Ukraine Reports Major Drop in Grain Exports | White House Plan May Aid Grain Shipments

China slashed key interest rate | Deere: ‘Strong demand’ helped offset supply-chain pressures

|

In Today’s Digital Newspaper |

The Senate overwhelmingly approved a $40 billion military and humanitarian package for Ukraine, its largest foreign-aid package in at least two decades, bringing America’s commitment to almost $54 billion. The Senate also confirmed Bridget Brink as the American ambassador to Ukraine, filling a post that had been vacant for three years. Meanwhile, Reuters reported that the White House may give Ukraine advanced anti-ship missiles, which could help defeat Russia’s naval blockade and allow grain shipments to resume, easing a global food crisis. Meanwhile, Russia dismissed calls from top United Nations and Western officials to halt a Black Sea blockade that has prevented Ukraine from exporting much of its grain to world markets, causing price hikes and exacerbating food shortages.

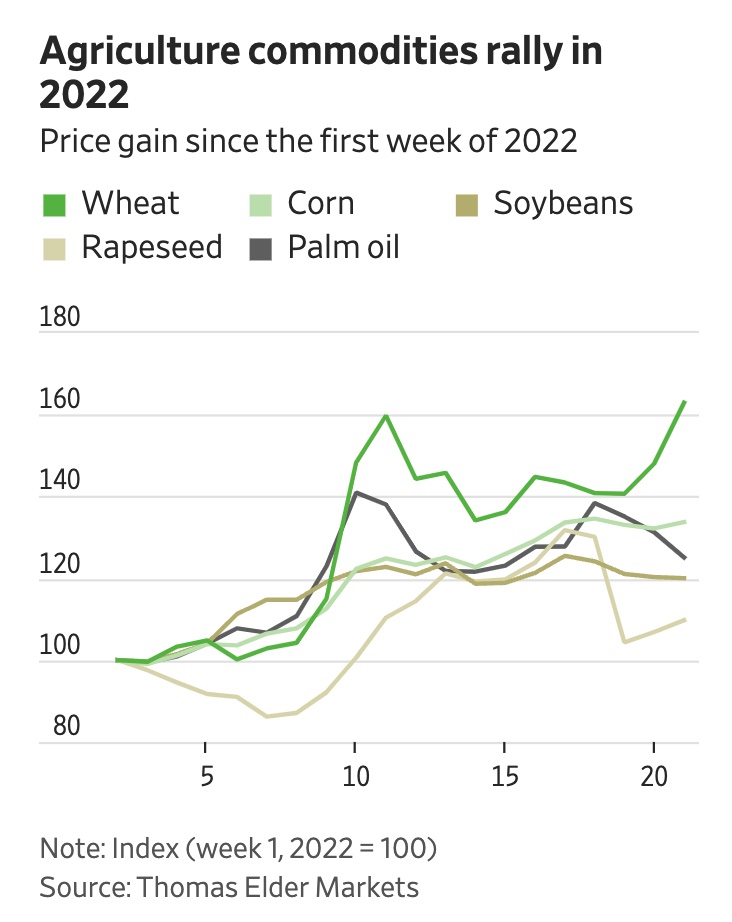

Ukraine reported a major drop in grain exports, threatening food security for millions worldwide. Grain exports from Ukraine are down 64% so far in May compared to the same timeframe last year, the country’s agriculture ministry said Thursday according to Interfax Ukraine.

Ukrainian President Volodymyr Zelenskyy yesterday said Donbas is "completely destroyed" as a result of Russia’s constant strikes. Donbas blankets much of eastern Ukraine and has been at the front of the country's conflict with Russia since 2014. “This is a deliberate and criminal attempt to kill as many Ukrainians as possible,” he added.

President Biden said Finland and Sweden had the “full, total, complete backing of the United States” as they apply to join NATO, prompted by Russia’s invasion of Ukraine. Standing next to Magdalena Andersson, Sweden’s prime minister, and Sauli Niinisto, Finland’s president, in Washington, Biden said the Nordic countries “meet every NATO requirement and then some.”

China slashed a key interest rate for long-term loans to revive its ailing property sector. The cut to the mortgage-reference rate was the largest in more than two years, a cut of more-than-expected 15 basis points. The country's property market has experienced 8 straight months of home-price reductions with developers under extreme pressure. Meanwhile, loan growth in the country in April was at its lowest level in almost five years.

