No Senate Vote on BBB This Year, Potentially Major Setback for Biden’s Top Legislative Priority

Grassley wants DOJ probe of fertilizer industry

In Today’s Digital Newspaper

Editor’s note: The joys of airline travel. Talk about a late flight… My trip back from a great time speaking at the MKC event in Newton, Kansas, took a long time. A Delta flight from Atlanta to Washington Dulles was initially delayed after we were all boarded, but then the pilot announced we would have to get off the plane and go down a few gates to another plane, which didn’t arrive in Washington until… 2:20 a.m. A short night. But the good part: MKC personnel are such good hosts and always have a good meeting. The crowd of wheat and cattle producers were in a good mood following good crops and prices thus far. The major issue in Kansas was like other locations visited recently: fertilizer prices… supply and price. Meanwhile, one farmer asked me why lawmakers from the two major political parties can’t just sit down and work things out. Logic has not left Kansas, but it has Congress. The winds in Kansas were harsh as in other locations across the country. I could barely get the front door opened on a Ford F-150 while the winds were howling. (The dust storm across western Kansas had roots being pulled up; reports out of Colorado has wheat blown out.) But the temperature in Wichita when I arrived was 69 degrees. I had to go to Kansas to get warm in mid-December! This was the 11th year I have spoken at the MKC event, and each year Christmas starts for me when I descend the Wichita airport to find school carolers singing Christmas songs by a beautiful tree. It gives one hope that the ways of Kansas will eventually return to our nation’s capital.

Market Focus:

• USDA daily export sales for marketing year 2021-22:

— 132,000 MT soybeans to China and 33,000 MT soybean oil to India

• Bank of Japan to trim extra stimulus but keeps rates steady

• Eurozone inflation record high in November

• Rising Covid-19 infection rates, inflation and labor shortages slow U.S., Europe

• U.S. Fed officials start delivering remarks

• Grassley wants DOJ probe of fertilizer industry

• Vilsack, DOT’s Buttigieg urge ocean carriers to prioritize agricultural shipments

• Gold prices surge to a nearly three-week high

• Coal-fired electric generation expected to reach all-time high in 2021

• Ag demand update

• Mild followthrough buying in soybeans, winter wheat overnight

• Ukraine grain exports remain strong

• EPA: generation of RINs rose in November

• Still some cash cattle to clean up

• Traders build hog premiums to the cash index

Policy Focus:

• Build Back Later… ‘President’ Manchin punts Biden’s top legislative issue into 2022

• BIF infrastructure law’s $15 billion in federal lead pipe replacement funding delayed

Afghanistan:

• House lawmakers urge Biden admin. to help avert economic collapse in Afghanistan

• More than 60,000 Interpreters, visa applicants remain in Afghanistan

Personnel:

• Senate plans to vote on the nomination for assistant administrator of USAID

• Senate confirms Nicholas Burns as U.S. ambassador to China

China Update:

• Senate clears bill re: China’s Xinjiang region and forced labor

Trade Policy:

• House Dems urge Biden administration to re-engage with Cuba

• USTR adjusts sugar trade for several countries

• NPC backs USDA in stance on imports of spuds from Prince Edward Island

• Britain signed a free-trade deal with Australia

Energy & Climate Change:

• EPA extends comment period on emissions guidelines for oil and gas

• DOE announces $100 million in funding for clean energy technologies

Coronavirus Update:

• Biden warns of 'winter of severe illness and death' for the unvaccinated

• CDC changes recommendations for Covid-19 vaccines

• France to ban most travel from the U.K. starting Saturday

Politics & Elections:

• Rep. Lowenthal joins 19 other Democrats not running again in 2022

• WSJ interviews VP Harris

Other Items of Note:

• Biden walking away from talks to compensate families separated at U.S./Mexico border

• Mexico comments on proposed U.S. tax credits re: electric vehicles

• Cyber vulnerabilities overwhelming security professionals in government and industry

