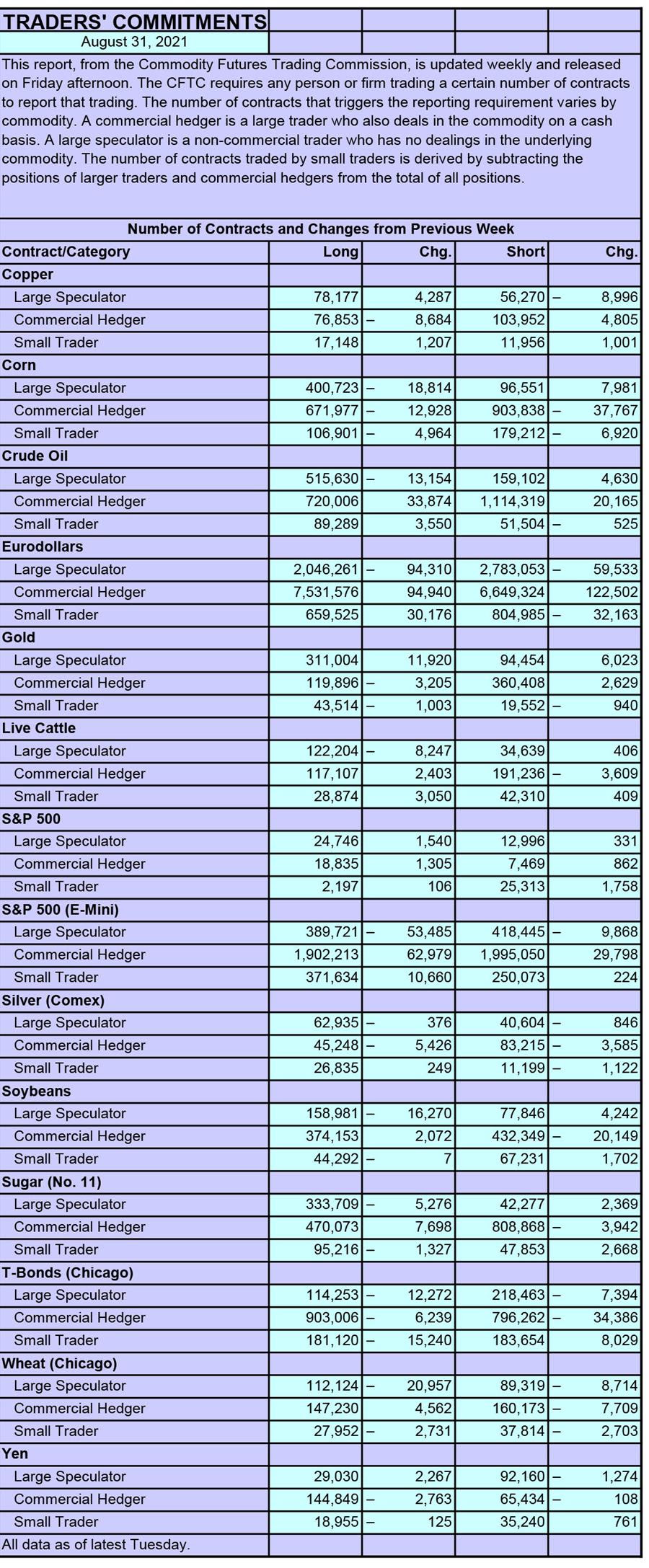

• CFTC Commitments of Traders report. Money managers reduced combined net-long positions in corn, soybeans, soybean meal and soyoil futures and options by 10.6% in the week ended Aug. 31, the most since June. (Source of table: Barron’s)

