Some Ag Details Surface Re: Dems’ $3.5 Trillion Human Infrastructure Package

USDA daily export sales | Vilsack pressed on hog producer aid | Belarus sanctions/potash

In Today’s Digital Newspaper

Market Focus:

• Export sales of 182,880 metric tons of corn for delivery to Mexico

• Export sales of 132,000 metric tons of soybeans to China 2021-2022

• Export sales of 130,000 metric tons of soybeans to unknown destinations 2021-2022

• Yellen: Debt ceiling should be raised ‘on a bipartisan basis’ but GOP balks

• Federal budget deficit $2.5 trillion in irst 10 months of fiscal year 2021

• Job openings hit new record in June

• For first time, average pay for supermarket and restaurant workers tops $15 an hour

• Canadian Pacific upped its bid for Kansas City Southern railroad to $31 billion

• Front-month Comex silver on Monday hit lowest settle value since November

• Lawmakers, Vilsack weigh in on shipping container rates

• India plans effort to boost oilseed production, trim imports

• Russia's wheat values are rising but still well below U.S. values

• Ag demand update

• Corn under pressure, as soybeans climb

• Corn, soybean CCI ratings virtually unchanged

• Cordonnier holds U.S. corn and soybean yield projections steady after recent rain

• Late-season rains result in slow start to France’s wheat export season

• Beef price surge continues

• Heavy pressure on lean hogs to kick off the week

Policy Focus:

• Senate Democrats unveil $3.5 trillion spending plan

• Senate today expected to clear $550 billion physical infrastructure measure

• Little change in either CFAP 1 or 2 payments

• Iowa and Minn. senators press USDA on contract hog grower aid, top-up CFAP hog aid

Biden Administration Personnel:

• USDA nominations vote delayed

China Update:

• China’s consumer price index rose 1.0% from a year earlier in July

• Forced labor in China gets U.S. attention

Trade Policy:

• Blinken makes clear new trade deals not the focus for Biden administration

• Tai, Vilsack to meet with USTR ag advisory committees on Friday

Energy & Climate Change:

• Proposed increases in standards for light vehicle auto emissions published

Livestock, Food & Beverage Industry Update:

• Tyson Foods projected higher meat costs ahead

Coronavirus Update:

• Pentagon to require Covid-19 vaccine for troops

• Teachers and vaccines

• France and Italy begin requiring proof of vaccination for dining in restaurant

Politics & Elections:

• Lindsey Boylan to sue Gov. Cuomo, accuses him of ‘gaslighting’ women

Other Items of Note:

• Bayer loses appeal of jury verdict finding its Roundup weedkiller causes cancer

• U.S. sanctions on Belarus potash leave out nation’s sole seller

MARKET FOCUS

Equities today: Global stock markets were mixed but mostly firmer overnight. The U.S. stock indexes are pointed mixed to weaker openings. Traders will be closely parsing speeches by a couple of Federal Reserve officials today, Loretta Mester and Charles Evans, looking for clues on the timing and direction of U.S. monetary policy — especially after last Friday’s much-stronger-than-expected U.S. jobs report. Asian equities finished higher despite COVID worries. The Nikkei gained 68.11 points, 0.24%, at 27,888.15. The Hang Seng Index was up 322.22 points, 1.23%, at 26,605.62. European equities are mixed in early action, with the Stoxx 600 up 0.3% while other markets are mixed from being down 0.1% to up 0.3%.

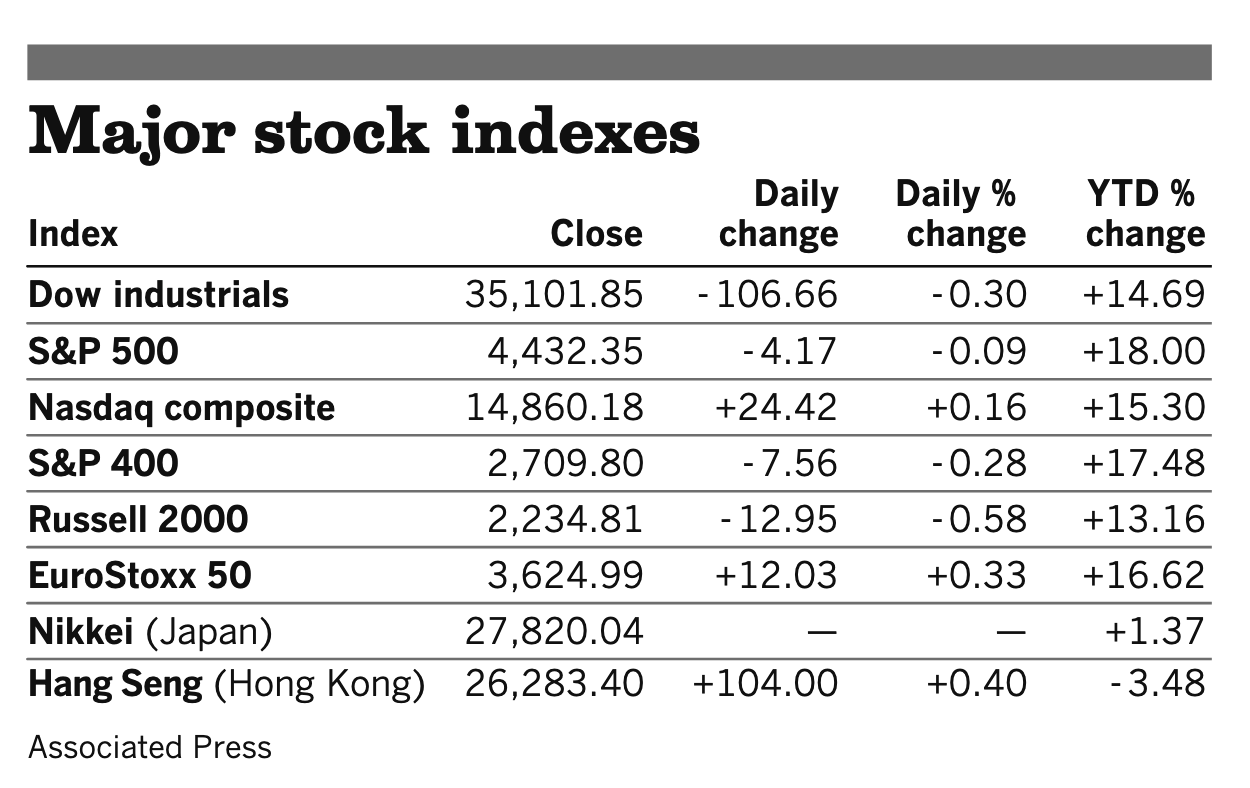

U.S. equities yesterday: The Dow closed down 106.66 points, 0.30%, at 35,101.85. The Nasdaq managed to gain 24.42 points, 0.16%, at 14,860.18. The S&P 500 was down 4.17 points, 0.09%, at 4,432.35.

