Powell and Fed Admit They Were Wrong: U.S. Inflation Was Not ‘Transitory’

Dems want CR until Jan. 28; GOP wants into mid-Feb. | Some progress on debt limit talks

In Today’s Digital Newspaper

Market Focus:

• Fed leader Powell has to admit defeat on use of transitory inflation

• Traders try to assess what now hawkish Fed means to equities, other markets

• OECD also updates its inflation outlook

• USDA daily export sale: 150,000 MT of corn to Colombia during MY 2021-2022

• U.S. credit-card applications hit a pandemic high

• Delta variant made supply problems worse, not better

• Canada's economy rebounded in the third quarter

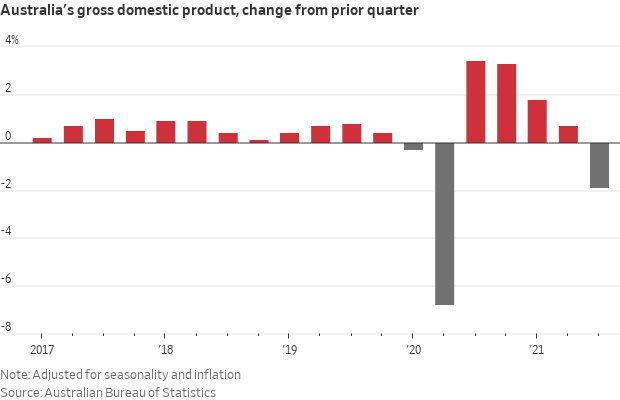

• Australia’s economy shrank in the July-September quarter

• Tel Aviv ranked the world’s most expensive city to live in

• Ag trade update

• Grain, soy markets rebound overnight

• Big jumps expected in soy crush, corn-for-ethanol figures

• Ukraine’s 2021-22 grain exports top 25 MMT

• Lower sugar supplies as India boosts ethanol production

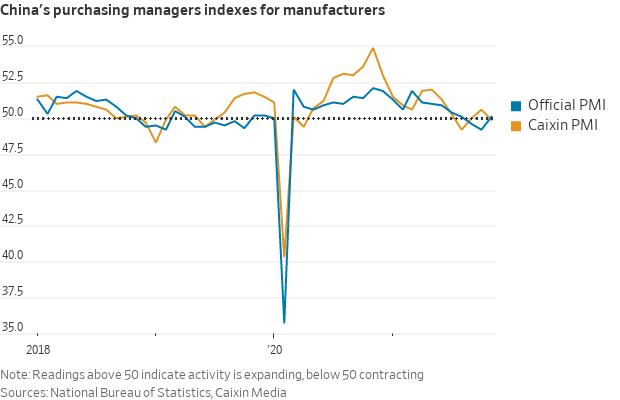

• China’s smaller factory activity contracts a little in November

• Early cash cattle trade at steady prices

• Price drop sparks heavy pork movement

Policy Focus:

• USDA reports slight reduction in CFAP 2 payouts

• Update on must-have policy issues

• Milk pricing reform proposal introduced but no industry consensus

Biden Administration Personnel:

• Biden to tap Cordray

China Update:

• China’s smaller factory activity contracts a little in November

Trade Policy:

• USTR publishes notice on monitoring Turkey DST situation

* Canada continues push on potential EV tax credit; several trade issues on agenda

Energy & Climate Change:

• DOE seeks feedback on sites to store spent nuclear fuel

• Statutory deadline on RFS levels comes without EPA action

• IEA releases Renewables Market Report

Coronavirus Update:

• Biden weighing stricter Covid-19 testing requirements for travelers entering U.S.

