Mourning in America as 13 U.S. Service Members Killed, 18 More Wounded

Biden comments on Afghan situation | Focus on Fed Chairman Powell

In Today’s Digital Newspaper

Market Focus:

• U.S. consumer spending, income grew in July

• Slower spending growth signals recovery lost momentum amid Delta variant

• USDA daily export sales:

— 129,000 MT soybeans to China during 2021-2022 marketing year (MY)

— 150,000 MT corn to Colombia during 2021-2022 MY

• Three Fed policy hawks push early taper

• Fed Chairman Powell kicks off KC Fed's virtual symposium today

• Social Security beneficiaries in line for biggest COLA since 1980s due to inflation

• World’s largest contract chip maker is raising prices by up to 20%

• Prices for new vehicles up 16% from last August; used vehicles up 20%

• California advances zoning law to open suburbs to development

• Russia raises export tax to $39 last night

• Indonesia raises September crude palm oil reference price, export tax

• Gulf Coast faces serious hurricane threat

• Ag demand update

• Rains weigh on corn and soybean futures

• Argentine exchange notes dryness, but maintains wheat crop forecast

• Rains again slow French soft wheat harvest, but finish line nearing

• Big jump in Russian wheat export duty

• Ukraine’s grain exports off to a solid start

• Tepid demand at latest Chinese auction of corn reserves

• Beef prices show some resilience

• Futures too far under the cash market

Policy Focus:

• Supreme Court rejects Biden’s eviction moratorium

Afghanistan:

• Updates on U.S. withdrawal, Biden comments on situation

China Update:

• U.S. frozen beef exports to China surge

• China plans to ban U.S. IPOs for data-heavy tech firms

• China’s arable land shrinking but holds above Chinese targets

• China’s pork imports will rise in 2022: U.S. attaché report

• Kerry heads to China with coal on agenda

Trade Policy:

• New definition of agricultural trade alters trade data, forecasts

Energy & Climate Change:

• EPA sends proposed RFS levels to OMB for review

Livestock, Food & Beverage Industry Update:

• USDA prepares ASF ‘protection zone’ around Puerto Rico

• FDA food survey finds ‘forever chemicals’ in tuna, fish sticks

Coronavirus Update:

• Hawaii wants tourists to postpone trips to the islands

• U.S. will ship 2.2 million coronavirus vaccine doses to South Africa today

Politics & Elections:

• Texas House advances GOP voting bill

• Former President Donald Trump is being sued by a group of Capitol Police officers

Other Items of Note:

• GOP members seek extension on WOTUS deliberations

• Politico sold itself to Axel Springer, the German publishing giant

MARKET FOCUS

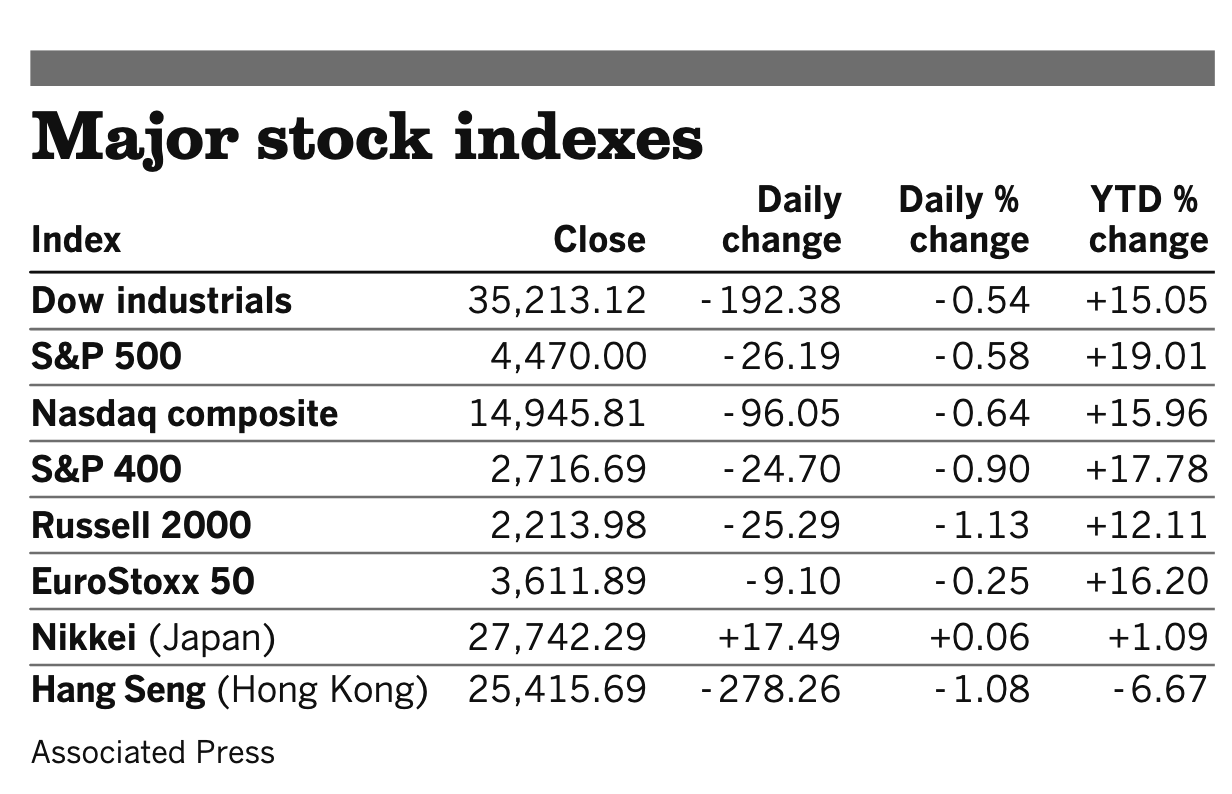

Equities today: Global stock markets were mixed in quieter trading overnight. The U.S. Dow today opened up around 60 points higher. Traders await more clues on Federal Reserve policy from the Jackson Hole symposium and remarks from Chair Jerome Powell — see related items below. Asian equities were mixed with attention focused on remarks today by US Fed Chairman Powell. Japan’s Nikkei was down 101.15 points, 0.36%, at 27,641.14. Hong Kong’s Hang Seng fell 7.80 points, 0.03%, at 25,407.89. European equities are mostly lower in early dealings. The Stoxx 600 is down 0.1% with most regional markets seeing losses of 0.1% to 0.4%. Swiss and Italian markets, however, were slightly higher.

U.S. equities yesterday: U.S. equity markets finished with losses as the Dow was down 192.38 points, 0.54%, at 35,213.12. The Nasdaq declined 96.05 points, 0.64%, at 14,945.81. The S&P 500 fell 26.19 points, 0.58%, at 4,470.00.