On tap today:

• U.S. labor productivity in the second quarter, due at 8:30 a.m. ET, is expected to increase 3.2% from the prior quarter.

• Federal Reserve: Cleveland’s Loretta Mester speaks on inflation risk at 10 a.m. ET, and Chicago's Charles Evans speaks with the media at 2:30 p.m. ET.

Yellen: Debt ceiling should be raised “on a bipartisan basis.” Treasury Secretary Janet Yellen on Monday urged Congress to pass a bipartisan resolution to raise the amount of money the U.S. government can borrow, saying failing to increase the debt ceiling so would “cause irreparable harm” to the economy. Republican lawmakers, led by Senate Minority Leader Mitch McConnell (R-Ky.), have threatened to refuse to vote for raising the debt ceiling, which came back into force on Aug. 1. They’ve instead called on Democrats to do so in their multitrillion-dollar budget reconciliation package, which can’t be filibustered and requires only a simple majority to pass. Yellen released a statement reading: “In recent years Congress has addressed the debt limit through regular order, with broad bipartisan support. Congress should do so again now by increasing or suspending the debt limit on a bipartisan basis.” Yellen noted that, “The vast majority of the debt subject to the debt limit was accrued prior to the administration taking office. This is a shared responsibility, and I urge Congress to come together on a bipartisan basis as it has in the past to protect the full faith and credit of the United States.”

Federal budget deficit was $2.5 trillion in the first 10 months of fiscal year 2021, CBO estimates — $269 billion less than the deficit during the same period last year.

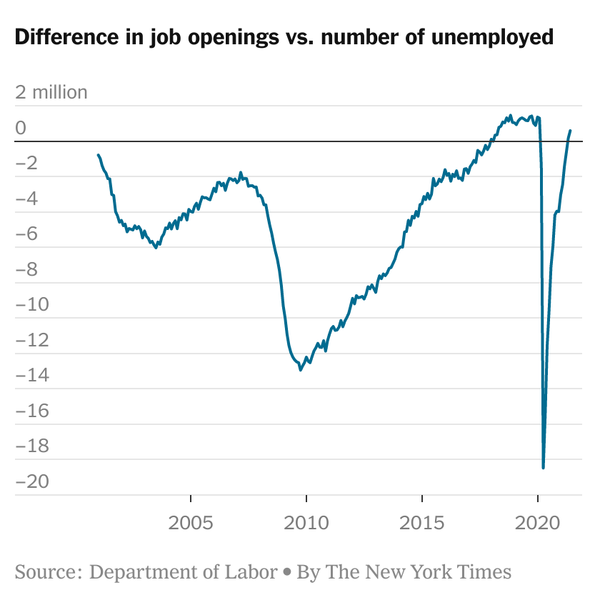

Job openings hit new record in June. U.S. job openings rose in June by more than forecast to a fresh record high, highlighting businesses’ persistent struggles to hire enough workers to keep up with rebounding economic activity. The number of available positions rose to 10.1 million during the month from an upwardly revised 9.5 million in May, a Labor Department survey showed Monday. That is the highest level since record-keeping began in 2000. Economists in a Bloomberg survey had called for an increase to 9.27 million openings.

Unfilled job openings in the U.S. outnumber unemployed Americans seeking work, a sign of an unusually tight labor market. The Labor Department report also showed the rate at which workers quit their jobs, a proxy for confidence in the labor market, rose in June to just below the record high touched in April.

