SCMP: Beijing Vowed Before Xi/Biden Summit to ‘Buy Whatever the U.S. Can Ship Over’

Biden, Manchin talked Monday evening as revised BBB still possible

In Today’s Digital Newspaper

Market Focus:

• Biden speaks this afternoon on Covid update

• IMF: U.S. tied for highest inflation rate; global debt hits record $226 trillion

• Supply chains: companies shift from ‘just in time’ to ‘just in case’

• Fed’s Waller sees first rate rise shortly after tapering ends

• Lira plunged to a record low Monday

• Battery installations on the U.S.’ electric grid set to hit records this

• New variable for wheat has come about from insurance data

• Cold weather sends European energy prices to new highs

• Ag demand update

• Two-sided trade overnight

• Consultant cuts most South American crop forecasts amid dryness concerns

• Sluggish start to beef trade

• Cash hog index firms

Policy Focus:

• Collin Peterson is Pro Farmer’s co Ag Person of the Year; interviewed on podcast

• CFAP 2 payouts edge back higher

• Next steps after BBB blowup

• GAO critical of USDA re: 2019 MFP payments; overpayments to corn farmers

• Interior outlines progress under ‘America the Beautiful’ (30x30) initiative

Personnel:

• Biden’s nominee to lead the agency overseeing the trucking industry leaving

• Senate confirmed nine federal trial court judges, ambassadors before departing

China Update:

• Trump demands China pay $60 trillion in reparations for coronavirus pandemic

• U.S./China gas deals defy tensions between world powers

• SCMP: Beijing vowed before Xi/Biden summit to ‘buy whatever the U.S. can ship over’

Trade Policy:

• Canada reports atypical BSE case to OIE

• U.S. allows adoption of WTO report on Spanish olives

Energy & Climate Change:

• EPA publishes proposed RFS levels for 2020, 2021 and 2022

• EPA also comments on small refinery exemptions (SREs)

• Biden administration is raising vehicle mileage standards to significantly reduce emissions

• Dems will likely overhaul plans for electric vehicle tax credits — or scrap them all together

Coronavirus Update:

• Omicron variant responsible for 73% of recent Covid-19 infections in U.S.

• Biden to speak at White House this afternoon about Covid

• Biden tested negative for days after he came in contact with staff testing positive

• Biden administration pushing back vaccine mandate date for large businesses

• Trump told audience he had received a booster shot, and was booed

Politics & Elections:

• Two more House Democrats announced their retirements

• California Dems have better shot at winning more House seats under congressional map

• Bridgewater’s CEO moves closer to running for the Senate

Other Items of Note:

• Foreign-born population soars to new record under Biden

• Biden admin. will make an additional 20,000 H-2B seasonal guest-worker visas available

• Russia warns of military action as fears mount of Christmas invasion of Ukraine

MARKET FOCUS

Equities today: Global stock markets were mostly higher in overnight trading. U.S. Dow opened up 1% higher. A look at the daily bar charts for the Nasdaq and S&P futures, according to analyst Jim Wyckoff, “shows higher daily price volatility at higher price levels. That’s one warning signal of a topping process in a market and favors the bearish camp. Look for more daily increased price volatility in the near term, which could be amplified even more by thin holiday trading volumes in the coming days.” Asian equities finished higher, recovering some of their losses registered to open the week. The Nikkei gained 579.78 points, 2.08%, at 28,517.59. The Hang Seng Index rose 226.47 points, 1.00%, at 22,971.33. European equity markets are seeing solid advances in early trading. The Stoxx 600 was up 1.2% while regional markets were seeing gains of 1% to 1.3%.

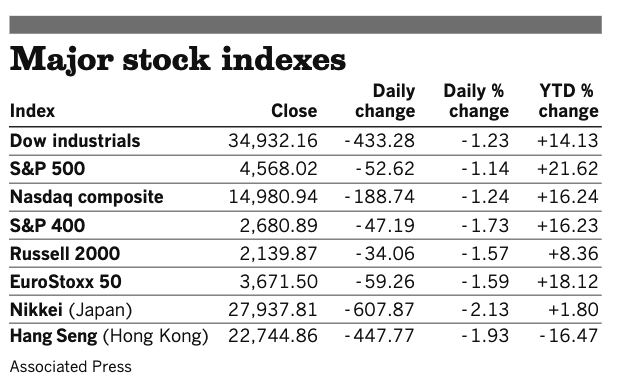

U.S. equities yesterday: The Dow was down 433.28 points, 1.23%, at 34,932.16. The Nasdaq dropped 188.74 points, 1.24%, at 14,980.94. The S&P 500 lost 52.62 points, 1.14%, at 4,568.02.