On tap today (see detailed list of events and reports below):

• U.S. consumer spending and personal income for July are both expected to increase 0.3% from the prior month. (8:30 a.m. ET) Update: Consumer spending grew 0.3% in July and income rose 1.1%. The slower spending growth suggests the recovery has lost momentum amid Delta variant uncertainty.

• Personal-consumption expenditure price index excluding food and energy for July is expected to increase 0.3% from a month earlier and 3.6% from a year earlier. (8:30 a.m. ET)

• U.S. advance economic indicators are out at 8:30 a.m. ET.

• Federal Reserve Chairman Jerome Powell speaks about the economic outlook at the Kansas City Fed's virtual Jackson Hole Economic Policy Symposium. Livestream here. (10 a.m. ET)

• University of Michigan consumer sentiment index for August is expected to increase to 71 from a preliminary reading of 70.2 (10 a.m. ET)

• Baker Hughes rig count is out at 1 p.m. ET.

• CFTC Commitments of Traders report, 3:30 p.m. ET.

• Biden administration: Biden at 8:30 a.m. ET is scheduled to meet with his national security team about Afghanistan. At 10:30 a.m. ET he will meet with Israeli Prime Minister Naftali Bennett, after the meeting was delayed yesterday. The White House Covid-19 Response team is slated to give a briefing at 11 a.m.ET and Press Secretary Jen Psaki will brief reporters at 1 p.m. ET.

Three Fed policy hawks push early taper. Ahead of the U.S. Federal Reserve’s annual Jackson Hole symposium, three of its leading hawks came out in favor of accelerating the timeline for slowing asset purchases aimed at propping up the U.S. economy. Federal Reserve Bank of Dallas President Robert Kaplan said he favors an announcement at the central bank’s September meeting to begin tapering bond buying and implementing it in October or shortly after. St. Louis’s James Bullard called for a start in the fall — finishing by the end of the first quarter in 2022, while Kansas City Fed’s Esther George urged an early move begin this year.

A divergence of opinions among FOMC members was already seen in minutes from the Fed's July meeting, with "most" officials preparing to reduce the $120 billion in monthly asset purchases this year, though "several" thought the move should wait until 2022.

Federal Reserve Chairman Jerome Powell kicks off the Kansas City Fed's annual symposium today with remarks on the economic outlook. The central bank continues to debate over how and when to begin dialing back its stimulus, including $120 billion in monthly asset purchases. Investors are looking for clues from Powell over whether the Delta variant has altered plans to begin scaling back, or tapering, those purchases in coming months.

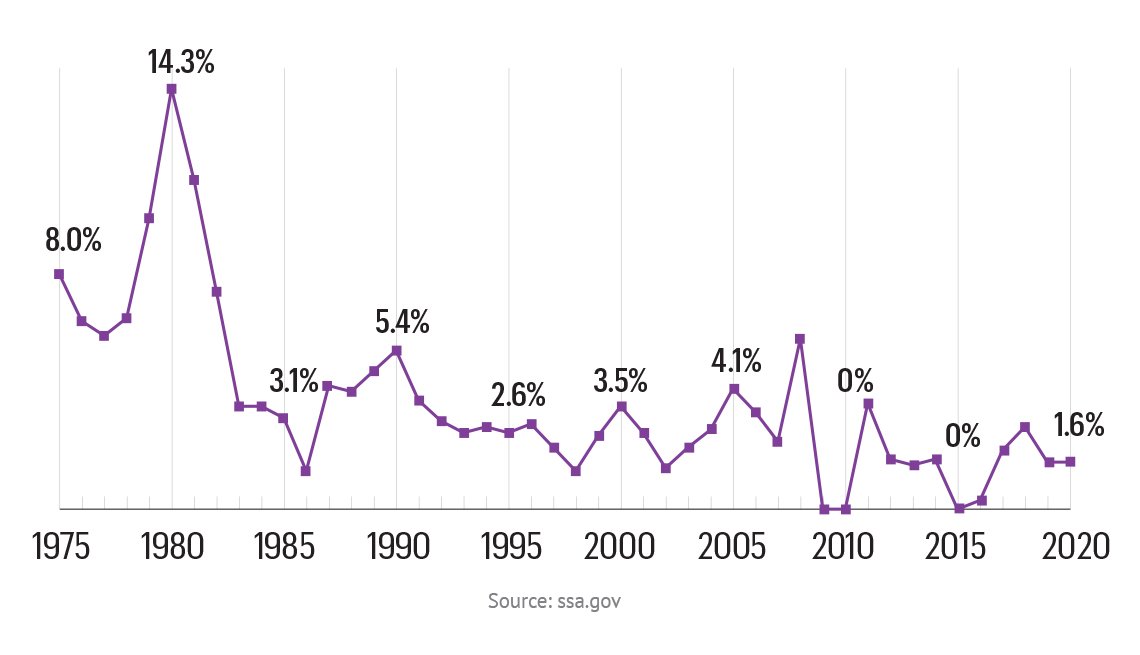

Social Security beneficiaries in line for biggest cost-of-living adjustment (COLA) since the 1980s due to the recent burst of inflation. "The COLA will no doubt be higher than it has been for the last decade, probably in the 5.5% to 6% neighborhood because of rising prices,” says David Certner, legislative counsel, and director of legislative policy for government affairs at AARP. Any estimates are preliminary, and the actual COLA will depend on changes in prices between July and the end of September. “With one-third of the data needed to calculate the COLA already in, it increasingly appears that the COLA for 2022 will be the highest paid since 1983 when it was 7.4%,” says Mary Johnson, Social Security policy analyst for The Senior Citizens League. The Social Security Administration typically announces the amount of the annual adjustment, if any, in October. The increase in benefits typically goes into effect in January.

California votes to open suburbs to development in bid to ease housing shortage. The state’s Legislature passed a bill that allows two-unit buildings on lots that for generations have been reserved for single-family homes. By allowing two units per parcel and permitting property owners to subdivide their lots, the law would increase density to as many as four units on a single-family plot.

World’s largest contract chip maker is raising prices by as much as 20%, according to people familiar with the matter cited by the Wall Street Journal (link), a move that could result in consumers paying more for electronics. Taiwan Semiconductor Manufacturing plans to increase the prices of its most advanced chips by roughly 10%, while less advanced chips used by customers like auto makers will cost about 20% more, these people said. The price increases come in the wake of a global semiconductor shortage.

Prices for new vehicles are up 16% from last August, and used vehicles are up 20%, says Tyson Jominy, vice president of data and analytics at the research firm J.D. Power. In addition, there has been a pullback in leasing offers. According to IHS Markit, the share of leases is currently 26%, down from nearly 30% in June.

Market perspectives:

• Outside markets: The U.S. dollar index is weaker amid strength in several U.S. currency rivals. The yield on the 10-year U.S. Treasury note is weaker, trading just under 1.34%, with a mixed-to-lower tone in global government bond yields. Gold and silver futures are firmer ahead of U.S. trading and Powell remarks. Gold is trading around $1,798 per troy ounce and silver around $23.60 per troy ounce.

