House Clears CR/Debt Suspension Bill but Faces Coming Defeat in Senate

How a House Ag hearing on blueberries turned into a black eye for Democrats

In Today’s Digital Newspaper

Market Focus:

• Fed focus on taper timing amid mixed economic signals

• Fed officials to release updated economic projections

• Construction of new homes in the U.S. picked up in August

• Seeing through the haze to hire

• FedEx Corp. cut its financial outlook as labor shortages caused expenses to soar

• OECD: Global growth delayed, not derailed

• Sometimes it feels like economy is running low on everything

• Treasury Dept. targets cryptocurrency’s role in ransomware attacks

• SEC Chairman Gensler likens stablecoins to "poker chips at the casino"

• Ida to join Katrina, Sandy, Harvey and Irma on list of five costliest hurricanes

• Ag demand update

• Corn, soybean, wheat gains overnight

• Chances for some significant rain in the U.S. Southern Plains next week

• Hurricane Ida made a thin input supply situation worse

• Fed focus is on taper timing amid mixed economic signals

• Argentine soybean sales percentage continues to run ahead of year-ago

• Big jump in rice production expected to push India’s summer grain crop to record

• Beef prices renew slide

• Strong pork movement Tuesday on modest price pullback

Policy Focus:

• House clears combined CR/debt limit suspension, but Senate GOP will defeat

• Update on traditional and human infrastructure (reconciliation) bills

• How a House Ag hearing on blueberries turned into black eye for Dems

• More explaining needed from Vilsack after Farm Bureau analysis re: stepped-up basis

Afghanistan:

• Taliban brought some outsiders into their new Afghan government, but no women

• Pentagon’s top officer met with his Russian counterpart in Helsinki re: terrorism

• Help for Afghan refugees

Biden Administration Personnel:

• Senate votes 49-48 to advance Rohit Chopra's nomination to lead CFPB

China Update:

• Russia and China agree to supply terms, which could simplify beef trade

• China to release fertilizer reserves

• China’s Evergrande says it can repay at least some of its debts

• WSJ analysis: Evergrande is the Chinese economy in miniature

• Secret Service, FBI & Defense Dept. bought surveillance drones from Chinese company

Trade Policy:

• U.K. PM Johnson hints trade deal with U.S. unlikely by 2024

Energy & Climate Change:

• Grassley: EPA to release proposed RFS marks Friday afternoon

• Biden pledges a lot more funding to help developing nations deal with climate change

• ConocoPhillips to become 2nd-largest oil & gas producer in Lower 48 U.S. states

• Energy Transfer LP wants help from Supreme Court

Livestock, Food & Beverage Industry Update:

• Biden’s DOJ: Ag market consolidation has hit ‘tipping point’

Coronavirus Update:

• China cracks down again

• Big vaccine purchase announcement

Politics & Elections:

• Trump campaign officials knew claims about voting machine company were bogus

• Race for Wyoming’s single U.S. House seat a battle of titans

Congress:

• Funding for county fairs wins House Ag Committee support

Other Items of Note:

