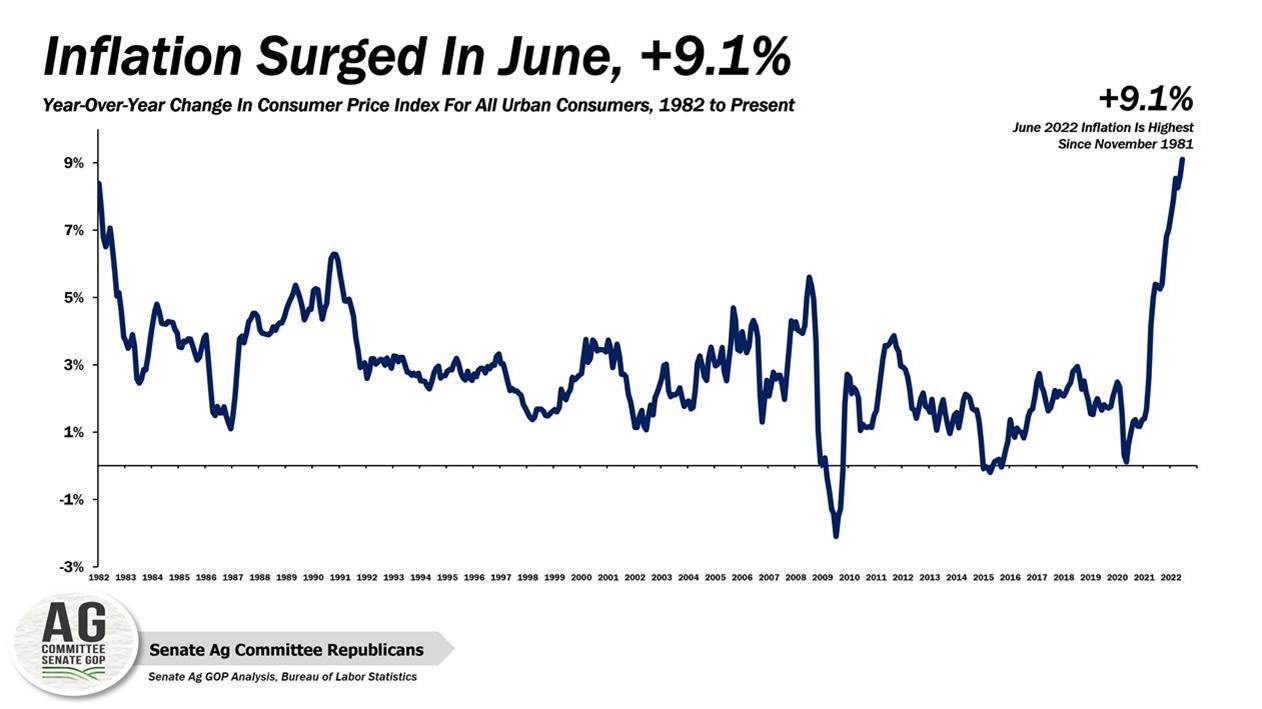

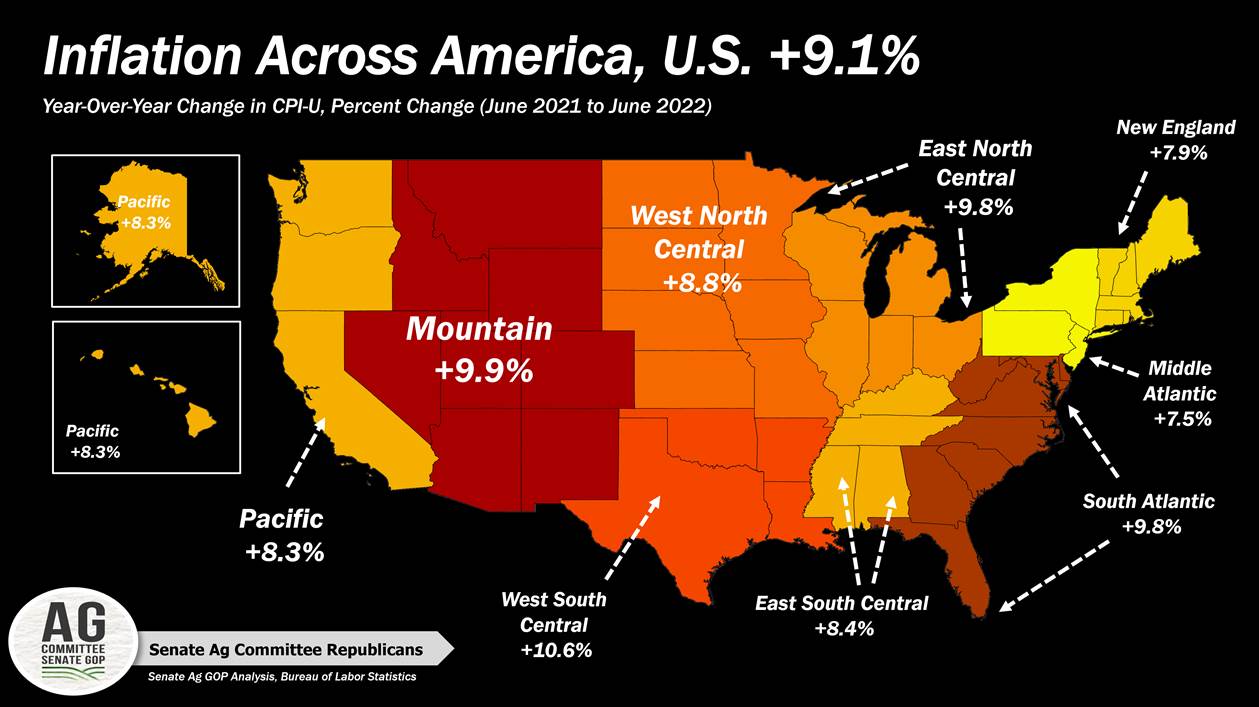

Inflation in June Soared 9.1% Higher Vs Last Year on Rising Gas Prices

Russian, Ukrainian militaries again set to discuss grain exports amid murky outlook

|

In Today’s Digital Newspaper |

Prices soared 9.1% in June compared to a year ago, a new peak with inflation the highest since 1981. The newest inflation report, released this morning by the Bureau of Labor Statistics, showed June prices rose 1.3% compared to the month before. Details below.

Russian, Ukrainian militaries set to discuss grain exports. Military officials from Russia and Ukraine were set to hold their governments' first face-to-face talks in months Wednesday during a session in Istanbul devoted to a United Nations plan to export blocked Ukrainian grain to world markets through the Black Sea. U.N. Secretary-General Antonio Guterres said yesterday that there was “still a way to go” on talks. Among a number of concerns, Russian officials have demanded the right to search ships bound for Ukrainian ports while Ukraine has been wary of de-mining its waterways for fear of weakening its defenses. Also, the Ukrainian foreign minister says grain exports from his country's ports won't resume without security guarantees for ship owners, cargo owners and Ukraine as an independent nation. More in Russia/Ukraine section.

President Biden and Mexican President Andrés Manuel López Obrador met Tuesday and discussed a surge in illegal border crossings and growing differences on energy, trade and the extradition of WikiLeaks co-founder Julian Assange to the U.S.

Oil prices on Tuesday fell below $100 as signs of a global economic slowdown increase. U.S. benchmark prices were higher today, after plunging about 8% yesterday on concerns about the economic outlook for China, the world’s leading oil importer. Meanwhile, the euro was slightly higher against the U.S. dollar today after slipping to near parity yesterday for the first time in nearly 20 years.

The White House is considering some last-ditch efforts to bring Sen. Joe Manchin (D-W.Va) on board with Democrats' reconciliation package, including potentially approving new oil drilling in Alaska and the Gulf of Mexico and greenlighting a pipeline in West Virginia, according to four administration officials. White House aides are unsure whether approving the projects would bring Manchin into agreement with the climate package, the officials said. Link for details via the Washington Post

The IMF on Tuesday again cut its growth forecast for the U.S. to 2.3% for 2022 from 2.9% in late June.

