House and Senate Clear $2.5 Trillion Boost in Debt Limit, Sending Measure to Biden

Trade panel: U.S. at risk of falling behind in markets large and small

In Today’s Digital Newspaper

Note: Today’s dispatch is a shortened version due to travel for a speaking assignment in Newton, Kansas.

MARKET FOCUS

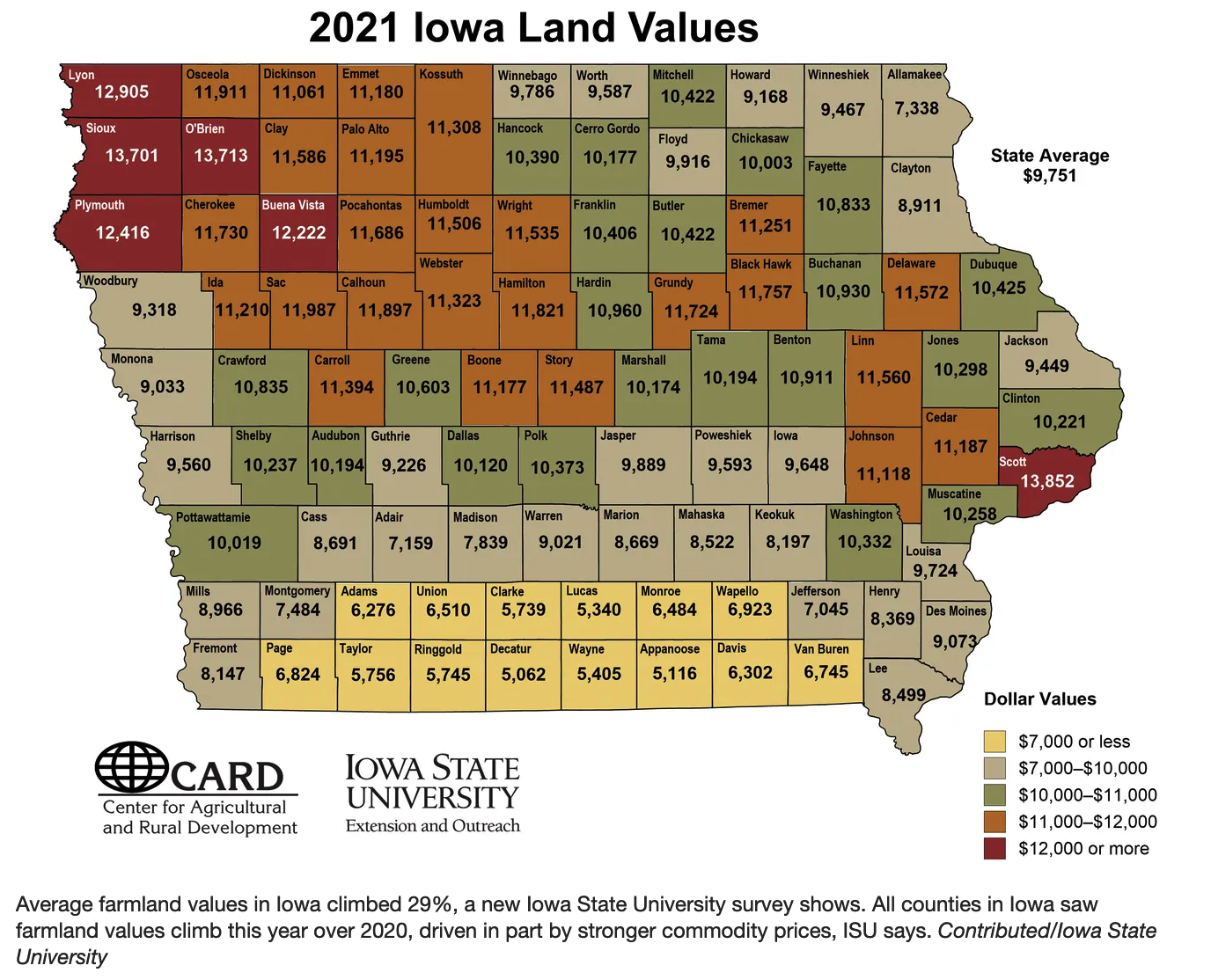

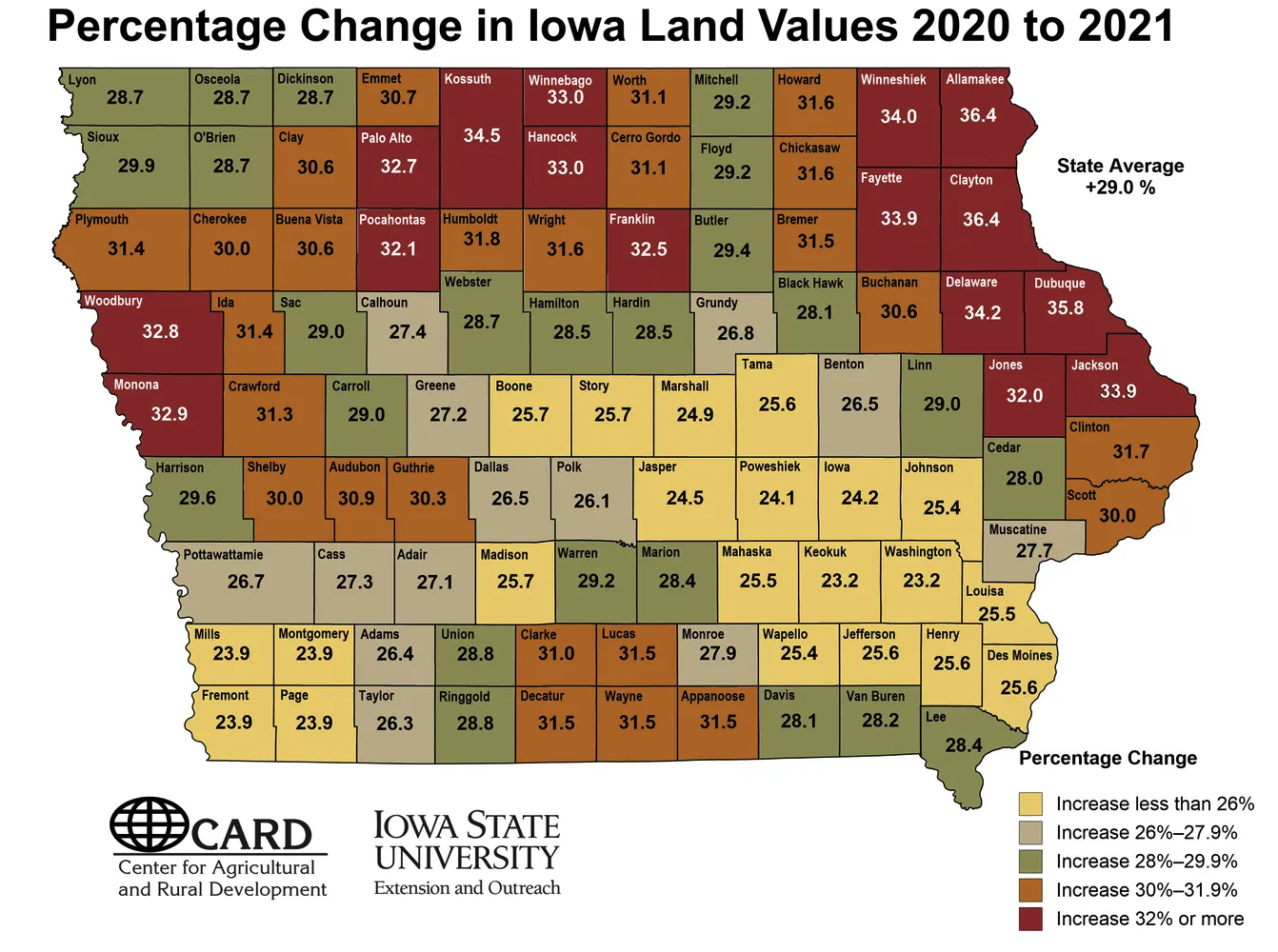

Iowa farmland prices explode 29% higher to a record. The average value of an acre of Iowa farmland skyrocketed 29% in 2021 to $9,751, according to Iowa State University’s (ISU) annual survey. The last time Iowa's farmland values increased more than 25% was in 2011, when values rose 32.5%. The nominal value of an acre of farmland is now higher than at any point since ISU began surveying land prices in 1941 — 12% higher than the previous peak in 2013. But the current value in inflation-adjusted terms is still lower than those for 2012 and 2013. (Note: Sources say a lot of activity was due to 1031 land exchanges because (1) some thought Congress would end such exchanges, but they did not and (2) the expansion of cities and people are trying to capitalize at this moment.)

Other reasons for the farmland price rise. ISU associate professor of economics Wendong Zhang said, “The increase this year is in part due to much stronger commodity prices thanks to higher exports, stronger than expected crop yields, and strong ad hoc Covid-19 related government payments.” Zhang also noted, “Inflation is driving some investors to consider farmland as an alternative investment asset.”