• Highlights from the U.N. General Assembly

• Justice Dept. suing American Airlines and JetBlue

• Justice Dept.-led panel investigating Zoom’s nearly $15 billion deal

• L.A.’s water use up despite pleas/drought

MARKET FOCUS

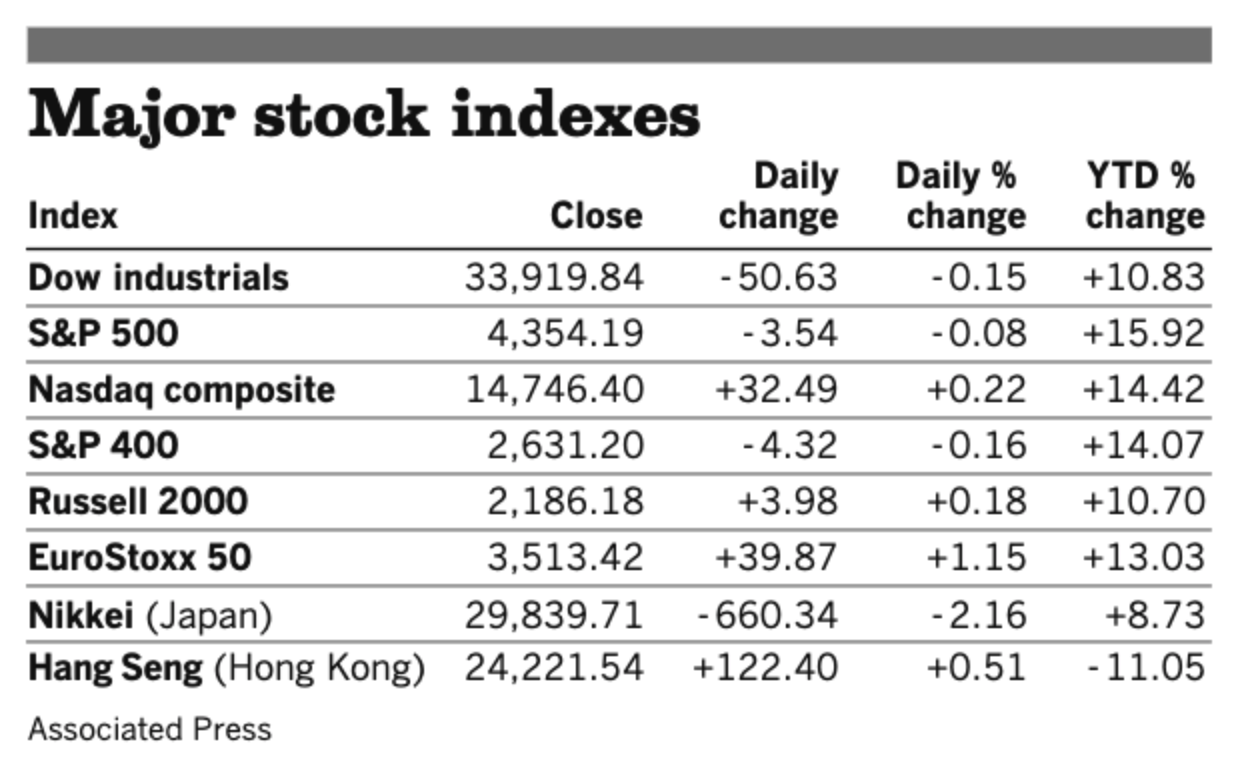

Equities today: Global stock markets were mixed in overnight trading. The U.S. Dow opened around 200 points higher. Asian equities finished mixed as traders continued to assess the Evergrande situation. The Nikkei fell 200.31 points, 0.67%, at 29,639.40. The Hang Seng Index gained 122.40 points, 0.51%, at 24,221.54. European equities remain higher in early trade action, with the Stoxx 600 up 0.7% and regional markets showing gains of 0.5% to 1.2%.

U.S. equities yesterday: The Dow closed down 50.63 points, 0.15%, at 33,919.84. The Nasdaq rose 32.49 points, 0.22%, at 14,746.40. The S&P 500 was down 3.54 points, 0.08%, at 4,354.19.

On tap today (see detailed list of events and reports below):

• U.S. existing-home sales are expected to fall to an annual pace of 5.87 million in August from 5.99 million a month earlier. (10 a.m. ET)

• Federal Reserve releases a policy statement and economic projections at 2 p.m. ET, and Chairman Jerome Powell holds a press conference at 2:30 p.m. ET. See related items below.

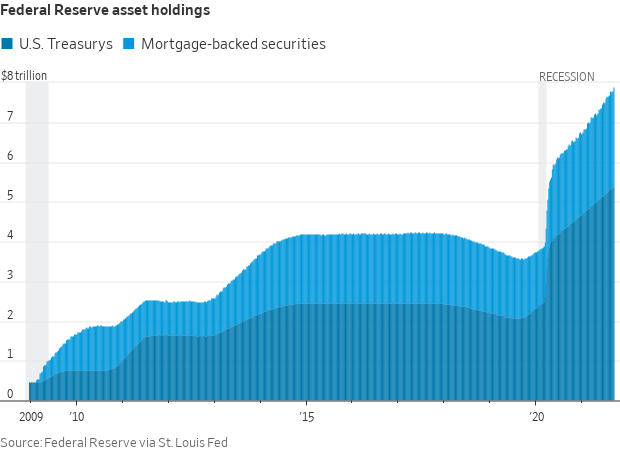

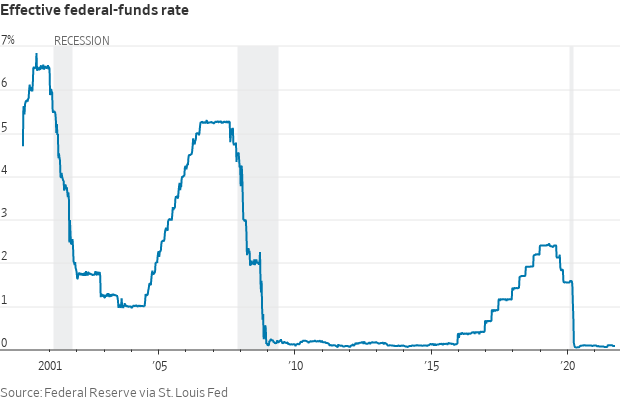

Fed focus is on taper timing amid mixed economic signals. The two-day meeting of the Federal Open Market Committee (FOMC) concludes this afternoon with attention mostly on signals from the U.S. central bank on timing of the expected tapering of their bond purchases that have been taking place at $120 billion per month.

Expectations are there will be more talk about the tapering, but it is not yet clear there will be a definitive agreement reached at the meeting nor a unified view on when reducing the bond purchases will begin. Expectations have been for a start to the taper later this year, something Fed Chairman Jerome Powell has alluded to without offering any specific timeline. The Fed has indicated the condition of “substantial further progress” has been met on price stability, but not yet on the Fed’s other goal of full employment. With the Delta variant rising, most agree it will not have the negative economic impacts like the initial stages of the pandemic. But the global rise of the Delta variant could exacerbate supply chain issues, ones that the Fed has said are a key factor in inflation running above expectations even as they view upward price pressures as temporary.

Attention will also be on the composition of the tapering relative to the monthly purchases of $80 billion in Treasuries and $40 billion in mortgage-backed securities.

Fed officials will also release their updated economic projections and those will be notable, particularly the infamous dot plot showing when Fed officials see the need for an increase in the target range for the Fed funds rate. In July, seven of 18 FOMC members expected that to be on tap sometime in 2022. Whether that expectation remains the same will be of note.

Powell will be tasked with explaining the Fed’s stance and views in his post-meeting presser, one that will include some attention on the Evergrande situation and whether the U.S. central bank sees a potential global impact.

Coming up… While this Fed meeting may not answer all the questions about Fed policy ahead, the session will set the stage for the November 2-3 meeting to be an even more important one.