• Crude oil futures are posting solid advances ahead of U.S. trading, with U.S. crude trading above $68.90 per barrel and Brent above $71.45 per barrel. Futures were firmer overnight in Asian trade.

• Russia raises export tax to $39 last night. U.S. wheat is getting cheaper in the world; U.S. soft wheat is cheaper than spot French. The Russian wheat is more affordable, but with a crop of 72 million tons, the Russian wheat price is expected to rise over time.

• Indonesia raises September crude palm oil reference price, export tax. The Indonesia crude palm oil export reference price was set at $1,185.26 per tonne, up 13% from $1,048.62 per tonne in August. This also raises the export tax to $166 per tonne for September, up from $93 per tonne in August. Reports indicated that export levies for crop palm oil would remain the same at $175 per tonne.

• USDA daily export sales:

— 129,000 MT soybeans to China during 2021-2022 marketing year (MY)

— 150,000 MT corn to Colombia during 2021-2022 MY

• Ag demand: Korea Feed Association issued an international tender to buy up to 138,000 MT of corn from optional origins. Pakistan bought around 160,000 MT of milling wheat from optional origins in an international tender for up to 400,000 MT of the grain. Tunisia bought around 50,000 MT of soft wheat and 50,000 MT of barley in a tender. Jordan’s state grain buyer bought around 60,000 MT of animal feed barley to be sourced from optional origins. An importer in the Philippines tendered to buy around 60,000 MT of animal feed wheat.

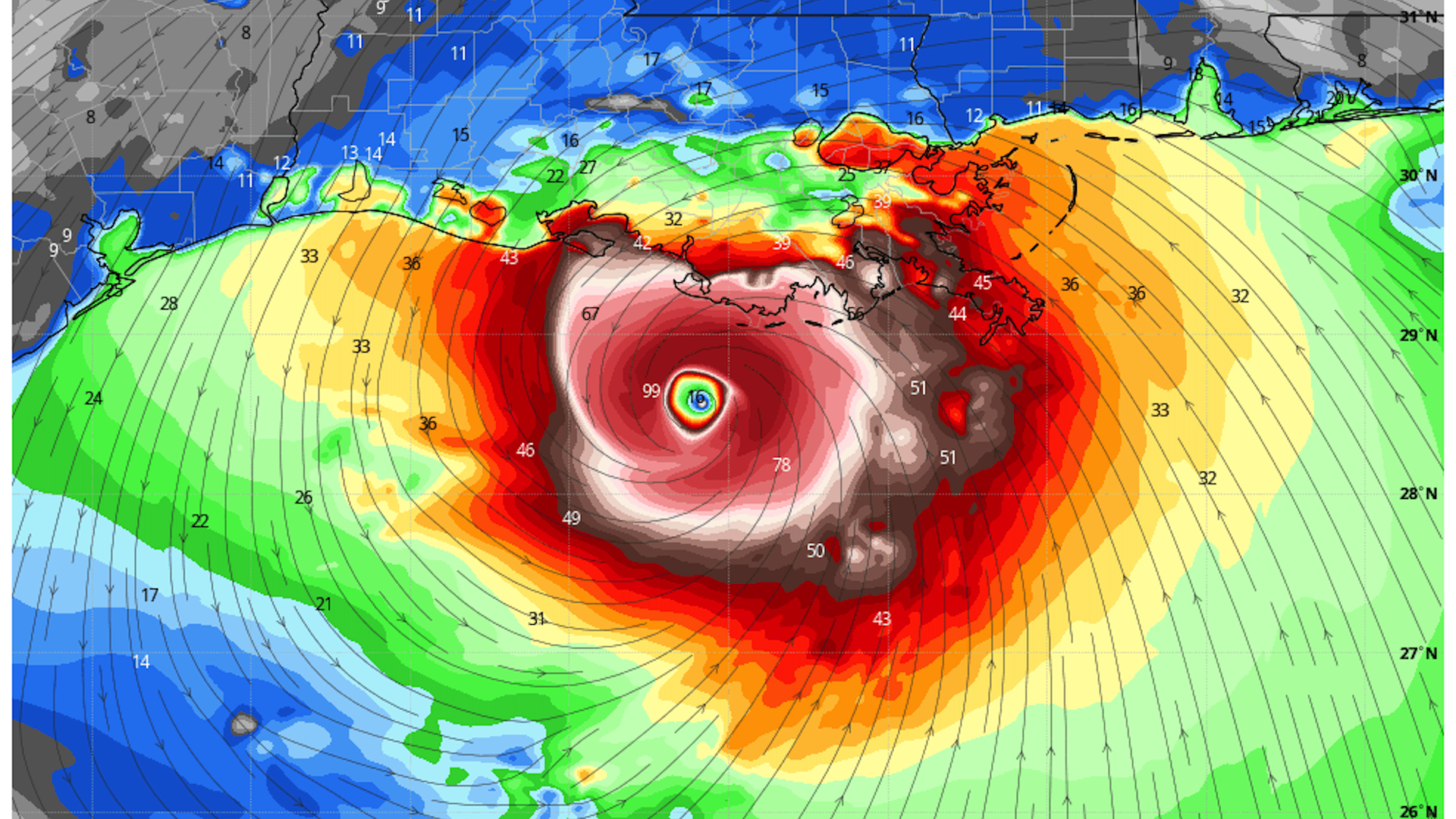

• Gulf Coast faces serious hurricane threat. The storm is forecast to become a major hurricane of Category 3 intensity or greater by the time it makes landfall somewhere in coastal Louisiana, with significant impacts possible in New Orleans. Oil companies have already begun evacuating personnel from Gulf drilling platforms, and the storm may prompt oil and gas infrastructure shutdowns along the coast.

Computer model simulation of the winds in Hurricane Ida as it approaches Louisiana on Sunday. (Weatherbell.com)