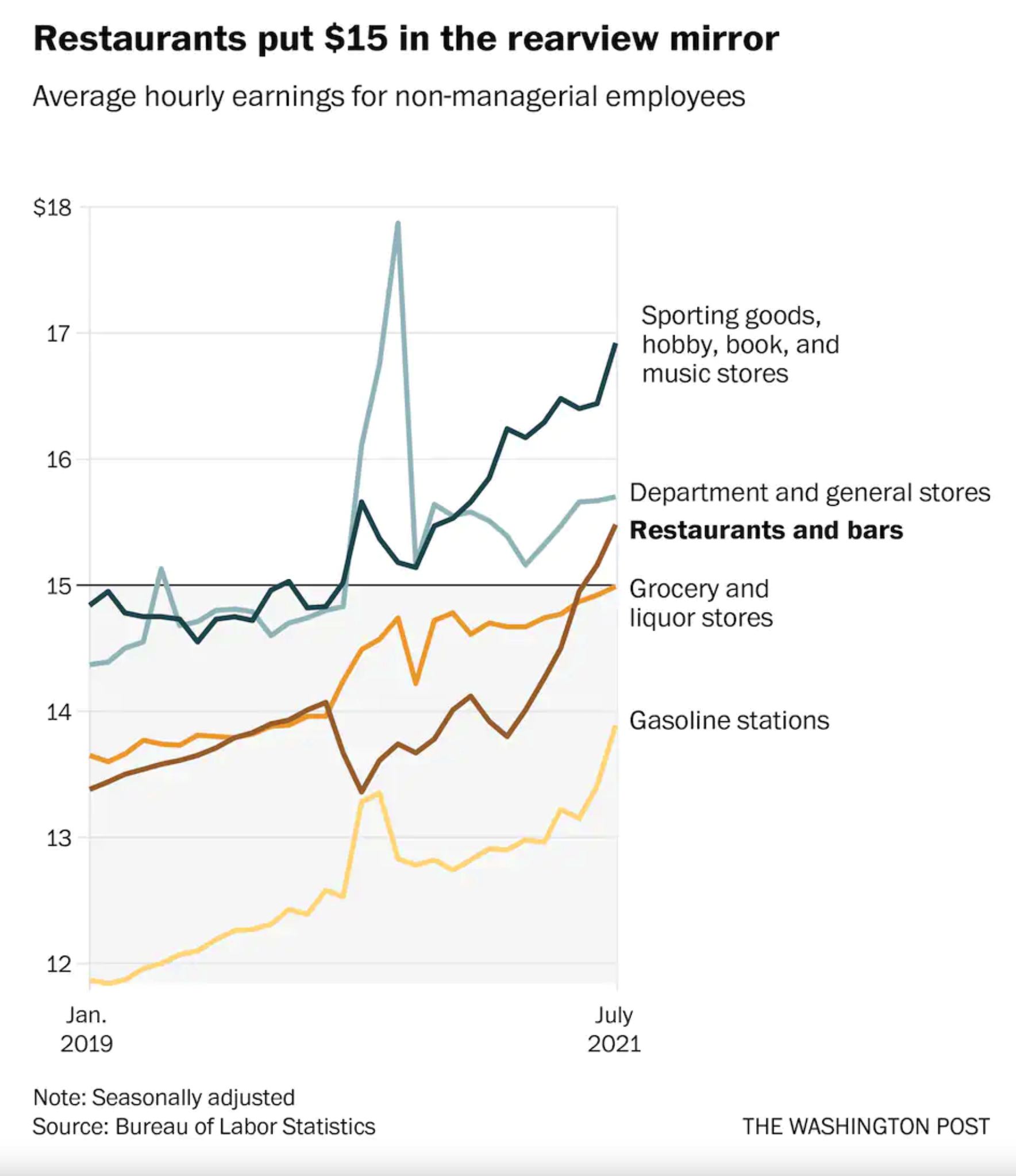

For first time, average pay for supermarket and restaurant workers tops $15 an hour. Wages have been rising rapidly as the economy reopens and businesses struggle to hire enough workers. Some of the biggest gains have gone to workers in some of the lowest-paying industries. Overall, nearly 80% of U.S. workers now earn at least $15 an hour, up from 60% in 2014. Job sites and recruiting firms say many job seekers won’t even consider jobs that pay less than $15 anymore. For years, low-paid workers fought to make at least that much. Now it has effectively become the new baseline. Link to more via the Washington Post.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer in trading ahead of U.S. markets action, with the euro slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note has eased slightly to trade just under 1.32% ahead of U.S. economic data. Gold and silver futures are seeing gains, with gold around $1,733 per troy ounce and silver around $23.43 per troy ounce.

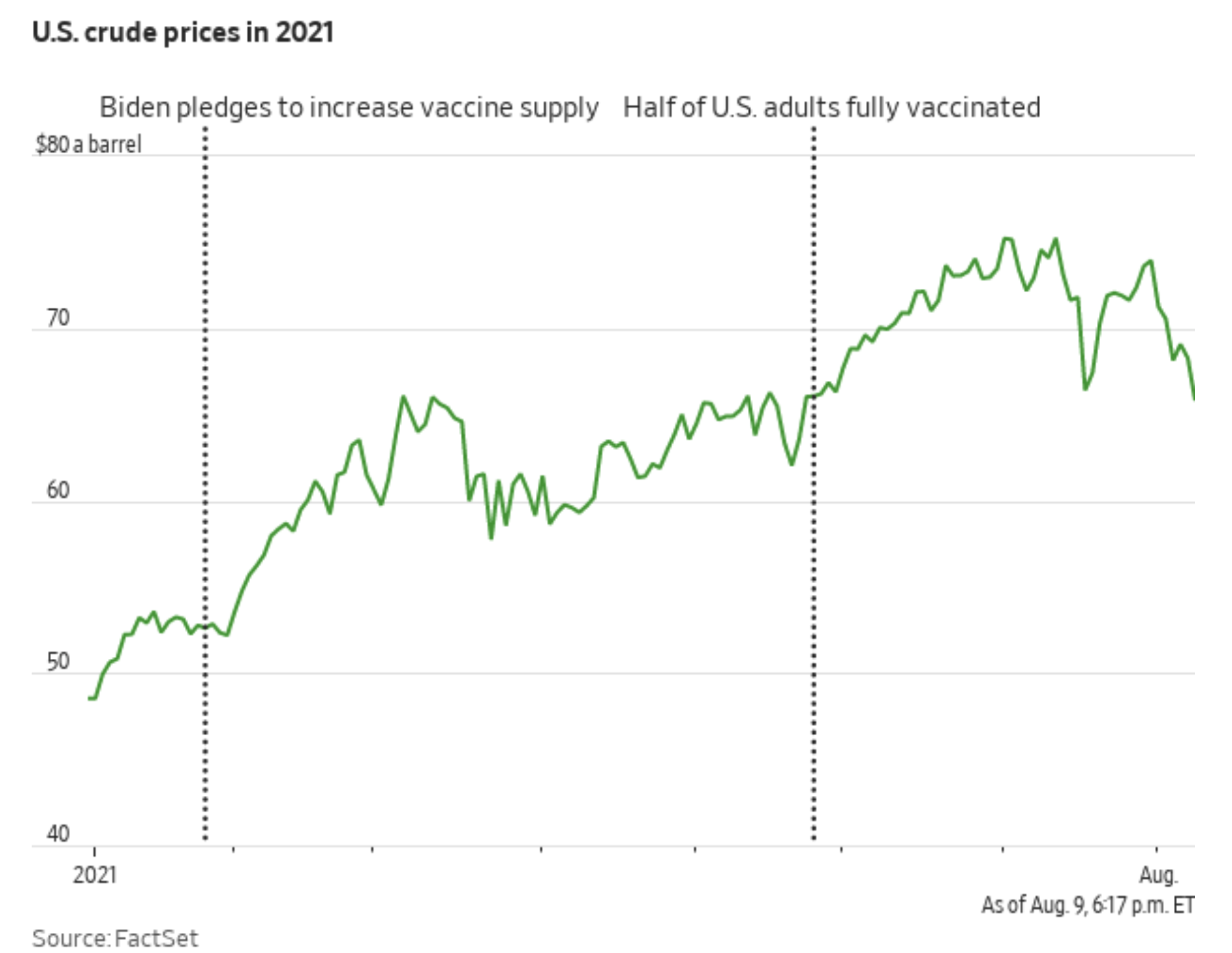

• Crude prices neared their lowest levels since May as investors worry that travel restrictions and delayed office reopenings will limit fuel consumption.

• Crude oil has headed higher before the trading session, with U.S. crude around $67.60 per barrel and Brent around $70 per barrel. Futures moved higher in Asian action, with U.S. crude up 32 cents at $66.80 per barrel and Brent up 15 cents at $69.19 per barrel.

• Front-month Comex silver on Monday hit its lowest settle value since November, after having fallen for four consecutive sessions, putting it down nearly 12% this year.