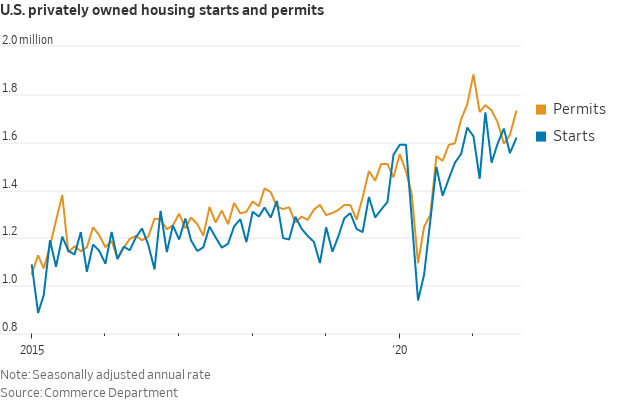

Construction of new homes in the U.S. picked up in August, a sign builders are working through rising costs for labor and materials while interest rates remain low and demand remains strong. Housing starts rose 3.9% to a seasonally adjusted annual rate of 1.615 million, led by a jump in multifamily construction.

Seeing through the haze to hire. “We’ve found that eliminating pre-employment testing for cannabis allows us to expand our applicant pool,” said Beth Galetti, the head of human resources at Amazon, which announced yesterday that it was lobbying the federal government to legalize marijuana.

FedEx Corp. cut its financial outlook as labor shortages caused expenses to soar in the latest quarter and shipping demand unexpectedly slowed due to supply-chain disruptions. The delivery giant on Tuesday posted an 11% drop in profit for the quarter ended Aug. 31 as the tight labor market added $450 million to costs, including increased overtime, higher wages to attract workers and extra spending on transportation.

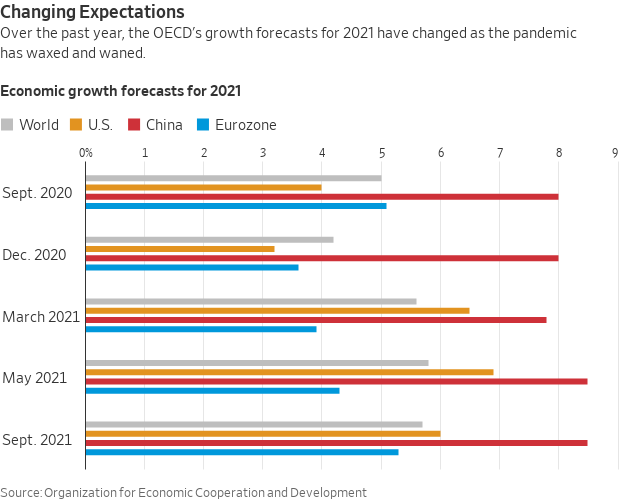

OECD: Global growth delayed, not derailed. The fast-spreading Delta variant of Covid-19 has slowed the pace of the global economic recovery but won’t derail it, according to new forecasts released by the Organization for Economic Cooperation and Development (OEC). In its latest quarterly report on the economic outlook, the Paris-based research body lowered its growth forecasts for the global and U.S. economies in 2021, the first downgrade since December of last year, when new infections were surging. But it also raised its forecasts for next year, indicating that some output has been delayed by, rather than lost to, the Delta surge.

Sometimes it feels like the economy is running low on everything. "The U.K. carbon dioxide shortage threatening industries from steel to food is spilling over into Europe, one of the world’s largest distributors of the gas has warned. Nippon Gases, which sold almost $1.5 billion of industrial gases on the continent last year, said 'other countries in Europe will also suffer shortages' of CO2, estimating that its supplies had fallen 50% across the region. Soaring natural gas prices have forced closures of fertilizer plants, the U.K.’s main source of CO2 used to make drinks fizzy, stun animals for slaughter and cool nuclear power plants," Harry Dempsey and Emiko Terazono write in the Financial Times (link/paywall).

Market perspectives:

• Outside markets: The U.S. dollar index was essentially steady ahead of US economic updates with an eye on the Fed meeting conclusion. The yield on the 10-year Treasury note was firmer, trading around 1.34% ahead of U.S. market action. Gold and silver futures were mixed, with gold lower and trading around $1,774 per troy ounce, while silver was higher, trading around $22.70 per troy ounce.

• Crude oil is posting gains ahead of U.S. gov’t inventory data due later this morning. US crude was trading around $71.50 per barrel while Brent was around $75.35 per barrel. Futures were higher in Asian trading, with U.S. crude up 54 cents at $71.03 per barrel and Brent up 43 cents at $74.78 per barrel.

• Treasury Dept. targets cryptocurrency’s role in ransomware attacks. As part of a series of actions to prevent cybercrime, the department placed sanctions on Suex, a crypto exchange based in Russia that it said facilitated payments in multiple attacks. The department said that more than 40% of the exchange's transactions can be linked to criminal actors. In 2020, ransomware payments topped $400 million, four times larger than the year before, according to officials. Meanwhile, appearing at a Washington Post event, Securities and Exchange Commission Chairman Gary Gensler likened stablecoins to "poker chips at the casino" and noted that without stronger oversight "people get hurt." Gensler said that the SEC has "robust authorities" to regulate the cryptocurrency sector and said that the agency will use them.

• Ag demand: Morocco’s state grains office received no offers in a tender to import around 363,000 MT of U.S. origins soft wheat as part of its reduced-tariff import quota tender. An importer group in the Philippines tendered to buy an estimated 224,000 MT of animal feed wheat. Pakistan issued an international tender to buy and import 640,000 MT of wheat. Bangladesh’s state grains buyer issued an international tender to buy 50,000 MT of rice. Jordan made no purchase in its tender to buy 120,000 MT of wheat. Egypt’s state grain buyer tendered to buy 30,000 MT of soyoil.