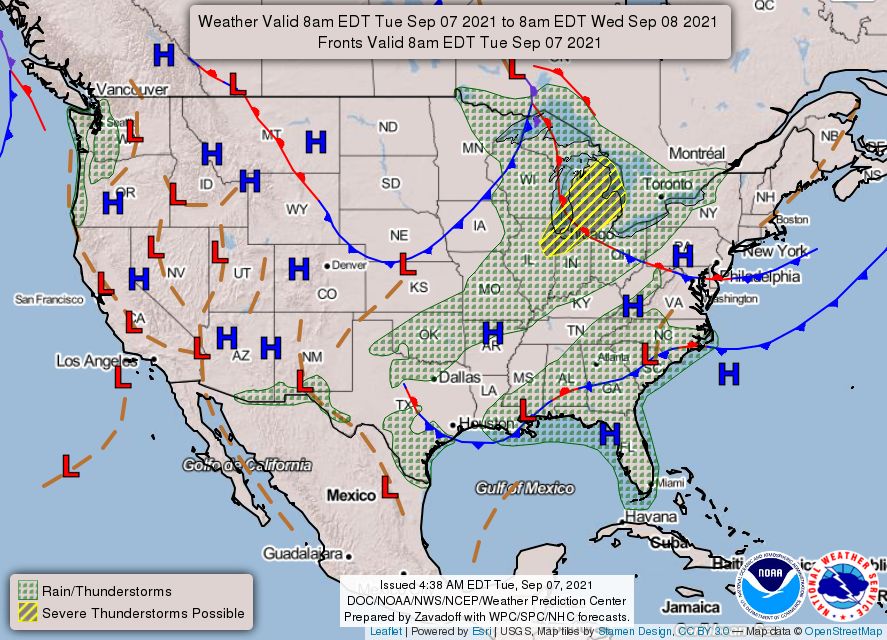

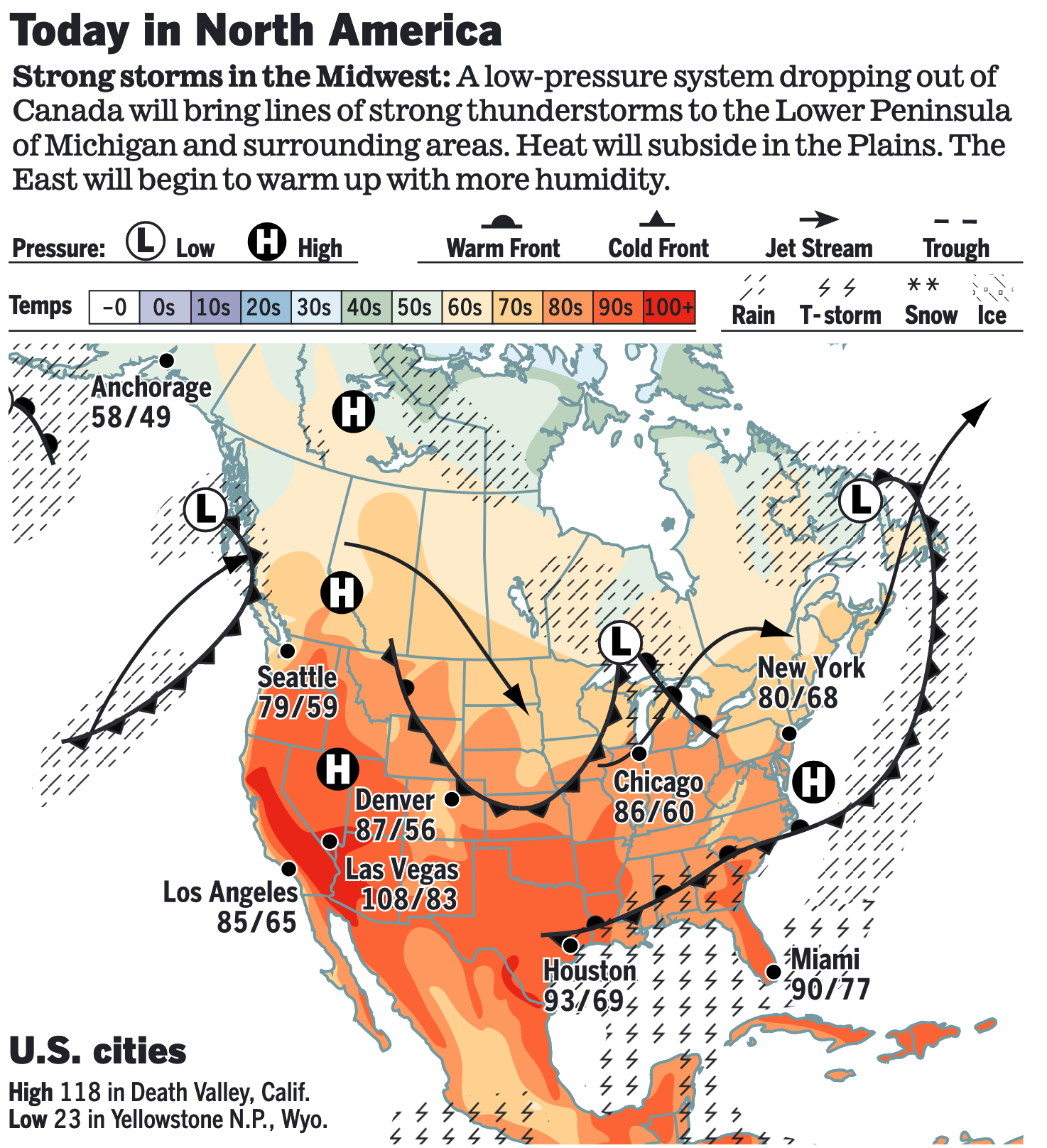

• NWS weather: A heat wave will encompass much of the West with record high temperatures possible... ...A strong cold front will bring the threat of locally heavy rains and severe weather across the Great Lakes through tonight.

POLICY FOCUS

— If the Democrats eventually find the sweet zone for its hefty “social” infrastructure measure, it will include some tax increases, especially a boost for the corporate tax rate. But thus far, markets do not seem worried about the topic. A delayed reaction is likely based on history. In 2017, stocks didn’t start pricing in the effects of Trump’s Tax Cuts and Jobs Act until about six weeks before it was signed into law that Dec. 20.

Impact of a corporate tax rate increase. Bank of America strategist Ohsung Kwon estimates that a 25% corporate rate would cut 2022 earnings estimates by 5%, potentially erasing all of next year’s expected profit growth. The tech and health-care sectors, with a 7% decline, would take the biggest hit, while energy, real estate, and utilities, for the most part, would be unscathed.

— House Ag GOP leadership urge Chairman Scott against “another partisan reconciliation process.” On Sunday, Sept. 5, House Ag Committee Republican Leader Glenn "GT" Thompson (R-Pa.) and Republican Committee leadership urged Chairman David Scott (D-Ga.) to uphold his pledge and “return to the Committee's storied history of bipartisanship ahead of this week's reconciliation process.” The letter (link) highlighted recent bipartisan wins, including unanimous support of both broadband and disaster programs, while cautioning against a process