• USDA releases Vilsack end-of-year video

MARKET FOCUS

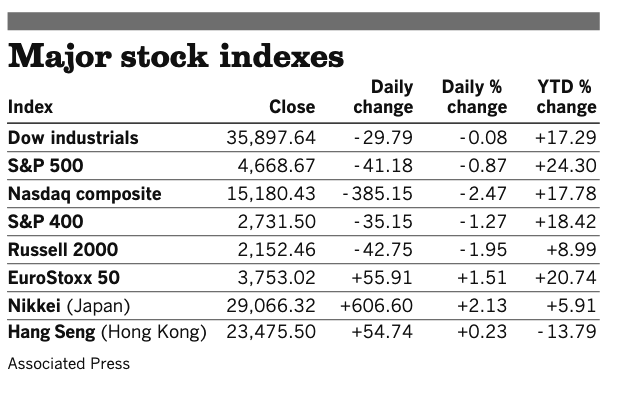

Equities today: Global stock markets were mostly lower in overnight trading. The U.S. Dow opened 30 points lower but then plunged more than 500 points lower. Today is the quarterly triple-witching phenomenon — the simultaneous expiration of stock options, index options and index futures. These days can cause higher volatility. Asian equities fell as losses in tech shares led declines. Japan’s Nikkei was off 520.64 points, 1.79% at 28,545.68. Hong Kong’s Hang Seng Index shed 282.87 points, 1.20%, at 23,192.63. European equities are mostly lower in early action, with the Stoxx 600 down 0.9% with most regional markets seeing losses of 0.8% to 1.4%. However, the FTSE was slightly higher.

U.S. equities yesterday: The Dow ended down 29.79 points, 0.08%, at 35,897.64 after falling into negative territory late in the session. The Nasdaq dropped 385.15 points, 2.47%, at 15,180.43. The S&P 500 declined 41.18 points, 0.87%, at 4,668.67.

On tap today:

• President Biden delivers a commencement address at South Carolina State University at 10 a.m. ET, in a state that was key to his winning the Democratic presidential nomination.

• Federal Reserve governor Christopher Waller speaks to the Forecasters Club of New York at 1 p.m. ET.

• Baker Hughes rig count is out at 1 p.m. ET.

• San Francisco Fed President Mary Daly participates in a virtual WSJ Q&A session on the 2022 economic outlook at 1 pm ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

Bank of Japan to trim extra stimulus but keeps rates steady. This week has seen several central banks indicate they are adjusting their policy plans in a bid to address rising inflation. The Bank of Japan announced today (Dec. 17) it would reduce its purchases of corporate bonds to pre-pandemic levels but kept its monetary policy largely unchanged. “Japan’s economy has picked, although it has remained in a severe situation due to the impact of Covid-19 at home and abroad,” the BOJ statement said. The bank also noted that risks from the pandemic and supply chain issues remain. The BOJ said it would continue guiding the yield on 10-year Japanese government bonds to around zero, well below the U.S. where equivalent government bonds are yielding more than 1.4%.

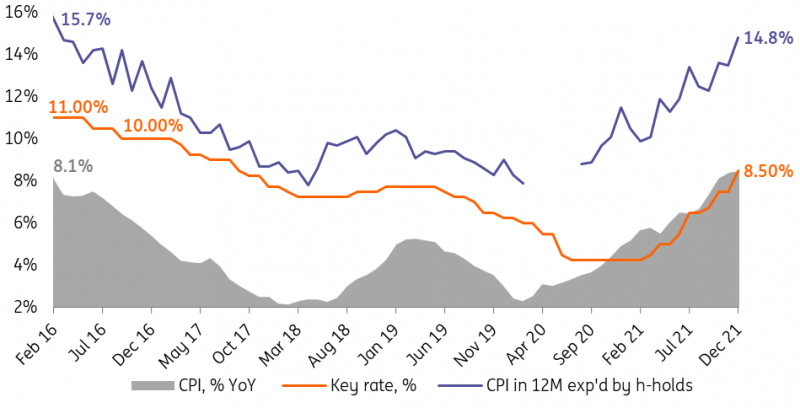

Central banks around the globe are starting to remove accommodation — tightening monetary policy. The Bank of England raised rates along with the Mexican central bank this week. Also, Russia's central bank raised its key interest rate by 100 basis points to 8.5%, the seventh rate hike this year, in an attempt to tame surging inflation. Russia’s interest rates are now the highest since 2017. Its inflation surged to 8.1% over year-ago as of Dec. 13.