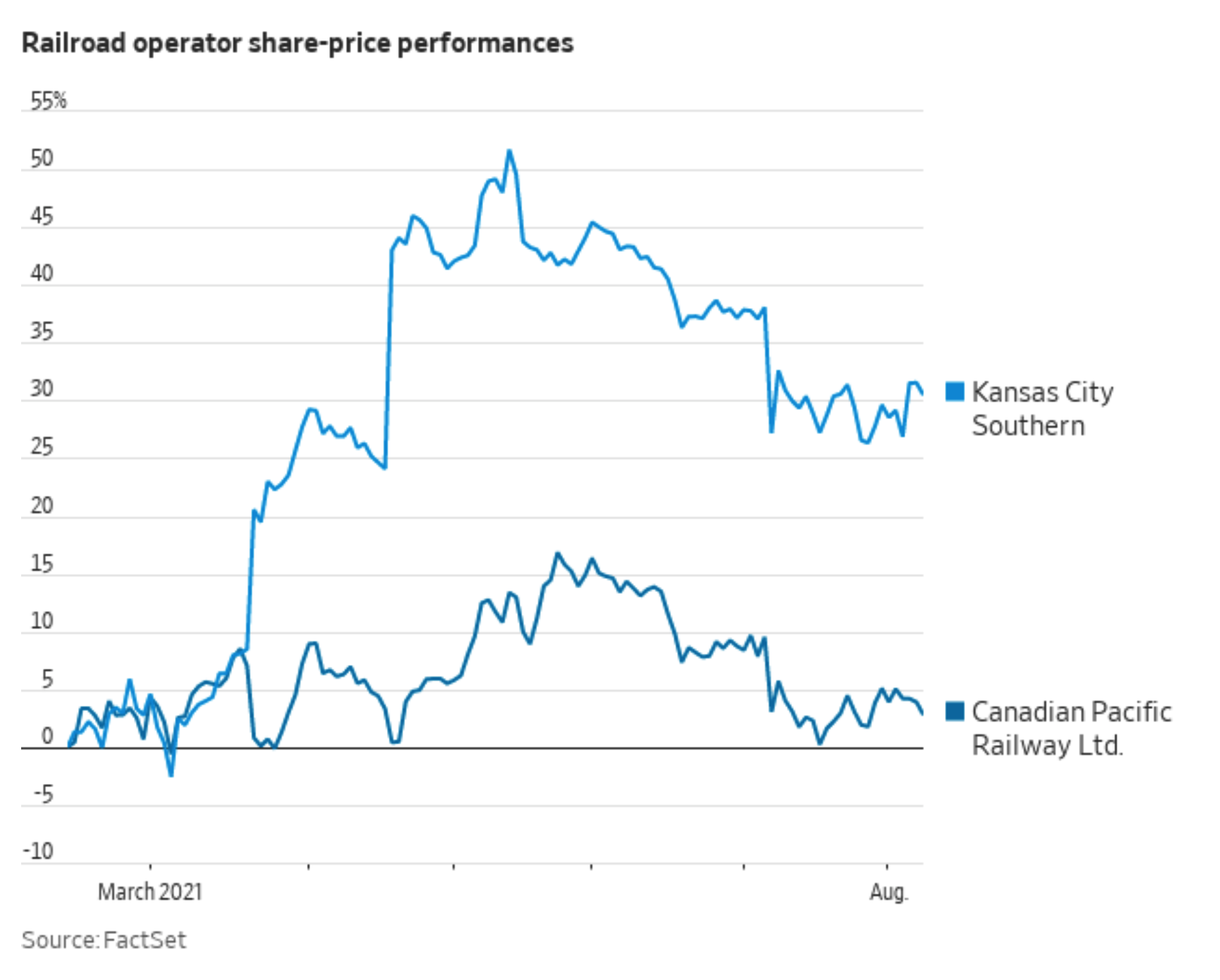

• Canadian Pacific Railway is planning to make a new, increased offer for Kansas City Southern, according to people familiar with the matter, reigniting a takeover battle with Canadian National Railway for the coveted U.S. railroad. Canadian Pacific’s board of directors met Monday to authorize a bid that values Kansas City Southern near $300 a share, or about $27 billion, up from its existing $25 billion offer. There is no guarantee Canadian Pacific will follow through with the plan; if it does, it is expected to do so soon. Kansas City Southern shareholders are planning to vote later this month on a $30 billion offer from Canadian National.

• Lawmakers, Vilsack weigh in on shipping container rates. USDA Secretary Tom Vilsack took to Twitter Monday and called shipping container rates as reported last week something that looks like price gouging. Including a snapshot of a graph from a Reuters item last week that China/U.S. shipping container rates have gone beyond $20,000, Vilsack said, “This sure looks suspiciously like price gauging. It’s hurting farmers, it's hurting businesses and it has got to stop. I applaud @FMC_gov for launching an inquiry into the massive spike in shipping costs and urge that it take action to fix this problem.” Vilsack was referencing a Federal Maritime Commission (FMC) investigation into shipping container rates. Meanwhile, Reps. Dusty Johnson (R-S.D.) and John Garamendi (R-Calif.) plan to introduce legislation that would help secure access for agricultural shipments via containers. The two are hoping the Ocean Shipping Reform Act of 2021 will be melded into the reauthorization package for the U.S. Coast Guard later this year.

• India plans effort to boost oilseed production, trim imports. India announced it will seek to boost domestic oilseed production by launching an effort valued at 110 billion rupee ($1.48 billion) and cut its reliance on imports as the country annual spends around $8.5 billion to $10 billion annually on such imports. "The government will invest more than 110 billion rupees via the National Mission on Oilseeds and Oil Palm to provide farmers everything possible, including better seeds and technology," India Prime Minister Narendra Modi said on Twitter. "When India is emerging as a major exporter of farm goods, we should not depend on imports for our edible oil requirements.” There are no details about the effort and how the country seeks to boost its oilseed output.

• Russia's wheat values are on the rise but still well below U.S. values, notes grain industry analyst Richard Crow. He says HRW values are narrowing spreads and eventually should go premium to Chicago. “World production for wheat will be the key Thursday as many crops could be revised lower,” he adds.

• Ag demand: A South Korean flour mill bought an estimated 135,100 MT of wheat, including around 50,000 MT from the U.S., 50,000 MT from Australia and 35,100 MT from Canada. South Korea’s state-backed Agro-Fisheries & Food Trade Corp. issued a tender to buy around 3,700 MT of GMO-free soybeans. Morocco’s state grains agency issued a tender to buy around 363,000 MT of U.S.-origin durum wheat under a preferential tariff import quota. Jordan’s state grains buyer issued a new international tender to buy 120,000 MT of animal feed barley.