that lacks oversight, transparency, and collaboration. "We fear the reputation of this Committee has been tarnished by the actions of Speaker Pelosi and others in the Democrat leadership. It seems as though the days we come together for the common good of rural America are now few and far between. Instead, this Committee is being held hostage by party leaders who have zero interest in protecting the farmers, ranchers, and foresters that feed, clothe, and fuel this great nation," they said in the letter. "When our Committee is working together in a collaborative and bipartisan manner, things get done for rural America," they continued.

AFGHANISTAN

— Biden administration officials head abroad after Afghan pullout. Secretary of State Antony Blinken and Defense Secretary Lloyd Austin left Sunday for the Middle East to meet local officials, express U.S. gratitude for help with the evacuation and discuss ways to help others escape from Afghanistan.

— At least four planes chartered to evacuate several hundred people seeking to escape Taliban rule have been unable to leave Afghanistan for days, officials said Sunday. An Afghan official at the airport in the northern city of Mazar-i-Sharif said the would-be passengers were Afghans, many of whom did not have passports or visas, and thus were unable to leave the country. He said they had left the airport while the situation was sorted out. The top Republican on the U.S. House Foreign Affairs Committee, however, said that the group included Americans, that they were aboard the planes and that the Taliban was not letting them take off, in effect “holding them hostage.” He did not say where that information came from.

