Strong Jobs Report: 467,000 Added Jobs in January; White House Predicted Somber Report

Initial livestock WHIP+ payouts coming by March

|

In Today’s Digital Newspaper |

Market Focus:

• White House, others miss a more robust jobs report than forecast

• What the latest jobs report means for policy and markets

• USDA daily export sale:

— 295,000 MT soybeans to unknown destinations. Of the total, 252,000 metric tons is for delivery during the 2021-2022 marketing year and 43,000 metric tons is for delivery during the 2022-2023 marketing year.

• Corteva expects prices for grains and oilseeds to remain high this year

• Corteva expects 90 mil. acres each for U.S. corn and soybean plantings

• Many workers reaping largest pay gains in years

• U.S. bridges failing faster than expected (W.Va. and Iowa the worst)

• Oil tops $92

• End of the U.S. shale boom

• Senate Ag panel to hold crypto hearing

• China bidding on more U.S. soybeans

• Transportation and infrastructure nuggets

• Ag demand update

• Outside markets support grain, soy futures overnight

• Cash cattle, wholesale beef prices going in opposite directions

• Modest gain in cash hog index

• World Weather Inc. (Drew Lerner's group) gives kudos to Farmer’s Almanac

Policy Focus:

• Hoeven: USDA to begin sending out livestock disaster assistance by March

• GAO report: Trade war payments skipped specialty crop, underserved farmers

Personnel:

• Clyburn making aggressive case for Childs for SCOTUS appointment

• Two Biden regulator nominees face big hurdles to confirmation

• Energy Secretary Jennifer Granholm acknowledged paying $400 in penalties

China Update:

• Russia/China appear to be aligning forces

Trade Policy:

• No announcement on Canada dairy TRQ situation

Energy & Climate Change:

• House Ag subcommittee examines climate/environment issues for livestock industry

Livestock, Food & Beverage Industry Update:

• Biden administration to unveil school nutrition standards

• Candy shortage

• Farm Bureau asks Justice Dept. for update on investigation into volatility in cattle prices

Coronavirus Update:

• Blood is in short supply in the U.S.

Politics & Elections:

• RNC consider a resolution today to censure Reps. Liz Cheney (R-Wyo.) and Adam Kinzinger (R-Ill.)

• For first time, Dems take lead on Cook Political Report’s redistricting scorecard

• Palin defamation suit

Congress:

• Congress on course to pass a third gov’t funding stopgap for FY 2022

• Proposal to revamp U.S. international ocean-shipping laws

• Ocean shipping bill

Other Items of Note:

• Growing certainty in Washington Putin will order some kind of military strike

• Planned sanctions if Russia invades Ukraine may not have major impact

• Perspective on ag market impacts if Russia invades Ukraine

• AFBF applauds Supreme Court decision to hear Clean Water Act case

• Cotton AWP rises, remains well above $1 per pound

• FGIS increases official inspection and weighing fees

• Farmer anticompetitive tip line

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. U.S. Dow opened down around 100 points. Nasdaq is higher in early trading. Asian equities were mostly higher despite the tech-related losses on Wall Street Thursday. The Nikkei rose 198.68 points, 0.73%, at 27,439.99. Hong Kong’s Hang Seng was up 771.03 points, 3.24%, at 24,573.29 after being closed earlier this week for the Lunar New Year holiday. However, markets in mainland China and Taiwan were still closed for the holiday. European equities were mostly lower in early trading. The Stoxx 600 was down 1.1% while most regional markets were seeing losses of 0.3% to 1.5%. However, British markets were nearly flat.

U.S. equities yesterday: The Dow fell 518.17 points, 1.45%, at 35,111.16. The Nasdaq dropped 538.73 points, 3.74%, at 13,878.82. The S&P 500 was down 111.94 points, 2.44%, at 4,477.44.

Facebook on Thursday suffered the biggest one-day stock drop of any U.S. company in history. Facebook parent company Meta shed more than $220 billion in market capitalization, the largest such single-day decline for a U.S. company in history. Meta’s stock closed down more than 26% on Thursday, an 85-point decline. The drop was largely driven by a quarterly earnings report that found the company was hemorrhaging daily users for the first time in its history. CEO Mark Zuckerberg personally lost about $24 billion. Meta’s crash drove declines across the stock market.

On tap today:

• U.S. nonfarm payrolls are expected to increase by 150,000 in January and the unemployment rate is forecast to hold at 3.9%, unchanged from one month earlier. (8:30 a.m. ET) See related item below for results and analysis.

• Farm income, 11 a.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• President Biden will speak on the January employment report at 10:45 a.m. ET.