On tap today:

• U.S. current account deficit is expected to widen to $205.5 billion in the third quarter from $190.28 billion in the second quarter. (8:30 a.m. ET)

• European Union's flash consumer confidence indicator for the eurozone is expected to fall to minus 8 in December from minus 6.8 the prior month. (10 a.m. ET)

IMF: U.S. tied for highest inflation rate; global debt hits record $226 trillion. The U.S. economy tied for the highest level of inflation in 2021 among developed economies, the International Monetary Fund (IMF) reported. IMF data found that the U.S. and Iceland were at the top of the list of 35 nations for rising consumer prices. The organization noted that the inflation rate clocked in at 4.3% for both countries. For the rest of the world, Venezuela ranked the highest, with a 2,700% inflation rate, followed by Sudan (194.6%) and Zimbabwe (92.5%).

Supply chains: companies shift from ‘just in time’ to ‘just in case’. All over the world, companies have encountered snags in their supply chains during the pandemic and the shipping bottlenecks that have followed as economies restarted. Car production lines have been halted by a lack of semiconductors, liquor distillers have run out of bottles and department stores are short of Christmas stock. Such troubles are forcing a rethink of corporate strategy. For decades, companies prioritized costs above all else when selecting suppliers, building factories and deciding how much stock to keep on hand. This philosophy was often dubbed “just in time.” Companies also moved production to low-wage locations, consolidated orders to maximize economies of scale, and tried to minimize their physical presence in high-tax jurisdictions. During the pandemic, companies are revamping existing supply chain policies to build additional resilience. Some businesses are increasing the inventory they keep on hand and entering into longer term contracts with key suppliers. Others are diversifying their manufacturing to create regional hubs with local suppliers and investing in technology to give them greater advance warning of potential bottlenecks. Some companies are also investigating ways of working with their rivals to share information to develop emergency backup facilities without falling foul of competition regulators. Link to more via the Financial Times (paywall).

Fed’s Waller sees first rate rise shortly after tapering ends. Fed Governor Christopher Waller was first out of the chute with public remarks after the Federal Open Market Committee (FOMC) meeting last week saw the Fed quicken the pace of its tapering of bond purchases, setting the stage for a rate increase. Waller told the Economic Club of New York he sees the U.A. economy being very close to full employment and those working are within one-and-one-half million of the pre-pandemic level in February 2020. Waller also commented that inflation has persisted far longer than the Fed expected and that factored into the increase in tapering of the Fed’s bond buys which will be completed in March. While cautioning that the first rate rise will depend “on the evolution of economic activity,” Waller stated, “But given my expectations for inflation and labor market conditions, I believe an increase in the target range for the federal funds rate will be warranted shortly after our asset purchases end.” He did express caution at the Omicron variant Covid virus, signaling it is not certain how it could affect the U.S. economy, including whether it causes more labor and goods supply shortages “and add inflation pressures, derailing the moderation of inflation next year that is my baseline.” but pledged Fed policymakers “will adjust as needed.” Waller is not a well-known Fed member, but his comments are very straightforward and signal he is on the hawkish side of Fed policy at this point.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker amid strength in the euro, yen, and British pound versus the greenback. The yield on the 10-year U.S. Treasury note was higher to trade around 1.44% with a higher tone in global government bond yields. Gold and silver futures have risen ahead of U.S. economic updates, with gold around $1,797 per troy ounce and silver around $22.72 per troy ounce.

• Crude oil futures are higher ahead of U.S. trading, with U.S. crude trading around $69.55 per barrel while Brent was trading around $72.50 per barrel. Crude oil firmed in Asian trade, with U.S. crude up 81 cents at $69.42 per barrel and Brent up 69 cents at $72.21 per barrel.

• Lira plunged to a record low Monday and Turkey’s business community went into revolt, signs that the currency crisis dogging the country’s economy was heading into a dangerous new phase.

• Battery installations on the U.S.’ electric grid are set to hit records this year as government mandates and a steep decline in costs fuel rapid growth in power storage.

• New variable for wheat has come about from the insurance data. The recent data suggests the winter wheat crop acreage is down at least 1 million acres if not more, says analyst and trader Richard Crow. The majority of the acreage is in the HRW area.

• Ag demand: Turkey purchased 320,000 MT of milling wheat from unspecified origins.”