CBS News’ Eena Ruffini reported the State Department had begun notifying members of Congress that Taliban approval was preventing chartered planes from taking off from Mazar-i-Sharif for Doha, Qatar. Sen. Richard Blumenthal (D-Ct.) took aim at the White House and State Department on Monday, saying he is “furious” over struggles to secure planes to evacuate a group of Americans and Afghan allies from Afghanistan. “I have been deeply frustrated, even furious, at our government’s delay and inaction,” Blumenthal, who sits on the Senate Armed Services Committee, said. “I expect the White House and State Department to do everything in their power, absolutely everything, to make this happen. These are American citizens and Afghans who risked everything for our country. We cannot leave them behind.”

— Taliban fighters violently suppressed a women’s protest on Saturday in Kabul.

— The Taliban said they had captured the Panjshir Valley, raising their flag over Bazarak, the last Afghan provincial capital not under their control, even as representatives of the opposition forces there maintained that they would fight on from the mountains. National Resistance Front leader Ahmad Massoud9 has not surrendered, calling for a “national uprising” and saying on Twitter that his fighters remain in Panjshir and “our resistance will continue.”

CHINA UPDATE

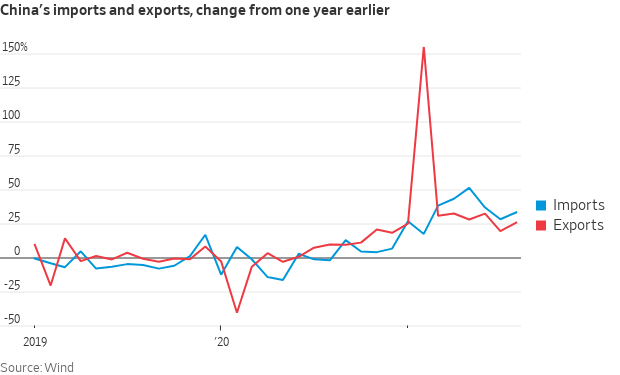

— China’s export growth unexpectedly surged in August, with demand from the U.S. and Europe resilient as retailers probably brought forward their Christmas shopping orders. The pickup came despite disruptions at China’s second-largest port last month, which pushed up shipping costs. China’s outbound shipments rose 25.6% in August from a year earlier, higher than the 19.3% increase in July, the General Administration of Customs said today. The result also comfortably topped the 17% increase expected by economists. Exports to the European Union, China’s No. 2 trading partner, jumped 29.4% in August from a year earlier, accelerating from July’s 17.2% rise, while shipments to the Association of Southeast Asian Nations and the U.S. — China’s No. 1 and No. 3 trading partners, respectively — rose by 16.6% and 15.5%.

— China continues to buy U.S. soybeans and their appetite appears to be robust ahead. Meanwhile, the Economist reports that Russia’s gov’t has started leasing land in the country’s far east to Chinese, South Korean and Japanese investors. Much of the land, which was once unproductive, is now used to grow soybeans. Most are imported by China, helping the country reduce its reliance on imports from America. Russia’s deputy minister of ag has predicted that soybean exports from its far-eastern farmlands may reach $600 mil. by 2024, nearly five times what they were in 2017.

— Chinese officials are acknowledging that the country's statistics are riddled with fraud now that Xi Jinping has targeted statisticians in his expanding campaign to purify the Chinese communist system. Chinese statistics in the "new era" will be improved by endless audits, punishment of perpetrators, and replacement of humans with "smart" computers and gadgets when possible. According to Dim Sums: Rural China Economics and Policy, frustrated by immoral and incompetent human statisticians, Chinese officials are putting their trust in machinery to collect statistics. China's National Animal Husbandry Station (NAHS), an arm of the agriculture ministry, held a March meeting to implement a new auditing requirement for the data its network of town, prefecture, provincial and national veterinarians, and technicians who count animals and meat. “It's unclear whether China's new, improved statistics will be released to the public before they have been massaged and manipulated,” concludes Dim Sums.