- USDA daily export sales:

— Export sales of 182,880 metric tons of corn for delivery to Mexico. Of the total, 152,400 metric tons is for delivery during the 2021-2022 marketing year and 30,480 metric tons is for delivery during the 2022-2023 marketing year;

— Export sales of 132,000 metric tons of soybeans for delivery to China during the 2021-2022 marketing year; and

— Export sales of 130,000 metric tons of soybeans for delivery to unknown destinations during the 2021-2022 marketing year.

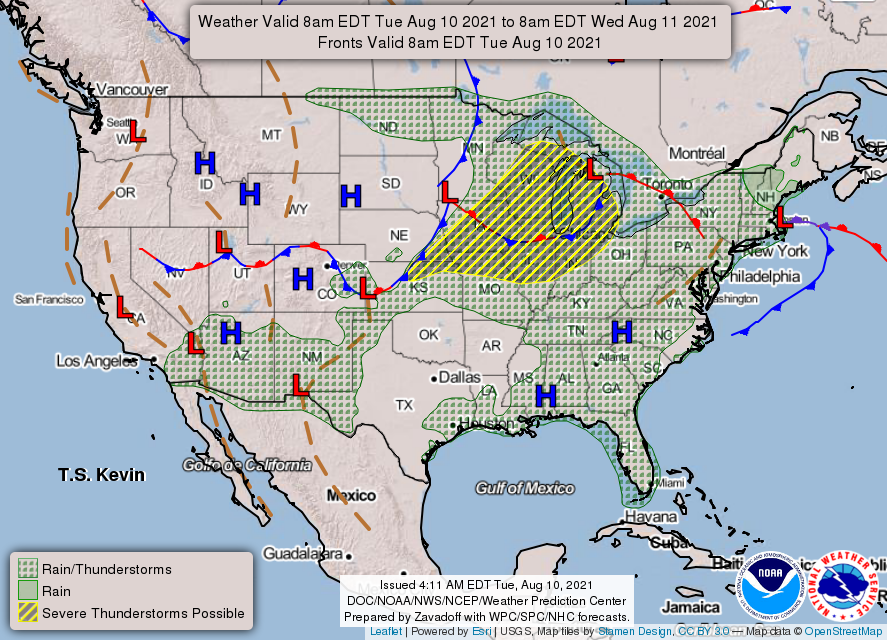

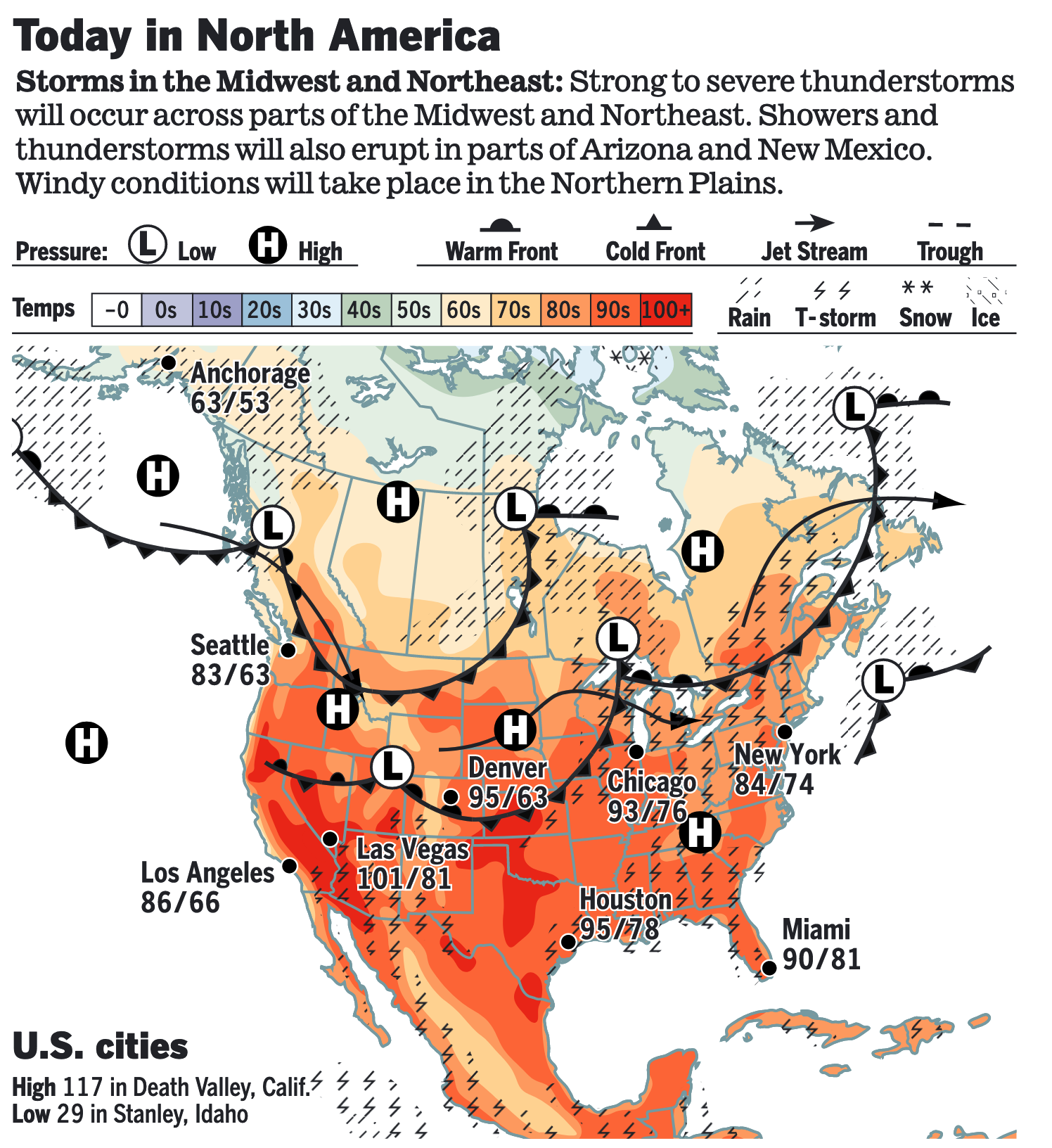

• NWS weather: Heavy rain and severe storms possible in the Midwest and Great Lakes; severe weather also possible into the Mid-Atlantic... ...Sultry conditions to persist across portions of the Southern Plains into the Midwest, excessively hot temperatures take shape across the Pacific Northwest... ...Poor air quality due to wildfire smoke continues in the western and central U.S., monsoon showers and storms to drench parts of the Southwest.