POLICY FOCUS

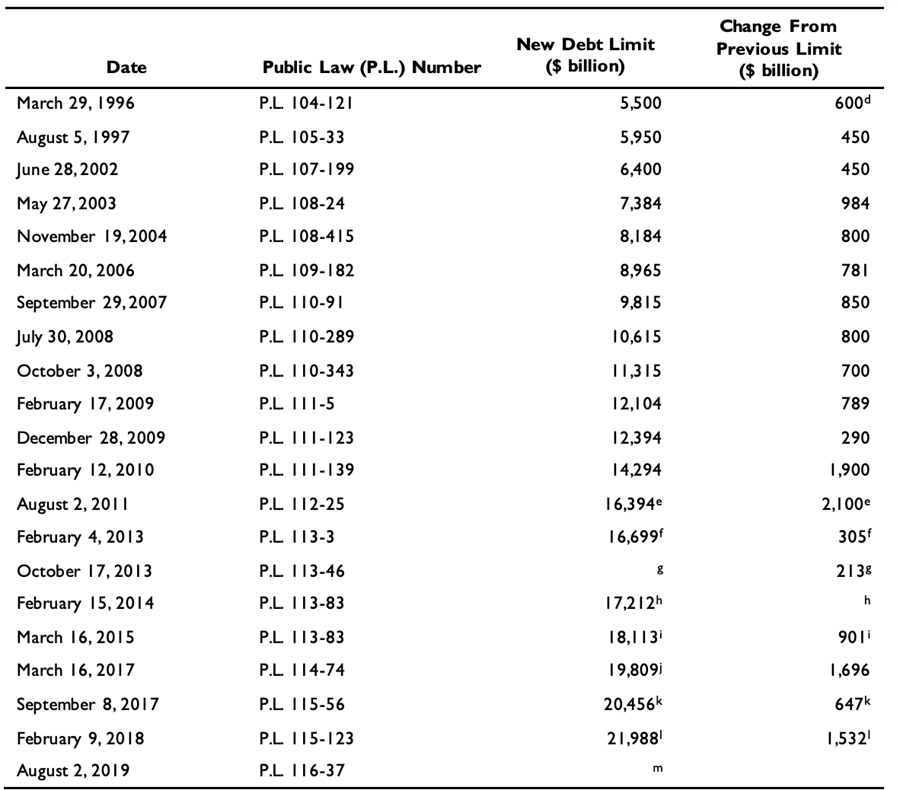

— Senate and House Dems approved lifting the debt limit by $2.5 trillion, the largest increase in the federal government’s borrowing authority in recent history. It passed on a party-line vote — 50 to 49 — in the Senate and a near party-line vote in the House, 221-209. One Senate Republican, Sen. Cynthia Lummis of Wyoming, was absent, and the rest of the Republican conference opposed the measure. In the House, the bill drew only one Republican vote, from Illinois Rep. Adam Kinzinger. The largest previous debt limit increase was in 2011 as part of the Budget Control Act, when Congress lifted the cap by $2.1 trillion. It would be a smaller percentage boost than the 2011 law or a 2010 measure that raised the limit by $1.9 trillion, each of which lifted the borrowing cap by roughly 15%.

Timeline. This new debt limit is aimed at allowing the U.S. gov’t to borrow money through the 2022 midterm elections and into early 2023. (Link to CRS report on the debt limit.)

Background. Congress last week approved legislation establishing a one-time process to fast-track the measure by shielding it from the threat of a GOP filibuster in the 50-50 chamber. Instead, the legislation passed in the Senate with a simple majority. Treasury Secretary Janet Yellen had warned that the U.S. gov’t could hit the debt limit and have difficulty meeting its obligations after Dec. 15, while private analysts have said the government has a bit more time.

— Border congestion feared as vaccination requirements change in January. All inbound foreign national travelers seeking to enter the U.S. via land points of entry or ferry terminals — whether for essential or nonessential reasons — must be fully vaccinated for Covid-19 and provide related proof of vaccination,” according to a bulletin from the U.S. Department of Homeland Security. While the Nov. 23 announcement said only that the restrictions would be adopted in January, it’s expected they’ll take effect Jan. 22.

Here’s an update on the topic from Transport Topics:

The DHS rule applies to non-U.S. citizens crossing into the country.