ENERGY & CLIMATE CHANGE

— Senate Finance Committee Democrats floating idea of a carbon price as one of several options they’re looking at to help pay for their $3.5 trillion spending package. Democrats are in the process of crafting the reconciliation bill, but it’s murky what the final package will contain.

A document lists several three potential approaches for a carbon pricing scheme:

- A tax on the carbon dioxide content of “leading” fossil fuels like coal, oil and natural gas upon extraction. This tax would start at $15 per ton and increase over time.

- A tax per ton of carbon dioxide emissions from major industries including steel, cement and chemicals

- A tax per barrel on crude oil

Each of these provisions would come with a rebate or other form of relief for low-income taxpayers and a border adjustment to make sure that foreign companies also have to pay for the tax.

The document also suggests repealing “major” fossil fuel tax subsidies including tax credits and deductions for extraction, “preferential treatment” for foreign income and the ability for pipeline companies to avoid corporate income tax. It also suggests a 20-cent pound fee on the sale of virgin plastic that’s used to make single-used plastics.

— Maritime group backs carbon levy for cargo ships. A major maritime industry association on Monday backed plans for a global surcharge on carbon emissions from shipping to help fund the sector’s shift toward climate-friendly fuels, the Associated Press reported. The International Chamber of Shipping, which represents shipowners and operators covering more than 80% of the world merchant fleet, said it’s proposing to the United Nations that all vessels above a certain size should pay a set amount per metric ton of carbon dioxide they emit. Environmental groups welcomed the proposal to the International Maritime Organization, a U.N. body, but cautioned that it doesn’t say what carbon price the group would support. The shipping industry is estimated to account for nearly 3% of the greenhouse gas emissions that are driving global warming and projected to rise significantly in the coming decades.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 221,158,456 with 4,576,306 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 40,070,034 with 649,034 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 373,225,052 doses administered, 175,968,266 have been fully vaccinated, or 53.61% of the U.S. population.

— Trump says he is unlikely to get Covid-19 Vaccine booster shot. The former president has urged his supporters to get vaccinated but tells the WSJ he ‘probably won’t’ get a booster shot when it is available.

— Tyson Foods strikes deal with unions on Covid-19 vaccines, sick pay. The agreement with the United Food and Commercial Workers International Union and the Retail Wholesale and Department Store Union will keep workers safe and help recruitment efforts, Tyson said.

— FDA will meet Sept. 17 to discuss Covid-19 booster shots. Last month, the White House said people who got the two mRNA vaccines —the two-shot vaccines made by Pfizer/BioNTech and Moderna — may receive boosters starting Sept. 20. But on Thursday, FDA Acting Commissioner Dr. Janet Woodcock said the administration still doesn't have enough safety data on booster shots.

— New Zealand announced it would ease restrictions outside Auckland, ending a series of lockdowns that began in August. Residents outside Auckland will be allowed to return to work and school, and the nationwide alert level will be lowered to Level 2 starting Wednesday morning, Prime Minister Jacinda Ardern said at a news conference. Auckland, a city of around 1.7 million, will remain at Level 4, which means that everyone but essential workers must stay at home. Schools will reopen on Thursday morning. While the average number of daily new cases remains relatively low, at 36, New Zealand’s vaccination campaign got off to a sluggish start: only 49% of the population has received at least one dose, below the 62% in the U.S. and 72% in Britain.

POLITICS & ELECTIONS

— Biden's standing nosedives in wake of rocky Afghanistan exit, Covid surge. Biden’s approval rating hovered in the low to mid 50s since taking office in late January. But his numbers started sliding last month, as the crisis in Afghanistan dominated media coverage and mask mandates started returning in certain spots across the country as coronavirus cases rose. The president stands at 45%-49% approval/disapproval in an average of the latest surveys compiled by RealClearPolitics, and at 46%-48% in a compilation by the polling and analysis website FiveThirtyEight. Some 44% of Americans questioned in an ABC News/Washington Post poll released this weekend said they approved of the job Biden’s doing in the White House, down six points from June. Just over half of those polled (51%) gave the president a thumbs-down on how he’s handling his duties, a jump of nine points from June. Gary Langer, the longtime director of polling at ABC News, highlighted that in data dating back to the Harry Truman administration, "only two presidents have had a lower approval rating at this point in their terms: Donald Trump, at 37% in August 2017, and Gerald Ford, also 37%, in March 1975."