• Ida is poised to join Katrina, Sandy, Harvey and Irma on the list of the five costliest hurricanes as measured by insured losses.

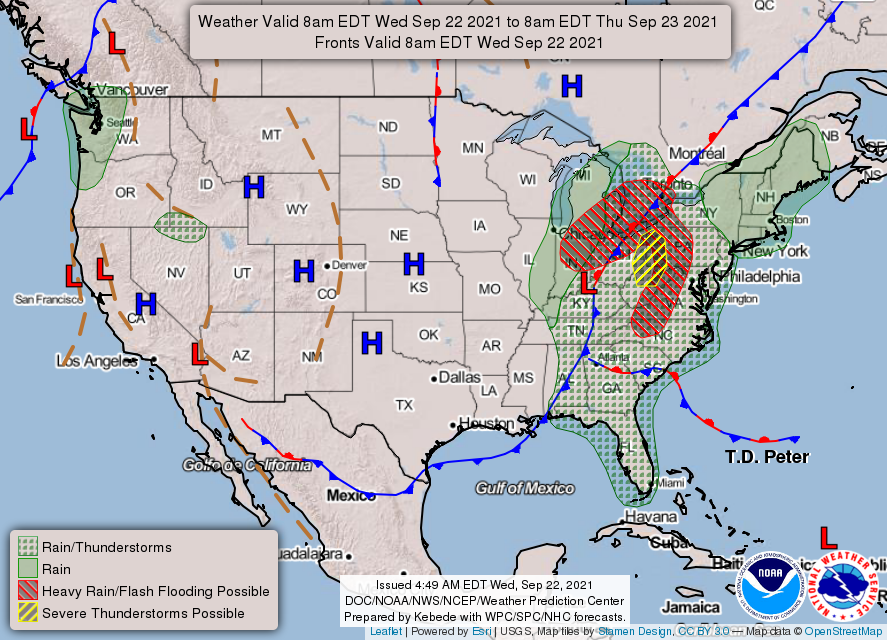

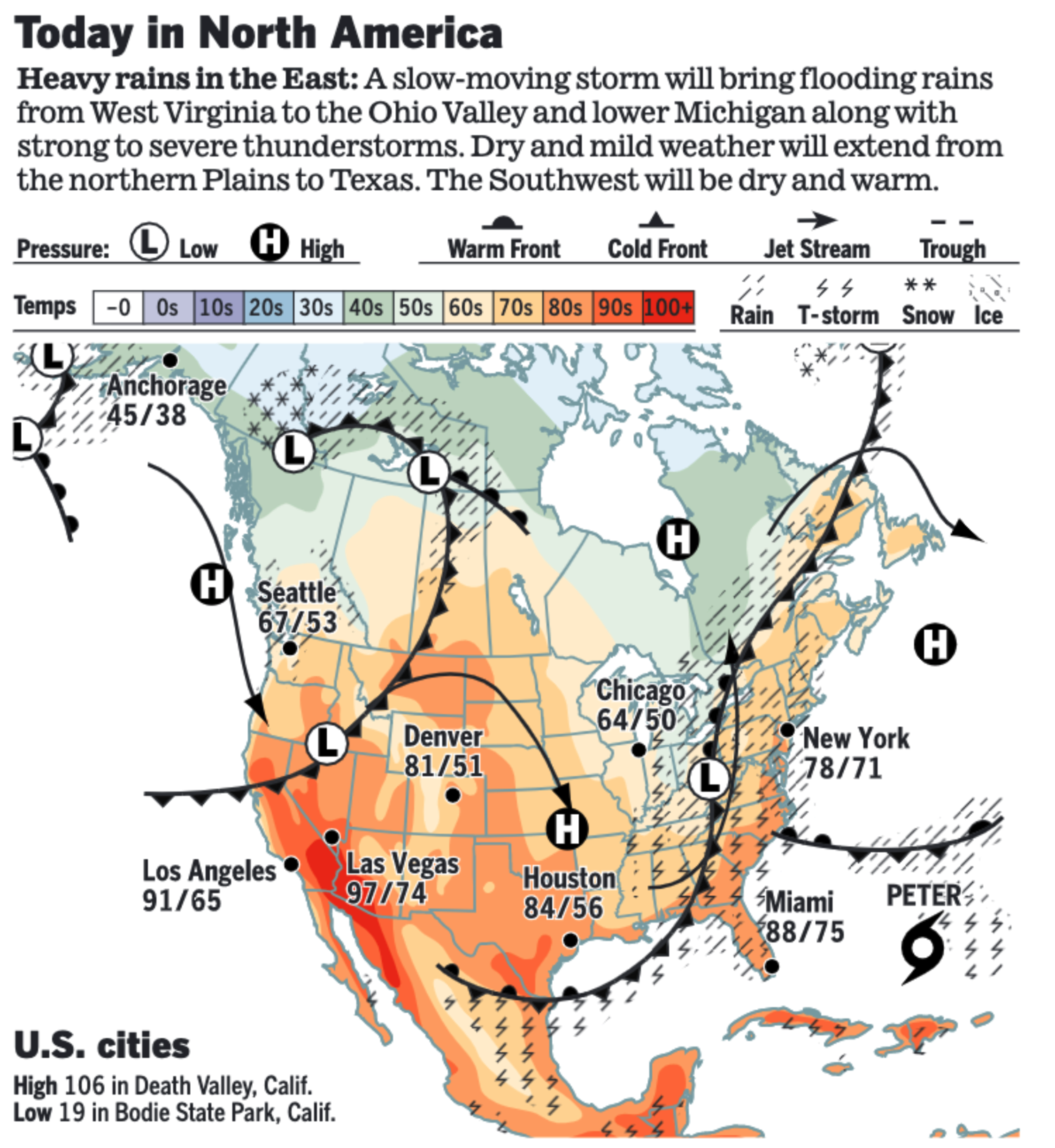

• NWS weather: Widespread heavy rains likely with flooding possible from the Great Lakes to the central Appalachians on Wednesday... ...Strong to severe storms possible across the upper Ohio Valley and central Appalachians on Wednesday... ...Heavy rain threat expected to shift farther east across the northern Mid Atlantic on Thursday.