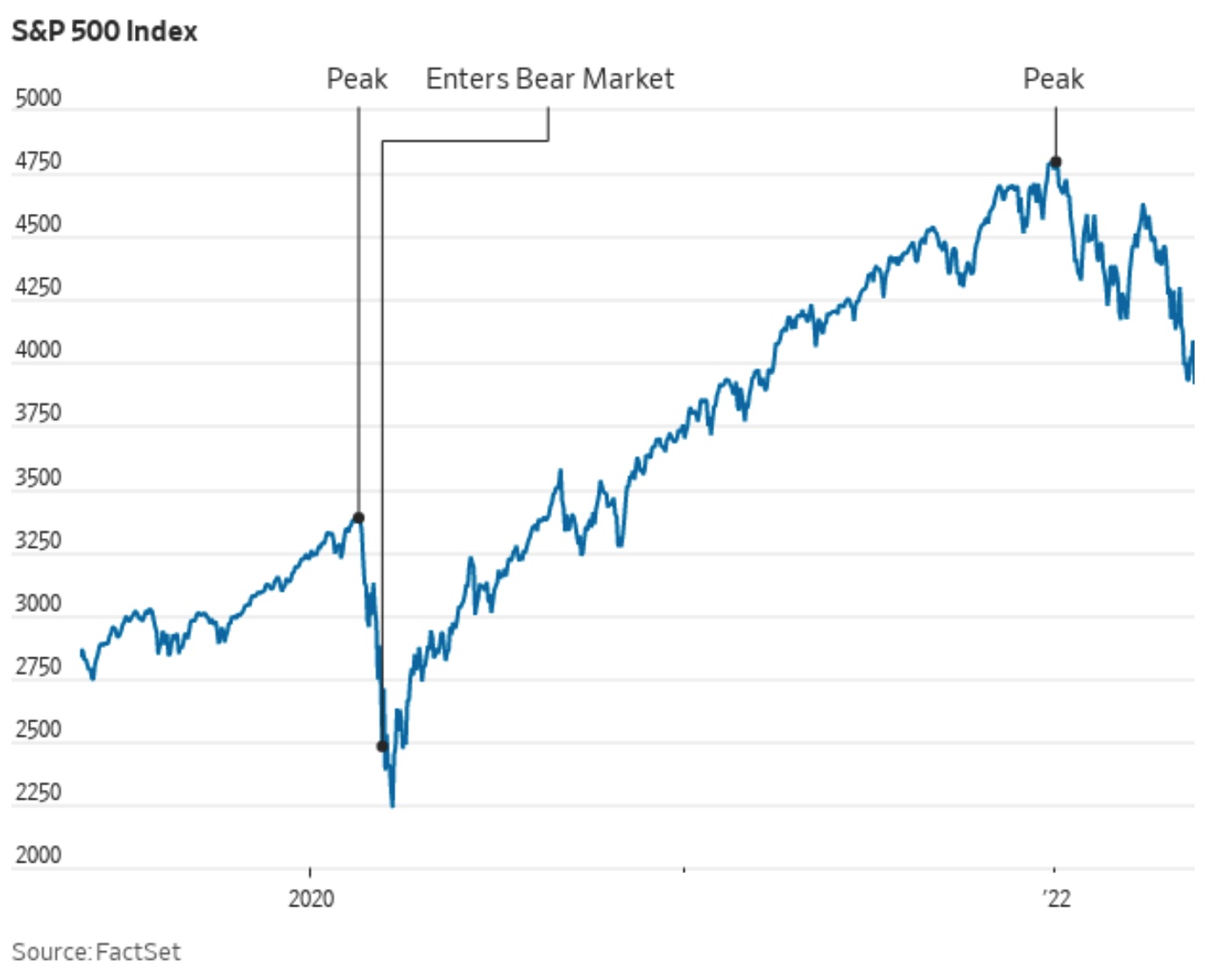

The S&P 500 is down 18.6% from its record closing high set in early January. Only eight companies (of the 500 in the index) are responsible for nearly half of the weighted benchmark's year-to-date losses.

Commodities and related shares are being used as an inflation hedge, especially as Russia's war in Ukraine exacerbates energy prices globally.

Biden administration will propose a five-year plan for offshore oil-and-gas drilling by June 30, Interior Secretary Deb Haaland said Thursday at a congressional hearing, but she declined to say if the plan would include any new lease sales.

Ask any farmer about rising costs and the producer will mention (1) diesel prices (2) propane prices and (3) fertilizer prices… if you can get it.

President Biden embarked Thursday on his first trip to Asia since taking office. USA Today Share reports that the trip “is meant to send a signal that the U.S. can handle issues in two regions at once, Europe and the Indo-Pacific.” The New York Times says the president is “hoping to demonstrate that the United States remained focused on countering China, even as his administration stage-managed a war against Russia in Europe,” and Reuters said that “advisers and analysts” say Biden is “carrying a clear message to China...don’t try what Russia did in Ukraine anywhere in Asia, and especially not in Taiwan.”

White House is working towards a first presidential meeting with Saudi Arabia. President Biden and Saudi Arabia's de facto ruler, Crown Prince Mohammed bin Salman, could meet for the first time as soon as next month, multiple sources told CNN.

Shares of Deere & Co. fell 1.8% toward a three-month low in premarket trading Friday, even after the agriculture, construction and forestry equipment maker reported fiscal second-quarter profit and revenue that rose above expectations, as "strong demand" helped offset supply-chain pressures.