There are 427 days until the 2022 midterm elections.

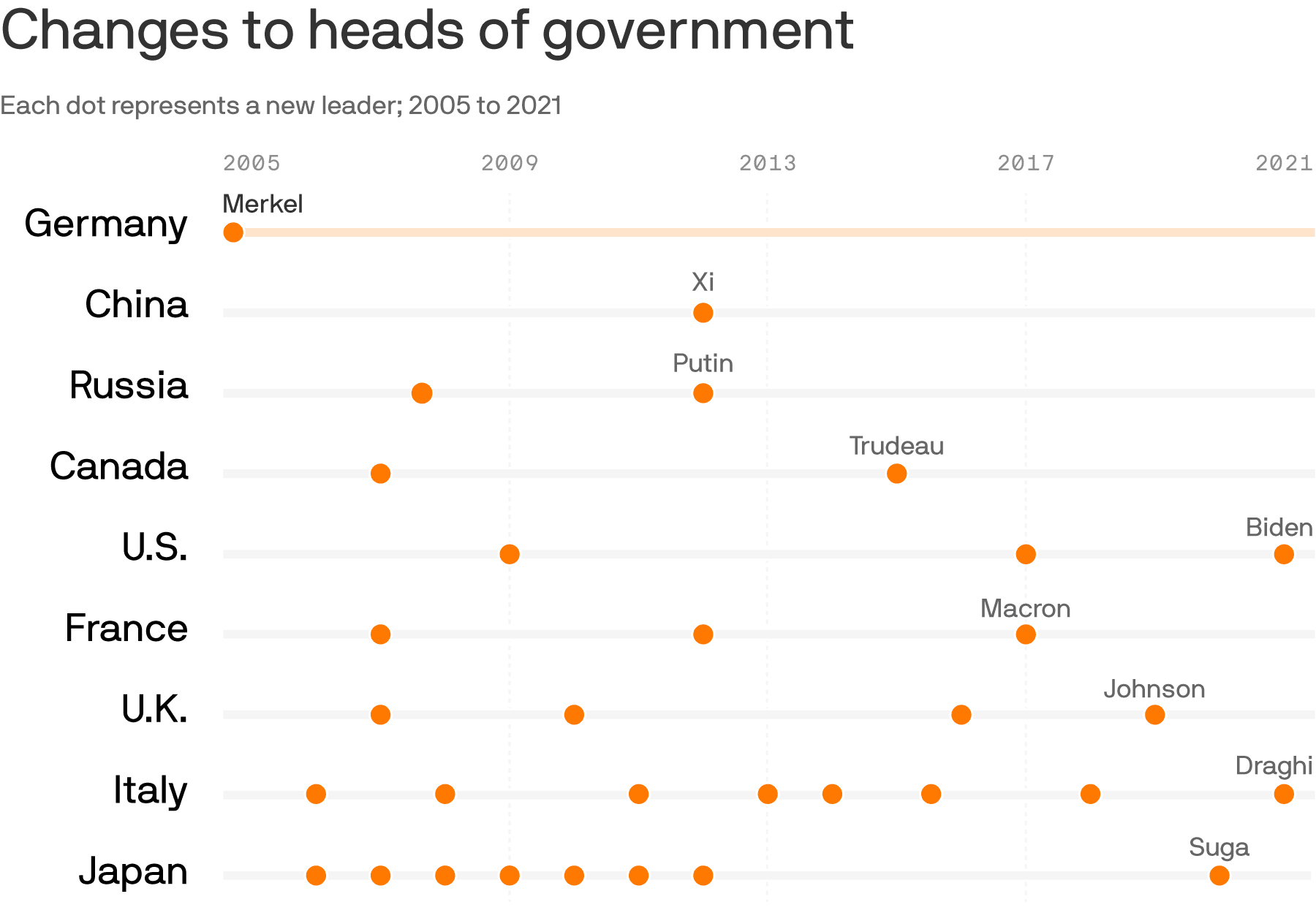

— End of the Angela Merkel era is near. Angela Merkel, 67, has been the face of European leadership, a global power broker, a force for stability and close to multiple U.S. presidents. Now she’s about to exit. The German chancellor, who has been in power since 2005, has promised to leave the country after the outcome of Sept. 26's election has been determined. Merkel is the longest-serving leader of a major Western democracy; Russian President Vladimir Putin is one of the few contemporaries now set to outlast her. Many Germans view the end of the Merkel era with anxiety as she remains the country's most popular politician, and her nickname of "Mutti," or mom, speaks to the national role she has played for so long. The race to replace Merkel is between Olaf Scholz, the leader of the Social Democrats, and Armin Laschet, Merkel's successor as leader of the Christian Democrats.

— Japan PM front runner surfaces. Opinion polls showed that Japan’s vaccine czar, Taro Kono, has the public’s support in the race to replace Prime Minister Yoshihide Suga, the Japan Times reports (link). Although Kono has strong popular support, a tight vote on Sept. 29 could see the decision come down to Liberal Democratic Party (LDP) members. In that scenario, Fumio Kishida, the only candidate to officially declare so far, and Sanae Takaichi, the reported choice of former Prime Minister Shinzo Abe, could upset Kono’s bid.

— Belarus opposition leader sentenced to prison. A Belarusian court yesterday sentenced Maria Kolesnikova to 11 years in prison after a closed-door trial in Minsk, the capital. Kolesnikova tried to run for president last year. She and her colleague, Maksim Znak, another opposition figure and a lawyer, were charged with extremism, conspiring to seize power illegally and damaging state security. Znak received a 10-year sentence in a maximum-security penal colony.

CONGRESS