The Canadian Ministry of Health’s new regulations, set to take effect Jan. 15, state that certain groups of travelers — among them essential providers such as truck drivers — cannot enter Canada unless they have been fully vaccinated. This applies to U.S. drivers entering the country, a group that previously had been exempt from vaccination requirements.

Mexico’s rule, also set to take effect Jan. 15, states, “all inbound non-immigrant foreign national travelers crossing U.S. land ports of entry or ferry terminals – whether for essential or non-essential reasons – must be fully vaccinated for Covid-19 and provide related proof of vaccination.” Here again, U.S. drivers are included.

Will the courts or Congress intervene? A proposal from the Biden administration that would require vaccinations or regular Covid-19 testing for those working at companies with 100 or more employees is currently on hold and is being litigated at the federal appeals court level. It also is receiving congressional attention. On Dec. 8, the Senate voted 52 to 48 to approve a proposal that specifically aims to repeal the mandate, but the measure faces an uphill battle in the Democratic-controlled House and an almost certain veto from President Biden. On Dec. 7, a federal appeals court judge in Savannah, Ga., blocked enforcement of a vaccine requirement for certain federal contractors nationwide. The order means that three vaccine policies for people not employed by the federal government — including contractors, certain health care workers and employees of larger companies — are frozen across the country.

TRADE POLICY

— Rep. Costa, ag industry experts urge Biden administration to focus on Asia trade to boost sector. House Livestock and Foreign Agriculture Subcommittee Chair Jim Costa (D-Calif.) and a panel of experts from across the ag sector said inking new trade agreements across the Asia Pacific region — including moves to revisit U.S. participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) — remains a key policy focus for the U.S. agricultural sector, during an event Tuesday (Dec. 14) hosted by Farmers for Free Trade (FFT).