• Cold weather sends European energy prices to new highs. As cold temperatures set in across much of Europe this week, already high energy and carbon emission permit prices are again trending sharply upward. So far, European natural gas prices have risen more than 600% this year, and regional benchmarks climbed nearly 9% Monday (Dec. 20) as cooler weather is expected to ramp up demand. Carbon emission permit prices also jumped over 8% Monday as European countries are seen burning more fossil fuels to meet energy demand after recent forecasts suggest there will be a dip in wind energy generation. Also complicating matters, in France — which relies on nuclear for around 70% of electricity generation — around one quarter of reactors are offline for maintenance. That led French Ecology Minister Barbara Pompili to push Electricite de France SA to restart some nuclear reactors earlier than planned to help with a winter energy crunch across Europe. Some observers have warned that if temperatures turn cold enough for a long enough period Europe could see rolling blackouts in some areas as demand for electricity outstrips supply.

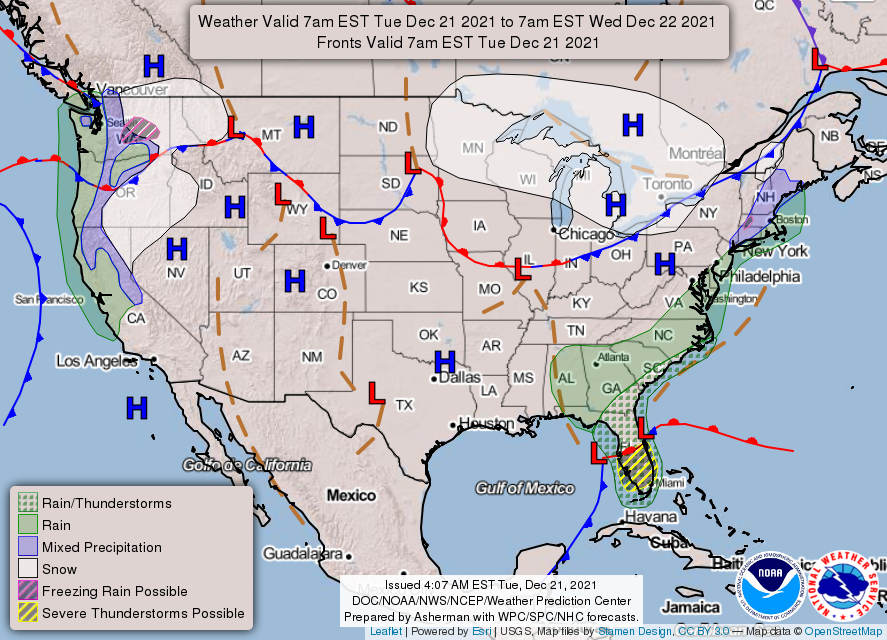

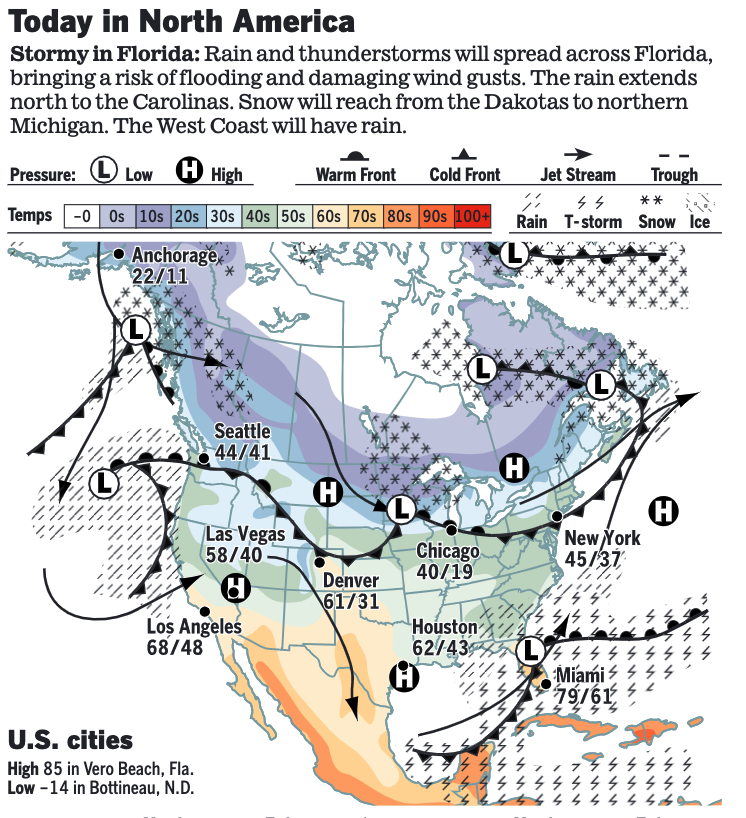

• NWS weather: Low pressure system expected to bring locally heavy rain/thunderstorms across Florida and the Southeast coast today... ...Another low pressure system will spread snow across the northern tier states today into tonight and then a quick round of snow for Maine later on Wednesday... ...Unsettled weather spreads farther south from the Pacific Northwest into California as well as farther inland across the northern Rockies.

Items in Pro Farmer's First Thing Today include:

• Two-sided trade overnight

• Consultant cuts most South American crop forecasts amid dryness concerns

• Sluggish start to beef trade

• Cash hog index firms

POLICY FOCUS

— Former House Ag Chairman Collin Peterson (D-Minn.) was Pro Farmer’s co Ag Person of the Year. We had Peterson and Tom Sell of Combest-Sell consulting group with us on Monday’s DC Signal to Noise podcast. The two talked about recent policy and other Washington-related issues in a wide-ranging discussion. Link for details.

Here is what Pro Farmer wrote in its latest letter regarding Peterson:

“Former House Ag Committee Chair Collin Peterson is our other choice for ag person of the year. Why? By far the biggest policy threat to ag was the potential elimination of stepped-up basis. Peterson couldn’t directly lobby but he did pick up the pen and articulate to readers, including lawmakers, how seriously damaging this would be. His opeds got a lot of traction. Sen. John Thune (R-S.D.) was a key GOP point man on the issue and Rep. David Scott (D-Ga.) eventually weighed in. But Collin got the ball rolling.