Items in Pro Farmer's First Thing Today include:

• Corn, soybean, wheat gains overnight

• Chances for some significant rain in the U.S. Southern Plains next week

• Hurricane Ida made a thin input supply situation worse

• Fed focus is on taper timing amid mixed economic signals

• Argentine soybean sales percentage continues to run ahead of year-ago

• Big jump in rice production expected to push India’s summer grain crop to record

• Beef prices renew slide

• Strong pork movement Tuesday on modest price pullback

POLICY FOCUS

— House stopgap funding (CR) with debt suspension bill clears House but expected to be defeated in Senate amid hefty GOP opposition.

- The stopgap funding bill (HR 5305) passed on a 220-211 party-line vote. (Rep. Debbie Lesko (R-Ariz.) didn’t vote.)

- It would extend federal agency budget authority through Dec. 3.

- Next step: It will be sent over to the Senate today without any parliamentary advantage for quick consideration. Senate Majority Leader Chuck Schumer (D-N.Y.) will then call the bill up and file cloture. That cloture vote won’t occur until Friday, Sept. 24, just six days from the end of the fiscal year and a possible (but unlikely) shutdown.

- House measure includes nearly $35 billion in aid to disaster victims and relocation assistance for Afghan refugees who helped the U.S. government during two decades of war. It includes $6.3 billion to resettle Afghan refugees. The bill would provide $28.6 billion to help state and local governments recover from natural disasters, including $10 billion to cover agricultural losses from 2020 and 2021 weather events, nearly $6 billion for Army Corps of Engineers flood control projects, $5 billion for housing and economic development projects and $2.6 billion for highway repairs, among other items. The measure would separately put more cash into the Federal Emergency Management's disaster relief fund on Oct.1. As of Aug. 31, the agency estimated an end-of-September balance of $36.4 billion; the CR would increase that figure to more than $55 billion.

- Progressive (far left) Dems succeeded in deleting an initial decision to grant Israel's $1 billion request for air defense system funds.

- The combined bill would suspend the statutory debt limit through Dec. 16, 2022, or beyond the midterm elections.

- Senate Republicans are expected to have enough votes to defeat the combined House measure. Sen. John Kennedy (R-La.) predicted the package would "go down like a fat guy on a seesaw," despite the possibility that Kennedy and a few of his colleagues will vote in favor of the package. Senate Minority Leader Mitch McConnell (R-Ky.) has argued for months that despite years of bipartisan negotiations on the debt limit, Democrats should go at it alone this year since they are using the partisan budget reconciliation process to enact their fiscal priorities without GOP input. Senate Republicans will filibuster the motion to proceed to the combined CR-debt limit bill passed by the House. Democrats could then move a “clean” CR to avoid a gov’t shutdown on Oct. 1. And Republicans will vote for that. McConnell and Sen. Richard Shelby (R-Ala.), ranking Republican on the Appropriations Committee, have filed their own version of a stopgap funding bill without the debt limit. McConnell’s legislation keeps federal agencies open until Dec. 3, and it includes $27 billion in disaster aid and more than $6 billion for resettling Afghan refugees. This is what the White House has requested. BTW, McConnell will hold a news conference on the debt limit at noon ET today.

- Moody’s Analytics warned Congress against exacerbating uncertainty on a debt limit suspension, saying if a bill isn’t enacted before the Treasury Department runs out of cash and borrowing room “the resulting chaos in global financial markets will be difficult to bear… The U.S. and global economies, which still have a long way to go to recover from the recession caused by the pandemic, will descend back into recession,” Moody's Chief Economist Mark Zandi and Assistant Director Bernard Yaros wrote. Wrightson ICAP, a private investment advisory firm, said this week the drop-dead deadline was likely Oct. 25 or 26.

- House Majority Leader Steny Hoyer (D-Md.) acknowledged the Senate could make changes and send the package back to the House. Without a presidential signature on the continuing resolution, starting Oct. 1 the federal gov’t would begin a partial shutdown. Dozens of agencies would have to furlough workers and require others to work without pay (but Congress usually restores the worker pay).

— Update on traditional and human infrastructure (reconciliation) bills:

- Clear divisions in the House Democratic Caucus were evident Tuesday as progressives threatened to tank a vote on the bipartisan (traditional) infrastructure bill next week if the party’s $3.5 trillion reconciliation package is not complete, leading President Biden to convene meetings with lawmakers today at the White House to smooth over tensions.

- Jayapal warns Pelosi. Rep. Pramila Jayapal (D-Wash.), chairwoman of the Congressional Progressive Caucus, said following a two-hour meeting with House Speaker Nancy Pelosi (D-Calif.) that roughly half of her 95-member group is prepared to vote against the $1 trillion bipartisan infrastructure proposal (BIF) if the Speaker sticks to her plan to vote on it by Monday without a complete reconciliation bill. “Our vote for the BIF has to happen in tandem with or after the reconciliation vote,” Jayapal said, using the acronym for the bipartisan infrastructure framework, predicting that no vote will ultimately take place. “I don’t think the Speaker is going to bring up a bill that is going to fail.”

