More States Hit $5-Plus for Gasoline as National Average Reaches $4.91

Nat gas prices surge 13.3 cents higher after 79.9-cent rally in Monday’s session

|

In Today’s Digital Newspaper |

Conflicting reports on getting grain out of Ukraine continue, with the various viewpoints detailed below.

Ukraine retook parts of Severodonetsk amid brutal street fighting. Russia still holds the majority of Luhansk, however, as it pushes on in its goal to control the entire eastern Donbas region.

Russia’s ambassador to the United Nations stormed out of a Security Council meeting after the EU accused his country of causing a global food crisis. Charles Michel, the European Council president, said the Kremlin was using food supplies as a “stealth missile against developing countries”. Vassily Nebenzia, the Russian envoy, left the meeting as Michel spoke, accusing him of spreading lies.

The SEC is expected to outline ideas for improving markets. Chairman Gary Gensler plans to detail potential changes in a speech tomorrow that the SEC believes will make markets more efficient for small investors and public companies, according to the Wall Street Journal. Meanwhile, pension funds have been pushing the agency to proceed with a proposed rule that would require private-equity funds to provide more disclosures to investors.

U.S. Treasury Secretary Janet Yellen will face U.S. the Senate today and House Wednesday as she testifies on the Biden administration’s FY 2023 budget request and its plans to deal with rising inflation.

Three of the key supply-side factors driving today’s global inflation levels have already turned around, meaning relief could be on the horizon for shoppers worldwide.

Forty-year high inflation has pushed the national average for a gallon of gas to another record, just 9 cents shy of $5, according to AAA. Meanwhile, natural gas futures pushed further higher in early trading Tuesday. Coming off a 79.9-cent rally in Monday’s session, the July Nymex contract was up another 13.3 cents to $9.455/MMBtu at around 8:50 a.m. ET.

Let us talk about inflation and supply glitches in Australia, where some companies have substituted cabbage for lettuce due to a supply shortage and surging prices.

The trade gap in the U.S. for April narrowed to $87.1 billion, shrinking more than economists had forecast, after reaching a record deficit the prior month.

Japanese yen weakened 0.7%, reaching the lowest level against the dollar since April 2002.

Keen on attracting college graduates for essential jobs in rural villages, one Chinese province is looking to sweeten the pot by splashing out on cash handouts.

U.K. Prime Minister Boris Johnson survived a no-confidence vote that would have booted him from office, but the fact that 41% of lawmakers from his own Conservative Party opted to remove him shows there’s…little confidence in him. Johnson has been dogged by reports that he was throwing parties at 10 Downing Street, violating Covid lockdown rules, while the rest of the country was in Covid lockdown.

Mexican President Andrés Manuel López Obrador will skip the Summit of the Americas in Los Angeles later this week over objections to President Biden’s guest list for the event. López Obrador confirmed his decision after weeks of threats that he would stay home if the White House refused to invite authoritarian leaders from Cuba, Nicaragua and Venezuela to the summit.

Biden’s attempt to deal with a complicated trade dispute that’s paralyzed the U.S. solar industry is drawing criticism from some of the same companies the White House had been seeking to appease.

An FDA panel will convene today to consider Novavax's approval application for its Covid vaccine. Novavax shares rose 3.8% in the premarket. If approved, the Novavax vaccine would be the fourth cleared for use in the U.S.

Voters head to the polls today in seven U.S. states to vote in consequential primary elections. Primaries will be held in California, Iowa, Mississippi, Montana, New Jersey, New Mexico and South Dakota. Two most closely watched races of the day will both be in California. Without any major Senate or gubernatorial races on the ballot, they are a pair of local races that could nevertheless have national implications. One is the Democratic primary for mayor of Los Angeles; the other is a recall campaign against the San Francisco district attorney. In both races, frustrations about crime and homelessness in Democratic-run cities threaten to set back the progressive wing of the party. Details in Politics section. Meanwhile, a political term has surfaced regarding prior Democratic voters upset about the defund the police movement and its impacts: “I’m now a cop Republican.”

President Biden is likely to decide later this summer whether to partially forgive student-loan debt for millions of borrowers, according to people familiar with the matter, the Wall Street Journal reported.

A respected cotton industry lobbyist, Reece Langley, is resigning from the National Cotton Council due to personal health and well-being matters in his family.

House Ag Committee ranking member G.T. Thompson (Pa.) and Senate Ag Committee ranking member John Boozman (Ark.) sent a letter to President Biden asking him to withdraw the administration’s brief in the SCOTUS Roundup case. They question the White House's decision to file a brief, alleging administration officials failed to consult experts before doing so.

Will this experiment catch on? A six-month program that began in the U.K. will test the effects of the four-day workweek on thousands of workers across 70 companies. The results of the trial will be announced sometime in 2023. In January, there were just 1,700 jobs advertising a four-day workweek in the U.S. for every 1 million posted.