Items in Pro Farmer's First Thing Today include:

• Corn under pressure, as soybeans climb

• Corn, soybean CCI ratings virtually unchanged

• Cordonnier holds U.S. corn and soybean yield projections steady after recent rain

• Late-season rains result in slow start to France’s wheat export season

• Beef price surge continues

• Heavy pressure on lean hogs to kick off the week

POLICY FOCUS

— Senate Democrats on Monday, as expected, unveiled a $3.5 trillion spending plan — a massive redefinition and expansion of the U.S. government if approved.

Timeline: It will take months for the House and Senate to negotiate the details. The Senate is expected to begin voting on the framework of the budget resolution today. The committees will then hold virtual meetings during the August recess and start drafting their pieces of the reconciliation bill, which likely wouldn’t clear Congress until fall at the earliest. Senate Majority Leader Chuck Schumer (D-N.Y.) instructed committees to finish drafting their separate pieces of legislation by Sept. 15.

Big caveat: The proposed reconciliation instructions are “not final and not exclusive,” according to the documents.

Included in the plan:

- Extending the childcare tax credit.

- Creating universal pre-K.

- Paid family and medical leave.

- Tuition-free community college.

- Lower prescription drug costs.

- Medicare expansion — including dental, hearing and vision coverage.

- Lowering the eligibility age for Medicare.

- Expanding the Affordable Care Act.

- Major funding for climate and energy programs.

- Immigration and border security.

Regarding immigration, the Senate Judiciary Committee is tasked with providing “lawful permanent status for qualified immigrants” as part of the Democrats’ budget reconciliation package. The plan aims to grant green cards to millions of immigrant workers and families, per an outline of the document. Congress has been unable to pass any kind of immigration reform measure on a bipartisan basis. But the details of the policy, which has yet to be written, will dictate whether it can survive the strict budgetary rules governing the reconciliation process. Ultimately, Democrats are hoping that whatever they include on immigration won’t get stricken by an unfavorable ruling from the Senate parliamentarian.

The Ag Committee would be directed (link) to focus on several issues related to climate change, including farmland forestry conservation, reducing carbon emissions and preventing wildfires. It includes $135 billion for agriculture and child nutrition programs over a decadeand equal to a 9% increase from pre-pandemic levels. The funding includes money that Senate Ag Chairwoman Debbie Stabenow (D-Mich.) wants for USDA conservation programs. The instructions also call for boosting agricultural climate research and putting money behind the Civilian Climate Corps — a Biden administration proposal to employ young people to help combat climate change. The budget plan would also direct the Agriculture Committee to draft provisions related to rural development, clean energy, child nutrition and debt relief.

Free school meals for all students. Far-left lawmakers and school nutrition groups have pushed for the reconciliation package to permanently make school meals free for all students, regardless of their household income. That policy has effectively been in place temporarily since last year in response to the coronavirus pandemic.

Farm debt relief. Senators led by Kirsten Gillibrand (D-N.Y.) are want to offer farm debt relief for small agricultural producers and stem the tide of farm bankruptcies, while USDA deals with a legal battle to send debt relief to farmers of color after decades of discrimination.

What is not in the resolution… so far: language dealing with the debt limit. Democrats would like to use separate legislation to extend the Treasury’s borrowing authority to a future date, not a dollar limit — a far less fraught political target. Senate Minority Leader Mitch McConnell (R-Ky.) has vowed the GOP won’t cooperate in lifting the federal borrowing cap, potentially setting up a fiscal cliff with the risk of both a federal shutdown and a default, because Democrats are moving ahead on their own with a massive spending plan. “They want Republicans to give them political cover for the partisan debt bomb that they will go right onto detonate with zero input from us,” he said. As previously noted, Treasury Secretary Janet Yellen noted, “The vast majority of the debt subject to the debt limit was accrued prior to the administration taking office. This is a shared responsibility, and I urge Congress to come together on a bipartisan basis as it has in the past to protect the full faith and credit of the United States.”

The Democratic plan gives the Senate Finance Committee wide latitude to draft policies to raise taxes and asks the committee to find additional revenue to fund the $3.5 trillion in spending from health care savings and a new fee on carbon polluters — Biden has called on Congress to raise the corporate tax rate from 21% to 28%. Though the panel would have to cut the deficit by at least $1 billion, others would be permitted to add about $1.75 trillion over a decade. Democrats say tax hikes will provide the primary source of funding for their resolution's spending, though they would also include increased funding for the IRS to boost tax enforcement, a measure that was stripped out of the bipartisan infrastructure bill amid Republican opposition. Democrats have said they’ll undo or modify the limit on federal deductions for state and local taxes (SALT), a provision that targeted wealthy households in blue states like New York and California.

Senate Finance Committee Chairman Ron Wyden (D-Ore.) said his committee is “working on a menu of options” for Democrats to consider. Those include Wyden’s plan to raise taxes on multinational corporations and remove tax provisions that incentivize outsourcing.

One way to help pay for the human infrastructure measure is via a minimum tax on corporations, proposed yesterday by senators Elizabeth Warren, Democrat of Massachusetts, and Angus King, Independent of Maine. They want businesses reporting profits of $100 million or more to investors to pay a minimum 7% tax, saying it will affect at least 1,300 public companies and raise $700 billion over a decade.

Democrats say their proposed tax hikes won’t impact middle-class families. Their plans would prohibit new taxes on small businesses, family farms and families making less than $400,000 annually, fulfilling a Biden campaign promise.

Republicans on House Ways and Means and Senate Finance released a Joint Committee on Taxation (JCT) analysis showing that 57% of the burden of illustrative increases in the corporate tax rate from 21% today to 24-25% — as Democrats are mulling for their budget reconciliation bill — would fall on households earning less than $500,000 in 2022. That share would rise to about 66% by 2031, the JCT said.

The Democrats’ plans also call for the extension of tax credits for families and low-income individuals, including the child tax credit, which provides millions of families with monthly checks of up to $300 per child.

Healthcare benefits. One of the top priorities of Sen. Bernie Sanders (I-Vt.): adding dental, hearing and vision benefits to Medicare. However, the final package is not expected to include another progressive priority, lowering the Medicare eligibility age to 60, which opens up debate about Medicare for All. The reconciliation package is expected to include measures to have the federal government step in and provide health coverage in the 12 GOP-led states that have declined to expand Medicaid under the Affordable Care Act (ACA), though the exact mechanism for doing so remains murky. The measure is also expected to extend enhanced ACA subsidies that help lower people’s premiums, which were provided for two years in the American Rescue Plan earlier this year. The package will fund care for elderly people at home, known as “home and community-based services,” and create a paid family and medical leave benefit, Democrats said in a list of top-line items for the fiscal 2022 plan.