- “Six days is an eternity in this place,” Rep. Hakeem Jeffries (D-N.Y.) told the Democratic caucus on Tuesday, referring to the planned Monday vote on the infrastructure bill. “We are going to get this done, we always do.”

- Temporary SALT repeal a possibility. Sen. Bob Menendez (D-N.J.) said that repealing the $10,000 limit on the federal deduction for state and local taxes known as SALT for a few years could be a possibility. “That’s the beginning toward helping to create relief. That could be a possibility,” he said. The Ways and Means Committee didn’t include SALT relief in a bill they advanced this month, but Chair Richard Neal (D-Mass.) promised to work on a way to ease the cap.

— House Ag Committee goes viral amid Democrats hiding key details of ag portion of reconciliation. It’s hard to hide $28 billion but that is what occurred with House Ag Democrats, led by Rep. David Scott (D-Ga.) not providing any details despite repeated inquiries from panel Republications. The session was called to consider unrelated measures — one designating this past July as National Blueberry Month and the other providing additional funding for agricultural fairs. But Republicans quickly confronted Chairman Scott of ignoring more pressing issues and demanded info of the conservation provisions included in the $3.6 trillion budget reconciliation measure.

Important issues are not being dealt with, said Rep. Dusty Johnson (R-S.D.), who said the panel should be working on topics such as mandatory price reporting for livestock because the current rules for the reporting system are set to expire at the end of the month. “I am sorry, Mr. Chairman, but I cannot understand why, instead of dealing with ASF, wildfires, drought, or mandatory price reporting, we are trying to earn respect for the blueberry,” Johnson said. “I hope tomorrow brings more serious work for this committee.”

Chairman Scott comments. Responding to repeated questions for details on the “missing” $28 billion in conservation, Chairman Scott simply said they would be available “at the appropriate time.” That refrain is analogous to a Biden Cabinet member who keeps saying the southern border is closed while thousands of illegal immigrants enter Texas, a situation so blatant that CNN had to even cover the matter.

— More explaining needed from Vilsack after Farm Bureau analysis shows “Transfer Tax Could Impact a Huge Portion of U.S. Farm Production.” Where’s the 2% now? Recall that is what USDA Secretary Tom Vilsack said would be impacted by President Biden’s tax increase relative to stepped-up basis. It’s more like family farms producing 65% U.S. agricultural commodities would be saddled with devastating taxes — $1.5 million to $1.8 million would be the average NEW taxable gain per farm family. Link to Farm Bureau analysis.

AFGHANISTAN

— The Taliban brought some outsiders into their new Afghan government, giving positions to technocrats, businessmen and members of ethnic minorities — but no women.

— Pentagon’s top officer met with his Russian counterpart in Helsinki, as the U.S. and allies seek ways to fight terrorism after the withdrawal from Afghanistan.

— Help for Afghan refugees. More than 30 companies, including Amazon and UPS, joined a coalition founded by the Chobani CEO, Hamdi Ulukaya, to hire and train Afghan refugees in the United States. Link for more via the Associated Press.

BIDEN ADMINISTRATION PERSONNEL

— Senate voted 49-48 last night to advance Rohit Chopra's nomination to lead the Consumer Financial Protection Bureau, following months of Republican opposition that's held up a vote on the matter since March. Chopra could receive his final nomination vote as early as next week.

CHINA UPDATE

— Russia and China agree to supply terms, which could simplify beef trade. Russia’s ag safety watchdog announced China and Russia have agreed on supply terms for Russian beef, which could help simplify trade between the countries. Currently, Russia supplies just a small amount of beef to China, with only two Russian producers currently allowed to ship their product to Beijing. Interfax news agency says Russia supplied 3,660 MT of beef to China in the first quarter of 2021.

— China to release fertilizer reserves. The National Development and Reform Commission (NDRC) said the Chinese government will take steps to keep fertilizer supplies and prices stable and will release potash fertilizer reserves in a timely manner. Compares are being ordered to prioritize supplying raw materials and energy to fertilizer makers and those operations are being asked to boost their capacity utilization, the NDRC said, while shipping for fertilizer imports was also listed as a priority.

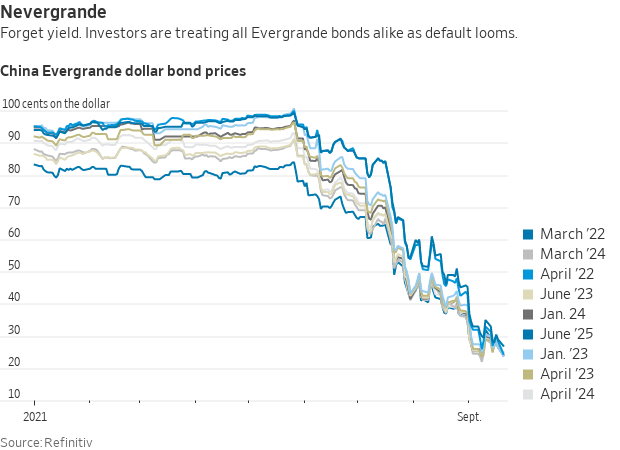

— China’s Evergrande says it can repay at least some of its debts, noting in a filing today that a $36 million interest payment due this week was “settled through negotiations.” But the cash-crunched property developer, which owes creditors $300 billion, could miss other payments this week, with prospects for a bailout unclear. Hedge funds have been buying Evergrande’s bonds and hiring advisers to make money off the company’s potential collapse.