The U.S. economy added 467,000 jobs last month, significantly better than the 150,000 that most economists had expected. That showed the resilience of the recovery in the face of a resurgent pandemic. The unemployment rate rose to 4%, the first increase in the jobless rate since June 2021. Biden administration officials errantly warned of a somber report, which shows there isn't a data leak within Washington! Details and analysis:

- Market impacts: Bonds instantly reacted. The 10-year yield on U.S. Treasury notes jumped higher to 1.90%, the highest since December 2019. Dow futures fell 200 points. Nasdaq futures rose early today, boosted by Amazon's 11% premarket surge on strong cloud-led earnings after the bell Thursday. But Nasdaq futures turned lower after the jobs data.

- It is the strongest job creation since October.

- Some note the job creation resulted from employers keeping holiday workers on their payrolls who in a typical year would have been discharged in January. Categories with strong job growth included retail (+61,000) and transportation and warehousing (+54,000).

- The week on which the Labor Department data is based coincided with the peak of Omicron infections. The report said that 6 million Americans were unable to work because their employer was closed due to the pandemic, up from 3.1 million in December. But what many got wrong prior to the report: The virus mostly did not affect the status of most salaried employees or those with paid sick leave. But the jobs of hourly employees who went unpaid due to illness vanished from employers' payrolls under the procedures used by the Bureau of Labor Statistics.

- A key in the situation is that the labor force participation rate shot up to 62.2% from the December mark of 61.9%. That is being tabbed as a key for jobs growth to continue moving forward in 2022. The data show that the US economy appeared to weather the Omicron Covid variant. The number of unemployed is at 6.5 million, but still is above the pre-pandemic level of 5.7 million being unemployed. Job gains in January were led by 151,000 added in the leisure and hospitality industry, but employment in that sector is still some 1.8 million or 10.3% million under where it was before the pandemic began. Another 61,000 were added in the retail trade sector, now putting employment there above where it was before the pandemic.

- Wages also rose by 5.7% in January compared with year-ago levels.

Corteva expects prices for grains and oilseeds to remain high this year; 90 mil. acres each for corn and soybean plantings. Relatively high prices for grains and oilseeds are in store this year thanks to record demand levels, CEO Chuck Magro said on the company's earnings conference call. "Over the medium to long term, we see constructive fundamentals continuing, as possible new demand to support renewable fuels such as bio-based diesel will likely support healthy agricultural commodity price levels," Magro said on the call.

Strong demand for Corteva's seed and crop protection products are helping the company to raise prices to offset higher costs due to inflation, Magro said: "Growers need the products, they need the technology. And certainly, from a pricing execution perspective, I think we've demonstrated that we can move prices to cover costs and grow margins."

Magro noted high fertilizer prices will prompt some growers to rotate into soybeans from corn and boost demand for the company's Enlist biotech soybean seeds and complementary herbicides. "This provides further support for systems like Enlist, where customer demand and industry-wide penetration remains strong and we anticipate it will grow to at least 40% of total U.S. soybean acres in 2022,” Magro said.

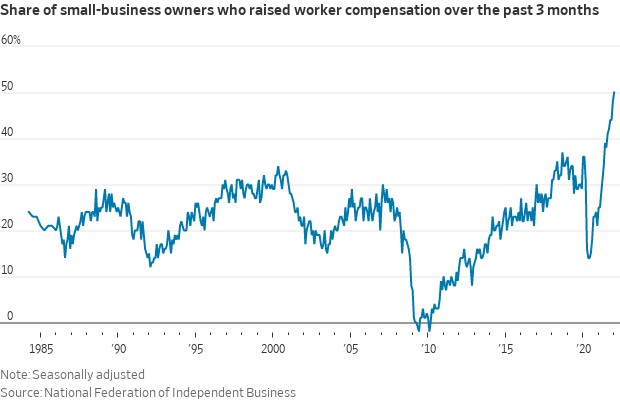

Many workers are reaping their largest pay gains in years. “Small business owners are managing the reality that the number of job openings exceeds the number of unemployed workers, producing a tight labor market and adding pressure on wage levels,” said Bill Dunkelberg, chief economist at the National Federation of Independent Business.

