Senate Ag Appropriations Subcommittee Includes $7 Billion in Ag Disaster Aid Via WHIP+ Plus

Will Sen. Graham and perhaps other senators getting Covid impact infrastructure vote?

In Today’s Digital Newspaper

Market Focus:

• U.S. construction spending inched ahead in June

• Yellen reveals further measures to avoid breaching borrowing limit

• Fed’s Waller: September taper call may be warranted

• Ag demand update

• Corn, soybean, wheat losses overnight

• CCI rating improves for spring wheat and soybeans, drops for corn

• Cordonnier sticks with U.S. yield pegs, but anxious about dry northwest Corn Belt

• Consultant makes another cut to Brazil’s corn crop

• Frost shrinks Brazil’s winter wheat crop

• Egypt to raise subsidized bread prices

• Update reminds of China’s efforts to curb commodity market speculation

• ASF spreading across the Dominican Republic

• Beef prices still marching higher

• Pork cutout value surges, too

Policy Focus:

• $7 bil. in ag disaster aid included in FY 2022 Senate Ag spending measure

• CFAP 2 payouts reach $13.78 billion

Biden Administration Personnel:

• Biden taps Touloui for State economics post

China Update:

• China continues push back on Xinjiang ‘smear campaign’

• China NDRC releases fertilizer to flood-hit Henan

• Price of shares in Chinese video game companies Tencent and NetEase fall

Trade Policy:

• USTR Tai to hold ag roundtable in Seattle

Energy & Climate Change:

• Food vs fuel debate still evident

• Carbon capture language included in bipartisan infrastructure measure, more sought

• Stricter fuel-efficiency standards for cars and light trucks are expected

Livestock, Food & Beverage Industry Update:

• PepsiCo plans to sell Tropicana, Naked and other juice brands in North

• New animal welfare rules could cause a bacon shortage in California

• Egypt leader says he will increase subsidized bread prices

Coronavirus Update:

• Major retailers and restaurant chains require workers to wear masks

• Global Covid-19 liquidity

• Sen. Graham tested positive for Covid-19 despite being vaccinated

• FSA outlines efforts on USDA borrowers relative to Covid

Politics & Elections:

• Biden moves to stave off mass evictions

• Donald Trump to fight release of tax returns

• Pelosi-McCarthy relationship continues to deteriorate

Congress:

• Navigable waters rule pushed by Arkansas GOP senators

Other Items of Note:

• Fading farms, dying dreams in Arizona

• Vilsack traveling to Oregon today to discuss wildfire response

MARKET FOCUS

Equities today: U.S. stock futures edged higher as investors awaited more corporate earnings. In Asia, Hong Kong’s broader Hang Seng Index drifted 0.2% lower, while Japan’s Nikkei 225 fell 0.5%, and Australia’s S&P / ASX 200 dropped 0.2%.

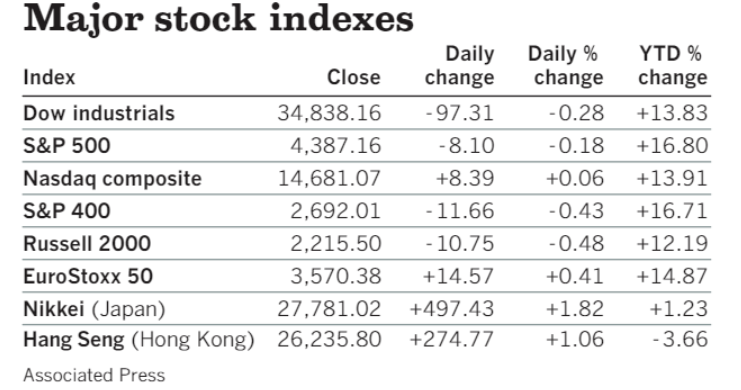

U.S. equities yesterday: The Dow declined 97.31 points, 0.28%, at 34,838.16. The Nasdaq, however, rose 8.39 points, 0.06%, at 14,681.07. The S&P 500 was down 8.10 points, 0.18%, at 4,387.16.

On tap today:

• U.S. factory orders for June, due at 10 a.m. ET, are expected to rise 1% from a month earlier.