Politics & Elections:

• CNN suspending anchor Chris Cuomo indefinitely

Other Items of Note:

• NATO-Russia tensions

MARKET FOCUS

Equities today: Global stock markets were mostly higher in overnight trading. The U.S. Dow opened up 0.7% higher, with the S&P 500 rising 1.2%. Asian equities finished with gains despite the sharp selloff in US equities Tuesday. Japan’s Nikkei gained 113.86 points, 0.41%, at 27,935.62. The Hang Seng Index rose 183.66 points, 0.78%, at 23,658.92. European equities were showing advances in early action. The Stoxx 600 was 1.2% higher with other markets up 0.5% to 1.8%.

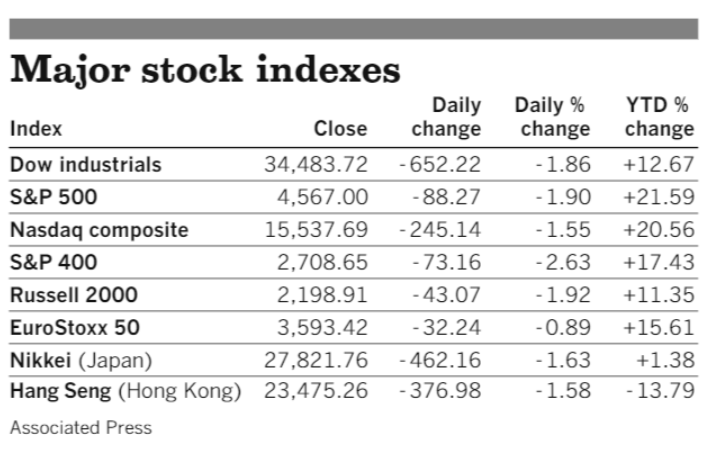

U.S. equities yesterday: The Dow fell 652.22 points, 1.86%, at 34,483,72. The Nasdaq dropped 245.14 points, 1.55%, at 15,537.69. The S&P 500 lost 88.27 points, 1.90%, at 4,567.00.

On tap today:

• ADP employment report is expected to show the U.S. private sector added 506,000 jobs in November. (8:15 a.m. ET)

• Bank of England Gov. Andrew Bailey speaks to the Institute and Faculty of Actuaries at 9 a.m. ET.

• IHS Markit's U.S. manufacturing index for November is expected to hold at 59.1, unchanged from a preliminary reading. (9:45 a.m. ET)

• Institute for Supply Management's manufacturing index is expected to rise to 61.1 in November from 60.8 one month earlier. (10 a.m. ET)

• U.S. construction spending for October is expected to increase 0.3% from the prior month. (10 a.m. ET)

• Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen testify at a House Financial Services Committee hearing at 10 a.m. ET.

• Federal Reserve releases its Beige book report on U.S. economic conditions at 2 p.m. ET.

Powell jolts equities in laying groundwork for potential quicker action on rates to fight inflation. Fed Chairman Jerome Powell told the Senate Banking Committee Tuesday it would be appropriate for the Fed to consider speeding up the reduction in its asset purchase program when the Federal Open Market Committee (FOMC) meetings Dec. 14-15. “The risk of higher inflation has increased,” Powell told lawmakers. “The economy is very strong and inflationary pressures are high, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases…perhaps a few months sooner.” Powell also said that describing inflationary pressures as “transitory” was no longer accurate. “It’s probably a good time to retire that word and explain more clearly what we mean.” And those earlier assessments of inflation were the result of the Fed expecting that pandemic-related inflationary pressures would come to an end as the pandemic declined.

While still expecting inflation to decline next year, Powell said what the Fed “missed about inflation was we didn’t predict the supply-side problems, and those are highly unusual and very difficult, very nonlinear. And it’s really hard to predict those things.”

The reduction in asset purchases is currently set to be at $15 billion per month. But if that were to be increased to $30 billion per month, it would mean the tapering would wind down in March versus mid-2022, a move that could give the Fed more policy room to act on inflation.

The Fed today will issue the Beige Book report, the anecdotal recap of the US economy that is released two weeks prior to the next FOMC meeting. Given Powell’s comments, we expect the report to continue to highlight inflation pressures in the US economy. And the possible quickening of the tapering pace could also mean that the Fed could increase rates much earlier than anticipated, especially if inflationary pressures persist.