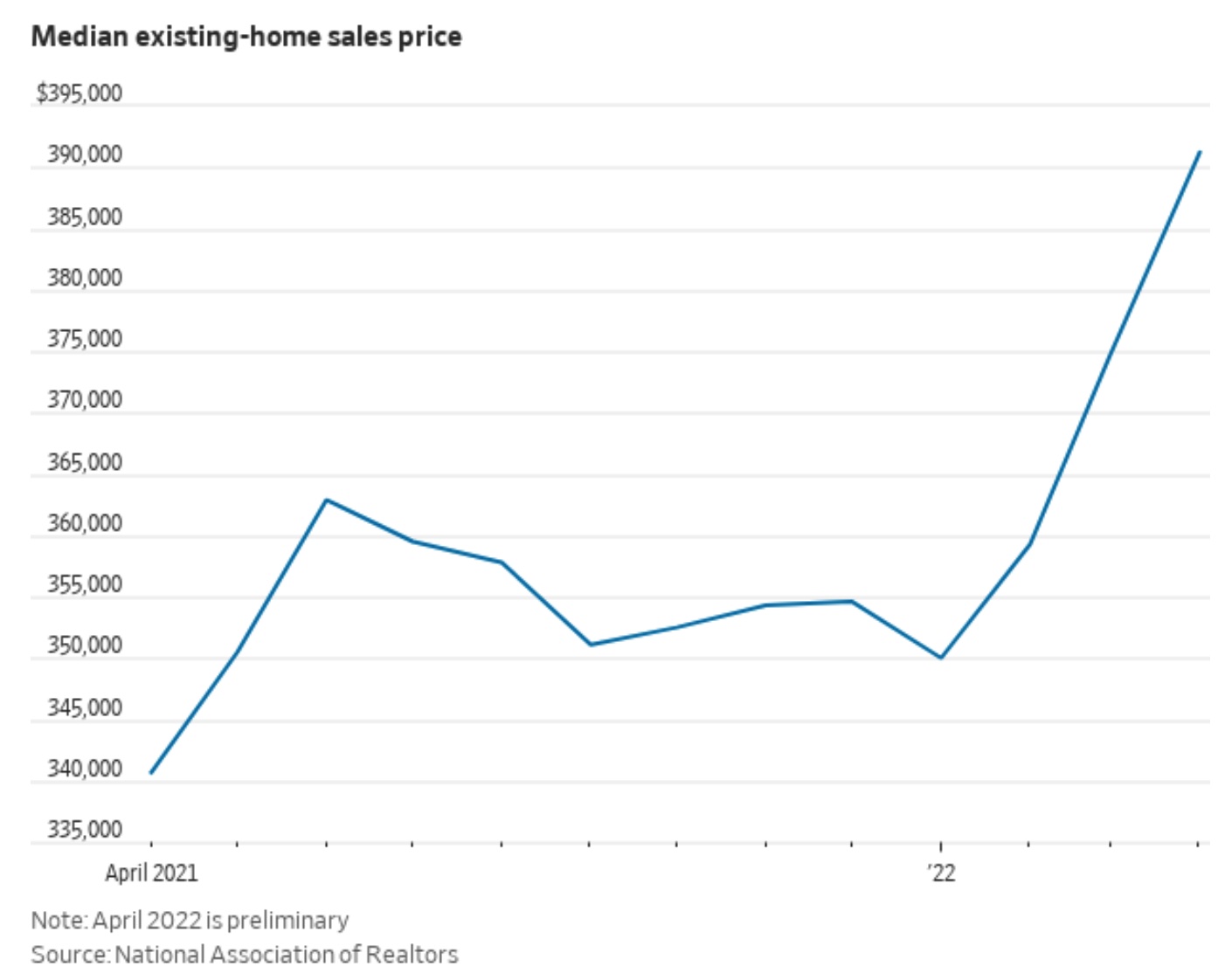

Average existing home sold for a record $391,200 in April, up 14.8% from last year. Rising mortgage rates combined with higher prices are making homes less affordable, especially for first-timers, who were 28% of buyers in April, down from 30% in March and 31% a year ago.

Average rate on a 30-year fixed home loan this week was 5.25%, a more than two percentage-point increase from the final reading in 2021, and well above the pandemic low of 2.65% in January 2021, according to Freddie Mac data out Thursday. Homes spent about 17 days on the market in April, and 88% of homes sold in less than a month, NAR reported. Sales are also lower because “we don’t have inventory,” Chief Economist Lawrence Yun said. The 1.03 million homes for sale in April are down 10.4% from last April.

Rail users urge National Economic Council to address service issues. In a letter today to the National Economic Council, members of the Rail Customer Coalition (RCC) urged the council to address freight rail service as a critical element of strengthening the nation’s supply chains.

|

MARKET FOCUS |

Equities today: Global stock markets were mostly up overnight. U.S. stock indexes are pointed toward higher openings. China cut a key reference rate for mortgages by an unexpectedly wide margin Friday. That's the second reduction this year in this key rate as Beijing seeks to revive the country's ailing housing sector. The Stoxx Europe 600 index added 1.5%, erasing the week’s losses.

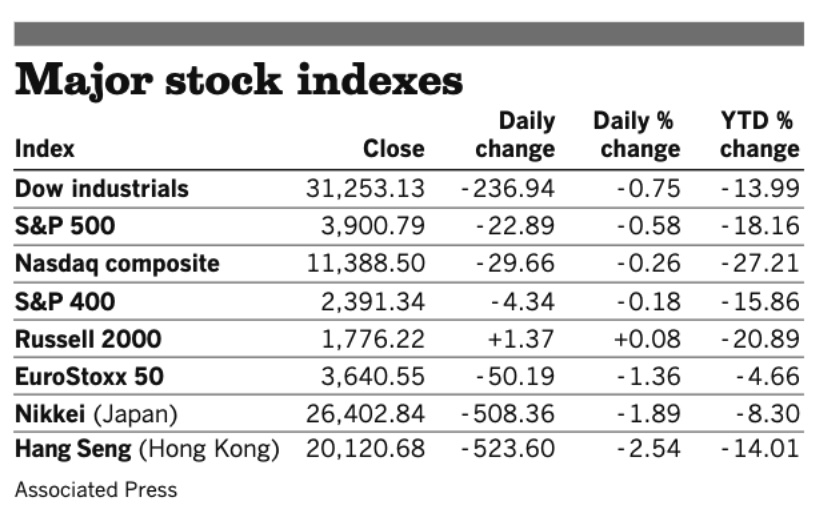

U.S. equities yesterday: The Dow fell 236.94 points, 0.8%, to 31,253.13. The S&P 500 lost 22.89 points, 0.6%, to 3,900.79, coming close to bear-market territory — a 20% fall from a recent high. Both indexes closed at their lowest level since March 2021. The Nasdaq, which entered bear-market territory earlier this year, retreated 29.66 points, 0.3%, to 11,388.50.

Federal Reserve Bank of Kansas City President Esther George said "the rough week" in the markets wasn't surprising and was "one of the avenues though which tighter financial conditions will emerge.” Today may be a particularly stern test of the market — with a risk of further volatility — as Goldman Sachs Group Inc. estimates that $460 billion worth of derivatives across single stocks and $855 billion of S&P 500-linked contracts will expire.

Agriculture markets yesterday:

- Corn: July corn futures rose 1 3/4 cents to $7.83 1/4, while December futures fell 4 1/4 cents to $7.36.

- Soy complex: July soybeans rose 27 3/4 cents to $16.90 1/2, the contract’s highest close since April 27. November soybeans rose 15 cents to $15.14 1/2. July soymeal rallied $11.30 to $425.30, while July soyoil fell 102 points to 79.53, a four-week low.

- Wheat: July SRW wheat fell 30 1/4 cents to $12.00 1/2. July HRW wheat fell 29 1/4 cents to $12.95 1/4. July spring wheat futures tumbled 22 1/4 cents to $13.30 1/2.

- Cotton: July cotton jumped 323 points to 147.70 cents per pound.

- Cattle: June live cattle closing unchanged at $131.50, while August feeder futures fell 60 cents to $165.20. Choice cutout values rose $1.23 to $261.70, up from $258.95 at the end of last week, but movement was relatively light at 86 loads.

- Hogs: June lean hogs fell 80 cents to $105.30 and July hogs fell $1.55 to $106.975. Pork cutout values fell 15 cents to $103.46 but are still up from $101.17 at the end of last week. The day’s movement was light at 220 loads.