“Peterson also forcefully argued that Democrats should not mandate greenhouse gas or methane emission reductions through Clean Air Act or new legislation, including the social spending/Build Back Better (BBB) Act. He stated that it would set back efforts by decades. And Democrats listened.”

— CFAP 2 payouts edge back higher. Payouts under the Coronavirus Food Assistance Program 2 (CFAP 2) increased to $19.06 billion as of Dec. 19, up from $19.04 billion the prior week. The increase was in original CFAP 2 payments which are now shown at $14.24 billion, up from $14.22 billion the prior week. There was no major change reported in the top-up payments which are at $4.82 billion. CFAP 1 payments are now shown at $11.74 billion, down slightly from the prior week when they were at $11.75 billion. Original CFAP 1 payments are at $10.56 billion, essentially steady with the prior week with top-up payments at $1.19 billion, also essentially steady.

— Next steps after BBB blowup:

- Senate Democrats have a conference call scheduled tonight at 8 p.m. ET to discuss what’s ahead on the agenda. Focus is whether centrist Sen. Joe Manchin (D-W.Va.) will be on the call.

- President Joe Biden and Manchin spoke Monday evening. Reports note the call ended with a vague understanding that talks would continue about the Democrats’ social spending and climate bill, in some form, in the new year. Manchin has outlined a roadmap to revive a slimmed-down version of the Democrats’ Build Back Better (BBB) bill.

- Progressives are pressing Biden to use his executive authority to accomplish at least parts of his economic agenda. Congressional Progressive Caucus Chair Pramila Jayapal (D-Wash.) said Biden may be able to act on some climate issues and easing of student loan burdens, without providing details. She said Democrats can’t wait for a restart of talks with Manchin and expect a different outcome.

- Environmental activists and Democrats are mulling how to revive climate provisions in the plan. “We are intent on getting this done,” said Tiernan Sittenfeld, senior vice president of the League of Conservation Voters. The effort to salvage even some of the bill’s planned $555 billion in clean energy spending could result in new and expanded tax credits for renewable power, nuclear plants, biofuels and clean-energy manufacturing.

- Majority Leader Chuck Schumer (D-N.Y.) said his chamber will vote early next year on the social spending bill — even though Manchin has vowed to oppose it — and said the Senate "will keep voting on it until we get something done." Schumer also announced plans in other areas including voting rights and rules changes.

— GAO critical of USDA methods to set 2019 MFP payments, noting overpayments to corn farmers versus actual trade impacts. The Government Accountability Office (GAO) released a report (link) examining the 2019 Market Facilitation Program (MFP) payments issued by USDA, finding fault in the process USDA used to determine the payments.