Election Day 2022 is 154 days away. Election Day 2024 is 882 days away.

|

MARKET FOCUS |

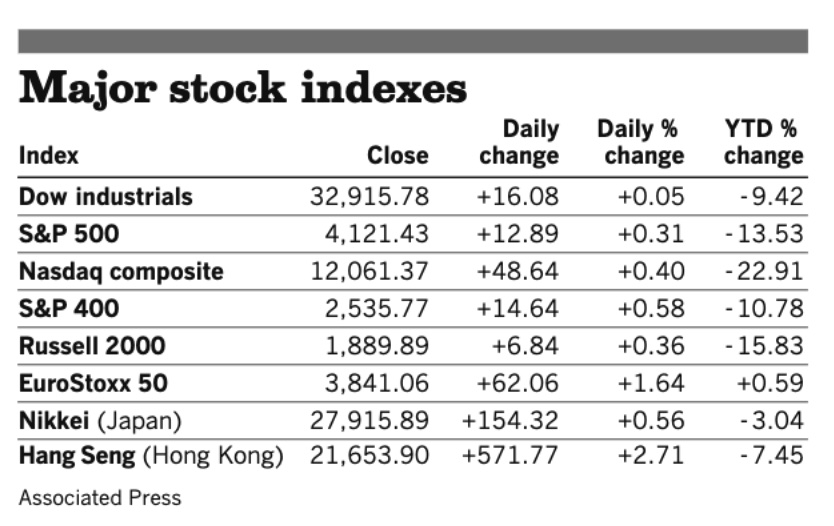

Equities today: Global stock markets were mixed to weaker overnight. U.S. Dow opened around 250 points lower. In premarket trading, Target plunged 8% after issuing a warning that its profit would decline because it needs to cancel orders or offer discounts to clear out unwanted goods, a potential sign of lower consumer spending. In Asia, major benchmarks were mixed. The Shanghai Composite Index added 0.2%, while Hong Kong’s Hang Seng Index declined 0.6%. Japan’s Nikkei 225 edged up 0.1%. The Stoxx Europe 600 Index slipped, with retailers among the worst performers.

U.S. equities yesterday: The Dow ended slightly higher, giving up early gains and only managed to push back into positive territory just before the close. The Blue Chip index finished up 16.08 points, 0.05%, 32,915.78. The Nasdaq rose 48.64 points, 0.40%, at 12,061.37. The S&P 500 was up 12.89 points, 0.31%, at 4,121.43.

The 10-year Treasury yield shot back above 3%. The benchmark yield hit its highest level in nearly a month on Monday, as investors continue to try to account for the Federal Reserve's next moves. The Fed's next meeting — and 50-basis-point expected rate hike — is on June 14 and 15. Comments from central bank officials last week pointed toward a continued tightening of policy even as economic growth and inflation showed early signs of slowing.

Securities and Exchange Commission is preparing to propose major changes to how the stock market operates as soon as this fall, the Wall Street Journal reports (link). Among the ideas gaining traction: Requiring brokerage firms to send most individual investors’ orders to be routed into auctions where trading firms compete to execute them.

Agriculture markets yesterday:

- Corn: July corn rose 15 1/2 cents to $7.42 1/2, while December rose 12 1/2 cents to $7.02 1/2.

- Soy complex: July soybeans rose 1 1/2 cents to $16.99 1/4. July soymeal fell 80 cents to $407.10 per ton. July soyoil fell 66 points to 81.19 cents per pound.

- Wheat: July SRW wheat rose 53 cents to $10.93 and July HRW wheat rose 49 cents to $11.70, both near session highs. July spring wheat rose 38 3/4 cents $12.30 1/2.

- Cotton: July cotton dropped 44 points to 137.74 cents per pound.

- Cattle: August live cattle fell 95 cents to $132.90. August feeder cattle sank $1.90 to $171.975.

- Hogs: July lean hogs fell $1.775 to $108.975, the lowest closing price since May 31. The CME lean hog index rose $1.02 to $106.05 (as of June 2), the 11th gain in the past twelve days.

Ag markets today: The wheat market gave back a small portion of Monday’s strong gains overnight, while corn and soybeans traded mixed. As of 7:30 a.m. ET, winter wheat futures were trading mostly 6 to 9 cents lower, spring wheat was 2 to 4 cents lower, while corn and soybeans were narrowly mixed. Front-month U.S. crude oil futures were around 40 cents lower and the U.S. dollar index was around 250 points higher this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. trade deficit is expected to narrow to $89.4 billion in April from $109.8 billion one month earlier. (8:30 a.m. ET) UPDATE: The trade gap in the U.S. for April narrowed to $87.1 billion, shrinking more than economists had forecast, after reaching a record deficit the prior month.

• U.S. Treasury Secretary Janet Yellen appears before the Senate Finance Committee to discuss the White House's budget at 10 a.m. ET.

• Federal Reserve releases consumer credit data for April at 3 p.m. ET.

• World Bank’s Global Economic Prospects report is due today. OECD Economic Outlook, a twice-yearly analysis of major global economic trends and prospects for the next two years, is due Wednesday.

Some inflation reprieve. Three of the key supply-side factors driving today’s global inflation levels have turned around, meaning relief could be on the horizon for shoppers worldwide. Prices of semiconductors, shipping containers and fertilizer are all down — all good news for consumers in the long run when it comes to things like electronic goods and food.

PriceRelief

JPMorgan’s Kasman sees no recession as Dimon’s ‘hurricane’ ebbs. JPMorgan Chase & Co. Chief Economist Bruce Kasman says there’s little chance a U.S. recession is imminent — and for the moment, investors agree with him more than his boss. “There’s no real reason to be worried about a recession,” Kasman told Bloomberg Television’s Surveillance on Monday. “There is some slowing in the picture.”