Ag markets today: Wheat futures faced followthrough selling pressure overnight, while corn also traded lower. Soybeans traded lower for much of the overnight session but has turned mixed this morning. As of 7:30 a.m. ET, wheat futures were trading 9 to 14 cents lower, corn was 6 to 7 cents lower and soybeans were fractionally higher to 3 cents lower. Front-month U.S. crude oil futures were around 25 cents higher and the U.S. dollar index was up a little more than 150 points this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. quarterly services survey for the first quarter is out at 10 a.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• USDA Cattle on Feed report, 3 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

• President Biden arrived overnight in Pyeongtak, South Korea, where he met with South Korean President Yoon Suk-yeol. The two leaders visited a Samsung plant that will serve as a model for one being built in Taylor, Texas. Biden is set to travel to Seoul on Friday night, where he will spend the weekend before flying to Tokyo on Sunday night.

• Davos returns. After a two-and-a-half-year hiatus, about 1,300 business and government leaders will travel to the Swiss mountain village of Davos this weekend for the annual meeting of the World Economic Forum. President Biden, who as noted will be on a six-day diplomacy trip to South Korea and Japan, will not attend this year.

Deere misses sales estimates as inflation weighs on customers, but raises profit forecast as equipment demand increases. Deere & Co., the largest maker of agricultural machinery, reported quarterly sales that were below estimates as the company said higher costs impact farmers. The Moline, Illinois-based company reported revenue for its largest business segment, production and precision agriculture, of $5.12 billion, below the average estimate of $5.89 billion. “Looking ahead, we believe demand for farm equipment will continue benefiting from positive fundamentals in spite of availability concerns and inflationary pressures affecting our customers’ input costs,” Chief Executive Officer John May said Friday in a statement. “Deere’s second-quarter performance reflected a continuation of strong demand even as we face supply-chain pressures affecting production levels and delivery schedules.” Deere also said it suffered from higher production costs and impairments related to the Russian invasion. Deere in March told investors it halted shipments of its equipment to Russia. Deere forecast 2022 net income between $7 billion and $7.4 billion, above analysts’ average estimate of $6.99 billion and up from a prior range of $6.7 billion to $7.1 billion, according to a statement on Friday.

Japan inflation tops 2% for first time in 13 years. Consumer prices in Japan rose at a pace above 2% for the first time in more than 13 years, a sign of how higher costs of energy and raw materials are hitting even the world’s most inflation-resistant regions. It was the first time since September 2008 that inflation topped 2%, excluding the impact of sales-tax increases. It was also the fastest rise since 1991. Both the BOJ and outside economists see consumer demand in Japan as relatively weak and believe inflation above the bank’s 2% target is unlikely to take hold.

Yellen rejects idea of Fed raising its 2% inflation target. Treasury Secretary Janet Yellen rejected any idea that the Federal Reserve and its counterparts should boost their inflation targets given the importance of stable price expectations at a time when living costs are surging.

Rapidly rising mortgage rates and record home prices are cooling the U.S. housing market, as April sales dropped for the third straight month and fell to their weakest pace in nearly two years.

Retail sales in Britain unexpectedly rose 1.4% in April, despite consumer confidence falling to its lowest level since the 1970s. The retail sales, driven by a boost in supermarket alcohol spending, may reflect a shift in consumer behavior, with shoppers choosing to drink at home rather than pubs.

CBO Budget Outlook. Congressional Budget Office (CBO) Director Phillip Swagel is scheduled to testify next Thursday before the House Budget Committee on the CBO’s budget and economic outlook.

Market perspectives:

• Outside markets: The U.S. dollar index is a bit firmer in early trading. Bond prices, which move inversely to yields, fell Friday. The 10-year Treasury yield was trading around 2.9%. That's just under the key 3% level that's been breached on and off for weeks as traders push yields higher on the belief that the Fed will have to hike interest rates more aggressively to get inflation under control. West Texas Intermediate crude was little changed. Gold futures rose 0.2% to $1,850.70 an ounce.

• A surging dollar raises the possibility of parity with the euro, the WSJ reports (link).

• Average price for a gallon of regular unleaded gasoline in the U.S. hit a record of $4.59 on Thursday, according to AAA. It is the highest national average recorded by AAA since they began tracking fuel costs in 2000. On average, prices are about 50 cents more a gallon than they were a month ago. A year ago, the average cost of a gallon of gas was $3.04.