U.S. trade policy has “been challenging” over the past two decades — regardless of the administration in office — Costa said, adding it is critical going forward that “we try to develop some not only consensus but continuity.” An example of the lack of continuity is the fate of CPTPP, which was previously known as the Trans-Pacific Partnership (TPP) before former President Donald Trump pulled the U.S. his third day in office in 2017. That withdrawal marked a policy reversal after years of negotiations under the Bush and Obama administrations. However, the Biden administration has yet to move to revive U.S. participation in the pact and some officials have simply said that is not currently likely. U.S. Trade Representative (USTR) Katherine Tai has been lukewarm when asked about U.S. reengagement on CPTPP and pointed to shifts in the trade policy landscape since the US withdrawal.

Going forward, Costa said he believes reengagement with the 11 members of CPTPP over potential U.S. reentry represents “an important opportunity” for the U.S. ag sector. “I think we need to explore whether or not under what circumstances we can re-engage there,” he observed.

The problem with bilateral agreements. While bilateral deals, like the initial agreement reached between CPTPP-member Japan and the U.S., have brought some of the benefits that would have come from membership in the broader agreement, University of Nebraska-Lincoln ag economist John Beghin pointed out they lack the benefits of “deep integration” on issues like biotech and sanitary and phytosanitary (SPS) protocols. “Stepping out of the TPP was a major blunder in terms of economics and geopolitical terms… major opportunities that we have lost and that… the Japan/U.S. agreement hasn't even put a dent in,” he remarked.

Costa described the administration’s trade policy agenda as “a work in progress,” noting that other USTR officials — namely chief ag trade negotiator nominee Elaine Trevino — are still awaiting confirmation. “She needs to be confirmed,” he stressed, saying that once the full Biden trade team is in place a clearer picture of the administration’s trade and foreign policy plan will come into view.

Costa said he has had “a couple of conversations” so far with Tai and said she is “very cognizant of certainly the concerns that I and others have related to American agriculture.”

Looking ahead, Costa said both his subcommittee and the full House Ag panel have asked Tai to testify and his sense is “they’re at a place where they want to do that [at] the beginning of next year.” If that happens, Costa said it would hopefully yield “greater clarity as to what the priorities are, in terms of this administration's policy and where agriculture fits in.”

If CPTPP reentry not in the cards, experts say Asia Pacific bilaterals a key. While prospects for U.S. reentry to CPTPP are unclear, participants in the event agreed that U.S. engagement across the Asia Pacific region remains an imperative. “Even if a regional trade agreement would be difficult today, then we could focus on bilaterals,” said U.S. Grains Council (USGC) China Director Manuel Sanchez. “We need to start, because the more we delay, the worse [position] it puts us [in].” Experts said key markets where the U.S. should explore bilateral agreements include Vietnam, the Philippines, Indonesia and other members of the Association of Southeast Asian Nations (ASEAN). “These are countries that, for me, are obvious” for inking a bilateral pact, Sanchez remarked.

To illustrate how the U.S. is at risk of falling behind key trade competitors in Asia, United Dairymen of Arizona CEO Robert Chesler said one needs only to look at the volume of new trade agreements reached. “The U.S. produces six times the volume of milk as New Zealand does, yet we have the same number of trade agreements,” he said, noting both Australia and the EU have inked more trade agreements than the U.S.

Regarding the Phase 1 agreement with China, Costa and the industry experts said building on the agreement is another key for U.S. ag exporters. “We want to maintain access to all markets, including the large Chinese market,” he noted. “But we must, I think, demand a level playing field and fair trade.” With ag and other purchase commitments under the agreement set to lapse at the end of this year, Costa said the Biden administration is “putting pressure” on China in multiple ways to continue buying U.S. goods at a robust pace, but acknowledged the administration is dealing with “a host of other issues,” relative to China and other trade partners. Bottom line, Costa said, is he hopes “to get some clear understanding as to under what circumstances the administration is going to proceed,” given the purchase commitment sunset, but he acknowledged that the issue could run into the new year.

Beghin called Phase 1 “a very good agreement in the sense that it was a ‘deep integration’ agreement with chapters on SPS, [technical barriers to trade (TBTs)] and so forth,” but he noted that most retaliatory tariffs imposed during the U.S./-China trade war remain in place and Phase 2 negotiations with China are “not anywhere to be found.” He later said that beyond reengagement on CPTPP, work towards a Phase 2 agreement should be a priority for the administration.