Australia’s central bank announced a larger-than-expected interest rate increase. The Royal Bank of Australia raised a key interest rate range by 50 basis points. The bank lifted rates to 0.85%, when 0.75% had been expected. The head of the central bank has warned that rates could reach 2.5% before inflation is brought under control. Prices in Australia have not shot up as fast as in Europe or America, but the annual inflation rate of 5.1% in the first quarter of 2022 was still the highest in two decades. Jim Chalmers, the new treasurer, has said that the figure has risen “significantly higher” since then.

Surging home prices and mortgage rates cut housing affordability by 29% over the last year, as measured by the National Association of Realtors. It is the sharpest year-over-year decline in affordability on record.

Dubai is selling stakes in some of its most prized assets, including the port that helped transform the city into a global trade hub, to a Canadian fund as the emirate seeks to alleviate its debt burden. Link to details via Bloomberg.

Market perspectives:

• Outside markets: The U.S. dollar index was firmer in early trading. The yield on the 10-year U.S. Treasury note was fetching 3.02%. West Texas Intermediate crude fell 0.4% to $118.04 a barrel. Global benchmark Brent crude ticked down 0.3% to trade at $119.13 a barrel. Gold futures rose 0.4% to $1,851.80 an ounce.

• The yen fell to a 20-year low of nearly 133 against the dollar today. The sell-off was fueled by rising interest rates in America — and not by Japan’s, which look set to stay close to zero while inflation remains stubbornly low. Investors also worry that high fuel prices will increase Japan’s trade deficit. With monetary options limited, the yen’s fall may not have reached the bottom, some analysts note.