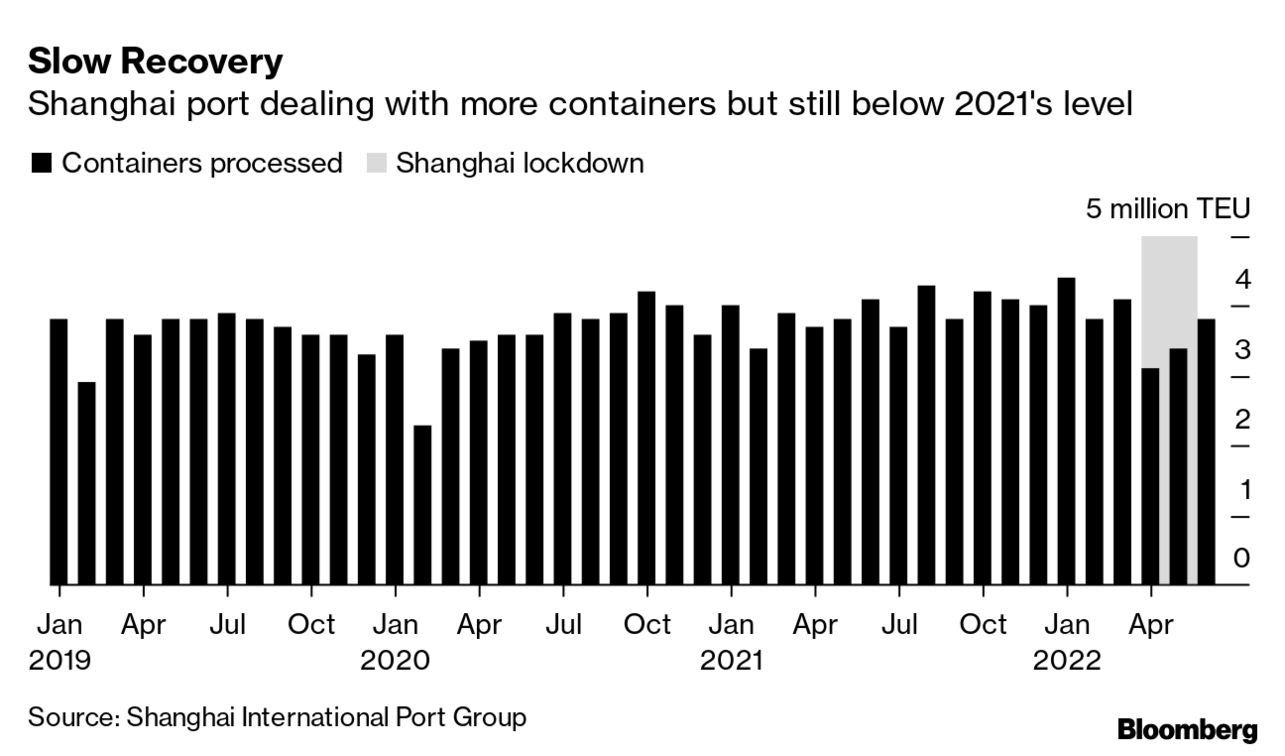

The price of sending a 40-foot container from Shanghai to Los Angeles was $7,566 last week, about 39% lower than the peak of more than $12,000 last September.

USDA releases info on 2023 expanded double crop insurance availabilities. Details in Policy section.

China Update: Its exports grew more than expected in June; soybean imports slowed in June; meat imports inch higher.

Biden administration is weighing a plan to make a second Covid-19 booster available to all adults, the Washington Post reported.

Sri Lanka’s president, who fled the country on a military aircraft today, appointed Prime Minister Ranil Wickremesinghe as the country’s acting leader, the speaker of parliament said, as protesters breached the prime minister’s office and the island was placed under a state of emergency.

|

MARKET FOCUS |

Equities today: Global stock markets were mixed overnight. The U.S. Dow opened nearly 400 points lower after a hotter-than-expected inflation report (see details below), but are currently down 270 points in volatile trading. European stocks halved losses throughout the morning. In Asia, Japan +0.5%. Hong Kong -0.2%. China -0.1%. India -0.7%. In Europe, at midday, London -0.7%. Paris -0.6%. Frankfurt -0.9%. Delta Air Lines offered the first taste of how carriers are doing while fares surge and cancellations jump amid overwhelming travel demand and staffing shortages. Delta posted revenue that beat Wall Street’s expectations, and it said it expected both sales and costs to grow in the third quarter. Rivals United Airlines and American Airlines are slated to report quarterly results next week.

U.S. equities yesterday: A late sell off pushed all three indices lower into the close. The Dow fell 192.51 points, 0.62%, at 30,981.33. The Nasdaq was down 107.87 points, 0.95%, at 11,264.73. The S&P 500 lost 35.63 points, 0.92%, at 3,818.80.

Agriculture markets yesterday:

- Corn: July corn futures fell 48 1/2 cents at $7.32 3/4. December corn futures closed down 42 1/2 cents at $5.86 1/2. Prices closed near their session lows.

- Soy complex: November soybeans closed down 62 cents at $13.43. September Soybean meal $4.20 lower, closing at $400.9. September bean oil down $3.49 at $58.57

- Wheat: September SRW futures closed 42 1/4 cents lower at $8.14 1/4. September HRW down 47.50 at $8.67 ¾. September spring wheat futures tumbled 45 cents to settle at $9.18 3/4.

- Cotton: December cotton closed down the 400-point daily limit at 90.84 cents. The daily limit will expand to 500 points on Wednesday.

- Cattle: Live cattle futures advanced broadly Tuesday, with nearby August climbing 52.5 cents to $136.675. Diving grain prices sent feeder prices soaring; August feeder futures rocketed $4.70 higher to close at $179.575.

- Hogs: Nearby hogs rose moderately Tuesday, while the deferred contracts declined. Expiring July futures gained 45 cents to $113.60, while most-active August rose 62.5 cents to $109.00.