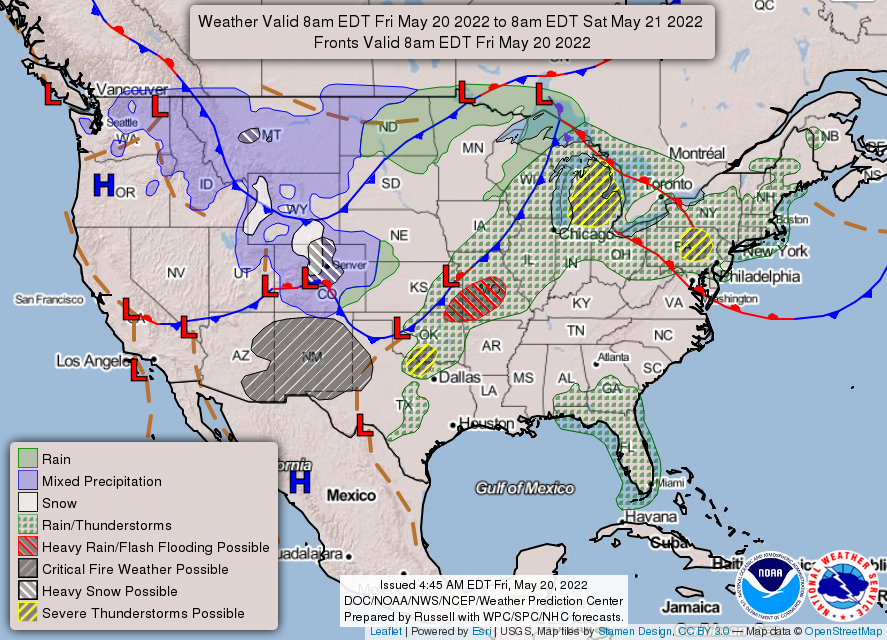

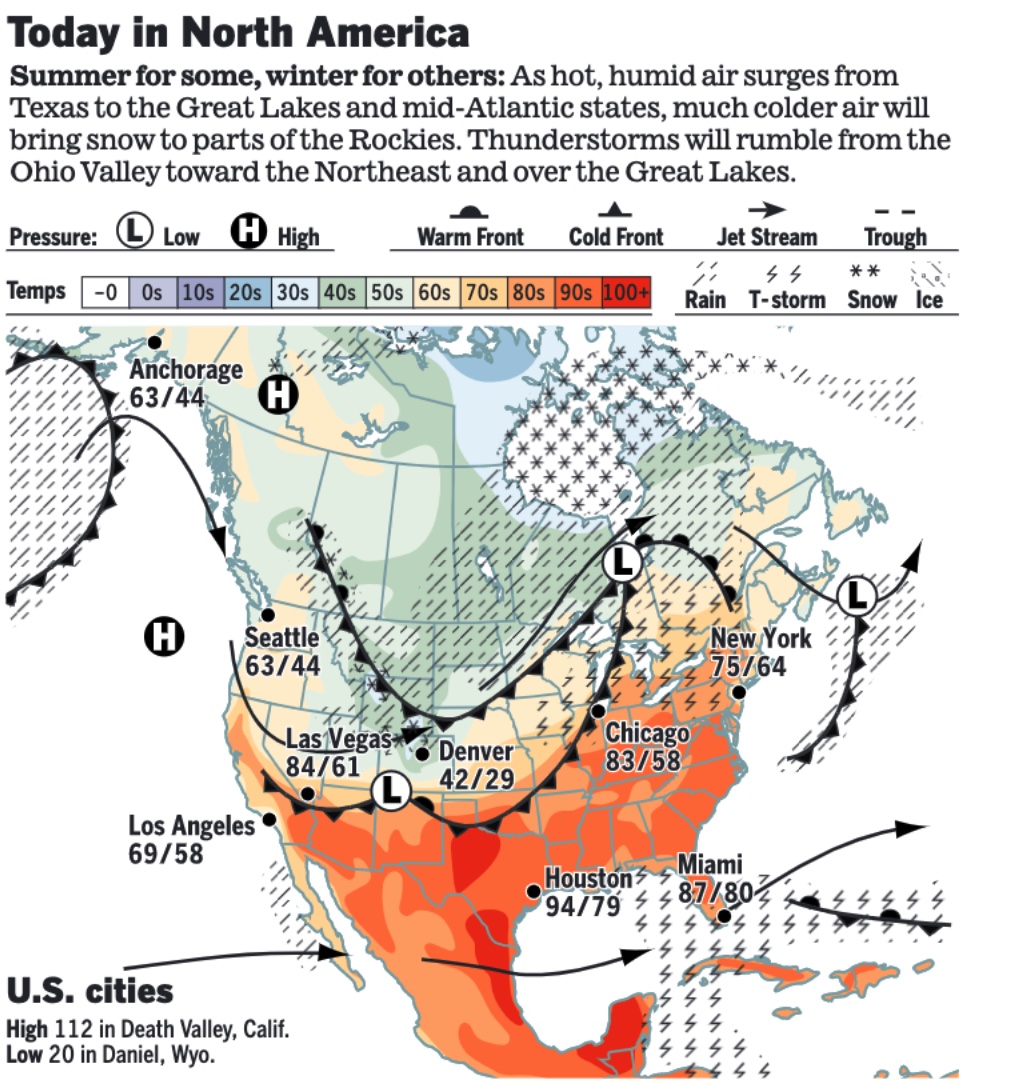

• Filling a tractor tank daily now costs some farmers $1,000, twice what it was a year ago. And the most intensive part of the farming season is still ahead. U.S. diesel prices are the highest ever, with warnings of shortages, especially in the eastern U.S. “Diesel is the lifeblood of farming,” Iowa corn and soybean farmer Ben Riensche told Bloomberg. His fuel costs have jumped to $70 an acre from $35. Fertilizer, grain and machinery parts can’t move efficiently through the system without diesel, which is also needed for his massive earth-moving equipment. Meanwhile, propane has nearly doubled in price from last year. It is used to heat farmers’ homes and power dryers during harvest to reduce corn moisture and make the grain suitable for storage and sale. That’s likely to be significant this season for producers who are battling heavy rains and flooding in the U.S. northern states and Canadian prairies.

• Persistently strong commodity prices in the opening months of the year fueled a sharp growth in farmland values throughout the Midwest and Plains, said a Federal Reserve report on Thursday. “Similar to the previous quarter, the value of nonirrigated cropland rose by more than 20% from a year ago in Federal Reserve Districts with a large agricultural concentration,” said the quarterly Ag Finance Update (link). The report, based on surveys of ag bankers, said the increases were particularly large in Kanas, Iowa, and three Rocky Mountain states. Land values soared 29% in Kansas, 28% in Iowa, and 32% in Colorado, Wyoming, and northern New Mexico.

• Price of the key building material just dropped to its lowest level of the year, as builders adjust their expectations for housing demand amid rising mortgage rates. Lumber futures were trading at $700 per thousand board feet yesterday, down as much as 6%.

• Agricultural commodities may be one of the last options left on the menu for investors reeling from a global stock- and bond-market crash, the WSJ notes (link).

• Rail users urge National Economic Council to address service issues. In a May 20 letter to the National Economic Council, members of the Rail Customer Coalition (RCC) urged the council to address freight rail service as a critical element of strengthening the nation’s supply chains. “The rail service problems we are experiencing today are not solely the result of the Covid-19 pandemic,” the RCC stated. “Years of railroad decisions to cut tens of thousands of jobs, eliminate switch yards, and idle locomotives have gutted network resilience. As a result, service disruptions have become more frequent, severe, and long-lasting.” The solutions to these challenges extend beyond the responsibilities of the Surface Transportation Board (STB), the groups noted, urging the council to focus its engagement on preventing future rail service disruptions. “It will be critical to ensure that major freight railroads have the proper incentives to promote the level of service and reliability needed to support U.S. supply chains,” the letter noted.

• NGFA urges Corps to delay closure of Old River Lock. The NGFA led a letter from agricultural organizations to the Army Corps of Engineers urging it to delay its planned closure of the Old River Lock in Lettsworth, La. for dewatering from Aug. 15 to Nov. 13 this year. “The timing of this closure would cause severe economic impact to farmers, domestic shippers, and domestic and international merchants of agricultural commodities,” noted the letter sent to Major General Diana M. Holland on May 13.