• Federal Reserve governor Michelle Bowman speaks at a seminar on an inclusive economic recovery at 2:45 p.m. ET.

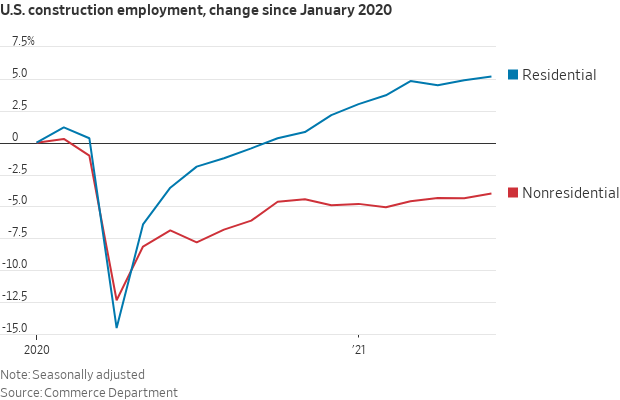

U.S. construction spending inched ahead in June, supported by strong demand for housing. Most other segments — from energy and manufacturing to retail and office to highway and street construction — have been lagging through the pandemic. "The recovery remains uneven as supply chain disruptions and labor shortages constrain builders’ ability to move projects past the planning stages," said Grant Thornton economist Yelena Maleyev. "The rise of the Delta variant will remain the number one risk to the outlook as it affects the return to offices and schools."

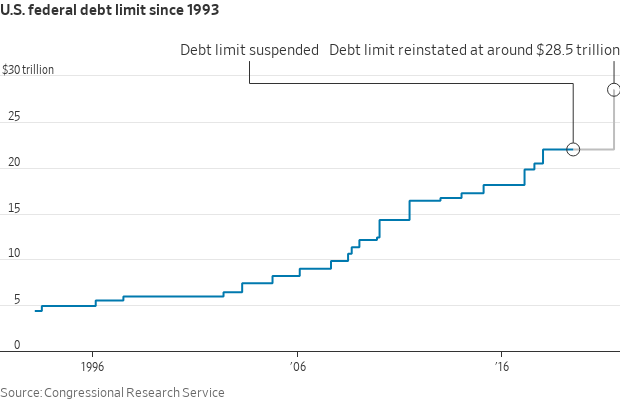

Treasury Secretary Janet Yellen revealed further measures to avoid breaching the federal government’s borrowing limit and urged Congress to increase or suspend the ceiling. Congress voted in July 2019 to suspend the debt limit until July 31, 2021, after which the prior limit of $22 trillion would be reset to include any new borrowing in the intervening years. On Sunday, the limit was reinstated at around $28.5 trillion, a figure that includes debt held by the public and by government agencies. The Treasury uses emergency accounting maneuvers to conserve cash so the government can keep paying its obligations to bondholders, Social Security recipients, veterans and others. Once those measures run out, the Treasury could begin to miss payments on its obligations, which could trigger a default on U.S. debt.

Treasury Department said the government will borrow almost $1.4 trillion in the second half of 2021 assuming lawmakers raise or suspend the newly reinstated debt limit, as money continues to support coronavirus relief even before the impact of additional economic programs being considered by Congress.

Fed’s Waller: September taper call may be warranted. Federal Reserve Governor Christopher Waller said that if the next two monthly U.S. employment reports show continued gains, he could back an announcement soon on scaling back the central bank’s bond purchases.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker with strength in the euro and British pound. The yield on the 10-year U.S. Treasury note is slightly higher, trading around 1.18% with a mixed tone in global government bond yields. Gold and silver futures are weaker ahead of US trading, with gold around $1,813 per troy ounce and silver around $25.50 per troy ounce.

• Crude oil futures are firmer ahead of U.S. trading action. U.S. crude is trading around $71.35 per barrel while Brent is around $73.10 per barrel in buying after sharp losses in Monday US trading. Futures were little changed in Asian action. U.S. crude was down one cent at $71.25 per barrel while Brent was down three cents at $72.86 per barrel in overnight action.

• Gasoline and natural gas have seen some of the biggest price jumps among commodities this year, having risen 61.5% and 55% respectively.