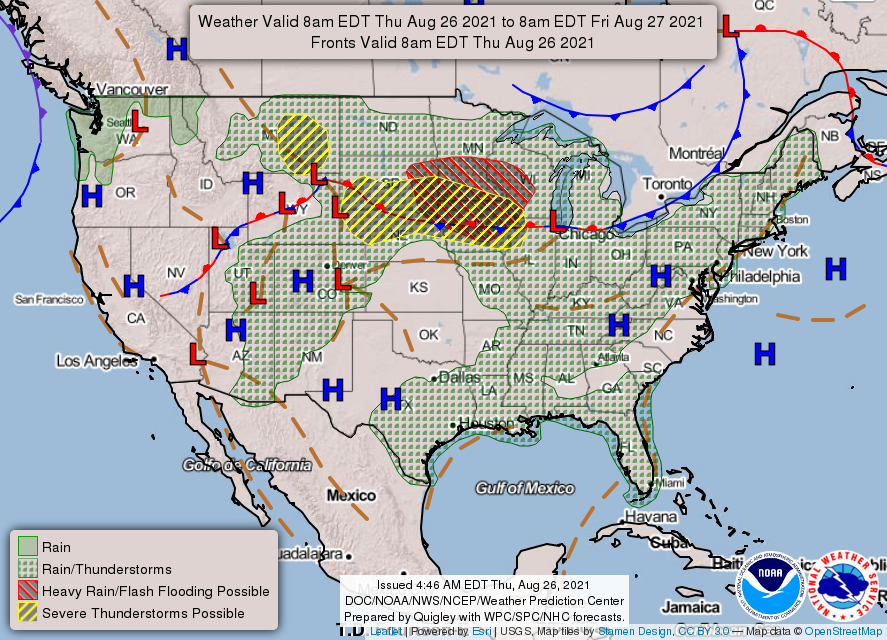

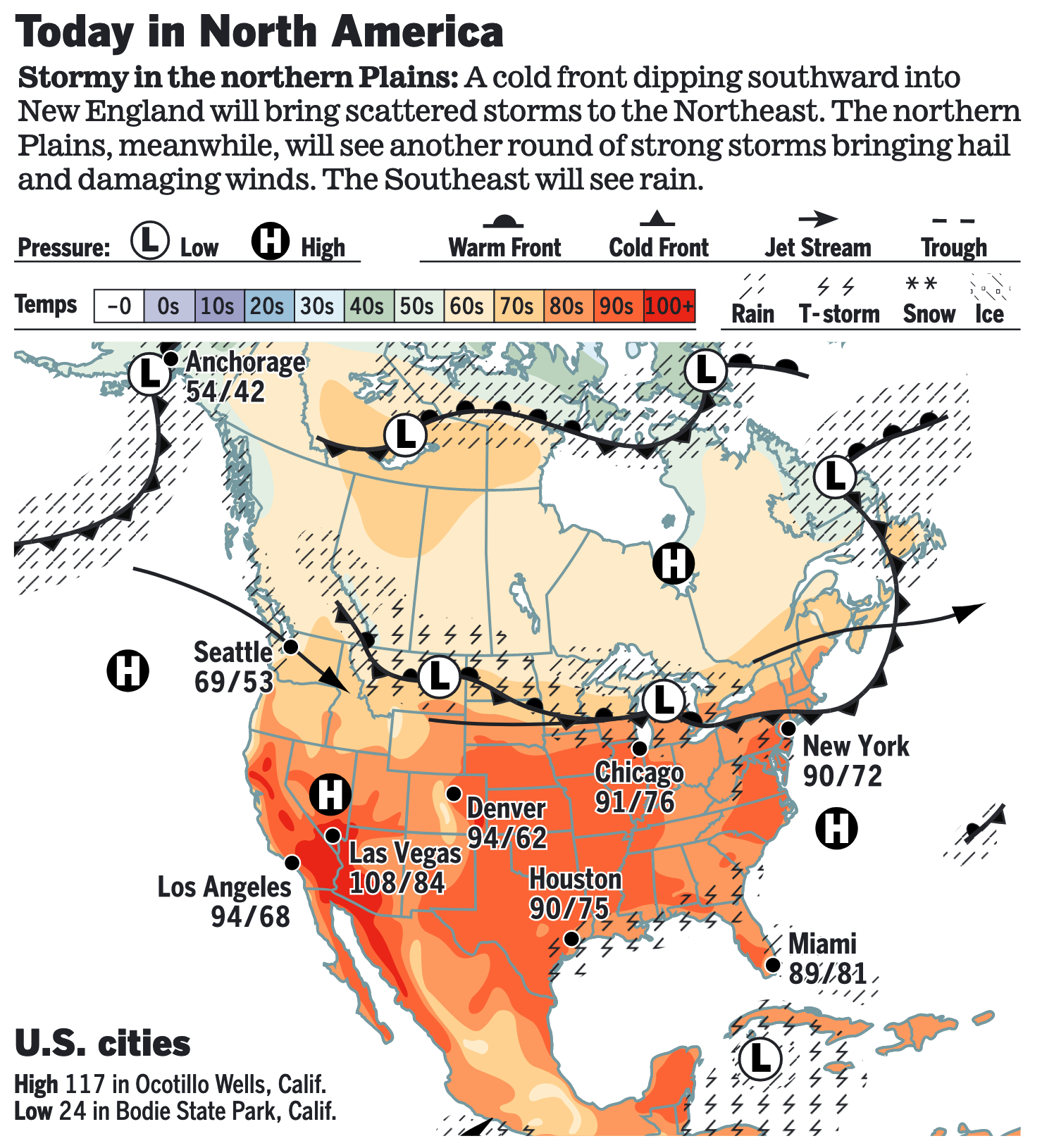

• NWS weather: The potential for flash flooding and severe weather continues across portions of the Northern Plains and Midwest... ...Heavy rain and flooding possible for the Mid-Atlantic Friday... ...Uncomfortable and potentially dangerous heat continues throughout much of the central and eastern United States, as well as the Desert Southwest.

Items in Pro Farmer's First Thing Today include:

• Rains weigh on corn and soybean futures

• Argentine exchange notes dryness, but maintains wheat crop forecast

• Rains again slow French soft wheat harvest, but finish line nearing

• Big jump in Russian wheat export duty

• Ukraine’s grain exports off to a solid start

• Tepid demand at latest Chinese auction of corn reserves

• Beef prices show some resilience

• Futures too far under the cash market

POLICY FOCUS

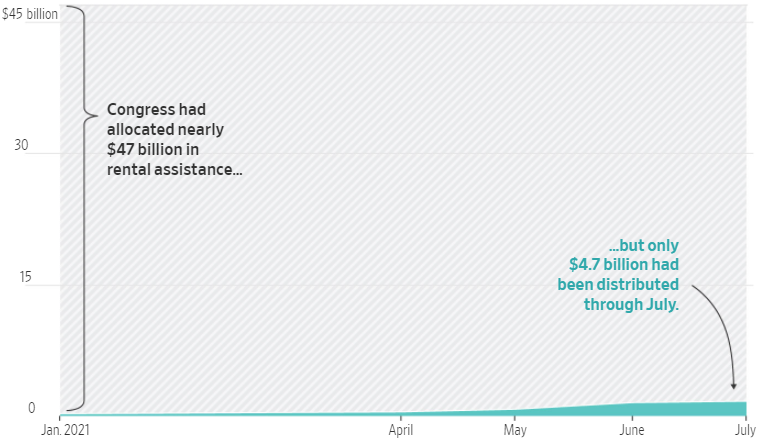

— Supreme Court overturns ban on U.S. evictions. The Supreme Court ruled for a group of Alabama landlords on Thursday and blocked President Biden from extending for two more months a nationwide pandemic-related ban on evictions. The 6-3 decision was made along ideological lines, with all six Republican-appointed conservatives voting in favor of striking down the eviction moratorium and the three Democratic-appointed justices voting to maintain it. After Congress failed to renew a federal evictions moratorium that expired on July 31, Democratic activists pressed Biden to reverse course. He did so Aug. 3, conceding he stood on shaky legal ground. He added, however, that “by the time it gets litigated, it would probably give some additional time while we’re getting that $45 billion out to people who are, in fact, behind in the rent and don’t have the money.” The Centers for Disease Control and Prevention introduced a new extension unilaterally as an urgent measure to tackle the impact of a wave of Covid infections. The Supreme Court’s majority ruled that the CDC had exceeded its authority in imposing the evictions ban without legislation after hearing a challenge from a group of Alabama realtors. The high court’s ruling is no surprise. In late June, four conservative justices voted to strike down the national eviction moratorium. The Supreme Court ruling did not invalidate local laws preventing evictions in many cities and states across the country, such as in California, which could protect some families from losing their homes.