• NWS weather: Record breaking heat is expected to intensify and expand up the East Coast over the next couple of days as heat becomes less intense over the southern Plains... ...Drastically colder air will surge across the western U.S., culminating in a late-season wintry weather event over the central Rockies/High Plains late tonight into Saturday... ...Heavy rain and severe thunderstorm threats will focus near a stalled front from the southern Plains to the Great Lakes today and Saturday... ...Critical fire danger continues from the Southwest into the central/southern High Plains before the arrival of cold air this weekend.

Items in Pro Farmer's First Thing Today include:

• Wheat leads overnight price declines

• China cuts 5-year LPR (details in China section)

• China to auction more soybean reserves

• Malaysia keeps palm oil export tax at 8%

• Russian wheat export tax falls for third straight week

• Another sharp drop in French wheat crop ratings

• Placements key in Cattle on Feed Report

• Retailers remain reluctant buyers of beef

• Cash hog index starting to firm

|

RUSSIA/UKRAINE |

— Summary: Ukraine’s president, Volodymyr Zelenskyy, described conditions in the east of the country as “hell” as an intensifying Russian bombardment has left the Donbas region “completely destroyed.” Ukraine has reported intense fighting around Lysychansk and Severodonetsk, two cities in the region. Russia is using artillery, rocket-launchers and aircraft. Many civilian targets have been hit.

- President Biden announced a new security assistance package for Ukraine that includes artillery, radars and other equipment, although the White House did not state the value of the new aid package in a statement announcing the new security assistance.

- Finance chiefs from the Group of Seven leading economies pledged to deliver $19.8 billion of budget aid to Ukraine this year after the U.S. pressed its allies to provide the beleaguered country with more financial support. The finance ministers of the Group of Seven major advanced economies, meeting in Germany, are targeting a package that would plug holes in Ukraine’s government budget for three months, European officials said. “While also addressing Ukraine’s humanitarian and other material needs, we recognize, in particular, Ukraine’s urgent short-term financing needs,” G7 finance ministers said Friday in a communique following two days of meetings near Bonn. The International Monetary Fund will be assisting with the package, German Finance Minister Christian Lindner, the host of the meeting, told reporters. An even bigger aid package may be approved next month when G-7 government leaders gather in Elmau, Germany on June 26-28.

- President Biden offered his “strong support” for Finland and Sweden’s bids to join NATO and sent the countries’ accession reports to the Senate “to efficiently and quickly move on advising and consenting to the treaty.” Biden met with Finnish President Sauli Niinisto and Swedish Prime Minister Magdalena Andersson at the White House on Thursday. The bid, though opposed by Turkey, would represent a strategic embarrassment for President Vladimir Putin, who has sought to constrain expansion of the North Atlantic Treaty Organization (NATO). Meanwhile, Gasum, Finland's state-owned gas wholesaler, said in a statement Friday morning that natural gas imports from Russia will be halted from Saturday.

- Yellen: Secondary sanctions on Russia oil discussed at G7. Treasury Sec. Janet Yellen said officials have discussed secondary sanctions and other ways to limit Russia’s oil revenues while minimizing the impact on energy prices during a meeting of finance ministers from the Group of Seven (G7) countries. The U.S. has already banned oil imports from Russia, and European Union countries are aiming to do the same thing, gradually over the next year. In the meantime, G7 officials also discussed the potential of using secondary sanctions to enforce a price cap on Russian oil, Yellen told reporters in Bonn, Germany on Thursday.

— Market impacts:

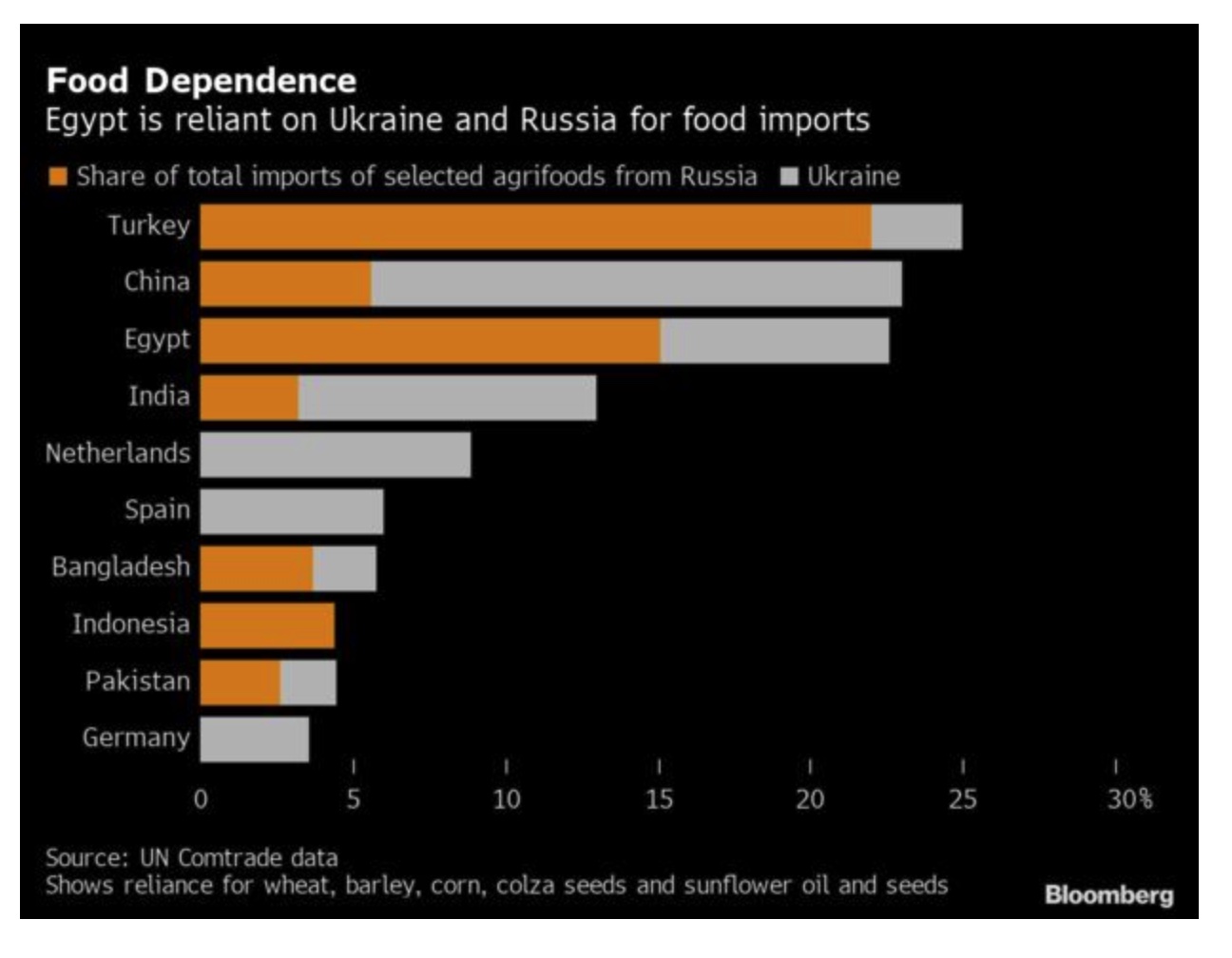

- Egypt refused to allow a shipment of undocumented Ukrainian wheat to land at its ports, the country’s supply minister said in an interview with Bloomberg. Ukrainian harbors are sealed off by Russian forces in a blockade that’s cut off a vital source of grain and vegetable oils, sending global food prices soaring. Ukraine accuses Russia of stealing grain in occupied areas and selling it abroad, and local traders have said Russian troops have confiscated grain, equipment and fertilizers in occupied areas in the southeast of the country. “There was a Ukrainian wheat ship that Russia had allowed to sail, it is said it was going to the Egyptian ports.” Aly El-Moselhy said on the sidelines of an event in Cairo earlier this week. “The ship did not have shipping documents, nor any request from any government or even the private sector for this cargo. We refused its entry to the Egyptian ports and it moved away.” Egypt relies on Russia and Ukraine for 42% of its grain imports. Its wheat bill is set to rise more than half to $4.4 billion this fiscal year that ends in June, as grain prices soared on supply concerns over the war and poor harvests elsewhere. Egypt is in talks with Ukraine about how to receive contracted wheat while export routes are blocked. Ukrainian Foreign Minister Dmytro Kuleba tweeted that he was “grateful to Egypt for turning away a Russian ship loaded with grain stolen in Ukraine.” Egypt’s foreign ministry said in a statement that Foreign Affairs Minister Sameh Shoukry received a phone call from Kuleba, but the statement didn’t mention the wheat cargo issue.

- Ukraine reported a major drop in grain exports, threatening food security for millions worldwide. Grain exports from Ukraine are down 64% so far in May compared to the same timeframe last year, the country’s agriculture ministry said Thursday according to Interfax Ukraine. Ukraine accounted for 10% of global wheat exports in 2021, according to the United Nations, while Russia produced about 17% of all wheat globally. Ukraine’s ports have suspended activities since the war launched due to Russian blockades, and the U.N. estimates about 20 million tons of harvested grain are stuck in the country. Meanwhile, global hunger is at a “new high,” U.N. Secretary-General António Guterres said Thursday, estimating “tens of millions” of people worldwide will “edge into food insecurity, followed by malnutrition, mass hunger and famine, in a crisis that could last for years.”

|

POLICY UPDATE |

— Senate passed a more than $40 billion Ukraine aid package on a bipartisan 86 to 11 vote, sending the bill to President Joe Biden for his signature.

|

CHINA UPDATE |

— China’s central bank cut a benchmark interest rate, a move most expect will help the beleaguered housing market but bring only limited relief to the struggling economy. The latest in a series of targeted steps by the central bank highlights how policy makers in China are constrained by rising interest rates in the U.S. and Beijing’s zero-tolerance approach to the pandemic. The uncertainty over China’s trajectory this year has further clouded the prospects for global growth.

Details: The five-year loan prime rate (LPR) was lowered by 15 basis points to 4.45%, while the one-year LPR was unchanged at 3.70%.

|

ENERGY & CLIMATE CHANGE |

— House clears bill banning ‘excessive’ gasoline prices; hurdles in Senate. Legislation that would allow the president to bar selling gasoline at “excessive” prices passed the House Thursday, as Democrats seek to address record-high prices at the pump. The bill isn’t expected to garner the Republican support needed in the Senate. So the House measure is mainly a talking point as House Democrats return home for a two-week recess with the average price of a gallon of regular unleaded gasoline setting a new record every day for the past 10 days.

— Biden administration committed to laying out an initial plan for offshore oil and gas lease sales following mounting pressure from key centrist Sen. Joe Manchin (D-W.Va.) and other lawmakers. Interior Secretary Deb Haaland told senators on Thursday that the proposed program, which could outline potential auctions in the Gulf of Mexico and other U.S. waters, will be issued by June 30, when the current schedule expires. But there will be at least five months of public comment and other review before it could be finalized. And the final program might not actually authorize sales. Manchin, who complained that the Biden administration is “blocking increased energy production at home,” while encouraging more oil flows from Venezuela and OPEC producers. Energy Secretary Jennifer Granholm assured lawmakers Thursday that the U.S. doesn’t have any plans to accept oil imports from Venezuela even as the Biden administration seeks to ease sanctions to bring more crude from the South American nation to Europe. Reports note that Chevron could boost its crude output in Venezuela by 33% this year if the U.S. allows the oil explorer to resume drilling in the country.

— EPA plans ‘flexibility’ for refineries on old biofuel quotas. The Biden administration will soon announce a plan to give small oil refineries more flexibility in fulfilling older biofuel-blending quotas when the facilities are denied exemptions from the requirements, according to reports. The plan, now under White House review, comes as the Environmental Protection Agency (EPA) prepares to deny scores of refinery waivers from 2019, 2020 and 2021 biofuel-blending quotas. It also follows a decision to revoke 31 previously granted exemptions from 2018 targets. The move could help address concerns there are not sufficient valid biofuel credits, known as RINs, for refineries to satisfy the old quotas. A draft proposed rule would create an “alternative RIN retirement schedule for small refineries.”