GAO noted that USDA adjusted the payment calculations for the 2019 program versus the 2018 MFP effort to address “limitations” in the 2018 effort. But GAO said the changes resulted in producers of the same crop being paid different amounts in different counties. “USDA paid higher rates to producers of a crop in a county where others planted crops with higher trade damages per acre than it paid producers of that same crop where others planted crops with lower trade damages per acre,” GAO said, noting that process created regional differences. While USDA used minimum and maximum county rates to address the situation, “regional differences remained.”

GAO said their review of the effort found that 2019 MFP payments to corn farmers were approximately $3 billion more than estimated trade damages, while payments to soybeans, sorghum and cotton producers were lower than estimated trade damages.

GAO faulted USDA for using an “unrepresentative baseline value of U.S. exports” and failed to provide transparency in its methodology in describing the parameters used. “As a result of the lack of transparency about its baseline selection and the 2019 MFP baseline choice, USDA’s methodology increased its trade damage estimates in a manner that was not clearly identifiable to decision makers and the public,” GAO said. GAO said it recommended USDA make sure the Office of the Chief Economist revises its internal review process to make sure that future economic analyses used in these cases address the transparency issued raised and called for the use of an internal review process relative to the baselines used to make payments.

However, the Office of the Chief Economist told GAO they disagreed, arguing their role was to provide “objective, data-driven economic analyses in order to inform policymakers’ decision-making.”

It is not clear what impacts the GAO report could have on any future MFP-type payments, but this may be something referenced in the future should another payment program for farmers of this nature be deployed again.

— Interior outlines progress under “America the Beautiful” (30x30) initiative. The Interior Department cited conservation investments through the 2021 bipartisan infrastructure law and the 2020 Great American Outdoors Act, as well as administrative actions to restore protections to three national monuments, among its 2021 accomplishments in a conservation progress report released yesterday (link).

Interior also pointed to its efforts to jumpstart new reviews designed to boost protection of Alaska’s Bristol Bay; Tongass National Forest and the Arctic National Wildlife Refuge; Boundary Waters Canoe Wilderness in Minnesota; and Chaco Culture National Historical Park in New Mexico. Interior announced it would restart a federal advisory committee — the Hunting and Wildlife Conservation Council — to provide recommendations on advancing habitat conservation. The initiative is to protect 30% of the country’s lands and waters by 2030 and focus more on conservation overall.

The White House said the new $1 trillion infrastructure law “provides a major boost” to the “30 by 30” initiative with “the largest investment in the resilience of physical and natural systems in American history.”

Nebraska GOP Gov. Pete Ricketts suggested last summer that “30x30” was a land grab and said too few details were available.

In a step linked with release of the report, the USDA modified its Conservation Reserve Enhancement Program (CREP) to make it easier for state and local “partners” to take part. Under CREP, landowners who take fragile cropland out of production qualify for incentives, such as higher payment rates than the standard Conservation Reserve rate. There are 34 CREP projects in 26 states covering 860,000 acres. CREPs are aimed at land with high environmental benefits.

Facts and figures. An estimated 12% of U.S. land and 28% of its ocean territories are under some form of environmental protection at present.

PERSONNEL

— Biden’s nominee to lead the agency overseeing the trucking industry is leaving before her confirmation to join New York City’s mayoral office. Meera Joshi, who serves as deputy administrator at the Federal Motor Carrier Safety Administration, was picked yesterday by New York City Mayor-elect Eric Adams to be deputy mayor for operations.

— Senate confirmed nine federal trial court judges, ambassadors before departing. Lawmakers voted to confirm four district court judges for seats in California, two in Michigan and one each in Minnesota, New Mexico, and Washington.

The confirmed ambassadors are for posts throughout the world and include Biden’s picks to represent the U.S. at the European Union and in countries that include France, Belgium, Ireland, Spain, Sweden, and Vietnam.

Separately, the Senate confirmed former Chicago mayor Rahm Emanuel to serve as U.S. ambassador to Japan on a roll call vote of 48 to 21 with some Republicans joining Democrats in backing the pick.

CHINA UPDATE

— Trump demands China pay $60 trillion in reparations for the coronavirus pandemic. Former President Donald Trump said Sunday that China should pay reparations for its role in the Covid-19 pandemic. Trump told Fox News’ Maria Bartiromo that the communist regime should be held responsible for its role in helping spread the coronavirus. “China has to pay, they have to do something,” said Trump. “They have to pay reparations . . .” The former president argued that if the worldwide damage of the coronavirus was properly estimated, China would likely owe upwards of $60 trillion.