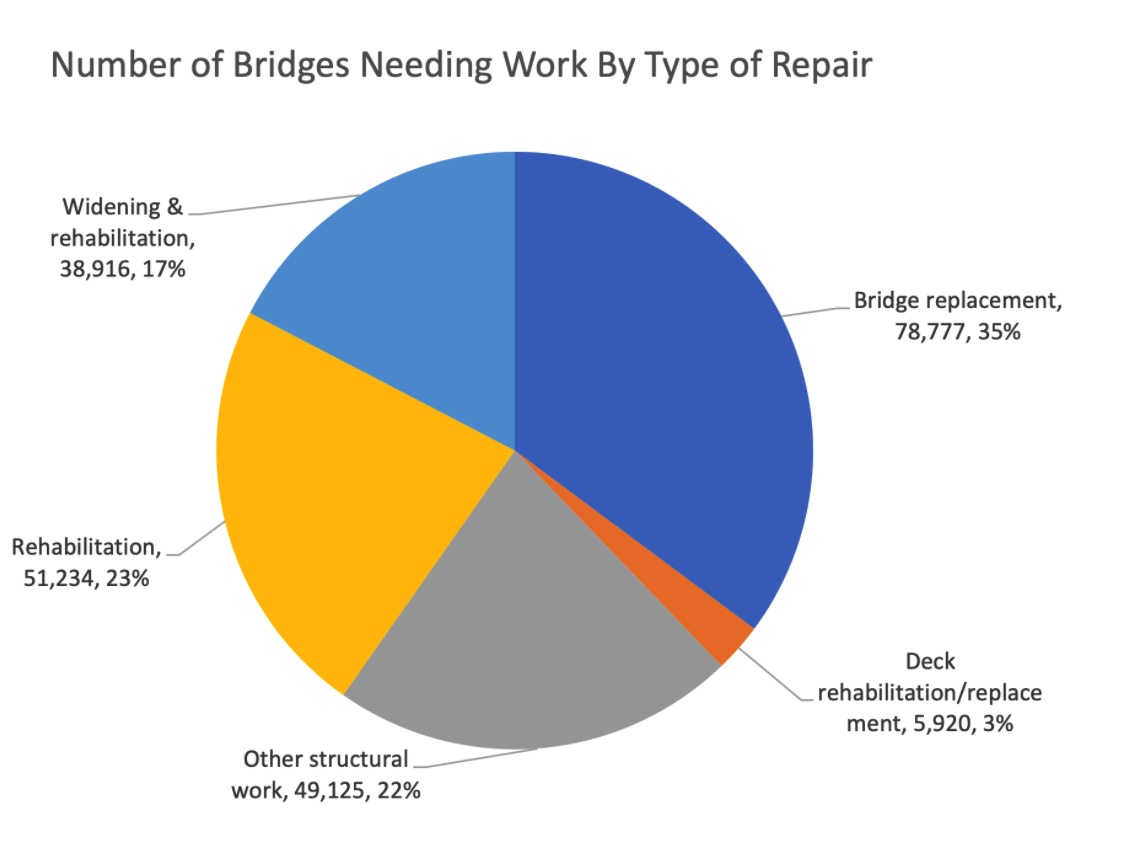

U.S. bridges are failing faster than expected. A third of the nation's 620,000 bridges — 36% — need major repair work or replacement, according to a new report (link). The estimated cost to replace all the structurally deficient bridges based on average price data from the U.S. DOT is over $58 billion. West Virginia and Iowa are the top states needing repairs (link).

Market perspectives:

• Outside markets: The U.S. dollar index was weaker ahead of the U.S. jobs update with a mixed tone in foreign currencies versus the greenback. The yield on the 10-year U.S. Treasury note was weaker, trading just under 1.82% with a mixed-to-firmer tone in global government bond yields. Gold and silver were registering solid gains ahead of the U.S. jobs report, with gold above $1,810 per troy ounce and silver above $22.50 per troy ounce.

• Crude oil futures were posting strong gains ahead of U.S. trading, with U.S. crude above $92.10 per barrel and Brent around $92.85 per barrel. Crude futures were firmer in Asian action, with U.S. crude around $90.80 per barrel and Brent around $91.50 per barrel.

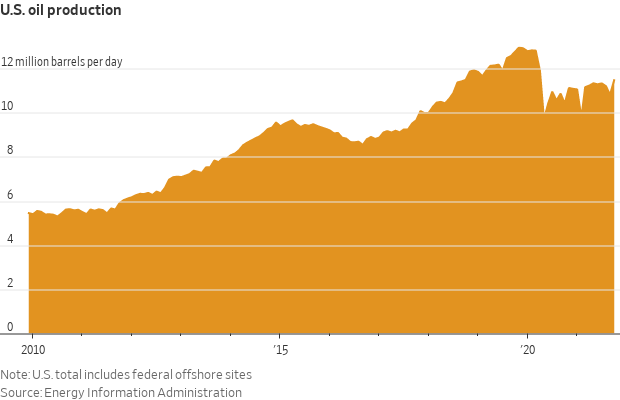

• Oil tops $92. With inventory levels in Cushing at multi-year, seasonally adjusted lows, and prices for the U.S. crude grade encroaching on seaborne levels, WTI is trading above $90 for the first time since mid-2014. Currently, global crude inventories are at unusually low levels, meaning supply increases from OPEC+ and American shale will need to meet post-pandemic demand (if oil prices are to remain at current levels). Unfortunately for consumers and oil-price bears, OPEC+ continues to miss quotas, while shale heavyweights like Conoco, Exxon and Chevron have all budgeted for flat, portfolio-wide output growth in 2022. "The oil market is so tight that any shock to production is going to send prices soaring," says Ed Moya, senior market analyst at OANDA. Several Wall Street analysts have already forecast $100 oil, with WTI up nearly 20% YTD, building on 2021's more than 50% gain.