Ag markets today: Two-sided trade was seen in the grain and soy markets overnight, with corn and wheat firmer this morning while soybeans were modestly weaker. As of 7:30 a.m. ET, corn futures were trading 3 to 5 cents higher, soybeans were mostly 2 to 4 cents lower and wheat futures were 9 to 15 cents higher. Front-month U.S. crude oil futures were around 50 cents higher and the U.S. dollar index was just below unchanged this morning.

Technical viewpoints from Jim Wyckoff:

On tap today:

• U.S. Consumer Price Index for June is expected to rise 1.1% from one month earlier and 8.8% from one year earlier. Excluding food and energy, the CPI is forecast to increase 0.5% and 5.7%. UPDATE: See item below.

• Bank of Canada announces a rate decision at 10 a.m. ET.

• U.S. federal budget deficit is expected to narrow to $62.5 billion in June from $174 billion one year earlier. (2 p.m. ET)

• Federal Reserve's Beige Book is due out at 2 p.m. ET.

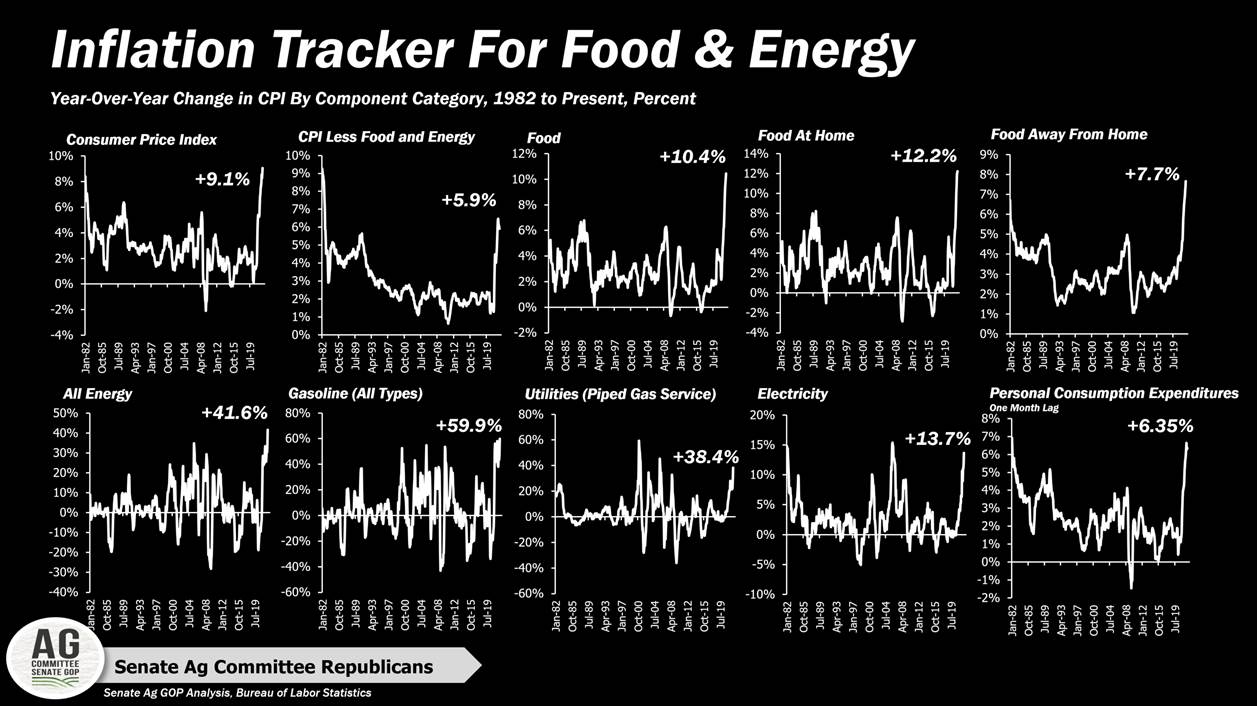

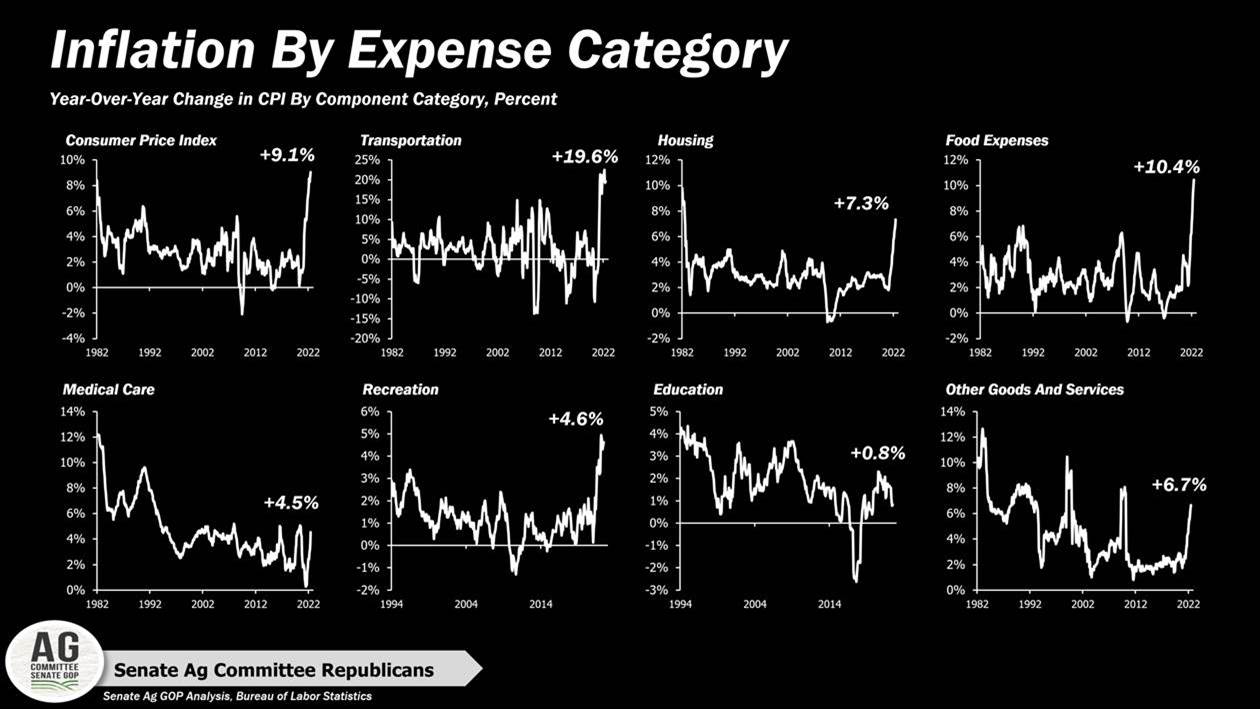

Inflation surged 9.1% in June, spiking to its highest level since November 1981 as Americans faced record gas prices, soaring rents and abnormally high grocery bills. On a monthly basis, the Consumer Price Index, a closely watched inflation gauge that measures what consumers paid for goods and services, rose 1.3% from May to June. The core CPI, or the price of goods excluding volatile food and energy costs, was 5.9% on an annualized basis. The core index climbed 0.7% in June from May. That is a pickup from 0.6% the previous month.

Prices were up broadly across the economy, with gasoline far outpacing other categories with an 11.2% gain over the prior month. The national average cost of a gallon of unleaded gas peaked at about $5 last month. The national average for a gallon of gasoline on Wednesday was $4.63, more than two cents below Tuesday’s price, according to the AAA motor club. Gasoline has fallen 17 cents over the last week and 37 cents over the last month. The price is still well below the $3.15 motorist paid a year ago.