U.S. Meat Export Federation (USMEF) Economist Erin Borror stressed that China is among the top markets where U.S. meat exporters face major tariff disadvantages compared to their competitors. “China is the biggest importer in the world of both pork and beef, and U.S. pork is still subject to Section 232 retaliatory tariffs — so that's a 25% tariff disadvantage in the biggest pork importing market in the world,” she detailed. Meanwhile, U.S. beef has waivers from Section 301 retaliatory tariffs but “we compete against countries that have free trade agreements with China, so they're at zero tariff for product from New Zealand, from Chile, and Australia is headed there — they’re at 3.6% today.”

The U.S. is at risk of falling behind in markets large and small. While participants emphasized the need for more U.S. engagement with Asia Pacific trade partners, they said negotiations with the EU, and African and Latin American partners are also important. Costa said he was pleased that the U.S. and EU ironed out their dispute over steel and aluminum, but added he is still working to persuade his EU colleagues “to engage in meaningful conversations about how we deal with agricultural trade between Europe and the United States.”

Meanwhile, Corn Refiners Association (CRA) President and CEO John Bode pointed to a new analysis from his group that showed the U.S. is falling behind the EU, China and others when it comes to expanding trade opportunities through new agreements. “Our analysis has found the following benefits over the last decade from trade barrier reductions: The EU has $553 billion in benefits, China $420 billion in benefits, and the U.S. $171 billion,” he detailed. “To put those numbers in perspective, the U.S. benefit was about 30% of what the EU achieved, and about 40% of what China achieved — that’s not even competitive.”

Gains by U.S. competitors have come not only from the pursuit of deals in fast-growing regions like Asia, but also making inroads in markets primed for growth in the future like Africa and Latin America, noted Beghin. “Africa may not be a very important market right now, as income per capita is still low, [but] population is still growing in many African markets and so those markets are going to become eventually important markets for U.S. commodities and food goods,” he explained. While the EU and others are working hard to integrate with Africa and other developing markets, the U.S. is “losing ground not only in terms of market access, but especially in terms of setting standards on biotech, or phytosanitary regulations.”

Upshot: The session again underscored that U.S. ag exporters view the Asia Pacific region as a major priority in terms of trade policy. Whether that means reentry to CPTPP, new bilateral agreements, or further trade negotiations with China, panelists are keen to see a full court press by the Biden administration across the region given the gains competitors are making there. Meanwhile, there is also rising concern that the U.S. is falling behind in other regions like Africa — which do not represent major export markets now but are primed to be in the future.

ENERGY & CLIMATE CHANGE

— Here’s another ethanol legislative proposal that will not likely clear Congress. EPA would be prohibited from reducing the U.S. biofuel-blending mandate once annual rules are final under bipartisan legislation by Sens. Amy Klobuchar (D-Minn.) and Chuck Grassley (R-Iowa). The measure would prevent the Biden administration from retroactively reducing 2020 or future finalized Renewable Volume Obligation levels, Klobuchar says in a statement (link).

Comments: The bill is unlikely to pass in the current Congress and follows EPA proposing a cut to biofuel-blending quotas retroactively for 2020.

— Energy Secretary Granholm: Crude export ban not under consideration. As the Biden administration looks to tame surging energy prices, a ban on crude oil exports is not on the table, according to Energy Secretary Jennifer Granholm. “We are not considering reinstating the ban on exports,” she said in remarks to the National Petroleum Council Tuesday (Dec. 14).