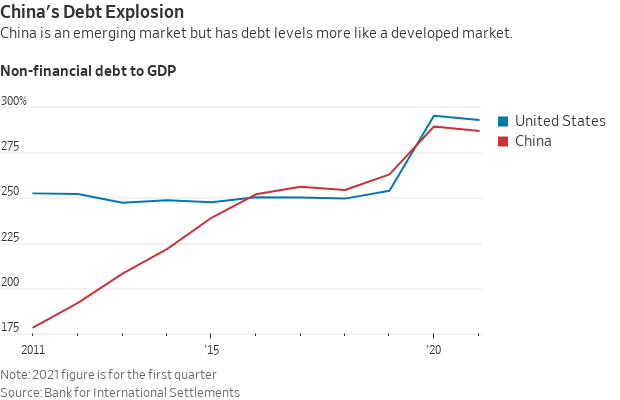

Evergrande is the Chinese economy in miniature, the WSJ’s Streetwise columnist James Mackintosh writes (link). Both have operated for decades on the principle that it was worth borrowing to build, in Evergrande’s case mostly housing, in China’s case not just apartments, but roads, rail, airports and other infrastructure. Evergrande’s business has run out of credit. China’s economic model has also run out of road, and the process of putting it on a new track is likely to bring more Evergrande-like mistakes.

— The Secret Service, the FBI and the Defense Department all bought surveillance drones from DJI, a Chinese company the Pentagon deemed a security threat.

TRADE POLICY

— U.K. PM Johnson hints trade deal with U.S. unlikely by 2024. U.K. Prime Minister Boris Johnson signaled he doesn’t expect to secure the free-trade deal he seeks with the U.S. before the next U.K. general election due in 2024. Speaking ahead of his meeting with President Biden in Washington Tuesday, Johnson declined to comment when asked by Sky News if an agreement could be struck before the election.

ENERGY & CLIMATE CHANGE

— Grassley: EPA to release proposed RFS marks Friday afternoon. Sen. Chuck Grassley (R-Iowa) told reporters that EPA Friday afternoon will release its proposed biofuel levels under the Renewable Fuel Standard (RFS). Grassley said he had no details on the levels the agency will announce as the proposed marks.

Reports previously signaled EPA will propose RFS levels for 2021 that are below 2020, but the agency is said to be considering retroactively lowering the 2020 level in reflection of the pandemic. It is not clear if the 2021 proposed levels will be below the original or the potentially reduced 2020 levels. Reports also were that EPA would propose levels for 2022 that were above both 2020 and 2021.

Grassley issues warning. “If we get a bad RVO out of EPA, the farmers aren't going to forget it and they are going to blame Biden and [from] the rumors we are hearing, they could even be worse than what we had under Trump," Grassley said.

The proposed levels are also still shown as being under review at OMB where they have been since August 26. Importantly, the EPA proposed levels could well change before they are finalized later this year.

Some may meet with OMB after conjectured announcement. The comments from Grassley come as the Office of Management and Budget (OMB) has scheduled two additional meetings on the proposed RFS levels that have been under review at OMB since Aug. 26. Two more meetings have been added to the schedule on the proposed EPA levels, one Sept. 27 with the Northwest Ohio Building and Constructions Trade Council and one on Sept. 28 has been added with the Pennsylvania Chamber of Business and Industry.

— Biden pledges a lot more funding to help developing nations deal with climate change. President Joe Biden said at the U.N. General Assembly that he intends for the U.S. to double its annual funding to help developing nations deal with climate change, up to $11.4 billion, a move he said will "make the United States a leader in public climate finance." This comes as poorer countries grow increasingly frustrated over the annual $100 billion in total that developed countries pledged to provide by 2020, which has never materialized in full.

— ConocoPhillips will become the second-largest oil and gas producer in the Lower 48 U.S. states following its $9.5 billion acquisition of Shell's assets in the Permian Basin. Adding an estimated 200,000 barrels of oil equivalent (boe) per day will put Conoco within striking distance of leader Exxon Mobil, which is expected to produce about 1 million boe/day from the Lower 48 this year. Conoco's deal will propel it past Chevron, EQT Corp., Occidental Petroleum and EOG Resources, according to consulting firm Rystad Energy.

— Energy Transfer LP, which operates the 570,000 barrel-per-day Dakota Access Pipeline, asked the Supreme Court to throw out a requirement for an additional environmental review, saying it is unnecessary and "carries enormous ramifications" for the oil industry. A lower court had revoked a key environmental permit for the controversial pipeline last year, and the U.S. Army Corps of Engineers is set to complete its subsequent review by March 2022. Link to details via Reuters.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Biden’s DOJ: Ag market consolidation has hit ‘tipping point’. Consolidation in agricultural markets is fueling higher prices for consumers and lower prices paid to farmers, according to the U.S. Justice Department’s (DOJ) No. 3 official, who promised aggressive antitrust enforcement in the industry. Large buyers of agricultural products hold too much power and are creating supply bottlenecks between farmers and consumers, Associate Attorney General Vanita Gupta told a virtual meeting of the National Farmers Union Tuesday. “Consolidation in agricultural markets has reached a tipping point, making it harder for small family farms and growers to survive,” Gupta said. “Farmers are being forced to bargain with large processors when they buy and sell goods, squeezing your profits while Americans pay more at the grocery store.”

The Biden administration is taking steps through regulation and antitrust enforcement to bring more competition to industries across the economy following a wave of consolidation that has led many markets controlled by a handful of big players.