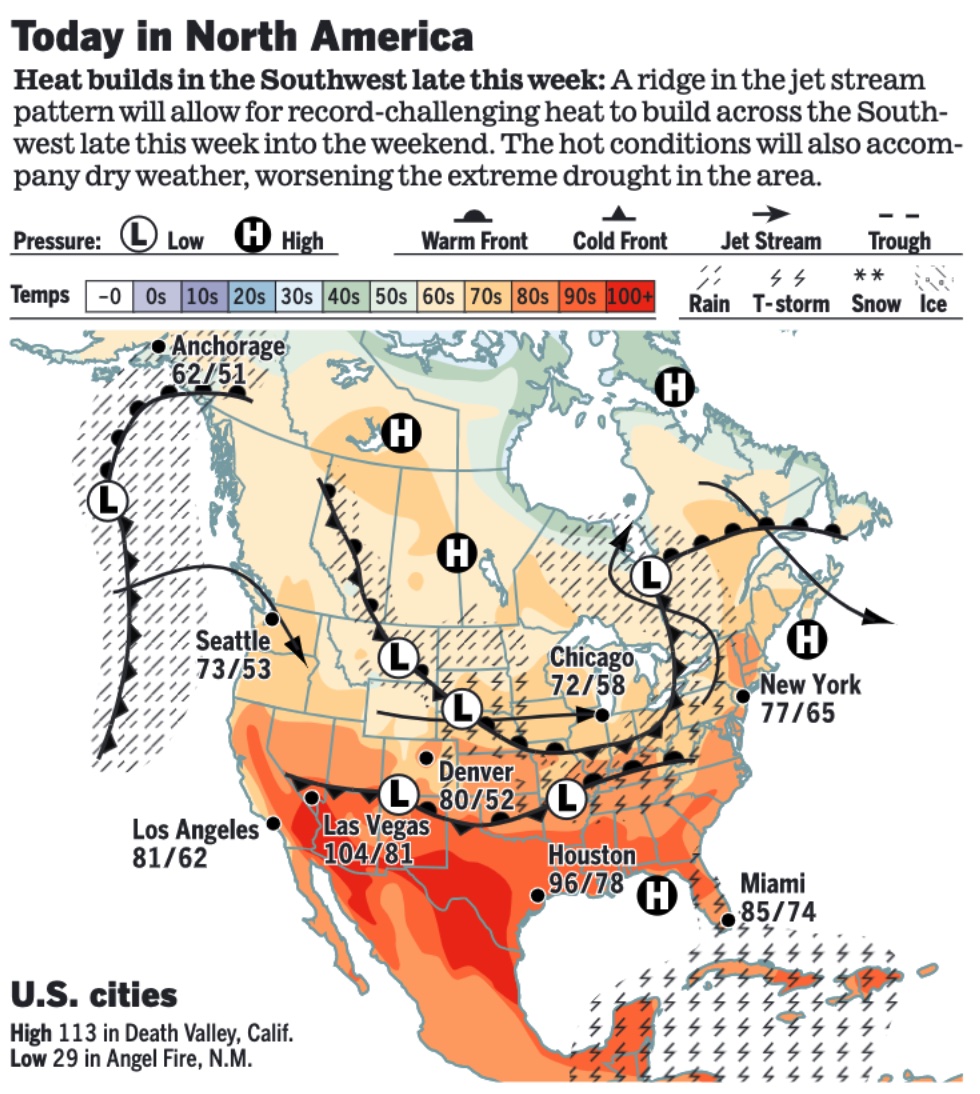

• Average national gas prices climbed to a record high of $4.91 per gallon on Monday, according to AAA — a 30-cent increase from the previous week and a $1.86 jump compared to the same point last year, when gas prices stood at just $3.05 per gallon. Areas in the Midwest saw some of the largest one-week gains, with prices rising by 45 cents per gallon in Michigan, 41 cents per gallon in Indiana, and 39 cents per gallon in Wisconsin. Ohio, Nebraska, Kentucky, Colorado, Minnesota, and Texas all saw one-week increases of more than 30 cents per gallon. California and Nevada continued to top the list of the most expensive markets, with gas costs rising to $6.34 per gallon in California and $5.49 in Nevada, according to AAA. Hawaii came in third at $5.47. The national average is expected to hit $5 a gallon within the next two weeks, according to Tom Kloza, global head of energy analysis for the OPIS, which tracks gas prices for AAA. The national average has been rising steadily for the past month, setting 27 records in the last 28 days. And in 10 states, plus Washington, DC, the average price is already at $5 or more.

• Why is gas so much more expensive now than just a few months ago? The price of crude oil is the most important factor in setting the price of a gallon of gas, but it’s far from the only one. Link for details via Forbes article.

• USDA details FY 2022 sugar marketing allotments, processor allocations. USDA published a notice in the Federal Register (link) on revisions to state cane sugar allotments, revising company allocations for sugarbeet and sugarcane processors, and reassigning some cane sugar marketing allotments to raw cane sugar imports already expected.

• Australia is facing a lettuce shortage that’s led to soaring prices and even spurred fast food giant KFC to put cabbage in its burgers.

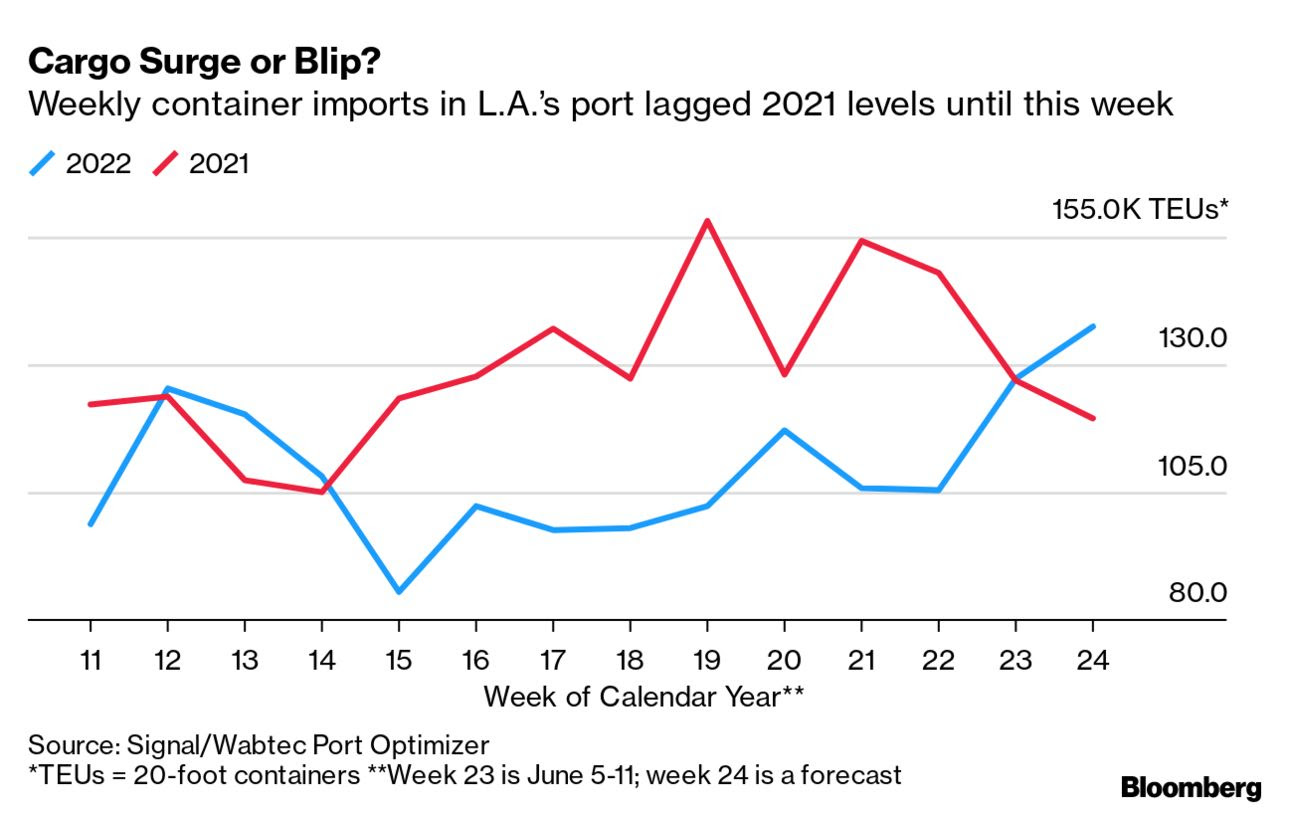

• For the first time in two months, the Port of Los Angeles expects inbound container volumes will exceed year-earlier levels. As of early Tuesday, LA’s Wabtec Port Optimizer shows 26 vessels with about 127,000 20-foot containers are scheduled to be offloaded this week, which is a 0.4% increase from the same week in 2021. Next week, the number increases to 27 ships loaded with 137,000 TEUs, up 15.1% from a year earlier.