Market impacts: Stocks tanked yesterday after Powell’s comments but are bouncing back today as sentiment shifts between competing interpretations of how things will play out. After Powell’s remarks, financial markets estimated a 50-50 chance the Fed will raise U.S. interest rates as early as May of 2022. Powell and Treasury Secretary Janet Yellen speak in front of the U.S. House of Representatives today.

Inflation predictions rise. The Paris-based OECD think tank forecast rising global inflation in 2022, including predicting U.S. annual inflation at 4.4% and Eurozone inflation at 2.7%. Both of those numbers are above the OECD’s September forecasts. OECD says inflation is the main risk to the global economic outlook. It expects global GDP of 5.6% this year (down 0.1 point from its previous forecast) and 4.5% next year (unchanged). Its first forecast for 2023 calls for 3.2% global economic growth.

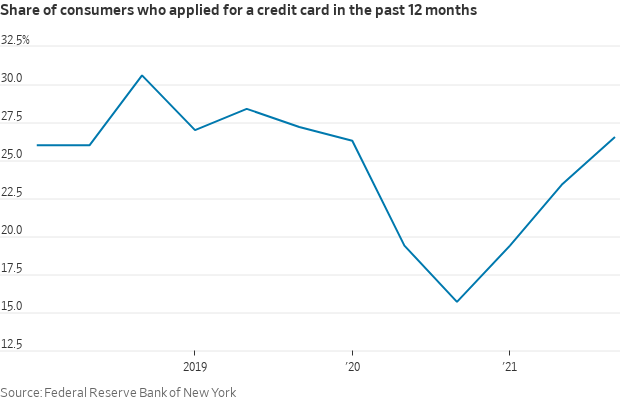

U.S. credit-card applications hit a pandemic high. Close to 27% of U.S. consumers said in October that they had applied for a credit card in the past 12 months, according to the Federal Reserve Bank of New York, well above the record low of 16% recorded a year ago. The rebound suggests consumers could continue to drive the U.S. economic recovery.

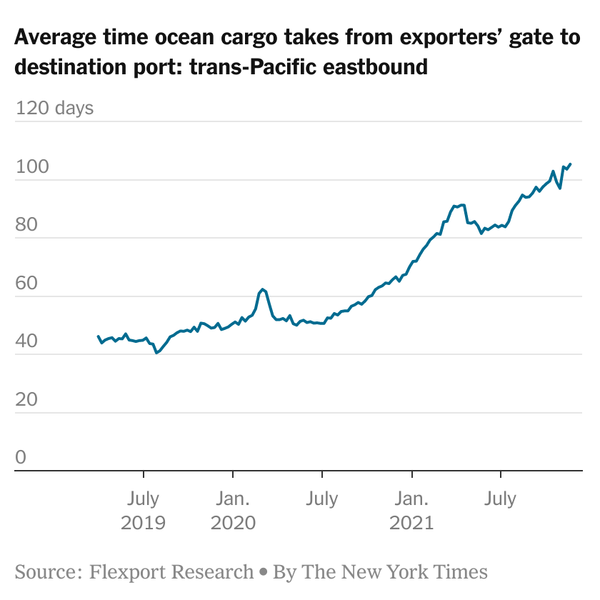

New data suggests that the Delta variant made supply problems worse, not better. Shipping times, which had been falling since March, shot up in early July, as Delta was causing a surge in cases, according to a shipping index that the logistics company Flexport Research is releasing. As of last week, it took an average of 105 days to ship goods to the U.S. from China, up from 84 in early July and 50 prepandemic. “Every time you interrupt the flow,” said Phil Levy, Flexport’s chief economist, “you add to the backup.”