• Ag trade: Egypt bought 60,000 MT of wheat from Romania. Turkey’s state grain board initially bought around 325,000 MT of animal feed barley from optional origins; more is expected to be purchased later today. Taiwan’s MFIG purchasing group bought around 55,000 MT of animal feed corn that’s expected to be sourced from South Africa. The country’s Flour Millers’ Association also tendered to buy 48,000 MT of grade 1 milling wheat from the United States. Ethiopia cancelled a tender to buy 400,000 MT of wheat after limited participation. Japan is seeking 119,435 MT of food-quality wheat from the U.S., Canada and Australia in a regular tender.

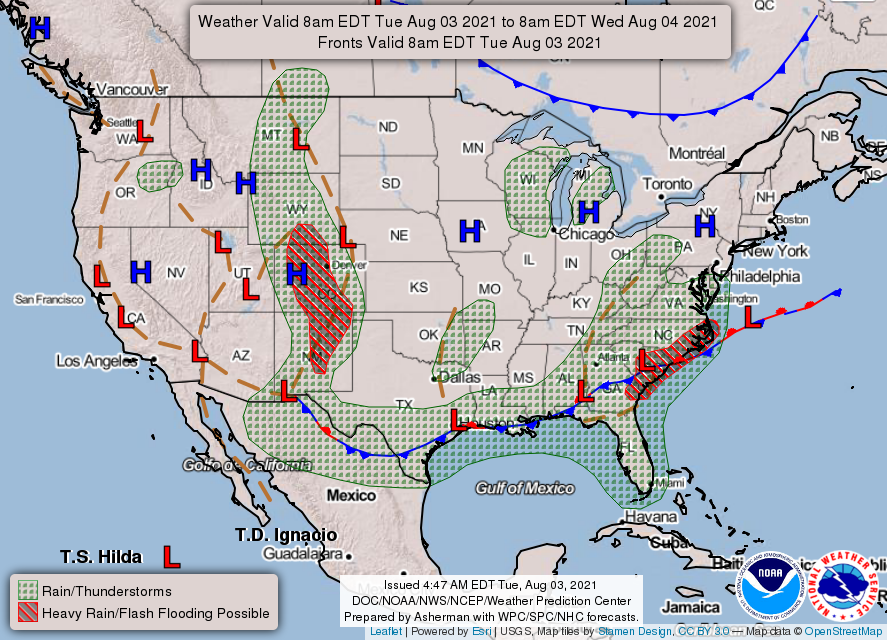

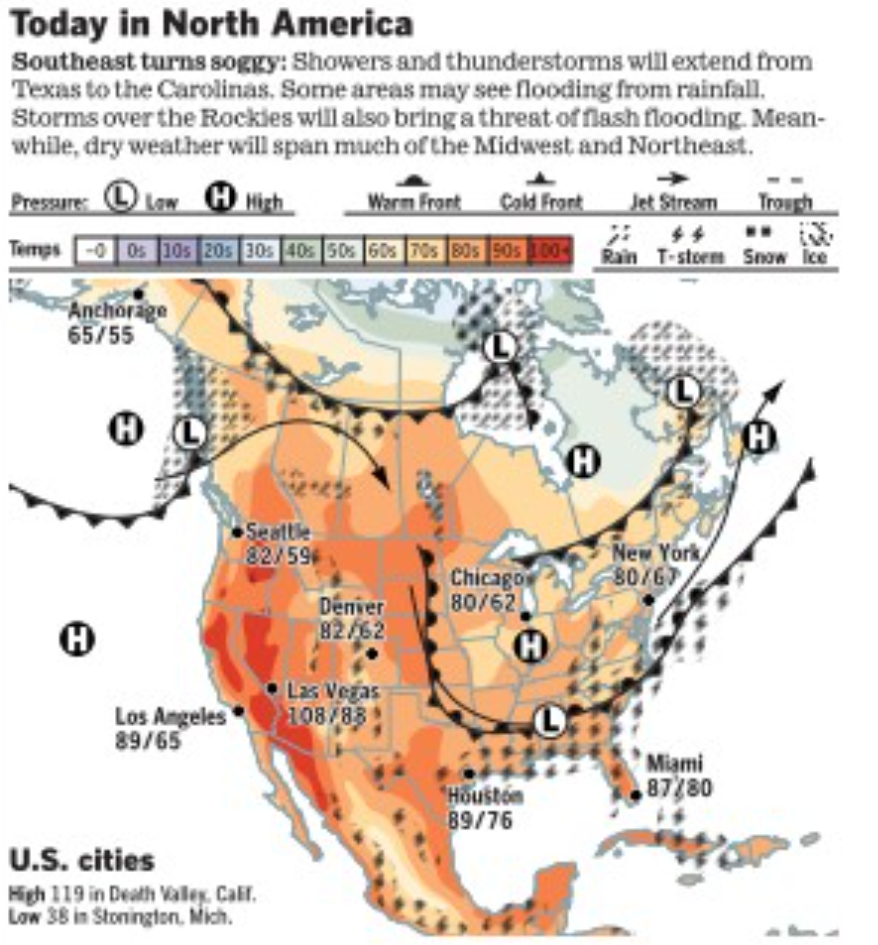

• NWS weather: Monsoonal showers expected to bring heavy rains and localized flash flooding across central to southern Rockies through tonight before gradually diminishing... …Heavy rains and flooding possible along the central Gulf coast northeastward across the coastal Southeast and into eastern Carolinas... ...Below average temperatures from the central Plains to the East Coast while heat returns across the interior West Coast and into the northern Plains.

Items in Pro Farmer's First Thing Today include:

• Corn, soybean, wheat losses overnight

• CCI rating improves for spring wheat and soybeans, drops for corn

• Cordonnier sticks with U.S. yield pegs, but anxious about dry northwest Corn Belt

• Consultant makes another cut to Brazil’s corn crop

• Frost shrinks Brazil’s winter wheat crop

• Egypt to raise subsidized bread prices

• Update reminds of China’s efforts to curb commodity market speculation

• ASF spreading across the Dominican Republic

• Beef prices still marching higher

• Pork cutout value surges, too

POLICY FOCUS

— Senate Ag Appropriations Subcommittee clears $25.5 billion FY 2022 bill for USDA; includes $7 billion in ag disaster aid. The full Senate Appropriations Committee will take up the bill on Wednesday.

In what is being termed WHIP+ Plus, the measure includes:

- $6.28 billion for disaster assistance to aid producers who suffered losses due to droughts, hurricanes, wildfires, floods and other qualifying disasters in calendar years 2020 and 2021. The $6.28 billion is for the Wildfire Hurricane Indemnity Program (WHIP+) disaster program for 2020 and 2021 losses. The House Agriculture Committee last week approved an extension of WHIP+ for $8.5 billion but left the funding for appropriators later.

- $750 million for livestock producers for losses incurred during 2021 due to drought or wildfire. This disaster assistance will build on top of existing farm bill programs for livestock producers.

More broadband funding. USDA’s ReConnect broadband grant and loan program would get another $700 million.

The Senate’s FY 2022 funding is $2.5 billion more than the FY 2021 enacted level. The Senate version compares with $26.6 billion in discretionary funding in the package approved by the House Thursday (July 29). The House version does not contain the WHIP+ funding but as noted the House Ag panel recently marked up a disaster aid bill. In the Senate, discretionary funding for FDA would be at $3.4 billion, up $200 million from FY 2021. There were no amendments during the subcommittee action, but full committee action Wednesday is expected to see amendments.

Comments: The Senate ag disaster aid is reportedly offset by savings elsewhere, but the House separate ag disaster aid measure is not. Sources say House Democrats want to put the WHIP+ ag aid into a budget reconciliation measure.

— CFAP 2 payouts reach $13.78 billion. A total of $13.78 billion in payments have been authorized under the Coronavirus Food Assistance Program 2 (CFAP 2) as of Aug. 1, up slightly from the prior week’s mark of $13.76 billion. The total includes $6.28 billion in acreage-based payments, $3.46 billion for livestock, $2.76 billion for sales commodities, $1.22 billion for dairy and $65.2 million for eggs/broilers.

CFAP 1 payments are little changed at $10.6 billion.