Helping pay for it all is “hundreds of billions” of dollars in savings from lowering prescription drug costs, Democrats said. The exact amount of savings is not yet clear.

Links:

▪ Concurrent Resolution on the Budget for Fiscal Year 2022

▪ FY 2022 Budget Resolution Agreement Framework

▪ Sen. Schumer Letter to Senate

— Senate today expected to clear the $550 billion physical infrastructure measure. The vote is expected at 11 a.m. Eastern time. (While the Senate’s procedural clock technically won’t allow a final vote until 4 a.m. ET today, senators are working on an agreement that would instead allow the vote to come during more normal business hours.) The bill would then go to the House. All told, some 70 senators appear poised to carry the bipartisan package to passage.

Sen. Kevin Cramer (R-N.D.), who has supported the bipartisan bill while opposing the Democrats’ reconciliation measure, is OK giving the president a bipartisan “win,” believing GOP lawmakers will benefit from delivering to their voters long-needed improvements and projects. “Not every transaction requires a winner and a loser,” Cramer said. “Some transactions can have winners on both sides. I think infrastructure along with national defense are the policy issues that provide opportunities for us to do the right thing.” The problem President is going to have, Cramer noted, is “he’s going to shift within minutes of passage of this bipartisan bill into a hyperpartisan bill. He will in that moment, I think, squander all the goodwill he would rightfully deserve.”

Many Democrats believe the clear benefits for Americans in the go-it-alone measure — and potential tax hikes on people earning more than $400,000 a year that would pay for the new programs — are popular, setting up their 2022 campaigns to draw sharp distinctions to their GOP opponents. “I look forward to running on both bills,” said Sen. Michael Bennet (D-Colo.), who is up for re-election next year. “After years and years of obstruction, years and years of just partisan warfare that hasn’t delivered much for the American people, we now, with these two bills, are going to deliver quite a lot.”

“The Democratic Party is attempting to pass what could be the most radical left-wing legislation this country has ever seen — and they’re rushing it through Congress, hoping no one notices,” said Sen Josh Hawley (R-Mo.). “The Senate is not just a rubber stamp for this kind of insanity. I will make sure that my colleagues lining up to support this agenda are held accountable.”

The House is expected to consider both Biden infrastructure packages when it returns from recess in September. House Speaker Nancy Pelosi (D-Calif.) has said the two bills will be considered together.

Market impact: Financial markets for now believe Democrats will not have the votes to pass the $3.5 trillion human infrastructure package. But Democratic leaders are just beginning to see what it will finally take the get all Senate Democrats to vote for it, and then make sure the House follows. The final package is murky at this time because the package must change to get moderate Democrats like Joe Manchin (D-W.Va.) and Krysten Sinema (D-Ariz.) on board. The bottom line on the package’s bottom line will not be known for several months.

— Little change in either CFAP 1 or 2 payments. Payments approved under the Coronavirus Food Assistance Program 2 (CFAP 2) were little changed at $13.78 billion as of Aug. 8, and CFAP 1 payouts were also basically steady at $10.6 billion.

USDA has sent forward a final rule to the Office of Management and Budget (OMB) on CFAP, additional assistance and flexibilities related to the Consolidated Appropriations Act of 2021 that was approved in December. It is not clear what the scope of the regulation entails and whether it includes aid to contract hog producers that so far have not received help despite being made eligible for aid in the legislation. Reliable sources say the coming announcement will include payment information to contract hog producers.

— Iowa and Minnesota senators press USDA on contract hog grower aid, top-up CFAP hog aid. A bipartisan group of senators urged USDA Secretary Tom Vilsack to deliver not only aid to contract hog growers that was authorized in the Consolidated Appropriations Act of 2021 approved in December but also top-up payments to hog producers that were announced in January under the Coronavirus Food Assistance Program (CFAP). Iowa Sens. Joni Ernst and Chuck Grassley are Republicans. Minnesota Sens. Amy Klobuchar and Tina Smith are Democrats.

As for the contract grower aid, the lawmakers said in a letter (link). to Vilsack they were concerned that USDA’s June 15 announcement that it would finalize the program within 60 days “only focused on poultry growers and made no mention of providing assistance to swine growers.” Congress has authorized payments to contract producers, but the payments appear to be lingering in the wait for new regulations (see previous item).

As for the top-up swine payments under CFAP, they acknowledged there can be delays under a change of administration. “However, over the past eight months, USDA has given no indication as to how it plans to put these funds to use,” the lawmakers said.

“Our livestock and poultry contract growers have been waiting patiently for USDA to provide financial relief that so many desperately need,” the four senators wrote.

BIDEN ADMINISTRATION PERSONNEL

— USDA nominations vote delayed. Members of the Senate Agriculture Committee were scheduled to meet at the side of the Senate chamber to vote on the nominations of Robert Bonnie to be USDA undersecretary for farm production and conservation and Xochitl Torres Small for undersecretary for rural development. But without explanation, the vote did not take place and the panel now lists a vote on the nominations as TBD – to be determined. We still do not expect an issue with the nominations at the Committee level, but the reason for the delay is not yet clear.

CHINA UPDATE

— China’s consumer price index rose 1.0% from a year earlier in July, down from June’s 1.1% gain, kept in check by food prices that fell 3.7% in July from a year earlier, compared with June’s 1.7% drop.

— Forced labor in China gets U.S. attention. U.S. lawmakers and Biden administration officials are stepping up pressure on American businesses to stop imports from the Western Chinese region of Xinjiang as Beijing’s alleged use of forced labor emerges as a top item on their bilateral trade agenda. Western officials say the Chinese government uses forced labor of Uyghur and other Muslim minorities in Xinjiang, the world’s leading producer of cotton and raw materials used in solar panels. Beijing strongly denies the claim.

Imports of cotton and tomato products have already been effectively banned since January, and penalties on purchases of some solar materials were implemented in June. Tougher restrictions are coming. Congress is expected to approve legislation later this year that would prohibit imports of all products from Xinjiang unless the importer can prove their items are free of forced labor.

TRADE POLICY

— Blinken makes clear new trade deals not the focus for the Biden administration. Secretary of State Antony Blinken Monday left no doubt that inking new trade deals is not an immediate focus for the Biden administration.