The prospect of a Russian invasion of Ukraine comes as oil supplies are already tight. Russia produces roughly a tenth of the world’s oil, and any disturbance because of war or sanctions would push up global prices. Ben Cahill, a senior fellow at the Center for Strategic and International Studies in Washington, wrote this week that a significant disruption could result in prices “well above $100 per barrel.”

Tempering the bull market in oil: OPEC and its oil-producing allies announced this week that they would gradually increase supply. And some expect that the U.S. could strike a new nuclear arms treaty with Iran this year that would increase supply from that country as well. Analysts at Oxford Economics expect accelerating output to reduce oil prices by the end of this year.

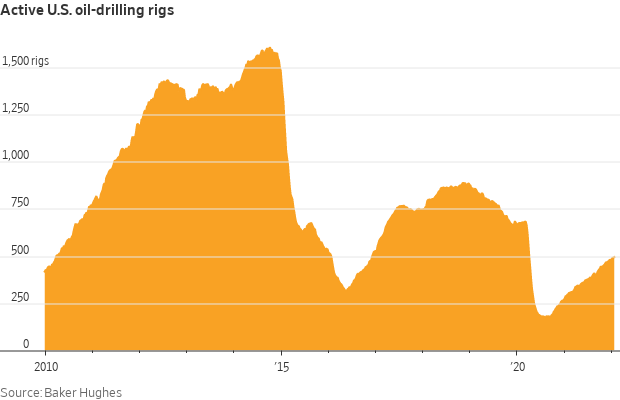

• End of the U.S. shale boom. The end of the boom is in sight for America’s fracking companies. Less than 3½ years after the shale revolution made the U.S. the world’s largest oil producer, companies in the oil fields of Texas, New Mexico and North Dakota have tapped many of their best wells. If the largest shale drillers kept their output roughly flat, as they have during the pandemic, many could continue drilling profitable wells for a decade or two, according to a Wall Street Journal review (link) of inventory data and analyses. If they boosted production 30% a year — the pre-pandemic growth rate in the Permian Basin, the country’s biggest oil field — they would run out of prime drilling locations in just a few years.

• Senate Ag panel to hold crypto hearing. The Senate Ag Committee will hold a Wednesday hearing on digital assets. The top Democrats and Republicans on the Senate and House Agriculture committees sent a letter to the chairman of the Commodity Futures Trading Commission calling on the derivatives regulator to take a more active role in overseeing cryptocurrencies.

• China reportedly is bidding for more U.S. soybeans. The CIF values were firmer yesterday, especially in the Sept forward positions. Some note China has already booked some U.S. beans this week. China will return from holiday Monday but international trading desks aren't closed.

• USDA daily export sale:

— 295,000 MT soybeans to unknown destinations. Of the total, 252,000 metric tons is for delivery during the 2021-2022 marketing year and 43,000 metric tons is for delivery during the 2022-2023 marketing year.

• Ag demand: South Korea purchased up to 65,000 MT of corn from an unspecified origin.

• Transportation and infrastructure nuggets:

- Canada’s Port of Prince Rupert is expanding capacity by about 200,000 containers by 2024. (Canadian Press)

- Grains cooperative Ag Processing will build a soybean plant in Nebraska near BNSF Railway and Union Pacific rail lines. (Progressive Railroading)

- Freight rates for large bulk carriers are off more than 90% from last year's peak amid sharply lower demand for iron ore in China. (Nikkei Asia)

- Authorities are working to free a Maersk container ship that ran aground just outside Germany’s Port of Bremerhaven. (Reuters)

- Rotterdam may briefly disassemble a historic bridge to let a $500 million superyacht commissioned by Jeff Bezos pass through. (NYT)