BIDEN ADMINISTRATION PERSONNEL

— Biden taps Touloui for State economics post. President Biden recently announced he intends to nominate Ramin Touloui as assistant secretary for economic and business affairs in the State Department. The position includes coverage of agricultural issues. Toloui is professor of the Practice for International Finance at Stanford University, and Tad and Diane Taube policy fellow at the Stanford Institute for Economic Policy Research. He recently led the policy review for international economics on the Biden-Harris transition team, in addition to serving on the State Department agency review team. He served in the Obama-Biden administration as Treasury assistant secretary for international finance, representing the United States in forums like the G7 and G20. Previously he was global co-head of emerging markets portfolio management at the Pacific Investment Management Company, overseeing more than $100 billion in investments. He began his career as a civil servant at the Treasury Department.

CHINA UPDATE

— China continues push back on Xinjiang ‘smear campaign.’ China has continued to criticize efforts by the U.S. and the West relative to producing “so-called ‘cultural products’ as part of a smear campaign against Xinjiang,” according to a Xinhua recap of a press conference held July 30 in Beijing. Xu Guixiang, a spokesperson with the regional government, said there had been novels, films, documentaries, cartoons, and video games produced that target Xinjiang. Xinhua quoted Xu as saying the efforts have “appalling non-existent stories, fabrications and lies” about the situation in the province. “The anti-China forces in the U.S. and the West have used cultural works to engage in political manipulation, attacking and slandering Xinjiang regardless of cost and consequences," said Xu. "This is a desecration of cultural works and a provocation to the people of all ethnic groups in Xinjiang." The report indicated there were “several Xinjiang residents” who shared stores via video link disputing that the training centers in Xinjiang are “concentration camps.”

— China NDRC releases fertilizer to flood-hit Henan. China’s National Development and Reform Commission (NDRC) has delivered the first batch of fertilizer to flood-hit Henan province to help the province’s efforts for post-disaster agricultural production, according to a Xinhua report. The NDRC issued a notice requiring “relevant companies” to release national reserves of “disaster-relief fertilizer” to areas hit hard by floods in Henan, the NDRC said. The agency said it would monitor crops in affected areas and the fertilizer market across the country and “may continue to release national commercial reserves of fertilizer if needed,” Xinhua reported.

— Price of shares in Chinese video game companies Tencent and NetEase initially fell more than 10% after state-run outlet Economic Information Daily published an article likening the games to “electronic drugs” and “spiritual opium.” Share prices began recovering once the article was deleted from the Economic Information Daily Wechat account. Perhaps wary of a government crackdown on Chinese tech companies, Tencent then announced reductions in the amount of time that people under 18 can play the company’s online games: 90 minutes maximum on regular days and 3 hours maximum on holidays.

TRADE POLICY

— USTR Tai to hold ag roundtable in Seattle. U.S. Trade Representative (USTR) Katherine Tai will travel to Seattle and on Thursday morning take part in a roundtable discussion with Rep. Suzan DelBene (D-Wash.) on how trade can help agriculture and farm industries, as well as tour the Washington State University Breadlab in Burlington, Wash. On Thursday evening, Tai and DelBene will lead a roundtable to discuss a worker-centered trade policy with labor leaders and union representatives at the Seattle Machinists Hall.

ENERGY & CLIMATE CHANGE

— Food vs fuel debate still evident. Reuters reports that a trade group representing some of America’s biggest baked goods companies is urging the Biden administration to ratchet back its biofuel ambitions, arguing that using fuel made from crops could raise the cost of donuts, bread and other foods. It appears they are now taking on biodiesel because of a lack of oilseed supplies.

— Carbon capture language included in bipartisan infrastructure measure; more sought via reconciliation. Carbon capture backers got some of the provisions they want in the physical infrastructure bill moving in the Senate, but say they want to expand federal incentives in a budget reconciliation measure ahead.

Background. Including in the $550 billion infrastructure bill is the SCALE Act, which is touted as the biggest effort to date for scaling up projects that capture and store carbon dioxide. The legislation includes billions of dollars in demonstration projects to divert and store carbon dioxide, the most prevalent greenhouse gas.