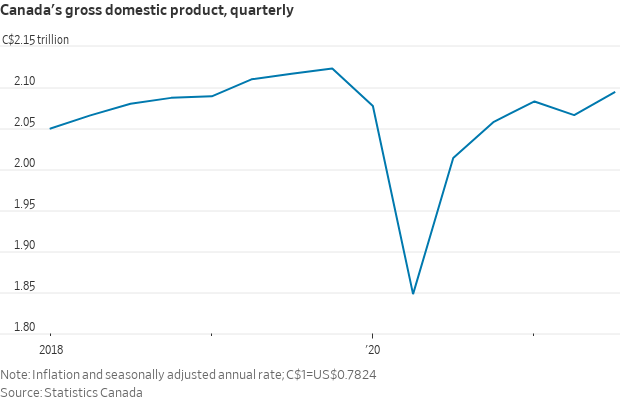

Canada's economy rebounded in the third quarter after a surprise setback in the previous three-month period, with household spending doing much of the heavy lifting. Canada's gross domestic product increased at a 5.4% annualized rate in the third quarter, Statistics Canada said.

Australia’s economy shrank in the July-September quarter as efforts to combat the Delta variant of the Covid-19 virus forced more than half the country into strict and lengthy lockdowns. The economy contracted by 1.9% in the third quarter from the previous quarter, the Australian Bureau of Statistics said Wednesday. Still, with lockdowns now easing, the focus of attention has already shifted to a fourth-quarter recovery.

Tel Aviv has been ranked the world’s most expensive city to live in, jumping five places in the 2020 rankings to secure the top spot in this year’s Worldwide Cost of Living Index, compiled by the Economist Intelligence Unit. The Israeli city led the list, which compares prices in U.S. dollars across 173 cities, in part due to the strength of the shekel against the dollar as well as increases in food and transport costs. Paris, last year’s joint leader along with Zurich and Hong Kong, came second. Syria’s capital, Damascus, was the cheapest on the list.

Market perspectives:

• Outside markets: The U.S. dollar index was higher ahead of US economic updates, with the euro slightly weaker against the greenback. The yield on the 10-year U.S. Treasury note was higher, trading around 1.47%, with a positive tone in global government bond yields. Gold and silver futures were both higher ahead of US trading, with gold trading around $1,785 per troy ounce and silver around $22.90 per troy ounce.

• Crude oil prices were rising ahead of the U.S. market day, with US crude around $68.25 per barrel and Brent around $71.50 per barrel. Crude prices were up around 4% in Asian action.

• USDA daily export sale: 150,000 MT of corn to Colombia during MY 2021-2022.

Ag trade: Tunisia issued an international tender to buy up to 175,000 MT of soft wheat and up to 92,000 MT of durum.