— U.S./China gas deals defy tensions between world powers. China’s voracious appetite for natural gas has sparked a wave of deals with U.S. exporters of the fuel, strengthening energy trade between the world’s two biggest economies even as their relationship grows more fraught. The latest sales were announced on Monday when Venture Global LNG, a company building a pair of liquefied natural gas export plants in Louisiana, said it had agreed two contracts to ship 3.5m tonnes a year of the fuel to state-owned China National Offshore Oil Corporation, the country’s biggest LNG importer. The CNOOC deals bring to seven the number of big contracts signed between U.S. exporters and Chinese customers since October. Some of the contracts are to last decades. China is poised to surpass Japan as the world’s largest LNG buyer this year, analysts say, while the U.S. will leapfrog Australia and Qatar in LNG export capacity next year, according to its Energy Information Administration. Link for more via the Financial Times (paywall).

— With U.S./China Phase 1 trade deal set to expire, insiders reveal what’s really happening behind the scenes, according to the South China Morning Post (link). It says Chinese sources say trade talks between Washington and Beijing occur more frequently than authorities have revealed, while neither politics nor supply-chain disruptions are determining factors behind China’s lagging purchases. Beijing allegedly vowed before last month’s Xi/Biden summit to “buy whatever the U.S. can ship over.”

TRADE POLICY

— Canada reports atypical BSE case to OIE. The World Animal Health Organization (OIE) said that Canada has reported an atypical case of BSE in Alberta. The case was reported Dec. 17, according to the OIE, and marks the first BSE case in Canada since Aug. 7, 2015. The case was discovered after a private veterinarian on Dec. 6 visited a farm reporting an eight-and-one-half-year-old beef cow (born April 13, 2013) was injured and displayed some neurological signs, according to the OIE recap. Rapid tests conducted at the provincial laboratory in Edmonton, Alberta were non-negative which was reported to Canadian Food Inspection Agency (CFIA). These results were confirmed by CFIA's OIE BSE reference laboratory in Lethbridge, Alberta on Dec. 16, 2021, according to the OIE, as an Atypical (H-type) case of BSE. The carcass was held and did not enter the human food or animal feed chains. Alberta Minister of Agriculture, Forestry and Rural Economic Development, Nate Horner, said in a statement that Alberta government and CFIA officials met Dec. 20 with “stakeholders from across the province’s cattle industry to answer questions and reassure them that all levels of government are working together on this case.” He noted that the discovery of the first case in six years is due to “our cattle producers’ vigilance and the success of surveillance and control measures we’ve implemented across the country over the past 20 years.”

It is not clear whether there will be calls for the U.S. to halt imports of Canadian beef as some have urged relative to shipments of Brazilian beef to the U.S. after Brazil confirmed two atypical cases of BSE. However, the main issue raised by those wanting to halt imports of Brazilian beef are that the country waited several weeks before reporting the discovery. Canada appears to have reported the find in a timely manner, according to details of the case released so far by the OIE.

— U.S. allows adoption of WTO report on Spanish olives. The U.S. surprisingly opted to let the WTO Dispute Settlement Body approve a report ruling the U.S. did not meet world trade rules in setting duties on imports of ripe Spanish olives. The report does not totally reject the U.S. actions but will result in lower duties remaining in place. The U.S. opted to not appeal the report, a move which effectively would have resulted in the dispute being prolonged as the U.S. has blocked appointment of new members of the Appellate Body, the WTO arm that would have considered the appeal.

ENERGY & CLIMATE CHANGE

— EPA publishes proposed RFS levels for 2020, 2021 and 2022. EPA’s proposed levels announced Dec. 7 for biofuels under the Renewable Fuel Standard (RFS) for 2020, 2021 and 2022 have now been published in the Federal Register (link). The agency reiterated the RFS levels it is proposing for 2021 “are based on actual renewable fuel use for months in 2021 where data are available and projections of renewable fuel use for the remainder of the year.” The levels proposed for 2022, the agency noted, are “significantly” higher than those for 2020 and 2021, but also reflect what the agency said were “including market and infrastructure constraints to the ability of RFS annual volume requirements to incentivize increased production and use of renewable fuel in the near term.” Those constraints include “commercial availability of cellulosic biofuel, the price and availability of feedstocks, and the availability of infrastructure to distribute higher level blends of ethanol.”