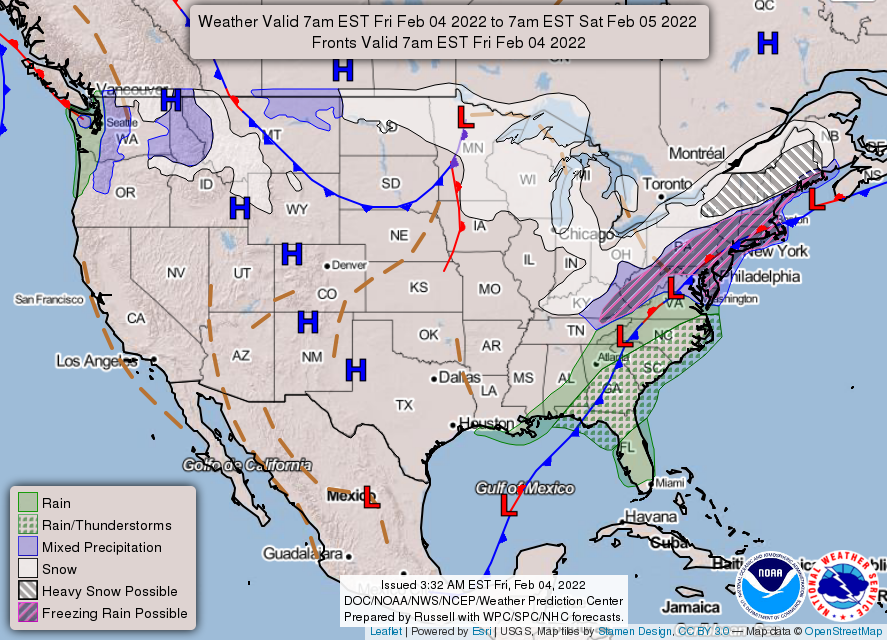

• World Weather Inc. (Drew Lerner's group) gives kudos to Farmer’s Almanac. In a special report titled "This Week’s U.S. Weather Makes Farmer’s Almanac Look Good,” the group writes: "Do you remember last autumn when weather speculations were made over the winter season laying ahead? Some references about this winter being harsh were made by the Farmer’s Almanac? This week’s weather seems to be vindicating some of that outlook. Prior to this week, though, winter weather had been relatively tame across the contiguous United States, but this week’s winter storm is certainly grabbing the headlines and creating some Mayhem."

• NWS weather: Major winter storm to produce heavy snow and treacherous ice accumulations in the Northeast today; scattered showers and thunderstorms possible in the Southeast... ...Bitterly cold temperatures ranging between 15 to 30 degrees below average from the Southern Plains to the Ohio Valley, very cold weekend in the Northeast... ...High winds expected in parts of the northern Rockies & Plains, light snow accumulations possible in the Upper Midwest and northern Great Lakes on Saturday.

Items in Pro Farmer's First Thing Today include:

• Outside markets support grain, soy futures overnight

• Cash cattle, wholesale beef prices going in opposite directions

• Modest gain in cash hog index

|

POLICY FOCUS |

— Hoeven: USDA to begin sending out livestock disaster assistance by March. USDA is expected to begin providing the initial phase of $750 million in livestock disaster assistance payments by March, Sen. John Hoeven (R-N.D.) announced. According to USDA, Phase 1 will:

- Use existing Livestock Forage Program (LFP) data.

- Require no or minimal additional paperwork from producers.

- Distribute at least half of the $750 million by the end of March.

“Our livestock producers have been hit by drought and other natural disasters over the last year, which has really taken a toll on their operations,” said Hoeven. “That’s why we worked to set-aside $750 million in disaster assistance specifically to help our ranchers weather the challenges of 2021. We’ve been pressing USDA to get these funds out as soon as possible, and USDA now expects this aid to begin flowing to producers by March. This is good news, and we’ll continue working to ensure the assistance is provided as effectively and efficiently as possible.”

More aid ahead. The $750 million for livestock producers is part of $10 billion in disaster aid, with an additional $9.25 billion in disaster funding to extend WHIP+ to aid producers who suffered losses due to droughts, hurricanes, wildfires, floods and other qualifying disasters in calendar years 2020 and 2021. USDA announced it will provide that assistance in a two-phase approach as well, beginning this spring.

— GAO report: Trade war payments skipped specialty crop, underserved farmers. USDA sent $23 billion in trade war payments to more than a half million farming operations, with the lion's share of the aid going to row-crop producers, said the Government Accountability Office (GAO) on Thursday (link). Historically underserved farmers received less than 4% of the money. Specialty crop growers received less than 1% of the $8.6 billion that was distributed for 2018 losses, said the GAO. An additional $14.4 billion was paid under different rules to mitigate the impact of retaliatory tariffs on U.S. agriculture in 2019.

Senate Ag Committee chair Debbie Stabenow (D-Mich.), who requested the report, said it showed that the Trump administration fell short in its stopgap aid. “We have to make sure there is fairness and accountability so all farmers can get the support they need from USDA,” she said.

|

PERSONNEL |

— Clyburn making an aggressive case for Childs for SCOTUS appointment. The New York Times reports (link) that House Majority Whip James Clyburn (D-S.C.) “is mounting an aggressive campaign” to persuade President Biden to nominate Judge J. Michelle Childs, a district court judge in his home state of South Carolina. The NYT calls it “a blatant effort to call in a political favor in the form of a lifetime appointment to the nation’s highest court and, perhaps, the most consequential test yet of the Biden-Clyburn relationship.” The result “has been the kind of pressure campaign that longtime Biden aides say can sometimes backfire. Biden recoils at being lobbied through the television. And there is sensitivity among some of his allies and former aides that his selection must look like the president’s own historic pick, not like a political chit he owes to Clyburn. But for Biden, a believer in sticking with the people who helped him get to where he is, Clyburn, a friend of many decades, still enjoys a special status.”

— Two Biden regulator nominees face big hurdles to confirmation. Sarah Bloom Raskin, who is up to lead banking regulation at the Fed, faced hostile questions from Republicans on Thursday about whether the central bank should use its powers to fight climate change. And Dr. Robert Califf, the nominee to lead the FDA, faces opposition from Republicans over his views on abortion and from Democrats over his ties to the pharmaceutical industry.