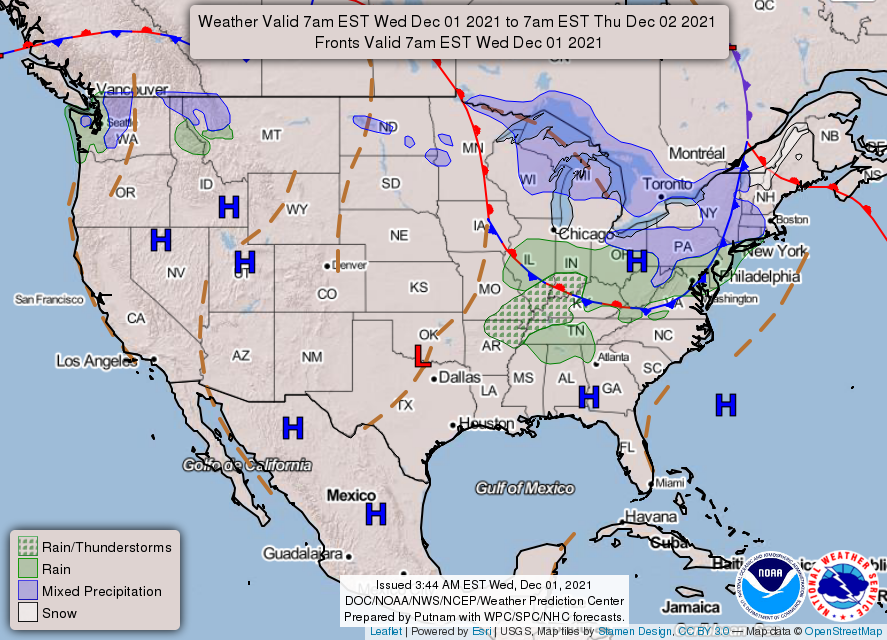

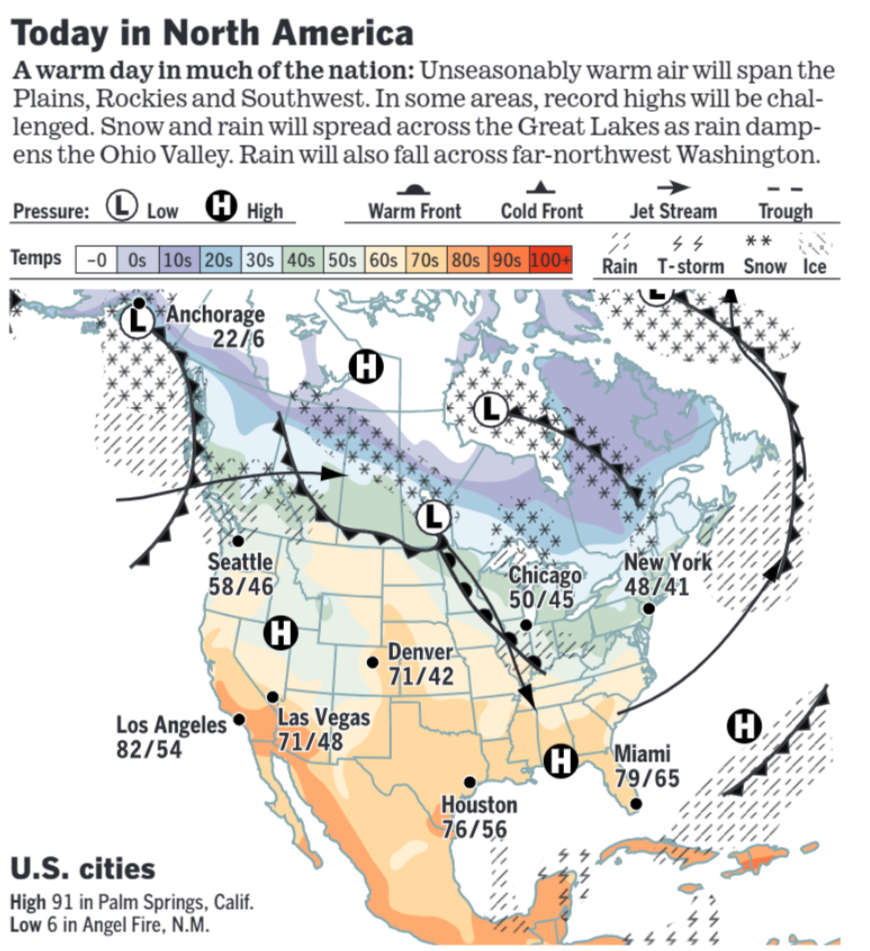

• NWS weather: Widespread record breaking temperatures likely from Northwest into Great Plains through Thursday; Elevated Fire Weather Risk for Southern California... ...Atmospheric river winds down over the Pacific Northwest today; river flooding and isolated landslide risks remain... ...Light rain and snow showers over portions of the Great Lakes and Northeast through midweek.