U.S. Fed officials start delivering remarks. The end of the blackout period following the Federal Open Market Committee (FOMC) meeting arrives today and that will bring public remarks from U.S. Fed officials. Fed Governor Christopher Waller speaks to the Forecasters Club of New York while San Francisco Fed President Mary Daly participates in a virtual Wall Street Journal question and answer session on the 2022 economic outlook. Key will be their remarks on inflation and when they expect the increases in the target range for the Fed funds rate to take place. Fed Chairman Jerome Powell indicated that increases could be in the cards once the tapering of bond purchases ends in March. Markets will pay close attention to whether officials indicate a quicker timeline to rate increases.

Analyst commentary: "The bigger challenge for the Fed and for the markets is that they may not have the scope to raise rates as much as they say they do without inverting the yield curve and slowing down the economy more than they want," said Kathy Jones, chief fixed income strategist at Charles Schwab. "What the market's telling you is the Fed doesn’t have much scope to go beyond two or three hikes."

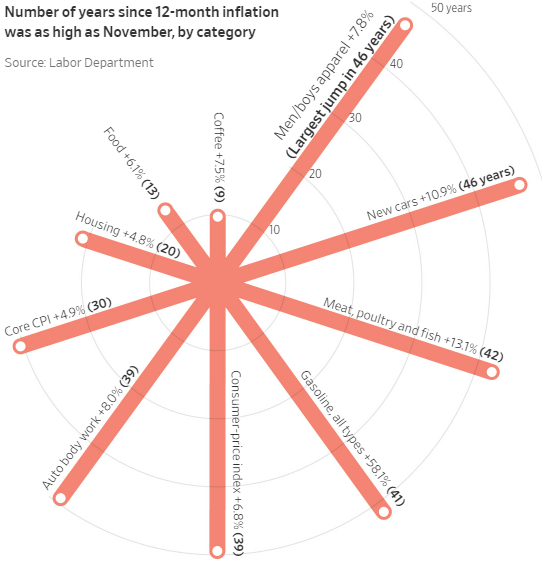

Eurozone inflation record high in November. Eurozone inflation surged 4.9% in November, the highest rate on record, Eurostat confirmed today, with more than half of the increase due to a spike in energy prices. Month-on-month, inflation was revised down to 0.4% from a previously reported 0.5%. Without volatile energy and food prices, the so-called core inflation rose 0.1% from October and 2.6% for the year. On Thursday, the European Central Bank agreed to end an emergency stimulus scheme next March but topped up another bond buying program and said it will take its time in raising interest rates to combat inflation, feeling prices will ease in 2022.

U.S. inflation climbed to a 39-year high in November, but prices didn’t change at the same rate for all goods and services. Gasoline and other energy sources, along with cars, have been the primary drivers of this year’s inflation burst. Here’s how the Wall Street Journal says the latest bout of inflation looks like:

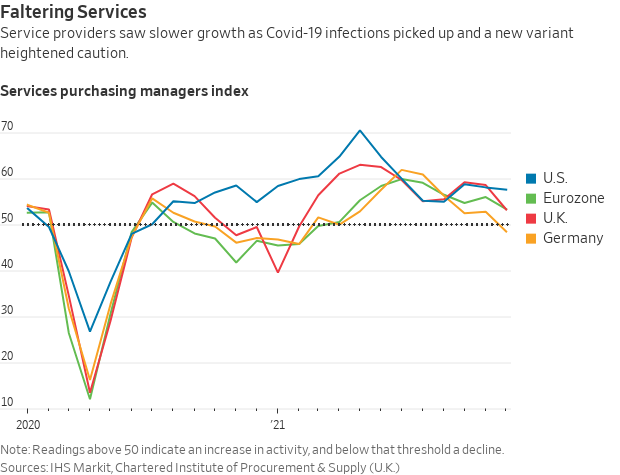

Rising Covid-19 infection rates, inflationary pressures and labor shortages slowed the economic recovery in the U.S. and Europe this month. Surveys of purchasing managers released Thursday by data firm IHS Markit showed that in the early weeks of December, U.S. business activity continued to expand but at the slowest pace in three months despite strong demand from customers. In the eurozone, activity fell to its lowest level since March. Activity in Germany’s service sector declined for the first time in eight months, while the economy stalled. Even before the existence of the Omicron variant was confirmed in late November, Covid-19 infection rates in Germany and other parts of Europe were on the rise, prompting a fresh wave of government restrictions and consumer hesitancy.