— Energy Secretary Jennifer Granholm acknowledged paying $400 in penalties for late reporting of stock trades.

|

CHINA UPDATE |

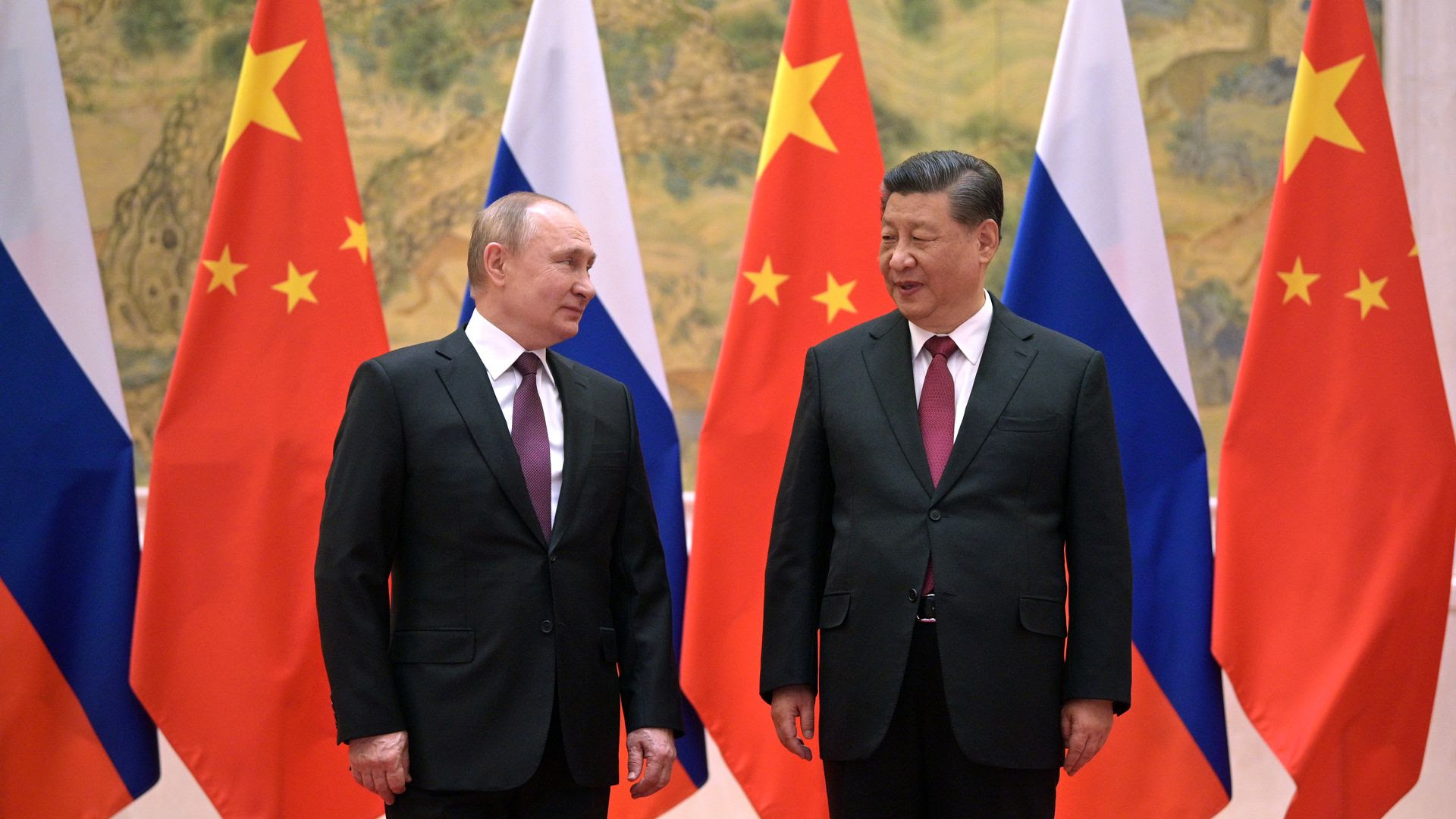

— Russia/China appear to be aligning forces. Russia and China in a joint statement today called for NATO to halt its expansion while Moscow said it fully supported Beijing’s One-China policy toward Taiwan, following a meeting between presidents Vladimir Putin and Xi Jinping. The Beijing Olympics’ motto is “Together for a Shared Future.”

The two countries expressed concern about “the advancement of U.S. plans to develop global missile defense and deploy its elements in various regions of the world, combined with capacity building of high-precision non-nuclear weapons for disarming strikes and other strategic objectives.” The two countries said they opposed further enlargement of U.S.-led NATO and called on the alliance to abandon its “ideologized Cold War approaches.” China supports Russia’s proposals to create legally binding security guarantees in Europe, the joint statement said.

Putin as expected unveiled a major new gas deal with China, a further sign of the deepening of the relationship between the two countries.