Items in Pro Farmer's First Thing Today include:

• Grain, soy markets rebound overnight

• Big jumps expected in soy crush, corn-for-ethanol figures

• Ukraine’s 2021-22 grain exports top 25 MMT

• Lower sugar supplies as India boosts ethanol production

• China’s smaller factory activity contracts a little in November

• Early cash cattle trade at steady prices

• Price drop sparks heavy pork movement

POLICY FOCUS

— USDA reports slight reduction in CFAP 2 payouts. Payments approved under the Coronavirus Food Assistance Program 2 (CFAP 2) are reported at $19.03 billion as of Nov. 28, down slightly from $19.06 billion in the prior weekly update. There were slight reductions in both original CFAP 2 payments and the top-up payments. Original CFAP 2 payments are at $14.22 billion ($14.24 billion previously) while top-up payments are at $4.81 billion (4.82 billion previously). There were also slight reductions reported in CFAP 1 payments, with total payments standing at $11.77 billion ($11.78 billion previously), reflecting original CFAP 1 payouts now at $10.58 billion ($10.59 billion) and while top-up payments remained at $11.19 billion. There was no explanation given for the reductions in payments, but one possibility could be the issuance of the remaining 10% of 2019 and 2020 Wildfire and Hurricanes Indemnity Program Plus (WHIP+) payments that were issued by USDA around Nov. 8.

— Update on must-have policy issues:

- Fiscal Year 2022 spending: Democrats on Tuesday offered a continuing resolution (CR) until Jan. 28, which would give both parties almost two months to put together an omnibus package covering all 12 annual spending bills. But Republicans want the CR to run until at least mid-February. A deal is expected today. House Majority Leader Steny Hoyer (D-Md.) has included the CR on the list of possible votes for today.

- NDAA: The annual defense policy bill could get wrapped up by the Senate as soon as today. There would still have to be a conference with the House. Senate leaders are pushing a proposed unanimous consent agreement calling for votes on 21 amendments, which would then be followed by a vote on final passage.

- Debt limit: Discussions between the two political party leaders are focusing on a long-term lift of the debt ceiling. Both Democrats and Republicans want to lift the limit beyond the 2022 elections. But GOP Senate leader Mitch McConnell (R-Ky.) is under a lot of pressure to force Democrats to commit to raising the debt limit by a dollar amount instead of allowing a suspension of the borrowing limit to a date certain.

- Build Back Better (BBB) Act: Focus remains on centrist Sen. Joe Manchin (D-W.Va.) and his daily comments. Another topic is the fate of the State and Local Tax (SALT) tax deduction language. Majority Leader Chuck Schumer (D-N.Y.) keeps saying he wants BBB done before Christmas. Schumer has told his Democratic colleagues that he’d like to begin floor debate on the package in two weeks, with a December deadline for completion, but Manchin hasn’t committed to any timeline. Meanwhile, GOP senators will hold a press conference at noon today.

— Reforms to the milk pricing formula in federal marketing orders is the thrust behind a proposal being introduced by Sen. Kirsten Gillibrand (D-N.Y.) It would require USDA to hold hearings on reforms. Gillibrand scheduled a news conference on the issue today, has support from Vermont Democratic Sen. Pat Leahy and Maine Republican Susan Collins. But contacts note there is no consensus within the industry on this topic and leadership will be reluctant to move a measure in this Congress without widespread support. Also, a hefty amount of pandemic aid to dairy producers and a recent uptick in prices have tempered any push for policy changes.

BIDEN ADMINISTRATION PERSONNEL

— Biden to tap Cordray. Richard Cordray, the first director of the Consumer Financial Protection Bureau, is expected to be President Biden’s pick as the Fed’s top banking regulator. Republicans suggested that they’re likely to oppose his nomination, the Wall Street Journal reports.

CHINA UPDATE

— China’s smaller factory activity contracts a little in November. China’s Caixin/Markit purchasing managers index (PMI), which gauges mostly smaller privately owned factories, fell to 49.9 in November, down from 50.6 the previous month and just below the 50-mark that separates growth from contraction. New orders fell slightly following two months of expansion, while both export sales and employment shrank for the fourth month in a row and buying levels declined further. Meanwhile, supplier performance deteriorated again due to low stock levels at vendors and logistical delays. Factory activity is expected to pick up in the months ahead amid hopes of a recovery in supply chains.