There were signs of optimism in the manufacturing sector on both sides of the Atlantic, however, as supply problems showed early signs of improvement.

Grassley wants DOJ probe of fertilizer industry. Sen. Chuck Grassley (R-Iowa) asked the Justice Department (DOJ) to look into why fertilizer prices have increased so much this year. He wrote a letter to Attorney General Merrick Garland asking him to “examine the current structure of the domestic fertilizer industry and investigate potential market and price manipulation, collusion, restrictions on competition and/or other unfair and deceptive practices under U.S. antitrust law.” There has been “dramatic growth in the price of fertilizer” this year and Grassley detailed: Anhydrous ammonia prices are up by 131%, urea by 110%, and potash by 120%. Grassley cited the lack of companies in the marketplace. For potash, “only two companies control the supply for farmers,” he said. In the nitrogen arena, four companies control three-quarters of the market. What he did not say was regulations and other factors drove several U.S. companies out of the business in the 1980s.

— USDA’s Vilsack, DOT’s Buttigieg urge ocean carriers to prioritize agricultural shipments. USDA Secretary Tom Vilsack and Department of Transportation Secretary Pete Buttigieg have sent a letter to ocean cariers, urging them to minimize disruptions for agricultural exports, according to Politico. The two have been pushing on agricultural exports with Buttigieg to be at the Port of Savannah today where he will focus on issues at ports.

Buttigieg told Agri-Talk (link) that other efforts on the supply chain side have begun to show progress. “We have seen very encouraging signs of things like the rate at which containers are sitting around those ports for a long time,” he noted. “That's been cut in half at some of the key ports on the west coast. And that's very encouraging.”

Market perspectives:

• Outside markets: The U.S. dollar index is slightly weaker even as most foreign rival currencies are also weaker against the greenback. The yield on the 10-year U.S. Treasury note has weakened to trade under 1.39% with a mostly weaker tone in global government bond yields. Gold and silver futures continue to see inflation-risk-related buying, with gold above $1,810 per troy ounce and silver above $22.65 per troy ounce.

• Gold prices surged to a nearly three-week high today, above $1,800.00, on safe-haven demand and as traders seek out the metals as an inflation hedge.

• Crude oil futures are under pressure ahead of U.S. trading, with U.S. crude around $70.90 per barrel and Brent around $73.55 per barrel. Futures were lower in Asian trading, with U.S. crude down 77 cents at $71.61 per barrel and Brent down 78 cents at $74.24 per barrel.

• Coal-fired electric generation is expected to reach an all-time high in 2021, threatening global-warming efforts, the International Energy Agency said.

• Ag demand: Taiwan tendered to buy 110,000 MT of U.S. milling wheat.

• USDA daily export sales for marketing year 2021-22:

— 132,000 MT soybeans to China and 33,000 MT soybean oil to India

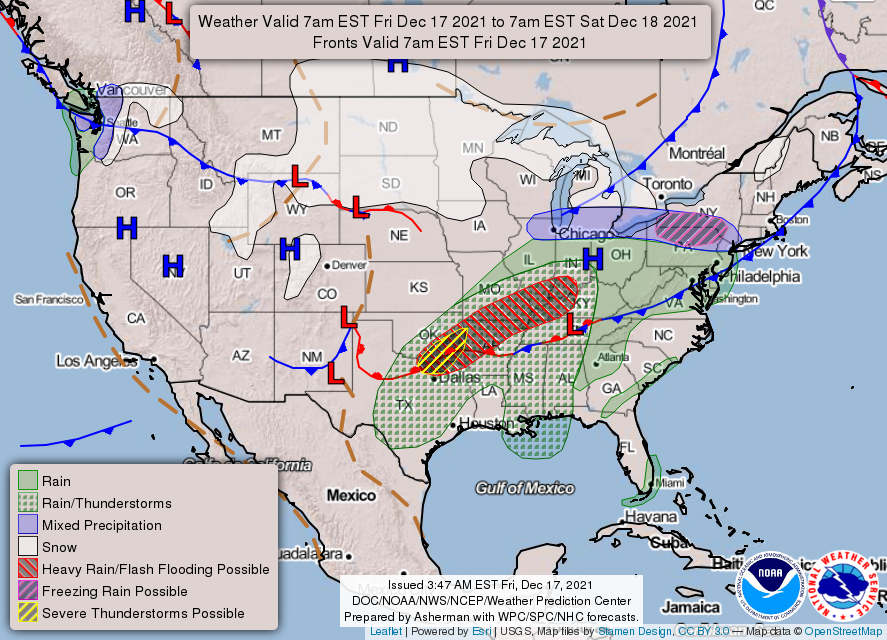

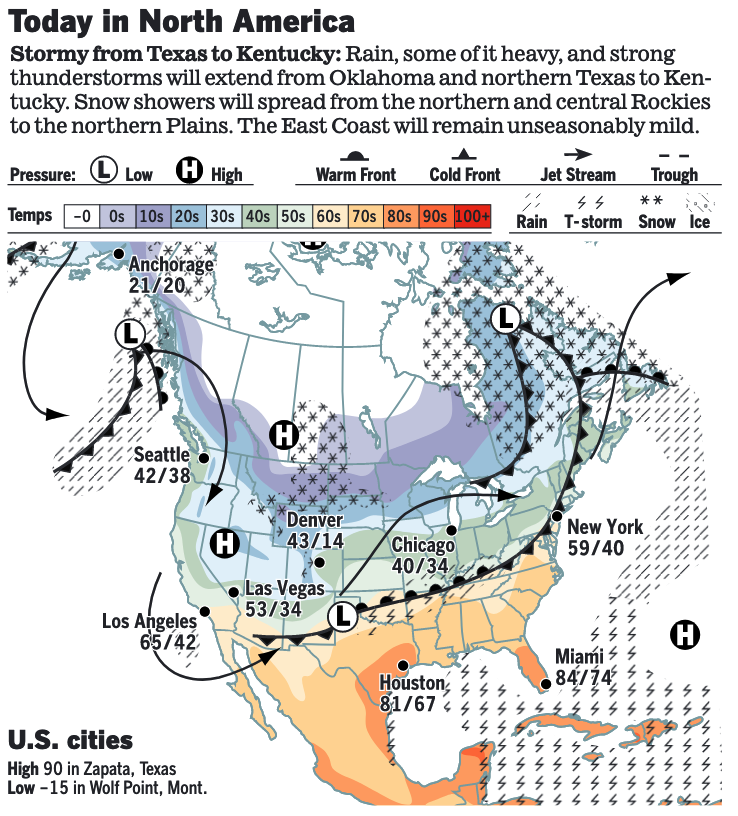

• NWS weather: Heavy rain and potentially severe thunderstorms near a meandering front expected from the southern Plains to the Mid-Mississippi Valley through Saturday morning... ...Moderate to heavy snow across northern New England later this weekend with freezing rain over central New England... ...Showers and thunderstorms will gradually move across the Deep South and into the East Coast during the weekend ahead of a cold front.

Items in Pro Farmer's First Thing Today include:

• Mild followthrough buying in soybeans, winter wheat overnight

• Ukraine grain exports remain strong

• EPA: generation of RINs rose in November

• Still some cash cattle to clean up

• Traders build hog premiums to the cash index

POLICY FOCUS

— Senate vote on BBB punted to 2022. Weeks of negotiation between President Joe Biden and Sen. Joe Manchin (D-W.Va.) failed to bring the moderate Democrat over to the “yes” side on the Build Back Better (BBB) package and now a decision by the Senate parliamentarian all but assures that the social and climate policy package will not see a vote in the Senate this year. “It takes time to finalize these agreements, prepare the legislative changes, and finish all the parliamentary and procedural steps needed to enable a Senate vote,” Biden said in a statement, noting their efforts with Manchin will continue next week. “We will advance this work together over the days and weeks ahead.” Senate Majority Leader Chuck Schumer (D-N.Y.) had set Christmas as his deadline to advance the bill through the Senate. In the House, Speaker Nancy Pelosi (D-Calif.) canceled planned votes on the bill more than once before it was approved.