Month over month, the pace of food price increases slowed slightly, to a growth of 1.0% in June, down from 1.2% the previous month. The data showed broad price increases across most categories of food, with especially sharp increases in butter, sugar, sweets and flour. One area where we did see relief was in prices of beef, pork, poultry, fish and eggs, which have driven rising grocery bills this year but fell from the previous month in May.

Market impact: The two-year Treasury yield, which is closely tied to expectations for interest rate increases from the Federal Reserve, shot higher after the inflation data was released, rising 0.12 percentage points to 3.14%. The information cements expectations the Federal Reserve will deliver another large interest rate increase this month. Now 41.6% odds for 1% hike by Fed; 58.4% odds of 75 basis points.

The International Monetary Fund on Tuesday again cut its growth forecast for the United States to 2.3% for 2022 from 2.9% in late June, with officials citing recent downward revisions to first quarter U.S. GDP output and consumer spending growth. The IMF included the new forecasts in the full report of its annual assessment of the U.S. economy, which highlighted the challenges of high inflation and the steep Federal Reserve interest rate hikes needed to control prices.

Economic growth in Britain rebounded in May, after two consecutive months of decline. GDP increased by 0.5% over the previous month, higher than most forecasts. Growth was driven by increased construction activity and a boom in the health-services sector. Businesses reported higher fuel and electricity costs were forcing them to increase prices.

Number of U.S. workplaces where employees have started trying to organize unions jumped this year to the highest level in half a dozen years, a rise that reflects warming public attitudes toward unions amid a strong labor market. In the first half of the year, workers at 1,411 U.S. workplaces filed petitions with the National Labor Relations Board, the first step in joining a union, according to a Wall Street Journal analysis of federal data. That represents a 69% increase from the same period in 2021 and the most of any year since 2015. The union push comes as public opinion about organized labor is the most positive in decades. A Gallup poll last year found that 68% of Americans approve of unions, the highest share since 1965.