The largest rental assistance program in U.S. history has distributed just $4.7 billion of the nearly $47 billion in federal emergency funds as of July 31, according to the latest data released by the Treasury Department. While the Treasury Department is overseeing the program, it is up to the states and local governments to set up systems to process applications, screen tenants and distribute aid.

Rep. Maxine Waters (D-Calif.), who leads the House Financial Services Committee, said she would “immediately set to work on a legislative solution to address issues with the slow implementation of the emergency rental assistance program.” “My new proposal would ensure that both renters and landlords can independently apply for emergency rental assistance so that landlords get paid their back rent, and that the program works with less bureaucracy and red tape,” Waters said in a statement issued after the ruling.

Comments: The eviction moratorium was originally set to expire on Dec. 31, 2020, but Congress stretched the order until late January, and it was then extended several more times under the Biden administration. While the moratorium has protected tenants nationwide, it has also resulted in financial hardships for landlords. Property owners, who say they are losing $13 billion a month in unpaid rent, are still liable for taxes, insurance and maintenance costs tied to their real estate.

AFGHANISTAN

— Updates:

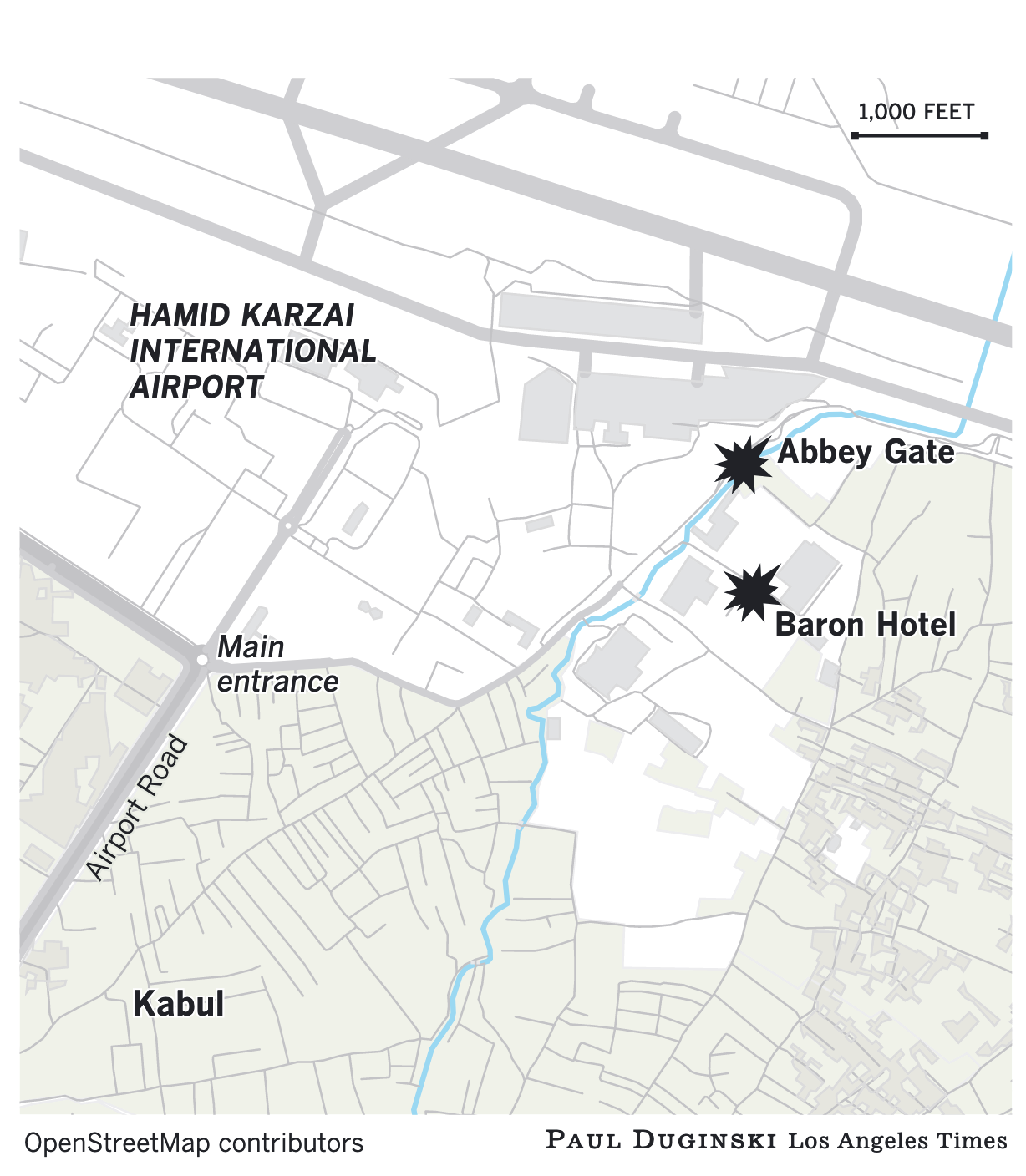

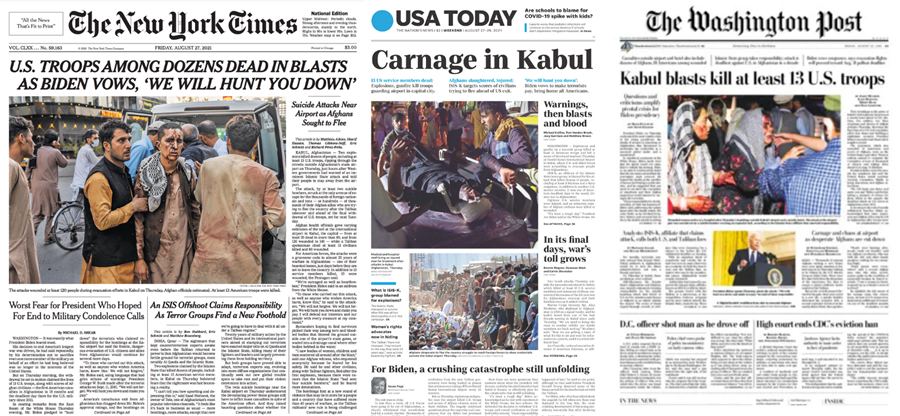

- Thirteen U.S. service members were killed Thursday and 18 more were wounded in an Islamic State terrorist attack outside the airport in Kabul, the Pentagon said. They were the first U.S. casualties in Afghanistan since February 2020, making it the deadliest day for the U.S. military in Afghanistan since August 2011 and the darkest day of President Joe Biden’s young administration. One of the explosions took place at an airport hotel; the other was a suicide bombing carried out at the airport’s Abbey Gate, which the U.S. had been using to screen people attempting to flee Afghanistan. Dozens of Afghan civilians also appear to be killed — at least 95 Afghans were killed.