More funding needed. Carbon capture developers and some environmental groups are pushing House and Senate leadership to make boosting the incentives a priority in any next round of legislative packages moving after infrastructure. That includes the $3.5 trillion reconciliation package needing just a simple majority in the Senate.

— Stricter fuel-efficiency standards for cars and light trucks are expected from the Biden administration as soon as this week.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— PepsiCo plans to sell Tropicana, Naked and other juice brands in North America to private-equity firm PAI Partners, receiving pretax proceeds of $3.3 billion and retaining a 39% stake in a new joint venture. As people have cut back on sugar, consumption of fruit juices and drinks has slipped, with PepsiCo’s sales of them down 36% between 2011 and 2020, according to Beverage Marketing Corp. Along with rivals, it is shifting toward the likes of diet soda, flavored seltzer and bottled water.

— New animal welfare rules could cause a bacon shortage in California. At the beginning of next year, California will begin enforcing an animal welfare proposition approved overwhelmingly by voters in 2018 that requires more space for breeding pigs, egg-laying chickens and veal calves. According to the Associated Press, while national veal and egg producers are optimistic they can meet the new standards, only 4% of hog operations now comply with the new rules. “That means that unless the courts intervene or the state temporarily allows non-compliant meat to be sold in the state, California will lose almost all of its pork supply, much of which comes from Iowa, and pork producers will face higher costs to regain a key market,” the AP item said (link)

“Our number-one seller is bacon, eggs and hash browns,” said Jeannie Kim, who for 15 years has run SAMS American Eatery on San Francisco's busy Market Street. “It could be devastating for us.”

— Egypt leader says he will increase subsidized bread prices. Egyptian President Abdel Fattah al-Sisi Tuesday said the country needs to increase the price of subsidized bread, wading into a potentially volatile issue in the country where efforts some 44 years ago to raise bread prices caused deadly riots. "It is time for the 5 piaster loaf to increase in price. Some might tell me leave this to the prime minister, to the supply minister to (raise the price); but no, I will do it in front of my country and my people," Sisi said Tuesday. [One Egyptian pound is equal to $0.0637; there are 100 piastres in one Egyptian pound.] “It's incredible to sell 20 loaves for the price of a cigarette." While insisting the price increase would not be significant or take it to the level of 60 piastres or 65 piastres, the cost of making bread, Sisi said, but an increase is “necessary.” He added that “nothing stays stagnant like this for 20 or 30 years.” The country in 2020 decreased the size of the subsidized loaf of bread by 20 grams. I hope that this is not poorly received, as if we are planning to make a big jump in prices ... we are only talking about achieving balance," Sisi added.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 198,993,465 with 4,237,546 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 35,131,467 with 613,679 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 346,924,345 doses administered, 164,919,666 have been fully vaccinated, or 50.2% of the total U.S. population.

— Major retailers and restaurant chains said they would require workers to wear masks in many of their stores, restaurants and offices regardless of vaccination status. Home Depot said it would require all workers nationally to wear masks, while Target and McDonald’s said they would only require mask wearing for all employees in counties deemed at high risk for Covid-19 transmission by the Centers for Disease Control and Prevention.

— Global Covid-19 liquidity. The International Monetary Fund is set to allocate $650 billion of its special drawing rights (SDR) to shore up finances of poorer countries hit hard by the Covid-19 pandemic. The assets will be allocated based on the size of a member nation’s economy, but plans are already in place to encourage richer countries to funnel their SDRs to countries more in need. “This is a historic decision — the largest SDR allocation in the history of the IMF and a shot in the arm for the global economy at a time of unprecedented crisis,” IMF chief Kristalina Georgieva said in a statement. Unlike traditional IMF loans, SDRs come without conditions and do not have to be repaid.

— Sen. Lindsey Graham (R-S.C.) tested positive for Covid-19 despite being vaccinated, raising concerns about the Delta deviant on Capitol Hill. His symptoms are mild, which he attributed to being vaccinated. He has gone into a 10-day quarantine, and if infections spread to other supporters of the bill, it may cost the votes required to pass the physical infrastructure legislation, delaying a vote into the Senate’s planned August recess.