Gupta said the Justice Department’s antitrust division intends to closely scrutinize mergers in the industry and anticompetitive conduct. For example, the department has been investigating the country’s biggest beef processors.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 229,573,932 with 4,709,427 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 42,413,623 with 678,503 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 386,780,816 doses administered, 182,012,243 have been fully vaccinated, or 55.5% of the U.S. population.

— China cracks down again. Officials in Harbin, China — a city of 10 million people — closed gyms, cinemas and other venues after a single confirmed case.

— Big vaccine purchase announcement. At a virtual Covid-19 summit on the sidelines of the General Assembly today, President Biden is expected to announce that the U.S. will purchase 500 million additional doses of the Pfizer-BioNTech vaccine to donate to developing countries, bringing the total commitment to 1.1 billion doses.

POLITICS & ELECTIONS

— Trump campaign officials knew that conspiratorial claims about a voting machine company were false, court documents show.

— Race for Wyoming’s single U.S. House seat pits two of the biggest names in Republican politics arguing against one another: both of the party’s living former presidents. Link for details via the WSJ.

CONGRESS

— Funding for county fairs wins House Ag Committee support. The money poured out by Congress never seems to stop. This time, the House Agriculture Committee approved a bill to create a $500-million-a-year grant program to support local, county and state fairs that lost attendance and revenue due to the pandemic. An estimated 98% of the fairs were canceled last year and more are at risk in the fourth wave of Covid-19.

OTHER ITEMS OF NOTE

— Highlights from the U.N. General Assembly:

- António Guterres, the U.N. secretary general, warned that climate change and Covid had contributed to “the greatest cascade of crises in our lifetimes.”

- President Biden challenged autocracies, without specifically naming China and Russia, but said that the U.S. was “not seeking a new Cold War.”

- President Xi Jinping said that China would stop building coal-fired power plants abroad. China currently has plans to build 40 gigawatts of international coal power, but did not fund any new coal projects under its global development program, the Belt and Road Initiative, in the first half of 2021.

- The Taliban nominated an ambassador to the U.N., but the envoy of Afghanistan’s toppled government is still in that post.

- Biden will convene a summit Friday with the leaders of Australia, India and Japan — the other members of an alliance called the Quad. The regional shift, following earlier efforts by the prior two administrations, puts the U.S. at odds with China, a U.N. Security Council member seeking to carve out a major U.N. role.

— Justice Department is suing American Airlines and JetBlue, saying that their alliance hurts consumers. In bringing the suit, officials called the cooperation a “de facto merger” between the carriers in the New York and Boston markets. Attorneys general in six states and the District of Columbia joined the action. The airlines said they planned to fight the suit in court.

Meanwhile, a Justice Department-led panel is investigating Zoom’s nearly $15 billion deal to buy a U.S. customer-service software company, citing Zoom’s China ties.

— L.A.’s water use up despite pleas/drought. The push for voluntary conservation falls flat in the Southland even in midst of drought. Link to LA Times article.

EVENTS AND REPORTS

Wednesday, September 22

· Pandemic relief efforts. House Oversight and Reform Coronavirus Crisis Subcommittee hearing on "Recognizing and Building on the Success of Pandemic Relief Programs."

· Energy issues. Business Council for Sustainable Energy sponsors the virtual 2021 National Clean Energy Week Policy Makers Symposium Sept. 21-23 with keynote remarks from Sen. Lisa Murkowski (R-Alaska).

· China and U.S. markets. House Financial Services Investor Protection, Entrepreneurship, and Capital Markets Subcommittee hearing on "Taking Stock of 'China, Inc.': Examining Risks to Individual Investors and the U.S. Posed by Foreign Issuers in U.S. Markets."

· East Asia policy. House Foreign Affairs Asia, the Pacific, Central Asia and Nonproliferation Subcommittee briefing on "Administration Engagement in East Asia."

· US Coast Guard. Final day of the Coast Guard meeting of the National Navigation Safety Advisory Committee.

· Small businesses. The Atlantic holds its virtual 2021 Atlantic Festival "to explore ideas for building a better future — and visions of what America can be," with Small Business Administration Administrator Isabel Guzman delivering remarks on "Strengthening the Small-Business Support System."

· CPSC, Commerce nominations vote. Senate Commerce, Science and Transportation Committee markup to vote on the nominations of Alexander Hoehn-Saric to be a commissioner and chair of the Consumer Product Safety Commission; Mary Boyle to be a commissioner of the Consumer Product Safety Commission; Richard Trumka Jr. to be a commissioner of the Consumer Product Safety Commission; and Grant Harris to be assistant Commerce secretary for industry and analysis.

· Transportation nominees hearing. Senate Commerce, Science and Transportation Committee hearing on the nominations of Victoria Marie Baecher Wassmer to be CFO of the Transportation Department; Mohsin Raza Syed to be assistant Transportation secretary of government affairs; Amitabha Bose to be administrator of the Federal Railroad Administration; and Meera Joshi to be administrator of the Federal Motor Carrier Safety Administration.

· Voting rights. Senate Judiciary Constitution Subcommittee hearing on "Restoring the Voting Rights Act: Combating Discriminatory Abuses."

· Energy and net-zero emissions. Third Way virtual discussion on "Firm Energy Sources: How the U.S. and Europe are Financing the Path to Net-Zero."

· Electrifying homes, businesses. Joint Economic Committee hearing on "Examining the Economic Benefits of Electrifying America's Homes and Buildings."

· Economic reports. Existing Home Sales | FOMC Meeting Conclusion and Updated Summary of Economic Projections

· Energy reports. EIA Petroleum Status Report | Weekly Ethanol Production

· USDA reports. NASS: Chickens & Eggs | Cold Storage | Broiler Hatchery