From Capitol Hill, Senate Majority Whip Dick Durbin (D-Ill.) lamented he was “truly disappointed. We had more than ample opportunity to reach ... a Democratic agreement. We missed that opportunity, but I'm not giving up."

The other blow to getting BBB through this year came from Senate parliamentarian Elizabeth MacDonough who determined the immigration plan in BBB did not pass muster under the Byrd Rule. The third version of immigration plans would have put “parole in place” authorities to allow some immigrants to apply for five-year work permits and get relief from deportation. MacDonough indicated the policy changes in the plan would outweigh their budgetary impact. CQ Roll Call said the guidance from MacDonough was the “proposed parole policy is not much different in its effect than the previous proposals we have considered.”

Child tax credit will expire. Missing the year-end deadline would likely mean that a child tax credit that has been sending checks to many parents will expire for at least a month.

Bottom line: The Senate will exit Washington until next year without getting the BBB through to a finish line, unable to clear Biden’s top priority. The longer they wait, the harder it will be for Senate Democrats to act on BBB. Democrats expect Majority Leader Chuck Schumer (D-N.Y.) to try again in January. But structuring the bill to meet Manchin’s latest conditions — keeping the total cost to $1.75 trillion and extending Biden’s signature expanded child tax credit for a decade if at all — would leave only a few hundred billion dollars to be squeezed out for the rest of Biden’s agenda.

— Many states say they haven’t yet made specific plans to distribute any of the new BIF infrastructure law’s $15 billion in federal lead pipe replacement funding because there are too many unanswered questions about where and how to spend the money. The timeline for lead pipe replacement is not clear even as the White House yesterday unveiled a long-term plan to remove all the country’s nearly 10 million lead pipes over the next decade.

AFGHANISTAN

— House lawmakers are calling on the Biden administration to help avert a looming economic collapse in Afghanistan. Humanitarian organizations have warned that Afghanistan is on the brink of disaster as its economic and medical systems collapse and millions face starvation in the months since the Taliban takeover and U.S. withdrawal. Billions of dollars in the country’s central bank reserves, much of which is held in the US, have been frozen since August. The group of mostly Democratic House members wants the administration to release funds to an appropriate U.N. agency to help pay for things like teachers' salaries and meals for schoolchildren.

— More than 60,000 Interpreters, visa applicants remain in Afghanistan. More than 60,000 Afghan interpreters and others who have applied for visas to seek shelter in the U.S. after working alongside American forces still remain in Afghanistan, a State Department official said Thursday. About 33,000 Afghans, including principal applicants and their families, have already cleared the more-onerous vetting requirements and could be eligible for immediate evacuation. This is the first time that the State Department has provided a number on those left behind since the Afghanistan government collapsed this summer. A total of 62,000 Afghans are believed to have been left behind, the official said.

PERSONNEL

— Senate plans to vote on the nomination of Atul Atmaram Gawande to be an assistant administrator of USAID.

— Senate confirmed Nicholas Burns as U.S. ambassador to China, a front-line diplomatic post in Biden’s administration as the two countries ramp up economic and strategic competition globally.

CHINA UPDATE

— Senate clears bill requiring companies to prove that goods imported from China’s Xinjiang region were not produced with forced labor. Several companies, including Coca-Cola, Apple and Nike, have criticized the bill, fearing it would disrupt global supply chains. Earlier the Biden administration said it will impose sanctions against the Chinese army’s medical-research institutes for enabling the government’s surveillance of Uyghurs. After the Senate passage, the bill now heads to President Joe Biden’s desk to be signed into law. The Senate passage, by unanimous consent, comes as Washington cracks down on China for its treatment of the Uyghurs, which lawmakers have said amounts to genocide. The administration also took actions targeting Chinese companies and research institutes for their actions in Xinjiang.