EPA also continues to note that the situation regarding small refinery exemptions (SREs) remains uncertain. In a separate rulemaking (link), EPA is proposing to deny all pending SREs, seeking public comment on that proposal. In their RFS rulemaking, EPA again noted that it was “still unclear at this time whether we will be granting SREs for 2020, 2021, or 2022, and if so, to what degree.” Comments on the proposed RFS levels are due Feb. 4 and EPA is holding a public hearing on their plans Jan, 4 (and Jan. 5 if needed) to gather public input. It is not clear when EPA will finalize the RFS levels and there have been changes in the final levels versus proposed levels previously. However, those changes have not typically been significant.

— Biden administration is raising vehicle mileage standards to significantly reduce emissions of planet-warming greenhouse gases. The rule requires automakers to reduce emissions output in new makes beginning with model year 2023 vehicles and to reach 161 grams of CO2 emissions per mile by model year 2026, which is equivalent to 55 miles per gallon of fuel efficiency. The new rule would be stricter than the rolled-back standards put forward by the Trump administration. In that version, the emissions standard for model year 2026 allowed for 208 grams of CO2 per mile, or equivalent to 43 miles per gallon. The fleetwide mileage standard for the current 2021 model year is 40 mpg. Link for details.

Impact: The standards, which will apply to model years 2023-2026, are projected to avert over 3 billion tons of carbon dioxide emissions, equivalent to the majority of nationwide emissions in 2019, between now and 2050. The final standards are expected to encourage more electric vehicle sales, hastening an industry shift that is already underway, with nearly all major automakers having promised to transition their fleets to zero-emission models. Under the EPA’s projections, the standards are expected to help put more electric vehicles on the road — pushing sales of EVs and plug-in hybrids to about 17% in model year 2026 from an expected 7% in model year 2023. The transportation sector is the single-largest source of greenhouse gas emissions in the U.S.; passenger cars and trucks alone contribute 17% of the national total. EPA forecasts the new rules will save U.S. drivers between $210 billion and $420 billion in fuel costs through 2050. It will also save each buyer about $1,000 over the lifetime of their vehicle from model year 2026, even after factoring in higher purchase prices for cleaner vehicles.

— Democrats will likely need to overhaul their plans for electric vehicle tax credits — or scrap them all together. The current bill provides a $7,500 consumer tax credit to be made refundable and expanded by $4,500 for cars assembled domestically in union plants with an extra $500 for batteries made in the United States. Centrist Sen. Joe Manchin (D-W.Va.), whose state is home to a non-union Toyota factory, said he is opposed to the union portion of the tax credit. He also wants income limits on the credit.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 275,518,046 with 5,363,070 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 51.100,799 with 807,952 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 496,239,573 doses administered, 204,098,982 have been fully vaccinated, or 62.17% of the U.S. population.

— Omicron variant was responsible for 73% of recent Covid-19 infections in the U.S., according to the Centers for Disease Control and Prevention. In some states, such as New York, the figure is thought to be 90%.

— Biden to speak at White House about Covid. The Biden administration will distribute 500 million free at-home Covid-19 testing kits to Americans and take steps to deploy federal medical personnel to overburdened hospitals this winter. However, the system is not expected to be online until January — after people travel and gather for the holidays. Biden will outline the plan during a speech at the White House today scheduled to begin at 2:30 p.m. ET. Meanwhile, although an estimated 1 million booster doses are being administered each day, less than a third of vaccinated Americans have received one, according to the Centers for Disease Control and Prevention. Only 30% of people who are fully vaccinated have received a booster dose. Among people who are at least 65 years old — those considered to be among the most vulnerable to the virus because of their age — the number stands at 54%.

Biden will also deliver a stark warning to the unvaccinated, a senior administration official said, telling them that they risk serious disease or death while assuring Americans who’ve gotten their shots that they can safely gather with their families over the holidays.

— President Biden tested negative for the coronavirus Monday, days after he came in contact with a “mid-level staffer” who tested positive for the virus, the White House said in a statement. The aide “spent about 30 minutes near the president on Air Force One on the way from South Carolina to Philadelphia,” CNBC reports. Biden will be tested again Wednesday.

— Biden administration is pushing back the date by which large businesses must comply with its Covid-19 vaccine mandate as legal uncertainty continues to hang over the requirement. Following a federal appeals court ruling reinstating the administration’s vaccination rules, the Labor Department said it would give employers until Feb. 9 to comply with the rule’s testing requirements and until Jan. 10 to comply with the rest of it. The original deadline announced by the administration was Jan. 4.