The price of sending a 40-foot container from Shanghai to Los Angeles was $7,566 last week, about 39% lower than the peak of more than $12,000 last September. Those costs rose a little during the lockdowns in Shanghai and elsewhere but then resumed their declines again as port capacity rebounded. China’s top 10 ports processed a record 17.8 million containers in May.

Market perspectives:

• Outside markets: The U.S. dollar index is down after hitting after hitting a 20-year high Tuesday. The yield on the 10-year U.S. Treasury note is fetching 2.972%. Oil prices rose $1 per barrel, rebounding from Tuesday's plunge — ICE Brent settled more than 7% lower Tuesday, which left it to close below $100/bbl for the first time since April. Gold was around $1,728 per troy ounce and silver around $18.95 per troy ounce.

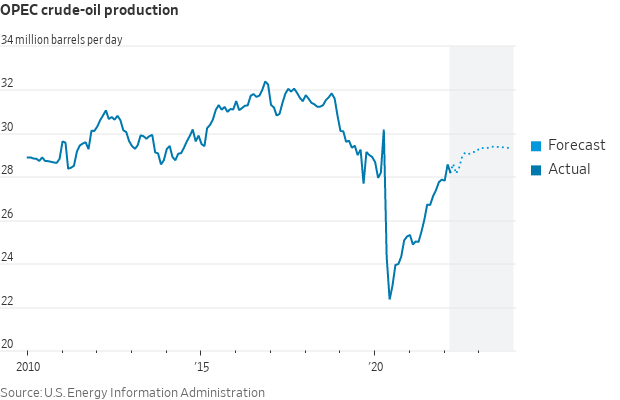

• Oil production from the Organization of the Petroleum Exporting Countries continued to lag behind targets in June, raising fresh concerns about whether the cartel is capable of easing the worst supply crisis in decades.

• OPEC released its latest monthly market report yesterday, which included its first forecasts for 2023. OPEC forecasts that oil demand will grow by 2.7MMbbls/d, partly supported by a recovery in Chinese demand following Covid lockdowns this year. However, the group expects that non-OPEC oil supply will grow by 1.7MMbbls/d. To balance the global market next year, OPEC would need to produce on average 30.1MMbbls/d, which is around 1.4MMbbls/d above where the group is currently producing. Given that OPEC has struggled to hit their production target for months, it will likely be a struggle for group to hit this production level, which suggests that the tightness in the global oil market will persist through 2023, according to ING Economics.

• The EIA also released its latest Short Term Energy Outlook yesterday, in which US crude oil production in 2022 is expected to average 11.91MMbbls/d, up 732Mbbls/d YoY. This is largely unchanged from previous forecasts. However, for 2023 the EIA expects that oil output will grow by 860Mbbls/d YoY to average 12.77MMbbls/d, which is below a previous forecast of 12.97MMbbls/d.

• AMLO boasts to Biden that gas is cheaper in Mexico: Mexican President Andrés Manuel López Obrador boasted to Biden that gas prices are cheaper in his country during a White House meeting Tuesday aimed at shoring up ties between the two countries after several disagreements. Fuel is more heavily subsidized by the government of Mexico.

• Bottle trash has become a hot commodity as companies try to make their goods and packaging more sustainable. The price of recycled polyethylene terephthalate, or PET, flake, which is usually made from old drink containers, is up around 35% in Europe since January, according to data from Independent Commodity Intelligence Services.

• Ag trade: Taiwan purchased 44,725 MT of U.S. milling wheat. South Korea purchased 68,000 MT of corn expected to be sourced from South America. Japan received no offers in its tender to buy 70,000 MT of feed wheat and 40,000 MT of feed barley.