EPA Administrator Michael Regan on Wednesday stressed the agency was seeking to provide flexibility for small oil refineries that have historically received waivers from federal mandates to mix renewable fuel into their products. “When you take a look at the exemptions that were not recently granted, there’s also compliance flexibility built into that,” Regan told a Senate panel Wednesday. “Some decisions have been made in the past so far back that some of that compliance was forgiven.” And for more recent rejections, compliance plans are phased in, he said. “It wasn’t a blanket denial” and then “you’re on your own.”

Dateline. EPA will finalize biofuel-blending quotas for 2022 and 2021 —and retroactively revise 2020 requirements — by June 3.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Senate GOP blocks restaurant industry push for new covid relief. A bid by the restaurant industry to secure $40 billion in new Covid relief grants hit a big hurdle in the Senate Thursday after Republicans blocked an attempt to begin debate on a bipartisan aid bill. The 52-43 vote — short of the 60 needed — likely spells the end of the move to fund restaurants left out of last year’s rescue efforts unless the bill sponsors can find a way to fully pay for the spending.

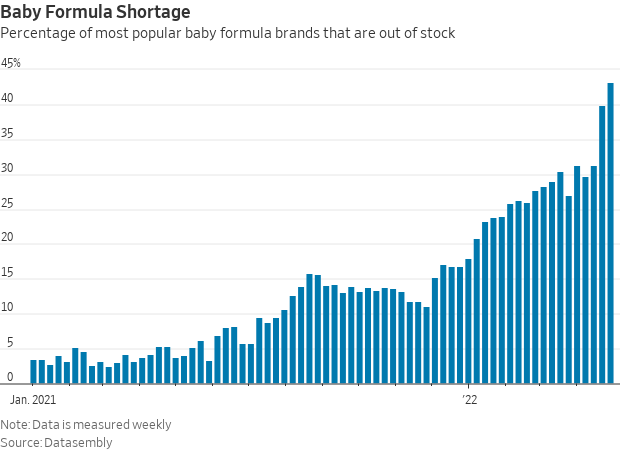

— Califf: Baby formula shortage details coming next week. FDA Commissioner Robert Califf at a hearing dodged questions from House Appropriations Chairwoman Rosa DeLauro (D-Conn.) about a whistle-blower’s report from October of quality lapses and falsified records at an Abbott Laboratories baby formula plant that’s shutdown has contributed to a nationwide shortage. Califf said he would go into more detail next week at a House Oversight and Reform Committee hearing, and pleaded for more resources for the agency to evaluate infant formula safety.

|

CORONAVIRUS UPDATE |

— Latest Covid-19 case surge is expanding beyond the Northeast, with places from the Midwest to Florida and California under rising pressure.

— Billions in school Covid-relief funds remain unspent. Districts have yet to spend 93% of $122 billion sunk into the K-12 education system last year as part of the $1.9 trillion American Rescue Plan. Link for details via the WSJ.

— New York’s mayor rejects mask mandates. Eric Adams has said that he does not plan to bring back mandates unless the hospital system approaches “a state of emergency.” So far, Covid hospitalizations and deaths in the city have risen more slowly than in previous waves.

— Covid numbers:

- 66.5% of the U.S. population have received two vaccine doses

- 46.4% of fully vaccinated people in the U.S. have had a booster shot

- 109,740 new U.S. cases recorded yesterday

- 339 deaths in the U.S. recorded yesterday

- 1,001,60 total recorded U.S. deaths

- 6,273,636 total deaths recorded world-wide

|

POLITICS & ELECTIONS |

— New maps and 2022 ratings: Kansas, Missouri. According to David Wasserman, House editor of the Cook Political Report with Amy Walter: “On Wednesday, the Kansas Supreme Court gave Republicans a surprise victory when it reinstated a GOP map that a lower court judge had struck down as an illegal gerrymander. And in Missouri, GOP Gov. Mike Parson signed into law a new congressional map that locks in the state's 6R-2D delegation after months of GOP infighting. At this writing, the only three states remaining to finalize redistricting are Florida, New Hampshire and New York.

Meanwhile, Charlie Cook, notes: “This game of political ping pong is likely to continue, with policy ricocheting from the left to right and back in two- and four-year intervals, with each party taking turns absorbing the hits until they are thrown out of power. A helluva way to run a country."

|

CONGRESS |

— Vilsack to testify before Senate Ag May 27. USDA Secretary Tom Vilsack will testify next Thursday at a Senate Agriculture Committee hearing titled “Opportunities and Challenges Facing Farmers, Families and Rural Communities.”

|

OTHER ITEMS OF NOTE |

— Cotton AWP moves higher. The Adjusted World Price (AWP) for cotton is 143.24 cents per pound, effective today (May 20). That is up from 140.82 cents per pound and the third straight week it has been above 140 cents per pound. USDA announced Special Import Quota #5 as of May 26 for 45,462 bales of Upland Cotton and applies to cotton purchased not later than Aug. 23 and entered into the U.S. no later than Nov. 21.

— President Joe Biden is weighing a meeting with Saudi Arabia’s Mohammed bin Salman as soon as next month, according to people familiar with the matter. Relations between the two countries have been strained since the murder of columnist Jamal Khashoggi. Biden may visit the Middle East, an unidentified administration official said.

— Cases of monkeypox were detected in Britain, Portugal, Spain and the U.S. The viral disease, which causes fever symptoms and a distinctive rash, is endemic in west and central Africa. The virus spreads through close contact and was first discovered in 1958 in monkeys. Link for details via Bloomberg.

— 2020 census undercounted six states, overcounted eight. The undercounted states are Arkansas (-5%), Florida (-3.5%), Illinois (-2.0%), Mississippi (-4.1%) Tennessee (-4.8%) and Texas (-1.9%). The overcounted states are Delaware (5.5%), Hawaii (6.8%), Massachusetts (2.2%), Minnesota (3.8%), New York (3.4%), Ohio (1.5%), Rhode Island (5.1%) and Utah (2.6%). No census results will be adjusted. However, the bureau has begun studying whether results from the survey can be used to improve annual population estimates that the bureau produces for states, counties and cities, said Deborah Stempowski, assistant director for decennial census programs. Population estimates guide distribution of some federal and state aid.