Background. Last week, White House National Economic Council Director Brian Deese told reporters that an oil export ban is “not an issue that we’re currently focused on,” though he added that President Joe Biden has indicated “all options should be on the table to try to address challenges in the market and bring relief to American consumers.” Granholm’s comments, however, appear to shut the door on the idea of halting exports — a proposal floated last month by groups of House and Senate Democrats. “A ban on U.S. crude oil exports will boost domestic supply and put downward pressure on prices for American families,” read a Nov. 22 letter to Biden spearheaded by Reps. Ro Khanna (D-Calif.) and Darren Soto (D-Fla.). Earlier that month, Sens. Jack Reed (D-R.I.) and Bob Casey (D-Pa.) led a similar letter to Biden in the Senate.

LIVESTOCK, FOOD & BEVERAGE INDUSTRY

— Rep. Hartzler urges USDA Sec. Vilsack to make promised “top up” payments to hog producers. Here is the contents of a letter Hartzler (R-Mo.) wrote to Vilsack on Dec. 6:

Dear Secretary Vilsack,

I commend the United States Department of Agriculture (USDA) for their recent announcement issuing $270 million to eligible livestock contract growers who applied for pandemic assistance through the Coronavirus Food Assistance Program (CFAP 2) payments.

Despite this critical investment, I am concerned that United States pork producers, who are not contract growers, are continuing to experience ongoing financial burdens as a result of Covid-19 market disruptions. As you know, on January 15, 2021, USDA announced that eligible swine producers would receive additional assistance through a “top up” payment of $17 per head, increasing the total CFAP 1 inventory payment to $34 per head. However, since then, USDA has given no indication of when and how they will distribute the “top up” payment saying they want to “re-evaluate the program.” On July 13, 2021, USDA announced that up to $50 million in pandemic assistance funds would be provided to small hog producers who use the spot market or negotiated price. We have yet to see how these funds will be distributed as well. Pork producers are still feeling the economic hardships of the pandemic and look forward to USDA carrying out these programs.

On October 7, 2021, you testified before the House Agriculture Committee on the state of the livestock industry. In response, I submitted the following question for the record on October 15, 2021:

“Secretary Vilsack, for several months now USDA has held pork producers in the balance as they await a formerly promised “top-up” payment of $17 per head. Members and staff have requested additional information several times and to my knowledge, not received a clear answer. Can you please provide a specific update as to the status of these payments and details as to when U.S. swine producers will receive formal notice regarding this payment?”

As of December 2, 2021, this question for the record has still not been answered. With this in mind, I respectfully request answers to the following questions:

- When will USDA release guidance on how U.S. hog farmers can receive their promised “top up” payment of $17 per head as well as the $50 million for small hog producers?

- What modifications is USDA making to the “top-up” program as announced by the Trump Administration and what are these changes designed to accomplish?

- Hog farmers often cap out of the $250,000 payment limit quickly due to their higher volume of livestock. Will a new payment limit be issued for swine producers to better ensure producers receive adequate financial assistance?

I encourage USDA to support our hardworking farmers and provide them with the much-needed financial relief that was promised. I thank you for your timely consideration of this matter and look forward to working with you on this important issue.

Sincerely,

Vicky Hartzler

Member of Congress

— President Biden urges Congress to hold hearings on the concentration of power in the food processing industry in light of rising prices. The White House focus on the food industry continues and follows repeated criticism of the meat processing industry which it believes is too concentrated among several big packers.

POLITICS & ELECTIONS

— District of Columbia is suing the Proud Boys and the Oath Keepers. The lawsuit alleges the far-right groups conspired to attack the U.S. Capitol on Jan. 6 and disrupt the certification of President Biden’s election victory.

CONGRESS

— Senate releases new 2022 calendar. Senate Majority Leader Chuck Schumer (D-N.Y.) released a new calendar (link) that has the chamber returning from its Christmas break on Jan. 3. This is earlier than the House, which returns Jan. 10. The date fueled speculation that Democrats’ $2.2 trillion reconciliation package (HR 5376) wouldn’t get a vote by the Christmas deadline set by Schumer, though that was quickly tempered by Democrats.