Photo: Alexei Druzhinin/Sputnik/Kremlin Pool Photo via AP

|

TRADE POLICY |

— No announcement on Canada dairy TRQ situation. Thursday was the deadline for Canada to indicate how it will bring its tariff rate quota (TRQ) system for dairy products in line with a ruling handed down under dispute settlement procedures under the U.S.-Mexico-Canada Agreement (USMCA). Politico reported that Canada has submitted a proposal to the U.S., but the Canadian official would not indicate what was contained in that proposal. While the U.S. can hit Canada with retaliation in the dispute, indications are that U.S. officials are not wanting to push forward on that front just yet. Resolution on this matter is key as it will provide a glimpse into how effective the dispute-settlement provisions of USMCA will be. While they have a much shorter timeline for a resolution to be found than multilateral routes like the WTO, if there are not changes to provisions found in violation, it will dampen the effectiveness of those provisions — one of the areas that many touted as being a key advancement under USMCA.

|

ENERGY & CLIMATE CHANGE |

— House Agriculture subcommittee examines climate/environment issues for livestock industry. More research on the topic of greenhouse gas emissions of methane, including the key of updating the measuring of those emissions in the livestock sector, was one of the focal points of a Thursday hearing by the House Agriculture Livestock and Foreign Agriculture Subcommittee.

Panel chair Jim Costa (D-Calif.) warned that livestock and poultry producers will not be able to make changes in their operations if lawmakers and regulators make “unreasonable” demands and that any changes have to make financial sense. “We must look forward to market-based solutions,” he commented, and come up with ways to “incentivize sustainable practices.”

Issues discussed: Updating the way methane emissions are measured, streamlining the regulatory process for animal feed additives that can address livestock emissions, and providing more help to farmers on manure management.

The hearing also touched on whether expanding the number of small processing facilities would aid the livestock sector, with a push for making sure that new plants are USDA inspected facilities cited as a key for expanding processing capacity.

The hearing was aimed at examining issues as the panel gets ready to work on the next U.S. farm bill, but this session appeared to lack some of the partisan fireworks that dominated a session on conservation programs earlier this week.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Biden administration to unveil school nutrition standards. The Biden administration today will unveil its final rule on a series of recommendations for the school lunch program, rules that seek to help the program get back on track to meeting basic nutrition rules. The rule to be unveiled today puts stricter limits on sodium, calls for more whole-grain items to be service and allows schools to keep serving flavored 1% milk, a change which the Trump administration put in place.

The U.S. dairy industry was the only industry that was shown as having met with the Office of Management and Budget (OMB) while the USDA plan was under review by the White House.

The new standards take effect with the 2022-23 school year. But if a push to keep a waiver authority in place for schools, that could mean the nutrition standards, including the new ones, may not be put in place.

— Candy shortage. Hershey and other candy makers are running low on goodies ahead of Valentine’s Day because of a shortage of labor and factory capacity.

— Farm Bureau asks Justice Department for update on its investigation into volatility in cattle prices during the pandemic in 2020 and following a 2019 fire at a Kansas slaughter plant. Link for details.

|

CORONAVIRUS UPDATE |

— Summary: Global cases of Covid-19 are at 388,512,793 with 5,714,637 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 75,994,966 with 897,377 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 541,410,847 doses administered, 212,336,183 have been fully vaccinated, or 64.68% of the U.S. population.

— Blood is in short supply in the U.S., with donation drives stalled amid Covid-19 and demand rising as people resume medical care they put off earlier in the pandemic. The number of people donating blood each month was 10% lower at the end of last year than before the pandemic began in February 2020, said the American Red Cross. Blood drives at schools and colleges have decreased by 62% during the same time. Hospitals throughout the U.S. are spacing out procedures to ensure they have enough blood to perform them, and some facilities have postponed or canceled elective surgeries.

|

POLITICS & ELECTIONS |

— Republican National Committee is expected to consider a resolution today to censure Reps. Liz Cheney (R-Wyo.) and Adam Kinzinger (R-Ill.), two of the most vocal GOP critics of Donald Trump, for serving on the House committee investigating the attack on the Capitol last year. The RNC’s resolutions committee unanimously approved censuring the two lawmakers last night, sending the measure to the full RNC for a vote today at its winter meeting in Utah.

— For the first time, Democrats take the lead on Cook Political Report’s redistricting scorecard. David Wasserman, House editor for the publication, writes: “On Thursday, New York became the 30th state to adopt a new congressional map, and although several states are still subject to court challenge, the redistricting process is now about two-thirds over. And owing to acrobatic gerrymanders in Illinois and New York — as well as favorable court developments in Alabama, Ohio and Pennsylvania — Democrats have taken a small lead in our redistricting projections for the first time all cycle.”

What it means: “Democrats are now on track to net two to three seats from new maps alone — a significant shift. But a 42% President Biden approval rating could still equate to several dozen losses in November, and Republicans remain overall favorites for the House majority.”