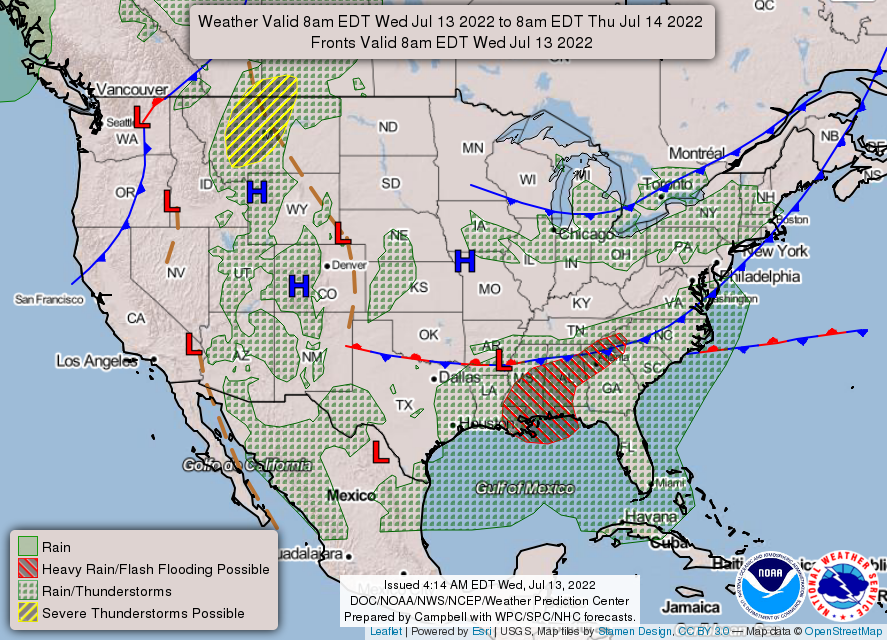

• NWS weather: There is a Slight Risk of excessive rainfall over parts of the Central Gulf Coast to The Southern Appalachians on Wednesday and expanding to the southern Mid-Atlantic Coast on Thursday... ...There is a Slight Risk of severe thunderstorms over parts of the Northern Rockies/High Plains through Thursday morning... ...Dangerous heat and humidity across parts of the South Plains to the Lower Mississippi Valley will continue as well as parts of the Northern High Plains and Great Basin.

Items in Pro Farmer's First Thing Today include:

• Corn and wheat higher, beans mildly weaker this morning

• China finalizes quarantine paperwork for Brazilian corn

• French wheat exports expected to reach three-year high

• Big day of beef trade

• Cash hog fundamentals remain firm

|

RUSSIA/UKRAINE |

— Summary: Ukrainian forces targeted an air-defense system deep inside Russian-occupied territory in the country’s east late Tuesday.

- Talks today on resuming Ukrainian grain exports. Military officials from Russia, Ukraine and Turkey will hold talks today in Istanbul with U.N. officials on resuming Ukrainian grain exports via the Black Sea port of Odesa. Reuters quoted diplomats as saying the effort focuses on Ukrainian vessels escorting grain ships in and out of port while Russia would agree to a truce while shipments are made. Turkey would have responsibility for inspecting ships to ease Russian concerns they are not being used to smuggle weapons. Others think Russia could still drag the talks out.

Ukrainian Foreign Minister Dmytro Kuleba, speaking to the Associated Press ahead of the talks, said any agreement needs to ensure Russia “will respect these corridors, they will not sneak into the harbor and attack ports or that they will not attack ports from the air with their missiles.” Kuleba also told the AP on Tuesday that Ukraine's military is “planning and preparing for full liberation” of Russian-occupied cities and towns near the country's Black Sea coast. Ukrainian forces already have stepped up their activity to retake territory in the south as Russia concentrates on eastern Ukraine. Asked about the likelihood of negotiations to end the war that started when Russia invaded neighboring Ukraine on Feb. 24, the foreign minister said peace talks were unlikely to happen soon. “Russia continues to be in the war mood, and they are not seeking negotiations in good faith. They are seeking a way to make us implement their ultimatums, which is not going to happen,“ Kuleba said.

|

POLICY UPDATE |

— USDA releases info on 2023 expanded double crop insurance availabilities. USDA announced the counties initially determined to be eligible for expanded double crop insurance opportunities for 2023 to plant sorghum or soybeans after winter wheat.

USDA’s Risk Management Agency (RMA) released the list of counties for the two crops, with a press release (link) noting at least 681 counties will have double crop coverage expanded to or streamlined for soybeans. Link to maps showing where the option for soybeans and sorghum will be available.

For sorghum, at least 870 counties will have expanded or streamlined coverage. Via written agreements, RMA said there will be maximum flexibility for producers to get coverage, but not require the coverage of both the spring and winter crops as is the case in permanent double-crop counties.

RMA will work with stakeholders to finalize details and requirements for getting insurance and will have all changes finalized prior to the Nov. 30 contract change date.

|

PERSONNEL |

— Senate this morning will vote on Michael Barr’s nomination for the Federal Reserve.

|

CHINA UPDATE |

— China says it used naval and air forces to “drive away” an American destroyer that sailed close to the disputed Paracel Islands in the South China Sea on Wednesday. The U.S. Navy claims that the USS Benfold was simply asserting navigational freedoms in line with international law. But China’s government accused America of provoking tensions by violating its territorial waters and followed the ship. Vietnam and Taiwan also claim the waters around the Paracels.