At the neighboring Port of Long Beach, projections for incoming cargo are also on the rise. Some 25 container vessels are planning to arrive during the week of July 3, up from 15 expected in the next week, according to its latest forecasts. Long Beach’s weekly import volumes are projected to total about 424,000 TEUs from this week through early July, compared with 357,000 handled in June 2021.

• Ag trade: Japan is seeking 169,250 MT of milling wheat in its weekly tender.

• California considers water buyout. Democrats in the state Senate have proposed spending $1.5 billion to buy senior water rights from farmers in order to reduce demand for water and cope with long-running drought. The $1.5 billion would be enough to buy about 200,000-acre feet of water, based on an average price of $7,500 per acre foot, according to Tom Birmingham, general manager of Westlands Water District, the largest agricultural water district in the country. Link to details via AP.

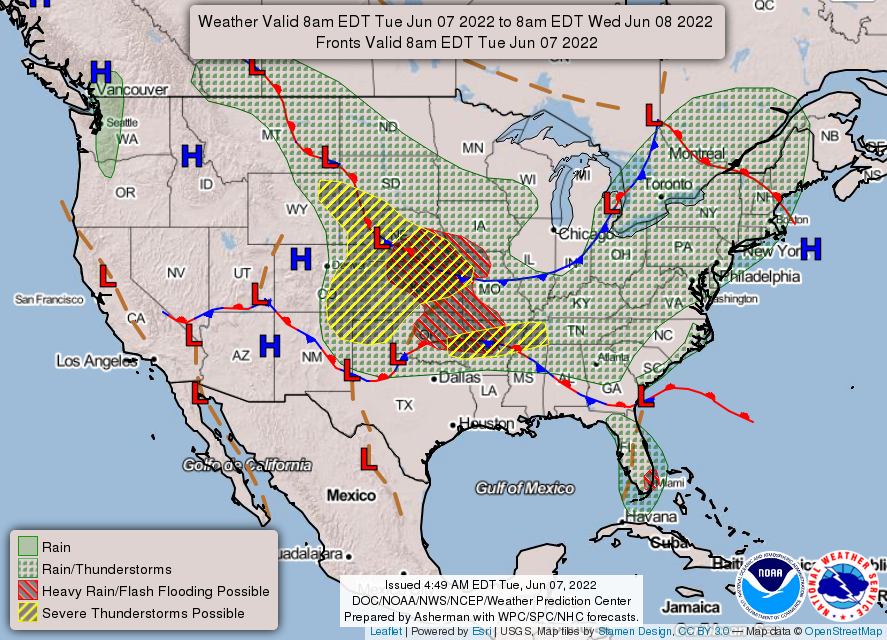

• NWS weather: There is an Enhanced Risk of severe thunderstorms over parts of the Central High Plains and a Slight Risk over parts of the Tennessee/Lower Mississippi Valleys through Wednesday morning... ...There is a Slight Risk of excessive rainfall over parts of the Central/Southern Plains and the Middle/Lower Mississippi Valley and a second area over parts of the southern tip of Florida Wednesday morning... ...Record high temperatures will be across portions of Texas.

Items in Pro Farmer's First Thing Today include:

• Wheat retreats a little overnight

• Russia says two Ukrainian ports ready to ship grain

• Above-average initial corn CCI rating

• Kazakhstan extends wheat export restrictions

• EU wheat crop increased

• Philippines reduces tariffs to tame inflation

• Big wholesale beef price gains, light movement

• Cash hog index again rises sharply

|

RUSSIA/UKRAINE |

— Summary: Ukraine retook parts of Severodonetsk amid brutal street fighting. Russia still holds the majority of Luhansk, however, as it pushes on in its goal to control the entire eastern Donbas region.

- U.S. Secretary of State Antony Blinken accused Russia of exporting hunger beyond Ukraine, pointing to its blockade of the country’s ports and vital grain exports. He claimed Moscow was blocking Ukrainian grain exports and hoarding its own domestic supply to generate backlash against Western sanctions. “The Kremlin needs to realize that it is exporting starvation and suffering well beyond Ukraine’s borders,” he said during a roundtable on food insecurity with business leaders and Agriculture Secretary Tom Vilsack. Blinken noted that African countries are “experiencing an outsized share of the pain.” Ukrainian President Volodymyr Zelenskyy has sought a corridor to export grains held up in Ukrainian ports. United Nations Secretary-General Antonio Guterres has held talks to try to free up the grain supply.

Meanwhile, EU foreign-policy chief Josep Borrell cast doubt on Russia’s claims that it isn’t hindering grain exports. Link for details via the WSJ. Also, speaking at the United Nations Security Council, European Council President Charles Michel slammed Russia's claims that Western sanctions are causing a global food crisis. “The EU has no sanctions on the agricultural sector — zero,” Michel said in a speech delivered in person at U.N. headquarters in New York. “And even our sanctions on the Russian transport sector do not go beyond our EU borders,” he continued. “They do not prevent Russian-flagged vessels from carrying grain, food or fertilizers to developing countries.” Instead, blame Moscow, Michel said. - Senegalese President Macky Sall, the current chairman of the African Union, on Friday when visiting Putin, addressed Putin as "my friend Vladimir." Sall said he received assurances that Russia will "facilitate the export of Ukrainian cereals." He also noted that Western sanctions on Russia has "worsened the situation" by making it harder to buy Russian wheat and fertilizers.