TRADE POLICY

— More than 100 House Democrats called on the Biden administration to re-engage with Cuba and lift policies put in place by former President Donald Trump while normalizing relations on everything from travel to financial transactions. Democrats from Florida are not on board. And, at this time, neither is the White House. The Washington Post reported that when asked, the State Department continued to say that Cuba policy remains “under review.”

— USTR adjusts sugar trade for several countries. The Office of the U.S. Trade Representative (USTR) has published a notice in the Federal Register (link) which makes adjustments to amounts of sugar the countries can ship to the U.S. under preferential treatment in various free trade deals. The changes take effect Jan. 1 and cover Chile, Morocco, Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, Nicaragua, Peru, Colombia, and Panama.

— NPC backs USDA in stance on imports of spuds from Prince Edward Island. The National Potato Council (NPC) met with a Canadian delegation this week that was in Washington for meetings on the situation regarding potato wart being found in Prince Edward Island, prompting the Canadian Food Inspection Agency (CFIA) to halt shipments of PEI potatoes to the U.S. at the request of the USDA Animal and Plant Health Inspection Service (APHIS). Canada has been pushing the U.S. to relax its position, but the NPC backed the APHIS position and stated, “this is a plant health issue, not a trade dispute.” They noted APHIS has requested CFIA provide data on where potato wart is found in PEI production areas which would allow for quarantine zones and additional mitigation efforts to be established. “We further understand that all of these requirements need to be in place to enable trade to resume safely,” NPC CEO Kam Quarles said. “The ultimate solution in satisfying the plant health experts at APHIS involves aggressive testing, quarantining, enhanced mitigation, and monitoring efforts.”

— Britain signed a free-trade deal with Australia, which eliminates tariffs on British exports and is expected to generate £10.4 billion ($13.8 billion) of additional trade between the two countries. Dan Tehan, the Australian trade minister, described the deal as “a true free-trade agreement” in which “everyone wins.” However, some British farmers are concerned that they may now be undercut by cheaper imports.

ENERGY & CLIMATE CHANGE

— EPA extends comment period on emissions guidelines for oil and gas sector. EPA has extended the comment period on its proposed rule issued Nov/ 15 which would set new source performance standards (NSPS) and emissions guidelines for the crude and natural gas sector. EPA said they received several requests to extend the comment period from its original end date of Jan. 14 “given the complexity and length of the proposed rulemaking.” EPA has extended the comment period through January 31. Link to Federal Register notice extending the deadline.

— DOE announces $100 million in funding for clean energy technologies. The Department of Energy (DOE) will award $100 million in funding for the development of commercially viable clean energy technologies. The funding is being provided through DOE’s Advanced Research Projects Agency-Energy (ARPA-E) Seeding Critical Advances for Leading Energy technologies with Untapped Potential (SCALEUP) program. The effort provides further funding to previous ARPA-E awardees for technologies with the potential for commercial deployment. The program aims to promote “novel technologies that can significantly change how communities, industries and businesses reduce emissions, promote energy efficiency, and drive grid modernization,” DOE said. The first SCALEUP funding round in 2019 supported efforts to commercialize new grid technologies, methane detection systems, next generation batteries, and devices aimed at increasing energy efficiency.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 273,0464,222 with 5,339,662 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 50,513,437 with 803,652 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 490,030,849 doses administered, 201,159,327 have been fully vaccinated, or 61.89% of the U.S. population.

— President Biden warned that unvaccinated Americans face “a winter of severe illness and death” as he urged initial doses and booster shots amid a surge of coronavirus cases and the emergence of the omicron variant. Infections have surged 40% over the past two weeks across the country, and deaths have increased by more than a third during that same period, with more than 1,300 Americans dying of coronavirus daily.

— The CDC changed its recommendations for Covid-19 vaccines to clarify that shots made by Moderna and Pfizer/BioNTech are preferred over Johnson & Johnson's vaccine. A CDC advisory committee endorsed the recommendation after hearing new data indicating that a rare blood clotting syndrome is more common among people who recently received the J&J vaccine than previously thought. However, the severe side effect is still very rare.