- President Biden said the nation would “not forgive” the deadly assault. Addressing the assailants, he said, “We will hunt you down and we will make you pay,” adding that he had directed military officials to develop plans to respond on the U.S.’ own timetable.

- Marine Gen. Kenneth F. McKenzie Jr., chief of U.S. Central Command, attributed the attack to the Islamic State-Khorasan, which claimed responsibility Thursday, and indicated that U.S. military action in response is possible. ISIS-K is an offshoot of the group that was once powerful in parts of Iraq and Syria, is not affiliated with the Taliban leaders and raises fears the country could again turn into a proving ground for terror.

- McKenzie said an estimated 1,000 Americans remain in the country. More than 250,000 Afghans who worked with the U.S. are expected to be left behind, the New York Times calculates (link).

- More than 100,000 people have been flown out of Kabul during the nearly two-week operation, including more than 5,000 Americans.

- President Biden said U.S. airlift efforts would move forward after the deadly attack on Kabul's airport. While the situation on the ground remained volatile, he said, “We will not be deterred by terrorists,” adding, “We will continue the evacuation.” Biden said flights would continue and that more than 100,000 people have been airlifted out of Afghanistan to date.

- In response to questions, Biden conceded that he bore responsibility "for, fundamentally, all that’s happened of late… I know of no conflict, as a student of history, no conflict where, when a war is ended, one side was able to guarantee that everyone they wanted to be extracted in that country would get out," he said of his botched withdrawal. In his East Room remarks, Biden accepted responsibility for the attack — although he also sought to pass off blame to his predecessor — but remained unwavering in defending the U.S. withdrawal from Afghanistan.

- "Bottom line is that our work is not done in Afghanistan," Leon Panetta, secretary of Defense and CIA director under President Obama, said on CNN. "We're going to have to go back in to get ISIS… "Bottom line is that our work is not done in Afghanistan," Leon Panetta, secretary of Defense and CIA director under President Obama, said on CNN. "We're going to have to go back in to get ISIS… We can leave a battlefield, but we can't leave the war on terrorism."

- GOP focus. On a House GOP conference call Thursday night, the ranking members of several committees — who could wield gavels and subpoena power in 2023 — said they’ve already sent document preservation requests to the administration. Sen. Ben Sasse (R-Neb.) is now referring to the list of names given to the Taliban as a “kill list,” and demanding to know whose idea it was. One of the Republicans who called for Biden’s resignation, Rep. Tom Rice (R-S.C.), was also one of the 10 House Republicans who voted for then-President Donald Trump’s impeachment last year. “Do the American people a favor,” Rice said Thursday. “Resign and turn the job over to someone who can handle it.”

- Democrats also have some complaints. Senate Foreign Relations Chair Bob Menendez (D-N.J.) issued a statement about U.S. reliance on the Taliban: “We can’t trust the Taliban with Americans’ security,” he said. Rep. Susan Wild (D-Pa.) said: “It is clear to me that it was long past time to end the U.S. military presence in Afghanistan, and that we could not continue to put American servicemembers in danger for an unwinnable war. At the same time, it appears that the evacuation process has been egregiously mishandled. “In order to move forward, our country will need to receive answers and accountability regarding the cascading failures that led us to this catastrophic moment, and I look forward to using my platform on the House Foreign Affairs Committee to secure answers from the Biden administration about what went wrong. Our troops deserve nothing less than a complete and unvarnished account of the truth.”

- Political damage. The attacks President Biden’s repeated arguments since taking office that he would offer a steady hand on foreign policy.

CHINA UPDATE

— U.S. frozen beef exports to China surge, adding to Canberra-Beijing tensions but boosting trade deal. Australia has traditionally exported more frozen beef to China, but since April its exports have plunged, with the gap between the two widening quickly in favor of the U. S. In April, the U.A. shipped $68 million worth of frozen beef to China compared to $80 million from Australia, according to Chinese customs. In May, trade patterns reversed, and the U.S. had shipped $90 million of frozen beef to China compared to Australia’s $47 million.

— China plans to ban U.S. IPOs for data-heavy tech firms. China plans to propose new rules that would ban companies with large amounts of sensitive consumer data from going public in the U.S., a move that is likely to thwart the ambitions of the country’s tech firms to list abroad.

— China’s arable land shrinking but holds above Chinese targets. China had around 490,000 square miles of arable land at the close of 2019, a 6% decline from a decade before, according to the country’s survey of land use that’s conducted once in a decade. Arable land accounts for 13% of China’s total area, which tops the state target to keep around 480,000 square miles of arable limits from urban encroachment by the end of 2020. But land dedicated to agriculture has fallen by roughly 29,000 square miles since 2009, with some arable land converted to forest and industrial and urban use. China expects that trend to continue, and in fact the country plans to plant nearly 14,000 square miles of new forest a year from 2021 through 2025, the country announced last week. China has drawn “red lines” to protect farmland from industrial encroachment and to shield its most vulnerable ecosystems.

— China’s pork imports will rise in 2022. China’s hog and pork production are expected to decline next year, according to a USDA attaché report from the country, as “government policies designed to limit price fluctuations inadvertently undermine [hog herd] expansion.” The attaché forecasts China’s hog production will fall 5% next year as “low prices and disease outbreaks in 2021 led to significant slaughter and delayed [herd] restocking.” The post expects China’s pork production to plunge 14% next year. As a result, it forecasts China’s pork imports will rise to 5.1 MMT as “consumer demand for pork exceeds domestic production.” The post forecasts beef imports will expand “at a slower rate to 3.3 MMT, as high beef prices are balanced by more diverse beef suppliers entering the market.”

— Kerry heads to China with coal on agenda. Special Climate Envoy John Kerry heads to China next month with plans to prod the world's largest carbon emitter on taking stronger climate steps as the crucial United Nations summit looms this fall, Axios notes. Kerry will be in Tianjin, China from Sept. 1-3 after an Aug. 31 meeting in Tokyo. The WSJ (link) says Kerry will "press Chinese leaders to declare a moratorium on financing international coal-fired projects."