TRADE POLICY

— USTR publishes notice on monitoring Turkey DST situation. The Office of the US Trade Representative (USTR) announced Nov, 22 that the U.S. and Turkey reached a deal on Turkey’s transitional approach to its Digital Services Tax (DST). USTR today published a notice in the Federal Register (link) formally setting in place its monitoring effort on the matter and formalizing the termination of the Section 301 investigation into Turkey’s DST. The termination of the Section 301 investigation was effective Nov. 28. “In coordination with Treasury, USTR will monitor implementation of the removal of Turkey's DST” as called for in the first pillar of the Organization for Economic Cooperation and Development (OECD)/G20 agreement on DSTs where the U.S. and 134 other countries agreed to remove existing DSTs and other relevant similar measures.

— Canada continues push on potential EV tax credit; several trade issues on agenda as Canada delegation to be in U.S. U. Trade Representative (USTR) Katherine Tai met virtually Tuesday (Nov. 30) with Canadian Minister of International Trade Mary Ng, with Ng continuing to express opposition to the provision in the Build Back Better (BBB) package that would provide an additional tax credit for the purchase of electric vehicles (EVs) made by U.S. unionized workers, one of the “discriminatory, protectionist elements” of the package. Ng also expressed “disappointment” on a recent increase in duties on imports of lumber from Canada. According to a statement from Tai’s office, she pointed to the Biden administration’s “commitment to tackling the threat of climate change by supporting the transition to electric vehicle manufacturing and stressed the importance of engaging a range of stakeholders, including our close trading partners, as Congress considers legislation to strengthen U.S. leadership in the sector.”

Meanwhile, Ng and a group of Canadian lawmakers are expected to arrive in Washington today for meetings with congressional leaders and stakeholders, according to Ng’s office. Their effort is to “advocate for Canadian workers and industry in light of harmful Buy America and EV provisions.” But that is not the only focus of the sessions, with Ng’s office indicating they will also raise the softwood lumber tariffs and “trade challenges facing potato exports.” The latter is in reference to Canada voluntarily halting its exports of potatoes from Prince Edward Island due to the presence of potato wart even though Canada insists the blanket halt to trade was not necessary.

Expectations are those on the U.S. side will probably relate their disappointment on Canada’s implementation of dairy provisions of the U.S.-Mexico-Canada Agreement (USMCA) in their sessions with the Canadian officials.

ENERGY & CLIMATE CHANGE

— DOE seeks feedback on sites to store spent nuclear fuel. The Department of Energy (DOE) issued a request for information (RFI) in the Federal Register today (Dec. 1) seeking feedback on a “consent-based siting process” to find communities willing to host a temporary storage facility for the nation’s spent nuclear fuel (link). The department emphasized that nuclear energy is a key to the Biden administration’s zero carbon emissions efforts. The interim spent fuel storage siting effort was called for and funded under the Fiscal Year (FY) 2021 omnibus spending bill. The department said the effort will “inform development of a consent-based siting process, overall strategy for an integrated waste management system, and possibly a funding opportunity.” DOE is using the term “interim” in the notice as a facility that “would need to operate until the fuel can be moved to final disposal,” and the duration would depend on several steps including “the need to identify, license, and construct a facility, plus the time needed to move the spent nuclear fuel.” DOE noted that any final decisions on such facilities will be subject to congressional appropriations. Responses are due by March 4, 2022.

— Statutory deadline on RFS levels comes without EPA action. EPA is required by law to finalize the annual Renewable Volume Obligations (RVOs) under the Renewable Fuel Standard (RFS) by Nov. 30 for the biofuel levels the following year. That date arrived and passed without even the proposed RFS levels for 2022 being announced or even the 2021 levels.