— Palin defamation suit. Court proceedings in Sarah Palin’s lawsuit against the New York Times for a June 2017 editorial kicked off in a trial that could have broad ramifications for the future of media law.

|

CONGRESS |

— Congress is on course to pass a third gov’t funding stopgap for the fiscal year that began Oct. 1. Negotiations on a 12-bill omnibus package continue at a slow pace barely two weeks before the Feb. 18 deadline appropriators set in the last continuing resolution.

— A proposal to revamp U.S. international ocean-shipping laws for the first time in over two decades was added to a sweeping House bill that aims to boost competition against China. The House voted 367-59 to add an update to federal maritime shipping laws as an amendment to the measure on the floor yesterday, reviving a legislative effort to address supply chain bottlenecks at U.S. ports. That effort also got a boost in the Senate, where lawmakers released two related shipping bills. The House is set to vote on the U.S./China competition package today.

Details: The legislation is a $350 billion initiative to boost U.S. competitiveness with China and other rivals. Differences with the Senate version of the bill signal struggles ahead. Both measures aim to increase federal support for scientific research and new technologies, and both provide for new federal incentives to boost domestic advanced semiconductor manufacturing. But numerous differences in the two versions have emerged in recent weeks.

— Ocean shipping bill. Responding to congestion at U.S. ports, 14 senators filed a bill that would bar shipping lines from unreasonably refusing to carry U.S. goods and would require reports every three months on their balance of import and export tonnage. Link for details.

|

OTHER ITEMS OF NOTE |

— Growing certainty in Washington that Russian President Vladimir Putin will order some kind of military strike. Biden administration officials on Thursday commented on the topic to a closed-door Senate briefing. Sen. John Cornyn (R-Texas) following the briefing said: “I think Putin is gonna do something. We just don’t know exactly what it is yet.” Senate Foreign Relations Committee Chair Robert Menendez (D-N.J.) said the briefing increases the need to pass a sanctions package immediately. “Collectively, what I heard only makes the case that this is more pressing more timely, and that time in this regard, if we want to be preventative, is of the essence.” Menendez revealed he is preparing pre-attack sanctions that would look to punish Russia for cyber-attacks and false flag operations, as some reports have alerted have or will take place. Sen. Jim Risch (R-Idaho), the top Republican on Foreign Relations, said he has seen intelligence that shows Russia is producing “false proof” that the Ukrainians are the aggressors. “It's important that all of you get that out there,” Risch declared. “And that the world understands that this is a false operation to try to justify them in an invasion.”

— Would planned sanctions if Russia invades Ukraine have “a devastating impact” on its economy as President Biden says? The Kremlin has spent the last eight years preparing by building up currency reserves and reducing foreign debt. Combined with rising oil prices, that may temper the pain of any potential penalties, Bloomberg reports.

— Perspective on ag market impacts if Russia invades Ukraine. Pro Farmer reports that in 2014 when Russia invaded Ukraine, there was virtually no disruptions to grain exports from Black Sea ports. If Russia enacts military force on Ukraine again, Pro Farmer expects a similar short, but explosive fear-driven rally that “would be an opportunity to advance corn and wheat sales.”

— AFBF applauds Supreme Court decision to hear Clean Water Act case. “AFBF is pleased that the Supreme Court has agreed to take up the important issue of what constitutes ‘Waters of the U.S.’ under the Clean Water Act. Farmers and ranchers share the goal of protecting the resources they’re entrusted with, but they shouldn’t need a team of lawyers to farm their land. We hope this case will bring more clarity to water regulations," AFBF President Zippy Duvall said of the U.S. Supreme Court decision to hear Sackett v. Environmental Protection Agency, which challenges EPA’s overreach of its Clean Water Act jurisdiction.

— Cotton AWP rises, remains well above $1 per pound. The Adjusted World Price (AWP) for cotton rose to 116.10 cents per pound, effective today (Feb. 4), the eighth weekly rise and fifth week above $1 per pound. This also marks the highest AWP since it was 123.43 cents per pound the week of June 17, 2011. Meanwhile, USDA announced Special Import Quota #16 would be established February 10 for 46,837 bales of Upland Cotton, applying to cotton purchased not later than May 10 and entered into the U.S. not later than Aug. 8.

— FGIS increases official inspection and weighing fees. Effective Feb. 1, the Federal Grain Inspection Service (FGIS) increased official inspection and weighing service fees by 5%. This is the second year in a row FGIS has increased national fees since the agency began using a five-year rolling average of export tons in its calculations. FGIS also reviewed local tonnage fees which were adjusted to reflect fiscal year 2021 costs and a five-year average of export tons. Link for details.

— Farmer anticompetitive tip line. The Justice and Agriculture departments launched a website, farmerfairness.gov, where farmers and ranchers can anonymously report potentially unfair or anticompetitive practices in the meat and poultry sectors. Link for details.