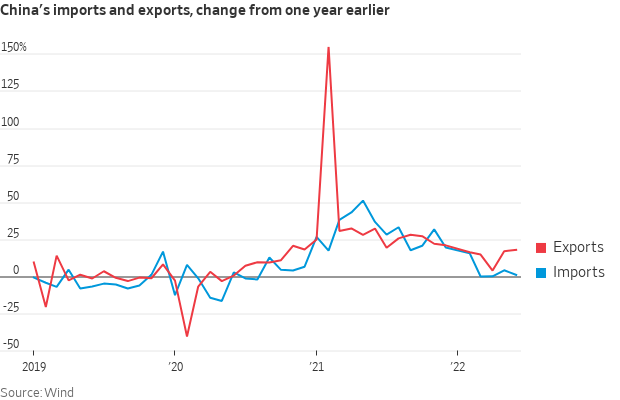

— China’s exports grew more than expected in June as Beijing eased Covid-19 restrictions to support economic growth. Outbound shipments increased 17.9% from a year earlier last month, up from May’s 16.9% expansion, the General Administration of Customs said. Imports rose 1% from a year earlier in June, lower than the 4.1% increase recorded in May. "We expect imports to grow faster and the export recovery to continue until the U.S. economy slows down," said Iris Pang, chief economist for Greater China at ING.

— China soybean imports slowed in June. China imported 8.3 MMT of soybeans in June, according to preliminary customs data, down 14.7% from May and 23% less than last year. don’t want to further build their inventories due to slackened demand from the country’s hog sector, which is saddled with poor production margins. Through the first half of 2022, Chinese soybean imports stood at 46.3 MMT, down 5.4% from the same period last year.

— China meat imports inch higher. China imported 603,000 MT of meat in June, up 1.5% from May but down nearly 19% from last year. Through the first six months of this year, China imported 3.5 MMT of meat, down 31.9% from the same period last year, driven by a sharp reduction in arrivals of pork.

|

TRADE POLICY |

— The nominee for chief agricultural negotiator at the Office of the United States Trade Representative, Doug McKalip, should support market access commitments for American farm exports, according to a letter (link) from Sens. Tim Scott (R-S.C.) and John Boozman (R-Ark.), as lawmakers on both sides of the aisle complain that the post remains unfilled amid supply chain issues, the war in Ukraine and food inflation.

|

ENERGY & CLIMATE CHANGE |

— Cheniere Energy Inc., a major liquefied natural gas supplier, and other companies are warning the Environmental Protection Agency that new limits on cancer-causing formaldehyde emissions could disrupt natural gas supply to Europe amid Russia's war in Ukraine. The gas turbines targeted for a Sept. 5 compliance deadline had been waived from some national emissions limits for nearly two decades, but the EPA lifted the exemption in March. Link for more via Bloomberg.

|

LIVESTOCK, FOOD & BEVERAGE INDUSTRY |

— Starbucks is planning to close at least 16 locations across various cities, citing safety concerns. "After careful consideration, we are closing some stores in locations that have experienced a high volume of challenging incidents that make it unsafe to continue to operate," a spokesperson told CNN. The stores are in Seattle; Los Angeles; Philadelphia; Washington, DC, and Portland, Oregon. They will be closed by the end of July.

— Pig-heart transplants. Two brain-dead individuals received genetically modified pig-heart transplants, part of growing efforts by scientists who want to improve tests on pig organs for pig viruses and gather data that could help launch clinical trials of animal-to-human organ transplants.

|

CORONAVIRUS UPDATE |

— Summary:

- Global Covid-19 cases at 557,824,287 with 6,356,015 deaths.

- U.S. case count is at 88,947,827 with 1,021,853 deaths.

- Johns Hopkins University Coronavirus Resource Center says there have been 597,655,035 vaccine doses administered and 222,455,652 have been fully vaccinated, or 67% of the total U.S. population.

— Biden administration is weighing a plan to make a second Covid-19 booster available to all adults, the Washington Post reported (link), as White House coronavirus experts urged everyone aged 5 and older to keep up with their Covid-19 vaccines and boosters amid a new surge of cases.

|

POLITICS & ELECTIONS |

— Britain’s next prime minister. Conservative MPs begin voting on Wednesday in their party’s leadership contest, the winner of which will replace Boris Johnson as Britain’s prime minister. The eight candidates will be whittled down to two for an election among the Tory party’s members. Early frontrunners include Rishi Sunak, a former finance minister, whose resignation last week triggered Johnson’s departure , and Liz Truss, the foreign secretary.

|

CONGRESS |

— Sen. Pat Leahy (D-Vt.) is recovering from hip replacement surgery. And Sen. Ben Ray Luján (D-N.M.), who will not be voting all week, is back home in New Mexico “dealing with a family matter,” according to a spokesperson. “He will be back in D.C. as normal next week,” the spokesperson added.

|

OTHER ITEMS OF NOTE |

— Police in Sri Lanka fired tear-gas at protesters in Colombo following the news that Ranil Wickremesinghe, the prime minister, was appointed interim president, after Gotabaya Rajapaksa fled to the Maldives on a military jet. The speaker of parliament issued a statement that Rajapaksa had contacted him and reiterated his promise to resign on Wednesday. Wickremesinghe declared a nationwide state of emergency. Parliament intends to choose a new president on July 20.