— Former President Donald Trump told an audience that he had received a booster shot, and was booed. Link for details via the New York Times.

POLITICS & ELECTIONS

— Two more House Democrats announced their retirements Monday — Reps. Stephanie Murphy of Florida and Lucille Roybal-Allard of California, the first woman of Mexican descent elected to Congress and who is chair of a House Appropriations subcommittee. This comes after word broke over the weekend that Rep. Albio Sires (D-N.J.) wouldn't run again either. There have been 23 Democratic retirements so far, and 13 GOP retirements.

— California Democrats have a better shot at winning more House seats under the congressional map approved last night by the state’s redistricting commission, a win for the party as it seeks to maintain its majority in the U.S. House in 2023. The new map increases the number of Democratic-leaning seats in the state as it lost one congressional district, going from 53 seats to 52. The number of competitive seats would increase from eight to 14, 10 of which would favor Democratic candidates, according to an analysis from the Campaign Legal Center’s PlanScore.

— Bridgewater’s CEO moves closer to running for the Senate. David McCormick is creating an exploratory committee for a potential U.S. Senate campaign in Pennsylvania in the GOP primary, and is expected to run his first television ad today. He would be the latest top financier to seek office after the former Carlyle co-CEO Glenn Youngkin ran for governor of Virginia, and he might compete against Dr. Mehmet Oz, the celebrity physician. Link for details.

OTHER ITEMS OF NOTE

— Foreign-born population soars to new record under Biden. The U.S. has had a massive surge in immigration this year, with as many as 1.5 million newcomers and a record 46.2 million foreign-born people, according to a report for the Center for Immigration Studies. The flow of people rebounded around the time President Biden was elected. In numbers never seen before, they are coming legally through airports and land border crossings and illegally across the Rio Grande and remote regions of Arizona and California. “There was pent-up demand for legal immigration, and illegal immigration has exploded in one of the greatest surges, if not the greatest, we’ve ever seen,” said Steven A. Camarota, the demographer who was the chief author of the report. As it stands, 14.2% of the U.S. population is foreign-born, or 1 out of every 7 people. That is the highest rate of immigrants in the population since 1910, when the number was 14.7%. Link for more via the Washington Times.

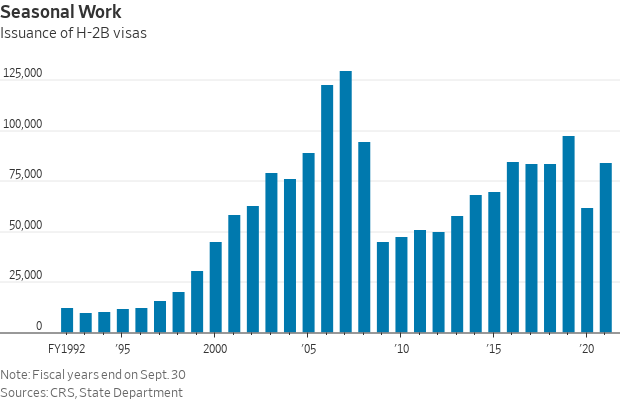

— Biden administration will make an additional 20,000 H-2B seasonal guest-worker visas available to employers ahead of the winter hiring season, the Department of Homeland Security said. The seasonal-worker program enables U.S. employers to hire as many as 66,000 temporary foreign workers a year. Since 2017, Congress has permitted the department each year to raise that cap by as many as 64,000 additional visas, though neither the Trump nor Biden administrations have approached that limit despite demand.

— Russia warns of military action as fears mount of Christmas invasion of Ukraine. Russia upped the ante Monday in its standoff with Ukraine, openly warning of military action if President Biden and America’s NATO allies ignore a list of demands Moscow announced late last week — a far-reaching list that some key U.S. lawmakers have dubbed a “pretext to war.” Russian Deputy Foreign Minister Sergei Ryabkov said his country is fully prepared to respond through “military-technical means” if Western powers fail to address those demands. He said NATO must not expand to include Ukraine or Georgia and the U.S. must not base additional military assets in former Soviet republics in Central Asia. Most of Moscow’s proposed security guarantees seemingly have little chance of becoming a reality. Still, some foreign policy specialists warn that Russian President Vladimir Putin could use their rejection to justify a major land invasion of Ukraine. Russia’s proposal and the direct threat of military action put renewed pressure on the White House to defuse a crisis that seems to be nearing the boiling point. Link for more via the Washington Times.