- Turkey and Russia have reached a tentative deal to restart shipments of Ukraine’s ag products from a key Black Sea port, but Kyiv remains skeptical of the proposed pact, according to people familiar with the discussions cited by Bloomberg. Turkish President Recep Tayyip Erdogan’s government has offered military help to clear mines off the coast of Odesa and escort grain ships but Ukraine has yet to endorse the plan, worried that removing defenses could leave the vital port open to Russian attack, the people said. Ukrainian President Volodymyr Zelenskyy said Kyiv wasn’t invited to talks on the deal set for Ankara this week.

Kremlin spokesman Dmitry Peskov said that Ukraine needed to demine approaches to ports so that the Russian military could clear ships to export grain. He also said that Russia is pledging not to use shipping corridors cleared with mines to launch an offensive against Ukraine, but that Russia continues to hear distrust from Ukraine. - Ukraine officials said they will only be able to export 2 million tonnes of grain per month if Russia will not lift its blockade of Ukrainian Black Sea ports. Taras Vysotskyi, first deputy minister of Agrarian Policy and Food, said the country has a limit of about 2 million tonnes per month versus 6 million tonnes per month before the Russian invasion. He also said it would take some six months to determine waters around Black Sea ports.

- Russia bans entry to 61 U.S. nationals, including Yellen. Russia banned entry to the country “indefinitely” to 61 U.S. officials and executives to retaliate for “constantly expanding sanctions” against its citizens, the Foreign Ministry said in a statement on its website. Treasury Secretary Janet Yellen and Energy Secretary Jennifer Granholm are on the list, along with several White House advisers and State Department officials.

|

POLICY UPDATE |

— EPA’s Regan again assures coming WOTUS regs will be ‘complementary’ to Supreme Court ruling. EPA Administrator Michael Regan said the new definition of Waters of the U.S. (WOTUS) that EPA is writing will be “complementary” to an expected ruling from the Supreme Court in a case covering the scope of the Clean Water Act relative to waters and wetlands connected to large navigable bodies of water. According to Bloomberg, the Supreme Court is expected to narrowly define what constitutes WOTUS in a case pending before it. EPA is preparing a rule with a new definition of what constitutes WOTUS and has held three out of 10 regional roundtables to gather stakeholder input. Regan said if the EPA held back waiting on the Supreme Court it would be even further behind on the regulation.

|

PERSONNEL |

— Reece Langley is resigning from the National Cotton Council due to personal health and well-being matters in his family that need his attention at this time. In an email, Langley wrote: “My time with NCC has been tremendous and I have greatly enjoyed working for and on behalf of the cotton industry and getting to partner with you all on many important activities and efforts. While I need to take this pause on the professional front at this time, I look forward to re-engaging with new opportunities at the appropriate time in the future.”

|

CHINA UPDATE |

— Much of Beijing lifted restrictions on dining in restaurants and many workers returned to their offices. But new flare-ups of Covid-19 clusters around the country and fresh lockdowns in parts of Shanghai continued to pose major risks for China’s economy. Also, some China watchers report that full resumption of economic life in Shanghai won’t happen for at least two more weeks — and that’s provided Covid doesn’t make a comeback.

— China is offering free Covid vaccine insurance packages to encourage skeptics to get vaccinated.

— China’s unemployment woes see Yunnan offer big cash subsidies to entice college graduates to rural villages. 50,000 yuan (US$7,500) annual living bonus is equal to multiple months’ salary for many workers in the southwestern province of Yunnan. Subsidy plan is in line with the central government’s demand that local cadres help find people find work amid record unemployment levels. Link to details via the South China Morning Post.

|

TRADE POLICY |

— U.S. tariffs on China still under contentious review. The Labor Advisory Committee urged Biden to extend former President Trump's China tariffs on approximately $300 billion worth of Chinese goods. Commerce Secretary Gina Raimondo said that it "may make sense" to lift some of Trump's China tariffs and mentioned specific products — like bicycles — that could be exempted. Raimondo is joined by other Biden officials, like Treasury Secretary Janet Yellen, in arguing that removing some tariffs could ease the pain for Americans fed up with high prices. But others, like U.S. Trade Representative Katherine Tai, argue that the U.S. should take a more strategic approach to the tariffs — both to protect American workers and to maintain leverage over China.