In remarks in Maryland on U.S. infrastructure and technology, Blinken said the U.S. is “falling behind” its rivals in those areas. On trade, he noted the U.S. pursued new trade deals based as the U.S. “thought we could trade more with the world while investing less here at home. That didn't work out for our economy, for our workers or for our communities.”

Competitiveness is the key. He noted that President Joe Biden has “made clear that before making more trade deals, we must first make a generational investment in our own competitiveness. Our domestic renewal comes first.” He argued those investments will make the U.S. better able to negotiate in the future on issues like labor, intellectual property and the environment.

— Tai, Vilsack to meet with USTR ag advisory committees on Friday. U.S. Trade Representative Katherine Tai and USDA Secretary Tom Vilsack will meet online Friday with members of the Agricultural Policy Advisory Committee (APAC) and the Agricultural Technical Advisory Committees (ATACs). The committees are managed jointly by the Office of the U.S. Trade Representative and USDA’s Foreign Agricultural Service. The APAC provides advice on the administration of U.S. trade policy, including implementation and enforcement of existing trade agreements and negotiating objectives for new trade agreements. The six ATACs offer technical advice and information about specific agricultural commodities and products. Link.

ENERGY & CLIMATE CHANGE

— Proposed increases in standards for light vehicle auto emissions published. EPA today is publishing in the Federal Register (link) its proposed changes for emissions standards for light duty cars and trucks for the 2023-2026 model years. EPA is proposing to raise greenhouse gas (GHG) emissions standards compared with those in the Safer Affordable Fuel Efficient (SAFE) Vehicles rule that was put in place by the Trump administration. EPA is proposing an increase of 10% in the stringency standards for model year (MY) 2023 and 5% increases annually for MY 2024-2026.

Comments on the proposed increases are due by Sept. 27.

EPA has also scheduled a virtual public session for Aug. 25 (and 26 if needed) to gather additional public input on the proposed levels.

Timeline comments. EPA said in proposing the more-stringent standards that even though automakers have less time than normal to comply with the more-stringent standards, advanced gasoline technologies in the fleet and advances in electric vehicle and hybrid technology mean that additional lead time is not necessary.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

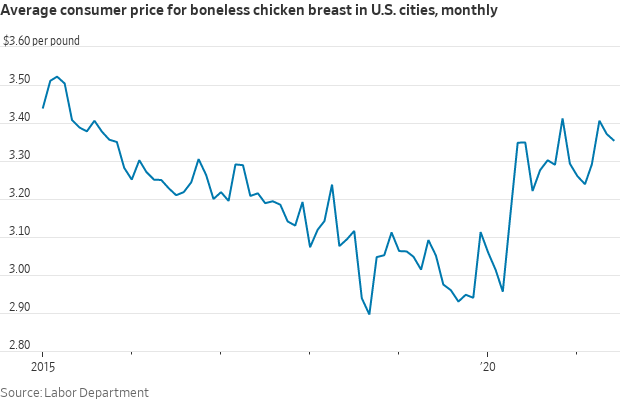

— Tyson Foods projected higher meat costs ahead, as the company seeks to pass along elevated prices for animal feed, increased wages and ongoing pandemic expenses to restaurants and supermarkets. “We’ve seen unprecedented and accelerating inflation and we’re trying to catch up with that,” said Tyson Chief Executive Donnie King, on a conference call with reporters, according to the Wall Street Journal (link). Tyson and other U.S. meat suppliers including JBS USA Holdings, Sanderson Farms and Cargill are under pressure to fill rising orders from restaurants, which are reopening pandemic-closed dining rooms. Consumers, meanwhile, continue to spend heavily at grocery chains.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 203,443,396 with 4,304,230 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 35,948,214 with 617,231 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 351,933,175 doses administered, 166,654,374 have been fully vaccinated, or 50.8% of the U.S. population.

— Pentagon to require Covid-19 vaccine for troops. The Department of Defense will require all active-duty military members to get a Covid-19 vaccine, Defense Secretary Lloyd Austin said on Aug. 9. The requirement could be in place in the coming days, Austin said in a memo sent to all Pentagon employees. Austin will seek a waiver to make the vaccines mandatory since they haven’t yet been approved, unless approval comes soon, Pentagon spokesman John Kirby told reporters in Washington. President Joe Biden said in a statement that he supports Austin’s plan.

— Teachers and vaccines. White House chief medical adviser Anthony Fauci said on MSNBC that he believes teachers should be mandated to have the Covid-19 vaccine but that such a requirement would not come from the federal level.

— France and Italy have begun requiring proof of vaccination for activities such as dining in at a restaurant, placing the countries at the forefront of a European trend toward rules that effectively separate populations into the vaccinated and the unvaccinated—and that make the resumption of normal daily life easier for the former.

POLITICS & ELECTIONS

— Lindsey Boylan to sue Gov. Cuomo, accuses him of ‘gaslighting’ women. In her Monday Medium post, Boylan said that “digesting each line” of the scathing 165-page report issued by Attorney General Letitia James’ office last week was “like swallowing a shard of glass.”

OTHER ITEMS OF NOTE

— Bayer has lost another appeal of a jury verdict finding its Roundup weedkiller causes cancer, its third-straight appeals court defeat among the cases that have gone to trial. A California state court of appeals refused to overturn the 2019 jury verdict that awarded more than $2 billion to a couple who claimed they were sick after using Roundup for more than 30 years; the court also left intact the trial judge's decision to reduce the award to $86.7 million. Bayer recently said it set aside an additional $4.5 billion to handle Roundup lawsuits, bringing its reserves for the cases to more than $16 billion.

— U.S. sanctions on Belarus potash leave out nation’s sole seller. Potash buyers anxious over U.S. sanctions on Belarus’s state-owned producer, which controls about a fifth of the global market for the crop nutrient, might not need to panic right away. Bloomberg notes that the penalties announced on Monday target Belaruskali, which ships much of its products to China, India and Latin America, along with more than a dozen companies with ties to President Alexander Lukashenko. Yet Belarusian Potash, in which Belaruskali owns a 48% stake and which is the sole handler of the country’s potash exports, wasn’t included in the sanctions list. The U.S. issued licenses allowing counterparts to wind down transactions with Belaruskali — or any entity in which it owns at least a 50% interest — by Dec. 8, giving consumers time to find alternative supplies. “The penalties against Belaruskali add negative sentiments for the global potash market, but the fact that BPC is not the subject of the sanctions may ease the situation,” said Elena Sakhnova, an analyst at VTB Capital.