— FSA outlines efforts on USDA borrowers relative to Covid. Through Sept. 1, 2021, USDA said that the Farm Service Agency’s Disaster Set-Aside (DSA) provision is available to direct loan borrowers who have been impacted by the pandemic. This allows for an upcoming annual installment to be set aside for the year and added to the final installment. For annual operating loans, the loan maturity date may be extended up to twelve months to set aside the installment. This provision is normally used in the wake of natural disasters, USDA said, and a second Disaster Set-Aside may be available for direct loan borrowers who already have a DSA in place on a loan due to another designated natural disaster.

POLITICS & ELECTIONS

— Biden moves to stave off mass evictions. President Biden and top White House officials sought yesterday to stave off a wave of evictions after the expiration of a federal moratorium, pressing federal, state and local government agencies to act quickly to stop tenants from losing their homes. The push follows intensifying criticism from liberals within his own party, who have complained the White House waited too long to ask Congress to pass legislation extending the moratorium. Treasury Secretary Janet Yellen will talk today to House Democrats about getting rental assistance out to more tenants.

CDC resists. Biden’s request yesterday that the Centers for Disease Control and Prevention consider another extension of an evictions moratorium — as requested by some Democrats on Capitol Hill — was resisted by the agency’s leaders, who said they were unable to legally justify even a narrow ban following a Supreme Court ruling last month. Biden asked the agency to consider a 30-day moratorium focused on counties with high or substantial spread of coronavirus, White House Press Secretary Jen Psaki said in a statement yesterday.

Key to the effort is encouraging states to speed up rental assistance: So far, $3 billion has been dispersed from a $47 billion fund authorized by Congress in March.

— Donald Trump to fight release of tax returns. The former president will fight any move by the Treasury Department to turn over his tax returns to Congress, his lawyer said, days after the Justice Department directed the agency to provide the documents to a House panel.

— Pelosi-McCarthy relationship continues to deteriorate. The Los Angeles Times reports (link) that while House Speaker Nancy Pelosi (D-Calif.) and Minority Leader Kevin McCarthy (D-Calif.) “both are from California, the two House leaders have a more acrimonious relationship than Pelosi had with McCarthy’s two predecessors, when there was at least a degree of civility,” as the “recent spate of name-calling and political maneuvering between the two brought an already-fraught relationship to a new low.” However, the LAT adds Pelosi and McCarthy “never had much of warm relationship, and it only got worse under President Trump, who was impeached twice by the House under Pelosi.”

CONGRESS

— Navigable waters rule pushed by Arkansas GOP senators. Sens. John Boozman and Tom Cotton, both Republicans from Arkansas, offered legislation to codify former President Donald Trump’s 2020 Navigable Waters Protection Rule. The bill seeks to block the EPA from imposing regulations along the same lines as what the senators call a “heavy-handed” Obama-era Waters of the United States (WOTUS) Rule, according to a joint statement. “As we repeatedly reminded the Obama administration, giving the federal government the authority to control virtually every ditch, pond and puddle on private land in Arkansas and nationwide is unlawful and will have terrible consequences. Now the Biden administration is determined to follow the same playbook,” Boozman said.

OTHER ITEMS OF NOTE

— Fading farms, dying dreams in Arizona. Nearly all of Arizona is in drought, with large swaths in extreme distress. Experts say the picture may get worse. Link to Los Angeles Times article.

— Vilsack traveling to Oregon today to discuss wildfire response. USDA Sec. Tom Vilsack will be in Oregon where he will join Gov. Kate Brown, a Democrat, for events focused on the Biden administration’s response to the serious drought and wildfire conditions in the state. Vilsack and Brown will tour a farm in Salem that has been impacted by drought. Later that morning, they will attend a briefing on the status of wildfire response efforts and efforts to strengthen wildfire prevention and preparedness. They will take questions from reporters after the briefing. Vilsack is co-chair of the Biden administration’s Wildfire Resilience Interagency Working Group and Interagency Drought Relief Working Group.

Meanwhile, the U.S. plans new tactics to fight the West’s flames. The head of the Forest Service said extreme drought and the pandemic are limiting the agency’s resources and it will focus on fires that threaten communities and infrastructure in the drought-ravaged region.