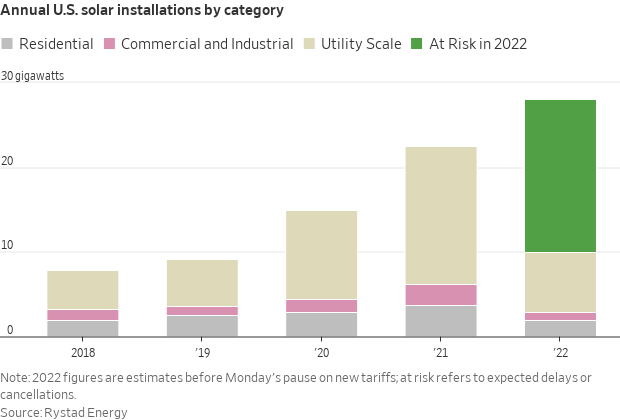

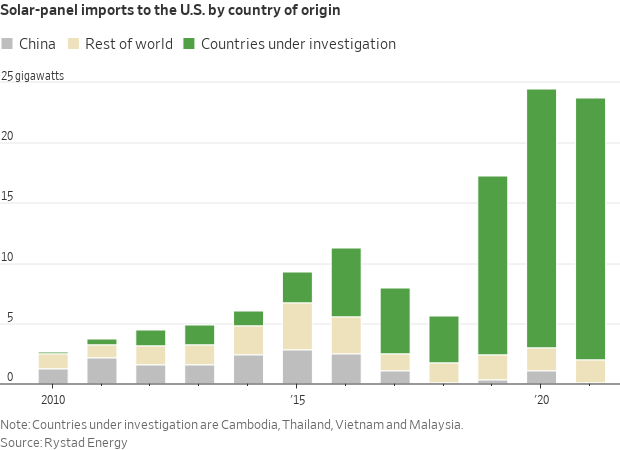

The Commerce Department is investigating whether Chinese solar producers are illegally circumventing tariffs by routing operations through the four Southeast Asian countries. The investigation had led importers to halt shipments, putting in jeopardy more than half of the 27 gigawatts of new solar-power capacity developers had been expected to install this year, according to the energy consulting firm Rystad Energy.

— Pacific trade group meeting planned. The U.S. is working toward a formal gathering of members of the administration’s new economic initiative in Asia by the summer, according to U.S. Trade Representative Katherine Tai.

|

ENERGY & CLIMATE CHANGE |

— As expected, the Biden administration is granting a two-year tariff exemption on solar panels produced in Southeast Asia and invoking the Defense Production Act to jumpstart American manufacturing of panels at a time when the sector has been paralyzed due to a government investigation. Citing the prospect of electricity shortfalls, Biden authorized solar parts from Cambodia, Thailand, Vietnam and Malaysia to be imported duty-free for two years. That action ended, at least temporarily, the prospect that tariffs could be levied retroactively on those imports following a Commerce Department investigation. The New York Times says (link) the move “is a victory for domestic solar installers” but “goes against the wishes of some American solar manufacturers and their defenders, who have been pushing the administration to erect tougher barriers on cheap imports to help revive the domestic industry.” The NYT says it is the “latest example” of the president “being caught between competing impulses when it comes to trying to steer” the U.S. away from fossil fuels.

|

CORONAVIRUS UPDATE |

— Summary:

- Global cases at 532,442,617 with 6,300,262 deaths.

- U.S. case count is at 84,882,287 with 1,008,857 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 589,231,370 doses administered, 221,506,997 have been fully vaccinated, or 67.23% of the U.S. population.

— FDA panel to consider approving 4th Covid-19 vaccine from Novavax. A federal vaccine advisory committee will meet today to decide whether Americans could soon get a fourth Covid-19 vaccine option. Development of the vaccine from Novavax, a Maryland-based company, was started at the same time as others in 2020, but the company struggled to produce its shot in large quantities.

|

POLITICS & ELECTIONS |

— U.K. Prime Minister Boris Johnson survived a confidence vote by members of his own party — but his margin of victory was lower than supporters expected. Johnson won by 211 votes to 148 in a secret ballot on Monday. It means almost half of his own parliamentary party failed to back him, three years after he led the Conservative Party to a landslide victory in the last general election. With a comfortable majority in Parliament, the party is in no danger of losing power. Johnson may attempt to ride out the storm by claiming that he got a larger mandate than when he was first elected leader of the party in July 2019.

— Federal judge blocks Louisiana congressional map. A federal court in Louisiana blocked the state’s congressional map and ordered the state legislature to draw a new map by June 20. U.S. District Judge Shelly Dick ruled that the state should have an additional majority-Black congressional district. If the ruling is upheld, it would likely net Democrats an additional seat in the House of Representatives. Democratic Gov. John Bel Edwards said Monday that he will call the Legislature into special session soon to draw new boundaries.

— Primary elections in seven U.S. states today will set the stage for U.S. House and Senate races this fall. Some races to monitor:

- California: In the state’s congressional primaries, the top two finishers advance to the mid-terms regardless of party affiliation. A slew of retirements and redistricting has left eight competitive seats across the state, an unusually high number. In a heavily Democratic district in the state’s Central Valley farm belt, Republican U.S. Rep. David Valadao is seeing pushback for his vote to impeach Trump over the Jan. 6 U.S. Capitol riot. Republican Chris Mathys has made Valadao’s vote a centerpiece in his campaign to oust him. High California gas prices are rattling Democrats, especially ahead of eventual Nov. 8 midterms. Meanwhile, San Francisco voters are considering whether to recall District Attorney Chesa Boudin, a progressive Democrat who critics say has failed to prosecute repeat offenders, amid widespread frustration with crime and homelessness. Of note: 40% is the share of prosecutors in San Francisco’s district attorney’s office who quit or were sacked in the 22 months after Boudin took office. In Los Angeles, voters will select its candidates for the mayoral race. The pair most likely to advance are Karen Bass, a progressive Democratic congresswoman, and Rick Caruso, a billionaire former Republican who wants to crack down on crime and homelessness. Caruso has put more than $34 million of his own money into the campaign.