TRADE POLICY

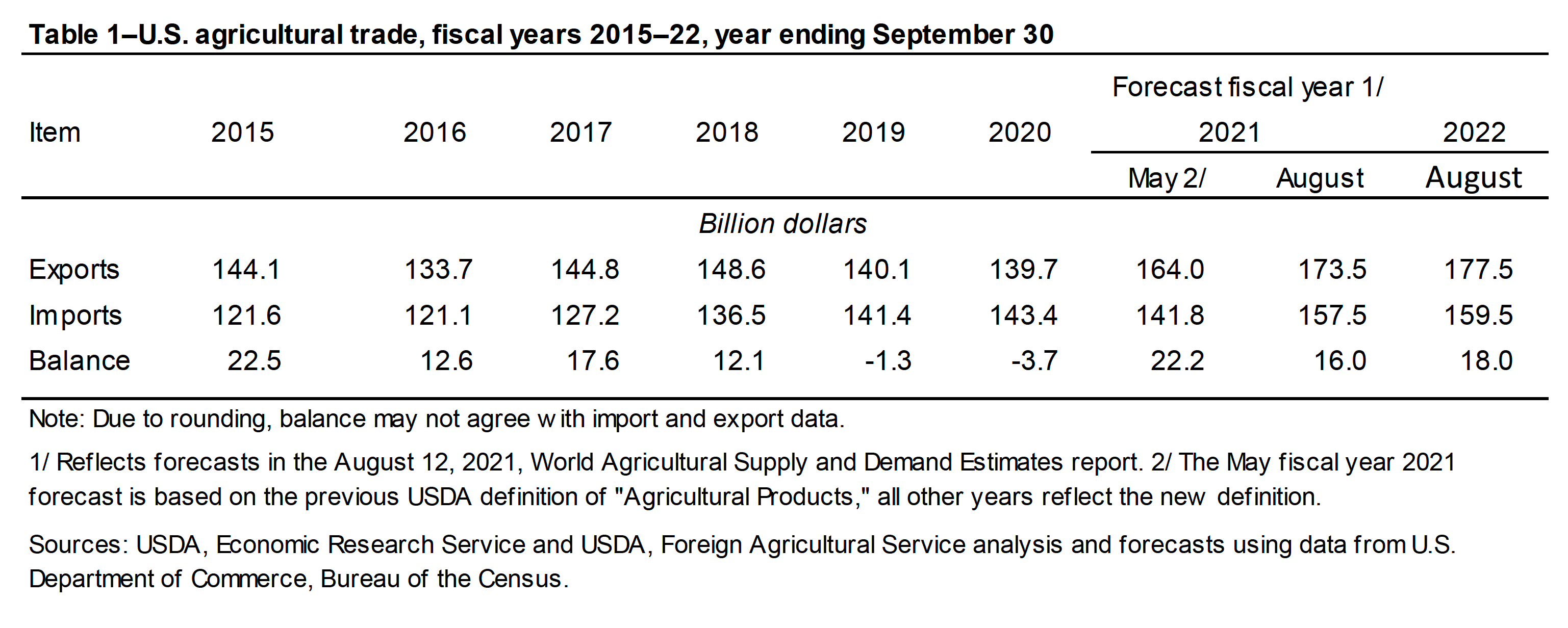

— New definition of agricultural trade alters trade data, forecasts. As USDA has adopted the WTO definition of agricultural products relative to U.S. ag export and import data, it has affected the levels. And USDA's Outlook for US Ag Exports (link) released Thursday also now adopts that new definition. USDA noted the higher forecast is in part due to the updated definition “which adds ethanol, distilled spirits, manufactured tobacco, and others to the agricultural total.” The result is that fiscal year (FY) 2021 U.S. ag exports are seen at a record $173.5 billion against imports at a record $157.5 billion for a $16 billion surplus. In May, using the old definition of agricultural products, the forecast was for exports of $164 billion against imports of $141.8 billion for a surplus of $22.2 billion.

For FY 2022, USDA's first forecast (also using the updated definition of ag products) is for exports at a new record of $177.5 billion against imports at a record $157.5 billion for an $18 billion surplus.

The other impact of the new definition? U.S. agriculture registered trade deficits in both FY 2019 and 2020. USDA said the net effect of the definition on historical trade values is that U.S. agricultural exports under the new definition averaged $4.7 billion higher per year during FY 2018–2020 from the previous definition, and US agricultural imports averaged $9.9 billion higher annually during the same period. Follow this link to read more about the updated definition.

Impact of monetary policy, dollar, inflation. USDA’s analysis of the macroeconomic situation noted that “higher commodity prices, as well as low interest rates across central banks, are expected to continue to support inflationary pressures.” They pointed out that monetary policy “will continue to be closely monitored around the world, as multiple central banks have already begun to adjust rates higher.” While U.S. interest rates on gov’t debt will remain low, USDA noted they are above other advanced economies. “The relatively higher rates are expected to help support the U.S. dollar during the rest of 2021, though the U.S. agricultural-exports weighted dollar is anticipated to depreciate on average by 2.4% in 2021,” USDA observed. “The annual average depreciation is due in large part to weakness of the dollar at the start of 2021.”

China top customer for FY 2021, 2022. Agricultural exports to China are forecast at $39.0 billion in FY 2022, up $20 billion from the FY 2021 forecast of $37 billion. In FY 2020, USDA pegged those shipments at $16.97 billion. So far in FY 2021 (October-June), U.S. agricultural exports are at $28.28 billion, up from just $11.07 billion in the same period in FY 2020. The rise in FY 2022 forecast U.S. agricultural exports to China is on “higher expected soybean prices and strong cotton and sorghum demand.” For FY 2021, USDA increased their forecast by $2 billion compared with May “mainly due to a quickening pace of corn shipments in recent months, strong sales of beef, and the addition of ethanol.” And ethanol was a key add — FY 2021 U.S. fuel ethanol exports to China “reached their second-highest level on record due to low, early-year U.S. prices.”

Ethanol trade outlook. FY 2021 U.S. ethanol exports are forecast at $2.2 billion, down by $60 million from the previous year with “higher export unit values only partially offsetting lower export volume,” USDA said. Much of the shift is on Brazil, as U.S. exports of fuel ethanol to Brazil in FY 2021 “have fallen to levels not seen in a decade.” USDA also noted that Colombia’s lower blend mandate has cut U.S. exports to that destination. Lower sales of ethanol to Mexico and Nigeria also factored into the mix as those had reached record marks last year. U.S. industrial ethanol sales to India are lower due to higher U.S. prices and the substitution of surplus sugar supplies to ethanol. U.S. sales to Canada and South Korea are up on fuel demand recovery and record demand for industrial product, respectively.

ENERGY & CLIMATE CHANGE

— EPA sends proposed RFS levels to OMB for review. EPA sent their proposed Renewable Fuel Standard (RFS) levels to the Office of Management and Budget (OMB) for review and it is not on the agency’s internet site. The levels will spell out the Renewable Volume Obligations (RVOs) for 2021 and 2022.