The proposed levels for 2021 and 2022 are still showing as being under review at the Office of Management and Budget (OMB) where they have been since Aug. 26.

Biofuel proponent Sen. Chuck Grassley (R-Iowa) Tuesday made mention of the RFS deadline in a tweet, noting, “Someone should let EPA know 2day is statutory deadline for 2022 renewable fuel levels & this EPA has yet to even put out 2021 levels Pres Biden your EPA is breaking the law + turning their back on farmers & rural America by not supporting biofuels.”

It is not yet clear when EPA will release the RFS plan, with EPA Administrator Michael Regan indicating in November they would be out “sooner rather than later.” But EPA is also working on its plans relative to determining RFS levels for 2023 and beyond, releasing a timeline earlier this year that it would come forth with a proposal outlining that plan by the end of this year. However, that has not yet been forwarded to OMB for review at this point.

— IEA released its latest Renewables Market Report, which forecasts the planet's renewable electricity capacity will jump to more than 4,800 GW by the year 2026, an increase of over 60% compared to levels in 2020. Capacity here represents the maximum amount of energy that installations can produce, not what they will necessarily generate. Renewables are even expected to account for almost 95% of the increase in global power capacity through 2026 despite the pandemic and surging inflation seen across the globe. "We have revised up our forecast from a year earlier as stronger policy support and ambitious climate targets announced for COP26 outweigh the current record commodity prices that have increased the costs of building new wind and solar PV installations,” the report noted.

Nearly 290 GW of new renewable energy generation capacity has been installed around the world, and based on current trends, renewable energy generating capacity will exceed that of fossil fuels and nuclear energy combined by 2026. Of note, the world's biggest polluter has installed the most new renewable energy capacity this year. China is even expected to reach 1,200 GW of wind and solar capacity in 2026, four years earlier than its target of 2030, and ahead of the U.S., Europe and India.

Outlook: "The high commodity and energy prices we are seeing today pose new challenges for the renewable industry, but elevated fossil fuel prices also make renewables even more competitive," said IEA executive director Fatih Birol. Other headwinds include a "range of policy uncertainties and implementation challenges" like financing grid integration and social acceptance. Despite the predictions of rapid growth, the capacity additions would not be enough to meet the IEA's scenario for net-zero emissions by 2050, and would need to be "80% faster than in our accelerated case."

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 262,091,023 with 5,218,935 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 48,557,723 with 780,223 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 460,773,508 doses administered, 197,058,988 have been fully vaccinated, or 60.03% of the U.S. population.

— Biden administration is weighing stricter Covid-19 testing requirements for travelers entering the U.S., including U.S. citizens, to slow the spread of the emerging Omicron variant. The Centers for Disease Control and Prevention said rules under consideration would require all travelers, regardless of their vaccination status, to present a negative Covid-19 test within 24 hours of boarding a plane to the U.S.

POLITICS & ELECTIONS

— CNN is suspending anchor Chris Cuomo indefinitely over his efforts to help his brother, former New York Gov. Andrew Cuomo, respond to sexual-misconduct allegations. The move comes as CNN executives met with their future boss, David Zaslav of Discovery.

OTHER ITEMS OF NOTE

— NATO-Russia tensions. NATO Secretary-General Jens Stoltenberg warned Russia on Tuesday that it would pay a “high price” and U.S. Secretary of State Antony Blinken spoke of “serious consequences” if Russia used force against Ukraine. NATO foreign ministers finish up a two-day summit in Riga today, with tensions in Eastern Europe high on the agenda. Russian President Vladimir Putin on Tuesday said that any attempts by NATO to place advanced missile systems in Ukraine would not be taken lightly. “If some kind of strike systems appear on the territory of Ukraine, the flight time to Moscow will be 7-10 minutes, and five minutes in the case of a hypersonic weapon being deployed. Just imagine,” Putin said. “What are we to do in such a scenario? We will have to then create something similar in relation to those who threaten us in that way. And we can do that now,” he said.