- Iowa: Several Democrats are jockeying for the chance to take on seven-term Republican Sen. Chuck Grassley, with the campaign showcasing the breach between the Democratic Party’s progressive and establishment wings. Retired Navy Vice Adm. Michael Franken is waging a competitive contest with former U.S. Rep. Abby Finkenauer in a bid to take on the 88-year-old Grassley, who has been endorsed by former President Donald Trump. Meanwhile, three Republicans are competing for a chance to run against Iowa’s lone Democratic member of Congress, Rep. Cindy Axne.

- Mississippi: Republican U.S. Rep. Steven Palazzo is facing a large field of challengers after a congressional ethics watchdog raised questions about his campaign spending.

- Montana: Former Trump Interior Secretary Ryan Zinke is seeking the GOP nomination in a newly created House district in Montana. His opponents are drawing attention to Zinke’s troubled tenure at the agency, which was marked by multiple ethics investigations. Three Democrats are vying for their party’s nomination: public health advocate Cora Neumann, Olympic rower and attorney Monica Tranel and former state Rep. Tom Winter.

- New Jersey: A dozen House districts are on the ballot.

- New Mexico: Five Republican candidates are competing to take on Democratic Gov. Michelle Lujan Grisham. The incumbent is favored to keep her job in a state where Democrats control every statewide office and dominate the Legislature.

- South Dakota: Gov. Kristi Noem, considered a potential White House prospect, is favored to win the GOP nomination. U.S. GOP Sen. John Thune has no well-known challenger. One of his opponents, Mark Mowry, was among the crowd that demonstrated near the Capitol on Jan. 6. In the House, Republican state lawmaker Taffy Howard is trying to unseat GOP Rep. Dusty Johnson in the state’s lone district. Johnson touts his conservative voting record while keeping an ability to work across party lines, but, according to the Associated Press, Howard has tried to paint him as a foot soldier for House Speaker Nancy Pelosi.

— Five members of the far-right group the Proud Boys were indicted on charges of seditious conspiracy for their role in the attack on the U.S. Capitol on Jan. 6, 2021.

|

CONGRESS |

— GOP and gun control talks. Leading Republican senators involved in gun talks on Capitol Hill have signaled that it's unlikely Congress will raise the age requirement for purchasing semi-automatic firearms from 18 to 21, instead saying they are looking at changing the criminal background check system. Meanwhile, centrist Sen. Joe Manchin (D-W.Va.) voiced his support for raising the age to 21 for purchasing semi-automatic weapons and questioned why individuals need to own high-powered AR-15-style guns. White House Press Secretary Karine Jean-Pierre on Monday insisted President Biden “views any legislation Congress might pass to address gun violence as better than no legislation.” Jean-Pierre said that Biden is “always going to call for more,” but “we want to see action.”

— House to vote on PPP fraud, Covid bankruptcy relief bills. The House is scheduled to vote today on two bills related to Paycheck Protection Program (PPP) fraud and Covid bankruptcy relief:

- Federal prosecutors would have up to 10 years to file fraud charges against recipients of any loan under the PPP, including those issued by financial technology companies, under HR 7352. The House Small Business Committee approved the bill by voice vote on May 11.

- Bankruptcy relief for small businesses enacted during the Covid-19 pandemic would be extended for two years under S 3823, which would also allow additional individuals to qualify for debt repayment proceedings. The Senate passed the bill by unanimous consent on April 7.

— GOP lawmakers argue for preemption re: pesticide-label law. The senior Republicans on the House and Senate Agriculture committees said federal pesticide-label law preempts a California state law calling for a cancer warning on glyphosate, a key issue in lawsuits against the most widely used weedkiller on earth. Link for details.

|

OTHER ITEMS OF NOTE |

— In a blow to President Biden, Andrés Manuel López Obrador, the Mexican president, said he would not attend the Summit of the Americas after learning that Cuban, Venezuelan and Nicaraguan leaders had not been invited. Biden plans to announce a new economic framework for Latin America on Wednesday, focusing on climate change, worker’s rights and supply chains, an administration official said. Biden will outline his “Americas Partnership for Economic Prosperity” plan. The economic pact will initially be offered to a handful of countries with which the U.S. already has free trade agreements. Several countries in the hemisphere, such as Ecuador and Uruguay, have expressed frustration that Biden has been unwilling to negotiate such agreements. Biden also plans to unveil his "Los Angeles Declaration" on migration, which will include countries like Canada and Spain agreeing to accept more migrants.

— Elon Musk threatened to pull out of his $44 billion deal to buy Twitter, accusing the company of withholding data about spam accounts. Twitter reiterated that it will hold Elon Musk accountable to the terms of his proposed $44 billion takeover offer. Last month, Musk said he wouldn’t proceed with his offer unless the social media giant can prove bots make up fewer than 5% of its users, as the company has stated in public filings. Musk estimated that fake accounts make up at least 20% of all users. Meanwhile, Texas’ Republican attorney general, Ken Paxton, is investigating whether Twitter has misled users by underreporting the number of bots on its platform. He announced the investigation yesterday.

— Thousands of workers in the United Kingdom are testing out a four-day workweek as part of a new pilot program. The trial includes more than 3,300 workers in 70 companies and organizations in sectors ranging from financial services to health care, retail and even a fish and chip shop. The workers "are receiving (100%) of the pay for (80%) of the time, in exchange for a commitment to maintain at least (100%) productivity," according to the pilot program’s site. It will include workshops and other training for participants, in addition to "wellbeing and productivity assessment."