Reuters report that EPA has also proposed a retroactive lowering of the 2020 RFS levels in its recommendations to OMB, a move that apparently reflects the impacts of greatly reduced fuel demand from the pandemic. EPA did not confirm that report.

EPA comments. “The proposal aims to get the (Renewable Fuel Standard) program back on track while addressing challenges stemming from decisions made under the prior administration,” and EPA spokesman said in a statement.

The move to retroactively reduce the 2020 mandate is seen benefiting refiners as it would increase the pool of Renewable Identification Numbers (RINs) available that are generated when biofuels are produced. The lowering of the mandates for 2020 would mean refiners that do not blend enough biofuel into motor fuels to comply would not have to purchase as many RINs. RIN prices were trading lower Thursday versus levels seen on Wednesday, trading at around $1.37 versus $1.48, and they are now well off their highs of more than $2.

News services reported that EPA was proposing lower RFS levels for 2021 compared with 2020, though it is not clear if that is still the case given the reports that EPA was seeking to retroactively reduce the 2020 marks. However, reports have also indicated that the proposed levels for 2022 were above the levels for 2021 and 2020.

Now the wait is for an official announcement of the actual proposed levels from EPA. That will not happen until after OMB has completed their review of the proposed levels, hold several meetings with other government agencies and those in the private sector. Typically, the description of the proposed levels includes mention of the year/years involved in the proposal. But the review document this time simply notes the following: “This action establishes the annual percentage standards for cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel that apply to gasoline and diesel transportation fuel.” After the OMB process is nearly completed, there are “leaks” about the potential levels for biofuel mandates as meetings with industry stakeholders take place.

By law, EPA is to finalize the RFS levels for the coming year by Nov. 30, but the Trump administration did not meet that goal. Their proposed levels for 2021 biofuels and 2022 biodiesel were sent to OMB for review, but the review was never completed, presumably as the pandemic dramatically changed fuel consumption and altered the landscape for the RFS levels.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— USDA prepares ASF ‘protection zone’ around Puerto Rico. USDA is preparing a “Foreign Animal Disease Protection Zone” around Puerto Rico and the U.S. Virgin Islands to prevent the spread of African Swine Fever (ASF) to the U.S. mainland in case the pig disease jumps to the islands from the Dominican Republic. USDA’s Animal and Plant Health Inspection Service (APHIS) is taking the step “out of an abundance of caution” and the disease hasn’t been detected in either Puerto Rico or U.S. Virgin Islands. Once the zone is established, movement of live swine and products out of the region will be restricted and surveillance measures stepped up to quickly detect any outbreak, the agency said.

APHIS is offering technical support to the Dominican Republic to assist in its response to the disease and has offered the same support to neighboring Haiti, where the disease hasn’t yet been confirmed.

Background: An African swine fever outbreak in China around 2018 devastated the hog herd in that country, the world’s top pork producer. The outbreak in the Dominican Republic is the first detected in the Western Hemisphere in about 40 years, according to the U.S. National Pork Producers Council.

— FDA food survey finds ‘forever chemicals’ in tuna, fish sticks. The Food and Drug Administration announced yesterday () that it’s found “forever chemicals” in few processed foods, but the amount found supports its plans to keep monitoring seafood. The FDA released the results of its first survey of nationally distributed processed foods, including several baby foods, collected for the Total Diet Study (TDS). Results showed that 164 of the 167 foods tested had no detectable levels of the per- and polyfluoroalkyl substances (PFAS) measured. But fish sticks, tuna, and protein powder had three specific PFAS.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 214,670,231 with 4,456,536 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 38,384,595 with 633,566 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 365,767,674 doses administered, 172,171,009 have been fully vaccinated, or 52.5% of the U.S. population.

— Hawaii wants tourists to postpone trips to the islands. As hospitals reach capacity and intensive-care units fill up, Gov. David Ige is urging visitors to delay their plans through October. But some airlines were still running sales this week, and travelers who’d already booked trips have been weighing the state’s admonition alongside their reservations’ fine print.

— U.S. will ship 2.2 million coronavirus vaccine doses to South Africa today, a show of support to one of the countries that has led the push to loosen restrictions on global production and shrink the gap between wealthy and developing nations. The 2.2 million doses of the Pfizer-BioNTech vaccine will be shipped today through the Covax vaccine-sharing initiative, and arrive Saturday.

POLITICS & ELECTIONS

— Texas House advances GOP voting bill. The Texas House on Thursday moved forward a voting measure that opponents say will make casting ballots and administering elections harder in the state, with proponents arguing voting rules should be tightened to prevent voter fraud. Elections bill SB1 passed 79-37 mostly along party lines after 12 hours of debate. Democrats — who broke quorum for weeks, fled Texas and faced the threat of arrest to stave off passage of the measure this summer — did not have the numbers to overcome the chamber’s Republican majority. The bill is set for final passage in the Senate today.

— Former President Donald Trump is being sued by a group of Capitol Police officers who served during the Jan. 6 riot, the first suit to accuse Trump of working in concert with far-right extremists to disrupt the transition of power.

OTHER ITEMS OF NOTE

— GOP members seek extension on WOTUS deliberations. Republicans on the House Transportation and Infrastructure Committee (T&I) want the Biden administration to provide a 60-day extension to allow for more public comments and meetings on the rewrite defining the Waters of the United States (WOTUS) regulations. “The decision to host meetings within such a short timeframe on a wide range of topics is indicative of a rushed, insincere notice-and-comment process by this Administration. A mere single month of public meetings is a woefully insufficient amount of time to collect meaningful input on a regulation that will have a profound, long-term impact on the everyday lives of American farmers, businesses, families, and our environment,” T&I ranking member Sam Graves (R-Mo.) and Water Resources and Environment Subcommittee ranking member Rep. David Rouzer (R-N.C.) wrote in a letter yesterday (link). If the agencies don’t provide an extension, the final public meeting will be on Aug. 31, with public comments due the following week.

— Politico sold itself to Axel Springer, the German publishing giant that owns Insider and Morning Brew, for more than $1 billion. A key attraction for the buyer: Politico’s subscription service, which generates more than half its $200 million in annual revenue. Robert Allbritton, who helped found Politico in 2007, will remain publisher, and the company will operate separately from Springer. The deal could quash Springer’s talks to acquire Politico’s competitor Axios.

EVENTS AND REPORTS

Friday, August 27

· Federal Reserve. Federal Reserve Board Chairman Jerome Powell delivers virtual remarks on "The Economic Outlook" during the Jackson Hole Economic Policy Symposium conducted by the Kansas City Fed.

· Economic report. International Trade in Goods | Wholesale Inventories |Personal Income & Outlays | Consumer Sentiment

· Energy reports. Baker-Hughes Rig Count

· USDA reports. NASS: Cash Rents - County | Peanut Prices | Peanut Stocks and Processing