— France said it would ban most travel from the U.K. starting Saturday, in response to soaring Omicron infections in Britain. France will also require all travelers to present a negative Covid-19 test taken within 24 hours, compared with 48 hours under the current rules.

POLITICS & ELECTIONS

— Rep. Lowenthal joins 19 other Democrats not running again in 2022. Rep. Alan Lowenthal (D-Calif.) announced Thursday he will not seek another term in the House. Lowenthal is a member of the House Transportation and Infrastructure Committee and represented the district in California that includes the Port of Long Beach. Lowenthal represents a safe Democratic district based in Long Beach, but its lines are expected to be redrawn as the California redistricting commission finalizes a new congressional map.

Aside from Lowenthal, 19 other House Democrats aren't running for re-election next year. Eight are running for other offices, including Reps. Tim Ryan (Ohio), Val Demings (Fla.), Conor Lamb (Pa.) and Peter Welch (Vt.) for the Senate. A total of 13 House Republicans, meanwhile, have also announced they won't seek reelection. Rep. Devin Nunes (R-Calif.), the top Republican on the House Intelligence Committee, is resigning at the end of this month to become the CEO of former President Trump's new media company.

— WSJ interviews VP Harris. Vice President Kamala Harris said in an interview with the Wall Street Journal that she and President Biden haven’t discussed whether he plans to run for re-election and that she doesn’t think about the topic as they near the end of their first year in office. Harris, the nation’s first female vice president, has been in the spotlight as a potential future leader of the Democratic Party, but she said that her focus has been on fighting the pandemic, rebuilding the economy and strengthening U.S. alliances. Link for more.

OTHER ITEMS OF NOTE

— Biden administration is walking away from negotiations to compensate families who were separated at the U.S./Mexico border under a Trump-era policy, immigrant rights advocates say. The American Civil Liberties Union, which represents families in the litigation over the Trump-era rules, announced the development yesterday and said that the group will return to court. The government will instead begin taking individual cases to trial, litigating lawsuits filed on behalf of hundreds of families seeking monetary damages for the psychological trauma they say the separations caused, according to the American Civil Liberties Union.

— Mexico comments on proposed U.S. tax credits re: electric vehicles. The WSJ reports (link) that Mexico’s economy minister said a U.S. proposal to give tax credits to Americans who buy U.S.-built electric vehicles as part of the Build Back Better spending bill threatens to hurt Mexico’s industry and spur illegal migration to the U.S. Tatiana Clouthier said the proposal risked creating market distortions and pulling jobs away from Mexico to the U.S. — and suggested it could jeopardize bilateral cooperation in controlling the flow of migration.

— Cyber vulnerabilities overwhelming security professionals in government and industry. Making sense of ongoing cyberattacks and the villains responsible is overwhelming professionals in government and business alike. The FBI has told victims that it may not respond to them because of how large the pool of potential victims is growing in the wake of vulnerabilities in the widely used software Apache Log4j. The Log4j chaos is a top priority for the government because of the long list of potential victims and the powerful adversaries leveraging the hack for future attacks. Industries including electric power, water, food, transportation and manufacturing are vulnerable, according to the cybersecurity firm Dragos. Cyber vulnerabilities overwhelming security professionals in government and industry. Link for more details.

— USDA releases Vilsack end-of-year video. USDA released a five-and-a-half-minute video (link) in which USDA Sec. Tom Vilsack discusses USDA's accomplishments during 2021. Vilsack acknowledged that Americans have continued to face pandemic-related challenges but said the situation has shown the resilience of American farmers and others in agriculture. “Throughout 2021, I traveled the country and spoke to farmers, ranchers, and folks living in our rural communities. I was able to hear about your concerns and your optimism about the future,” Vilsack said in the message. “We heard you and have deployed every resource available to help build a better future together. As we meet the opportunities and the challenges of the moment, know that the U.S. Department of Agriculture is here to support the viability and profitability of our nation’s producers, into the next year and beyond.”