— Democrats are meeting this week to begin drafting their plan for a transformation of the American social safety net, with markups expected to wrap up by the nonbinding Sept. 15 deadline written into the budget resolution. Democratic leaders indicated they want to bring the reconciliation package to the floor the week of Sept. 20, though no scheduling decisions have been made official. Republicans charge the Democratic plans are nothing short of socialism and are concerned that the plan is financially unsustainable and would undermine economic growth, by rendering Americans too dependent on the government for their basic needs.

— Biden administration's plan to raise revenue by boosting funds for IRS tax enforcement capabilities hit a snag when nonpartisan budget scorekeepers found it would raise $116 billion less than prior White House projections. The Congressional Budget Office estimated that Biden's plan to increase IRS funding by $80 billion over the next decade would return $200 billion in tax revenue, substantially less than the Treasury Department's projection of about $316 billion and even higher projections released earlier by the White House.

— Rep. Suozzi: ‘No SALT, no deal.’ Rep. Thomas Suozzi (D-N.Y.) is warning that he and a group of blue state Democrats won’t support any legislation that fails to restore the full deduction for state and local taxes (SALT) eliminated by the 2017 GOP tax bill. “No SALT, no deal,” Suozzi said in an interview. Suozzi serves on the House Ways and Means Committee, which writes tax policy. The issue is how long any repeal would cover or will Democrats seek to phase it in by raising the deduction from its current $10,000 cap? Some sources signal the now likely deduction will be limited to those making $400,000 or less, to adhere to President Biden’s pledge to not raises taxes on those making below that level.

OTHER ITEMS OF NOTE

— Gensler to join panel aimed at curbing consolidation. The chairman of the Securities and Exchange Commission will join the debut meeting of Biden’s competition council, a group intended to curb corporate consolidation that Biden says raises prices for consumers. The council, announced in July, will hold its first meeting on Sept. 10 at the White House. The panel includes eight cabinet secretaries and chairs of six independent agencies, according to officials familiar with the plan. The council is led by National Economic Council Director Brian Dee se, and attendees will speak about steps their agencies have taken to lower consumer costs, the officials said.